11.1 Introduction

The mining sector is an important industry to Canadians and the Canadian economy. The mining industry at large is a significant contributor to prosperity for Canadians as it is responsible for providing jobs, supporting communities, and attracting investment. In 2015, the mining industry contributed $56 billion (approximately 4 percent) to Canada’s gross domestic product (GDP).Footnote 1 Canada is internationally recognized as one of the leading mining countries in the world. Some of the largest Canadian and international mining companies have chosen to headquarter their companies in Canada as it is one of the largest producers of minerals and metals. Moreover, almost 60 percent of the world’s publicly listed mining companies are listed on the Toronto Stock Exchange (TSX) and the TSX-Venture Exchange, which is a stock exchange for emerging companies. The Government of Canada’s department of Natural Resources Canada indicated that for Canada to create and maintain a competitive advantage, it is essential to ensure the sustainable development of our minerals. Sustainable development will in turn help Canada attract investment, avoid project disruptions, enhance technological advancements, and strengthen domestic and international partnerships for the benefit of Canadians.Footnote 2

Research and development (R&D), innovation, and commercialization are key challenges for the Canadian mining sector. In 2013, investment in R&D in the mining sector reached $677 million, surpassing that of the machinery sector, the pharmaceutical sector, and the wood products and paper sector. It should be noted that 2013 was a rather difficult year for the mining industry and the resources invested in R&D may underrepresent the average annual resource allocation. Nevertheless, Canada faces a challenge in facilitating a robust environment to foster innovation and enhance R&D.Footnote 3

Intellectual property assets are also an important component of the Canadian mining sector. Mining is the sixth largest sector in Canada for firms filing patents. Moreover, the number of Canadian firms in the mining sector with more than one type of IP asset (patent, trademark, or industrial design) is high compared to other sectors and comparable to Canadian firms operating in the pharmaceutical and transport equipment industries.Footnote 4

To further promote innovation in the mining sector, the Canada Mining Innovation Council has developed a strategy to stimulate innovation in Canada toward achieving zero waste in mining and mineral processing within 10 to 20 years. This strategy focuses on four key areas: exploration projects, underground mining projects, energy and processing projects, and environmental stewardship projects. The Canada Mining Association states that for the Canadian mining sector “to remain sustainable, progressive and profitable, the industry must innovate.” What is noteworthy is that certain technological advances have considerably improved the ability of firms to perform exploratory work while minimizing the impact on the environment, such as GPS surveying, airborne technologies, and down-hole seismic imaging. These technologies have facilitated locating new deposits that would not have been possible using traditional methods.Footnote 5

Patent data is a good starting point for the analysis of the development of new technologies as it provides important information on the specific technical knowledge embedded in the invention. This chapter, resulting from a collaborative effort between the Centre for International Governance Innovation (CIGI) and the Canadian Intellectual Property Office (CIPO), examines the importance of patenting in the mining sector from a Canadian perspective following WIPO’s methodology (Reference Daly, Valacchi and RaffoDaly et al., 2019).

The structure of this chapter is as follows: Section 11.2 broadly examines the use of intellectual property in the Canadian mining sector and provides an overview of the latest developments around promoting innovation in the sector based on qualitative interviews, and additional primary and secondary sources.Footnote 6 Section 11.3, which is based on EPO PATSTAT data, presents the patent landscape and the Canadian companies leading in terms of patenting activity. Section 11.4 dives deeper into the patent data, exploring patenting activity in the mining subsectors, examining collaborationFootnote 7 between firms, and identifying industry clusters based on patenting activity. Section 11.5 concludes by highlighting the main findings.

