1. Introduction

The focus of this paper is on the study of performance fees in investment funds, that play an important role in the development of retirement savings for many retirees, either through self-managed superannuation/retirement accounts or through pension funds outsourcing of asset management. We believe this is particular relevant in situations where retirees have at least some reasonable portion of their retirement savings in a self-managed account of some form and typically have the ability to allocate retirement capital to different managed funds, which can incur differing fee structures.

There are multiple aspects one could study when it comes to looking into the relationship between fund performance, investment manager decision-making and structuring of remuneration. There exists a robust literature that explores the role of investment decision-making when a fund manager is directly incentivised via options written on the underlying assets that are present in the portfolio under their management. Such problems are very important to study as the choice of such remuneration structuring could compromise the investment decision-makers ability to remain objective and to act in the best interest of the investors in their fund. Such problems have been studied in works such as Carpenter (Reference Carpenter2000) and the references therein.

In this paper, we explore a different but related class of problems compared to those studied in the aforementioned paper and related literature. In particular, our primary interest is to seek to understand how to undertake a valuation of various fee structures that arise in fund management, when the funds are not actively traded and whereby efficient market conditions do not occur, thereby requiring alternatives to risk-neutral pricing of such fee structures.

The paper extends the literature seeking to understand the relationship between fund performance, risk and return versus fee structures, building upon prior works that studied various aspects of performance fee structures in Davanzo & Nesbitt (Reference Davanzo and Nesbitt1987), Foster & Young (Reference Foster and Young2010), Golec (Reference Golec1996), Dellva & Olson (Reference Dellva and Olson1998) and Golec (Reference Golec2003). The term investment or managed fund can refer to numerous types of fund including mutual funds which give small or individual investors access to professionally managed portfolios of equities, bonds, and other securities; exchange traded funds or ETF’s; and actively managed funds seeking to earn an active return or alpha such as hedge funds, to name a few examples. We will not be particularly concerned with the class of fund in this work; rather we will be focused instead on the mathematical interpretation and pricing of fees charged by such funds for a variety of fee model structures.

We also observe that there is a robust literature on the study of option compensation mechanisms for fund managers, where for instance a risk averse fund manager may be compensated with a call option on the assets within the portfolio under their control, see interesting works in this area and the references therein Coles et al. (Reference Coles, Daniel and Naveen2006), Hall & Murphy (Reference Hall and Murphy2002), Low (Reference Low2009) and Ross (Reference Ross2004).

In order to undertake this study, we first develop two dependent stochastic Lévy process models for the Net Asset Value (NAV) of the fund and the NAV of the reference index fund upon which relative performance of the managed fund NAV versus index fund NAV will determine the performance fee payouts. Having developed the stochastic model, the main contributions of this work are then to explore pricing of various industry-based models for fee structures and performance incentive mechanisms that arise regularly in fund management. We seek to price such fee structures in order to quantitatively assess their value to investors and to determine if such fund management fees are competitive from an investors perspective. In order to perform the pricing, we demonstrate that such fee structures can be interpreted under an option-like payoff function that can then be priced via a Monte Carlo pricing simulation. We utilise a Monte Carlo simulation-based approach since the pricing framework will require the evaluation of the various fee and incentive mechanisms which result in the payoff function of the option, characterising such fee and incentive structures, being path-dependent, and therefore, it does not admit a closed form solution. Consequently, we calibrate examples based on diffusion and on jump diffusion models that represent the assumptions regarding the pricing framework in the real-world context and then perform the pricing numerically under different complete and incomplete market assumptions.

To achieve this, we demonstrate how to formulate the resulting pricing problem as an option pricing challenge in an incomplete market pricing context, and this naturally leads us to an actuarial pricing framework. In this context, we explore and contrast models for the managed fund NAV and index fund NAV with and without jumps, and we also explore assumptions of complete and efficient risk-neutral pricing to contrast to the realistic setting in this context of incomplete market pricing undertaken by distortion pricing frameworks. We argue that incompleteness naturally arises in this context as the majority of such funds are not tradable intra-daily and instead just allow position changes at end-of-day only, resulting in a deviation from the standard efficient market assumptions.

In order to make the case studies as practical as possible, the framework we develop in the experimental results section will focus on the performance fee structures used by J.P. Morgan asset management company. We selected their fee structures and incentive mechanisms as this firm is representative of large commercial wealth management investment bank fee and incentive structures used more widely in the asset and fund management sector. We price the fee under different scenarios based on the variations in historical volatility of the data, the variations in fee structure, and the variations in charging mechanism.

The structure of this paper is as follows; in section 2, an overview of wealth management funds fee and performance incentive mechanisms is reviewed. In section 3, the NAV models for the managed fund and reference index fund are developed. Section 4 introduces the details of the fee model and fee-adjusted fund NAV structures. Section 5 presents the valuation frameworks for the fees when applied to the fund NAV relative to a reference index fund NAV for a variety of pricing frameworks ranging from complete to incomplete actuarial pricing. This reviews the various ways that one could approach the pricing of such fee structures and concludes with a Monte Carlo pricing framework and algorithm for implementation of the pricing frameworks applied in non-distortion and distortion-based pricing settings. Section 6 presents a real data case study to study the performance fee pricing frameworks proposed and in the process outlines the required data and information to set up such an analysis. Section 7 develops the results and analysis of the pricing simulation studies, and section 8 provides discussion and analysis of the results.

2. Background on Wealth Management Funds, Fees and Performance Incentive Mechanisms

An ideal fund structure aligns investors’ goals with fund managers’ incentives, which is aimed to be achieved through a fee-based mechanism. There are four basic components that influence this alignment: market forces, government regulation, incentive contracts and ownership structure. Mutual funds generally emphasise the first two factors. In contrast, hedge funds tend to rely more heavily on the latter two.

Fund fees are considered as a cost of capital for investors. Understanding the mechanism of fee charging as well as pricing the fees correctly is vital since the fee structures affect the investor’s net return. There exist numerous types of fee structures for management and performance of investment funds.

The main components of managed funds fee structures involve:

-

1. the expense ratio which is an ongoing fee found in every mutual fund which is typically a fixed percentage of assets under management;

-

2. the sales commission which is an upfront fee known as a “front-end load”;

-

3. a redemption fee that is otherwise known as a “surrender charge” when exiting a fund;

-

4. short-term trading fees which typically disincentivise regular trading in-and-out of funds which may for instance be in 401(k) or managed superannuation; and

-

5. service or distribution fees.

The expense ratio component of fee structures can vary significantly according to several attributes of the fund. One can readily delineate fees according to three basic attributes: active management versus passive management; domestic versus foreign holdings; and constituent assets in the fund such as small-cap versus large-cap funds.

Historically, actively managed funds are argued to have higher operating expenses than passive funds or index funds and consequently this results in relatively higher fee structures. The operating expenses of active funds are attributed to the ongoing analysis and research work required to be conducted when trying to determine the best securities to own.

There are also differences between domestic and internationally focused funds. Typically international funds have higher fees than domestic funds as it can cost more to purchase investments that are traded outside of say the US, and this cost is passed along in the form of higher expense ratios.

Small-cap funds have higher fees than large-cap funds. It costs more to buy and sell small stocks due to challenges with their market liquidity, price volatility and volume available to trade of such assets when compared to large-cap funds. This higher cost is passed along in the form of higher expense ratios.

Index funds or passively managed funds typically have the lowest fees, and these types of funds have proven to be a strong indicator of good future fund performance. Furthermore, the challenging situation with assessment of different fee models is compounded by the fact that different companies may charge widely varying expense ratios for similar funds.

In addition to these aforementioned fee structures that are present in various manifestations in all funds, one can also increasingly encounter what are known as performance fee funds, which charge total expenses, including the performance fee. A performance fee is a type of fee paid to a fund manager as a reward for outperformance. As note in Arnott (Reference Arnott2005), one may view clients who favour performance-based fees as “tacitly accepting their inability to choose active managers.” The performance fee is aimed to incentivise the portfolio manager with the objectives of the investor, driving the outcomes towards a type of Pareto efficiency where both parties are as well off or better off when the fund performs well and, consequently, management effort should be higher for funds with incentive fees.

Symmetric (fulcrum fee) and asymmetric (bonus plan) fees are two main types of performance fees. Although both types provide rewards for the manager’s performance, the fulcrum fee structure symmetrically penalises the manager in the case of under-performance while the bonus plan structure does not do so. According to Carhart (Reference Carhart1997), the asymmetric fees result in riskier strategies compared to symmetric fees. Moreover, asymmetric fees lead to sub-optimal performance compared to symmetric fees in Pohjanpalo (Reference Pohjanpalo2013). It should be noted that an asymmetric structure for the performance fee is, at the time of writing, illegal in the United States if applied to mutual funds (Pohjanpalo, Reference Pohjanpalo2013).

The reason for the ongoing debate regarding what types of performance fees allow for flexible incentive structures while not adversely exposing investors to excess risk is due to the fact that a fund manager’s decisions and strategy can also be affected by the performance fee structure. It is possible that the manager will take more risks and act on their own interest to maximise their own wealth instead of an investors’ wealth. In other words, there is a challenge with asymmetric fee structures in that there is a potential for increased downside risk and investment draw-down that may arise when a fund manager is incentivised to take on greater risk to maximise the expected fee return without taking into account tail exposure, draw-down, diversification factors that may penalise the investors longer-term holdings, sentiments echoed in numerous earlier works such as Grinold & Rudd (Reference Grinold and Rudd1987). According to Guasoni & Obłój (Reference Guasoni and Obłój2016), the performance fee can cause risk shifting in hedge funds. Interestingly, in their work, the notion that high watermarks always increase risk taking is proven to be wrong. Instead, the risk-shifting direction depends on the risk aversion of the manager and higher performance fees will shrink the manager’s risk aversion toward unity.

Regarding mutual funds, according to Pohjanpalo (Reference Pohjanpalo2013), managers with poor mid-year performance tend to take more risks in order to get back on track in a single-period study while, in a multi-period study, there are mixed empirical findings in risk-taking behaviour of the managers. This is because risk shifting is affected by concerns related to the future value of fee income due to the fact that increasing risk in the first period can cause a negative effect to the income in the subsequent periods (Pohjanpalo, Reference Pohjanpalo2013). There are also empirical results in Huang et al. (Reference Huang, Sialm and Zhang2009) showing that risk-shifting funds perform worse compared to risk-stabilising funds.

Often the performance fees have to be allocated based on some evidence of outperformance relative to some pre-defined benchmark. A substantial and growing fraction of mutual funds earn performance/incentive fees which are based on their returns relative to a benchmark. Often the structure of these fees act asymmetrically. They tend to reward the fund manager for outperformance relative to pre-defined benchmark over a pre-defined assessment period, but do not penalise poor performance.

Several studies have been undertaken to explore the relationships between performance fee structures and performance of the fund. In Servaes & Sigurdsson (Reference Servaes and Sigurdsson2018), they demonstrated that funds with performance fees have annual risk-adjusted returns that under-perform funds that don’t charge such fees. They attribute this result to two classes of funds and their structuring, rather than the fund manager attributes, that bias the sample performance. The two classes are those funds without a stochastic benchmark against which performance is measured and funds with a benchmark that is easy to beat.

