Introduction

Do international disputes harm commerce by galvanizing consumer boycotts of foreign products, or do “consumers remain stuck in their habitual buying patterns” (Davis and Meunier Reference Davis and Meunier2011, 643)? In theory, boycotts represent a “commercial weapon” (Pollins Reference Pollins1989a) that could substitute for military coercion as international tensions rise. Consumers may shun foreign products which come to be seen as socially undesirable by way of citizen anger and perhaps state amplification. Yet consumers may not be willing to switch away from their preferred brands or products for long durations, given brand loyalty, differences in product quality, and incentives to free ride (Friedman Reference Friedman1999; Klein, Smith, and John Reference Klein, Smith and John2004; Sen, Gürhan-Canli, and Morwitz Reference Sen, Gürhan-Canli and Morwitz2001). How do international disputes remake consumer choices and shape patterns of global commerce? The objective of our study is to investigate this question in the context of calls for consumer boycotts triggered by a territorial dispute between China and Japan by leveraging detailed data on new vehicle registrations in China from 2009 to 2015.

Many studies have found that international conflict harms trade, even when the conflict falls short of military hostilities (Anderton and Carter Reference Anderton and Carter2001; Davis, Fuchs, and Johnson Reference Davis, Fuchs and Johnson2019; Glick and Taylor Reference Glick and Taylor2010; Keshk, Pollins, and Reuveny Reference Keshk, Pollins and Reuveny2004; Kim and Rousseau Reference Kim and Rousseau2005; Long Reference Long2008; Pollins Reference Pollins1989a, Reference Pollins1989b). Yet other studies have not found a significant impact of militarized disputes on international trade (e.g. Barbieri and Levy Reference Barbieri and Levy1999; Morrow, Siverson, and Tabares 1998; Morrow Reference Morrow1999). At lower levels of political tensions, Davis and Meunier (Reference Davis and Meunier2011) find that “aggregate economic flows and high salience sectors like wine and autos are unaffected by the deterioration of political relations,” and that “sunk costs reduce incentives for state and private actors to link political and economic relations” in the globalized era.

We argue that despite sunk costs and brand attachments, calls for boycotts can still change consumer behavior in a persistent fashion when international tensions arise—in large part through the mechanism of social desirability. Whether or not individual consumers agree with the call to consumer action, such calls can raise the social costs and material risks of owning certain types of goods, particularly in the case of highly visible and expensive products such as personal automobiles. If political control can shape social desirability of particular goods, then economic ties may serve less as a “shock absorber” (Davis and Meunier Reference Davis and Meunier2011, 632) than a conduit for signals of resolve (Gartzke, Li, and Boehmer Reference Gartzke, Li and Boehmer2001), perhaps akin to that argued under the expansive term “weaponized interdependence” (Farrell and Newman Reference Farrell and Newman2019; Flores-Macías and Kreps Reference Flores-Macías and Kreps2013; Kastner Reference Kastner2016).

Three differences distinguish our analysis from prior studies. First, we employ city- as well as national-level measures of the 2012 anti-Japanese protests to capture the strength of boycott activity. Spatial variation in the location of anti-Japanese protests captures community-level differences in the social stigma associated with owning a Japanese-branded automobile. In communities where citizens are able to overcome collective action barriers to participate in a street protest, individuals are more likely to be persuaded or pressured into joining a consumer boycott.

Second, we look at consumer purchases of locally produced foreign-branded goods, instead of imports. An important shortcoming of past studies is that they have largely overlooked the localization of production. In the era of globalization, “foreign” goods are often not imported but domestically assembled or produced, including through joint ventures (Oh Reference Oh2013). In China, less than 5 percent of cars sold in China are imported (Barwick, Cao, and Li Reference Barwick, Cao and Li2017), so trade data offer a limited window into the performance of foreign automobile brands in China.

Finally, we examine monthly data over several years to uncover possible short-term effects that the annual or quarterly statistics used in previous research might mask as well as extending the analysis well after the events to assess potential long-term impacts.

We focus on the effect of the Sino-Japanese tensions in 2012 and the anti-Japanese boycott on the automobile industry. In some ways, the automobile sector represents a most-likely case for a consumer boycott to have measurable effects. First, the national identification of automobile brands is relatively strong compared with other consumer goods, such as clothing and household appliances. Second, cars are expensive and highly visible durable goods compared to home appliances, wines or other consumer goods studied in the literature. Cars are also used more often to signal social preference and status (Brown, Bulte, and Zhang Reference Brown, Bulte and Zhang2011; Heffetz Reference Heffetz2011; Kahn Reference Kahn2007). Third, the automobile market is one with many competitors and potential substitutes for those inclined to boycott. Fourth, automobiles face the possibility of vandalism or defacement, being both highly visible and often readily accessed in public. They are also easy to deface in costly ways; destruction or damage to vehicles is a regular practice in street demonstrations, including in anti-Japanese demonstrations in 2005 and 2010 in China.

Thus, compared with other cases of political tensions, such as US–French tensions over the Iraq war, the 2012 China–Japan crisis is a relatively likely context to observe the effects of a consumer boycott, at least at the national level. Tensions between China and Japan were also quite high in 2012, even higher than the 2010 flare-up in tensions over a collision between a Chinese fishing trawler and Japanese coast guard vessels near the islands. As one of the most likely settings for conflict escalation (Copeland Reference Copeland1996, 39), if political tensions do not harm commerce in this context, they are unlikely to do so in others.

