1. Introduction

The insurance industry has invested significant time and resources over the past decade into developing Enterprise Risk Management (ERM) Frameworks, not least due to the implementation of Solvency II. More recently, there has been a trend for companies to focus on further enhancing and embedding their risk management frameworks, in particular through ensuring that risk considerations are better reflected within their key decision-making processes.

Over a similar period, there has been a marked increase in the influence that the digital world is having on the insurance industry, often referred to as “InsurTech.” InsurTech is a broad term, representing a wide range of developments and approaches, which embrace and leverage the opportunities presented to the insurance sector by technological advancements and the increased availability of data. Many InsurTech start-up ventures focus on providing services using digital technology, to either enhance customers’ experience of insurance services or to provide operational efficiencies for insurance companies. As a result of the potential opportunities, many insurance companies have been investing in InsurTech, either through in-house developments or via investment in InsurTech start-ups.

The Risk Management in a Digital World Working Party is interested in the extent to which insurance companies are utilising their existing ERM capabilities when evaluating and managing InsurTech investments or partnerships. Our hypothesis is that by ensuring that insurers are appropriately deploying their ERM Framework, there will be greater alignment between the InsurTech investment or partnership and the organisation’s risk strategy and business objectives. All other things being equal, this will increase the chances of success and the return on capital invested, from the insurance company’s perspective.

In order to test the hypothesis, the Working Party carried out an industry survey on a number of risk management topics relating to InsurTech. This was followed up by carrying out interviews with a number of relevant senior stakeholders across the insurance industry, in order to better understand current sentiment and how risk management plays a part when considering opportunities in InsurTech. The Working Party views on the findings from these activities are summarised in this report.

The focus of this report is to provide guidance to actuaries and risk professionals, insurance companies and their Boards. This guidance can be used to facilitate appropriate questioning, to help ensure that InsurTech-related business decisions are fully cognisant of the risk management issues. The report serves to prompt readers to engage early in InsurTech projects, through considering (i) the full range of risks associated with InsurTech developments, (ii) the lifecycle of an InsurTech venture and how any risk considerations may vary over this lifecycle and (iii) the extent to which InsurTech ventures align with risk strategy and risk appetite.

The Risk Management in a Digital World Working Party recognises the benefits of innovation in the insurance sector, and it is not our intention to provide guidance which stifles that innovation. Rather, our hope is that the guidance helps facilitate engagement with a broader set of stakeholders and helps ensure that InsurTech decision-making processes are more efficient and effective, thereby maximising the chances of success. In this context, we urge readers to consider both the use of existing ERM Frameworks as well as the development of new ERM Frameworks or components of Frameworks, in order to facilitate the likelihood of success of InsurTech opportunities.

Different sections of this paper have been authored by different individuals across the working party, so the views expressed in this paper are not necessarily the views of all members. The members of the working party are listed in the Appendix.

The Working Party has ensured that the scope of this report remained focussed on improving the success of InsurTech opportunities from the insurance company perspective.

Subsequent phases of output from the Working Party may consider the design, development and appropriateness of ERM Frameworks from both an InsurTech start-up perspective and the investor/venture capital perspective.

2. Executive Summary

The “Risk Management in a Digital World” Working Party was formed in response to the ever-increasing influence that the digital world is having on the insurance sector, commonly referred to as “InsurTech.”

The objective of this report is to help actuaries, risk professionals and other stakeholders working in insurance to improve the success rate of InsurTech opportunities, by better leveraging risk considerations during the key stages of the decision-making process.

In preparing this report, we have considered, in the context of InsurTech, both the appropriateness of existing ERM Frameworks and the capability of practitioners within insurance companies.

The Working Party commissioned a survey and carried out interviews in order to obtain insights and inputs from key individuals and companies, from both within and outside the Actuarial Profession.

The survey and interviews have highlighted a broadly positive view on the potential of InsurTech, but also indicated that insurers are adopting different strategies when it comes to exploring InsurTech opportunities, and any digital transformation projects.

When it comes to managing the risks associated with InsurTech, it is clear that existing risk management frameworks may need some refinement. The existing frameworks were created before the material emergence of InsurTech, and subsequently there are now gaps in the skills, knowledge and processes in relation to managing the risks of these new technologies. Closing this gap will become increasingly more important if InsurTech is to fulfil its potential.

Furthermore, insurers, actuaries and risk managers need to develop their expertise in InsurTech, either through training sessions on new technologies or by gathering more insights and data on the effectiveness of the new technologies being applied to insurance. This will ensure they are able to articulate and effectively manage the risks associated with InsurTech opportunities and propositions.

Looking forward, this suggests that insurers will need to consider developing their existing risk frameworks to more effectively cater for developments in InsurTech and ensure that stakeholders are appropriate skilled to engage in the innovation.

The Working Party has produced a guide comprising of a timeline and checklist as part of this report, in order to support the further development of risk considerations in decision making throughout the InsurTech investment process. It is our hope that this helps to ensure that InsurTech innovation is efficient and effective, to assist insurers in meeting their objectives.

3. Scope and Objectives

The Risk Management in a Digital World Working Party was formed in the summer of 2017 and is overseen by the Institute and Faculty of Actuaries’ Risk Management Research & Thought Leadership Committee.

In early working party discussions, it was recognised that the breadth and depth of the subject matter necessitated a focus on a relatively narrow scope, in order that deliverables could be targeted, timely and useful.

Accordingly, it was decided that the first phase should look at the extent to which insurance companies are utilising their existing ERM capabilities when evaluating and managing InsurTech investments or partnerships. The scope of the first phase considers both the appropriateness of existing ERM Frameworks as well as the capability of practitioners within insurance companies, in the context of InsurTech.

As such, we felt it would be useful to carry out a survey on InsurTech to get insights and inputs from key individuals and companies, from both within and outside the Actuarial Profession. Furthermore, we carried out interviews with relevant senior practitioners within the insurance industry, who provided their views on risk management practices in the context of InsurTech.

This report summarises the results of the survey and interviews and subsequently provides guidance on the key considerations for practitioners when engaging in the world of InsurTech from a risk management perspective.

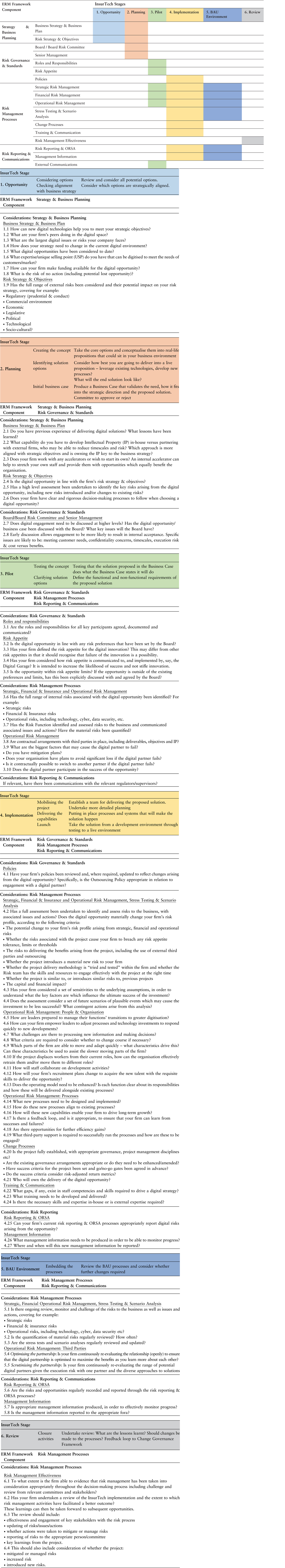

The guide includes two elements, an InsurTech lifecycle timeline and an InsurTech risk checklist. The timeline provides an overview of the typical lifecycle of an InsurTech venture/project, allowing practitioners to understand where they are on the journey from assessing the opportunity through to reviewing the outcome of their investments. The checklist provides a set of example questions that can be used to provide challenge and oversight at each stage of the project lifecycle, corresponding to the key elements of a typical ERM Framework.

