The two World Wars mark turning points in the evolution of capital/assets ratios and the perception of capital adequacy. During the First and Second World Wars, three major factors contributed to a further leveraging of the banking system: government financing, inflation, and the generally unfavourable political and legal environment for the capital issuances of banks. Each of these factors on its own influenced the capital/assets ratios. During wartime, these drivers jointly accelerated the further deterioration of capital levels.

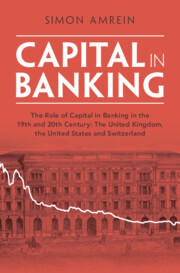

The capital/assets ratios of banks in Switzerland, the United Kingdom, and the United States fell substantially during the two World Wars. Figure 4.1 shows the banks’ capital ratios from 1910 to 1950. In the United Kingdom, the capital ratios were already at a low level in 1914. During the First World War, the capital/assets ratios fell from 8.3% to 5.5%. The Second World War brought another decline of 2.5pp for British banks, falling to as little as 3.0% in 1945.

Figure 4.1 Capital/assets ratios, United Kingdom, United States, and Switzerland, 1914–50Footnote 1

The Swiss and the US banks showed a similar deterioration in capital/assets ratios, albeit at a higher level. Capital/assets ratios stood at 15.0% (Switzerland) and 17.0% (United States) by 1914. They fell by 1.9 and 3.7pp, respectively, during the First World War. During the Second World War, the capital/assets ratios fell by 1.6pp in Switzerland and 5.3pp in the United States. In Switzerland, the group of the big banks experienced an even more pronounced decline. Their capital ratios fell by 5.2pp during the First and 4.4pp during the Second World War (see Table 4.1).

Table 4.1 Capital/assets ratios during the First and Second World WarsFootnote 1

| 1914 | 1918 | Change in pp | 1939 | 1945 | Change in pp | |

|---|---|---|---|---|---|---|

| Switzerland | 15.0% | 13.1% | −1.9 | 12.0% | 10.4% | −1.6 |

| – big banks | 20.1% | 14.9% | −5.2 | 15.4% | 11.0% | −4.4 |

| United Kingdom | 8.3% | 5.5% | −2.8 | 5.5% | 3.0% | −2.5 |

| United States | 17.0% | 13.3% | −3.7 | 12.0% | 6.7% | −5.3 |

1 Data: see Footnote footnote 1.

The two wars had fundamentally shifted conventions on what was deemed adequate capital. At the beginning of the twentieth century, the big banks in Switzerland followed a target capital/assets ratio of about 25%. For British joint-stock banks, the conventional capital/assets ratio fluctuated around 10%. In the United States, the supervisory practice of federal bank supervisors focused on a capital/deposits ratio of about 10% until the 1930s.

The idea that the share of required capital should relate to the risk inherent in a bank’s balance sheet existed already in the nineteenth century, but the recognition of risks developed over time. At first, the focus was on the duration of assets, whereby banks and their managers preferred short-term over long-term assets. However, the growth of government debt in banks’ balance sheets during the First and Second World Wars shifted the attention to the default risk of assets.

The economic dynamics of war financing were very similar in the United Kingdom, Switzerland, and the United States: government debt grew, inflation rates were high, and banks became involved in securing capital for the state. The three countries primarily differed in the amount of government debt accumulated during the two wars and banks’ exposure to government debt. The massive build-up of government debt in banks’ balance sheets initiated the demise of old capital adequacy guidelines – and gave rise to approaches considering the riskiness of assets when measuring capital adequacy.

Another dimension where the three countries deviated from the beginning of the First until the end of the Second World War was the organisation of bank supervision. In the United States, the Office of the Comptroller of the Currency (OCC) was established in 1863, the Federal Reserve (FED) in 1913, and the Federal Deposit Insurance Corporation (FDIC) in 1933. While the US central bank did have some supervisory responsibility for member banks of the Federal Reserve System, there were also two other federal agencies with supervisory responsibilities and, additionally, many state banking supervisory agencies. In Switzerland, the banking supervisor – the Federal Banking Commission (FBC) – was established in 1934. The Swiss National Bank (SNB), founded in 1906, only had limited macroprudential supervisory authority for banks. In the United Kingdom, banking supervision and monetary policy were both conducted by the Bank of England (BoE), and monetary goals were the primary concern that guided banking supervision.

4.1 Wartime Dynamics of Balance Sheets

Banks play a central role in times of war as an integral part of the economy and a facilitator of credit. Thus, banks’ balance sheets are a mirror of monetary and fiscal policy in wartime. During the First and Second World War, bank balance sheets in Switzerland, the United Kingdom, and the United States showed very similar characteristics.

Banks became crucial providers of government debt in all three countries by pooling deposits and investing in government bills and bonds. The share of government investment increased substantially compared to other assets, leading to a structural change on the asset side. Inflation rates and the velocity of money were high during both World Wars. The balance sheet items most affected by the rising price level were deposits. Moreover, the ‘liquidity preference’ of the public in uncertain times further contributed to the deposits’ growth. Customers switched to financial products with shorter maturities, such as accounts payable at short notice or on demand.

Inflation also undermines the value of paid-up equity capital. The paid-up capital’s value is fixed and increases when a bank issues new capital. In real terms, the value of the paid-up capital is reduced by inflation. Besides the devaluation of the paid-up capital, the process of raising fresh capital was hampered in wartime by formal and informal constraints. In Great Britain, for example, capital issuances had to be approved by a committee. In Switzerland, similar regulations did not exist, but bankers deemed it inappropriate to issue capital and compete with the state for the scarce resource of capital. In the United States, federal bank supervisory agencies suspended disciplinary measures against banks with deteriorating capital ratios. The combination of formal and informal restrictions on capital issuances, the devaluation of paid-up capital in real terms, and balance sheet expansion contributed substantially to the decline of capital/assets ratios.

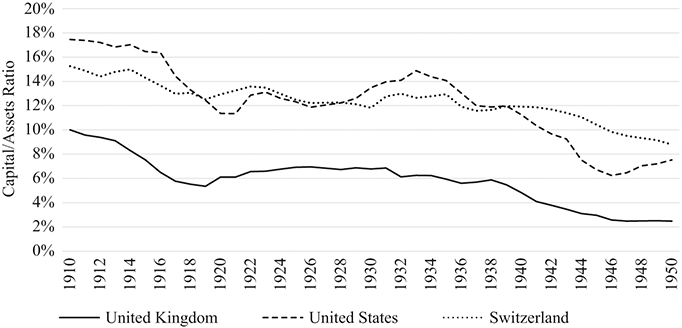

Figures 4.2 and 4.3 show two key aggregates of the economic policies between 1910 and 1950: government debt and inflation rates. Figure 4.2 highlights the substantial growth of the total government debt in the three countries during the two World Wars. British government debt grew strongly during wartime. In 1918, it reached £5.9bn – more than 8.3 times larger than by the end of 1913. The US government debt grew to $12.5bn in 1918 (10.4 times larger than before the war). The United States officially declared war during the First World War in 1917 and was actively involved in the war for nineteen months only. Nevertheless, the economic mobilisation – as in Switzerland – was extensive.

Figure 4.2 Gross government debt in Switzerland (in CHFbn), the United Kingdom(in £bn), and the United States (in $bn), 1910–50Footnote 4

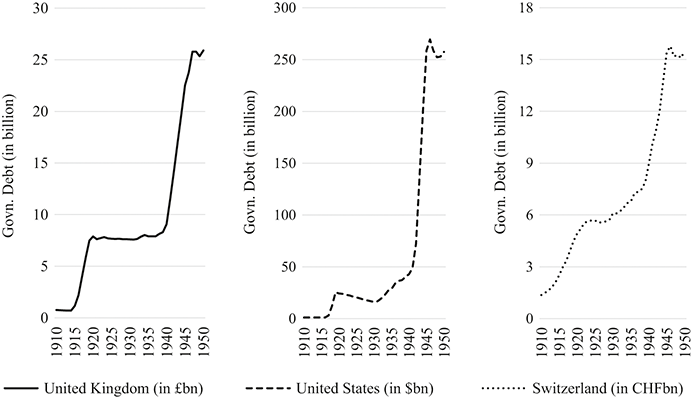

Figure 4.3 Inflation (change of consumer price index) in the United Kingdom, the United States, and Switzerland, 1910–50Footnote 5

Government debt grew substantially during the Second World War, but growth rates were lower than from 1914 to 1918. The US federal government had a total of $258.7bn in debt outstanding in 1945, which was almost seven times the amount before the war. In the United Kingdom, government debt almost tripled during the Second World War. Switzerland was not directly involved in either of the two wars through warfare.Footnote 2 Nevertheless, government debt doubled in both war periods. The Swiss government (at all government levels) had CHF 3.9bn debt outstanding in 1918 and CHF 15.4bn in 1945.

