1. Introduction

British governments have been foremost in declaring objectives aimed at staunching the nation’s emissions of greenhouse gasses. The Climate Change Act of 2008 contained a legally binding objective for reducing UK greenhouse gas emissions by 2050 to at least 80% below 1990 levels. The Act created an independent advisory body, the Climate Change Committee, which was charged with reporting on the progress towards this goal. In 2019, in recognition of the 2015 UN Paris Agreement and following advice of the Climate Change Committee, the long-term goal was updated to at least 100% below the 1990 level. This is nowadays commonly interpreted as the aim to achieve net-zero emissions by 2050.

The government’s commitment to achieve the net-zero target was called into question by its announcement, on 31 July 2023, of the issuance of 100 new licences for exploratory drilling in the North Sea to support a policy aimed at the maximum exploitation of the reserves of oil and gas. Then, on 23 September 2023, it was announced that the ban on the sale of new internal combustion engine cars and vans, which was to have commenced in 2030, had been postponed until 2035.

The optimism that accompanied the declaration of the original targets seemed to be justified by the remarkable downwards trajectory in the level of CO2 emissions, which had declined from an estimated 800 megatonnes per year in 1990 to barely more than 400 megatonnes by 2019. This decline can be attributed partly to the replacement of coal by gas as the major source of energy for generating electricity, but much of it is also due to the deindustrialisation of Britain over that period.

The Climate Change Committee has recently asserted, in a document of June 2023 titled Progress in Reducing Emissions (Climate Change Committee, 2023), that Britain now seems unlikely to meet its targets. A policy for emissions reduction should contain detailed targets to be met by industries and by other activities that are major consumers of energy that has hitherto been derived from fossil fuels. Amongst such industries are the manufacturers of steel, cement, glass, bricks and chemicals.

Such targets should be accompanied by plans for the necessary technological changes in the manufacturing processes, but the government has not made any such prescriptions. This unwillingness can be attributed to the reluctance of the Conservative administration to indulge in state interference.

A laissez-faire attitude regarding the provision of electricity had been seemingly justified by the way the privatised electricity utilities were able rapidly to convert from coal to gas and to windpower. However, the attitude has been called into question by the failure of private enterprises to provide the nuclear power stations that have been judged by many to be essential if the nation is to have a secure and reliable supply of energy.

