Climate finance is a hotly disputed topic, the contestation over what it means adding to the controversy. While the term is sometimes used to refer to all financial flows that influence climate mitigation or adaptation/resilience, in the context of this book, I focus on financial flows from developed to developing countries ‘whose expected effect is to reduce net greenhouse gas emissions and/or to enhance resilience to the impacts of climate variability and the projected climate change’ (Reference Gupta, Harnisch, Barua, Edenhofer, Pichs-Madruga and SokonaGupta et al., 2014, p. 1212). Thus, flows within countries, to developed countries and among developing countries are not included in the discussion. Yet, public climate finance, which unlike fossil fuel subsidy reform constitutes fiscal expenditure, is included.

Climate finance has been addressed within and outside the climate regime complex since the 1992 Rio Conference on Environment and Development. Simultaneously, increasing amounts (though small compared to estimated needs) of climate finance have been delivered from developed countries. The governance of climate finance straddles the international and the domestic levels, the latter including the developed countries which are supposed to deliver it and the developing countries in which it is spent. Furthermore, as an issue that involves both climate change and economic issues, it also straddles economic and environmental (as well as development) institutions and actors at both the international and domestic levels. The name highlights this duality: the purpose is to address climate change (an environmental issue), but the way of achieving this purpose is to use finance (an economic instrument). Hence, it is unsurprising that climate finance is the issue in the United Nations Framework Convention on Climate Change (UNFCCC) climate negotiations that finance ministries are most involved with (Reference SkovgaardSkovgaard, 2017b).

Although climate finance has been part of the climate regime complex since its inception (Pickering, Skovgaard, et al., 2015) in 1992, this book focuses on the discussions from the run-up to the 2009 Fifteenth Conference of the Parties to the UNFCCC (COP15) in Copenhagen to the 2015 Twenty-first Conference of the Parties in Paris. The UNFCCC, adopted at 1992 Rio Conference, stipulates how developed countries shall ‘provide new and additional financial resources’ to meet the ‘costs incurred by developing country Parties in complying with their obligations under the Convention’ (UNFCCC, 1992: 4(3)). It also requires that such finance shall be provided in accordance with the principle of ‘Common but Differentiated Responsibilities and Respective Capabilities’ (UNFCCC, 1992: 4(2)). A key dividing line in the negotiations and in the international debates about climate finance has been that between developed and developing countries. The UN Framework Convention on Climate Change’s Annex II stipulates which countries shall provide climate finance (essentially the countries which were OECD members in 1992), and within the UNFCCC negotiations these countries have been the ones defined as developed countries (UNFCCC, 1992). Developing countries are according to the Convention defined as non-Annex I countries; Annex I countries consisting of the Annex II countries plus economies in transition, i.e. post-communist countries.

The other Multilateral Environmental Agreements (MEAs) adopted in Rio (the Convention on Biological Diversity, the United Nations Convention to Combat Desertification) contain similar provisions, and in the decade following Rio, climate finance was mainly treated as a subtype of the ‘environmental finance’ provided under these MEAs (Reference Keohane and LevyKeohane and Levy, 1996). Actual climate finance flows remained modest during this period (Reference Michaelowa and MichaelowaMichaelowa and Michaelowa, 2011b). Yet, developing countries progressively raised climate finance as an issue in the UNFCCC negotiations, and development finance institutions including the multilateral development banks (MDBs) and the OECD Development Assistance Committee increasingly addressed the provision of climate finance. Within the UNFCCC, the culmination came with the adoption of the USD 100 billion target at the 2009 Fifteenth Conference of the Parties in Copenhagen to the UNFCCC (COP15). The USD 100 billion target is often described as one of the few successes of COP15 (Reference Gomez-EcheverriGomez-Echeverri, 2013). Developed countries committed to ‘mobilizing jointly USD 100 billion dollars a year by 2020 … from a wide variety of sources, public and private, bilateral and multilateral, including alternative sources of finance’ (UNFCCC, 1992: para 8). These provisions opened up for subsequent contestation regarding what sources should count towards the target and how (see Section 9.1). The Copenhagen Accord was also the first decision to mention the Green Climate FundFootnote 1, which was formally established the following year at the Sixteenth Conference of the Parties to the UNFCCC in Cancún (COP16).

