1. Introduction

Trade has played a key role in shaping the history of the UK and indeed its emergence: it was one of the motivating factors for the Act of Union in 1707. Accessing the growing Empire and trading routes brought benefits to many of Scotland’s aristocracy of the 18th and 19th centuries. Global markets powered Scotland’s industrial revolution and the creation of the Scotland that we know today. It is perhaps with some consistency, therefore, that the UK’s decision to leave the EU and erect new trade barriers with its largest international partner has reignited debates over Scotland’s place in the UK.

In 2014, the people of Scotland voted to remain part of the UK. But the Scottish National Party (SNP)-led Scottish Government has argued that Brexit—contrasting it with Scotland voting to ‘Remain’ in the EU by a margin of 62 per cent versus 38 per cent—represents a ‘material change in circumstance’ that justifies a second independence referendum. Opinion polling has shown a rise in support for independence driven, in part, by voters seeing this as an opportunity to rejoin the EU (Curtice and Montagu, Reference Curtice and Montagu2020). Several commentators who had warned of the dangers of independence back in 2014 have expressed sympathy—or at least a willingness to be more open—to the economic case for Scottish independence post-Brexit (MacPherson, Reference MacPherson2016; Wren-Lewis, Reference Wren-Lewis2017).

But Brexit also adds new complexities to the economics of an independent Scotland. Back in 2014, the pro-independence ‘Yes’ campaign argued that little would change for Scotland’s international trade outlook should voters choose independence. Their vision, set out in an Independence White Paper, was for Scotland to continue as a member of the EU Single Market (Scottish Government, 2013). There would be free movement between Scotland and the EU, and between Scotland and the UK. Borders would not be a problem. The UK’s subsequent exit from the EU has illustrated the importance of borders, and with a ‘hard border’ now in place between the UK and the EU, this 2014 vision of independence is no longer an option. Should Scotland vote for independence, it will face a choice over where to erect its ‘border’. Three are of relevance—the border with the rest of the UK (RUK), the border with the EU and the border with the rest of the world (ROW). In this paper, we discuss the options facing an independent Scotland and assess the strength of any possible ‘border effects’. We review what we know and do not know about the likely impacts on Scotland’s trading profile (both in the short- and long run).

To illustrate the relative magnitude of the economic effect of different border choices facing any future independent Scotland, we make use of a well-established macroeconomic model of Scotland (‘A Macro–Micro Model of Scotland’—AMOS) developed at the University of Strathclyde. This builds on work undertaken using this model to inform the Scottish Government’s Brexit analysis, following its use for a cross-party Committee report in 2016. We simulate three trade scenarios: 1) Brexit for the whole of the UK (our ‘new’ baseline); 2) Brexit for the rest of the UKFootnote 1 and an independent Scotland and 3) Brexit for RUK and reinstating EU membership for a newly independent Scotland. These simulations are necessarily indicative but are useful to illustrate the broad features that would arise in any debate over what border arrangements to prioritise in any future negotiation.

When simulating the effect of Brexit for the whole of the UK, we arrive at economic impacts in line with previous studies including Brakman et al., (Reference Brakman, Garretsen and Kohl2021) and Huang et al., (Reference Huang, Sampson and Schneider2021). Having established this baseline we show that, unsurprisingly given the shocks that we have implemented, Scottish independence generates a further and negative economic impact as it involves putting up additional barriers with a key trading partner. However, in the final scenario, we reverse the ‘hard’ border between Scotland and the EU, but maintain this between Scotland and RUK, and show that this substantially reduces the economic impact that a combination of Brexit and Scottish independence implies.

Of course, the impact of trade frictions from national and regional borders is only one—albeit important—contribution to any debate on the economics of independence. For example, some may argue that independence provides an opportunity for Scotland to take concerted domestic policy action to either improve productivity (thus making it more competitive globally than it is currently) or seek to grow its access to external markets through additional (and new) export growth initiatives. We also do not offer any comment on wider macroeconomic issues that would undoubtedly have a bearing on Scotland’s economy, and, in turn, its competitiveness. Other papers in this special issue examine some of the other key issues, including fiscal sustainability and currency options facing an independent Scotland. In short, the focus of this paper on the single issue of trade impacts should not be read as implying a judgement upon the desirability or otherwise of independence or greater devolution.

In addition, whether an independent Scotland should re-join the EU is not simply a matter of what the impact on trade might be and includes wider issues such as the benefits/costs of membership of the EU more broadly such as migration, as well as complex political economy questions surrounding EU membership (including negotiations with EU partners, most notably other States with regional pro-independence movements).

The rest of this paper is structured as follows. In Section 2 we summarise the evidence on Scotland’s current trading patterns and set out hypothetical scenarios for future Scottish trade under different constitutional arrangements. In Section 3 we introduce our modelling framework and database construction, before presenting our results under each scenario in Section 4. Section 5 concludes the paper.

2. What do we know about Scotland’s current trade?

A useful starting point for understanding the potential implications of future trading partnerships for Scotland is to examine existing trade flows. It is important to emphasise that estimates of these flows must be treated with a degree of caution. For the purposes of most economic statistics, Scotland is treated as one of 13 UK ‘regions’, and as a result, there is no one official process for collecting trade statistics for Scotland. Instead, we must make use of a variety of sources and estimates.

A particularly important gap in our statistical knowledge is the lack of estimates of Scottish ‘imports’. Whilst the Scottish Government does publish an estimate of ‘total imports’—both from the rest of the UK and the rest of the world—this is a residual product in the balancing of National Accounts (Scottish Government, 2021). There are no estimates of Scottish imports drawing upon measurement data. Data on cross-border financial flows are also limited. In recent years, the Scottish Government has developed experimental Gross National Income statistics which estimate Credit and Debit flows; however, these statistics remain in development (Scottish Government, 2018a).

