1. Introduction

Financial literacy is an essential skill for individuals to thrive in today’s society. The need to raise personal financial knowledge has captured the attention of academics, practitioners, and policymakers, and rightly so. Amid a rapidly changing landscape of digital innovation and cutting-edge technology in the financial sector, retirement planning that places more responsibility on individuals, and broader access to financial markets, the conversation about financial literacy and financial education has picked up pace. The most recent experiences, with the economic fallout of the global pandemic, financial market volatility, and rising inflation, have showcased that individuals must know how to navigate many uncertainties that impact financial decision-making.

To assess financial knowledge, Lusardi and Mitchell (Reference Lusardi and Mitchell2011b) introduced a set of questions on basic financial concepts at the root of financial decision-making (interest, inflation, and risk diversification). Dubbed the “Big Three,” these questions have become the standard way financial literacy is measured and have unveiled the lack of knowledge that most individuals display, even in countries with well-developed financial markets such as Japan. The main goal of this paper is to provide an in-depth analysis of the current state of financial literacy in Japan using the Big Three.

Further, given the rising inflationary environment around the globe, we pay particular attention to Japanese adults’ understanding of inflation. The rise in consumer prices in Japan was lower than in other major economies. Yet, the Consumer Price Index (CPI) rose by 2.5% in Japan in 2022. This is markedly higher compared to an increase in the CPI of 0% in 2020 and −0.2% in 2021. Additionally, the growth of nominal wages has not kept pace with inflation, leaving Japanese consumers dealing with some price pressure.

Previous research using data from Japan also shows that financial literacy is an important skill: it is related to higher participation in the stock market (Kikyusyo et al., Reference Kikyusyo, Kondo, Shirase and Misumi2019; Yamori and Ueyama, Reference Yamori and Ueyama2022), higher investment returns (Kikyusyo et al., Reference Kikyusyo, Kondo, Shirase and Misumi2019), greater wealth (Sekita, Reference Sekita2020; Sekita et al., Reference Sekita, Kakkar and Ogaki2022), lower tendency to gamble (Watanapongvanich et al., Reference Watanapongvanich, Binnagan, Putthinun, Khan and Kadoya2021a), greater demand for non-face-to-face financial services and cashless payments during the COVID-19 pandemic (Fujiki, Reference Fujiki2021), lower tendency to become a victim of fictitious billing fraud and loan guarantee fraud (Kadoya et al., Reference Kadoya, Khan, Narumoto and Watanabe2021), and a lower tendency to smoke (Watanapongvanich et al., Reference Watanapongvanich, Khan, Putthinun, Ono and Kadoya2021b).

Moreover, there is a strong link between financial literacy and retirement readiness (Sekita, Reference Sekita2011; Kadoya and Khan, Reference Kadoya and Khan2018; Kadoya et al., Reference Kadoya, Khan, Hamada and Dominguez2018). Japan has a pay-as-you-go public pension system, and the population is aging rapidly. Thus, people are becoming increasingly anxious about their retirement preparedness. According to a public opinion survey on Japan’s household financial behavior in 2022 (“Kakei no Kinyu Kodo ni kansuru Yoron Chosa”), 84.5% of household heads under 60 living with one or more members reported being concerned about life after retirement. Footnote 1 Thus, preparing for retirement and being equipped with the necessary financial knowledge to make these decisions is becoming increasingly important.

In this paper, we expand on the previous literature and analyze the connection between financial literacy and investment behavior. Specifically, we focus on those investments where respondents get to choose how their money is invested, including their retirement savings.

When it comes to investing, Japan has dedicated more attention to ESG, that is, (i) environmental performance (E), (ii) social responsibility (S), and (iii) corporate governance (G) to improve the sustainability and ethical impact of financial activities. About a decade ago, Japan launched the “Japan’s Stewardship Code” Footnote 2 and “Corporate Governance Code,” Footnote 3 which provide guidelines and recommendations for institutional investors and companies to promote sustainable growth in the medium and long run. Thus, we also analyze the connection between financial literacy and basic knowledge of ESG.

The main findings of this paper are fourfold: first, the level of financial literacy in Japan is low, with only 36% of the respondents in the whole sample being able to correctly answer the Big Three financial literacy questions in the Fall of 2022. These low levels of financial literacy may be related to limited access to financial education and consumer education in schools, the workplace, and the community at large. For example, the Financial Literacy Survey conducted in 2019 by the Central Council for Financial Services Information Footnote 4 reports that only 9% of the survey respondents had access to financial education, such as life planning and household financial management in schools, universities, or workplaces. Moreover, a previous paper by Sekita (Reference Sekita2011) analyzed the Big Three financial literacy questions and reports similar results. In fact, in 2010, only about 27% of Japanese respondents could correctly answer the Big Three financial literacy questions.

