In this opening essay to the debate on the rise of China's digital economy, we provide an overview of China's strength in relation to the United States of America (US). Since there is no widely accepted definition of the digital economy[Footnote 1], our opening position focuses on e-commerce and internet-based services. But we welcome a broader discussion of other digital sectors such as information and communication technology (ICT) hardware manufacturing if contributors believe it is central to understand the current and future economic strength of the Chinese digital economy. Even though internet-based services may include any service provided over the internet, we think it is useful to limit our discussions in this article to four types: (1) internet access services which are usually provided by telecommunication companies, (2) internet-based platform services and complementary applications, which include business-to-business (B2B, e.g., remote equipment maintenance platforms), business-to-customer (B2C, e.g., online education platforms), and customer-to-customer services (C2C, e.g., eBay and Taobao), (3) internet search services (e.g., Google), as well as (4) internet content services which include audio, video, online games, and news. E-commerce refers to the sale or purchase of goods or services over the internet and can be deemed part of internet-based platform services.

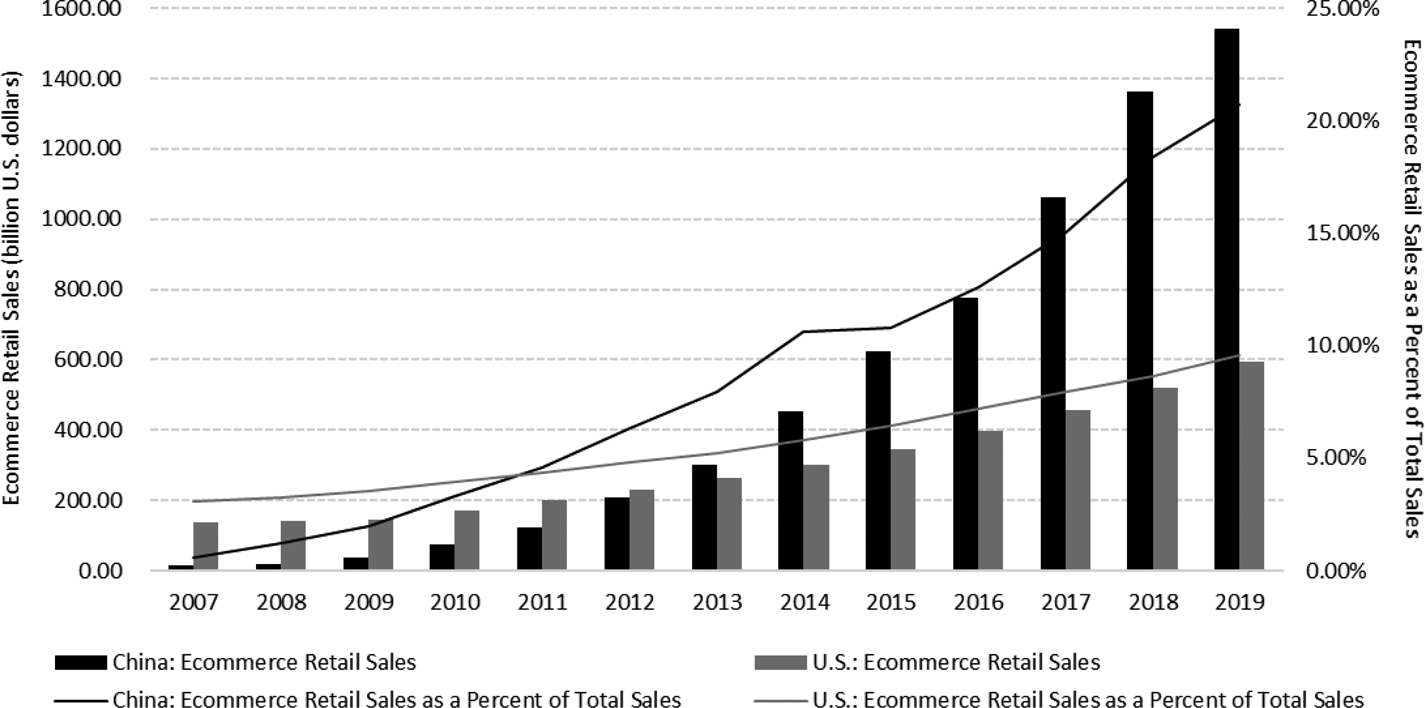

The US and China are creating most of the innovations and wealth in international e-commerce and other internet-based services. China has been catching up quickly and leads in online retail sales by a large margin – accounting for over half of the global online retail sales over the past three years (United Nations Conference on Trade and Development, hereinafter referred to as UNCTAD, 2020). As can be seen in Figure 1, overall online retail sales in China swelled from $13.15 billion in 2007 to $1.54 trillion in 2019 and 20.7% of total retail sales, more than twice the value and percentage of that in