3.1 Introduction

Much of the world’s private sector receives support, interventions and subsidies from the public sector. In the case of energy subsidies (including those for fossil fuels), their use has been linked to energy security, domestic energy production and access to energy. In recent years, however, the heavy economic, social and environmental costs of subsidies for fossil fuels and the development of other means to achieve the same objectives have led to demands for their removal. High-level commitments to phase out fossil fuel subsidies have been made by the Group of 7 (G7), Group of 20 (G20), Asia-Pacific Economic Cooperation (APEC), North American Leaders’ Summit and EU countries, as well as in international agreements such as the United Nations Sustainable Development Goals (APEC 2009; European Commission 2011; United Nations 2015; G20 2016; G7 2017).

To increase understanding of the rationale and potential for phasing out fossil fuel subsidies, this chapter first outlines evidence of their economic, social and environmental costs, as well as the benefits of and opportunities for reform. It then synthesises lessons from the literature and from case studies on several countries that have made progress in phasing out subsidies before setting out the key ingredients for successful reform.

3.2 Economic, Social and Environmental Consequences of Fossil Fuel Subsidies

There are often valid public policy objectives for fossil fuel subsidies, including improved energy security, domestic energy services and access to energy. Production subsidies, for example, may temporarily sustain jobs in the oil and gas sectors, and consumption subsidies may help to improve access to (affordable) energy. The short-term benefits of subsidy reform may not be distributed evenly and depend on the approach and complementary measures adopted (see Section 3.3).

Nonetheless, evidence demonstrates that the costs of subsidies far outweigh their benefits and that less costly alternatives can achieve the same policy objectives (UNEP 2015). The interconnected economic, social, public health and environmental costs of fossil fuel subsidies are discussed in the following sections.

3.2.1 Macroeconomic and Fiscal Consequences

Fossil fuel subsidies place a burden on government budgets (and on wider trade flows and exchange rates), a burden that increases when international fuel prices rise and governments must offset a portion of that rise. Consumption subsidies lead directly to greater domestic demand for energy products that must be imported or that could be exported, reducing revenue and worsening the trade balance (IEA et al. 2010).

Governments often use under-pricing of energy inputs to support production across sectors or firms (IEA 2014). The purpose is often to promote economic development by giving domestic energy-intensive industries or energy producers an advantage and to increase the competitiveness of export-oriented firms (IEA 2014). These subsidies may, however, result in inefficient allocation of resources across the economy by undermining efficiency and encouraging over-consumption.

Countries where energy prices are lower than the cost of its production are characterised by very high consumption per capita and low energy efficiency. Venezuela, for example, has some of the world’s highest fossil fuel subsidies, and its petrol consumption per capita is 40 per cent higher than in any other Latin American country and more than three times the regional average (UNEP 2015). The impact of such inefficient use of resources by key industries and energy production goes beyond Venezuela, as its highly subsidised oil is distributed internationally via the black market or government deals with selected allies (Hou et al. Reference Hou, Keane, Kennan and te Velde2015). Furthermore, every subsidised barrel sold domestically at a subsidised price cannot be exported at the international market price for hard currency.

Similarly, subsidies for fossil fuel production can promote consumption of one type of fuel by reducing input costs for energy service providers (see also Chapter 2). Such policies were often applied to the coal used to produce electricity in Eastern and Central Europe and still apply in many countries, including China and India (IEA et al. 2010). Subsidies to inputs for electricity production, for example, can create a vicious cycle by artificially lowering costs and discouraging investment in efficiency, maintenance and increased supply (IEA 2014). Such under-investment reduces the ability of companies to invest in meeting growing demand, especially by potential consumers who lack access to energy.

3.2.2 Social Consequences

Consumer subsidies are justified as a way to help poor households obtain access to energy. There is evidence, however, that fossil fuel subsidies are regressive, with their benefits accruing mainly to middle- and higher-income groups, while their costs are borne by the whole population (IEA 1999). A review by the International Monetary Fund (IMF) of subsidies in developing countries found that only 7 per cent of the benefits accruing from fossil fuel subsidies reached the poorest 20 per cent and that subsidies for gasoline (petrol) and liquefied petroleum gas (LPG) are particularly regressive (Figure 3.1).

Figure 3.1 The wealthy benefit most from fossil fuel subsidies in developing countries

Fossil fuel subsidies often exacerbate inequalities, particularly in countries where most people lack access to electricity or commercial fuels and rely on biomass collected in rural areas or purchased at an unsubsidised cost in urban areas. These people do not share the benefits of lower prices for commercial energy, as subsidies tend to go to large, capital-intensive projects or to wealthier users, sometimes at the expense of support to smaller-scale biomass-based energy (van der Burg and Whitley Reference van der Burg and Whitley2016).

Subsidies may also prevent the poorest people from accessing energy. Where electricity production is based on fossil fuels, subsidies can create a disincentive to invest in the power sector because without this support the sector is unable to recover the full costs of production. On average, electricity tariffs in sub-Saharan Africa cover only 70 per cent of the cost of power production (Alleyne et al. Reference Alleyne, Josz and Singh2014), and such under-investment in the power sector contributes to poor access, transmission and distribution losses and persistent shortages (Alleyne et al. Reference Alleyne, Josz and Singh2014).

Subsidies also make households less likely to invest in energy-efficient equipment and appliances; when a fuel is subsidised, there is little savings incentive to buying more energy-efficient devices. The higher the rate of fuel or electricity subsidy, the longer the payback period for household investment in energy efficiency and the lower the likelihood of households making such investments (IEA 2014).