11.2 Intellectual Property in the Mining Sector

Intellectual property rights are generally used to protect intangible assets in the mining industry, as they are in other industries. Mining technologies include a wide range of innovation in exploration, mining methods, and processing, and even “aim to improve worker safety, increase efficiency, and minimize environmental impacts.”Footnote 8 Due to the range of innovation taking place in the mining sector, there is a mixed approach to the type of intellectual property strategies used. For example, patents can be used for inventions, confidential information for “know how,” and copyright for software, plans, and designs.Footnote 9

Even though it is not widespread, some companies within certain segments of the mining industry may apply for patent registration to protect inventions or processes.Footnote 10 New patented technologies in the mining industry can lead to increased efficiency, productivity, and innovation, from “LED mining headlamps” to “tele-mining” robots.Footnote 11 Companies apply for patents for a number of reasons, including to use the subject matter exclusively, to serve as evidence of prior art, to use in negotiations, and to mark clear boundaries of ownership in the case of collaboration.Footnote 12 On the other hand, patent registrations may be abandoned for reasons such as low return on investment or that the company has decided to invest in alternative inventions.Footnote 13

Although this report predominantly focuses on data available from patent applications and registrations, patenting is not the only means by which mining companies protect their inventions and processes: an alternative to patenting frequently used in the mining industry is undisclosed or confidential information (trade secrets).Footnote 14

Patenting requires disclosure of the claim of the invention or process, while confidential information can only be protected so long as the information remains confidential.Footnote 15 Furthermore, the protection afforded to confidential information is not as robust as patent law. For example, confidential information is not protected by reverse engineering or independent creation. On the other hand, companies can protect a wide range of proprietary information using confidential information. Therefore, the scope of protection offered by confidential information is broader because it can protect inventions and processes that may or may not ordinarily qualify for patent protection.Footnote 16 A mining company may, for example, require that the resulting data from the performance of new equipment remain confidential.Footnote 17 Other uses of confidential information may include extraction methods or exploration data.Footnote 18

In the context of patent-eligible inventions or processes, confidential information can be used where a competitive advantage (and not necessarily the intent to commercialize the invention or process itself) is sought.Footnote 19 Notably, determining whether to use patents or confidential information is always based on careful consideration and the overall objectives or strategy of the company.Footnote 20 Due to the nature of confidential information, without qualitative research and voluntary admission from those who use it, it’s impossible to gauge exactly how widely and for what subject matter confidential information (trade secret) protection is used.

In order to appreciate the preference for certain intellectual property strategies, it is important to understand the environment within which innovation in the mining industry takes place. For example, as Reference Brierly, Kondos, Vaikuntam, Raja and RamachandraBrierly and Kondos (2016) observe, innovation can arise both from within the mining industry and from peripheral industries. It has been suggested that “evolutionary” innovation comes from the mining industry, whereas “revolutionary” innovation comes from secondary sources, such as manufacturers and suppliers of mining equipment, technology, and services (METS), government, and universities. Furthermore over the last few decades, there has been a shift in the Canadian mining sector.Footnote 21 Where mining companies traditionally invested in research and development internally, the landscape has shifted more to an outsourcing model, which has led to the development of a broad and growing METS industry.Footnote 22 These newer firms have been developing technologies and sophisticated intellectual property strategies.Footnote 23

Generally, the mining industry was and remains extremely competitive.Footnote 24 The competitive environment, coupled with the large magnitude and scale of operations in the mining industry, can create risks associated with investing, developing, and testing new technologies and innovation.Footnote 25 Ultimately, this can result in companies becoming proprietary and increasingly cautious about sharing their innovations.

In 2007, the federal, provincial, and territorial Mines Ministers met and “agreed to press forward in key areas to support the competitiveness of the mining sector.”Footnote 26 In doing so, they “endorsed” the creation of the Canada Mining Innovation Council (CMIC). CMIC’s mandate was to help the industry develop a strategy to increase research and innovation in the mining industry.Footnote 27

In 2008, as part of their mandate, CMIC published the Pan-Canadian Mining Research and Innovation Strategy, setting the stage for collaboration and innovation systems within the industry.Footnote 28 The report also stated:

Canada’s mining and mineral processing sector faces key challenges related to R&D, innovation, and commercialization. There is a need for technological solutions to advance sustainable mining, meet environmental standards and regulations, reduce costs, increase the value added, and protect the health and safety of workers. There is a lack of efficient and cost-effective access to R&D capacity in Canada and globally. There are shortages of necessary engineers and scientists that are not being matched by increasing enrolment in most university mining departments. Furthermore, Canada is not fully capturing the commercial benefits of R&D for domestic and international markets.Footnote 29

