4.1 IntroductionFootnote 1

The electricity system has several special characteristics. First, electricity is an invisible and undifferentiated energy carrier, which does not directly fulfil end-use functions. Instead, it powers electric appliances that provide functionalities such as lighting, heating, freezing/cooling, washing, drying, cooking, entertainment, computing, or powering electric motors that perform mechanical work in households, the commercial sector, and industry. Second, while production and consumption of electricity have become geographically separated, they are integrated in real-time because precise balancing is needed to prevent blackouts. This geographical separation implies the need for electricity grids to transport power from (often centralised) sites of production to (often decentralised) sites of consumption (e.g., households, offices, factories). There are high-voltage transmission grids, which transport power over long distances, and low-voltage distribution grids, which disseminate power locally.

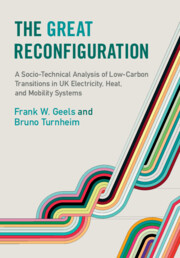

In terms of system architecture, these considerations imply that the electricity system can be distinguished into three sub-systems: production, grids, and consumption. The system architecture has a horizontal ‘hour-glass’ shape: multiple upstream inputs (e.g., coal, gas, nuclear material, biomass, wind, sunshine) are transformed into a single homogenous product (electricity), which is transported by a fine-grained, integrated power grid to sites of consumption where its use in electric appliances enables multiple end-use functions (Figure 4.1). This means that grids not only connect production and consumption but also act as a buffer in the sense that users hardly notice ‘upstream’ changes in power generation (which is an important difference with the mobility and heat systems).

Figure 4.1 Schematic representation of the material elements and flows in the electricity system

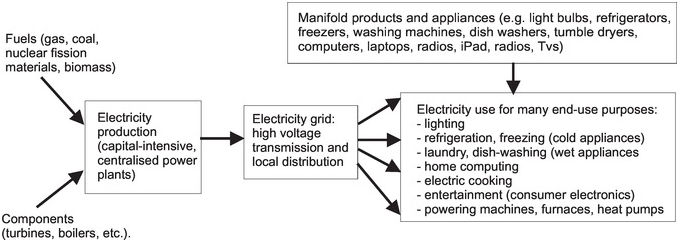

Direct greenhouse gas emissions, which are generated mostly in electricity generation, decreased by 71% between 1990 and 2019 (Figure 4.2), which suggests a low-carbon transition is well under way. The chapter aims to provide an interpretive assessment of underlying changes in various sub-systems. To that end, Sections 4.2, 4.3, and 4.4 respectively investigate the main developments in electricity generation (including coal, gas, and nuclear power), grid, and consumption sub-systems (including washing; cooling; information, communication, and entertainment; and lighting). For each sub-system, we first analyse techno-economic developments and then actors and institutions. Section 4.5 analyses nine niche-innovations across electricity generation (onshore wind, offshore wind, biomass, solar-PV), consumption (energy-efficient lighting, smart meters), and grids (smart grid, battery storage, demand-side response). Section 4.6 draws conclusions about the speed and depth of low-carbon system reconfiguration.

Figure 4.2 Greenhouse gas emissions from power stations in MtCO2, 1990–2019

4.2 Electricity Generation Sub-system

4.2.1 Techno-Economic Developments

The electricity generation sub-system traditionally consists of large, centralised base-load units (coal, nuclear, or large gas turbines), complemented with flexible units for peak-load generation (e.g., smaller gas turbines). Power generation is a complex, engineering-heavy, and capital-intensive activity, linked upstream to specialised supply-chains for different fuels (e.g., coal, gas, uranium, oil) and equipment manufacturing, installation, and maintenance (e.g., thermal/nuclear reactors, turbines, boilers).

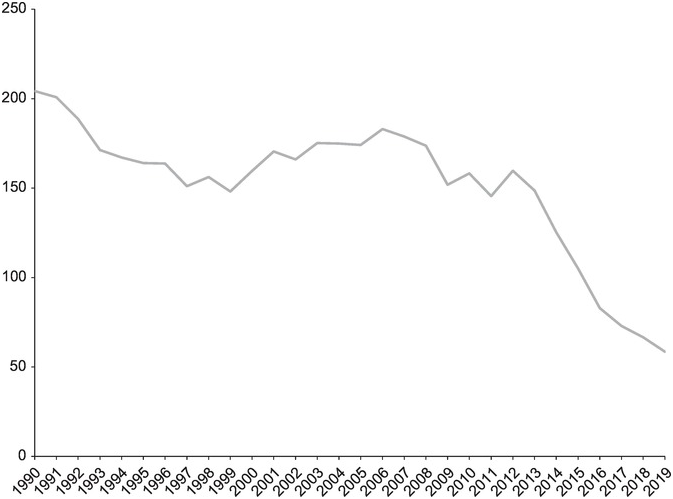

The direct economic relevance of the electricity supply industry decreased since the 1980s, rebounded since the late 2000s, and is still substantial in 2019, generating 98,000 jobs and contributing 1.15% to the Gross Value Added of the UK economy (Figure 4.3). The indirect economic relevance is broader, when taking into account supply chains and the importance of reliable electricity provision to the wider economy.

Figure 4.3 Relative contribution of UK electricity industry to Gross Value Added (in %, left-hand axis) and number of jobs (in thousands, right-hand axis), 1980–2019

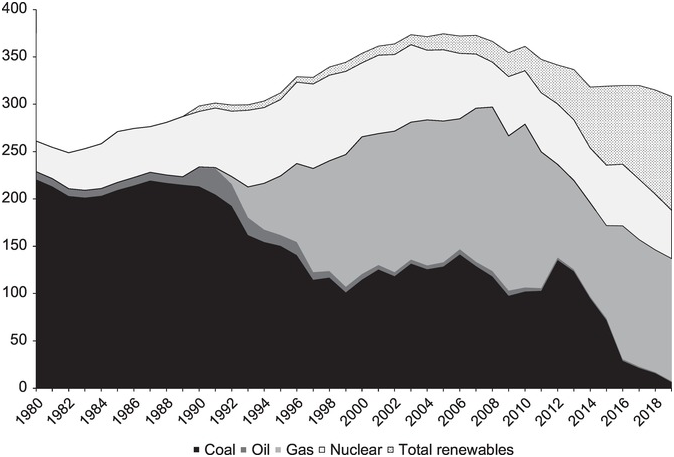

The relative importance of different fuel inputs to power generation has changed substantially since 1980 (Figure 4.4):

nuclear power expanded in the 1980s and 1990s and then gradually contracted;

the use of natural gas increased rapidly after the 1990 privatisation policies;

renewable power generation has increased gradually since 1990, reaching 39% in 2019;

coal use declined very substantially, reducing its relative contribution to power production from 69% in 1990 to 2% in 2019. This decline occurred in two steps. The first step was the market-driven ‘dash for gas’ in the 1990s. The second step was related to climate and energy policies, which stimulated the expansion of renewables and made coal more expensive (e.g., the Carbon Floor Price instrument).

Figure 4.4 also shows that electricity supply peaked in 2005 and subsequently decreased by 18%, owing to decreasing electricity demand, which will be discussed further in Section 4.3.

Figure 4.4 Electricity supplied by fuel type in TWh, 1980–2019

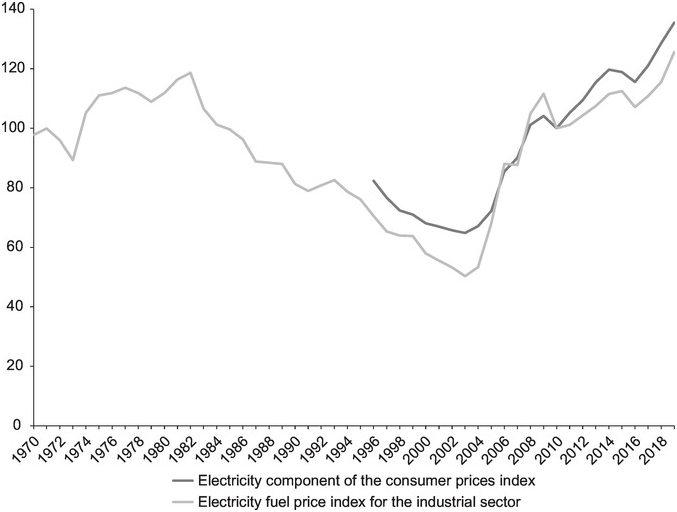

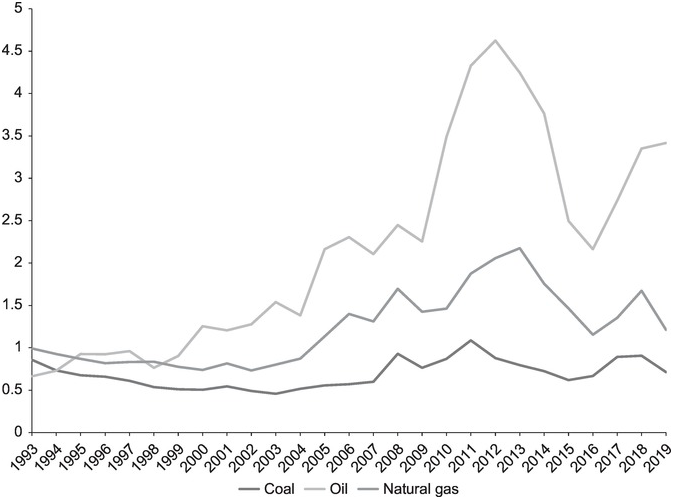

Electricity prices decreased in the 1980s and 1990s (Figure 4.5) because of decreasing fuel input prices such as coal and gas (Figure 4.6) and because privatisation in 1990 increased competition between power producers, which led to lower prices. Since the early 2000s, however, electricity prices have started increasing (Figure 4.5), first because of rising gas prices (which are linked to oil prices) and second because of new investments, related both to decarbonisation and to replacement of old coal and nuclear power plants.

Figure 4.5 UK electricity price index in real terms for industrial and domestic sectors, 1970–2019 (2010=100)

Figure 4.6 Average prices of fuel inputs (in pence per kWh in real terms) purchased by the major UK power producers, 1993–2019

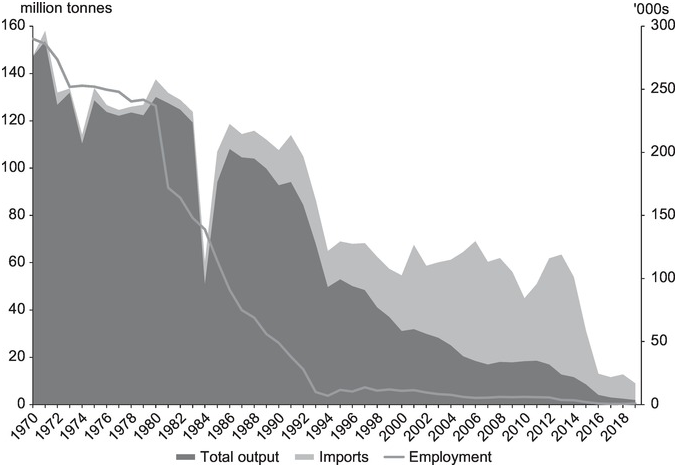

In terms of fuel supplies, the long-term decline in the domestic production of coal was accelerated by the 1984 coal miners’ strike (Turnheim and Geels, Reference Turnheim and Geels2012). Mine closures continued, leading to major declines in coal-related employment (Figure 4.7). Competition from cheaper coal imports and declining coal demand from power producers in the 1990s further reduced domestic coal production. The increasing reliance on imported coal helps explain why electricity-related coal phase-out since the mid-2010s received relatively little industrial opposition.