Since 2009, climate finance flows have increased, although it is greatly disputed whether they are meeting the USD 100 billion target (OECD, 2019b; Reference Roberts and WeikmansRoberts and Weikmans, 2017). At the 2015 Twenty-first Conference of the Parties to the UNFCCC in Paris (COP21), the Parties agreed to set a new, higher collective financing goal before 2025 (UNFCCC 2015: para. 53) and did not solve the definitional issues. Subsequent negotiations have focused on what flows of finance should count towards the USD 100 billion target, scaling up climate finance both before and after 2020, the balance between mitigation and adaptation finance and the role of public and private finance. At the same time, most climate finance has flowed outside the UNFCCC and the other UN institutions in which developing countries yield significant influence (CPI, 2019). Rather, most of the flows have been determined by public and private actors in developed countries and by MDBs. A persistent feature of climate finance flows has been that mitigation receives the bulk of (particularly private but also public) finance and that – depending on the definition – private finance is several times larger than public (CPI, 2019).

This chapter proceeds with an outline of the cognitive debate regarding what kinds of financial flows can be defined as climate finance, followed by a discussion of the key normative issues of contestation in climate finance discussions. The following section focuses on equity versus efficiency regarding the generation and allocation of climate finance. Finally, the most important groups of actors (beyond the three international economic institutions) and their roles in climate finance are discussed.

9.1 What Financial Flows Constitute Climate Finance?

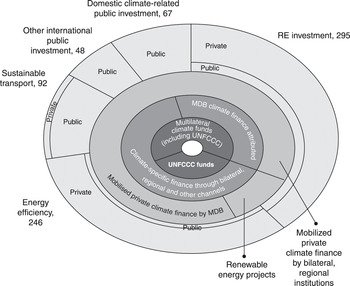

The framing of particular flows of finance as climate finance constitutes an important cognitive aspect of climate finance. While other cognitive aspects may also be relevant, the question of what flows of finance count as climate finance is the single most important question involving cognitive ideas and climate finance. This question has been strongly contested even before the USD 100 billion target, including whether and under which conditions private finance and development aidFootnote 2 can be considered climate finance. Defining the target as USD 100 billion mobilised by developed countries without specifying what ‘mobilised’ meant added to the uncertainty. To gain an understanding of the different kinds of finance that are sometimes framed as climate finance and sometimes not, the UNFCCC Standing Committee’s so-called ‘onion diagram’ is instructive (see Figure 9.1). This diagram places different kinds of climate finance in concentric circles: the more undisputed their character as climate finance is, the closer they are to the centre; the larger the flow, the larger the circle. At the very centre is the funding provided by designated multilateral climate funds. These include the UNFCCC climate funds (the Green Climate Fund and other Funds operating under the UNFCCC such as the Adaptation Fund), in 2015 and 2016 disbursing about USD 600–1,600 million annually, as well as other multilateral climate funds such as the Climate Investment Funds (anchored within the World Bank), funds which in 2015–16 amounted to USD 1,400–2,400 million annually (UNFCCC Standing Committee on Finance, 2018). Some observers argue that only such finance can be counted as climate finance (Reference DasguptaDasgupta and Climate Finance Unit, 2015).

Figure 9.1 The concentric circles of climate finance. All numbers refer to the size of flows measured in USD billions.

The second layer consists of public finance flowing through channels not designated as climate institutions: MDB climate finance not stemming from climate funds and public finance from developed countries flowing through bilateral, regional and other non-MDB channels.Footnote 3 According to the Standing Committee (2018), the former amounts to USD 17–20 billion annually, the latter to around USD 30 billion. Of these two kinds of finance, the latter has proven most controversial (Reference Roberts and WeikmansRoberts and Weikmans, 2017). It consists of bilateral Official Development Assistance (ODA), provided by developed countries marked as mitigation or adaptation-related by the country itself in its Bi-Annual Reports to the UNFCCC. Because it is up to the individual contributor country to identify its own projects as climate-related, climate-related ODA is often overcoded in the sense that the climate objectives are overstated (Reference Michaelowa and MichaelowaMichaelowa and Michaelowa, 2011b; Reference Weikmans, Roberts, Baum, Bustos and DurandWeikmans et al., 2017). Yet, the controversy regarding treating ODA as climate finance stems not only from overcoding but also from the provision already stipulated in the UNFCCC Convention that climate finance should be ‘new and additional’ to ODA (see discussion in Section 9.2.1).

