One of the most important decisions made by pension institutions is in which assets to invest. This decision is critical because asset allocations are a key driver of performance and sustainability. According to Brinson et al. (Reference Brinson, Hood and Beebower1986), over 90% of investment returns can be explained by a fund's asset allocation policy. Despite the relevance that asset allocation has on performance, there is only scant evidence on whether and how pension fund governance shapes asset allocations.Footnote 1 Existing studies mostly examine how the presence of a dominant player in the investment decision process, e.g., the sponsor company, has consequences in risk-taking decisions. Using an institutional setting where balance of power in the control of pension assets is the rule, our goal is to study other governance considerations and the implications they have for asset allocation policies.

In our view, asset allocations are potentially associated with board inefficiencies that can arise when board members lack investment expertise, show limited engagement or, simply, favor their own interests. To evaluate this statement, we use a unique sample of 169 Swiss pension funds over the period 2010–2012. This sample provides us with a comprehensive set of governance attributes that is free from self-selection bias. To evaluate governance, we focus on the governing body of the pension institution: the board of trustees. Usually, the board is the key internal governance mechanism in pension funds, has fiduciary duty, and is responsible for the investment policy.Footnote 2 In our setting, equal representation of employers and beneficiaries is a key characteristic of the board and, as such, the potential influence of a dominant group is largely neutralized. To characterize board governance, for each pension fund, we collect a list of 22 governance attributes that are considered best practice, are relevant, and available. These attributes proxy for different aspects of the organization, composition, and functioning of the pension board and, as such, capture various governance dimensions.

We then construct a composite index that measures the extent to which a board works according to generally accepted principles of good governance. We relate this index to the percentage of assets invested in risky assets, in foreign assets, held in cash and equivalents, and document a significant association between board governance and asset allocation decisions. Because governance is highly correlated to fund size, we neutralize the effect of fund size on asset allocations that is due to governance. All else being equal, a one standard deviation increase in the governance index is related to an additional 2.7% of total investments held in risky assets, 3.3% in foreign assets, and to a lower 3% in cash and equivalents. Even after controlling for governance-driven scale effects, well-governed boards hold more foreign assets, less cash and, when pension funds are small (having total assets below the sample median), invest more in risky assets. Further, existing studies typically include fund size in asset allocation regressions but provide no rational to do so. We show that fund size is related to asset allocations at least through two channels: through governance considerations and through other non-governance-driven factors such as scale effects.

To further investigate our main results, we examine which governance attributes are particularly relevant. Well-governed boards have in place well-defined investment objectives and a comprehensive framework to guide the investment process. We evaluate the comprehensiveness of the investment policy and build an equally weighted index that includes a subset of governance attributes. This construct measures the extent to which a pension fund meets best practice investment policy guidelines. We find that a one standard deviation increase in the comprehensiveness of the investment policy is associated with a higher investment of 2.1% in equities, 5.5% in foreign assets, and to a lower investment of 2.5% in cash holdings. We also evaluate whether a specific governance attribute is behind the relations we uncover. Various attributes such as having investment objectives and investment benchmarks defined, as well as a risk policy available, are relevant to decisions on equity, cash holdings, and foreign diversification. Note that the return implications of holding excessive levels of cash are not negligible. Over the period 1900–2010, stocks and bonds have exceeded the return on cash equivalents by 4.5 and 0.7% per year.Footnote 3 For a portfolio with a strategic asset allocation of 50/50 stocks/bonds, this represents a foregone annual return of 260 basis points for the amount of idle cash. If we assume idle cash is 5% of the portfolio, an investment of this cash in stocks (in a 50/50 stocks/bonds mix) would bring an additional 22.5 (13) basis points of return per annum.

We argue that a comprehensive investment policy is likely to proxy for the financial expertise available to the fund while it provides the set up to facilitate decision making. Higher levels of guidance and expertise in financial matters bring confidence and expand risk-taking capacity while acknowledging the benefits of foreign diversification and the opportunity costs of holding excessive cash. We further show that the involvement of external experts in financial matters is also related to lower cash holdings and greater foreign diversification. The association with foreign diversification though becomes insignificant when we control for the size of the pension fund.

Our paper contributes to the few studies that evaluate how governance shapes pension fund asset allocations. Existing studies mostly document how conflicts of interest of a dominant player are often correlated to risk-taking behavior and disregard other governance aspects. This is because the incentives of a dominant group, such as the sponsor company or politicians, find their way into investment decisions.Footnote 4 When the sponsor company is the dominant trustee, sponsor incentives and characteristics are significant determinants of pension allocation policies (Cocco and Volpin, Reference Cocco and Volpin2007; Rauh, Reference Rauh2009; An et al., Reference An, Huang and Zhang2013; Atanasova and Gatev, Reference Atanasova and Gatev2013; Phan and Hedge, Reference Phan and Hedge2013; Anantharaman and Lee, Reference Anantharaman and Lee2014). Most of these studies focus on US corporate pension schemes with the exception of Cocco and Volpin (Reference Cocco and Volpin2007) that use data on UK pension schemes. When a significant share of trustees are politicians, there are local biases, more investments in equities of politically-connected firms (Bradley et al., Reference Bradley, Pantzalis and Yuan2016), or higher risk-taking (Andonov et al., Reference Andonov, Bauer and Cremers2017). We complement these studies in three ways. First, we use governance measures that are broader in scope so we can evaluate other governance dimensions. We provide some evidence suggesting that a deficit in guidance and financial expertise may be a relevant factor to target. Second, we examine not only risk-taking behavior but also other aspects of asset allocation policy such as foreign diversification and cash holdings. Finally, by analyzing the relation between governance and pension fund size, we provide a rational for the use of size as a control variable in asset allocation regressions.

Using Swiss data, Ammann and Zingg (Reference Ammann and Zingg2010) and Ammann and Ehmann (Reference Ammann and Ehmann2017) also investigate the governance of Swiss pension funds. These studies are similar to ours in that they also build a governance index covering a large spectrum of governance attributes. We all use different metrics that emphasize different dimensions of governance as the attributes used to build the indices are gathered from different information sources. While Ammann and Zingg (Reference Ammann and Zingg2010) and Ammann and Ehmann (Reference Ammann and Ehmann2017) use self-reported answers to a survey, we directly collect governance indicators from pension fund filings and investment policies. Further, their main focus is on the empirical relation of governance with investment performance while ours is on the relation of governance with asset allocations. In particular, Ammann and Ehmann (Reference Ammann and Ehmann2017) also test the link between governance and asset allocations but fail to find evidence of significant relations; a finding that differs from ours. There are two reasons that can explain these diverging results. First, the use of a survey-based sample dominated by large pension funds, as opposed to our hand-collected sample that includes a cross-section of pension funds with more variation in size and governance policies. Second, our proxy for governance is built on different attributes and we focus on the characteristics of asset allocations such as risk-taking, foreign diversification, and cash holdings rather than individual asset classes. Summing up, we extend the work of the cited papers by showing that different governance aspects, those embedded in a comprehensive investment policy, are related to higher equity, greater international diversification, and lower cash holdings.

Finally, it is important to note several limitations in our study. Our results indicate that it is likely that a strong board shapes asset allocations. However, given the nature of our data, our emphasis is on the cross-section and on the association of board governance and asset allocation. We thus share the imperfections inherent in cross-sectional studies and have limited possibilities to strongly conclude a causal relationship. Furthermore, our analysis is deeply rooted in the institutional and legal environment of our sample and further analysis would be necessary to conclude whether the relations we uncover are likely to hold in a different institutional setting. Nevertheless, our results contribute to the debate on how pension organizations should evolve and what the necessary conditions are that should be put in place to promote sensible asset allocations.

This paper is organized as follows: Section 1 lays out the theoretical reasons as to why governance might relate to pension fund asset allocation. Section 2 presents the dataset and describes the construction of the governance index and asset allocation variables. Section 3 describes the model and provides results. Section 4 briefly concludes.

