Book contents

- Frontmatter

- Contents

- Preface

- List of contributors

- 1 Introduction

- 2 Trends in federal tax progressivity, 1980–93

- COMMENTS

- 3 The lifetime incidence of state and local taxes: measuring changes during the 1980s

- COMMENTS

- 4 Trends in income inequality: the impact of, and implications for, tax policy

- COMMENTS

- 5 The efficiency cost of increased progressivity

- COMMENTS

- 6 On the high-income Laffer curve

- COMMENTS

- 7 Tax progressivity and household portfolios: descriptive evidence from the Survey of Consumer Finances

- COMMENTS

- 8 Progressivity of capital gains taxation with optimal portfolio selection

- COMMENTS

- 9 Perceptions of fairness in the crucible of tax policy

- COMMENTS

- 10 Progressive taxation, equity, and tax design

- Index

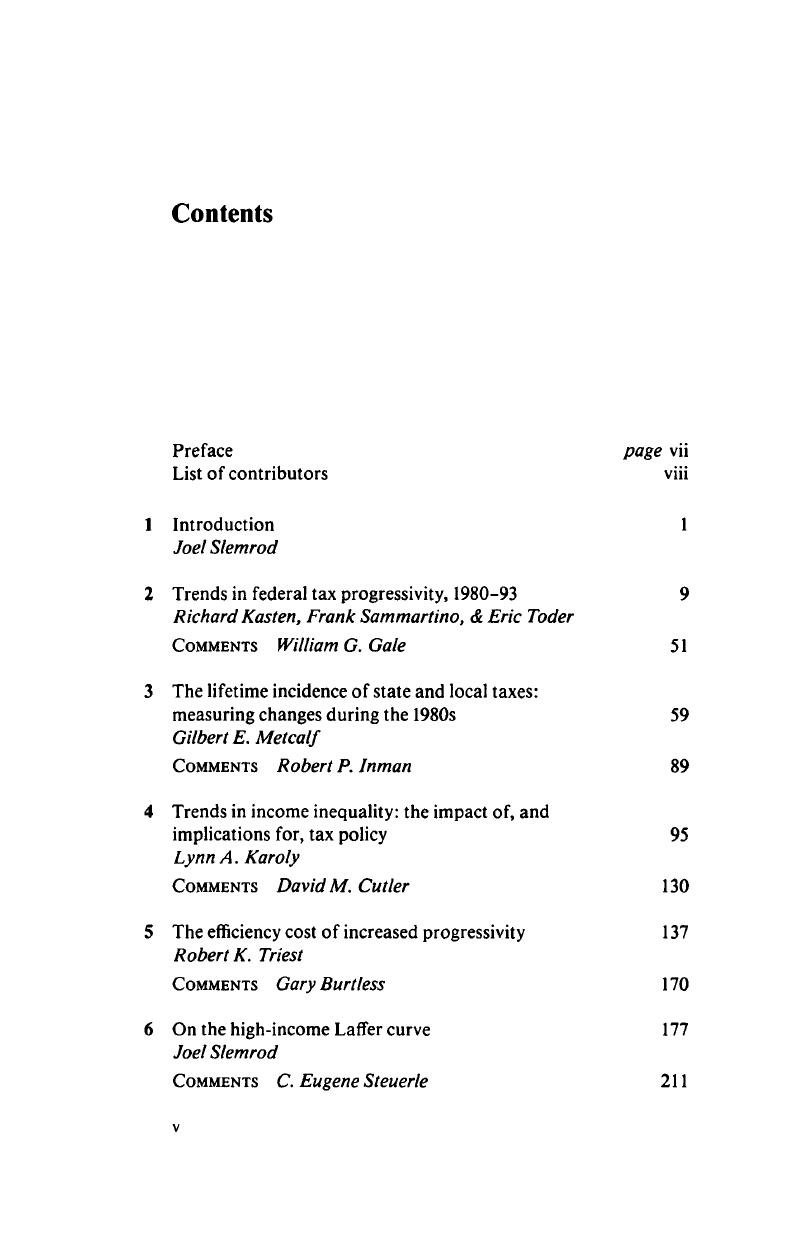

Contents

Published online by Cambridge University Press: 20 May 2010

- Frontmatter

- Contents

- Preface

- List of contributors

- 1 Introduction

- 2 Trends in federal tax progressivity, 1980–93

- COMMENTS

- 3 The lifetime incidence of state and local taxes: measuring changes during the 1980s

- COMMENTS

- 4 Trends in income inequality: the impact of, and implications for, tax policy

- COMMENTS

- 5 The efficiency cost of increased progressivity

- COMMENTS

- 6 On the high-income Laffer curve

- COMMENTS

- 7 Tax progressivity and household portfolios: descriptive evidence from the Survey of Consumer Finances

- COMMENTS

- 8 Progressivity of capital gains taxation with optimal portfolio selection

- COMMENTS

- 9 Perceptions of fairness in the crucible of tax policy

- COMMENTS

- 10 Progressive taxation, equity, and tax design

- Index

Summary

- Type

- Chapter

- Information

- Tax Progressivity and Income Inequality , pp. v - viPublisher: Cambridge University PressPrint publication year: 1994