1 Introduction

Individuals often make trade-offs for different outcomes that occur at various points in time, for instance, saving for the future or enjoying consumption now, having the pleasure of eating delicious food at the moment or having a slim body in the future. This tradeoff is known as intertemporal choice (Reference Frederick, Loewenstein and O’donoghueFrederick et al., 2002). In the literature, intertemporal choice is usually considered to involve making decisions between a smaller-sooner (SS) outcome and a larger-later (LL) outcome (e.g., making a choice between “gain $5 three days later” and “gain $15 ten days later”). The outcomes of an intertemporal choice will occur not only at different temporal distances but also at different spatial distances. Imagine Jack is in his home in New York City, thinking about investing $1500 in a project to build a leisure center. There are two investment return options available for Jack to choose from. One of them is expected to earn $180 a year later, while the other has an estimated profit of $350 two years later. Jack can choose only one option and can invest only once. Will the spatial distance between the location of the planned leisure center (the leisure center is located in New York City/Seattle/Shanghai, China) and Jack affect his choice of investment return options?

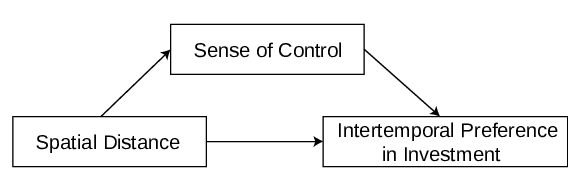

Both individual investors and companies often face tension between managing short- and long-term investments (Reference Litov, Moreton and ZengerLitov et al., 2012). Given the intertemporal feature of investment projects and the current universality of long-distance investments, the present research intends to explore the effect of the spatial distance between the decision maker’s location and the place where the decision outcomes occur on intertemporal preference in the investment scenario. Furthermore, we try to reveal the underlying psychological mechanism of this effect from the perspective of the sense of control. Although sense of control has been applied in the research areas of spatial distance (e.g., Reference Wakslak and KimWakslak & Kim, 2015), intertemporal choice (e.g., Lee et al., 2013) and investments (e.g., Reference Whitson and GalinskyWhitson & Galinsky, 2008), few studies have examined its mediating role in the relationship between spatial distance and intertemporal investment preferences. Thus, the goal of this research is to examine the direct and indirect effects of spatial distance on intertemporal preference in investments (see Figure 1 for the framework).

Figure 1: Theoretical framework of the present research.

1.1 Spatial distance and intertemporal preference

Spatial distance is the subjective feeling that an object is near or far in space from one’s current location and is one of the dimensions of psychological distance (Reference Trope and LibermanTrope & Liberman, 2010). Spatial distance has been found to affect people’s judgments and evaluations (Reference Williams and BarghWilliams & Bargh, 2008; Reference O’Connor, Meade, Carter, Rossiter and HesterO’Connor et al., 2014; Reference Thompson, Wiener and MichaelisThompson et al., 2015). Some studies in the literature have explored the potential relationship between spatial distance and intertemporal decision making. Maglio et al. (2013) asked participants to choose between receiving a smaller, immediate payoff and a larger, delayed payoff, with the funds being deposited into either a spatially distal or proximal bank. The result showed that participants in the distal group were more likely to choose the delayed payoff than those in the proximal group. Researchers attributed this result to that experiencing spatial distance reduced participants’ sensitivity to the time interval between immediate and delayed outcomes; that is, the subjective perception of the time interval between immediate and delayed payoffs was shorter due to the spatial distance. In the case where the subjective difference between the amount of money of immediate and delayed payoffs did not change, participants would prefer the delayed but larger payoff. However, this explanation ignores the possibility that the subjective difference between the amounts of money may also vary due to spatial distance. In another study, Kim et al. (2012) revealed a negative relationship between spatial distance and patience in intertemporal choice. Participants imagined visiting one location tomorrow and another location 1 month later on a map, and then responding to an intertemporal choice. Researchers manipulated the spatial distance between the two locations and found that those who considered a longer spatial distance perceived the same future time (i.e., the duration between tomorrow and a day in 1 month) to be longer and required a larger reward to postpone the reward available today for 1 month.

