1 Introduction

People want to be happy: when confronted with a decision, they’d rather choose the path to joy than the path to misery. If only it were that simple! One problem is that the paths are rarely labeled; instead people have to imagine the feelings that the outcome of their decisions would trigger. And, although people are relatively skilled at predicting how a certain outcome will make them feel, they are less skilled at predicting the intensity and duration of those emotions. You can guess that getting tenure will make you happy, but the elation will dissipate faster than you would imagine. This asymmetry between anticipating and experiencing emotions has been studied in the laboratory, as well as in natural settings, under the banner of “affective forecasting” (Wilson & Gilbert, Reference Wilson and Gilbert2003).

In a typical laboratory study of affective forecasting, participants first report their general happiness and next engage in some experimental procedure with uncertain outcome. Finally, some participants are asked to predict how happy they would feel after receiving a particular outcome, while others are told the outcome first and then are asked to report the happiness they experience. This allows researchers to measure the extent to which anticipated and experienced feelings depart from the baseline level of happiness reported at the beginning of the session. The typical result is that participants overestimate the duration of their forecasted emotions, which leads them to overestimate how intense their feelings will be some time after the outcome. For example, when asked to imagine how they would feel 10 minutes after losing money in a gambling task, people predict more unhappiness than the unhappiness they experience 10 minutes after actually losing (Kermer, Driver Linn, Wilson, & Gilbert, Reference Kermer, Driver Linn, Wilson and Gilbert2006). People also overestimate the intensity of their initial reaction (Buehler & McFarland, Reference Buehler and McFarland2001).

Considerable evidence has accumulated over the last 10 years in support of the basic finding that people overestimate the impact that future events will have on their emotional response (Gilbert, Pinel, Wilson, Blumberg, & Wheatley, Reference Gilbert, Pinel, Wilson, Blumberg and Wheatley1998). Most of these studies have equated emotional response with changes in valence. For example, some studies have asked participants to report their happiness on a scale ranging from not happy to very happy. Other studies have asked participants to report the intensity of several different emotions and those reports were later converted into composites scores of positive and negative valence (Buehler & McFarland, Reference Buehler and McFarland2001). This emphasis on the pleasant/unpleasant dimension has proved useful for the study of affective forecasting. However this approach also begs the question of whether the forecast bias extends beyond the pleasant/unpleasant dimension to include biases when predicting the intensity of specific emotions. We know that people are relatively skilled at predicting which specific emotions (e.g., anger, fear, disgust, etc.) they will experience in different situations (Robinson & Clore, Reference Robinson and Clore2002). We know less about how accurate people are at predicting the intensity and duration of those specific emotions. A few studies have started to examine this question particularly for the feeling of regret. The current study is another step in that direction.

Regret can be defined as “a negative, cognitively based emotion that we experience when realizing or imagining that our present situation would have been better, had we decided differently” (Zeelenberg, Reference Zeelenberg1999, p .94). Thus, regret is unique among emotions in its reliance on counterfactual thinking: “If I had chosen differently, then things would have turned out better.” When counterfactuals are readily available, regret seems to grow more intense. For example, people’s intuition is that poor choices are most regretful when they are unusual choices; in those cases, the conventional approach is readily available as a counterfactual. For a similar reason, people believe that they will experience more regret when the desired outcome is narrowly missed than when it is missed by a wide margin. Presumably, a loss by a narrow margin highlights the unfulfilled success (Medvec, Madey, & Gilovich, Reference Medvec, Madey and Gilovich1995). As a consequence, people believe that missing a flight by 5 minutes should cause more regret than missing it by an hour. Psychologists have shared that same intuition for over 20 years (Kahneman & Tversky, Reference Kahneman and Tversky1982).

