6.1 Introduction

The heat system is relatively localised because heat cannot easily be transported over long distances. The heat system is therefore closely linked to buildings, where heat is used to warm up rooms (space heating) or water (e.g., for showers, baths, laundry). While there are many types of buildings (e.g., homes, offices, factories, schools, shops), the residential sector uses most heat-related energy (Table 6.1). This chapter therefore focuses on the residential sector, and particularly on space heating, which is the largest segment.

Table 6.1. UK heat consumption (in thousand tonnes of oil equivalent) in different building types in 2018 (constructed using data from BEIS Statistics; Energy Consumption in the UK; energy consumption by end use, Table U1)

| Space heating | Water heating | |

|---|---|---|

| Domestic | 27,144 (58%) | 7,040 (15%) |

| Services (public administration, and commercial & miscellaneous) | 9,531 (20%) | 1,349 (3%) |

| Industrial | 1,872 (4%) | 0 |

| Total | 38,547 | 8,389 |

UK domestic space heating is dominated by gas-fired boilers, which are used in 85% of homes. Electric storage heating is used in 5% of homes, oil central heating in 4%, other options (e.g., coal) in 4%, and 2% of homes are linked to heat networks (BEIS, 2018a: 20). The UK’s gas-dominated residential heat system has a hybrid centralised-decentralised form, because most heat conversion is done on-site (using individual gas-fired appliances), but fuel is supplied by a national gas distribution infrastructure.

We conceptualise heating and buildings as two ‘orthogonal’ or intertwined systems. On the one hand, energy infrastructures (for gas) or supply chains (for coal, oil, biomass) feed into conversion devices (e.g., gas boilers, coal or biomass stoves, electric heaters, heat pumps) to generate heat. The schematic representation in Figure 6.1 focuses on the dominant gas-based heating system. On the other hand, heat demand is shaped by the building shell (including walls, roofs, windows, doors, floors) and design choices made in the construction industry and its supply chains. Many UK buildings are poorly insulated and draughty, leading to relatively high heat demand (and heat losses).

Figure 6.1 Schematic representation of the material elements and flows in the dominant UK (domestic) heat system (involving heating and buildings)

Despite increasing numbers of homes, greenhouse gas emissions from residential buildings decreased by 29% between 2001 and 2014 (see Figure 6.2).Footnote 1 These reductions mostly came from incremental efficiency improvements in gas boilers and the thermal performance of buildings (e.g., various insulation measures). Since 2014, emissions have stagnated and slightly increased, leading the Committee on Climate Change to warn that progress is not on track to meet climate change targets: ‘The progress made on buildings remains insufficient even to meet the previous target for an 80% reduction in emissions relative to 1990 levels … In order to go further to meet net-zero ambitions, bold and decisive action is urgently needed from Government’ (CCC, 2019a). Further decarbonisation will require deeper and more fundamental changes in heating and buildings systems (e.g., low-carbon heat sources, very energy efficient buildings).

Figure 6.2 UK greenhouse gas emissions (in MtCO2e) from buildings 1990–2019

To further explain heat-related emission trends and assess potential options for deeper system reconfiguration, we will analyse the heating system (including fuel supply, distribution, on-site conversion, and heating practices) in Section 6.2 and the buildings system in Section 6.3. These systems are related to different actors, technologies, and policies. We will then address several niche-innovations (heat pumps, biomass heating, solar thermal, greening the grid, heat networks and passive housing) in Section 6.4, and finally assess the speed and depth of low-carbon heat reconfiguration in Section 6.5.

6.2 Heating System

6.2.1 Techno-Economic Developments

Energy supply for UK heating is dominated by natural gas, which is distributed through a dense, centrally operated, piped network established from the 1960s through the integration of local networks and systematically expanded as the UK ‘dashed’ for gas (Arapostathis et al., Reference Arapostathis, Pearson and Foxon2014). Relevant technical operations include gas production (exploration, drilling), delivery and processing (at coastal terminals), gas transport, storage, shipping, supply, and third-party activities. The UK gas network involves (high-pressure) transmission and (medium- to low-pressure) distribution to end-users, though ownership and transport operations have been unbundled.

Domestic (North Sea) gas production peaked in 2000. Since then, gas imports (largely from Norway, but also LNG from further afield) have steadily increased (Figure 6.3). This was accompanied by investments in storage and (LNG) import facilities (Kopp, Reference Kopp2015), and a trend towards the diversification of sources to ensure energy security (Bradshaw et al., Reference Bradshaw, Bridge, Bouzarovski, Watson and Dutton2014), shorter contracts (for LNG), but also increasing dependence on global market fluctuations. The costly expenses associated with the creation of new facilities (storage, pipelines, controls) were passed on to users, but rising gas prices (Figure 6.4) were mainly caused by rising oil prices (to which gas prices are linked).

Figure 6.3 Gas production, imports, and demand in the UK in million cubic metres, 1998–2020

Figure 6.4 Evolution of average gas price (in GPB/GJ) for households in the UK, 1991–2019

Heat conversion in the UK is highly decentralised and located at the point of consumption in individual home-based boilers and stoves. Most households are self-contained heating generation and consumption units. Gas-based central heating systems have been installed in 85% of homes, with oil, coal, electric storage, and heat networks making up the remainder (BEIS, 2018b). Biomass (pellets and woodchips), solar-thermal, and heat pumps are slowly emerging as alternatives, but mainly as additional sources of heat for environmental or aesthetical motives (see Section 6.4.2).

The number of homes without a boiler has decreased substantially since the 1970s, which was linked to the diffusion of central heating. Since the 1990s, there have also been shifts towards more fuel-efficient boilers, first from standard to combination boilers, and then towards condensing and condensing-combination boilers (Figure 6.5). These incremental boiler improvements helped to reduce domestic gas use (see Figure 6.6) and greenhouse gas emissions.

Figure 6.5 Boiler types in the UK, 1975–2017

Figure 6.6 Domestic energy consumption for space heating and water heating in kilotons of oil equivalent, 1970–2019

Energy use for residential space heating increased from the 1970s to the mid-2000s (Figure 6.6) because of the switch to gas-fired central heating systems (which enabled heating of multiple rooms in houses) and because of increases in the average internal temperature in UK homes (Figure 6.7), which was driven by desires for higher thermal comfort and the heating of multiple rooms (Chappells and Shove, Reference Chappells and Shove2005). From the mid-2000s, energy use for space heating started to decline, with the exception of an unusually cold winter in 2010 leading to a heat consumption spike (Figure 6.6). This decline was driven by a switch to more efficient boilers (Figure 6.5), stabilisation and slight decrease of internal temperatures (Figure 6.7), and domestic insulation improvements (discussed under buildings system). Energy use for water heating has declined steadily since the 1970s, as hot water storage tanks were replaced by other heating appliances.

Figure 6.7 Average internal temperature in UK homes, degrees Celsius, 1970–2012

6.2.2 Actors

Energy Supply Actors: The actor configuration for gas distribution is like that of electricity distribution; it is fairly concentrated around a large technical infrastructure and a regulated market. National Grid Gas owns the National Transmission System (NTS), while eight regional Gas Distribution Networks (GDNs) are owned by four operators (Cadent, Northern Gas Networks, SGN, and Wales & West Utilities) who, for a fee, distribute gas to households on behalf of gas supply companies. Privatisation and liberalisation processes in the 1990s culminated in the emergence of the ‘Big Six’ suppliers (Centrica/British Gas, E.ON, NPower, SSE, Scottish Power, and EDF), which dominated the domestic gas market (Figure 6.8) in a vertically integrated oligopoly until 2014. Since then, the emergence of new players (e.g., Bulb, Co-operative Energy, Green Star Energy, Octopus Energy, OVO Energy, Shell Energy) has led to increased competition and shrinking market shares of the Big Six (Figure 6.8), notably for British Gas.Footnote 2

Figure 6.8 Domestic market gas supply market shares in GB, 2005–2020

Gas industry actors face increasing economic pressures from recent decreases in gas demand (for heating and for power generation), substantial infrastructure costs, operational challenges to maintain supply security, and alternative low-carbon heating options that may increase to address climate change (National Grid, 2019). In this context, gas industry actors strategically seek to maintain their position of centrality with regards to heating. Indeed, most of the energy supply actors are strongly attached to the gas-based heating system, because of sunk investments in pipeline infrastructures, business models, market positions, and technical capabilities. Their historic centrality is also proving an important advantage for shaping heat decarbonisation pathways amid significant uncertainties and policy indecision (Lowes and Woodman, Reference Lovio and Kivimaa2020).