Since then, CMIC has been championing an “open innovation” approach to the development of technology platforms and developing consortiums involving various segments within the industry.Footnote 30 Notably, the term “open innovation” is industry and context specific. This can be a nuanced term as the definition and boundaries associated with “open” and “sharing” can vary among stakeholders.Footnote 31 It may be that in a consortium model, the intellectual property is still owned by the entity that brought it in but is open to being shared with project participants. Belonging to the consortium in some cases may give member companies the ability to access and share new inventions or innovations on a preferred royalty basis or even royalty free.Footnote 32 For the purpose of this analysis, the term “open” may be interchangeable with collaborative but should not be confused with “free.”

However, despite these efforts, the culture of the mining industry has remained a challenge for collaboration in this industry. For example, “Openness to Sharing and Intellectual Property Considerations” was identified as one of the eight barriers in a report based on stakeholder inputs at the Energy and Mines Ministers’ Conference in 2017:

[G]iven the competitive nature of the mining sector, there is a lack of transparency and a closed culture of sharing information, including valuable intellectual property (IP), between industry and the supporting stakeholder groups. This results in a preference to develop ideas in-house or with a small group of partners, rather than sharing information and cross-pollinating ideas across the broader mining ecosystem.Footnote 33

Furthermore, based on qualitative research carried out on the Canadian mining industry in 2016, it was revealed that companies “are also very reluctant to trust each other, since the concept of formalized collaboration is still new and constituents are protective of their intellectual property (IP) and competitive advantage” and that “[f]or many companies, the concept of collaboration simply isn’t in their DNA.”Footnote 34 As previously mentioned, the environment in which the mining industry operates is very competitive and there are some risks associated with the development of new technologies. While collaboration may seem like an interesting avenue, it is not surprising that some companies remain cautious or reluctant.

Due to the lack of evidence and indicators used to measure collaborative initiatives in this sector, there’s a large variance in the value of the intellectual property in question from the perspective of companies. As more collaboration occurs, one would expect the perceived values to converge. Despite this, there have been initiatives that demonstrate the shift that mining and related extractive industries have been making toward collaboration.Footnote 35

Many firms now desire to move toward riskier initiatives and breakthroughs or disruptive innovation and, due to the lack of internal capacity, are increasingly collaborating with external parties. This strategy is aligned with emerging evidence that such collaborations will enable them to accelerate innovation and be more competitive as opposed to firms remaining internally focused.Footnote 36 In line with this idea, the Government of Canada proposed a new intellectual property strategy in Budget 2018 that will enable better access to shared intellectual property so that small and medium-sized enterprises (SMEs) can grow their business.Footnote 37

The following section presents the approach taken in this chapter to use patents as a metric of innovation.

11.3 Patented Inventions in the Mining Sector

Measuring innovation is a difficult task. Currently, a universal indicator for measuring innovative activities does not exist, as it is difficult to capture all of the elements that comprise the innovation process. However, patenting activity has been identified as a good proxy for measuring innovative activities. It was noted in the report, “The Use of Intellectual Property Rights and Innovation by Manufacturing Firms in Canada,” that world-first innovators patent more frequently and firms that patent infrequently tend to be imitators.Footnote 38 In addition, the study finds that firms that protect their intellectual property are more likely to increase their profits than those that do not. Moreover, SMEs that patent are more likely to be high-growth firms and are more likely to export, which is important for success.Footnote 39 These conclusions are reinforced by a Canadian study that noted that firms that are aggressive innovators, meaning that they introduced a radically new product that involves patent protection, have higher profits.Footnote 40 Finally, while some inventions are not patented, patents are obtained for almost all economically and historically significant inventions.Footnote 41

Patent data, like most data sets, does have limitations. While patents measure the flow of new ideas, they only partially measure innovation for three important reasons: patents do not include non-patented innovations (e.g., trade secrets), not all patents result in commercialization, and many patents are strategic in nature.Footnote 42 It is important to understand that patent data will not provide a representation of innovation in the mining sector in its entirety, but rather a good approximation of the overall level of inventive activity.