In all three countries, government debt grew beyond the GDP, underlining the significant amount of outstanding debt. Debt/GDP ratios in 1945 were 235.4% in the United Kingdom, 116.0% in the United States, and 103.9% in Switzerland.Footnote 3

The United Kingdom, the United States, and Switzerland followed an expansionary monetary policy during the two wars. Figure 4.3 shows the inflation rates of the three countries from 1910 to 1950. The changes in the consumer price indices have similar patterns: inflation rates reached their high point in 1917/18 at around 25%. The First World War followed a deflationary period from 1921 to 1923/4. The Second World War was marked again by a period of high inflation, albeit on a comparatively lower level. The inflation rates during the Second World War peaked between 15% and 16% in 1940/1 (United Kingdom, Switzerland) and 1947 (United States).

4.1.1 Assets Side: Financing Wars

Banks’ contributions to financing governments can be traced by analysing the asset side of balance sheets. Such investments are usually in the form of direct loans to governments or investments in government securities, which are part of a bank’s investment portfolio. While finding data on bank loan composition is challenging, data on banks’ investment portfolios are available in many cases.

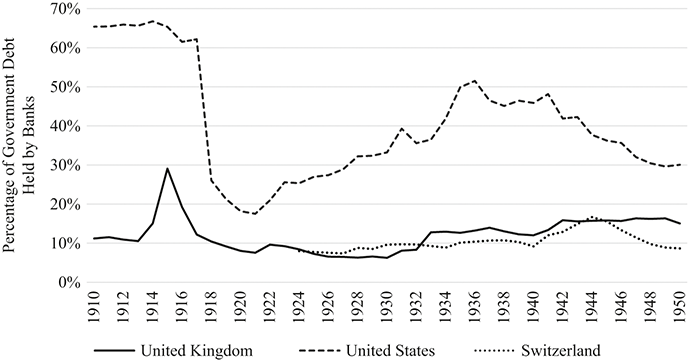

Figure 4.4 shows the government securities at face value that banks held as a percentage of the total gross government debt. For the United Kingdom and the United States, data is available from 1910 to 1950. Data on Swiss banks and their government investments are available after 1924. All three data sets have various shortcomings. The amount of British treasury bills is based on estimates.Footnote 6 The US data covers federal government debt only, leaving states aside. The Swiss data includes bonds only. Short-term debt instruments, more specifically treasury bills (‘Schatzanweisungen’) and rescriptions (‘Reskriptionen’), could not be considered.Footnote 7 Direct loans to the Swiss government are neglected even though they were an important funding source.Footnote 8

Figure 4.4 Percentage of gross government debt held by banks, United Kingdom (1910–50), United States (1910–50), and Switzerland (1924–50)Footnote 12

Nevertheless, Figure 4.4 serves as a reference point for banks’ key position in financing government debt. British banks held up to 29% of the total British government debt during the First World War. This share dropped substantially in subsequent years. It rose again during the Great Depression and further increased after 1939. British banks’ share of government debt reached about 16% during the Second World War.

Government debt in US banks’ balance sheets grew rapidly during the First World War but was outpaced by the rapid increase of the total government debt, of which substantial parts were allocated outside the banks’ balance sheets. Until 1917, banks held about two-thirds of federal government debt. The banks’ share in government debt fell substantially in 1918, to about one-fourth. The share of government debt increased again from 1921 onwards. As a result of the Great Depression, US banks provided more than 50% of US government debt in 1936. In 1941, 48% of federal government debt was in the books of US banks.

In Switzerland, banks were also crucial lenders to the government.Footnote 9 Besides the commercial banks, the SNB was also a central creditor. It held most of the rescriptions during the First World War.Footnote 10 The SNB directly financed the government, which was not the case to such a large extent by the Second World War. The engagement of Swiss banks in public debt rose sharply in 1941, and by 1944 Swiss banks held about 17% of all government securities. This number, however, understates the actual contribution of Swiss banks to government financing. Considering all debt instruments (loans, treasury bills, rescriptions), the Swiss banks funded about a quarter of Switzerland’s government debt by 1945.Footnote 11

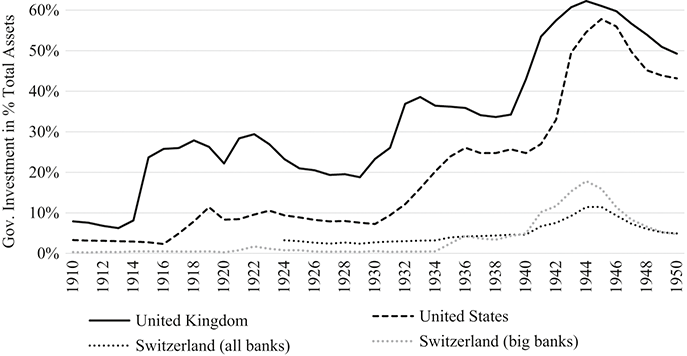

What was the effect of government securities on banks’ balance sheets? Figure 4.5 shows the percentage of government securities compared to banks’ total assets in the United Kingdom, the United States, and Switzerland. In all three countries, banks were vital lenders to the government during wartime and – in the United Kingdom and the United States – also in the 1930s. By 1944, 62.2% of the total assets of British banks consisted of government debt. In the United States, this ratio peaked at 57.8% in 1945.

Figure 4.5 Government securities as a percentage of banks’ total assets, United Kingdom, United States, and Switzerland, 1910–50Footnote 13

The total assets of Swiss banks consisted of 11.5% government bonds in 1945. Considering all debt types (loans, rescriptions, bills) would increase the ratio to 18.5%.Footnote 14 Figure 4.5 also displays the share of government securities in the big banks’ balance sheets in Switzerland.Footnote 15 The big banks held comparatively more government debt on their balance sheets than other banks (17.8% in 1944).Footnote 16

Apart from being lenders to the government, the big banks were also involved in underwriting government securities. They formed a cartel with the Association of Cantonal Banks. Excluding the first war loan in 1914, the cartel was involved in all the government issuances during the First World War. In most cases, the cartel provided a firm commitment of underwriting. Thus, the banks were responsible for the risk of selling federal and cantonal bonds and bills to customers or other banks. The total volume underwritten by the cartel between 1914 and 1921 was about CHF 3bn.Footnote 17

The high ratios of government investments in all three banking systems show that banks were crucial lenders to the government. This raises the question of how banks increased their government debt exposure. From an accounting perspective, there are two ways: firstly, banks can reallocate assets. In that case, banks would have divested some assets and increased their exposure to government investments. Secondly, banks can increase total assets through investments in government debt, which also requires an increase on the liability side.

A reallocation effect on the asset side did not occur on a larger scale in the United Kingdom, the United States, or Switzerland. One of the largest balance sheet items on the asset side in all three banking systems was amounts due to customers, such as loans and advances. In wartime, the amounts due to customers usually increased, which supported the supply of capital for the war economy. However, government debt growth outpaced the growth of amounts due to customers substantially in all three countries during the two wars.

Within the short-term assets, however, there were some reallocation effects. In Switzerland, there was a rapid decline in foreign commercial paper investments. Treasury bills quickly replaced commercial papers during the First World War.Footnote 18 Similar effects were observed in London, where the declining share of commercial papers and the drop of investments in foreign credit went in hand with the growth of treasury bills during both World Wars.Footnote 19

4.1.2 Liabilities Side: Deposits and Capital Issuances

How was the enormous growth of government debt in bank balance sheets financed? On the liabilities side, customers’ deposits (due from customers) were the most relevant funding source. In the United Kingdom, deposits contributed almost 90% of the balance sheet total from 1910 to 1950. About 65–70% of the total liabilities in Switzerland and the United States came from customers.Footnote 20 The United Kingdom’s higher share relates to statistical differences (no separate data on government deposits and interbank borrowing).

Table 4.2 shows the changes in volumes and percentages of the two most important items of the banks’ balance sheets during the two World Wars (1914–18/1939–45): deposits (liabilities) and government securities (assets). In all three countries, customers’ deposits grew substantially during the two wars and outpaced the growth of the balance sheet total. In terms of volume, the deposits grew more than the total of government securities. In the United Kingdom, for example, government securities held by banks grew by £391m during the First World War and £2.3bn during the Second World War. The deposits increased by £774m and £2.5bn, respectively.