At the same time, the particularities of the Chinese automobile market do not all suggest a bias towards finding a boycott effect. First, outside of housing, a vehicle is often the largest purchase that an individual or household will make. If consumers have brand preferences, one might expect those preferences to outweigh the politically induced sentiments of a boycott when deciding on such a durable and expensive good.

Second, the Chinese automobile sector is characterized by overwhelmingly domestic production. While automobile brands are linked with their home countries, the majority of automobiles sold in China are produced domestically by joint ventures between foreign automakers and Chinese firms, as required by the Chinese government.Footnote 1 A consumer contemplating changing purchasing choices and boycotting Japanese products may recognize that the reduced demands for those goods will likely harm the Chinese labor that makes them.

Third, the Chinese automobile market is fiercely contested and growing. Numerous entrants are locked in serious battle for a market that is already the world's largest, in the hundreds of billions of dollars annually.Footnote 2 Unlike a disturbance in a less consequential market, the dynamics of the Chinese automobile market are closely monitored by the international firms competing in it. The size of the stakes means that foreign invested firms often undertake efforts to preempt and remedy the potential effects of a political boycott, particularly if they have been targeted by protesters (Vekasi Reference Vekasi2017). In the wake of the 2012 demonstrations, Japanese automakers unveiled new financial incentives and marketing campaigns in more than a hundred Chinese cities, including programs to compensate consumers whose cars were damaged in anti-Japanese boycotts.Footnote 3

Prior studies of the economic effects of China–Japan tensions show mixed results. Looking between 1990 and 2006, Davis and Meunier (Reference Davis and Meunier2011) find no effect of greater tensions on imports of Japanese products, while Heilmann (Reference HeilmannForthcoming) finds a stark one-year decrease in Chinese imports of Japanese cars after the 2012 boycott. While Li and Liu (Reference Li and Liu2019) find a sharp drop in Chinese imports of Japanese automobiles and cameras after the 2012 dispute and Chen, Du, and Yang (Reference Chen, Du and Yang2020) find a brief dip in sales of Japanese-branded automobiles during a 2010 dispute between China and Japan, Luo and Zhou (Reference Luo and Zhou2019) find that the boycott effect dissipated after six months.

Drawing upon a more spatially disaggregated dataset of boycott activity and the universe of individual registration records of new passenger vehicles in China during the escalation of tensions between China and Japan in 2012, we find that consumer boycotts can have significant and persistent effects on consumer purchases. Japanese-branded automobiles produced in China lost significant market share in the immediate aftermath of the boycott, and the loss of market share was larger in cities that witnessed anti-Japanese protests. These losses persisted for multiple years in contrast with past research showing a sharp but temporary drop in Japanese imports. Overall, these losses were substantial: sales of domestically produced Japanese brands fell by 1.1 million from August 2012 to the end of 2013, with an estimated value of nearly 200 billion yuan during this period.

These findings provide important evidence that commercial relations are still vulnerable—and may even be weaponized—amid political tensions in an era of globalization. The next section lays out existing perspectives on the linkage between political tensions, international commerce, and consumer behavior, and sets forth our argument about the local and national effects of political boycotts. The third section presents our findings from the Chinese automobile market and anti-Japanese boycott activity across mainland Chinese cities during the 2012 crisis between China and Japan. Last, we return to the theoretical debate over economic interdependence and conflict and conclude that consumer boycotts can be a potent channel for political tensions to shape international commerce.

Political tensions and commerce: the role of consumer boycotts

The relationship between international conflict and commerce has long been debated. Liberal theorists from Montesquieu to Kant have argued along with numerous international relations scholars that international commerce fosters cooperation and deters conflict (e.g. Oneal and Russett Reference Oneal and Russett1997; Oneal et al. Reference Oneal, Oneal, Maoz and Russett1996; Polachek Reference Polachek1980). Realists have countered that commerce can aggravate interstate relations (Hirschman Reference Hirschman1980; Waltz Reference Waltz1979). Both schools of thought may also be true: commerce may heighten tensions but restrain outright conflict between states (Copeland Reference Copeland2015; Pevehouse Reference Pevehouse2004).

Fundamental changes in the globalized economy and the diminished frequency of international war in the post-Cold War era necessitate updated empirical studies of international relations and commerce (Davis and Meunier Reference Davis and Meunier2011, 629). Yet such research has also reached mixed conclusions. Davis and Meunier (Reference Davis and Meunier2011) find no significant effect of negative diplomatic events, including protest demonstrations, on US–French and China–Japan trade and investment. In contrast, Michaels and Zhi (Reference Michaels and Zhi2010) find that a sharp deterioration in American attitudes toward France in 2002–2003 was associated with a decline in bilateral trade. Fuchs and Klann (Reference Fuchs and Klann2013, 175) show that countries whose heads of state host the Dalai Lama suffer a yearlong decrease in exports to China, particularly machinery and transport equipment.