This section takes a more in-depth look at the Canadian contribution to the patent landscape using patent families as the primary metric. Overall, Canadian patenting activity in the mining industry increased 159 percent between 1990 and 2014. As seen in Figure 11.1, in the early 1990s, patent families filed by Canadian applicants, hereinafter referred to as “assignees,” actually decreased before climbing in 1995. The increasing trend gradually continued until 2004, although with some degree of fluctuation over the years, before experiencing a significant uptick in 2005. In 2008, around the time of the Great Recession, patent families filed decreased considerably; however in 2009, those losses were negated as filing activity picked up and continued to grow until 2015. Although the drop in patenting activity in 2015 is generally consistent with slumping industry performance worldwide driven by lower oil and natural resource prices, it may also be partially due to data truncation.

Figure 11.1 Canadian patenting activity in the mining sector between 1990 and 2015.

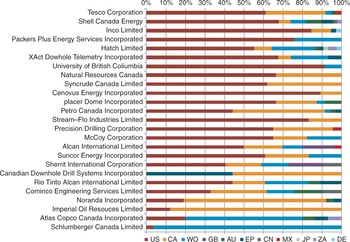

In order to gain a better understanding of Canada’s business and institutional strengths in relation to patenting in the mining sector, the following analysis examines the filing tendencies for the most active mining firms and METS. Note that the assignee name(s) on a patent are not always updated to the most recent entity assigned to the patent. Should a merger or takeover occur, for example, the decision is up to the acquiring firm about whether to update the information contained on the patent. As such, this analysis does not update the names of the patent assignees to reflect mergers and acquisitions, but rather maintains the information as presented in the data. For this reason, Inco Ltd., for example, still appears as the patent assignee in our dataset although it was acquired by a foreign company over a decade ago. Keeping the names as they appear on the patent documents is a good opportunity to show how some of the top companies performed prior to being acquired.

In Figure 11.2, we see that many of the leading Canadian patent filers, including Tesco, Shell, Imperial Oil, and Petro Canada are companies active primarily in the oil and gas field. Considering the methodology used to extract the patent data for this analysis follows the same approach used in the other chapters of this book and explicitly excludes oil and gas patents, this finding suggests that these companies are actively patenting in areas outside of their core business as the inventions being protected apply to many industry sectors that use similar instruments and practices. Notably, the patent families associated with these mining firms and METS are predominantly in the exploration and environmental categories. With respect to companies that operate primarily in the mining sector, Inco Ltd., the third-ranked company in terms of quantity of patent families filed, was formerly the world’s leading producer of nickel. The Toronto-based company now operates as a subsidiary of Vale Canada Ltd. following its acquisition by the Brazilian mining company Vale in 2006.Footnote 43 Inco’s patent families are predominantly tagged to the refining category, but also to the exploration category. Alcan, the fifth-ranked mining company and one of the world’s largest aluminum manufacturers, is also a significant patenting entity. In 2007, the company was acquired by Australian-British multinational Rio Tinto, and was subsequently renamed Rio Tinto Alcan. Also among the top Canadian filers in this field are two public entities: the Government of Canada’s Department of Natural Resources and the University of British Columbia.

Figure 11.2 Top Canadian mining firms and METS and their associated mining sector category, 1990-2015.