The third layer consists of private finance for activities addressing climate change mobilised by the MDBs and by regional and bilateral institutions as well as renewable energy projects, in total amounting to around USD 15–17 billion annually in 2015–16, the bulk mobilised by MDBs. These flows differ from the inner layers in stemming from private sources, and from outer layers in being mobilised by public finance from developed countries, for example, an MDB providing guarantees or taking on parts of the risk associated with loans for climate projects.

The fourth layer covers all the flows that do not flow from developed to developing countries, including public and private finance spent within countries and between developed countries as well as between developing countries, so-called South–South finance (and are hence beyond the main focus of this part of the book). This layer was estimated at around USD 680 billion annually in 2015–16, although the difficulties in collecting reliable data are greater here than in the inner layers (UNFCCC SCF 2018). Some observers have argued that there de facto is a fifth layer of climate finance, namely the finance flowing to activities with a negative climate impact, such as fossil fuel extraction and consumption (e.g. coal-fired power plants, aviation), unsustainable logging, steel and cement production, and so forth (Reference Paul, Caroline, Joe, Laetitia and BiankaPaul et al., 2017; Reference Whitley, Thwaites, Wright and OttWhitley et al., 2018). Such finance is often referred to as brown finance as opposed to the green finance constituting the finance identified by the Standing Committee on Finance (SCF) (CPI 2018; Climate Transparency 2018), and also includes fossil fuel subsidies discussed in Part II of the book. While such brown flows are undisputedly several times greater than the green ones, they remain outside of the focus of this part of the book.

The preceding discussion concerns the question of the sources of finance that can be considered climate finance, yet the question of which kinds of finance (grants, guarantees, loans, equity) can be considered climate finance has also loomed large. While there is consensus that grants may count as climate finance, whether and how loans should be counted as climate finance is more disputed. Given that the vast majority of climate finance (including the two inner layers of the onion diagram) is provided as loans or equity, this is important (CPI, 2019). Even public finance constitutes predominantly loans, the MDBs almost solely providing loans. Many of the public loans are provided on more favourable terms than those that could finance a project if they were obtained in the financial market, for example, the interest rate is lower or the loan period longer (what is known as a concessional loan). Equity, where financing comes from ownership rather than loans, is mainly private finance.Footnote 4 A key issue is how to calculate the value of especially loans but also equity. As regards the USD 100 billion target, to many it seems counterproductive and unfair to equate USD 1 million provided as a grant with USD 1 million provided as a loan that has to be repaid with interest. One solution has been to calculate the ‘grant equivalent’ of a concessional loan, i.e. the difference between the value of a loan obtained in the market and the actual value of the loan (value calculated as the sum of future repayments and interests, Reference ScottScott, 2017). Likewise, there is consensus within the UNFCCC that only private finance caused or leveraged by public finance should count towards the USD 100 billion target. In both cases, there has been much technical debate regarding how to carry out the calculations.

9.2 Contested Issues in Climate Finance

Besides the cognitive dimension discussed earlier, contestation over important normative issues have also characterised climate finance (Reference Dellink, den Elzen, Aiking, Bergsma, Berkhout, Dekker and GuptaDellink et al., 2009; Reference Pickering, Betzold and SkovgaardPickering et al., 2017; Reference SkovgaardSkovgaard, 2017b). This includes purely legal norms such as ‘Common but Differentiated Responsibilities and Respective Capabilities’ (CBDR) that have drawn much attention (Reference Brunnée and StreckBrunnée and Streck, 2013; Reference JinnahJinnah, 2017), as well as less explicitly legally defined normative ideas such as efficiency and equity. Efficiency and equity have been key themes in international climate finance politics, as discussed in the two following subsections. This book will focus on two key issues regarding the different normative ideas that have emerged in climate finance governance, and which are particularly pertinent to international economic institutions:

1. Generating resources: Which normative ideas should guide the generation of climate finance?

2. Allocating resources: Which normative ideas should guide the allocation of climate finance?

9.2.1 Generating Resources

Regarding the generation of resources, as mentioned at COP15, close to all countries agreed on a USD 100 billion target for 2020 as well as a fast-start finance target of USD 30 billion in 2010–12. Developing countries had in the preceding negotiations proposed a target of 1–1.5 per cent of developed countries’ GDP, while several developed countries were opposed to any targets at all, although not to providing climate finance in itself (Reference Bailer and WeilerBailer and Weiler, 2015). Subsequently, in the Paris Agreement it was agreed that this goal shall continue through 2025 but that prior to 2025 a new goal shall be set from a floor of USD 100 billion (UNFCCC, 2015). Two kinds of normative ideas, focusing on equity and efficiency respectively, have been central to the discussions of the sources that may count towards the USD 100 billion target. On the one hand, equity-oriented normative ideas, among which CBDR (enshrined in the UNFCCC) constitutes an important norm, and implies that developed countries take on a greater burden than developing countries due to their higher level of development, and arguably provide all the climate finance. Another important equity norm, historical responsibility, recommends that countries contribute to the global effort against climate change, including climate finance, according to how much they have emitted historically, thus placing a significant burden on developed countries (Reference Persson and RemlingPersson and Remling, 2014). On the other hand, efficiency (or cost-effectiveness) concerns generating climate finance in a way that provides the maximum benefit for a given level of climate finance resources (Reference Stadelmann, Persson, Ratajczak-Juszko and MichaelowaStadelmann et al., 2014). Importantly, efficiency as a normative idea entails an emphasis on the economic costs and benefits of climate finance, which fits in with the worldviews of the economic institutions. Aiming to maximise benefits at the global level is a key tenet of much environmental economics literature, whereas national governments have often sought to maximise the national benefits from the climate finance they provide (Reference SkovgaardSkovgaard, 2017b). A third notion, effectiveness or focusing on the degree to which a measure is effective in mitigating or adapting to climate change irrespective of economic costs or equity concerns, has been contested in international climate finance discussions, since all actors agree that climate finance should be effective.

These normative ideas have repercussions for how the USD 100 billion target should be met. First, regarding public finance, key issues have been whether to adopt a burden-sharing key based on GDP or emissions determining the individual country contributions and whether emerging economies are obliged to provide climate finance. Several developing countries and non-governmental organisations (NGOs) have used CBDR and historical responsibility to argue in favour of the former and (in the case of emerging economies) used CBDR to argue against the latter. Developing countries do not always agree on these issues, for instance China has been sceptical of historical responsibility, whereas Least Developed Countries advocated softening the sharp distinction between developed and developing countries regarding climate finance by encouraging the latter (especially emerging economies) to also contribute such finance (Least Developed Countries’ Group, 2014). The United States (including the Obama administration) has been against burden-sharing and strongly in favour of contributions from developing countries, while the EU has been in favour of both. In the end, no burden-sharing key has been adopted, while in the Paris Agreement, developing countries are encouraged to provide or continue to provide climate finance voluntarily (UNFCCC, 2015: Article 9.2).

The normative ideas have also been salient regarding the relationship between public climate finance and development aid, particularly the norm that climate finance should be new and additional to ODA. Already before Rio, developing countries worried that environmental finance would be taken from existing ODA. Accordingly they (successfully) insisted on provisions that environmental finance should be new and additional to the existing commitment of developed countries to provide 0.7 per cent of Gross National Income in development aid, a commitment few of them have met (Reference Roberts and WeikmansRoberts and Weikmans, 2017; Reference Stadelmann, Roberts and MichaelowaStadelmann et al., 2011). According to several developing countries, only when a country has met its target of 0.7 per cent ODA can finance above that level be considered climate finance. Yet, the Paris Agreement does not entail the provision that climate finance should be new and additional (UNFCCC, 2015), and in general the post-Paris UNFCCC climate finance discussions have focused more on other issues than whether climate finance is additional to the 0.7 per cent ODA target.