We move this debate forward by substantiating the theoretical and empirical foundations of the argument that consumer boycotts—that is, calls to abstain from purchasing particular goods—could serve as a potent “commercial weapon” in international disputes. For the threat of politicizing consumer behavior to be credible, they must have measurable effects. Yet existing studies of boycotts point in competing directions. On the one hand, scholars have argued that international tensions can activate “consumer ethnocentrism” and beliefs or social judgments about what purchases are patriotic and which are treasonous (Shimp and Sharma Reference Shimp and Sharma1987). Consumers may participate in a boycott with the aim of self-fulfillment and self-expression (Friedman Reference Friedman1999), avoiding goods associated with a particular country of origin as a “vote pro or contra the policies and practices” of the country or as an “expressive act to signal anger”.Footnote 4 As Pollins (Reference Pollins1989a, 740) notes, “consumers may wish to express goodwill or solidarity toward those whom they identify as friends, while shunning or punishing those they perceive as foes.” Klein, Ettenson, and Morris (Reference Klein, Ettenson and Morris1998) find that Chinese respondents who harbored more animosity toward Japan over its invasion and occupation during World War II were less likely to own a variety of Japanese goods, particularly electronics, independent of their assessment of product quality.Footnote 5 Sun et al. (Reference Sun, Wu, Li and Grewal2018) find a dramatic dip in purchases of Japanese automobiles in four Chinese cities for at least a year after the 2012 boycott.

On the other hand, consumers face a collective action problem in contemplating a boycott (John and Klein Reference John and Klein2003). The individual cost of boycott participation reflects the lost utility from switching to other substitutes or delaying a purchase (Friedman Reference Friedman1999). The utility loss from substitution in turn hinges on the similarity of other products, while the horizon of purchase delay depends on the intensity and duration of the boycott. Consumers may be particularly reluctant to switch away from a particular country-of-origin if it is associated with superior product quality. Due to the simultaneous localization and globalization of production, consumers may also doubt whether a proposed boycott will have the desired expressive or substantive effect. These factors suggest that individuals remain stuck in habitual buying patterns, akin to a business's sunk costs (Davis and Meunier Reference Davis and Meunier2011, 643).

Both perspectives on individual participation in politically motivated boycotts have given insufficient weight to social factors and spatial heterogeneity. Numerous studies have shown that sociotropic factors often dominate individual perceptions of costs and benefits. Mansfield and Mutz (Reference Mansfield and Mutz2009) show that individual preferences over free trade are driven more by perceptions of how the overall economy is performing than an individual's own skill or industry. Similarly, the social prestige or stigma associated with a particular set of brands or products affects consumer choices (Charles, Hurst, and Roussanov Reference Charles, Hurst and Roussanov2009; Veblen Reference Veblen1965) alongside material and expressive considerations. In the automobile market, for example, “community environmentalism” shapes individual decisions to own hybrid vehicles (Kahn Reference Kahn2007).

We argue that political boycotts operate by altering the social penalty of owning goods associated with the targeted entity. Taste is neither natural nor arbitrary but socially constructed, with individuals seeking to distinguish themselves from others by what they consume and do not consume. Visible goods provide a costly indicator of status, with consumption choices presenting “opportunities to experience or assert one's position in social space, as a rank to be upheld, or a distance to be kept” (Bourdieu Reference Bourdieu1984, 57). In turn, peer influence affects what goods individuals deem socially desirable to consume conspicuously, such as cars, clothing, and jewelry. In China, a consumer survey found that more than seventy percent of car buyers relied on word of mouth in deciding what kind of cars to buy (Barwick, Cao, and Li Reference Barwick, Cao and Li2017). Even less well-off individuals engage in consumption as status signaling, sometimes to the detriment of household purchases affecting nutrition and other less visible goods (Charles, Hurst, and Roussanov Reference Charles, Hurst and Roussanov2009; Chen and Zhang Reference Chen and Zhang2017).

Boycotters seek to influence consumer choices by increasing the social censure and material risk associated with the targeted goods. During an international dispute, boycotters target brands associated with the foreign country in a “surrogate boycott” (Friedman Reference Friedman1999) aimed at changing the foreign government's policies. Blacklists visibly tarnish the social stature associated particular brands, and individuals who defy the boycott risk being labeled unpatriotic or even stigmatized as a traitor (Goffman Reference Goffman1963; Jones Reference Jones1984). As Li and Liu (Reference Li and Liu2019) show, highly identifiable Japanese imports (such as automobiles and cameras) suffered more during the 2012 boycott in China than less salient raw and intermediate goods. Products that are visibly associated with the foreign adversary also risk defacement and devaluation on the secondary market.

We expect the social penalty that accompanies a political boycott to vary over space as well as time. Local communities are likely to support a political boycott with different degrees of intensity, reflecting differences in factors that affect subnational mobilization and nationalist protest (Wallace and Weiss Reference Wallace and Weiss2015) as well as historic patterns of foreign occupation and trauma (Fouka and Voth Reference Fouka and Voth2013). In some locales, calls for boycotts are accompanied by street-level action, with protest placards, physical obstruction of the targeted businesses, and even property destruction, such as overturned cars and smashed windows. We expect political boycotts to have a stronger effect on consumer behavior in communities where street-level action makes visible the social penalty associated with boycotted goods. Such effects are likely to be detectable for at least the duration of the boycott, if not longer, so long as the underlying dispute is unresolved or fears of personal property damage persist.