For a long time, these actors paid limited attention to climate change. But since the mid-2010s, they have ‘woken up’ to potential threats of climate change and heat decarbonisation (Pearson and Arapostathis, Reference Pearson and Arapostathis2017), because many low-carbon transition scenarios (by the government, Committee on Climate Change, or researchers) envisaged a smaller role for gas in UK heating and a greater role for low-carbon alternatives such as heat pumps, heat networks, or biomass (discussed further later). The Energy Networks Association (ENA), which represents interests of transmission and distribution operators, has therefore started to use lobbying and framing strategies that propose alternative visions of the future, which advocate for a continued role for gas infrastructures, notably around arguments of security and affordability in the face of uncertainties, claiming that ‘Decarbonising gas – reducing the carbon emissions linked to its use – is the least disruptive way of delivering a cleaner, greener future’ (ENA, 2018: 10). These visions and scenarios include continued use of natural gas (via hybrid heat pumps or energy efficiency improvements) but also large-scale distribution of biomethane (which is currently practised in demonstration facilities and requires little to no adjustments to infrastructure and appliances, but poses significant scaling challenges) or hydrogen (which is less developed and more technically challenging) through repurposed gas grids (Lowes et al., Reference Lovio and Kivimaa2020; Richards and Al Zaili, Reference Richards and Al Zaili2020; Speirs et al., Reference Spaargaren, Cohen, Mol, Sonnenfeld and Spaargaren2018, see also Section 6.4.1). An ENA-commissioned report by KPMG (2016) suggested that a heat transition based on the ‘evolution of gas’ relying mainly on conversion of the gas grid to hydrogen would be as much as three times cheaper than other scenarios. These defensive strategies have increased the uncertainties that policymakers face with regard to potential low-carbon heat transition pathways (Lowes and Woodman, Reference Lovio and Kivimaa2020).

Appliance Manufacturers and Installers: Concerning heat conversion, there are many appliance manufacturers (e.g., boilers, radiators, controls) and installers (e.g., plumbers, builders, heat technicians). More than twenty companies supply gas boilers, but four international companies (Baxi, Worcester Bosch, Vaillant, and Ideal) dominate the UK market (DECC, 2013a: 74). While appliance manufacturers have remained committed to gas-dependent heating,Footnote 3 producers of other heat-related products (e.g., cylinders, radiators, controls) are more versatile and hence less resistant to significant changes in the sector (Lowes et al., Reference Lowes and Woodman2018). The Energy and Utilities Alliance (EUA), which represents the appliance manufacturers, ran an advocacy campaign on ‘Green Gas’ that also advocated continued use of existing gas infrastructure:

Rather than rip out heating systems and make the grid obsolete, it makes sense to decarbonise the gas we use; using so called green gases such as Biomethane and bio SNG, in addition to hydrogen, will deliver affordable and sustainable solutions to the challenges the UK faces.

There are also many heating equipment installers in the UK (e.g., builders, plumber, heating engineers) whose skills are mainly tied to conventional gas-fired boilers and central heating systems. While there are 74,000 registered Gas Safe registered businesses (representing over 100,000 gas engineers) in the UK (Gas Safe Register, 2017), the number of installers certified under the Microgeneration Certification Scheme (MCS) never exceeded 4,000, most of which were specialised in the installation of solar PV rather than heat pumps or biomass boilers (Hanna et al., Reference Hanna, Leach and Torriti2018).

The community of gas heating installers is concerned that a transition towards renewable heat or heat networks may disrupt their livelihood and knowhow (Gas Safe Register, 2017) and would require significant re-training to address the skills gap:

Heating engineers are naturally familiar with [conventional gas-fired] technology, meaning that a domestic boiler can be bought and installed in under a day. Low carbon heating technologies do not have these advantages, being relatively new to the market. With greater complexity and longer installation time, such technologies tend to be far more expensive. The high price of alternative heating systems is a clear barrier to uptake.

The existing skills of installers thus help to lock-in the gas-based heating system, while a transition to low-carbon heat systems is hampered by the lack of technical installation skills:

Growth in the low carbon heat sector will lead to new installer jobs, and upskilling of existing jobs as existing gas installers cross-train.

As ‘middle actors’ between appliance manufacturers and users, heating installers play important mediating roles through the advice they provide to users (Wade et al., Reference Wade, Hitchings and Shipworth2016), often in periods of stress when the existing boiler has broken down. Because they know more about gas-fired boilers, and have their own views on the reliability and performance of different brands, they tend to advise households to purchase conventional systems (Wade et al., Reference Wade, Hitchings and Shipworth2016).

Policymakers: Interventionist supply-side heat policies of the 1960s and 1970s, which focused on the transition from coal to gas and central heating (Pearson and Arapostathis, Reference Pearson and Arapostathis2017), were followed by privatisation, liberalisation, and a more hands-off approach in the 1980s and 1990s, focused on increasing competition and lowering prices. British Gas was privatised in 1986 and broken up in 1997 to create Centrica and Transco. Freedom of supplier choice was established for all customers from 1998, leading to more competition, overseen by the regulator (Ofgas, later Ofgem).

Affordability became a salient political issue in the mid-2000s, when rising gas prices and higher heating bills led to critical debates about affordability and energy company pricing strategies. These debates led Ofgem to emphasise its role as maximising access to affordable energy for all (Ofgem, 2019).

Energy security also became an important issue in the mid-2000s (Kuzemko, Reference Kuzemko2014), when increasing reliance on gas imports strengthened concerns about vulnerability (especially when Russia closed gas supplies to Eastern Europe in 2005), price stability, and so on. This led to ‘considerable debate as to whether the UK Government should incentivise new storage, but the current position is to leave it to the market. The net result being that very little new storage capacity has been built’ (Bradshaw, Reference Bradshaw2018: 3).

Energy poverty reduction has been a policy goals since the 1990s, because many vulnerable social groups (e.g., elderly, benefit claimants) struggled to afford decent heating. Winter fuel payments for elderly people were introduced in 1997. Policymakers also introduced the Warm Home Discount (for low-income pensioners) in 2008 and increased Cold Weather Payments (for benefit claimants) in 2009.

Heat remained a relatively unproblematic and invisible part of climate policy until 2008, when the Climate Change Act triggered debates about the decarbonisation of heat. Since then, the strategic policy visions on preferred options and transition pathways have changed several times (Winskel, Reference Winskel, Hawkey, Webb, Lovell, McCrone, Tingey and Winskel2016), focusing initially on heat pumps, then on heat pumps and heat networks, and recently also on hydrogen and biomethane in gas grids.

The various visions were not translated, however, into concrete strategies or plans for action, leading the Committee on Climate Change to lament in 2016 about a lack of direction and delivery: ‘Progress to date has stalled. The Government needs a credible new strategy and a much stronger policy framework for buildings decarbonisation over the next three decades’ (CCC, 2016: 7). In 2019 the Committee still concluded that UK ‘buildings and heating policy continues to lag behind what is needed’ (CCC, 2020: 19) to reach emission reduction targets.

For policymakers, climate change thus appears to have been of less importance than other heat-related issues such as affordability, energy poverty, and energy security.

Users: There are around 29 million homes in the UK, corresponding to a slightly lower number of heating installations, given that a small number of homes are supplied by block- or district-level heat networks. Domestic heating has relatively low cultural visibility and consists of a relatively undifferentiated product, with largely routinised and taken-for-granted practices and low levels of user engagement. The operation of heating systems requires little competence, and basically consists of pushing a button or adjusting a thermostat. Conventional heating practices are passive (Hope et al., Reference Hope, Roberts and Walker2018), and domestic residents primarily demand comfortable, hassle-free, and affordably heated homes regardless of the heat source (CCC, 2016). From a user-perspective, there are few current incentives to shift away from gas:

Surveys report that customer satisfaction with natural gas boilers is extremely high. Gas-fired central heating is affordable, provides very high levels of thermal comfort, responds quickly when customers adjust the required temperature, and is convenient and familiar to both householders and installers.