Subsequent phases of the Working Party are expected to broaden the focus to wider risk management issues in an increasingly digital world. Current ideas being considered include: RegTech,Footnote 1 FinTech,Footnote 2 emerging digital risks and the Market, Economic and Social impact of advancements in the digital world.

The Working Party welcomes any feedback regarding the outputs of this report, as well as the areas to consider in subsequent phases.

4. Survey Summary

In our aim to provide guidance on the key risk management considerations regarding InsurTech investments or partnerships, we identified that an important first step was to understand the current situation among insurers. We therefore commissioned a survey to help us assess:

∙ the views and general understanding of InsurTech

∙ the extent to which insurance companies are utilising their existing ERM capabilities when evaluating and managing InsurTech investments or partnerships and

∙ their understanding of the full range of risks associated with InsurTech developments.

In the rest of this section, we provide a summary of the survey participants and an overview of the survey findings. The full set of survey responses are included in Appendix 12.

4.1. Who Participated in the Survey?

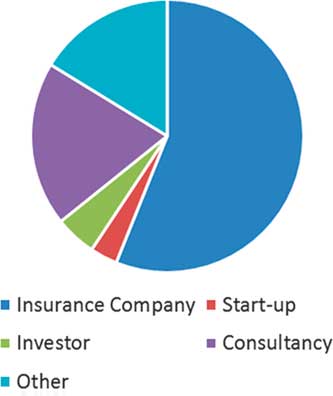

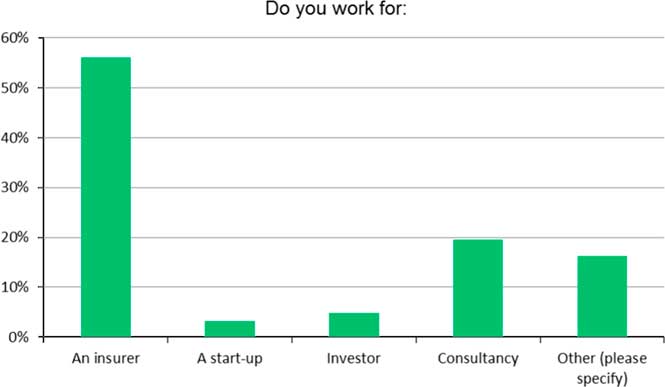

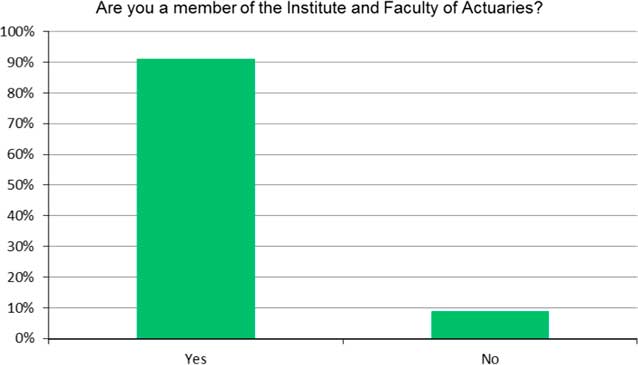

The survey, performed between the start of October and 8 December 2017, had 124 respondents. Figure 1 shows a breakdown of the respondents by company background. With just over 55% working for an insurer, a further 20% worked for consultancies, with the remaining 25% working for start-ups, investors, brokers or other interested parties. 91% of all respondents were members of the Institute and Faculty of Actuaries.

Figure 1 Company background

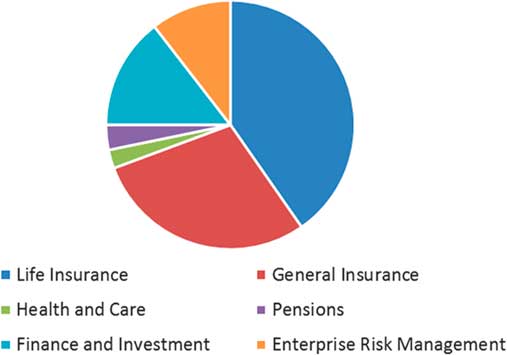

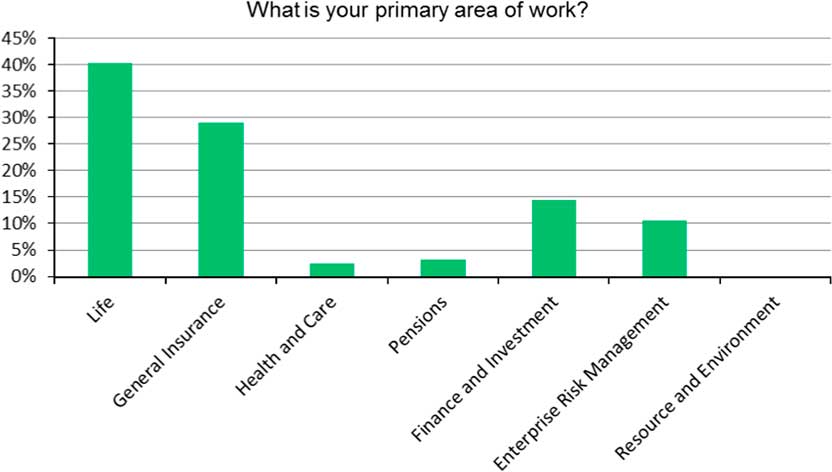

Figure 2 shows a breakdown of the respondents by their primary area of work. Highlighting that 70% of respondents said that they work directly in insurance, with there being a bias for life insurance over general insurance. The remaining 30% work predominantly in investment or risk management fields.

Figure 2 Primary area of work

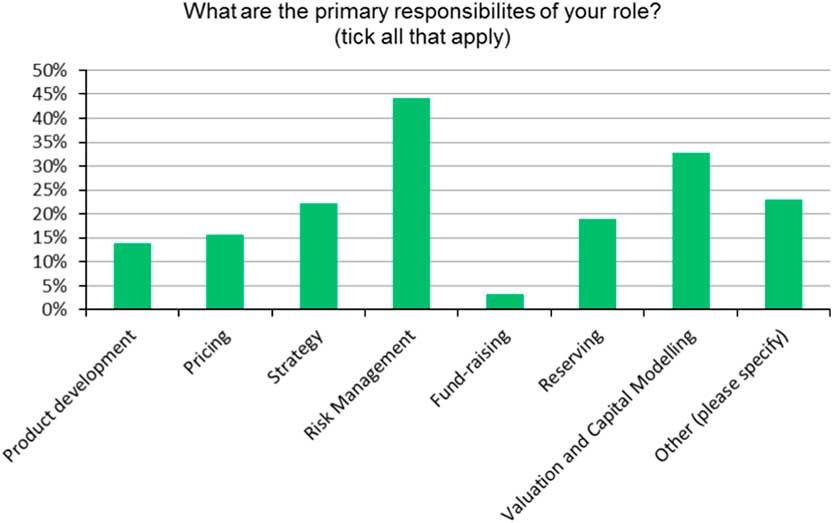

In terms of the actual responsibilities associated with their role (with the option to choose all that applied), Figure 3 shows that 44% of respondents have responsibilities for risk management, with Capital & Valuation, Strategy, Product Development and Pricing featuring highly.

