OVERVIEW

This report is a summary of APSA’s finances for the 2019–20 fiscal year, ending September 30, 2020, and the Short Period October 1, 2020 through December 31, 2020. More detailed financial information is available on the APSA 990 federal tax form, which is available on the APSA website and the FY-20 audit report that is available on request from the APSA Finance office.

APSA continues to have ample resources for current and future operations (see table 1). From October 1, 2019 through December 31, 2020 APSA's assets have increased in value from $47.5 million to $55.0 million. During the same period, liabilities remained relatively the same at $4.8 million.

Table 1. Balance Sheet: December 31, 2020 (With Comparable Totals for 2016–2019)

* In FY 2019–2020, APSA changed Year end from September 30 to December 31, therefore all financials cover a 15 month period.

As awful as this pandemic has been, APSA has been able to financially weather the last year. APSA avoided employee layoffs for the duration of this pandemic partially due to the influx of $450,000 from the Paycheck Protection Program (PPP). Further, we received an insurance reimbursement in the amount of $286,000 to help compensate for the loss of income due to the cancellation of the in-person annual meeting. Since the portions of the APSA building that are normally rented out to other tenants have been vacant because of the widespread shutdown, APSA has undertaken long overdue maintenance and improvements to the headquarters building. Additionally, we are offering our members a one-time rebate of $25 off their next payment to APSA in 2021 as a small way of assisting our members during a time that is unusually difficult for many.

Overall, the association's financial condition remains healthy. APSA continues to operate in a sound financial environment, with steady growth-producing programs, minimal long-term liabilities, professional accounting practices, and a diversified investment portfolio.

THE FISCAL YEAR 2020 ENDING SEPTEMBER 30, 2020

When the pandemic started, APSA was affected by lower membership revenue and financial uncertainty pertaining to the annual meeting. At the close of the 2020 fiscal year on September 30th overall revenues were over $1 million below budgeted revenue. However, expenses were significantly under budget as well. Though APSA incurred increased expenses from assisting members to attend the virtual annual meeting, significant savings were realized due to the shift to an online format. The event cancellation insurance payment of $286,000, received in March 2021, covered the financial shortfall from the annual meeting.

APSA and Cambridge University Press began a 10-year agreement, effective January 1, 2017 through December 2026, for the publication of the American Political Science Review (APSR), PS: Political Science & Politics and Perspectives on Politics. Per the contract, Cambridge University Press will reforecast revenues in 2021 for the remaining five years of the agreement and we anticipate a reduction in publication revenues.

A development strategy outlining a $2.5 million fundraising goal for the Ralph Bunche Fund to support Ralph Bunche Summer Institute programming through institutional and individual philanthropy is continuing. As of January 2021, APSA is at 95% of the campaign goal, and we anticipate successfully completing the campaign in the near future.

In summer 2019, Dr. Paula D. McClain, RBSI Director and APSA immediate past president, secured continued National Science Foundation (NSF) funding support for the RBSI from 2019 through 2021. However, in summer 2020, the RBSI at Duke University was cancelled due to the ongoing pandemic, so no NSF grant funds were expended in FY2020.

Instead, APSA staff organized and led the virtual Bunche Program, with the majority of program costs and a portion of the TA salary costs met by repurposing APSA’s existing Diversity and Inclusion program FY20 budgeted funds that were unexpended due to canceled in person events. Additionally, the Duke University political science department provided departmental summer support for the Bunche TAs who worked on the alternative programming. Due to the pandemic and the resulting uncertainty that arose for universities around the country, Duke University had to put in place additional institutional controls that made it impossible for the department or the university to offer any other direct assistance for this alternative programming. As the 2020 RBSI Program was cancelled, NSF funds could not be spent on alternative programming that was not a part of the original grant proposal.

In summer 2021, the RBSI will be a virtual program run by Duke University, led by Dr. Paula D. McClain, and supported using funds from NSF and Duke University. APSA also made available, for this year only, flexible spending grants to support those 2021 RBSI students who expressed need due to housing insecurity, and lack of adequate internet connectivity and access to technology. This funding will assist students in their effort to be able to participate fully in the 2021 virtual RBSI program.

