Introduction

Extant studies posit the existence of significant differences between the internationalization process of family owned versus non-family owned businesses (Arregle, Duran, Hitt, & van Essen, Reference Arregle, Duran, Hitt and van Essen2017; Tasavori, Zaefarian, & Eng, Reference Tasavori, Zaefarian and Eng2018; Vahlne & Johanson, Reference Vahlne and Johanson2021). As such, an investigation around the specific nature of the internationalization process of family owned businesses (FOBs) is important for managerial theory and practice (Arregle, Chirico, Kano, Kundu, Majocchi, & Schulze, Reference Arregle, Chirico, Kano, Kundu, Majocchi and Schulze2021). Unfortunately, ‘current research on family business internationalization offers very limited knowledge on the processes and strategies that make [family businesses] unique in their internationalization’ (Kontinen & Ojala, Reference Kontinen and Ojala2010, p. 106).

Despite the growing number of studies and debates on this question, findings about the capacity of family businesses to internationalize remain inconclusive (Arregle et al., Reference Arregle, Duran, Hitt and van Essen2017; Bauweraerts, Sciascia, Naldi, & Mazzola, Reference Bauweraerts, Sciascia, Naldi and Mazzola2019; Metsola, Leppäaho, Paavilainen-Mäntymäki, & Plakoyiannakic, Reference Metsola, Leppäaho, Paavilainen-Mäntymäki and Plakoyiannakic2020). Some authors posit that FOBs face structural and functional disadvantages stemming from specific characteristics related to their family ownership and management (Calabrò, Campopiano, Basco, & Pukall, Reference Calabrò, Campopiano, Basco and Pukall2017; Sanchez-Famoso, Maseda, & Iturralde, Reference Sanchez-Famoso, Maseda and Iturralde2017). Others suggest that familiness – defined as the bundle of idiosyncratic internal resources that exist due to the involvement of the family in the firm (Habbershon, Williams, & MacMillan, Reference Habbershon, Williams and MacMillan2003; Randolph, Fang, Memili, & Nayir, Reference Randolph, Fang, Memili and Nayir2020) – is in fact the source of a competitive advantage and specific entrepreneurial behaviours in both domestic and foreign markets (Calabrò et al., Reference Calabrò, Campopiano, Basco and Pukall2017; Pötschke, Reference Pötschke2021). Since both sides offer meaningful results to support their arguments, the logical solution is to concede that FOBs are heterogeneous and that their market behaviour and success are contingent on the intelligent use of a combination of organizational features and strengths. In fact, ‘while some families can be assets to their firms and build familiness, other families could be characterized more as liabilities’ (Zellweger, Eddleston, & Kellermanns, Reference Zellweger, Eddleston and Kellermanns2010, p. 55).

This paper answers the call made by Bauweraerts et al. (Reference Bauweraerts, Sciascia, Naldi and Mazzola2019), Metsola et al., (Reference Metsola, Leppäaho, Paavilainen-Mäntymäki and Plakoyiannakic2020), and Yu, Lumpkin, Praveen Parboteeah, and Stambaugh (Reference Yu, Lumpkin, Praveen Parboteeah and Stambaugh2019), among others, to expand our understanding of the internationalization process of family businesses, notably as most extant studies focus exclusively on internationalization performance and neglect the idiosyncratic aspects that inform the specificity of the internationalization process in FOBs (Miroshnychenko, De Massis, Miller, & Barontini, Reference Miroshnychenko, De Massis, Miller and Barontini2020; Rienda & Andreu, Reference Rienda and Andreu2021). However, instead of trying to demonstrate that FOBs are or are not capable of successful internationalization, this study asks: What combination of family business characteristics is necessary and conducive to performance in cross-border activities? To answer this general research question, the authors focused on two complex variables – entrepreneurial orientation (EO) and family social capital (FSC) – and investigated their articulation and contribution to the level of success of small and medium-sized FOBs in international activities. Although the salience of these variables has already been identified in the family business literature (e.g., Arregle et al., Reference Arregle, Chirico, Kano, Kundu, Majocchi and Schulze2021; Arz, Reference Arz2019; Miller & Le Breton-Miller, Reference Miller and Le Breton-Miller2021), this study approaches them from a novel perspective, that is, considering EO as an antecedent of FOB internationalization (INT), with FSC – representing the essential condition for the positive manifestation of familiness (Calabrò et al., Reference Calabrò, Campopiano, Basco and Pukall2017; McAdam, Clinton, & Dibrell, Reference McAdam, Clinton and Dibrell2020) – serving to moderate the relationship between EO and INT. Although extant studies rarely include family relationships among the building blocks of social capital, the concept of FSC indeed appears central in shaping FOB strategies and achieving performance (O'Shannassy, Reference O'Shannassy2021; Salvato & Melin, Reference Salvato and Melin2008). Furthermore, it has been shown that good family relationships enhance the wellbeing and the social cohesion of family members while also fostering the development of associative, communitarian, and general social capital (Barrett & Moores, Reference Barrett and Moores2020; Valenza, Caputo, & Calabrò, Reference Valenza, Caputo and Calabrò2021).

In pursuing our research question, we collected primary data from 159 Spanish FOBs through a phone survey administered by a professional research firm. The empirical model was tested using partial least squares structural equation modelling (PLS-SEM), a variance-based structural equation modelling method (Richter, Cepeda, Roldán, & Ringle, Reference Richter, Cepeda, Roldán and Ringle2015; Roldán & Sánchez-Franco, Reference Roldán, Sánchez-Franco, Manuel and Ovsei2012).

The findings provide an original and relevant contribution to our understanding of FOB internationalization as well as to its theory and practice. Instead of adopting a descriptive stance, this study attempted to generate insights that are pragmatically relevant to the internationalization strategy and performance of FOBs. From this perspective, although the authors aimed for modelization and theory building, the research undertaken here is essentially problem-driven, addressing practical managerial challenges rather than filling theoretical gaps simply because they exist (Corley & Gioia, Reference Corley and Gioia2011).

