Introduction

The impact of political tensions on economic relations has received considerable scholarly interest. Building on the neoclassical assumption that international trade leads to mutually beneficial economic exchanges, it has been argued that interstate conflict dampens trade because it prevents firms from maximizing their utility.Footnote 1 Empirical studies have generally yielded evidence consistent with this insight, showing that hostile political relations may lead to either the complete shutoff of, or severe restrictions on, trade for countries in such an environment or increases in various forms of protectionism for countries in peace.Footnote 2 Because there is considerable variation in the level of cooperation or hostility embedded in political relations, more recent studies have shifted the empirical focus away from militarized disputes to political tensions, which capture “disagreement over policy issues, hostility between leaders, and negative public sentiment,”Footnote 3 yielding inconclusive evidence.

Building on this literature, we examine the role of bilateral tensions in influencing trade relations between the United States and China, the two largest economies in the world. Given the reduced likelihood of major power war in an era of growing economic interdependence, we follow the lead of Du et al. and focus on political tensions as reflected in “difficulties in political relations that fall short of war” or political relations that are “less than extremely antagonistic.”Footnote 4 As many scholars have shown, while both countries have sought to build positive ties with each other through engagement, US–China relations have also faced many challenges that threatened to erode the basis of bilateral cooperation. Events such as the bombing of the Chinese embassy in Belgrade in 1999 and the EP-3 incident in 2001 as well as tensions arising from the US support for Taiwan, the huge bilateral trade imbalance, human rights, and the South China Sea, to name a few, have all threatened the stability of bilateral relations. The ongoing power transition between the United States and China is likely to fuel existing tensions, leading to heightened pressure for downward spiral in the relationship.

In this article, we measure tensions in US–China relations using negative sentiment as reflected in major US newspaper coverage of bilateral relations instead of actual conflicts or negative events. Such a measure captures tensions in both geopolitics and economics that shape the business environment. To the extent that geopolitical and economic issues are closely intertwined, with economic tensions negatively impinging on geopolitical relations, and vice versa, it should present a relatively comprehensive view of the fluctuations in the underlying levels of tensions in US–China relations.

In addition to analyzing the aggregate effect of bilateral tensions on trade flows, we extend the previous literature to examine the potential variation in the responses of industries with different levels of supply chain integration with China. As the recent US–China trade war shows, heightened bilateral tensions have increased the vulnerability of supply chain networks to the imposition of tariffs and substantially raised supply chain risks. However, the impact of the trade war on the production and trade patterns of companies with supply chain operations in the United States and China is far from clear. On the one hand, there are reports of US companies, including those in a highly integrated sector such as electronics, exiting from the Chinese market or relocating production to other regions such as Southeast Asia to evade the tariffs.Footnote 5 On the other hand, however, statistics on nonfinancial foreign direct investment (FDI) in China seem to point in the other direction, suggesting that anecdotes of a handful of firms exiting the Chinese market do not necessarily represent a broad trend.Footnote 6 Questions therefore remain about how the nature of American firms’ ties to the Chinese market may shape their response to the escalation of bilateral tensions.

To address this question, we examine the possibility that variation in considerations about “sunk costs,” or unrecoverable, specific assets dedicated to the Chinese market, may generate divergent industry responses to political tensions, postulating that industries with a high level of supply chain linkages to China may be less likely to experience significant shifts in trade flows compared to those with more moderate linkages to the Chinese market due to the greater costs involved in adjusting their existing supply chain relationships to rising political risks. Specifically, we examine three different types of supply chain linkages—input sourcing, as measured by backward global value chain (GVC) linkages; downstream exports, as measured by forward GVC linkages; and vertical FDI, as measured by related-party (RP) trade. We further innovate by examining the impact of political tensions since the initiation of President Trump's trade war against China to see if heightened tensions under trade war conditions may have had any different impact on trade patterns.

In our empirical analyses, we first utilize our media-based measure of bilateral tensions derived from sentiment analysis to examine its effect on monthly bilateral trade volumes during the pretrade war period (between January 2002 and February 2018). Regression analyses indicate that bilateral tensions have negatively affected US imports from China. However, this effect is driven mainly by economic rather than political tensions during the pretrade war period. In addition, contrary to our expectations, tensions have had a more significant effect on industries with high, rather than medium or low, levels of GVC linkages to China.

We further examine whether the policy shocks introduced by the US–China trade war which began in March 2018 may have generated a different pattern. For this set of analyses, we continue to focus on the impact of tensions on US imports from China and additionally consider the effect that US tariff increases may have had on trade patterns. Somewhat surprisingly, this set of analyses yielded some evidence that industries with a high level of GVC linkages to China may have both been subject to higher tariffs and experienced more sustained decline in imports than those with less extensive ties to the Chinese market. While these results are tentative, they indicate that, in general, market actors have been negatively impacted by rising political and economic tensions both under routine diplomacy and when faced with exogenous shocks such as those generated by the trade war. It is also not clear to what extent “sunk costs” considerations have constrained the behavior of business actors.

This article makes several contributions to existing literature. First, unlike previous studies that focus on the effect of militarized disputes or negative events on trade relations,Footnote 7 our research shows that bilateral tensions dampen trade relations even short of military conflicts. To the extent that media coverage shapes businesses’ expectations of the overall tone and trajectories of US–China relations, an increase in negative sentiment as reported in the media could lead businesses to be more circumspect in their trade and investment decisions and reduce consumer confidence and spending, therefore curtailing trade activities.