Efficiency, more specifically the complementarities between addressing climate change and promoting development, has been key to the arguments of developed countries and development banks for an integrated approach to climate finance and development aid (Reference Bailer and WeilerBailer and Weiler, 2015). Yet, developing countries and NGOs argue that the two kinds of finance are fundamentally different since public climate finance is based on developed countries’ historical responsibility and CBDR, whereas development aid is based on the responsibility of the wealthy to assist the poor (Reference Michaelowa and MichaelowaMichaelowa and Michaelowa, 2011b). Consequently, climate finance should be delivered in a way that reflects developing countries’ ‘entitlement’ to funds, that is, with minimal conditions attached and as grants rather than loans (Reference Ciplet, Roberts and KhanCiplet et al., 2013; Reference MooreMoore, 2012). This discussion of the relationship between public climate finance and development aid also concerns the fundamental question of who gets to decide the allocation of climate finance (see Section 9.2.2), since treating it as development aid means that the decisions over how climate finance is spent are de facto left to the individual contributor countries (and to multilateral development institutions such as the MDBs).

Regarding private finance, developed countries as well as development banks have argued that private finance is key to an efficient response to climate change. Most developing countries do not disagree with the importance of private finance, but prefer targets solely for public finance to keep developed countries to their (equity-based) obligations, and fear that including private finance under targets will erode the obligations of developed countries. Other sources discussed include so-called innovative or alternative sources (e.g. levies on international aviation), which have been less popular among states due to concerns over relinquishing sovereign control over taxation, but popular among non-state actors for both equity and efficiency-based reasons (see inter alia Reference Stadelmann, Michaelowa and RobertsStadelmann et al., 2013).

More recently, the discussions of climate finance have become intertwined with discussions of investment and greening private financial flows (Reference Campiglio, Dafermos, Monnin, Ryan-Collins, Schotten and TanakaCampiglio et al., 2018; Reference Hong, Karolyi and ScheinkmanHong et al., 2020). In this way, the emphasis is shifting towards making financial flows consistent with climate (and other sustainability) objectives, including ensuring that there is sufficient private investment in renewable energy, energy efficiency, the building of infrastructure that is resilient to climate change and so forth. These more technical discussions rarely address equity issues.

9.2.2 Allocating Climate Finance

The normative ideas guiding the allocation of climate finance concern principles for allocating climate finance between countries as well as between mitigation and adaptation and involve efficiency and equity-oriented normative ideas such as vulnerability. The principle of vulnerability entails prioritising adaptation finance over mitigation finance and the most vulnerable countries over the ones that provide most adaptation for the money (Reference MooreMoore, 2012). Efficiency in the context of climate finance allocation refers to the ‘allocation of public resources such that net social benefits are maximised’ (Reference Persson and RemlingPersson and Remling, 2014, p. 489; see also Reference GrassoGrasso, 2007; Reference Stadelmann, Persson, Ratajczak-Juszko and MichaelowaStadelmann et al., 2014). Thus, efficient climate finance is spent where it provides most mitigation or adaption for the money, which at least in the case of mitigation means emerging economies rather than Least Developed Countries (Reference Fridahl, Hagemann, Röser and AmarsFridahl et al., 2015).

Adaptation and mitigation finance differ in that mitigation constitutes a global public good which it is in the interest of developed countries to contribute to independently of where it takes place, whereas adaptation in developing countries only has indirect benefits to developed countriesFootnote 5 (Reference Ciplet, Roberts and KhanCiplet et al., 2013; Reference Persson and RemlingPersson and Remling, 2014). Adopting a global efficiency perspective, mitigation finance is Pareto-improving due to the lower mitigation costs in developing countries, while adaptation finance is not (Reference RübbelkeRübbelke, 2011). Consequently, arguments in favour of adaptation are based on vulnerability and historical responsibility norms, unlike mitigation which can be argued for in terms of efficiency and effectiveness. Several developing countries – particularly Least Developed Countries and Small Island Developing States – have called for an even split between mitigation and adaptation finance, while developed countries generally have been more interested in contributing mitigation finance (Reference RübbelkeRübbelke, 2011).