Although these studies investigated the effects of spatial distance on time perception and intertemporal choice, the manipulations of spatial distance were different. Specifically, spatial distance was related to decision outcomes in the former study but not in the latter. In addition, spatial distance in the two studies was not the distance between the decision maker’s location and the place where the decision outcomes occurred. So there is still a lack of research about how the spatial distance between the decision makers’ location and the place where the decision outcomes occur influences intertemporal preferences, especially in the investment scenario.

1.2 The mediating role of the sense of control

In this research, we aim to clarify the impact of spatial distance on intertemporal investment preferences from the perspective of the sense of control, which has attracted considerable attention in the research fields of spatial distance (e.g., Reference Wakslak and KimWakslak & Kim, 2015), intertemporal choice (e.g., Lee et al., 2013) and investments (e.g., Reference Whitson and GalinskyWhitson & Galinsky, 2008). Sense of control refers to individuals’ belief in their abilities to predict, influence, and steer present or future events (Reference Kay, Whitson, Gaucher and GalinskyKay et al., 2009). In addition to the common sense idea that “spatial proximity facilitates control but spatial remoteness decreases control over objects”, there is only a little evidence regarding the relationship between spatial distance and the sense of control. For instance, Reference Wakslak and KimWakslak and Kim (2015) required participants to imagine that they lived in Los Angeles and that an employee who worked in Sacramento was under their supervision. A map showing the locations of Los Angeles and Sacramento was presented to participants. The map was zoomed in (in the distant group) or zoomed out (in the close group) so that the spatial distance between participants and the employee looked large or small. The results showed that participants expected to have a lower sense of control over the employee when the spatial distance was larger (see also Latané et al. (1995) for similar results). This relationship also holds in the opposite causal direction. Specifically, Wakslak and Kim (2015) found that participants who believed they were unable to control work-related issues from far away judged a job location’s distance as farther. In addition, it is generally believed that events occurring in distant locations are correlated with high uncertainty (e.g., Wakslak, 2012), and high uncertainty usually means low control over events. Thus, it can be speculated that people will have a lower sense of control over events that occur farther away. In the same way, investors will have a lower sense of control over spatially distant projects than spatially proximal projects.

When investors with a low sense of control are faced with intertemporal choices, will they prefer the SS or LL investment returns? We argue that low sense of control will lead to an increase in the preference for SS investment returns for the following reasons: First, in intertemporal choice, the SS outcome occurs earlier in time than the LL outcome. Thus, the subjective uncertainty of the SS outcome is less than that of the LL outcome (Reference Keren and RoelofsmaKeren & Roelofsma, 1995; Reference Myerson and GreenMyerson & Green, 1995). In other words, people subjectively feel that their sense of control over the SS outcomes is stronger than that of the LL outcome. Second, investors with low control over projects (due to a long spatial distance) will want to improve their sense of control, because pursuing and maintaining control has long been a basic need and a key motivation of humankind (Reference KelleyKelley, 1971). Based on these two reasons, it can be inferred that investors who have low control over projects will prefer the SS investment returns in intertemporal decision making because choosing SS returns is more helpful to reduce the long-term tolerance for low control (i.e., high subjective uncertainty) and to compensate for the lack of control than choosing later returns. There is some evidence in the literature supporting this prediction.

First, locus of control has been found to be related to short- and long-term outcome preferences (e.g., Crilly, 2017; Reference Lasane and JonesLasane & Jones, 1999; Reference Platt and EisenmanPlatt & Eisenman, 1968). Crilly (2017) explored the effects of locus of control and ways of framing the future on intertemporal decision making, and found that, as long as executives had confidence in their ability to achieve forecasted results (i.e., internal locus of control), they weighted long-term investment returns more heavily when they recognized the advent of the future as inevitable (the time-moving frame). Some other studies also revealed that a strong control belief (i.e., an internal locus) was positively associated with long-term choice and suppression of impulses for immediate rewards (Reference Lasane and JonesLasane & Jones, 1999; Reference Platt and EisenmanPlatt & Eisenman, 1968). These results may be due to the fact that people with internal locus of control have a stronger sense of control over outcomes, so there is no need for them to obtain immediate or short-term outcomes to compensate for control. People with an internal locus of control will be more concerned about the value of outcomes than the time delay. However, people with an external locus of control have a weaker sense of control over outcomes, so they prefer immediate or relatively short-term outcomes to reduce long-term tolerance for low control and to compensate for control.