Second, our more nuanced industry-level analysis further shows that the negative effects of bilateral tensions and the trade war have been concentrated more heavily on industries with extensive supply chain linkages to China. These results suggest that “sunk costs” considerations may not have been strong enough to prevent the decline in trade relations and that, so far, US–China trade relations may not have been “business as usual.”

Third, our research relates to another strand of literature, mostly by economists, on the impact of economic or trade policy uncertainty on growth and investment.Footnote 8 This strand of the literature generally examines the effect of monetary, fiscal, and regulatory policy uncertainty on economic outcomes such as stock market volatility or private investment. The focus of these studies is on uncertainty in the economic environment. Our study differs from them in that we focus on not only uncertainty or tensions in the economic realm but also those arising from geopolitics.

Finally, we follow the lead of recent studies that utilize newspaper text search methods to develop proxies for economic and political conditionsFootnote 9 in building our main index of bilateral tensions. To the best of our knowledge, few studies have specifically investigated media coverage of China or US–China relations. A major exception is Yang and Liu which examines the “China threat” coverage in the US print media.Footnote 10 However, that study focuses on the 1992–2006 period, leaving out more recent years when China rose as a major economic and political player. Our study fills this gap in the literature and contributes to a more comprehensive portrayal of US–China relations in the US media.

Theoretical Perspectives

Existing theories of international relations approach the relationship between political relations and trade in different ways. The realist theory of international relations emphasizes how the anarchical nature of the international system leads states to be rational utility maximizers mainly concerned about their security and chances of survival. For fear that commercial exchanges may generate relative gains disproportionately benefiting partner countries at their own expense, states may be more likely to favor trade with political allies rather than adversaries. Along similar lines, it has been argued that “trade follows the flag” as risk-averse businesses actors should be motivated by a desire to minimize the risk of disrupting commercial transactions to pursue trade relations with friendly countries.Footnote 11 From this perspective, the nature of political relations, such as whether two countries are in a military alliance relationship with each other, is an important variable influencing the level of trade as well as the potential for trade conflicts.Footnote 12

Realist views contrast sharply with those of liberal theories that emphasize the peace-inducing effect of economic interdependence. From the liberal perspective, frequent economic interactions encourage domestic interests that have benefited from such relations to lobby against policies that may jeopardize political cooperation.Footnote 13 Alternatively, it has been argued that commercial exchanges provide an information channel by allowing states to more credibly signal their resolve without having to resort to a costly war or foster a sense of trust between partner countries.Footnote 14 A key assumption underlying these arguments is that political conflict damages commercial relations.Footnote 15 Given the emphasis on the peace-inducing effects of international trade, liberals generally contend that international power relations do not affect national welfare to nearly the same extent as realists expect.

More recent studies have revisited the debate between realist and liberal theories about the nexus between economic and security linkages, pointing to the need for more nuanced analyses to better capture the growing complexities of international economic interdependence. Davis and Meunier, for example, argue that the rise of intraindustry trade and FDI increasingly constrains governments’ ability to unilaterally intervene in international economic affairs and reduces the likelihood that political tensions can generate any perceptible impact on commercial transactions.Footnote 16 This is because growing capital mobility has accentuated the need for firms to exploit economies of scale and product differentiation. It has additionally magnified the salience of considerations for relationship-specific sunk costs, or “costs in assets dedicated to specific markets” such as fixed costs for skilled labor, production techniques, and product branding.Footnote 17

Research on the economic statecraft of China and other major international players has yielded inconclusive evidence. On the one hand, based on analyses of China's trade relations with Europe or Japan, studies have pointed to the possibility that a high level of commercial interdependence may dampen the negative impact of political tensions.Footnote 18 It has also been shown that the effects of heightened tensions on trade may vary depending on the product under consideration.Footnote 19 On the other hand, however, the argument that market interactions may be immune to rising bilateral political tensions has been challenged by more recent empirical studies, with scholars showing that political animosity has led to a significant reduction in trade flows or has visibly affected consumer preferences and behavior.Footnote 20 Overall, existing studies have yielded somewhat conflicting evidence about how rising political tensions may impact the expectations and behavior of market actors.

Hypotheses

We expect heightened tensions surrounding US–China political and economic relations to affect commercial relations through a couple of channels. Increased tensions could lead firms to decide to shift existing trade relations to less-risky countries or regions, delay investment, and reduce hiring, in addition to negatively affecting consumer confidence and spending, all of which could dampen commercial activities.Footnote 21 They could further reduce demand for the national currency of exporters, thereby increasing trade costs. In addition, by leading investors to reevaluate the risks associated with their returns, bilateral tensions may trigger capital inflow or outflow from residents.Footnote 22 Just as importantly, even in the absence of the previously mentioned effects, rising tensions may directly affect the confidence of market participants and shape their assessment of the risks of conducting business with China, which may in turn lead to instant changes in bilateral exchange rates and therefore trade and investment flows.Footnote 23

Preliminary evidence from actual developments in US–China relations lends some support to the preceding conjectures. For example, the ongoing US–China trade war underscores the importance of headlines related to US–China trade talks in influencing investor confidence and stock market performance. In late 2019, media reports of a pending “phase one” agreement on less controversial portions of the trade deal were “welcomed as relief for the market,” while news that the bilateral trade talks have hit an impasse has had the opposite effect.Footnote 24 Other major developments in US–China trade relations as they were reported in the media, such as President Donald Trump's threats on May 6, 2019, to raise tariffs on some Chinese imports to 25 percent and the White House's subsequent decision to place Huawei Technologies on a banned entity list and limit its access to the US market, have had similar effects.Footnote 25

The preceding analysis suggests that by increasing the costs of trade and investment and negatively affecting the confidence of market participants, rising bilateral tensions may dampen trade relations between the US and China (hypothesis 1).

