The Northern European country Norway has a population of 5.5 million and is among the wealthiest countries in the world. Norway was part of Denmark until the nineteenth century and gained independence from Sweden in 1905. The country is one of the founding members of the North Atlantic Treaty Organization (NATO) and, while it chose not to join the EU, it is required to follow some EU legislation and has access to the EU internal market via the European Economic Area (EEA) Agreement, signed in 1992. Norway is located on the western side of Sweden and has limited borders with Russia and Finland to the north. On the northern, southern, and western sides, Norway is surrounded by the Barents Sea, the Norwegian Sea, and the North Sea. Its coastline is over 2,000 kilometers. The continental shelf governed by Norway is four times the size of the mainland and one third of the whole European continental shelf. Therefore, Norway has substantial access to offshore oil and gas reserves located on its continental shelf. It has also deliberated opening an enormous area for deep sea mining of critical minerals (Alberts, Reference Alberts2023).

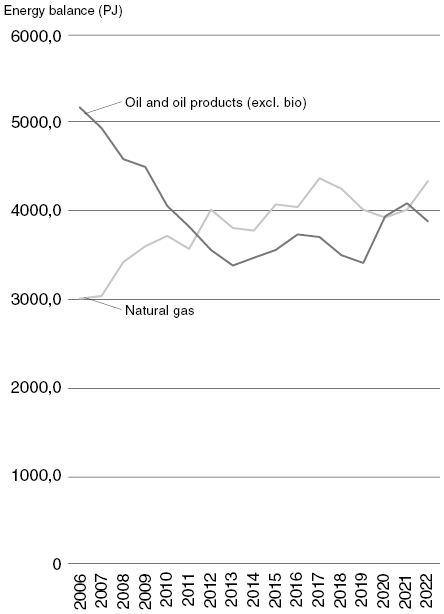

Norway is a unique country case as it holds such a large magnitude of different kinds of energy reserves: oil, natural gas, and hydropower. These reserves have made Norway fully energy independent in terms of domestic energy consumption, apart from some dry years when it imported electricity to compensate for the lack of hydropower (Figure 7.1). Norway exports about nine tenths of its energy production (Figure 7.2). The country generated 3 percent of global gas (being the seventh-largest producer) and 2.3 percent of global oil production in 2020; the International Energy Agency (IEA) has described Norway as having a politically and economically “stabilizing role in the world’s oil and gas supply” (IEA, 2022, p. 9), which is otherwise concentrated in the Organization of the Petroleum Exporting Countries (OPEC) and the US. The income generated from the export of oil and gas has created substantial societal gains for Norway, but has also meant the country is economically dependent on this income. Despite increasing climate concerns and risks associated with oil and gas production the governance structures of Norwegian hydrocarbon production remained unchanged during 2013–2018 (Bang and Lahn, Reference Bang and Lahn2020).

Figure 7.1 Norway’s electricity imports and exports, 2006–2022, GWh.

Figure 7.2 Norway’s export of oil and gas, 2006–2022, in millions of tons oil equivalent.

Besides hydrocarbons, Norway has ample waterfalls that have, over several decades, led to the development of a sizeable hydropower sector that covers nine tenths of Norway’s total electricity production. Therefore, as Norwegian society is highly electrified and decarbonized, other renewable energy sources have been rather poorly supported politically. Instead, the oil and gas sector were supported by, for example, new concession rounds for exploration during 2015–2017 (Mäkitie et al., Reference Mäkitie, Normann, Thune and Sraml Gonzalez2019). Unlike the other case countries in this book, for Norway, the renewables niche expansion via wind power has often been perceived to mean rising levels of exports and power exchange to other countries without improved security of supply (Hansen and Moe, Reference Hansen and Moe2022). Wind power can, however, play an important role for local security of supply in areas where connections to the transmission network are weak (Skjølsvold et al., Reference Skjølsvold, Ryghaug and Throndsen2020). Whereas wind power was perceived positively in the early 2010s (Karlstrøm and Ryghaug, Reference Karlstrøm and Ryghaug2014), subsequently it faced increasing citizen resistance for various reasons, including the dispossession of Sámi areas (Normann, Reference Normann2021) and the rise of resource nationalist arguments (Hansen and Moe, Reference Hansen and Moe2022). It is only since the 2020s that increased policy support has been given to wind power to accelerate its expansion (see details in Section 7.5).

The abundance of fossil energy has led to a kind of dissonance between Norway’s export-oriented fossil fuels policy and its domestic zero-carbon energy policy, which are dealt with administratively in different domains and ministries, perhaps to reflect the different values involved. The fossil fuel sector represents economic security for Norwegians, while zero-carbon energy reflects the country’s environmental values. Therefore, to limit the emissions of the fossil fuel sector, Norway has developed its hydrocarbon production to be the world’s least carbon-intensive and has invested heavily in the development of carbon capture and storage (CCS). Nevertheless, this dissonance has meant that energy security concerns played a substantially smaller role in Norway prior to 2022 than in the other case countries.

The war instigated by Russia in Ukraine and the resulting energy crisis in Europe have affected Norway differently than other European countries, due to the country’s large energy reserves. The events nevertheless caused changes in Norwegian energy policy too. The impact was twofold. First, Norwegians experienced much higher electricity prices than before due to interconnections with other European countries (Germany, Finland, Sweden, the UK, the Netherlands), although the government compensated consumers for this rise to a large extent. Second, the Norwegian government was able to benefit from record high exports of oil and gas, replacing the quantities previously supplied by Russia to Europe and receiving thanks from the EU President Ursula von der Leyen, for being a valuable source of help in the European energy crisis (von der Leyen, Reference von der Leyen2023). This surplus in income accrued to the whole of Norwegian society because of large state ownership in the fossil fuel sector and a specific fund that saves and reinvests these profits for the benefit of the country and its future generations. Effectively, the way in which the Norwegian fossil fuel sector is governed represents thinking associated with positive security. The approach in which social benefits come from the fossil fuel funds has enabled, for a long time, the creation of high living standards and an economically and socially stable society. It has, however, also created an economic problem related to the potential future phaseout of fossil fuel production, on which no decisions have been made.