The intuition that narrow margins of loss are highly effective at triggering regret has been challenged by a recent study on affective forecasting (Gilbert, Morewedge, Risen, & Wilson, Reference Gilbert, Morewedge, Risen and Wilson2004). In a naturalistic setting, people who missed the subway by a narrow margin reported no more regret than those who missed it by a wide margin. This result was in stark contrast to the predictions people made when interviewed before the train arrived. The finding was replicated in an experimental setting. For this, a new set of participants was recruited to play a game inspired by the TV show The Price is Right. Before starting the game, participants were asked to report their emotional state at the time, including a report on their level of regret and of disappointment. Next, people were asked to rank several household products by price. Participants had to create two arrangements that exemplified their two best guesses, and then proceeded to choose the best one for an opportunity to win a prize. Some participants were asked to predict how much regret they would feel if they were to find out that the correct arrangement was the one they did not choose (a narrow margin of loss). This condition aimed to experimentally recreate the situation in which a participant is asked to imagine having narrowly missed a desired outcome (e.g., catching the subway). Participants’ predictions in this condition were compared to the actual feelings of regret, as reported by participants who actually experienced a narrow margin of loss. Other participants were asked to predict how much regret they would feel if they found out that neither of the two arrangements was correct (a wide margin of loss). As hypothesized by the authors of the study, participants predicted they would feel more regret after losing by a narrow margin, but in reality they did not. In other words, there was an asymmetry between the amount of regret anticipated and the amount of regret experienced.

These results were consistent with a theory of affective forecasting that has received substantial empirical support over the years (Wilson & Gilbert, Reference Wilson and Gilbert2003). At the same time, some aspects of the experimental design cast doubt on the generalizability of the findings. In particular, participants in Gilbert et al.’s (Reference Gilbert, Morewedge, Risen and Wilson2004) study were offered a consolation prize after being told they had lost. This small prize may have helped participants to re-conceptualize the loss as a minor win, thus reducing the amount of regret experienced. In fact, previous research shows that people recover most quickly from negative events when it is easier for them to rationalize the outcome to their favor (Gilbert et al., Reference Gilbert, Pinel, Wilson, Blumberg and Wheatley1998). Thus, the absence of a consolation prize might lead to a very different pattern of results, one in which the experience of regret is stronger than anticipated. Our study tested this hypothesis.

Another limitation of the 2004 study by Gilbert et al. is its reliance on a self-report measure. While this approach has been validated for basic emotions such as happiness, its use for assessing more complex emotions such as regret is a matter of debate. Asking people directly to report how much regret they are feeling assumes that people can easily associate their feelings with the verbal label. Although some researchers claim this is indeed possible (Zeelenberg et al., Reference Zeelenberg, van Dujk, van der Pligt, Manstead, van Empelen and Reinderman1998), others argue that such direct questioning fails to discriminate regret from other negative emotions such as disappointment (Connolly & Butler, Reference Connolly and Butler2006; Marcatto & Ferrante, Reference Marcatto and Ferrante2008). Furthermore, self-report measures are subject to possible carry-over effects when the same emotion is probed twice, as is often the case in studies of affective forecasting.

One way to overcome the limitations of self-report measures is to explore the influence that regret has on future behavior. Some researchers have argued that emotions in general, and regret in particular, exist for the sake of guiding behaviors (Zeelenberg, Nelissen, Breugelmans, & Pieters, Reference Zeelenberg, Nelissen, Breugelmans and Pieters2008). Many of the choices people make aim to minimize the experience of regret, and anticipation of regret serves to deter risk taking (Mellers, Schwartz, & Ritov, Reference Mellers, Schwartz and Ritov1999; Zeelenberg, Reference Zeelenberg1999). Merely imagining the regretful consequences of our potential actions is sometimes enough to make us decide differently (Kahneman & Tversky, Reference Kahneman and Tversky1982; Simonson, Reference Simonson1992). Thus, by measuring risky behavior after a narrow loss it should be possible for us to assess whether experiencing or imagining the narrow loss is more effective in triggering the emotion.

We explored this possibility with a variant of a gambling task first introduced by Slovic (Reference Slovic1966), which our participants completed after participating in The Price is Right task. Participants viewed ten cards face down on a computer screen with the instructions that nine of the cards were good (i.e., selecting any of them would earn the participant a dollar per card), but one of the cards was a disaster card (i.e., choosing it would cause the loss of every dollar collected up to that point and end the game). Following these instructions, participant reported how many cards they would like to turn. After turning the initial number of cards, participants made a second and more important decision. They had to decide whether to stop and walk away with the money or continue and pick one more card for the chance to win another dollar. Thus, the opportunity of winning a relatively small prize was pitted against the risk of losing a larger amount (i.e., a regret prone situation).

In sum, using self-report and behavioral measures of regret, we aimed to show that in the absence of a consolation prize, the experience of regret is larger than anticipated. More precisely, we hypothesized that, after losing by a narrow margin, participants would express increased regret and behave more cautiously, the cautiousness being mediated by the regret.