1. Why and how board governance may impact asset allocations?

A well-governed board has structures in place that promote investment policies and asset allocations to serve pension beneficiaries at an efficient cost to employees, sponsors, and taxpayers. However, in the absence of appropriate mechanisms, there may be situations where the board does not function well, resulting in poor governance. In our view, asset allocations are potentially associated with poor governance that can arise when board members are too busy, lack appropriate incentives, are short of investment expertise, or, simply, favor their own interests. We conjecture that poorly governed boards – with the aim to favor their interests, limit engagement or protect themselves – will show higher levels of conservatism, greater home bias and hold more liquid assets.

This hypothesis is consistent with John et al. (Reference John, Litov and Yeung2008) who show that, in corporate boards, the presence of conflicts of interest promotes conservative behavior in capital budgeting decisions. Similarly, Phan and Hedge (Reference Phan and Hedge2013) show that poor governance in corporate boards leads to lower risk-taking in pension fund investment decisions. In contrast, there are studies supporting a different view (Cocco and Volpin, Reference Cocco and Volpin2007; Davis and De Haan, Reference Davis and De Haan2012; An et al., Reference An, Huang and Zhang2013). When the pension board is controlled by a dominant party, such as the employer, these studies explain that there are situations where conflicting interests can instead promote risk-taking. However, this view seems less relevant in our setting where the influence of the employer is largely mitigated. The sponsor company and the pension fund are two separate legal entities, and the pension fund board is composed of employer and beneficiary representatives in equal parts.Footnote 5 Furthermore, to curb excessive risk-taking, the law puts limits on the amount of risky investments and prescribes conservatism by requiring the board to guarantee the security of investments.Footnote 6 Nevertheless, we can subject to empirical study the different predictions that result from the two alternative views.

Our conjecture also draws from empirical and experimental studies that, in a corporate setting, show how managerial ability has implications for risk-taking (Brenner, Reference Brenner2015; Yung and Chen, Reference Yung and Chen2017). Further, investor competence has been related to greater foreign diversification (Graham et al., Reference Graham, Harvey and Huang2009). While in pension funds, board competence in financial matters is a crucial ingredient of good governance, several authors have highlighted the general lack of competence of trustees in the investment decision-making process (Clark, Reference Clark2004; Clark et al., Reference Clark, Caerlewy-Smith and Marshall2006, Reference Clark, Caerlewy-Smith and Marshall2007; Ambachtsheer et al., Reference Ambachtsheer, Capelle and Lum2008). If pension boards lack the necessary skills to guide the investment process, we could observe conservative investment policies, such as low risk-taking behavior, excessive cash holdings, and under diversification. In line with this idea, Useem and Mitchell (Reference Useem and Mitchell2000) show that pension boards subjected to independent performance evaluations decide to invest more in equity, and argue this is because external evaluators bring external knowledge to the fund. Alternatively, competence in financial matters may emphasize asset-liability investing in the long-term rather than the classical asset-only investing based on minimum variances. In particular, boards may emphasize hedging interest rate and inflation risks and focus on the hedging properties of different asset classes. According to Hoevenaars et al. (Reference Hoevenaars, Molenaar, Schotman and Steenkamp2008), when investing in the long-term, this focus also leads to similar predictions: a greater share of risky assets and lower cash holdings than investing according to an asset-only approach.Footnote 7 In summary, the quality of pension board decisions rely on high levels of expertise and sophistication and falling short of these standards can have asset allocation consequences.

Finally, poor governance is also consistent with board trustees showing limited engagement toward their mandate, either because they are too busy, not sufficiently remunerated, or wish to enjoy a quiet life (Mace, Reference Mace1986; Bertrand and Mullainathan, Reference Bertrand and Mullainathan2003; Fich and Shivdasani, Reference Fich and Shivdasani2006). With limited engagement, trustees may devote less time and effort in decision making. They may be less dynamic, less reactive, and will avoid taking difficult and risky decisions which might involve additional dedication. All these lead to significant consequences concerning the allocation of pension assets; for example, holding excessive liquid assets, insufficient diversification, as well as avoiding risky investments.Footnote 8

All in all, well-governed boards should have higher risk tolerance and be willing to invest more in risky assets. They should be reactive in allocating excess funds and hold less cash while reaping the benefits of diversification.

2. Data and variable construction

This section describes the data and presents the methodology we use to measure pension board governance and to evaluate its relation to asset allocation.

2.1 Data and descriptive statistics

To conduct our study, we manually gather data for all active occupational pension funds registered in four Swiss cantons that report to a regional supervision authority.Footnote 9 Occupational pension funds are part of the employer-based pension system, the so-called second pillar.Footnote 10 Pension funds are required to send regularly to the supervision authority the following files: (1) the audited annual reports under Swiss GAAP RPC 26 (balance sheet, income statement, notes to the accounts), (2) the foundation statutes (or laws for public pension funds), (3) the internal rules regarding the organization and the investments. We have access to documents filed during the period 2010–2012. As the supervision authority was reorganized, there were no pension fund filings from before 2010 physically available for data collection. Collecting additional data for the period after 2012 was not possible due to a change in data sharing policy. From available documents, we gather asset allocation, board governance attributes, and structural variables for each pension fund. From the initial list of pension funds, we exclude fully reinsured funds because trustees are no longer in control of asset allocations as assets are fully transferred to insurance companies. We also exclude pension funds if the liquidation of the fund is in progress or it is expected in the near future as indicated on the annual reports. Our dataset comprises a sample of 169 pension funds and 489 fund-year observations that collectively manage CHF 55.5 billion on behalf of 475,386 beneficiaries, both active and retired members, at the end of 2012. This sample represents about 8.2% of the total 2,073 pension funds (including not-registered, fully reinsured, and in liquidation) in Switzerland at the end of 2012, about 8.3% of total assets and 9.7% of total beneficiaries covered by the Swiss occupational pensions system.Footnote 11 Appendix A describes the data in detail. Appendix B provides a synthesis of the key institutional features of the Swiss pension system.

This hand-collected dataset has some advantages with respect to surveys that are often used in related literature. Surveys are subject to self-selection biases and, with the goal of representing the population, inherently overweigh large pension funds. In contrast, our sample covers a wide range of pension funds with varied characteristics and size, which is important when studying governance issues as governance quality is likely to be subject to larger variation than in samples heavily biased toward large pension funds. This is because investing in governance is a decision that trades off costs and benefits. As costs are to a large extent fixed, it is reasonable to expect governance quality to be correlated with fund size. Thus, samples including large pension funds are likely to show less variation in governance measures, making it harder to evaluate the association of governance attributes and asset allocation. Also, the verification of submitted documents by the authority plus two independent experts, an auditor and an expert in occupational pensions, underscores the reliability of reported numbers as opposed to surveys that could be subject to misreporting. Nevertheless, our collection is constrained by the quality of disclosure and level of transparency in pension fund files.

Table 1 presents descriptive statistics of pension funds' structural variables for the full sample and shows there are significant differences across pension funds. Panel A, for example, shows that fund size varies from CHF 11.4 million in assets (71 beneficiaries) in the lower decile, to CHF 718 million (8,084 beneficiaries) in the upper decile, with a mean value of CHF 322.3 million in total assets and 2,856 beneficiaries. The largest pension fund in our sample has almost CHF 8 billion in total assets and covers 76,687 beneficiaries. The average fund has 8.3 times more active employees than passive members, was founded 39.3 years ago, and has a coverage ratio of 102.6% over the sample period.

