INTRODUCTION

Transforming economies pose significant challenges to multinational corporations’ (MNCs) business models (e.g., Chan, Gountas, Zhang, & Handley, Reference Chan, Gountas, Zhang and Handley2016; Sánchez & Ricart, Reference Sánchez and Ricart2010). This is because they are characterized by uncertain, highly volatile, and changing institutional frameworks (Peng, Wang, & Jiang, Reference Peng, Wang and Jiang2008). For instance, China is distinguished by weaker regulatory regimes and industry standards (Tan, Reference Tan2009; Tsai & Child, Reference Tsai and Child1997). So, whilst business models contribute to rapid internationalization (Dunford, Palmer, & Benveniste, Reference Dunford, Palmer and Benveniste2010) and local competition in transforming economies (Tallman, Luo, & Buckley, Reference Tallman, Luo and Buckley2018), entering those economies incurs institutional and market challenges. These fundamentally threaten MNCs’ business model viability (Birkinshaw, Zimmermann, & Raisch, Reference Birkinshaw, Zimmermann and Raisch2016b).

A business model (BM) is defined as a bundle of specific practices, including value proposition, creation, delivery, capture, and allocation (Tallman et al., Reference Tallman, Luo and Buckley2018: 522; Teece, Reference Teece2010: 172), ‘conducted to satisfy the perceived needs of the market’ (Foss & Saebi, Reference Foss and Saebi2018: 13). In the context of market entry and expansion, a BM contributes to firm performance in the way resources and capabilities are configured (Zott & Amit, Reference Zott and Amit2007, Reference Zott and Amit2008). However, previous studies suggest that MNCs entering transforming economies should alter their existing BMs (Tallman et al., Reference Tallman, Luo and Buckley2018; Teece, Reference Teece2014), innovate new BMs that better address the changing competitive landscape (Chan et al., Reference Chan, Gountas, Zhang and Handley2016), or introduce new BMs while simultaneously exploiting existing models (Birkinshaw et al., Reference Birkinshaw, Zimmermann and Raisch2016b; Snihur & Tarzijan, Reference Snihur and Tarzijan2018). Despite the recognition that firms increasingly use multiple BMs (Casadesus-Masanell & Tarziján, Reference Casadesus-Masanell and Tarziján2012), adopt flexible BMs (Mason & Mouzas, Reference Mason and Mouzas2012), and that the challenges of managing multiple BMs (Khanagha, Volberda, & Oshri, Reference Khanagha, Volberda and Oshri2014; Markides, Reference Markides2013; Smith, Binns, & Tushman, Reference Smith, Binns and Tushman2010) are discussed, recognizing some of the adverse performance effects of adopting multiple BMs simultaneously (Kim & Min, Reference Kim and Min2015; Pati, Nandakumar, Ghobadian, Ireland, & O'Regan, Reference Pati, Nandakumar, Ghobadian, Ireland and O'Regan2018), there remains significant limitations in this literature.

First, the literature is theoretically underdeveloped and provides limited conceptual guidance on how to manage multiple BMs simultaneously (Foss & Saebi, Reference Foss and Saebi2017). Second, except for a few empirical examples (Pati et al., Reference Pati, Nandakumar, Ghobadian, Ireland and O'Regan2018; Snihur & Tarzijan, Reference Snihur and Tarzijan2018), the literature is inconclusive on how MNCs address this challenge in transforming economies. As recently noted by Tallman, Luo, and Buckley (Reference Tallman, Luo and Buckley2018: 531), ‘in no case is “one size fits all” a suitable mantra for business models across all markets’. Yet, it remains unclear what the impact of ‘locational differences in BM creation’ are, as most research to date is largely ‘pragmatic and acontextual’ (Tallman et al., Reference Tallman, Luo and Buckley2018: 533). Indeed, contextualizing business model innovation (BMI) in transforming economies is not only important for developing context-sensitive theory (Plakoyiannaki, Wei, & Prashantham, Reference Plakoyiannaki, Wei and Prashantham2019), but also making such theory relevant for practice.

Our aim, in this article, is to address the current weaknesses in BM research by exploring how contextual dynamics affect BMI in transforming economies. The literature suggests two distinctive ways in which firms may address these challenges. First, in pursuit of global integration, firms replicate their existing BMs in host markets but are liable to the different local demands and, therefore, respond to the local conditions of the host market through experimentation and co-optation of practices developed or used elsewhere (Dunford et al., Reference Dunford, Palmer and Benveniste2010). Second, when firms find their existing BMs are threatened in the new context, notably when facing complexity in the institutional regime and turbulence in the market, they engage in trial-and-error and explore alternative BMs (Teece, Reference Teece2014). To capture these disparate, yet important views into a coherent framework, we offer the concept of multidexterity, which recognizes the coexistence of multiple BMs. Specifically, multidexterity aims to explain an organization's capability to develop and maintain multiple BMs at the same time in order to address institutional and organisational dynamics.

The concept of multidexterity, while scarcely used in the management literature, involves the enactment of ‘numerous different strategies and tactics’ (Kodama, Reference Kodama2017: 167) by different organisational actors and the simultaneous management of competing strategic agendas of different stakeholders (Ritter & Geersbro, Reference Ritter and Geersbro2018). Dispersed organisations, such as MNCs, are exposed to different stakeholders and different institutional, regulatory regimes and industrial standards in different host markets and are expected to manage these challenges locally while remaining coherent globally (Bartlett & Ghoshal, Reference Bartlett and Ghoshal1989). We, therefore, define multidexterity as ‘the ability to develop, nurture, and execute several distinctive BM strategies simultaneously across different levels and functions of the MNC and its host markets'. Similar to the dynamic capabilities view (Helfat et al., Reference Helfat, Finkelstein, Mitchell, Peteraf, Singh, Teece and Winter2007), we assume that multidextrous MNCs have the ability to perform multiple practices simultaneously in pursuit of realizing an intended or emergent goal in any local market that challenges the firm's global integration agenda.

To investigate multidexterity, we use an in-depth case study of a European healthcare provider who initially failed to implement a global BM in China and subsequently adopted a successful multidextrous BMI approach. From our findings, we theorise the multidexterity concept in transforming economies and discuss theory and practice implications.

THEORETICAL BACKGROUND

Because transforming economies are highly volatile, uncertain, and characterized by changing institutional frameworks (Peng et al., Reference Peng, Wang and Jiang2008), the regulatory regime of such countries may offer advantages for some and disadvantages for others. Market entry into transforming economies is increasingly conditioned by market-based capabilities, that is, specific knowledge about the institutional and regulatory regimes of the host country (Peng et al., Reference Peng, Wang and Jiang2008). Some of the conditions underlying local market and institutional regimes may share the same characteristics as other countries, allowing transferability or adaptability globally, whereas transforming economies place high demands on products and services that need to adhere to local standards, regulatory requirements, with locally responsive marketing and distribution systems (Ghoshal & Nohria, Reference Ghoshal and Nohria1993). Transforming economies, however, constantly challenge the balance between the BMs originating from the home market and the localised BMs (Tallman et al., Reference Tallman, Luo and Buckley2018) such that global BMs require adaptation to local needs or arbitrating disadvantageous home country practices with advantageous host market practices (Ghemawat, Reference Ghemawat2007).

Indeed, while combining internationalisation strategies have proven effective for some MNCs (e.g., GE Healthcare), managing the tensions between the global integration and local responsiveness strategies is challenging. Transforming economies in general and China, in particular, may be advantageous for some MNC strategies (Luo & Child, Reference Luo and Child2015), but this does not mean that it is unproblematic to find a good fit between the local institutions and entrant firms’ practices (Teece, Reference Teece2019). On the contrary, any combination of BMs in pursuit of balancing global integration and local responsiveness is likely to be subject to the dynamism inherent between the two (Kumar & Puranam, Reference Kumar and Puranam2011; Luo & Child, Reference Luo and Child2015).

BMI in Transforming Economies

The uncertain and volatile nature of transforming economies requires localised capabilities to adapt BMs (Teece, Reference Teece2014) and managerial efforts to continuously make BMs more distinctive and agile against competition (Doz & Kosonen, Reference Doz and Kosonen2010). These capabilities are important for MNCs as they allow them to recognise differences in the local business environment and reinstate ‘fitness’ between the firm's global BM and the local institutional and regulatory regimes. Indeed, the adaptability of global BMs will be contingent on ‘how fragmented regulations and standards turn out to be’ (Teece, Reference Teece2019: 192) and how localised actions underpin the MNC's host market strategy (Teece, Reference Teece2014). These specific challenges have implications on BM adaptation and innovation in such environments where markets are volatile and institutional regimes are subject to rapid changes (Tallman et al., Reference Tallman, Luo and Buckley2018; Teece, Reference Teece2018).