2 Method

Participants. Ninety-two participants who had signed up for course credit in an introductory psychology course were recruited for this experiment. Demographic information was not gathered, but based on the composition of the student population at this private institution, the majority of the sample was White, Catholic, and upper-middle class.

Regret manipulation task. The task was adapted from the television show The Price is Right.

Stimuli. Two identical sets of seven common household products were placed on two shelves, one above the other. The items were randomly clustered in the center of each shelf. The left end of the shelves was labeled “lowest price” and the right end was labeled “highest price.” The price of the items ranged from $ 2.59 to $8.59.Footnote 1

Procedure. In a 2 x 2 between-participants design, participants either experienced making the wrong choice or imagined doing so. Participants in the experience condition were correctly told they would have an opportunity to win $10. Participants in the imagine condition were told that the task was at a pilot stage and thus there would be no money involved. In each group, half of the participants were told that the forgone choice was correct (narrow loss) while the other half was told that both choices were wrong (wide loss). Participants were tested individually.

Participants were asked to arrange the products by price, creating the two arrangements (one on each shelf) that exemplified their two best guesses. Next, each participant was asked to choose the arrangement s/he thought was most likely to be correct. At that point, participants in the imagine/narrow-loss condition were asked to report how much regret they would feel if they were to find out that the chosen arrangement was wrong and the forgone choice was right. Participants in the imagine/wide-loss condition were asked the same question but imagining that both options were wrongly arranged. Participants reported their answers in a sheet of paper by drawing a slash through a 225 mm line. One end of the line was labeled “very slightly or not at all” and the other was labeled “extremely.”

Participants in the experience condition arranged the products following the same instructions as the imagine group. After selecting their preferred set, participants in this group were told to enter the data in the computer to find out whether they had made the right choice. The reliance on a computer to provide feedback was intended to minimize suspicions about the feedback accuracy. Participants’ skepticism was a concern particularly in the experience-narrow condition, which required participants to believe the rather unlikely scenario that their choice was wrong but the forgone option was indeed correct. Participants typed the items in the same order as they had placed them on the shelves, and clicked the mouse to identify their preferred choice. After the mouse click, a message to the right of the arrangements provided feedback. In the narrow loss condition, the feedback said that the selected set was incorrect and the forgone set was the correct one. In the wide loss condition, the message stated that both selected and forgone sets were wrongly arranged. Immediately after receiving the feedback, participants were asked to report their feelings of regret using the same scale as participants in the imagine condition, as already described.

Card gambling task. Immediately after completing the regret scale, participants completed the Card Gambling task.