The few security concerns regarding the energy system in Norway, prior to 2022, focused mainly on the safety of hydropower installations (see Section 7.5). An area of focus in Norway concerning oil and gas has been control over the Svalbard area where many hydrocarbon resources have been of interest to both Norway and Russia. Additionally, the northern Finnmark region has a border with Russia and, hence, is important for the country’s territorial defence.

As with previous country chapters, this chapter describes the key context, that is, the energy and security regimes in Norway. It then continues with the analytical sections, drawing on Chapter 4, namely the perceptions of Russia as a landscape pressure for the energy sector; policy coherence and interplay between energy and security regimes including the level of securitization; and, finally, positive and negative security related to potential niche development and regime (de)stabilization. The analyzed material covers Norway’s energy- and security-related government strategies published since 2006 and two rounds of interviews with energy and security experts, first between November 2020 and March 2021 and then again between November 2022 and March 2023. The chapter draws from these materials and related literature and selected policy reports.

7.1 Energy Regime

As noted, Norway has a high share of renewable energy in its total energy consumption and its electricity sector is practically fully decarbonized. In 2022, 88 percent of Norway’s electricity consumption was produced with hydropower (reduced circa 10 percent from previous year due to dryer conditions) and 10 percent from wind power (an approximately 25 percent increase from 2021) (Statistics Norway, 2023b). Contrary to an earlier slow development of wind power, particularly due to bottlenecks in the concession process (Blindheim, Reference Blindheim2013), wind power production doubled between 2019 and 2020, increasing threefold by 2022. Despite Norway already being a leading country in the electrification of its society, there are new demands for further electrification, for instance, from the industry and petroleum sectors, data centers, green hydrogen production, and transport (IEA, 2022). This is likely to affect electricity prices and creates a need to expand wind power capacity.

If one looks at total energy production instead of domestic consumption, a different picture emerges. Oil and gas, with an even share, constitute nine tenths of energy production and the remainder is largely hydropower. There are no explicit and immediate plans to phase out oil or gas production. This is due to the economic security these provide for Norway, but also to broader European energy security and arguments that Norwegian oil and gas are produced in a more environmentally friendly way than elsewhere. Still, uncertainty exists regarding future demand for fossil fuels from other countries, even though the events of 2022 stabilized Norway’s role as an oil and gas provider for Europe in the short term and resulted in plans to expand current production fields. In addition, future energy regime development in Norway is described in terms of visions for both blue hydrogen (fossil fuels) and green hydrogen (from renewable electricity generation).

The largest fossil fuel producer in Norway is Equinor. In 2022, it produced over two million barrels of oil equivalent per day and circa 1,650 gigawatt hours of renewable energy (Equinor, 2023). When energy transition began gaining ground, in 2018, Equinor changed its name from previous Statoil and began new renewable energy projects. The state owns 67 percent of Equinor, and it is operated by the Ministry of Trade, Industry, and Fisheries. Other oil and gas producers are less than half of the size of Equinor. The largest of these include Esso Norge (part of Exxon Mobil) and Total E&P Norge.

The largest electricity-sector companies include Norsk Hydro, Statkraft AS, and Statkraft Energi AS. The Norwegian state owns 34 percent of Norsk Hydro; with the rest of company owned by private investors. Statkraft AS has multiple subsidiaries, all fully owned by the Norwegian state. It was described by an interviewee as Europe’s largest renewable energy company. Also, municipal ownership of hydropower is significant. Contrary to hydropower, most wind power is foreign-owned. Statnett, the transmission network operator, was established in 1990 when the electricity market was liberalized. In contrast to companies in the other countries described in this book, Statnett is fully owned by the Norwegian state, more specifically by the Ministry of Petroleum and Energy.

Norway’s large public-sector ownership of energy companies is nowadays quite a unique feature and enables tight collaboration between key energy-sector companies and the government. In the administrative side, there are several ministries that can be regarded as key actors pertaining to energy and security. The Ministry of Petroleum and Energy deals with the exporting oil and gas sector, while the Ministry of Trade, Industry, and Fisheries is the majority shareholder in Equinor and Statkraft SF. The former has overall responsibility for energy and water resources. The Ministry of Climate and Environment is relevant from the perspective of the climate and the environmental effects of the energy sector. A few experts interviewed described the Ministry of Climate and Environment as weak compared to the energy ministry, which was seen as very strong:

The Ministry of Petroleum and Energy is a very strong and entrenched ministry with a long tradition. It’s come of age alongside Equinor and the industry, and it’s over the years clearly been seen as strongly promoting the exploration of oil and gas on the Norwegian continental shelf and then increasingly abroad.

The Norwegian Water Resources and Energy Directorate (NVE) operates under the Ministry of Petroleum and Energy. It is responsible for the management of energy resources and is the regulatory authority regarding the electricity sector. Interestingly, some experts described the NVE as almost as a ministry itself and pointed out that oil and gas exports are in practice separated from electricity production. Such an arrangement can be seen as, on the one hand, advancing the zero-carbon transition of the electricity sector and, on the other hand, as maintaining the oil and gas export sector:

That is a kind of a strange feature of Norway … so you have one ministry for petroleum and energy, but in practice it’s two ministries, or it has been so for a long time where we have separate processes for electricity and for petroleum.