the US. Besides e-commerce, China is also becoming a global force in social media, digital finance, cloud computing, and other internet-based platform services. In 2018, of the digital platform valued at more than $1 billion, 72% of the market value was based in the US and 25% in China (Dutch Transformation Forum, 2018). In 2019, the US and China dominated 90% of the market value of the 70 largest global digital platforms, of which 68% was rooted in the US and 22% in China (UNCTAD, 2019).

Figure 1. E-commerce retail sales and the share of e-commerce sales of total sales by country Data Source(s): National Bureau of Statistics of China, US Census Bureau.

China's progress toward becoming a digital giant in e-commerce and internet-based services relies heavily on widely available low-cost internet access services, which are enabled by rapidly expanding world-class digital infrastructure. The size of a population does not guarantee the size of a digital market, unless a large share of the population is connected. While the US leads in penetration rates of the internet, China has been closing the gap quickly over the last two decades. In 2001, the percentage of the US population using internet was 43.08%, compared with just 1.78% in China (see Figure 2). These figures increased to 84.87% in the US and 64.54% in China by the end of 2019. As China's population is more than four times that of the US, China now stands as the largest market of internet users, despite the 20-percentage point gap in the penetration rate. This pattern of China's catch-up applies to all types of internet connections. For instance, in 2019, China still lagged the US in smart phone penetration and fixed broadband penetration, but increasingly closing penetration rates yielded a large difference in total user base between China and the US.

Figure 2. Penetration rates of internet, fixed broadband, and smart phones as the percentage of general population by country

Data Source(s): CNNIC, International Telecommunication Union, OECD, CAICT, and Newzoo.

