The Basel I framework of 1988 led to a new set of capital regulations in Switzerland, the United States, the United Kingdom, and many other countries. One of the critical aspects was the risk-adjusted view on capital requirements. The capital/assets ratio, as a simple measure of a bank’s leverage, disappeared from the public discourse. Only during the financial crisis from 2008 did non-risk-adjusted capital ratios gain importance again. The subsequent reforms of the Basel framework – the revised version of Basel II and then Basel III – led to a revival of risk-unweighted capital requirements in the form of a leverage ratio. Moreover, risk-weighted capital measures were revised, and requirements were increased. Does that leave us with a more stable banking system?

6.1 Basel Capital Requirements and the Characteristics of Leverage Before the 2007/2008 Financial Crisis

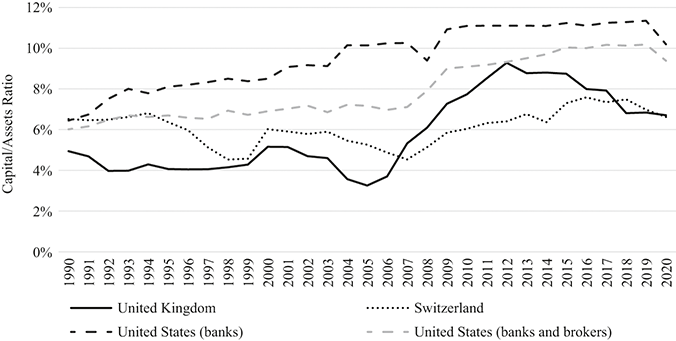

The 2007/8 financial crisis led to increased concern over a highly leveraged banking system.Footnote 1 Figure 6.1 shows banks’ capital/assets ratios in the United Kingdom, Switzerland, and the United States from 1990 to 2020. Several distinct features must be considered when analysing bank capital in the period leading up to the 2007/8 financial crisis. Firstly, capital ratios from 2000 to 2006/7 indicate increasing leverage in the British and Swiss banking systems. The trend in the United States was different, indicating continuously growing capital/assets ratios among commercial banks from 1990 to 2006. However, the data is somewhat misleading and conceals that a significant part of the banking system was highly leveraged. The data excludes investment banks, which increased their leverage substantially from the early 2000s.Footnote 3 Therefore, a second line combines banks and brokers in the United States. Overall, the leverage in the United States banking system was relatively stable from 2000 to 2007, ranging around the 7% mark, but one specific segment of the US banking market became particularly vulnerable to losses. After 2007, the banking markets of all three countries deleveraged substantially. Banks’ capital/assets ratios in all three countries peaked between 2012 and 2019 at levels unseen for several decades.

Figure 6.1 Capital/assets ratios in the United Kingdom, the United States, and Switzerland, 1990–2020Footnote 2

A second peculiarity during the period before the 2007/8 crisis was that large global banks operated with higher leverage than the rest of the banking market. In Switzerland, the capital/assets ratio of UBS and Credit Suisse by the end of 2007 was 1.5 percentage points lower than that of the Swiss banking market. In the United Kingdom, the six largest banks had average capital/assets ratios 0.7 percentage points lower than the market average.Footnote 4 In the United States, the deviation in the capital/assets ratio of the five largest banks from the rest of the banking market was even more pronounced (3.9 percentage points lower).Footnote 6

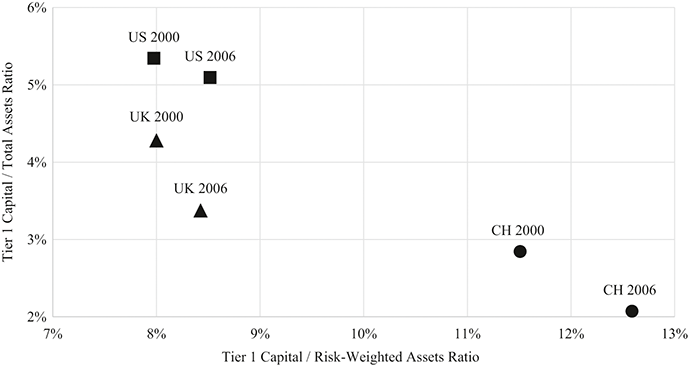

A third feature of the pre-crisis period was that many large banks’ risk-weighted and risk-unweighted capital ratios diverged from the early 2000s. The most important risk-weighted capital measure was the Tier 1 capital ratio. This measured a bank’s capital and reserves against the risk-weighted assets (RWA). If the two Tier 1 ratios and the capital/assets diverge, it means that the difference between the total assets and the RWA grows, as both ratios use capital as the numerator.