In addition to investigating the aggregate effect of bilateral tensions on trade relations, we examine how they may affect industries with varying levels of supply chain integration with China. Previous studies in both economics and political scienceFootnote 26 suggest that businesses may be limited by “sunk costs” in their ability to make adjustments in responding to changes in the political and economic environments.Footnote 27 When businesses sink funds into new business initiatives, such as into physical assets or the development or expansion of distribution, sales, advertising, or servicing channels, they incur the so-called sunk costs that may not be easily recovered. Such “sunk costs” may not only constitute barriers to entryFootnote 28 but may also increase the difficulties firms face in changing production, trade, or investment patterns following the initial business decisions. This is especially the case if firms are engaged in investment in overseas markets as relocating production or other business activities from the host market would have entailed significant adjustment costs.Footnote 29

If the preceding argument is valid, then it is possible that industries with stronger supply chain relationships with China may be more muted in their responses to shifting trends in US–China relations. In the case of US–China trade relations, growing supply chain integration has taken several organizational forms. Noticeably, China's economic reform and opening to the outside world in the recent decades stimulated the expansion of the so-called backward GVC linkages between the two countries whereby US companies increasingly drew on imported inputs from China for production and export.Footnote 30 Such a development took place mainly as a result of China's growing participation in the so-called buyer-driven production networks in which nonmanufacturing or sourcing firms “played the pivotal role in setting up decentralized production networks” through design, marketing, and sales instead of manufacturing activities.Footnote 31

China's growing international economic integration has also deepened the United States’ forward GVC linkages to China, or the domestic contents produced in the United States that are embodied in Chinese exports to world markets.Footnote 32 As an indicator of such a development, the forward GVC linkages between the United States and China, defined as US domestic value added in Chinese exports as a share of total US gross exports (or the value added source country), have increased from 0.313 percent in 1995 to 1.79 percent in 2018.Footnote 33

In addition, China has increased its participation in producer-driven production networks in which lead firms not only engage in manufacturing activities but also “exert control over backward linkages with raw material and component suppliers, and forward linkages into distribution and retailing.”Footnote 34 As the Chinese government has gradually liberalized control over FDI, a growing number of American companies have relocated production to China to take advantage of the country's cheap labor and natural resources as well as proximity to the Chinese market. Such activities help to cement forward GVC linkages when these companies export from the Chinese market back to the home country through the so-called vertical FDI.Footnote 35

Regardless of the specific form of global supply chain integration under consideration, it remains important that firms are able to maintain steady access to the raw materials, inputs, and other intermediate products necessary for their operations. Whether firms engage in input sourcing to capitalize on the networks of local suppliers or undertake vertical FDI to protect proprietary knowledge or technology, preserve dedicated assets, or ensure the enforcement of contracts, they invariably incur sunk costs that should render “exit” less attractive and limit firms’ operational flexibilities in the presence of political and economic uncertainties.Footnote 36 Such costs should be even more substantial for firms with extensive supply chain linkages to China. It is possible, therefore, that industries more closely integrated with the Chinese market through input sourcing, downstream export, or vertical FDI should be less sensitive to rising tensions in US–China relations. If this is the case, then industries with extensive GVC linkages to China should be less likely to experience declines in import volumes in response to bilateral tensions (hypothesis 2).

Measuring Bilateral Tensions

In the following analysis, we utilize sentiment analysis to derive a measure of bilateral tensions aimed at capturing disagreements and conflicts in US–China political and economic relations. We expect that such tensions may impinge on private actors’ assessment of the future trajectory of the relationship, the likely timing of major policy developments, and the effects of either cooperation or conflict on bilateral relations. We choose a media-based measure instead of measures of highly salient and visible conflicts or negative eventsFootnote 37 because, compared to the latter, which have been more infrequent in US–China relations in recent years, media reports of escalating rhetoric about growing strategic competition and the potential for decoupling should have weighed more heavily in firms’ assessment of the future development of the bilateral relationship, and this should especially be case in the periods leading up to and following the onset of the trade war.

Both economists and political scientists have investigated the effect of political and economic uncertainty using media-based measures. For example, a number of studies have examined the role of media-based economic policy uncertainty, including volatility in the stock market, investment, output, and employment, on economic performance.Footnote 38 Caldara and Iacoviello develop a Geopolitical Risk Index that captures the instability generated by geopolitical events based on news headlines dealing with geopolitical tensions, wars, or terrorism and empirically assess the impact of geopolitical risks on capital flows.Footnote 39 Drawing on the political relations index developed by Yan and Qi and Yan et al., which is based on reports of bilateral political events from Chinese news and government sources,Footnote 40 Du et al. analyze the effects of China's bilateral political relations on trade, finding that the impact of political shocks tends to be short-lived.Footnote 41 Despite potential concerns with bias and error associated with media-based event counts,Footnote 42 studies have found that claims of significant bias in media coverage are exaggerated and that there is little evidence of systematic differences in story selection or news reporting of either domestic or international issues based on the outlet's ideological position.Footnote 43 Furthermore, while the ambiguity of the natural language may potentially pose challenges to the accuracy of sentiment analysis, the method has been applied to the study of a wide range of phenomena such as public opinion or the polarization of parliamentary debatesFootnote 44 because it allows researchers to capture the emotions and attitudes expressed in a large number of texts and hence improve their ability to understand complex social interactions.

