I

The bill of exchange and the currency market (today's foreign exchange market) are among the most interesting and at the same time complex themes of economic historical research. We are indebted to Raymond De Roover (Reference De Roover1953) and Federigo Melis (Reference Melis1972) for their studies of the workings of bills of exchange and for their understanding of the mechanisms of speculation that these made possible.Footnote 1 Their research cleared the way for the reconstruction of the financial market of preindustrial Europe. Indeed, from the late 1960s many scholars began to devote their attention to the circulation of currencies by means of bills of exchange. A number of studies have examined the fairs of Champagne, where by the thirteenth century bills were bought and sold together with goods; others, meanwhile, have analyzed those of Geneva, Lyon, Medina del Campo, Besançon and Piacenza, which saw a gradual increase in this business, culminating in the rise of Novi Ligure, which in the seventeenth century attracted the elite of international finance – a true City avant la lettre.Footnote 2

Still today, the circulation of capital through the networks of fairs represents a topic of considerable interest among economic historians. Recently, however, other related themes have also gained ground: many scholars have moved their focus to the broad subject of the price of money, using the ‘hearsay’Footnote 3 exchange rates indicated in commercial correspondence to study and recreate historical series, which they in turn analyze to understand rate fluctuations and variations over different times of the year; in addition, they have investigated the possibility of using foreign exchange transactions to dodge the prohibition of applying interest (Koyama Reference Koyama2010). Other scholars, meanwhile, have compared exchange rates in bills with those of public debt and consumer credit (Rubin Reference RUBIN2010; Bell, Brooks and Moore Reference Bell, Brooks, Moore, Casson and Nigar2013, Reference Bell, Brooks and Moore2017a; Orlandi Reference Orlandi, Iradiel, Navarro, Igual and Villanueva2016).Footnote 4 Finally, some researchers have aimed to clarify the reasons behind the issuing of bills of exchange and the ways these were employed: in some cases, unusual appropriations have come to light, such as the use of bills as simple instruments of money transfers (Nigro Reference Nigro, Iradiel, Navarro, Igual and Villanueva2016).

This variegated historiographical framework provides the context for our attempt to answer several questions. Above all this work aims to follow the monetary flows set in motion by a late medieval company which was consistently involved in exchange operations. Analysis of monetary flows makes possible a sort of internal study of a company, in particular to comprehend the specific weight of a firm on the market on the basis of the bills of exchange which it issued and received. Such a line of inquiry inevitably leads to the attempt to understand the reasons behind exchange-rate oscillations, the ways in which these occurred and their level of predictability. To this end, we identified a source which seems able to shed light on both of these topics, namely the book of exchange bills from the Datini company of Barcelona, which contains details of the exchange contracts it made in 1403.Footnote 5

This account book constitutes a reliable primary source for this type of analysis, as it has allowed us to work with the rates which were effectively applied – the actual prices involved – rather than the ‘hearsay’ rates mentioned above. We opted not to use ‘hearsay’ rates because the data at our disposal show a systematic difference with respect to the real rates. This discrepancy is by no means a minor one. Analysis of the data at our disposal relative to all the markets with which Barcelona had exchange transactions that year reveals that in 57.56 per centFootnote 6 of cases the real exchange rate was higher than the ‘hearsay’ one, while in 23.84 per cent it was lower; in only 18.60 per cent of transactions did the two values coincide. Observation of the individual exchange markets confirms that correspondence of the real and ‘hearsay’ rates was quite rare. For example, this was the case in only 6.67 per cent of transactions in Avignon and 9.09 per cent in Bruges. The highest percentages of matching rates, which are still on the whole low, are found in Florence and Genoa (26.92 per cent and 30.00 per cent, respectively). All other markets show values of between 16.67 per cent and 12.50 per cent.