ENOVA SF is a state-owned enterprise that is tasked with the advancement of more environmentally sound energy-sector development and supervised by the Ministry of Climate and the Environment. It does this by managing the Climate and Energy Fund, which aims to realize projects advancing Norway’s climate commitments.

Norway is not an EU member state but is still bound by many EU policies: It participates in the internal energy market as part of the EEA Agreement as well as in EU climate legislation for the period 2021–2030 (IEA, 2022). The EU is also Norway’s largest energy export market. An interviewee, however, remarked that Norway lacks similar holistic climate and energy policy preparation processes to many EU member states. Indeed, compared to many EU countries, renewable energy beyond hydropower has received little policy support in Norway. Renewable energy support was first highly politicized, but from 2010 its status as a salient political issue reduced: “Norway was producing more electricity than it needed domestically; electricity prices dropped, and the electricity utilities changed their position towards the certificate scheme” (Boasson, Reference Boasson, Boasson, Leiren and Wettestad2021, p. 205).

Norway aims to reduce its greenhouse gas emissions by at least 50 percent by 2030 and by 90–95 percent (from 1990 levels) by 2050. It also has a goal for carbon neutrality by 2030 via domestic reductions, the EU emission trading system, and international cooperation on emission reductions (IEA, 2022). The IEA assesses that Norway has already gone down the easiest routes, such as electrification of many parts of the society, so further greenhouse gas reductions will be more difficult to achieve (IEA, 2022). The Climate Change Act was enforced in 2017 to make the emission targets legally binding. In addition, the 2050 Climate Committee was established to conduct an overall review of Norway’s choices with regard to achieving its 2050 climate target.

In 2021, the Norwegian government published a White Paper “Putting Energy to Work,” which aimed to continue fossil fuel exploration indefinitely. It, however, also described a strategy to repurpose the skills and assets of the Norwegian oil and gas industry toward the development of new industries and technologies, largely offshore wind and green hydrogen but also CCS and blue hydrogen. Therefore, it seems that Norway is on board with the renewables niche expansion but, due to high economic security, it cannot endorse the decline of the fossil fuel export regime. Following the 2022 events, the Norwegian government issued a supplementary White Paper. The updated White Paper stated more strongly than before that policy for the further development, not discontinuation, of the petroleum industry needs to be put in place.

Indeed, since 2022, according to the interviewed experts, Norwegian energy policy has changed substantially. One significant difference is the strengthening of Norway’s role as a stable and credible energy provider to Europe. In 2022, Norway supplied 8 percent of Europe’s oil consumption and it continues to play an important role producing oil and gas for Europe. Existing oil and gas production areas were opened for further exploration. At the same time, wind energy is of interest too, and new areas were opened for offshore wind development. However, an interviewee expressed a concern that the oil and gas sector, as a higher salary-paying sector, will attract the majority of the skilled workforce, with less workers available for the offshore wind sector. This has proved to be the case before too (Mäkitie et al., Reference Mäkitie, Normann, Thune and Sraml Gonzalez2019).

The new plan for wind power expansion could be seen as a break from previous political practice (Kuzemko et al., Reference Kuzemko, Blondeel, Dupont and Brisbois2022). One of the latest developments includes building the world’s largest floating offshore wind farm (Hywind Tampen), based on Equinor’s floating wind technology, with a total installed capacity of 88 megawatts (IEA, 2022, p. 12). Equinor has also invested in wind power production outside Norway. One of the bottlenecks in Norway is the status of transmission and distribution networks. An interviewee argued that the grid is ruled by institutions that were set up following energy market deregulation in the 1990s and geared toward curbing grid investments. Nevertheless, Norway’s industrial policy is pushing for a new direction that focuses on access to renewable energy, battery production, hydrogen production, and new energy infrastructure for shipping:

There has been a strong drive for this green transition. On the one hand, we are producing as much oil and gas as we can, and on the other side, we’re trying to make us be looked at as the greenest country ever. It’s a schizophrenic position somehow. But the war in Ukraine has increased the importance of oil and gas at least for a period of time. The efforts being done in order to position Norway as a key contributor of technology, when it comes to onshore wind, onshore wind, is very much increasing, and it’s a very high priority for the Norwegian government.

Norway has the lowest-emitting oil production facilities globally. It heavily invests in CCS to reduce the greenhouse gas emissions of fossil fuel production, driven by the carbon tax introduced in 1991, with Equinor implementing several CCS projects (IEA, 2022).

In February 2022, the Norwegian government appointed an Energy Commission to assess future challenges in Norwegian energy policy up to 2030. In the resulting report in spring 2023, the commission called for a change of pace and the establishment of new green industries. If power production is not increased, the commission warned, there is risk of an energy deficit – potentially as early as 2027. Figure 7.3 summarizes the key aspects of Norway’s energy policy.

Figure 7.3 Key aspects of Norwegian energy policy.

7.2 Security Regime

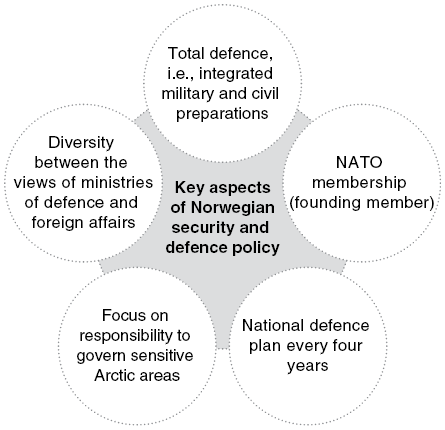

Norway applies a total defence concept in its defence policy. Total defence has been described as integrated military and civil preparations supported by institutionalized cooperation between ministries, civic organizations, the private sector, and the general public (Wither, Reference Wither2020). The Directorate for Civil Preparedness heads up the Total Defence Working Group and coordinates exercises. A key aspect of Norway’s defence policy has been its membership of NATO. Norway was one of the founding members in 1949. Also, akin to Finland and Estonia, Norway now considers Russia to be the main threat to its national security. Before 2022, Norway (as well as Finland) collaborated with Russia on many economic, environmental, and border security questions (Wither, Reference Wither2020).