Second, substantial variation in financial literacy levels exists across demographic groups which is in line with previous studies (Sekita, Reference Sekita2011; Yeh, Reference Yeh2020; Kawamura et al., Reference Kawamura, Mori, Motonishi and Ogawa2021): the most vulnerable groups include the young, women, and those with lower educational attainment. Third, when examining financial literacy across respondents with a basic knowledge of ESG, we find that those who are ESG-literate are also more financially literate than those who are not. Fourth, our data show that financial literacy is strongly correlated with active investment behavior. Still, among the Big Three, the risk diversification concept – the topic with the closest link to investing – is least understood even among active investors.

The paper is structured as follows. Section 2 describes the sample and the Big Three financial literacy questions. It further provides a discussion of the findings about financial literacy, as well as an analysis of the knowledge of inflation and the relationship between financial literacy and ESG literacy. Section 3 discusses the connection of financial literacy to active investment behavior, and Section 4 concludes.

2. Data overview and summary statistics

This research is based on a dataset that was collected by the Global Financial Literacy Excellence Center (GFLEC) in September 2022 using YouGov’s Global Omnibus online panel Footnote 5 and called the SKBI (Sim Kee Boon Institute for Financial Economics)-GFLEC Sustainable Investment Survey. Footnote 6 The survey included many questions, including the Big Three and information on investments. All statistics presented in this paper use sampling weights, so to make the statistics nationally representative of the Japanese population. The weights consider age, gender, social class, region, and level of education. Footnote 7 After excluding respondents with incomplete socioeconomic information, the total sample consists of 1,701 observations. The survey was administered among Japanese adults aged 23 years and older. More than half of the population (56%) is older than 50 years of age, about 60% are married, 53% have a college degree or more, 59% are employed, and 12% are retired. It needs to be noted that we find a slightly higher education level in our sample compared to the population census. Otherwise, the demographic distribution is in line with population census data provided by the Statistics Bureau of Japan. Footnote 8 For part of the analysis, the sample will be restricted to those in their working ages, that is, 25–65-year-olds. By excluding those most likely to be retired and in the decumulation phase of the life cycle, we can focus on investment decisions during the working life. Footnote 9

2.1. Findings regarding financial literacy

Financial literacy is measured by using the Big Three financial literacy questions, which have become the benchmark by which researchers and policymakers measure financial literacy (Lusardi and Mitchell, Reference Lusardi and Mitchell2011b). These three questions were designed to be simple and measure basic financial concepts that are pertinent to peoples’ day-to-day financial decisions. Together they have proven to be a reliable measure of financial literacy (Lusardi and Mitchell, Reference Lusardi and Mitchell2011a, Reference Lusardi and Mitchell2014, Reference Lusardi and Mitchell2023). By using these questions, we ensure comparability with other studies across countries.

The exact wording of the questions is as follows:

1. [Interest question] Suppose you had $100 in a savings account and the interest rate was 2% per year. After 5 years, how much do you think you would have in the account if you left the money to grow?

-

i. More than $102

-

ii. Exactly $102

-

iii. Less than $102

-

iv. Don’t know

-

v. Prefer not to say

2. [Inflation question] Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After 1 year, with the money in this account, would you be able to buy…

-

i. More than today

-

ii. Exactly the same as today

-

iii. Less than today

-

iv. Don’t know

-

v. Prefer not to say

3. [Risk question] Do you think the following statement is true or false? Buying a single company stock usually provides a safer return than a stock mutual fund.

-

i. True

-

ii. False

-

iii. Don’t know

-

iv. Prefer not to say

Overall, few adults in Japan were able to answer these three fundamental financial literacy questions correctly. The results are shown in Table 1. Only two-thirds of Japanese adults (65%) correctly answered the interest question (Panel A). Among the Big Three, this was the topic people knew the best. Still, more than one in three did not answer correctly; among them, 20% answered with “don’t know (DK).” Given the simplicity of the questions – it does not involve any complex calculation or an understanding of compound interest – the above results already hint at a low level of financial literacy.

Table 1. Summary statistics on three financial literacy questions (%)

Note: All figures are weighted. DK indicates the respondent does not know the answer.

Source: Author’s calculations using the 2022 SKBI-GFLEC Sustainable Investment Survey.