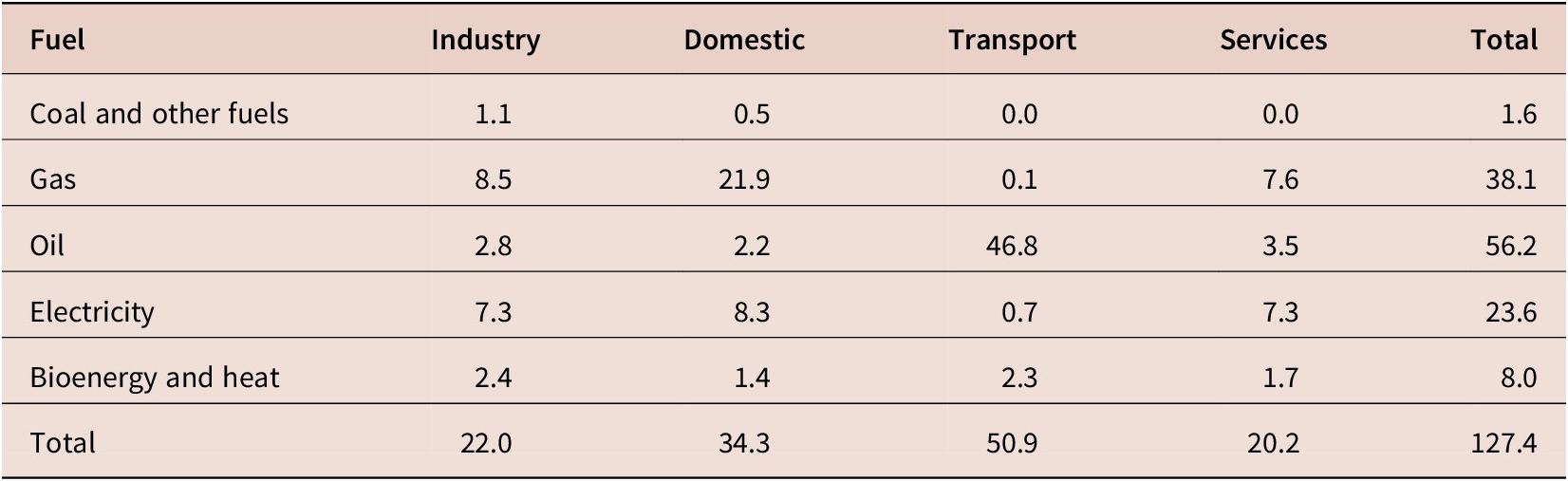

The decline of industry has meant that it is no longer the major contributor to emissions. In 2022, it accounted for an estimated 17% of the total demand for energy, whereas the transport sector was the major consumer of energy, accounting for 40%. A detailed breakdown of energy consumption by sector and by fuel is provided in Table 1.

Table 1. UK energy consumption in 2022 by fuel and by sector in millions of tonnes of oil equivalent

Source: United Kingdom Statistics Authority (2023).

If the injunction to create detailed plans for technological transformation is to be fulfilled, then detailed plans for transport are required. The conclusion of this essay, which surveys the opportunities for decarbonising transport, is that the existing plans are sorely lacking in detail and in ambition. An invidious comparison with what is being achieved elsewhere in the world is unavoidable.

The technologies by which transport might be decarbonised will depend almost exclusively on electric batteries and fuel cells, albeit there should also be industrial and other applications of these technologies, which will be mentioned in this essay. Much of the information it conveys can also be found in a report of the Science and Technology Committee of the House of Lords of July 2021, titled Battery Strategy Goes Flat: Net-Zero Target at Risk (House of Lords, Science and Technology Select Committee, 2021) and in a more recent report of the Business and Trade Committee of the House of Commons of November 2023, titled Batteries for Electric Vehicle Manufacturing (House of Commons Business and Trade Committee, 2023).

The Commons report was followed, in the same month, by a document from the Department of Business and Trade declaring the UK Battery Strategy (HM Government, Department of Business and Trade, 2023a). This revealed the government’s vision of how the UK could develop a globally competitive battery supply chain by 2030.

2. The deployment of batteries and fuel cells in the UK

Fuel cells and lithium-ion batteries are expected to play a major role in decarbonising the UK economy. Their principal contributions are expected to be in transport, which comprises passenger cars, vans, busses, heavy freight lorries, rail, shipping and aviation. There are also contributions they can make to the reduction of industrial emissions. They might also have a role to play in balancing the supply and the demand for electricity, which is subject to wide diurnal and seasonal variations.

The government can create incentives for the uptake of these technologies in a variety of ways. It can make financial contributions to research and development. It may make subventions to manufacturers of fuel cells and batteries and to the manufacturers that use them, which are predominantly the manufacturers of road vehicles. The government and other authorities can put restrictions on the use of the modes of transport that give rise to the emissions. Ultimately, they can ban the sales and, eventually, the use of the equipment responsible for the emissions.