Users give relatively little thought to their heating systems, which are linked to routine behaviour. DECC (2013a: 82) reports that ‘the majority of homeowners would only consider replacing their heating system if it needed significant repairs or services’. Homeowners who rent their properties to tenants also have limited incentives to upgrade their heating equipment. Nevertheless, households have steadily adopted more energy-efficient boilers (Figure 6.5), which is partly due to public policies that have phased out inefficient boilers (discussed in Section 6.2.3), and partly due to anticipated cost savings associated with reduced gas use. Combined with insulation measures (discussed in Section 6.3.1), this has resulted in average reductions in household gas use.

Concerns over rising costs have led to more user switching between energy providers, which can lead to substantial savings. Since 2014, annual gas supplier switching rates have increased, reaching over 20% of customers in 2019 (Ofgem, 2019).

Most users have few motivations to adopt more radical low-carbon innovations such as heat pumps, biomass boilers, or solar thermal options (Balcombe et al., Reference Balcombe, Rigby and Azapagic2014). The Renewable Heat Incentive (RHI) sought to encourage the uptake of these technologies but has had only limited effect and largely benefited more affluent users and homeowners. Furthermore, user trust with regards to the quality of installers is an additional structural barrier to wider uptake of radical innovations. The industry quality insurance scheme (the Microgeneration Certification Scheme) does not appear to have substantially addressed these concerns (Hanna et al., Reference Hanna, Leach and Torriti2018), notably due to poor inspections and the recurrence of sub-optimal installations.

Wider Publics: Heating is not a highly visible issue in public debates, because it remains rather abstract and technical. If there are societal debates about heating, these are mainly about costs (because of rising energy prices) and energy poverty. There is little discussion about the environmental implications of heating, which is remarkable because households use much more energy for space heating than for electricity.

Civil society activity on heating is primarily oriented towards raising awareness, putting issues on the policy agenda, and maintaining pressure for more ambitious policies. NGOs have been most vocal on the issue of fuel poverty, which is a particular form of inequality and injustice. NGOs dedicated to fuel poverty include National Energy Action, National Right to Fuel Campaign, Fuel Poverty Action, Energy Bill Revolution, and End Fuel Poverty Coalition.

Several more generalist organisations seek to promote low-carbon heating by influencing policy, supporting the development of supply chains, or enabling informed user choices. For instance, the Centre of Sustainable Energy manages sustainable energy projects, and the Association for the Conservation of Energy represents the energy conservation industry and lobbies for more stringent energy efficiency policies. The Green Alliance is a green think tank that published a Manifesto for Sustainable Heat (Green Alliance, 2007), which contributed to raising policy awareness of the need to develop a long-term heat strategy and supporting a wider portfolio of options. The Energy Saving Trust offers information and user advice about low-carbon heating and home insulation options.

6.2.3 Policies and Governance

Formal Policies

Since the 1990s, successive governments have introduced a range of policy instruments to address fuel poverty and financially assist vulnerable groups in cold periods (Table 6.2).

Table 6.2. Direct financial support for users in vulnerable situations (Ofgem, 2019: 107)

| Policy | Eligible | Recipients (winter 2017–2019) | Payments to individuals, nominal (£) | Total cost, 2018 prices (£m) | Funding source |

|---|---|---|---|---|---|

| Winter Fuel Payments | All pensioners | 11.8 million individuals | £100 to £300 | £2,055 | Central government |

| Warm Home Discount (core group) | Low-income pensioners | 1.2 million individuals | £140 | £173 | Energy bill payers |

| Warm Home Discount (broader group) | Consumers on a low income and vulnerable to fuel poverty | 0.6 million individuals | £140 | £161 | Energy bill payers |

| Cold weather payment | 3.8 million benefit claimants | 4.7 million payments | £25 for each cold week of weather | £121 | Central government |

European and UK policymakers also played an active role in supporting the diffusion of more efficient gas boilers and appliances, which led to substantial yet incremental changes in existing technologies (Figure 6.5). The European Boiler Efficiency Directive (1992), for instance, mandated minimum performance standards, which led to the phase-out of boilers with efficiencies under 70% (G-rated), though it excluded back boilers. Efficiency standards were ramped up in the Building Regulations revision (2000), requiring a phase-out of boilers with efficiencies under 78% (D-rated) by 2002. The 2005 Building Regulations, brought forward by the Energy White Paper of the same year, further raised efficiency standards, requiring a phase-out of boilers with efficiencies under 86% (B-rated). This effectively mandated a switch to condensing boilers. In 2018, the Boiler Plus Standard further mandated new boilers to comply with a minimum efficiency of 92% as well as to include time and temperature controls.

Besides tightening standards, policymakers also used other instruments to stimulate the diffusion of more efficient gas boilers. Between 2009 and 2010, the Boiler Scrappage Scheme provided a £400 incentive for 125,000 households to upgrade from the least efficient, G-rated boilers to new high efficiency boilers (Dowson et al., Reference Dowson, Poole, Harrison and Susman2012). The government also ran several programmes that placed energy savings obligations on energy suppliers, which required them to make energy efficiency improvements in households (Rosenow, Reference Rosenow2012). The third Energy Efficiency Standards of Performance programme (2000–2002), the Energy Efficiency Commitments (2002–2008), the Carbon Emissions Reduction Target (2008–2012), the Community Energy Saving Programme (2009–2012), and the Energy Company Obligations (from 2013 onwards) all stimulated energy suppliers to assist the diffusion of efficient gas boilers as well as other measures (e.g., insulation, lighting, appliances).

Policy engagement with more radical heat innovations has been much more fragmented, patchy, and short-lived, however. The Renewable Heat Premium Payments (2011–2014) offered a single payment to assist households with the purchase of renewable heating technology (e.g., solar thermal panels, heat pumps, biomass boilers). It was replaced by the domestic Renewable Heat Incentive (RHI) (from 2014 onwards), which provides varying subsidies for alternative heating systems based on renewable sources (e.g., biomass boilers, heat pumps, deep geothermal, solar thermal). This scheme has been criticised as ineffective, narrowly targeted, and under-delivering on emission targets (NAO, 2018). It also ‘provided a disproportionate incentive for domestic biomass boilers compared to other technologies’ (CCC, 2020: 100). Although the RHI-scheme offered generous returns, roll-out remained limited and less than £100 million was spent in 2018 (CCC, 2019b: 29). This was because the RHI was ‘not supported by a package of measures to encourage and enable customers to make changes easily’ (CCC, 2020: 96). The reliance on a single (financial) instrument has thus remained ineffective in boosting renewable heat options.

These limited and relatively ineffective instruments have created major discrepancies between actual policy delivery and the far-reaching visions of heat decarbonisation transition that have been advanced since 2009. Already in 2016, the Committee on Climate Change (CCC) warned that: ‘The existing set of policies is not an effective overall package for decarbonising heating’ (CCC, 2016: 13). In 2018, the CCC commended the vision of the 2017 Clean Growth Strategy but also diagnosed that it contained ‘few new specific policies to deliver real emissions reduction’ (CCC, 2018a: 16). And in 2020, the CCC welcomed extensions of RHI and plans for a Green Gas Levy (to support green gas) but also assessed that ‘the current plans are far too limited to drive the transformation required to decarbonise the UK’s existing buildings’ (CCC, 2020: 20). It therefore urgently suggested that ‘policy needs a step change in ambition and delivery this year’ (CCC, 2020: 21).

There have been some recent policy announcements, but these remain relatively limited and do not yet add up to a step change in ambition and delivery. In 2019, the government announced plans for a ban on gas boilers in new homes from 2025, but this does not apply to replacement of boilers in existing homes, which is a far greater market, and has since then been reformulated as a rather vague ambition in the Energy White Paper (HM Government, 2020a):

We will […] consult in early 2021 over new regulations to phase out fossil fuels in off-grid homes, businesses and public buildings, including a backstop date for the use of any remaining fossil fuel heating systems.

In June 2020, the government awarded £14.6 million for the Electrification of Heat Demonstration Project, but the heat pump trial remains limited to 750 homes. There are also plans to replace the non-domestic RHI in 2021 with a Green Gas levy to further support the deployment of biomethane in the existing gas grid. More substantially, perhaps, the government launched the £320million Heat Networks Investment project in 2018 that supports local governments, firms, and third sector organisations in building and operating heat networks in areas of denser heat demand. The first projects to receive funding were announced in February 2020, but overall funding in this round was limited to £40m.