Similar to the interest question, only 62% answered the inflation question correctly (Panel B). This number is low, especially when considering that the data were collected during a time of higher inflation than in the past. Moreover, one-in-four Japanese adults responded with DK to the inflation question. In other words, 25% of adults do not know whether they would be able to buy more or less a year from now in an environment where savings earn a 1% interest and the yearly inflation rate is 2%. A comparison with results from the U.S. in 2019, where about 76% correctly answered the inflation question and only 4% answered with DK (Lusardi and Mitchell, Reference Lusardi and Mitchell2023), shows that knowledge of inflation in Japan is low. One possible reason for this difference could be the fact that Japan faced zero inflation or deflation for a very long time and has experienced a low rate of inflation just very recently, while the inflation rate in the U.S. and other countries around the world has hovered around 2% but peaked at record-high levels in 2022. Footnote 10 The central banks of many developed countries have pursued monetary policies targeting low inflation since around the mid-1990s. Similarly, the Bank of Japan also introduced a price stability target of 2% in January 2013 and continued to pursue that policy since then. Nonetheless, the inflation rate hovered around 0% from the mid-1990s until 2021 and increased to 2.5% just in 2022, making Japan’s inflation experience altogether different from other developed countries. The Bank of Japan (2021) states that “the situation where the inflation rate does not rise easily has continued, mainly because (1) the mechanism of adaptive inflation expectations formation in Japan is complex and sticky, (2) elastic labor supply has constrained wage increases, and (3) a rise in firms’ labor productivity has absorbed upward pressure on costs.”

Furthermore, comparing the inflation results in Japan between 2022 and 2010 (Sekita, Reference Sekita2011), 56% of respondents aged 25–65 years could give correct answers in 2022, while 59% could do so in 2010, which means that the level of inflation literacy did not increase much, even in the face of inflation. This result might be linked to Japan’s adoption of several strategies in 2022 to support households with an inflation-relief package, such as subsidies for energy and financial support for low-income households and their children. Footnote 11 Such measures may have mitigated the impact of inflation on Japanese consumers and perhaps prevented them from focusing on the effects of inflation. Footnote 12

Lastly, Panel C shows that risk diversification is the concept people know the least. Only about half of Japanese adults (51%) correctly answered the question on risk diversification and 41% – the highest percentage across the Big Three – answered with DK. This is problematic since risk is inherent in most aspects of personal finance. The experience of the past few years alone, with the economic consequences of the global pandemic and financial market volatility, has forced individuals to deal with many risks that impact financial decision-making in consequential ways. Further, the question also tests knowledge of “stock” and “stock mutual funds,” financial instruments that individuals should be familiar with when asked to select their investment portfolios in defined contribution pension plans or when making investment decisions.

When considering these three questions combined, we find that only 36% of Japanese adults could correctly answer all three questions, and the corresponding rate among respondents aged 25–65 years is also low at 33% (Panel D). However, compared to the results obtained in a previous study, the level of financial literacy seems to have increased a bit over time. Sekita (Reference Sekita2011) reported that in 2010 about 27% of respondents aged 25–65 years could correctly answer the Big Three financial literacy questions.

Looking at the results in 2010 and 2022 more specifically, it appears that the increase in financial literacy is due to a better understanding of risk diversification. In 2010, only 39% of respondents aged 25–65 years correctly answered the risk diversification question, whereas in 2022, about 50% of respondents did so. One possible reason could be the introduction of tax exemption programs such as NISA Footnote 13 (introduced in 2014) and Tsumitate NISA (introduced in 2018). Normally, when people in Japan invest in financial assets, such as stocks and mutual funds, they are subject to a tax of approximately 20% on capital gains and dividends. However, NISA exempts from paying taxes if the profits are earned from financial assets purchased up to a certain amount within a NISA account each year. The number of NISA (or Tsumitate NISA) accounts was 8,253,799 at the end of 2014 and increased to 18,007,257 at the end of 2022. Providing such tax incentives for risky asset holdings may have encouraged people to learn about risk diversification, leading to increased financial literacy.

Another possible reason is the so-called “20 million-yen problem for retirement funds.” Footnote 14 A report by the Financial Services Agency (FSA) in 2019 Footnote 15 estimated that couples would need an average of 20 million yen in retirement savings, in addition to the public pension, and the awareness of the importance of investing and asset management has increased following this report and associated news coverage.