The MNC's value creation and value delivery model will face disruptions unless the firm substitutes key elements in its BM that reflect changes in its external business environment (Hacklin, Björkdahl, & Wallin, Reference Hacklin, Björkdahl and Wallin2018). Depending on the strategy underpinning the new BM, value may migrate and augment the MNC's global strategy (Ghemawat, Reference Ghemawat2007) or reinforce its localisation strategy (Luo & Child, Reference Luo and Child2015). However, earlier studies treat the transforming economy context as constant and do not provide any clues other than micro-level contingencies. Hence, in previous studies, the macro-level context is not accounted for, leaving it conceptually underdeveloped and empirically limited (Markides, Reference Markides2013) in the context of transforming economies (Luo & Child, Reference Luo and Child2015).

Despite the importance of maintaining a fit between BMs and local business environments, context-sensitive approaches to BMI, especially in transforming economies, remain scant (Luo & Child, Reference Luo and Child2015; Tallman et al., Reference Tallman, Luo and Buckley2018). For example, prior studies have focused on how multiple BMs generate value (e.g., Sánchez & Ricart, Reference Sánchez and Ricart2010) and contribute to MNCs’ performance in transforming economies (Kim & Min, Reference Kim and Min2015), but we know little about how existing BMs are coupled with resources in transforming economies, hence disregarding the resource dynamics involved in managing multiple BMs. There is a need for research that explores the contextual dynamics of BMI in transforming economies and captures the micro details of combining old models with new ones in order to reveal new insights.

Some studies have suggested that MNCs may refine their existing global BMs upon market entry rather than localising them. Monaghan and Tippmann (Reference Monaghan and Tippmann2018) found that some MNCs avoid rushing into new markets to be able to adapt their BMs. However, adaptation of BMs is part of the global integration process in which new experiences continuously add to the firms’ ‘recipe heuristic’ (Monaghan & Tippmann, Reference Monaghan and Tippmann2018). Other studies have suggested different states of BMI. For example, Khanagha et al. (2014: 324) take an evolutionary view, including ‘incremental changes in individual components of business models, extension of the existing business model, introduction of parallel business models, [and] disruption of the business model, which may potentially entail replacing the existing model with a fundamentally different one’. Such evolutionary processes towards convergence to a dominant BM encompasses BMI as an incremental process towards local adaptation but ignore the effects of external contingencies that require more radical shifts in the MNCs BMs.

These specific contingencies not only have implications on the MNC's local organisational structure, processes, and the power regime (Begley & Boyd, Reference Begley and Boyd2003; Ghoshal & Nohria, Reference Ghoshal and Nohria1993), but also on the ability to adapt the BM to fit with the MNC's global BM. As Tallman et al. (Reference Tallman, Luo and Buckley2018) note, transforming economies spur bottom-up developments of new BMs that oppose the traditional top-down approach practiced by many MNCs (Birkinshaw et al., Reference Birkinshaw, Crilly, Bouquet and Lee2016a). This indicates that transforming economies require a close interaction between localised BMs and the orchestration of the MNC's ‘subsystems and processes to accomplish a specific purpose’ (George & Bock, Reference George and Bock2011: 97). However, transforming economies add to the complexity of orchestrating actors along a vertical value chain that is not under the direct ownership or bureaucratic control of the focal firm (Zeng, Simpson, & Dang, Reference Zeng, Simpson and Dang2017).

While this recursive process between BMI and organizational design seems intuitive, Foss and Saebi (Reference Foss and Saebi2017: 214) found that this relationship is scarcely studied and that ‘more research is required to understand the organizational design aspects of BMI’, where BMI is defined as ‘nontrivial changes to the key elements of a firm's BM and/or the architecture linking these elements’ (Foss & Saebi, Reference Foss and Saebi2017: 216). This definition suggests that BMI is an evolutionary process (Khanagha et al., Reference Khanagha, Volberda and Oshri2014; Monaghan & Tippmann, Reference Monaghan and Tippmann2018), led by key decision-makers in pursuit of making changes to the ordinary, yet not stabilised BM.

In sum, with some general exceptions (Casadesus-Masanell & Zhu, Reference Casadesus-Masanell and Zhu2013; Markides & Oyon, Reference Markides and Oyon2010; Smith et al., Reference Smith, Binns and Tushman2010), it remains largely unclear how MNCs can strike a balance between the original BM designed to address global integration while at the same time innovating BMs for local responsiveness (Snihur & Tarzijan, Reference Snihur and Tarzijan2018). Part of this complexity lies in implementing integrative yet different BMs in several geographically dispersed sites while trying to innovate BMs and adapt them to changing legal and institutional environments simultaneously (Teece, Reference Teece2018). This may be due to obstacles in transforming economies associated with the (i) internal fit between diverse BMs, (ii) external fit with localized foreign markets, and (iii) dynamic interaction between internal and external cultural, institutional, and socio-economic factors (Tallman et al., Reference Tallman, Luo and Buckley2018). While previous studies provide some clues for how to alter the value-generating and capture mechanisms in BMs in response to these factors, empirical accounts of the use and development of multiple BMs in transforming economies remains scant.

Multidexterity

In addressing these limitations of multiple BMs in transforming economies, we introduce a novel concept – multidexterity. The root form – dexterity – is associated with readiness or skilfulness and has been used to denote start-up firms’ skilfulness in executing individual organising processes in response to international market entry uncertainties (Autio, George, & Alexy, Reference Autio, George and Alexy2011). While dexterity denotes deliberate and focused enactment of specific organisational capabilities at the expense of others, multidexterity denotes an ability to simultaneously orchestrate strategic actions within and outside the firm at multiple levels. Multidextrous organisations are further capable of balancing the inherent relationship between selection and evaluation practices. The former denotes the ability to enact multiple selection regimes, where some of which are not necessarily aligned, legitimated, or resourced by the existing strategic context of the organisation (Burgelman, Reference Burgelman1983). The multiplicity of selection regimes is dependent on the performance measurement practices as any choice will be subjected to scrutiny and evaluation, both internally and externally (Adner & Levinthal, Reference Adner and Levinthal2008). This suggests that multidexterity implies an ability to balance the conditions emerging in one domain with those of another domain. Multidexterity, therefore, is geared towards achieving ‘different and multiple objectives’ (Ritter & Geersbro, Reference Ritter and Geersbro2018: 75) at once.

As such, multidexterity is a bundle of practices (Schatzki, Reference Schatzki, Spaargaren, Weenink and Lamers2016) that intersect variably into other practices enacted for localised BMs. Hence, multidexterity is a multimodal capability of performing, experiencing, and evaluating activities within and outside organisational boundaries. In the case of MNCs, this implies an ability to balance the unique requirements of local markets that differ both from the global BM and unique local BM of other specific markets. For example, an actor in a supply chain may enact the same BM as another but handles industry standards with different levels of skilfulness and may enact a different response strategy to local institutional norms and legal regulations than those of another market (Oliver, Reference Oliver1991).

Multidexterity is particularly promising for understanding how MNCs orchestrate the multiple and conflicting demands of different stakeholders, institutional and regulatory regimes, industrial standards, resources, value creation, and appropriation regimes. For example, while the use of multiple BMs is essentially a response to problems of technological discontinuities (Ettlie, Bridges, & O'Keefe, Reference Ettlie, Bridges and O'Keefe1984), autonomous middle managers (Burgelman, Reference Burgelman1983), and frontline managers (Birkinshaw et al., Reference Birkinshaw, Crilly, Bouquet and Lee2016a), prior analytical models have not adequately captured how MNCs simultaneously orchestrate various resource dynamics in global and local BMs. For example, when BMs are exposed to international markets, value creation and value delivery activities may not only face a certain degree of disintegration, they may also undermine each other (Tallman et al., Reference Tallman, Luo and Buckley2018). Hence, ‘how to obtain resource commitments for initiatives that appear foreign and at odds with existing BMs’ (Adner & Levinthal, Reference Adner and Levinthal2008: 49) remains unclear.