Theoretical background

There are many definitions of what constitutes an FOB. Among these, we selected the one proposed by Leach, Kenway-Smith, Hart, Ainsworth, and Beterlsen (Reference Leach, Kenway-Smith, Hart, Morris, Ainsworth, Beterlsen and Pasari1990, p. 2) namely because it has precisely defined characteristics, that is, ‘a company in which more than 50 percent of the voting shares are controlled by one family, and/or a single-family group effectively controls the firm, and/or a significant proportion of the firm's senior management is members from the same family’. As for internationalization, the authors chose to define it in keeping with Caputo, Matteo, Dabic, and Paul (Reference Caputo, Pellegrini, Dabic and Paul2016) ‘as the strategic process of increasing involvement in international operations across borders’ (p. 361). This comprehensive and well-established definition implies potential restructuring of governance systems, managing and operating activities, and changes in the values and culture of the firm (Hennart, Majocchi, & Forlani, Reference Hennart, Majocchi and Forlani2019). In addition to selling across international boundaries, it may also involve sourcing from foreign markets, at times crossing cultural boundaries often with the requirement of possibly adapting current strategy, product and/or service, price, and/or promotion (Dabić, Maley, Dana, Novak, Pellegrini, & Caputo, Reference Dabić, Maley, Dana, Novak, Pellegrini and Caputo2020).

The theoretical interpretation of internationalization as it relates to small and medium-sized enterprises (SMEs) is usually predicated on the resource-based view (RBV) (Barney, Clark, & Alvarez, Reference Barney, Clark and Alvarez2002) which was later combined with the markets-as-networks paradigm (Felzensztein, Saridakis, Idris, & Elizondo, Reference Felzensztein, Saridakis, Idris and Elizondo2021; Vahlne & Johanson, Reference Vahlne and Johanson2019). The RBV argues that, if they are to penetrate and expand in foreign markets, internationalizing SMEs need sufficient resources in order to overcome the liability of foreignness (Dabić et al., Reference Dabić, Maley, Dana, Novak, Pellegrini and Caputo2020; Vahlne & Johanson, Reference Vahlne and Johanson2021) and require control or access to these resources as well as the organizational commitment to invest and manage these resources in cross-border activities. The markets-as-networks paradigm replaces the liability of foreignness with the liability of outsidership (Vahlne & Johanson, Reference Vahlne and Johanson2021) by predicating that successful internationalization depends on the capacity of SMEs to develop and manage relationships that ensure a favourable place in cross-border sectoral and professional networks. However, despite this shift of focus, the RBV continues to be relevant in the markets-as-networks framework as an internationalizing firm needs varied resources to support and sustain its integration in the relevant international networks. The link between these two models is bridged by the concept of social capital (Bratkovic, Antoncic, & Ruzzier, Reference Bratkovic, Antoncic and Ruzzier2009; Hennart, Majocchi, & Forlani, Reference Hennart, Majocchi and Forlani2019) which, on the one hand, can facilitate access and integration in relevant networks through personal and/or professional relationships and, on the other, can also allow the firm to identify and access the necessary resources for its internationalization activities.

In terms of FOBs, the overlap between family and business represents not only a specific feature (Arregle et al., Reference Arregle, Chirico, Kano, Kundu, Majocchi and Schulze2021; McAdam, Clinton, & Dibrell, Reference McAdam, Clinton and Dibrell2020), but also the source of specific behaviours, resources, and management methods that, depending on the organizational and market context, may either impede or enhance the internationalization process (Pötschke, Reference Pötschke2021; Yu et al., Reference Yu, Lumpkin, Praveen Parboteeah and Stambaugh2019).

Scholars adopting a restrictive perspective posit that the internationalization of FOBs is often limited by a lack of financial resources, human resources, or managerial capabilities, or by risk avoidance and conservative management rooted in a fear of losing control of the firm or a desire to preserve the family's socio-emotional wealth (Gomez-Mejia, Makri, & Larraza-Kintana, Reference Gomez-Mejia, Makri and Larraza-Kintana2010; Moreno-Menéndez & Castiglioni, Reference Moreno-Menéndez and Castiglioni2021). Another reason behind this posited reluctance to internationalize relates to FOBs' commitment to domestic markets and cultures as well as their inherent lack of financial resources and knowledge regarding foreign markets (Baù, Block, Discua Cruz, & Naldi, Reference Baù, Block, Discua Cruz and Naldi2017; Pino, Felzensztein, & Chetty, Reference Pino, Felzensztein and Chetty2021) even when internationalization may represent a better business decision (Bauweraerts et al., Reference Bauweraerts, Sciascia, Naldi and Mazzola2019). The level of local embeddedness of FOBs and their reluctance to change (Barrett & Moores, Reference Barrett and Moores2020; Kellermanns & Eddleston, Reference Kellermanns and Eddleston2017) is said to make them hesitant to invest in risky projects (Cabrera-Suárez, De Saá-Pérez, & García-Almeida, Reference Cabrera-Suárez, De Saá-Pérez and García-Almeida2016) and may result in missed cross-border business opportunities (Miller & Le Breton-Miller, Reference Miller and Le Breton-Miller2021; Miroshnychenko et al., Reference Miroshnychenko, De Massis, Miller and Barontini2020). Therefore, from this perspective, FOBs have a lower propensity towards internationalization than non-family firms (Kontinen & Ojala, Reference Kontinen and Ojala2010).

However, other studies (Arregle et al., Reference Arregle, Chirico, Kano, Kundu, Majocchi and Schulze2021; Campopiano, Calabrò, & Basco, Reference Campopiano, Calabrò and Basco2020; Gimmon & Felzensztein, Reference Gimmon and Felzensztein2021) consider that the existence of familiness may on the contrary facilitate opportunity recognition, encourage risk-taking, enhance the FOB internationalization process, and strengthen their competitive advantage by offering FOBs the advantages of stability, managerial stewardship, trust-based cohesion including access to long-term, patient capital and capabilities: ‘Regular communication, enduring relationships, and strong social capital among family members facilitate the sharing of experiences and knowledge, enforce a clear understanding of the firm's mission, and build trusting relationships that help to create an organizational culture promoting autonomy, flexibility, and risk taking conducive to strategic actions with long term returns such as internationalization’ (Arregle et al., Reference Arregle, Duran, Hitt and van Essen2017, p. 803). Indeed, family firms can often secure long-term, trust-based cross-border partnerships with other family firms that share the same organizational culture and ethos (Astrachan, Astrachan, Campopiano, & Baù, Reference Astrachan, Astrachan, Campopiano and Baù2020; Chrisman, Madison, & Kim, Reference Chrisman, Madison and Kim2021) which ultimately reduces the risks related to, and the resources required by, internationalization.

Considering the specific characteristics of the internationalization process alongside the regulating effect of FSC, the authors developed their research hypotheses and proposed an empirical model with which to specifically view the internationalization of FOBs.