It must be noted that the sample used in 2010 differs from the current sample. Hence, we must be cautious with directly comparing our findings to previous studies as we cannot conclusively say if the change is attributed to increased financial literacy levels or differences in the underlying demographics of the two samples. Further, in contrast to this paper, the findings presented by Sekita (Reference Sekita2011) did not rely on a sample representative of the Japanese population.

As mentioned above, the Big Three questions cover basic but distinct personal finance concepts. Hence, we expect responses to the Big Three financial literacy questions to be correlated, but this correlation may not be very high. This is the case, as shown in Panel D. The percentage of people correctly answering the interest or inflation question was slightly above 60%; however, only 51% answered both questions correctly.

Moreover, half of Japanese adults responded with DK to at least one of the Big Three. This is a very high percentage and worrisome: half of Japanese adults are making financial decisions with a limited understanding of the most fundamental personal finance concepts. Looking back to Panel A, B, and C, the DK response rates are 20% even in the simple question on interest, 25% in the inflation question, and 41% in the risk diversification question. These rates are higher than in other countries. For example, Bucher-Koenen et al. (Reference Bucher-Koenen, Alessie, Lusardi and van Rooij2021, May module of Table 1) show that the DK response rates are only 5% in the interest question, 7% in the inflation question, and 41% in the risk diversification question, using a representative sample of the Dutch population. Japanese culture and, in particular, the cautious nature of Japanese people could be an explanation for the high DK response rates observed in Table 1. JILPT (2015) shows that the most needed abilities to work in Japan are carefulness and avoid making mistakes. Moreover, a lack of confidence might be another reason for these high DK response rates. A report from the OECD (2017) finds that self-reported financial knowledge in Japan is low, with only 13% of individuals assessing their knowledge as very high or high. Instead, 78% of individuals in the U.S. rated their own levels of knowledge as very high or high.

The findings across the Big Three for the working-age restricted sample (age 25–65 years) show similar patterns albeit at a slightly worse level. The largest difference is shown for the inflation question where only 56% of respondents in the restricted sample knew the correct answer. This is particularly discouraging as inflation had been prevalent for most of 2022 and impacted all people.

2.2. Who is financially illiterate?

Table 2 reports financial literacy levels across demographics. Footnote 16 There are four main takeaways: first, financial literacy increases with age. A majority of those older than 65 years (77%) could correctly answer the interest question, whereas only 41% of the youngest respondents (those aged 35 years and younger) showed that comprehension. Inflation knowledge follows the same pattern (79% of those aged 65+ years vs. 37% of those aged 35 years or younger). Interestingly, the increase in inflation literacy with age seems steeper in Japan, compared to other countries. For example, in the U.S., even among young people aged 18–29 years, 61% could correctly answer the inflation question while about 82–83% of those aged 50 years or older could do so (Lusardi and Mitchell, Reference Lusardi and Mitchell2023). As stated in section 2.1, the inflation rate in Japan hovered around 0% from the mid-1990s until 2021. Thus, most people aged 64 years or younger have not experienced inflation in their adult lives, while people aged 65 years or older faced two oil shocks in the 1970s which created high levels of inflation, as explained in more detail below. This could be one of the reasons why the increase in inflation knowledge with age is steeper in Japan than in, for example, the U.S.

Table 2. Distribution of responses to financial literacy questions by age, sex, education, and employment status (%)

Note: All statistics are weighted. DK indicates respondent does not know.

Source: Author’s calculations using the 2022 SKBI-GFLEC Sustainable Investment Survey.

Moreover, 56% of the elderly (older than 65 years) correctly answered the risk diversification question compared to 44% among the youngest cohort. This gap being less pronounced compared to the previous questions reiterates that risk is the most difficult concept for people to grasp. Additionally, the risk diversification concept is the only one for which the DK response rates are relatively similar across age groups (ranging from 43% for the youngest cohort to 37% for the elderly).

Overall, we do not observe a decrease in knowledge among the elderly in Japan as observed in other countries (Lusardi and Mitchell, Reference Lusardi and Mitchell2011a). This finding is confirmed by the Financial Literacy Survey of 2019 which also shows a linear increase in financial literacy with age. This result may be linked to Japan’s higher life expectancy and the higher longevity risk Japanese adults face.

Moreover, Japan’s household savings rate was one of the highest among the G20 countries until the early 1990s but dropped sharply in the years following and is now among the lowest in the developed world. Footnote 17 It seems plausible that saving could teach about financial concepts; thus, the high propensity to save among the older population could help explain part of the observed difference in financial literacy compared to the younger cohorts.