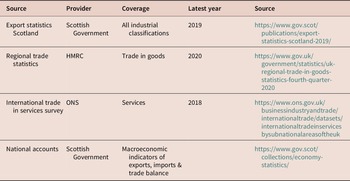

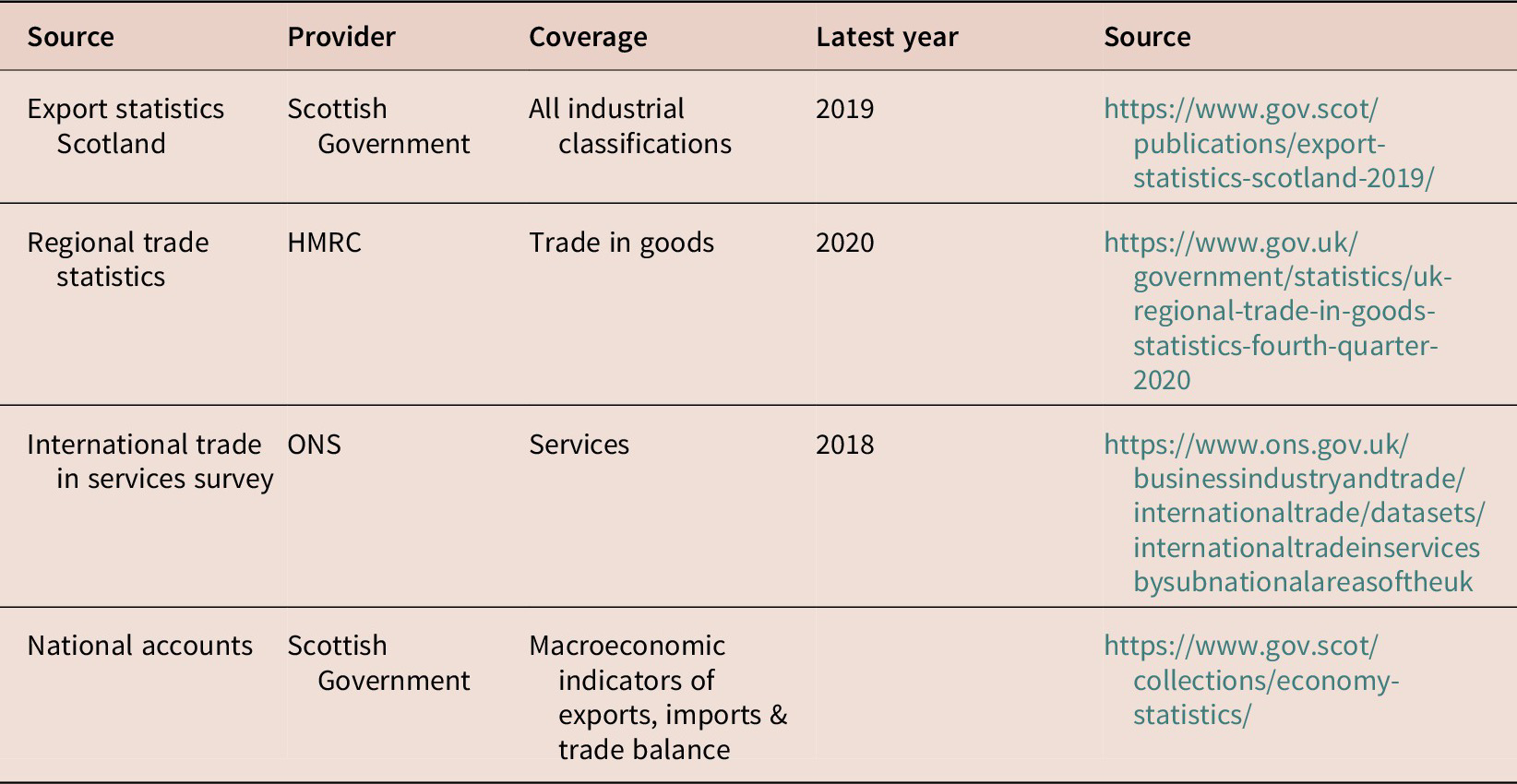

The data for Scottish exports are more detailed. One challenge, however, is that there are several different sources all compiled in different ways. There can be differences in reported statistics depending upon the source (table 1).

Table 1. Sources of Scottish export statistics

Abbreviations: HMRC, Her Majesty’s Revenue and Customs; ONS, Office for National Statistics.

Source: Scottish Government, HMRC and ONS.

Two further caveats are worth bearing in mind when examining Scottish trade data. First, many firms might not know the exact destination of their export. This gives comparisons of market destinations a higher degree of sampling error than the industry estimates. Second, given the close links many firms have across the UK, it is highly possible that some exports that are reported as flowing to the rest of the UK are subsequently re-exported (including as part of other products). Scottish Government statisticians ‘believe the figure will be small’ (Scottish Government, 2021, p. 38) as much of Scotland’s exports to the rest of the UK comprise services and utilities where re-exporting is low. Perhaps of more significance are exports that form part of longer supply chains, with Scottish goods often just one part in a much wider global value chain. At the same time, many Scottish exporters are also likely to rely on inputs from elsewhere in the UK.

In what follows, given their comprehensive nature and wide use, we focus on the statistics in the Scottish Government’s Export Statistics Scotland annual report. We return to a discussion of other statistical sources in the next section when discussing our analytical approach which draws upon additional sources for the purposes of our economic modelling.