Although incremental boiler improvements in the 1990s and 2000s were achieved with a mix of policy instruments (e.g., efficiency standards, supplier obligations, financial incentives), the governance style with regard to low-carbon heat transitions seems to have narrowed in the 2010s to a technology-neutral, market-based approach (relying mainly on incentives and information): ‘Across all the different heating strands, the Government wants to make progress without prescribing the use of specific technologies. Instead, information for market players, including households and businesses, should be improved to enable effective decision-making’ (DECC, 2013a: 79).

Governance Style

In terms of governance style, heating has largely been approached as a demand-side technical performance problem to be addressed through efficiency improvements at the point of heating. Mandated performance levels and minimum standards have been rather effective in improving the efficiency of fossil heating appliances, but the potential for further incremental improvements is limited. Aside from clarity on performance standards, low-carbon heat policy has been marked by hesitancy and a lack of coherence.

The reliance on isolated market modulation mechanisms (e.g., the RHI) has, so far, been ineffective in driving low-carbon heat transitions, because instruments tended to be fragmented, short-lived, and not part of a wider policy mix. Transition governance has been weak and the successive changes in long-term visions have not provided clear directionality to support innovation, market formation, supply-chain development, or the build-up of relevant skills and competences on the required scale. Strategic visions (e.g., 2012, 2013, 2020), although multiplying in recent years, were also not translated into concrete policies and instruments, leading to lack of delivery. These strategic visions were also shaped by various influence groups, leading to a lack of coherence concerning technological preferences (Broad et al., Reference Broad, Hawker and Dodds2020).

A new Buildings and Heat Strategy was expected in 2020 but has been delayed, and it remains to be seen if this will provide more clarity about future directions of travel and back these up with effective policy instruments. The general heat policy objectives that such a strategy needs to meet have been spelled out in the latest Energy White Paper (HM Government, 2020a) and Ten Point Plan (HM Government, 2020b), but many uncertainties remain concerning delivery on these announcements. Repeated delays in publishing the new Buildings and Heat Strategy are indicative of disagreement about implementation and feasibility.

6.3 Buildings System

6.3.1 Techno-Economic Developments

The demand for domestic space heating is strongly influenced by the insulation properties of the building shell, which are poor in the UK compared to other countries. The UK housing stock is relatively old: most houses were built before 1960 (Figure 6.9). Houses also have high material obduracy and are deeply locked-in: 80% of the current building stock is projected to still be in use by 2050 (Dowson et al., Reference Dowson, Poole, Harrison and Susman2012).

Figure 6.9 Age profile of UK housing stock, thousands of dwellings

The largest heat loss components in UK homes are walls, ventilation, windows, and roofs. Between 1970 and 2008, the average heat loss per dwelling was reduced by about 33% (Figure 6.10) through a range of incremental improvements in existing houses. Most houses with lofts now have some degree of loft insulation (although the depth of insulation varies). Since the 1970s, the percentage of houses with some degree of double glazing also increased very substantially, to 96% in 2016 (Figure 6.11), although this does necessarily imply that all windows are double glazed. The percentage of houses with some degree of cavity wall insulation increased from close to zero in the 1970s to 69% in 2016 (Figure 6.11). Solid wall insulation, which is expensive and ‘hard to treat’, has been limitedly applied, however. While the diffusion rates of these insulation techniques are impressive, these have often been applied in piecemeal fashion rather than with a whole-house approach, which presents significant limits as to the efficiency improvement potential.

Figure 6.11 Diffusion of different home insulation measure in UK homes, 1976–2018

The number of UK dwellings has increased steadily to 28.9 million in 2018 (Figure 6.12). Between 2014 and 2019, 1,095,870 new dwellings were built (Figure 6.15), representing a 4% building stock increase. Most UK homes are owner-occupied (outright owned and owned with mortgage). Social renting (from local authorities or housing associations) has declined strongly since the 1980s’ Right to Buy policy (Figure 6.12).Footnote 4 Private renting has increased steadily since the turn of the century. Penetration rates of insulation measures vary greatly according to tenure type, with privately rented homes ranking poorer on average. Privately rented homes are less likely to benefit from cavity wall insulation, loft insulation, or double glazing (Figure 6.13), owing to split incentives problems.Footnote 5

Figure 6.12 Total number of UK dwellings (in millions) and per tenure category, 1980–2018

Figure 6.13 Insulation measures in English houses by tenure, 2010 and 2019

The deployment of incremental insulation measures in the existing building system (Figure 6.11) helped to reduce heat demand from the early 2000s (Figure 6.6) and contributed to decreasing greenhouse gas emissions from UK buildings (Figure 6.2). Most of the thermal efficiency improvements have, so far, been piecemeal and incremental rather than leading to radical changes in building methods or building stock (e.g., whole-house retrofits). They have also focused on relatively easy and inexpensive measures (so-called low-hanging fruits). This means there is still large potential for further thermal insulation improvements as the government also noted in 2013: ‘There are hardly any homes with no insulation, but more than two thirds of the stock still has insufficient insulation by modern standards’ (DECC, 2013b: 51). Nevertheless, recent policy changes, which are further discussed in Section 6.3.3, have made this problem more acute because they led to a collapse in delivery rates of key insulation measures (Figure 6.14).

Figure 6.14 Delivery rates of key insulation measures in UK houses, in millions of installations

Since the late 1960s, the housebuilding sector has also experienced substantial decreases in the number of new homes that have been built (Figure 6.15). This is particularly due to major declines in social housing construction by local authorities and a slump in private enterprise construction after the 2008 financial-economic crisis (Figure 6.15), which only recently has begun to recover. These trends helped to create serious housing shortages and limited the role of the public sector in driving low-carbon innovation and renovation. The houses that were built in the past decade do not meet high insulation standards, which not only suggests that the housing crisis has been a more pertinent issue than climate change but also that future adjustments may be needed: ‘Since the Climate Change Act was passed, nearly two million homes have been built that are likely to require expensive zero-carbon retrofits and have missed out on lower energy bills’ (CCC, 2020: 19).

Figure 6.15 Number of permanent dwellings completed, by sector, United Kingdom, 1949–2019

6.3.2 Actors

Housebuilding Sector: The UK housebuilding sector is diverse and includes contractors, developers, architects, builders and engineers, and many suppliers of specialised materials (e.g., doors, windows, insulation, construction materials). The UK house building sector is economically substantial (Table 6.3).

Table 6.3. House building sector in the UK, 2017 (HBF, 2018)

| Total | |

|---|---|

| Economic output (£ billion), including builders, contractors, suppliers, excluding induced economic output | 38 |

| Employed in on-site building | 239,000 |

| Indirect employment supported | 119,500–186,420 |

| Induced employment supported | 174,470–272,270 |

The sector is dominated by volume housebuilders, who minimise risk and maximise profit margins through the use of Standardised Design and Production Templates and the contracting out of physical construction to local builders (Barlow, Reference Barlow1999; Lees and Sexton, Reference Lees and Sexton2014). In 1960 the top 10 housebuilders accounted for about 9% of all new housing production. By 2004 this had increased to 46% (Archer and Cole, Reference Archer and Cole2014). By 2015 large housebuilders (building over 2,000 units per year) had increased their market share to 59% (DCLG, 2017). This increasing concentration in the sector has enhanced the economic and political power of large housebuilders, who also make large profits through ‘land banking’, which is the practice of buying land and getting planning permission but then delaying actual construction to benefit from increasing land prices (Ryan-Collins et al., Reference Ryan-Collins, Lloyd and Macfarlane2017). The structural power of large private housebuilders also increased because of changing market structures, particularly the virtual collapse of local authority commissioned buildings since the 1970s (Figure 6.15), which increased the influence of the private sector.

When building regulations started to address energy saving in the mid-1990s (Raman and Shove, Reference Raman, Shove and Fineman2000), most volume housebuilders took a compliance-only approach, focused on incremental changes that stayed within the Standardised Design and Production Templates (Lees and Sexton, Reference Lees and Sexton2014). Only a few incumbents (e.g., George Wimpey Ltd., Crest Nicholson) experimented with low-energy innovations in the early 2000s, but the experiences did not lead to strategic reorientation or commitment. Measures to reduce energy demand continued to be viewed as an add-on to existing practices rather than encouraging a change in building design (Smith, Reference Smink, Negro, Niesten and Hekkert2007).