Energy subsidies often start as temporary income buffers. According to many governments, they aim to protect populations from international price hikes (Clements et al. Reference Clements, Coady and Fabrizio2013). In fact, governments may be less concerned about fluctuating energy prices than about resulting fluctuations in income (potential consumption) and its distribution. Since fossil fuel subsidies can aggravate inequality and undermine the capacity of the poorest to access energy, they may do more harm than good in protecting populations from volatile energy prices.

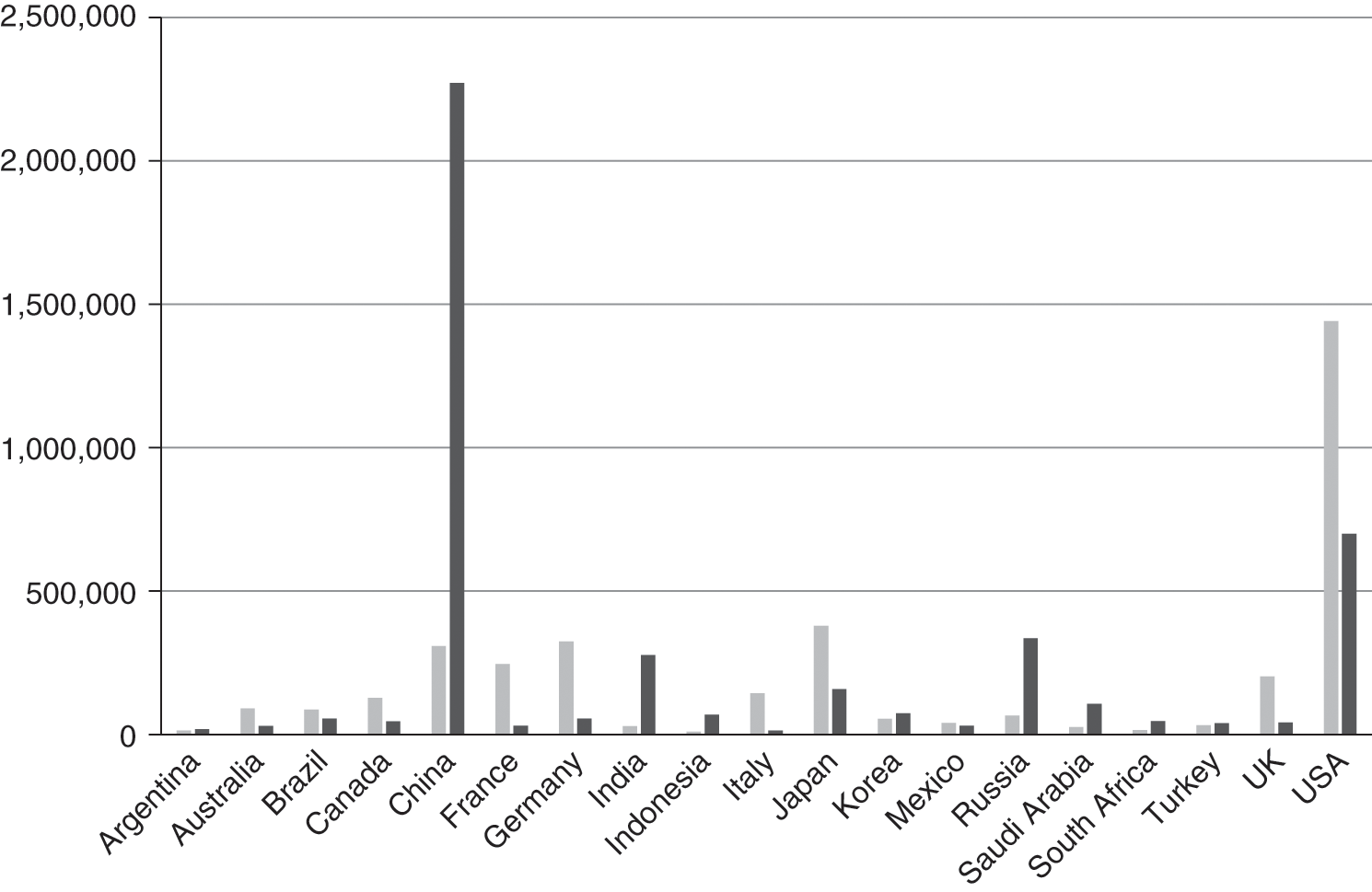

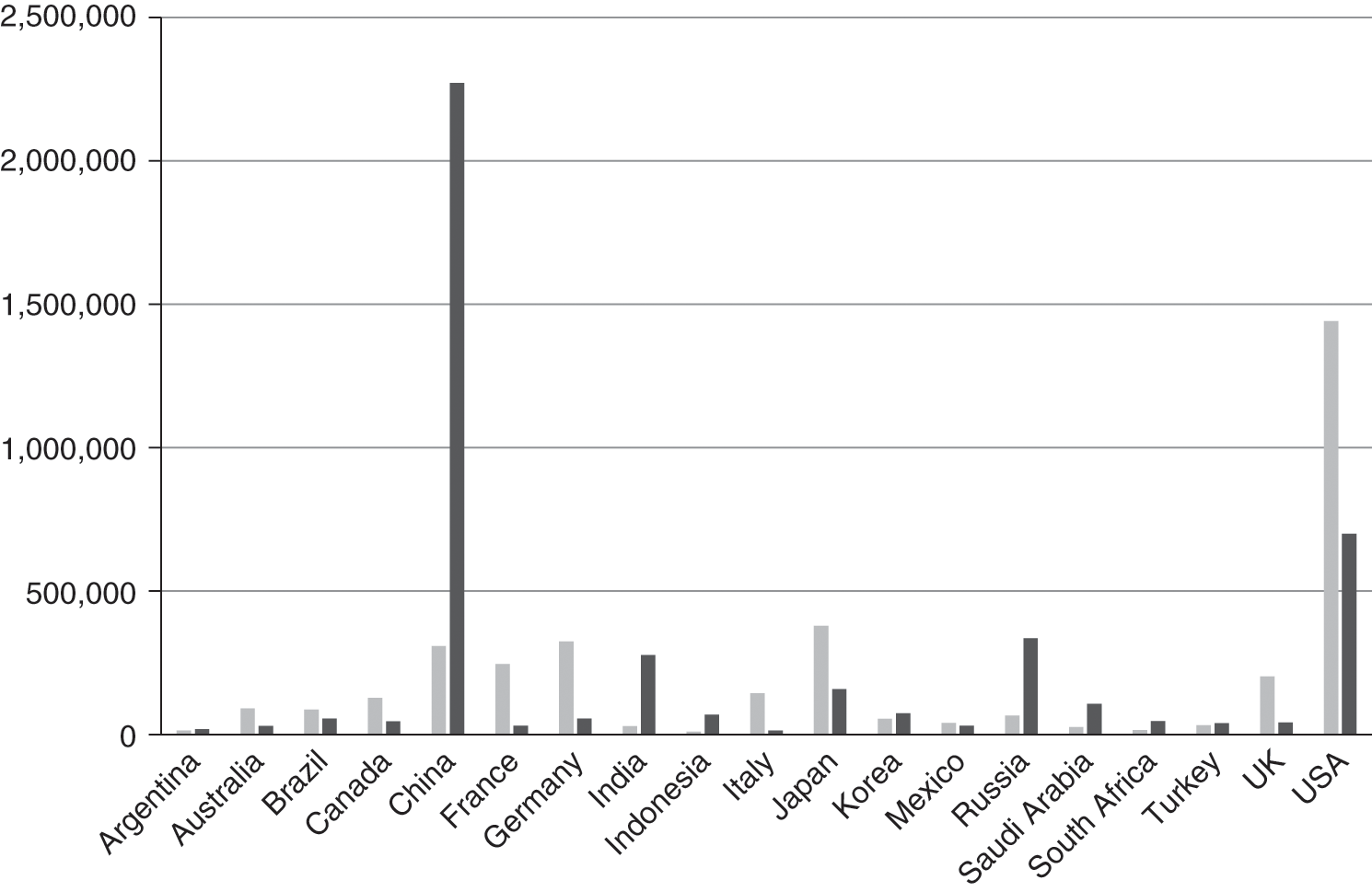

A significant proportion of spending on fossil fuel subsidies could be redirected to national economic or social development goals, such as improving health services and education, and financing the development of low-carbon infrastructure (Koplow Reference Koplow, Halff, Sovacool and Rozhon2014; van der Burg and Whitley Reference van der Burg and Whitley2016). In several countries, the levels of fossil fuel subsidies may be equivalent to, or exceed, expenditure on health (Figure 3.2). Many aid-recipient countries also subsidise fossil fuels at levels that exceed the official development assistance they receive (Whitley and van der Burg Reference Whitley and van der Burg2015).

3.2.3 Public Health Consequences

In many countries, the pollution caused by combustion of fossil fuels is a major public health problem (IEA 1999). Estimates suggest that air pollution resulting from the combustion of fossil fuels and biomass caused 3.7 million premature deaths worldwide in 2012 (Parry Reference Parry2014). The health hazards are borne disproportionally by people who cannot avoid heavily congested and polluted urban areas (IEA 1999).