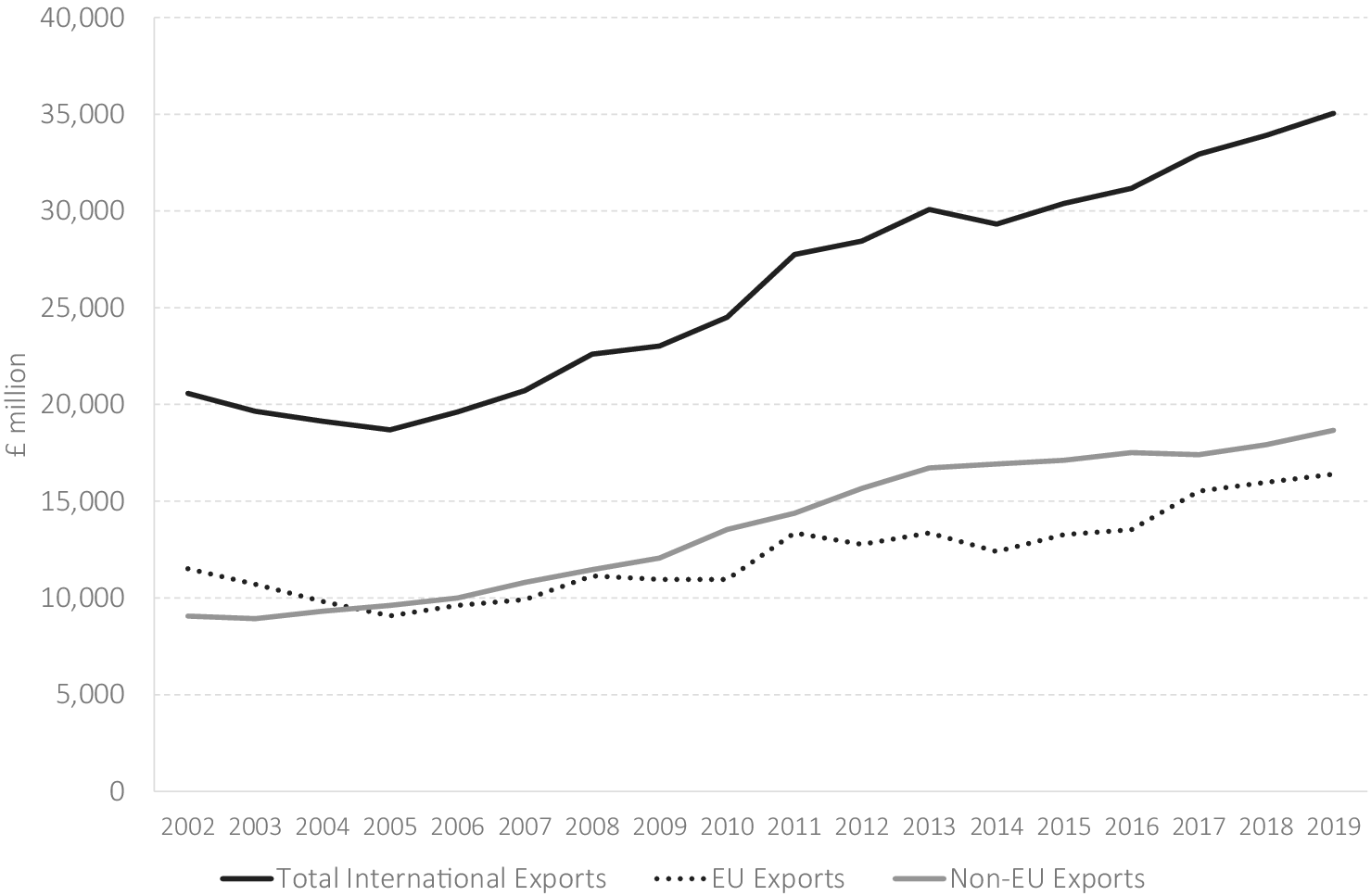

Figure 1 highlights Scotland’s current international export market pattern (excluding exports to the rest of the UK). Since 2002, EU exports have grown more slowly than ROW exports. However, as a single destination market, international exports to the EU are the largest source market for Scottish goods and services. Indeed, at £16,150 million in 2018, exports to the EU were worth more than exports to North America, South America, the Middle East, Asia, Africa and Australasia combined. Seven of Scotland’s top 10 markets for exports were countries in the EU in 2018, with a further country—Norway—part of the Single Market.

Figure 1. Scottish international export markets, 2002–2019. Source: Export Statistics Scotland.

Successive administrations have sought to improve Scotland’s export position, in part to narrow a performance gap that sees Scotland lag behind other countries. For example, in 2019, Scottish international exports as a share of GDP were 21 per cent, compared to 31 per cent for the UK as a whole. The most recent attempt is through a new Export Action Plan (Scottish Government, 2019) with a target to grow international exports by 20–25 per cent by 2029. However, previous attempts to grow Scotland’s export base—including the ill-fated attempt to establish ‘Silicon Glen’ in the 1980s and 1990s—have had mixed results. A recent attempt to grow Scottish exports by 50 per cent between 2010 and 2017 was missed by over 10 percentage points.

The largest export markets for the EU consist of refined petroleum and chemical products followed by Food and Drink (including whisky). Together these two sectors account for around 34 per cent of total exports to the EU. It is partly these figures that have been used by the Scottish Government to argue that Brexit will damage Scotland and ‘have a major impact on economic and job prospects for current and future generations’ (Scottish Government, 2018b). Scottish Government analytical modelling to support this conclusion—using the Scottish Government’s Global Econometric Model (SGGEM)—puts the cost of a scenario approximately akin to the UK–EU partnership at Scottish GDP being 6.1 per cent (or £9bn in 2016 cash terms) lower by 2030 than had Scotland (and the UK) remained in the EU. Such findings are similar to other studies for the UK (see Tetlow and Stojanovic, Reference Tetlow and Stojanovic2018; UK Government, 2018) and Scotland (see Figus et al., Reference Figus, Lisenkova, McGregor, Roy and Swales2018).

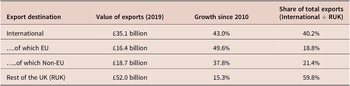

The same statistics, however, show the importance of trade with the rest of the UK.

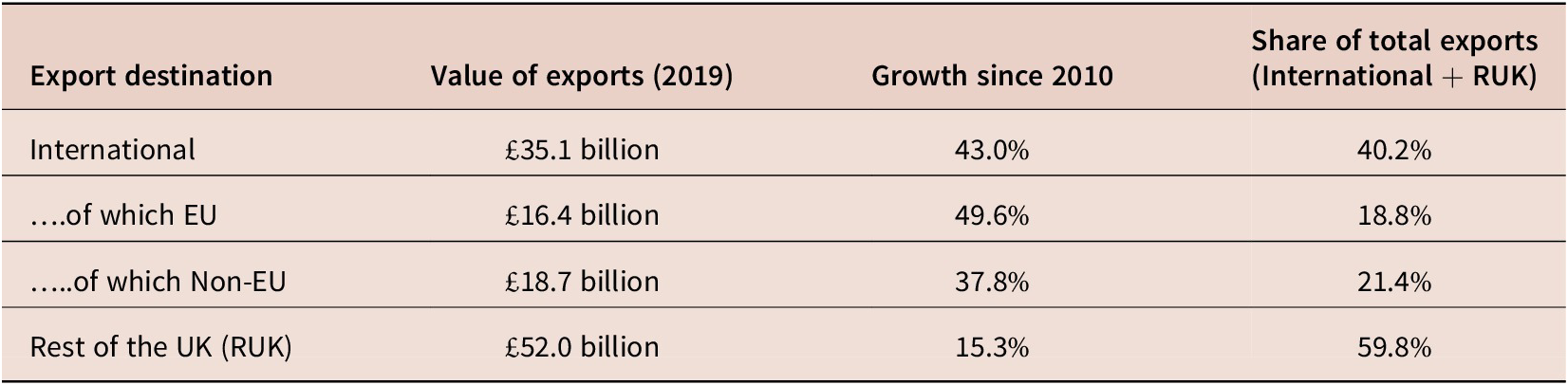

In 2019, around 60 per cent of Scottish exports were to the rest of the UK. This compares to 19 per cent of total exports destined for the EU (table 2). Little is known about the end source of UK trade although, unsurprisingly, new experimental figures show that most Scottish–RUK exports are to England. There are, however, significant variations by sector across the nations of the UK (Greig et al., Reference Greig, Roy and Spowage2020). In addition to differences in ‘scale’ of demand, there are also important differences in terms of composition, as Figure 2 highlights.

Table 2. Scotland’s exports

Source: Export Statistics Scotland.