Table 1. Descriptive statistics

This table presents summary statistics of structural variables of pension funds in the sample over the period 2010–2012. Panel A summarizes some key indicators. Total assets refers to the total assets held by the pension fund (in mio CHF). Total beneficiaries is the number of active employees plus passive pensioners. Foundation age refers to the age of the pension fund computed from its foundation year. Beneficiaries ratio equals active employees over passive pensioners and equals active employees if passive pensioners is zero. Coverage ratio refers to pension assets over committed pension liabilities and it is expressed in percentage. Technical rate is the rate used to value pension liabilities. Panel B provides information on the legal and administrative form of pension funds. Public equals one if the pension is founded as a public institution and zero otherwise (=Private (cooperative or foundation)). Defined-benefit is an indicator variable for plan type and equals one for defined-benefit plans and zero otherwise (=Defined-contribution or hybrid plans). Multi-employer equals one for multi-employer funds (collective or common) and zero otherwise (=Single-employer). Internal administration (investments) equals one if the pension fund manages the administration (investments) internally and zero (=External administration or investments) otherwise. Percentages on dummy variables are computed over non-missing values.

In panel B, we observe that 94% are private entities (vs. public) and that 19% offer defined-benefit (DB) plans (vs. 81% defined-contribution (DC) plans).Footnote 12 Also, only a few funds manage their administration and investments internally (23 and 22%, vs. externally) and 80.5% are single-employer. Even if multi-employer pension funds represent 19.5% of our sample, their importance is not negligible as they manage about 35% of total assets and cover 57% of beneficiaries. Our sample is representative of the average Swiss pension fund in terms of structural characteristics and fund size. The average pension fund in our sample managed CHF 354 million at the end of 2012, while the average pension fund in Switzerland managed CHF 325 million over the same period.Footnote 13

2.2 Board governance attributes

To measure board governance, we are guided by accepted principles of good governance that can be put in place to mitigate potential inefficiencies, align incentives, trigger engagement, and promote competence. We identify 22 attributes that proxy for aspects of the organization, composition, and functioning of pension boards that are considered best-practice, relevant, and are available. For example, it is well documented that the presence of independent directors and balance of power are desirable attributes that enhance governance. However, in Switzerland, boards are composed of representatives of the employer and employees in equal parts, and most pension funds do not have independent directors at all.Footnote 14 Considering attributes such as ‘independent directors available’ or ‘equal representation’ would be irrelevant because pension funds conform to the same norm. Furthermore, some attributes represent provisions that are required or recommended by the law while others constitute voluntary measures that can be crafted to the specific needs of the institution. We do not consider attributes that are legally required. Thus, the institutional environment and data availability in pension fund files conditions the list of attributes that we are able to collect, the aspects of board governance we focus on, and the analysis we can perform in this study.

We provide the list and definition of the 22 attributes in Appendix A, panel B. For each attribute, we set a value of one if a firm meets a minimally acceptable level, zero otherwise. Collecting and coding values for each attribute involves some degree of judgement. For most attributes, disclosure is required. For example, pension funds have to disclose in their annual reports the names of experts, consultants, and asset managers. To measure the presence of external experts, we define ‘external experts available’ that equals one if there is at least one name reported, zero otherwise. Thus, we assume that a pension fund does not rely on external experts if there are no names reported. Most attributes follow this pattern. For dichotomous attributes, we assign a value of one if the pension fund meets the requirement, zero otherwise. Sometimes the information disclosed is incomplete or missing. For example, pension funds report the name of board members and indicate who they represent. It is possible though, that a board member's first name or whom they represent is omitted. This generates missing values in attributes such as ‘chairman employees representative’ or ‘women representatives’. For non-dichotomous attributes, we examine if the pension fund meets a threshold level of implementation and then create indicator variables. For example, board size ranges from a handful to more than 10 or 15 members. To characterize board size and based on its median, we create a dummy that equals one if there are less than six board members, zero otherwise. This choice is somewhat arbitrary and we examine alternative partitions in our tests with no consequence on the findings.

In a few attributes such as ‘compensation for attending’ or ‘training of trustees’, there is a wide degree of difference in the level of implementation or the form of disclosure. In these cases, when a pension fund documents a note, a comment, or a related expense, the attribute equals one. If we cannot identify the piece of information, we infer that the pension fund does not implement the attribute and we assign a zero. This coding is questionable, but we keep these attributes for three reasons. First, ‘good governance is also consistent with appropriate disclosure in a clear, accurate and timely manner’, thus these attributes may proxy for the quality of disclosure.Footnote 15 Second, they provide us with information on what pension funds do and keeping them will simply add measurement error that will attenuate our results toward no significance. And third, we re-run tests abstracting from them and conclude that they do not have a bearing on our conclusions.

Table 2, panel A lists the 22 governance attributes and shows the proportion of pension funds meeting each attribute over the sample period. With few exceptions, a pension fund has no more than two missing attributes and most missing values concentrate on the attributes ‘board meets at least twice per year’, ‘chairman employees representative’, and ‘compensation for attending’. We note that most pension funds disclose that they have their own code of best-practices preventing conflicts of interests (77%) and many have adopted the ASIP charter and directive (24%).Footnote 16 Representativeness of beneficiaries' interests on the board of trustees is secured with equal representation and most boards do not include the internal manager of the pension fund (80%) or external trustees such as politicians (94%). Interestingly, an election procedure is only clearly exposed and disclosed in 43% of the cases, the chairman is rarely an employees' representative (20%) during our sample period, and an alternation between representatives of the employer or employees is rarely foreseen (21%).

Table 2. Descriptive statistics of pension fund board governance attributes and indices

This table provides descriptive statistics for the governance attributes and composite index BGOV. For each governance attribute (1) to (22), Panel A reports the number of pension funds with non-missing observations and the number of pension funds with the attribute being equal to one. A detailed description of each attribute is provided in Appendix A. Panel B provides summary statistics of the composite index BGOV and other constructs used in our analysis. BGOV is the equally-weighted average of attributes (1) to (22) with non-missing observations and scaled to 100. The construct INVESTMENT POLICY is an equally-weighted average of attributes (18) to (22) and scaled to 100. BGOV-IP is a composite index of board governance that excludes investment policy-related attributes. EXTERNAL EXPERTISE equals one if there are external investment experts available, zero otherwise. INTERNAL EXPERTISE is the equally weighted average of attributes (14), (9), and (16). β represents the slope estimate of an OLS univariate regression of the respective governance indicator on the logarithm of fund total assets. ρ represents pairwise correlation coefficients between the governance measure and the logarithm of fund total assets. *** indicates significance at the 1% level. All other legal and administrative from related variables are described in Appendix A.

The setup and incentives to promote commitment such as sufficient board tenure (98%) and women representatives on boards (65%) are often met. Although most boards meet at least once a year, only 19% meet two or more times per year. Few pension funds offer any kind of compensation for board participation (24%) or report to have an internal manager (66%). In fact, often board participation counts as regular working time and therefore is not remunerated. What stands out is that a board organization comprising a small board (58%), with specialized committees (48%), with at least an investment committee (46%) is not the norm yet. Expertise in investments is mostly assured by external investment experts (91%) as pension boards do not seem to have an election procedure based on expertise or provide for systematic training programs (61%). Last, most boards have in place a basic framework to guide investment decisions, including an investment policy (98%) and clearly defined investment objectives (85%) for their asset allocation. In contrast, they do not seem to have in place investment benchmarks (44%) to guide performance measurement, asset-liability management (ALM) study to guide the investment strategy (25%), or a risk policy (12%) for their investments. The time-variation in the scores of attributes is very low so we only report averages for each attribute over the sample period. Some governance elements have been in place a long time as we can find them in the statutes of the pension funds. Others have been recently implemented in anticipation of or following the structural reform of occupational pension funds, adopted in 2010 (effective in 2012), that required or recommended a number of attributes to be put in place.