Figure 3 Role responsibilities

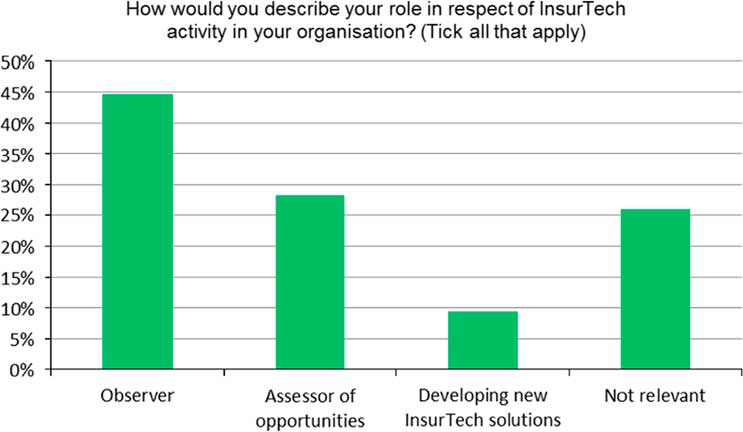

When we asked respondents how they would describe their role in respect of InsurTech activity within their organisation, most (45%) said they were an observer of InsurTech opportunities, while 28% said they were actively assessing opportunities. However only 10% were personally involved in developing new InsurTech solutions. The remainder said it was not relevant to their role.

4.2. Views on Trends and Opportunity

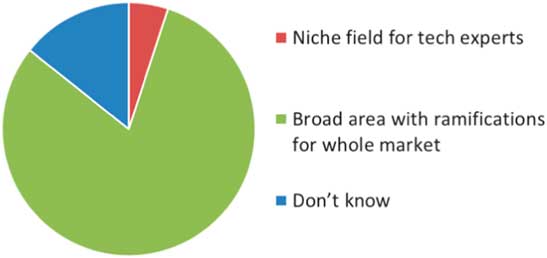

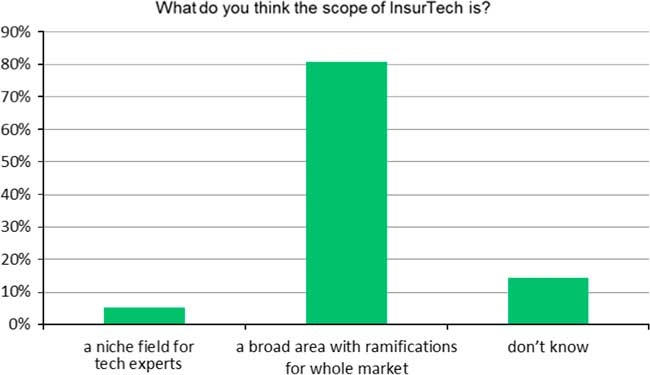

InsurTech has ramifications for the whole industry. Figure 4 confirms that 80% of respondents see InsurTech as a broad issue with ramifications for the whole industry. Only 5% see it as a niche field for technical experts, while 15% were unsure.

Figure 4 Will InsurTech have ramifications?

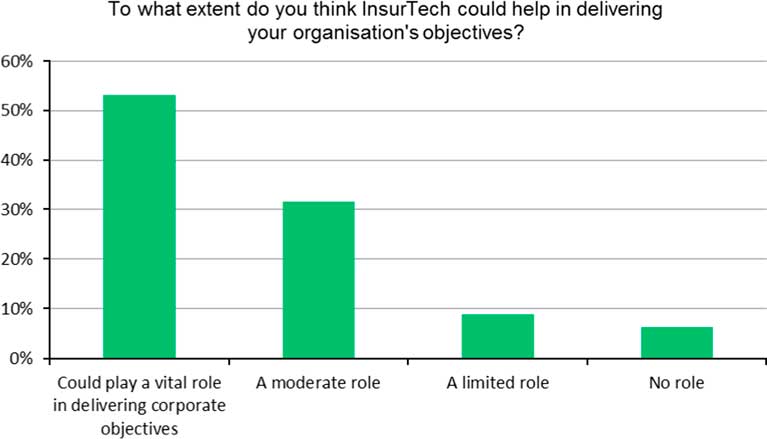

InsurTech can add significant value to insurers. It was interesting to see that over 50% of all respondents thought that InsurTech could play a moderate or vital role in delivering their organisation’s corporate objectives. When we explored in more detail the areas of their business that InsurTech could add the most value, both now and in the future, the emphasis was on front-end functions, including sales and distribution, marketing, product development and pricing, customer engagement, and underwriting and claims. However, there was considered less value in applying InsurTech to enhance business planning and reporting processes.

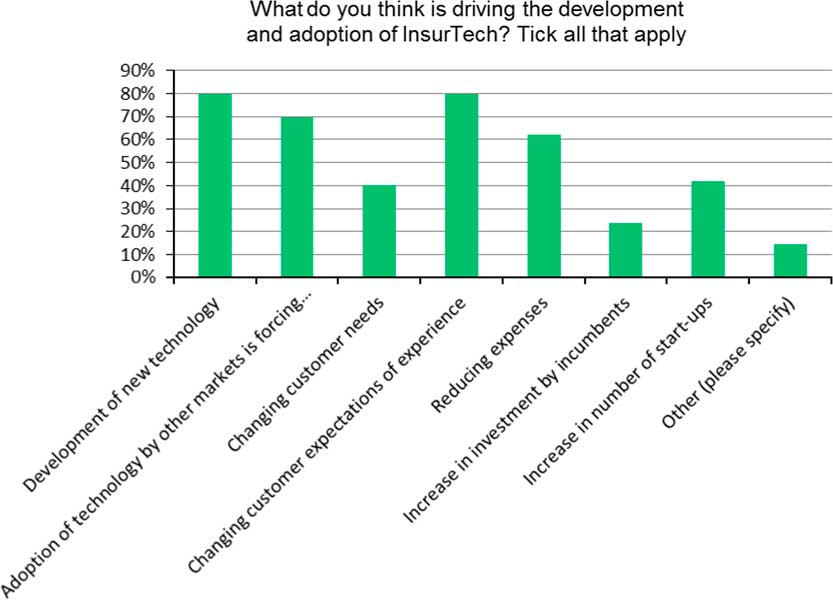

New technology and consumer expectations are key drivers of InsurTech. When we asked respondents, what they thought was driving the development and adoption of InsurTech, the development of new technology and evolving consumer expectations were jointly the highest responses. Other popular responses were activities taking place in other markets, and a drive by providers to lower expenses. Others saw recent activity as an acknowledgement by some incumbent insurers that they need to “keep up or die,” while others believed much of the activity or discussion to be hype.