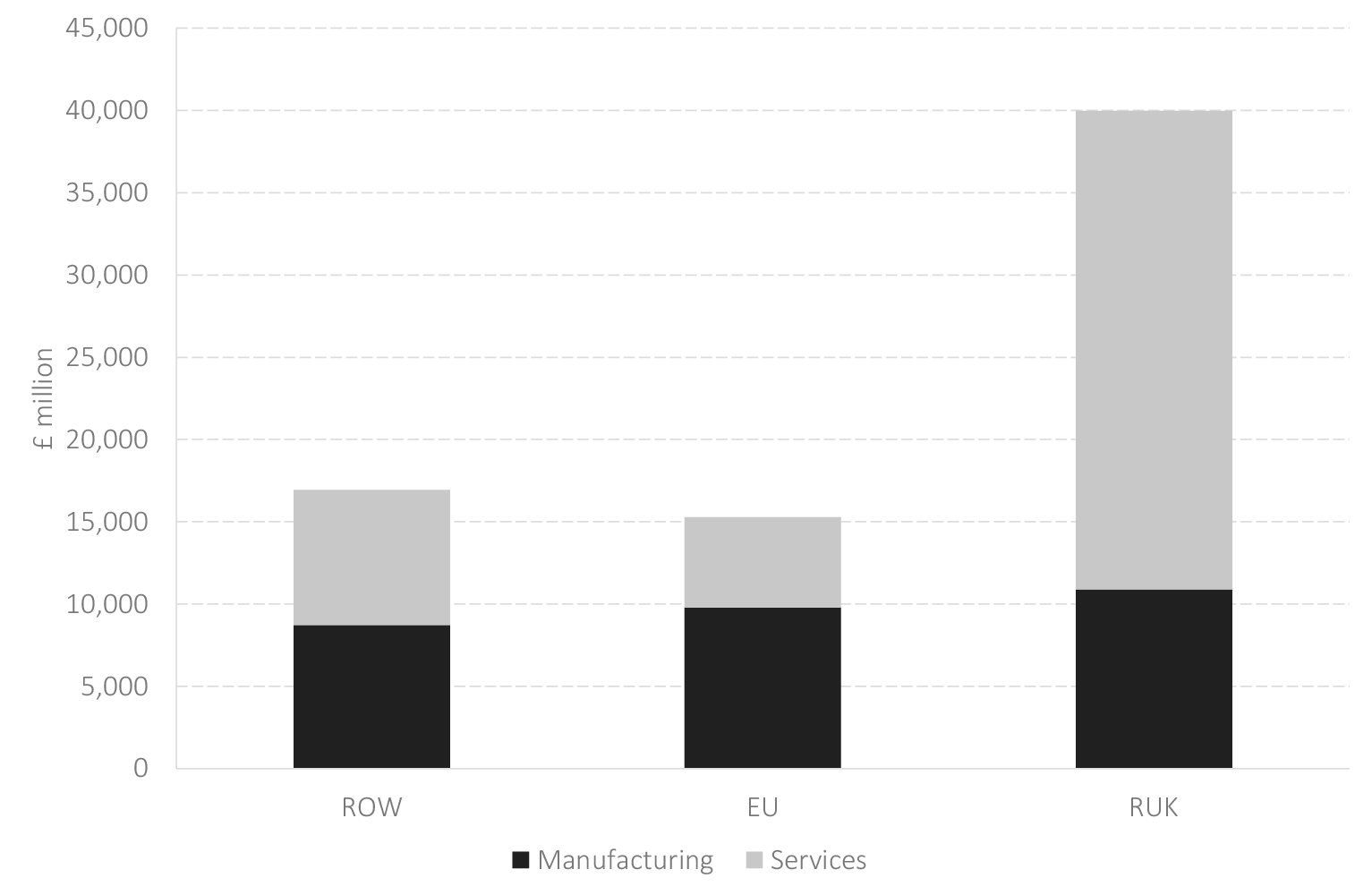

Figure 2. Composition of Scottish exports, services and manufacturing by export market, 2019. Source: Export Statistics Scotland.

The key difference between Scottish international exports and RUK exports apparent from Figure 2 is the propensity to export services. Manufacturing exports are largely the same between these three different markets (£10.9bn to RUK vs., £9.8bn to the EU and £8.7bn to ROW). Services exports are, however, valued at £29.1bn to RUK and only £5.5bn and £8.2bn to the EU and ROW, respectively. This mix of sectors will have important implications for any post-independence trade scenarios given the ease with which some products can be exported (e.g. tariffs) and the challenges in exporting services (which tend to have higher non-tariff barriers [NTBs]).

A final key feature of Scotland’s export performance is the concentration of export activity amongst a relatively small number of businesses. For example, it is estimated that there are only 11,000 businesses in Scotland currently exporting (out of a pool of 346,000), with 100 businesses accounting for nearly 60 per cent of total exports (Scottish Government, 2019). Whilst this is not uncommon, the relative concentration of activity both at a firm and sectoral level does leave the Scottish trading pattern exposed to rationalisation or changes in market conditions (or regulations) outside of the control of Scottish policymakers.

3. Assessing Scotland’s trading options post-independence

There is an extensive literature that assesses the impact of borders on international trade flows and patterns. Most studies document that borders can create frictions that can have negative effects on trade (Anderson and van Windcoop, Reference Anderson and van Windcoop2004; McCallum, Reference McCallum1995). This leads to a so-called ‘border effect’—the result that trade is higher within countries than between countries. Analysis of goods trade has found that border costs between EU countries are 13 per cent lower than border costs between countries where at least one of the partners is not an EU member. At the same time, border costs within the EU are still 23 per cent higher than trade costs between US states (Comerford and Mora, Reference Comerford and Mora2019).

This can have important implications for economic outcomes. Classical trade theory emphasises the value of comparative advantage, with countries specialising in products and services where the opportunity cost is lower. All countries can ‘gain from trade’ from such specialisation and trade (Ricardo, Reference Ricardo1817). More modern trade theories have proved that trade can bring benefits outside of comparative advantages (e.g. Krugman, Reference Krugman1980; Melitz, Reference Melitz2003), by expanding choice, creating clusters, securing benefits from agglomeration and enabling countries to take advantage of economies of scale.

Openness to trade can also bring with it benefits from greater productivity, through increased competition among firms. There is also evidence that openness to international trade can lead to higher levels of innovation and adaption of new technologies (Aghion et al., Reference Aghion, Blundell, Griffith, Howitt and Prantl2009). Other benefits include improved allocation and diversification of resources, leading to reduced costs of capital and better allocation of capital to projects. It follows, therefore, that putting up barriers to trade, through the introduction of tariff or non-tariff barriers, can erode these gains reducing economic activity, wages and employment relative to ‘what otherwise would have been the case’ (Baldwin and Venables, Reference Baldwin, Venables, Grossman and Rogoff1995; Eaton and Kortum, Reference Eaton and Kortum2002). An extensive literature has attempted to estimate the scale of these effects, including most recently for the UK leaving the EU.