An analysis of countries of the Organisation for Economic Co-operation and Development (OECD) found that the cost of mortality due to air pollution was USD 1.6 trillion in 2010, with almost USD 1 trillion attributable to road transport (OECD 2014). Most of these costs stem from the combustion of fossil fuels (Gorham Reference Gorham2002), of which a large proportion is subsidised (Ross et al. Reference Ross, Hazlett and Mahdavi2017).

The IMF has found that phasing out fossil fuel subsidies would reduce emissions of sulphur dioxides, nitrogen oxides and particulate matter, which are not only public health hazards but also cause damage to infrastructure and environmental problems such as acid rain. A combination of subsidy reform and corrective taxes on fossil fuels could result in a 23 per cent reduction in these emissions and a 63 per cent decrease in deaths worldwide from outdoor fossil fuel air pollution (Parry et al. Reference Parry, Heine, Lis and Li2014).

3.2.4 Environmental Consequences

Fossil fuel subsidies have a climate impact. Nonetheless, governments are subsidising the production and consumption of carbon-intensive fossil fuels rather than increasing the cost of fuel and activities that produce greenhouse gas emissions. The International Energy Agency (IEA), based on their estimates of fossil fuel consumption subsidies in 40 countries, found that 13 per cent of global energy-related carbon dioxide emissions receive an incentive of USD 115 per tonne through subsidies and that only 11 per cent of energy-related emissions are subject to a carbon price (on average USD 7 per tonne) (IEA 2015). These subsidies undermine the Paris Agreement, which aims to limit the global average temperature increase to well below 2°C. Analysis shows that one-third of oil reserves, half of gas reserves and more than 80 per cent of current coal reserves should remain unused from 2010 to 2050 to meet the 2°C goal (McGlade and Ekins Reference McGlade and Ekins2015).