3. Light road transport: Cars and vans

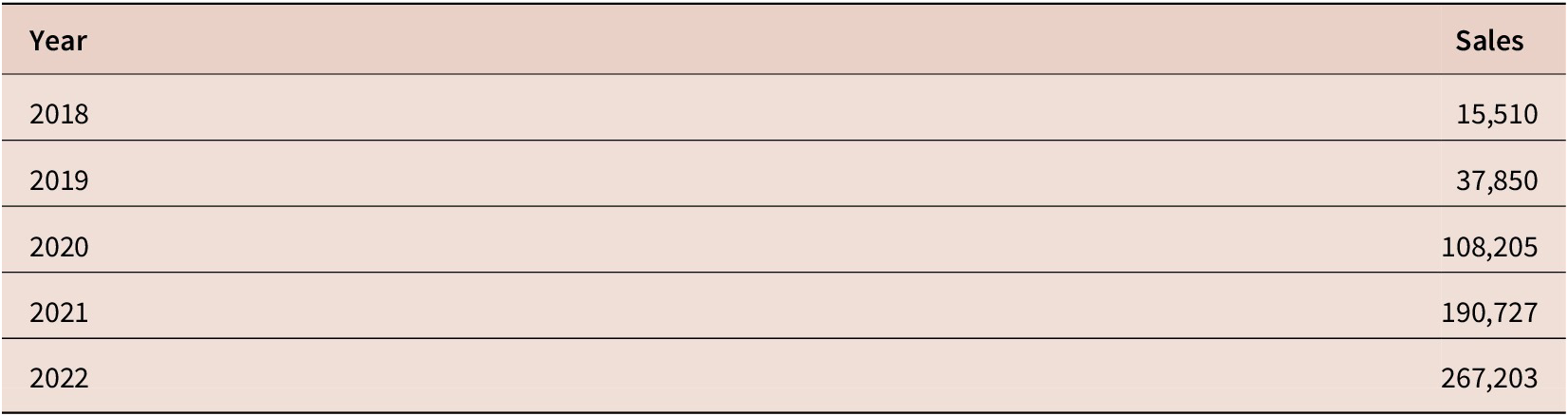

The most rapid progress in the electrification of transport has been in respect of cars and vans. The sales in the UK of battery-powered electrical vehicles appear to be increasing at an exponential rate. Table 2 records a series of annual sales figures of new electric cars in the UK.

Table 2. Annual sales of electric cars in the UK

Source: The Society of Motor Manufacturers and Traders (n.d.).

According to the Society of Motor Manufacturers and Traders, in April 2023 there were 760,455 pure electric battery-powered vehicles (BEVs) and 490,126 plug-in hybrids (PHEVs) on the UK roads. Since the end of 2021, BEV and PHEV numbers have increased by 363,958 and 141,774, respectively. In December 2022, electric vehicles (EVs) made up as much as 32.9% of new car registrations. The majority of these electric cars were of foreign manufacture, with the electric cars produced in the UK (the Electric MINI and the Nissan Leaf) accounting for little over 6% of the sales.

Doubts have arisen, recently, regarding the emissions abatement that can be attributed to hybrid vehicles. Pure hybrid vehicles are entirely reliant of petrol for their power, albeit their fuel efficiency is enhanced by using regenerative braking to charge their batteries. Plug-in hybrids can reduce their consumption of petrol only to the extent that their owners are prepared to replenish their batteries from an electric source. It appears that the owners typically exploit this facility to a limited extent.

The global motor industry has focused on battery-powered electric vehicles to the neglect of vehicles powered by fuel cells. Most motor manufacturers have added or intend to add one or more battery-powered vehicles to their range. According to a document from the Department of Energy Security and Net Zero of December 2023 titled Hydrogen Strategy Delivery Update (HM Government, Department of Energy and Net Zero, 2023b), there were 265 fuel cell vehicles in the UK, including buses, HGVs, vans and cars. These were served by only eight publicly accessible hydrogen refueling stations.

The government is keen to encourage the uptake of electric vehicles. However, it has deferred the ban on the sale of new vehicles with internal combustion engines until 2035, whereas, previously, it had accepted a recommendation of the Climate Committee that a ban should be effective from 2030.

4. Buses and urban transport

There are also signs of a growing uptake of electric vehicles in the bus industry, both for urban transport and for long-distance coaches. There is uncertainty about the appropriate means of powering the buses, albeit fuel cells afford a longer range than do batteries. In March 2023, the proportion of the buses in England that had a diesel fuel engine was 76%. A further 15% had diesel hybrid engines, 4% were electric and a very small proportion were powered by hydrogen.

In the UK, there is an ongoing consultation on the end date on the sale of new, non-zero-emission buses, which should be between 2025 and 2032. To encourage the transition, the Department for Transport (DfT) has invested £320 m towards the funding for 4,000 zero-emission buses, which are to be in service by 2025.

In October 2022, there were 1,724 zero-emissions buses in operation amongst a total fleet of 37,800. Approximately half of the UK’s zero-emissions buses (950) were operating in London, where there is a fleet of some 9,000 buses. There were 20 hydrogen fuel cell double-decker buses in the fleet. At present, there are two British companies in the market to sell hydrogen buses, which are Wright bus and Ryse Hydrogen. The two companies are now in joint ownership. In March 2021, it was announced that Wrightbus would receive £11.2 m from the government to develop hydrogen fuel technology.