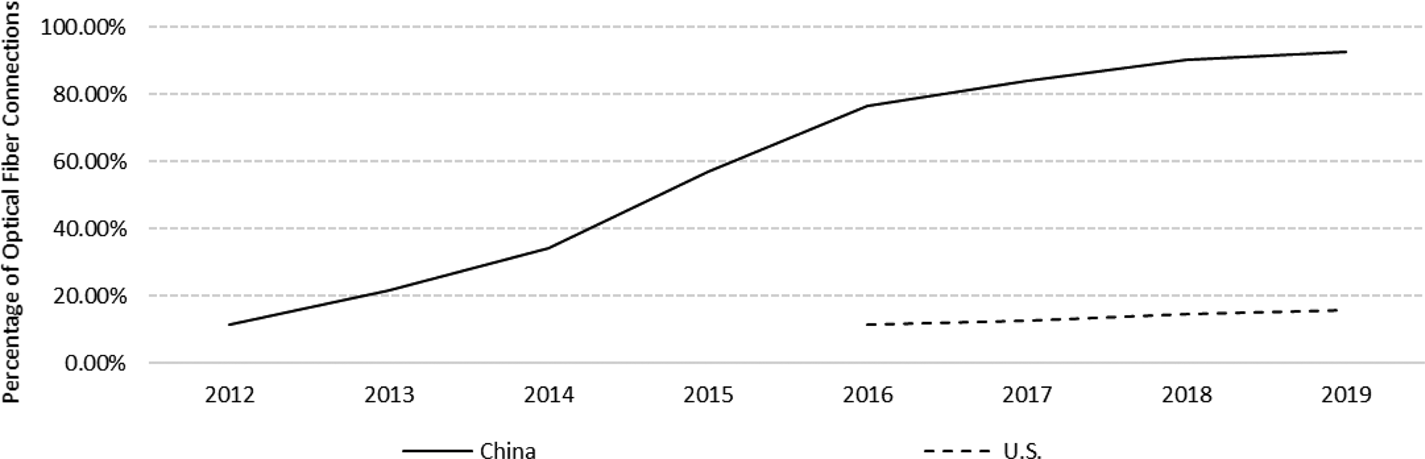

China's advance of digital infrastructure should not be summarized simply by the expansion of size. Three qualities distinguish China from the US, making China a mobile-first, fiber-intensive, and inclusive digital market. First, China has gained supremacy in high-speed fiber broadband availability. The percentage of optical fiber connections in China's fixed broadband jumped from 11.60% in 2012 to 92.90% in 2019, ranking first in the world (see Figure 3). Comparatively, in 2019, optical fiber connections accounted for only 15.82% of fixed broadband in the US.

Figure 3. Share of optical fiber connections in fixed broadband by country

Data Source(s): CNNIC and OECD.

Second, mobile devices are more deeply embedded in the daily usage of Chinese netizens. In 2016, nearly 20% of Chinese internet users relied on mobile only, compared with just 5% in the US (McKinsey Global Institute, 2017). The situation within China is more impressive. In 2019, 98.6% of Chinese netizens accessed mobile internet (China Internet Network Information Center, hereinafter referred to as CNNIC, 2021), while just 44.2% had access to fixed broadband (China Academy of Information and Communications Technology, hereinafter referred to as CAICT, 2019).

Third, China has made incredible progress in improving digital accessibility for inclusion, even in the most marginalized areas. In 2020, optical fiber networks and 4G mobile networks are available in over 98% of Chinese villages. Moreover, the cost of internet access is also significantly lower in China in absolute and relative terms. In 2018, Chinese telecommunication operators typically charged CNY49.8 ($7.53) monthly for 100 Mbps broadband access (see Table 1), accounting for 1.06% of Chinese gross national income (GNI). A similar package in the US costs $90 per month, or 2.08% of monthly American GNI. Wide accessibility and low pricing build internet into the entire society, transforming Chinese people into savvy digital consumers.

Table 1. Costs of fixed broadband services in the US and China (2018)

Data Source: Collected and calculated by authors.

China's improvement in internet access services would not have been achieved so quickly if not for its catch-up in telecommunication technologies. The most visible telecommunication field where China is significantly challenging the US technologically is 5G – the fifth generation wireless network. US firms are taking collaborative measures to thwart Chinese rivals. Huawei, China's leading 5G device vendor, has an edge under the conventional integrated technological trajectory, which has been adopted by all the other onetime telecom equipment champions. Under this trajectory, telecom equipment vendors integrate self-developed specific hardware and software into end-to-end devices and provide devices as ‘black boxes’ to telecom operators. Comparatively, the US now lacks strong integrated 5G equipment vendors after Lucent and Motorola were acquired by foreign companies.

US digital companies recognize it is difficult to compete with Huawei if they simply follow the integrated trajectory and have taken steps to popularize a nonintegrated one. Under the new trajectory, the telecom network will be composed of standardized hardware sourced from multiple component suppliers as ‘white boxes’, of which the overall performance is determined by tailored software and chips. The US companies such as Cisco and Intel are then likely to capitalize on their leads in software and semiconductors to reshape the playing field of the telecommunication industry and retain a central position, the way Qualcomm has dominated the cell phone industry. So far, this trajectory is in the early stage of development, but a handful of telecommunication operators – e.g., Rakuten Mobile in Japan – have already implemented it in wireless network buildouts. Given the competitive efforts of US firms to transform the technological trajectory and potential strikes on China's digital Achilles’ heel, such as chips, it would be premature to declare China the winner in the long-term race.

Regardless of the dominant product design of future telecom devices, China as the world's largest home market has already driven robust innovation and fast commercialization of internet-based B2C and C2C services, making China a global trailblazer in digitalizing consumer-facing businesses. The commercial success of Chinese 2C e-businesses is evident in its booming online transactions and payments related to consumption by individuals. China's penetration rate of online shopping in its population has increased from 12.04% to 55.69% in the last decade (CNNIC, 2012, 2021), which is still lower than the 75% in the US (Statista, 2021). Whereas US inhabitants are more active in online shopping, 56.67% of global online retail sales went to China-based e-commerce platforms (UNCTAD, 2020) and yielded the rocketing e-commerce retail figures as illustrated in Figure 1.