The concept of multidexterity, we argue, is particularly suited for this task as it helps to distinguish BMI on two dimensions i) coupling and ii) coherence. By coupling, we mean the extent to which BMs within the same system have interdependent variables (Weick, Reference Weick1976: 3) and share specific qualities depending on the contextual dynamics of the system. For example, multiple BMs may converge around strong couplings in asset use practices and in market barrier management (Casadesus-Masanell & Tarziján, Reference Casadesus-Masanell and Tarziján2012) and have loose couplings around service contracts and joint product development partnerships (Sabatier, Mangematin, & Rousselle, Reference Sabatier, Mangematin and Rousselle2010). How parts of a system are coupled is further determined by the extent to which they are coherent. We take coherence to mean the extent to which a BM is responsive to the larger value-creating ecosystem (Massa, Tucci, & Afuah, Reference Massa, Tucci and Afuah2017), demonstrated by consistency relative to the activities constituting the system. For instance, a BM may have a distinctive supply infrastructure from another and will, in that practice site, be non-coupled with other BMs. But the same BM may have an undistinctive demand infrastructure, sharing the same customer base of another BM and may, in that practice site, be coupled with other BMs simultaneously managed by the MNC.

Based on these initial arguments, the concept of multidexterity offers a promising view of MNCs operating in complex transforming economies. We argue that while MNCs can be competitive by arbitrating between the disadvantages of different markets, multidextrous MNCs can embrace the complexity and ambiguity inherent in and around different practices. Multidexterity accepts deviations from ordinary organizational practices as natural selection and adaptation processes (Anderson, Reference Anderson1999) across multiple organisational sites (Schatzki, Reference Schatzki, Spaargaren, Weenink and Lamers2016). Building from these theoretical arguments, we use the concept of multidexterity to explain how multiple and seemingly contradictory BMs can be enacted in transforming economies.

RESEARCH CONTEXT AND METHODS

Studying multidexterity in pursuit of BMI is contextually sensitive (Plakoyiannaki et al., Reference Plakoyiannaki, Wei and Prashantham2019) and particularly suitable for MNCs operating in transforming economies (Tallman et al., Reference Tallman, Luo and Buckley2018). Our study concerns an international healthcare service provider, OneHealth (pseudonym), that has pursued a rapid multinationalisation strategy (Monaghan & Tippmann, Reference Monaghan and Tippmann2018), growing from 150 to 360 clinics (3,000 to 11,000 employees) across 19 countries, including transforming economies such as Brazil, Chile, China, Russia, and Saudi Arabia. Because these countries have different regulatory frameworks, OneHealth has enacted a limitedly flexible global BM. This included a mix of freestanding clinics, management contracts with hospitals, and public-private partnerships in which OneHealth manages and operates clinics on long-term contracts on behalf of regional or local healthcare authorities.

Over the past few years, the newly formed Middle East & Asia (MEA) region has become the company's real growth engine, with Saudi Arabia having developed into the biggest market globally with 35 clinics and 1,300 employees. While OneHealth's strategic target for Saudi Arabia is continued growth, it predicts to become even bigger in China over the coming 5–7 years, aspiring to become a top-3 player. To reach such a position, they ‘need to operate some 75–100 mid-sized clinics’ as noted by the senior vice president for MEA (‘SVP’). This would be a very challenging task for the global BM as OneHealth is contracted by the Ministry of Health (MoH) in Saudi Arabia, whilst in China, each opportunity ‘has to be sourced and developed from scratch in the open competitive market’ (SVP). This challenge to the global BM is the research focus.

Research Design

Given the emerging nature of BMI in transforming economies, we used a longitudinal, multi-source data collection research design (Yin, Reference Yin2009) to better capture strategy-performance relationships (Junni, Sarala, Taras, & Tarba, Reference Junni, Sarala, Taras and Tarba2013). Similar to prior studies and recommendations (Heracleous, Gößwein, & Beaudette, Reference Heracleous, Gößwein and Beaudette2018; von Krogh, Rossi-Lamastra, & Haefliger, Reference von Krogh, Rossi-Lamastra and Haefliger2012), we inquired into this phenomenon in an early, embryonic stage, focusing on providing empirical and theoretical insights. OneHealth is a noteworthy and appropriate case for our investigation as it is an exemplar (Yin, Reference Yin2009) of multidextrous BMI in a transforming economy, and so provides insight to the challenges posed to MNCs’ global BMs. This case was, therefore, based on theoretical sampling (Yin, Reference Yin2009), allowing us to explore valuable insights at this early stage of the phenomenon (von Krogh et al., Reference von Krogh, Rossi-Lamastra and Haefliger2012).

We focused our data collection on extensive secondary data and in-depth primary interview, and observational data generated from well-informed actors. We collected data from the LexisNexis database (December 2007–February 2019), which yielded 700+ unique articles, and collected all available financial reports, press releases, and blog posts (approx. 150, May 2011–February 2019). Finally, data also comprised corporate-specific data, including PowerPoint presentations, BM configurations, strategic decisions, etc. These sources were used to identify the different market entry strategies and changes to the BM.

Starting in late 2017, the first author initiated a series of semi-structured interviews and discussions (n=10) with a key informant (Yin, Reference Yin2009), focusing on multidextrous BMI practice. Our informant (SVP) is a key decision-maker who has ‘extensive and exclusive information and the ability to influence important firm outcomes, either alone or jointly with others (e.g., on a board of directors)’ (Aguinis & Solarino, Reference Aguinis and Solarino2019: 3). Hence, sampling this key informant implied access to highly reliable and deep knowledge (Miles & Huberman, Reference Miles and Huberman1994) of multidextrous BMI activities. Similar to other scholars, we chose the SVP as he was personally responsible for the market entry (Bingham & Davis, Reference Bingham and Davis2012) and personally involved in BMI (Berends, Smits, Reymen, & Podoynitsyna, Reference Berends, Smits, Reymen and Podoynitsyna2016), which is typical to autonomous strategic actions by executives (Burgelman, Reference Burgelman1983).

Interviews and discussions lasted between 30 and 90 minutes with shorter exploratory, non-directive interviews at the beginning, to establish trust and interest, longer, more detailed ones later, and short gap-filling ones at the end. Questions revolved around the company's history, expansion paths, learning experiences, and failures, responses, as well as adjustments to the global BM and the details around the introduction of the new BMs. Using such directive and non-directive techniques helped us mitigate informant bias (Huber & Power, Reference Huber and Power1985; Miller, Cardinal, & Glick, Reference Miller, Cardinal and Glick1997) and build a strong ground for theoretical insights (Eisenhardt, Reference Eisenhardt1989).

In early 2018, we complemented these in-depth interviews with an observational study of a one-day open strategy workshop (Hautz, Seidl, & Whittington, Reference Hautz, Seidl and Whittington2017) in order to (1) corroborate the views of the key informant and (2) gather information on the evolution of the new BMs in vivo. Our key informant presented his case on ‘How to enter the Chinese market’ for informed insights from 12 non-competitor executives of Western MNCs in China. The workshop resulted in excess of 300 pages of notes and photos. In adopting this approach, our goal was to identify and explain multidexterity as a bundle of practices (Schatzki, Reference Schatzki, Spaargaren, Weenink and Lamers2016). This approach suggests that conflicts between structures and individual actions can be accommodated within the same explanatory frame (Sewell, Reference Sewell1992) and hence resonates well with a multidextrous approach.

Data Analysis

Because multidextrous BMI is poorly theorized, we took an ‘abductive’ process approach aiming to offer a plausible explanation to a theoretically incomplete ‘anomaly’ (Van de Ven, Reference Van de Ven2007; Weick, Reference Weick1989). This can help connect empirical observations ‘to extant theoretical ideas to generate novel conceptual insight and distinctions’ (Langley et al., Reference Langley, Smallman, Tsoukas and Van de Ven2013: 11) by recurrently examining alternative explanations. Abduction is, therefore, particularly suited to resolve ‘the status quo explanation of a given phenomenon’ (Van de Ven, Reference Van de Ven2007: 65), that strategies of global integration and local responsiveness can coexist through multiple BMs. Accordingly, we analysed our data in several iterative steps, aspiring to find the most plausible explanation to the practices underpinning multidextrous BMI. However, for the sake of simplicity, we present our approach sequentially.