2.3 Measuring pension fund board governance

We use the individual attributes and construct a composite index, BGOV, that aims to capture the various dimensions of board governance.Footnote 17 Because missing values are clustered in a few governance attributes rather than in certain pension funds, we compute the index as the equally-weighted average of non-missing observations. We express this index as a percentage.Footnote 18 Thus, if a pension fund meets 18 out of the 22 non-missing attributes, the index value is 82% (18/22). A higher value is consistent with a board that is governed according to generally accepted principles of good governance, thus indicative of a well-governed board. Table 2, panel B provides summary statistics for the board governance index. BGOV has a mean value of 55% over the 3-year period and shows significant cross-sectional variation ranging from a minimum of 21% to a maximum of 83% (of 38% in the lower decile to 73% in the upper decile). Panel B also reports summary statistics of BGOV for different subgroups of pension funds based on fund size, legal and administrative characteristics, as well as summary statistics for other governance sub-indices that we define and use in our analysis later on. Regarding fund size, large funds have on average larger mean values of BGOV than small funds (61 vs. 49%). In the last two columns of panel B, we further examine this finding. The coefficient β represents the slope estimate of an OLS regression of the governance construct on the natural logarithm of fund total assets, our measure of fund size. A one unit increase in the logarithm of fund assets (about doubling its size) leads to a 4% higher ranking in BGOV (R 2 is 29%). Similarly, the coefficient ρ denotes the pairwise correlation between a governance measure and fund size. All governance measures are correlated to fund size positively and significantly at the 1% level. This is expected because larger pension funds have the capacity to invest more in governance that is normally associated with significant costs and resources. Also larger pension funds seem to enjoy greater levels of competence, for example, to invest in complex assets, venture into foreign markets, and optimally manage cash. Finally, public, multi-employer, and internal administration are characteristics that are also associated with a higher value of the BGOV index.

Governance is a multifaceted and abstract concept; finding valid constructs is a challenging task. We note that the approach of aggregating scores assigned to a number of attributes into an index is imperfect and subject to several limitations that could result in a misleading representation of pension fund board governance. We build additive indices assuming cardinality and equal weights. We assume that each attribute has the same importance; however, it is difficult to argue that a score of one on ‘existence of an investment committee’ has the same value as a score of one on ‘chairman employees representative’. In addition, some attributes may be substitutes of each other; that is, a high rating on one attribute compensates for a low rating on another one. Unfortunately, there is little empirical guidance on how different attributes relate and complement each other. Although the indices we construct are imperfect instruments, they are easy to understand and provide a synthetic view of the multi-dimensional nature of governance matters.

2.4 Measuring asset allocation

To characterize the asset allocation of pension funds, we focus on the following measures: %Risky, %Foreign, and %Cash. %Risky refers to the proportion invested in risky assets to total investments.Footnote 19 Risky assets include equities, alternatives (private equity, hedge funds, and commodities), and real estate.Footnote 20 A higher value indicates a higher proportion of the pension fund investments in risky assets. We do not include bonds issued in foreign currencies in the measure of risky assets. By law, Swiss pension funds need to hedge their foreign exposure and only up to 30% of assets can be left unhedged. Furthermore, pension funds typically hedge currency exposure on bond holdings.Footnote 21 Also, pension funds are not allowed to use leverage so we can neglect the effect that leverage may have on our measure of risk. %Foreign is the proportion of total investments held in foreign bonds and stocks. A low value indicates excessive dependence on the Swiss market as well as a lack of diversification. An optimal benchmark should include a sufficient number of international assets to seize the benefits of international diversification. Finally, %Cash is the proportion of cash holdings and cash equivalents, such as term deposits, to total investments and measures pension fund liquidity. Liquidity is necessary to meet short-term obligations such as pensioners' benefits, vested benefits upon termination of employment, or lump sum payments upon retirement. However, excessive cash holdings translate into forgone returns and reinvestment risk and can be a symptom of poor governance.Footnote 22

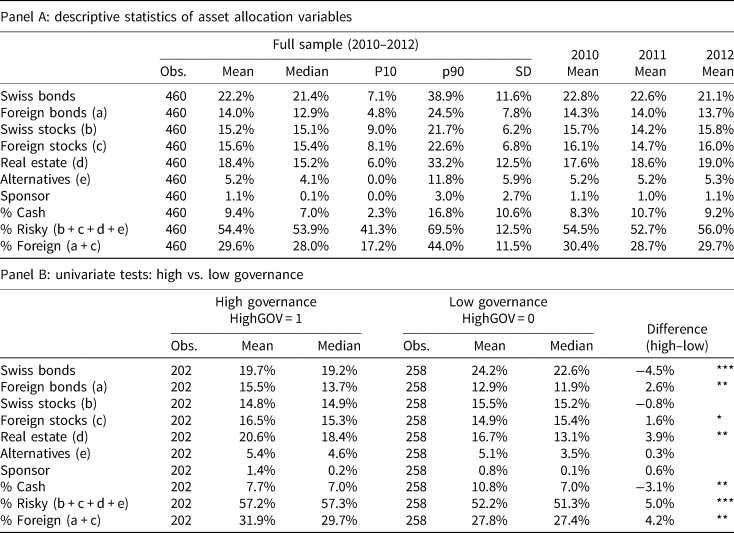

Table 3, panel A describes the asset allocation of the pension funds in our sample. On average, pension assets are invested as follows: 22% in Swiss bonds, 14% in foreign bonds, 15% in Swiss stocks, 16% in foreign stocks (totaling 31% in equities), 18% in real estate, and 5% in alternatives. Consistent with Hasa and Salva (Reference Hasa and Salva2020), about 9.4% of total investments are held as cash and equivalents (8.3% in 2010, 10.7% in 2011, 9.2% in 2012).Footnote 23 Further, we observe a significant variation regarding pension fund asset allocations across institutions. Some pension funds have undiversified portfolios and show a higher exposure to certain asset classes. For example, one pension fund holds 80.21% in foreign bonds and another 99.87% in real estate. Regarding sponsor allocation, pension funds invest on average only 1.1% in employer-related assets which reflects the legal limit of 5%. Finally, the allocation toward %Foreign and %Risky represents on average 30% and 54%, respectively.

Table 3. Descriptive statistics of asset allocations and univariate tests

This table presents summary statistics and univariate tests of pension fund asset allocations over the period 2010–2012. Panel A presents descriptive statistics of the main asset classes. Swiss bonds (stocks) refers to bonds (stocks) issued by a Swiss entity. Foreign bonds (stocks) refer to bonds (stocks) issued by a foreign entity. Real estate includes direct and indirect real estate investments. Alternatives includes investments in private equity, hedge funds, and commodities. Sponsor is the percentage of investments in current account, loans to the employer, and employer shares. %Cash refers to the percentage of cash and equivalents (CHF and foreign currencies). %Risky refers to risky assets and includes investments in equities, alternatives, and real estate. %Foreign refers to the proportion of investments held in foreign bonds and stocks. Asset allocations are computed as percentage of total investments, except for Sponsor which is computed as percentage over total assets. Panel B provides asset allocation descriptive statistics for pension funds with high vs. low ranking in governance. A t-test using standard errors clustered at the pension fund level tests whether the mean differences are statistically significant. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively.

In Switzerland, regulations set investment limits. In particular, pension funds face upper bounds for various asset classes, such as for equities 50%, real estate 30%, alternative investments 15%, and foreign currencies 30% unhedged. There is also a 5% limit on the amount that pension funds can allocate to sponsor-related assets. These legal limits, though, are not binding if a pension fund can demonstrate an adequate motivation and adherence to the principles of diversification. Consistent with this possibility, in our sample, there are few situations where the limits are met and exceeded, though in the majority of the cases, investment limits do not appear to be highly restrictive.