When, in 2006, the Labour government introduced the Zero Carbon Homes (ZCH) target (which would see all new homes zero-carbon by 2016), housebuilders responded in two ways. On the one hand, they more seriously started to explore radical technical house designs that would be needed to meet this target. Several incumbent firms investigated the possibility of building to the Passivhaus standard, while others (e.g., Barratt, Stewart Milne) worked with the Building Research Establishment on test houses that met the highest level of the Code for Sustainable Homes (CSH) (Lynch, Reference Lowes, Woodman and Speirs2014).Footnote 7 The industry also funded the Zero Carbon Hub (created in 2008), which engaged in research and technical demonstration, provided advice, hosted events to create forums for discussion, and aimed to strengthen coalitions between industry and government. These learning processes and coalition building efforts were relatively weak, however, and did not generate widespread commitment in the housebuilding sector (Heffernan et al., Reference Heffernan, Pan, Liang and de Wilde2015).

On the other hand, the industry mounted a sustained counter-lobby, which by 2011 succeeded in the watering down of the definition of ‘zero-carbon’, and by 2015 succeeded in the removal of the ZCH target altogether (Gibbs and O’Neill, Reference Gibbs and O’Neill2015). One reason the industry’s lobbying activities succeeded was that the Conservative-Liberal Democrat coalition (2010–2015) and the Conservative (post-2015) government felt less committed to the Labour government’s target. Another reason is that the 2008 financial-economic crisis and subsequent recession and austerity politics changed the economic and political priorities, leading to more concern about growth, business profitability, and reducing regulatory constraints: ‘While the government wanted to speed up house building amid concerns about housing affordability and economic recovery, the ZCH agenda was viewed as a threat to productivity rather than an opportunity to place the UK at the forefront of green building and retrofitting’ (O’Neill and Gibbs, Reference O’Neill and Gibbs2020: 126). Aligning their lobbying strategies to these changed political concerns, ‘industry actors like the Home Builders Federation, as well as some large-scale house-builders, took advantage of an opportunity to attack and unpick the ZCH agenda’ (O’Neill and Gibbs, Reference O’Neill and Gibbs2020: 126). A third reason is that the housing crisis increased the dependency of the government on housebuilders to build more homes. The building industry used this structural dependency to push for scrapping the ZCH (Edmondson et al., Reference Edmondson, Rogge and Kern2020).

Reluctance to engage with the low-carbon agenda characterises not only volume housebuilders but also smaller building firms, contractors, and suppliers who mostly lack the required competences, skills, and building templates. A low-carbon transition in housing would thus require extensive retraining, particularly in support of more energy efficient building and retrofitting (Martiskainen and Kivimaa, Reference Martiskainen and Kivimaa2019), as well as a unified framework for standard setting, monitoring, and enforcement of quality improvements (e.g., insulation) (Bonfield, Reference Bonfield2016).

There are a few organisations that promote the development of low-energy skills and buildings, but these operate mostly at the fringes of the industry. The Association of Environmentally Conscious Building (AECB), for instance, brings together contractors, trades people, architects, and builders to help develop, share, train, and promote sustainable building best practices. The UK Green Buildings Council also promotes greener approaches in the construction sector and lobbies the government to prioritise energy efficiency in buildings. The Energy Saving Trust provides information about low-emission retrofitting standards and practices. And the Zero Carbon Hub, which was disbanded in 2016, developed and disseminated knowledge and information regarding low and zero-carbon new homes.

Policymakers: Housing and housebuilding relate to different policy competences and responsibilities. The Ministry of Housing, Communities & Local Government (MHCLG), formerly the Department for Communities and Local Government (DCLG), has responsibilities for ensuring the safety and quality of buildings (e.g., through regulations and building standards) as well as for driving up housing supply and increasing home ownership. The UK has been characterised as a ‘property-owning democracy’ (Daunton, Reference Daunton1987): home ownership has been an explicit policy goal since the Thatcher government, with a range of policies to encourage user demand (e.g., Right-to-Buy, shared ownership).

Environmental, energy, and climate change issues in relation to buildings are responsibilities of other ministries, for example, DEFRA, DECC, BEIS.Footnote 8 BEIS also aims to drive innovation and improvements in the construction business, notably by encouraging the long-term development of suitable supply chains and skills. Local authorities built many houses in the 1950s and 1960s but their active contribution to construction has shrunk greatly since then (Figure 6.15). One of their main current roles is to inspect new homes to ensure that they meet building regulations and standards.

These split responsibilities not only create coordination challenges but also mean that energy and climate change issues have been layered on top of the Housing Ministry’s core remit. Building regulations and standards are an important policy instrument in the building sector, enabling the coordination of many dispersed actors. Building regulations historically focused on health, safety, and materials. Energy saving was added as an additional consideration in the mid-1990s (Raman and Shove, Reference Raman, Shove and Fineman2000), leading to gradual inclusion of incremental insulation measures in new buildings. Successive energy savings obligations on energy suppliers (further discussed in Section 6.3.3) also led to piecemeal retrofits and incremental insulation measures in existing buildings in the 1990s and 2000s. The 2013 Green Deal policy, which was meant to further accelerate the implementation of housing retrofits, was poorly designed and led to a collapse in the installation of key insulation measures (Figure 6.14), as will be further discussed in Section 6.3.3.

The 2006 Zero Carbon Homes (ZCH) target was a radical top-down policy that was meant to drive more radical low-carbon innovation in new homes. But this policy was first watered down in 2011 and then scrapped in 2015, because of industry counter-lobbying and changing political priorities (due to the financial-economic crisis and changes in government), as discussed previously.

These developments suggest that policymakers (have come to) perceive other issues as more important than climate change. These other issues include the limited supply of new buildings (which underpins the housing shortage crisis), limited availability of affordable housing (affecting younger generation), low quality of (many) new houses, and limited innovativeness in the construction sector. The weakening commitment of policymakers to climate change mitigation has led to less ambitious policies since the mid-2010s, which are presently not driving a low-carbon transition in housing: ‘Policies to support low-carbon measures have been weakened or withdrawn, including Zero Carbon Homes and the Code for Sustainable Homes. This has led to many new homes being built only to minimum standards for water and energy efficiency’ (CCC, 2019b: 11).

Users: Since the 1970s, people have gradually installed piecemeal insulation measures in their homes (Figure 6.11). For people with relatively low incomes, millions of insulation measures have been the result of government policies that required energy suppliers to make energy efficiency improvements in people’s homes (further discussed in Section 6.3.3). Non-subsidised insulation and retrofit decisions have been motivated by household interests in improved thermal comfort, long-run energy cost savings, environmental benefits, addressing immediate problems (draughts, condensation, air quality, health), increased property value, and improved aesthetic appearance (for an excellent summary see Wilson et al. (Reference Wilson, Crane and Chryssochoidis2015)). But these motivations are not pertinent for all households, particularly not for low-income groups and non-homeowners.

Additionally, people may refrain from efficiency measures because of a range of barriers or concerns, including limited interest in energy or environmental issues, lack of money to pay upfront costs (or high interest rates on loans), uncertainty about benefits (e.g., cost savings, improvements in comfort, or health), concerns about contractor reliability and quality, fear of disruption caused by building works, information search costs, cognitive burden to process specialist information, or fear of time-consuming or frustrating dealings with builders or contractors (Wilson et al., Reference Wilson, Crane and Chryssochoidis2015).

This multitude of barriers, which include but go beyond financial ones, helps explain why ‘there are numerous, cost-effective measures that could be installed in many, if not most, houses, but the building owners are not putting them in’ (Boardman, Reference Boardman2007: 41). The balance of motivations and barriers varies significantly across type of insulation measures, type of house, type of household, and type of occupancy. With regard to the latter, private tenancies (19% of the UK housing stock) offer the least motives for efficiency refurbishments due to the principal-agent problem (it is the tenant, not the landlord, who would reap the benefits of investment).

Wider Publics: Environmental movements and NGOs have long advocated for more attention to energy efficiency. National Energy Action, the Green Alliance, and WWF, for instance, have lobbied for more ambitious policy action, while the Association for Environment Conscious Building (AECB), which represents sustainable construction professionals in the UK, has lobbied for the adoption of more ambitious low-carbon home delivery targets and standards. It runs its own self-certification scheme for newbuilds, largely in line with the German PassivHaus standards.