If governments removed current subsidies for exploration and production, the economics of many fossil fuel exploration and production projects could shift. The Stockholm Environment Institute found that at recent oil prices of USD 50 per barrel, subsidies are needed to make nearly half of yet-to-be-developed oil fields profitable in the United States (Erickson et al. Reference Erickson, Down, Lazarus and Koplow2017). Existing subsidies for coal and gas production may also lock in high-emission sources of electricity generation by increasing investment in those activities (IEA 2013; Erickson Reference Erickson2015).

Subsidising fossil fuels also has an impact on the global goal of transitioning to more diverse low-carbon energy systems. Subsidies can hinder investment in renewables and energy efficiency, perpetuating dependence on fossil fuels (Bridle and Kitson Reference Bridle and Kitson2014). Slow adoption of renewables also reduces the pace of their development and of cost reduction as technologies mature. Put simply, the more a government subsidises fossil fuels, the more it should subsidise renewables if it wants to achieve a level playing field.

The impact of fossil fuel subsidies on investment in renewables is striking in the Middle East, where more than 33 per cent of the region’s electricity is generated by oil (Bridle et al. Reference Bridle, Kitson and Wooders2014). Both oil and natural gas are heavily subsidised, with oil subsidies holding electricity generation costs at around 30 per cent of the level they would be if full reference prices were paid, while gas subsidies reduce costs to around 45 per cent of the unsubsidised level. As a result, low-carbon power technologies struggle to compete against existing or new capacity (IEA 2014). Fossil fuel subsidies for consumers also undermine the development and commercialisation of new technologies that might become more economically (and environmentally) attractive.

3.3 The Benefits of, and Potential for, Fossil Fuel Subsidy Reform

The consequences of fossil fuel subsidies could be reversed by reforming these subsidies. A review of studies on the economic impact of reforming subsidies for the consumption of fossil fuels suggests that phasing them out would increase global real income or gross domestic product (GDP) by up to 0.7 per cent per year to 2050 (Ellis Reference Ellis2010). This benefit would not be spread equally, however, as fossil fuel importers would see rising GDP while producers would lose income. Given uncertainties about the exact impact of subsidy removal, these are only rough estimates, but they illustrate what is at stake.

The reform of fossil fuel subsidies could also generate health and environmental benefits. Several international organisations analysed data on fossil fuel consumption subsidies in developing countries and estimated that phasing out the subsidies between 2011 and 2020 would lower emissions of air pollutants that are harmful to public health and the environment (IEA et al. 2010). Limited evidence also suggests that the economic, social and environmental benefits of fossil fuel subsidy reform would exceed the transitional costs of such reform (Burniaux et al. Reference Burniaux, Château and Sauvage2011).

The Global Subsidies Initiative has found that removing fossil fuel consumption subsidies in 20 countries between 2017 and 2020 could reduce average national emissions by approximately 11 per cent (Merrill et al. Reference Merill, Bassi, Bridle and Christensen2015; see Chapter 8). Data for the G20 countries suggest that parallel emissions savings from the removal of subsidies for fossil fuel production could be roughly equivalent to eliminating all emissions from the aviation sector (Gerasimchuk et al. Reference Gerasimchuk, Bassi and Dominguez Ordonez2017).

Despite clear evidence of the costs of fossil fuel subsidies and the potential virtuous cycles that could result from their removal, governments are often reluctant to reform for several reasons (Whitley Reference Whitley2013; see Chapter 1). Some are explicit (or more openly discussed), such as a lack of information, whereas others are implicit and include the influence of special interests. Governments sometimes subsidise fossil fuels because they lack other effective means and institutional capacity to adopt more suitable policies (Victor Reference Victor2009). Taken together, these barriers to reform create inertia around subsidies, even in the context of new technological, economic and social developments (OECD 2007).

Despite the challenges of reform, several countries have made progress in reforming subsidies for fossil fuels across a number of sectors. Egypt, for example, raised fuel prices by 78 per cent in 2014 and will double electricity prices over the next five years (see Chapter 15); Indonesia raised petrol and diesel prices by an average of 33 per cent in 2013 and by another 34 per cent in 2014 (see Chapter 11) and India eliminated liquefied petroleum gas subsidies in 2014 (see Chapter 12).