Figure 6.2 shows the average risk-weighted capital ratios and risk-unweighted capital ratios of the thirteen largest commercial banks in the United Kingdom, the United States, and Switzerland in 2000 and 2006, the year before the 2007/8 financial crisis. Both ratios use Tier 1 capital as a numerator for a uniform definition of capital. The evolution of capital ratios among these thirteen global banks from 2000 to 2006 was similar: the risk-unweighted capital ratio fell, meaning the banks reduced the equity capital and increased debt capital in relative terms. At the same time, however, the risk-weighted Tier 1 capital ratio increased.

Figure 6.2 Tier 1 capital as a percentage of total assets and risk-weighted assets of large banks in the United Kingdom, the United States, and Switzerland (CH) in 2000 and 2006Footnote 5

The reasons for the two diverging ratios can be twofold: the riskiness of the assets as classified by the Basel framework could have been reduced, or the measurement approach to calculate RWA changed. Both adjustments result in lower RWA.Footnote 7

A critical aspect was that the Tier 1/RWA ratio provided a perception of increased banking stability until the 2007/8 crisis, and banks actively cultivated that view. Interestingly, the two banks most keen to boast their strong capital position were the most leveraged ones. By 2006, UBS referred to itself as ‘one of the best capitalised financial institutions in the world’, and Credit Suisse highlighted that it had the strongest capital base in its history.Footnote 8 These statements were true when analysing the risk-weighted Tier 1 ratio for the brief period that the ratio existed (since 1988). However, the simple and risk-unweighted capital/assets ratio reveals that these banks were never more leveraged in their history than in 2006. The large US and British banks were slightly more reserved than their Swiss counterparts, underlining that they are strongly capitalised and met the statutory capital requirements.Footnote 9

The Basel Accord in 1988 and its later versions (Basel II and Basel III) provide the framework for risk-weighted capital measurements. Many limits and weaknesses of the framework were understood and evident to policymakers and experts from the beginning of Basel I.Footnote 10 One crucial aspect was that Basel I did not cover market or operational risk. The focus on credit risk was a deliberate choice, leaving the treatment of other risk types to national regulators and supervisors. In 1996, the BCBS amended Basel I and included market risk.Footnote 11 A key characteristic was that the revision allowed banks to apply their internal risk models to derive capital requirements for their trading book. The use of proprietary risk models was subject to approval from the supervisor. This was the first time banks were allowed to use their risk models. In retrospect, it was a critical moment, as was the start of the so-called internal ratings-based (IRB) models to follow in subsequent years.

Other issues – such as off-balance sheet activities, the securitisation and buy-back of assets (leading to lower capital requirements), and the complexity of business models among international banks – had to be addressed by a more fundamental revision of the Basel framework. The BCBS published a new framework, Basel II, in 2004.Footnote 12 The new approach also covered operational risk, previously covered implicitly by credit risk. Moreover, it allowed banks to choose different levels of sophistication in calculating the required capital. The rationale was that large banks could use more sophisticated measurement methods for risk, which would lead to more accurate risk assessments. Accuracy was rewarded with less required capital, whereas a simple approach with less accuracy would yield a higher capital requirement. The simple approach was termed the ‘standard’ approach. The more sophisticated versions were the banks’ proprietary internal-ratings-based approaches. In retrospect, the Basel II framework is a testament to the faith in financial models to capture risk accurately. The critique that followed regarding financial modelling in general, and Basel II specifically, was widespread.Footnote 13