Norway also collaborates with the EU on defence and security. This collaboration has been described as ad hoc and based on informal arrangements (Hillion, Reference Hillion2019). In terms of formalized collaboration, Norway has relatively little influence on EU defence and security policy, although it indirectly plays a role as a NATO member country and as an Arctic state. In relation to security and foreign policy, Norway emphasizes the importance of international collaboration, NATO membership, and multilateral systems guided by the UN (Norwegian Ministry of Foreign Affairs, 2019).

The relevant ministries include the Ministry of Defence, the Ministry of Justice and Public Security, and the Ministry of Foreign Affairs. An interviewee reported some rivalry between the ministries of defence and of foreign affairs. This was prior to 2022 and pertained especially to their orientation toward Russia – the Ministry of Foreign Affairs being more open to collaboration. In the Norwegian parliament, Storting, the Committee on Defence and Foreign Affairs deals with security issues.

Norwegian defence spending gradually reduced by half from the 1960s to 2000. It was at its lowest in 2008, 2012, and 2013, representing 1.4 percent of the GDP. In 2021, 1.8 percent of GDP was used for defence, which corresponds to the lowest percentage of this book’s case countries, but, given Norway’s substantial wealth, in monetary terms this was not the lowest amount.

The national security legislation was revised in 2019. The national defence plan is renewed every four years, and it includes a section on energy security. There is some overlap via organizational roles: Besides its energy policy roles, the NVE (see Section 7.2) develops guidelines for cybersecurity in the energy sector and conducts inspections. A previous analysis of Norwegian security and defence policy documents showed that policies have highlighted the Norwegian responsibility to govern the sensitive and important Arctic areas, while globalization was expected to increase cybercrime and terrorist attacks (Sivonen and Kivimaa, Reference Sivonen and Kivimaa2023). Figure 7.4 shows the key aspects of this sector.

Figure 7.4 Key aspects of Norway’s security and defence policy.

7.3 Perceptions of Russia as a Landscape Pressure at the Intersection of Energy and Security

Norwegian policy documents relate principally to the importance of international collaboration and trade. For example, developments such as China’s Belt and Road Initiative, the proliferation of nuclear materials, world population growth, increasing resource demand, and climate change are seen as important landscape developments affecting the energy sector (Norwegian Ministry of Foreign Affairs, 2019).

In terms of Russia as a particular landscape pressure, Norway has not been dependent on its oil and gas, unlike Estonia and Finland. Otherwise, the perceptions and expectations in Norway prior to 2022 presented a similar dual approach to Finland, both in policy documents and interviews. Before 2022, about a half of the interviewed experts either did not really consider Russia with regard to the energy–security nexus or perceived relations with Russia to be neutral or good. Of the remainder, one quarter presented mixed perceptions of Russia as a landscape pressure. For instance, the geopolitical threat and increasing military activity of Russia was mentioned but, at the same time, no threat toward energy installations or collaboration in environmental issues was perceived.

There are some nuances about how to balance this so we have some voices that are more concerned about provoking Russia and others are saying that no we should be firmer. That’s a debate we’ve had since 2014 how to balance this. We don’t want to escalate things up North, but we still want to be firm.

Only three interviewees perceived potential Russian developments as a risk. Two mentioned Russia’s increased assertiveness. In addition, risks were perceived in relation to the potential environmental implications of oil and gas transport and nuclear power. Further, three interviewees reported the 2014 invasion of Crimea as a major shift in Norwegians’ perceptions of Russia.

We have experienced a more assertive Russia. A Russia that has become quite harsh when it comes to their characteristics on what’s happening. And then it’s, it’s also a difference on whether Russia speaks to Norway as a NATO member or whether it speaks to Norway as a neighbor.

Russia has become more assertive. They have increased their military reach, and they are very critical of whatever defence measures Norway decides to take, and our cooperation with the Americans and all the allies. So, after Crimea and the sanctions in 2014, Russia has increasingly become untrusted.

Although Norway’s connections with Russia have been quite different from Finland’s, that is, Russia is not an energy importer to Norway but rather shares interests in the Arctic Sea, nevertheless, perceptions of Russia were similar and there was an emphasis on collaborative relations. As in other case countries, 2022 gave rise to a major landscape shock, resulting in more uniform views about Russia in the energy–security nexus.

Norway is supporting all EU sanctions. Norway is supporting any statements from NATO and the European Union and the United Nations. So, we are rock solid on the Western perception of Russia.

Well, I think Russia is now considered a pariah. Even a rogue state. Nobody in the West, with the possible exception of Viktor Orbán, will ever trust Russia again in energy matters, as long as Vladimir Putin remains in the Kremlin.

I think our perception at the moment is that they’re not somebody you can plan with at all, for the European market.

Next, the chapter moves onto discussing policy coherence and interplay at the energy–security nexus.

7.4 Policy Coherence and Interplay

As Norway is a special case of a country fully independent in energy and a major energy exporter, the ways in which security issues unfold in its energy transition differ substantially from that of Finland and Estonia. Norway is not dependent on the import of any energy source and, hence, energy security in Norway does not relate to security of supply but rather broader energy security: the operation of hydropower plants and the potential disruptions they may face, either from hybrid attacks or weather events. As noted in previous literature, the mainstream energy policy discourse “does not see renewables as connected to energy security, independence, or sovereignty” (Hansen and Moe, Reference Hansen and Moe2022, p. 4). In practice, however, this is not so straightforward. There are limitations in transmission capacity between different regions in Norway, which mean that availability and prices of electricity can alter substantially between regions. These issues with the grid infrastructure were not, however, presented as a security issue in Norwegian interviews.