Second, research on the relationship between sense of power and intertemporal choice also hints at one reason to expect an association between sense of control and intertemporal preference. Duan et al. (2017) investigated the relationship between power and temporal discounting (i.e., the tendency to discount rewards in the future) and found that participants primed with a low sense of power (through recalling and writing a particular incident in which someone else had power over them) showed a higher tendency to discount rewards 1 year later than those primed with a high sense of power (through recalling and writing a particular incident in which they had power over others) (see Reference Joshi and FastJoshi & Fast, 2013, for similar results). In other words, participants with a low sense of power will be more likely to choose the smaller but immediate rewards, while giving up the larger but delayed rewards. A possible reason for this result is that people with a low sense of power have a lower sense of control over the outcome (Reference Fast, Gruenfeld, Sivanathan and GalinskyFast et al., 2009; Reference Keltner, Gruenfeld and AndersonKeltner et al., 2003), so they tend to choose immediate rewards in intertemporal choice to compensate for the lack of control and to reduce long-term tolerance for low control.

Taken together, these research findings support a mediating role of the sense of control in the relationship between spatial distance and intertemporal preference. The spatial distance between the decision maker’s location and the place where the decision outcomes occur should affect the decision maker’s sense of control over outcomes and further influence their intertemporal preferences. Specifically, a longer spatial distance between investment projects and investors will reduce investors’ sense of control over projects. In order to reduce long-term tolerance for low control and to compensate for control, investors will be more inclined to choose the SS returns in intertemporal choices.

1.3 Overview of the present research

Spatial distance has received much attention in the field of investment research (e.g., Carboni, 2013a, 2013b; Reference Lutz, Bender, Achleitner and KasererLutz et al., 2013), but there have been few studies on how spatial distance affects people’s intertemporal preferences for investment returns. The present research explores the influence of spatial distance on intertemporal preferences and the mediating role of the sense of control in the investment scenario. In this research, spatial distance refers to the distance between the location of investors (e.g., the location of Jake’s home in the example given at the beginning) and the location of investment projects (e.g., the location of the planned leisure center in the example given at the beginning). Alternative investment return options of a project are less profit with a shorter investment period or more profit with a longer investment period (i.e., an intertemporal choice).

This research contains three studies. Studies 1 and 2 used two different methods (text description or images with depth cues) to manipulate spatial distance and explored the impact of spatial distance on the intertemporal investment preferences. In addition, we examined the mediating effect of participants’ sense of control over investment projects. Study 3 further tested the effect of a generalized sense of control (i.e., evoking different levels of control through a physical priming method) on intertemporal preferences in investments with different spatial distances.

2 Study 1

Study 1 was conducted to directly examine the relationship between spatial distance and intertemporal preference in an investment scenario and the mediating effect of the sense of control in this relationship. We used textual descriptions to manipulate the spatial distance between the investors’ locations and the investment locations.

2.1 Method

2.1.1 Participants

Fifty-fourFootnote 1 corporate executives from MBA classes with business investment experienceFootnote 2 volunteered to participate in this study. The data for two participants were excluded because of incomplete responses. Thus, the sample size was 52 (male: 31; mean age: 29.7 ± 3.1 years).

2.1.2 Design

Study 1 adopted a 2 (spatial distance: proximal vs. distal) × 2 (investment return: little vs. large) × 2 (investment holding period: short vs. long) mixed design. Spatial distance was the between-subjects variable, and the other two factors were within-subjects variables. The participants were randomly assigned to the proximal group (N = 28) or the distal group (N = 24). We varied the magnitude of the investment return and the investment holding period over wide ranges to assess whether the effect of spatial distance on investment preference holds for different profits and holding periods.