To construct our measure, we build on the content analysis methods developed in previous researchFootnote 45 and examine media narratives and framing of US–China relations from 2002 to 2019. Specifically, we searched four leading news sources—the New York Times, Wall Street Journal, Washington Post, and Los Angeles Times—and an influential trade journal—Inside U.S. Trade. These publications are all dominant US-based news outlets that cover these topics extensively and have documented impact on public policy formation. We conducted our search along a broad filter that searches for US–China diplomatic and economic relations and a more focused economic filter for economic issues. Appendix 1 provides a list of the key terms used for the search. To return a sizable and relevant corpus of articles on this topic, we applied grounded theory, where we conducted an exploratory search, evaluated the results, and iterated with further refinements based on a review of the corpus, the historical literature, and knowledge of journalistic reporting conventions at the time. A total of 11,287 articles were retrieved from the search. We excluded opinion pieces and editorials from the analysis because our study is most concerned with the degree of hostility resulting from developments on the ground.

The articles were analyzed in a sentiment analysis dictionary using the R programming language.Footnote 46 We used a lexicon-based method that applies sentiment scores to individual words from a dictionary and tabulated them to provide a net positive or negative score per article.Footnote 47 There are various lexical dictionaries created that score words based on emotion, positive or negative sentiment, and other methods. We utilized the widely used Bing Lexicon by Hu and Liu.Footnote 48 Measuring a general discourse of 6,788 words, the Bing Lexicon provides a suitable method for detecting emotions in textual data and has been widely used in the data science field and in journalism to assess sentiment in news articles.Footnote 49 Following this approach, we assigned sentiment scores to individual words, aggregating the scores by article and discerning trends at the monthly level. Because positive media coverage implies decreases in bilateral tensions and vice versa, we flipped the data so that the shocks measured indicate a decline in the bilateral relationship.

To see if tensions in the economic environment may generate any different effect on trade relations from that in the political environment, we examined geopolitical tensions and economic tensions using the inversed sentiment scores generated using the broad filter and the economic filter in the following analysis. Figure 1, which presents the trends in our measures during the period examined, shows that both geopolitical tensions and economic tensions generally fluctuated through 2017 and peaked in 2018 with the onset of the US–China trade war under President Trump. Economic tensions, in particular, have demonstrated significant swings, with the rise in tensions being especially pronounced since the beginning of the trade war in early 2018.

Figure 1: Trends in bilateral tensions in US-China relations, January 2002–December 2019.

We further conducted the Chow structural break test for the onset of the trade war in March 2018. The test yielded an F-statistic of 22.06 for political tensions and 24.10 for economic tensions. Both are also statistically significant, indicating that a structural break does exist in the data (see table 1).

Table 1: Chow structural break test for March 2018.

Bilateral Tensions and US–China Trade Relations: The Pretrade War Period

In this section, we focus on the impact of bilateral tensions on US imports from China during the pretrade war period. We first examine aggregate US imports from China before considering how the effects of bilateral tensions may vary according to the industries' GVC linkages to China.

The Overall Pattern

Figure 2 presents changes in US exports to and imports from China as well as the bilateral trade balance between January 2002 and December 2019. We focus our analysis on the monthly volume of US imports from (imports) China due to the much larger volume of US imports from China than exports to that country. Import data are measured in million US dollars and are taken from the USA Trade Online database maintained by the US Census Bureau.Footnote 50 We take the logarithm of the data to facilitate the interpretation of the results.

Figure 2: US–China trade, January 2002–December 2019.

We take into consideration the influence of the size of the US economy (GDP_USA) in the analysis.Footnote 51 This is because market size may have an independent effect on trade relations.Footnote 52 The size of the US economy may additionally affect the country's demand for imports. Appendix 2 presents the descriptive statistics of the main variables.

We run ordinary least squares regressions of the impact of political and economic tensions on imports for the period between January 2002 and February 2018 and report the results in table 2. As table 2 shows, economic tensions have a much greater impact than political tensions on imports during the pretrade war period. Economic tensions are positively signed and statistically significant in all model specifications, while political tensions are largely insignificant. In the model for all industries (Model 1), a one unit increase in economic tensions leads imports to decrease by $130.76 million, indicating that the rise in economic tensions has had a significantly negative effect on imports.

Table 2: Impact of political and economic tensions on imports (January 2002–February 2018).

***, **, and * denote significance at the 1%, 5%, and 10% significance level, respectively; t statistics in parentheses.

Sectoral Variation

In addition to analyzing the effect of bilateral tensions on the overall import volume, we further investigated their effect on trade for industries with different levels of supply chain integration with China. We measure backward GVC linkage as the foreign value added originating from China in US domestic final demand. Forward GVC linkage is in turn measured as US domestic value added in China's final demand.Footnote 53 Data for these variables are drawn from the Trade in Value Added (TiVA) database published by the Organisation for Economic Co-operation and Development (OECD) and are generated from the OECD's Inter-Country Input-Output system using the International Standard Industrial Classification Revision 4.Footnote 54 The 536 six-digit North American Industry Classification System (NAICS) industries in our dataset are matched to 36 TiVA industries using the appropriate concordance table.