Investment to support the zero-emissions transition is also required from local and regional transport authorities and operators, who consist largely of private operators. These are dominated by five companies (Arriva, FirstGroup, Go-Ahead, National Express, Stagecoach) that run services on behalf of local authorities. However, a declining revenue from lower passenger numbers across most regions is limiting their ability to accomplish the transition.

5. Heavy vehicles

There is little certainty regarding the electrification of heavy goods vehicles. The Swedish Volvo firm joined with the German Daimler company in 2020 to develop fuel cell systems for use in heavy-duty trucks. The Swedish firm Volta Trucks, which was founded in 2017, is marketing a 16-tonne vehicle, which is powered either by a 150-kWh battery or a 22-kWh battery.

Britain appears to be lagging behind other European countries in this respect. The fuel cell firm Viritech has detailed several hydrogen-fuelled concepts while expressing concern that the UK could fall behind in the global market for hydrogen, citing a shortage of government funding in the most crucial areas for hydrogen development.

The government has announced plans to phase out new diesel heavy goods vehicles (HGVs) by 2040, but these plans are currently subject to consultation and they have yet to pass into legislation. The Department for Transport is considering a two-stage approach, in which the sale of new petrol- and diesel-powered HGVs weighing up to 26 tonnes are banned in 2035, and the sale of heavier vehicles using petrol or diesel is banned in 2040.

6. Rail transport

The rail sector in the UK accounts for 1.4% of the transport emissions and for 0.5% of all UK emissions. Therefore, it might be concluded that it is in little need of improvement. However, an enhanced rail service could displace road transport with a consequent reduction in emissions, lasting for as long as it takes to decarbonise road transport.

The excellent emissions performance of rail is due in part to the energy efficiency of this form of locomotion and in part to the extensive electrification of the service. That electrification should be extended; and, in 2018, the government proposed that diesel trains should be removed from the network by 2040.

Compared with other European countries that developed their rail networks at later dates, the UK system faces greater difficulties in modernising. The fitting of overhead electric powerlines is impeded by the restricted sizes of tunnels and the narrow apertures underneath the bridges that pass over the tracks.

An alternative to overhead electrification is to employ trains driven by batteries or fuel cells. Compared with fully electrified trains, such vehicles are at a disadvantage in consequence of the weight penalties they incur in carrying their fuel or batteries. A common judgment is that the program to electrify the UK rail network has fallen behind its schedule.

7. Aviation

Aviation poses some of the greatest difficulties in pursuit of the decarbonisation of transport. Flight requires fuels of the highest energy density, and this is provided by kerosene-type jet fuels that are derived from fossilised hydrocarbons. There is a natural unwillingness to abandon the technology of turbine propulsion, which is common to all modern aero engines. Therefore, there is an endeavour to find so-called sustainable aviation fuels that would preserve this technology.

There have been proposals to replace jet fuels, which come from fossil sources, by fuels synthesised from biological materials that are deemed to be renewable. The object is to create biofuels that can be blended seamlessly with the fossil fuels. The carbon emissions from biofuels can, supposedly, be reabsorbed in the growth of their biological feedstocks. The biofuels could be produced from agricultural crops, such as corn, sugar cane or used vegetable oil, and from forestry products.

An objection is that biofuels are liable to be competing for agricultural land with crops for human consumption. Nor is it clear that all of the emissions resulting from their combustion will be reabsorbed in new biological growth.

A more radical proposal is that the carbon content of aviation fuels should be provided by the direct air capture of carbon dioxide. Although this is a feasible and desirable recourse, it would be expensive, and it must be regarded, at best, as a long-term solution.

There have been proposals for powering short-haul aircraft by hydrogen fuel cells. Aircrafts that demonstrate this technology have already flown. The matter of whether liquified hydrogen can be used in long-haul flight is debatable. On the basis of mass, hydrogen has nearly three times the energy content of gasoline: 120 MJ/kg (mega joules per kilogram) for hydrogen versus 44 MJ/kg for gasoline. On the basis of volume, however, the situation is reversed; liquid hydrogen has a density of 8 MJ/L (mega joules per litre), whereas gasoline has a density of 32 MJ/L.

8. Shipping

Fuels for shipping must have a high energy density. At present, diesel oil is used in ships that operate close to shore, while heavy fuel oils, which are dirty and toxic and high in sulphur content, are used in ocean-going shipping. Ammonia (NH3) has been proposed as an alternative fuel for use in fuel cells and even for direct combustion. The Danish shipping company Maersk is developing an ammonia engine, but few technical details have been forthcoming.