During the expert interviews taking place in 2020 and 2021, security was seldom mentioned as connected to energy in general or energy transitions more specifically. This was due mostly to the energy independence of Norway; the security of the energy infrastructure alone was identified to be potentially at risk (of terrorist attack), yet most regarded this as unlikely. Some references to energy security were made, as potential electricity shortages in dry years would affect hydropower. In addition, cybersecurity was identified as an issue for the energy sector.

Likewise, in the first round of expert interviews, there was little consideration of how energy and security issues cohere with each other in public policymaking. There appeared to be “no committees, working groups or agencies advancing coherence between zero-carbon energy and security” (Kivimaa, Reference Kivimaa2022, p. 8). However, there were features that connect to the energy–security interface. For instance, emergency preparedness procedures and guidelines for cybersecurity by the NVE have been created in this interface. The NVE also heads up the Power Supply Preparedness Organization. Similarly to Finland, this organization, responsible for national emergency strategy, comprises representatives from different ministries, including those in charge of energy and of foreign affairs (IEA, 2022). The Petroleum Safety Authority has responsibilities regarding the security of petroleum production. Nonetheless, the overall interpretation of expert interviews was that, prior to 2022, energy and security policies were not coordinated between the four administrative organizations involved: three ministries and the NVE.

My main understanding is that this combination does not almost exist in Norway.

The oil and energy department has been quite adamant to demonstrate an independence from foreign affairs and security policy. For certain reasons, Norway has its foreign relations, it has its defence and security set up, but apart from the obvious things of securing oil installations and so on, we have tried to keep energy policy separate, not to politicize.

In principle, fossil energy has been depoliticized in connection to the importance of this sector for the Norwegian economy. This has also impacted how its coordination – or lack of it – was pursued in foreign and security policy (Kivimaa, Reference Kivimaa2022). On the domestic side, the security of hydropower installations has attracted attention, especially since a cyberattack on a Norwegian hydropower company in 2019 (see Section 7.5.2). In 2023, Storm Hans showed how extreme weather events resulting from climate change can also be a threat to energy infrastructure. Increase in the water level of the Glåma River destroyed a dam and inundated a hydroelectric power plant (Patel, Reference Patel2023).

There have also been differing views, such as the NVE having close connections to military forces and trials around total defence, and the energy ministry having a subsection conducting security analyses. Moreover, informal interactions via a small elite in a small country were mentioned as justification for the lack of more formalized processes – akin to Estonia. In 2018, the Council for Fuel Preparedness was formally established to increase cross-governmental cooperation on fuel security (IEA, 2022). Nevertheless, synergies between energy transition policy and security policy were not recognized, whereas the fossil fuel sector was identified as a positive factor for Norway’s economic and geopolitical security (Kivimaa, Reference Kivimaa2022).

Since 2022, more coordination has occurred, although an energy business actor noted that actors outside ministries have little awareness of whether and what kind of interaction takes place:

Equinor as the country’s major corporation has in its 50th year of operation finally in part come under the jurisdiction of the National Security Act … I think many of my colleagues will argue that this was long overdue.

Among the interviewees for this book, energy business actors appeared to have a broader awareness of security connections than civil servants. Since 2022, the security of electricity supply – or at least the affordable price of it – became a key part of political discussions. This was the result of new electricity export interconnections from Norway to other countries in 2021 and an overall reduction in energy supply from Russia to Europe in 2022. The updated energy policy from spring 2022 was much more explicit about security than previous strategies. It was entitled “Energy Policy for Employment, Transition and Security in Times of Uncertainty” and emphasized Norway’s continued and stable oil and gas production. Given previous obstacles to develop wind power further, the measures to speed up wind power development can, to a certain degree, be seen as exceptional measures (cf. Heinrich and Szulecki, Reference Heinrich and Szulecki2018). Future developments will show whether the coherence between energy and security policies will improve.

7.5 Niche Development, Regime Stabilization, and Positive and Negative Security

Given the fact Norwegian society is highly electrified and hydropower has been a long-established energy source, interest in new niche development in renewables has been lower in Norway than in the other case countries. However, alongside solar power and energy storage, offshore wind power began to attract more attention since 2022. Nonetheless, it could perhaps still be regarded a socio-technical niche in Norway.

For the same reason, and due to the hydrocarbon export sector being so important for the Norwegian economy (Andersen and Guldbrandsen, Reference Andersen and Gulbrandsen2020), there has been very little talk of regime destabilization among politicians and energy businesses. The petroleum sector pursues decarbonization and not phaseout (Afewerki and Karlsen, Reference Afewerki and Karlsen2022). There is some resistance to further plans for exploration by residents and fishers in certain areas (Korsnes et al., Reference Korsnes, Loewen, Dale, Steen and Skjølsvold2023). The latest policy from 2022 talks about the continuation and further development of the oil and gas sector – albeit a connected development is that of CCS. The latest IEA energy policy review of Norway also brought forward the question of critical materials and Norway’s plan to begin producing them (IEA, 2022). Interestingly, this topic did not come up in the expert interviews in either phase. Therefore, the security issues discussed in this section are associated with stabilizing the existing regime and its security connections.

This section starts with the most dominant issue, that is, the economic and geopolitical security of Norwegian fossil fuel supply, which also serves as grounds to keep stabilizing this regime. Subsequently, the dominant electricity regime, namely hydropower and its security questions, are discussed. Finally, the section will end with the expanding wind power sector and the increasing importance of securing critical energy infrastructure.