We use RP trade data from the US Census Bureau as a proxy for vertical FDI in our analyses.Footnote 55 Studies have found that this data source is similar to the WorldBase database compiled by Dun and Bradstreet that contains data on more than 43 million firms in more than 213 countries for 2015, as the total value of US imports from related parties reported by the Census Bureau is highly correlated with the aggregated sales of all US vertical affiliates in the WorldBase database.Footnote 56

We weight the previously mentioned GVC variables by the share of an industry's trade with China in its total trade to account for the potential effect that an industry's dependence on the Chinese market may have on its operations. We further classify industries as having low, medium, and high backward (forward) GVC linkages or RP trade with China if they fall below the 30th percentile, above the 70th percentile, or between the 30th and 70th percentile in each of the supply chain linkage measures, respectively.Footnote 57

When we break down the industries by the level of GVC linkages to China, we see that the coefficients for economic tensions are much larger for industries with high, rather than medium or low, levels of GVC linkages to China of either type. For example, a one unit increase in economic tensions is associated with a decrease of $102.60 million in imports for industries with high levels of backward GVC linkages to China, compared to $21.39 million and $6.77 million for those with medium and low backward GVC linkages to China, respectively. The same pattern can be observed for forward GVC linkages and RP trade.

Figure 3, which shows the scatterplot and predicted relationships between economic tensions and imports, reveals a similar pattern as industries with the highest backward and forward GVC linkages as well as the highest RP trade with China also have the largest actual and predicted declines in imports.

Figure 3: Scatterplot and predicted relationships between economic tensions and imports, pretrade war period.

A couple of robustness checks were conducted to increase our confidence in the validity of our results. First, we conducted additional tests using sentiment scores derived from a custom sentiment dictionary. Containing 176 words, the custom sentiment score more accurately measures discourse used in trade and economics journalism. Test results remain consistent with those reported for the main model estimates.Footnote 58

Second, because US–China trade relations may be influenced by factors not related to the policy shocks, we conducted a placebo test for US imports from the European Union (EU). We first present the trends in US imports from China and the EU between 2002 and 2019 (appendix 3A). The results show that US imports from both China and the EU decreased during the global financial crisis between 2008 and 2010. However, while US imports from China have seen another sharp decline since 2018, its imports from the EU have not expeirenced a similar decrease since the beginning of the trade war. Structural break analysis for US imports from the EU similarly suggests that the structural break took place around the time of the global financial crisis instead of the trade war (see appendix 3B). These patterns show that the policy shocks generated by the trade war have negatively impacted US imports from China, but not from the EU.

Third, besides tariffs, the US government has also sought to address its trade concerns with China by sanctioning major Chinese firms using the Entity List. Because many of these firms included in the Entity List belong to strategic sectors or occupy important positions in global production networks, the restrictions placed on these firms may potentially impact trade flows. It should be noted, though, that the companies, organizations, and legal persons included in the Entity List are subject to specific license requirements for the export, reexport, and/or transfer (in-country) of specific items under the Export Administration Regulations. However, the US Bureau of Industry and Security does not prohibit purchases from these entities, although firms considering such purchases are encouraged to exercise caution and additional due diligence in their transactions. Because we focus on the impact of political tensions on imports instead of both imports and exports in this study, the fact that the US companies are not barred from purchasing from persons placed on the Entity List should ameliorate concerns about the potential impact of the Entity List on import flows. Nevertheless, to address these potential concerns, we have rerun our analysis excluding the information and communication technology and electronics and electrical machinery sectors with a relatively large concentration of firms on the Entity List. Results from this procedure are consistent with those reported in the article.Footnote 59

Overall, the previously mentioned results lend some support to hypothesis 1 that tensions in the bilateral relationship may dampen trade relations. However, the finding that such effects are most pronounced with industries with high levels of GVC linkages to China presents some challenge to hypothesis 2 that suggests that “sunk costs” considerations may limit the extent to which tensions may damage commercial relations among industries with the most extensive supply chain linkages to the Chinese market.

Further Analysis of the Impact of the Trade War

A set of additional tests was conducted to see if elevated tensions since the beginning of the trade war may have had any different effect on trade patterns from those observed for the pretrade war period. Specifically, we examined data for the months after the onset of the trade war in March 2018 when the United States followed through on months of threats to announce plans to impose 25 percent tariffs on $50 billion worth of Chinese goods, prompting Beijing to announce its own retaliatory tariffs on steel and aluminum products.Footnote 60 To control for the effects of the tariff increases on trade volumes, we added a variable tariffs to our analysis. We continue to focus on the impact of tensions on US imports from, rather than exports to, China. Because US tariffs on Chinese goods are much more extensive than Chinese retaliatory tariffs, such a strategy can better help illuminate our main findings.Footnote 61 Tariffs is calculated by adding the US tariff increases implemented under each of the tariff lists to the average annual tariff rate and is recorded on a monthly basis.Footnote 62

Descriptive Analyses

We first conducted a set of descriptive analyses to see how the heightened tensions and tariff hikes associated with the trade war have affected US imports from China. Table 3 presents the changes in US real tariffs on Chinese products weighted by imports between 2017 and 2019. As table 3 shows, the average weighted tariff rate on Chinese imports have increased from 0.038 percent in 2017 to 0.403 percent in 2019, an increase of about 0.365 percent. Except for backward GVC linkages, the growth is the highest for industries with high, rather than medium or low, levels of GVC linkages to China.Footnote 63 For example, average weighted tariffs for industries with high levels of RP trade with China have experienced an increase of 0.411 percent, compared to 0.145 percent and 0.120 percent for industries with medium and low levels of RP trade with China, respectively. A similar pattern can be observed for industries with forward GVC linkages to China, with the difference in the average weighted tariff being 0.529 percent, 0.368 percent, and 0.090 percent for industries at high, medium, and low levels, respectively. These results generally suggest that the tariff increases have been the most pronounced for industries with the most extensive GVC linkages to China.