Furthermore, when assessing relative performance of funds compared to benchmarks in order to determine fee impacts on investors returns, one should also take into account the period of study. For instance, whether the period involves: “risk on” or “risk off” periods and what political and macro-economic factors may influence the observational study and consequently the results of such analysis. In recent times, from a UK/European perspective, following Brexit, and unprecedented financial disruption due to COVID-19 pandemic the future of the European capital market is more uncertain and hard to predict. The uncertainty of the market clearly affects the course of the fund prices. However, this market still represents a huge share of global investments and is open to access to British investors. The United States also face a new era under extreme quantitative easing measures brought forward by the Federal Reserve to tackle the financial shock that occurred at the onset of the first wave of the COVID-19 pandemic and the subsequent loss of economic activity that prevailed throughout 2020 and into 2021. Both large world-class regions are experiencing a period of unstable economics. Therefore, it is of immediate interest to study the performance fee price for European and American funds. We narrow the funds of interest to only mutual funds due to the availability of publicly accessible data. We choose to investigate funds offered by the J.P. Morgan asset management company since the company is ranked 6th as the best asset management company in the world, based on Investment and Pensions Europe ranks in The Top 400 Asset Managers (2017), and again because the fund data from this company is publicly accessible.

3. NAV Models

We will develop a class of stochastic models for the real-world and risk-adjusted pricing formulations of the NAV of a fund and the equivalent for the performance benchmark. Then, we will explore pricing of these fee-based options for a variety of different fee structures under two different pricing frameworks. One will be based on a complete and efficient market risk-neutral pricing formulation, and the second will be exploring an incomplete or inefficient market pricing formulation. The complete market pricing will be applicable to highly liquid funds and indexes while the incomplete will reflect NAV dynamics of much less liquid funds. In this section, we present the stochastic models for the fund NAV and reference index NAV.

We assume that we start with a price process for a portfolio of managed assets denoted generically by

![]() $ (X_t )$

, which will characterise the funds gross asset value (per share) at time

$ (X_t )$

, which will characterise the funds gross asset value (per share) at time

![]() $t$

before any charges and fees. We then build a pair of jump diffusion processes for two such funds, firstly the managed fund of interests NAV, which we will denote by process

$t$

before any charges and fees. We then build a pair of jump diffusion processes for two such funds, firstly the managed fund of interests NAV, which we will denote by process

![]() $ \left(X^{(F)}_t \right)$

to distinguish it from the reference fund price process since the managed fund will be affected by fees. As such, the random variable,

$ \left(X^{(F)}_t \right)$

to distinguish it from the reference fund price process since the managed fund will be affected by fees. As such, the random variable,

![]() $X^{(F)}_t \in \mathbb{R}$

, is the fund NAV at time

$X^{(F)}_t \in \mathbb{R}$

, is the fund NAV at time

![]() $t$

which includes an accrual for all fees and expenses including performance fees up to time

$t$

which includes an accrual for all fees and expenses including performance fees up to time

![]() $t$

. Secondly, the reference index funds NAV or benchmark NAV will be denoted throughout by process

$t$

. Secondly, the reference index funds NAV or benchmark NAV will be denoted throughout by process

![]() $ \left(X^{(I)}_t \right)$

with random variables at time

$ \left(X^{(I)}_t \right)$

with random variables at time

![]() $t$

given by

$t$

given by

![]() $X^{(I)}_t \in \mathbb{R}$

to indicate the benchmark reference index funds NAV at time

$X^{(I)}_t \in \mathbb{R}$

to indicate the benchmark reference index funds NAV at time

![]() $t$

.

$t$

.

We assume the fund NAV and benchmark NAV each follow a real-world jump diffusion model specified as follows:

\begin{align} \begin{split} dX^{(F)}_t &=(r - d_F -\mu _F)\,X^{(F)}_t\, dt\,+\,\sigma _{F}\,X^{(F)}_t\,dW^{(F)}_t + X^{(F)}_t d\!\left (\sum _{i=1}^{N^{(F)}(t)}\left(J^{(F)}_i - 1\right)\right ), \\ dX^{(I)}_t &= (r - d_I -\mu _I)\,X^{(I)}_t\,dt + \sigma _{I}\,X^{(I)}_t\,dW^{(I)}_t + X^{(I)}_t d\!\left (\sum _{i=1}^{N^{(I)}(t)}\left(J^{(I)}_i - 1\right)\right ), \end{split} \end{align}

\begin{align} \begin{split} dX^{(F)}_t &=(r - d_F -\mu _F)\,X^{(F)}_t\, dt\,+\,\sigma _{F}\,X^{(F)}_t\,dW^{(F)}_t + X^{(F)}_t d\!\left (\sum _{i=1}^{N^{(F)}(t)}\left(J^{(F)}_i - 1\right)\right ), \\ dX^{(I)}_t &= (r - d_I -\mu _I)\,X^{(I)}_t\,dt + \sigma _{I}\,X^{(I)}_t\,dW^{(I)}_t + X^{(I)}_t d\!\left (\sum _{i=1}^{N^{(I)}(t)}\left(J^{(I)}_i - 1\right)\right ), \end{split} \end{align}

where subscript

![]() $F$

and

$F$

and

![]() $I$

refer to the parameters/state process for the fund and the reference index fund, respectively, and we describe the model parameters as follows:

$I$

refer to the parameters/state process for the fund and the reference index fund, respectively, and we describe the model parameters as follows:

-

$r$

is the risk-free rate (domestic interest rates),

$r$

is the risk-free rate (domestic interest rates), -

$d_F$

and

$d_F$

and

$d_I$

are dividends (foreign interest rates),

$d_I$

are dividends (foreign interest rates), -

$\mu _F$

and

$\mu _F$

and

$\mu _I$

are the drifts,

$\mu _I$

are the drifts, -

$\sigma _{F} \geq 0$

is the volatility of the fund NAV,

$\sigma _{F} \geq 0$

is the volatility of the fund NAV, -

$\sigma _{I} \geq 0$

is the volatility of the benchmark NAV,

$\sigma _{I} \geq 0$

is the volatility of the benchmark NAV, -

$W^{(F)}_t$

is a

$W^{(F)}_t$

is a

$\mathbb{P}_{X^{(F)}}$

-Brownian motion and

$\mathbb{P}_{X^{(F)}}$

-Brownian motion and

$W^{(I)}_t$

is a

$W^{(I)}_t$

is a

$\mathbb{P}_{X^{(I)}}$

-Brownian motion,

$\mathbb{P}_{X^{(I)}}$

-Brownian motion, -

$N^{(F)}(t)$

and

$N^{(F)}(t)$

and

$N^{(I)}(t)$

are each independent Poisson processes with rates

$N^{(I)}(t)$

are each independent Poisson processes with rates

$\lambda _F \gt 0$

and

$\lambda _F \gt 0$

and

$\lambda _I \gt 0$

respectively,

$\lambda _I \gt 0$

respectively, -

$ \left\{J_i^{(F)} \right\}$

and

$ \left\{J_i^{(F)} \right\}$

and

$ \left\{J_i^{(I)} \right\}$

are independent sequences of identically distributed non-negative random variables such that

$ \left\{J_i^{(I)} \right\}$

are independent sequences of identically distributed non-negative random variables such that

$Y_i^{({\cdot})} = \log \!\left(J_i^{({\cdot})} \right)$

are random variables with an asymmetric double exponential distribution with density(2)with

$Y_i^{({\cdot})} = \log \!\left(J_i^{({\cdot})} \right)$

are random variables with an asymmetric double exponential distribution with density(2)with \begin{equation} f_Y(y) = p.\eta _1\exp\! ({-}\eta _1 y)\mathbb{I}_{y \geq 0} + (1-p)\eta _2\exp\! (\eta _2 y)\mathbb{I}_{y \lt 0} \end{equation}

\begin{equation} f_Y(y) = p.\eta _1\exp\! ({-}\eta _1 y)\mathbb{I}_{y \geq 0} + (1-p)\eta _2\exp\! (\eta _2 y)\mathbb{I}_{y \lt 0} \end{equation}

$p \in [0,1]$

.

$p \in [0,1]$

.

Having specified the Lévy process models for the fund NAV and benchmark NAV, it will be beneficial to also present the time discretised representations of these models. This will be required in section 4 where we define a variety of fee pricing models, each case will be some form of path-dependent payoff structure that will be priced or evaluated at time

![]() $t$

according to option pricing mechanism. The pricing of which will be performed numerically via Monte Carlo distortion pricing. To achieve this, we first need to provide a representation of the discrete time characterisations of the NAV models that will be used for Monte Carlo distortion pricing. We will do this for two classes of models, those without jump diffusion structures

$t$

according to option pricing mechanism. The pricing of which will be performed numerically via Monte Carlo distortion pricing. To achieve this, we first need to provide a representation of the discrete time characterisations of the NAV models that will be used for Monte Carlo distortion pricing. We will do this for two classes of models, those without jump diffusion structures

![]() $(\lambda _F=\lambda _I = 0)$

and those with jump diffusion structures

$(\lambda _F=\lambda _I = 0)$

and those with jump diffusion structures

![]() $(\lambda _F=\lambda _I = 1)$

.

$(\lambda _F=\lambda _I = 1)$

.

3.1 Time discretised net asset value models (no jumps)

If we consider the case that (

![]() $\lambda _F=\lambda _I = 0)$

, then we have a pure diffusion model. For a small time interval

$\lambda _F=\lambda _I = 0)$

, then we have a pure diffusion model. For a small time interval

![]() $\Delta t$

, given the NAV process values,

$\Delta t$

, given the NAV process values,

![]() $X^{(F)}_t$

and

$X^{(F)}_t$

and

![]() $X^{(I)}_t$

, at time

$X^{(I)}_t$

, at time

![]() $t$

, we discretise the fund NAV

$t$

, we discretise the fund NAV

![]() $X^{(F)}_{t+\Delta t}$

and the benchmark NAV

$X^{(F)}_{t+\Delta t}$

and the benchmark NAV

![]() $X^{(I)}_{t+\Delta t}$

at time

$X^{(I)}_{t+\Delta t}$

at time

![]() $t+\Delta t$

by applying the lognormal model given by

$t+\Delta t$

by applying the lognormal model given by

\begin{align} \begin{split} X^{(F)}_{t+\Delta t} &= X^{(F)}_t\,\exp \!\left(\left(\widetilde{\mu }_F-0.5\sigma _{F}^2 \right)\Delta t+\sigma _{F} \sqrt{\Delta t} Z_{X^{(F)},t+\Delta t} \right),\\ X^{(I)}_{t+\Delta t} &= X^{(I)}_t\,\exp \!\left(\left(\widetilde{\mu }_I-0.5\sigma _{I}^2 \right)\Delta t+\sigma _{I} \sqrt{\Delta t} Z_{X^{(I)},t+\Delta t}\right), \end{split} \end{align}

\begin{align} \begin{split} X^{(F)}_{t+\Delta t} &= X^{(F)}_t\,\exp \!\left(\left(\widetilde{\mu }_F-0.5\sigma _{F}^2 \right)\Delta t+\sigma _{F} \sqrt{\Delta t} Z_{X^{(F)},t+\Delta t} \right),\\ X^{(I)}_{t+\Delta t} &= X^{(I)}_t\,\exp \!\left(\left(\widetilde{\mu }_I-0.5\sigma _{I}^2 \right)\Delta t+\sigma _{I} \sqrt{\Delta t} Z_{X^{(I)},t+\Delta t}\right), \end{split} \end{align}

where

![]() $\widetilde{\mu }_F$

and

$\widetilde{\mu }_F$

and

![]() $\widetilde{\mu }_I$

are the generic drift functions. For instance, in the model in Equation (1) these would be given by

$\widetilde{\mu }_I$

are the generic drift functions. For instance, in the model in Equation (1) these would be given by

![]() $\widetilde{\mu }_F = r-d_F-\mu _F$

and

$\widetilde{\mu }_F = r-d_F-\mu _F$

and

![]() $\widetilde{\mu }_I = r-d_I-\mu _I$

, respectively. Furthermore, under this discretised lognormal distribution form, the random vector

$\widetilde{\mu }_I = r-d_I-\mu _I$

, respectively. Furthermore, under this discretised lognormal distribution form, the random vector

![]() $\left(Z_{X^{(F)},t+\Delta t}, Z_{X^{(I)},t+\Delta t}\right)$

is distributed as a standard bivariate normal distribution with correlation

$\left(Z_{X^{(F)},t+\Delta t}, Z_{X^{(I)},t+\Delta t}\right)$

is distributed as a standard bivariate normal distribution with correlation

![]() $\sigma _{FI}$

. We also denote the tracking error standard deviation of the difference between fund and benchmark returns by

$\sigma _{FI}$

. We also denote the tracking error standard deviation of the difference between fund and benchmark returns by

![]() $\sigma _{F-I}$

.