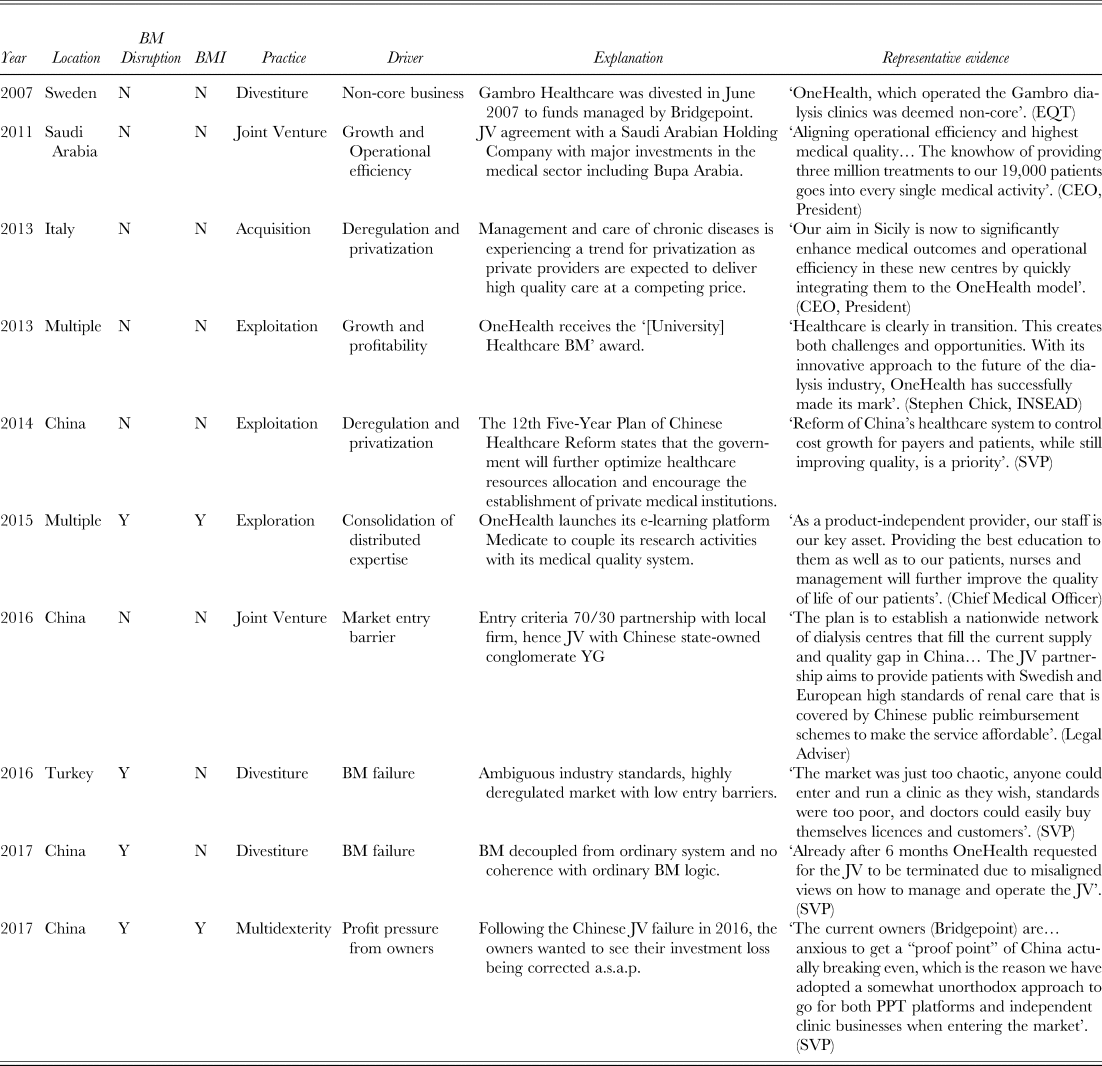

First and consistent with single-case methods (Siggelkow, Reference Siggelkow2007), we began our analysis while collecting data by reading our transcripts, notes, and other materials and condensing the data (Miles & Huberman, Reference Miles and Huberman1994). We wrote short narratives about the evolutionary steps in OneHealth's BMs during its multinationalisation. Throughout the entire process, we discussed potential discrepancies in our narratives and alternative plausible explanations to multidextrous BMI and, when necessary, refined the narratives by returning to our data. Once the whole period was covered, we decomposed critical, descriptive events and strategies into temporal brackets aiming to capture disruptions to the global BM, innovations, practices, and the drivers of BM disruptions (see Table 1).

Table 1. Evolutionary steps in the development of the global BM

This initial analysis revealed that the global BM was complemented by several local BMIs following a multidextrous approach. This was caused by the co-occurrence of challenges faced by both regulatory regimes and by conflicting industrial standards facing OneHealth during market entry into transforming economies. The institutional regulatory regimes could determine the ‘life and death of the business’, or the extent to which the global BM supports or threatens the survival of the firm in the local market (Hill & Birkinshaw, Reference Hill and Birkinshaw2014; Tallman et al., Reference Tallman, Luo and Buckley2018). The industrial standards for medical services are instrumental for the healthcare industry's technological environment and constitute the firms’ BM competitiveness (Casadesus-Masanell & Zhu, Reference Casadesus-Masanell and Zhu2013; Volberda, Van den Bosch, & Heij, Reference Volberda, Van den Bosch and Heij2017). Hence, these two dimensions emerged as our main analytical springboards for better understanding multidextrous BMI in transforming economies.

In a second step, we triangulated the different data sources to derive empirically viable evidence to illustrate relationships between these environmental and technological conditions emerging from transforming economies and the actions taken for strategic change and fitness (Helfat et al., Reference Helfat, Finkelstein, Mitchell, Peteraf, Singh, Teece and Winter2007). We discovered that different localized BMI were variably related to the regulatory regimes and the industrial standards of each market, revealing various degrees of coupling and coherence between local BMs and the global BM. Using this distinction, we discovered four types of BMIs, which, following axial coding (Corbin & Strauss, Reference Corbin and Strauss2008) and examining different theories to find plausible explanations for each, labelled as; resource integration, skunkworks, resource partitioning, resource orchestration (see Figure 1).

Figure 1. The multidextrous space

In order to substantiate our analyses, we distinguished empirical examples of multidexterity and used these to develop short narratives explaining how these relationships capture each of the elements for multidextrous BMI. We circulated these narratives to our key informant and the open strategy participants for so-called ‘member checks’ (Lincoln & Guba, Reference Lincoln and Guba1985: 314). These did not fundamentally challenge our model; they helped us refine it and increase its credibility and reliability (Yin, Reference Yin2009). The member checks helped us understand that the activities operate as bundles (Demir, Reference Demir2015) as their viability as BMs was dependent on whether they were coherent and how they were coupled with each other. This helped us to uncover multidextrous BMI practices (see marked area in Figure 1).

RESULTS

Our data suggests that multidextrous BMI takes place when the regulatory and industrial standards of the transforming economy challenge the MNC's global BM. The global BM largely builds on three critical elements: i) ownership of, or control over, resources; ii) European industrial standards and iii) deregulated and unambiguous market for healthcare provision. These factors can undermine the MNE's go-to-market strategy and its ability to generate value in local contexts due to their local variations. Therefore, developing alternative BMs that are either adaptations of the global BM or entirely new BMs is of central importance in highly uncertain and volatile local markets. We find that to respond to such uncertainties, local subsidiaries challenge the conditions underlying the global BM of the MNC.

We found that whilst OneHealth experienced significant success in entering highly regulated markets with unambiguous industry standards with their global BM, such as Saudi Arabia, they experienced failures when attempting to enter Turkey and in their first attempt to enter China. In Turkey, the market was highly deregulated with decentralized business licensing and ‘basically no medical standards’, meaning there was ‘too much volatility’; ‘doctors could attract patients from our clinics simply by offering them direct and indirect cash incentives’ (SVP). Incapable of accommodating these significantly different local practices into the global BM, OneHealth divested its clinics in Turkey. They then tried to enter the Chinese renal care market with a joint venture in order to replicate their global BM logic. Again, there were ambiguous industry standards, and the global BM was not effective as there were no private clinic chains for platform acquisitions available; foreign firms had restricted entry requirements, and relicensing of existing clinics was required when foreign investors acquired an already operating clinic business. The importance of the Chinese market meant that OneHealth management decided to ‘realize the international high growth plan by any means possible’ (SVP). Because ‘business model innovation is highly decentralized’ (SVP), the SVP developed three alternative BMs, each with a specific characteristic common to the global BM but also with distinctive features inimical to the global BM.