4.3. What Are Insurers Doing?

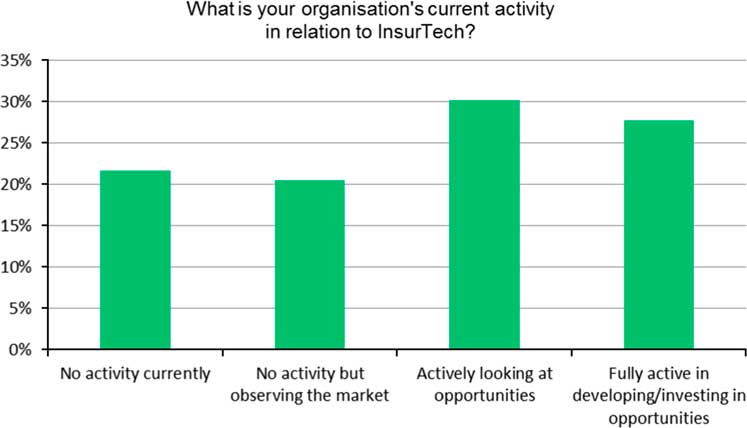

Most companies are engaging in InsurTech in some way: Figure 5 draws out the level of engagement across the respondents. The vast majority of organisations currently have some activity in relation to InsurTech, with 30% actively looking at opportunities, and another 30% fully active in developing or investing in new opportunities. Some were passively observing the market (20%), while the remaining 20% had no current activity. We note that general insurance companies as a whole seem to be engaging more than life insurance companies at this stage, with a more positive split across general insurance towards the “fully active” and “actively looking” categories.

Figure 5 Current level of InsurTech engagement

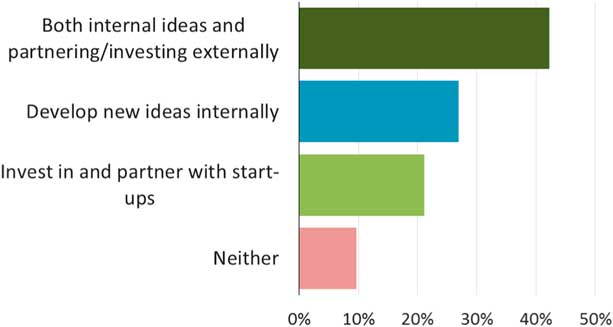

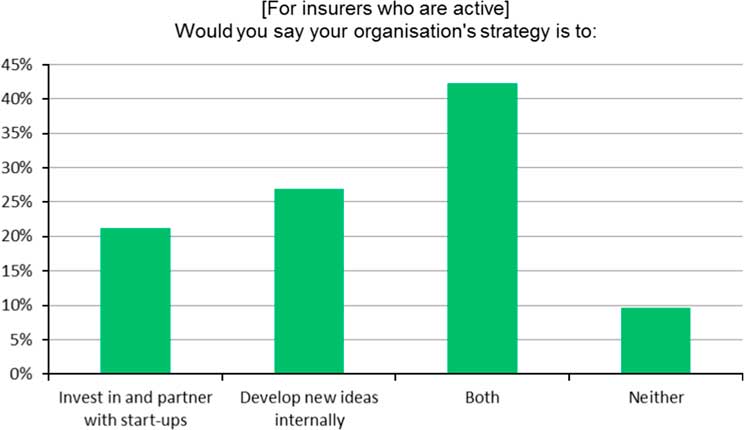

There is a variety of strategies. When it comes to strategy, Figure 6 shows what respondents were considering across a range of approaches, with 21% choosing to invest in start-ups, while 27% are looking to develop ideas internally. However, most (42%) were looking to pursue both approaches of developing their capability through a combination of internal development and collaborating with external parties.

Figure 6 Strategies for InsurTech

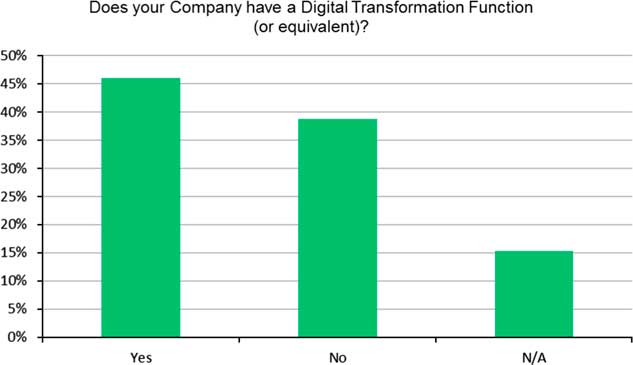

A mixed bag on transformation functions: when it comes to organising their activities internally, 54% of companies pursuing InsurTech had a digital transformation function. This means 46% of companies have no structured transformation function, which may reflect differences in companies’ intended operating models, or simply reflect the fact that many firms are not yet at an appropriately advanced stage.