Second, in line with research across countries (Yakoboski et al. Reference Yakoboski, Lusardi and Hasler2022; Klapper and Lusardi, Reference Klapper and Lusardi2020), we find a gender gap across all Big Three financial literacy questions. Compared to men, the percentages of women who know about interest and inflation are 14 and 19 percentage points (p.p.) lower, respectively. The gender gap is narrower for the risk diversification question, with a gap of 10 p.p. Based on these findings, it is not surprising that there is a significant disparity in the composite Big Three financial literacy measure between men and women. Only 28% of women answered all three financial literacy questions correctly, while 44% of men were able to do so. These findings are also confirmed by the Financial Literacy Survey of 2019.

Noteworthy, the level of DK answers is consistently higher for women across all three questions. Women struggle the most with the inflation (35%) and risk diversification questions (47%) compared to the interest rate question (26%). Overall, 60% of women answered with DK to at least one of the Big Three financial literacy questions compared to 40% of men. Lack of confidence might be one of the reasons for the higher DK response rate among women (Bucher-Koenen et al, Reference Bucher-Koenen, Alessie, Lusardi and van Rooij2021). This hypothesis seems to be confirmed by the Financial Literacy Survey of 2019, showing that 16% of men assessed their own financial knowledge as very high or high, compared to only 8% of women.

Third, higher educational attainment is positively associated with better financial knowledge: a significantly smaller percentage of those with a high school diploma could correctly answer the interest question compared to those with a college or postgraduate degree. The same is true for the other two financial literacy questions, whereas the difference is most striking for the risk diversification question. Considering the Big Three questions, less than one-third of those with lower education were able to answer all the questions correctly compared to half of those with a postgraduate degree.

Fourth and finally, our data show that a higher proportion of retirees could correctly answer each financial literacy question compared to those who are employed and those not employed. Footnote 18 This holds also for the Big Three: 56% of the retirees are financially literate (i.e., could correctly answer all three questions) compared to only 34% of those employed and 32% of those not employed. These findings are likely due to age (retirees are older than the other two groups) (see the age discussion above).

In summary, in line with previous literature in Japan (Sekita, Reference Sekita2011; Yeh, Reference Yeh2020; Kawamura et al., Reference Kawamura, Mori, Motonishi and Ogawa2021) and in other countries (Lusardi, Reference Lusardi2019; Hasler et al., Reference Hasler, Streeter and Valdes2022; Yakoboski et al., Reference Yakoboski, Lusardi and Hasler2022), we find that, when it comes to financial literacy, the most vulnerable groups are the young, women, and those with lower education. These findings highlight the importance of tailoring financial education programs and promoting equal opportunities for these groups.

2.2.1. Inflation knowledge in Japan

Looking at the CPI since 1970, inflation exceeded 5% only during the oil shocks in the 1970s. Since the mid-1990s, inflation has hovered around 0%, rising to 2.5% in 2022. Thus, for many Japanese adults, inflation is a very recent phenomenon. Additionally, nominal wages have not grown as much as inflation, which means that real wage growth has been negative, putting substantial pressure on Japanese consumers. Footnote 19 In this section, we shed more light on inflation knowledge and especially on which sociodemographic characteristics are more likely to be associated with a greater understanding of inflation.

Table 3 reports the results from an ordinary least squares (OLS) regression which regresses inflation knowledge on all demographic variables considered in Table 2. Footnote 20 The main findings are threefold: first, inflation knowledge is positively associated with age. The cohort of 65+ years of age is 38 p.p. more likely to correctly answer the inflation question than the youngest cohort (<35-year-olds). As discussed in the previous sections, this result may be influenced by their exposure to inflationary periods experienced during the oil shocks in 1973 and 1979. Retirees also show a better understanding of inflation (10 p.p.) compared to those employed. Second, the gender gap reported above holds even when controlling for other demographic characteristics: specifically, women are 16 p.p. less likely to answer the inflation question correctly compared to their male counterparts. Third, inflation knowledge is positively associated with education; respondents with a postgraduate degree are 12 p.p. more likely to correctly answer the inflation question compared to those with a high school degree.

Table 3. OLS estimates of inflation knowledge on sociodemographic characteristics in Japan

Note: Robust standard errors are in parentheses ***p < 0.01, **p < 0.05, *p < 0.1. The regression uses weights. The reference values used are the following: <35, male, high school, and employed.

Source: Author’s calculations using the 2022 SKBI-GFLEC Sustainable Investment Survey.