These different BMs reveal several distinctive multidextrous BMI practices that are illuminated using two key organisational dimensions of multidexterity; i) coupling and ii) coherence. These two dimensions result in a typology that identifies four distinct multidextrous types: i) ‘resource integration’; tight coupling of resources and strong coherence with corporate policies and procedures, ii) ‘skunkworks’ (Burgelman, Reference Burgelman1983); practices which involve activities that are loosely coupled from the organization and not necessarily sanctioned by top management (Adner & Levinthal, Reference Adner and Levinthal2008), iii) ‘resource partitioning’ (Carroll, Dobrev, & Swaminathan, Reference Carroll, Dobrev and Swaminathan2002); practices directed to partition a resource space into favourable parts vis-à-vis rivals, iv) ‘resource orchestration’ (Sirmon et al., Reference Sirmon, Hitt, Ireland and Gilbert2011); practices involving the arrangement and coordination of resources to gain advantages in the local marketplace. This may include structuring, bundling, integrating, and leveraging for competitive advantage (Helfat & Martin, Reference Helfat and Martin2015). Together, these multidextrous BMIs show how the MNC responded to local needs and constraints by managing their level of coupling and coherence with the global BM (see Table 2).

Table 2. Multidextrous BMI in transforming economies

Note: * Based on UN/WESP 2019 Country classification

Resource Integration (Quadrant 1) – The Global BM

A significant reason for OneHealth's international high-growth was the use of BM replication (Dunford et al., Reference Dunford, Palmer and Benveniste2010) or ‘recipe heuristic’ (Monaghan & Tippmann, Reference Monaghan and Tippmann2018). OneHealth's global BM was based on resource integration. OneHealth's expansion into Saudi Arabia's highly regulated transforming economy showed its global BM was only marginally adapted to the local context. The regulatory environment and prevailing industrial standards helped the local business tightly couple its resources with the rest of the organization. This further helped create a strong coherence between the local adaptations of the global BM. Our analysis revealed three underpinning practices; resource ownership, service integration, and technological nesting.

Resource ownership. Resource ownership allowed the MNC to be highly distributed and complex and yet able to tocontrol the stock of resources without assuring the standards required for resource quality, immobility of private information, availability during times of high growth, market uncertainty, and supply chain volatility. Although OneHealth's global BM was configured for a centralized model of market regulation and had limited ability to deal with variations across local host markets, resource ownership ensured controlled high growth in highly regulated markets. OneHealth designed its global BM to assure consistency and control across its global network of clinics by employing a full ownership strategy that allowed minority shareholder partners only as a transition strategy to overcome local regulatory liabilities. Resources such as machinery and clinics were either under the direct ownership of OneHealth or secured through long term contracts with hospitals or health authorities.

Centralized regulation enabled speedy market entry as it afforded a ‘one-stop-shop’ logic where OneHealth was negotiating licences, terms of operation, and clinic ownership with only one contractual partner (e.g., Ministry of Health, ‘MoH’). In dealing with only one governing body, OneHealth could gradually build trust and commitment vis-à-vis local authorities helping them to negotiate favourable conditions, thus mitigating market uncertainties. It also allowed quicker ramp up so that OneHealth's initial joint venture to run one single clinic became a five-year contract to run 50 percent of clinics managed by the MoH in just two years.

Resource ownership further helped OneHealth to rapidly and tightly couple local operations with the overall structure of the group, allowing them to ‘integrate clinics through a 100-day and 1-year integration plan’. It also helped control medical quality standards: ‘Quarterly follow-up shows an impressive increase in CPM [Clinical Performance Measures] scores after a newly acquired clinic has been integrated [and] the longer a clinic has been with OneHealth, the better the medical performance’ (CMO). Central regulatory regimes also favoured OneHealth's ownership strategy as senior management were physically located ‘close to clinic operations’ (CEO), allowing them to have full access to patients, staff, and referring medical team members (employed by hospitals). Hence, resource ownership was key to altering OneHealth's local responsiveness in highly regulated markets and allowed senior managers to ‘have an intimate understanding of customer needs and thus enable(ing) us to act quickly and decisively’ (CEO) to local needs, but also to constantly refine the global BM based on patient feedback on OneHealth's ‘standard of quality’ (CEO).

Service integration

In medical care delivery, the quality of service requires compliance with regulatory frameworks, industry standards, and organisation specific systems, practices, and processes. The latter also warrants some degree of efficiency in service delivery and hence can serve as a value capture mechanism. However, private clinics compete on several dimensions, such as delivery of high-quality service to patients (family members are normally involved in clinic selection), retention, and endorsement of clinics. Our analysis revealed that almost 50% of OneHealth's total new patient base were referrals from existing patients and their families. Medical clinics further compete through the establishment of close, trusting relationships with hospital physicians and nurses to become the alternative referral choice for patients that are dissatisfied with the service or medical quality of the existing clinic.

Our analysis revealed two integrated service practices; (1) integrated patient care and (2) patient empowerment. Integrated patient care is the practice of coordinating the patient's entire healthcare needs, including medical care, preventive care, management and treatment of kidney disease, and individualised patient care advise. These are monitored through patient satisfaction surveys twice a year at each clinic throughout the world, and the results directly alter the global BM. However, to be able to bring the service level of clinics up to global standards, surveys are made monthly for newly started (or acquired) clinics, and as improvement is achieved, surveys are made on a quarterly basis until they reach the threshold level (90%). Further, because industry standards vary across markets, with some markets having more ambiguous standards than others, OneHealth takes advantage of their integrated value creation practice of medical care, ‘In new markets, the policies and procedures are rolled out in close cooperation with the local teams… benefitting from the international experience of OneHealth’ (Annual Review, 2016). While medical care services are initially locally responsive, they are designed to continuously migrate towards global standards. As the CEO noted, ‘we were delighted to see the progress of the integration process [in Saudi Arabia] to achieve OneHealth care standards’.

Patient empowerment practice has the same integrational structure as the renal care practice; it is designed to continuously migrate from local responsiveness to global integration. Patient empowerment is devised to make local industrial standards a baseline criterion to be coupled with internal standards rather than aspirational criteria beyond OneHealth's internal standards. This involves educating patients to enable them ‘to better understand their disease and be empowered to take action to improve the quality of their lives’ (Annual Review, 2016). Despite some initial challenges in Saudi Arabia, patient empowerment was set to align with global standards. For example, to strengthen patient empowerment, OneHealth structurally integrated its Scientific Department with ‘Medicate’, ‘an umbrella for all education programs for nurses, doctors, patients, managers, etc.’ (SVP).

Technological nesting

Given the ambiguity of local standards of medical treatment and the variation of industrial regulation across the globe, responding to local requirements for medical practice license approval is heavily dependent on coherence between local and global practice. This was achieved through technological nesting, where localized variations in clinic management are gradually coupled and made coherent with a globalized standard. At OneHealth, technology nesting was viewed as ‘a methodology and working method for how to treat… in a standardized way with high quality’ (SVP). This is particularly important for high-reliability organizations (Weick, Sutcliffe, & Obstfeld, Reference Weick, Sutcliffe, Obstfeld, Staw and Sutton1999). For instance, ‘Would we perform serious medical errors… that would be a serious issue… globally’ (SVP). Technological nesting was, therefore, contingent on internal coupling of systems, practices, and processes as well as coherence with regulations and medical standards.

Our analysis shows that technological nesting underpinned the global BM in two respects: value proposition performance and medical treatment capability. For value performance, new clinics were surveyed on patient satisfaction and medical quality for every single treatment, and this was compared across OneHealth's global clinic network. ‘Everything is facts-based… We have statistics for fifteen years back, on every country’ (SVP). In this way, technological nesting provides a dynamic performance mechanism that allows the organization to constantly track performance gaps and failures locally and globally while at the same time, indicating areas of improvement. It also convinces local authorities of medical treatment capabilities and effectiveness. In addition, technology nesting is also a source of competitive advantage: ‘public hospitals and clinics can't afford systems like this… you can't achieve the same degree of benchmark as we have with 360 interconnected clinics. If you can't follow up on performance, it'll be difficult to improve’ (SVP).