Figure 4.7 UK coal production and imports in million tonnes (left-hand axis) and employment in thousands (right-hand axis), 1970–2019

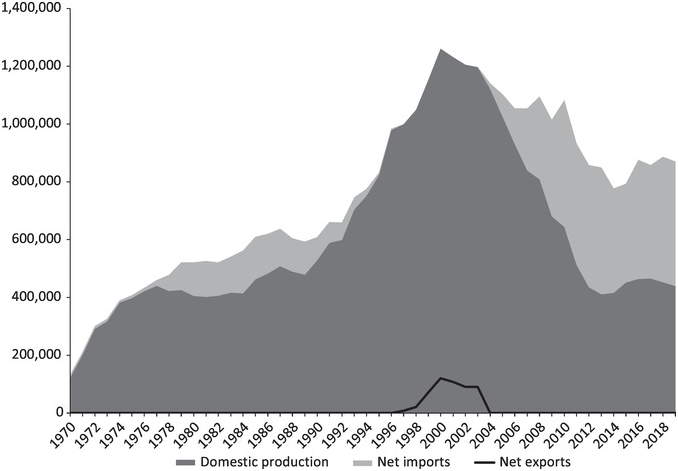

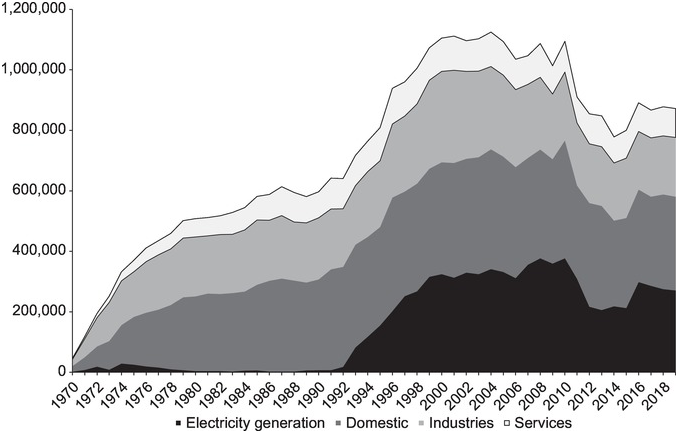

UK gas production increased very rapidly in the 1990s, owing to the exploitation of new North Sea gas fields (Figure 4.8). Between 1997 and 2003, the UK even became a net exporter of natural gas. Since then, however, domestic gas production has decreased, while gas imports (from Norway, the Netherlands, and Belgium) have increased, reaching 49% in 2019 (Figure 4.8). The use of gas in the electricity sector grew rapidly in the 1990s (Figure 4.9). Other important gas users are households and servicesFootnote 2 (which mostly use gas for heating) and industries (which use gas for a range of purposes).

Figure 4.8 UK natural gas production, net imports, and net exports in GWh, 1970–2019

Figure 4.9 UK natural gas consumption by main user categories in GWh, 1970–2019

4.2.2 Actors

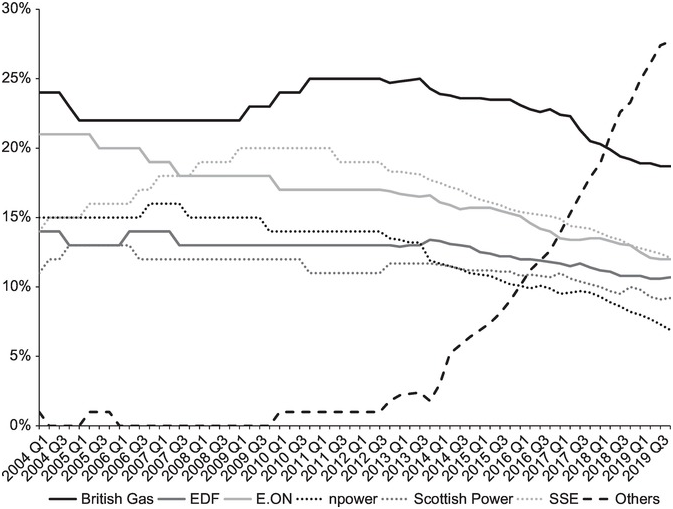

Firms: Following privatisation (1990) and liberalisation (1998), the UK electricity supply industry consolidated into the ‘Big Six’ electricity companies (EDF, E.ON, SSE, British Gas, Scottish Power, N-Power). Their strategies came to focus on price competition, sweating assets, decreased R&D spending, and fuel flexibility in response to fuel price fluctuations (Pearson and Watson, Reference Pearson and Watson2012). In the absence of clear product differentiation, competition mainly occurs on costs, and to a lesser extent on consumer relations and green profiles.

The Big Six are vertically integrated (owning both electricity generation and retail) and dominate the market. But since 2014, new entrants (such as First Utility, Ovo Energy, Sainsbury’s Energy) have begun to gain market share (Figure 4.10), which has increased competition. Organisations with new business models (e.g., community energy, transition towns) have remained small in the UKFootnote 3 because of unfavourable rules and institutions (Mirzania et al., Reference Mirzania, Ford, Andrews, Ofori and Maidment2019): ‘key features of socio-technical regime for electricity provision continue to favor large corporations and major facilities’ (Strachan et al., Reference Strachan, Pye and Kannan2015: 106).

Figure 4.10 UK market share evolution of energy companies, 2004–2019

Technology strategies in recent decades have been shaped by public policies and economic considerations. In the 1990s, utilities switched from coal to natural gas (Figure 4.4). This ‘dash for gas’ was stimulated by various factors (Pearson and Watson, Reference Pearson and Watson2012): a) utility preferences for power generation units with short lead times, low capital costs, and quick returns on investment, which aligned well with combined cycle gas turbines (CCGT); b) price/performance improvements in CCGT; c) new North Sea gas finds and cheap international gas; d) environmental benefits of gas compared to coal.

Coal-fired power generation in the 1990s also faced pressures from the European Large Combustion Plants Directive (LCPD), which prescribed substantial reductions in SO2 emissions. Existing coal-fired plants therefore had to either invest heavily in flue gas desulphurisation, which would further erode their competitive position, or close by 2015 (Turnheim and Geels, Reference Turnheim and Geels2012). Coal-fired plants also faced increasing pressure from climate change, which the newly elected (1997) Labour government saw as an important issue.

Nuclear power also faced difficulties in the 1990s because of nuclear waste storage scandals and because preparation for privatisation revealed its poor economic performance (Verhees, Reference Verhees2012). Privatisation was therefore delayed until 1996, when the government sold the nuclear plants to British Energy. But declining electricity prices created financial problems for British Energy, which had to be bailed out in 2002 (Hewlett, Reference Hewlett2005).Footnote 4 EDF bought British Energy and its nuclear power plants in 2009 for £12.5 billion.

Rising gas prices in the early 2000s (Figure 4.6) changed the fortunes of coal, leading utilities to burn more coal in existing plants between 2000 and 2006 (Figure 4.4). Concerns about energy security (due to increasing reliance on gas imports) also increased the appeal of coal. Promises of ‘clean coal’ (based on flue gas desulfurisation, supercritical pulverised coal technologies, coal gasification, and Carbon Capture and Storage) also intended to address environmental concern, including climate change (Geels et al., Reference Geels, Kern, Fuchs, Hinderer, Kungl and Mylan2016b).

By 2008, utilities were seeking approval to build new coal-fired power plants, totalling over 11 GW, to replace plants that would be phased out by 2015/16 (Turnheim, Reference Turnheim2012). Because these plans would threaten the ambitions of the 2008 Climate Change Act, policymakers announced that no new coal-fired plants would be permitted unless they incorporated Carbon Capture and Storage (CCS), which did not materialise. Since then, coal use has decreased rapidly (Isoaho and Markard, Reference Isoaho and Markard2020), as some coal-fired plants converted to burning biomass (Drax, Ironbridge) while others closed (Kingsnorth, Cockenzie, Tilbury Didcot, Uskmouth, Ferrybridge) because of LCPD-legislation, end-of-life considerations, and the 2013 Carbon Floor Price policy, which made coal more expensive compared to other options. Decline accelerated after 2015 (Figure 4.4), when the government announced a coal phase-out by 2025 (Isoaho and Markard, Reference Isoaho and Markard2020).

Increasing concerns about climate change and energy security (particularly increasing dependence on imported gas) also led to government plans for the expansion of nuclear power (see later). But utilities showed lukewarm interest, because waste processing liabilities, decommissioning costs, and unclear future electricity prices created uncertainties about the viability of nuclear investments, especially since the government had repeatedly ruled out subsidies. In 2013, the energy company Centrica abandoned new construction plans, leaving only EDF in negotiations with the UK government about a 3.2 GW plant at Hinkley Point C (Thomas, Reference Thelen, Mahoney, Mahoney and Thelen2016). To enable the deal, the government broke its non-subsidy pledge and in 2016 agreed to pay EDF a guaranteed strike price (£92.50 per MWh, twice the wholesale price) for 35 years. Since then, however, the project has encountered problems in securing finance for the £18 billion investment and delays in scheduled opening dates (to 2025). Half of the UK’s nuclear power plants are scheduled to retire in 2025 for end-of-life reasons, creating a potential capacity gap. Policymakers are therefore in discussion with possible suppliers about other new nuclear power plants (further discussed later).

In response to attractive government incentives, electricity generators also reoriented towards large-scale renewables such as biomass combustion in converted coal-plants (e.g., Drax, Ironbridge), onshore and offshore wind parks (Geels et al., Reference Geels, Kern, Fuchs, Hinderer, Kungl and Mylan2016b), which is further discussed in Section 4.5.

Policymakers: The government’s privatisation (1990) and liberalisation (1998) of the electricity supply industry were motivated by desires to unleash market forces and drive down electricity prices. The Labour government, elected in 1997, made climate change into an additional issue for energy policy besides low costs. The 2003 White Paper Our Energy Future: Creating a Low-Carbon Economy highlighted the need for a 60% reduction of GHG emissions by 2050 and committed to a target of 10% renewable electricity by 2010. Rising oil and gas prices in the early 2000s (Figure 4.6) and the 2005 Russia–Ukraine gas dispute (in which Russia closed gap supplies to pressure Ukraine) increased concerns about energy security and increasing reliance on gas imports (Figure 4.8). UK electricity policy was therefore increasingly framed in terms of an ‘energy trilemma’, which aimed to simultaneously address three goals: low cost, energy security, and climate mitigation (Kern et al., Reference Kern, Kuzemko and Mitchell2014a).

Public attention to climate change increased rapidly in the mid-2000s (Figure 1.1), making it an attractive issue for high-level politicians to compete on (Carter and Jacobs, Reference Carter and Jacobs2014). This competition resulted in cross-party consensus about the importance of climate change. This consensus and pressure from environmental NGOs culminated in the ambitious 2008 Climate Change Act that legally committed the UK to 80% GHG reduction by 2050 and 34% reduction by 2020 (Lockwood, Reference Lockwood2013). Nuclear power, Carbon Capture and Storage (CCS), and offshore wind (which will be discussed in Section 4.5) were seen as crucial low-carbon technologies.

The government’s 2008 White Paper on Nuclear Energy announced plans to construct eight new nuclear power reactors by 2025, which would address both climate change and energy security issues. Since the mid-2010s, the government has spend much political capital on the first project (Hinkley Point C), which encountered delays, cost increases, and financing problems, and has been criticised for very costly support policies (Thomas, Reference Thelen, Mahoney, Mahoney and Thelen2016).

CCS was seen as a crucial technology because it would enable continued gas and coal-fired power plants, while reducing GHG emissions. The government’s 2007 White Paper on Energy (Meeting the Energy Challenge) wanted to ‘make the UK a world leader in this globally important technology’ (p. 15) and therefore launched a competition for a £1 billion subsidy to build a CCS demonstration plant. Nine proposals were received and four were selected for further development and negotiation. The BP and Peel Consortiums subsequently withdrew, leaving E.ON and Scottish Power/Shell/National Grid in the negotiation. But E.ON pulled out in 2009 and Scottish Power in 2011, because both deemed the economic risks too high (Kern et al., Reference Kern, Gaede, Meadowcroft and Watson2016). Despite these setbacks, the government’s 2011 Carbon Plan repeated CCS aspirations, foreseeing up to 10 GW of CCS plants by 2030. A second £1 billion competition was launched in 2012, leading to prolonged discussions about the Peterhead project (led by Shell and SSE) and the White Rose project (led by Drax). But the government cancelled the competition in 2016, owing to concerns about the future costs for consumers.