Hypotheses development

There is widespread consensus (Cherchem & Keen, Reference Cherchem, Keen, Caputo, Pellegrini, Dabić and Dana2022; Gimmon & Felzensztein, Reference Gimmon and Felzensztein2021; Metsola et al., Reference Metsola, Leppäaho, Paavilainen-Mäntymäki and Plakoyiannakic2020) that internationalization requires bold managerial initiative, risk taking, innovativeness, high levels of resources, organizational commitment, and a long-term strategic approach. Since the business environment of foreign countries is unknown, unfamiliar, and competitive, the initiation of cross-border activities is riskier and more complex than domestic business, making international performance dependent on the adoption and application of an entrepreneurial approach (Arregle et al., Reference Arregle, Duran, Hitt and van Essen2017; Miroshnychenko et al., Reference Miroshnychenko, De Massis, Miller and Barontini2020). Consequently, FOB internationalization can be regarded as an entrepreneurial strategy, more specifically one that aims for company growth (Yu et al., Reference Yu, Lumpkin, Praveen Parboteeah and Stambaugh2019). To expand internationally, FOB owners and managers must have experience in assessing the risks and rewards of internationalization and engage in proactive risk-taking activities (Zahra, Reference Zahra2005).

The essence of entrepreneurship is the creation and pursuit of new venture opportunities, either domestically or internationally, through proactive action and organizational renewal (Arregle et al., Reference Arregle, Chirico, Kano, Kundu, Majocchi and Schulze2021; Gimmon & Felzensztein, Reference Gimmon and Felzensztein2021). Entrepreneurship becomes an integral part of the organizational culture when founders, owners, and/or top management create environments that both stimulate and support innovation and risk-taking behaviours aimed at aggressively seeking new business opportunities (Ayoko, Caputo, & Mendy, Reference Ayoko, Caputo and Mendy2021; Tang, Levasseur, Karami, & Busenitz, Reference Tang, Levasseur, Karami and Busenitz2021).

From a theoretical and empirical perspective, EO represents an integrated three-component strategic approach (proactivity, risk taking, and innovativeness) that facilitates the recognition and exploitation of market opportunities located in various countries (Arz, Reference Arz2019; McDougall & Oviatt, Reference McDougall and Oviatt2000). Extant studies also show that EO exerts a positive influence on FOB market orientation and collaborative orientation (Calabrò et al., Reference Calabrò, Campopiano, Basco and Pukall2017; Rodrigo-Alarcón, García-Villaverde, Ruiz-Ortega, & Parra-Requena, Reference Rodrigo-Alarcón, García-Villaverde, Ruiz-Ortega and Parra-Requena2018). FOBs with a strong EO are expected to invest more resources in pursuing uncertain or risky international opportunities and to adapt more quickly to the competitive environment of foreign markets (Arz, Reference Arz2019; Ray, Mondal, & Ramachandran, Reference Ray, Mondal and Ramachandran2018). Thus, EO can be considered a key organizational capability and an important competitive factor for FOBs engaged in international business (D'Angelo & Presutti, Reference D'Angelo and Presutti2019; Gupta, Pandey, & Sebastian, Reference Gupta, Pandey and Sebastian2021). On this basis, we propose the first hypothesis:

Hypothesis 1: Entrepreneurial orientation exerts a positive influence on the internationalization of family owned businesses.

According to Salvato and Melin (Reference Salvato and Melin2008), social interactions among family members are central in shaping and supporting FOB strategies. Since FOBs are organizations characterized by continuous and socially intense interactions, the specificities of their strategies and their performance capabilities are significantly influenced by their idiosyncratic social capital (Arregle et al., Reference Arregle, Chirico, Kano, Kundu, Majocchi and Schulze2021; Barrett & Moores, Reference Barrett and Moores2020). For the purposes of this study, we began with the general definition of social capital – ‘the network of relationships possessed by an individual or social unit, and the sum of actual and potential resources embedded within, available through, and derived from such network’ (Nahapiet & Ghoshal, Reference Nahapiet and Ghoshal1998, p. 243) – and apply it to the family circle to consider the influence of FSC on FOB internationalization. Despite the recognized importance of FSC (Randolph et al., Reference Randolph, Fang, Memili and Nayir2020; Zellweger, Eddleston, & Kellermanns, Reference Zellweger, Eddleston and Kellermanns2010), the understanding of its role in the development and application of entrepreneurial strategies is still limited.

As noted earlier, extant studies offer a two-sided image about the effect of familiness, family relationships, and family members interactions on the internationalization performance of FOBs. These elements are often interpreted using the RBV which is often combined and complemented by agency theory or stewardship theory (Arregle et al., Reference Arregle, Duran, Hitt and van Essen2017; Chrisman, Madison, & Kim, Reference Chrisman, Madison and Kim2021). Considering the high level and large variety of resources required for internationalization, these theories attempt to assess the capacity of FOB management and governance to efficiently access, attract, manage, and use various types of resources, to develop and maintain capabilities that cannot be easily imitated or substituted by their competitors, and to also reduce agency costs and create cohesion and trust towards supporting organizational mission, objectives, and strategies.

From the vantage point of the RBV, familiness can lead to unique competitive advantages (Calabrò et al., Reference Calabrò, Campopiano, Basco and Pukall2017; Randolph et al., Reference Randolph, Fang, Memili and Nayir2020) thereby facilitating access to specific resources, namely family human capital, social capital, patient capital, and survivability capital as outlined by Barrett and Moores (Reference Barrett and Moores2020) and Tasavori, Zaefarian, and Eng (Reference Tasavori, Zaefarian and Eng2018), and competitive strategies (entrepreneurial investment portfolios) that represent important bases for the international expansion of family firms (Yu et al., Reference Yu, Lumpkin, Praveen Parboteeah and Stambaugh2019; Zhou, Han, & Gou, Reference Zhou, Han and Gou2019). However, some FOBs are ridden with a negative form of familiness, expressed through adverse selection of talent, nepotism, rigidity, and reluctance to share control with non-family owners or managers (Arregle et al., Reference Arregle, Chirico, Kano, Kundu, Majocchi and Schulze2021; Chrisman, Madison, & Kim, Reference Chrisman, Madison and Kim2021). Here, familiness hinders business development and performance (Glyptis, Hadjielias, Christofi, Kvasova, & Vrontis, Reference Glyptis, Hadjielias, Christofi, Kvasova and Vrontis2021) and excessive family control may ultimately have a negative effect on firm internationalization (Ray, Mondal, & Ramachandran, Reference Ray, Mondal and Ramachandran2018).