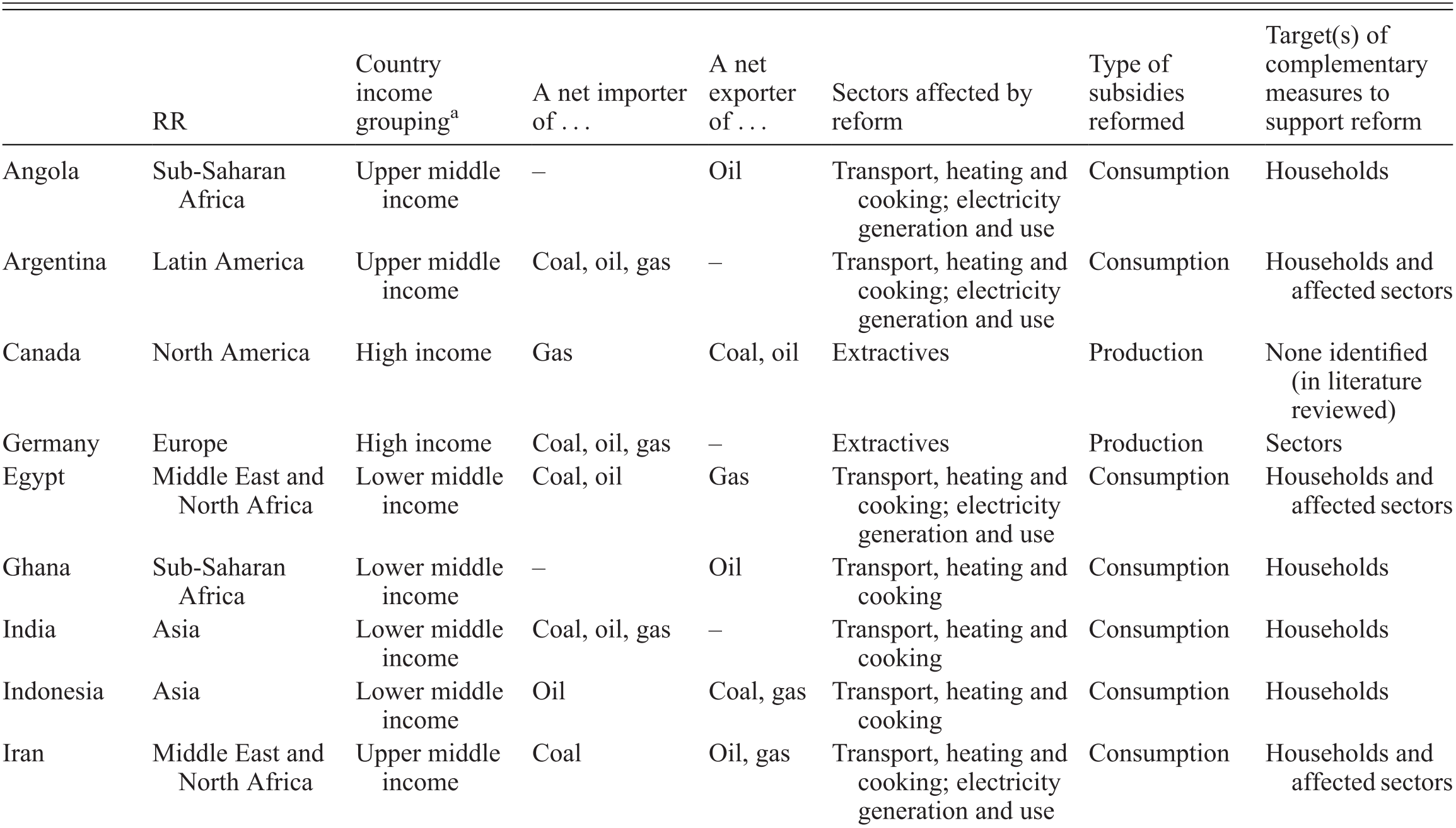

Based on the work of the IMF, World Bank and other international organisations, Table 3.1 summarises important fossil fuel subsidy reforms across a range of countries and sectors, highlighting drivers that are relevant to different national contexts.

Table 3.1 Summary of case studies of fossil fuel subsidy reform

| RR | Country income groupinga | A net importer of … | A net exporter of … | Sectors affected by reform | Type of subsidies reformed | Target(s) of complementary measures to support reform | |

|---|---|---|---|---|---|---|---|

| Angola | Sub-Saharan Africa | Upper middle income | – | Oil | Transport, heating and cooking; electricity generation and use | Consumption | Households |

| Argentina | Latin America | Upper middle income | Coal, oil, gas | – | Transport, heating and cooking; electricity generation and use | Consumption | Households and affected sectors |

| Canada | North America | High income | Gas | Coal, oil | Extractives | Production | None identified (in literature reviewed) |

| Germany | Europe | High income | Coal, oil, gas | – | Extractives | Production | Sectors |

| Egypt | Middle East and North Africa | Lower middle income | Coal, oil | Gas | Transport, heating and cooking; electricity generation and use | Consumption | Households and affected sectors |

| Ghana | Sub-Saharan Africa | Lower middle income | – | Oil | Transport, heating and cooking | Consumption | Households |

| India | Asia | Lower middle income | Coal, oil, gas | – | Transport, heating and cooking | Consumption | Households |

| Indonesia | Asia | Lower middle income | Oil | Coal, gas | Transport, heating and cooking | Consumption | Households |

| Iran | Middle East and North Africa | Upper middle income | Coal | Oil, gas | Transport, heating and cooking; electricity generation and use | Consumption | Households and affected sectors |

| Mexico | Latin America | Upper middle income | Coal, gas | Oil | Transport, heating and cooking; electricity generation and use | Consumption | Affected sectors |

| Nigeria | Sub-Saharan Africa | Lower middle income | – | Oil, gas | Transport, heating and cooking; electricity generation and use | Consumption | Households and affected sectors |

| Peru | Latin America | Upper middle income | Coal, oil | Gas | Transport, heating and cooking; electricity generation and use | Consumption | None identified |

| Tunisia | Middle East and North Africa | Upper middle income | Oil, gas | – | Transport, heating and cooking; electricity generation and use | Consumption | Households |

| Turkey | Europe | Upper middle income | Coal, oil, gas | – | Transport, heating and cooking; electricity generation and use | Consumption | Households and affected sectors |

| United Arab Emirates | Middle East and North Africa | High income | Coal, gas | Oil | Transport, heating and cooking; electricity generation and use | Consumption | None identified |

a According to World Bank country and lending groups classification (World Bank 2017).

3.4 Key Principles for Fossil Fuel Subsidy Reform

A growing body of policy recommendations based on past experiences highlights different important factors for robust subsidy reform (across all sectors). While there is no single recipe for success, the prospects for sustained reforms can be enhanced by adherence to basic principles and by recognising national circumstances and changing regional and international market conditions.