Meanwhile several political countertrends gathered pace after the 2007/8 financial-economic crisis and the election of a new Conservative-Liberal Democrat government in 2010 altered political priorities. Public attention to climate change diminished, leading politicians to realise that they were ahead of their voters (Lockwood, Reference Lockwood2013). Especially the right wing of the Conservative party became more vocal, questioning the climate change science and criticising subsidies for renewables. The financial-economic crisis also enhanced concerns about jobs, competitiveness, and energy prices. The Treasury used these concerns to regain influence over climate policy through the Levy Control Framework (Carter and Jacobs, Reference Carter and Jacobs2014), issuing warnings that green policies should not hinder the economy. In 2013, cost concerns escalated into a full-scale political row over rising energy bills, with the Prime Minister reportedly telling aides to ‘get rid of all the green crap’ (The Guardian, 23 November 2013). These concerns led the government to scrap, delay, or water down various green policies (discussed later).

In this context, the government was also keen to emulate the US shale gas revolution, which it hoped would create jobs, reduce gas prices, and reduce dependence on natural gas imports. In 2012, it therefore lifted restrictions on fracking. In an official statement on 19 July 2013, the Chancellor promised tax breaks for shale gas companies, arguing that shale gas ‘has the potential to create thousands of jobs and keep energy bills low for millions of people’. Since then, shale gas has developed slowly because of public protests, mixed results from underground explorations (because UK soils were found to be fractured and difficult to exploit), and correlations between fracking and local earthquakes that heightened public concerns (Williams and Sovacool, Reference Williams and Sovacool2019). In November 2019, the government therefore announced a moratorium on further shale gas development.

In 2015, the newly elected Conservative Government announced an ‘energy policy reset’, which led to major reductions in financial support for renewables and CCS. To protect its green credentials, the government also announced in 2015 that it intended to phase-out unabated coal-fired power plants by 2025. This phase-out unfolded quicker than anticipated (Figure 4.4) and substantially decreased GHG emissions from the power sector (Figure 4.2). Since the mid-2010s, the government has also started negotiations about other new nuclear power plants, but several of these (Wylfa, Moorside, and Oldbury) have since stalled because project developers (Hitachi, Toshiba) pulled out in 2020 due to problems in securing funding. Negotiations about other plants (Sizewell, Bradwell) are ongoing but challenging because decreasing costs of renewables erode the business case for nuclear power plants (and the political will to subsidise them), creating major business and political uncertainties. Despite the various implementation and delivery problems, the 2020 Energy White Paper states that the government aims ‘to bring at least one large-scale-nuclear project to the point of Final Investment Decision (FID) by the end of this Parliament’, which is 2024 (HM Government, 2020a: 48).

In the context of ‘climate emergency’ debates, the UK government committed in 2019 to a net-zero target by 2050. For the electricity sector specifically, the 2020 Energy White Paper aimed for ‘an overwhelmingly decarbonised power system in the 2030s’. Nuclear power and offshore wind (further discussed later) are thought to play important roles in this decarbonisation process, while the government also aims for ‘at least one’ CCS plant for power production to be operational by 2030 (HM Government, 2020a).

Users: UK consumers have limited direct involvement in power generation. Electricity production by households (through rooftop solar-PV) has remained relatively small in the UK (see Section 4.5.4). Nevertheless, households indirectly shape upstream power generation investments since they ultimately pay for them, either through their electricity bills (which allows utilities to pass costs onto consumers) or through general taxation (which pays for government subsidies to power generators). Additionally, consumer switching between electricity suppliers accelerated after 2013, providing space for new electricity suppliers (Figure 4.10).

Wider Publics: Increasing public attention for climate change and the 2006 Big Ask campaign by environmental NGOs prepared the ground for the 2008 Climate Change Act and stimulated the development of low-carbon electricity plans and policies. Public attention for climate change declined as the 2007/8 financial crisis and austerity increased public concerns about jobs, growth, and energy costs (Lockwood, Reference Lockwood2013). Cost concerns underpinned various public debates about specific issues. Complaints about rising electricity bills culminated in a political row in 2013 and subsequent efforts to reduce public spending on renewables. There were also heated debates about pricing strategies of utilities, which were accused of being slow to pass on decreases in fuel input prices to consumers. They were also accused of too rapidly increasing standard variable tariffs, which would disproportionally affect lower-income people on these tariffs who were traditionally less likely to switch suppliers. Additionally, there were public debates about dysfunctional markets and insufficient competition between utilities that underpinned the market power abuse. This concern led to an energy market investigation by the Competition and Markets Authority, which in 2016 published a critical report with 30 improvement recommendations. Last, there were critical debates about excessive subsidies in the 2016 Hinkley Point C deal. These critical debates decreased public attention to climate change and weakened the climate policy consensus (Gillard, Reference Gillard2016).

There were also public campaigns and debates about specific technologies. In 2008–2009, activist groups such as Climate Camp campaigned against utilities’ plans to expand coal-fired power stations. Demonstrations against a new plant at Kingsnorth attracted much media attention, which pressured the government to not grant licenses (Carter and Jacobs, Reference Carter and Jacobs2014). Public opposition against nuclear expansion plans was more limited because the environmental movement was divided, with some activists (e.g., Stephen Tindale, George Monbiot, Mark Lynas) perceiving nuclear power as a necessary evil to address climate change (Verhees, Reference Verhees2012).

Environmental NGOs and local communities also contested the government’s plans for fracking and shale gas technologies because of concerns about water and noise pollution, industries invading the countryside, and insufficient stakeholder engagement (Williams and Sovacool, Reference Williams and Sovacool2019). Nevertheless, the government decided to move ahead in supporting fracking, with the Prime Minister personally expressing strong commitment in a letter to The Telegraph, dismissing protesters as uninformed NIMBY-activists (11 August 2013). Protests continued, however, and gathered wider support as increasing numbers of earthquakes in fracking areas enhanced public concerns. Combined with lower than anticipated exploration results, this led the government to halt shale gas in November 2019.

4.2.3 Policies and Governance

Governance Style

Governance styles and policy paradigms have changed substantially in the past three decades. Privatisation and liberalisation in the 1990s, which were based on neoliberal principles, introduced market-principles to the electricity system, with the specific aim of focusing utilities on low cost competition (Pearson and Watson, Reference Pearson and Watson2012). The government increasingly adopted a hands-off governance style, leaving decisions to the market. The Department of Energy was disbanded in 1992 and energy policy was relegated to a sub-division of the Department of Trade and Industry (DTI). To depoliticise energy governance, DTI set the regulatory framework, but left implementation to the newly created independent regulator Ofgem (Office of Gas and Electricity Markets). Ofgem’s main remit was to ensure that markets were sufficiently competitive and to protect consumer interests (Kern et al., Reference Kern, Kuzemko and Mitchell2014a).

In the 2000s, climate change became an additional policy concern, which was layered on top of neoliberal arrangements, leading to an emphasis on market-based policies. The 2002 Renewables Obligation introduced technology-neutral trading policies, while the 2003 White Paper Our Energy Future emphasised carbon pricing (via European emissions trading) as the main instrument for creating a low-carbon economy.

The 2008 Climate Change Act marked a shift towards a more interventionist governance style (Kern et al., Reference Kern, Kuzemko and Mitchell2014a; Pearson and Watson, Reference Pearson and Watson2012), in which the government actively shaped markets and stimulated specific technologies. It also created new policy actors such as the Department of Energy and Climate Change (DECC) and the independent Committee on Climate Change (CCC) with responsibility for monitoring progress against climate change targets and advising the government accordingly. DECC’s translation of high-level goals into more specific plans created policy delivery momentum through the UK Low Carbon Transition Plan (2009), the amended Renewables Obligation (2009), the UK Renewable Energy Strategy (2009), the Carbon Plan (2011), the Energy Bill (2012), and the Electricity Market Reform (2013), which stimulated technology implementation and deployment.

Formal Policies

In terms of specific policy instruments, the 2013 Electricity Market Reform introduced Contracts for Difference (from 2017 onwards), which aimed to attract private investors. CfDs guarantee that low-carbon electricity generators receive a stable and predictable ‘strike price’ for long periods.Footnote 5 While CfDs offer protection against the volatility of wholesale prices, the closed auction design makes potential suppliers compete against each other with the aim of driving prices down. The Hinkley Point C nuclear power plant, however, received a generous strike price (£92.50 per MWh for 35 years) to entice EDF as single bidder (Thomas, Reference Thelen, Mahoney, Mahoney and Thelen2016).

The Carbon Price Floor (CPF) is another policy instrument, which was introduced in 2013 to complement the EU Emissions Trading System (ETS). Since the price of carbon in the ETS has remained too low to drive low-carbon investment, the CPF taxes fossil fuels used to generate electricity via Carbon Price Support (CPS) rates set by the government. The Carbon Price Floor thus consists of two components paid by electricity generators: ETS carbon prices and the CPS which further increases carbon prices to the carbon floor price target. The CPF was supposed to increase every year until 2020 (to a price of £30/tCO2), but in 2014 the government decided to cap the CPS component of the floor price at a maximum of £18/tCO2 from 2016 to 2020 to reduce energy bills for consumers. Despite this weakening, the CPF increased the relative price of coal, which contributed to its rapid decline in power generation (Figure 4.4).

Another instrument was the Levy Control Framework, which the Treasury established in 2011 to control financial spending by DECC. It did so by setting a maximum annual budget for projected costs on levy-funded schemes such as the Renewables Obligation, Feed-in-Tariff, and CfDs.

The 2015 energy reset not only reduced financial support for renewables and CCS but also signalled a desire for less interventionism, with the Secretary of State for Energy and Climate Change stating: ‘We want to see a competitive electricity market, with government out of the way as much as possible, by 2025.’Footnote 6 The newly elected (2015) Conservative government thus expressed its preference for restoring a neoliberal approach to electricity policy. In 2016, DECC was reorganised into BEIS (the Department for Business, Energy & Industrial Strategy), which also indicated that low-carbon energy transitions were explicitly viewed in relation to business opportunities and industrial strategy. The 2017 Clean Growth Strategy saw ‘clean, smart, flexible power’ as an industrial growth opportunity, focused particularly on large-scale generation options such as nuclear power, offshore wind, and large solar farms (BEIS, 2017a). The latter two options are further discussed in Sections 4.5.2 and 4.5.4.

4.3 Electricity Grid Sub-system

4.3.1 Techno-Economic Developments

Great Britain’s electricity gridFootnote 7 includes a high-voltage transmission network, which carries electricity from power generators to sub-stations and a low-voltage distribution network for localised electricity delivery from sub-stations to end-users. The GB transmission network consists of 26,000 km of overhead lines, 575 sub-stations, and over 1,000 transformers that transform electricity from high to low voltage (Cotton and Devine-Wright, Reference Cotton and Devine-Wright2012).

Local distribution networks are organised into 14 regional area monopolies, which are managed by distribution network operators (DNOs). DNOs operate one-directional passive networks, which distribute power from electricity generators to end-users. DNOs do not measure or monitor their distribution networks, which remain relatively ‘dark’: DNOs cannot see technical problems or blackouts but rely on customers calling them to report problems (Lockwood, Reference Lockwood2016).

The electricity grid took decades to build and represents major sunk investments that create material and economic path dependencies. Grid operation requires specialised technical and managerial skills to balance the supply and demand of electricity flows, which always needs to be finely tuned to prevent operational problems and blackouts. The operational model traditionally consisted of baseload generation, which operates more or less continuously, and dispatchable generation, which are more flexible sources of electricity that can be dispatched at the request of power grid operators to meet fluctuating consumer demand, including electricity peaks. To keep costs low, choices for baseload and dispatchable operation were conventionally guided by the merit order, which refers to the ranking of electricity generation sources in ascending order of short-run marginal production costs. This often resulted in the use of coal or nuclear plants for base-load generation and gas-powered plants for dispatchable generation.