Table 3, panel B evaluates asset allocation for well and poorly governed pension funds and provides univariate tests. For that, we classify pension funds into two groups. The first group includes well-governed pension funds with a BGOV index higher than its median and the second group includes the rest. On average, well-governed pension funds invest more in risky assets (57 vs. 52%), in foreign stocks and bonds (32 vs. 28%), and hold considerably lower levels of cash (8% vs. 11%) than funds with low governance. Univariate t-tests adjusted for clustering at the pension fund level show that all these differences are statistically significant.Footnote 24 Univariate analysis suggests that on average well-governed pension funds take more risk, enjoy higher levels of international diversification and hold lower levels of cash.

3. Methodology and results

3.1 Base model

In this section, we explore in a multivariate setting whether asset allocation is related to board governance while controlling for other factors that may shape asset allocation in pension funds. Our basic specification is

where subscripts i and t refer to pension fund i and fiscal year t respectively. AA is one of the asset allocation measures (%Risky, %Foreign, and %Cash), BGOV refers to the board governance index, C captures a set of pension-level control variables, η represents year fixed effects, and ɛ is the idiosyncratic error term. Following our hypotheses, we expect βs to be positive for %Risky and %Foreign but negative for %Cash. A time fixed-effect is added to control for specific events over the period 2010–2012 that could have affected asset allocations such as changing economic and financial market conditions. Control variables correct for heterogeneity across pension funds and include proxies for known determinants of pension fund asset allocation. To estimate the model, we use simple pooled OLS regressions with heteroscedasticity-robust pension-fund-clustered standard errors.Footnote 25

As controls, we include the logarithm of ‘total assets’ to control for scale effects on asset allocation. Large pension funds seem to take more risk and thus have more equity (Weller and Wenger, Reference Weller and Wenger2009; Ammann and Ehmann, Reference Ammann and Ehmann2017). Large pension funds might benefit from lower transaction costs as well as having a stronger sponsoring employer who can afford additional contributions if needed. They may also enjoy more investment opportunities and advanced risk management structures.

Following existing studies, we also control for the demographics and funding status of the pension fund that influence the capacity to take investment risk. We include two variables: ‘beneficiaries ratio’ and ‘coverage ratio’. The ‘beneficiaries ratio’ is the number of contributing employees over pensioners. According to the life-cycle theory, pension funds with a younger age structure would benefit from investing more in equities and as a fund matures, asset allocations should be more conservative.Footnote 26 Mature pension funds may also be constrained by urgent liquidity needs for their pensioners and have more cash. Empirical studies also provide evidence that the age structure of beneficiaries is an important determinant of asset allocation. Andonov et al. (Reference Andonov, Bauer and Cremers2017) show that, except for US public pension funds, a higher percentage of pensioners correlates with less risk-taking; Rauh (Reference Rauh2009) shows that there is a positive correlation between the risk-taking behavior of corporate pension plans and the ratio of employees to pensioners. The ‘coverage ratio’ proxies for the financial health of the pension fund, with a high level of being associated with a good funding status. As discussed in Rauh (Reference Rauh2009), when pension funds take a risk management perspective, investment in risky assets is positively correlated to the funding status; this relation can be reversed, though, when the incentive of the pension fund is to catch up on performance in which case worst-performing pension funds take more risk.

We also include a dummy ‘public’ (vs. private) that equals one for public pension funds and controls for the different agency and regulatory settings that characterize public vs. private funds. As Ammann and Ehmann (Reference Ammann and Ehmann2017) show, public pension funds tend to have more sponsor and domestic assets, as well as more real estate. While Gerber and Weber (Reference Gerber and Weber2007) argue that the legal form may not be relevant for equity allocation, Weller and Wenger (Reference Weller and Wenger2009) reason that public pension funds might actually take less risks due to more scrutiny by the authorities as well as different financial and investment constraints; Andonov et al. (Reference Andonov, Bauer and Cremers2017) show that, due to regulatory incentives, public pension funds in the US take more risk.

Finally, we also include other pension fund characteristics that may affect pension fund asset allocation. We control for employer risk, or more precisely for when the employer has to bear the investment risk itself, and include ‘defined-benefit’ and ‘multi-employer’ that equal one for DB plans and for multi-employer funds, respectively, zero otherwise.

3.2 Results

3.2.1 Main results

Table 4 reports coefficient estimates, standard errors, and significance tests for regressions of the general index BGOV on the asset allocation measures according to the base model. Consistent with our hypothesis and univariate tests, columns (1)–(3) show that pension funds with a higher ranking in board governance invest significantly more in risky and foreign assets and less in cash.

Table 4. Base regressions: Is board governance associated with asset allocation?

This table presents pooled regressions where asset allocation measures are regressed on BGOV and a set of control variables. BGOV is a composite index of board governance. A higher value indicates higher adherence to accepted principles of good governance. %Risky refers to risky assets and includes equities, alternatives, and real estate. %Foreign refers to the proportion of investments held in foreign assets. %Cash is the percentage of investments held in cash and equivalents. Regressions (1)–(3) provide pooled OLS coefficient estimates and regressions (4)–(9) include a set of control variables. Total assets is the natural logarithm of total assets held by the pension fund. In regression (4)–(6), we orthogonalize Total assets on BGOV and use the residual O_Total assets. Coverage ratio refers to pension assets over committed liabilities. Beneficiaries ratio equals active employees over passive pensioners and equals active employees if passive pensioners is zero. Public equals one if the pension fund is a public institution and zero otherwise. Defined-benefit equals one for defined-benefit plans. Multi-employer equals one for multi-employer funds. Column (7a) includes only small pension funds with total assets less than the sample median. All estimations include year fixed effects. We report pension fund clustered and robust standard errors in (.). ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively.

In columns (4)–(6), we include the set of control variables. Because the governance index is significantly correlated with fund size (correlation of 0.54), we orthogonalize the logarithm of fund assets on BGOV to remove, out of fund size, the governance correlated component.Footnote 27 In this process, we obtain O_Total assets as the residual from the regression and use it as a control to capture non-governance-driven scale effects on asset allocations. Our results are robust to the inclusion of control variables and uncover relations that are also economically significant. According to columns (4), (5), and (6), a one standard deviation increase in the value of the BGOV is associated with an additional 2.7% of total investments held in risky assets, 3.3% in foreign assets, and with a lower 3% in cash and equivalents. This amounts to 22, 29, and 28% of the standard deviation in the allocation of risky assets, foreign assets, and cash, respectively.

In columns (7)–(9), we use the raw measure of fund size instead of the orthogonalized version. Regarding %Risky regressions, the coefficient on BGOV is still positive but no longer statistically significant. This indicates that, for the average pension fund, board governance is not significantly related to risk-taking beyond the influence that governance has through fund size. In additional analysis, we examine two sub-samples including large and small pension funds, respectively. In column (7a), to save space, we report only the results for the sub-sample of small pension funds with total assets lower than the sample median. When pension funds are small, well-governed boards invest significantly more in risky assets. In contrast, there is no incremental role for governance when pension funds are large. Regarding %Foreign and %Cash regressions, our previous results continue to hold. A one standard deviation increase in the value of the BGOV is associated with an additional 1.6% of total investments held in foreign assets and with a lower 1.2% in cash and equivalents.Footnote 28 Thus, governance has a significant and sizable relation to foreign diversification and cash holdings beyond the impact it has through size. These findings complement Graham et al. (Reference Graham, Harvey and Huang2009) who show that investor competence increases foreign diversification and Hasa and Salva (Reference Hasa and Salva2020) who show that cash holdings are to a large extent unexplained by pension funds operational and investment needs. We show they are related to governance considerations.

It is worth noting that pension fund size plays an important role shaping asset allocations in general.Footnote 29 Larger pension funds take on more risk, invest more in foreign assets, and hold less cash. Recent studies typically include fund size as a control in asset allocation regressions but they do not provide an economic rational to do so (e.g., Rauh, Reference Rauh2009). The argument they put forward is that including fund size absorbs scale effects.Footnote 30 Our analysis allows us to learn more about the role of fund size. We show that fund size is related to asset allocations at least through two channels. First, through governance considerations as it absorbs the relation that governance has on %Risky, column (7), and reduces the governance coefficients on %Foreign and %Cash regressions, columns (8) and (9). Second, through other non-governance-driven factors such as scale effects or, for example, by providing pension funds with access to further investment opportunities. We can see that in specifications (4)–(6), where the coefficient on the orthogonalized measure of fund size is statistically significant in all three regressions.