$\sigma _{F-I}$

.

3.2 Time discretised net asset value models (with jumps)

If we consider the case that (

![]() $\lambda _F=\lambda _I = 1)$

, then we have a jump diffusion model where we consider the Lévy Process structures which incorporate the Poisson Process jump diffusion components in addition to the geometric random walk components. It was shown in Kou (Reference Kou2002) that the solution to this class of NAV jump diffusion models is given by

$\lambda _F=\lambda _I = 1)$

, then we have a jump diffusion model where we consider the Lévy Process structures which incorporate the Poisson Process jump diffusion components in addition to the geometric random walk components. It was shown in Kou (Reference Kou2002) that the solution to this class of NAV jump diffusion models is given by

\begin{align} \begin{split} X^{(F)}_t &= X^{(F)}_0\exp \!\left \{\left (\widetilde{\mu }_F - \frac{1}{2}\sigma _F^2\right )t + \sigma _F W^{(F)}_t \right \}\prod _{i=1}^{N^{(F)}_t}V_i^{(F)},\\ X^{(I)}_t &= X^{(I)}_0\exp \!\left \{\left (\widetilde{\mu }_I - \frac{1}{2}\sigma _I^2\right )t + \sigma _I W^{(I)}_t \right \}\prod _{i=1}^{N^{(I)}_t}V_i^{(I)}, \end{split} \end{align}

\begin{align} \begin{split} X^{(F)}_t &= X^{(F)}_0\exp \!\left \{\left (\widetilde{\mu }_F - \frac{1}{2}\sigma _F^2\right )t + \sigma _F W^{(F)}_t \right \}\prod _{i=1}^{N^{(F)}_t}V_i^{(F)},\\ X^{(I)}_t &= X^{(I)}_0\exp \!\left \{\left (\widetilde{\mu }_I - \frac{1}{2}\sigma _I^2\right )t + \sigma _I W^{(I)}_t \right \}\prod _{i=1}^{N^{(I)}_t}V_i^{(I)}, \end{split} \end{align}

where in each model one has (dropping temporarily index F or I)

with

![]() $\eta _1 \gt 1$

ensuring that

$\eta _1 \gt 1$

ensuring that

![]() $\mathbb{E}[V] \leq \infty$

and

$\mathbb{E}[V] \leq \infty$

and

![]() $\mathbb{E}[X_t] \leq \infty$

. From these solutions to the diffusion equations, one can then obtain a discretised return over an interval of time

$\mathbb{E}[X_t] \leq \infty$

. From these solutions to the diffusion equations, one can then obtain a discretised return over an interval of time

![]() $\Delta t$

as follows:

$\Delta t$

as follows:

\begin{align} \begin{split} \frac{X^{(F)}_{t+\Delta t} - X^{(F)}_{t}}{{X^{(F)}_{t}}} &= \exp \!\left \{\left (\widetilde{\mu }_F - \frac{1}{2}\sigma _F^2\right )\Delta t + \sigma _F \!\left (W^{(F)}_{t+\Delta t} - W^{(F)}_{t} \right ) + \sum _{i=N^{(F)}_t+1}^{N^{(F)}_{t+\Delta t}}Y^{(F)}_i \right \},\\ \frac{X^{(I)}_{t+\Delta t} - X^{(I)}_{t} }{X^{(I)}_{t}} &= \exp \!\left \{\left (\widetilde{\mu }_I - \frac{1}{2}\sigma _I^2\right )\Delta t + \sigma _I \!\left (W^{(I)}_{t+\Delta t} - W^{(I)}_{t} \right ) + \sum _{i=N^{(I)}_t+1}^{N^{(I)}_{t+\Delta t}}Y^{(I)}_i \right \}. \end{split} \end{align}

\begin{align} \begin{split} \frac{X^{(F)}_{t+\Delta t} - X^{(F)}_{t}}{{X^{(F)}_{t}}} &= \exp \!\left \{\left (\widetilde{\mu }_F - \frac{1}{2}\sigma _F^2\right )\Delta t + \sigma _F \!\left (W^{(F)}_{t+\Delta t} - W^{(F)}_{t} \right ) + \sum _{i=N^{(F)}_t+1}^{N^{(F)}_{t+\Delta t}}Y^{(F)}_i \right \},\\ \frac{X^{(I)}_{t+\Delta t} - X^{(I)}_{t} }{X^{(I)}_{t}} &= \exp \!\left \{\left (\widetilde{\mu }_I - \frac{1}{2}\sigma _I^2\right )\Delta t + \sigma _I \!\left (W^{(I)}_{t+\Delta t} - W^{(I)}_{t} \right ) + \sum _{i=N^{(I)}_t+1}^{N^{(I)}_{t+\Delta t}}Y^{(I)}_i \right \}. \end{split} \end{align}

where the summation over an empty set is taken to be zero. Of course, one can then make a small time scale approximation for the exponential which would expand as approximately

![]() $\exp\! (x) \approx 1 + x + x^2/2$

by

$\exp\! (x) \approx 1 + x + x^2/2$

by

\begin{equation} \frac{X^{({\cdot})}_{t+\Delta t} - X^{({\cdot})}_{t} }{X^{({\cdot})}_{t}} = \widetilde{\mu }_F\Delta t + \sigma _F \sqrt{\Delta t} Z + B Y \end{equation}

\begin{equation} \frac{X^{({\cdot})}_{t+\Delta t} - X^{({\cdot})}_{t} }{X^{({\cdot})}_{t}} = \widetilde{\mu }_F\Delta t + \sigma _F \sqrt{\Delta t} Z + B Y \end{equation}

where

![]() $Z$

and

$Z$

and

![]() $B$

are standard normal and Bernoulli random variables, respectively, with

$B$

are standard normal and Bernoulli random variables, respectively, with

![]() $\mathbb{P}\text{r} (B=1 ) = \lambda \Delta t$

and

$\mathbb{P}\text{r} (B=1 ) = \lambda \Delta t$

and

![]() $\mathbb{P}\text{r} (B=0 ) = 1 - \lambda \Delta t$

and

$\mathbb{P}\text{r} (B=0 ) = 1 - \lambda \Delta t$

and

![]() $Y$

is given by the following

$Y$

is given by the following

\begin{equation} Y=\begin{cases} E^+, & w.p. \;\; p\\[4pt] E^-, & w.p. \;\; 1-p,\\ \end{cases} \end{equation}

\begin{equation} Y=\begin{cases} E^+, & w.p. \;\; p\\[4pt] E^-, & w.p. \;\; 1-p,\\ \end{cases} \end{equation}

where

![]() $E^+$

and

$E^+$

and

![]() $E^-$

are exponential random variables with means

$E^-$

are exponential random variables with means

![]() $1/\eta _1$

and

$1/\eta _1$

and

![]() $1/\eta _2$

respectively.

$1/\eta _2$

respectively.

Having defined the real-world processes and their time discretisations under consideration for describing the NAV of the fund and the reference index fund, we next introduce the fees models.

4. Fee Models and Fee-Adjusted Fund NAV

In this section, we analyse various charging mechanisms of performance fees, and we will explicitly characterise both their functional form and frequency of payment. We will base the development of these fee structures on those one may obtain from the prospectus of the J.P. Morgan asset management company. We feel such a model is an appropriate representation of leading industry practice. However, we note that such fee structures are in general widely adopted in the industry in various similar forms. Furthermore, on occasion we have generalised some components when they were presented in public disclosure with some ambiguity, and as such, the results we obtain represent a fair coverage of realistic fee structures but may not mirror perfectly the practical fee schemes in all ways in the industry practice across different firms.

In developing the fee structure models, we will assume that all the fees are paid through deduction from the fund and the word “being charged” is the same as “being paid” but different from “being accrued.” Due to ambiguity in the definition of high watermark and high watermark return, we assume that high watermark return is the return defined in Equation (12). We use the maximum charged rates if no exact rate is available, and there is no change in the charged rates for the whole period of study. The cumulative share class and cumulative benchmark returns are assumed to be set to zero after the performance fee is paid. We assume no accrual of the performance fee across each valuation year, since fees will be required to be paid in full at or prior to the close of each year. The number of shares is assumed to be constant during the whole period of study. We also assume the operating and administrative fee (OF), and management and advisory fee are paid on the last business day of the valuation month and the performance fee is paid on the last business day of the valuation year where the valuation month and valuation year are the month and year on which we perform our analysis of the fees.

In this section, we will seek to outline the structure of performance fee models considered. The three models for charging performance fees will be the “Claw-Back” mechanism, the “High Watermark” mechanism, and “High Watermark with Cap” mechanism.

Using these three performance fee models, we will construct the following comparative models for fees. The first will act as a reference model (model 0) obtained by disregarding the claw-back condition, which will be based on the cumulative share class return greater than the cumulative benchmark return and will therefore have a symmetric-penalisation structure. The remaining three models (Models 1-3) will be based on the three mechanisms given by “Claw-Back” mechanism, the “High Watermark” mechanism, and “High Watermark with Cap” mechanism, and model 4 which was created as a “Replicate High Watermark” to investigate further the “High Watermark” mechanism.

For each model, we provide the details of how fee accrual and payment are calculated and deducted. We also give the payoff function of each mechanism. Because the share classes of interest to this study are I and C, we take only management and advisory fee (MF), OF, and performance fee (PF) into consideration. Table 1 summarises the frequency of fee accrual and payment for all mechanisms.

Table 1. Overview of fee payment schedules.

Using these time schedules outlined in Table 1, we can then develop the NAV processes presented for the fund and the reference index, to construct the process

![]() $AX_t$

which will characterise the fee-adjusted fund NAV at time

$AX_t$

which will characterise the fee-adjusted fund NAV at time

![]() $t$

which is a fund NAV adjusted for daily accumulated performance fee accrued on the prior valuation period in

$t$

which is a fund NAV adjusted for daily accumulated performance fee accrued on the prior valuation period in

![]() $[0,t-1]$

. We will denote the process for

$[0,t-1]$

. We will denote the process for

![]() $AX_t$

as defining the fee-adjusted fund NAV obtained by assuming the earned fund performance fee is reinvested into the fund and therefore, at any time

$AX_t$

as defining the fee-adjusted fund NAV obtained by assuming the earned fund performance fee is reinvested into the fund and therefore, at any time

![]() $t$

, one would have an adjusted fund NAV given by the process:

$t$

, one would have an adjusted fund NAV given by the process:

where the performance fee determined at the valuation day

![]() $t$

is denoted by

$t$

is denoted by

![]() $PPF_t^{ ( \mathcal{M}_s )}$

which depends on the type of performance fee structure (indexed by model index

$PPF_t^{ ( \mathcal{M}_s )}$

which depends on the type of performance fee structure (indexed by model index

![]() $\mathcal{M}_s$

outlined below in section 4.1) and which depends on the NAV processes of the fund and the reference index, to be defined below.

$\mathcal{M}_s$

outlined below in section 4.1) and which depends on the NAV processes of the fund and the reference index, to be defined below.