Boycotts, protests, and the 2012 China–Japan island dispute

We test these arguments in the context of a sovereignty dispute and crisis between China and Japan, which escalated in August and September of 2012. A Chinese boycott of Japanese brands arose following Japan's purchase of three of the contested Senkaku/Diaoyu islands in the East China Sea. In April 2012, Tokyo governor Shintaro Ishihara stated his intent to purchase the islands from their private Japanese owner and develop facilities on them. In July, Japan's central government announced that it would buy the islands to preempt Ishihara's bid. To dissuade Japan from proceeding with the sale, the Chinese government began a tacit campaign to use grassroots pressure to signal Chinese resolve (Weiss Reference Weiss2014). On the anniversary of Japan's surrender in World War II, the Chinese government allowed nationalist activists to land and plant flags on the islands for the first time in over fifteen years; this was covered live on Chinese state television and in banner headlines on Chinese websites and newspapers. Chinese internet censors uncharacteristically allowed calls of protest to remain online.Footnote 6 Street demonstrations outside Japan's embassy in Beijing began with the landing and continued the next day. When a rival group of Japanese activists landed on the islands on 19 August 2012, calls for anti-Japanese actions in China—including boycotts and demonstrations—proliferated. Over the next five weeks, over 377 street demonstrations took place in 208 of 287 Chinese prefectural-level cities.Footnote 7

Anti-Japan demonstrations were accompanied by calls to boycott Japanese brands and merchants, aiming to compel the Japanese government to relinquish its claim to the islands. During the protests, many Japanese-branded cars, automobile dealerships, retailers, and restaurants were vandalized (Johnson and Shanker Reference Johnson and Shanker2012). Even where demonstrators did not damage property, many protest placards and banners called for a boycott of Japanese goods (dizhi rihuo). Some protesters handed out flyers listing Japanese brands to boycott; one local newspaper published a similar list.Footnote 8 Although the Chinese government did not explicitly endorse the boycott, state-controlled media gave prominent coverage to the anti-Japanese protests and consumer boycott. Weibo, China's version of Twitter (now X), featured a front-page poll asking users if they would participate in a boycott of Japanese goods, which became the hottest topic on the social media forum.Footnote 9

Industry background and data

Our analysis focuses on passenger cars (sedans, SUVs, minivans and pickup trucks). The automobile industry in China is considered a strategic or pillar industry by central and local governments for its large spillover effects to both upstream (e.g., iron and steel) and downstream (e.g., sales and service) sectors and in overall economic growth (Barwick, Cao, and Li Reference Barwick, Cao and Li2017). Before the turn of the century, the automobile manufacturing sector in China was relatively limited in terms of product range, and was focused exclusively on commercial vehicles such as buses and heavy-duty trucks. As household income rose, sales of new passenger cars skyrocketed from 0.85 million in 2001 to nearly 24 million in 2016, with total sales of all automobiles topping 28 million. Surpassing the US in 2009, China is now by far the largest automobile market in the world.

The Chinese automobile market is highly competitive, with nearly 70 producers offering more than 300 models each year. All major international automakers have a presence through joint ventures (JVs) with Chinese domestic producers. At the same time, many domestic automakers also produce indigenous models under own brand. Our analysis is at the brand level. We define a brand as the entire collection of vehicle models from a joint venture (e.g., FAW–VW, the joint venture between the First Auto Works and Volkswagen), the set of indigenous models of a domestic firm (e.g., FAW), or the imported models of a foreign automaker (e.g., Toyota). Automobile brands from JVs account for two-thirds of the market while domestic brands account for about 30 percent of the market, with the rest coming from imports. The high-end segment of the market is dominated by JVs and imports, while domestic firms concentrate on the low-end of the product spectrum.

Our data contain the universe of individual vehicle registration records from 2009 to 2015 for new passenger cars (sedans, SUVs, minivans, and pickup trucks), which are compiled by the State Administration of Industry and Commerce.Footnote 10 There are a total of 100 million records with information on the location of registration (county), registration month, vehicle model, and attributes (size and type), and owner demographics (age, gender). We aggregate the data to the brand and city level, leading to 1,207,909 city-month-brand observations. We then merge the registration data with detailed vehicle attributes data from R. L. Polk and Company (henceforth, Polk; part of Information Handling Services Markit). The attributes include the manufacturer suggested retail prices (MSRPs) (yuan), vehicle size (length by width in m2), engine size (liters), and weight (tons). MSRPs are set by manufacturers and are the same nationwide for each model year. We do not observe real transaction prices and discounts offered by individual dealers may lead to transaction prices that are different from the MSRPs. However, Barwick, Cao, and Li (Reference Barwick, Cao and Li2021) discuss that MSRPs are likely a reasonable approximation of the unobserved transaction prices due to the lack of large price discounts and the retail price maintenance practice observed in the industry.

Table 1 presents summary statistics of vehicle attributes by the country-of-origin (COO), with the top panel showing the simple average and the bottom panel showing the sales-weighted average. We separate vehicle brands into six groups based on COO: domestic, German, Korean, Japanese, US, and other European brands (such as French, Swedish, and British brands). JV Brands are categorized by the country of the foreign partner, as these models inherit the same brand and model names as their international counterparts. Panel A suggests that German brands (e.g., Mercedes-Benz, BMW, Audi, Volkswagen) are the most expensive, while domestic indigenous brands are the least expensive. Japanese brands are most similar to US brands in price and other vehicle attributes, suggesting that the cross-brand substitution is likely to be the strongest between this pair.Footnote 11

Table 1. Summary Statistics of Vehicle Registration Data

Note: Summary statistics are based on the universe of new passenger car registrations from 2009 to 2015 in China. Vehicle size is defined as vehicle length by width.

Figure 1 plots the total sales (in logarithm) by country-of-origin, while Figure 2 depicts market shares. In the beginning of the sample period in 2009, Japanese brands and domestic brands had similar market shares, with a healthy lead over other brands in the order of German, US, Korean, and other European (non-German) brands. By 2015, the end of the sample period, domestic brands had the largest market share by a considerable margin while Japanese and German brands competed closely for the second spot. US brands had gained a significant market share over time. The market share of Korean brands dropped slightly and that of other European brands remained largely stable.