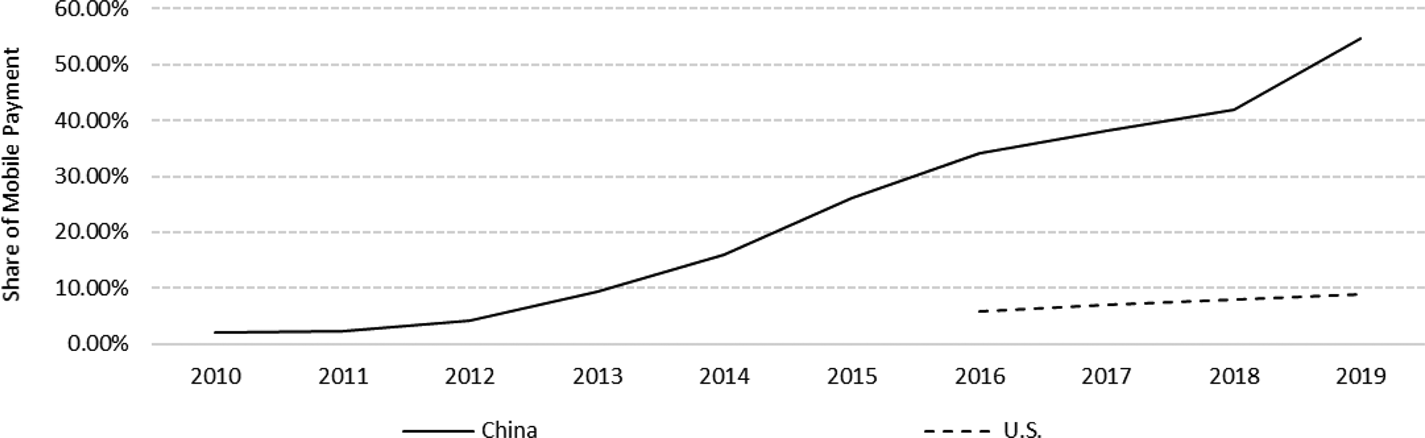

In digital payment, mobile payment in particular, China dwarfs the US in size and penetration. In 2018, China generated $414 billion in mobile payment transactions, more than six times that of the US – $64.15 billion (Rolfe, Reference Rolfe2019). Moreover, the Chinese payment systems of Alipay and WeChat Pay introduced mobile payment into the daily habits of Chinese consumers more quickly and more broadly than Google Pay, Apple Pay, and Venmo have achieved in the US. The share of the Chinese population using mobile payment grew by 30 times, from 1.91% in 2010 to 60.71% in 2019, as shown in Figure 4. In the US, users of mobile payment accounted for merely 8.80% of the total population in 2019. This may be attributed to two reasons. First, China's penetration of credit cards was much lower than that in the US when mobile payment became available; hence, the benefits that mobile payments offered to the Chinese were much larger. Second, Alipay and WeChat Pay have been compatible with smart phones and other mobile devices of all sorts, whereas two important mobile payment options in the US are device-specific (i.e., Google Pay exists only on Android and Apple Pay only on iPhone).

Figure 4. Mobile payment penetration as the percentage of general population by country

Data Source(s): CNNIC and Statista.

China's overtaking the US in retail e-commerce and digital payment is not only fueled by the sheer scale of market but also by the contextualized innovations of local platform companies. These innovations helped to overcome institutional deficiencies in the fledging market and activated a large population of customers in China, although not helping much in penetrating the market outside China. How Taobao displaced eBay in the Chinese C2C e-commerce market is quite revealing (Jiang, Liu, Huang, & He, Reference Jiang, Liu, Huang and He2015). Alibaba launched Taobao in May 2003 and eBay entered China by acquiring EachNet – the first and fastest-growing Chinese C2C e-commerce platform – in June the same year. The outbreak of SARS (severe acute respiratory syndrome) that year stimulated China's internet population to visit online shopping sites, but they were resistant to buying online (UNCTAD, 2003) mainly due to the lack of a social credit system and consequent online fraud. A survey conducted by CNNIC in 2002 showed that 13.9% of online buyers had the experience of not receiving goods they paid for. Whether the payment mechanism offered by a C2C e-commerce platform can enhance platform-based institutional trust (Zucker, Reference Zucker1986) thus determines whether the platform could win out. Taobao launched its payment system – later known as AliPay – in October 2003. It was the earliest online payment system providing escrow services for buyers. AliPay would hold the buyer's payment until the acceptance of goods was confirmed and provided insurance to protect buyers from financial losses generated by online fraud. The first transaction using the escrow payment system took place on October 15, with a university student in Xi'an buying a second-hand camera from an overseas student in Japan.