2.3. The relationship between financial and ESG literacy

Japan has made significant efforts to promote ESG practices and principles both at the corporate and individual levels. First introduced about a decade ago, Japan put into effect the “Japan’s Stewardship Code” Footnote 21 and “Corporate Governance Code.” Footnote 22 These provide guidelines and recommendations for institutional investors and companies to promote sustainable growth. In 2021, the Japan FSA launched the Strategy on Sustainable Finance to promote corporate efforts toward carbon neutrality. Furthermore, the Tokyo Stock Exchange has introduced voluntary reporting requirements on ESG factors for listed companies.

At the corporate level, the influences of the new policies toward ESG led the Japanese corporate sector to establish sustainability goals, implement environmental management systems, and improve their disclosure of ESG-related information. At the individual level, the growing investor demand for responsible investment led Japanese pension funds and asset management companies to increasingly integrate ESG considerations into their investment decision-making processes.

Introducing ESG factors to investing potentially adds more complexity to the decision-making process of investors. Investors can now make investment decisions based not only on risk and return considerations but also on ESG-related impact. Integrating more criteria into investment strategies raises the question of whether people have the required knowledge to make such decisions, especially given the already low financial literacy levels. Thus, this section aims to provide more information on Japanese’s financial and ESG literacy. Specifically, we explore how the level of financial knowledge differs between those who know the basics of ESG principles and those who do not know them.

We measure ESG literacy through nine multiple-choice questions (three questions for each of the three ESG areas) designed to assess respondents’ knowledge of basic ESG concepts. Similar to how the Big Three financial literacy questions measure an understanding of fundamental financial concepts, this ESG literacy indicator aims to provide a summary measure of respondents’ ability to evaluate ESG criteria. For environmental topics, we asked questions on the leading causes of greenhouse gas emissions, food waste, and threats to wildlife. For social topics, we asked questions on the prevalence of poverty, the gender pay gap, and the leading causes of childhood malnutrition. For responsible governance topics, we asked questions on the goal of corporate governance policy, the main corporate governance stakeholders, and how to minimize conflicts of interest among companies’ boards of directors. Footnote 23 We constructed a summary measure of ESG literacy in the following way: those who correctly answered at least one question in each of the three ESG areas are considered ESG literate.

Overall, 24% of Japanese respondents answered at least one question correctly in the three areas and could be considered ESG literate. Our results further show that those who are ESG literate are also more financially literate compared to those who are not ESG literate. Footnote 24 As shown in Table 4, more than 80% of those classified as ESG literate could also correctly answer the interest (83%) and inflation questions (84%), compared to less than 60% among those not classified as ESG literate. As discussed above, the risk diversification question is the most difficult concept for people to understand, and this also holds for ESG-literate respondents. Still, almost three-quarters (73%) of those considered ESG-literate can correctly answer the risk diversification question, compared to only 44% of those who are not.

Table 4. Distribution of responses to financial literacy questions by ESG literacy (%)

Note: All statistics are weighted. DK indicates respondent does not know.

Source: Author’s calculations using the 2022 SKBI-GFLEC Sustainable Investment Survey.

The lack of ESG literacy is associated with a higher percentage of DK responses to the Big Three financial literacy questions. Around 30% of those not classified as ESG literate responded with DK to the interest and inflation questions and almost 50% to the risk diversification question. This compares to around 7% for the ESG-literate respondents for both the interest and inflation questions and 22% for the risk diversification question.

Overall, among the ESG literate, 60% correctly answered all Big Three financial literacy questions, compared to 29% of those who are not ESG literate. These findings underscore the positive association between financial literacy and basic ESG knowledge, both necessary skills for making informed and sustainable financial choices.

3. The link to active investment behavior

In this section, we discuss the importance of financial literacy by examining its relationship to investment behavior. Footnote 25 Being able to build and grow wealth is essential for financial wellbeing. In this context, actively investing in financial markets has gained importance, especially with the introduction of defined contribution pension plans in Japan in 2001 where participants are expected to also make investment choices. Therefore, we explore the relationship between being an active investor and financial literacy.

Active investors Footnote 26 are defined as those who own retirement accounts where they get to choose how the money is invested Footnote 27 and those who have investments in stocks, bonds, mutual funds, or other securities aside from private or employer-provided retirement accounts. Footnote 28 A strong relationship exists between being an active investor and being financially literate (Table 5). Among active investors, 53% could correctly answer all Big Three financial literacy questions compared to only 21% among non-active investors. Across all three questions, active investors perform better. The risk diversification concept is where the differences are most noticeable. More than 70% of those classified as active investors know about the risk diversification concept, compared to only 37% of those classified as non-active investors. This is not surprising. Risk diversification is the concept closest associated with investing, as terms like “stock” and “stock mutual funds” are part of investment decisions. To explore these results further, multivariate regression analyses are presented in the following subsection.