Often pension fund-level control variables exhibit expected signs. Consistent with Phan and Hedge (Reference Phan and Hedge2013), funds with a high coverage ratio hold a larger proportion of risky assets but the relation is not statistically significant. Also, the proportion of foreign assets and cash holdings are unrelated to the coverage ratio. Regarding the ratio of employees to pensioners, the life-cycle theory predicts that the larger the beneficiaries' ratio (1) the longer the investment horizon for the pension fund, which justifies investing more in risky assets, and (2) the larger the inflows with respect to outflows, which should translate into lower levels of cash holdings. Surprisingly, our results are not consistent with these predictions. Pension funds with a larger ratio of employees to pensioners invest significantly less in risky assets and more in cash. Finally, we also observe that public pension funds hold significantly more risky and less foreign assets. This greater risk-taking by public pension funds is mostly due to larger holdings of real estate.

3.2.2 Results on particular aspects of board governance

To further explore if certain aspects of board governance are particularly relevant, we conduct a principal component analysis and evaluate how attributes load on principal components with eigenvalues greater than one. This exercise guides us in detecting variables in the list of governance attributes with the largest influence.Footnote 31 We identify a cluster of attributes (specifically (18)–(22)) that are all relevant and jointly summarize aspects of the pension fund investment policy. This is not surprising since, in Switzerland, regulations place minimum standards on aspects of governance such as board integrity and balance of power while they leave the pension board considerable freedom on other issues such as the definition of the investment process. According to the law, it is the task of the board to clearly define the investment strategy, to provide a clear framework to guide and facilitate the execution, and to monitor performance. The above observation indicates that the quality of the investment policy may be a relevant aspect to explore on its own.

Why would the quality of the investment policy be associated with asset allocation? Best-practice recommendations stress that having in place a comprehensive investment policy (including detailed investment objectives and a clear framework) is necessary to guide and facilitate the investment process (Carmichael and Palacios, Reference Carmichael, Palacios, Musalem and Palacios2004; Koedijk et al., Reference Koedijk, Slager and Bauer2010). It provides the set up to facilitate decision making because it puts a limit on the liability of trustees and managers. In fact, trustees/managers may feel protected if they follow clear guidelines and therefore should be more dynamic and reactive. An alternative view is that a comprehensive investment policy also proxies for the level of financial expertise that is available to the pension fund. Pension funds drawing on greater financial expertise should show more rigor, deeper analysis, and more completeness in the investment statement. Consistent with our hypothesis, with a narrow investment policy, execution may not be timely, decisions may be overly conservative, and the board may lack the tools to make necessary adjustments. This could translate into the accumulation of liquidity, under diversification, and risk avoidance.

A comprehensive investment policy should include the key elements to bring clarity of goals, tasks, and controls with respect to the investment process. Clark and Urwin (Reference Clark and Urwin2008) and Carmichael and Palacios (Reference Carmichael, Palacios, Musalem and Palacios2004) identify critical areas that should be covered such as clarity of mission, investment objectives for strategic/tactical asset allocation, performance targets, performance monitoring including the definition of clear benchmarks, effective risk management such as defining clear risk tolerance indicators and an ALM study on which to base investment decisions: that is, a risk policy and an ALM study to support the strategy. In our dataset, attributes (18)–(22) are measures of these elements and capture the degree to which these are integrated into the investment policy. Using these attributes, we compute the equally-weighted average, express it as a percentage, then name it INVESTMENT POLICY. This construct is a sub-index of BGOV and measures the extent to which a pension fund meets best practice investment policy guidelines.

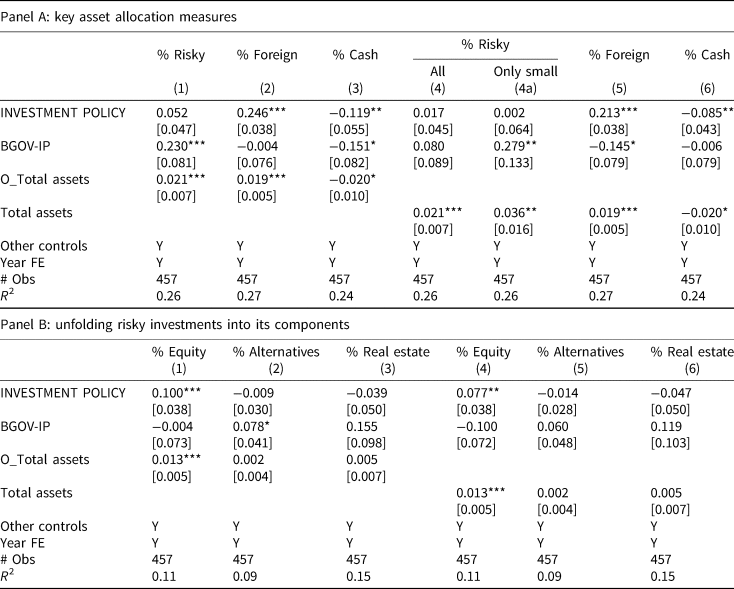

To measure whether the comprehensiveness of the investment policy is associated with certain patterns in asset allocations, we add INVESTMENT POLICY to the base model, exclude INVESTMENT POLICY attributes from BGOV to get BGOV-IP, and report results in Table 5.

Table 5. Investment policy and asset allocation

This table presents pooled regressions where asset allocation measures are regressed on BGOV-IP, INVESTMENT POLICY and a set of control variables. Panel A presents the results for our key asset allocation measures. INVESTMENT POLICY is a construct that measures the extent to which a pension fund meets best practice investment policy guidelines (including attributes from (18) to (22)). BGOV-IP is a composite index of board governance that excludes investment policy-related attributes. A higher value of the index indicates higher adherence to accepted principles of good governance. %Risky refers to risky assets and includes equities, alternatives, and real estate. %Foreign refers to the proportion of investments held in foreign assets. %Cash is the percentage of investments held in cash and equivalents. Panel B presents results for each asset class included in %Risky. %Equity refers to investments in stocks. %Alternatives refers to investment in alternative assets (hedge funds, commodities, and private equity). %Real estate includes both direct and indirect investments in real estate. In both panels, we include the set of control variables. Total assets is the natural logarithm of total assets held by the pension fund. O_Total assets is the orthogonalized value or residual of regressing Total assets on BGOV. Coverage ratio refers to pension assets over committed liabilities. Beneficiaries ratio equals active employees over passive pensioners and equals active employees if passive pensioners is zero. Public equals one if the pension fund is a public institution and zero otherwise. Defined-benefit equals one for defined-benefit plans. Multi-employer equals one for multi-employer funds. Column (4a) includes only pension funds with total assets less than the sample median. All estimations include year fixed effects. We report pension fund clustered and robust standard errors in (.). ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively.

Overall, Table 5, panel A, shows that INVESTMENT POLICY is a key element behind the relations we have previously uncovered. A higher ranking in INVESTMENT POLICY is associated with greater foreign diversification and lower cash holdings. These associations are statistically significant after controlling for the heterogeneity across pension funds and for known determinants of pension fund asset allocations. According to specifications (2) and (3), a one standard deviation increase in INVESTMENT POLICY is associated with an additional 5.2% of total investments held in foreign assets and with a lower 2.5% of total investments held in cash and equivalents. This amounts to 45 and 24% of the standard deviation in the allocation of foreign assets and cash, respectively. Regarding %Risky regressions (1) and (4), the coefficient on INVESTMENT POLICY is positive but not significant. Note that the inclusion of INVESTMENT POLICY still renders the BGOV-IP statistically significant in %Risky and %Cash regressions (1) and (3). However, when using the raw measure of fund size as a control in (4) and (6), BGOV-IP becomes insignificant for the average fund. Jointly, these results indicate that the relation of the remaining attributes in BGOV with risk-taking and cash holdings operates mainly through fund size.