Centralizing decision-making in the US headquarters, eBay China continued to use the payment system developed by EachNet, hoping that the global platform of PayPal would be bundled with the Chinese website in a short time. However, it soon found that PayPal could not be introduced into China very quickly because of tight regulation, and it could not bring an advantage over Taobao even if it had been launched, given the very limited availability of credit cards in the fledgling market. Therefore, eBay China started to develop a new payment system called An Fu Tong, which also provided escrow and insurance services, and launched it in October 2004, one year after AliPay. Meanwhile, AliPay was updated continuously and spun off in December 2004 as a third-party platform independent of Taobao, enabling it to innovate more quickly. In 2005, AliPay introduced a new service of ‘full compensation’ – paying buyers for all the financial losses created by sellers or deliverers before transaction disputes were settled, and eBay finally launched PayPal in China. As the integrated platform of AliPay was being rapidly adopted by Chinese who found their risks of online shopping were minimized on Taobao, the introduction of PayPal yielded serious customer confusion between the two separate systems of PayPal and An Fu Tong. During 2005, 79% of listings on Taobao accepted online payments and only 21% on eBay China, driving more buyers and transactions to shift to Taobao.[Footnote 2] A CNNIC survey conducted in 2006[Footnote 3] shows that, in the C2C e-commerce markets of Beijing, Shanghai, and Guangzhou – the three largest Chinese cities – Taobao occupied a share of 67.3% and eBay got only 29.1%. The share of eBay dropped so quickly that it soon turned from a first mover to a trivial player in China's C2C e-commerce market.

Besides B2C and C2C services, China also enjoys the advantage of market size in internet-based B2B platforms and applications, notably those assisting the digital transformation of industries. After GE coined the term ‘Industrial Internet’[Footnote 4] (Evans & Annunziata, Reference Evans and Annunziata2012) in 2012 and launched the world's first industrial internet platform, implementing ICT technologies to connect devices with industrial applications has become a common priority among Chinese industries. In 2019, the added value of China's industrial digitalization (i.e., investing in ICT technologies to transform industries) hit $4.17 trillion (CAICT, 2020). Apart from ICT device vendors, application developers, and platform providers, industrial users of almost every Chinese sector had tremendous interests in harnessing the potential synergies of digitalization. In a survey conducted by International Data Corporation (IDC) in 2019, 84.9% of Chinese manufacturing firms were pursuing transformation through digitalization. However, varying difficulties of digitalization in each sector led to varying paces (see Figure 5). Between 2016 and 2019, the penetration rate of digitalization – the proportion of added value generated by ICT investments – rose from 29.6% to 37.8% in China's service sector, and from 16.80% to 19.5% in its manufacturing sector. Despite still being lower for now, the digitalization penetration of China's manufacturing sector is witnessing a continual increase in annual growth rate, narrowing the Sino-US gap by more than five percentage points in the last five years (CAICT, 2020). As the largest manufacturing powerhouse, currently having a lower rate of digitalization plus a faster growth rate indicates the vast remaining potential of industrial digitalization for China.

Figure 5. Penetration of digitalization by sector in China

Data Source(s): CNNIC and Statista.