In order to define the fee structures to specify

![]() $PPF_t^{ ( \mathcal{M}_s )}$

, we will first define below the share class return (

$PPF_t^{ ( \mathcal{M}_s )}$

, we will first define below the share class return (

![]() $FR$

), the benchmark return (

$FR$

), the benchmark return (

![]() $IR$

) and then the excess return (

$IR$

) and then the excess return (

![]() $ER$

) of the fund relative to the reference index fund return. Then in section 4.1, we will be able to use these definitions to define the

$ER$

) of the fund relative to the reference index fund return. Then in section 4.1, we will be able to use these definitions to define the

![]() $PPF_t^{ ( \mathcal{M}_s )}$

.

$PPF_t^{ ( \mathcal{M}_s )}$

.

By considering a time interval

![]() $t_0$

to

$t_0$

to

![]() $t_1$

, we define these quantities as follows:

$t_1$

, we define these quantities as follows:

\begin{align} \begin{split} FR_{t_1,t_0} &= \frac{AX_{t_1}-AX_{t_0} }{AX_{t_0}},\\[4pt] IR_{t_1,t_0} &= \frac{X^{(I)}_{t_1} - X^{(I)}_{t_0} }{X^{(I)}_{t_0}},\\[4pt] ER_{t_1,t_0} &= FR_{t_1,t_0}-IR_{t_1,t_0}. \end{split} \end{align}

\begin{align} \begin{split} FR_{t_1,t_0} &= \frac{AX_{t_1}-AX_{t_0} }{AX_{t_0}},\\[4pt] IR_{t_1,t_0} &= \frac{X^{(I)}_{t_1} - X^{(I)}_{t_0} }{X^{(I)}_{t_0}},\\[4pt] ER_{t_1,t_0} &= FR_{t_1,t_0}-IR_{t_1,t_0}. \end{split} \end{align}

For some of the fee structure models, the high watermark

![]() $HWM_t$

at time

$HWM_t$

at time

![]() $t$

, which is the highest value of the funds NAV since the start of the investment period, and its return

$t$

, which is the highest value of the funds NAV since the start of the investment period, and its return

![]() $RHWM_t$

, for

$RHWM_t$

, for

![]() $\widetilde{\tau }\leq t_Y \leq t$

, are given by:

$\widetilde{\tau }\leq t_Y \leq t$

, are given by:

\begin{align} \begin{split} HWM_t &= \max \!\left \{X^{(F)}_0,\ldots,X^{(F)}_t\right \},\\ RHWM_t &=\frac{HWM_t-X^{(F)}_{t_Y}}{X^{(F)}_{\widetilde{\tau }} }, \\ \end{split} \end{align}

\begin{align} \begin{split} HWM_t &= \max \!\left \{X^{(F)}_0,\ldots,X^{(F)}_t\right \},\\ RHWM_t &=\frac{HWM_t-X^{(F)}_{t_Y}}{X^{(F)}_{\widetilde{\tau }} }, \\ \end{split} \end{align}

where

![]() $t_Y$

denotes the first business day of the valuation year and

$t_Y$

denotes the first business day of the valuation year and

![]() $\widetilde{\tau }$

denotes the day for which the last time a performance fee was paid. However, the High Watermark mechanism applied in the both 2017 and 2021 prospectuses (J.P.Morgan Asset Management, 2017, 2021) is based on high watermark return

$\widetilde{\tau }$

denotes the day for which the last time a performance fee was paid. However, the High Watermark mechanism applied in the both 2017 and 2021 prospectuses (J.P.Morgan Asset Management, 2017, 2021) is based on high watermark return

![]() $HWMR_t$

as defined below

$HWMR_t$

as defined below

\begin{equation} HWMR_t =\frac{X^{(F)}_t-X^{(F)}_{t_Y}}{X^{(F)}_{\widetilde{\tau }} }, \end{equation}

\begin{equation} HWMR_t =\frac{X^{(F)}_t-X^{(F)}_{t_Y}}{X^{(F)}_{\widetilde{\tau }} }, \end{equation}

where

![]() $\widetilde{\tau }\leq t_Y \leq t$

and the difference in this definition is that the numerator of the second definition utilises the fund NAV at time t, instead of the highest fund NAV up until time t.

$\widetilde{\tau }\leq t_Y \leq t$

and the difference in this definition is that the numerator of the second definition utilises the fund NAV at time t, instead of the highest fund NAV up until time t.

Using these defined return series, one may then specify several practical classes of fee structures used widely in the fund management industry. In order to define accrual performance fee on day

![]() $t$

, denoted by

$t$

, denoted by

![]() $PPF_t^{ ( \mathcal{M}_s )}$

, we will represent for each fee model choice

$PPF_t^{ ( \mathcal{M}_s )}$

, we will represent for each fee model choice

![]() $\mathcal{M}_s$

a fee structure formulated as a type of discounted option with different payoff functions, used to specify the fee model type.

$\mathcal{M}_s$

a fee structure formulated as a type of discounted option with different payoff functions, used to specify the fee model type.

4.1 Model-specific Performance Fee (PF) structures

A daily accrual of a fee will take place constantly, for each fee model type, whenever the following fee model structure conditions are satisfied:

-

$\mathcal{C}_1$

(Claw-Back condition)

$\mathcal{C}_1$

(Claw-Back condition)

$\sum _{s=\widetilde{\tau }}^{s=t}\,FR_{s,s-1} \gt \sum _{s=\widetilde{\tau }}^{s=t}\,IR_{s,s-1}$

,

$\sum _{s=\widetilde{\tau }}^{s=t}\,FR_{s,s-1} \gt \sum _{s=\widetilde{\tau }}^{s=t}\,IR_{s,s-1}$

, -

$\mathcal{C}_2$

(HWM condition)

$\mathcal{C}_2$

(HWM condition)

$\sum _{s=t_Y}^{s=t}\,FR_{s,s-1} \gt HWMR_t$

,

$\sum _{s=t_Y}^{s=t}\,FR_{s,s-1} \gt HWMR_t$

, -

$\mathcal{C}_3$

(CAP condition)

$\mathcal{C}_3$

(CAP condition)

$\sum _{s=t_Y}^{s=t}\,FR_{s,s-1} -\sum _{s=t_Y}^{s=t}\,IR_{s,s-1} \gt CAP$

,

$\sum _{s=t_Y}^{s=t}\,FR_{s,s-1} -\sum _{s=t_Y}^{s=t}\,IR_{s,s-1} \gt CAP$

, -

$\mathcal{C}_4$

(RHWM condition)

$\mathcal{C}_4$

(RHWM condition)

$\sum _{s=t_Y}^{s=t}\,FR_{s,s-1} \gt RHWM_t$

,

$\sum _{s=t_Y}^{s=t}\,FR_{s,s-1} \gt RHWM_t$

,

where the threshold

![]() $CAP$

is a percentage set by the fund manager charging the fees. Using these conditions, one may define several versions of Performance Fee Model (PPF). We will distinguish the

$CAP$

is a percentage set by the fund manager charging the fees. Using these conditions, one may define several versions of Performance Fee Model (PPF). We will distinguish the

![]() $i$

-th model via a model index

$i$

-th model via a model index

![]() $\mathcal{M}_i$

. For each model, there will be a family of PPF’s for that model such that each member of the family of models is determined by the parameter

$\mathcal{M}_i$

. For each model, there will be a family of PPF’s for that model such that each member of the family of models is determined by the parameter

![]() $a_2 \in \mathbb{R}^+$

, which set by the fund manager.

$a_2 \in \mathbb{R}^+$

, which set by the fund manager.

Definition 1. (Reference Mechanism (Model

![]() $\mathcal{M}_{0}$

)) The (daily) accruing payoff of performance fee

$\mathcal{M}_{0}$

)) The (daily) accruing payoff of performance fee

![]() $PPF_t^{(\mathcal{M}_0)}$

at day

$PPF_t^{(\mathcal{M}_0)}$

at day

![]() $t$

is given by

$t$

is given by

Definition 2. (Claw-Back Mechanism (Model

![]() $\mathcal{M}_{1}$

)) The (daily) accruing payoff of performance fee

$\mathcal{M}_{1}$

)) The (daily) accruing payoff of performance fee

![]() $PPF_t^{(\mathcal{M}_1)}$

at day

$PPF_t^{(\mathcal{M}_1)}$

at day

![]() $t$

is given by

$t$

is given by

\begin{equation} PPF_t^{(\mathcal{M}_1)} = \begin{cases} a_2 ER_{t,t-1} AX_{t-1}, \quad \, \text{if $\mathcal{C}_1$ is true,} \\[4pt] 0, \qquad \qquad \qquad\quad \text{otherwise.} \end{cases} \end{equation}

\begin{equation} PPF_t^{(\mathcal{M}_1)} = \begin{cases} a_2 ER_{t,t-1} AX_{t-1}, \quad \, \text{if $\mathcal{C}_1$ is true,} \\[4pt] 0, \qquad \qquad \qquad\quad \text{otherwise.} \end{cases} \end{equation}

In the

![]() $\mathcal{M}_1$

fee model family, the indicator function of the event that

$\mathcal{M}_1$

fee model family, the indicator function of the event that

![]() $\sum _{s=\widetilde{\tau }}^{s=t}\,IR_{s,s-1}$

acts as a hurdle rate, and the word “Claw-Back” reflects the characteristic of the mechanism that the payoff will be accrued in case of claw-back performance but not a jump-back performance (i.e. the under-performance needs to recover before any accrual). Although

$\sum _{s=\widetilde{\tau }}^{s=t}\,IR_{s,s-1}$

acts as a hurdle rate, and the word “Claw-Back” reflects the characteristic of the mechanism that the payoff will be accrued in case of claw-back performance but not a jump-back performance (i.e. the under-performance needs to recover before any accrual). Although

![]() $PPF_t^{(\mathcal{M}_1)}$

can be negative, to penalise the manager in case of under-performance, the cumulative

$PPF_t^{(\mathcal{M}_1)}$

can be negative, to penalise the manager in case of under-performance, the cumulative

![]() $PPF_t^{(\mathcal{M}_1)}$

will never be negative since we will not accrue negative

$PPF_t^{(\mathcal{M}_1)}$

will never be negative since we will not accrue negative

![]() $PPF_t^{(\mathcal{M}_1)}$

if it makes the cumulative amount drop below zero.

$PPF_t^{(\mathcal{M}_1)}$

if it makes the cumulative amount drop below zero.

![]() $PPF_t^{(\mathcal{M}_1)}$

is also called the “Periodic Performance Fee Accrual” in typical fund manager parlance.

$PPF_t^{(\mathcal{M}_1)}$

is also called the “Periodic Performance Fee Accrual” in typical fund manager parlance.

Definition 3. (High Watermark Mechanism (Model

![]() $\mathcal{M}_{2}$

)) The (daily) accruing payoff of performance fee

$\mathcal{M}_{2}$

)) The (daily) accruing payoff of performance fee

![]() $PPF_t^{(\mathcal{M}_2)}$

at day

$PPF_t^{(\mathcal{M}_2)}$

at day

![]() $t$

is given by

$t$

is given by

\begin{equation} PPF_t^{(\mathcal{M}_2)} = \begin{cases} a_2 ER_{t,t-1} AX_{t-1}, \quad \, \text{if $\mathcal{C}_1$ and $\mathcal{C}_2$ are true,} \\[4pt] 0, \qquad \qquad \qquad \quad \text{otherwise,} \end{cases} \end{equation}

\begin{equation} PPF_t^{(\mathcal{M}_2)} = \begin{cases} a_2 ER_{t,t-1} AX_{t-1}, \quad \, \text{if $\mathcal{C}_1$ and $\mathcal{C}_2$ are true,} \\[4pt] 0, \qquad \qquad \qquad \quad \text{otherwise,} \end{cases} \end{equation}

In the case of the

![]() $\mathcal{M}_2$

fee model family, it builds upon the claw-back condition and adds an additional High Water Mark condition to be exceed in order to satisfy the condition to begin accruing fees.