Because subsidies are mainly provided at the national and sub-national levels, reform guidance must be country or context specific. Specific elements of a subsidy reform process contribute to its effectiveness and sustainability, as observed during the subsidy reform in some countries and as outlined in policy recommendations from international organisations and non-governmental organisations (NGOs) such as the Global Subsidies Initiative. These elements are a ‘whole-of-government’ approach, research and analysis, consultation and communication, mobilising resources, complementary measures (for sectors and households), phasing in and linking to wider reform processes.

3.4.1 Whole-of-Government Approach

Efforts to reform fossil fuel subsidies might, at first glance, seem relevant to only one subsector and one energy department or ministry. However, the importance of energy for the economy and the impact of subsidies on wider economic, environmental and social objectives justify a whole-of-government approach. The OECD has also found that individual government ministries lack access to the tools required to mitigate the impacts of higher energy prices, support economic diversification or convene reform processes (OECD 2007). Thus, coalitions that include key ministries and agencies at the national and sub-national levels are more likely to succeed (see also Chapter 12).

Such processes are also needed to bring together the many relevant agencies and to avoid sending conflicting signals to the public and businesses (Vis-Dunbar Reference Vis-Dunbar2014). In the Dominican Republic and Honduras, for example, joint action by public actors across the government, rather than just one or two ministries, was seen as essential for creating broad political ownership of reform (Gamez Reference Gamez2014; Toft Reference Toft2015).

3.4.2 Research and Analysis

Governments and other stakeholders should conduct research and analysis before, during and after subsidy reform. The resulting findings should inform communication and consultation processes and provide evidence to support cross-government collaboration and resource mobilisation. Several contributions to this book (e.g. Chapters 2, 11, 13, 15 and 16) point to awareness of fossil fuels being subsidised as a key factor influencing whether fossil fuel subsidies can be successfully reformed. In many cases, the selection of who should complete this research and analysis, and how, may be as important as the resulting analysis. For example, a supportive review of subsidy reform written by a member of the industry benefiting from the subsidy – and in consultation with relevant stakeholders – may be more influential than a report by an academic institution or government body (OECD 2007).

The process of data collection needs to recognise the limits to the scale of analysis that can be undertaken and implemented, that hard evidence alone is not sufficient to enable and sustain reform and that some information collected can also be used to support reforms for carbon pricing (OECD 2007).

3.4.3 Consultation Before, During and After Reform

Any subsidy reform process must be supported by transparent and extensive communication and consultation with stakeholders, including the general public. There is strong evidence on the need for clear and honest messages on the scale of subsidies, their costs and impacts, the plans for reform and any complementary measures (Clements et al. Reference Clements, Coady and Fabrizio2013; IEA 2014). Both consultation and communication are critical to dispel myths about subsidies, correct information asymmetries, build coalitions for reform, improve participation in collective efforts and get the support of those resistant to change (OECD 2007; Aldahdah Reference Al-Dahdah2014; see also Chapter 15).

Broad stakeholder consultation and engagement are important for durable reform and to ensure that reforms are perceived as fair and legitimate reflections of citizens’ preferences (IEA 1999; OECD 2006, 2007). Alliance building may mean engaging unlikely allies, such as well-performing segments of sectors or regions, to offset those lobbying against reforms (OECD 2006).

Stakeholder groups are diverse and go beyond government officials to include industry associations, companies, trade unions, consumers, political activists and civil society organisations. All must be involved if subsidies are to be eliminated. Reform efforts may originate from, or can be supported by, international organisations and civil society organisations, which can increase interest and participation in reform processes (OECD 2006; see also Chapters 6 and 10).

Communication about subsidies and reforms should be tailored to different audiences and use a range of channels, such as television, radio, digital media, direct engagement and print. Malaysia’s reform processes, for example, included a public forum on fossil fuel subsidies, a public survey on whether and when subsidies should be reduced, YouTube videos on the country’s fuel subsidies, a Twitter account for announcements and answering questions from the public and the engagement of public figures to write about the issue in the media (Vis-Dunbar Reference Vis-Dunbar2014; Fay et al. Reference Fay, Hallegatte and Vogt-Schilb2015). Reform processes in Indonesia included text messages explaining the new subsidy policy, and in the Philippines reform efforts included a nationwide roadshow.

Civil society organisations can play an important role here. For example, the Global Subsidies Initiative has supported subsidy reform efforts in Bangladesh, India, Indonesia and Nigeria by publishing citizens’ guides to fossil fuel subsidies, written in accessible language to increase public understanding (e.g. IISD 2012; see also Chapter 10).

It is also essential to develop metrics to measure the overall impact of media and communications outreach. Surveys and polls provide insights into current habits, and follow-up surveys reveal whether these have changed (Vis-Dunbar Reference Vis-Dunbar2014). Such surveys can also be paired with wider government efforts to monitor the impacts of subsidy reform, aiming to support sustainability, so that policies are not reversed and subsidies are not re-introduced (Whitley and van der Burg Reference Whitley and van der Burg2015; van der Burg and Whitley Reference van der Burg and Whitley2016). The aim should be to demonstrate the progress made towards the desired goals of subsidy reform and to monitor and disseminate information on the use of the fiscal space created by reforms. Surveys should also offer transparent and up-to-date information on the costs of any remaining subsidies.