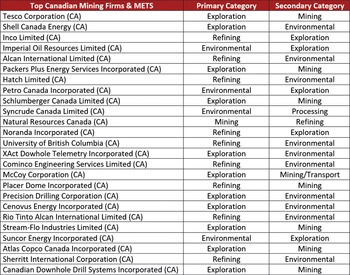

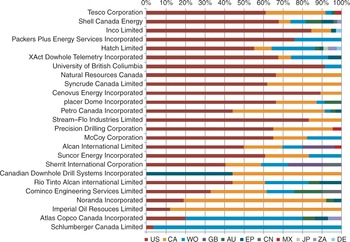

Understanding in which countries the leading Canadian mining firms and METS are seeking protection provides an indication as to what markets they see as strategic priorities. However, examining priority country shares for the top applicants shows a strong bias by companies to file first in countries in which they operate. Canadian companies do have a tendency to file predominantly in the United States, likely due to its large market size and the presence of competitors working in similar fields. In Figure 11.3, all of the leading Canadian mining firms and METS have priority filings in the United States.

Figure 11.3 Priority country share for top Canadian mining firms and METS.

Overall, the observed behaviour in priority patent family filings by the top Canadian mining firms and METS is consistent with the filing tendencies for all Canadian assignees. The United States and Canada account for more than 80 percent of all countries where patents are filed first. Patent Cooperation Treaty (PCT) patent families, represented by the WO country code, account for approximately 8 percent of all priority country filings. Other jurisdictions identified in Figure 11.4 that are targeted by Canadian assignees, but to a significantly lower degree, include the European Patent Office (EP), Great Britain (GB), Mexico (MX), Japan (JP), South Africa (ZA), and Germany (DE). Also highlighted is the distribution for other participating countries in this publication, specifically, Australia (AU), China (CN), Brazil (BR), Colombia (CO), and Chile (CL).

Patenting activity is an important indicator of innovation within an industry and can further explain the directions and types of technologies being created. The patent landscape map in Figure 11.5 is an interesting way to visualize patent data. The map is generated by an algorithm that uses keywords from patent documentation to cluster patent families according to shared terminology. The patent families are organized based on common themes and are grouped as “contours” on the map to identify areas of high and low patenting activity. The “snow-capped” peaks in white represent the highest concentrations of patented inventions, and each peak is labelled with key terms that tie the common themes together. Shorter distances between peaks indicate that the patented inventions they represent share more commonalities relative to those that are further apart. The distance between keywords helps to illustrate their relationship to one another. Keywords that are located closer together may refer to similar systems or technologies, whereas keywords located further apart have less of a relationship.

As noted previously, the use of the keywords presented in the map along with the most common International Patent Classification (IPC) codes found in the patents, allows for the identification of various technological areas under development in the sector. Note that many keywords are ubiquitous and would also be found in other industries and technologies. For this reason, the mining-specific keywords found in the landscape map are more useful. More widely used keywords could then be used to further refine the patent search. The opaque or less-visible keywords would provide a second level of detail. The intention is to facilitate the exploration of patent data for those interested in the technology or industry. Figure 11.5 shows that the highest concentration of patents in this Canadian dataset relates to patents comprising keywords such as “drill, involve, string,” “pipe, drill, rig,” “data, computer, involve,” “mandrel, house, rotation,” “tubular, wall, wellbore,” “solution, ion, remove,” “leach, copper, contain,” and “port, valve, flow.” The ocean separating the islands highlights technological areas of patenting activity that are very different from each other. The top IPC in this dataset is predominantly E21B (earth or rock drilling), which, not surprisingly, is tagged to the exploration mining category. Other IPCs found in the map include C22B (production or refining of metals) and B01D (separation) but to a much lesser extent. To facilitate a deeper understanding of specific mining industry subsectors, specific mining categories have been highlighted in yellow. The size of the grouping is representative of the breadth of patent families tied to a specific category. Groupings with multiple snow-capped peaks are indicative of categories with a larger number of patent families. In this case, the exploration category grouping also includes patent families that are categorized to the other mining sector categories as one patent family can be associated with many IPC codes.

Section 11.4 of this chapter examines patenting activity in the mining sector categories in more detail.

11.4 Patented Inventions in the Mining Sector Categories

The following section contains three subsections. The first presents the filing trends by mining category and highlights the mining categories in which the Canadian mining sector is relatively specialized. The second includes an analysis of collaborations that took place in specific mining categories and finally, the third presents a cluster analysis showing patenting intensity by provinces.