Table 4.2 Changes in percent (nominal changes) and volume (in million domestic currency) of amounts due to customers, domestic government securities, and total assets, United Kingdom, United States, and Switzerland, 1914–18 and 1939–45Footnote 1

| Change in | 1914−1918 | 1939−1945 | ||

|---|---|---|---|---|

| United Kingdom | Customers’ deposits (liability) | % (p.a.) | 14.4% | 11.3% |

| £m | 774 | 2,543 | ||

| Government securities (asset) | % (p.a.) | 53.8% | 22.9% | |

| £m | 391 | 2,293 | ||

| Total assets | % (p.a.) | 13.3% | 10.8% | |

| £m | 782 | 2,547 | ||

| United States | Customers’ deposits (liability) | % (p.a.) | 10.0% | 14.4% |

| $m | 12,538 | 92,128 | ||

| Government securities (asset) | % (p.a.) | 32.9% | 27.9% | |

| $m | 2460 | 76947 | ||

| Total assets | % (p.a.) | 9.5% | 13.3% | |

| $m | 14,994 | 94,439 | ||

| Switzerland | Customers’ deposits (liability) | % (p.a.) | 7.0% | 2.4% |

| CHFm | 2,554 | 2,537 | ||

| Government securities (asset) | % (p.a.) | n/a | 16.9% | |

| CHFm | n/a | 1,585 | ||

| Total assets | % (p.a.) | 5.9% | 1.9% | |

| CHFm | 3,116 | 2,631 |

1 Data: United Kingdom: Sheppard, The Growth and Role of UK Financial Institutions. Switzerland: Swiss National Bank, Die Banken in der Schweiz (annual issues 1906–2015). United States: United States. Bureau of the Census, Historical Statistics of the United States. Colonial Times to 1970, tables 581, 585, 640, 662.

The high share of deposits on the liabilities side and the rapid growth of deposits (in volume and per cent) highlight the crucial role of deposits when it comes to the balance sheet expansion during the two wars.

Why did customers’ deposits grow to such a large extent during the two wars? The high inflation rates during wartime, shown in Figure 4.3, substantially depreciated the value of money. Banks mainly deal with nominal financial instruments. Exceptions on the asset side are, for example, direct holdings of bank premises or real estate. The payments related to nominal financial instruments are fixed in nominal amounts. An increase in the expected inflation raises nominal interest rates, which translates into a change in the nominal value of a financial instrument.Footnote 21 Therefore, nominal balance sheet items adjust to inflation.

One of the drivers of inflation during the wars was the velocity of money. These effects were already understood and described during the First World War. The Economist outlined the driving forces behind the deposit growth in 1916: namely, four processes that can contribute to the increase of deposits: first, deposits grow if the country’s stock of gold is increasing and the gold is brought to the banks. This increases the cash on the asset side and deposits on the liabilities side. Second, deposits grow if the stock of paper currency is increased and the currency is paid in. Third, banks can create money by giving discounts, loans, and advances, which then create deposits. The fourth and last channel runs from banks buying securities to deposit growth. As banks invested in government securities, cash was transferred from the BoE to the government. British banks, therefore, held securities instead of cash. The government drew on the balance at the BoE and invested this capital in the economy. The companies that had received capital were depositing it into their accounts, which increased the volume of deposits.Footnote 22 The Economist heavily criticised the expansionary monetary policy of the government and the BoE and argued that private individuals would have to start investing in government securities more substantially to reduce inflation.Footnote 23 The role of inflation as a driver of deposit growth during the two wars was also discussed in Switzerland.Footnote 24

Besides inflation, various other reasons were frequently mentioned in the context of growing deposits. Both in the United Kingdom and Switzerland, it was argued that the public had a ‘liquidity preference’ during the two World Wars. In times of uncertainty and depressed securities prices, bank customers shifted their long-term investments into deposits, making their wealth more readily available.Footnote 25 Other domestic effects, such as the liquidation of inventories at the beginning of the wars, might have also impacted the growth of deposits.Footnote 26

Another relevant driver of deposits’ growth in Switzerland was foreign capital inflows. The SNB mentioned the stream of capital from abroad many times in its annual statistical publications during the First and Second World Wars. Whereas capital inflows were directly referred to as ‘tax flight capital’ during the First World War, such specific remarks were not made in later years.Footnote 27 The SNB simply referred to it as ‘foreign capital inflows’.Footnote 28 No figures available provide insights into the volume of foreign deposits during the two wars, even though the Independent Commission of Experts Switzerland attempted to make such estimates when examining Switzerland’s role during the Second World War.Footnote 29 Switzerland was a stable financial hub in the turmoil of war, which was the basis for large financial transactions. The Swiss franc was a stable currency and the only currency in Europe which was almost freely convertible. Indeed, Swiss banks also participated in purchases of Nazi gold and provided credit to Germany, Italy, and the Allies. Moreover, banking secrecy – codified in the Banking Act of 1934 but already rooted in the Swiss banking sector since the end of the nineteenth century – certainly also attracted foreign funds.Footnote 30

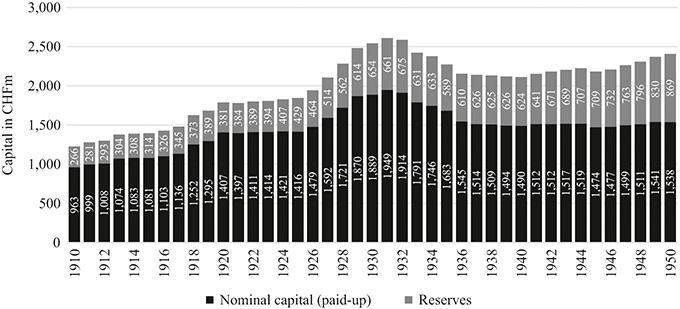

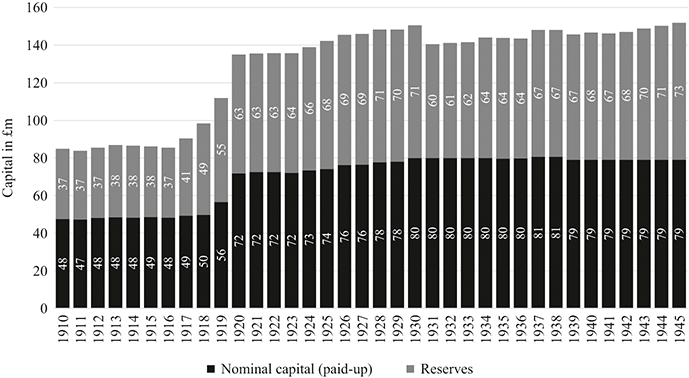

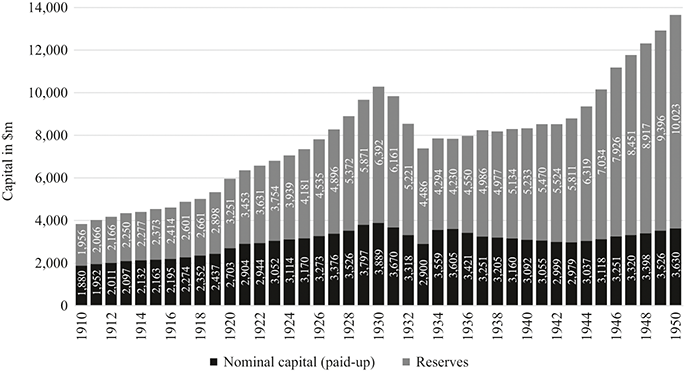

Changes in two components can lead to a rise of equity capital. New shares might be issued, or reserves increased. Figures 4.6, 4.7, and 4.8 show the paid-up capital and the reserves of Swiss, British, and US banks.

Figure 4.6 Nominal capital (paid-up) and reserves in CHF millions, Swiss banks, 1910–50Footnote 33

Figure 4.7 Nominal capital (paid-up) and reserves in £ millions, British banks, 1910–45Footnote 41

Figure 4.8 Nominal capital (paid-up) and reserves in $ millions, US banks, 1910–50Footnote 45

Swiss banks were hesitant with new capital issuances in the early years of the First World War. There were almost no recapitalisations from the summer of 1914 to 1916. The capital increases shown in Figure 4.6 are mostly related to banks that were newly included in the SNB statistics. It was only in 1916 that a more considerable amount of capital was issued (CHF 25m). The reasons mentioned for these issuances were the positive development of the economy after 1916 as well as growing deposits.Footnote 31 These capital increases had little effect on the capital/assets ratio.