This literature assessed the economic impact of the UK’s exit from the EU under a range of different scenarios that were proposed (see e.g. Hantzsche et al. (Reference Hantzsche, Kara and Young2019), and again once a deal was ultimately reached (Fusacchia et al., Reference Fusacchia, Salvatici and Winters2022). For Scotland, Figus et al. (Reference Figus, Lisenkova, McGregor, Roy and Swales2018) estimate the longer-term economic consequences of Brexit under a range of hypothetical trade arrangements between the UK and EU. It found that, while the economic effect on Scotland was similar in nature to the UK as a whole, because Scotland is less directly exposed to trade with the EU, the magnitude of these effects was smaller.

The findings from this research on the economic impacts for the UK and Scotland of leaving the EU have been crucial to the argument that ‘the only way to protect Scotland’s interests and our place in Europe is to become an independent country’ (Blackford, Reference Blackford2021). But it is not hard to see the difficult trade-off here. Arguments concerning ‘border frictions’ between the UK and EU immediately translate into the Anglo-Scottish border context. For example, a key factor to consider is how any transition will be managed. Brexit has highlighted the challenges, and costs, of a delayed and uncertain transition. There is no reason to suggest that the transition to Scottish independence would be any easier, either in terms of negotiating any future relationship with the UK or re-joining the EU.

But looking at the long-term impacts, which is the purpose of this paper, if Scotland decided to re-join, and was granted access to, the EU, it would regain access to the Single Market (and the largest trading block in the world). But it would have to leave the UK Customs Union. As the statistics in Section 2 highlighted, whilst the EU might be a larger market in terms of overall size, the close connections between Scotland and the rest of the UK mean that Scotland currently trades far more with the rest of the UK than it does with the EU. In time, of course, trading patterns can change, and this would seem inevitable if Scotland re-joined the EU. But adjustment would take time and would not be without challenges, particularly given the prominence of services exports in the Scottish–RUK trade basket. The greater the divergence on trade issues between the EU and the UK, the more frictions there will be at the border.

In the early years of independence, Irish trade was dominated by trade with the UK, which was the destination of over 50 per cent of Irish exports as late as the 1970s. Today, however, less than 10 per cent of Irish exports go to the UK, although even now the UK remains the main destination for Irish agricultural products, and many employment-intensive sectors such as food processing rely on this relationship (De Bromhead et al., Reference De Bromhead, Adams and Casey2021). Of course, like Ireland, an independent Scotland re-joining the EU could be attractive for investors. A well-educated English-speaking workforce, a degree of integration with the rest of the UK likely to remain and access to EU markets is likely to be viewed favourably by some UK firms and international investors. Equally, however, should independence impose economic costs on Scotland and harm access to RUK markets for Scottish-based firms there will be countervailing negative forces here. How these and other incentive effects might balance out will be key.

To understand the scale and impact of changes in trade arrangements, in this paper we simulate three scenarios as set out in table 3. These scenarios differ in which trade flows experience NTBs.Footnote 2 Scenario 1 is referred to as the Brexit scenario, imposing NTBs on trade between the whole UK and the EU; in Scenario 2 we refer to as the Scottish independence scenario where we simulate NTBs between Scotland and the RUK of the same magnitude as those implied by the UK–EU trade deal and in Scenario 3 we reverse the imposition of NTBs for trade between a newly independent Scotland and the EU. We refer to this as the reverse Scottish Brexit case. In effect, this represents returning NTBs between Scotland and the EU to the same level they were when the UK was a full member of the EU.

Table 3. Three scenarios to explore the importance of NTBs in Scotland and the RUK

In terms of parametrising the scale of these NTBs, we follow Duparc-Portier and Figus (Reference Duparc-Portier and Figus2021) and utilise data from the UK Government quantifying the scale of the NTBs implied by its trade agreement with the EU, which we summarise (as a percentage of trade value) in table 4. These are, of course, only illustrative of what the scale might be of the increase in NTBs between each of the trading partners in our model. The agreement that was reached between the UK and EU was the product of extensive negotiations and compromise over a much broader range of concerns than simply the trade impacts, as any new agreement between an Independent Scotland and RUK would be. However, they offer an insight into the relative magnitudes of different trade flows with respect to NTBs.Footnote 3

Table 4. Non-tariff barrier estimates from the UK–EU trade agreement

Source: HM Government (2018, p. 19).

Note that, for simplicity, and in the absence of better information, in Scenario 2 we assume that NTBs between an independent Scotland and RUK and between Scotland and the EU are the same as the NTBs estimated for a free trade deal between the UK and the EU that are used in Scenario 1 to simulate Brexit. In reality, the magnitude of NTBs between Scotland and RUK and between Scotland and the EU will depend on the ability of Scotland to sign bilateral trade agreements with RUK and the EU and on the characteristics of these. If no trade deals are signed, Scotland would trade with the EU and/or RUK under World Trade Organization (WTO) rules, thus NTBs are expected to be higher than those used in the simulations. However, if the new hypothetical trade deals achieve a greater degree of liberalisation with either of the two trade partners, NTBs are expected to be lower. We present the results from these scenarios in the next section.

There have been two recent papers that look at similar questions to this, which use different empirical approaches. One (Brakman et al., Reference Brakman, Garretsen and Kohl2021) uses a gravity modelling approach to estimate the impact of Brexit on the UK and the devolved nations on aggregate trade flows. They find that the trade impacts of Brexit, which are in line with predictions of the impact on the UK as a whole, on the devolved nations can be offset by independence from the UK and a renewed trade deal with the EU. Huang et al. (Reference Huang, Sampson and Schneider2021), in contrast, make use of a more detailed multicountry, multisector general equilibrium model and reach a quite different conclusion. While only looking at the impacts on Scotland and the UK, rather than each of the devolved nations, they find that the trade impacts of Brexit cannot be offset for Scotland with independence, concluding: ‘The trade-related costs of independence are similar regardless of whether Scotland rejoins the EU, since the benefits of lowering trade barriers with the EU by re-joining are roughly offset by the costs of putting the EU’s external border between Scotland and the rest of the UK’ (Huang et al., Reference Huang, Sampson and Schneider2021, p. 1).