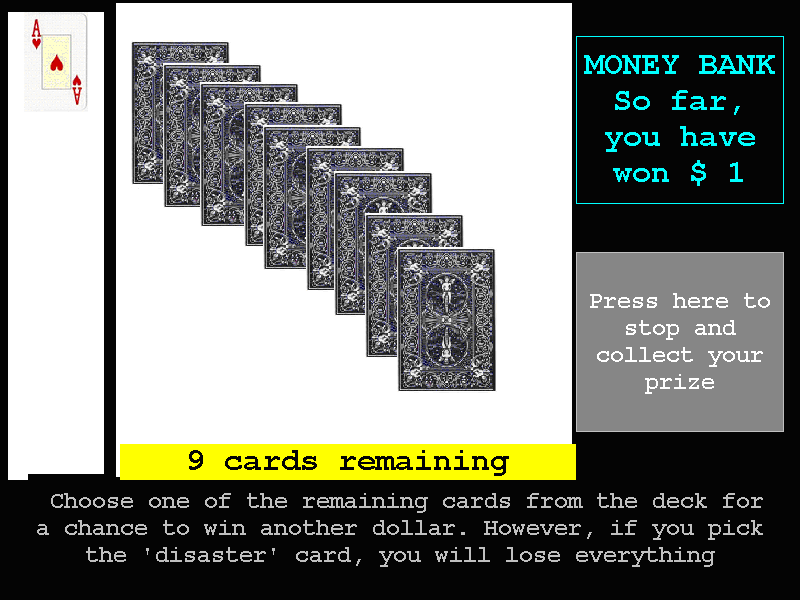

Stimuli. The game stimulus screen was identical to that of our previous studies (Fernandez Duque & Wifall, 2007) (see Figure 1). Using the mouse, participants played by selecting a face down card. When a card was selected, one of the good cards was displayed on the feedback screen for two seconds. The identity of the cards was fixed to ensure that all participants received the same feedback.Footnote 2 Following the feedback screen, an updated version of the stimulus screen appeared. The updated information included a reduction in the number of cards available for selection, an increase in the amount of money won, and the addition of the most recently selected card to the pile of cards already chosen. These updates occurred each time a card was selected. Unbeknownst to participants, the game was rigged so that the disaster card was displayed only when/if the participant turned the ninth card.

Figure 1: The stimulus screen following the selection of the first card. The nine cards remaining appear face down in the middle of the screen. To the left, the selected card appeared face up. To the right the amount of money won up to that point was displayed. In the lower right part of the screen, there was a box where participants could click after having selected the cards, to stop playing and collect the prize. In the bottom part of the screen, a yellow banner reminded participants of the number of cards remaining, below which were the main instructions for the task.

Procedure. At the beginning of the task, participants were read the following instructions from the computer screen:

In the deck there are 10 cards. Nine cards are good and one is bad. You will win one dollar for each “good” card you turn but if you turn the bad card you will lose everything and the game will end. You will get to keep whatever money you win, so try to play as well as possible. Choose one card at a time by clicking on it.

Participants were asked to decide how many cards to turn before beginning to select which cards to turn. The instructions were read out-loud from the stimulus screen by the experimenter, asking:

How many cards would you like to turn over before stopping? You don’t need to decide at this point “which” cards you will choose, but you do need to decide how many you will turn.

After reporting how many cards they would like to turn, participants selected which cards they wanted turned, by clicking on them. After completing this initial bet, participants were given the option to stop and collect their money or turn another card for the opportunity to win an extra dollar. This decision to stop or continue was the main dependent variable in the task.

At the end of the session, participants completed a debriefing form reporting whether they believed that money would be awarded in the game/s and that the games were not rigged. They also reported whether they thought the pricing task had influenced their decision on the card task. Finally, participants were debriefed and paid the money they had won.

3 Results

Twelve participants in experience-narrow condition reported not believing some aspect of the instructions when debriefed at the end of the session (i.e., they thought that one or both games were rigged and/or that money would not be awarded). In contrast, only three of the participants who experienced a loss by a wide margin were skeptical about the instructions. Thus, experiencing a loss by a narrow margin led to greater skepticism about the instructions than the other conditions, χ2 (1, N = 92) = 5.3, p = .02.Footnote 3 Furthermore, participants who were skeptical after experiencing a narrow loss reported less regret than those who believed such an outcome (Mskeptics = 95; Mbelievers = 145), t(28) = .025 (CI: 6.6 - 93.7). For these reasons, data from skeptical participants were excluded from the analyses.

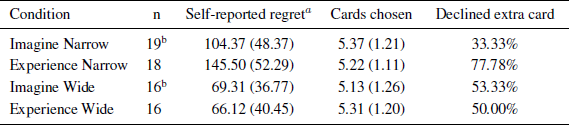

Self-report measure: Amount of regret reported. Data from the remaining 69 participants (43 females) were analyzed in a 2 x 2 design with Game Style (Imagined, Experienced) and Margin of Loss (Narrow, Wide) as between-participants factors (see Table 1).Footnote 4

Table 1: Self-reported regret, number of cards initially chosen, and percentage of participants who declined turning an extra card, as a function of condition in the “Price Is Right task”. Standard deviations appear in parentheses

a Scale ranged from 0 to 225 millimeters.

b One participant in this group initially chose 9 cards and therefore was not asked whether to turn an extra card.

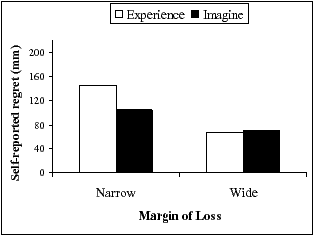

Participants reported more regret following a narrow margin of loss than a wide margin of loss, F(1, 65) = 27.3, p < .001. This is consistent with the idea that regret stems from counterfactual thinking: in losing by a narrow margin, the person is aware that s/he could have won had s/he selected the forgone choice. More interestingly, the effect of margin of loss interacted with the game style, F(1, 65) = 4.1, p = .05. (See Figure 2.) In particular, participants who experienced a narrow loss reported more regret than those who imagined such a loss, t(35) = 2.48, p = .02, (CI: 7.5–74.7).Footnote 5 In contrast, losing by a wide margin led to similarly low levels of regret across the experience and imagine conditions, t(30) = .8, ns. This makes sense, as participants in the wide margin of loss conditions were told that the forgone choice would have also led to a loss. Therefore, there was no reason for these participants to regret the choice they had made.