9. Stationary applications

Batteries and fuel cells have been proposed for a variety of applications that are not associated with transport. The use of batteries as storage devices for the electrical power grid has been proposed to compensate for the intermittence of renewable power generation.

It has been suggested that, when a large number of batteries reside in electric vehicles, they would be available for the storage of electricity. This proposal does not survive closer examination. The vehicles are liable to be in use at times when there is a high demand for electricity, making their storage capacity unavailable to the grid. Moreover, the storage capacity of batteries is limited. However, there are currently some examples of large-scale battery storage, such as a 20-megawatt battery, located in Carnegie Road in Liverpool.

Batteries may have a role in addressing the short-term fluctuations in the grid supply, where the voltage must be kept within a narrow band. Their power can be deployed rapidly for this purpose, which may be served better by batteries than by hydro-electricity that depends on the pumped storage of water.

Fuel cells coupled with a plentiful reserve supply of hydrogen would be a more appropriate means of generating electricity to overcome the diurnal and seasonal variations in the demand for electricity as well as the variability in its supply from renewable sources. The hydrogen needs to be generated in a manner that is not associated with emissions. A combination of renewable power and nuclear power could be relied on to provide the electricity to be used in generating the hydrogen by the electrolysis of water.

10. Batteries and fuel cells in the UK economy

It is notable that the political party that forms the present government (in 2024) has been traditionally opposed to state intervention. Ministers appear to believe that the setting of targets and the imposition of restrictions that prevent the sales of polluting vehicles after certain dates should be sufficient to ensure that the targets will be met.

They have also provided financial support to stimulate research and encourage the manufacture of low-emissions equipment. However, the funding that has been made available for addressing the problems of climate change by governments of other nations exceeds what has been made available in the UK, both in absolute terms and in proportionate terms.

The UK has a sizeable automotive industry employing more than 16,000 workers. However, the industry is dwarfed by some of its European and foreign competitors. (The German automotive industry, which had a labour force of over 857,000 in 2016, is vastly bigger.) In 2022, the UK exported almost 80% of the vehicles that it manufactured, with 60% of the exports going to the EU. However, there was a negative balance of trade. The country imported £59 billion of automotive products compared with £43 billion in exports.

The UK industry is dominated by large global manufacturers, which are Nissan, Jaguar Land Rover, Stellatis (comprising the Fiat-Chrysler Group and the Peugeot-Citroen Group), BMW and Toyota. These companies are in foreign ownership. They have the opportunity to pursue their manufacturing in other countries. Therefore, the UK automotive industry is vulnerable to disinvestment and plant closures whenever the companies envisage better prospects elsewhere.

The manufacturers are liable to be drawn to places where a supply of batteries is close at hand. Honda and Ford have recently ceased to manufacture vehicles in the UK and others might do likewise. Honda closed its Swindon plant in July 2021, ending 35 years of production in Europe. Ford ended more than 100 years of vehicle manufacturing in the UK when it closed its plants in July 2013. It continues to manufacture diesel engines and transmission systems in the UK.

The automotive sector around the world is investing heavily in facilities to manufacture the batteries to meet the demand for electric vehicles. Large-scale production of batteries takes place in gigafactories. China has planned to have 149 gigafactories by 2030; the EU plans 19; for the USA it is 12; and for the UK it is 2. However, the Faraday Institute has predicted that the UK will need 8 gigafactories by 2040.

According to the report of the House of Commons Business and Trade Committee titled Batteries for Electric Vehicle Manufacturing (House of Commons Business and Trade Committee, 2023), which reflects the government’s estimates, 100GWh of battery manufacturing capacity would be required by 2030 to satisfy the demand from the UK’s automotive industry and other sectors. This requirement would increase to 200GWh by 2040. The UK faces a gigafactory gap, with insufficient domestic manufacturing capacity to satisfy the demand for batteries.

The first of the British gigafactories is that of the Nissan car company, which supports the production of the Leaf electric vehicle in Sunderland, and which is run by the Chinese Envision AESC company. It has a capacity for manufacturing 2GWh/pa (2 gigawatts per annum) of battery storage. There is a plan to accompany it by a second plant rated at a capacity of 10GWh. The other automobile manufactures in the UK rely on imported batteries.