4. Emerging findings and areas for future debate and research

To assess the economic impacts of these scenarios, we use a computable general equilibrium model of Scotland and the rest of the UK, calibrated on a 2013 Social Accounting Matrix. Such models are widely used by policymakers, particularly in assessing international trade options, including national governments and international organisations such as the World Bank and the WTO. The particular model that we employ here was used by the Scottish Parliament’s Europe Committee in 2016 to inform its work into the economic impact of Brexit on the Scottish economy (BBC, 2016; Scottish Parliament, 2016).

The full model specification is given in detail by Figus et al. (Reference Figus, Lisenkova, McGregor, Roy and Swales2018). However, we highlight some key features below. The model is essentially a multisectoral, multiregional, dynamic variant of a Layard et al. (Reference Layard, Nickell and Jackman2005)) model in which there is imperfect competition in labour markets and there are two endogenous regions—Scotland and RUK—and one exogenous region, ROW. There are 18 production sectors and 3 domestic transactor groups in each region: households, firms and government.

Sectoral disaggregation allows us to accommodate the sectoral-specific nature of disturbances associated with creating/eliminating borders and responses to these. The use of an explicitly interregional model allows us to capture important spillover effects between Scotland and RUK; regional results are not obtained by a mechanistic attribution process, but directly from the modelling.Footnote 4 The interregional, multisectoral structure of the model also minimises the probability of aggregation bias.

The model assumes that producers minimise cost using a nested, multilevel production function in each sector and region. The combination of intermediate inputs with RUK and ROW inputs is based on an Armington (Reference Armington1969) interlink. Gross output is produced by these composite intermediates and value added, which in turn is produced by labour and capital, in a constant elasticity of substitution function, allowing for substitution between these factors in response to relative price changes.

There are four components of final demand in the model: household consumption, investment, government expenditure and exports. Household consumption is a linear function of real disposable income. Real government expenditure adjusts to ensure an unchanged government deficit, while exports are determined again through an Armington function and so are dependent on relative prices.

The dynamics reflect adjustments in the stocks of capital and (in general) labour. Capital stocks are initially fixed, but in subsequent periods each sector’s capital stock is updated through investment, which responds partially to the gap between the desired and actual (adjusted for depreciation) levels of capital stock—in line with the neoclassical investment formulation (e.g. Jorgenson, Reference Jorgenson1963). In this paper we focus exclusively on long-run equilibria in which capital stocks (and the labour force) are at their new desired levels (so that investment is simply replacement investment).

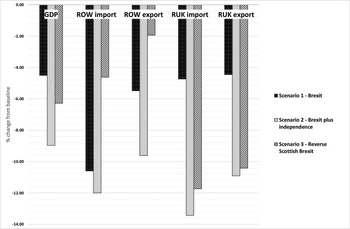

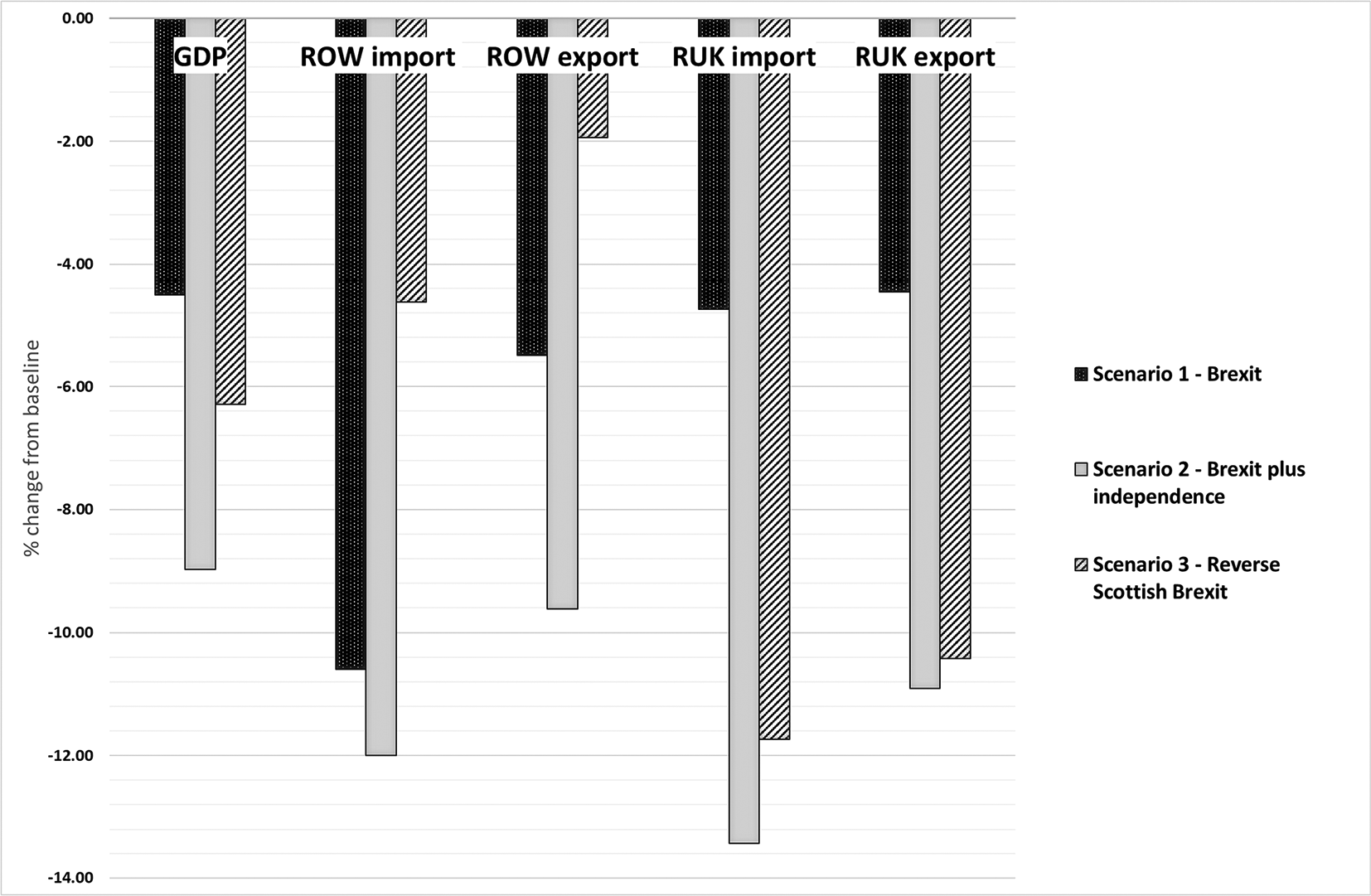

The NTBs are introduced as implicit price shocks to the relevant import and export prices, as indicated in table 4. Simulation results from our three scenarios are presented in Figure 3.Footnote 5 Figures are reported as percentage change from the baseline. Note that, since our model is calibrated on pre-Brexit data, the results should be interpreted as being measured relative to a no-Brexit counterfactual.