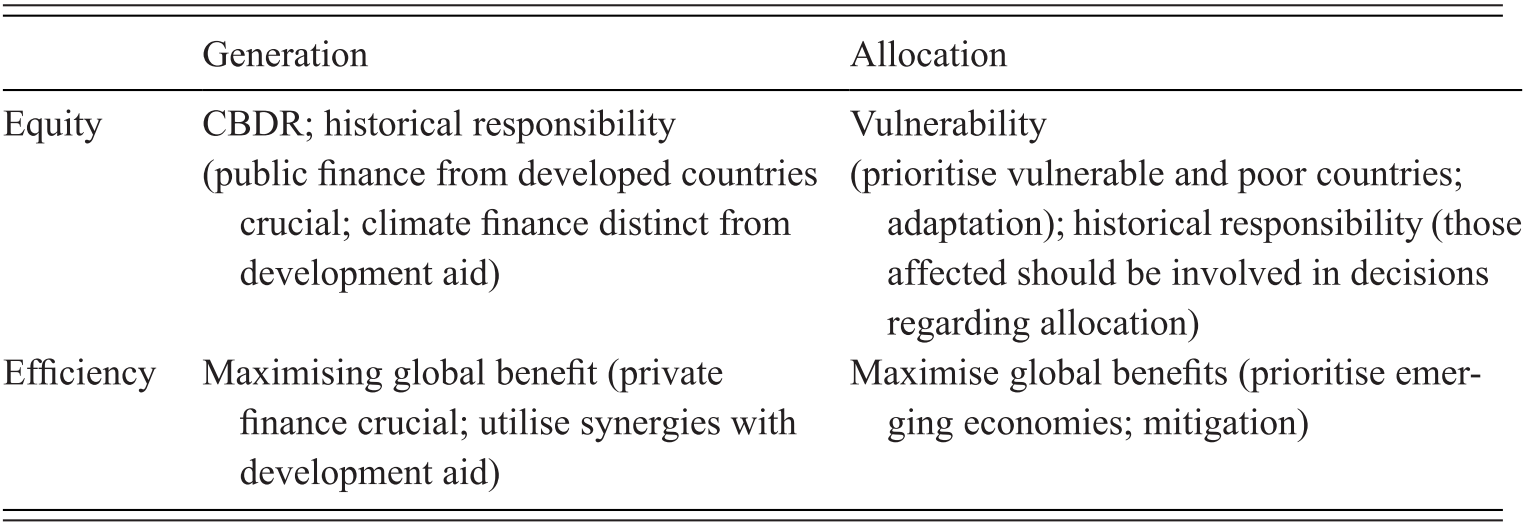

Table 9.1 Overview of key climate finance norms and the resulting positions on issues (in brackets)

| Generation | Allocation | |

|---|---|---|

| Equity | CBDR; historical responsibility (public finance from developed countries crucial; climate finance distinct from development aid) | Vulnerability (prioritise vulnerable and poor countries; adaptation); historical responsibility (those affected should be involved in decisions regarding allocation) |

| Efficiency | Maximising global benefit (private finance crucial; utilise synergies with development aid) | Maximise global benefits (prioritise emerging economies; mitigation) |

On a more overarching level, equity and efficiency in the allocation of climate finance also concerns the question of who determines the allocation (Reference Duus-OtterströmDuus-Otterström, 2016). If public climate finance is treated in equity terms as constituting a solution to developed countries’ historical responsibility, those affected, particularly developing countries, should have a say in how it is allocated. If it is treated as a subtype of development aid, decisions regarding its allocation are de facto left to the contributors (see Section 9.2.1). Hence, efficiency in itself does not lead to specific conclusions regarding who should determine the allocation of climate finance, but may lend itself to arguments for utilising synergies with development aid and economies of scale and avoid building costly new governance structures, de facto favouring developed countries.

9.3 The Climate Finance System and Its Main Components

At the international level, besides the normative fragmentation outlined earlier, the climate finance system is also characterised by considerable institutional fragmentation, with a range of institutions addressing the issue (Reference Pickering, Betzold and SkovgaardPickering et al., 2017). These institutions include UN and non-UN, environmental and non-environmental, public and private institutions.