The application of agency theory to the specificities of FOB internationalization led to inconclusive results on whether agency costs for non-family firms are in fact lower (Zahra, Reference Zahra2003; Zhou, Han, & Gou, Reference Zhou, Han and Gou2019) due to lower information asymmetry and conflicting interests between principal and agent (Caputo, Marzi, Pellegrini, & Rialti, Reference Caputo, Marzi, Pellegrini and Rialti2018; Chrisman, Madison, & Kim, Reference Chrisman, Madison and Kim2021) or higher because of the family conflicts generated by divergent groups pursuing competing goals or by difficulties in implementing relational contracts between family generations (Chrisman, Madison, & Kim, Reference Chrisman, Madison and Kim2021; Randolph et al., Reference Randolph, Fang, Memili and Nayir2020). Family members who act passively and are mainly interested in their own welfare contribute to weakening family cohesion (Kubíček & Machek, Reference Kubíček and Machek2020; Salvato & Melin, Reference Salvato and Melin2008) by minimizing the importance of socio-emotional wealth and managerial stewardship.

In looking at stewardship theory instead (Davis, Schoorman, & Donaldson, Reference Davis, Schoorman and Donaldson1997), which assumes that firm managers and employees act altruistically, prioritizing cooperative or organizational goals and attempting to make personal contributions to firm survival and development (Arregle et al., Reference Arregle, Duran, Hitt and van Essen2017; Calabrò et al., Reference Calabrò, Campopiano, Basco and Pukall2017; Caputo et al., Reference Caputo, Marzi, Pellegrini and Rialti2018), the authors found that when these values define the prevailing culture of an FOB, management involvement will positively contribute to firm internationalization they ultimately act as stewards of family resources and socio-emotional wealth (Sciascia, Mazzola, Astrachan, & Pieper, Reference Sciascia, Mazzola, Astrachan and Pieper2012; Smith, Nordqvist, De Massis, & Miller, Reference Smith, Nordqvist, De Massis and Miller2021).

These contradictory findings support the view that FOB firms are heterogenous and context specific (Arregle et al., Reference Arregle, Chirico, Kano, Kundu, Majocchi and Schulze2021; Rienda & Andreu, Reference Rienda and Andreu2021). While some families are assets to their firms and build familiness, other families represent liabilities to organizational success (Gimmon & Felzensztein, Reference Gimmon and Felzensztein2021; Miller & Le Breton-Miller, Reference Miller and Le Breton-Miller2021). This potentially two-way effect of FSCs on FOB performance may instead indicate that it has a moderating influence (Stam & Elfring, Reference Stam and Elfring2008) on the complex variable (Arz, Reference Arz2019; Gupta, Pandey, & Sebastian, Reference Gupta, Pandey and Sebastian2021) that is the relationship between EO and INT. On this basis, we propose the second hypothesis:

Hypothesis 2: The relationship between entrepreneurial orientation and the internationalization of family owned businesses is moderated by family social capital.

Methodology

The proposed model (Figure 1) was tested using primary data collected through a phone survey from a sample of 159 Spanish FOBs before the start of the COVID-19 pandemic. To ensure quality, the survey was administered by a professional survey research firm. Using company information found in the Iberian Balance Sheet Analysis System, we chose firms corresponding to the following criteria: (1) Spanish FOBs with at least 10 employees; (2) FOBs not influenced by exceptional circumstances such as liquidation and/or insolvency; and (3) FOBs with a legal obligation to establish a board of directors. The survey process enabled the identification of FOBs with at least 51% family ownership (Molly, Laveren, & Deloof, Reference Molly, Laveren and Deloof2010) and verify that family members were involved in management activities.Footnote 1 Since the study's aim was to collect general information about FOB strategy, the survey was addressed to owner-managers directly involved in strategic decision-making and resource allocation and control, therefore duly playing the role of expert informant (Klein, Astrachan, & Smyrnios, Reference Klein, Astrachan and Smyrnios2005). Though focusing on owner-managers may not capture the attitudes of other family members, researchers commonly consider the perspective of these key decision-making agents as representative (Carr, Cole, Ring, & Blettner, Reference Carr, Cole, Ring and Blettner2011; Klein, Astrachan, & Smyrnios, Reference Klein, Astrachan and Smyrnios2005). As with all self-reported data, there is the potential for common method bias for reasons such as consistency and social desirability (Podsakoff, MacKenzie, Lee, & Podsakoff, Reference Podsakoff, MacKenzie, Lee and Podsakoff2003).

Figure 1. Proposed model.

As signalled by Podsakoff and Organ (Reference Podsakoff and Organ1986), the authors attempted to avoid potential biases by asking respondents to use objective information found in the minutes of company meetings or in firm documentation. Respondents were family members with managerial functions who were directly involved in day-to-day operations and who had first-hand information about company structure and functioning making them appropriate choices for reducing common method bias (Sanchez-Famoso, Maseda, & Iturralde, Reference Sanchez-Famoso, Maseda and Iturralde2017). The methodology used also protected the anonymity of respondents by ensuring the confidentiality of their responses.

Based on the above conditions for the identification and selection of a company as a family firm, the population under study consisted of 901 Spanish family firms. We received valid responses from 159 FOBs (17.65% response rate), which is higher than previous studies focusing on family firms (Cruz & Nordqvist, Reference Cruz and Nordqvist2012; Gallo & Vilaseca, Reference Gallo and Vilaseca2016). The number of answers collected is also higher than the required threshold (n = 134) for a.95 statistical power (two-tailed) for model testing using G*Power (Faul, Erdfelder, Buchner, & Lang, Reference Faul, Erdfelder, Buchner and Lang2009). The authors thus concluded that the sample size was appropriate for the purposes of this study.