Table 5. Financial literacy of those who are active investors and those who are not active investors (%)

Note: All statistics are weighted. DK indicates the respondent does not know. The sample consists of 1,047 non-retired respondents aged 25–65 years.

Source: Author’s calculations using the 2022 SKBI-GFLEC Sustainable Investment Survey.

3.1. A multivariate model of active investing and financial literacy

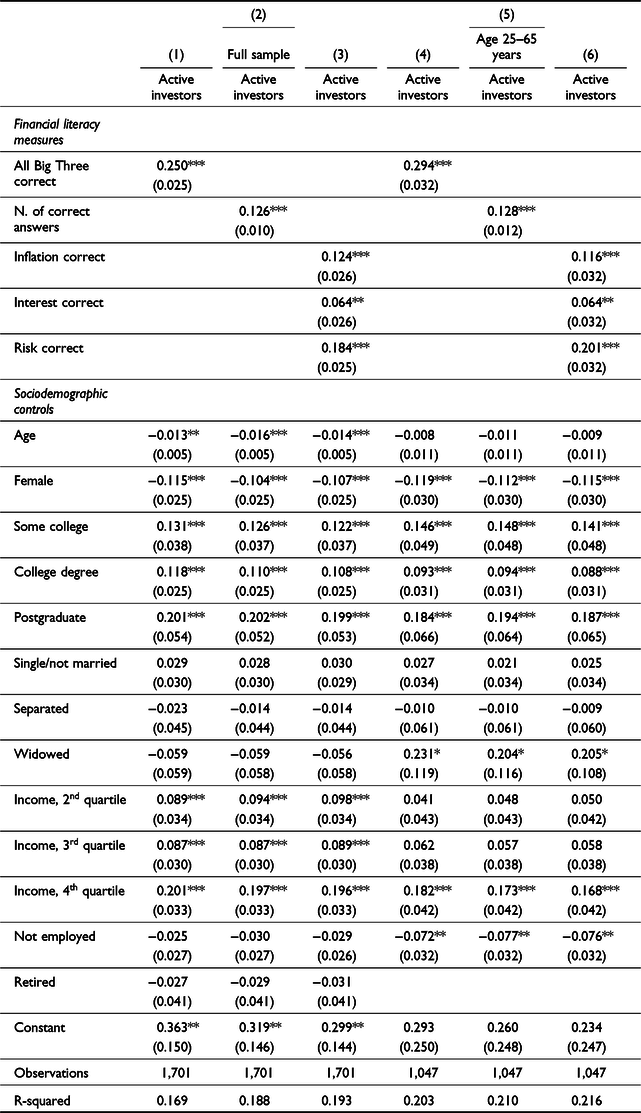

To further investigate the relationship between financial literacy and active investment behavior, we run OLS regression models Footnote 29 first on the full sample (Models 1–3 of Table 6) and then on the restricted subsample of non-retirees aged 25–65 years (Models 4–6 of Table 6).

Table 6. OLS estimates of active investments on financial literacy in Japan

Note: All regressions use weights. Other controls include age squared and district of residence. The reference values of the categorical variables used are the following: male, high school, married, income 1st quartile, and employed. Robust standard errors are in parentheses ***p < 0.01, **p < 0.05, *p < 0.1.

Source: Author’s calculations using the 2022 SKBI-GFLEC Sustainable Investment Survey.

We used different specifications to measure financial knowledge following Lusardi and Mitchell (Reference Lusardi and Mitchell2011a). The first specification of the model includes a dummy variable that takes the value 1 if the respondent correctly answered all Big Three financial literacy questions. The second specification includes an indicator of the total number of correct answers. The third specification includes three separate dummy variables for each correct answer to the financial literacy questions. Additionally, we control for age, age squared, gender, marital status, and other sociodemographic characteristics such as income, district of residence, and educational attainment to follow Lusardi and Mitchell (Reference Lusardi and Mitchell2011b) and to make results comparable across countries.

Table 6 shows that financial literacy is strongly associated with the likelihood of actively investing. Specifically, results reported in column 1 indicate that those who can correctly answer all Big Three financial literacy questions show a 25 p.p. higher probability of being active investors than those who do not correctly answer all three questions. Results in column 3 show that while all three financial literacy concepts are associated with active investment behavior, understanding risk diversification is particularly important. Similar results are found for the subsample of 25–65-year-olds.