2.1.3 Procedure

The participants were required to complete a paper-and-pencil questionnaire in the laboratory. They were instructed to imagine a situation in which they needed to make investment decisions for their companies without considering inflation and deflation. The participants in the proximal group were told that the project would be implemented locally, while the participants in the distal group were told that the project would be implemented distally — 5,000 kilometers away.Footnote 3 All participants were informed that each project could be invested in only once and that the investment returns would be obtained online.

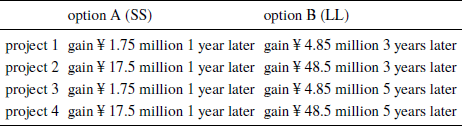

The participants then evaluated their investment willingness for four intertemporal choices (Table 1) on 7-point scales ranging from 1 (totally prefer option A) to 7 (totally prefer option B), where a smaller value corresponds to a stronger willingness to invest in option A, and a larger value corresponds to a stronger willingness to invest in option B. The order of the four pairs of choices was counterbalanced. Half of the participants completed the evaluations in the order shown in Table 1, while the other half responded in the reverse order. Then, the participants reported the strength of their sense of control over the four investment projects on a 7-point scale (“How strong is your sense of control over these investment projects? [1 = not at all, 7 = very strong]”).Footnote 4 At the end of the survey, they provided their demographic information, including gender and age. See the supplement for more details.

Table 1: Four investment projects in the questionnaire of Study 1. Option A has smaller-sooner investment returns in intertemporal choice, while option B has LL investment returns

2.2 Results and Discussion

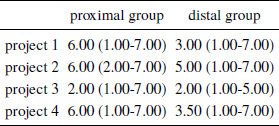

The results of Mann-Whitney U testsFootnote 5 showed that the preference scores for the four investment projects in the distal condition were significantly or almost significantly smaller than those in the proximal condition (project 1: Z = −3.198, p = .001, effect size r = .443; project 2: Z = −2.190, p = .028, r = .304; project 3: Z = −2.418, p = .016, r = .335; project 4: Z = −1.825, p = .068, r = .253), indicating that the participants in the distal group were more likely to choose the SS returns regardless of the magnitude of profit and the holding period, as shown in Table 2. High reliability existed across the four preference scores (Cronbach’s α = .78). Thus, the preference scores for the four items were averaged as the index of the participants’ intertemporal investment preferences. A two-tailed t-test revealed that the participants in the distal group (M = 3.53, SD = 1.46) were significantly more willing (t(50) = 3.326, p = .002, d = .933) to invest in projects with SS profits than those in the proximal group (M = 4.95, SD = 1.58).

Table 2: Median (range) for the four investment projects in the proximal and distal groups

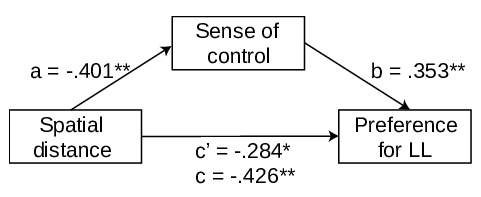

In addition, participants in the distal group (median [range] = 2.50 [1.00–7.00]) experienced a significantly lower sense of control (Mann-Whitney U test: Z = −2.686, p = .007, r = .372) than those in the proximal group (median [range] = 5.00 [1.00–7.00]). The bootstrapping (N = 5,000) method (Reference HayesHayes, 2013) was used to test the mediating role of the sense of control in the relationship between spatial distance and investment preference in intertemporal choice. The results showed that the indirect effect of spatial distance on the preference for LL investment returns through a sense of control was statistically significant (standardized indirect effect: −.142, 95% confidence interval (CI): [-.310, -.041]; effect size: PM (ab/c) = .332, 95% CI [.087, .868]). Therefore, the sense of control mediates the relationship between spatial distance and investors’ intertemporal preferences in this study (see Figure 2).

Figure 2: The mediating role of the sense of control in the relationship between spatial distance and investment preference in intertemporal choice (Study 1). * p < .05, ** p < .01. a, b, c and c’ in the figure are standardized regression coefficients (Y = cX + e1; M = aX + e2; Y = c’X + bM + e3).