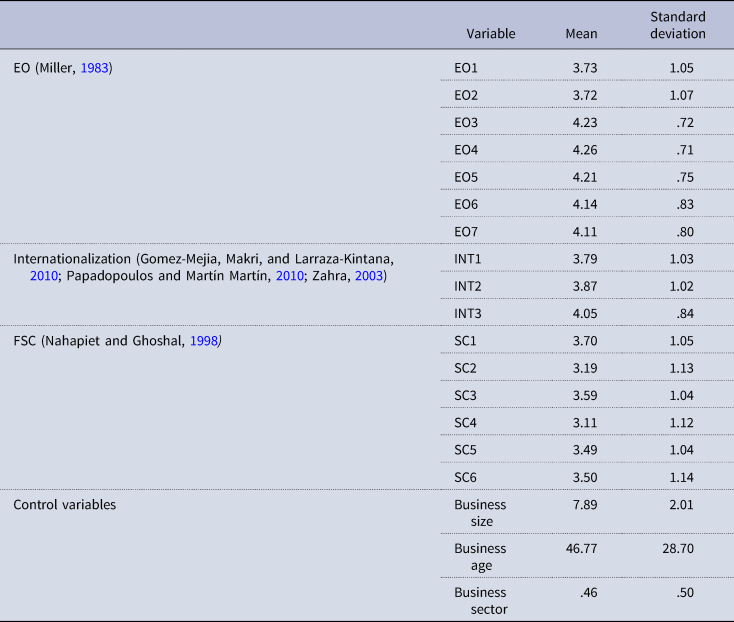

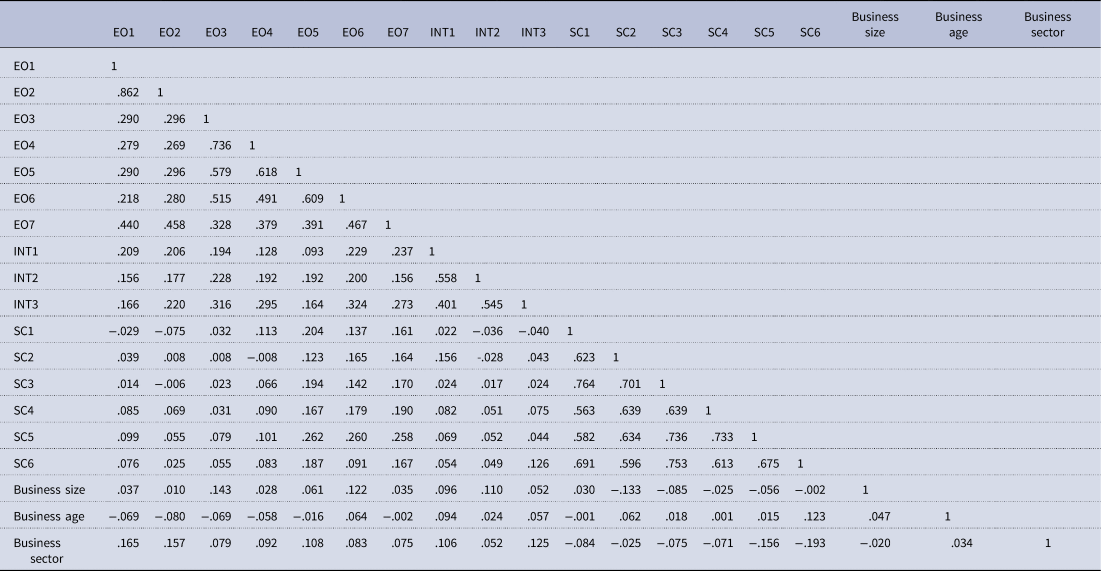

The descriptive statistics for the sample are similar to those of earlier studies on Spanish FOBs: the average firm had 91 employees, had been in business for about 47 years, with 95% of CEOs being family members. Descriptive statistics and correlations for all variables are shown in Tables 1 and 2, respectively.

Table 1. Descriptive statistics

Table 2. Correlations

Measures

EO, FSC, and internationalization (INT) were measured using multiple metrics taken from existent measurement scales that have been validated in the literature (Gomez-Mejia, Makri, & Larraza-Kintana, Reference Gomez-Mejia, Makri and Larraza-Kintana2010; Miller, Reference Miller1983; Nahapiet & Ghoshal, Reference Nahapiet and Ghoshal1998). The questionnaire was designed in Spanish and then pilot tested on 10 family member managers from different family firms, as well as three academics, each an expert in research methods and FOBs. The results of this validation test ensured that the questions would not be interpreted ambiguously by respondents and that all displayed high content validity.

The independent variable, Entrepreneurial Orientation (α = .842), was measured using the 7-item scale developed by Miller (Reference Miller1983). Items were evaluated by respondents using a 5-point Likert scale, ranging from ‘1’ (strongly disagree) to ‘5’ (strongly agree).

The dependent variable, Internationalization (α = .751), was measured using three parameters: (1) the proportion of the firm's total sales earned abroad (Gomez-Mejia, Makri, & Larraza-Kintana, Reference Gomez-Mejia, Makri and Larraza-Kintana2010); (2) the type of entry mode selected (Papadopoulos & Martín Martín, Reference Papadopoulos and Martín Martín2010); and (3) the geographical dispersion of the target countries (Zahra, Reference Zahra2003). As in a previous study by Kidwell, Fuentes-Lombardo, Sanchez-Famoso, Cano-Rubio, and Kloepfer (Reference Kidwell, Fuentes-Lombardo, Sanchez-Famoso, Cano-Rubio and Kloepfer2020), the authors converted the original percentage ratings in a 5-point Likert scale.

The moderator variable, Family Social Capital (α = .922), was measured using the 6-item scale proposed by Nahapiet and Ghoshal (Reference Nahapiet and Ghoshal1998) which was adapted for a family firm context by Chirico and Salvato (Reference Chirico and Salvato2016). All six items were evaluated using a 5-point Likert scale.

Finally, because various factors can influence dependent and independent variables, we selected three control variables. First, we controlled for size, as larger firms might have a greater tendency to internationalize (Bantel & Jackson, Reference Bantel and Jackson1989). Business size was therefore measured using the natural log of total assets (Sanchez-Famoso, Maseda, & Iturralde, Reference Sanchez-Famoso, Maseda and Iturralde2017). Second, the methodology controlled for age, as older firms are more likely to accrue greater knowledge and experience which can also drive internationalization (Kidwell, Cox, & Kloepfer, Reference Kidwell, Cox, Kloepfer, Memili and Dibrell2019). Finally, the methodology controlled for sector, as Melin (Reference Melin1992) suggested that internationalization is sectoral, and indeed industrial sectors tend to have managers with longer tenures and who possess superior skills and knowledge as they relate to internationalization (Manolova, Brush, Edelman, & Greene, Reference Manolova, Brush, Edelman and Greene2002).