The practices of resource ownership, services integration, and technological nesting show how resource integration is underpinned by tight coupling and strong coherence between the global BM and local BM (Tallman et al., Reference Tallman, Luo and Buckley2018). Our findings add a contextual contingency to this view, suggesting that with ‘resource integration’, BMs will remain unchallenged where markets are characterised by unambiguous standards, so MNCs are unlikely to be inclined to engage in BMI. This leads to our first proposition:

Proposition 1: When transforming economies are characterized by low ambiguity in regulatory and industrial standards, MNCs are likely to use resources that are tightly coupled and strongly coherent with global BM practice.

Skunkworks (Quadrant 2)

With the increasing pressure from the owners and the board to close the gap in China by ‘significantly increasing the chances of success…as soon as possible’ (SVP), there were few options at hand. Clinic license regulations and application procedures were lengthy, complex, and incurred high risk. Both OneHealth and other international competitors struggled to set up their own clinics. Moreover, there were almost no prospects to make a platform acquisition that would breakeven quickly enough. In fact, the initial failures in China had pushed the OneHealth board and owners to become even more restrictive with respect to their ownership regime as they ‘could not afford losing this battle as both of its global competitors had recently made serious attempts to set up clinics in the Mainland [China]’ (SVP). Effectively this constrained entrepreneurial initiatives and local operations using the global BM.

To compensate, the SVP resorted to skunkworks, which are autonomous practices that challenge the structural context of the organization (Burgelman, Reference Burgelman1983) and loosen the selection and validation regimes of the current strategy (Adner & Levinthal, Reference Adner and Levinthal2008). SVP used his autonomy to work on initiatives without having them prematurely evaluated by top management. This enabled him to introduce a localised BM that was loosely coupled with the global BM and was largely incoherent with its value capture principles.

More specifically, skunkworks resulted in the acquisition of a product distributor. Whilst local BM adaptations of the group's medical standards only allowed for marginal adjustments, the product distribution acquisition helped develop ‘an unorthodox business model’ (SVP) and a new performance metric that did not exist in other parts of the MNC network. Essentially, it would help ‘quickly reach a breakeven situation in China and expand the target's existing product distribution… to generate cash in China for investing in China’ (SVP). It was exactly this decoupled performance objective that merited the new BMI as a viable option. To pursue this, the new BM was developed along two dimensions of multidexterity typology. First, service integration was reconsidered by disintegrating parts of the practices and processes and replacing them by other parts. Second, it decoupled the ownership regime of the global BM.

Disintegrating service integration

The main difficulties for OneHealth in the Chinese market were a complex network of layered local distributors, resulting in higher end-user prices than international markets, large international competitors that were both product and service providers (although due to complex regulations, they couldn't offer both) and a few local Chinese competitors that ran both clinics and offered the technology, which gave them the advantage of a more ‘seamless’ value proposition. In acquiring the distributor, SVP sought to launch a double-sided BM. The first side of the BM was designed to providing hospitals with treatment machines and other equipment ‘for free’ or at a relatively low cost, hence generating value to customers by minimizing their capital expenses. In return, the distribution business captures value from consumables sales. The other side of the BM is a so-called Price Per Treatment (PPT) model. The model, which was later named ‘PPT+’, is largely a sourcing model offered to hospitals and includes machines, consumables, and other products to the actual treatment (not the medical diagnosis). This includes the provision of some basic training to patients and medical staff as well as offering management of clinics. The SVP found the PPT model as a viable solution as ‘the people who run these [distributors] have often built this business for a very long time and have very strong contacts with the hospitals, staff, and local authorities’. Despite the lack of coherence with OneHealth's global BM, especially with respect to its service regime, the PPT was designed to mitigate local constraints.

The PPT model also addressed a competitive challenge from international rivals – it was not bound to a single machine manufacturer, ‘even if this is more of a product business, they are neither bound to delivering products from one supplier [which is usually the case] nor inhibited by local regulations’ (SVP). The product distribution offering would, however, have to be loosely coupled with OneHealth's overall organizational structure and resource base, as there are few established systems, practices, and processes to accommodate for product distribution business at the corporate level: ‘Our hypothesis regarding this model [PPT] is to do a quite light integration to start with, as it is a somewhat different business, and we don't want to overload it with overhead costs’ (SVP). Hence, given the specific design of the PPT-based BM, there was little coherence with OneHealth's service integration logic.

Decoupling ownership

Arbitrating the global BM with a localised BM was a high-risk endeavour, at least initially, as the skunkworks had some dependency on the resources, processes, practices, and technologies underpinning the global BM. Acquisitions were normally of established clinics which had already passed internal project validation and selection regime controlled by global BM ownership policies. Skunkworks decoupled this ownership regime by keeping the new BM secret. As one workshop participant advised, ‘I think you should work your way through the market in secrecy… Do not speak so much about how you go about. Save it till later. Tell it along the way, till you get the licenses and work your way into the market’. Because hard proof of the viability of the PPT model was missing, the SVP continued ‘underground’ until he had secured the conditions for acquiring the local Chinese distributor.

The global BM required full ownership of local businesses, but instead, SVP liaised with lawyers to acquire the distributor using a local partner. Although the local partner was indirectly a shareholder in OneHealth, the legal setup circumvented the internal ownership policy. While the acquisition fully complied with Chinese foreign ownership regulations, it was unconventional for OneHealth's board and owners as it was a decoupling of the global BM ownership policy. Setting up a JV with a remote partner was unconventional, especially as the new (quasi) wholly-owned venture had built a BM based on (1) agreements with a hospital in south China to operate its new built clinic as a management contract, (2) acquired two different private actors running independent clinics, and (3) an additional acquisition of another medical products distributor to be used as a vehicle for market entry into the medical care sector. When challenged by workshop participants on the long-term viability of this model, SVP argued that ‘Although indirectly, this model can be regarded as a wholly owned OneHealth business and, surely, we will always be treated as a foreign investor in China, we have freed ourselves from the uncertainty of having a Chinese minority owner’.

The PPT model responded to the local conditions with the lengthy or ‘prohibitively long licensing procedures’ by being ‘an effective way to buy some time for success to happen in China’ (SVP). The model further helped address the financial pressures exerted from headquarters with the distribution business yielding financial breakeven less than six months after the acquisition. In this respect, a skunkworks BM was a crucial means to achieve local responsiveness despite conflicting with validated performance measures in the global BM.

The BMI literature has largely ignored skunkworks, focusing more on adaptations of structure, scale, and scope of organisations (Fjeldstad & Snow, Reference Fjeldstad and Snow2018), but our findings show that skunkworks can expand beyond both resource and structural boundaries of an MNC. Skunkworks are likely to emerge as distinctive practices in an MNC's multidextrous activities when the firm's global BM is challenged in transforming markets that are characterised by high entry barriers, low degrees of private investment, poor evidence of institutional learning, and decentralized regulatory bodies. Where managers can disentangle themselves from formal organisational structures by taking advantage of resources that are loosely coupled with the organization's core business and are marginally coherent with existing resources in the local environment, there will be opportunities for BMI skunkworks in order to be locally responsive. This leads us to our second proposition:

Proposition 2: When transforming economies are characterized by high regulatory ambiguity and industrial standards that are inimical with MNCs’ global BMs, new BMs will be developed through skunkworks using resources that are loosely coupled and weakly coherent with global BM practice.

Resource Partitioning (Quadrant 3)

Competition in the Chinese healthcare industry is focused to larger cities and provinces and mainly based on the size of the clinic base. Medical care resources are, therefore, highly concentrated in large, more medically sophisticated public hospitals (L3): ‘Dialysis is currently mostly done in L3 hospitals. This is an extremely underserved market with c.1/3 patients on the waiting list. But tiered healthcare has constrained the expansion of L3 hospitals’ (Deputy president L3 hospital). Moreover, the pricing structure of L3 hospitals varies across the population, normally requiring a higher relative share to be paid by the patient and a higher total cost incurred – between 11% and 14% variation between L1 and L3 hospitals across different geographical markets. However, recent government reforms caused some patients to be redirected to smaller hospitals and the private sector creating space for resource partitioning in the market, and increasing ambiguity for new entrants, as treatment standards were vaguely defined and clinic licencing procedures were opaque: ‘There are also provincial and city-level requirements that are not always specified in publicly available sources’ (SVP).