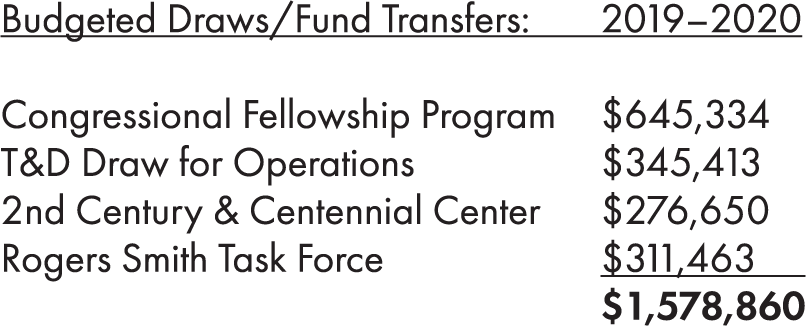

Please note that in accordance with Generally Accepted Accounting Principles (GAAP), board approved draws/fund transfers on the following programs are not included in the reporting of actual revenue activities within the financials. These amounts are only included in the budget column for budgeting and council reporting.

Board approved draws/fund transfers on the following programs for the fiscal year were as follows:

Draws/fund transfers are reflected as a reduction of the restricted funds with a corresponding increase of APSA General Operating Fund on the balance sheet. APSA is authorized to use 5.5% of the Congressional Fellowship Fund annually, and 4% of the Trust and Development and 2nd Century and Centennial Center Funds. During the fiscal year ended September 30, 2020, the Congressional Fellowship used only 3% of the fund. The Trust and Development Fund used 1.8%, and the Centennial Fund used 4.6%. The Roger Smith Task Force also used all budgeted draw amounts.

APSA’s net income for the year ended September 30, 2020 equaled $2.82 million.

APSA received $450,000 from a Paycheck Protection Program (PPP) loan in April of 2020, the first round of applications. Currently, this money is recorded as a liability and not included in revenue as forgiveness of the loan has not been officially granted by the Small Business Administration. However, Bank of America has recommended forgiveness of the loan on APSA’s behalf to the SBA and we expect that will be the final decision.

A SHORT FISCAL YEAR ENDING DECEMBER 31, 2020

At the September 2020 Council meeting the Council approved a decision to change APSA’s fiscal year to a calendar year. Thus, we had a three-month transitional fiscal year from October 1, 2020 to December 31, 2020. For this abridged fiscal year, both revenues and expenses were under budgeted expectations. Loss of a tenant caused a decrease of rental income, but expenses were also down except for some annual meeting awards, travel/support grants and member support fund payments.

APSA’s net income for the 3 months ended December 31, 2020 equaled $4.58 million. Please see tables 2, 3 and 4 for multi-year comparisons.