7.5.1 Economic Security, Oil, and the Energy Transition

As this chapter has described, oil and gas production have provided substantial income for the Norwegian state, with the state being also a significant owner of the production capacity. The sector is also a sizable employer (Andersen and Guldbrandsen, Reference Andersen and Gulbrandsen2020). A specific sovereign fund was created in the 1990s, which aims to invest this government money wisely in a way that benefits current and future Norwegians, that is, the whole of society: “Emphasis is placed on smoothing out economic fluctuations to contribute to sound capacity utilisation and low unemployment. The framework aims to preserve the real value of the fund for the benefit of future generations. It also isolates the budget from short-term fluctuations in petroleum revenue and leaves space for fiscal policy to counteract economic downturns” (IEA, 2022, p. 17). The way in which the fund has been created reflects elements of positive security, while it also in its own way contributes to increasing climate security risks. The oil fund is argued to be the largest sovereign wealth fund in the world, making up about one third of the Norwegian state budget. Therefore, oil production has brought economic security for Norway alongside global (geo)political influence.

The economic security of Norway is so inherently tied to the oil and gas industry which is a massive problem. And it’s a problem that the Norwegian government doesn’t really seem to take in. And to have a society that is so dependent on one type of industry and high oil price. And we don’t have to be, right?

To put it very bluntly and very simply is that Norway punches above its weight. It has gained some advantages both economically and politically, globally. It’s simply because it has had lots of income.

The political mindset has been much more about how to protect the income streams from these industries and no concern that we will run out of power or energy.

Yet some argue that this wealth has also enabled positive environmental developments, such as investments into environmentally beneficial solutions in Norway and abroad. The Norwegian government has made efforts to balance fossil fuel production and the climate and environment. Yet, it is clear that the broader global efforts to lower carbon dioxide emissions bring uncertainty to the Norwegian oil sector. This was especially the case during 2020–2021, although the substantial demand for Norwegian fossil fuels since 2022 has somewhat lowered these concerns.

If the demand side were suddenly taken away, it would be a big risk to unemployment and it would definitely reduce income to Norway, so that aspect of security is present.

The fossil fuel sector is also tied to the more traditional protection of energy infrastructure against physical attacks. For instance, around 2010, the risk of terrorist attacks on Norwegian oil infrastructure was a security concern and military protection and surveillance are now used to protect oil and gas production.

More broadly, and especially since 2022, the Norwegian fossil fuel production has also been argued to be important for European energy security and global stability: “As a reputable and reliable producer, Norway has played a stabilising role in the world’s oil and gas supply, particularly in meeting European demand” (IEA, 2022, p. 137). Norway is a stable insider partner for the EU with respect to fossil fuel supply, as a politician interviewed remarked. Recent strategies emphasize the continued development of the fossil fuel sector:

As the energy crunch struck, there was a sense of anything goes in Europe. Nuclear, coal, you name it. Any kind of energy to compensate for the loss of Russian imports. I believe that the right assessment is that the energy transition has suffered a temporary setback. Even if some people in Brussels and Berlin and wherever will contest that assessment. And I emphasize temporary, because there is little doubt about the direction of travel in the EU longer term. This of course creates a dilemma for a producer like Norway.

Today, it appears that the strong security arguments behind Norway’s oil and gas production support its continuation for the foreseeable future. That is, arguments for the support of economic and geopolitical security of Norway as well as European energy security currently prevail. Hence, regime decline is not evident in terms of disruptions to skills and assets, unlearning, or deinstitutionalization.

7.5.2 Security of Hydropower

As noted, hydropower provides most of Norway’s electricity production and, therefore, protecting this against intentional and unintentional disruptions is important. Annual precipitation levels influence the availability of hydropower. However, it can be stored, so, it is not affected by weather as much as wind and solar power are. Yet, changes in annual precipitation levels, affecting the amount of hydropower generation in Norway, mean that Norway is somewhat dependent on its neighboring countries for electricity supply during dry years. However, during the 1995–2020 period, Norway has maintained a power surplus for seventeen out of these twenty-five years (Hansen and Moe, Reference Hansen and Moe2022). According to the interviewed experts, hydropower infrastructure is not particularly vulnerable to external disruptions or attacks. One of the experts stated that generally hydropower has a very limited military component:

I think most of our large hydropower plants are inside the mountains. I mean there is maybe a one-kilometer tunnel that you have to drive through, so they are, not easy to access, from the outside.

Nonetheless, an event in 2019 showed that the operation of hydropower companies can, for instance, be substantially disrupted by cyberattacks. In March 2019, a Norwegian renewable energy and aluminum manufacturer Norsk Hydro suffered a ransomware attack. The attack on the company, a producer of energy to 900,000 homes, encrypted key areas of the company’s IT network on over 3,000 servers and locked everyone out (Austin, Reference Austin2021). Norsk Hydro did not pay the attacker, which meant stalling production in all manufacturing facilities, because the company needed to shut down all access to the network and stick to manual operation of its critical systems for several weeks – costing approximately $70 million (Austin, Reference Austin2021). Also, as mentioned, stormy weather in 2023 revealed the vulnerability of hydropower dams to extreme weather events, such as flooding.

Indeed, hydropower dam safety and preparedness are some of the few physical security issues mentioned in the expert interviews. Around 500 dams and reservoirs are categorized as having the highest risk of effect if they were to collapse. Increased securing of the dams to withstand larger attacks has driven up the costs of the hydropower sector in relation to wind power:

If one of these dams is destroyed it will give the most damaging effect on the society of all the installations we have in Norway. They are the most dangerous installations we have, because they are so huge and there’s so much water behind them.

Some experts saw tensions in the security regulation concerning the dams, holding the view that civil servants were being overly cautious:

But if you look in the area of security policy, military issues and energy, I’ve only noted one area where we have had significant conflicts or friction … We believe that those risk assessments are not based on best science in the area and that they are very much higher than in other comparable sectors for example oil and gas or industry or let’s say road infrastructure. And that they are very high compared to other countries that also have hydropower.