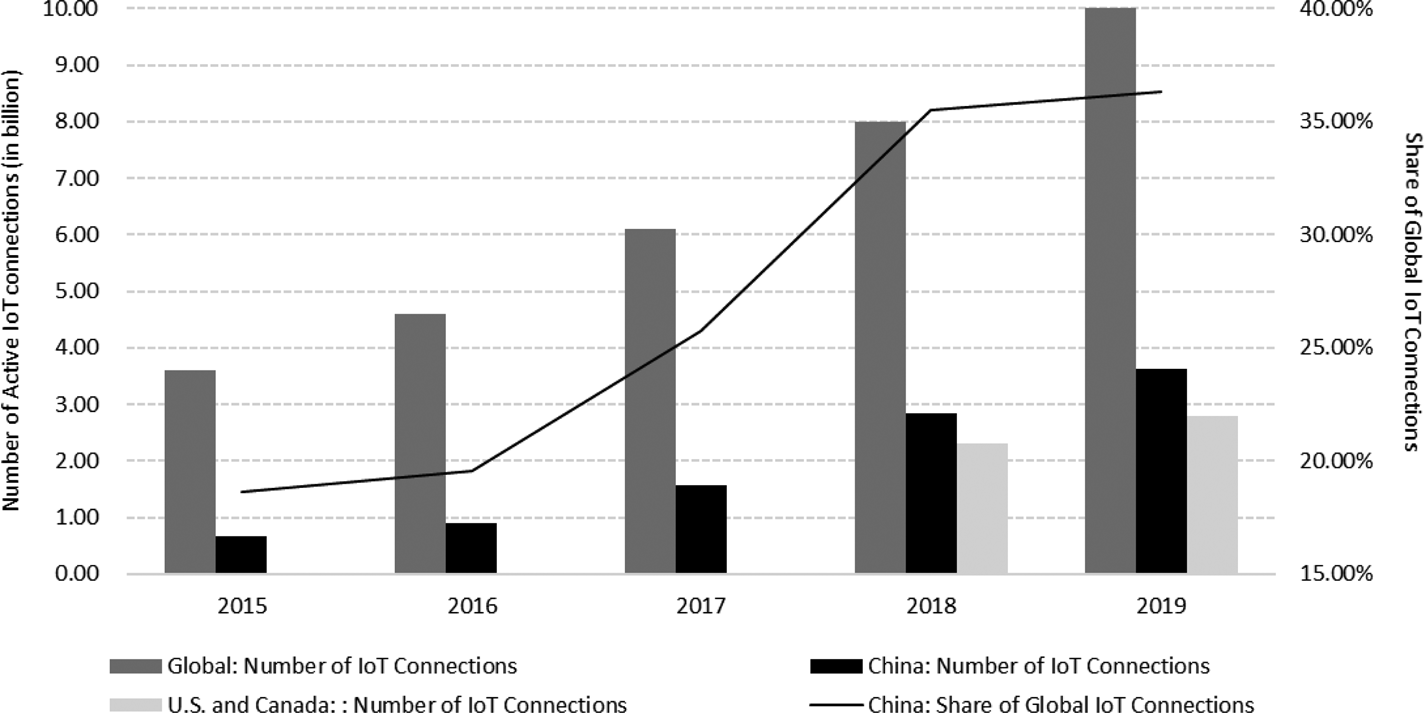

While internet-based B2B services are expanding rapidly across a variety of industries in China, local firms are not as strong in innovation as their peers in 2C services in dominating the local market. Consider the internet of things (IoT), a key enabler of industrial digitalization that makes possible remote monitoring and control of equipment. In 2015, as can be seen in Figure 6, the number of active IoT connections in China was 0.67 billion, accounting for 18.6% of all in the world. The two figures shot up, respectively, to 3.63 billion and 36.3% in 2020, more than the US and Canada combined. A fast-growing IoT market boosted Chinese vendors of wireless modules, which must be deployed ubiquitously to connect physical devices into a network. In 2016, none of the world's top three wireless module vendors was based in China. In 2018, the largest Chinese vendor already ranked third in revenue and first in module shipment globally. However, China still cannot match the US in core technologies and components underlying wireless modules. Most local vendors rely on Qualcomm and Intel for module chips, which make up over 80% of their material costs. China is also suffering from the inadequacy of technically advanced end-to-end IoT solution providers in leveraging the overall opportunity.

Figure 6. Number of IoT connections in China and in the world

Data Source(s): CNNIC and Statista.