3.4.4 Mobilising Resources Before and During Reform

While subsidy reform can generate fiscal space and additional government revenue that far exceeds upfront costs, these positive impacts on government budgets are felt only after reforms have been implemented (Koplow Reference Koplow, Halff, Sovacool and Rozhon2014). As a result, most governments need to mobilise resources – both domestically and internationally – before reform to support the elements necessary for a robust reform process (see Chapters 6 and 12). This is crucial to cover the costs of analysis, communication, consultation, complementary measures and institutional reforms that are needed before wider subsidy reform processes. Recent reforms in Indonesia illustrate the need for upfront finance; it used the 2014 state budget to fund its reform process, reserving the savings from reform for later complementary measures (Lontoh Reference Lontoh2015).

3.4.5 Complementary Measures

Although the benefits of fossil fuel subsidies accrue mostly to the wealthy, the adverse impact of subsidy removal can fall disproportionately on the poor. Income groups differ greatly in their energy consumption patterns, and the distributional impact of subsidies – or their removal – is not the same for all types of fuel and electricity. On average, poorer households (particularly in urban areas) spend a higher proportion of their energy budget on fuel, particularly for cooking, and less on electricity and private transport (IEA et al. 2010).

As a result, the poor are affected directly by the rising prices that result from subsidy reform and indirectly through the increased cost of transport and food (IEA et al. 2010). The implementation of measures to mitigate these likely negative impacts increases the likelihood of successful fossil fuel subsidy reform. In several countries, poor households may represent a large proportion of the population, and a key element of successful reform is the efficient and visible reallocation of resources to those most affected (Clements et al. Reference Clements, Coady and Fabrizio2013).

Complementary measures (including new subsidies) can be developed through resources mobilised before reforms and resources saved or generated by removing fossil fuel subsidies. The efficient use of these resources as part of well-designed and clearly communicated complementary measures increases the likelihood that reform processes will be successful and sustained. However, economies evolve constantly, and it is impossible to safeguard all parts of society from all negative consequences (OECD 2007).

The following sections provide specific guidance for complementary measures directed towards sectors and households affected by fossil fuel subsidy reform. While any given measure may target one affected group, the benefits will spill over to others; for instance, job creation supports sectors as much as households.

3.4.5.1 Sectors, Industries and Firms

Fossil fuel subsidies often become embedded in the operations of sectors, industries and firms, which may engage in coalitions opposed to, or in favour of, subsidy reform (see Chapter 1). As a result, any reform process can gain political support only if it is designed to allow these groups to adapt to new economic circumstances. While support is required for the growth of new sectors, the rapid economic transition needed for decarbonisation requires active government policies to smooth the decline of old sectors (Fay et al. Reference Fay, Hallegatte and Vogt-Schilb2015).

These measures can include incentives to diversify the regional economic base, infrastructure development, assistance with business restructuring and adoption of alternative technologies, initiatives for retraining and relocation, unemployment insurance and support for early retirement (OECD 2007). If these can be developed through existing social security systems, it can reduce costs and simplify administration. When this is not possible, the development of new institutions and systems may be required and could be linked to support at the household level (OECD 2007).

Reforms to coal subsidies in several European countries show how governments have provided complementary measures for a specific industry. Reforms of coal subsidies in Germany and Poland were accompanied by support for regional economic development and social assistance related to the closure of mines. Poland also offered generous severance packages for affected workers (IEA et al. 2010). Reforms to the United Kingdom’s coal mining industry were initially imposed without such measures, leading to high unemployment and poor health in the affected regions and to significant protests. In 2000, the UK government began to provide financial support to help the coal industry develop viable investment projects, to provide employment opportunities in disadvantaged areas and to enable the development of alternative economic opportunities in (former) coal mining areas (IEA et al. 2010). These programmes create new subsidies for specific sectors, but it is advisable for governments to focus resources on strengthening and enhancing economy-wide social protection measures that support all workers affected by economic transitions.

Where the quality of energy services, infrastructure or public transport is low, engaging in broader reforms to improve services before reforming energy subsidies can make tariff increases more acceptable (Vagliasindi Reference Vagliasindi2014). While Indonesia’s fossil fuel subsidy reform programme did not make such improvements in advance, the fiscal space created through reform aims to enable funding for infrastructure improvements, largely by increasing contributions to state-owned enterprises in the construction and transport sectors (Lontoh Reference Lontoh2015; see Chapter 11). When complementary measures support emerging industries, firms and infrastructure, they should favour those which contribute to a more energy-efficient, lower-carbon economy (Fay et al. Reference Fay, Hallegatte and Vogt-Schilb2015). In implementing its fossil fuel subsidy reform, Iran made funds available to industry for investment in energy efficiency (Guillaume et al. Reference Guillaume, Zytek and Reza Farzin2011).

3.4.5.2 Households and Individuals

In addition to support for sectors, industries and firms, subsidy reform should be accompanied by programmes at the household level to improve equity and protect the poorest (OECD 2007). Such programmes are known as ‘social safety nets’ or ‘social-assistance transfers’. They include direct transfers (cash benefits or near-cash transfers) and indirect transfers (fee waivers) to help households maintain access to essential services, including health, education and public transport (IEA et al. 2010).

Some reforms have been used to create entirely new social programmes, serving as an impetus for wider social reforms. Others, as in India, have modernised existing social programmes to facilitate subsidy reforms (Fay et al. Reference Fay, Hallegatte and Vogt-Schilb2015; see Chapter 12). Strong social protection systems can protect households and individuals against economic hardship, regardless of its origin (OECD 2006).