Several trends are increasing pressures on the grid and the conventional operational model (Bolton and Foxon, Reference Bolton and Foxon2015; Jenkins et al., Reference Jenkins, Long and Wu2015): 1) under-investment over the past few decades has led to aging grid assets (e.g., switchgear, transformers, cables) that require replacing or upgrading, 2) the creation of wind farms in remote locations (e.g., Scottish islands, Welsh coast, offshore) requires the creation of new transmission networks to connect them to the grid, 3) increasing electricity flows from Scotland and Wales (where most wind parks are situated) to England (where most electricity is used) requires upgrading, extension, and intensification of the onshore transmission grid, 4) increasing amounts of intermittent renewables (wind, solar-PV) create load management problems (matching supply and demand) and disrupt the baseload-dispatchable generation model, especially as renewables become the cheapest option and thus rank high in the merit order, 5) increasing amounts of distributed generation (e.g., solar-PV, community energy) need to be integrated into local distribution grids, which involves two-way flows instead of traditional one-directional flows, 6) possible future increases in domestic heat pumps and electric vehicle charging may create new stresses on local distribution networks that require monitoring and management.

These pressures have led to incremental changes in the high-voltage transmission grid, including: 1) extensions of Scottish onshore power cables to wind parks in remote locations; 2) the strengthening of existing transmission connections between England and Scotland and England and Wales, 3) the creation of a new west coast undersea high-voltage direct current transmission cable between Scotland and England, 4) the creation of new offshore grids to connect various wind parks, 5) the building of new interconnectors to Norway, France, Belgium, Denmark, and Iceland to increase import capacity beyond the current four interconnectors (to France, Northern Ireland, Ireland, the Netherlands). Costs for these projects between 2010 and 2020 are estimated to be around £54 billion (DECC, 2014a). Although these projects are complicated and expensive, they are incremental in the sense that they build on and extend existing technological knowledge and capabilities (Andersen, Reference Andersen2014). They also do not fundamentally change the transmission architecture but strengthen and extend it.

The grid pressures have also increased attention for more radical innovations in local distribution networks, including smart grids, demand-side response, and electricity storage. These radical innovations will be discussed in Sections 4.5.7 and 4.5.8.

4.3.2 ActorsFootnote 8

Policymakers: Electricity networks are highly regulated markets, in which the independent regulator Ofgem plays a central role. It provides oversight of the system operator (National Grid), Transmission Network Operators (TNOs), and Distribution Network Operators (DNOs); it implements and monitors regulations; and it approves network investment plans. Ofgem is traditionally dominated by mainstream economists (Cary, Reference Cary2010; Lockwood, Reference Lockwood2016) and focused on lowering cost (through economic competition), which is how it interpreted its original regulatory remit of ‘protecting the interest of consumers’.

To minimise operational costs and improve cost-efficiency, Ofgem introduced price control regulation (called RPI-X) for electricity grids in the late 1990s. This regulation meant that the fees that TNOs and DNOs could charge electricity companies for transmission and distribution services could increase in line with an inflation index (the Retail Price Index) minus an X% reduction each year, which was intended to stimulate TNOs and DNOs to make efficiency gains (Jamasb and Pollitt, Reference Jamasb and Pollitt2007).

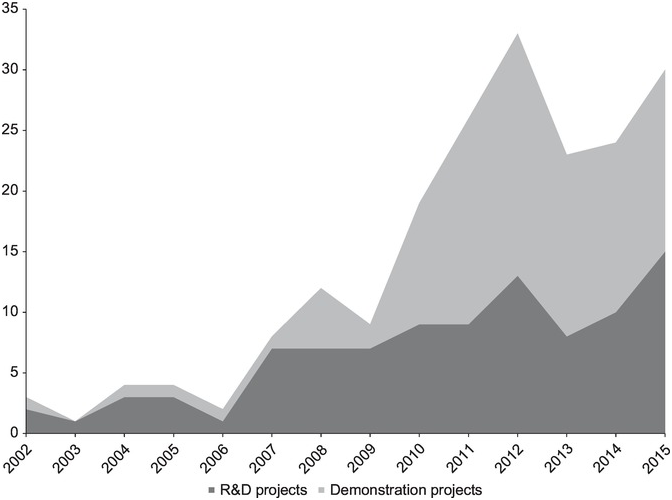

Although mainstream economic thinking, which informed Ofgem’s policies, predicted that efficiency orientations would drive innovation, this did not occur, especially not for DNOs (Bolton and Foxon, Reference Bolton and Foxon2015). To stimulate innovation, Ofgem therefore introduced new policies for the 2005–2010 period (Innovation Funding Incentive, Registered Power Zones scheme) and the 2010–2015 period (Low Carbon Network Fund), and a new policy framework called RIIO for the post-2015 period (RIIO stands for Revenue = Incentives + Innovation + Outputs). While these new instruments stimulated DNO R&D activities (Jamasb and Pollitt, Reference Jamasb and Pollitt2015), wider deployment of new technologies in distribution networks has so far remained relatively limited (Lockwood, Reference Lockwood2016).

For grid investments, Ofgem used to have a negotiated model, in which DNOs and TNOs could make proposals that legitimated technical details and costs with regard to demonstrated needs (Lockwood, Reference Lockwood2016). This approach of ‘wait for proven need and then choose the optimal solution’ (Shaw et al., Reference Shaw, Attree and Jackson2010) might be efficient according to economic theory, but in the real world discouraged radical innovations that did not address well-articulated needs. In the mid-2010s, Ofgem announced that it wanted to change from the negotiated model to a competitive tendering model (the CATO regime), which was intended to commence in 2018 (see further discussion later). This change was partly inspired by experiences with the creation of new offshore transmission grids, which began using a competitive tendering model in 2009 (further discussed later).

Climate change was incorporated into Ofgem’s remit in the early 2000s, but has long received far less attention than efficiency improvements and cost reduction. Since 2007, Ofgem has been repeatedly criticised (by the Sustainable Development Commission, the Labour Party, and Parliament’s Energy and Climate Change Select Committee) for insufficiently acting on this additional goal. These criticisms have only slowly been accommodated, because Ofgem was created as an independent organisation with a substantial degree of autonomy and discretion in relation to policymakers (Lockwood, Reference Lockwood2016).

Firms: Different kinds of companies operate different parts of the electricity grid. The transmission grid is managed by a single system operator (National Grid) and three regional Transmission Network Operators (TNOs). Most of the extension, intensification, and reinforcement of onshore transmission networks has been driven by the three TNOs and supply chain firms (e.g., ABB, Alstom), based on investment proposals approved by Ofgem. Since pressures on transmission grids were visible and imminent (e.g., connecting new wind parks, reinforcing grids connections between England and Scotland), these proposals could easily be framed in terms of demonstrated needs. But besides clear demand or regulatory pressure from Ofgem, TNOs had little incentive to innovate since they faced no competition (Jamasb and Pollitt, Reference Jamasb and Pollitt2015). Most transmission grid innovations have therefore been incremental. The new CATO regime intends to change that by creating competitive tendering processes for discrete infrastructure projects. The new regime would also give the System Operator greater power in terms of overall coordination (as a ‘system architect’).

The local distribution system is organised into 14 regional area monopolies, run by six Distribution Network Operators (DNOs). DNOs are passive distributors, who transmit power from sub-stations to end-users. They receive a fee from the electricity companies for transmitting this power but do not have direct commercial relations with end-users. Various DNO-related lock-in mechanisms help explain the limited degree of innovation in distribution networks: 1) the RPI-X regulatory regime’s focus on efficiency and short-term cost reduction stimulated TNOs and DNOs to ‘sweat the assets’ (by postponing network investments) and downscale R&D investments, which decreased to 0.1% of revenue by 2004 (Jamasb and Pollitt, Reference Jamasb and Pollitt2008), 2) DNOs have therefore lost technical capabilities and lack the incentives for major long-term innovations (Bolton and Foxon, Reference Bolton and Foxon2015), 3) DNOs do not have pro-active long-term innovation strategies but react to the regulatory contract or act when this is required (e.g., when distributed power generators seek connections to the distribution network), 4) DNOs also do not face much articulated need from concrete clients, which complicates the legitimation of investment proposals to Ofgem.

DNOs increased their R&D activities in response to Ofgem’s Innovation Funding Incentive and Registered Power Zones scheme (Jamasb and Pollitt, Reference Jamasb and Pollitt2015), but real-world implementation of new technologies has remained slow. Since the Low Carbon Network Fund and the RIIO policy framework, DNOs have become more engaged in larger, real-world demonstration projects.

A third actor, Offshore Transmission Owners (OFTOs), are consortia of large-scale investors, project developers, and construction companies that build and operate offshore transmission networks (Firestone et al., Reference Firestone, Bates and Prefer2018). They have been attracted by Ofgem’s regulations, in which attractive revenues are awarded for providing the availability of transmission infrastructure regardless of the amount of electricity that is generated and transmitted. Two dominant OFTOs are Transmission Capital Partners (including Transmission Capital, International Public Partnerships, and Amber Infrastructure Group) and Blue Transmission (including 3i Group Plc and Diamond Transmission Corporation, which is a UK subsidiary of Mitsubishi Corporation).

Wider Publics: While grid planning and decision-making is a technocratic process involving a small group of actors, on-the-ground implementation and construction affects the lives of citizens and local communities. Various infrastructure projects have encountered protests because residents and NGOs had concerns about various issues (Cotton and Devine-Wright, Reference Cotton and Devine-Wright2012): 1) pylons and overhead power lines that caused visual intrusion in rural and suburban landscapes and noise burdens (related to zooming sounds), 2) negative influences on property and local amenity values, 3) potential cancer risks due to electric and magnetic fields emitted by power lines, 4) distrust of large electricity companies, including National Grid, 5) limited local consultation causing feelings of being ‘bulldozed over’. Examples of protests against grid infrastructure projects include the following (Cotton and Devine-Wright, Reference Cotton and Devine-Wright2013). In the early 2010s the John Muir Trust, a wild land charity, led fierce protests against the creation of new pylons and wires across 220 km of Scottish Highlands, which attracted much public attention. In Suffolk and Essex protesters created the Essex & Suffolk Coalition of Amenity Groups, whose protests led National Grid to decide (in 2013) to postpone its plans for new pylons until the early 2020s. There were also prolonged protests between 2011 and 2014 against new power lines from Mid-Wales through the Shropshire countryside.

The protests in Scotland and Wales led to substantial delays in consultation, approval, and construction of grid projects:

Major delays of 2 to 4 years were announced late in 2012 for many projects in Northern Scotland and the reinforcements required in mid and north Wales remain behind schedule. Our indicators envisaged that construction would begin in 2012 (mid Wales) and this year (north Wales), but there have been continued delays in planning, largely due to local public opposition.

These social acceptance problems were one reason for constructing the west-coast undersea transmission cable between Scotland and England and considering a similar east-coast undersea cable.

4.3.3 Policies and Governance

Governance Style

The governance style in the electricity grid sub-system has characteristics of ‘club governance’ (Lockwood, Reference Lockwood2016; Moran, Reference Moran2003): actors meet frequently in relatively closed networks, know each other well, share mindsets and outlooks, and take each other’s interest into account. The Electricity Networks Strategy Group, for instance, provides a high-level forum where the National Grid, TNOs, DNOs, Ofgem, and policymakers (e.g., DECC, BEIS) meet to discuss electricity grid challenges, policies, and plans. Ofgem has strongly shaped the grid institutions and outlooks, leading to an emphasis on efficiency and costs rather than on transformative change.

Formal Policies

The efficiency-oriented RPI-X price control regulation, introduced in the late 1990s, succeeded in decreasing costs but also hampered innovation and reduced R&D investments, especially by DNOs (Bolton and Foxon, Reference Bolton and Foxon2015). To address this problem, Ofgem introduced two new innovation-oriented instruments for the 2005–2010 period, which were layered on top of the efficiency-oriented institutions (Lockwood, Reference Lockwood2016). The Innovation Funding Incentive (IFI) allowed DNOs to spend up to 0.5% of their revenue on R&D and distribution system asset management. The Registered Power Zones (RPZ) scheme provided additional revenue (capped at £500,000 per DNO per year) to demonstrate innovative solutions for connecting distributed generation facilities to the network.