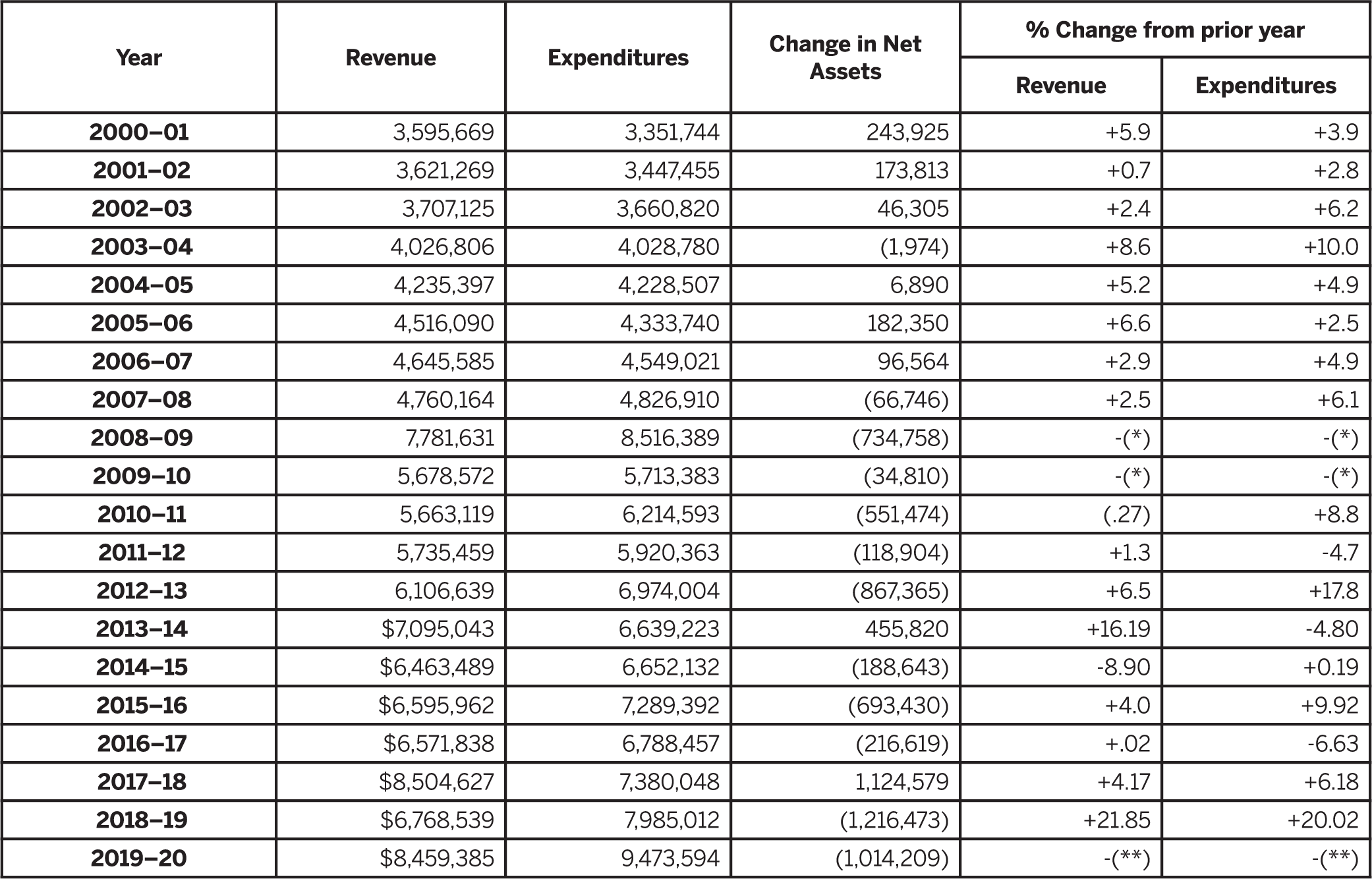

Table 2. Operating Budget 2000–2020: A Multi-Year Perspective

(*) In FY 2008-2009, APSA changed Year end from June 30 to September 30, therefore all financials cover a 15 month period.

(**) In FY 2019-2020, APSA changed Year end from September 30 to December 31, therefore all financials cover a 15 month period.