Figure 3. Impact of counterfactual scenarios on GDP and trade in Scotland.

The black bars represent results from Scenario 1 (Brexit), that is, a situation where NTBs are imposed on trade between the whole of the UK, including Scotland, and the EU. NTBs increase the cost of imports that are used as intermediates in production or directly consumed by households. Thus, production costs in Scotland increase. This is reflected in an overall increase in the cost of living and a loss in competitiveness in international markets. Imports from ROW (including the EU) fall by 10.6 per cent due to the increase in costs and the overall reduction in economic activities indicated by the fall in GDP of 4.5 per cent. Exports to ROW fall by 5.5 per cent, partly due to the frictions in trade with the EU and because of the further induced increased costs of Scottish goods. Trade with RUK falls too. This is partly because Scottish goods are more costly than before Brexit, therefore RUK consumers and firms tend to demand less of them, but also because the RUK economy experiences a Brexit driven contraction.

The grey bars represent results from our Scenario 2, Brexit plus independence. In this scenario, Scotland has new NTBs both with the EU and with RUK. The additional barriers on trade between Scotland and RUK nearly doubles the fall in GDP. This is not surprising, as RUK is the main trading partner for Scotland in our dataset. Similarly, trade with the RUK falls more than trade with ROW.

Finally, the bars with the diagonal pattern represent a situation where Scotland re-joins the EU (post-UK Brexit and independence), thus all NTBs in trade with the EU are removed, but the same NTBs with RUK associated with the previous scenario remain in place. Re-joining the EU mitigates the negative impact of independence but does not offset it completely. Interestingly, changes in trade with RUK relative to Scenario 2 are comparatively modest, but trade with the ROW recovers to a level that is higher than that in the Brexit scenario but still lower than the pre-Brexit level.

As discussed above, the modelling assesses the impact of different border effects in isolation from any other change in policy or macroeconomic disturbance. The government of an independent Scotland could potentially pursue policies to attempt to mitigate the losses driven by the introduction of NTBs with its main trading partner. Indeed, the ability to set different policies targeted at the Scottish economy is a key motivation for many supporters of independence.

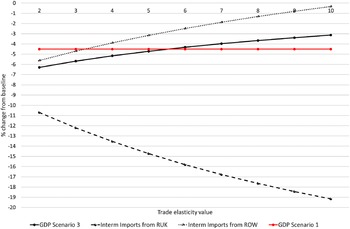

To explore this situation, we consider two additional scenarios. In the first, we repeat the simulation from Scenario 3 (reverse Scottish Brexit) but increase the ease with which Scottish firms can substitute imports of intermediates from RUK with imports of intermediates from ROW, by gradually increasing the elasticity of substitution in trade between Scotland and RUK. Results from this exercise are presented in Figure 4.

Figure 4. (Colour online) Sensitivity of results in Scenario 3 to trade elasticity values.

The red line represents the fall in GDP in the Brexit scenario. We want to identify what increase in elasticity is required for our Scenario 3, Reverse Scottish Brexit, to generate the same reduction in GDP as Scenario 1, UK Brexit. Our baseline models are calibrated with an elasticity value of 2. At that point on the horizontal axis, the fall in GDP corresponds to the results reported for Scenarios 1 and 3 in Figure 3. As the elasticity increases, Scottish firms substitute imports from ROW for RUK imports. Given that the former is not affected by NTBs, costs of production in Scotland fall and the country recovers some of its lost competitiveness. For an elasticity value of six, the fall in GDP from the two scenarios equalises. At this point, Scottish imports from RUK fall by approximately 16 per cent (as compared to nearly 11 per cent with default elasticity values), while ROW imports fall by 1.7 per cent (as compared to nearly 5 per cent).