Figure 1. Brand Sales by Country of Origin.

Note: National sales in logarithm by month by country of origin. The red vertical line denotes the boycott event.

Figure 2. Market Shares by Country of Origin.

Note: Market shares of different countries of origin by month.

During this seven-year period, the most salient pattern in the data is the rise of domestic brands and the decline of Japanese brands. The clear switch of market leadership between these two groups happened distinctively in September of 2012, at the height of the anti-Japanese demonstrations and boycott.Footnote 12 Relative to the pattern pre-August 2012, we observe a dramatic drop in the market share of Japanese brands and visible increases in which of other brands. The discrepancy remains evident several months later. Japanese brands never recovered after the boycott, and domestic brands collectively dominated the market, especially toward the end of the data period. The market position of German brands increased relative to Japanese brands: from being behind Japanese brands in 2009 to closely competing for the second spot after 2012.

To examine if the decline of Japanese automobile brands observed in the Chinese market was caused by reasons other than the boycott event, we investigate US market share dynamics during the same period. Appendix Table 1 presents the summary statistics of vehicles sold in the US by country of origin based on data from IHS Automotive. In stark contrast to the Chinese market, the sales and market share of Japanese brands in the US market were stable around August–September of 2012, as shown in the monthly vehicle sales and market share plots by country of origin from 2009 to 2015 in Appendix Figures 1 and 2. The pattern suggests that the decline of Japanese brands was confined within China and was not a worldwide phenomenon. It is worth noticing that March–May 2011 shows a sharp drop in the market share of Japanese brands in the US due to the disruption of automobile and more importantly, auto parts production in Japan due to earthquake and tsunami damage. All three major automakers, Toyota, Honda, and Nissan and their parts suppliers were affected. As a result, exports from Japan to the US market were low for several months. As the vast majority of Japanese brands sold in China were produced by JVs in China, and the parts suppliers are located within China as well, the tsunami did not have much impact on the Chinese market.Footnote 13

The graphical evidence from the raw data demonstrates two important findings: (1) the anti-Japanese boycott in August–September 2012 is associated with a dramatic negative impact on vehicle sales of Japanese brands in China and the impact persists through the end of 2015; and (2) the large loss in market share by Japanese brands in China is accompanied by gains for other brands, altering the market position of different brands.

Empirical framework

Figures 1 and 2 provide consistent evidence that the boycott was associated with a large and persistent negative impact on new vehicle sales of Japanese brands at the national level. In this section, we employ detailed vehicle sales data to examine variation over space and time using a regression framework that can better control for unobserved demand shocks such as seasonality or economic conditions. In particular, we leverage city-level anti-Japanese protest data to assess community-level heterogeneity in the intensity of perceived change in social penalty associated with possessing a Japanese-branded car during the 2012 dispute.

The baseline regression equation specifies vehicle sales as the dependent variable and the boycott event as the key explanatory variable. Denote c as a city, b as a brand (e.g., Ford), and t as a month, the baseline regression equation is defined as:

where S cbt is the market share of brand b in city c and month t. O c is a vector of dummy variables representing COO (e.g., Japan, US, and Korea) for brand c. D t is a dummy variable indicating the boycott event, being 1 for all months after August 2012. The coefficient vector β on the interaction of these two variables captures the impact of boycott on sales (in percentage terms) for different brands by country of origin.Footnote 14

We include a rich set of fixed effects to control for unobserved demand shocks that could confound the boycott event. η cb is a set of city-brand fixed effects, controlling for the baseline sales of different brands across cities. This allows different cities to have different baseline market shares for a given brand. For example, a brand might have a larger market share in the city where it is manufactured or where vehicle attributes better match consumer demographics (e.g., income). γ t is a set of year-month fixed effects to control for the impact of macroeconomic conditions on vehicle sales. Note that City-brand fixed effects η cb subsumes COO fixed effects O c. Time (i.e., year-month) fixed effects γ t subsumes the event dummy D t.

As we are particularly interested in the possibility that communities might have different levels of social penalty associated with the boycott and wave of demonstrations as well as the duration of such possible impacts, we examine the heterogeneous impact across cities by allowing the coefficient β to vary across cities based on city characteristics. We focus particularly on whether a city witnessed anti-Japanese street demonstrations in August or September 2012. To examine the long-term impact of the boycott on sales, we analyze models allowing the coefficient β to vary over time.

Finally, a remaining concern is that the observed reduction in vehicle sales of Japanese brands after the boycott might be due to other (unobserved) reasons, such as increased competition from local brands and European brands that induced consumers to switch their purchasing decisions. We use two strategies to address this concern. First, we include O c × t in regressions to control for different time trends across brands, for example, allowing for brands to have different growth rates over time. Second, we examine sales trends for Japanese brands relative to other brands prior to the start of the boycott in August 2012. If pre-boycott sales trends are similar, then post-boycott changes are likely driven by political tensions, rather than by unobserved confounding factors, analogous to the parallel-trend argument for Diff-in-Diff studies (Angrist and Pischke Reference Angrist and Pischke2009).