In many countries, the 2007/8 financial crisis fell into the Basel II transition period. The US banking supervisory agencies published the final implementation of Basel II (for large banks only) in December 2007, with a three-year transition period.Footnote 14 In Switzerland and the United Kingdom, Basel II was introduced in 2007.Footnote 15 The BCBS addressed many crisis-related and evident problems by revising Basel II (Basel II.5) in 2009.Footnote 16 By 2010, the BCBS issued the new Basel III framework. Critical features of Basel III were a new definition of capital (CET1 capital), higher capital requirements, a leverage ratio, and liquidity requirements.Footnote 17 Finally, the BCBS published the latest revision of Basel III in December 2017.Footnote 18 The focus of the 2017 revision is on the risk models to calculate the RWA. Especially the use of internal models are more constrained again, which somewhat reverses the evolution towards such models initiated in 1996.

6.2 The Limits of Capital

The perception of an adequate level of bank capital and how it is measured has changed fundamentally since the nineteenth century. Simple rules of thumb developed into complex models. Regulatory texts and supervisory guidelines on capital grew from a few sentences to hundreds of pages. This book has presented financial crises and wars as two crucial catalysts for change in the perception of capital. Another – neglected – dimension is the role of knowledge. Before the 1950s, finance was mainly a ‘literary’ subject. The introduction of mathematics, modelling, and statistics as techniques for analysis triggered innovation in risk management that also found its way into the Basel framework.

If the authors of banking textbooks of the nineteenth century were presented with the capital adequacy frameworks of today, they might be positively surprised. First, the functions of capital in banking did not change since the first commercial banks emerged. The loss absorbency and the guarantee function of capital are still crucial for ensuring trust. Second, it was already apparent in the nineteenth century that the size of a bank’s capital should relate to its risk. The various measurement approaches for capital adequacy developed in the twentieth century aimed to do precisely that: measuring risk more accurately to allocate the capital needed for a stable bank. However, the nineteenth century banking literature authors might be less impressed with the outcome. Never before were methods to derive capital requirements more sophisticated than now – but banks remain unstable.

In a historical perspective, the United Kingdom, the United States, and Switzerland provide various attempts to create more stable banking systems. The United Kingdom opted for a system of informal supervision with a strong focus on liquidity. Not even the Banking Acts of 1979 and 1987 introduced statutory minimum capital ratios. Switzerland introduced nationwide banking legislation with minimum solvency and liquidity ratios in 1934/5. And the United States had a long tradition of minimum capital ratios applied by bank supervising agencies but harmonised and formalised minimum capital ratios only by the 1980s. Eventually, all three countries arrived at a system that regulated capital based on a risk-weighted approach during the 1980s, before the introduction of Basel I.

Looking at the evolution of capital requirements, it is somewhat surprising that the premise of financial market stability was often not the starting point when capital requirements were discussed. Existing regulatory frameworks or conventions served as a blueprint, resulting in the ever-growing complexity of banking regulation. Instead of fundamentally reconsidering banking stability, time after time regulators focused their attention on ameliorating the weaknesses of the existing framework. This approach was often backwards looking and neglected the fact that lessons of the past are not necessarily the solution to tomorrow’s problems.

At the same time, one must bear in mind that banking instability is not surprising. If banks accept deposits and lend, then by their very nature they are prone to bank runs from creditors. Capital plays an integral part in inducing trust for creditors, but it is not the only possible source of trust. Governments, shareholders, and banks can also provide guarantees that provide trust for creditors. Historically, there was a clear risk-shifting from shareholders and bank managers to the state, which took over more guarantor roles. Unlimited liability or double liability for shareholders is long gone. At the same time, states implemented capital regulation, created bank supervising agencies and deposit insurance schemes, formalised the lender-of-last-resort function, and accepted implicit and explicit government guarantees for banks. On the side of banks’ management, history also provides numerous cases of speculative behaviour and mismanagement with little or limited consequences for decision-makers.

Once we accept that modern banks are unstable by their very nature, the attention falls on the impact of bank failures. Losses of failed banks must be covered by those who own a bank, and no bank should be too big to fail.