9.3.1 The UNFCCC

The most important international institution for the governance of climate finance is the UNFCCC (Reference Pickering, Betzold and SkovgaardPickering et al., 2017). As discussed earlier, it was the origin of the USD 100 billion target and has been instrumental in institutionalising norms such as CBDR. Yet, the vast majority of the decisions regarding how much to contribute and how to allocate climate finance are reached outside the UNFCCC, in governments of developed countries, MDB headquarters and as regards private finance, corporate headquarters (Pickering, Jotzo, et al., 2015). Hence, the UNFCCC institutions have not played the role that most developing countries would have liked it to play, and often argued in favour of in the climate finance negotiations. The Green Climate Fund (GCF), Adaptation Fund, Least Developed Countries Fund, the Strategic Climate Change Fund and to some degree the Global Environment Facility (GEF)Footnote 6 operate under the UNFCCC, and allocated USD 0.6–1.6 billion during the period 2015–16 (the vast majority by the GCF). These funds have their own boards, but the UNFCCC Conference of the Parties provides them with guidance and directions. Despite the GCF increasing its volume of finance, the UNFCCC funds only disburse a small share of the total of public climate finance and have been plagued by internal disagreement and by the Trump administration’s unwillingness to contribute to them. The UNFCCC’s most important role has been to guide climate finance through the introduction and institutionalisation of norms (e.g. CBDR), targets (the USD 100 billion target). The SCF, a climate finance institution under the UNFCCC, has also played an important role in providing knowledge about climate finance, especially estimates of flows, as well as guidance to the Funds under the UNFCCC.

Decision-making within the UNFCCC takes place on the basis of consensus, which de facto grants developing countries considerable leverage compared to the institutions studied here or the MDBs, in which developed countries have the greatest influence. Unsurprisingly, developing countries have often pushed to have the majority or at least a larger share of climate finance flowing through UNFCCC funds, and greater UNFCCC influence over non-UNFCCC climate finance. Such influence has taken the shape of clearly defined guidelines concerning what constitutes climate finance and how it should be allocated, for instance prioritising Least Developed Countries, adaptation and other priorities that may be downplayed by developed countries (UNFCCC, 2015).

9.3.2 Other UN Institutions

UN institutions beyond the UNFCCC have mainly been important as implementers of climate finance projects, for example, the United Nations Development Programme (UNDP) and Environment Programme (UNEP). Similarly to the UNFCCC, developing countries have significant influence within these institutions. Among the non-UNFCCC UN initiatives, the most important one has been the High-level Advisory Group on Climate Change Financing (AGF), which was established in 2010 by UN Secretary Ban Ki-Moon to draft a report on the sources of climate finance, including various public, private and so-called innovative or alternative sources, for example, levies on international aviation (United Nations, 2010). This report provided a range of different ideas and possible solutions, which were utilised in climate finance discussions during the subsequent years. More recently, several other UN institutions have also been active in producing knowledge, notably the UNEP Finance Initiative, a partnership between UNEP and the global financial sector. This partnership aims to create principles for what qualifies as sustainable investment and to disseminate knowledge about such investment among public and private stakeholders (United Nations Environment Programme Finance Initiative, 2020).

9.3.3 The World Bank

The World Bank is another central institution in the governance of climate finance. Developed countries have been more in favour of granting the Bank a more important role than developing countries have been, because of the former group’s significant influence within the Bank (votes are allocated on the basis of financial contributions and GDP) and its worldview being closer to the positions of developed countries than to developing ones (Reference SchalatekSchalatek, 2012). The World Bank’s main role has been as a provider of climate finance through the Climate Investment Funds (CIFs) and its main lending activities – of which climate related lending is greater than the CIFs (Reference Dejgaard and HattleDejgaard and Hattle, 2020), but it has also sought to influence the wider governance of climate finance. The latter role has involved hosting and participating in climate finance relevant forums such as the Climate Action Peer Exchange for finance ministry representatives as well as knowledge production, including climate data on climate finance recipients (Climate Action Peer Exchange, 2020; World Bank, 2020a). The Bank has also been instrumental in promoting the CDM and developing CDM projects (Reference LazarowiczLazarowicz, 2009; Reference LedererLederer, 2012), as well as private climate finance in general. These climate efforts should be seen in the light of the Bank’s desire to be a leader on climate change (World Bank et al., 2016). Yet, there has also been criticism of the Bank’s considerable lending to fossil fuel projects (Reference Redman, Durand, Bustos, Baum and RobertsRedman et al., 2015; The Big Shift Global, 2019).