4.4. Awareness and Skills

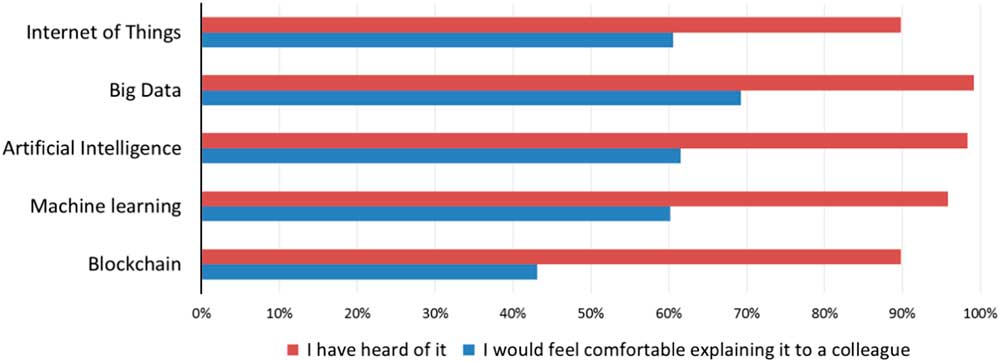

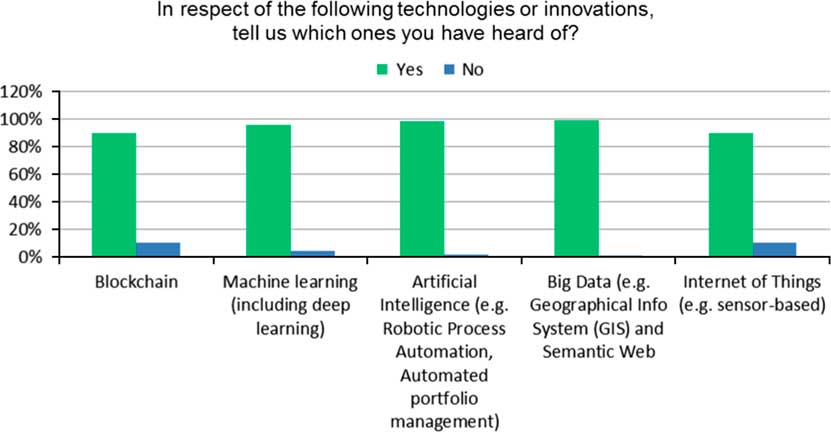

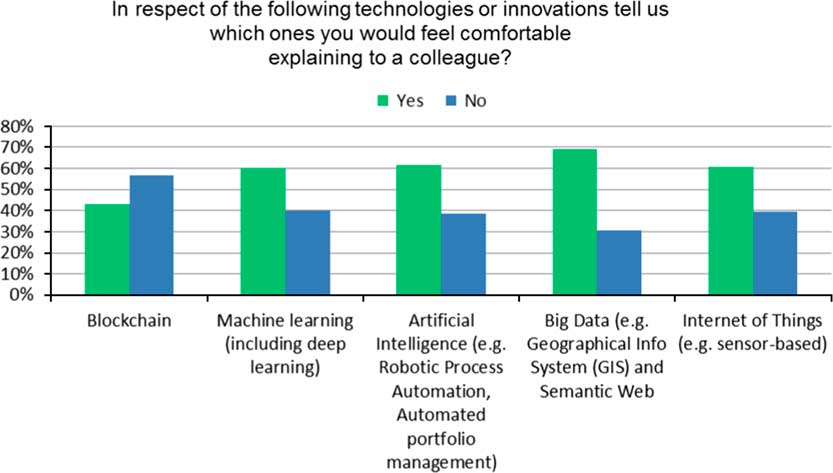

High awareness: to gauge awareness, we asked respondents if they had heard of a list of new technologies and innovations, including Blockchain, Machine Learning, Artificial Intelligence, Big Data and the Internet of Things. Figure 7 shows responses were 90% plus for all technologies and innovations, showing strong awareness, although this is perhaps not surprising given the self-selecting nature of those choosing to participate in the survey.

Figure 7 Level of awareness and skill

Lack of confidence and understanding: to test the depth of respondents’ understanding, beyond just a simple awareness of the new technologies and innovations, we asked how comfortable they would be in explaining the new technologies to a colleague. Figure 7 shows for this, the responses were somewhat lower, between 60% and 70% in most cases, the highest being 69% for Big Data. Blockchain was the area where respondents were least comfortable explaining it to a colleague, with just 43% being happy to do so. This highlights either a lack of confidence or understanding of these new technologies and suggests that actuaries, and other interested parties, may struggle to articulate the risks involved with some of the emerging technologies. Furthermore, it was noted that on average, those working in general insurance were marginally more comfortable explaining these concepts to their colleagues relative to those working in life insurance (64% on average, relative to 56% for life insurance).

4.5. Suitability of Risk Management Framework

Respondents believe insurers are familiar with the key risks: When we asked respondents what they thought the top three risks might be in respect of adopting or developing new InsurTech solutions, there were a significant range of responses. Some of the highlights included:

∙ Cyber risk

∙ Data privacy

∙ Lack of understanding of risk

∙ Timing, i.e. going too early/missing the boat

∙ Not really meeting customers’ needs/mis-selling risk

When we then asked respondents whether insurers are already familiar with the risks they identified, 80% believed they were, while 20% did not.

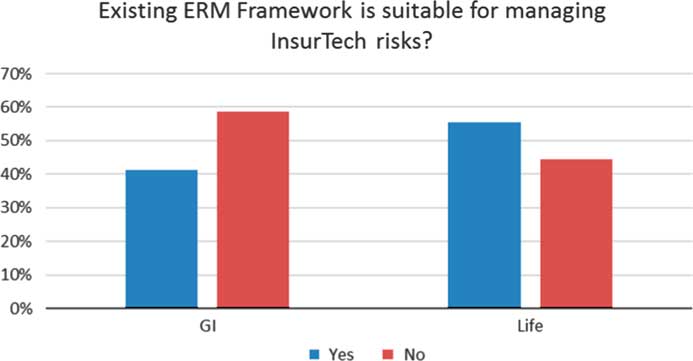

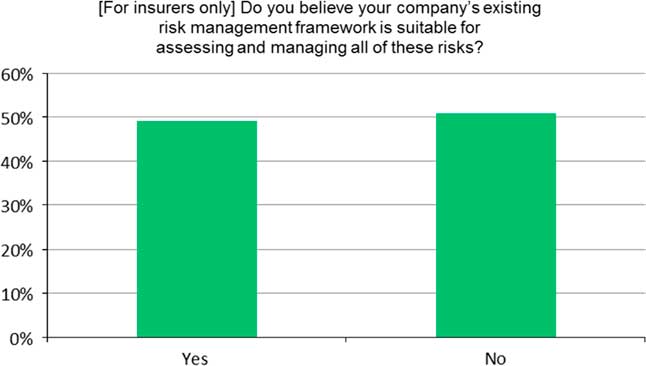

However, insurers say they have gaps in their risk frameworks and skills. When we just asked respondents working for an insurer whether they thought their company’s existing risk management framework is suitable for assessing and managing all these risks, perhaps surprisingly, as shown in Figure 8, 50% thought they were. The rest indicated that either some refinements to the framework would be required to reflect the nature of the emerging new risks, or that there was a general lack of expertise in understanding, assessing and managing these new risks, making it difficult to apply the judgement often required.

Figure 8 Suitability of risk framework

Interestingly, when comparing answers across life insurance and general insurance, Figure 9 draws out that the majority of life insurance respondents felt their frameworks to be suitable (56%), whereas only 42% of general insurance respondents felt the same way. This feels somewhat counter-intuitive given that general insurance companies tend to be more involved in InsurTech than life companies are.

Figure 9 Suitability of risk frameworks breakdown by life and general insurance

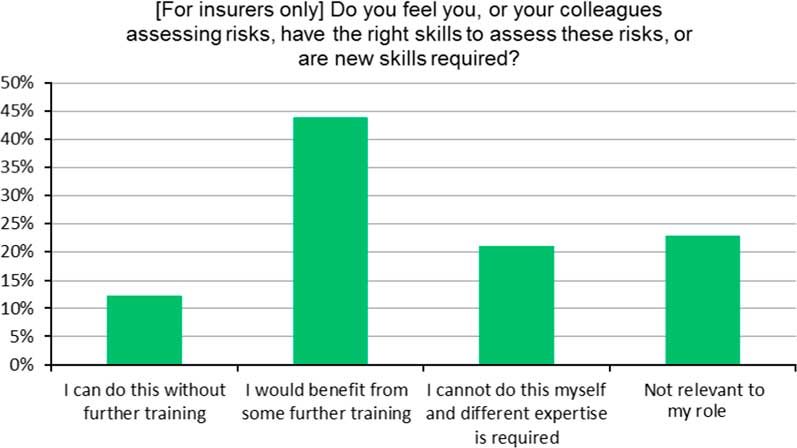

Figure 10 shows the results of when we asked respondents whether they or their colleagues had the right skills to assess these risks. Only 16% thought they did, while 57% thought they would benefit from further training and the remaining 27% thought they could not do this themselves and that different expertise was required.

Figure 10 Suitability of skills

5. Interviews Summary

Working Party members held one-to-one interviews with a number of senior stakeholders across the insurance and finance industry. Reponses helped us to understand industry sentiment and how risk management plays a part when considering opportunities in InsurTech.