Results

Our research model was tested using PLS-SEM, a variance-based structural equation modelling method (Richter et al., Reference Richter, Cepeda, Roldán and Ringle2015; Roldán & Sánchez-Franco, Reference Roldán, Sánchez-Franco, Manuel and Ovsei2012).

The assessment of the measurement model for reflective indicators in PLS was based on individual item reliability, internal consistency reliability, convergent validity, and discriminant validity (Roldán & Sánchez-Franco, Reference Roldán, Sánchez-Franco, Manuel and Ovsei2012). Individual item reliability was considered adequate as all indicators and dimensions exhibited loadings greater than.60 (Table 3). Although Cronbach's alpha (α) for the FSC construct was slightly higher than.90, the disadvantage of the α is its sensitivity to the number of items in the scale and its general tendency to underestimate the internal consistency reliability (Hair, Hult, Ringle, Marko, & Thiele, Reference Hair, Hult, Ringle, Marko and Thiele2017). Therefore, α could be slightly greater than.90 even if the internal consistency is correct. In any case, due to the limitations of α, ‘it is more appropriate to apply a different measure of internal consistency reliability, which is referred to as composite reliability’ (Hair, Sarstedt, Hopkins, & Kuppelwieser, Reference Hair, Sarstedt, Hopkins and Kuppelwieser2014, p. 101). The authors rectified this problem with composite reliability by taking into account the different outer loadings of indicator variables. As suggested by Garson (Reference Garson2016), this index falls between.60 and.95 in all constructs. As such, the study's results confirm internal consistency reliability (i.e., indicators of all constructs are representative of the desired dimension, with one of them, FSC, being highly correlated). To assess convergent validity, the authors examined the average variance extracted (AVE). All latent variables achieved convergent validity since their AVEs surpassed the.50 level (Fornell & Larcker, Reference Fornell and Larcker1981) (Table 3).

Table 3. Evaluation of the measurement model

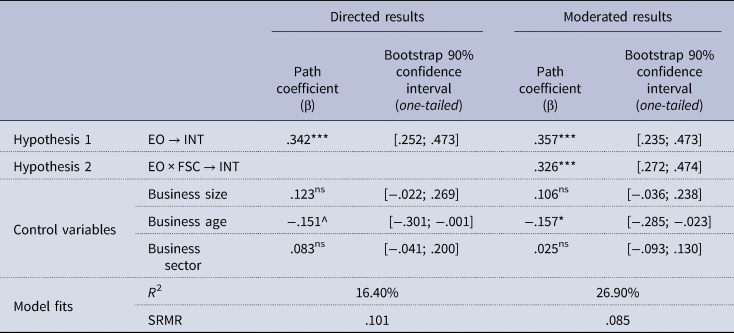

Table 4 shows that all constructs attained discriminant validity both according to the Fornell–Larcker and the strictest HTMT85 criteria (Hair et al., Reference Hair, Hult, Ringle, Marko and Thiele2017). Hence, all constructs were empirically distinct. In the structural model, the authors assessed the path coefficients, their significance via bootstrap tests, the R 2 values, and the Q 2 tests for predictive relevance. The Q 2 value was obtained using the blindfolding procedure for a specified omission distance (in our case, 7). When a PLS path model exhibits predictive relevance, it accurately predicts data not used in the model estimation. Q 2 values greater than zero for a specific reflective endogenous latent variable indicate the predictive relevance of the path model for a particular dependent construct. In our case, all the reflective constructs surpassed zero thereby indicating predictive relevance. To assess the model, the authors also calculated the standardized root mean square residual (SRMR). Henseler et al. (Reference Henseler, Dijkstra, Sarstedt, Ringle, Diamantopoulos, Straub and Calantone2014) and Mulaik, James, Van Alstine, Bennett, Lind, and Stilwell (Reference Mulaik, James, Van Alstine, Bennett, Lind and Stilwell1989) advocated for the use of the SRMR indicator to measure a model's goodness of fit, and recommended values equal to or less than.10. The value is.10 for the structural direct model and.86 for the structural moderate model.

Table 4. Discriminant validity of the measurement model

Notes: The diagonal represents the square root of AVEs in italic. The Fornell–Larcker criterion appears below the diagonal and the HTMT85 criterion appears above the diagonal.

This study's two hypotheses were analysed according to the procedure advocated by Nitzl, Roldan, and Cepeda (Reference Nitzl, Roldan and Cepeda2016). An effect is significant with 90% probability if the resulting confidence interval does not include the zero value after generating 10,000 bootstrap samples (Hair et al., Reference Hair, Hult, Ringle, Marko and Thiele2017; Hayes, Reference Hayes2013). The authors found that EO has a significant influence on FOB internationalization (β = .342; p < .001; Table 5). This result was also confirmed by the confidence interval [.252; .473]. Thus, we were able to validate hypothesis 1. Regarding hypothesis 2, Table 5 shows that the moderating effect of FSC on the relationship between EO and family firm internationalization is significant (β = .326; p < .001), a result also confirmed by the confidence interval [.272; .474]. Thus, the authors can conclude that FSC positively moderates the relationship between EO and family firm internationalization: the stronger the FSC, the stronger the relationship between EO and INT.

Table 5. Results of the PLS path analysis

Note: ***p < .001; *p < .05; ^.10; ns, not significant.

Among the control variables considered, only one (business age) appeared to exert an influence on FOB internationalization (Table 5). It is interesting to note that this influence is negative, meaning that older FOBs have a higher propensity to become internationalized, a result which confirms previous findings (Hennart, Majocchi, & Forlani, Reference Hennart, Majocchi and Forlani2019).

Discussion

The main finding of this study reveals that EO exerts a positive impact on FOB internationalization. Despite international involvement raising the level of uncertainty and risk for the wealth of an FOB's future generations, the presence of EO increases its propensity to initiate and deploy international activities. The results confirm the entrepreneurial nature of FOB internationalization and the importance of FOBs embracing proactiveness, risk taking, and innovativeness (i.e., the three components of EO) to achieve international performance. In keeping with Vahlne and Johanson (Reference Vahlne and Johanson2019) and Yu et al. (Reference Yu, Lumpkin, Praveen Parboteeah and Stambaugh2019), this study also confirms the important role of family interactions and relationships with results indicating that the stronger the FSC, the more successful the firm's internationalization process. Furthermore, the findings indicate a significant relationship between business age (considered as a control variable) and internationalization. Although one stream of research argues that business age has a negative effect on internationalization because older firms tend to value stability and predictability and hence display more inertia and an increased reluctance to adopt riskier cross-border strategies (Kidwell, Cox, & Kloepfer, Reference Kidwell, Cox, Kloepfer, Memili and Dibrell2019), this research contradicts these findings by demonstrating that older firms have a higher propensity to becoming internationalized. As such, and in keeping with Hennart, Majocchi, and Forlani (Reference Hennart, Majocchi and Forlani2019), the authors posit that older FOBs find benefit from having family managers with longer tenures, possibly more developed business relationships, larger networks, and a better understanding of the business, all of which ultimately facilitate internationalization deployment and performance.