11.4.1 Specialization of the Canadian Mining Sector

Now that a high level overview of the patenting activity by Canadian assignees in the mining sector has been presented, this section dives deeper into the data and examines the categories of the mining sector, namely, and in no particular order, exploration, automation, mining, transport, refining, blasting, environmental, processing, and metallurgy. As explained in Chapter 2, the patent family data has been categorized according to designated sectors of activity in the mining industry.

Examining the trend in patent family filings for each of the mining categories can provide a better indication as to which ones are responsible for higher levels of inventive activity. It comes as no surprise that the exploration category is tagged to the most patent families considering most of the leading Canadian assignees are involved in this field. The trend in patenting activity in this category follows very closely the trend for all categories combined in Figure 11.1. Overall, the trends observed for each of the categories in Figure 11.6 seem generally to follow similar growth patterns over time, but the magnitude of the growth does vary.

Figure 11.6 Canadian patenting activity by mining category between 1990 and 2015.

In order to gain a better understanding of Canada’s performance in terms of patenting activity in the mining sector, we use the Relative Specialization Index (RSI) (additional detail in Annex). The measure uses patenting intensity to allow for industries to be compared between countries of different sizes on a similar basis. The RSI index provides a ratio of each country’s share of patent families within the mining sector as a share of the country’s total patent families produced within a given timeframe. In categories where the value is greater than zero, Canada is seen to be relatively specialized compared to the rest of the world. Figure 11.7 reveals that Canadian assignees are relatively specialized in the exploration, blasting and processing categories.

Figure 11.7 Relative Specialization Index (RSI).

Note: The automation subcategory has been removed from the RSI figure because Canada holds only one patent family tagged to this category. The RSI figure is based on patent family data used by WIPO rather than INPADOC patent families that are used throughout this Canadian section of the chapter.

Figure 11.8 represents a more focused patent landscape map, created to determine the type of technologies that have been protected. This provides a deeper understanding of patenting activity within the exploration category and identifies the areas in which Canadian assignees are specialized. As noted previously, the use of the keywords presented in the map along with the most common IPCs found in the patents allows for the identification of various technological areas under development in this category.

In the exploration category, 1,385 patent families were identified, with the prominent keywords being: “data, computer, base,” “transmit, signal, transmitter,” “reservoir, production, injection,” and “pipe, handle, rig.” These keywords are not particularly mining-specific and neither are the second-level keywords. The use of these keywords with the appropriate IPCs would be required to identify mining patents related to this category. The IPCs classified to the exploration category as identified in the methodology section (WIPO section) include predominately E21B (earth or rock drilling), and others such as C09 K (materials for applications not otherwise provided for), G01 V (geophysics; gravitational measurements; detecting masses or objects), and G01 N (investigating or analysing materials by determining their chemical or physical properties), but to a much lesser extent.

Inventions around the “data, computer and base” as well as the “transmit, digital and transmitter” snow-capped peaks are related to data transmitting and gathering methods and systems. Digital technologies, now more affordable and available, are used to improve productivity in the mining sector.Footnote 44 The snow-capped peaks characterized by “pipe, handle and rig” and “reservoir, production and injection” are related to technologies aimed at improving pipe handling and methods for lifting fluids. These peaks are related to drilling and extraction techniques often applicable to both the oil and gas and the mineral mining industry.

The red dots in Figure 11.8 represent patent families involving more than one company, hereinafter referred to as “collaborations.” While these collaborations are scattered throughout the map, they seem to be concentrated around the “reservoir, production and injection” and “data, computer and base” peaks. The fact that there are a number of collaborations further away from these peaks could be an indication that the collaborative work is occurring outside of the main areas of research that many companies are involved in.