Study 1 shows that people are more impatient with the profit (i.e., prefer the lower but earlier gains in intertemporal choice) in investments when the location of the investment project is far away than when it is close. In addition, in Study 1 we tried for the first time to explain the psychological mechanism of the influence of spatial distance on intertemporal preference from the perspective of control. We found that people’ sense of control over investment projects mediates the relationship between spatial distance and intertemporal preference for investment returns. In Study 2, we intended to use a different method to manipulate spatial distance to repeat the effect of spatial distance on intertemporal investment preferences and the mediating effect of the sense of control with a sample of college students.

3 Study 2

Study 2 aimed to examine the relationship among spatial distance, sense of control and intertemporal investment preference again with a sample of college students. Images with depth cues were adopted to manipulate the spatial distance between participants and investment locations to increase the intuitiveness of the participants’ feelings about the spatial distance.

3.1 Method

3.1.1 Participants

Ninety-twoFootnote 6 undergraduate students (male: 45; mean age: 19.0 ± 0.9 years) participated in the experiment for course credit. They had not previously participated in a similar study.

3.1.2 Design

Study 2 adopted a single factor (i.e., spatial distance) between-subjects design. The participants were randomly assigned to the proximal group (N = 46) or distal group (N = 46).

3.1.3 Procedure

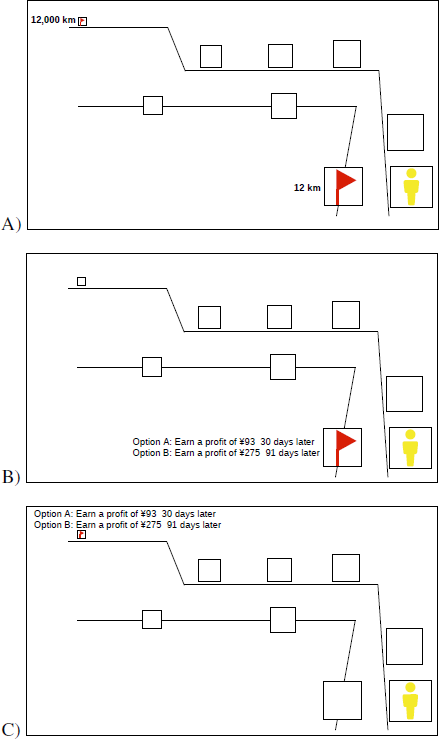

This study required each participant to complete an experiment individually in the laboratory using a computer program. The participants were told that they would attend a study to assess their investment preferences. First, all participants were presented with a hypothetical map (Figure 3A), which was used to evoke a sense of spatial distance. The map showed the relative positions of the participants and two alternative investment locations and the spatial distance between them.

Figure 3: (A) The hypothetical map used to evoke the sense of spatial distance in Study 2. (B) The image presented to the participants in the proximal group (in the intertemporal choice task of Study 2). (C) The image presented to the participants in the distal group (in the intertemporal choice task of Study 2). All participants were told that the different-sized boxes in the images represented locations with different spatial distances. They were also told that the position of the person icon in the images represented “where you are”, and the position of the flag represented the “investment location”. See the supplement for more descriptions regarding the images.

Next, the participants were instructed to imagine that they would invest 1,000 RMB in a project. The participants in the proximal group were presented with two alternative options about investment returns (i.e., an intertemporal choice) close to them (see Figure 3B), while the participants in the distal group were presented with the same intertemporal choice far from them (see Figure 3C). Option A (earn a profit of 93 RMB 30 days later) was the SS option in this intertemporal choice, while Option B (earn a profit of 275 RMB 91 days later) was the LL option. All participants were informed that the project could be invested in only once and that the investment returns would be obtained online. Then, the participants were required to evaluate their investment willingness on a 9-point scale ranging from 1 (totally prefer Option A) to 9 (totally prefer Option B) without considering inflation and deflation. Moreover, we measured the participants’ sense of control over the investment (“How strong is your sense of control over this investment project? [1 = not at all, 9 = very strong]”) and their subjective feelings regarding spatial distance (“How far do you feel this investment project is located from your current location? [1 = very close, 9 = very far”). Finally, the participants reported their genders and ages. See the supplement for more details.