Furthermore, younger respondents are more likely to be active investors. One possible reason could be the introduction of the Tsumitate NISA in January 2018. As mentioned before, Tsumitate NISA is a tax exemption program that was introduced to encourage periodic, long-term, diversified investments. Individuals can use the account even for small investments. For example, some brokerage firms offer Tsumitate NISAs with a minimum investment of only 100 yen. Such investment products might have helped grow investment interest among young people. Moreover, men, the better-educated, and those with higher income are more likely to be active investors; these results are robust, hold for both samples and different specifications, and align with previous literature.

Those who want to actively invest could also choose to learn about financial topics; thus, the financial literacy measures used in Table 6 could be endogenous (Lusardi and Mitchell, Reference Lusardi and Mitchell2014). It could also be measured with error (van Rooij et al., Reference van Rooij, Lusardi and Alessie2011). To address these concerns, we use a potentially more exogenous measure of financial literacy as a robustness check of the results presented in Table 6. This alternative variable uses information on exposure to financial literacy. It is measured with a variable that assesses whether financial education was offered in schools or at the workplace, regardless of whether people participated in such education or not. The exact wording of the question is the following:

Was financial education offered by a school or college you attended or a workplace where you were employed?

-

Yes, but I did not participate in the financial education offered

-

Yes, and I did participate in the financial education offered

-

No

-

Don’t know

-

Prefer not to say

Table 7 reports the regression results and confirms the previous results discussed in Table 6. Those who reported that financial education was offered to them in school or at the workplace are approximately 19 p.p. more likely to actively invest, and this holds for both samples.

Table 7. OLS estimates of active investments on financial education offered in Japan

Note: All regressions use weights. Other controls include age squared and district of residence. The reference values of the categorical variables used are the following: male, high school, married, income 1st quartile, and employed. Robust standard errors are in parentheses *** p < 0.01, ** p < 0.05, * p < 0.1.

Source: Author’s calculations using the 2022 SKBI-GFLEC Sustainable Investment Survey.

4. Discussion and conclusions

This paper provides evidence about the current state of financial literacy in Japan, using the most recent data collected in the Fall of 2022. The data show that financial literacy is low in Japan: only one-third of the respondents (36%) correctly answered the Big Three financial literacy questions, three well-known questions assessing the understanding of interest, inflation, and risk diversification. Even in the face of rising inflation, only 62% could correctly answer the inflation question. Further, and in line with previous studies, vulnerable groups that struggle the most with these fundamental financial concepts are the young, women, and those with lower education.

Japan has focused on ESG practices to promote sustainable growth, which may affect ESG as well as financial literacy among Japanese. We do find that financial literacy is higher for those who know the basics of ESG principles. Finally, we show that financially literate people are more likely to engage in active investment behavior. Interestingly, the concept most related to active investing – risk diversification – is the concept that people struggle the most with, including investors.

It is worrisome that financial literacy is still so low in Japan, because low financial literacy may affect not only active investment behavior but also financial decision-making overall, including planning and saving for retirement. Japan has a pay-as-you-go public pension system, and the population is aging rapidly. Hence, people are increasingly taking on responsibility for their own financial wellbeing in retirement, which means that low financial literacy will likely have negative implications.

These findings speak of the importance of targeted initiatives to improve financial literacy. Increased efforts to promote financial education in school could be one way to build financial literacy from an early age. Unfortunately, in Japan, according to the Financial Literacy Survey from 2019, only 9% of the survey respondents reported having had access to financial education in schools, the workplace, or community organizations. Therefore, it is necessary to step up the efforts to expand the provision of financial education. Our findings also highlight the need for financial education programs that are tailored to the most vulnerable groups such as the young, women, and those with lower education to improve their financial literacy and ultimately financial wellbeing.

Acknowledgments

The data were collected with financial support from the Sim Kee Boon Institute for Financial Economics (SKBI) at Singapore Management University. Findings and conclusions are solely those of the authors and do not represent the views of any institutions with which the authors are affiliated. The authors thank Annamaria Lusardi, Alessia Sconti, and the three anonymous referees for their valuable suggestions and comments. ©2023 Sticha, Sekita.

Appendix

Table A1. Summary statistics in the Japan total sample

Note: All statistics are weighted.

Source: Author’s calculations using the 2022 SKBI-GFLEC Sustainable Investment Survey and 2020 population census.