Panel B evaluates the different components in %Risky, namely investments in stocks (%Equity), in alternatives (%Alternatives), and real estate (%Real estate), separately, and reports further analysis. In column (1) and (4), we regress only equity holdings (%Equity) on the set of explanatory variables. While INVESTMENT POLICY is not significantly associated with overall pension fund risk-taking, it is positively and significantly related to the share of equity investments. According to (1), a one standard deviation increase in INVESTMENT POLICY is consistent with a 2% greater level in equity holdings that represents 16% of the standard deviation in the allocation to stocks. While specifications (2) and (3) reveal that the comprehensiveness of the investment policy does not correlate with investment allocation in alternative assets or real estate, the construct BGOV-IP is positively and significantly associated with investments in alternative assets in column (2).Footnote 32 Our governance measures are, however, unrelated to real estate investments that are likely dictated by other factors. Because the governance attributes that matter for equity allocation seem different from those that matter for allocation in alternative assets, it is possible that investment in different risky asset classes requires different governance dimensions to guide the investment process.

In unreported analysis, we further evaluate whether specific attributes that compose INVESTMENT POLICY are responsible for the results. To do that, we unfold INVESTMENT POLICY on each of its components, drop attribute (18) as it is common to most pension funds (mean of 98% for the availability of an investment policy), and re-estimate the various specifications to mirror previous tables. The results show that the relations we have uncovered are not the outcome of a single attribute. Various attributes such as having investment objectives and investment benchmarks defined, as well as a risk policy available, are relevant to decisions on equity and cash holdings as well as the share of foreign diversification. In contrast, we do not find evidence that the presence of an asset-liability study correlates with asset allocation decisions.

To rationalize our findings, we highlight two possible aspects of governance that are likely to be at play. First, we argue that a comprehensive investment policy is likely to proxy for the financial expertise that is available to the fund. Second, an investment policy provides clarity of action to managers who then dare to reallocate liquid assets and increase the share of foreign and equity investments. Thus, a comprehensive investment policy that establishes a clear set of goals, tasks, and controls, and draws from financial expertise, facilitates taking difficult and risky decisions. Ultimately, a comprehensive investment policy should not only relate to different asset allocations, but it should also lead to superior risk-adjusted returns. Ideally, it would be important to test this claim and evaluate whether and how our governance measures ultimately affect performance. Unfortunately, in our data, we do not have any self-reported measure of performance so we are limited in the analysis we can do.

Summing up, the results show that among all governance dimensions, having a developed and complete investment policy is particularly relevant to asset allocation decisions. Pension boards that put in place clear guidance in the investment process take on more equity, hold more foreign assets and less cash. Our results expand those in Ammann and Zingg (Reference Ammann and Zingg2010) and Ammann and Ehmann (Reference Ammann and Ehmann2017). Although these studies focus on the relation of governance and performance, they highlight the importance of having a defined framework, including elements of target setting, investment strategy, and risk management for investment performance. As these elements are distinct from ours, we complement their findings and show that other governance dimensions, concretely, a comprehensive investment policy is associated with asset allocations.

3.2.3 Is there a role for external financial expertise?

In the previous section, we argue that higher levels of expertise in financial matters can shape asset allocations. In the following, we further examine this claim. Given the emphasis on equal representation on Swiss pension fund boards, it is likely that boards do not have the necessary financial expertise to guide the investment process on their own, even though both representation and competence should be key ingredients of a strong board (Besley and Prat, Reference Besley and Prat2003; Clark, Reference Clark2007). This rationale is consistent with Andonov et al. (Reference Andonov, Hochberg and Rauh2018) who show that elected beneficiaries in public pension boards are associated with a lower level of financial experience that might lead to poor choices affecting pension fund performance. The board has, however, different sources of expertise to complement or outweigh its own competences. It can rely on internal specialized sub-committees, on internal staff, or it can contract external service providers. Internal sub-committees are an integration of employer and/or employee representatives and members of the board. While their existence may signal the presence of financial expertise, they may also suffer from the same limitations as the board. Internal managers can also bring financial knowledge to the fund. For some of its functions and duties, the board may require additional expertise gained by means of external advice from consultants and other professionals; for instance, for the setting of investment and funding policies, ALM analysis or asset management for specific asset classes. Finally, trustees can also acquire a minimum level of expertise in investments through, for example, training programs.

To evaluate if financial expertise relates to asset allocation, we measure external and internal sources of financial expertise and add EXTERNAL and INTERNAL EXPERTISE to the base model. EXTERNAL EXPERTISE equals one if there are external investment experts (attribute 17) available, zero otherwise. External investment experts are consultants, independent investment specialists, or asset managers. The construct INTERNAL EXPERTISE is an equally weighted average of the attributes: existence of committees (14), existence of a manager (9), training of the trustees (16), and it measures investment expertise within the pension fund. We also include INVESTMENT POLICY but exclude other remaining attributes. The inclusion of other attributes or indices does not alter the results.

Table 6 reports the results and suggests that the role of external investment experts goes beyond the support they may provide to shape investment policy. Specifications (3) and (7) show that the presence of external experts is associated with a greater share invested in foreign assets and thus greater diversification, though statistical significance vanishes in (7) when we add the raw measure of fund size as a control. In %Cash regressions, specifications (4) and (8) display a negative and statistically significant coefficient on EXTERNAL EXPERTISE. Thus, external experts play a role in disciplining the amount held in cash as their presence is related to lower cash holdings. Finally, in %Risky and %Equity regressions, we fail to find evidence of an incremental relation of EXTERNAL EXPERTISE with risk-taking beyond the relation it may have through investment policy.

Table 6. Is there a role for external financial expertise?

This table presents pooled regressions where asset allocation measures are regressed on EXTERNAL EXPERTISE, INTERNAL EXPERTISE, INVESTMENT POLICY, and a set of control variables. EXTERNAL EXPERTISE equals one if there are external investment experts available, zero otherwise. INTERNAL EXPERTISE is the equally weighted average of attributes (14) existence of committees, (9) existence of a manager, and (16) training of trustees. INVESTMENT POLICY is a construct that measures the extent to which a pension fund meets best practice investment policy guidelines (including attributes from (18) to (22)). %Risky refers to risky assets and includes equities, alternatives, and real estate. %Foreign refers to the proportion of investments held in foreign assets. %Cash is the percentage of investments held in cash and equivalents. In regressions (1)–(4) we orthogonalize Total assets on BGOV and use the residual O_Total assets. Total assets is the natural logarithm of total assets held by the pension fund. In regressions (5)–(8) we use the raw measure Total assets. Other controls are included in all regressions. Coverage ratio refers to pension assets over committed liabilities. Beneficiaries ratio equals active employees over passive pensioners and equals active employees if passive pensioners is zero. Public equals one if the pension fund is a public institution and zero otherwise. Defined-benefit equals one for defined-benefit plans. Multi-employer equals one for multi-employer funds. All estimations include year fixed effects. We report pension fund clustered and robust standard errors in (.). ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively.

Overall, we find little incremental role for INTERNAL EXPERTISE except in %Risky regression (1) where the coefficient on INTERNAL EXPERTISE is positive and significant. This result indicates that greater internal ability in financial matters is associated with higher risk-taking. We note though that statistical significance vanishes in (5) when we control for the raw measure of pension fund size. The limited incremental role of internal expertise may reflect that it is geared toward expertise in liabilities rather than investments. Surprisingly, in column (7), the coefficient on INTERNAL EXPERTISE is negative and statistically significant at the 10% level indicating that a higher ranking on internal expertise is related to lower diversification.