Although these instruments increased DNO R&D spending in subsequent years (Bolton and Foxon, Reference Bolton and Foxon2015), they hardly influenced the broader implementation and deployment of new technologies (Lockwood, Reference Lockwood2016). For the 2010–2015 period, Ofgem therefore created a new Low Carbon Network Fund (LCNF), which was an order of magnitude larger than IFI and allowed DNOs to bid for up to £500 million over five years for demonstration projects.

Based on an internal review, Ofgem (2013) also introduced the new RIIO-framework that aimed to stimulate innovation and promote a ‘step-change’ in the prominence of low-carbon futures. Coming into force in 2015, RIIO introduced several new instruments: a Network Innovation Competition, in which DNOs can bid for large-scale projects (funded from a £70m per year pot); a Network Innovation Allowance, which is an allowance each RIIO network licensee receives to fund smaller scale innovative projects that have the potential to deliver benefits to network customers; and an Innovation Roll-out Mechanism to fund the roll-out of proven low-carbon innovations for transmission owners (up to £10m).

While the RIIO-framework introduced several changes, Lockwood (Reference Lockwood2016: 120) diagnosed that it ‘retained the basic structure of revenue cap regulation at its core’. More broadly, it is not guaranteed that these new instruments will be sufficient to drive actual uptake and widespread deployment of new innovations in the electricity grid:

The understanding of innovation processes within Ofgem has evolved over time but remains incomplete. … Despite a shift away from a purist view of innovation based on Austrian economics to a more nuanced approach, it remains … to be seen if … the incentive to reduce costs in the wider regulatory framework will now be sufficient to drive network companies to take the lessons learned in LCNF trials and apply them in business-as-usual network planning, investment and operation.

Ofgem’s belief in market competition also led to the introduction of competitive bidding schemes for transmission grid projects. For offshore transmission projects, DECC and Ofgem introduced the Offshore Transmission Regulatory Regime in 2009. The regulations distinguish between a ‘transitional regime’ (2009–2012), which forced offshore wind farm operators to sell their self-constructed transmission grids to Offshore Transmission Owners (OFTOs), and an ‘enduring regime’ (post-2012), in which offshore transmission grids were either built directly by OFTOs or transferred to OFTOs once construction was completed. Licenses to build and/or operate offshore grids were distributed through a competitive tendering process overseen by Ofgem. To attract private investments, the OFTO license regulations are deliberately appealing, offering investors a solid fixed 20-year return on a relatively low risk profile, underwritten by a stable regulatory framework (KPMG, 2012).

Following the 2012–2015 ITPR policy review (Integrated Transmission Planning and Regulation), Ofgem announced that it wanted to change its onshore transmission regulations from the negotiated model to a competitive tendering model, known as the Competitively Appointed Transmission Owner (CATO) regime. By providing stable, long-term (25-years), financially attractive revenues, the CATO regime aims to mobilise large amounts of private investment (e.g., from the financial community) for discrete infrastructure projects with expected capital expenditures of over £100 million. The competitive tendering process also aims to keep costs low, allowing TNOs, construction companies, and other companies to bid for the design, financing, construction, ownership, and operation of onshore transmission grid assets. Although the new CATO regime was supposed to commence in 2018, Ofgem announced in June 2017 that it had to be postponed because, in the aftermath of the 2016 Brexit decision, Parliament had been unable to make the necessary legislative changes (Ofgem, 2017).

4.4 Electricity Consumption Sub-system

4.4.1 Techno-Economic Developments

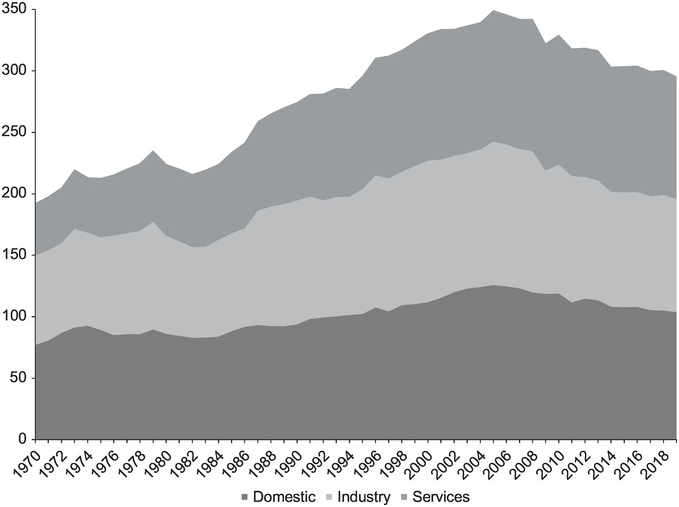

Electricity consumption (Figure 4.11) peaked in 2005 and then declined by 15% to 2019, owing to the combined effect of energy efficiency innovations, the financial crisis (and austerity policies), and offshoring which reduced industrial demand (Hardt et al., Reference Hardt, Owen, Brockway, Heun, Barrett and Taylor2018, Reference Hardt, Barrett, Brockway, Foxon, Heun and Owen2017). Although electricity consumption by households, industry, and servicesFootnote 9 is of roughly equal size, we focus here on domestic consumption, because of our interest in social practices and end-use functionalities.

Figure 4.11 Final electricity consumption by different sectors in TWh, 1970–2019

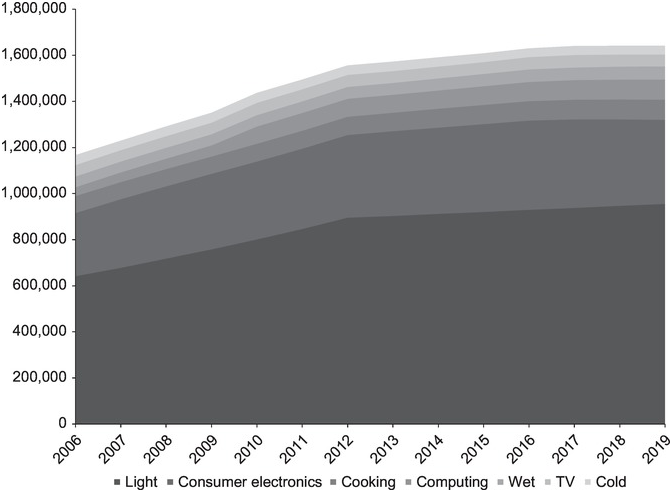

The number of appliances in UK households has increased continuously since the 1970s (BEIS, 2019; Figure 4.12) because of the introduction of new products (e.g., juicers, microwaves, mobile phones, television flat screens), more use of existing products for different purposes (e.g., more lightbulbs to create ambiance), multiple household ownership of some appliances (e.g., fridges, TVs, computers), and increasing affordability due to manufacturing efficiencies and cost decreases (EST, 2011; McMeekin et al., Reference McMeekin, Geels and Hodson2019; Van Buskirk et al., Reference Van Buskirk, Kantner, Gerke and Chu2014).

Figure 4.12 Total number of electrical appliances owned by UK households in thousands, 2006–2019

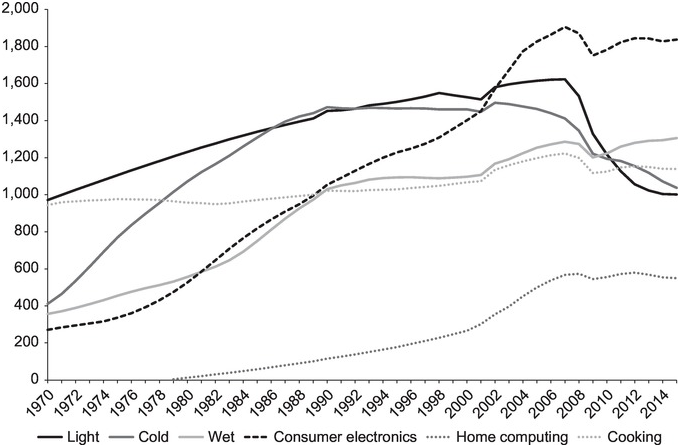

Household electricity consumption increased until 2005, but then declined by 17% until 2019 (Figure 4.11), despite increasing appliance use (Figure 4.12) by an increasing population. Electricity consumption by various domestic appliances has evolved in different ways in the last four decades (Figure 4.13), reflecting different diffusion patterns and innovation trajectories.

Figure 4.13 UK domestic electricity consumption by appliance category (1970–2015) in kilotons of oil equivalent

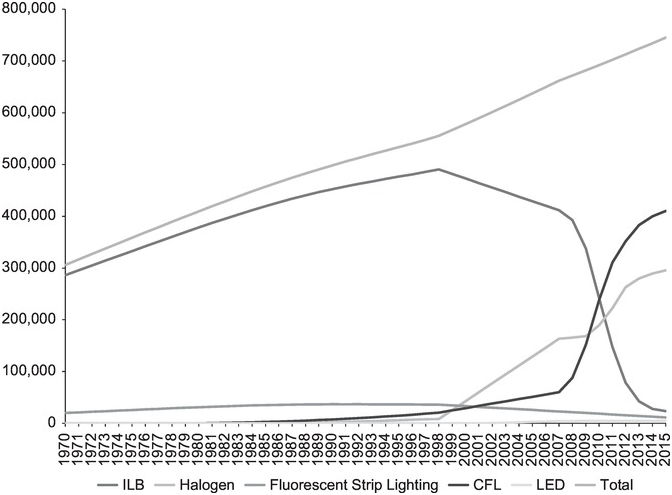

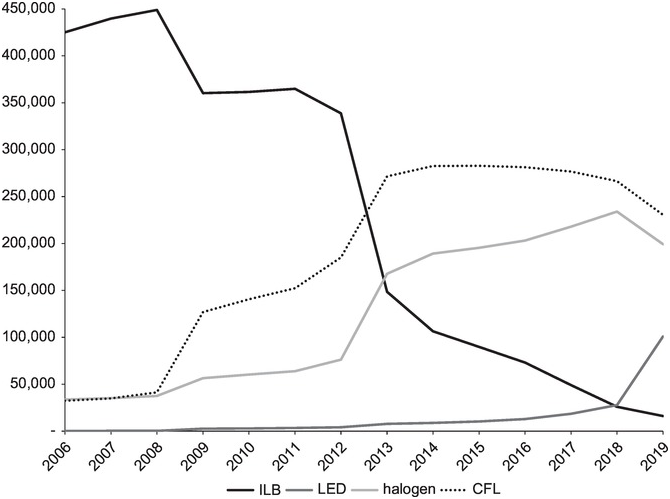

Electricity use for lighting increased until the mid-2000s, owing to expanding numbers of lightbulbs in UK households. Between 2007 and 2015, however, electricity use for lighting decreased by 38% (Figure 4.13), owing to a technological shift from ILBs (incandescent light bulbs) to CFLs (compact fluorescent lighting), halogen bulbs, and LEDs (light emitting diodes) (Figure 4.14). This unfolding transition (which is further analysed in Section 4.5.5) has reduced electricity consumption because the new technologies are more energy efficient than ILBs, which convert only 5% of electrical energy into light (Aman et al., Reference Aman, Jasmon, Mokhlis and Bakar2013).