Such tensions have perhaps been alleviated since 2020–2021. The Nord Stream pipeline explosions in 2022 and the destruction of the Nova Kakhovka Dam in Ukraine in 2023 showed in real terms how energy installations can be targets of physical attacks and the substantial potential harm that may be caused. These events have emphasized the importance of securing critical infrastructure (see Section 7.5.4), that is, increasing the “negative security” orientation of the energy regime.

7.5.3 Tensions around Wind Power Expansion

Wind power expansion has been contentious in Norway, especially since the early 2000s (Korsnes et al., Reference Korsnes, Loewen, Dale, Steen and Skjølsvold2023), although is not directly linked to security. Due to the fact the Norway–Russian border is located at quite some distance from most of Norway’s population, the operation of air surveillance radars was not seen as a problem to the same extent as in Estonia and Finland:

For some of these windfarms that are located in close proximity to where we have military installations, that is an issue. But it’s few and far between still. So, it’s not something that generates lots of attention.

Opposition to new wind power has been based on local environmental effects combined with the little added value perceived by those in opposition. One of the opposing parties has been the Center Party, which has voiced explicit concerns that Norwegian wind power is used to supply mainland Europe and paid for by Norwegian residents, industry, and the environment – something that has been labelled as a resource nationalist view (Hansen and Moe, Reference Hansen and Moe2022). This has created societal tensions, but not to such a degree that the many experts interviewed saw it as a question of internal security. Nevertheless, an ad hoc antiwind power organization, Motvind Norge, was established in 2019. This group was successful in halting all NVE-approved new onshore projects until April 2022 (Korsnes et al., Reference Korsnes, Loewen, Dale, Steen and Skjølsvold2023). There have also been other groups that have used extreme language and compared wind power to wartime occupation, treason, and the Nazi occupation (Hansen and Moe, Reference Hansen and Moe2022). The protests and opposition resulted in a freeze of new wind power permissions from 2019 until 2022, when the European energy crisis somewhat changed the outlook on wind power in Norway. Further, some experts interviewed mentioned the intention by some to physically damage new wind power development sites:

There have been extreme protests against building of windmills in Norway over the last two years. From being a symbol of progress towards an emissions-free energy system and something that has actually been stimulated through tax breaks and state aid, it has turned to be the symbol of destroying Norwegian nature. People don’t want them anymore and that’s been really a very difficult situation … So, there are no new wind parks being established after those that have already had a concession. And those that are being built are having large protests.

The White Paper issued in 2020 proposed changes that involved increasing local and regional involvement in onshore wind power projects and ensuring that environmental matters are taken into account (IEA, 2022), that is, improving the positive security perspective. In 2022, onshore wind development continued in cases where the local authority agreed with the state government.

7.5.4 Security of Critical Infrastructure and Supply since 2022

Security of supply was very rarely discussed by the interviewed experts in Norway prior to 2022. When it was mentioned, it was mainly in the context of electricity (as opposed to the defence sector security of supply, which pertained to oil and petroleum products). Only two out of fifteen interviewees brought this up during 2020–2021, and one noted that

There’s no Norwegian politician, for many decades, who has woken up being afraid that there was no power. That’s simply not, it’s not our problem. Apart from technical collapse there’s clearly no shortage. It’s more price-related and that debate has been surprisingly fierce in my view.

It is, however, important to note that the security of Norwegian energy infrastructure is also of importance to other countries. The Norwegian fossil fuel infrastructure in the North Sea is sizeable, with around 9,000 kilometers of pipelines. For instance, a disruption to the gas pipelines between Norway and rest of Europe would lead to substantial harm to countries at the receiving end (Godzimirski, Reference Godzimirski2022). Moreover, the events of 2022 led to a realization that, although Norway has frequently been the energy exporter, there is mutual reliance on other countries, which is also beneficial for Norway during times when hydropower resources are smaller. Despite this recognition, in Norway the energy crisis did not materialize to the same extent as in rest of Europe and, as an interviewee put it, there is not the same sense of urgency in Norway as elsewhere in Europe.

Since 2022, focus on critical infrastructure in Norway has markedly increased and security zones around energy installations have been broadened. The interviewees reported an increasing number of military capabilities assigned to the North Sea, highlighting the rising negative security focus on energy infrastructure. This has been a result of the war conducted by Russia in Ukraine as well as the explosions of Nord Stream pipelines.

On the security side, it was a wake-up call, when we had the explosions close to Nord Stream 1 and 2. In the lead-up to those explosions, there were observations in Norway on drones close to our onshore installations and also offshore installations.

Both the government and the company have been extremely focused on doing what we can to prevent or mitigate attacks in the cyber domain or indeed physical attacks on sea or land installations or against cables on the seabed. We have seen, this is public knowledge, we have seen the home guard, a branch of the armed forces, patrolling our main onshore installations, and also armed forces have contributed to the patrolling of the Norwegian continental shelf.

Another security implication, associated with positive security and people’s experiences, links to increasing electricity prices. Higher prices, to which Norway’s residents had been unaccustomed, made energy more politicized than before. The political discussions also covered international powerline connections, where some extreme voices argued that Norway should halt its international electricity supply:

Now energy policy is left, right and center in all political discussion, and it didn’t used to be. This [energy] was something we were taking for granted or for given before, but now we see that this is actually not adding up [to] the demands.

Increased demand has put us in a position where Norway occasionally has had the highest energy prices in Europe, which is a significant political challenge because the Norwegian population really doesn’t understand how this can be.

It became very nationalistic, in the beginning, [i.e.,] we need to make sure that we have the power that we need and make sure that we can keep it for ourselves. Also, on the political side, there were those types of discussions.