The interpretation of our findings is mainly based on the RBV which posits that the internationalization process is both risky and resource intensive because foreign markets are often unknown, unpredictable, and competitive (Vahlne & Johanson, Reference Vahlne and Johanson2021). Therefore, to counter the disadvantages stemming from the liability of foreignness, FOBs should be encouraged to take bold action and curtail their initial reluctance to engage in potentially risky activities that will allow them to develop innovative and effective solutions to face the challenges of crossing borders, but also to better control or simply access the necessary types and levels of resources or competencies needed to sustain their investment in international activities. If the three components of EO are considered as competencies/capabilities that are essentially managerial in nature, they could therefore be labelled, from an RBV standpoint, as behavioural resources. From this perspective, this study's proposed model shows the importance of these behavioural resources for FOBs in their pursuit of internationalization in light of the significant interplay between EO and INT. The moderating effect of FSC on the relationship between EO and INT indicates that closer and more positive relationships between family members enable easier access to other material, financial, or informational resources required to initiate and sustain the internationalization process.

This interpretation can then be widened and supplemented through the lens of the markets-as-networks paradigm. Using this perspective, the integration of family members in personal or professional networks may be seen as helping FOBs facilitate a reduction or even the elimination of Vahlne and Johanson's liability of outsidership (Reference Vahlne and Johanson2021). In this view, the social capital of family members can offer access to the necessary and relevant resources not owned by the firm and/or can facilitate the development and smooth functioning of inter-organizational partnerships, such as strategic alliances or joint ventures (Arregle et al., Reference Arregle, Chirico, Kano, Kundu, Majocchi and Schulze2021; Calabrò et al., Reference Calabrò, Campopiano, Basco and Pukall2017). Furthermore, markets are not the only entities that can be seen as networks; organizations and families can also be seen as such. This helps reveal the moderating role of the FSC on the relationship between EO and INT by seeing how an FOB's productive access to, and integration into, relevant cross-border networks depends on the existence and cohesion of its family network, in other words, from a relational perspective, the family's social capital (Salvato & Melin, Reference Salvato and Melin2008).

In support of an even deeper interpretation of the complex relationship between EO, FSC, and INT among family firms, the authors further mobilize assemblage theory, already present in the FOB literature (Reuber, Reference Reuber2016). According to assemblage theory, the world is made up of entities, assemblages of heterogeneous components. For example, an FOB represents an assemblage of resources, material (e.g., buildings, offices, machinery, cars), human (e.g., family and non-family members, managers, employees), relational (e.g., interactions and relations between family and non-family members), and cultural (e.g., values, beliefs, narratives). From a systemic perspective, these can be seen as subsystem components (Habbershon & Williams, Reference Habbershon and Williams2016), that is, an assemblage of non-fixed components that may change over time, disappear, or be replaced while the FOB assemblage continues to exist. Furthermore, specific FOB components can participate independently in different assemblages by playing the same or different roles from one assemblage to the next (Reuber, Reference Reuber2016), for example, the family firm accountant participating as husband and father in the family assemblage while also being an independent entity unto himself. Assemblage theory is therefore highly relevant in studying family firms, underlining the existence of multiple, interacting dynamic elements and identities that can result in coexisting logics (Caputo et al., Reference Caputo, Marzi, Pellegrini and Rialti2018) and which may also lead to various tensions and conflicts (Ayoko, Caputo, & Mendy, Reference Ayoko, Caputo and Mendy2021; Kubíček & Machek, Reference Kubíček and Machek2020).

The dynamic nature of these multiple components interacting determines the nature of assemblages of ever-changing, continuously evolving through destabilizing and restabilizing states and processes which can often change the composition and the boundaries of the assemblage (De Landa, Reference De Landa2006). Per Reuber (Reference Reuber2016), ‘an assemblage is stabilized through processes that increase its internal homogeneity and coherence, and therefore sharpen its boundaries, such as those involving routines and shared values. An assemblage is destabilized through processes that decrease its internal homogeneity, therefore opening its boundaries, such as those involving learning and conflicting beliefs’ (p. 1274). Using a dynamic assemblage perspective, FOB internationalization can be viewed as a complex chain of changes and interactions between routines, activities, and components that modify the boundaries of a family firm, not only through novel interactions between components, but also through geographical expansion of activities which can therefore easily lead to assemblage destabilization. In such a case, a highly developed and positive FSC can act as a correcting and restabilizing mechanism, on one hand by creating a strong core of shared values, routines, and mission in the strategic centre of the organization and on the other by providing rapid access to components relevant and necessary for the effective functioning of the assemblages during international expansion. Thus, studying FOB internationalization through the lens of assemblage theory may provide better insight into the destabilizing and restabilizing components and processes associated with this risky but highly necessary organizational strategy.

Theoretical implications

The findings of this study have important theoretical implications that span across multiple theoretical perspectives, that is, the RBV, and agency, stewardship, and assemblage theories. This research validates the heterogeneity of family firms and points to two central factors in internationalization performance, one general (i.e., the consistent application of an EO) and one specific to FOBs (i.e., the existence of strong FSC). As such, this paper addresses the need identified by Hennart, Majocchi, & Forlani (Reference Hennart, Majocchi and Forlani2019), Yu et al. (Reference Yu, Lumpkin, Praveen Parboteeah and Stambaugh2019), and Santulli, Torchia, Calabrò, and Gallucci (Reference Santulli, Torchia, Calabrò and Gallucci2019) to expand our understanding of the internationalization of heterogeneous FOBs from an entrepreneurial perspective (McAdam, Clinton, & Dibrell, Reference McAdam, Clinton and Dibrell2020; Moreno-Menéndez & Castiglioni, Reference Moreno-Menéndez and Castiglioni2021) by investigating the central role of FSC (Rodrigo-Alarcón et al., Reference Rodrigo-Alarcón, García-Villaverde, Ruiz-Ortega and Parra-Requena2018) towards understanding internationalization performance. To the authors' knowledge, this study is the first to apply and expand the scope of the FSC concept into the area of FOB internationalization, as, in our opinion, FSC is not fully interchangeable with the concept of familiness (Zellweger, Eddleston, & Kellermanns, Reference Zellweger, Eddleston and Kellermanns2010). Finally, by offering a multi-level interpretation rooted in various theoretical perspectives, we attempt to do justice to the complexity of the FOB internationalization process, outlining the coexisting logics of the RBV and agency, stewardship, and assemblage theories, and underscoring the essential role of FSC as a determinant of internationalization success or failure. Unfortunately, the importance of this role is at best weakened if not left incomplete in studies that merely view FSC as a one-dimensional construct (Rodrigo-Alarcón et al., Reference Rodrigo-Alarcón, García-Villaverde, Ruiz-Ortega and Parra-Requena2018).