Figure 2: Self-reported regret in a 225 mm line, as a function of participants’ game style and margin of loss.

Participants in the imagine groups were told upfront that the feedback was going to be hypothetical and that they would not be playing “for real.” Those instructions aimed to prevent actual regret from influencing participants’ behavior in the subsequent task. Nonetheless, the instructions may have dampened participants’ ability or motivation to simulate their future emotions. To test this alternative hypothesis, a new batch of participants was run in the imagine-narrow condition. These participants were engaged in the task as actual contestants, except they had to forecast their feelings. Even with this procedure, forecasted regret of a narrow loss (M = 86.67, SD = 39.9) was lower than experienced regret (M = 145.50), t(25) = 2.96, p = .007.

Behavioral measure: Declining to turn an extra card. Two of the 69 participants were excluded from analysis on this variable because they chose to turn nine cards, thus hitting the disaster card. Therefore, the question of whether they wanted to continue did not apply to them. Of the remaining 67 participants, 46.3% decided to continue risking once the initial goal was reached. In other words, these participants chose to engage in a bet that they most likely would have come to regret if it turned bad. On the other hand, 53.7% of participants preferred to stop, thus avoiding the possibility of future regret.

Was the decision to stop gambling influenced by the conditions in the previous task? One might expect that after experiencing a loss by a narrow margin, people will be reluctant to put themselves in a position that could lead them to experience more regret. To examine this hypothesis, we ran a chi square analysis on the decision to take an extra card by the four conditions of the preceding task (experience-narrow, experience-wide, imagine-narrow, imagine-wide). The analysis revealed a marginally significant effect, χ2 (3, N = 67) = 7.3, p = .06. To explore the source of this effect, we ran follow-up chi square tests for each level of Margin of Loss. As predicted, when the margin of loss was narrow, participants who experienced the loss were more reluctant to continue gambling than those who merely imagined the loss, χ2 (1, N = 36) = 7.2, p = .007. When the loss was by a wide margin, the decision to continue gambling did not vary between those who experienced and those who imagined the loss (see Figure 3).

Figure 3: Percentage of participants who declined to turn an extra card in the Card task as a function of game style and margin of loss in the Pricing task.

The risk of turning an extra card is a function of the number of cards initially chosen: turning an extra card is relatively safe after an initial bet of 4 cards, but much riskier after a bet of 8. Thus, the reluctance to turn an extra card after experiencing a narrow loss might have been an artifact of unusually high initial bets in the experience-narrow group. To rule out this alternative interpretation, we ran an analysis of variance on the initial bets, with Game Style (imagine, experience) and Margin of Loss (narrow, wide) as the between-subjects factors. This ANOVA revealed no significant effects (ps > .3). Furthermore, the overall initial bet was similar to that of another study in which participants only did the Card task [Current study: 5.26 cards (SD: 1.17); without Pricing task: 5.38 cards (SD: 1.02)] (Fernandez Duque & Brown, Reference Fernandez Duque and Brown2008). Thus, it seems that the Price Is Right Task had little or no impact on the initial bet of the Card task. Therefore, differences in the initial bet cannot account for the cautious behavior that followed the experience of a narrow margin loss.

Was the reluctance to turn an extra card linked to the regret elicited by the preceding task? This question asks about the correlation between self-reported regret in the Pricing task and rejection of an extra card in the Gambling task as a function of the experimental manipulation. The idea is that regret (as measured by self-report after a narrow loss in the Pricing task) will make participants more reluctant to engage in a bet that they would come to regret if it turns bad.