Although the Norwegian government has compensated consumers for high electricity prices, questions about sovereignty and control over electricity exports have been increasing for some time. In particular, exports based on renewable energy – especially wind power – have raised a resource nationalist discourse based on claims that such exports weaken Norway’s energy sovereignty (Hansen and Moe, Reference Hansen and Moe2022). It is true that, unlike in the other case countries of this book, Norway’s sovereignty is not directly improved by the renewable energy expansion. However, the degree to which such expansion actually leads to adverse sovereignty depends on the perspective taken. Making a distinction between actual and perceived sovereignty, Hansen and Moe (Reference Hansen and Moe2022) pointed out that the resource nationalist discourse, which claims renewable energy exports have adverse impacts on Norwegian sovereignty, is not new but has simply received increasing attention in the last few years. They say that this discourse is not targeted at Norway’s operation in the Nord Pool power exchange but is related to the country’s relationship with the EU. Yet, the counterargument to the sovereignty concern is that, without export, the Norwegian electricity sector is not viable when prices fall too low due to excess supply (Hansen and Moe, Reference Hansen and Moe2022) – not to mention the beneficial effects on European stability of Norwegian electricity exports.

Some interviewees argued that a degree of securitization of energy policy has happened in terms of these questions on control and sovereignty, in addition to the increased perceptions of energy infrastructure as a critical and potential target for military attacks. A further example is bringing Equinor under the Security Act. None of these issues were regarded by the interviewees as examples of a high degree of securitization, though. When taking the view presented in the political economy of energy research on securitization, securitization has happened in Norwegian energy policy to the extent that energy security as a term has become part of the vocabulary in Norway, which it wasn’t before. Further support for some degree of securitization are the exceptional measures taken during 2022–2023 as part of Norway’s energy policy: the more visible military presence safeguarding the critical energy infrastructure and accelerated support for wind power. Some have remarked that higher fossil fuel prices are an additional incentive for the defence sector to implement energy-efficient measures:

It’s definitely been more securitized on [the] political level, and after the explosion of the Nord Stream 1, there [have] been measures and increased attention of the need to make sure that you have both physical and also technical security around the energy grid.

Yet these measures and changes in rhetoric would not be sufficient to meet the security studies’ definition of securitization.

7.6 Concluding Remarks

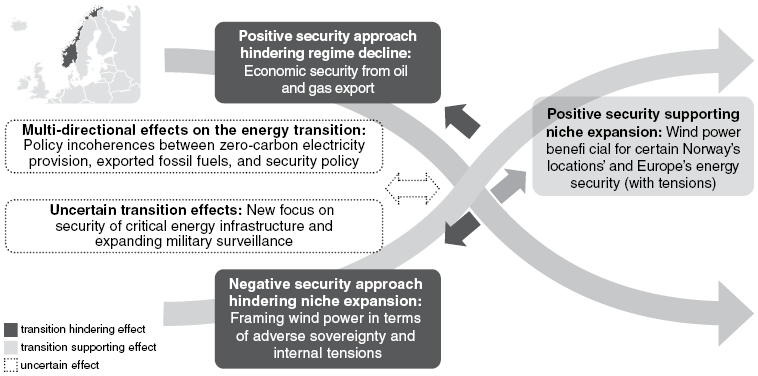

Norway presents as a very different country case study compared to Estonia and Finland in the previous chapters. In sustainability transition terms, one can say that regime stabilization of the oil and gas sector is taking place instead of regime destabilization. Wind power niche expansion has been rather modest and contentious, especially since 2019, although it has been gaining new traction since 2022. Moreover, energy security only appeared in the vocabulary after 2022.

The importance of the exporting hydrocarbon sector for the Norwegian economy can be framed both in terms of positive and negative security. There is much long-term positive security associated with oil and gas via the revenues generated, which have been used to improve the social security and living standards of Norwegian residents. This has enabled a sense of “freedom from insecurity” and community in Norway (cf. Booth, Reference Booth2007). In addition, there is negative security associated with possible future regime decline, whereby Norway would lose the economic and geopolitical security its fossil fuel reserves offer. The petroleum sector export and revenue have given Norway more geopolitical power and leverage than a country this size would otherwise have and losing this leverage might be seen as a kind of a security threat. Nevertheless, there is also implicit negative security associated with the continuation and further development of the fossil fuel regime. As the negative and disruptive impacts of climate change via adverse weather events and melting permafrost become increasingly evident, this sector – supplying circa 3 percent of world’s oil supply – contributes to increasing climate security risks in the future.

Expectations for future development are divided – or perhaps held together by dissonance – around the continuation of the fossil fuel regime and the partial switch of the electricity regime to wind power, although the latter has been much weaker than the former (see Figure 7.5). Explicit interconnections between energy transitions and security questions were missing before 2022 – this interface was exemplified mostly by incoherent policymaking and a lack of policy coordination mechanisms. There has been a marginal debate whereby some actors have associated negative security, via adverse sovereignty, with the sustainable energy transition (Hansen and Moe, Reference Hansen and Moe2022). This is linked to resistance to the transition, based on opposition to wind power and partly on higher electricity prices due to international electricity interconnections. This has seen aggressive use of language yet, so far, few physical security implications. Nevertheless, one could argue that the negative and polarized discourse reduces the overall positive security of Norwegian society.

Figure 7.5 Key energy security aspects and their transition impacts in Norway, 2006–2023.

Finally, a clear repoliticization of Norwegian energy policy took place in 2022, which also has dealt with these questions of energy sovereignty and energy security that have become part of Norway’s energy policy vocabulary. A strong degree of securitization is not evident, but there have been breaks from previous energy political practices – evidenced by new support for offshore wind power and visible military protection of critical energy infrastructure.