9.3.4 Regional Multilateral Development Banks

Similarly to the World Bank, the regional MDBs (the African Development Bank, the Asian Development Bank, the European Bank for Reconstruction and Development and the Inter-American Development Bank) have also scaled up their climate finance, while also facing criticism for their financing of fossil fuel projects (see Reference DelinaDelina, 2017 regarding the Asian Development Bank). In general, they have been less active in promoting climate finance and climate action than the World Bank, but have co-produced reports (particularly on the tracking of climate finance) together as a group also including the World Bank (World Bank Group et al., 2011).

9.3.5 Civil Society Actors

Various kinds of civil society organisations have also been active at the international level. These can roughly be divided into two groups: think tanks and NGOs. The think tanks include environment and development think tanks and research institutions such as the Climate Policy Initiative (CPI), Overseas Development Institute and World Resources Institute, and have mainly focused on producing knowledge in the shape of reports on the global state of climate finance as well as how to implement climate finance projects. Notably, the CPI (2017, 2018, 2019) has produced regular reports providing an overview of global climate finance flows. The NGOs include mainly environmental NGOs, for example, Climate Action Network (an umbrella organisation of environmental NGOs), Greenpeace and the World Wildlife Fund, as well as development NGOs such as Oxfam. They have focused more on activism and influencing public agendas but have also (especially the World Wildlife Fund and Oxfam) produced reports on climate finance. In general, they have emphasised equity and often sided with developing countries.

9.3.6 Corporate Actors

Corporate actors, especially from the financial sector, have been very active in funding climate finance projects. Some of them have also been active in various networks promoting climate action from the corporate world, for example, the Global Investor Coalition on Climate Change and Institutional Investors Group on Climate Change (2020). These networks seek inter alia to enhance knowledge about climate issues such as climate risk among investors and to promote policies facilitating climate-friendly investment as well as commitments to net-zero emissions in companies. In general, individual corporate actors as well as private networks and institutions focus on mitigation rather than adaptation.

9.4 Domestic Politics

The domestic level is arguably the most important for the actual flows of climate finance. The fragmented nature of the climate finance governance system leaves most of the decisions of how public climate finance should be allocated to the governments of developed countries (Reference Pickering, Betzold and SkovgaardPickering et al., 2017), which also hold considerable sway over MDBs. The decisions regarding how to allocate climate finance are mainly driven by domestic factors such as income, attention to environmental issues, responsibility and vulnerability to climate change, political orientation of government or the ministry that is responsible (Reference HalimanjayaHalimanjaya, 2015, Reference Halimanjaya2016; Reference Michaelowa and MichaelowaMichaelowa and Michaelowa, 2011b; Reference Peterson and SkovgaardPeterson and Skovgaard, 2019; Reference Pickering, Skovgaard, Kim, Roberts, Rossati, Stadelmann and ReichPickering et al., 2015b). Developing countries have less influence over the allocation, but develop climate finance projects within their borders, sometimes together with international funders and sometimes on their own with the intention of applying for funding. Nevertheless, there are crucial influences from the international level regarding all kinds of domestic climate finance decisions, in the shape of norms, targets and other commitments, the monitoring of climate finance, and knowledge about how to allocate and implement climate finance.

9.5 Summary

Climate finance is a topic at the intersection of climate and economic politics, yet more anchored within the UNFCCC than fossil fuel subsidies. The issue is characterised by considerable contestation over what flows of finance can be defined as climate finance and which normative ideas (particularly equity or efficiency) should guide the allocation and generation of climate finance. Furthermore, the climate finance system is also characterised by institutional fragmentation. Much, but not all, of this contestation and fragmentation reflects a dividing line between, on the one hand, developed countries promoting broad definitions of climate finance, efficiency and maintaining control over climate finance and, on the other, developing countries promoting narrow definitions of climate finance, equity and influence over climate finance. How economisation has worked in the case of the institutions addressing climate finance, including the definitional issues and normative issues outlined above, within the climate finance system, is the topic I turn to next.