$\mathcal{M}_2$

fee model family, it builds upon the claw-back condition and adds an additional High Water Mark condition to be exceed in order to satisfy the condition to begin accruing fees.

Definition 4. (High Watermark with Cap Mechanism (Model

![]() $\mathcal{M}_{3}$

)) The (daily) accruing payoff of performance fee

$\mathcal{M}_{3}$

)) The (daily) accruing payoff of performance fee

![]() $PPF_t^{(\mathcal{M}_3)}$

at day

$PPF_t^{(\mathcal{M}_3)}$

at day

![]() $t$

is given by

$t$

is given by

\begin{equation} PPF_t^{(\mathcal{M}_3)} = \begin{cases} a_2 \!\left (CAP-\sum _{s=t_Y}^{s=t-1}\,ER_{s,s-1}\right ) AX_{t-1}, \, \text{if $\mathcal{C}_1$, $\mathcal{C}_2$, and $\mathcal{C}_3$ are true,} \\[4pt] a_2 ER_{t,t-1} AX_{t-1}, \qquad \qquad \qquad \quad \quad \,\, \text{if $\mathcal{C}_1$ and $\mathcal{C}_2$ are true but $\mathcal{C}_3$ is false,} \\[4pt] 0, \qquad \qquad \qquad \qquad \qquad \qquad \qquad \, \text{otherwise,} \end{cases} \end{equation}

\begin{equation} PPF_t^{(\mathcal{M}_3)} = \begin{cases} a_2 \!\left (CAP-\sum _{s=t_Y}^{s=t-1}\,ER_{s,s-1}\right ) AX_{t-1}, \, \text{if $\mathcal{C}_1$, $\mathcal{C}_2$, and $\mathcal{C}_3$ are true,} \\[4pt] a_2 ER_{t,t-1} AX_{t-1}, \qquad \qquad \qquad \quad \quad \,\, \text{if $\mathcal{C}_1$ and $\mathcal{C}_2$ are true but $\mathcal{C}_3$ is false,} \\[4pt] 0, \qquad \qquad \qquad \qquad \qquad \qquad \qquad \, \text{otherwise,} \end{cases} \end{equation}

In the case of the

![]() $\mathcal{M}_3$

fee model family, it builds upon the claw-back condition, the High Watermark condition and adds a third condition based on a performance fee cap in case the fund does exceptionally well relative to the reference index. This has the effect of protecting the investors gains should exceptional gains be achieved in a given period by the fund manager, where

$\mathcal{M}_3$

fee model family, it builds upon the claw-back condition, the High Watermark condition and adds a third condition based on a performance fee cap in case the fund does exceptionally well relative to the reference index. This has the effect of protecting the investors gains should exceptional gains be achieved in a given period by the fund manager, where

![]() $CAP-\sum _{s=t_Y}^{s=t-1}\,ER_{s,s-1}$

implies there will be no accrual of performance fee above

$CAP-\sum _{s=t_Y}^{s=t-1}\,ER_{s,s-1}$

implies there will be no accrual of performance fee above

![]() $CAP$

.

$CAP$

.

Definition 5. (Replicate High Watermark Mechanism (Model

![]() $\mathcal{M}_{4}$

)) The (daily) accruing payoff of performance fee

$\mathcal{M}_{4}$

)) The (daily) accruing payoff of performance fee

![]() $PPF_t^{(\mathcal{M}_4)}$

at day

$PPF_t^{(\mathcal{M}_4)}$

at day

![]() $t$

is given by

$t$

is given by

\begin{equation} PPF_t^{(\mathcal{M}_4)} = \begin{cases} a_2 ER_{t,t-1} AX_{t-1}, \quad \, \text{if $\mathcal{C}_1$ and $\mathcal{C}_4$ are true,} \\[4pt] 0, \qquad \qquad \qquad \qquad \text{otherwise,} \end{cases} \end{equation}

\begin{equation} PPF_t^{(\mathcal{M}_4)} = \begin{cases} a_2 ER_{t,t-1} AX_{t-1}, \quad \, \text{if $\mathcal{C}_1$ and $\mathcal{C}_4$ are true,} \\[4pt] 0, \qquad \qquad \qquad \qquad \text{otherwise,} \end{cases} \end{equation}

Having now defined the different fee model structures, it is now important to ask about the valuation of these different fee structures under the specified fund NAV stochastic models and the reference index NAV stochastic models. We will do so by considering two basic questions:

-

Does their valuation warrant their application with regard to performance gains for investors? and

-

Which of these fee structures is most reasonably valued from the investors perspective?

To achieve the required analysis to address these questions, we will reformulate the valuation question for these fee structures as an option pricing question. We will then consider the option pricing framework in both a classical risk-neutral and also an actuarial incomplete distortion pricing contexts.

This will involve consideration of the following pricing challenge. We would like to determine, at any time

![]() $t \in [0,T_j]$

in the

$t \in [0,T_j]$

in the

![]() $j$

-th year, the values of performance fees at the end of the year which are paid annually, denoted generically by

$j$

-th year, the values of performance fees at the end of the year which are paid annually, denoted generically by

![]() $\mathcal{P}_{j} \left(\mathcal{F}^{X^{(F)}}_{t},\mathcal{F}^{X^{(I)}}_{t};\, \mathcal{M}_s \right)$

. This is the model

$\mathcal{P}_{j} \left(\mathcal{F}^{X^{(F)}}_{t},\mathcal{F}^{X^{(I)}}_{t};\, \mathcal{M}_s \right)$

. This is the model

![]() $\mathcal{M}_s$

performance fee structures discounted present valuation, which can be obtained by taking the pricing kernel discounted valuation as follows

$\mathcal{M}_s$

performance fee structures discounted present valuation, which can be obtained by taking the pricing kernel discounted valuation as follows

for an appropriately selected pricing framework, to be discussed in the following section and an option-like discounted end-of-year payoff denoted generically by

![]() $H_t$

which is selected from one of the fee models

$H_t$

which is selected from one of the fee models

![]() $ \left\{PPF_t^{(\mathcal{M}_1)},PPF_t^{(\mathcal{M}_2)},PPF_t^{(\mathcal{M}_3)},PPF_t^{(\mathcal{M}_4)} \right\}$

.

$ \left\{PPF_t^{(\mathcal{M}_1)},PPF_t^{(\mathcal{M}_2)},PPF_t^{(\mathcal{M}_3)},PPF_t^{(\mathcal{M}_4)} \right\}$

.

4.2 Valuation incorporating Performance Fees (PF), Operation Fees (OF) and Management Fees (MF)

We denote the (daily) accruing payoff of OF

![]() $OF_t$

at day

$OF_t$

at day

![]() $t$

and the (daily) accruing payoff of management and advisory fee

$t$

and the (daily) accruing payoff of management and advisory fee

![]() $MF_t$

at day

$MF_t$

at day

![]() $t$

, respectively, by:

$t$

, respectively, by:

\begin{align} \begin{split} OF_t &= \frac{a_0}{252} X_t,\\ MF_t &= \frac{a_1}{252} X_t, \end{split} \end{align}

\begin{align} \begin{split} OF_t &= \frac{a_0}{252} X_t,\\ MF_t &= \frac{a_1}{252} X_t, \end{split} \end{align}

for pre-defined constants

![]() $a_0, a_1 \in \mathbb{R}^+$

where the gross asset value per share

$a_0, a_1 \in \mathbb{R}^+$

where the gross asset value per share

![]() $X_t$

is given by

$X_t$

is given by

\begin{equation} X_t=\frac{X^{(F)}_t+\mathcal{P}_{j}\!\left (\mathcal{F}^{X^{(F)}}_{t},\mathcal{F}^{X^{(I)}}_{t};\, \mathcal{M}_s\right )}{1-\frac{a_0}{252}-\frac{a_1}{252}}. \end{equation}

\begin{equation} X_t=\frac{X^{(F)}_t+\mathcal{P}_{j}\!\left (\mathcal{F}^{X^{(F)}}_{t},\mathcal{F}^{X^{(I)}}_{t};\, \mathcal{M}_s\right )}{1-\frac{a_0}{252}-\frac{a_1}{252}}. \end{equation}

which is derived from the relation

![]() $X^{(F)}_t=X_t-OF_t-MF_t-\mathcal{P}_{j} \left(\mathcal{F}^{X^{(F)}}_{t},\mathcal{F}^{X^{(I)}}_{t};\ \mathcal{M}_s \right)$

.

$X^{(F)}_t=X_t-OF_t-MF_t-\mathcal{P}_{j} \left(\mathcal{F}^{X^{(F)}}_{t},\mathcal{F}^{X^{(I)}}_{t};\ \mathcal{M}_s \right)$

.

5. Valuation Frameworks for Performance Fee Structures

In this section, we outline the framework adopted to study performance fees as well as the mathematical approaches used to value the performance fees.

We note that different fee structures will indeed generate different remuneration outcomes for the fund managers. The standard practice in the industry involves the fund establishing the given fee structures to be adopted; these are typically fixed, at least for a reasonable length of time such as annual but often a lot longer than just annual and they are communicated to the investor through the prospectuses that summarise these structures. Changing fee structures too often requires a lot of investor communication and reporting requirements, changes to accounting systems and costs as well as providing the potential to deter investors from keeping their capital in the fund. As such, we will assume that the fund fees structures are held constant throughout the period of study.

5.1 Scenario-based analysis versus stochastic optimal control approaches

There are two approaches one could adopt to study the valuation of performance fees, the first assumes that the fund manager desires to fix apriori the fee structures based on their target level of risk-return over a range of various investment strategies that they have a mandate to consider to apply when deploying capital from investors. The objective in this context is then to study which fee structures will achieve the desired outcomes for the fund manager profit expectations as well as satisfy the risk averse investors with regard to returns that keep the fund competitive with regard to competitors for a tolerable level of risk dictated by the investors at initial date of investment.

The second approach assumes that the fund manager may dynamically modify any combination of their fee structures, strategies or investment practices over time and that the optimal sequence of such decisions is then obtained by solving a stochastic optimal control problem, see examples in Soner (Reference Soner2004) and Guasoni & Obłój (Reference Guasoni and Obłój2016).

We have not adopted this latter case, as we believe that the scenario-based framework aligns more realistically with a framework that would be practically useful for industry practitioners and investors when compared to the assumptions required to be made for the second case in the context of the studies undertaken in this work. In the first approach, one develops a framework based on scenario analysis valuation that prices the different fee structures in various economic scenarios and under different fund strategy simulations which may seek to assess for each fee structure the expected best case outcomes, the worst case outcomes and typical outcomes under various economic scenarios. This may also include assessment of the sensitivity and stability of the fee structures to changes in various model components.

From the fund manager perspective, such an approach would provide the fund manager with a model-based assessment of the fee dynamic behaviour. In this context, different strategies for the investment practice of the fund combined with various fee structures considered can then be assessed to determine which were optimal for a given risk-return profile of the investors and fund manager cost basis.

From the investors perspective, such a framework is also valuable as it would allow them to compare for a given class of investment strategies characterised by the fund NAV model and a reference benchmark, how different fee structures may impact on their profit in various economic scenario contexts.

Furthermore, fees are not paid out every day but rather accumulate daily over some fixed period, say annually. Then they are paid out at the end of each period. So, if a fund manager was accumulating fees throughout the year, it is unlikely they would be altering their strategies drastically throughout that period too often to try to maximise fees. Rather we believe that they would explore a scenario-based approach to understanding the likely accumulation of fees over time, based on different economic scenarios and investment strategies adopted.