Acquiring a distributor would help address this opportunity through the new PPT+ BM, allowing coherence with OneHealth's global BM on two levels. First, it responds to OneHealth's value capture policy. As the SVP noted, although ‘the board of directors says, “We must earn profits within six years”, we can actually offer a profitable business from day one’ (SVP). Given the local conditions, the PPT+ model was designed to augment OneHealth's value capture policy (i.e., reimbursement system) as it was well entrenched in a province where the reimbursement levels were ‘in acceptable levels with the policy’. Second, the PPT+ model is scalable and can be used as a platform for expansion, thereby restoring OneHealth's international high growth plans. However, the PPT+ model challenged the global BM in two respects:

Augmenting service integration

To be able to compete in China, the PPT+ model required a unique service integration platform. This was done by reconciling the exclusive focus on upstream service integration inherent in the global BM, with the distributor's contracts. The contracts were used as levers to augment their old clinic operations model to be exclusively based on medical care. The PPT+ model was based on ‘converting the existing hospital contracts from products and some limited service elements into full-fledged medical service management contracts’ (SVP). The PPT+ model further implied using an existing product distribution platform with weak coherence with both the existing resource base and the global BM for developing a fully integrated dialysis product offering and treatment service. Because the original PPT model was to a large extent based on product distribution to hospitals, OneHealth used the PPT+ model to leverage the distributor's relational position in some regions in China. The relations were important as they provided opportunities to establish a strong coherence with local medical standards using the materials sold to hospitals as a learning and influencing platform. In this way, the practices carried out by medical technology salespeople helped accessing medical care practices.

Hence the PPT+ model coupled high concentration of resources, residing mainly in L3 hospitals, with strongly coherent resources at the fringes of Chinese hospitals’ medical practices. Specifically, the PPT+ model enabled access to medical care via two legally separated units supplying a whole range of medical services, clinic management, machinery, and consumables to local hospitals. As noted by the SVP, ‘in other countries, OneHealth is a clean clinic operator. But, in this case, we invest in the owners of the existing supply company who have very well-established contacts with authorities and hospitals; thus, we consider it a very good platform to build clinics on’. Even though the PPT+ model threatened the global BM, as emphasised by the SVP: ‘We haven't done this anywhere else in the world. We are a total service provider now, and we've never bothered about selling products, only buying them…’, the PPT+ model also augmented the service integration element of OneHealth's BM.

Refitting technological nesting

OneHealth's global BM competes on the supply side variable of its medical quality benchmarking system: ‘It's actually our medical quality benchmarking between clinics within and between clinics in OneHealth and the rest of the private/public sector and patient satisfaction we [compete on]’ (SVP). However, markets are characterised by ‘Healthcare providers, public as well as private are very reluctant at sharing medical outcomes… and because different actors can choose to measure certain aspects and not others or measure certain aspects in slightly different ways, results are difficult to compare on an apple-by-apple basis’ (SVP). This creates information asymmetries in the market which OneHealth can use to its advantage, as a measure of value creation, which aligns with its value-based pricing model that the CEO and President see as a future model of pricing medical services. However, in China, reimbursement levels vary across different regions and hospitals, making patients liable to a co-payment agreement where the cost of care is split between patients and the health insurance system. Thus, the value-based pricing model underpinning the global BM needed refitting in the PPT+ model.

Specifically, value-based pricing in the global BM was contingent on (1) rigorous, internationally standardized and institutionalized measurement standards, (2) that treatments were measured systematically, and (3) continuous improvements in the quality of care could be proven, and (4) eventually normalized at validated and accepted level of medical quality in a short time span. However, the PPT+ model incorporated a value capture model where legitimacy was based on (a) trusted medical equipment (machinery and disposables) expertise and (b) clinic business and managerial expertise, and (c) a ‘proof-of-concept’ drawn from OneHealth's ‘international success stories’. Hence, rather than garnering more value from upstream value-creating activities by adjusting backstream activities (a strategic position refined in the global BM), the PPT+ model was refitted such that it created even stronger coherence with the entire value chain. In this way, the PPT+ model leveraged on the concentration of medical technology at the core of the Chinese healthcare by soaking up peripheral capabilities inherent in OneHealth's global BM.

The BM innovation of PPT+ shows that an ambiguous regulatory framework and opaque local standards will lead local managers to take advantage of resources that are loosely coupled with the organization's core business but strongly coherent with local resources, which maybe relatively novel and peripheral in the resource space. This leads us to our third proposition, suggesting that contextual conditions underpinning resource partitioning may drive MNCs’ local BM innovation:

Proposition 3: When specific industries in transforming economies are characterized by resource partitioning, BMI practice will be strongly coherent with local demands but loosely coupled with global BM practice.

Resource Orchestration (Quadrant 4)

OneHealth's China operations had quickly moved from a failed single BM operation to a multidextrous BM configuration of running several BMs in parallel. Although the global BM was built on the idea of global integration, OneHealth had a resource and capability base sufficient to address the local Chinese conditions. To make use of such resource slack, OneHealth recombined its flexible managerial structure in China to better orchestrate the resources between the weakly coherent units residing in the new BMs (see above) with the global BM. For the sake of simplicity, we term this model PPT++. This was enabled by combined investments in the distributor and managerial abilities to shift and balance between different duties and areas of expertise. Each manager was multi-competent with several years of experience and could, therefore see the needs and challenges of local responsiveness. The PPT++ model was devised to orchestrate this resource and asset base by combining elements of the three BM models to create a unique model. To be able to access local licenses and speed up market entry, both dominant aspects of the global BM – ownership and service integration – were adapted.

Distributing ownership

A positive outcome of the failed initial JV was that a new senior executive joined OneHealth. With a wide network among hospital clinics, the local executive had spotted doctors who had considered running their own clinics but had little resources and other expertise. While the global BM was strict on its ownership policy, the PPT++ model reconsidered this by setting up an individual partnership program with doctors and other medical experts who were both recognized for their expertise and had an entrepreneurial drive to ‘operate a professional clinic according to international standards’. The program was initially rolled out in some select regions and quickly gained traction among local medical entrepreneurs. The individual entrepreneurs would not only help realize OneHealth's plans for China by opening new clinics but were also important for gaining necessary contacts with local authorities. As the SVP explained, ‘The rules in China are very opaque. That's why we try to work with this local partner by acquiring part of the company. Because they have already received licenses, then it must somehow indicate that they… have a relationship [with local health authorities] needed to acquire licenses for operating clinics’. While beneficial indeed, this was only a liminal stage in establishing a more large-scale acquisition and greenfield operation. Partnering with these local doctors also helped creating further links with local medical service suppliers with whom the doctors had been dealing in their previous positions at the hospitals.

Retrofitting service integration

Well aware that ‘the alignment of operating requirements to a common standard nationally should simplify OneHealth's management’, SVP retrofitted the so-called ‘platform acquisition’ model upon which the global BM had operated. The new model implied that the acquired product distributor would be used as a ‘base for accelerated clinic development’ (SVP). PPT++ was built on a reversed ‘value extension’ model, that is, using the localised value generation model (i.e., product distribution) as a vehicle to its global service delivery model rather than the other way around.

The distributor's close relationships with the local hospitals further provided access to recruiting professional medical staff needed to run the new clinics, ‘We also have an advantage in their management contracts with local clinics that can be used for recruiting people and building on their close relationships with the hospitals as a total service provider’ (SVP). These management contracts were used such that the partner owned the clinic license, but OneHealth controls the management, and de facto operates the clinic. ‘The key benefit here is that we don't need to worry about a clinic relicensing, but on the other hand, we are in a weaker position as we are not the license holder’. Further, the PPT++ model positioned them as a reliable total solutions provider rather than a medical care provider, advantaging them over others to be granted new licenses to open more clinics and reapprovement of existing licenses.

In addition, the PPT++ model expanded vertically. For example, shortly after the PPT+ model was launched, OneHealth acquired a clinic in Hong Kong to ‘benefit from the CEPA [Close Economic Partnership Agreement] rules for 100% investments in mainland China’ (SVP). Using the regulatory framework, OneHealth used the acquisition for entry and further clinic acquisitions in Mainland China. In this way, the PPT++ model was designed to orchestrate its local distributor networks, local doctors, and the Hong Kong-based partner to acquire another distribution company with hospital contracts in two provinces in China. Using these distributors helped processing clinic license applications at a larger scale. As reported recently, ‘26 independent clinic license applications are being progressed [in various regions] with the minority holder [HK partner]’ (SVP). The PPT++ model was devised such that OneHealth could use these relationships to make joint clinic license applications, ‘As part of this set-up, we have handed in a number of joint clinic applications (greenfield investments), of which 4 already approved by the MoH, with the first clinic starting construction in December [2018]’ (SVP).