3.2 Results and Discussion

The subjective spatial distance rated by the participants in the distal group (median [range] = 7.00 [2.00–9.00]) was farther than that in the proximal group (median [range] = 3.00 [1.00–8.00]; Mann-Whitney U test: Z = −6.332, p = .000, r = .660), indicating that the manipulation of spatial distance in Study 2 was successful.

A Mann-Whitney U test was conducted to test the effect of spatial distance on intertemporal preference. Similar to Study 1, the results showed that the participants in the distal group (median [range] = 3.00 [1.00–8.00]) were more willing to choose the SS investment returns than those in the proximal group (median [range] = 7.00 [1.00–9.00]; Mann-Whitney U test: Z = −5.298, p = .000, r = .552).

In addition, the participants in the distal group (median [range] = 4.00 [1.00–8.00]) felt a significantly lower sense of control than those in the proximal group (median [range] = 7.00 [3.00–9.00]; Mann-Whitney U test: Z = −5.488, p = .000, r = .572). The mediating effect was tested by the bootstrapping method (N = 5,000). Again, the indirect effect of spatial distance on investors’ intertemporal preference through a sense of control was statistically significant (standardized indirect effect: -.269, 95% CI: [-.416, -.161]; effect size: PM (ab/c) = .469, 95% CI [.256, .802]).

Study 2 replicated the results obtained in Study 1 using an alternative method to manipulate spatial distance. In sum, the findings of Studies 1 and 2 consistently provide support for the idea that the spatial distance between the location where outcomes occur and the location of the decision maker impacts on intertemporal preferences. More precisely, investors will be more likely to choose lower but earlier investment returns (rather than greater but later returns) when the location of the investment project is farther away. In addition, it is found that the investors’ sense of control over the planned projects mediates the relationship between spatial distance and intertemporal preference. Investors with low control over projects (due to long spatial distance) will be more likely to choose the SS returns to reduce long-term tolerance for low control and to compensate for the lack of control.

Study 3 aimed to extend the findings regarding control in the first two studies by exploring whether priming a more general sense of control over physical movement affects investment preferences with different spatial distances.

4 Study 3

In Study 3, we examined whether a generalized and previously evoked sense of control (through experiencing physical movements) could influence preferences for investment returns. Study 3 not only tested the influence of generalized control on intertemporal preference with different spatial distances but also provided further evidence for the mediating effect of the sense of control.

4.1 Method

4.1.1 Participants

One hundred and sixteenFootnote 7 undergraduate students (male: 46; mean age: 19.2 ± 1.0 years) from a course open to all majors in the school participated in this study for credit. They had not previously participated in any similar study.

4.1.2 Design

Study 3 adopted a 2 (spatial distance: proximal vs. distal) × 2 (evoked generalized sense of control: low vs. high) between-subjects design. The participants were randomly assigned to one of four conditions (N = 29 in each group).

4.1.3 Procedure

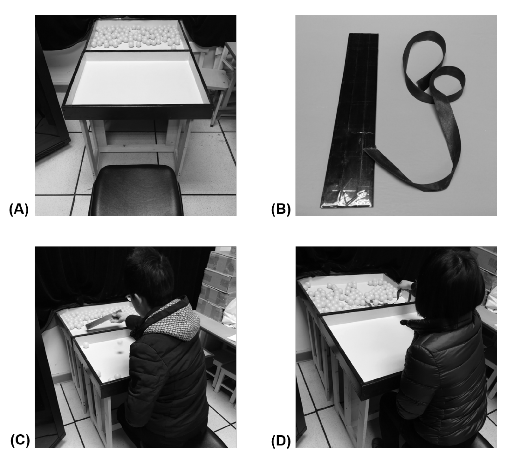

First, the participants were primed with either a low or high general sense of control through a game about moving table-tennis balls. In the game, the participants sat in front of a table that was similar to a pool table and was separated into two square grids by a wooden panel in the middle (see Figure 4A). At first, ping-pong balls were placed on the relatively distant grid, but none were placed on the near grid. The participants were instructed to move as many of the balls as possible from the distant grid to the nearby grid in 1 minute using only the tools provided (Figure 4B). The participants in the high-control group used cardboard (Figure 4C), which was easy to control when moving the balls. The participants in the low-control group used a soft cord (Figure 4D), which was difficult to control when moving the balls. All participants could use the tools with only one hand (see the supplement for more details).