If one were to adopt the second approach based on the stochastic optimal control perspective to study the valuation of performance fees, this would require modifications to the fund NAV jump diffusion model. Ideally, one would adopt a class of models that incorporates a feedback mechanism between the fund NAV and the historical dynamic of the fees accrued by the fund manager making investment decisions. Such an approach would consequently result in a non-linear path-dependent diffusion model, with an integrated fee functional incorporated into the drift, volatility or jump diffusion components of the fund NAV jump diffusion model. This would add significant complexity to the model and the problem formulation would be rewritten as a type of optimal stochastic control problem, which we do not believe reflects the approach that practitioners in the industry would adopt in practice. It is not the tendency of fund managers to dynamically change their fee structures regularly over time, rather these are typically fixed apriori and rarely get changed. A more realistic approach would be one in which the fund manager could alternatively vary their investment strategy for a given fee structure. We have not approached this class of solution in this manuscript, see approaches to formulate such a framework mathematically in Soner (Reference Soner2004)

5.2 Risk-neutral versus actuarial valuation

In this section, we set out the mathematical framework under which we seek to study the pricing of performance fees in fund management under the scenario-based framework described in context in section 5.1. It will be based upon the fact that one may identify fees attributed to a fund performance as a form of option type payoff. Take for example the case of a hedge fund, where incentive plans are primarily bonus plans. In such asset management structures, fund managers typically receive a fraction of the funds return each year in excess of the high watermark. The high watermark for each investor is the maximum share value since the time of his or her investment in the fund. We refer to this fraction of the funds return as a performance fee. This performance fee can be considered as a call option on the profits associated with managing other people money, since the fee structure gives the managers the positive fees with profits but no negative fees with losses.

We make a few further remarks on the treatment of fee structures as a type of optional like payoff and pricing problem formulation. Firstly, it is apparent that the fee structures act as an incentive mechanism for fund managers to attempt to manage funds to generate greater fees. When this activity aligns with improved PnL with managed risk profiles acceptable to investors, then it becomes an effective mechanism. This raises a few interesting considerations. Are there market contexts in which the fund manager can manipulate this outcome to their benefit without a tangible outcome for investors and secondly which fee structures may be more likely for this to occur?

We first remark on these points as follows. We first discuss the ideal setting of efficient markets. In such markets, there should be seldom opportunities to realise an arbitrage and any short-term or instantaneous arbitrage opportunities between an underlying asset market and derivatives such as options written on that asset would be rapidly closed. Furthermore, traders who hold in their portfolio positions in traded derivative contracts would seldom have sufficient capital to significantly influence or alter the price substantially in the underlying asset, simply by trading the underlying in a manner that would benefit their option positions and generate PnL, perhaps to the detriment of investors holding the underlying, such as the fund investors. This is because such efficient markets would have significant liquidity in the order books to prevent significant and permanent price impacts to be effectively enacted to drive price in any given direction. Therefore, in the context of this paper, it would be analogous to saying the fund managers would find it difficult to alter the state of the markets in which they manage positions for the fund in order to generate higher fees from particular fee mechanisms.

However, one can also argue that in practice it is certainly the case that derivative contracts can be used to influence the underlying asset price upon which they were written or that positions in such instruments can result in incentives for market participants to make attempts to influence the underlying assets price behaviour. This is regularly observed when there are large option positions that may expire out of the money, and there is a vested interest for market participants that may have positions expire well out of the money to incentivise shocks or changes in price momentum and volatility of the underlying asset, through either active trading in the underlying or motivating others to do similar actions.

This is clearly more effective in illiquid or incomplete markets more so than very liquid markets as the amount of capital would indeed make it prohibitive for most participants in deeply liquid efficient markets. We note that much of the paper is focussed on the actuarial pricing context of relevance to incomplete market pricing contexts and compared to risk-neutral approach in these settings.

Furthermore, the ability to influence the fund performance will depend on the type of fee structure designed, some fee structures would be harder to manipulate than others as they are referenced to a benchmark index that is not traded by the fund using the investors capital.

Hence, the natural question arises on how best to price such fee-based call options. We will explore the application of well-known methods for complete and incomplete actuarial pricing model frameworks in this context. We do not innovate in this regard but rather we apply these methods in an interesting problem domain in asset management, which in and of itself is a practically meaningful contribution.

Here we will distinguish between efficient and inefficient market valuation. This is of relevance to the context of the study of fees in asset management since some funds are highly liquid and possibly exchange traded and therefore more likely to be efficient in their price discovery while other funds are much less liquid and either only traded at end of day market close or just OTC traded.

One would typically perform valuation of a financial asset under an actuarial framework via a “deflator” or “pricing kernel” for a measurable payoff

![]() $H_t$

, which is given by

$H_t$

, which is given by

where the deflator

![]() $\xi _t$

is concerned with achieving market-consistent valuations of assets and liabilities, see detailed discussion in Bühlmann & Hansjörg (Reference Wüthrich, Bühlmann and Hansjörg2010). In addition to using deflators, the arbitrage-free market-consistent value can also be obtained in the mathematical finance audience by considering the notion of risk-neutral pricing according to a change of measure. These methods involve using probabilistic expectations of discounted present values of future cash flows, but in a world where all investors are risk-neutral. In the ideal complete market setting, the deflator and risk-neutral settings can yield the same unique result in general; however, if one moves to incomplete markets, this starts to differ.

$\xi _t$

is concerned with achieving market-consistent valuations of assets and liabilities, see detailed discussion in Bühlmann & Hansjörg (Reference Wüthrich, Bühlmann and Hansjörg2010). In addition to using deflators, the arbitrage-free market-consistent value can also be obtained in the mathematical finance audience by considering the notion of risk-neutral pricing according to a change of measure. These methods involve using probabilistic expectations of discounted present values of future cash flows, but in a world where all investors are risk-neutral. In the ideal complete market setting, the deflator and risk-neutral settings can yield the same unique result in general; however, if one moves to incomplete markets, this starts to differ.

5.3 Risk-neutral pricing for option-like fund performance fees

Under a risk-neutral pricing framework, one typically assumes that an investor would have the ability to trade the fund position as often as desired in a frictionless manner and this market participant behaviour would be reflected by the NAV of the fund and the benchmark index at all times. The pricing of options in the risk-neutral formulation has been developed for several decades now, based on early seminar works by Black & Scholes (Reference Black and Scholes1973), Merton (Reference Merton1973, Reference Merton1976) and Cox et al. (Reference Cox, Ross and Rubinstein1979). See the review articles of Smith (Reference Smith1976) and Broadie & Detemple (Reference Broadie and Detemple2004). In Merton’s aforementioned work, “ideal conditions” in the market for the underlying stock and the option are discussed. These ideal conditions were based around the concepts of frictionless market characteristics, see further discussion in Rogers (Reference Rogers1998), and may not lead to practically realistic frameworks upon which to price the fee structures outlined in this manuscript. As such we will compare the classical risk-neutral option pricing framework to alternative approaches developed in the actuarial pricing literature, see coverage of such topics in the actuarial literature in Gerber & Shiu (Reference Gerber and Shiu1996, Reference Gerber and Shiu1995), Embrechts (Reference Embrechts2000), Goovaerts & Laeven (Reference Goovaerts and Laeven2008) and a book length treatment in Bühlmann & Hansjörg (Reference Wüthrich, Bühlmann and Hansjörg2010) .

Consider a maturity (future time)

![]() $T$

that the derivative on the asset price process

$T$

that the derivative on the asset price process

![]() $ (X_t )_{0 \leq t \leq T}$

pays an amount (payoff function for the fee from one of the models

$ (X_t )_{0 \leq t \leq T}$

pays an amount (payoff function for the fee from one of the models

![]() $\mathcal{M}_0$

to

$\mathcal{M}_0$

to

![]() $\mathcal{M}_4$

) denoted by

$\mathcal{M}_4$

) denoted by

![]() $H_T$

, which is a

$H_T$

, which is a

![]() $\mathcal{F}_T$

measurable random variable. Under the fundamental theorem of asset pricing, it is implied that in a complete market with no-arbitrage opportunities a derivative’s price is the discounted expected value of the future payoff under the unique risk-neutral measure. This leads to the standard risk-neutral pricing formulation producing the present fair value given by a discounted expected value

$\mathcal{F}_T$

measurable random variable. Under the fundamental theorem of asset pricing, it is implied that in a complete market with no-arbitrage opportunities a derivative’s price is the discounted expected value of the future payoff under the unique risk-neutral measure. This leads to the standard risk-neutral pricing formulation producing the present fair value given by a discounted expected value

where

![]() $r$

is the risk-free interest rate and

$r$

is the risk-free interest rate and

![]() $\mathbb{Q}$

denotes the risk-neutral pricing measure and

$\mathbb{Q}$

denotes the risk-neutral pricing measure and

![]() $\mathbb{P}$

the real-world measure that characterises the observed probabilities of price dynamics, where these are connected via the standard change of measure formula based on the Radon–Nikodym derivative

$\mathbb{P}$

the real-world measure that characterises the observed probabilities of price dynamics, where these are connected via the standard change of measure formula based on the Radon–Nikodym derivative

![]() $\frac{d\mathbb{Q}}{d\mathbb{P}}$

.

$\frac{d\mathbb{Q}}{d\mathbb{P}}$

.

This framework was relaxed and extended in works by Merton (Reference Merton1973) to allow for stochastic interest rates and other features. Furthermore, if the asset price process follows a continuous time stochastic jump process such as a Lévy process examples of works treating option valuation include Duffie et al. (Reference Duffie, Pan and Singleton2000) and Sepp & Skachkov (Reference Sepp and Skachkov2003).

In the pricing undertaken for the performance fee valuation in this manuscript, one already sees from the specification of the payoff structures under fee models

![]() $\mathcal{M}_0$

to

$\mathcal{M}_0$

to

![]() $\mathcal{M}_4$

that the payoff functions will be less trivial and generally path-dependent; therefore, they will not admit closed form solutions and are therefore alternatively evaluated numerically via Monte Carlo methods.

$\mathcal{M}_4$

that the payoff functions will be less trivial and generally path-dependent; therefore, they will not admit closed form solutions and are therefore alternatively evaluated numerically via Monte Carlo methods.

In the setting of no jump structure,

![]() $\lambda _F=\lambda _I=0$

, we will be able to develop an efficient Monte Carlo sampling strategy based on the discretisation schemes previously presented with

$\lambda _F=\lambda _I=0$

, we will be able to develop an efficient Monte Carlo sampling strategy based on the discretisation schemes previously presented with

![]() $\widetilde{\mu }_F$

and

$\widetilde{\mu }_F$

and

![]() $\widetilde{\mu }_I$

being specified under the Girsanov transform drift adjustment and with the added exception that now

$\widetilde{\mu }_I$

being specified under the Girsanov transform drift adjustment and with the added exception that now

![]() $\tilde{W}_t$

is a

$\tilde{W}_t$

is a

![]() $Q_{F}$

-Brownian motion and

$Q_{F}$

-Brownian motion and

![]() $\tilde{V}_t$

is a

$\tilde{V}_t$

is a

![]() $Q_{I}$

-Brownian motion representing the risk-neutral drivers. Under the Black–Scholes model, there exists a unique probability measure

$Q_{I}$

-Brownian motion representing the risk-neutral drivers. Under the Black–Scholes model, there exists a unique probability measure

![]() $Q_{F}$

and a unique probability measure

$Q_{F}$

and a unique probability measure

![]() $Q_{I}$

such that they are equivalent martingale measures. In this framework, one can then use the martingale measures so that the models for the fund and benchmark NAVs are arbitrage-free and complete.