Thermal improvement and comfort also relate to issues such as energy poverty, decent living conditions, and health benefits (Martiskainen and Kivimaa, Reference Martiskainen and Kivimaa2019), which have been recognised as a particular form of social inequality and injustice. Low-energy housing can significantly reduce energy bills, improve thermal comfort, and improve indoor air quality if combined with appropriate ventilation (Chenari et al., Reference Chenari, Dias Carrilho and Gameiro da Silva2016). Several NGOs have advocated energy poverty issues in the UK, such as National Energy Action, the National Right to Fuel Campaign, the End Fuel Poverty Coalition, and the Centre of Sustainable Energy. Other campaigns have been oriented towards information and emergency assistance, such as Beat the Cold, the Big Energy Saving Network, Citizens Advice, or the Energy Saving Trust.

Civil society organisations have also led energy poverty projects such as the Warm Homes for Health project that installed double glazing in social housing in Sunderland; the Warm Zones programme that provided advice and subsidies for household insulations in specific areas; or Green Doctors, who offer simple energy-efficiency measures (e.g., draught-proofing) and advice to energy poor households across London.

6.3.3 Policies and Governance

Formal Policies

Incremental building improvements have been stimulated by a range of policies since the mid-1990s. Part L of the Building Regulations (which relate to conservation of fuel and power) were tightened in 1995, requiring new buildings to meet higher insulation standards. This was complemented by the introduction in 1995 of the Standards Assessment Procedure, which allowed the energy performance of homes to be measured and compared (Mallaburn and Eyre, Reference Mallaburn and Eyre2014). Three successive Energy Efficiency Standards of Performance programmes (1994–1998, 1998–2000, 2000–2002) further required energy suppliers to meet increasing energy-saving targets by making improvements in people’s homes, which were mostly met through insulation measures.

The 2002 European Energy Performance of Buildings Directive (EPBD) increased regulatory pressures, setting minimum energy performance standards for new buildings and requiring owners or landlords to provide Energy Performance Certificates (EPC) when selling or renting existing buildings. UK policymakers introduced EPCs in 2007 (with Energy Efficiency Rating ranging from G to A+++) to provide information to users. The Energy Efficiency Commitments (EEC), the Carbon Emissions Reduction Target (CERT), and the Community Energy Saving Programme (CESP) were further programmes that placed energy savings obligations on energy suppliers, which between 2002 and 2012 led to the installation of millions of insulation measures in existing homes (Table 6.4), focusing particularly on disadvantaged customers.

Table 6.4. Number of insulation measures installed under EEC and CERT (data from UK Housing Energy Fact File 2012)

| Cavity wall insulation | Loft insulation | Solid wall insulation | |

|---|---|---|---|

| EEC1 (2002–2005) | 792,000 | 439,000 | 24,000 |

| EEC2 (2005–2008) | 1,336,000 | 799,000 | 35,000 |

| CERT (2008–2012) | 2,103,000 | 4,549,000 | 47,000 |

Although these policies stimulated incremental, piecemeal improvements in new and existing buildings, they substantially contributed to reduced heat loss in buildings (Figure 6.10) and reduced greenhouse gas emissions in the 1990s and 2000s. The number of annual insulation improvements collapsed in the 2010s (Figure 6.14), because the Energy Company Obligations (ECO) and the Green Deal policies, both introduced in 2013, were weaker and poorly designed: ‘Insulation rates fell very significantly after installation programmes (i.e., CERT and CESP) ended in 2012, with the replacement obligation (ECO) less ambitious than its predecessors and the Green Deal failing to deliver’ (CCC, 2019a: 84).

The Green Deal, in particular, was a major failure, because it was introduced as the government’s flagship policy to drive a mass rollout of low-energy housing retrofits. The Green Deal was a finance-based energy efficiency policy that deviated substantially from the previous regulatory approach (e.g., energy savings obligations, building regulations). It aimed to stimulate the use of private finance through a pay-as-you-save finance mechanism (in which households would pay back loans with money saved on energy bills). The Green Deal failed because the loan interest rate was too high, because the marketing campaign only emphasised financial savings (and ignored the multitude of other user barriers or motivations), and because policymakers failed to listen to critics and make adjustments (Rosenow and Eyre, Reference Rosenow and Eyre2016): ‘The Green Deal too suffered from a lack of flexibility after initial poor design, which was heavily criticised at the time’ (CCC, 2020: 99).

To stimulate radical innovations and drive a low-carbon transition, the government introduced the Zero Carbon Homes plan in 2006, which mandated that all new buildings from 2016 would be carbon-neutral or -negative (Kern et al., Reference Kern, Kivimaa and Martiskainen2017). This was a radical top-down policy that was introduced rather suddenly, without much consultation. The ZCH-plan was accompanied by the 2006 launch of the Code for Sustainable Homes (CSH), which was a voluntary certification scheme that included performance measures for energy, CO2 emissions, and other sustainability indicators, as part of a commitment towards 100% zero-carbon homes for newbuilds by 2016 (Heffernan et al., Reference Heffernan, Pan, Liang and de Wilde2015). The Code had six levels, with Code 1 representing a 10% energy efficiency improvement over the 2006 building regulations, while Code 6 referred to zero carbon homes.

Policymakers hoped that the ZCH-target, increasingly stringent Building Regulations, and voluntary standards would encourage reorientation of incumbent housebuilders (O’Neill and Gibbs, Reference O’Neill and Gibbs2020). To support this reorientation, the government also helped to create the Zero Carbon Hub (which was primarily funded by industry actors) to investigate, test, and demonstrate various zero-carbon options and create a platform for discussion and network building between industry and government (Edmondson et al., Reference Edmondson, Rogge and Kern2020). As discussed in Section 6.3.2, some housebuilders did indeed start exploring more radical low-carbon building options. But most industry efforts focused on political lobbying, which strategically aligned with changing political priorities in the early 2010s, leading to dilution of the ZCH-target in 2011 and its dismantling in 2015.

The suddenness of policy changes (which characterised both the introduction of the ZCH-policy and its removal) has been characterised as a major policy shortcoming (CCC, 2020). The limited effort to build stakeholder support has also been identified as a weakness:

The creation of the Zero Carbon Hub Task Force may have been intended to create a coalition to support a green building transition, but governments failed to build strong alliances with those groups such as the Royal Institute of British Architects and the Association of Environmentally Conscious Building, which could have supported the policies.

The failures of the Green Deal, Energy Company Obligation, and Zero Carbon Homes policy have left UK housing policy without effective low-carbon policy for new and existing homes. The 2018 progress report from the Committee on Climate Change therefore rightly concluded that: ‘Energy efficiency must urgently be improved across the building stock. Current policy is failing to drive uptake, including for highly cost-effective measures such as loft insulation. Policy needs to incentivise efficient long-term investments, rather than piecemeal incremental change’ (CCC, 2018a: 85). And its 2019 progress report further assessed that: ‘The progress made on buildings remains insufficient … In order to go further to meet net-zero ambitions, bold and decisive action is urgently needed from Government’ (CCC, 2019a: 67).

The 2018 Construction Sector Deal, which was developed together with the building sector, mentions energy-efficient homes in passing, but overwhelmingly aims to ‘transform the sector’s productivity through innovative technologies and a more highly skilled workforce’ (p. 3). BEIS’s heat-oriented clean growth plan (BEIS, 2018a) includes a Buildings Mission that aims to halve the energy use of new buildings by 2030. It also refers to £170m of public money to back the mission, which the government hopes will be matched by £250m of private sector investment (BEIS, 2018a: 110–111). Further operationalisation of this mission-oriented policy is still lacking, however. In its 2019 Spring statement, the government mentioned a Future Homes Standard by 2025 with a possible zero-carbon target for new homes. The technical specifications for the standards are expected to be ready for public consultation in 2023, legislation in 2024, and implementation in 2025. It remains to be seen, however, if this standard will indeed be adopted and what complementary policies will be advanced to reach it.

Governance Style

In terms of governance style, low-carbon building policy has largely been characterised by a satisficing approach to efficiency performance improvements, primarily driven by standards and sporadic demand-side incitation measures. This has delivered incremental but insufficient efficiency improvements, which have not substantially reconfigured the housebuilding sector. Policies supporting low-carbon building and retrofit measures in the UK are therefore not currently set to reach decarbonisation and net-zero objectives.

Until the early 2010s, the governance style largely rested on regulation (such as energy savings obligations and mandatory performance standards for buildings), which delivered incremental efficiency improvements through isolated insulation measures.