11.4.2 Analysis of Collaborations

As indicated in Section 11.2, there has been a shift in the mining sector recently, as the sector moves toward more collaboration. Patent data is one source of information that can be used to get an idea of the level of collaborative activity between companies in this sector. The increasing trend in the number of patent families involving two or more companies as observed in Figure 11.9 confirms the culture shift that the industry is said to be experiencing. The significant number of collaborations from 2013 onward is noteworthy. The increase in collaborations over the last few years may be a result of companies pooling resources to collectively pursue similar objectives during a downturn in the sector. Optimizing research efficiency and innovation potential through collaboration was one of five strategic goals of the Pan-Canadian Mining Research and Innovation Strategy in 2008 to help better maximize the limited pool of funding accessible.Footnote 45

Figure 11.9 Collaborations and their distribution by mining sector category between 1990 and 2015

Note: The patent family counts represented by the trend line will not equal the sum of collaborations for all categories since some patent families are included in more than one category.

Figure 11.9 breaks down the number of patent families involving collaborations from 1990–2015 by category and highlights their share as a percentage of all patent families filed annually. Patent activity in the exploration category is an area where Canadians assignees who are collaborating, regularly seek protection. The environmental, mining, and refining categories are other categories involving collaborations where protection is sought, but to a lesser extent. Although on average between 1990 and 2015 patent families involving collaborations represent 4 percent of the total number of patent families, we notice that collaborations are representing a growing share of patent families in more recent years.

Increases in innovation in the area of exploration may partially be attributed to incentives offered by the Canadian federal and provincial governments to attract investment in mining, including the Canadian Exploration Expense Claims (CEE) and Mineral Exploration Tax Credit (METC).Footnote 46 Exploration activities are both costly and risky and it has been suggested that incentives such as METC are the key to financing these activities and to sharing knowledge, especially where junior mining companies are concerned.Footnote 47

As the Prospectors & Developers Association of Canada Report suggests:

Canada’s unique mining ecosystem is largely comprised of thousands of small-to-medium enterprises.

…

This subcontracting of risk from big mining companies to entrepreneurial small businesses is part of the unique system that keeps Canada’s mining pipeline full.

Unlike large companies, however, juniors cannot rely on revenues or on bank loans for financing – their development sites are not yet proven, and they are working with a potential for profit, not the certainty of one. As such, they rely heavily on equity investors who must weigh the possibility of high reward against the risk that nothing valuable may be found.

The METC & flow-through shares system is globally unique.

No other country has such a sophisticated, forward-thinking policy infrastructure in place to encourage investments in grassroots mining exploration, which in turn sustains its mining industry. The METC and flow-through shares system only applies to the grassroots exploration expenditures that junior companies undertake, and acts as an investment incentive.Footnote 48

While it is not easy to quantify the number of collaborations between companies within the mining industry without conducting extensive empirical research, patent data may capture some relevant information about these collaborations as they relate to patentable subject matter. Collaboration maps are useful for visualizing patent data and facilitating the identification of collaborations. These maps are not only used to identify which companies are working together but can also be used to examine the data more closely to extract potentially valuable insights.

In the collaboration map in Figure 11.10, each yellow dot represents a patent family and the dots linking two applicants indicate that they are named as joint applicants on a patent application. This collaboration map highlights joint work between two of the top applicants in the Canadian mining sector, Inco Ltd. and Noranda Inc., before both were acquired by other companies. These two companies are associated with patent families categorised in multiple mining categories, but the patent family to which they are jointly assigned in this collaboration map is tied to the exploration category. These two companies also collaborated with other companies that patented in other mining categories. This demonstrates how these two large companies were actively working in various areas of the mining sector. Interestingly, Noranda also collaborated with McGill University, which is assigned to patent families linked to the environmental and refining categories. When two or more entities work together, they each bring to the table a specialization that, when combined, can lead to more advanced ideas if the proper synergies exist. In the case of Noranda Inc. and Inco Ltd., these two companies have leveraged their collaborative work and established a commercial agreement to refine copper anodes.Footnote 49

11.4.3 Cluster Analysis

In Figure 11.11, Canada’s mining clusters are presented in a geographic map highlighting the active mining sites. Comparing this map to the geographic map in Figure 11.12, which highlights clusters based on the areas with a concentration of patent families identified by using the company address information on patents, we can observe some similarities in areas of activity based primarily in Canada’s major cities as well as in more remote regions located closer to the mining sites. There are many benefits for firms in the same industry to cluster together, including increased productivity, faster innovation through collaborative research, and the creation of small businesses to cater to the niche needs of this industry.