Respondents included, for example, an ex-Chief Executive Officer of a large insurance company and Chief Risk Officers of well-known financial services groups, among other industry experts. Respondents considered the trends, opportunities and risks, based on their experience in InsurTech.

A high level summary of their thoughts is provided below. This has contributed to our overall understanding of the risk and issues, and accordingly has assisted us in producing the guides.

Growth of InsurTech is being driven by the pressure to stay in line or ahead of the competition in price sophistication, as well as by fresh thinking about the customer experience and whether traditional insurers are really giving customers what they need. Technological developments offer new tools and techniques for firms to innovate and develop in both of these areas.

Existing ERM Frameworks remain relevant, but there may be “unknown unknowns” to deal with. You may find you simply have to launch a new product or venture without fully understanding all the risks. Speed and flexibility in processes and decision making are required to allow firms to take appropriate risks in a managed way, without stifling innovation.

The key risks for InsurTech are: Conduct and Regulatory risks – will you fall foul of the regulator, for example: whether an app is seen as providing advice; or whether one can really read Terms and Conditions on mobile devices? Model Risks – an error in a pricing algorithm could cause problems if not spotted early, and increased use of “Black Box” models (e.g. potentially machine learning techniques) may lead to worse customer outcomes than if a human was involved. Other relevant areas are IT Risks, Fraud Risk, and People Risks.

Managing threats to business models and strategy. How can you keep pace with developments to ensure you understand what is happening in the industry, including threats from outside the UK? If you do get involved in InsurTech, the fear of missing out may mean you act too quickly and implement inappropriate or inefficient solutions. How do you ensure your company board has the knowledge and experience to make the right call on an InsurTech venture? How do you ensure you’ve understood the full range of risks, and possible mitigating actions? In the event of a problem, speed of action is paramount – digital-related issues can escalate much more quickly than traditional, human-system issues, causing greater financial and reputational loss.

However there are significant opportunities for collaboration. Existing insurers typically have a stronger capital base than start-ups and hence it may be easier for start-ups to generate revenue if they partner with an existing insurer. A test-and-learn environment can be used to help mitigate risks.

6. Working Party Views and Recommendations

The survey and interviews have highlighted a broadly positive view on the potential of InsurTech, but also indicated that insurers are adopting different strategies when it comes to exploring InsurTech opportunities and digital transformation projects.

When it comes to managing the risks associated with InsurTech, it is clear that existing risk management frameworks may need some refinement. The existing frameworks were created before the material emergence of InsurTech, and subsequently there are now gaps in the skills, knowledge and processes in relation to managing the risks of these new technologies. Closing this gap will become increasingly more important if InsurTech is to fulfil its potential.

Looking forward, this suggests:

∙ Insurers will need to consider developing their existing risk frameworks to more effectively cater for developments in InsurTech. We consider how this could be supported through the use of a new guide (see section 7)

∙ Insurers, actuaries and risk managers need to develop their expertise in InsurTech, either through training sessions on new technologies or by gathering more insights and data on the effectiveness of the new technologies being applied to insurance. This will ensure they are able to articulate and effectively manage the risks associated with InsurTech opportunities and propositions.

6.1. Introduction

Our survey indicates that most insurance companies are looking at InsurTech in some capacity, through both direct investment and internal development routes.

The key challenge most firms face is how to make the innovation process more efficient and effective. This helps to ensure that scarce capital is used wisely and appropriately, and that the right balance is struck between deploying capital and utilising existing infrastructure.

Our belief is that companies need to be clear on the purpose of any new innovation, and be able to directly link this to their business strategy and risk strategy. Although one such purpose is to reduce costs, our interviews with senior stakeholders in the insurance industry indicated that, often, the purpose is to improve the customer journey and profitability. This relies somewhat on customer behaviour and on understanding what customers want, which can often be challenging for insurance companies to confidently assimilate for different types of customers.

Furthermore, companies need to have a full understanding of the potential back-end implications of these types of innovation initiatives, including items such as:

∙ Overall costs and scalability

∙ Data implications such as security and privacy

∙ Governance implications

∙ Skills and training requirements

∙ How actuaries and wider risk management professionals add value to the process, and how Board members (including Non-Executive Directors) contribute to the process

6.2. Risk Management Frameworks

The Working Party view, based on the survey and interviews carried out (see sections 4 and 5), is that there are gaps in insurance companies’ understanding and processes in relation to appropriately managing the risks associated with InsurTech. The closing of these gaps is increasingly important as InsurTech becomes more prevalent across the insurance industry.

A key potential gap relates to existing ERM Frameworks. The Working Party believes that, in general, existing ERM Frameworks within the industry have not been developed with InsurTech in mind, so may need reviewing and refining in order to keep up with the latest developments, taking care to not unintentionally stifle innovation.

There is value in reviewing all the risks associated with InsurTech, as it may be relatively easy to miss certain new and emerging risks in this context. Our survey has highlighted the industry-wide belief that the exposure to the following risks may materially change in the context of InsurTech, making the Board’s risk preferences an important consideration in the risk management process:

∙ Regulatory risk (including Conduct risk)

∙ Governance risk

∙ Legal risk

∙ Fraud risk

∙ Model risk

∙ Data risk

∙ Asset side risks

∙ Cyber security risk

∙ IT risks

∙ Risks contained within embedded options.

Revisions to existing ERM processes will need to facilitate appropriate risk considerations at each of the key steps in the innovation journey. Examples could include:

∙ The inclusion of risk information in Board and Committee papers that consider InsurTech proposals, to better facilitate the risk/reward trade-off during decision making

∙ The need to define a risk appetite for failure of InsurTech ventures. More broadly, companies will need to determine how to ensure that their ERM Frameworks identify potential impacts on their reputation, keep pace with developments in technology, innovations in the market both locally and internationally, and new and emerging regulations in the context of InsurTech.

6.3. Education

By considering the output of the survey and interviews, the Working Party believes there are many opportunities for actuaries and risk managers to add value to their companies in the context of InsurTech.

However, we believe we have identified a skills gap, where the knowledge of relevant concepts falls short of the widespread awareness of the concepts. This leads us to consider how we might address this perceived gap, in order to ensure an appropriate mix and balance of skills. We believe that education and training are necessary and would benefit many aspects of insurance organisations, including in particular:

∙ Board Members including Non-Executive Directors

∙ Executives and Senior Managers across the business

∙ Internal Auditors

∙ Risk Managers and

∙ Actuaries.

6.4. Summary

Organisations will need to consider further developing their existing ERM Frameworks to more effectively cater for developments in InsurTech.

Individuals will need to improve their understanding of and expertise in InsurTech, in order to fully articulate and effectively manage the risks associated with InsurTech opportunities and propositions.

The Working Party has produced a guide in order to help address these challenges, and facilitate the effectiveness with which risk management activities can be deployed, to help with the consideration and implementation of InsurTech solutions.

This guide is set out in the next section.

7. Working Party Guides

This section sets out a guide consisting of a timeline and checklist developed by the Working Party.

Respondents to the Working Party’s survey indicated a high level of awareness of new technologies and innovations, but showed a lack of confidence and understanding of these developments.