The first years of the Second World War in Switzerland are comparable to the period of 1914 to 1916. Only two cantonal banks issued fresh capital in 1941. The big banks did not issue capital at all during the war. There were no formal constraints with regards to capital issuances during both wars. Especially during the Second World War, however, there was a widespread conception that banks should not lock up capital that could be used for sovereign debt. As an observer at the time put it: ‘Issuing capital during the war forbade itself’.Footnote 32

Whereas almost no capital was issued in Switzerland during wartime due to informal constraints, the same happened in the United Kingdom due to formal restrictions. During the First World War, capital issuances had to be approved by the Treasury. In January 1915, the Treasury announced that ‘in the present crisis all other considerations must be subordinated to the paramount necessity of husbanding the financial resources of the country with a view to the successful prosecution of the war’ and that ‘it feels it imperative in the national interest that fresh issues of capital shall be approved by the Treasury before they are made’.Footnote 34

The control of capital issuances was only one dimension of wartime control of financial resources. The export of capital was also severely restricted.Footnote 35 The Treasury’s embargo had a substantial impact on the British financial market. In 1914, £512.6m were issued in the United Kingdom, of which £180.1m was not for the government. In 1916, £585.6m were issued, with only £31.5m left for non-government issuances. The figures diverged even more in 1917, with total issues of £1.3bn – of which all but £40.9m were government securities.Footnote 36 After the war, the government attempted to maintain this capital control policy. However, a less restrictive regulation was eventually introduced, forbidding only capital issuances that could contribute to foreign capital purposes.Footnote 37 The government withdrew the domestic ban on capital issuances in March 1919.Footnote 38

During the Second World War, the British government again controlled private capital operations. Based on a Treasury Memorandum of Guidance that was issued on 12 September 1939, capital issuances were to be restricted to production and services related to defence, essential services (such as transport and food supplies), and export purposes.Footnote 39 Moreover, the BoE asked banks to focus their lending on defence production, exports, coal mining, and agriculture. After the war, in May 1945, new capital issuances were allowed again, but only for reconstruction purposes.Footnote 40

Figure 4.7 shows the paid-up capital and reserves of British banks from 1910 to 1950. During these four decades, there was only one major increase of capital, in 1919 and 1920.

In the United States, the amount of bank capital in the banking system was much more volatile than in the United Kingdom and Switzerland. The changing capital was partly related to market entries and exits, and banks could still increase their capital. Figure 4.8 shows the capital and reserves in US banking from 1910 to 1950. During the First World War, capital and reserves gradually grew, at around 2.3% and 3.4%. The number of banks grew at about the same pace. The situation during the Second World War was different. The nominal capital remained stable, but the reserves grew steadily, averaging 5.1% yearly.

Despite the increase in bank capital, capital/ratios deteriorated, given the substantial growth of total assets during wartime. War financing was prioritised over capital adequacy. Adhering to strict capital ratios would have restricted war financing.Footnote 42 Therefore, the supervisors decided to suspend the use of capital ratios in 1942. The Comptroller of the Currency, the FDIC, the Board of Governors of the Federal Reserve System, and the Executive Committee of the National Association of Supervisors of State Banks issued a joint statement assuring banks that they would not take action against them due to investments in government securities or short-term loans to customers to purchase government bonds.Footnote 43 The FDIC was even more specific, stating that banks with deteriorating capital ratios due to war financing would not be sanctioned.Footnote 44

The war years were a period of extraordinary conditions, which left their mark on banks’ balance sheets in the United States, the United Kingdom, and Switzerland. Contemporaries in all three countries argued that balance sheets – and, with them, capital ratios – would return to ‘normal’ in peacetime. On a broader level, there was also the idea of returning to the pre-war economic system, most prominently represented by the gold standard. A normalisation in the banking sector meant that government debt and deposits would contract again. However, a transition to pre-war balance sheets and to a pre-war macroeconomic environment did not happen after either of the two wars or in either of the three countries. An economic recession followed the First World War. After the Second World War, Great Britain first dealt with reconstructing and reorganising the economy, while the United States and Switzerland rapidly entered a period of economic expansion.

4.2 British Banking and Capital: The Absence of a Topic

By the beginning of the twentieth century, bank capital was no longer a central topic in British banking. Referencing Gilbart’s 1:3 rule stipulated in 1827, The Bankers’ Magazine noted in 1914 that ‘this practice is now but a matter of history’.Footnote 46 Instead, the magazine praised the advantages of short-term securities, which allow for lower capital ratios.Footnote 47

One of the key references on England’s amalgamation movement, Joseph Sykes, argued that capital adequacy did not receive serious attention in England until 1918.Footnote 48 This view is undoubtedly accurate from the 1880s to 1918. The collapse of the City of Glasgow Bank in 1878 briefly triggered a reassessment of capital liability and capital policies in banking. After that, little was said about capital. And if bank capital was discussed, at least bankers seemed to view it as a necessary evil. Several large mergers of banks took place in 1917 and 1918. With the discussions of these mergers – or, more specifically, the growing market power of the merged banks – capital briefly resurfaced as a topic. One might add to Sykes’s statement that capital adequacy largely disappeared from the public discourse after 1920, and it disappeared entirely as a topic until the late 1960s.

4.2.1 Amalgamations Movement in England

From 1914 to 1918, the First World War led to an expansion of the balance sheet totals. Combined with the loss in the real value of the paid-up capital, it put the capital/assets ratio under pressure. Even though the macroeconomic environment was an essential driver of the capital ratios, it was not this process that raised interest in the capital of English banks in 1918. Instead, the rapidly growing market concentration of English banking – the amalgamation movement – led to inquiries about the adequacy of banks’ capital.

After the first establishment of joint-stock banks in England in the 1820s, the number of joint-stock banks grew rapidly for about six decades, reaching its high point in the 1880s with around 110 joint-stock banks.Footnote 49 From the 1880s onwards, the structure of the banking system changed as larger banks started to take over smaller, mostly local or provincial and private banks. The characteristics of bank sizes of the merged banks changed with time, mainly because the number of small local banks diminished, and private banks based on a partnership model became almost extinct. From 1910 to 1918, larger banks started to merge among themselves. These banks often did not operate in different geographical locations, as had been the case before, but in the same overlapping regions. The concentration process culminated in a series of large mergers. In 1917, the National Provincial Bank amalgamated with the Union of London and Smiths Bank. In March 1918, Westminster amalgamated with Parr’s Bank. During the summer of 1918, London City and Midland merged with the London Joint Stock Bank, Lloyds amalgamated with the Capital and Counties Bank, and Barclays with the London Provincial and South Western Bank. In 1918, there were only twenty-six joint-stock banks left in England.Footnote 50

Five major banks emerged from the amalgamation period: Barclays Bank, the London County Westminster and Parr’s Bank, Lloyds Bank, the London Joint City and Midland Bank, and the National Provincial and Union Bank of England. In 1918, these Big Five combined held more than four-fifths of the total assets of all banks in England and Wales.Footnote 51 Overall, nineteen amalgamations, involving thirty-eight banks, took place in 1917 and 1918.Footnote 52 With these large amalgamations, public opinion became increasingly critical towards the concentrated market and requests in favour of a regulatory intervention were voiced. Generally, there was a lack of trust towards the oligopolistic banking structure, which was usually referred to as the ‘Money Trust’.Footnote 53

In February 1918, the Chancellor of the Exchequer appointed a Committee on Bank Amalgamations, also known as the Colwyn Committee.Footnote 54 The committee was assigned to consider the effects of amalgamations and discuss potential legislation on this matter.Footnote 55 The Colwyn Committee finished its report in May 1918 and outlined the advantages and disadvantages of amalgamations.Footnote 56 One of the key findings of the report dealt with capital adequacy:

The proportion of capital to deposits is now so small in the case of English joint stock banks – even excluding the temporary war increase in the amount of deposits – that any further shrinkage of Bank capital is clearly undesirable, in the interest of depositors, if it can be avoided. Attention has been drawn to the fact that amalgamation schemes usually mean a reduction in the total paid-up capital and uncalled liability of the two pre-amalgamation units.Footnote 57

Banks reduced their capital through mergers when shares of a bank were paid in cash. In such a process, the shares of one of the two banks were cancelled. Other takeovers were achieved by paying old shareholders with fewer but more valuable shares of the surviving bank. The liabilities were then transferred, leading to a further leveraging of the new entity.Footnote 58

The statement quoted earlier shows that the committee was aware of the problems of low bank capital. In addition, it emphasised the conflicting interests of depositors in safety versus shareholders in high dividends, confirming the view that capital was seen as a form of insurance for depositors. The Colwyn Committee also took a critical standpoint towards the reduction of uncalled liability. In an internal circular summarising the committee’s provisional impressions, this opinion became even more evident: the cancellation of uncalled liability was thought to reduce the security of depositors. According to the committee, further large amalgamations were not in the interest of the public – the only interests such amalgamations would have served were those of shareholders.Footnote 59

In its official report, the committee was more diplomatic and stated that arguments against further mergers outweighed those in favour. It proposed legislation that required governmental approval for amalgamations by the Board of Trade and the Treasury, which should be advised by a Statutory Committee. Regarding larger amalgamations of banks with overlapping territories, the committee suggested prohibiting such mergers.Footnote 60 Despite these proposals, a law on bank amalgamations was never introduced, even though a bill was forwarded to Parliament in 1919.Footnote 61 The government opted for informal arrangements with the banks instead of introducing statutory banking legislation.Footnote 62

However, the informal approach to convince banks of the importance of higher capital levels was successful. The fact that the government appointed a new Advisory Committee in the summer of 1918 to analyse pending mergers certainly helped.Footnote 63 The committee did not have legal power, but the government could provide de facto power to the committee based on the embargo for capital issuances introduced at the beginning of the First World War.Footnote 64

The clear stance of the Amalgamations Committee – and later also the Advisory Committee – against further leveraging through mergers triggered bankers to strengthen their capital position.Footnote 65 The fact that a war-related increase in deposits had led to an additional leveraging of the banking sector further raised awareness among bankers.