4. Conclusion

The main message of this paper is that pension fund asset allocation is related to its governance. We argue that pension boards are legal necessities whose involvement and organization can matter with respect to asset allocation and risk capacity. We show that well-governed boards hold a larger proportion of foreign assets, lower levels of cash holdings, and, when pension funds are small, they invest more in risky assets. In particular, boards that establish a comprehensive investment policy, and therefore provide clear investment guidance, invest more in equities, diversify more internationally, and hold less cash. Finally, we also show that the presence of external investment experts is consistent with lower cash holdings. We argue that these results can be explained by the higher levels of financial expertise embedded in the process.

Legal prescriptions only assure minimum governance standards. Additional investment enhancing pension fund governance and available expertise, on a voluntary basis, comes hand in hand with an environment that is conducive to more international diversification, less cash holdings, and a greater capacity to invest in complex asset classes and take more risk. That is, an environment that enhances asset allocation decisions that should ultimately translate into superior long-term performance. Ideally, it would be important to test this claim and evaluate whether and how our governance measures ultimately affect performance. Unfortunately, in our data, we do not have any self-reported measure of performance so we are limited in the analysis we can do.

The governance attributes that we are able to evaluate are highly dependent on the institutional environment and, given the nature of our data with our tests, we can only mitigate concerns about causal effects. Nevertheless, our results contribute to the debate on how pension organizations should evolve and what are the necessary conditions that should be put in place to reach sensible asset allocations and provide sufficient performance. Our analysis suggests that pension boards should facilitate and guide decision making and that adequate investment expertise should be embedded in the whole process. Boards should anchor and set a clear long-term investment strategy, define clear investment benchmarks, implement performance measurement protocols, evaluate and follow investment risks, and factor exposure of liabilities, so that asset managers have the ammunition to make investment decisions.

While providing new insights, this study leaves important issues unresolved and opens several new questions for future research. Are pension funds really investing according to the risk tolerance of beneficiaries? What other aspects of governance shape asset allocations? Are asset allocations of well-governed pension funds delivering superior performance? What specific mechanisms are more efficient in enhancing governance? Also, given the foregone revenues that holding sizable cash reserves involves, the allocation to cash and equivalents deserve further consideration. These and other related questions we leave to future research.

Acknowledgements

We are grateful to Monika Buetler, Michel Dubois, Vera Kupper Staub, and seminar participants at the University of Neuchatel for helpful discussions and comments on earlier drafts. We also thank the As-So and its team for giving access to the data and for sharing with us insights on the Swiss pension system. This paper was initiated in the context of the PhD thesis of Nadège Bregnard without the involvement of the Swiss Federal Statistical Office (FSO). All content and the views expressed in this paper are those of the authors and do not engage the FSO. All remaining errors are our own.

Appendix A: Definitions of the variables

This table provides definitions of all the variables used in the analysis, including pension fund structural variables and asset allocation variables (panel A), as well as board governance attributes (panel B).

Appendix B: Institutional context

The retirement pension system in Switzerland is a highly regulated system composed of three pillars. This paper focuses on the occupational or employer-based system (the second pillar) that is mandatory for all employees with salaries over a certain threshold and aims at maintaining the standards of living at retirement. The occupational system is organized by the employer and employees cannot choose their pension institution or, in general, the investment strategy on accumulated savings. In the rest of this Appendix, we present a brief overview of the key elements characterizing occupational pensions in Switzerland, since the institutional and regulatory environment, to some extent, can shape risk-taking capacity and asset allocations, as well as conditions the governance measures we evaluate.Footnote 33

The Swiss law establishes benefit guarantees through minimum contributions, a minimum interest rate, and a conversion rate. It imposes investment limits that affect equally all pension funds. In this context, pension institutions can offer plans that are either defined-benefit (DB) or defined-contribution (DC) plans or a mix of both. The main difference among DB and DC plans lies in who bears the investment risk, but in Switzerland, the minimum mandatory guarantees makes this distinction less relevant.Footnote 34 A minimum interest rate and a minimum conversion rate, applied on accumulated contributions, partially transfers the risk from the employee to the pension fund introducing elements of DB plans into DC plans (see, e.g., Queisser and Vittas, Reference Queisser and Vittas2000; Bütler and Ruesch, Reference Bütler and Ruesch2007; Gerber and Weber, Reference Gerber and Weber2007; Bütler, Reference Bütler, Mitchell and Shea2016).Footnote 35 Thus, DC plans that are widespread in Switzerland are, in fact, hybrid plans comparable to ‘cash balance plans’ as they have embedded minimum guarantees and employer responsibility.Footnote 36 For that reason, they are often considered as DB plans (or cash balance plans). In contrast, pension funds have some discretion in setting their technical rate as long as it does not exceed a national reference rate set by the Swiss Chamber of Pension Actuaries, else they need to provide a justification and constitute adequate provisions. It is the responsibility of independent actuaries, external to the pension fund, to judge the adequacy of the technical rate chosen by the pension fund.

With regards to investment limits, pension funds in Switzerland are legally constrained as to how much they can allocate to different asset classes and to each issuer. In particular, they face upper bounds for various asset classes, such as for equities 50%, real estate 30%, alternative investments 15%, and foreign currencies 30% unhedged. Furthermore, there is also a 5% limit on the amount that pension funds can allocate to sponsor related assets or to a particular issuer. These legal limits, though, are not binding if a pension fund can demonstrate an adequate motivation and adherence to the principles of diversification. Consistent with this possibility, in our sample, there are situations where the limits are met and overpassed, though in the majority of the cases, investment limits do not appear to be highly restrictive. Also, in contrast to practice in other countries, Swiss pension funds cannot use leverage in their investments.

In contrast, the Swiss law allows for different institutional arrangements to provide for pension insurance. Within the limits of the law, pension funds have a large degree of freedom to design their own organization. As a result, and given the large number of pension institutions, a variety of legal and organizational forms coexist. Depending on whether the pension fund is founded by a firm or a public institution, it can be private or public, respectively. Private pension funds can then be incorporated as foundations or cooperative societies. Pension funds can be set up by one employer (single-employer) or can provide for multiple employers through affiliation contracts. The latter are multi-employer funds that can be either collective or common. Collective ones maintain separate accounts and rules for each pension plan of affiliated employers, while common pension funds run one scheme that maintains similar accounts and rules.

Regarding the approach to provide for risk coverage, there are autonomous, semi-autonomous with partial reinsurance of some risks (i.e., actuarial risks), and fully reinsured pension funds. On one side of the spectrum, autonomous pension funds bear all the financial and actuarial risks themselves. On the other extreme, fully reinsured pension funds have risks that are fully covered by an insurance company, and for that, they transfer their premiums to the insurance company who will then decide on the asset allocation. Therefore, fully reinsured funds have a specific balance sheet with different asset allocation outcomes. This is the reason why fully reinsured funds are excluded from our study. Partial insurance is also common and seeks to cover the risks of potential losses due to financial market and economic conditions or actuarial risks of disability or death.

With the main goal of improving governance, supervision, and transparency, a structural reform was developed in Switzerland over our sample period. In March 2010, the Swiss Parliament adopted a new, amended law on occupational funds that came into force in 2011 (governance and transparency) and 2012 (supervision). This reform places a premium on integrity to minimize conflicts of interest and supervision and brings clarity to the tasks and responsibilities of the board of trustees. Furthermore, since 2004, a key characteristic is the so-called parity in board representation. The board is the superior governing body composed of an equal number of employer and employees representatives and it is responsible for setting the goals and principles in asset allocation, a task that it cannot delegate.Footnote 37 The board of trustees can either internalize or outsource the administration and the investment management of the fund by mandating either specialized committees and internal managers, or external experts and asset managers.