Figure 4.14 Number of light bulbs (in thousands) owned by UK households, 1970–2015

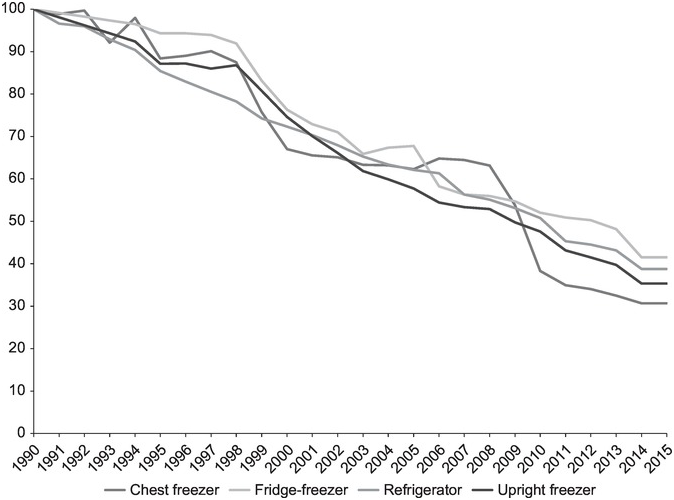

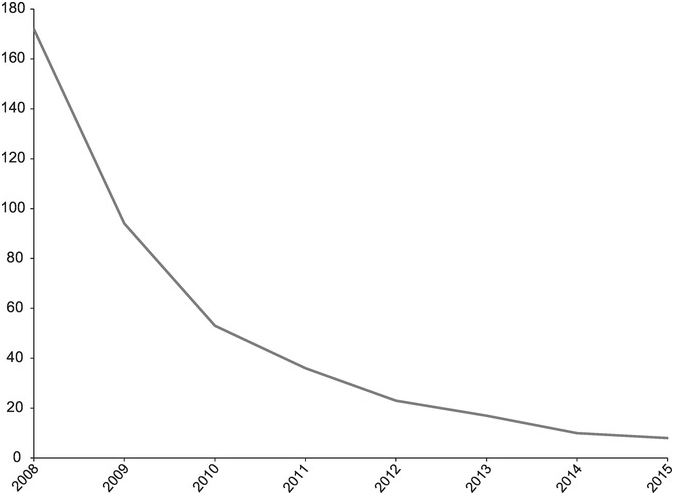

Electricity use by cold appliances started to decrease in the 1990s, despite continued proliferation of refrigerators, fridge-freezers, chest freezers, and upright freezers. This decrease was driven by impressive incremental energy efficiency innovations that reduced electricity consumption for new appliances by 59–69% between 1990 and 2015 (Figure 4.15).

Figure 4.15 Average energy consumption of new cold appliances, 1990–2015 (index 1990=100)

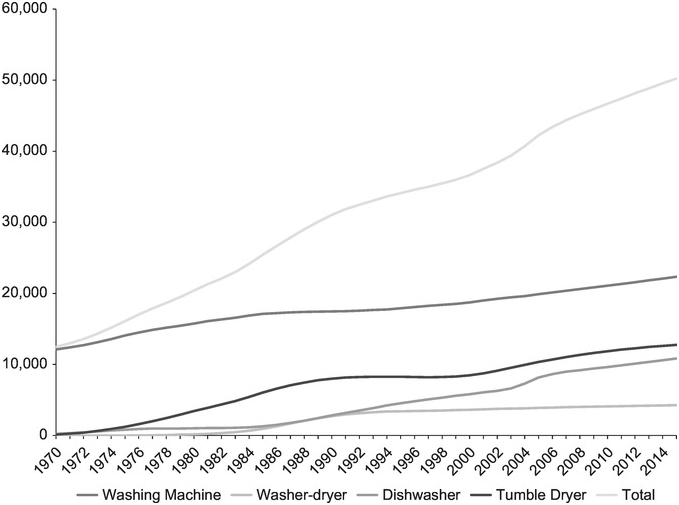

Electricity use by wet appliances increased in the 1970s and 1980s, plateaued in the 1990s, but has increased further since the early 2000s. Electricity use by washing machines decreased between 1986 and 2015, owing to 33% energy efficiency improvements in new washing machines in that period (DECC, 2016). But these effects were counteracted by the diffusion of new appliances such as dishwashers, tumble dryers, and washer-dryers (Figure 4.16), which also became larger and more powerful.

Figure 4.16 Number of wet appliances (in thousands) owned by UK households, 1970–2015

Electricity use for cooking has remained largely stable since the 1970s (Figure 4.13). Electricity consumption by consumer electronics has increased substantially since the 1970s, owing to a quadrupling of TV ownership (resulting in more than two TVs per household by 2015) and the proliferation of new appliances (set-top boxes, games consoles, and DVD/VCR products). Since the mid-2000s, however, energy efficiency innovations such as increasing use of light-emitting diodes (Park et al., Reference Park, Phadke, Shah and Letschert2013) has helped to stabilise electricity use by consumer electronics (Figure 4.13).

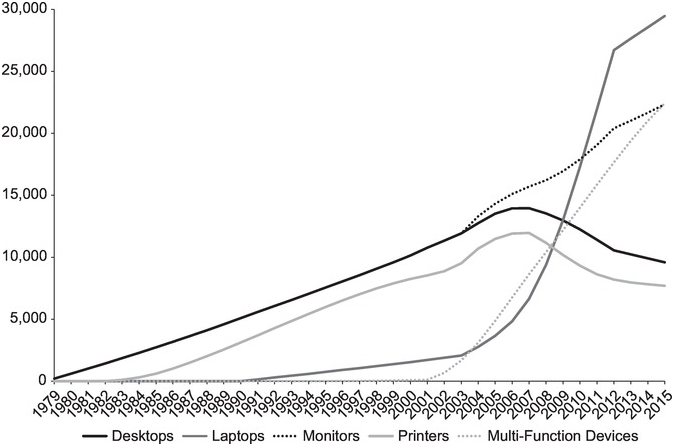

Electricity use by home computing increased substantially in the 1990s and 2000s due to the emergence of an information society and the associated proliferation of computers, monitors, gadgets, and devices with higher processing power, improved connectivity, and additional functionalities (Chandler, Reference Chandler2001; Røpke et al., Reference Røpke, Christensen and Jensen2010). Since the late-2000s, however, their domestic electricity consumption has stabilised (Figure 4.13) because of energy efficiency innovations and the shift from desktops to laptops and from printers to multi-functional devices (Figure 4.17).

Figure 4.17 Number of home computing devices (in thousands) owned by UK households, 1970–2015

4.4.2 Actors

Firms: Most electric appliances are imported into the UK or produced by foreign-owned manufacturing facilities, leading to the decline of UK electric appliance manufacturing (Beynon et al., Reference Beynon, Cam, Fairbrother and Nichols2003). While appliance brands have proliferated in the UK, these are owned by a small number of multinational companies operating in a highly concentrated and oligopolistic market. Multinational appliance manufacturers (of televisions, radios, computers, refrigerators) are economically important and technically dynamic, generating high degrees of product innovation along many quality and performance dimensions (Chandler, Reference Chandler2001; Godoe, Reference Godoe2000). The Association of Manufacturers of Domestic Appliances (AMDEA) is the UK appliance trade association, which represents the interests of international appliance firms active in the UK.

In the early 1990s, appliance manufacturers and trade associations such as AMDEA resisted the European Union’s energy efficiency initiatives (Boardman, Reference Boardman2004). They ‘refused to supply data and cooperate in an energy efficiency study upon which to base policy, hampering the efforts of the EU to meet its obligations under the Climate Convention’ (Newell and Paterson, Reference Newell and Paterson1998: 684). This resistance stemmed from the belief that energy efficiency was a marginal issue for consumers and that energy labels would therefore only impose costs on manufacturers (Toke, Reference Toke2000).

By the mid-1990s, however, these actors changed their strategic orientation and began to engage more actively with energy efficiency as an additional consideration. By 1996, ‘AMDEA had become convinced that they needed to protect their interests by acting within, rather than against the energy efficiency lobby. Their world view had changed. Peter Carver, AMDEA Director commented: “Pressure on us to improve energy efficiency is never ending. Unless we agree voluntary codes, regulations at a European level are inevitable”’ (Toke, Reference Toke2000: 850). Since then, AMDEA has been involved in several initiatives, further discussed later, and by the 2010s was actively lobbying for stronger energy efficiency policies: ‘A change in focus is required so that policies to reduce demand for electricity receive at least as much, if not more, attention than policies to encourage low carbon electricity generation’ (AMDEA, 2014: 7).

As such, the energy efficiency agenda has been actively incorporated by incumbent firms, partly as a strategy for regime protection and reproduction. Their mostly incremental innovation strategies substantially improved energy efficiency performance in cold appliances, wet appliances, consumer electronics, and home computing devices. In 2010, the Energy Saving Trust established a ‘voluntary retailer initiative’, in which eight leading retailers agreed to promote more energy efficient computers and televisions and remove the most inefficient models from their shelves by 2011 (IPPR, 2013).

Incumbent lighting companies pursued a more radical innovation strategy, shifting from ILBs to more efficient CFLs and LEDs (Franceschini and Alkemade, Reference Franceschini and Alkemade2016). This shift, which is further analysed in Section 4.5.5, was stimulated by pressure from environmental NGOs, regulatory pressure that culminated in the 2009 European ILB ban, and competitive pressure from Chinese companies, which made incumbent companies more willing to explore the economic opportunities of new lighting technologies.

In sum, appliance and lighting companies have incorporated energy efficiency as an additional regime dimension, which has led to some re-orientation of industry strategies and innovation patterns. But it also left other regime rules intact, such as a focus on persistent innovation, rapid product lifecycles, increasing functionalities, differentiation, and market expansion (Wieser, Reference Wieser, Bakker and Mugge2017; Wieser and Tröger, Reference Wieser and Tröger2018).

Wider Publics: From the main environmental UK NGOs, the Green Alliance has been the most active in pushing the consumer-focused energy efficiency agenda. Since the mid-1990s, its campaigns often aligned with AMDEA in putting pressure on the UK government (and European policymakers) to intensify policy support for energy efficiency (Boardman, Reference Boardman2004). At the European level, environmental NGOs such as WWF and Greenpeace started criticising the inefficiency of ILBs in the early 2000s and succeeded in establishing a new cultural framing that associated ILBs with energy waste (Franceschini and Alkemade, Reference Franceschini and Alkemade2016).

Policymakers: Electricity consumption generally receives less policy attention than electricity supply. Despite its limited visibility, policymakers have been relatively effective in stimulating the development and adoption of energy efficiency innovations in various appliances, leading to a 15% reduction in electricity consumption between 2005 and 2019 (Figure 4.11), despite an increase in the number of appliances (Figure 4.12).

The push for energy efficiency innovation initially came from European regulatory frameworks, and their translation into national demand-oriented policies (Boardman, Reference Boardman2004; Toke, Reference Toke2000). The 1992 European Directive on Energy Labelling, for instance, required manufacturers of light bulbs, white goods (e.g., refrigerators, washing machines, dishwashers), and other appliances to provide consumers with information about the energy efficiency performance of their products.

The UK government was initially slow and reluctant to implement this Directive into national policy, adopting a compliance-only approach in which it introduced labels but otherwise undertook little effort to raise public awareness (Boardman, Reference Boardman2004). The government did, however, establish the Energy Saving Trust in 1992 as an independent body to promote energy efficiency, publish research, and provide information to consumers. Since the mid-1990s, the UK government has begun to engage more strongly with demand reduction and efficiency improvement, which was helped by the strategic reorientation of appliance manufacturers, discussed earlier. Between 1994 and 2012, UK policymakers ran several programmes that placed energy savings obligations on energy suppliers (Rosenow, Reference Rosenow2012), which will be further discussed later.

Regulatory pressures further increased with the 2005 European Ecodesign Directive, which introduced a new framework approach in which minimum energy efficiency standards for energy-using products would be articulated that would increase over time and thus remove the worst products from the market. These tightening standards further stimulated international appliance manufacturers to innovate and improve energy efficiency. The 2005 framework approach was elaborated by the 2009 Ecodesign Directive that specified minimum standards for more than 40 energy-using product groups (including lightbulbs, televisions, refrigerators, and boilers), which were implemented and adjusted through successive Ecodesign working plans (2009–2011, 2012–2014, 2016–2019). For incandescent lightbulbs (ILB), the increasing policy pressure even culminated in a European phase-out policy, which in 2009 banned the sale of ILBs of more than 80W, progressing to lower wattage in successive years (which is further discussed in Section 4.5.5).

The Ecodesign Directive was complemented by the 2010 EU Framework Directive on energy labelling, which updated the 1992 policy by harmonising national measures on end-user information for energy-related products via labelling and product standard information. New Ecodesign and Energy Labelling measures were agreed in 2018 and 2019, covering more product categories and raising standards further.

In the late 2000s, UK policymakers also showed some interest in behaviour change, which led the Energy Saving Trust to initiate information campaigns encouraging consumers to switch off lights when not in use, fill the kettle to the level required, and reduce the use of standby functions. These campaigns were mostly limited in their success, which led policymakers to acknowledge that: ‘Currently we lack deep understanding of the complexities of what really drives energy demand and how to change it at user and provider level’ (DECC, 2012a: 56). Subsequent policy efforts therefore continued to focus mostly on energy efficiency improvements in technical appliances, which have been relatively effective in reducing electricity demand, as noted earlier.