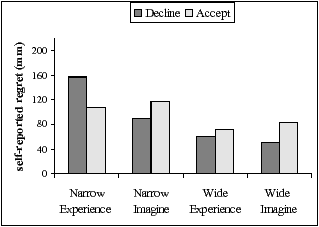

To test this hypothesis, we examined self-reported regret in the Pricing task as a function of whether participants declined to turn the extra card in the Gambling task. More precisely, we used self-reported regret in the Pricing task as the dependent variable for an ANOVA with three between-subjects factors: Decision about the Extra Card (Decline, Continue), Game Style (experience, imagine), and Margin of Loss (narrow, wide). This analysis revealed a 3-way interaction, F(1, 59) = 4.9, p = .03. (See Figure 4.) To explore that interaction, we ran follow-up t-tests in each of the four conditions of the Game Style x Margin of Loss design. Each of those t-tests contrasted the self-reported regret of participants who declined to turn another card to the regret of those who decided to continue.

Figure 4: Self-reported regret in the Pricing task as a function of its game style, margin of loss, and whether the option to turn an extra card in the Card task was accepted or declined.

These tests revealed that participants who declined an extra card after experiencing a narrow loss were more regretful of the narrow loss than participants who took the extra risk, t(8) = 2.3, p =.05. That is, the t-test revealed a correlation between the amount of regret experienced and the reluctance to turn another card, for participants who narrowly missed the prize. In other words, self-reported regret after experiencing a narrow loss biased participants toward regret-averse behavior. In sum, for this experimental condition, the decision to take an extra card was mediated by the level of regret experienced. The t-tests in each of the other three groups revealed no significant differences in the level of regret based on the decision to stop or continue gambling.

Were people aware of the influence that the preceding outcome had on their future behavior? We asked participants whether “the outcome of the pricing task influenced your decision in the card task.” Participants answered on a 5-point scale (1= strongly disagree; 5 = strongly agree). Participants who experienced a narrow loss agreed that the outcome influenced their future behavior to a larger extent than any other group, as revealed by Mann-Whitney tests comparing the experience-narrow group to each of the other groups, (MExperience-Narrow = 3.0; MImagine-Narrow = 1.2; MExperienceWide = 1.6; MImagine-Wide = 1.6), Zs > 2.5, ps < .02. Participants who declined turning an extra card claimed that the previous outcome influenced their behavior more than those who took the extra risk did (M stop = 1.14, M continue = 0.52), U = 434, Z = 1.9, p = .06.

4 Discussion

After finding out that they could have won had they chosen differently, participants in our study reported more regret than was anticipated by those who were asked to imagine that same scenario. Besides the increase in self-reported regret, experiencing a loss by a narrow margin also led participants toward more cautious behavior. In other words, those who experienced a narrow loss were most likely to decline the opportunity to turn an extra card in the following task. Having already suffered one regretful outcome, it seems they were reticent to risk another one.

Although these findings contradict the ones reported by Gilbert and collaborators (Reference Gilbert, Morewedge, Risen and Wilson2004), they are not necessarily incompatible with affective forecasting theory. To reconcile findings and theory, it is necessary to focus on a key methodological difference between the studies: the consolation prize. Participants in Gilbert et al.’s study were promised a consolation prize if they chose incorrectly.Footnote 6 This small prize may have helped participants to re-conceptualize the loss as a minor win, thus reducing the amount of regret experienced. In contrast, no consolation prize was offered to participants in our study. In the absence of a rationalization argument (e.g., “at least I won something”), our participants may have found it difficult to reduce their dissonance. Future studies should explore this possibility in more detail by systematically varying the presence and magnitude of the consolation prize.

A second methodological difference between the studies, namely, the delay in reporting the feelings, points toward the same interpretation. In the Gilbert et al. study, participants were probed about their feelings of regret 3 minutes after receiving the outcome. In contrast, in our study they were probed immediately after the outcome. Re-conceptualization requires some amount of time, and longer intervals between outcome and assessment usually lead to less intense emotions. Whether feelings of regret are so ephemeral that they evaporate in a delay of 3 minutes remains an open question. The answer might depend, once again, on whether an alternative interpretation is easily available for participants to re-conceptualize the outcome.