In general, China pioneers in translating the latest digital technologies into commercial success in e-commerce and other internet-based services, but the US is further ahead in general-purpose technologies that have the potential to alter the landscape of the digital economy at the root level. General-purpose technologies are those that can be used across a wide range of industries and create a strong spillover effect (Lipsey, Kenneth, & Clifford, Reference Lipsey, Kenneth and Clifford2005). Regarding the digital economy, typical general-purpose technologies include semiconductor design and manufacturing, 5G telecommunication, artificial intelligence, digital modeling and simulation, high-precision digital control, and advanced sensing. Although a handful of Chinese players are among the leaders in a few general-purpose fields such as 5G, the US giants, together with their European and Japanese allies, maintain advantages in various essential fields. In the fields of next-generation technologies including artificial intelligence, China may contribute more in some subsets such as facial recognition, but the US firms – Microsoft, Alphabet, and others – are clearly ahead in general research and advanced applications.

In the fields of digital hardware such as semiconductors, the US has an almost unassailable position – at least in the medium term – after constant upgrading of technologies over decades. Chinese firms cannot make the most cutting-edge chips for now and are unlikely to overtake the US in the next decade even if their huge investments in semiconductors pay off, since the US should have already pushed the technological frontier of chips forward by then.

In the fields of software such as operating systems and electronic design automation (EDA) tools, the US has built a global ecosystem, whereas Chinese latecomers can hardly get a leg up. After decades of efforts, China has developed homegrown operating systems that are good enough but have far to go in replacing the US systems (see Figure 7) due to extreme difficulties of establishing a supportive ecosystem. As for EDA tools, the US has long dominated. The three largest US EDA tool vendors – Synopsys, Cadence, and Mentor Graphics – occupied 70% of the global market and 95% of China's market in 2019. Whereas a handful of local companies have developed EDA tools for analog and mixed-signal integrated circuit (IC) design, Chinese firms are almost absent in EDA tools for digital and system-on-chip IC design; the only two exceptions are design input tools developed by Semitronix and Cellix (see Table 2), as digital and system-on-chip IC design requires much more complicated architecture and algorithms. Given that IC design companies tend to purchase all the EDA tools needed as a package to ensure compatibility and that the US leaders (i.e., Synopsys and Cadence) have established comprehensive full-flow design platforms using in-house developed tools, Chinese EDA tools can hardly compete with the US offerings even if they can match or even outperform the latter in some specific stages of IC design. Last and most importantly, Synopsys and Cadence provide for IC designers and foundries intellectual property cores (IP cores) – blocks of logic or data used in making IC and essential for design reuse – that are compatible with the latest process design kits (PDKs) implemented in foundries. In this way, they have established a large network composed of IC designers and foundries who are closely linked by strong ‘EDA + IP core + PDK’ connections. Comparatively, none of the Chinese EDA tool vendors have their own IP cores and some PDKs of mainstream foundries do not support their offerings, bringing about disadvantages in tool development lead time and compatibility.

Figure 7. Market share of operating systems for PC in China

Data Source(s): Pacific Securities.

Table 2. Vendors of EDA tools for semiconductor design in China (2020)

Data Source: Collected and organized by authors.

Our aim in this opening essay to the forum was to provide a comparative description of the relative strength of China in e-commerce and internet-based services. This essay was circulated to a team of Chinese scholars and a team of western scholars to first evaluate whether we presented the facts correctly and determine if we left out significant facts. Second and more importantly, we asked scholars to debate the causes for China's rise in e-commerce and digital services relative to that of the US. We intentionally said relatively little about the causes, so that other scholars can focus on the reasons behind the growth of e-commerce and internet services in China. Is the increasing strength of these digital sectors intimately tied to government policies? If so, how? Is the fact that China is much more lax about privacy a critical reason for the advances in China? Will China overtake the US in these digital services or will the fast growth slow down? On the assumption that the geopolitical struggles between China and the US continue to rise, what, if any implications will this have for the further development of e-commerce and digital services companies in China and the US? The Chinese government recently has made it more difficult for Chinese firms to list on US stock exchanges; will this have a negative impact?

Target article

Forum on ‘The Rise of China's Digital Economy’

Related commentaries (3)

Semiconductor Catch-Up Is Not Enough: Twigging the Context of China's Ambitions

The Driving Forces Behind the Phenomenal Rise of the Digital Economy in China

The Rise of China's Digital Economy: An Overview