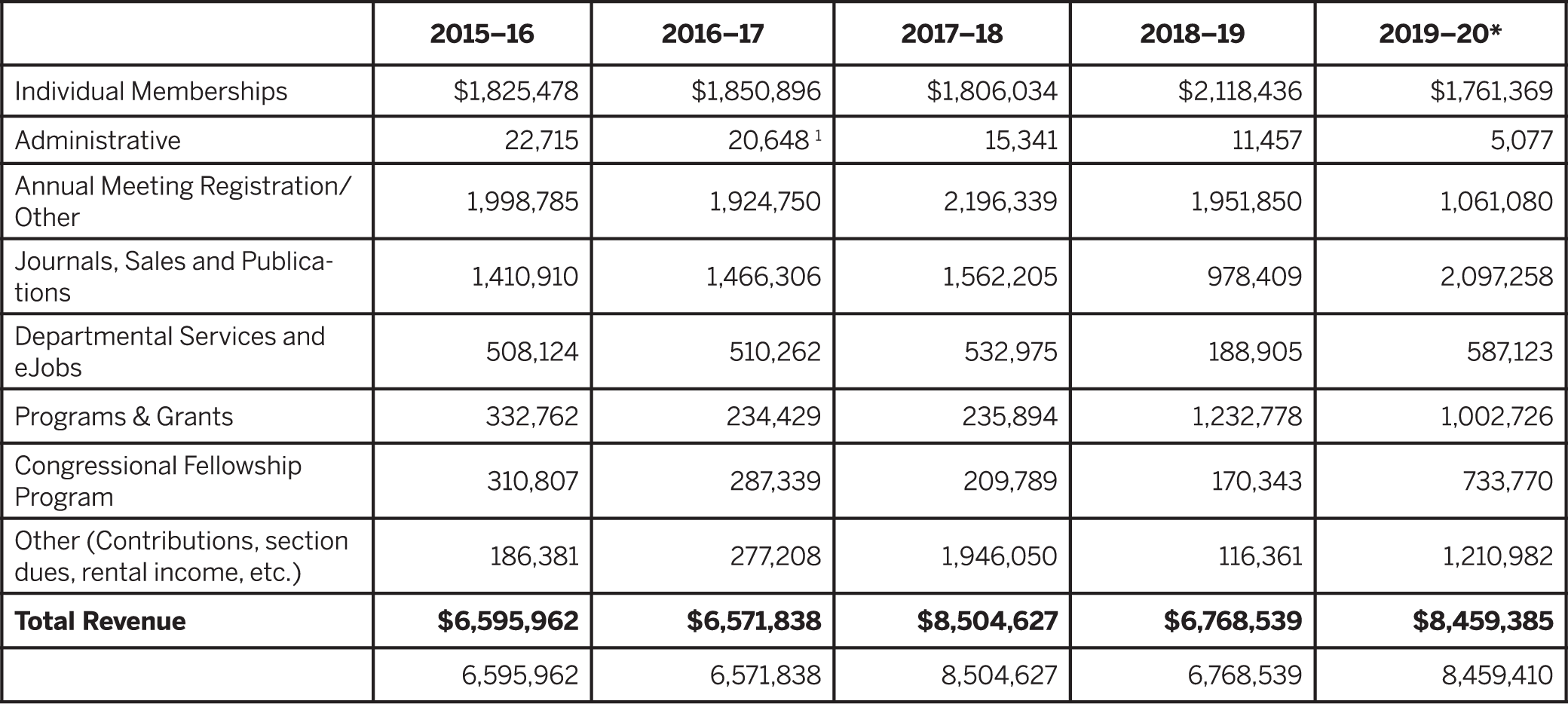

Table 3. Operating Revenue Trends, 2016–2020

1. Includes $6,700 2017 Bldg1527 Insurance Proceeds

* In FY 2019–2020, APSA changed Year end from September 30 to December 31, therefore all financials cover a 15 month period.