In 1919 and 1920, the paid-up capital of English banks grew by about £20m, reaching £72m by the end of 1920. In 1920, The Economist noted that ‘the danger of allowing this ratio [capital/deposits] to fall to so low a figure is being realised by bank directors’. One year later, The Economist stated:

It should be pointed out that some of this increase in capital is due to the rearrangement of capital necessitated by amalgamations and alliances. At the same time, tangible evidence has been given that banks’ directors have become alive to the fact that the ratio of capital and reserves to deposits had shrunk during the war to an abnormally low figure.Footnote 66

Despite these increases in the paid-up capital, the capital ratios grew only moderately. In 1918, the capital/assets ratio was 5.8%. The ratio grew slightly to 6.4% in 1920, even though the total assets also grew. During the second half of the 1920s, the ratio remained at the 7% level. However, this was primarily due to the contracting balance sheets of the British banks between 1920 and 1925. The capital/assets ratio never returned to pre-war levels above 10%.

4.2.2 During and After the Second World War: Banking Without Capital

Nowadays, in England at least, capital has ceased to be necessary.Footnote 67

Economist and historian Richard Sidney Sayers wrote this sentence in one of the most popular banking textbooks of the twentieth century. Modern Banking was first published in 1938 and issued in several editions up to the 1970s. Sayers argued that English banks had a long track record of stability and had built up substantial hidden reserves. If it came to the capital, the author was more concerned about foreign than domestic banks:

In some other countries, where the banks are less firmly established and public confidence could be more easily shaken, the capital of banks naturally retains its requirement relating the minimum capital to the deposit liabilities of a bank.Footnote 68

These sentences were printed in the sixth edition of Modern Banking, published in 1964. In the first edition of the textbook in 1938, Sayers avoided the topic of capital altogether.Footnote 69 He viewed liquidity as the primary source of stability in banking. This view was representative of the perception of liquidity and solvency after the Second World War.

The topic of capital and capital adequacy also received little attention in the media. Both The Economist and The Bankers’ Magazine had frequently discussed such topics before the war. Building up capital was seen as part of the progress of the British banking system, enhancing its resilience. The annual article in The Bankers’ Magazine discussing the evolution of the capital/deposits ratio was no longer published after the war, having until then been published for more than four decades. Later articles in The Bankers’ Magazine on the capitalisation of banks were mostly descriptive, simply announcing changes in the structure of the capital or capital issuances. The same applied to articles published in The Economist and, in contrast to the aftermath of the First World War, the idea of returning to pre-war capital ratios was not expressed in either of these two key publications.

Scholars’ lack of interest in the topic of solvency, as well as the lack of media coverage, have to be viewed against the policy environment at the time. As discussed, the amount of government debt was high, and so was the share of government debt in the banks’ balance sheets. One of the central goals of monetary policy after the Second World War was to ensure capital supply for government debt. Therefore the banks, as sources of finance for the government, were highly affected by the government’s repressive monetary policy.Footnote 70

Instead of statutory regulation – as, for example, in Switzerland and the United States – British banking regulation was exercised informally and flexibly through the BoE. This informal supervision was guided by moral suasion and the ‘Governor’s eyebrows’.Footnote 71 Cash and liquidity ratios were the crucial tools in the BoE’s supervisory practice. The cash ratio ensured that banks held a certain amount of their deposits at the BoE. The liquidity ratio forced banks to hold large amounts of cash, money at call, bills of exchange, and British government bills. This led to a high share of short-term government debt in banks’ balance sheets. The cash ratio was set at 8% and had to be adhered to daily between 1946 and 1971, while the liquidity ratio ranged around 30%.Footnote 72

With such a focus on liquidity, there was little room for capital requirements. The goal of monetary policy to ensure demand for short-term government debt, enforced through informal control and liquidity ratios, was often believed to conflict with capital requirements.Footnote 73 It was not surprising that no capital issuances took place in such an environment. No bank raised new capital during the Second World War, even though the capital/assets ratio fell from 5.7% to 3.0%. By 1953/4, capitalisation reached a low point at 2.3%. Barclays and Midland had even lower capital/assets ratios (1.9% and 2.1%, respectively, without hidden reserves).

Capital ratios were rapidly shrinking at the beginning of the 1950s. Were the banks reckless, not worrying about the deterioration of their capital resources? After all, banks frequently referred to shareholders’ and depositors’ interests when issuing capital until the First World War. Moreover, there seemed to be an agreement that banks would need to strengthen their capital position between 1918 and 1920. Was the depletion of capital a sign that all these ideas had disappeared?

Some banks had already expressed concerns about their capital position before the Second World War. In 1937, for example, the Westminster Bank considered its capital too low. Comparing ratios with the other Big Five banks, the General Manager of Westminster Bank (Sir Charles Lidbury) noted internally that their own capital/deposits ratio was lower than that of the other big banks and that Westminster paid comparatively higher dividends. On the one hand, Lidbury pointed out that banks should issue capital in periods of ‘cheap money’ and, therefore, the time was right to issue capital. On the other hand, he also referred to various problems arising from a possible capital issuance. In his view, it seemed difficult to adequately compensate new shareholders without ‘watering down’ the ‘preferential position’ of existing shareholders. Westminster eventually decided against a capital increase.Footnote 74

During the Second World War, several banks attempted to raise new capital. Between September and December 1943, the National Provincial, Midland, and Lloyds Bank all approached the Governor of the Bank of England, Montagu Norman, to discuss capital issuances. The governor replied to National Provincial that they ‘must abandon the idea’. Norman argued that if ‘£5/6 million were needed for one bank, the total for all banks might be £40 million or £50 million’, adding that ‘it seems impossible that a proposal of this kind could be allowed for a single bank’.Footnote 75 The argument that the capital issuance of one bank would trigger the other banks to recapitalise was frequently used in later years. It was always presented along with a brief calculation showing the total amount of capital that would be tied up by all the banks if they were to capitalise. The BoE would not have allowed such resources to be withdrawn.

Further attempts to raise capital and reorganise their capital structure were made after the war by the National Provincial (1946), District Bank (1946, 1949), Barclays (1948, 1949, 1953), Martins Bank (1953), and Midland (1958). The banks usually argued that capital was needed to protect depositors. In order to demonstrate the need for additional capital, they compared their capital with the fixed assets (premises, investments in subsidiaries and associated companies) they held. A frequently made argument with which the BoE did agree was that fixed assets should not exceed the capital.Footnote 76 The difference between capital and fixed assets was later known as ‘free resources’. The ratio between ‘free resources’ and deposits was called the ‘free resources ratio’. Thus, a new ratio emerged from the supervisory practice of the 1950s. The previously used capital/deposits ratio had lost importance in discussions between the BoE and the banks.

According to the BoE, issuing new capital in the post-war period ‘was completely out of the question under existing conditions’.Footnote 77 ‘Existing conditions’ referred to the credit squeeze of the 1950s. In the view of the BoE, capital should be used for the ‘productive’ industry.Footnote 78 Moreover, the BoE considered liquidity to be much more important than capital from a depositor’s point of view.Footnote 79 The bank also noted that depositors did not seem to worry about low capital/deposits ratios:

It cannot be said that depositors really look on the share Capital of the Clearing Banks as providing any significant protection for their deposits. The experience of the last few years, when depreciation of banks’ investments made heavy inroads on shareholders’ capital, underlines this; and if the safety of deposits were ever in doubt, it is, in any case, to liquidity that the depositors should rather look.Footnote 80

Despite postponing new capital issuances by the banks, the BoE was not completely ignorant of the importance of capital. In 1946, the bank told the Committee of London Clearing Bankers that they should be prepared to raise capital once the time was right.Footnote 81 The time for capital issuances came in 1958, when all of the Big Five were finally allowed to raise capital.Footnote 82 As a result, the average capital/assets ratio grew from 2.6% in 1957 to 3.2% in 1959.