$Q_{I}$

such that they are equivalent martingale measures. In this framework, one can then use the martingale measures so that the models for the fund and benchmark NAVs are arbitrage-free and complete.

5.4 Actuarial incomplete market distortion pricing for option-like fund performance fees

One may question the veracity of the assumptions regarding the existence of a complete arbitrage-free market in the context of the funds dynamics studied in this manuscript. This is especially the case when one recalls that market completeness assumes that the trading of the fund shares has negligible transaction costs and that the complete set of possible bets on future states of the world, valuations of the funds NAV incorporating fee structures, can be constructed with existing assets without friction. However, as discussed in Birge & Linetsky (2007, Chapter 12), one is sometimes best served to recognise explicitly that in reality, markets such as those under consideration in this manuscript are incomplete, meaning that some payoffs cannot be replicated by trading in security markets. The classic no-arbitrage theory of valuation in a complete market, based on the unique price of a self-financing replicating portfolio, is not adequate for non-replicable payoffs in incomplete markets. For a guide to surveys on incomplete market pricing settings in financial mathematics contexts, see Jouini & Napp (Reference Jouini and Napp2001), Tankov (2003, Chapter 10). There are several ways in which market incompleteness may manifest, as discussed in Birge & Linetsky (Reference Birge and Linetsky2007), for example, insufficiency of marketed assets relative to the class of risks that one wishes to hedge, which may involve jumps or volatility of asset prices, or variables that are not derived from market prices; market frictions related to transaction costs and portfolio constraints; or ambiguity in the appropriate model for the market prices.