In transforming economies where regulatory frameworks inhibit tight coupling between MNCs’ global resources and local assets, localised BMIs will take advantage of slack resources and orchestrate them in novel ways to effectively respond to local needs. In the case of PPT++, OneHealth was able to loosen its ownership regime to better orchestrate localised assets by accepting local and distributed ownership in order to speed up market expansion and elevate value capture. Also, localised BMs could retrofit existing service integration practices through alternative value-generating activities as vehicles for value extension. These show that novel attributes and efficiency-seeking can be orchestrated effectively to achieve local responsiveness even though this means weak coherence with global BM practices. This leads us to our fourth proposition:

Proposition 4: When transforming economies have restrictive regulatory frameworks of foreign ownership of local assets, new BMs will be developed around resource orchestration of assets that are strongly coupled locally and weakly coherent with global BM practice.

DISCUSSION: TOWARDS A MULTIDEXTROUS VIEW OF BMI

We introduced the concept of multidexterity to explain an organization's capability to develop and maintain multiple BMs simultaneously to be able to respond to institutional and organisational dynamics. This implies being able to keep ‘one hand for the globally consistent umbrella model and one for each local adaptation’ (Tallman et al., Reference Tallman, Luo and Buckley2018: 518–519, emphasis added). Hence, multidexterity embraces the inclusion of multiple models and is neither a version of ‘dexterity’; a single BM capability or skilfulness (Autio et al., Reference Autio, George and Alexy2011), or ‘ambidexterity’; dual BMs that are dichotomous or orthogonal (Gupta, Smith, & Shalley, Reference Gupta, Smith and Shalley2006). Multidexterity, we argue, is not only conceptually different but seems to be a ‘defining characteristic of the 21st-century enterprise’ (Grant, Reference Grant2008: 479). Yet, the concept is ‘notably overlooked and underutilized’ (Ritter & Geersbro, Reference Ritter and Geersbro2018: 75) in management research. However, our findings reveal several important conceptual characteristics that extend and substantiate the concept of multidexterity.

First, our case shows that global BMs are contingent on unambiguous regulatory frameworks and industry standards, and resource integration regimes serve as important boundary conditions for multidexterity. For OneHealth, these conditions were met in Saudi Arabia, but in Turkey and the first attempt to enter China failed due to ambiguous regulatory frameworks and unclear industry standards. These findings are important contingencies for the effective use of ‘industry recipes’ (Monaghan & Tippmann, Reference Monaghan and Tippmann2018) and reliance on resources integral in global BMs (Snihur & Tarzijan, Reference Snihur and Tarzijan2018). These conditions suggest that MNCs will be reluctant to disrupt global BM structures (Tallman et al., Reference Tallman, Luo and Buckley2018) and engage in BMI beyond the existing strategic agenda of the MNC (Adner & Levinthal, Reference Adner and Levinthal2008).

Second, MNCs operating in transitioning economies are commonly inclined to arbitrate their original full-ownership regime (Luo, Reference Luo2001) for more favourable regimes in the transitioning context (Witt & Lewin, Reference Witt and Lewin2007). To be able to maintain local BMs alongside global BMs, MNCs are likely to give up certain products and service practices when entering transitioning markets (Ghemawat, Reference Ghemawat2007). From the view of multidexterity, these are necessary but insufficient conditions for maintaining the global BM while developing local BMs. Our findings revealed that only when the transitioning economy has unfavourable institutional frameworks for MNCs’ global BMs will they consider arbitrating components of the global BM. However, this is only a viable option when the industrial and technological standards offer an opportunity to act entrepreneurially despite being inconsistent with the firm's BM (Ozcan & Eisenhardt, Reference Ozcan and Eisenhardt2009). Managers will, under such conditions, engage in skunkworks to arbitrate the MNC's organisational and strategic context (Burgelman, Reference Burgelman1983) by developing new performance regimes (Adner & Levinthal, Reference Adner and Levinthal2008). Our findings show that MNCs in transforming economies can do so by taking advantage of loosely-coupled resources and weakly coherent practices, such as the use of informal ties (Martin, Reference Martin2014) and open strategy network (Hautz et al., Reference Hautz, Seidl and Whittington2017) in pursuit of localised BMs. In this way, skunkworks offers a distinctive practice space within multidextrous BMI by means of accommodating several types of resource and practice couplings simultaneously (Orton & Weick, Reference Orton and Weick1990) despite the unique configuration of the global BM.

Third, transforming economies characterized by dense concentration of large generalised local incumbent actors leave underutilised resources to be soaked up by entrant firms. Under such conditions, entrant firms are inclined to take advantage of resource partitioning (Carroll et al., Reference Carroll, Dobrev and Swaminathan2002) by leveraging local regulations. While such environmental contingencies may be at odds with the global BM of the MNC, the multidextrous approach suggests that resource commitments can be made by using existing ownership regimes, thereby remaining strongly coherent with global BM practice. Our findings, demonstrate that some degree of supply chain integration (e.g., acquiring distributor) can help developing local BM by taking advantage of underutilised resources in the market and by loosening the coupling between the MNCs service and technology regimes from the global BM. This finding suggests that multidexterity, as opposed to other lenses, can help firms responding to market complexities by enacting BM practices that are variably interconnected in bundles of practices (Schatzki, Reference Schatzki, Spaargaren, Weenink and Lamers2016). In this way, the multidextrous framework offers a conceptual apparatus to better understand how resource partitioning can help bridging micro, meso, and macro-level contingencies in BMI in transforming economies.

Fourth, a common challenge of MNCs is to adequately orchestrate their resources when the distance (e.g., institutional, cultural, economic) between the home and host country increases (Verbeke & Kano, Reference Verbeke and Kano2016). Our findings substantiate and extend this conceptual argument, suggesting that multidextrous BMI is a distinctive practice, which can orchestrate both distributed ownership of local assets and retrofitting the global BM's service regime by taking advantage of local resources. This is an extension of the BMI literature, which suggests that resource orchestration can be achieved by technology integration and managerial industry experience (Frankenberger & Stam, Reference Frankenberger and Stam2020). We further argue that from a multidexterity perspective, resource orchestration may gradually extend the overall scope of the global BM and different local BMs to maintain a minimum degree of fitness between the firm's technology regime with the external environment (Helfat et al., Reference Helfat, Finkelstein, Mitchell, Peteraf, Singh, Teece and Winter2007). Such coherence includes, but is not limited to, alignment with emerging industry standards (Ozcan & Eisenhardt, Reference Ozcan and Eisenhardt2009) but also to the regulatory framework of local host markets. Our findings show that local managers’ specialist knowledge is instrumental in leveraging slack resources and capabilities and orchestrating them to fit emergent service requirements in the market. These findings suggest that MNCs enacting multidextrous BMI can use resource orchestration when (i) resources are available and adaptable to new local BMs and (ii) the local organisation has a coordination flexibility to adopt those resources (Sanchez, Reference Sanchez1995).

CONCLUSION

The aim of this study was to contribute to the limited understanding of development and enactment of multiple BMs by Western MNCs in transforming economies. We proposed the concept of multidexterity as a viable way to account for institutional and organisational dynamics in BMI. In doing so, we contribute in several ways to the emergent literature on BMI in general (Foss & Saebi, Reference Foss and Saebi2017, Reference Foss and Saebi2018) and in transforming economies, in particular (Tallman et al., Reference Tallman, Luo and Buckley2018). We reveal how MNCs develop and combine competing BMs in transforming economies depending on the extent to which regulatory frameworks and industry standards are ambiguous or opaque. We propose the concept of multidexterity as a response to the limitations of extant literature on BMI in explaining the underpinning mechanism by which firms can simultaneously deploy multiple conflicting BMs during market entry. We found that institutional contingencies play a major role for which strategies MNCs can adopt in developing local BMs. Through our conceptualisation of multidexterity, we outline some conditions that may affect different types of BMI practices. Accounting for the extent to which institutional contingencies pose challenges to global BMs, we proposed a typology that shows that BMI practices involve skunkworks, resource partitioning, and resource orchestration that take advantage of resources, assets, and capabilities that are variably coupled and coherent with global BMs.