Figure 4: Devices in the game that evoke a generalized sense of control and examples of the game processes (Study 3). (A) Table with two grids. (B) Tools for moving the table-tennis balls. (C) An example of using the cardboard tool to move the balls in the high-control group. (D) An example of using the soft cord to move the balls in the low-control group.

Before the beginning of the game, the participants had 10 seconds to practice and become familiar with the rules and operations. Once the game was completed, the participants assessed their general feelings of control on a 9-point scale (“How strong is your sense of control at present? [1 = not at all, 9 = very strong]”). Then, they were randomly assigned to the distal or proximal group to complete an intertemporal choice task regarding investments, which was identical to that in Study 2. Finally, the participants reported their genders and ages.

4.2 Results and Discussion

First, an analysis using a Mann-Whitney U test showed that the participants in the high-control group (median [range] = 47.5 [10–95]) moved more balls (Z = −9.377, p = .000, r = .871) in the game than those in the low-control group (median [range] = 0.0 [0–4]). In addition, a significant difference in the general sense of control was noted between the two groups (low-control group: median [range] = 2.00 [1.00–6.00]; high-control group: median [range] = 6.00 [2.00–9.00]; Mann-Whitney U test: Z = −8.347, p = .000, r = .775), indicating that the manipulation of the sense of control over physical movement was successful.

Next, spatial distance was again found to result in an increased preference for the SS investment returns in intertemporal choice (distal group: median [range] = 3.00 [1.00–9.00]; proximal group: median [range] = 6.00 [1.00–9.00]; Mann-Whitney U test: Z = −2.443, p = .015, r = .227).

More importantly, the results of a Mann-Whitney U test showed that the participants primed with a high level of generalized control (median [range] = 6.00 [1.00–9.00]) preferred the LL investment returns more than those who were primed with a low level of control (median [range] = 3.00 [1.00–9.00]; Z = −2.870, p =.004, r = .266). This preference pattern remained significant in the distal group (low control: median [range] = 3.00 [1.00–8.00]; high control: median [range] = 6.00 [1.00–9.00]; Mann-Whitney U test: Z = −2.096, p =.036, r = .195) and almost significant in the proximal group (low control: median [range] = 4.00 [1.00–9.00]; high control: median [range] = 7.00 [1.00–9.00]; Mann-Whitney U test: Z = −1.943, p =.052, r = .180).

Study 3 again revealed the positive relationship between spatial distance and the preference for SS investment returns in intertemporal choice. This finding is in line with the findings of the first two studies. Furthermore, Study 3 found that a more generalized sense of control led to a reduction in people’s impatience for investment returns. This result may be due to the fact that participants who were primed with a high generalized sense of control had stronger control feelings over projects and thus had a lower demand for choosing SS returns to reduce long-term tolerance for low control. Findings of Study 3 provides additional evidence for the mediating role of the sense of control and indicates that the feeling of control is important in intertemporal choice and investments.

5 General discussion

Advances in technology have allowed people to interact with others who are geographically distant and have also broken the limits of economic activity in terms of spatial distance. Currently, people can invest in projects distributed around the world through online platforms. On the one hand, this trend makes the issue of spatial distance particularly prominent; on the other hand, this also makes distance no longer an obstacle to economic activity, perhaps resulting in less impact. Through three studies, this research reveals that even in online investment scenarios, spatial distance still has an impact on investment preferences. When the location of the investment project is far away, investors will be more interested in earlier investment returns, even if the amount of profit is smaller. The underlying psychological mechanism of this effect can be, at least in part, attributed to investors feeling of not being in control of the project (Studies 1 and 2). In addition, this research suggests that endowing investors with global control can effectively decrease their impatience for investment returns (Study 3). Our findings indicate the important roles of spatial distance and sense of control (either context-related control or more generalized control) in investments.