Users: Most electricity consumption is routine, taken for granted, and detached from material supply realities. Most users know little about the worlds behind the socket (how it works, where it comes from, how it is organised). They mainly interact with suppliers through meters and bills, supplier choice, and the occasional need for electrical repair. Consumer switching between suppliers was limited until 2014 but then increased rapidly (Figure 4.10), leading to more new entrants and increased competitive pressure in the electricity market.

Climate change is of less concern to consumers than electricity bills. Few UK consumers opt for ‘green’ electricity suppliers. Although most consumers do not actively choose renewables, they ultimately pay for the upstream investments in RETs and grid innovations through their energy bills and general taxation (which finances government subsidies to generators). This ‘indirect’ or ‘involuntary’ market demand, which has been created through regulations and billing practices, helps explain the higher speed of low-carbon transitions in electricity, compared to other domains (where consumers need to make deliberate choices to buy electric cars, insulate homes, or change food purchases).

Electricity is used by specific appliances, which relate to particular end uses and social practices (Shove and Walker, Reference Shove and Walker2014). Regarding the laundry, for instance, more people have started to wash at low temperatures since the early 2000s (Mylan, Reference Mylan2017). But energy saving gains were counteracted by other behaviour changes such as washing clothes more frequently in smaller loads and drying them in tumble-dryers, driven by the desire for greater convenience (Mylan and Southerton, Reference Mylan and Southerton2018).

Regarding cooling, people have also adopted more energy-efficient fridges and freezers. But here, too, energy savings have been partly eroded by increasing use of multiple cold appliances in households and shifts towards larger appliances (DEFRA, 2009). The associated behavioural trends towards storing more foods and drinks in cold appliances partly relate to the stronger preferences for chilled goods and the increasing ‘cultural significance of freshness’ (Evans and Mylan, Reference Evans and Mylan2019: 426). The increasing use of freezers, in turn, relates to the diffusion of microwaves and ready-meals and to changes in food preparation patterns towards greater convenience and flexibility, which have consequently become significantly entrenched in modern ways of living (Hand and Shove, Reference Hand and Shove2007).

End-uses and social practices are thus deeply intertwined with persistent cultural conventions such as convenience (e.g., storing ready-meals in freezers, heating food in microwaves, dishwashers, drying clothes in tumble dryers), cleanliness (e.g., more frequent laundry cycles), fun and novelty (e.g., new gadgets and functionalities), and freshness (e.g., more cold drinks) as drivers of demand for domestic appliances (Hand and Shove, Reference Hand and Shove2007; Mylan, Reference Mylan, Bulkeley, Paterson and Stripple2016; Mylan and Southerton, Reference Mylan and Southerton2018; Shove, Reference Shove2003). Consumers also expect new functionalities and enhanced standards of home entertainment and digital connectivity (Crosbie, Reference Crosbie2008). More generally, electricity has become a taken-for-granted background to modern life. Increased appliance use is associated with progress, and associated electricity consumption is rarely questioned (Shove and Walker, Reference Shove and Walker2014). The increasing policy and business focus on energy efficiency does not question these cultural conventions or call for deeper behaviour change.

4.4.3 Policies and Governance

Formal Policies

Since the 1990s, European policies have been important in stimulating international appliance manufacturers to improve the energy efficiency of their products, which they actively engaged with after an initial period of resistance, as discussed previously.

National policies have been important to stimulate the adoption of energy-efficient appliances. Since the mid-1990s, UK policymakers have run several programmes that have placed energy savings obligations on energy suppliers, which incentivised them to engage with demand reduction and help diffuse energy-efficient appliances. These included the Energy Efficiency Standards of Performance (EESoP), which ran from 1994 to 2002, the Energy Efficiency Commitments (EEC) from 2002 to 2008, and the Carbon Emissions Reduction Target (CERT) from 2008 to 2012. While EESoP programmes focused exclusively on electric appliances, EEC and CERT also included gas, heating, and home insulation, which increasingly became the prime focus because of greater energy and carbon saving potential.

The various energy savings obligations set (gradually increasing) energy saving targets on energy suppliers, which could pass the costs for their actions and measures on to their customers via energy bills (although this was constrained by price control measures). This policy design fitted with neoliberal policy thinking because it was assumed that companies would compete to meet their targets at the lowest cost to consumers, who were themselves assumed to have incentives to switch to suppliers with the lowest prices (Rosenow, Reference Rosenow2012). The successive programmes with energy savings obligations were relatively effective, leading electricity suppliers to adopt give-away programmes of energy-efficient lightbulbs and the promotion (with retailers) of energy-efficient cold appliances through discounts and targeted in-store marketing strategies (AMDEA, 2014). Between 2002 and 2005, the EEC, for instance, brought forward an estimated 4.5 million sales of fridge-freezers, compared to the existing market trend (DEFRA, 2009).

From 2013, the Energy Company Obligations (ECO) focused exclusively on heating and insulation, which thus relieved electricity companies from demand-reduction obligations.

UK policymakers implemented the 2005 and 2009 European Ecodesign Directives and subsequent upgrades through their Products Policy (DEFRA, 2009), which: a) removed the least efficient products from the market (using European minimum standards), b) encouraged the development of more efficient products (through R&D and innovation policy), and c) stimulated market uptake (through labelling, public information, producer obligations, public procurement, and voluntary initiatives). Initial implementation was relatively slow, so that by 2012 only 13 out of 25 product categories in the first tranche had regulations applied to them (Cary and Benton, Reference Cary and Benton2012). In subsequent years, however, the Products Policy was further implemented, which together with tightening product standards stimulated substantial energy efficiency improvements.

Governance Style

Initial European Energy Labelling Directives were relatively weak market-based policies, which assumed that providing consumers with information (about energy efficiency ratings of appliances) would lead them to choose more energy-efficient products. When this proved limitedly effective, stronger regulatory control policies were introduced such as the European Ecodesign Directives, which articulated gradually strengthening minimum energy efficiency standards that pushed appliance manufacturers to innovate and improve their products.

The policy processes for these Directives were dominated by stakeholder consultation processes and technocratic debates about specifying the minimum level for environmental performance and the most appropriate layout of labels to communicate information to consumers (Rosenow et al., Reference Rosenow, Kern and Rogge2017). The European-level governance style thus has corporatist characteristics, with close interactions between policymakers and incumbent firms, aimed at negotiating the feasible speed of energy efficiency improvements and policies.

UK demand-focused policies also started relatively weakly but gradually strengthened over time, mostly through tightening regulations and standards. Successive energy savings obligations (1994–2012) set gradually increasing targets on electricity companies, which stimulated them to help deploy and diffuse energy-efficient appliances. Energy saving obligations on electricity suppliers were dropped by the 2013 Energy Company Obligations, which focused exclusively on heating and insulation. But since the late 2000s, the UK’s Products Policy has represented a fairly interventionist market shaping governance style, which advanced energy-efficient appliances through increasing minimum standards, labelling, public information, public procurement, and voluntary initiatives.

Energy saving policies thus focused centrally on energy-efficient products, addressing both upstream technological improvements and downstream consumer demand. This product-centred approach suits the interests of incumbent appliance manufacturers, which have therefore come to support the energy efficiency agenda.

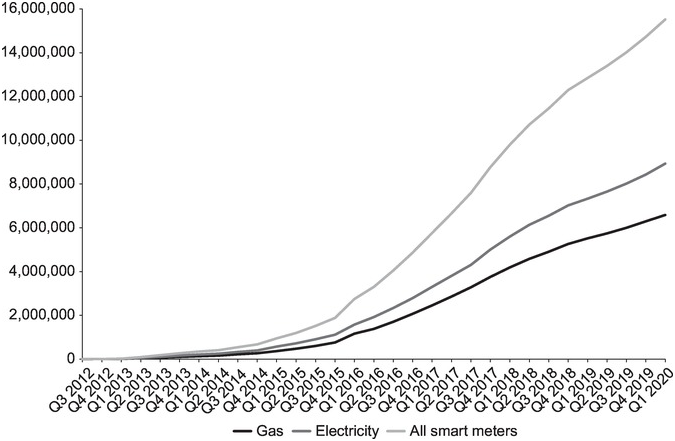

4.5 Niche-Innovations

Radical niche-innovations have emerged and diffused in each of the three electricity sub-systems, leading to substantial reconfiguration. For the electricity generation sub-system, we will analyse four niche-innovations: 1) onshore wind, 2) offshore wind, 3) bio-power, and 4) solar PV. For the electricity consumption sub-system, we will discuss two niche-innovations: 5) energy-efficient lighting, including CFL and LEDs, and 6) smart meters. And for the grid sub-system, we will also analyse two niche-innovations: 7) smart grids, and 8) two flexibility-enhancing options: battery storage and demand-side response.

The analysis of each niche-innovation will address both techno-economic developments and actors and institutions. Several niche-innovations have experienced substantial changes in both analytical dimensions as they first emerged and then diffused. The analysis of niche-innovations in the electricity systems is therefore somewhat longer than for the heat and mobility systems.