The BoE also discussed the importance and role of capital internally. It was clear that priority was given to liquidity ratios. On the issue of solvency, however, there was a range of opinions. In 1958, the bank’s Chief Cashier surmised that ‘even in the Bank of England we are beginning to believe that Capital plays little or no part in a soundly based banking structure’.Footnote 83 At the same time, internal reports at the bank discussed that long-run targets for capital/deposits ratios should be between 5% and 7%.Footnote 84 However, such deliberations never materialised as formal or informal minimum capital standards. Instead, the British system continued on a path of informal supervision with a clear focus on liquidity.

4.3 Switzerland: The Demise of Guidelines – and the Rise of Rules

In contrast to the British banking market, in Switzerland capital adequacy was a relevant topic during and after both World Wars. After the First World War, Swiss banks aimed to restore previous capital ratios and return to the old capital policy conventions. However, banks’ total assets did not contract, even though many contemporaries had expected it, as deposits continued to grow. The situation after the Second World War was different. Informal conventions that guided capital policies were no longer present, as the crisis of the 1930s triggered the introduction of minimum capital ratios. With that, the focus was on maintaining statutory capital requirements, and self-reflections of banks on what was an adequate capital for them disappeared from the public discourse.

4.3.1 After the First World War: Back to Normal?

Towards the end of the First World War, there was a widespread sentiment in Switzerland that economic conditions – and, with that, banks’ balance sheets – would return to pre-war conditions once the war was over. By 1918, the SNB expected that deposits would contract and that ‘the [capital/liability] ratios should, therefore, perhaps improve again by themselves over time’.Footnote 85 Contemporaries took a similar perspective and referred to the abnormally inflated balance sheets of banks as a result of the war economy.Footnote 86 And two of the big banks – Credit Suisse and the Swiss Bank Corporation – commented in their annual reports of 1917 that their large total assets and deposits were only a temporary phenomenon and would soon be shrinking again.Footnote 87

Once the war was over, it became clear that macroeconomic conditions would not normalise immediately. The post-war economic depression reached its high point in Switzerland in 1922 with high deflation and high unemployment rates. Moreover, asset prices had been falling and capital markets were not able to absorb large capital issuances at the time, which restricted Swiss banks’ capacity to refinance through capital issuances.Footnote 88

At the international level, the monetary disorders after the war had consequences for the Swiss financial centre, leading to large-scale foreign capital inflows in Switzerland. Against expectations and the adverse domestic economic development, the balance sheet totals and deposits of Swiss banks did not contract after the First World War. Total assets grew by 6.6% between 1918 and 1922 (1.6% p.a.). Deposits even increased by 15.6% (3.4% p.a.). This growth reinforced the belief among the Swiss banking sector that capital issuances could not be postponed any further, given ‘the unfavourable capital/liability ratio’, as concluded by the SNB.Footnote 89 Moreover, the SNB noted that ‘the uncertain outcome of the current depression and the need to counter it as a precaution really cannot be stressed enough’.Footnote 90

The Swiss banks started issuing capital once they realised that their balance sheets would not contract but grow due to foreign capital inflows.Footnote 91 Between 1918 and 1922, Swiss banks increased their paid-up capital substantially, by CHF 389.3 m (+20%). The capital was increased despite difficult economic conditions, and even though distressed prices at capital markets led to very low share premia. In addition to the nominal capital raised, only CHF 13.3m could be added to the reserves as premia.Footnote 92

Even though capital increases after the First World War were substantial in absolute terms, they had little impact on capital/assets ratios. The average capital/assets ratio of all Swiss banks grew from 13.1% in 1918 to 13.6% in 1922. For the big banks, the impact was more substantial. Their ratio increased from 14.8% to 17.5%. However, it was only a short-term recovery. The rapid growth of deposits as a key component of liabilities also continued in later years. From 1922 to 1929, the deposits of Swiss banks grew on average by 6.6% per year. The deposits of the big banks even increased by an average of 10.5% p.a. Foreign capital inflows were a substantial driver of this growth.

There are no exact figures for the volume of foreign deposits transferred to Switzerland during and after the First World War. Contemporaries estimated that about half of the deposits flowing to the Swiss banks in 1929 were transferred from abroad (about CHF 440m).Footnote 93 Gottlieb Bachmann, Head of Department I of the SNB from 1925 to 1939, estimated the total volume of foreign funds by the end of 1929 to be between CHF 1–1.3bn.Footnote 94 Domestic and foreign deposits in Swiss banks reached a volume of CHF 9.4bn in 1929.Footnote 95 Foreign capital inflows led to a further increase in the total assets, which in turn contributed to the deterioration of the capital/assets ratio. In 1929, the capital/assets ratio of all Swiss banks was 12.1%, while the ratio of the big banks fell to 14.0%.

Compared to the period before the First World War, these ratios were substantially lower. The perception of ‘adequate capital’ had changed substantially. Before the war, a capital/liability ratio of about 30% (c/a ratio = 23%) was considered adequate for the big banks.Footnote 96 After the First World War, contemporaries viewed a capital/liability ratio of about 20% as the new standard for the big banks.Footnote 97 The standard ratio for banks focusing on savings and mortgages was in between 9% and 10%.Footnote 98 The SNB was not worried about these new conventions, highlighting that the reserves had increased substantially since the end of the war and that the Swiss banks held more liquid assets, which would require less capital.Footnote 99

4.3.2 The Importance of Formal Capital Requirements

The early 1950s mark the end of two conventions that had directed the capital policies of Swiss banks for a long time. Firstly, the group of the big banks no longer had the highest capital ratio of all the banking groups in Switzerland.Footnote 100 Traditionally, the argument had been that the big banks conducted comparatively (to other banks) riskier business and therefore required more capital. However, with high shares of government papers in their balance sheets and sharply increasing amounts of deposits during and after the war, the business model of the big banks had changed. Moreover, the importance of direct industrial investments decreased. Secondly, and certainly related to that, the rules of thumb that had been used as a reference for capital adequacy were abandoned. Before the First World War, the big banks had frequently issued new capital in order to maintain a certain capital ratio. After the First World War, a capital/liability ratio of about 20% for big banks was accepted by the SNB. In 1945, the capital/assets ratio of the big banks was 11.0%; it had dropped by 4.4pp during the war. The combined capital/assets ratio of all banks stood at 10.5%.

After the Second World War, the idea of returning to pre-war capital levels did not exist. In contrast to the aftermath of the First World War, the economic conditions were fundamentally different. Switzerland was in an economic upswing and the balance sheets of the Swiss banks grew rapidly. Between 1945 and 1950, the average annual growth rate of the balance sheet totals was 5.5%, while the economy grew on average by 8.0% p.a.Footnote 101 Despite these economically favourable conditions, there were very few capital issuances in the post-war years. Between 1945 and 1950, Swiss banks issued new nominal capital of only about CHF 110 m (7% of the paid-up capital). The two largest big banks at the time – the Swiss Bank Corporation and Credit Suisse – did not increase their nominal capital in the years after the war at all.Footnote 102 Why did banks not consider a return to pre-war capital levels?

Firstly, the legacy of the Great Depression still influenced the post-war banking structure. The Second World War brought the period of restructuring and consolidation among the big banks to a halt. This process, which also affected the capital structure of the banks, had been triggered by the Great Depression. Once the war was over, one of the first items on the agenda of the banks was to deal with the legacies of the 1930s.

The Swiss Volksbank had to be rescued by the federal government in 1933.Footnote 103 The government held 50% of the Volksbank’s capital. Not long into the war, however, the bank considered its capital to be too high and aimed to pay back the government’s capital. However, the Volksbank postponed the transaction until after the war.Footnote 104 The Volksbank’s primary goal after the war was to become independent again and to start reducing the Swiss government’s capital share, which happened between 1947 and 1949.Footnote 105 By 1945, the bank’s capital/assets ratio was 10.5%. In 1950, the ratio was 7.6%.Footnote 106 Being the outcome of a long-planned capital reorganisation, it can be assumed that the management of Volksbank perceived a capital/assets ratio of roughly 7% to 8% as adequate.