This research explains the effect of spatial distance on intertemporal preferences for investment returns from the perspective of the sense of control. Investors usually have a lower sense of control over distant investment projects and are more inclined to choose the SS investment returns to reduce the long-term tolerance for low control as well as to compensate for a lack of control. There may be other explanations for the effect of spatial distance on intertemporal preferences. For instance, the effect may be explained by a relative change in subjective differences in money and time delay. Based on the principle of perspective projection, people usually feel that the difference in the height of two objects is smaller when they are located at distant locations than when they are located at close locations. For example, when a tall building and a short building are located at close locations, we feel that their difference in height is large; when the same two buildings are located at distant locations, the difference in height is less obvious. Similarly, after adding a common spatial distance to the SS and LL outcomes of an intertemporal choice, the perceived subjective differences in money and time delay between the two outcomes may both become smaller. If the subjective difference in money becomes smaller than the subjective difference in time delay, then the probability of choosing the SS outcome increases:

According to equation (1), in an intertemporal choice ((xS, tS) and (xL, tL)), if the subjective difference in investment return (S(xL-xS)) and the subjective difference in investment holding period (S(tL-tS)) are psychologically equivalent, then there is no difference in preferences for SS ((xS, tS)) and LL ((xL, tL)) returns. When a common spatial distance (d) is added to the two options (see equation (2)), if the subjective difference in investment return (S[(xL-xS)|d]) is smaller than the subjective difference in holding period (S[(tL-tS)|d]), the investors will prefer SS returns ((xS, tS, d)) to LL returns ((xL, tL, d)). Future research should examine which explanation is true or provide other explanations.

The current research extends past work on spatial distance and financial intertemporal choice. Many studies in the literature have explored people’s different behaviors in intertemporal choice when decision-making outcomes occur at different psychological distances (such as temporal, probabilistic and social distances). However, research studies in this field rarely involve spatial distance (although there are indeed many financial decisions involving outcomes currently occurring at different locations). Although limited to investment scenarios, our research makes up for this gap (Maglio et al. [2013] manipulated the location where outcomes were “stored”, not the location where outcomes “occurred”).

For the first time, we explain the impact of spatial distance on intertemporal preferences from the perspective of the sense of control. This explanation provides new theoretical insight into existing studies regarding the psychological mechanism of psychological distance affecting decision making. For example, when outcomes are delayed for a long time, people may have a low sense of control over the results, which perhaps results in more short-sighted and impulsive decisions. Similar phenomena may also occur when the probability of the outcome is low or when the outcome occurs to other people.

The current findings also have practical implications. Spatial distance has always been a concerned topic of investment research (e.g., Carboni, 2013a, 2013b; Reference Lutz, Bender, Achleitner and KasererLutz et al., 2013). Currently, an increasing number of online investment platforms (https://www.duocaitou.com/, for example) allow investors to invest in geographically distant investment projects without leaving their houses. The present research points out that increasing the sense of control, even a general sense of control that is not directly related to investment projects, can nudge investors to make long-term-oriented decisions.

Future research can build on the current findings in various ways. First, it is meaningful to consider whether the effect of spatial distance on intertemporal preference and the mediating effect of sense of control exist in other scenarios rather than being limited to investment. Indeed, decision makers have a lower sense of control over outcomes in the investment scenario than in a scenario about imagining receiving a winning prize (Reference Maglio, Trope and LibermanMaglio et al., 2013), because outcomes in the investment scenario (i.e., investment returns) are necessarily delayed and usually have a long delay. Decision makers also have a stronger need for control in the investment scenario. Because the investment scenario involves the input of money, decision makers will want to control the occurrence of outcomes. Future research can examine how spatial distance influences intertemporal choice (including both immediate and delayed rewards) in situations with less demand for control. Second, participants in our research evaluated their investment preferences on scales in only hypothetical situations (which is certainly a limitation of this research). Future research should examine the effect of spatial distance on real investment decisions. Third, we described the investment project as a “traditional investment project” across the three studies, which may be somewhat vague. It might be intriguing to test whether the results of this research exist for various specific sorts of investment projects. Finally, in our research, the participants were not explicitly informed whether the investment location was in their own country or in other countries. Future research can separately explore the impact of spatial distance on intertemporal investment preferences when the investment location is in participants’ own country or in other countries.