Regression results

Table 2 presents results for four regressions, in which the first three sequentially add more control variables. The third specification includes the full set of fixed effects and is our preferred specification. The coefficient estimate on the interaction between the Japan dummy and the boycott event dummy suggests that the market share of Japanese brands dropped on average by nearly a quarter, a substantial impact, after the protest and boycott wave in August and September 2012. The fourth specification uses data from 2012 to 2013 instead of the full data set from 2009 to 2015 to address the concern the ever-changing dynamic in automobile market in China, which could potentially be affected by many different market and non-market forces. Focusing on a shorter time window may better isolate the boycott event from other contemporaneous shocks. Nevertheless, the last regression based on data from 2012 to 2013 provides very similar coefficient estimates, suggesting that our findings are not driven by other shocks. The coefficient estimates from column 2.4 suggest that the boycott and protest wave reduced sales of Japanese brands by 1.1 million units from August 2012 to the end of 2013, compared to observed sales of Japanese brands of 5.2 million during 2012 and 2013.Footnote 15

Table 2. Boycott Impact on Japanese Brand Sales

Note: The dependent variable is log(market shares). The unit of observation is city-month-model. Standard errors in parentheses are clustered at the city level: * p < 0.05, ** p < 0.01, *** p < 0.001.

Did the boycott affect sales equally across China, or did some cities observe a stronger rejection of Japanese cars? Figure 3 presents a choropleth map of the estimated loss in Japanese market share across cities. These estimates come from a modified regression in column 2.4, with triple interactions of the boycott dummy, Japan dummy, and 266 city dummies based on the full sample from 2009 to 2015. The coefficient estimates on these 266 triple interactions (multiplied by −1) are shown in the map and point to significant heterogeneity across cities. While nearly all cities observed a negative impact for Japanese brand sales consistent with a strong national-level change in social penalty, there is a considerable range around the mean market share loss of 28 percent with some cities seeing Japanese brands lose over 65 percent of their market share.

Figure 3. Heterogeneous Impacts by City.

Note: The heat map shows the reduction of the market share of Japanese brands due to the boycott event based on the specification of the last column in Table 2 by allowing the impact to be different across cities. The impacts are the coefficient estimates (multiplied by −1) on Boycott*Japan*City dummies following the last regression in Table 2. The darker color represents a larger reduction in the market share of Japanese brands.

Table 3 explores whether the presence of anti-Japanese protests helps account for spatial heterogeneity in sales impact. The first variable is the triple interaction of the boycott event dummy (post-August 2012), the protest dummy, and the dummy for Japanese brands. The protest dummy takes a value of one if the city had an anti-Japanese protest during August or September 2012. Two key results emerge. First, as in Table 2, there is a strong, statistically significant national-level boycott effect in all model specifications. The national-level effect's magnitude is smaller in these models that include city-level protest data than those in Table 2. This difference is due to the second key result: in addition to this national-level effect, Japanese sales were even more negatively impacted in cities that witnessed anti-Japanese protests (Table 3).

Table 3. Cities with Protests See Additional Losses for Japanese Brands

Note: The dependent variable is log(market shares). The unit of observation is city-month-model. Standard errors in parentheses are clustered at the city level: * p < 0.05, ** p < 0.01, *** p < 0.001.