Figure 11.11 Canadian mining industry clusters.

The size of the clusters is also interesting. There are 12 business clusters, comprised of 10 or more companies, which emerge as key areas leading innovation in the Canadian mining sector. Nevertheless, there also appears to be a significant amount of patenting activity from individual companies outside of the clusters, as identified by the red dots overlaid on the map. The provinces have been color coded in different shades of blue, with provinces that have higher patent levels being darker. Most of the companies that have filed patent families in the mining field are located in Calgary, the largest of the clusters having 368 companies. This is not surprising considering the concentration of oil and gas companies in this area and the similarities in technologies used by the two industries.

Other cities with large clusters include Edmonton (127 companies), Toronto (123 companies), Vancouver (86 companies), and Montreal (71 companies). The fact that these clusters are major hubs of innovative activity is no surprise given that some of the largest international and Canadian mining firms and METS are headquartered or have a significant presence in these cities. For instance, Toronto, the second-largest cluster based on the number of patenting entities, includes companies such as Barrick Gold Corporation, Vale, and Glencore. It is also not surprising to find such large companies in this city, as it is the global center for mining finance. Toronto is also home to several dozen mining company head offices, as well as several hundred mining suppliers, consulting firms, and service providers.Footnote 50

Interestingly, the geographical map in Figure 11.12 can also be used to highlight centers of expertise based on clusters of companies specializing in a particular category of mining. For example, Vancouver is described as the global center of expertise for mineral exploration, with approximately 700 exploration companies located in the province of British Columbia. Among the many companies in Vancouver, Goldcorp and Teck Resources Ltd. are two of the largest players. Nevertheless, the patent families filed by Canadian companies in this city are tagged to a variety of categories including exploration. Interestingly, patent families linked to the exploration category are also present in other areas beyond the province of British Columbia, such as Calgary and Edmonton. Calgary, although primarily specialized in exploration, also has the highest number of patent families linked to the processing category of all the Canadian clusters; a category in which Canada has a specialization as per the RSI in Figure 11.7.

11.5 Conclusion

In this analysis, we have investigated patenting activity by Canadian mining firms and METS. The information presented provides a view of the innovative activity taking place in this sector. It provides a starting point for diving deeper into the patented inventions of the leading players and for exploring the data more closely. WIPO’s methodology for categorizing mining sector patents has facilitated a more thorough analysis to identify areas where Canada is relatively specialized. Having an understanding of Canadian technological strengths helps policymakers develop targeted policies that can be designed to increase our performance in specific fields with the ultimate objective of advancing innovation. Collaboration is another useful indicator of innovation in the mining sector used in this analysis.

Section 11.2 of this chapter provides an overview of the mining industry as it relates to the use of intellectual property rights to protect various forms of innovation. It also highlights a general shift in culture toward collaboration despite the nature of the mining industry and the fact that companies remain protective of their intellectual property rights. Overall, it seems that the industry is moving toward a more open environment and the trends observed in Section 11.4 corroborate this recent movement of increased collaborative activity, especially from 2010 onward.

The analysis in this chapter also uses patent landscape maps and geographic maps to present a more holistic understanding of innovation in the Canadian mining sector. Keywords presented in the landscape maps, along with the most common IPCs found in the patents, allow for the identification of specific inventions in the technological areas. Geographic maps are used to locate companies that patent, and to determine if they are in locations where there is a cluster of companies. Overall, this analysis presents the value obtained from examining patent data to extend our understanding of innovative activity within the industry.

As environmental standards and regulations continue to increase, the challenge for companies operating in this sector to develop new technological solutions to advance sustainable mining becomes more important. Patent data is a good source of information to better understand the innovative activity that is occurring. The information extracted from patent data is an important resource available to policymakers and companies for use in decision-making.