Table 3: Descriptive statistics of real tariff rate (weighted by imports).

Table 4 in turn presents the changes in US imports from China from 2017 and 2019. Notably, US imports from China averaged across all industries have experienced a decline of about 9.5 percent, from $116 million in 2017 to $105 million in 2019. Except for low RP trade, which has remained little changed, declines of varying magnitude can be observed for all industry categories.

Table 4: Descriptive statistics of US imports from China ($ million).

Figure 4 (a) and figure 4 (b) further show the histograms of US import tariff rates on Chinese products and US imports from China by all sectors in 2017 and 2019, respectively. As we can see from figure 4 (a), total US tariffs on Chinese products are clustered toward the left of the X axis, with 2,852 and 2,876 observations (i.e., NAICS industries recorded at the monthly level) having a tariff rate of 0 percent and between 0 and 1.04 percent, respectively. However, the number of industries with a tariff rate of more than 0.2 percent has increased significantly in 2019, with 2,251 observations having a tariff rate of 0.25 in that year. The distribution of the industries has shifted further away from 0, reflecting the substantial increase in US tariffs on Chinese imports since the beginning of the trade war. Figure 4 (b) in turn shows that the rise in tariffs has generally been associated with a decline in US imports from China. While 3,940 observations have an import volume of less than $271.31 million in 2017, 3,795 observations have an import volume of less than $206.4 million in 2019. Overall, the preceding descriptive data indicate that the substantial increases in US tariffs since the beginning of the trade war have been associated with a relative decline in US imports from China.

Figure 4: US import tariffs in China and imports from China by all sectors, 2017 versus 2019.

Appendix 4, which presents the histograms of US import tariffs on China and US imports from China by industry, indicates that tariff hikes can be observed for industries with varying levels of GVC linkages to China. A visual inspection of the data suggests that industries with high levels of GVC linkages to China seem to have experienced the most significant declines in imports. However, because this pattern is far from definitive, we conducted additional statistical analyses of the impact of bilateral tensions on imports during the trade war period.

The Impact of Political and Economic Tensions on Tariffs

Before proceeding, we first develop a partial equilibrium model to depict more formally the relationships among tensions, tariffs, and imports (see figure 5). In figure 5, political and economic tensions could directly affect international trade policies such as import tariffs, import quotas, export restraints, export taxes, and export subsidies. Trade policy tools such as import tariffs and quotas are in turn expected to have a direct impact on imports. We further explore how the relationships among bilateral tensions, tariffs, and imports vary depending on the level of the industry's global supply chain integration.

Figure 5: A partial equilibrium analysis.

We evaluate the effect of bilateral tensions on US–China trade relations using the panel vector autoregressive (PVAR) model for the trade war period.Footnote 64 For the ease of presentation, we present the orthogonalized impulse-response functions that describe the changes in a model's variables in response to a shock in one or more variables after a certain number of periods.

As a first step in the analysis, we show the impulse-response functions of the interactions among political tensions, economic tensions, and tariffs.Footnote 65 As figure 6 shows, while economic tensions had a much more significant effect on tariffs during the pretrade war period, the reverse is the case for the trade war period. During the trade war period, a standard deviation shock to political tensions leads to an immediate increase in tariffs, peaking at almost 0.036 percent during the third period. While the effect then gradually declines, it remains positive and statistically significant through the remaining periods. In contrast, a shock of the same magnitude to economic tensions only leads to an increase of about 0.01 percent in tariffs during the first period, declining to even lower levels in the rest of the periods under consideration. These results indicate that heightened political, rather than economic, competition between the US and China may have been the more proximate source of the rise in import tariffs during the trade war period.

Figure 6: Impact of political and economic tensions on tariffs, all industries.