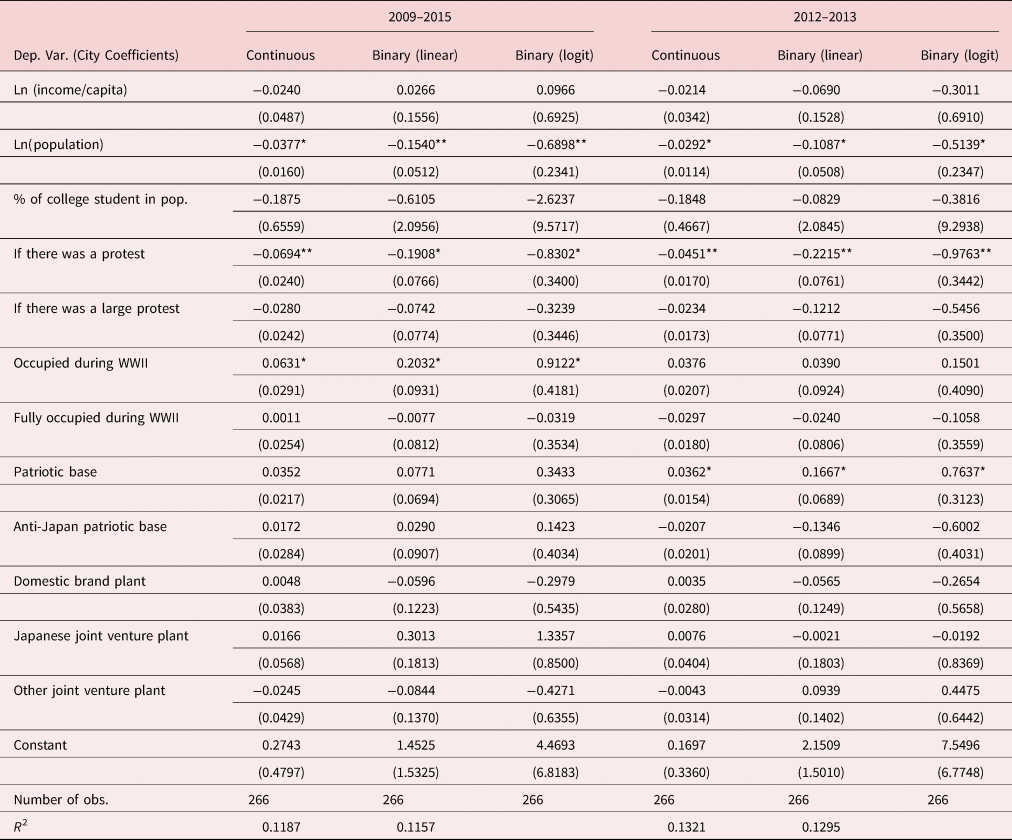

To explore these cross-city patterns further, we take the 266 coefficient estimates displayed on the map in Figure 3 as the dependent variable in an additional set of regressions. We examine their correlation with city demographics, historical factors, and the presence of automobile manufacturing plants in Table 4 where we regress the city coefficients on a rich set of city demographic variables. Across different specifications, the results show that the impact on sales was larger in cities with a larger population and in cities that experienced anti-Japanese protests. Historical factors do not seem to affect the extent of the sales impact, results that are consistent with the additional analyses in Appendix Tables 3 and 4. That historical factors did not affect the magnitude of the boycott effect likely owes to the inclusion of city-brand fixed effects (Che et al. Reference Che, Du, Lu and Tao2015). In addition, that so much of the country was affected by Japan's invasion and occupation, combined with substantial rural-to-urban and inter-regional migration over the last several decades, has likely muted geographic variation in this wartime legacy. The presence of an auto plant in the region and the COO associated with the plant also do not systematically explain heterogeneity in sales impact. The city-brand fixed effects capture differential purchasing patterns, with the non-findings here indicative of cities with automobile plants not having stronger changes in sales post-boycott and that the boycott was not primarily driven by government efforts to support national or local industries.Footnote 16

Table 4. Impact Heterogeneity and City Demographics

Note: The dependent variable is based on the 266 coefficient estimates on the triple interactions of Boycott*Japan*City dummies based on the specification in the column in Table 2. City-level income/per capita, population and college student ratio are based on 2010 population Census. The dependent variable in columns (1) and (4) is the raw coefficient estimates, while the other four specifications separate cities into high-impact (above-median) and low-impact cities and define the dependent variable as a binary variable. Columns (2) and (5) use OLS while Columns (3) and (6) use logit for estimation.

Having examined heterogeneity across space, we now turn to heterogeneity in impacts over time by examining the duration of the boycott effect. We re-estimate specifications in column 2.4 of Table 2 but allow month-specific time trends for Japanese brands by interacting month dummies with the Japan dummy. The coefficient estimates, capturing the time trend in the market share of Japanese brands relative to other brands, are plotted in Figure 4.

Figure 4. Coefficient Estimates on Japan × Year-Month, 2012–2013.

Note: Coefficients estimates are from a regression similar to the last column of Table 2 replacing Boycott*Japan with Japan dummy interacting with year-month dummies using data from 2012 to 2013.

There are two important findings from this figure. First, it shows a small and statistically insignificant time effect before the boycott event in August 2012. This supports the common trend assumption in our empirical strategy: the boycott event itself rather than other unobserved factors caused the dramatic dip in sales after the boycott. Second, the boycott had a large and persistent impact on the market share of Japanese brands. Immediately after the boycott event, the market share of Japanese branded automobiles dropped by nearly 50 percent. Although the impact decayed over time, it never fully disappeared even more than a year after the boycott event.Footnote 17 This result is consistent with the raw market share data depicted in Figure 2, which suggests that the boycott was a watershed moment for German and especially Chinese brands to surpass Japanese brands and become market leaders (see also Appendix Tables 3 and 4). The event could have brought Chinese consumers more awareness to non-Japanese brands and changed brand preference. Overall, our analysis shows that this international crisis significantly altered the dynamics of the automobile market, an important sector for high-value and high-visibility consumer goods.

Discussion

Several factors may account for the large magnitude of the boycott effect we have documented, compared with studies that have found negligible (Ashenfelter, Ciccarella, and Shatz Reference Ashenfelter, Ciccarella and Shatz2007; Davis and Meunier Reference Davis and Meunier2011; Pandya and Venkatesan Reference Pandya and Venkatesan2016) or modest (Fouka and Voth Reference Fouka and Voth2013) effects. First, compared with other studies, relations between China and Japan are more fraught with potential for armed conflict. No preferential trading agreement or shared democratic institutions or values mitigate the likelihood of war (Mansfield and Pevehouse Reference Mansfield and Pevehouse2000), which would be unthinkable between fractious allies like the US and France or Germany and Greece. Moreover, Chinese views of Japan are marked by not only historical acrimony (Fouka and Voth Reference Fouka and Voth2013) but also an unresolved contemporary territorial dispute and rivalry for regional influence.

Second, compared with other periods of tension in China–Japan relations, the precipitating event for the 2012 boycott posed a greater challenge to China's territorial claims in the East China Sea and led to a much tougher Chinese government stance against Japan (on this point, see also Li and Liu Reference Li and Liu2019). Japanese prime ministerial visits to the Yasukuni war shrine, which had previously sparked anti-Japanese protests and calls for consumer boycotts in China, produced a far less militarized response from the Chinese government and even public admonishments by then-Commerce Minister Bo Xilai against a boycott of Japanese goods in 2005.Footnote 18 As such, tensions between China and Japan in 2012 were far more likely to harm commercial relations than the 1990–2006 period studied by Davis and Meunier (Reference Davis and Meunier2011).