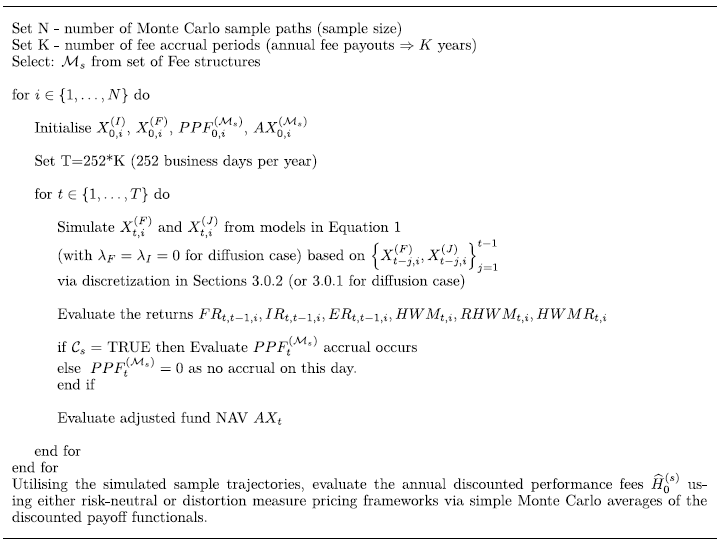

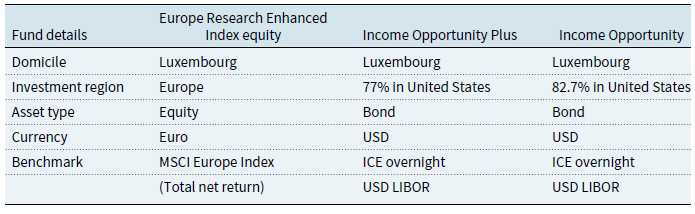

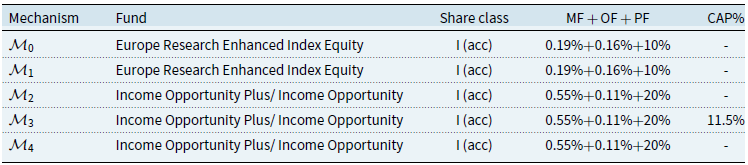

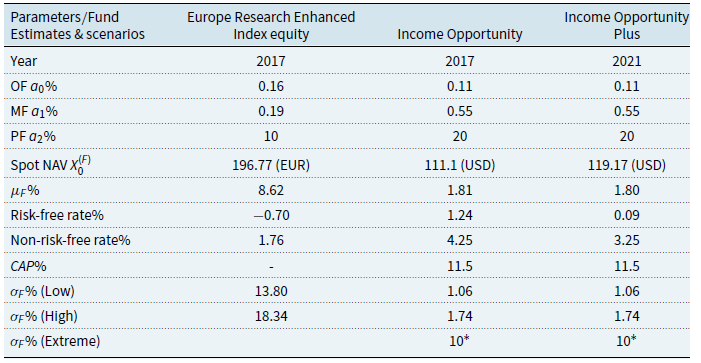

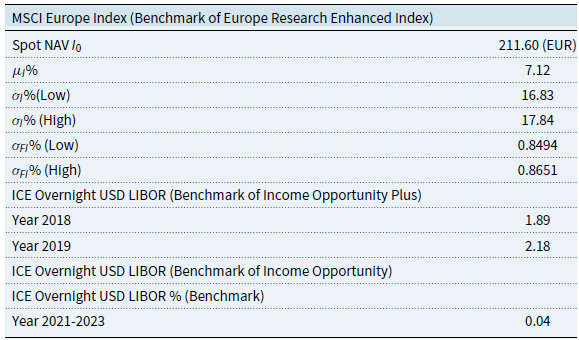

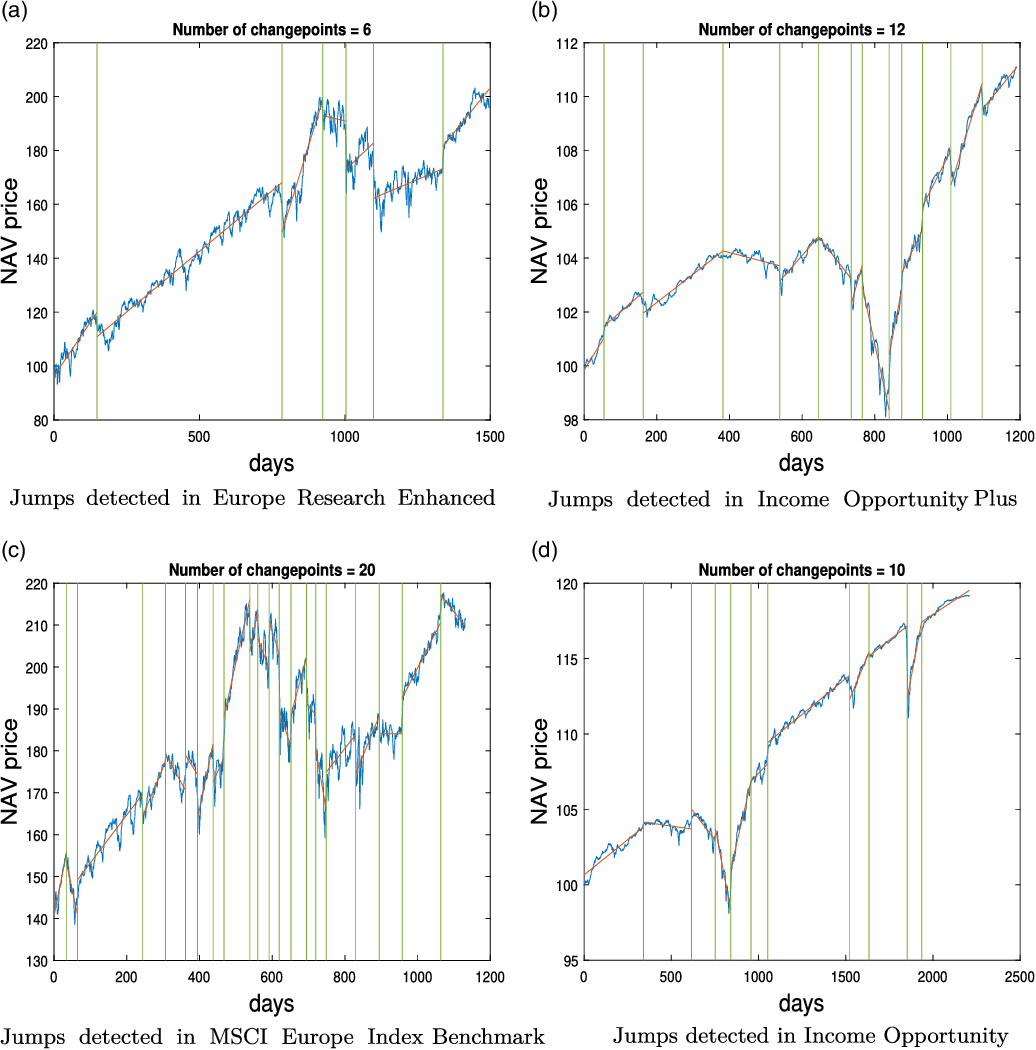

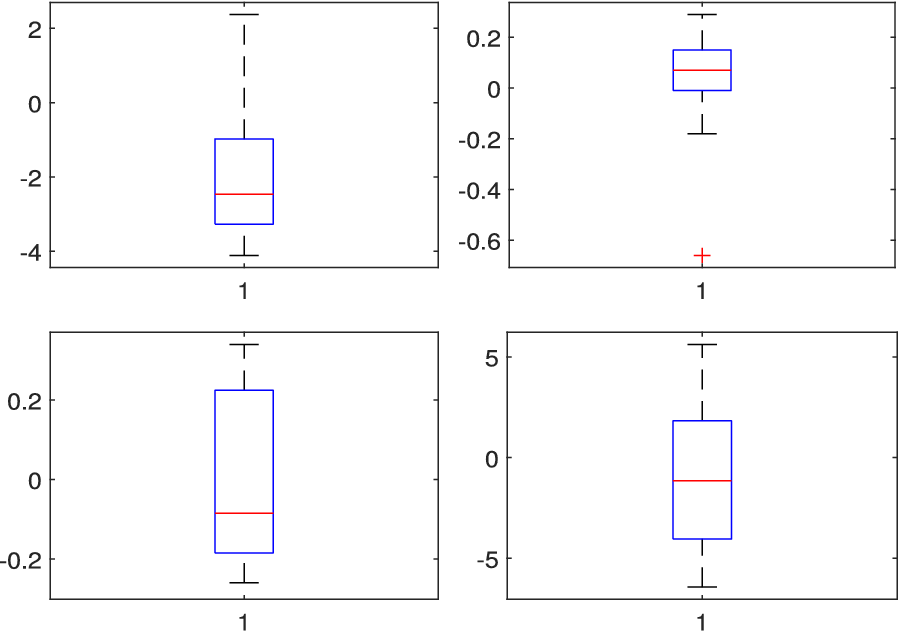

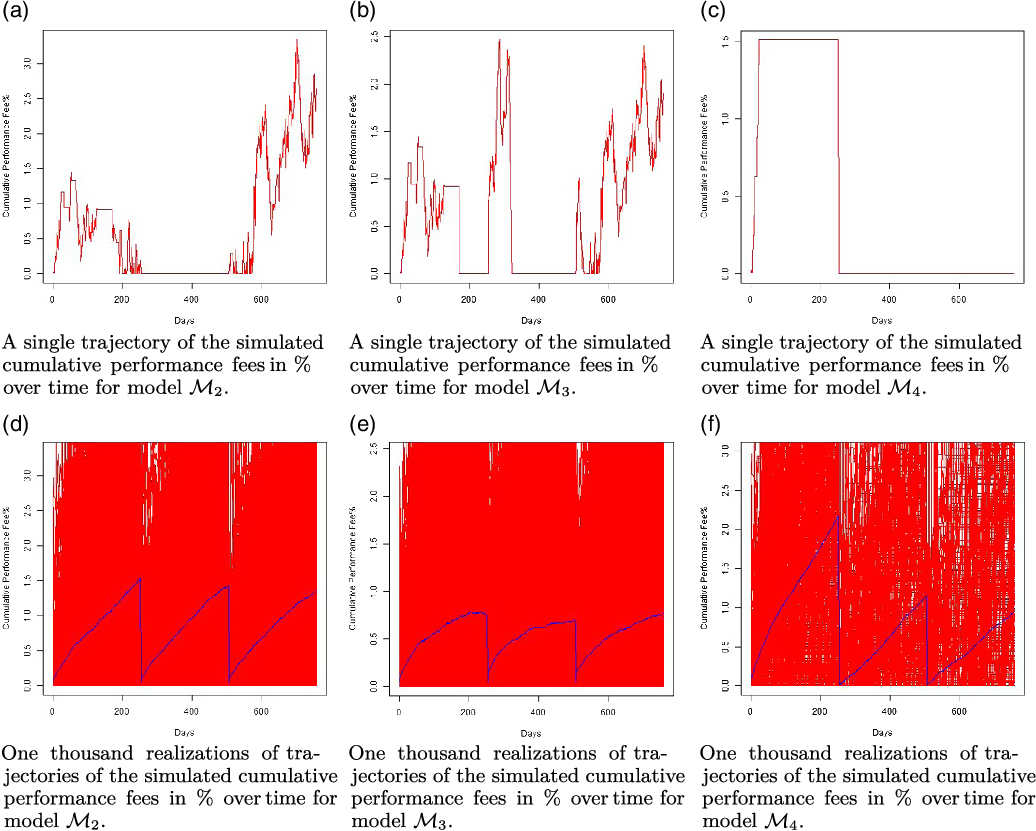

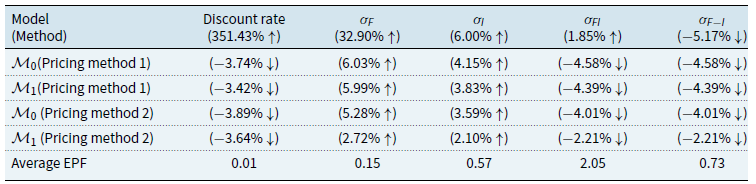

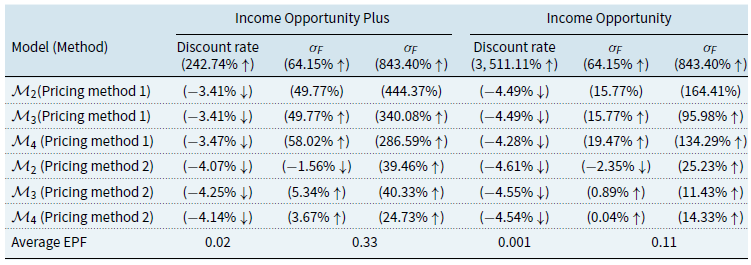

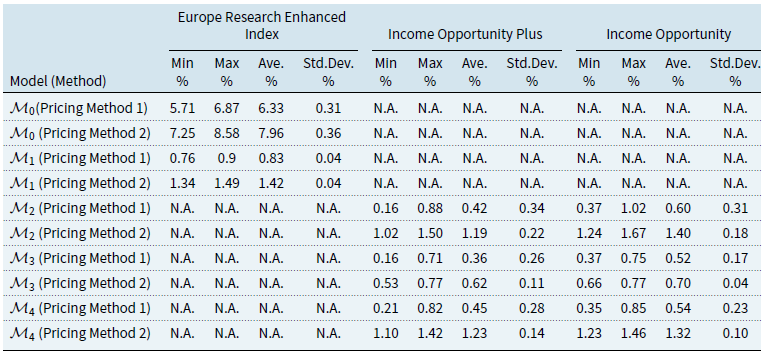

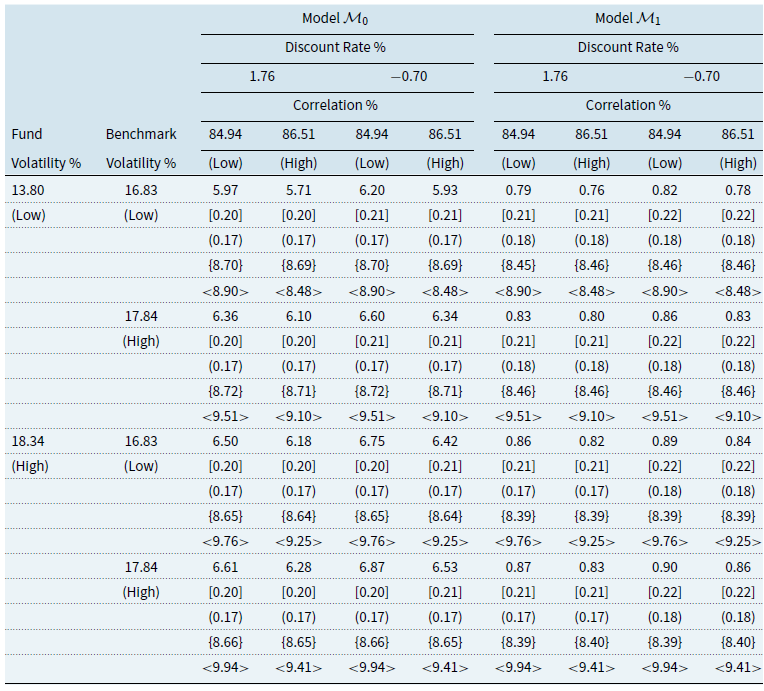

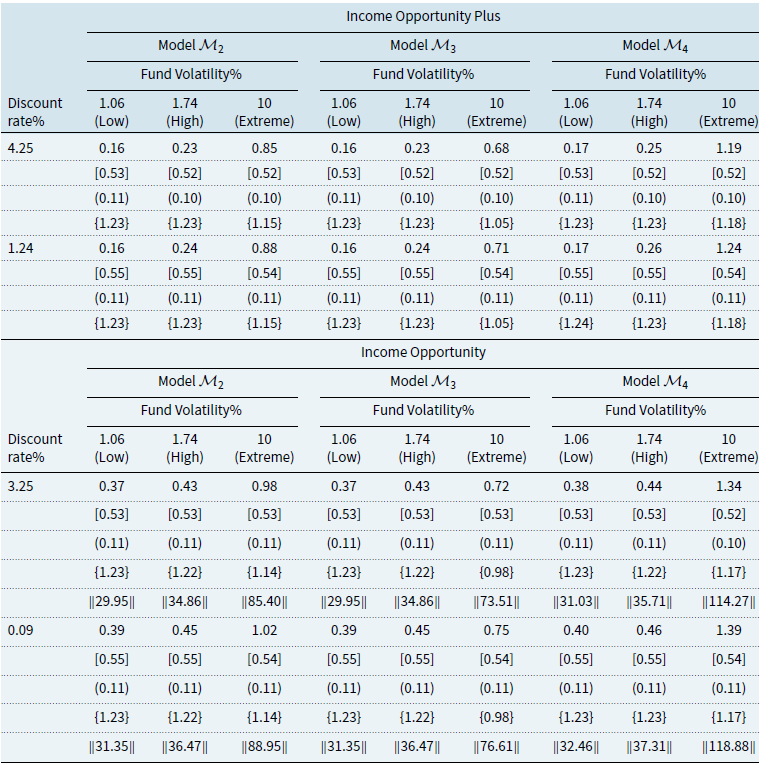

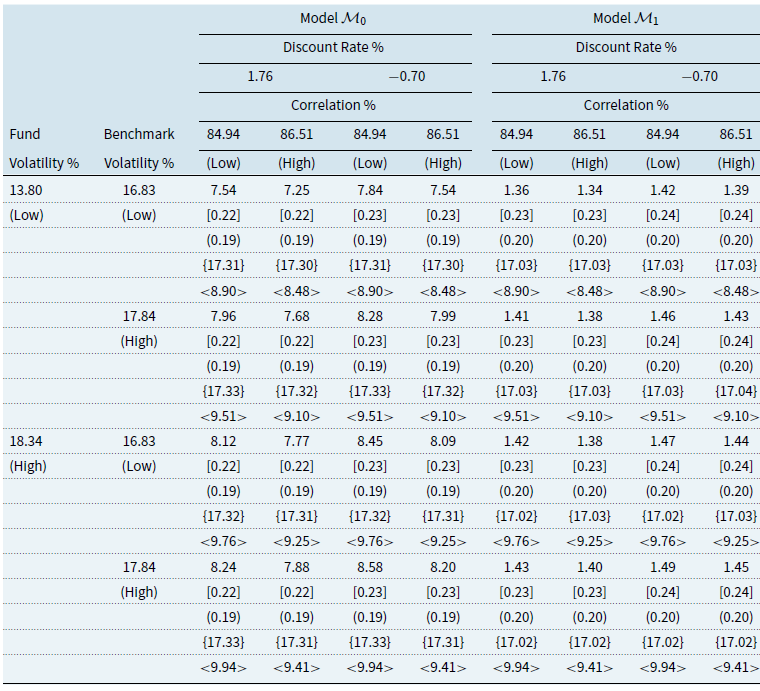

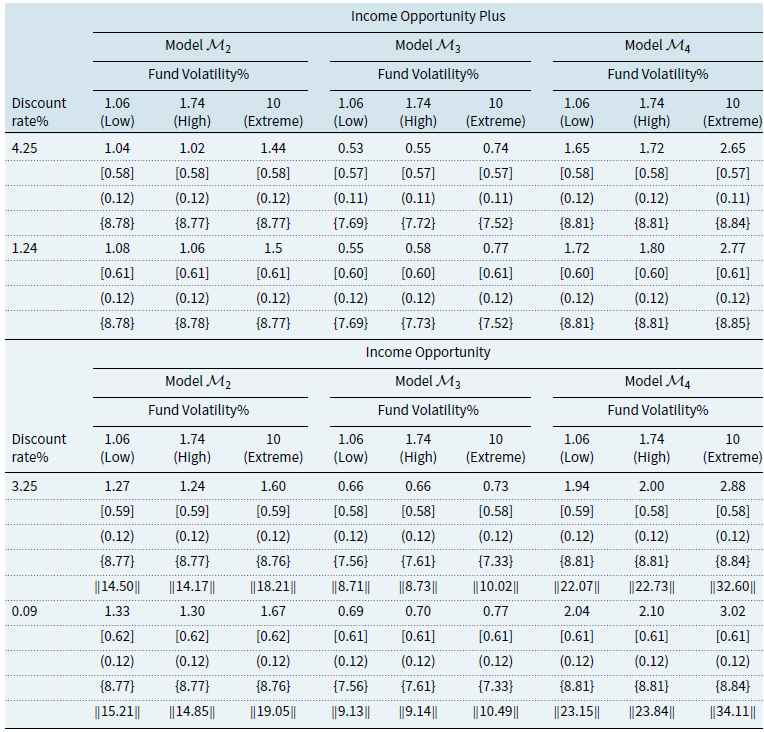

In order to develop alternative approaches to pricing derivatives, when markets are incomplete, the actuarial literature has developed numerous solutions approaches. In this section, we will recall some basic details of actuarial pricing methods that can be made consistent with risk-neutral arbitrage-free efficient market pricing methods described above. These are namely the Esscher transform approach based on early actuarial pricing methods from Swedish actuary (Escher, Reference Escher1932), and the Wang distortion measure approach based on Wang (Reference Wang2000). An excellent coverage of market-consistent actuarial pricing methods is provided in Bühlmann & Hansjörg (Reference Wüthrich, Bühlmann and Hansjörg2010).