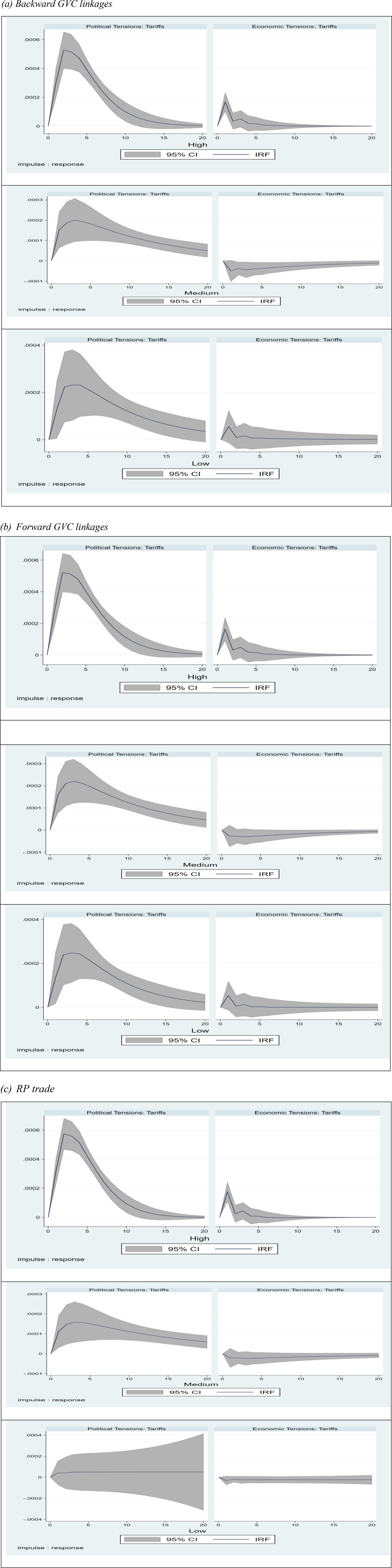

Disaggregating the relationships between tensions and tariffs for industries with different forms and levels of supply chain linkages to China shows that political and economic tensions have had a more notable impact on tariffs for industries with high, rather than medium or low, levels of GVC linkages to China (figure 7). For example, while a standard deviation shock to political tensions leads to an increase in tariffs of about 0.05 percent during the first two periods for industries with high levels of backward GVC linkages to China, an effect that then gradually declines over time, a similar shock only leads tariffs to increase by about 0.01 percent for those with medium or low levels of backward GVC linkages to China. The pattern is similar for industries with varying levels of forward GVC linkages or RP trade with China. Turning to economic tensions, we see that while a standard deviation shock to this variable is associated with an increase of about 0.02 percent for industries with high GVC linkages to China of either type in the initial period, it generates a positive response that is much closer to zero and even an occasionally negative response for industries with medium or low levels of GVC linkages to China. The effect becomes indistinguishable from zero during the remaining periods. Overall, bilateral tensions seem to have been associated with the largest increase in tariffs for high GVC-linkage industries. These patterns are also largely consistent with those observed in table 2.

Figure 7: Impact of political and economic tensions on tariffs, by industry (March 2018–December 2019).

The Impact of Tariffs on Imports

The second step in our analysis is to assess the impact of the tariffs on imports. Toward this purpose, we ran PVAR models with panel data that contains observations about different industries across time, with robust standard errors clustered on industry.

We include our main variables of interest, political tensions, economic tensions, and tariffs, in the analysis, in addition to controlling for the US GDP. We take the first difference of all variables to ensure the stability of the models.

Figures 8 presents the results of our PVAR analyses for the period between March 2018 and December 2019. As figure 8 shows, political tensions and economic tensions are largely insignificant during the period under investigation. However, tariffs do seem to have a negative impact on imports in the short term. A one standard deviation shock to tariffs leads to an immediate decline of about 2.7 percent in imports. The effect of tariffs remains negative and statistically significant during the first two periods and becomes insignificant afterward. This pattern is consistent with that of our descriptive analysis, which shows that the tariff hikes have had a negative impact on overall US imports from China through the end of 2019.

Figure 8: Impact of political and economic tensions on imports (all industries), March 2018–December 2019

Because political tensions and economic tensions are insignificant in this set of analysis, we focus on the impact of tariffs on imports in our sectoral analysis and present the results in figure 9. Somewhat contrary to our expectations, there is no significant variation in the magnitude of industry responses to the tariff shocks. Apart from figure 9 (g) where tariffs have remained insignificant, a one standard deviation shock to tariffs generally leads to an immediate decrease in imports of 2 to 4 percent, an effect that then gradually becomes insignificant after the first two to four periods. However, the tariffs seem to have had a more sustained negative impact on imports for high GVC industries. For example, the negative effects of tariffs have lasted longer (for four periods) for industries with high forward GVC linkages or RP trade with China (figures 9 [b] and 9 [c]) than for those at medium or low levels.

Figure 9: Impact of tariffs on imports (by industry), March 2018–December 2019

Taken together, these results indicate that rising tensions and the imposition of tariffs since the beginning of the trade war may have dampened overall US imports from China, a finding that is consistent with hypothesis 1. They also suggest that political rather than economic tensions may have been the primary driver of the tariff hikes. In addition, bilateral tensions seem to have been associated with the highest tariff increases for industries with high GVC linkages to China. There is also some tentative evidence that the tariffs have had a longer lasting effect on such industries. Overall, these results present challenges to hypothesis 2 and raise some questions about the degree to which considerations about the so-called sunk costs may have limited the extent to which businesses may seek to adapt to exogenous changes by searching for alternative sources of supplies, customers, or production destinations. Instead, they suggest that the trade war may have inflicted the most severe damage on those segments of the US and Chinese economies that are most closely connected to each other through global supply chain linkages.

Conclusion

In this article, we utilized a media-based measure of political and economic tensions in US–China relations to analyze their impact on bilateral trade relations. Our results lend some support to hypothesis 1, suggesting that bilateral tensions did exert a negative albeit somewhat small effect on US imports from China in the short term. Additional analyses indicate that bilateral tensions have most negatively affected trade relations at high rather than medium or low levels of GVC linkages to China during both the pretrade war and the trade war periods.

These preceding findings are puzzling for arguments emphasizing how “sunk costs” considerations may affect bilateral trade relations (hypothesis 2). In contrast to previous studies that show that “sunk costs” may limit the impact of political relations on economic transactions,Footnote 66 our study suggests that this is not necessarily the case in the context of US–China trade relations. Instead, rising bilateral tensions seem to have had the most significant impact on industries with the most extensive supply chain linkages to China. Escalating tensions and the imposition of large-scale tariffs during the trade war also did little to alter this pattern. It is possible that businesses may not have been able to effectively separate policy signals from the noise as reflected in media reports. Despite the increasingly frequent mentioning of impending tariffs in the media, there may have continued to exist a gap between the administration's decoupling rhetoric and the economic reality on the ground.