Third, our study takes into account the localization of production of many foreign-identified goods. Trade flows miss much of the action when it comes to consumer behavior in an increasingly globalized supply chain. Fourth, automobiles are much more publicly visible, expensive, and difficult to shield from community stigma and defacement than other consumer goods like wine, supermarket brands, or household electronics. Though those products are also common targets of political boycotts, our theory expects individuals to be more willing to defy a boycott when their consumption can be kept private and represents only a small share of household expenditures. These four factors appear to have overcome sources of bias against a boycott effect, including consumer habit, preference, and localized production via joint ventures.

We also find a long-lived boycott effect, one that persisted at least three years after the boycott began in August 2012. Prior studies have found that the boycott effect dissipates within 12 months (Fouka and Voth Reference Fouka and Voth2013;Heilmann Reference HeilmannForthcoming; Li and Liu Reference Li and Liu2019; Luo and Zhou Reference Luo and Zhou2019) or as little as a week (Pandya and Venkatesan Reference Pandya and Venkatesan2016). The persistent effects in our study likely result from a couple of factors. First, when goods are durable and brand appeal is socially constructed, brand choice can become path dependent. Second, the unresolved territorial dispute between China and Japan remained a source of heightened tensions through the end of 2014. Although the government censored calls for anti-Japanese boycotts and cracked down on anti-Japan protests after September 2012, consumers may have remained reluctant to buy an expensive, durable Japanese good, especially in communities that experienced protests during this crisis. Even though Chinese officials cautioned the public that going to war with Japan over the islands would derail China's economic development,Footnote 19 such messages may have reinforced fears that war, along with renewed protests and boycotts, could be on the horizon. Political and military relations remained heated, including a January 2013 incident in which a Chinese naval frigate locked weapons radar on a Japanese helicopter, and the November 2013 announcement of a Chinese Air Defense Identification Zone over the disputed islands. It was not until November 2014 that the two governments agreed to set aside their “different positions” on the islands and gradually resume diplomatic and security exchanges.Footnote 20

Conclusion

Boycotts that succeed in imposing commercial “casualties” may help states avoid more costly forms of conflict. As economist Charles Frederick Remer wrote in his 1933 A Study of Chinese Boycotts, “if, as we hope, the accepted form of coercion is no longer to be war, the boycott in some form will, no doubt, find an important place”.Footnote 21 To be credible instruments of diplomacy, boycotts must actually change consumer behavior, a proposition that has drawn both theoretical and empirical skepticism. We have shown that politically motivated boycotts can have large and persistent effects, particularly in cities where anti-foreign sentiment materialized in street demonstrations. This heterogeneity supports our argument that boycotts reflect not only individual preferences but also the heightened social penalty of goods associated with a foreign adversary. Most studies have focused on how political tensions alter the behavior of individual consumers and firms, without parsing effects at the community level. National shocks to commercial ties are often experienced unevenly, especially in a country with as many subnational communities as China.

We conclude by calling for more research on boycotts from a more diverse set of states and sectors. Many studies have examined the effect of political tensions on commerce between states that are democracies, allies, or both. Whether boycotts have an impact in such pairs of states is an important question, but not as a mechanism that could avert military conflict. Political boycotts where conflict is more likely could include Ukrainian calls to boycott Russian goods,Footnote 22 Pakistani calls to boycott Indian goods,Footnote 23 and Indian calls to boycott Chinese goods.Footnote 24

Within this broader set of cases, it may be that authoritarian states are more effective than democracies at wielding boycotts as a commercial weapon. State involvement in shaping the information environment as well as political and economic behavior in the marketplace may send clearer signals of resolve. Boycotts that arise without state support signal public support for getting tough on the adversary but reveal less about the government's own intentions. Government endorsements send signals of state resolve, while public appetite for boycotts without or against state approval reveals popular pressures on the government to act. Authoritarian governments have been more central in directing commercial boycotts and stoppages, although the US Congress did change its cafeteria menu to list “freedom fries” to register displeasure with “our so-called ally, France.”Footnote 25 After Turkey shot down a Russian fighter jet in 2015, Russian prime minister Dmitry Medvedev threatened retaliation against “foodstuffs, labor, and services from Turkish companies.”Footnote 26 In response to US sanctions, Turkish president Tayyip Erdogan called for a boycott of US electronics, including Apple iPhones.Footnote 27

Future studies may wish to look at the effect of elite endorsement or caution as well as other state efforts to hold up commerce to gain leverage in political disputes. Although the 2012 boycott against Japan was state-supported, the Chinese government has not always endorsed consumer boycotts. Amid tensions with Japan in 2005, Chinese officials specifically warned against a boycott's effects on the Chinese economy. After an international tribunal ruled against China's claims in the South China Sea in 2016, Chinese officials and state-affiliated media quashed the idea of a consumer boycott. Other Chinese efforts include alleged stoppages of rare earth exports to Japan in 2010 during the trawler crisis, restrictions on Philippine imports in 2012 during a standoff over territory in the South China Sea, and boycotts of Korean brands and cancellation of tourist visits in 2017, after South Korea agreed to deploy the US-supplied Terminal High Altitude Area Defense missile defense system.Footnote 28 During the 2012 boycott, the highly domesticated production of Japanese-branded automobiles meant that the local joint venture partners suffered collateral damage, with gains for indigenous brands only partially offsetting these domestic losses. The domestic costs of consumer boycotts may reduce its use as a commercial weapon but increase its credibility as a signal of resolve when employed.

Supplementary material

The supplementary material for this article can be found at https://doi.org/10.1017/jea.2023.19.

Conflict of interest

The authors declare none.