The Automotive Energy Supply Corporation (AESC) was established in 2007 as a joint venture between the Japanese companies Nissan, NEC and the Tokin Corporation. The majority ownership of the consortium is now in the hands of the Chinese Envision Group, which has embarked on strategic cooperations in battery manufacturing with Renault, Nissan, Daimler and Honda.

A second UK gigafactory was proposed by a group of entrepreneurs under the name of Britvolt. They sought government support, but the necessary finance was not forthcoming from the private sector and the enterprise collapsed. More recently, the Indian Tata organisation, which is the owner of Jaguar Land Rover, has announced, in July 2023, that it will invest £4bn in a gigafactory with the help of government support, which is reported to be some £500 m. The factory will be rated at 40WGh and should begin production in 2026. This would bring the total battery production in the UK to 52GWk, which would be halfway towards the target for 2030 that has been declared by the government,

A prevalent opinion is that if it is to be viable, a motor industry producing electric vehicles requires its supply chain for the batteries to be close at hand. It cannot expect to succeed if these crucial components have to be imported. The prospects for Britain’s motor industry were badly affected by an announcement in November 2021 by Johnson Matthey that the firm was relinquishing its car battery project, which had been aimed at supplying the essential materials to battery manufacturers. It had determined that, given the dominance of the battery industry by Asian manufacturers, it could not expect its enterprise to be profitable.

Other countries have been striving to expand their production of batteries. Large subsidies have been given for this purpose that have not been matched in the UK. Support has been provided in the US via the Inflation Reduction Act (The White House, Washington, 2023), which was introduced in August 2022, and in the EU via the Green Deal Industrial Plan (European Commission, 2023), which was published in February 2023.

The manufacture of batteries requires a supply of some essential materials, which include lithium, cobalt, nickel and graphite. Much of the current global supplies of these materials has been pre-empted by China through various trade deals. If battery production is to prosper in the UK, then it will be necessary to secure reliable supplies of the materials.

The government has outlined some of the steps that must be taken to this end in its Critical Minerals Strategy (HM Government, Department for Business, Energy & Industrial Strategy, 2022), which was published in July 2022. A free trade deal with Australia has been signed with the object of securing supplies of lithium, nickel, manganese and cobalt. It is also proposed to exploit some of the mineral resources of the UK, such as lithium that is available in northeast England and in the West Country.

Doubts have been expressed concerning the adequacy of the global supplies of lithium, of which the major reserves reside in Bolivia and Argentina in water-stressed regions. Another essential material in battery manufacture is cobalt. Misgivings have arisen over the working conditions under which cobalt is mined in Congo (Kinshasa), where approximately 70% of the world’s supplies originate.

Major deficiencies are also apparent in the government’s approach to the future of fuel cell technology. The government has paid far less attention to fuel cells than it has paid to batteries. The support of the UK government for fuel cells technology appears to be insignificant beside the support that has been provided by other European governments. The government has undertaken to devote, probably, no more than £250 million to fuel cells, whereas the amount forthcoming from the German government for the support of a hydrogen economy may amount to as much as £9 billion.

Evidence of the limited support of the UK government for the hydrogen economy can be gathered by trawling through a document of August 2021 titled UK Hydrogen Strategy (HM Government, Department for Business, Energy & Industrial Strategy, 2021). The document indicates the extent to which the government will be relying on the initiatives of the private sector. It declares the ambition that, by 2030, the low-carbon hydrogen production capacity should reach 5GW (gigawatts). This amount of power can be compared with the installed generating capacity of the UK electricity sector, which was estimated in 2021 to be 75.8GW.

The obstacles that have to be overcome by a successful fuel cell strategy are far greater than those affecting the battery strategy. Battery-powered vehicles can be recharged from power points that are attached to the existing electrical supply network. Until such vehicles become numerous, there will be no need to adapt this grid to meet the extra demand. By contrast, fuel cell vehicles demand a completely new infrastructure to supply their fuel. This is expected to arrive, in the first instance, in bus depots and in the depots of freight vehicles. Only at a later stage will the refueling be provided in the forecourts of the erstwhile petrol stations, which will have been largely converted for the recharging of battery-powered vehicles.