Our results have implications for understanding the trajectories of US–China economic relations. As US policy under the Trump administration increasingly shifted from engagement to the “decoupling” of the two economies, they suggest that such a more confrontational and aggressive negotiation approach may have had a chilling effect on US–China trade relations and the strong supply chain relationships that US companies have built with Chinese producers over the years. Should the Biden administration continue the hardline stance adopted by Biden's predecessor, such a policy could threaten to inflict considerable damage on the two largest economies in the world, with far-reaching implications for both regional and global economies and the pattern of geostrategic competition. Furthermore, the finding that bilateral tensions negatively affected US imports from China during the pretrade war period indicates that these tensions could have a long-term, instead of just a short-term, impact on trade relations.

A limitation of our study is that it is conducted at the industry instead of the firm level. Recent studies inspired by the “new new trade theory”Footnote 67 have shown that firm heterogeneity with respect to size, experience in the host market, or position in global value chains may influence their attitudes and behavior toward trade liberalizationFootnote 68 or response to political uncertainty.Footnote 69 We are unable to directly test our theory at the firm level due to the lack of detailed firm-level GVC data. However, we expect that our theoretical argument should have implications for understanding firm preferences and behavior in the presence of rising bilateral tensions.

Another limitation is that our analysis focuses on the impact of US media coverage of bilateral tensions on import patterns without also examining that of the Chinese media, thus potentially leading us to underestimate the trade impact of the tensions. However, since the trade war was initiated by the United States, with the Chinese side mostly reacting to the escalation of rhetoric and then the eventual trade restrictions by the United States, there is also reason to believe that Chinese media coverage should broadly parallel that in the United States. This should help to address concerns about the potential bias that the lack of a more comprehensive measure of media coverage may have created in our analysis.

In addition, recent studies have shown that trade may rise significantly in anticipation of future increases in tariffs as firms increase their inventory stock to hedge against such uncertainty.Footnote 70 However, our results indicate that stockpiling has not prevented the decline in US–China trade relations in the short term. Of course, it is possible that the drop in US imports from China could have been even more precipitous in the absence of firms’ inventory management strategies. However, we are unable to fully address this issue in this article due to space constraints and prefer to leave it to future investigation.

We examined the effect of bilateral tensions and tariffs on trade patterns before the beginning of the COVID-19 pandemic at the end of 2019. This strategy allows us to separate the effects of the tariffs from those of the pandemic on US–China trade relations. Future studies could extend the time frame of the analysis and carefully untangle the effects of these events to assess more fully the effect of Trump's tariffs on US–China trade and the supply chain relationships that have inextricably linked the two countries together until recently. If the logic described is valid, it may also help explain the pattern of American companies’ trade lobbying activities or the relocation of production from China.Footnote 71 How supply chain linkages may influence American multinational corporations’ China-related political activities or exit decisions may therefore represent fruitful avenues for future research.

Appendix 1A: Key Search Terms for Broad Filter

((pubid(PROQUEST PUBLICATION IDENTIFIER HERE) AND (su(China) AND su(United States))) AND (su(diplomacy) OR su(international relations)) AND (ft(tension) OR ft(dispute) OR ft(conflict) OR ft(confrontation) OR ft(standoff) OR ft(hostilities) OR ft(strained relations) OR ft(disagreement) OR ft(clash) OR ft(discord) OR ft(quarrel) OR ft(argument) OR ft(difference of opinion) OR ft(controversy) OR ft(blowup) OR ft(spat))) AND pd(20000101-20191231)

Appendix 1B. Key Search Terms for Economic Filter

(pubid(PROQUEST PUBLICATION IDENTIFIER HERE) AND (su(China) AND (su(United States))) AND (su(international trade) OR su(trade relations)) AND (ft(tariffs) OR ft(investments) OR ft(trade policy) OR ft(manufacturing) OR ft(trade agreements) OR ft(economic growth) OR ft(exports) OR ft(foreign investment) OR ft(american dollar) OR ft(currency revaluation) OR ft(globalization) OR ft(renminbi) OR ft(intellectual property) OR ft(free trade) OR ft(foreign exchange rates) OR ft(trade deficit) OR ft(State-owned enterprises) OR ft(Outsource) OR ft(Market access) OR ft(trade barrier))) AND pd(20020101-20191231)

Appendix 2: Descriptive Statistics of the Main Variables

Appendix 3: Placebo Test for US Imports from the European Union

Appendix 3A: Trends in US Imports from China and the European Union

Notes: EU_IMP: US imports from the European Union, customs import value (gen)

CHN_IMP: US imports from China, customs import value (gen)

Appendix 3B: Structural Break in US Imports from the European Union

Note: The CUSUM test is based on the cumulative sum of the residuals estimated by repeated recursive least squares estimation. The dotted red line gives the 95 percent confidence interval/5 percent critical lines. The test is significant if the solid blue line extends outside the critical line which indicates the instability of the parameter or the existence of a possible structure break. The CUSUM of squares test is constructed on the cumulative squared sum of residuals. As in the CUSUM test, the extension of the cumulated sum of squared residual out of the dotted line means the instability of the parameter.

Appendix 4: US Import Tariffs on China and Imports from China by Industry, 2017 versus 2019

(a) Backward GVC linkages (b) Forward GVC linkages (c) Related-party trade