More recently, however, efforts to drive innovative housebuilding and retrofitting techniques have failed to deliver, for a range of reasons including lack of consistency over time (e.g., shifting priorities, policy termination), lack of consistency across interventions (e.g., fragmented or single instrument approach), and lack of coordination between policy competences (e.g., BEIS, Treasury, MHCLG), leading to conflicting objectives.

While a more hands-on approach may be needed, the sector is still characterised by a governance style oriented towards regulation and standards, which are presently not stringent enough to drive ambition and have major loopholes (particularly regarding the existing housing stock) due to significant industry influence and counter-lobbying. Low-carbon building and retrofitting has not entered the mainstream of the housebuilding and renovation sector; it lacks dedicated innovation, skilling, and large-scale market roll-out policy components.

6.4 Niche-Innovations

Radical niche-innovations have emerged and to some extent diffused within the heating and buildings systems. This section first provides a general discussion of developments that affect most niche-innovations. The subsequent sections discuss five niche-innovations for heating (heat pumps, biomass heating, solar thermal heating, heat networks, and gas grid repurposing to hydrogen or biomethane) and two for buildings (passive house designs, whole-house retrofits). For each niche-innovation, we first analyse techno-economic developments and then actors and institutions.

Techno-Economic Developments: Although renewable and low-carbon heat technologies have developed quite steadily in a number of European countries (notably Sweden and Denmark), their diffusion in the UK has remained limited.

Although many technologies can be considered “mature” globally, the UK market in low-carbon heat technologies is only just emerging. This is due to the dominance of the gas boiler market driven by the wider availability of natural gas. Low carbon heat technologies remain niche, either because the target market is small or due to immature supply chains and low customer awareness.

There are significant differences in the installation and equipment costs of various domestic low-carbon heating systems (Table 6.5). The upfront capital costs of heat pumps and biomass boilers are significantly higher than gas boilers, which cost between £500 and £2,500, depending on size, brand, and type. Table 6.5 suggests that 1) heat pumps and advanced biomass boilers involve substantial upfront capital costs, 2) within heat pumps, GSHPs are considerably more expensive than ASHPs, 3) installing GSHPs in new buildings presents important cost savings (over installations in existing buildings).

Table 6.5. Average capital cost data for domestic low-carbon heating systems and conventional systems (adapted from Rosenow et al., Reference Rosenow, Guertler, Sorrell and Eyre2018)

| Building type | Individual low carbon heating system | Installed cost per dwelling (£) | Lifetime (years) |

|---|---|---|---|

| Existing building | Air source heat pump (ASHP) | 7,000 | 15 |

| Ground source heat pump (GSHP) | 14,000 | 20 | |

| Biomass boilers | 5,500 | 20 | |

| Gas boiler | 1,500 | 15 | |

| Wood stoves (with chimney liner) | 2,000 | 15 | |

| New building | GSHP | 10,500 | 17.5 |

The various niche-innovations also have different technical characteristics, which means that a low-carbon transition in heat and buildings may well lead to a more diverse overall system.

Heat pumps (Section 6.4.1) require more space than gas boilers and may thus be especially suitable for large, sub-urban houses and off-grid locations.

Heat networks (Section 6.4.5) are more suitable in locations with concentrated heat use (i.e., dense urban areas, tower-blocks, industrial/commercial applications). While they enable significant efficiency gains due to scale advantages accruing from collectivisation, their low-carbon nature is not automatic as it depends on the fuel source (which is presently mostly gas).

Biomass heating (Section 6.4.2) is mostly used as add-on technology in the living room, where people like to enjoy a cosy fire when they relax. Exhaust of particulate matter is, however, contributing to air pollution problems in dense residential areas, leading to increased policy concerns. They are different from advanced biomass boilers, which can be used as primary heat source with high efficiency ratios but are also more expensive.

Gas grid repurposing towards low-carbon energy carriers (e.g., biomethane or hydrogen) makes use of the existing infrastructure (Section 6.4.4).

Low- to zero-carbon housing relates to new building and renovation techniques focussed on radically improved insulation, ventilation, heat exchange innovations, as well as general design principles. While newbuilt zero-carbon housing (Section 6.4.6) enables the applications of such principles to design and delivery, whole-house retrofits (Section 6.4.7) are important because they apply to the existing building stock, which is the vast majority of UK housing.

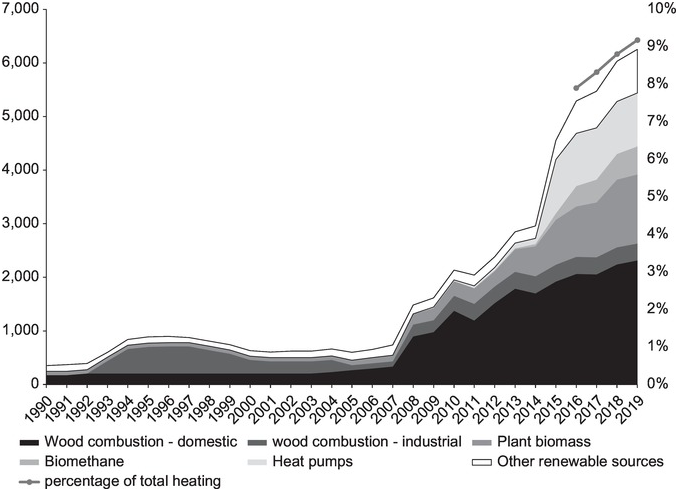

Since 2007, the uptake of renewable heat technologies has increased to a non-negligible portion of heating in combined sectors (residential, public administration, commercial) (Figure 6.16). Domestic wood combustion is the largest category, but heat pumps and biomass have also started to diffuse more substantially since 2014. Most heat pump deployment, however, has been in the commercial rather than the domestic sector. Regardless of end use and sector, renewable heatFootnote 9 made up just over 9% of overall heat use in 2019 (BEIS, 2020a: 106; Figure 6.16). Despite this rapid deployment, GHG emissions have still grown between 2014–2019 (Figure 6.2), because of increased heat demand (Figure 6.6) consistent with a growing number of heated dwellings (Figure 6.12) and because these renewable sources are not all low-carbon.

Figure 6.16 Renewable sources to generate heat (all sectors) in kilotons oil equivalent, 1990–2019

Policies: Since the 2008 Climate Change Act, radical niche-innovations have been central in strategic policy visions on long-term transition pathways. The content of these visions changed several times, however, which created deep uncertainties (Winskel, Reference Winskel, Hawkey, Webb, Lovell, McCrone, Tingey and Winskel2016). Initial views, articulated in the Low Carbon Transition Plan (DECC, 2009), 2050 Pathway Analysis (DECC, 2010), The Fourth Carbon Budget analysis (CCC, 2010), and Carbon Plan (DECC, 2011b), primarily emphasised a transition towards electric heat pumps, as part of the wider ‘all-electric society’ vision (in which first the electricity system would be decarbonised and then heat and transport would be electrified through heat pumps and electric vehicles). Winskel (Reference Winskel, Hawkey, Webb, Lovell, McCrone, Tingey and Winskel2016) suggests that: ‘The “all electric” vision for UK energy transition that emerged from these early scenarios was a rather simple blueprint, based on limited techno-economic research and modelling capacities which neglected many social, institutional and behavioural issues’.

Further analyses of the barriers for electric heat pumps (e.g., lack of installer skills, lack of space in dense urban areas, limited user confidence) and better understanding of potentials of other options led to revised visions a few years later. The Future of Heating: A Strategic Framework for Low Carbon Heat in the UK (DECC, 2012d) and The Future of Heating: Meeting the Challenge (DECC, 2013b) envisaged a smaller role for heat pumps than before and a more prominent role for heat networks. While both documents also identified an important transitional role for hybrid heat pumps (using gas and electricity), they envisaged that natural gas boilers would be phased out by 2050. Although some of the modelling still suggested a dominant role for heat pumps by 2050, the overall strategic vision of both documents involved a more diversified range of heat technologies than before.