Opportunities for re-conceptualization may also explain the findings from naturalistic setting studies (Reference Gilbert, Morewedge, Risen and WilsonGilbert et al., 2004, experiment 2). In other words, a participant who misses the train but gains an opportunity to earn money answering a brief questionnaire may re-calibrate how regretful the experience was. On the other hand, there are important differences between the naturalistic setup and its experimental counterpart. In the naturalistic set-up, the difference between a narrow-margin loss and a wide-margin loss runs on a continuum: one can miss a flight by 5 minutes, 20 minutes or any number of minutes. In contrast, in the experimental setup there is a qualitative difference between a narrow margin of loss and a wide margin of loss. In this context, losing by a narrow margin means that the forgone choice was correct, while losing by a wide margin means that the forgone choice was not correct. It remains an open question whether, when it comes to experienced and imagined regret, this qualitative difference is akin to the quantitative difference of naturalistic contexts.

It is also possible that the contrasting findings between our study and the Gilbert et al. study stemmed in part from improvements we made to the protocol. For example, we took special care to ensure that participants believed the instructions. We were most concerned about participants who were told that they had lost by a narrow margin. Such feedback required participants to believe the rather unlikely scenario that their choice was wrong but the forgone option was indeed correct. We reasoned that this feedback would be more believable if delivered by a computer program instead of an experimenter. Both experience groups received feedback by the computer, thus controlling for a possible influence of computer-based feedback on feelings of regret. Despite our efforts to minimize the suspicion from our participants, many became skeptical after experiencing a narrow loss. Fortunately, we were able to filter out those participants. It is unclear whether the same was done in the study by Gilbert et al. Another improvement in the protocol was the method for estimating self-reported regret. Gilbert and collaborators (Reference Gilbert, Morewedge, Risen and Wilson2004) measured imagined and experienced regret relative to baseline levels reported at the beginning of the session. Furthermore, participants were asked about their feelings of disappointment at the same time they were asked about feelings of regret. In contrast, our participants reported exclusively their feelings of regret and did so only once. Thus, our approach may have prevented carry-over effects from earlier reports and/or contamination effects from reports on other feelings.

A potential criticism of our methodology is that participants were not asked about their feelings of disappointment. As a consequence, they may have confounded the two emotions when reporting their feelings of regret. However, when asked about feelings of disappointment, people’s responses are independent of the margin of loss (Gilbert et al., Reference Gilbert, Morewedge, Risen and Wilson2004). In other words, people are equally disappointed by a narrow or a wide loss, but are more regretful after a narrow loss (“if I had selected the other set, I would have won”) than after a loss by a wide margin (“if I had selected the other set, I would still have lost”). Therefore, even if the emotional response were a combination of regret and disappointment, it would remain true that in our study the emotional reaction experienced in a narrow loss was more intense than anticipated.

Differences in opinion about the best way to probe feelings of regret and disappointment point to a larger problem. Namely, are self-report methodologies well-suited for addressing these questions? In our study, behavioral evidence was gathered to complement self-reported measures of regret. Behavioral and self-report measures converged to show that experiencing a narrow loss causes more regret than imagining it. The addition of a behavioral measure thus served a dual purpose: it provided convergent evidence for the self-report measure and in doing so it validated such self-reports.

The most consistent finding in the affective forecasting literature is that people overestimate how long their emotions will last. Such a bias is often expressed as an overestimation of how intense the feeling would be at later time. Evidence that initial emotional reactions are overestimated is less abundant, although it has been reported on occasion (Buehler & McFarland, Reference Buehler and McFarland2001; Gilbert et al., Reference Gilbert, Morewedge, Risen and Wilson2004; Sevdalis & Harvey, Reference Sevdalis and Harvey2007). Accurate forecasting and even of underestimation of future regret have also been reported (Crawford, McConnell, Lewis, & Sherman, 2002; Mellers et al., Reference Mellers, Schwartz and Ritov1999). For example, people underestimate how much they will regret having followed bad advice, but overestimate how much regret they will experience after refusing good advice. The context of the methodology also seems to play an important role: while naturalistic studies have consistently shown overestimation of the initial regret response (Gilbert et al., Reference Gilbert, Morewedge, Risen and Wilson2004; Mellers et al., Reference Mellers, Schwartz and Ritov1999; Sevdalis & Harvey, Reference Sevdalis and Harvey2007), experimental studies have yielded a more variable pattern of results (Crawford et al., Reference Crawford, McConnell, Lewis and Sherman2002; Mellers et al., Reference Mellers, Schwartz and Ritov1999). Trying to reconcile the findings from these two traditions is the challenge ahead of us, and the use of behavioral methods should help in that endeavor.