So, in response to this lack of confidence and understanding, the Working Party has created a guide which considers how risk management activities can help with the implementation of InsurTech solutions.

This is intended to help firms, and Board members in particular, by providing examples of when during the innovation process they may provide challenge and proposing some of the questions that they might ask of senior management.

To do this, we first created a timeline, based on a standard set of project implementation stages. The second step was to consider how components of a typical ERM Framework align with these implementation stages.

Finally, we created a suite of issues to consider, phrased as questions and presented as a checklist. Please note that, by definition, both the timeline and checklist are relatively generic, and individual ERM frameworks or innovation journeys may differ from how we have presented them. However, we hope that the guides are of benefit to a range of stakeholders, in helping to facilitate the successful development of InsurTech solutions across the industry.

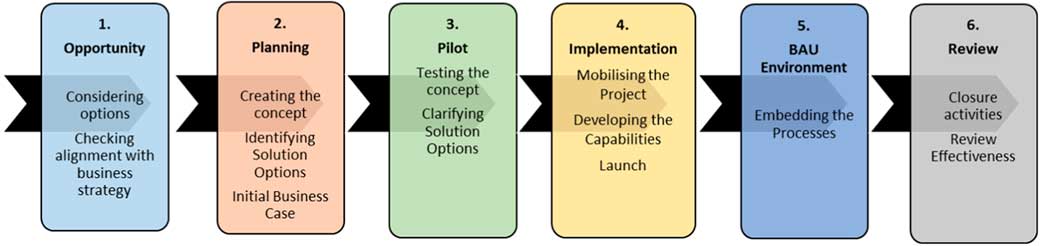

7.1. Timeline

The timeline represents the key lifecycle stages of an InsurTech innovation journey, as set out in the diagram below:

The reader should review the checklist set out in the table on the next page and then explore the considerations for each component of the ERM Framework and InsurTech implementation stage which is set out on subsequent pages.

7.2 Checklist

8. Next Steps

The scope of this report focuses on providing guidance on key considerations regarding InsurTech investments and development activities. The key outputs of this report are the InsurTech timeline and checklist, which consider how risk management can help with the implementation of InsurTech solutions.

This can be broadened to include a number of topics for further consideration as part of next stages of work carried out by the Working Party. Topics under consideration include the following:

∙ RegTech: Opportunities and Risks

∙ FinTech: Opportunities and Ethics

∙ Market, Economic and Social Impacts

∙ Development of Risk Appetite & Risk Strategy

∙ Emerging Digital Risks

∙ The “Digital Garage” in Practice

∙ Training and Education.

The details of each topic can be found in the Appendix.

Acknowledgements

Disclaimer: The views expressed in this publication are those of invited contributors and not necessarily those of the Institute and Faculty of Actuaries. The Institute and Faculty of Actuaries do not endorse any of the views stated, nor any claims or representations made in this publication and accept no responsibility or liability to any person for loss or damage suffered as a consequence of their placing reliance upon any view, claim or representation made in this publication. The information and expressions of opinion contained in this publication are not intended to be a comprehensive study, nor to provide actuarial advice or advice of any nature and should not be treated as a substitute for specific advice concerning individual situations. On no account may any part of this publication be reproduced without the written permission of the Institute and Faculty of Actuaries.

Appendix

A.1 Future Considerations

A1.1 The scope of this report focused on providing guidance on key considerations regarding InsurTech investments. This can be broadened to include a number of topics for further consideration as part of next stages of work carried out by the Working Party.

RegTech: Opportunities and Risks

A1.2 The Working Party could usefully explore new technologies that have been or are being developed to help overcome regulatory challenges in financial services, better known as RegTech.

A1.3 It is evident that firms are having to deal with greater reporting requirements and meet higher regulatory standards; RegTech can help with this by for example:

∙ Delivering outcomes that improve efficiency and transparency

∙ Helping firms better manage regulatory requirements and reduce compliance costs

∙ Helping to provide solutions to reduce the regulatory burden

A1.4 The Working Party could specifically explore, for example:

∙ Which RegTech solutions (and underlying technology) are becoming more prominent in the market?

∙ What are the challenges and risks faced by tech firms in providing RegTech solutions to financial services firms?

∙ What are the challenges and risks faced by financial services firms in adopting RegTech solutions?

∙ What, if anything, is stifling innovation? Are there existing regulatory rules which are restricting innovation?

FinTech: Opportunities and Ethics

A1.5 One natural extension of the Phase 1 work on InsurTech could be to consider the opportunities, corresponding ethical issue and potential risk management solutions to assist with a broad range of FinTech solutions. There have been a large number of well publicised digital developments in the FinTech space which are of direct relevance to the insurance industry, including:

∙ Telematics

∙ Peer-to-Peer lending

∙ Crowdfunding

∙ Big Data

∙ Data Analytics and Machine Learning

∙ Blockchain.

A1.6 For each of these digital developments, it would be beneficial for actuaries and risk professionals to have a working knowledge of at least the following:

∙ The focus of current solutions in the market, and the potential benefits they present relative to more traditional solutions

∙ The key ethical issues posed by these solutions relative to the key benefits

∙ Risk management considerations in the context of the solutions.

A1.7 The output of this proposed phase of work could be a report which includes a “cheat-sheet” for industry practitioners in this context, for each FinTech solution.

Market, Economic and Social Impacts

A1.8 The digital revolution represents a paradigm shift across all industries, reshaping markets, the economy, and society. The technology that would enable these profound changes has often been reduced to a sleuth of buzzwords (Blockchain, Artificial Intelligence, Internet of Things, etc.) and occasionally ridiculed as hype. However, what if all of its promises come to fruition?

A1.9 While forecasting is fraught with uncertainties, there are major trends in the digital revolution that requires no prediction, including:

∙ Disintermediation – peer-to-peer (P2P) business model is not new; distributed ledger technologies will make it more prevalent

∙ Automation – the march of automation continues as AI advances

∙ Omnipresent digital devices – these fuel the on-going explosion of data, measuring, monitoring, digitising the physical world, and expanding our digital identity.

A1.10 This phase of the working party would explore these trends in detail and focus on the implications arising from their widespread adoption. This would include understanding of:

∙ How would the business model of insurance/financial services companies change in the face of disintermediation (i.e. peer-to-peer financial services secured on the Blockchain)?

∙ How increased automation enabled by AI may change industries and societal norms in terms of work?

∙ How would data be commoditised and be traded on the market?

∙ What risks and opportunities may emerge and how the risk management framework should evolve to enable beneficial innovations in the insurance/finance industry?

Development of Risk Appetite & Risk Strategy

A1.11 One of the aims of the report was to prompt readers to consider the extent to which InsurTech ventures align with their existing risk strategy and risk appetite.

A1.12 During some of the events hosted by the Working Party during the development of this report, some observers highlighted the need for insurers to extend their risk strategy and appetite to capture activities in relation to InsurTech.

A1.13 While insurers are familiar with the process of developing a risk strategy and appetite for the key risks they face in their traditional market, this report has highlighted a gap in knowledge and skills in relation to InsurTech. The working party therefore believes there could be scope to extend the work carried out to date, and create additional tools or insights, including for example a new risk appetite metric, to support insurers in developing their risk strategy and appetite to capture InsurTech activities.