Another bank from the group of big banks, Bank Leu & Co., had to be restructured in 1936 and again after the war. The bank reduced its capital and re-issued new shares in 1945. The increase of the capital was related to the write-down of foreign investments made before the war. Two other banks, the Basler Handelsbank and the Eidgenössische Bank, were also heavily invested in German loans and securities during the 1930s and never fully recovered from their losses. The Basler Handelsbank was taken over by the Swiss Bank Corporation in 1945.Footnote 107 The Eidgenössische Bank was taken over by the Union Bank of Switzerland (UBS) in the same year. UBS increased its nominal capital for that purpose by CHF 10 m to CHF 50m.Footnote 108 Nevertheless, the capital/assets ratio of the Union Bank of Switzerland fell to 7.1% in 1950, and the ratio of the Swiss Bank Corporation to 7.6%.

Another legacy of the Great Depression and the war years was the low dividends for shareholders. Traditionally, Swiss banks aimed for stable dividends. The target dividend was usually met by augmenting or releasing internal or published reserves.Footnote 109 A case in point is Credit Suisse, which paid a dividend of 8% from 1895 to 1933.Footnote 110 The ‘traditional 8%’ became a benchmark for the big banks. Besides Credit Suisse, Bank Leu & Co., the Swiss Bank Corporation, the Eidgenössiche Bank, and the Basler Handelsbank all paid a dividend of 8% in 1930. The Union Bank of Switzerland paid 7% and the Swiss Volksbank 5%.Footnote 111 The losses of the 1930s forced banks to cut their dividends to between 0% and 5% (1935). A sharp reduction in foreign business in 1939 led banks to lower dividends even further – on average, by another percentage point.Footnote 112 It was not until 1952 that Credit Suisse and the Swiss Bank Corporation reached the 8% level again. The Union Bank of Switzerland paid 8% from 1956 onwards, and the Swiss Volksbank paid 8% only after 1960.

Given the low dividends after the war, it seems that the banks either opted in favour of their shareholders’ interest or thought that they could not place enough shares in the market given the low dividends. Instead of issuing shares, the banks increased dividends first. This process would have certainly been more difficult, if not impossible, the other way around.

Secondly, hidden reserves reduced the need for immediate capital issuances after the war. While capital ratios might not have been growing, hidden reserves (not represented in public figures) probably were. The extent of the hidden reserves after the war is unknown. It is likely that the Great Depression diminished most of the hidden reserves since only two of the big banks – Credit Suisse and the Swiss Bank Corporation – managed to get through the crisis without being forced to reduce their nominal capital. Many other banks used most of their hidden reserves and large parts of their published reserves.Footnote 113 As asset prices increased after the war, hidden reserves started to accumulate substantially.Footnote 114 The actual capital rose with the increase of the hidden reserves. This build-up of hidden reserves cannot be detected in published accounts, but it certainly strengthened the solvency of the banks.

Thirdly, new regulation replaced existing conventions on capital ratios. Bank capital was first regulated on a national level in Switzerland in 1934/5 with the Banking Law and the Banking Ordinance. According to the Banking Law, a bank’s capital would have to be in an ‘appropriate’ proportion to its liabilities.Footnote 115 The Banking Ordinance further specified minimum capital requirements.Footnote 116

The introduction of written rules certainly contributed to the demise of informal conventions on what amount of capital was perceived as adequate. The optimal amount of capital was discussed at times in the annual reports of banks and regularly in the statistical publications of the SNB. After the 1930s, however, the topic was not covered as frequently anymore. If capital was mentioned in the annual reports of banks or by the SNB, it was only in the form of a short note that the banks met the capital requirements.Footnote 117

Another vital part of the capital legislation was that it allowed lower capital requirements for liabilities invested in mortgages and government debt. This rule shows that the regulators aimed to adjust capital requirements to the credit risk of the assets. The more nuanced view on capital and risk coincided with structural changes in banks’ balance sheets at the time. During the war, the share of government debt in balance sheets grew. After the war, the big banks substantially increased their share in short-term loans to companies and later in mortgages. Short-term loans bore less risk than direct holdings of companies. Moreover, holding direct investments in companies had lost importance during the inter-war years.Footnote 118 The geographic diversification of loans also increased. Foreign investments had been particularly skewed towards Germany until the 1930s. As for mortgages, these were thought to be of low risk as the land was collateralised.Footnote 119 Overall, lower risks through shorter maturities, diversification, and secured assets meant that a bank would require comparably less capital – and both regulators and banks were aware of that.

The SNB also did not seem to be concerned by the falling capital/assets ratio, outlining that the structure of the assets had changed, and the fact that both the liquidity and the capital ratios of the big banks were substantially above the statutory requirements.Footnote 120

4.4 The United States: The Birth of Risk-Weighted Assets

The government debt of the United States grew rapidly in 1917/18, the 1930s, and during the Second World War. The large shares of government debt in the balance sheets of US banks had also changed the practice of assessing capital adequacy by the three federal bank supervisory agencies. A minimum capital/deposits ratio of 10% was the common supervisory practice in the United States until the Second World War. The bank supervisory agencies abandoned the traditional capital/deposits as a result of the fundamental change in the banks’ asset structure. A good example is the statement by the FDIC in 1945: ‘Enforcement of the traditional 10 per cent overall capital ratio would not be wise at this time because the increase in bank assets over the past few years has occurred largely in the non-risk category.’Footnote 121 Capital ratios of US banks had been falling since 1931. In 1941, the average capital/deposit ratio of banks in the United States hit the 10% threshold. The capitalisation of the large New York City banks was even more pronounced. Among seven large New York banks (Bank of New York, Chase, Chemical, City, Hanover, JP Morgan, Manufacturers) four had missed the 10% capital/deposits ratio in 1935. By 1941, the average capital/deposits ratio of these banks stood at 6.8%.

The trend towards lower capital ratios and higher shares of government debt in banks’ balance sheets was preceded by an increasingly nuanced view towards risk – or, more specifically, potential losses – in banking and the need for capital to cover such losses. The banking literature had established already in the nineteenth century that capital requirements should relate to a bank’s risk. Moreover, it was clear that a uniform capital/deposits ratio of 10% did not reflect the different asset compositions among US banks.Footnote 122 The late 1930s and 1940s produced a series of proposals by practitioners and academics for alternatives to the 10% capital/deposits requirement in the United States. Some of these suggestions aimed to modify the existing capital/deposits ratio by deducting risk-free cash from the amount of deposits.Footnote 123 Other ideas aimed to introduce additional reserves to strengthen capital through retained profits above a certain return threshold, to be defined for each asset class.Footnote 124 The most widespread opinion, however, was clearly that the time had come to change the focus from deposits to assets when determining the required amount of capital.Footnote 125

The transition to risk-based approaches are well documented by the communications of the three federal bank supervisory agencies. By the late 1930s, they had arrived at a system that classified assets of different risk into four groups. The 1940s and 1950s brought several proposals on how such categories could be related to a sufficient capital. One of them, the Federal Reserve’s ABC formula, eventually became one of the conceptual forerunners of the Basel I framework, introduced in the late 1980s.

4.4.1 From Deposits to Assets: A New Supervisory Focus

The FDIC was the last federal bank supervisory agency to highlight the relevance of the 10% capital/deposit ratio in its annual report in 1936. In the same year, the FDIC also stressed that a sufficient capital should have ‘due regard for the quality and character of the assets’ in 1937.Footnote 126 The FDIC repeated the statement regarding the quality of assets in various ways in the following years. In 1938, the FDIC referred for the first time to a capital/liabilities ratio of 10% as a ‘working rule’, rather than a capital/deposits ratio.Footnote 127

After 1938, the FDIC shifted its focus to the so-called ‘quality of assets’. It was the first of the three supervisory agencies to change from deposits to assets. The FDIC provided a nuanced view on sufficient capital by deducting cash and government debt from the banks’ total assets when discussing capital adequacy during the 1930s and 1940s. The ratio of capital to these adjusted assets was commonly known as the capital/risk-assets ratio. However, the FDIC was careful not to term this comparison a ratio and hesitant to refer to a specific minimum requirement. The FDIC was concerned that banks could use the new capital ratio as an argument against necessary capital increases.Footnote 128 Thus, the term ‘risk assets’ was publicly avoided until 1945, even though the FDIC considered the riskiness of assets.Footnote 129

The Comptroller of the Currency and the Board of Governors of the Federal Reserve seemed to go through a similar evolution as the FDIC, but adopted the idea of ‘risk assets’ much quicker. Throughout the Second World War, both agencies had acknowledged the growth of deposits and the change in the asset structure among banks, and had introduced an alternative measure for sufficient capital. The Federal Reserve was the first of the three supervisory agencies to use the term ‘risk assets’ in its 1943 annual report. It calculated risk assets by deducting cash, reserves, amounts due from banks, and government securities. The FED argued that the capital/risk-assets ratio was higher than it was before the war, and, thus, the banks were well capitalised.Footnote 130 The OCC started using the term ‘risk assets’ publicly in 1944. Similar to the statements by the FED, the OCC referred to the falling capital/deposits ratio and underlined that this picture changes once the risks of the assets are considered. By the end of the Second World War, all three federal agencies used a capital/risk-assets ratio.