A few years later, the strategic vision changed again. Both the Clean Growth Strategy (BEIS, 2017b) and its dedicated heat application (BEIS, 2018a) identified not only heat pumps and heat networks as possible low-carbon options but also the decarbonisation of gas grids by substituting natural gas with hydrogen or biomethane. This addition was partly the result of lobbying from gas industry actors (Lowes et al., Reference Lovio and Kivimaa2020), who worried that a low-carbon transition to heat pumps and heat networks might threaten the gas grid. The changing and diversifying visions reflected and created deep uncertainties, leading policymakers to conclude that ‘at present it is not certain which approaches or combination of them will work best at scale and offers the most cost-effective long-term answer. Decarbonising heat is our most difficult policy and technology challenge to meet our carbon targets’ (BEIS, 2017a: 75). The uncertainties and weak policies also hindered industrial and market development in the low-carbon heat sector, jeopardising decarbonisation ambitions (CCC, 2018a; Li and Pye, Reference Levinthal2018; Rosenow and Eyre, Reference Rosenow and Eyre2016).

To stimulate radical niche-innovations, the government introduced the Renewable Heat Incentive (RHI) in 2011, which provided subsidies for the installation of renewable heat technologies in non-domestic buildings. In 2014, the RHI was extended to domestic buildings, which stimulated demand for heat pumps, solar thermal, and biomass systems (Figure 6.17). The spike in 2014 and 2015 was caused by a large volume of ‘legacy applications’, which are RHI applications for systems that were installed between 2009 and 2014. RHI qualification criteria were adjusted after the 2015 Spending Review, leading to the introduction of a spending cap, new sustainability criteria that had to be met (especially for biomass), and a more restricted focus on strategically important technologies such as heat pumps and biomethane. Annual RHI-funded heating systems remained relatively stable after the initial legacy-induced peak, leading to steady growth of cumulative installations. Annual RHI-funded installations markedly increased from 2018, especially of pumps, which reached 21,500/year in 2019 (Figure 6.17). Subsidy levels for the RHI have fluctuated over time, according to policy priorities (Figure 6.18).

Figure 6.17 Quarterly (left-hand Y-axis) and cumulative (right-hand Y-axis) accreditations (new and legacy) of low-carbon heating installations under domestic RHI (number of installations).

Figure 6.18 Variations in domestic RHI subsidy levels between 2015 and 2020 (p/kWh), adjusted by the Retail Price Index (RPI) before 1 April 2016 and by the Consumer Price Index (CPI) thereafter

According to recent government proposal for the future of clean heat the policy priority is to ‘provide support for biomethane injection into the gas grid through the Green Gas Support Scheme and provide support for buildings technologies (heat pumps and in limited circumstances, biomass) through the Clean Heat Grant’ (BEIS, 2020b). The main instrument currently considered to support the deployment of low-carbon heating technologies in buildings is an upfront grant (as an alternative to a tariff-based mechanism) at a ‘technology-neutral, flat-rate grant of £4,000 for all technologies eligible under the Clean Heat Grant’ (BEIS, 2020b: 29) for all sizes of installation up to 45kW capacity, to be rolled out as a successor scheme to the domestic RHI from 2022.

In its consultation on ‘Future support for low carbon heat’, BEIS (2020b) spelled out some of the preferred technological options going forward, representing increased enthusiasm for heat pumps and biomethane, unchanged views of heat networks, and downgraded expectation for biomass and solar thermal:

Heat pumps ‘offer the greatest heat decarbonisation potential for the majority of buildings off the gas grid’ and ‘could enable us to almost completely decarbonise heat alongside the decarbonisation of electricity generation’ towards 2050 (BEIS, 2020b: 26–27)

Biomethane injection into the gas grid ‘accelerates the decarbonisation of gas supplies, by increasing the proportion of green gas in the grid. This transition is a necessary step towards meeting our carbon reduction targets’ (BEIS, 2020b: 11)

Heat networks ‘are expected to play a crucial role in the decarbonisation of heat’ (BEIS, 2020b: 42).

Biomass ‘although [it] has a wider strategic role to play in overall UK decarbonisation, its use in heating buildings should be limited’ (BEIS, 2020b: 27)

Solar thermal is no longer a priority, as ‘given current cost data and recent deployment trends, we do not have any strong evidence to suggest that supporting solar thermal water heating through this scheme would prove to be an effective measure for preparing supply chains for the future phase-out of high carbon fossil fuel heating’ (BEIS, 2020b: 40)

Most recently, the Government issued an Energy White Paper (HM Government, 2020a) and a Ten point Plan for a Green Industrial Revolution (HM Government, 2020b). The stated ambitions for domestic heating and buildings in these policy documents are to roll out 600,000 heat pumps per year by 2028, support the delivery of biomethane to 230,000 homes by 2030, initiate demonstration trials for hydrogen heating in selected locations from 2023, and work with Local Authorities to enable the designation of new heat network zones by 2025. The implementation means and policy specifications to deliver these objectives are expected to be articulated in the delayed Heat and Buildings Strategy.

In September 2020, the government launched the £2bn Green Homes Grant scheme as part of the 2020 COVID-19 stimulus package, which would release vouchers for up to £5–10,000 (depending on income) for home insulation and low-carbon heating installations in homes already fitted with at least one primary insulation measure. It included primary insulation measures (solid wall, under floor, cavity wall, loft, flat roof, room in roof, insulating a park home), primary low-carbon heat measures (air or ground source heat pump, solar thermal, biomass boilers), and a range of secondary measures (e.g., draught proofing, double/triple glazing, heating controls).

Subsequent implementation problems with administering and paying out vouchers led to concerns that the scheme would not deliver (Laville, Reference Laville2021). On 22 March 2021, the Environmental Audit Committee (2021: 27) provided a very critical evaluation of the implementation of the Green Homes Grant and its ability to deliver on retrofitting existing homes to higher efficiency levels:

The Green Homes Grant has been rushed in conception and poorly implemented. In its haste to create a scheme to deliver economic stimulus, the Government failed to consult industry adequately on its delivery, set a timescale which was overly short term and has presided over scheme administration which appears nothing short of disastrous. If the ambition for the scheme to retrofit 600,000 homes envisaged completion of the work by the end of the current financial year, then the Government has been wildly optimistic in its scheme planning and industry engagement. The impact of its botched implementation has had devastating consequences on many of the builders and installers that can do the work, who have been left in limbo as a result of the orders cancelled and time taken to approve applications.

A few days later, the Green Homes Grant was cancelled, owing to conflicting objectives between BEIS and the Treasury, which is indicative of a lack of policy coherence and coordination that further weakens supply chains and industry confidence (Institute for Government, 2021), and is ultimately detrimental to driving long-term heat decarbonisation.

Because of repeated problems and U-turns, there is substantial uncertainty about the upcoming Heat and Buildings strategy and the political desire and ability to develop visions and policy instruments that can deliver on decarbonisation and low-carbon heating deployment objectives.

6.4.1 Heat Pumps

Techno-Economic Developments

Heat pumps (HPs) are electrical or gas-powered devices that extract low-temperature heat from the ground, the ambient air, or even water (e.g., pond) to the desired heat sink (Greening and Azapagic, Reference Greening and Azapagic2012). HPs are a mature technology that requires more installation and operational space than gas boilers. They are therefore presently most suited for newbuilt homes and/or off-grid housing. HPs are relatively new to the UK context, which means that many socio-technical dimensions (e.g., supply chains, installation skills, user confidence, standards) are under-developed:

Heat pumps are an established solution in many other countries, but not yet in the UK. Establishing them as a mass-market solution will take some time, with strong progress required during the 2020s. There are particular opportunities in new-build properties, homes off the gas grid, non-residential buildings and for hybrid heat pump systems retrofitted around existing gas boilers.

Heat pumps are not only bulkier than gas boilers but also more expensive to buy and install. Total costs are between £6,000 and £11,500 for ASHPs and between £9,000 and £20,000 for GSHPs, with significant variation depending on size and complexity of installation (BEIS, 2018a). For this reason, HPs require significant support mechanisms and lower costs to be able to compete with gas.

The UK market for heat pumps is small by European standards (see Table 6.6) but has somewhat increased since 2018 (Figure 6.17. Although annual sales have remained relatively small, the cumulative number of domestic HPs has gradually increased. A mass roll-out of heat pumps faces significant barriers related to cost (and incentive mechanisms), the adequacy of supply chains (i.e., scaling up production), skilled installer base (i.e., number of skilled installers, level of consistency, and adequate dimensioning), and user trust and demand.

Table 6.6. Comparison of UK and major European heat pump markets (Data: EHPA (2018: 62–64))

| UK | France | Italy | Spain | Sweden | Germany | |

|---|---|---|---|---|---|---|