Emerging Digital Risks

A1.14 The crystallisation of risks once considered unlikely has increased over the last few years and significantly impacted the global economy, including the financial services industry.

A1.15 The impact of emerging risks can be significant, potentially destroying franchise value, but they can also be opportunities if they are identified, assessed and managed for competitive advantage.

A1.16 The agility to detect and adapt to changes, and appreciate the correlations between events when they occur, is therefore crucial to value protection and to value creation.

A1.17 Understanding such potentially game-changing events requires an awareness of changing conditions and an assessment of the emerging risk’s impact and implications for a firm’s strategy and business objectives.

A1.18 There is increased interest and demand at both a regulatory and an executive level to better understand emerging risk exposures, particularly in relation to digital and technological innovations.

A1.19 The Working Party could specifically explore, for example:

∙ The top emerging digital and technological risks and opportunities

∙ Current best practice approaches to identifying emerging risks and opportunities

∙ How emerging risks and opportunities evolve, adapt to external trends and their interconnectedness

∙ Reporting emerging risks and opportunities.

The “Digital Garage” in Practice

A1.20 During the course of producing this report, the working party has discussed Digital Garages several times, and indeed the concept arose during discussions with external interviewees. A subsequent phase could look in more detail at the advantages and disadvantages of a Digital Garage, and how they may be structured and managed. For example;

∙ A typical operating model and lifecycle for a Digital Garage, including the criteria for transferring the innovations into the “parent” company

∙ Governance structure, relative to the main “parent” company

∙ Recommendations on the extent to which various aspects of the “parent” company’s ERM framework should apply, or the extent to which adherence can be relaxed

∙ Summarise the specific risks relating to Digital Garages and how these might be managed, possibly through the use of guides or metrics

∙ Produce guidance/metrics for assessing the risk of going ahead with an innovation, versus the risk of not going ahead.

Training and Education

A1.21 The Phase 1 output identified further training as being beneficial to actuaries and other risk professionals. In particular, a number of the survey outcomes point to a lack of sufficient knowledge and understanding of the various InsurTech topics and concepts, in order for the participants to appropriately add value to their businesses.

A1.22 As part of a subsequent phase of work, the working party could help the IFoA to consider how best to meet the needs of its members in this regard, by considering, for example:

∙ Syllabus changes

∙ CPD opportunities and requirements

∙ Development of online training

∙ Publishing of guides and reference documents

∙ Publishing of thought pieces and white papers.

A.2 Survey Detail

A2.1 The Working Party commissioned a survey in order to better understand the following:

∙ the views and general understanding of InsurTech across the insurance industry

∙ the extent to which insurance companies are utilising their existing ERM capabilities when evaluating and managing InsurTech investments or partnerships and

∙ the extent of understanding of the full range of risks associated with InsurTech developments.

A2.2 The detailed survey outputs for each question, which support the Survey Summary in section 4, can be found below.

A2.3 QUESTION 1. (Number of Respondents who answered this Question: 123)

Common responses in “Other” were: Banking/Investment; Broker; Reinsurer; Pension Scheme.

A2.4 QUESTION 2. (Answered: 124)

A2.5 QUESTION 3. (Answered: 122)

“Other” contained a very wide range of responses, including: Modelling; Treasury; Trustee.

A2.6 QUESTION 4. (Answered: 123)

A2.7 QUESTION 5. (Answered: 124)

A2.8 QUESTION 6. (Answered: 119)

A2.9 QUESTION 7. (Answered: 119)

A2.10 Our follow-up question to list any other technologies provided the following suggestions: Quantum Computing; Wearables; Robotics; Tagging; Mobile phone payments; phones for medical assessment; RegTech/Process Industrialisation; Etherium.

A2.11 QUESTION 8. (Answered: 118)

A2.12 QUESTION 9. (Answered: 119)

A2.13 “Other” contained a very wide range of responses, including: It’s all hype/oversold by consultancies; desire to lift expectations; reduce costs; improve standards by removing human error; introduce efficiencies from new tech; strategic advantage/competition; entry by non-traditional players; overdue for change in the traditional insurance sector; demonstrate insurers can innovate; regulatory arbitrage; security; tech bubble.

A2.14 QUESTION 10. (Answered: 83)

A2.15 QUESTION 11. (Answered: 52)

A2.16 QUESTION 12. (Answered: 85)

A2.17 QUESTION 13. (Answered: 76)

What would you consider as the top 3 risks in respect of adopting or developing new InsurTech solutions, starting with the most important risk?

A2.18 There was a wide range of responses, but the most common answers were: Cyber attack; Data privacy; Lack of understanding of risk; Going too early/missing the boat; Not really meeting customers’ needs/mis-selling risk.

A2.19 QUESTION 14. (Answered: 76)

Thinking of your top 3 risks above, please tell us whether you believe these are risks that insurers are already familiar with.

A2.20 QUESTION 15. (Answered: 57)

A2.21 Reasons respondents provided for selecting “No” included: Too much focus on regulation/InsurTech risk not in Solvency II; Insufficient skill/knowledge/experience/more of an IT risk; Third-party data systems are a black box; InsurTech at too early a stage/separate from rest of organisation; Not a threat, more a lost opportunity; Changes introduce new risks/different risks; Lack of data; Framework needs refining/more technology driven risk management; Poor track record of IT implementation; Don’t know/not sure.

A2.22 QUESTION 16. (Answered: 57)

A2.23 QUESTION 17. (Answered: 79)

A2.24 QUESTION 18. (Answered: 65)

What areas of the business do you believe InsurTech can add most value to your organisation, both now and in 5 years’ time?

Now – the following items scored highest 5 years’ time – the highest were:

Now – the following items scored lowest 5 years’ time – the lowest were:

A.3 Review against IFoA Actuarial Risk Principles

A3.1 The IFoA has developed the Actuarial Risk Principles in order to summarise the key aspects of an actuarial approach to risk management, and how they are interrelated.

A3.2 The objectives of the principles are as follows:

∙ Provide risk managers with a holistic framework to better manage risk

∙ Provide case studies with practical, transferable examples of how to apply the principles

∙ Showcase the actuarial skill set in risk management

∙ Help financial and non-financial organisations to improve their risk management

∙ Generate opportunities for actuaries to help businesses make these improvements.

A3.3 The Working Party outputs contained in this report are consistent with the above principles.

A3.4 In particular, the Working Party Guides in section 7 provide risk managers and actuaries with a practical perspective on applying a holistic framework for managing risks within, and improving the success of, InsurTech opportunities.

A.4 Working Party Members

A4.1 The “Risk Management in a Digital World” Working Party comprises of the following members:

∙ Daniel Bruce (Chair) – Partner, Crowe

∙ Carole Avis – CRO Legal & General Insurance and General Insurance

∙ Matthew Byrne – Chief Actuary, NFU Mutual

∙ Visesh Gosrani – Director of Risk & Actuarial, Cyence

∙ Zhixin Lim – Senior Manager, HSBC

∙ Jools Manning – Head of Strategic Risk, Just

∙ Darko Popovic – Senior Manager, Crowe

∙ Richard Purcell – Technical & Innovation Lead, Hymans Robertson

∙ Weihe Qin – Senior Actuary, HSBC.