The matter of the availability of hydrogen is also a cause for concern. The quantities that are predicted to be available by 2030 appear to be very limited, and it is unclear how they might be generated. The UK Hydrogen Strategy (HM Government, Department for Business, Energy & Industrial Strategy, 2021) proposes an approach that combines the production of hydrogen by the steam reformation of methane with carbon capture together with its production by electrolysis powered by renewable energy.

Although the steam reformation of hydrogen is to be regarded as a temporary expedient, the capture of its carbon byproduct would rely on technology that has yet to be fully developed. Both methods of generating hydrogen are energy-intensive, and there may be doubts concerning the availability of the energy.

11. Future supply and demand for electricity in the UK

The title of the government’s Energy White Paper of December 2020 is Powering Our Net Zero Future (HM Government, Department for Business, Energy & Industrial Strategy, 2020). It addresses the need to staunch our emissions of carbon dioxide in view of the advancing crisis of climate change. It proposes that, by 2050, we should double our generating capacity for electricity while reducing our overall energy consumption to two-thirds of its present level. This is a gross underestimate of our requirements for electricity and power.

According to a widely accepted analysis, the electrification of transport alone would require a 75% increase in generating capacity. See Nicolaides (Reference Nicolaides2018). The decarbonisation of economy will create numerous additional demands. The only source that could meet such demands is nuclear power.

There are numerous industrial processes that require to be decarbonised. They include the manufacture of steel and cement, both of which are energy-intensive and both of which could be powered by electricity. Synthetic fuels that incorporate a carbon content that has been captured from the atmosphere could replace existing hydrocarbon fuels, but their manufacture would also be energy-intensive. Industrial processes that require heat could become reliant on hydrogen, but this would need to be generated using electrical power.

The present government appears to favour renewable sources of power for generating electricity. The large electricity companies have shown themselves to be willing and able to invest in wind-generated electricity; and the costs of such electricity have fallen markedly over time. However, given the intermittence of these sources of power, there is a limit to the extent to which they can be relied upon without the support of an ancillary system to back them up.

Hitherto, the backup for renewable energy has come from coal-powered electricity and from electricity generated by combined-cycle gas turbine power plants. Both of these sources generate carbon emissions and must be replaced. Either alternative sources of power must be utilised, or the energy from renewable sources must be stored to be available to meet the deficits.

A paper published by the Royal Society in 2023 titled Large-Scale Electricity Storage (The Royal Society, 2023) proposes that the energy from windpower and solarpower should be used to generate hydrogen, which should be kept in salt caverns and used to generate electricity when the sun does not shine and the wind does not blow. The energy of the hydrogen could be recovered as electrical energy by means of fuel cells. Hydrogen could also be used to power turbines or reciprocating engines attached to electrical generators.

The only viable alternative source of power that is carbon-neutral is nuclear energy. Moreover, hydrogen would be generated most cheaply and efficiently by high-temperature electrolysis using the heat and the power of nuclear reactors.

The recent history of civil nuclear power in the UK has been one of repeated failures, in which projects to build new power stations have failed to materialise. The coalition government of Clegg and Cameron recognised the need to renew Britain’s fleet of nuclear reactors, and, in 2010, it was agreed that the construction of eight new nuclear reactors should be called for.

The outcome was that prospective private constructors of the nuclear power stations withdrew successively from their projects. The only surviving contractor has been EDF, which is currently in the process of constructing a version of the European Pressurised Reactor known as Hinckley C. The reactor is not set to start generating electricity until June 2027, two years behind its original schedule, but an allowance has been negotiated with the government for a nominal deferment up to 2036.

Another rector to a similar design, to be known as Sizewell C, has been proposed with a putative completion date of 2031. It is claimed that it will meet 7% of the UK’s energy needs for at least 60 years. The project was expected to start before 2024, with construction taking between nine and twelve years A significant delay has arisen from the government’s desire to remove the China General Nuclear Power Group from the project, in which it had a 20% stake.

The consciousness of the shortfall of its nuclear program has recently led the government, in July 2023, to establish a new organisation known as Great British Nuclear and to propose to devote 20 billion pounds to the furtherance of a nuclear programme. This will involve a competition to supply small modular nuclear reactors. The outcome is imponderable; but there is a growing perception of the emergence of a severe deficit in the UK’s energy supply.