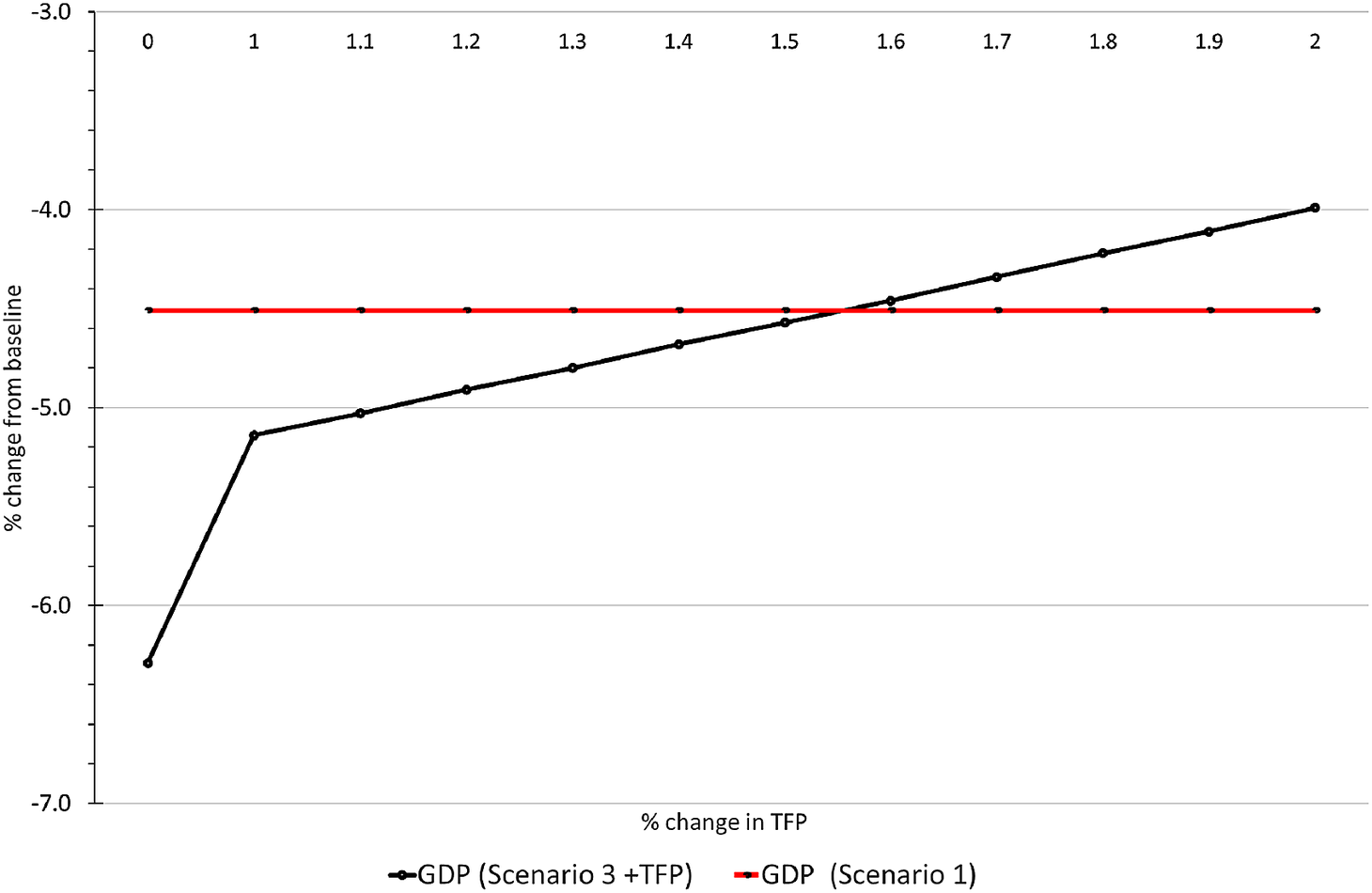

In the second sensitivity exercise, we repeat the simulations from Scenario 3, but imagine that Scottish total factor productivity (TFP) improves, initially by 1 per cent and then increasing incrementally by 0.1 per cent steps.

Results from these simulations are reported in Figure 5. Again, we report in red the change in GDP from Scenario 1 and use it as a benchmark. The results demonstrate that an additional increase in TFP—above trend—of approximately 1.6 per cent in all sectors of the economy would be required for the GDP outcome associated with Scenario 3 to match the GDP outcome for Scenario 1. It has proven difficult for the Scottish Government—and many others—to effect a step increase in productivity. Of course, the examples we consider here are far from exhaustive—there may be other policies that could be impactful here, including export promotion.

Figure 5. (Colour online) Sensitivity of results in Scenario 3 to higher levels of factors productivity.

5. Discussion and conclusions

Successive Scottish administrations have sought to improve Scotland’s international competitiveness. Brexit is likely to only make that task more challenging as it has put up significant trade barriers with Scotland’s largest international export market.

Unsurprisingly, therefore, Brexit has been used by supporters of independence to argue not only for a second referendum but also as evidence that Scotland’s economic interests are not best served by remaining in the Union. But Brexit opens up new and more challenging questions for proponents of independence than in 2014. The model advocated back then of Scotland and the UK remaining in the Single Market and therefore avoiding any trade frictions no longer holds. An independent Scotland would face a choice over where to erect a ‘hard’ economic border and which export markets to pursue preferential trade agreements with. This paper shows that there are no easy choices around borders facing the Scottish Government.

A key challenge is that the impacts of non-tariff barriers are complex, involving combinations of both supply and demand-side responses, and subject to considerable uncertainty. This uncertainty reflects inter alia: concerns about the accuracy of trade data for Scotland; the likely scale of the shocks to trade; the precise nature of the transmission mechanisms to the real economy and the potential for policy responses. Despite these uncertainties, however, our analysis supports several broad conclusions.

First, and most obviously, border choices really do matter for the future of the Scottish economy. They are highly likely to be associated with substantial changes in economic activity in Scotland.

Second, Brexit, as others have also found, is likely to have a major negative impact on the Scottish economy.

Third, independence would result in the creation of enhanced non-tariff barriers with RUK. All else remaining equal, this will generate significant, adverse, economy-wide impacts within Scotland. These impacts may endure for some time given uncertainty over the timing of successfully concluding negotiations to re-join the EU.

Fourth, re-joining the EU is likely to generate significant trade benefits as NTBs are reduced for Scotland’s trade with the EU. Our estimates suggest that other things being equal, re-joining the EU would partially, but not fully, offset the negative impacts of independence.

Fifth, other things may not be equal. One of the key motivations for independence cited by the Scottish Government is for better targeted domestic economic policies. Better supply-side policies, successful efforts to boost migration or strategies to grow more directly export shares in key external markets (e.g. attracting RUK companies to relocate to Scotland post-independence as happened in Ireland post-Brexit), all might help to improve shares of trade with ROW. This could, in principle, ensure an overall positive impact from this particular combination of border choices.

Nevertheless, such supplementary gains would not necessarily be automatically generated by re-joining the EU (though some would point to a ‘size of market’ effect). However, successive Scottish (and other) Governments have found it challenging to secure for example significant increases in total factor productivity (although Ireland provides an example of a successful shift towards new trading partners—albeit with an apparently very substantial time lag). Others will argue that an independent Scotland may face economic challenges, particularly during any transition, on a number of issues from currency to fiscal sustainability which might hamper efforts to grow competitiveness.

Future research could usefully address several additional issues. First, it would be instructive to explore the sectoral impacts of border choices, since this may facilitate targeting of responsive government policies. Second, and for similar reasons, the dynamics of adjustment is likely to prove important for all transactors. Third, decomposition analysis to enable attribution of impacts to different demand and supply shocks involved in the various border choices would further clarify the transmission mechanisms associated with the introduction of NTBs. This may matter for the appropriate design of any ‘compensating’ policies—as well as enhancing our understanding of the impacts. Fourth, further sensitivity analysis by for example: using other elasticity estimates (e.g. Huang et al., Reference Huang, Sampson and Schneider2021) and investigating the impact of alternative visions of the labour market (wage determination; migration), which again may be influenced by policy. Fifth, systematic exploration of the impact of Brexit/Independence and Reverse Scottish Brexit on the economies of RUK and the UK as a whole is important for potential UK policy responses.

Finally, perhaps the most important research project that this—and other studies—of the impact of Brexit and independence on Scotland’s economy have highlighted is the need for continued investment in regional UK trade statistics. Whilst there have been some improvements in compiling international trade statistics for Scotland in recent years, by the Scottish Government, Her Majesty’s Revenue and Customs (HMRC) and the Office for National Statistics (ONS), there remain important gaps. Most significantly, the lack of robust bottom-up import statistics is a major gap in the statistical landscape in Scotland. So too are detailed income flow statistics which would enable the construction of accurate balance of payments tables. Continued investment in such data is vital if informed predictions and assessments are to be made, not just of the options for constitutional change, but economic policies more generally.

Acknowledgements

The authors are grateful for the comments of an anonymous referee and of the participants in the workshop entitled ‘The political economy of devolution in, and secession from, the UK.’ hosted by the National Institute of Economic and Social Research on the 19th of November 2021. The authors also acknowledge the support of the Economic and Social Research Council Grant Ref: ES/W002434/1, Centre for Inclusive Trade Policy.