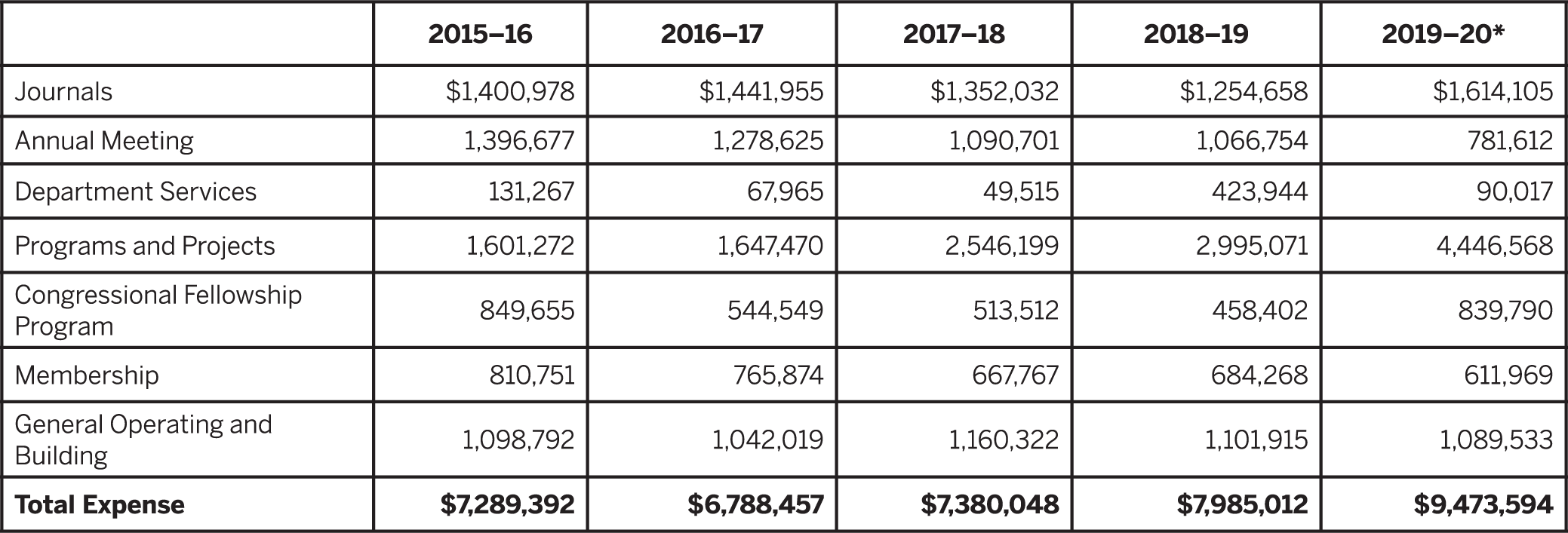

Table 4. Operating Expenditure Trends, 2016–2020

* In FY 2019–2020, APSA changed Year end from September 30 to December 31, therefore all financials cover a 15 month period.

INVESTMENTS

At the onset of the pandemic in March 2020, the stock market had a downturn of approximately 30%. However, by September 30, 2020, the market had rebounded and APSA’s portfolio had increased by $4.63 million for the fiscal year. During the short period from October to December, APSA’s investments increased another $5.22 million.