Such social safety nets can be developed before reforms through resources already mobilised (either domestically or internationally) or through revenues and savings from subsidy reform. The fiscal space created by reform can reduce wider costs to individuals by cutting payroll taxes, increasing personal income tax thresholds and providing tax credits for low-paying jobs. Governments can also use revenues saved through subsidy reform to increase spending on other priorities, including health and education (van der Burg and Whitley Reference van der Burg and Whitley2016). Together these are more efficient instruments for achieving distributional objectives than holding energy prices below levels warranted by their market, social and environmental costs (Fay et al. Reference Fay, Hallegatte and Vogt-Schilb2015).

Studies show that by alleviating the impact on the poor and middle classes, policymakers make successful subsidy reform more likely. In the Middle East and North Africa, ‘of the cases where cash and in-kind transfers were introduced, 100 percent were associated with a successful outcome, while only 17 percent of the cases where these transfers were not introduced resulted in a successful reform’ (Fay et al. Reference Fay, Hallegatte and Vogt-Schilb2015: 142; see also Sdralevich et al. Reference Sdralevich, Sab, Zouhar and Albertin2014).

Many reform experiences show the importance of direct and indirect support measures for households and individuals. India piloted a cash transfer to replace liquefied petroleum gas subsidies in 2014, linked to biometric identifier cards (see Chapter 12). Indonesia introduced programmes to mitigate the effect of higher energy prices through free healthcare, cash assistance to poor students and a one-year conditional cash-transfer scheme for poor households with pregnant women or school-age children. Iran implemented a quasi-universal cash transfer (approximately USD 45 per month per capita) when it reformed its energy subsidies. Ghana’s reforms included expanded primary healthcare, large-scale distribution of efficient light bulbs, public transport improvements and elimination of fees at state schools (Laan et al. Reference Laan, Beaton and Presta2010; Clements et al. Reference Clements, Coady and Fabrizio2013; Vagliasindi Reference Vagliasindi2013; Perdana Reference Perdana2014; Fay et al. Reference Fay, Hallegatte and Vogt-Schilb2015).

3.4.6 Careful Timing and Linking to Wider Reform

The rate at which OECD countries succeeded in phasing out coal subsidies varied considerably. Belgium, the Netherlands and the United Kingdom closed their mines in a short period of time, with social assistance and job training for unemployed coal miners provided in some cases. In Germany and Spain, the process has been slower; Germany phased out subsidies for hard coal production over 11 years (to 2018). Developing countries also present mixed evidence, with Jordan phasing out its fuel subsidies over a four-year period (IEA et al. 2010).

Sequencing is also important. Taking into account competitiveness, it may be easier to start with performance standards or fiscal incentives for low-carbon investments. These redirect new investments towards more efficient technologies and production capacity, progressively making the economic system more efficient and competitive with less distorted energy prices (Rozenberg et al. Reference Rozenberg, Vogt-Schilb and Hallegatte2014; Fay et al. Reference Fay, Hallegatte and Vogt-Schilb2015). To mitigate the impact of reform on the poorest, subsidies could first be reduced on goods consumed by wealthier segments of the population (such as petrol), before they are reduced on goods consumed by lower-income groups (such as diesel and kerosene) (Gamez Reference Gamez2014; Fay et al. Reference Fay, Hallegatte and Vogt-Schilb2015). Countries that have phased in reforms by fuel type include Angola, India and Peru (Whitley and van der Burg Reference Whitley and van der Burg2015).

Finally, fossil fuel subsidy reforms are more likely to be accepted if they are part of broader sector- or economy-wide reforms (IEA et al. 2010). The reduction of subsidies can be packaged with other policy changes or combined with reforms to the regulatory environment governing an industry to ease the adjustment process (OECD 2007). Case studies show that the larger the reform effort, the easier it is to achieve subsector reform efforts and that subsidy reform is often undertaken alongside wider changes in policies, pricing and programmes (OECD 2006), in this way using windows of opportunity (see Chapter 1). In Germany, for example, the process of reforming the coal subsector has been part of a broader process of energy sector reform (IEA et al. 2010). In addition, it is recommended that fossil fuel subsidy reform be undertaken as the first step in introducing or increasing carbon pricing (Fay et al. Reference Fay, Hallegatte and Vogt-Schilb2015).

3.5 Conclusion

Fossil fuel subsidies can inhibit sustainable economic development by creating a burden on government budgets, using resources that could be put to more efficient use within the economy, discouraging investment in renewable energy and energy efficiency, increasing the risk of stranded assets (in the event of climate change regulation), damaging public health by increasing air pollution and undermining carbon price signals.

Despite the challenges associated with reform, several countries have recently made significant progress in reforming subsidies for fossil fuels across a wide range of sectors. This chapter discussed several cases which, in conjunction with wider research on the processes of reforming subsidies, can help to identify the key ingredients for successful reform. These steps are very similar to those needed for any effective processes of policy change.

Although this chapter has highlighted the opportunities and processes for reforming fossil fuel subsidies at the national level, international cooperation is supporting national reform efforts in several ways. International efforts have identified and estimated the cost of subsidies, provided country-level support for reform processes and helped with coordination, lessons learned and advocacy.

The high-level commitments to reform made by the G7, G20, APEC and European countries, as well as key international agreements (see Chapter 5), present an opportunity for existing activities to be scaled up and for new efforts to be developed to (1) improve the availability of comparable information on fossil fuel subsidies, (2) increase technical and financial support for national reform efforts and (3) widen and strengthen countries’ commitments to reform.

Agencies such as the World Bank and bilateral donors are already providing resources and finance for complementary measures in developing countries, such as support for health services, education, social protection, energy-sector development and economic diversification. But it is seldom done in a way that links to subsidy reform processes. It is important to increase these resources and to foster linkages between existing support mechanisms and the processes and benefits of fossil fuel subsidy reform.