Practical implications

The findings of this study lead to important implications for managers and policymakers. From a managerial perspective, it is crucial to foster entrepreneurship as it allows FOBs to reinvent themselves by finding new growth avenues, including international development (Calabrò et al., Reference Calabrò, Campopiano, Basco and Pukall2017; Rodrigo-Alarcón et al., Reference Rodrigo-Alarcón, García-Villaverde, Ruiz-Ortega and Parra-Requena2018). As suggested by Gimmon and Felzensztein (Reference Gimmon and Felzensztein2021), FOBs attempting to expand internationally should not only act entrepreneurially, but also promote and stimulate their EO, notably proactiveness, risk taking, and innovativeness, as a strategic basis for their organizational culture. Furthermore, the findings of this study suggest that the positive effects of entrepreneurial behaviours could be strengthened by achieving strong and positive FSC. Given that internationalization can be considered a relational process that promotes knowledge base augmentation (Yli-Renko, Autio, & Tontti, Reference Yli-Renko, Autio and Tontti2002), the positive effects of FSC on goodwill, stewardship, organizational cohesion, effective communication, and access to resources (Yu et al., Reference Yu, Lumpkin, Praveen Parboteeah and Stambaugh2019) can all be seen as critical in encouraging international entrepreneurship (Rodrigo-Alarcón et al., Reference Rodrigo-Alarcón, García-Villaverde, Ruiz-Ortega and Parra-Requena2018). Active and diversified networks have an important positive impact on the internationalization process because they increase the level of FSC, thus reduce the uncertainty of the process (Gimmon & Felzensztein, Reference Gimmon and Felzensztein2021; Pino, Felzensztein, & Chetty, Reference Pino, Felzensztein and Chetty2021).

From a policymaker perspective, the findings of this study suggest that promoting entrepreneurship is essential for FOB internationalization. Thus, in addition to the support offered to facilitate SME internationalization (D'Angelo & Presutti, Reference D'Angelo and Presutti2019), it may be important for central and local governments to establish and promote different types of consulting and training programmes that can facilitate FOBs integrating and developing entrepreneurial capabilities, such as key cognitive and problem-solving skills. Furthermore, seeing as FOBs are the dominant type of business organization in many economies (Miroshnychenko et al., Reference Miroshnychenko, De Massis, Miller and Barontini2020; Smith et al., Reference Smith, Nordqvist, De Massis and Miller2021), any increase in the domestic and international performance of FOBs can help enhance general economic development, growth of national wealth, reduction of unemployment, and increased innovativeness.

Conclusions

This paper addresses an important knowledge gap in FOB internationalization theory and practice by investigating the role and articulation of EO and FSC on internationalization performance. Internationalization is inherently a risky strategy that augments a firm's level of organizational uncertainty. This study extends the findings of Gimmon and Felzensztein (Reference Gimmon and Felzensztein2021) in the sense that entrepreneurial characteristics of FOBs play a crucial role when overcome challenges inherent to new business opportunities. Idiosyncratic FOB characteristics can have risk mitigating effect on the international expansion of these organizations (Arregle et al., Reference Arregle, Duran, Hitt and van Essen2017). However, when the EO of these firms is considered, the effect of their very nature as FOBs is clearly positive; the more entrepreneurial the FOB, the higher its likelihood of identifying and exploiting business opportunities in foreign markets. Furthermore, the moderating effect of FSC on the relationship between EO and INT indicates how organizational stability and performance enhancement are in fact induced by this relational family specific asset. Thus, this research makes an important contribution to the FOB literature by better identifying and clarifying the factors that influence the internationalization of FOBs, a need recently identified by Morais and Ferreira (Reference Morais and Ferreira2020) and Yu et al. (Reference Yu, Lumpkin, Praveen Parboteeah and Stambaugh2019). In addition, this study reframes the natural heterogeneity of FOBs in terms of family relationships thereby widening the scope and application of the FSC concept (Sanchez-Famoso, Maseda, & Iturralde, Reference Sanchez-Famoso, Maseda and Iturralde2017) to achieve new insights into the international performance of these organizations.

These new findings and contributions to the FOB internationalization literature should, however, be interpreted with caution as this research is exclusively focused on Spanish FOBs. Pino, Felzensztein, and Chetty (Reference Pino, Felzensztein and Chetty2021) and Felzensztein et al. (Reference Felzensztein, Saridakis, Idris and Elizondo2021) pointed out that the context plays an important role in the internationalization. Neither did the authors control for family involvement, which may have an important impact on the FOB internationalization process as proposed by Pukall and Calabrò (Reference Pukall and Calabrò2013). Going forward, it could be beneficial to apply a mixed methodology (combining both quantitative and qualitative data collection and analysis) in order to better address the complex nature of FOB structures and processes. Future research could further elucidate the role of organizational heterogeneity and culture in FOB internationalization. The authors also propose that analysing a sample of FOBs located in different countries could facilitate a comparative approach and shed light on the importance of country of origin in internationalization performance. A multi-country study could indeed improve our understanding of how different cultural components might influence the internationalization of FOBs as well as the extent of family involvement. Finally, we encourage future studies to undertake more longitudinal studies of FOB internationalization in an effort to identify and evidence the various cycles of family business development, stabilization, and degrowth.

Acknowledgements

We highly appreciate the financial support received from the Spanish Research Program of the Ministry of Science, Innovation and Universities (RTI2018-097579-B-100), and the grant no. GIU19/057.