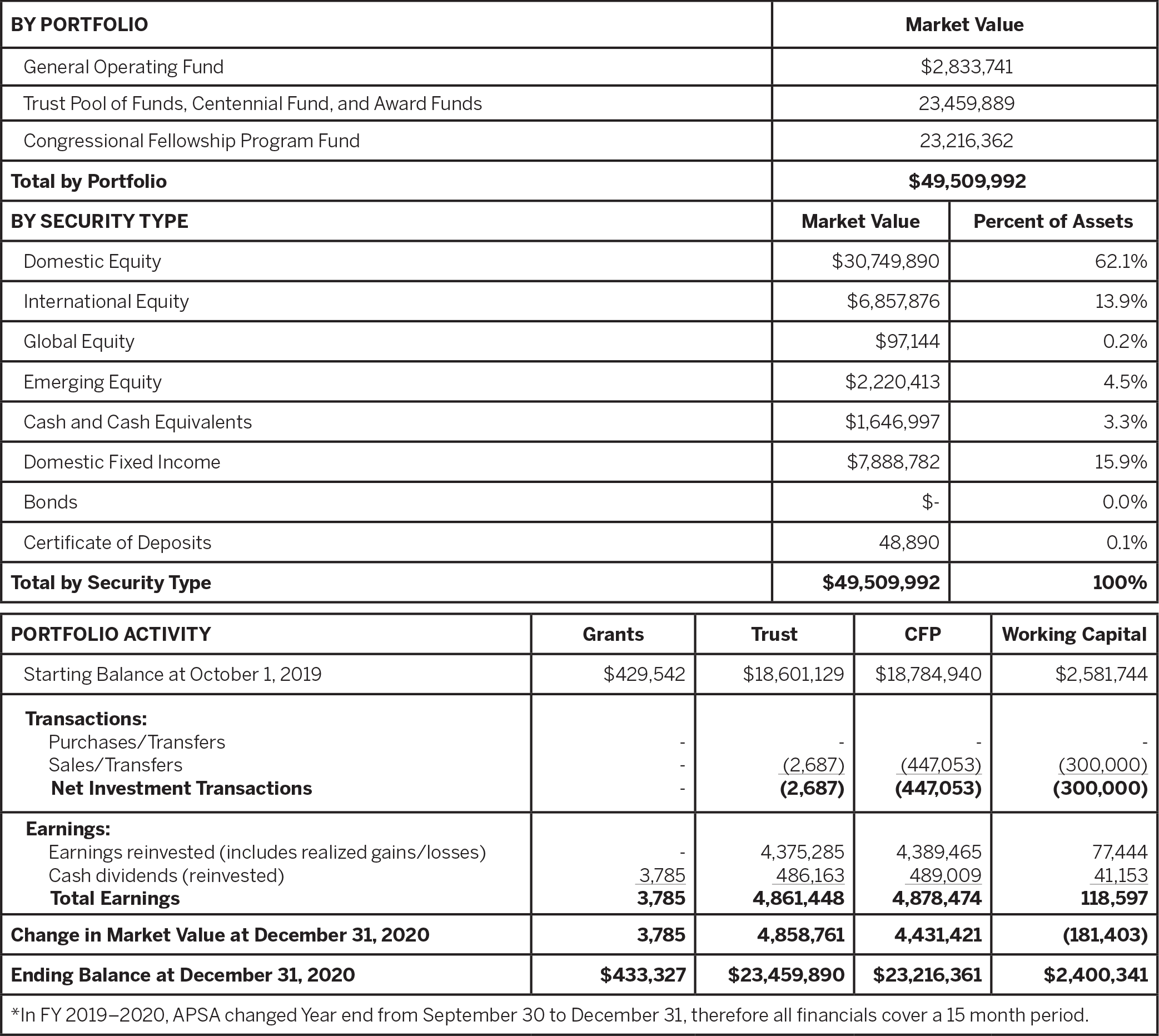

As of December 31, 2020, the total fair market value of all APSA investments was $48.9 million, compared to $39.5 million at the end of fiscal year 2019 (September 30, 2019), and $38.6 million at the end of 2018 (September 30, 2018). Please see table 5.

Table 5. Investment Portfolio Summary for Trust Pool and Endowed Funds, Fiscal Year Ended December 31, 2020*

APSA’s portfolios have slightly outperformed the S&P 500 in recent years and have benefited due to a strong economy and a heavily weighted portfolio towards US equity funds.

The most significant investment groups are the:

-

• CFP Trust Portfolio, which totaled $23.2 million.

-

• Trust and Development Portfolio, which totaled $23.5 million.

ESG INVESTMENTS

At their spring 2019 meeting, the APSA Council directed the APSA Investment Committee to explore shifting APSA investment funds into ESG (Environment, Social, and Governance) funds. ESG funds are bundled funds that avoid investments in a wide range of industries such as gun manufacturers and fossil fuel companies. Like non-ESG funds, ESG funds track broad sectors of the market excluding the avoided investments. An examination by the Investment Committee revealed that ESG funds have generated roughly the same levels of income—sometimes higher, sometimes lower—than non-ESG funds. The investment committee began to shift our investments to ESG funds in spring 2020. At a recent investment committee meeting in early April, the investment committee approved a shift of almost all our investment funds into ESG funds as soon as the changes can be implemented. This change was completed at the end of April 2021.

SUMMARY

Overall, APSA remains in a very strong financial position. Members with questions about our finances should contact Steven Rathgeb Smith, APSA Executive Director at [email protected]. Please see accompanying tables for additional information. ■