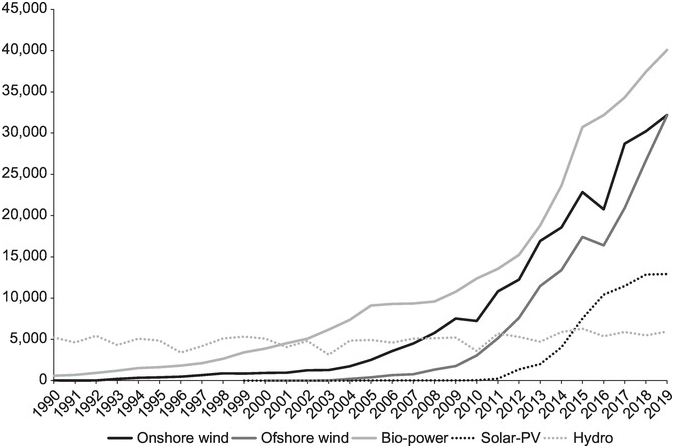

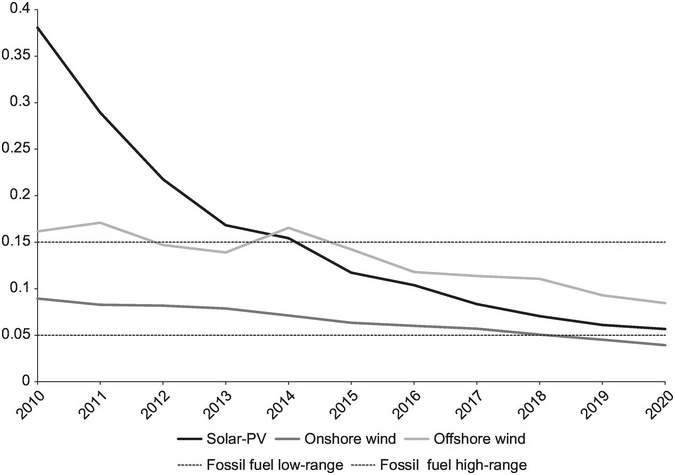

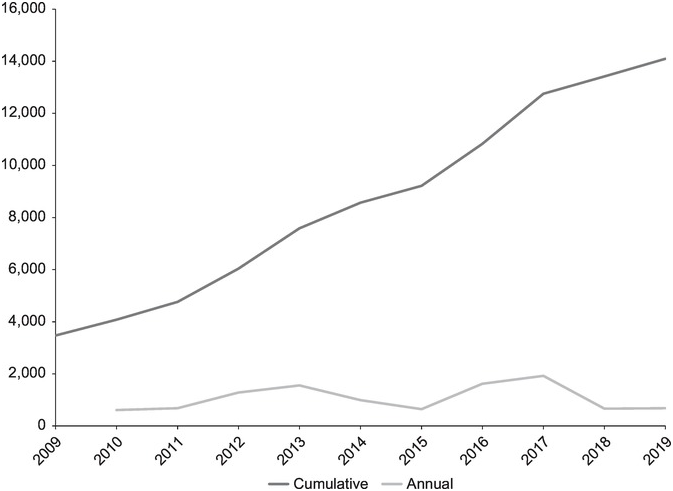

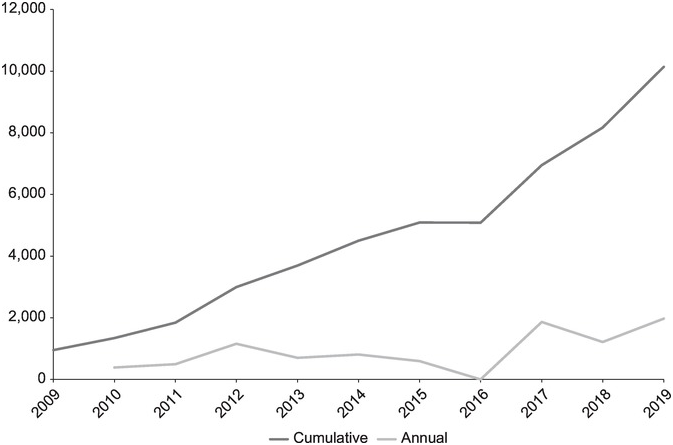

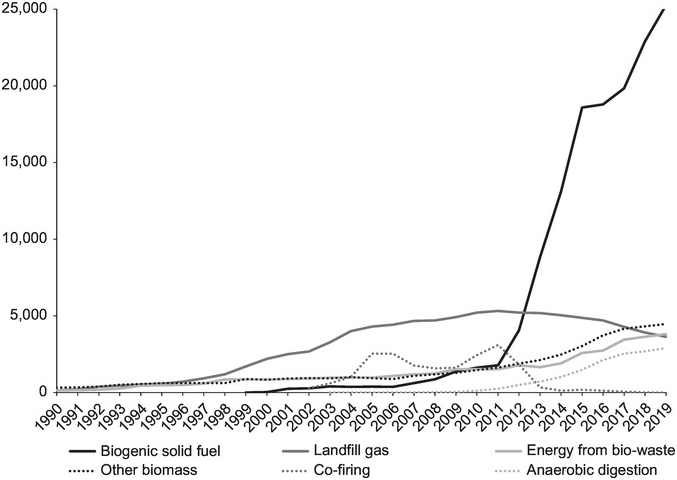

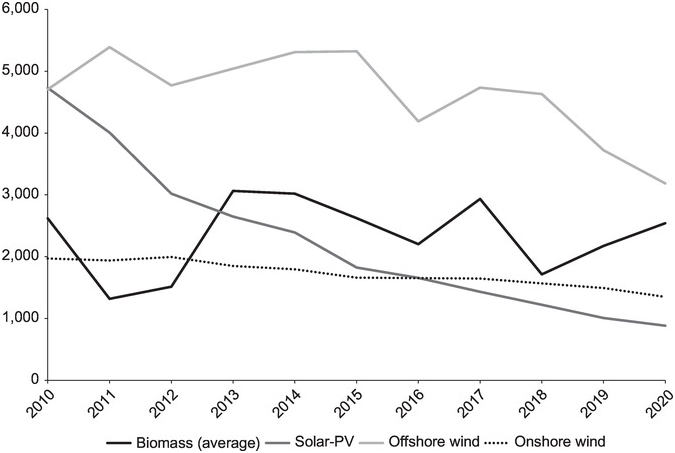

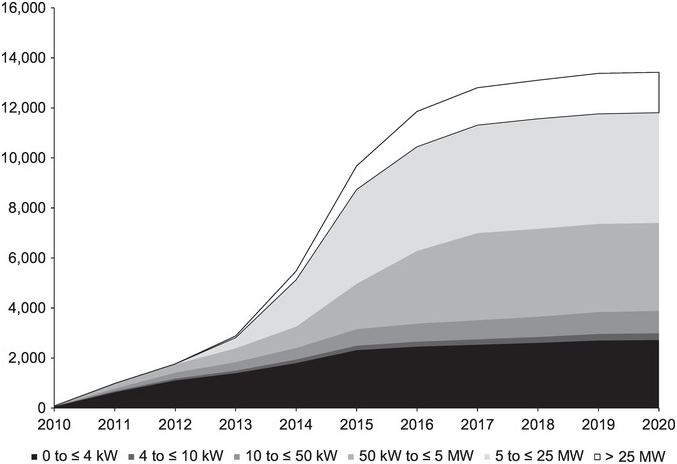

Power-generation niche-innovations, in particular, have experienced relatively long developmental trajectories. Renewable electricity technologies (RETs) emerged in the 1990s, experienced several ups and downs in the 2000s, and diffused quite substantially in the 2010s (Figure 4.18). Onshore wind, offshore wind, and bio-power diffused fastest in recent years, because of government support and deployment by incumbent actors (utilities, project developers, foreign energy companies). Solar-PV also diffused substantially, often through deployment by new entrants such as farmers and households. Cumulatively, RETs accounted for 39% of electricity generation in 2019, which means they are taking on regime-like characteristics. Rapidly falling costs (Figure 4.19) have been an important driver of the diffusion of RETs, which are increasingly cost-competitive with coal and gas-fired power plants. Between 2010 and 2020, the global average levelised cost of electricityFootnote 10 (LCOE) decreased by 85% for utility-scale solar-PV, 56% for onshore wind, and 48% for offshore wind (IRENA, 2021).

Figure 4.18 Electricity generated from renewable sources in GWh, 1990–2019

Figure 4.19 Global average levelised costs of electricity, 2010–2020 (in constant 2020 US dollars per kWh) for different technologies

Other important drivers for rapid diffusion were renewable energy policies, which affected all RETs and are therefore briefly discussed here, before we analyse the individual niche-innovations. Renewable electricity policies emerged as a ‘side-effect’ (Toke and Lauber, Reference Toke and Lauber2007) of support for nuclear power via the 1990 Non-Fossil Fuels Obligation (NFFO) that required electricity companies to buy certain amounts of nuclear power. Renewables’ advocates argued that renewable electricity technologies (RETs) should also qualify for non-fossil fuel subsidies, which led the government to introduce an NFFO policy for renewables in the form of a competitive auction system in five successive rounds between 1990 and 2004. Bidders could submit proposals to produce a certain amount of renewable electricity for a certain price. In each round, the government awarded contracts to the lowest bidders within particular technology bands (Mitchell and Connor, Reference Mitchell and Connor2004).

The NFFO-bidding process was complicated and required sophisticated financial capabilities and sufficient capital to cope with economic risks and policy uncertainties. These characteristics favoured professional corporate actors and discriminated against smaller new entrants with less-developed procedural and financial capabilities and resources (Mitchell and Connor, Reference Mitchell and Connor2004; Toke, Reference Tilly2005). The NFFO was limitedly effective because many accepted bids never resulted in actual RET-deployment, because many winning bidders realised their low-cost proposals were too uneconomical to be realised (Toke and Lauber, Reference Toke and Lauber2007). Over the whole period (1990–2004), only 30% of winning projects were actually completed (Wood and Dow, Reference Wood and Dow2011).

In 2002 the Labour government introduced the Renewables Obligation (RO) as a new policy, requiring utilities to meet gradually increasing annual renewable electricity targets in one of several ways: a) generate renewable electricity themselves, b) buy Renewable Obligation Certificates (ROCs) from other generators, c) pay a ‘buy-out’ penalty of 3p/kWh. The RO was more market-oriented than the NFFO, because it was based on free-market trading of ROCs and abolished the NFFO’s technology banding. Because all RETs received the same number of ROCs, the RO was biased towards cheaper (large-scale) technologies such as onshore wind and landfill gas (Foxon and Pearson, Reference Foxon and Pearson2007). The RO stimulated close-to-market options, neglected innovation, and created uncertainties about longer-term policy commitment (Woodman and Mitchell, Reference Woodman and Mitchell2011). The RO also disadvantaged new entrants, because the trading of ROCs created financial uncertainties, which were easier to manage for incumbent utilities.

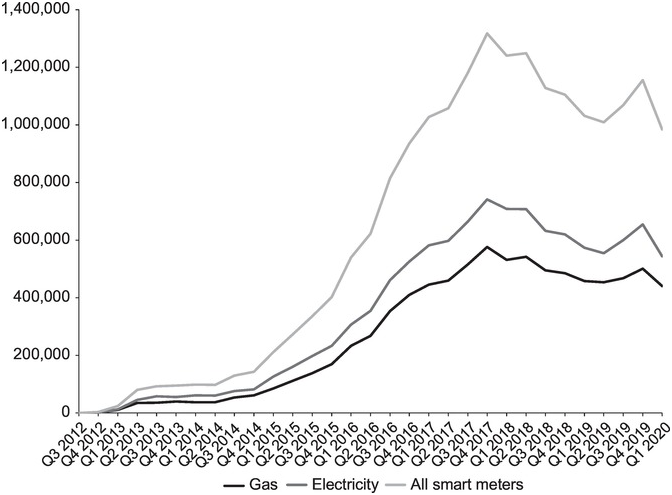

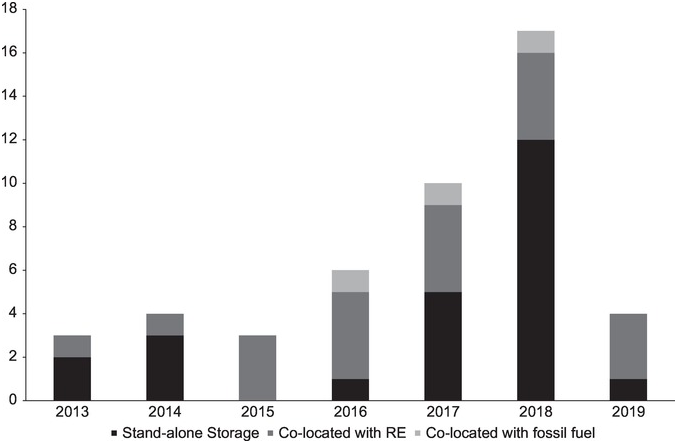

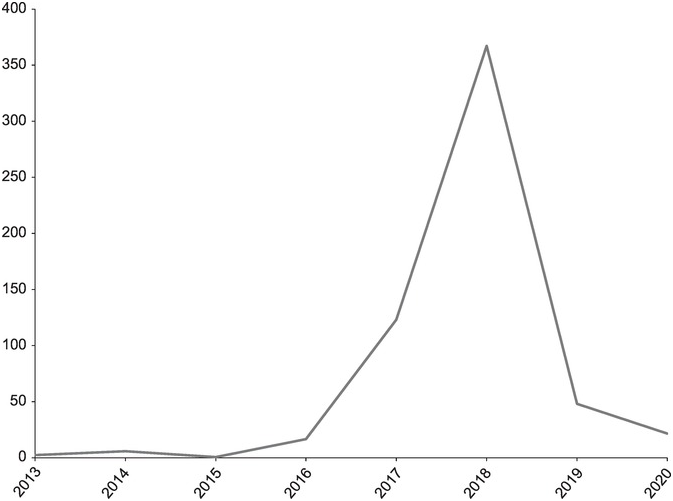

The increasing political salience of climate change resulted in the 2008 Climate Change Act. The translation of its high-level goals into more specific targets and plans increased policy delivery momentum, and the creation of multiple complementary instruments. For the electricity sector, the UK Low Carbon Transition Plan (2009) articulated a target of 30% renewable electricity by 2020 and an almost complete decarbonisation by 2030, which created clear directionality. Criticism of the limited effectiveness of the RO resulted in the amended Renewables Obligation (2009), which included technology bandings that allocated varying amounts of ROCs to different technologies, depending on the degree of maturity and level of risk. In 2010, the government also (reluctantly) introduced a Feed-in-Tariff (FiT) as part of a political deal with backbenchers, who wanted a stimulus for small-scale renewables in exchange for their support for nuclear and offshore wind (Smith et al., Reference Smith2014). The 2013 Electricity Market Reform (discussed in Section 4.2.3) further introduced Contracts for Difference (CfD), which provided attractive long-term incentives for large-scale renewables and nuclear power from 2017 onwards (replacing the Renewables Obligation).