Despite developing a new methodology for capital adequacy, the federal agencies were concerned about the evolution of capital in banking given that the war was coming to an end. The OCC stated that ‘more capital is one of the primary needs of the banking system’ and that it would be necessary to ‘protect the further expansion of liabilities and of risk assets which can be foreseen in the postwar period’.Footnote 131 Once the war was over, the FED and the OCC urged banks to re-examine their capital situation. It was expected that deposits and holdings of government securities would decline, which would require additional capital.Footnote 132

In reviewing its policy towards capital adequacy, the OCC announced in 1949 that it had placed more emphasis ‘on capital in relation to several factors, particularly competence of management, and volume and quality of assets’. As a rule of thumb, the Comptroller used a ratio of ‘capital funds to loans and investments other than United States government securities’. The Board of the Federal Reserve, too, referred to a capital/risk-assets ratio when assessing the capital of banks.

4.4.2 Categorising Assets According to Risk

Even though all three agencies used capital/risk-assets ratios from the late 1930s, they did not publicly communicate specific quantitative capital requirements. Initially, the federal bank supervisory agencies considered a minimum capital/risk-assets ratio of 20% as sufficient.Footnote 133 After the Second World War, supervisors often used benchmarks for comparing capital ratios of banks. Such benchmarks could consist of certain bank types or banks in a certain region. Banks below such averages would receive more attention from bank examiners.Footnote 134 Such an approach is – of course – problematic if the average of the benchmark is constantly falling.

One of the weaknesses of the capital/risk-assets ratio was certainly its inability to account for different degrees of risk: the two categories were either no risk (government securities, cash) or risk (everything else). Bank supervisors and other experts were well aware of this deficiency. By 1945, for example, the FDIC had discussed various factors that should be considered when assessing capital adequacy, most notably the types of assets and their expected losses. But the FDIC noted that ‘it has not been found practicable to devise a formula which would take into account all these factors’.Footnote 135 Yet such a formula emerged in the following years.

In supervisory practice, however, bank examiners had already developed more sophisticated approaches to assess asset quality. Moreover, federal and state banking supervisors held various conferences between 1934 and 1938 – often at the request of the Secretary of the Treasury – aiming to create uniform standards for banking supervision. Two vital subjects were the definition of capital and the valuation and classification of assets. Already early on in 1934, the supervisors agreed on a concept for classifying loans into four different risk categories.Footnote 136 The guidelines for loans were further developed and extended to securities in 1938, and led to a joint statement by the Secretary of the Treasury, the FED, the FDIC, and the OCC. The agreement defined four different securities groups:Footnote 137 Group I was dedicated to ‘obligations in which the investment characteristics are not distinctly or predominantly speculative’. Obligations with ‘distinctly or predominantly speculative characteristics’ were assigned to Group II. Group III covered obligations in default and group IV concerned stocks.

Beyond the different risk groups, the 1938 joint agreement also defined how the securities were to be valued by bank examiners. One key issue at the time was that fluctuating bond prices would have a negative impact on the so-called ‘net sound capital’ ratio of a bank if such bonds were valued at market prices. Before 1938, the net sound capital was usually calculated by deducting the difference between the value of a security in the bank’s book from the market price. This approach led to a high volatility in the capital ratios of banks, which bank supervisors at the time wanted to avoid. The problem was solved by allowing banks to value group I securities (government securities or obligations with high ratings) at book value or at cost, as they were not purchased for speculative reasons. For Group II, an 18-month average of the market price was used. Only securities in Groups III and IV were valued at market prices.Footnote 138

The evolution of new measurements for capital adequacy was also accompanied by various publications of academics. One of the leading voices in academia on capital in banking was Roland Robinson, professor of finance at Northwestern University and president of the American Finance Association in 1953. In 1941, Robinson reviewed the evolution of the capital/deposit ratio as a supervisory requirement in an article in the Journal of Political Economy. His article provided several suggestions and became a reference for many later publications. Robinson criticised the capital/deposits ratio by referring to the role of capital as a protection against asset losses. The probability of such losses would depend on the quality of assets and have no connection to the deposits. Moreover, Robinson concluded that the risk of assets varies to a great degree, from riskless cash to risky loans, and he argued that capital ratios for a bank mostly active in the money market should be different to those for provincial banks with a high undiversified credit risk to agriculture and industry. Robinson’s main contribution was to suggest different capital requirements for each asset category on a bank’s balance sheet.Footnote 139 The idea, however, must have already circulated earlier: John T. Madden, director of the Institute of International Finance of New York University, went in a similar direction in 1940.Footnote 140

Discussions on how to measure capital adequacy continued into the 1950s. Contributions on the topic usually focused on three questions: (i) should there be one uniform capital/risk-assets ratio for all banks?; (ii) who should determine the risk of an asset (banks independently or supervisors); (iii) what kind of ratios could be used in practice?Footnote 141

In 1952, the Illinois Bankers Association suggested a further developed version of the capital/risk-assets ratio. The proposal was based on a report by Gaylord Freeman, a banker and later chairman of the First National Bank of Chicago. Freeman argued that each bank would have to list all its assets and simulate the crisis of the 1930s. A deviation of the price from the price in the bank’s book would then be deducted from the bank’s capital. The proposal also came with several categories of assets and their potential losses, based on the experience of the Great Depression. Loans, for example, had a potential loss of 10%, municipal bonds of 20%.Footnote 142

Another suggestion in 1952 was brought forward by the New York FED. It suggested six risk categories for assets. Each category was assigned a certain percentage of required capital. No capital was required for the riskless category I (cash, government securities with a maturity less than five years and other ‘secure’ assets). Category II required 5% capital, category III 12%, category IV 20%, category V (defaulted bonds, stocks) 50%, and category VI (fixed assets) 100%. Assigning weights to all these categories leads to a required capital, which could then be compared to a bank’s actual capital. Each bank should hold between 100% and 125% of the required capital.Footnote 143

The most advanced model of the 1950s was developed by the Board of Governors of the Federal Reserve. The ‘Form for Analyzing Bank Capital’ became known as the ABC formula and was used into the 1970s.Footnote 144 Similar to the approach by the New York Federal Reserve Bank, the ABC formula categorised assets into different groups. These groups ranged from cash to high-risk securities. The FED already differentiated between credit risk and market risk, assigning weights to different asset classes for each risk category.Footnote 145 The sum of these risk-weighted assets (a term not used at the time), led to the required capital, which could then be compared to the actual capital of a bank.Footnote 146 The expected range of that ratio was 80–120%. If a bank fell below the 80% threshold, the Federal Reserve would further examine it. Compared to earlier proposals, the ABC formula featured several novelties: it considered the relationship of assets (correlations) and a potential lack of diversification. The ABC form also assessed the liquidity of a bank and specified higher capital requirements for banks with inflows and outflows of deposits. Additionally, the form considered potential liabilities for a bank active in trust activities.Footnote 147

4.5 Concluding Remarks

Rapidly growing balance sheets coupled with high inflation rates during the two World Wars led to substantially lower capital ratios. The growing shares of government debt in banks’ balance sheets led to a fundamental reassessment of what adequate capital in banking meant. This gave rise to the concept of risk-assets in the United States. Risk-assets were defined as assets minus cash and government securities. A first adjustment of assets by risk (or, to be more specific, no risk or risk) led to a new measurement of capital adequacy: the capital/risk-assets ratio.

The invention of risk-based approaches to capital requirements cannot entirely be attributed to the US bank supervisory agencies. The idea that the amount of capital should relate to risk existed already in the nineteenth century. It was discussed in the literature, and bank managers knew the trade-offs that came with high or low leverages. Moreover, Switzerland’s banking legislation of 1934 also provides an example of a first attempt for a simple risk-weighting by defining two different asset categories. Nevertheless, three specificities of the US system created a logical avenue for the thought process on capital adequacy: high government debt, the existence of bank supervising agencies, and the frequent public discussion of policies on bank supervision.

The share of government debt in US banks’ balance sheets was high. During the Second World War, many banks could no longer meet the 10% capital/deposits ratio. This forced the US supervisory agencies to reconsider their informal guidelines for capital requirements. War financing was prioritised, and bank supervisors suspended the use of capital/deposits ratios. All three federal bank supervisors publicly discussed their (discretionary) policies on capital adequacy publicly. The shift towards new, risk-based approaches is, therefore, well documented.