Our findings also enable us to highlight that the percentages in which real exchange rates were higher than ‘hearsay’ ones ranged from a maximum of 86.67 per cent in Avignon to a minimum of 23.08 per cent for Florence; with regard to the opposite case, the lowest percentage (6.67 per cent) was recorded once again in Avignon and the highest in Pisa (57.14 per cent). It is further of interest to note that the real exchange rate tended to be higher than the ‘hearsay’ one above all in the winter months (December–March), while the contrary is evident during the rest of the year. The greatest difference between the two types of exchange rates was observed in the case of Genoa, where the difference between the real and ‘hearsay’ rate reached a maximum of 18.60 per cent during the month of February.

These data are quite useful for explaining the particular rate fluctuations of certain markets, which we will presently analyze in more detail. It is clear, then, that using ‘hearsay’ rates would have caused systematic error and produced distorted results in the analysis of exchange-rate volatility.Footnote 7 From this documentation we created a database which collects financial operations concluded by the Datini company of Barcelona between 6 March 1403 and 10 March 1404. Examination of these data was supplemented by an econometric study with both univariate and multivariate analyses.

We are well aware that this study considers only a single firm and treats a limited timeframe. We must bear in mind, though, that the Datini group was one of the most important companies operating in the regions of Catalonia and Aragon, controlling the trade in Maestrazgo wool, a crucial raw material in the economy of the era, in oligopsonistic fashion (Orlandi Reference Orlandi and Nigro2010a, Reference Orlandi and Nigro2010b). As we will see below, the Barcelonan firm played the leading role in the Catalan holding company, collaborating with and supporting its two sister branches of the company of Catalonia (Valencia and Mallorca) in a great variety of ways. On the one hand, the cooperation of the three branches enhanced the polycentric character of the Catalan–Aragonese economy, which was based on the three cities which interacted through a network of ports and large and small markets in the territories of the Aragonese crown. On the other hand, these Datini firms had a significant impact on the commodities trade with the major economic centers of the Mediterranean and northern Europe (Orlandi Reference Orlandi2019).

In this framework, much of the activity of the Barcelonan branch was financial, as it managed not only the cash flows within the Datini system but also the movement of money in the broadest sense of the term (Orlandi Reference Orlandi2019). Not by chance, then, do we find that of the 5,417 bills of exchange that have come down to us (conserved today in their original form at the Datini Archive in Prato) 2,587 were issued in Barcelona, 378 in Valencia and 116 in Palma. While these figures show the important financial role played by Barcelona, we must bear in mind that we do not know how many bills have been lost.

With regard to the brief period under consideration in our analysis, we will see that over 1,000 financial operations were transacted in those twelve months, for an average of over 80 per month.

II

As cities launched upon a period of continuous growth from the mid-fourteenth century, the monetary economy began to expand as a result of a reduction in forms of payment in kind. Yet while the trend toward monetization rose, thereby increasing the need for financial capital, the quantity of circulating money did not keep pace. The problem of scarce liquidity was therefore a basic reality of the most advanced cities of the late Middle Ages. The problem was faced in various ways: deferred payments, down payments in raw materials or money, loans to a business on the part of a partner through a sovraccorpo,Footnote 8 but above all by means of diverse operations of usury and new forms of payment, including bills of exchange and written orders, which in Tuscany were transformed into veritable bank cheques (Melis Reference Melis1972, pp. 75–103).

These new forms derived from mechanisms of abstracting from the concept of money, operations which merchants engaged in from the middle of the fourteenth century. In part, such operations were successful thanks to the refinement of linguistic jargon, that is, to the invention and use of formalized techniques for describing economic phenomena (Puncuh Reference Puncuh2002; Toccafondi Reference Toccafondi and Cecchi Aste2004). The intrinsic value of metallic money was replaced by the value of a written document in the form of a bill of exchange, bank transfer or bank cheque, which allowed money to change hands more conveniently and safely.

With the bill of exchange, the operator needing to transfer funds to another market was the remitter (the purchaser of the foreign currency); he deposited a certain sum with the taker, receiving in return a payment order which he then sent to the payee. When the latter received the bill, he went to the taker's foreign representative (drawee), who upon accepting the payment order signed by the taker paid him the sum indicated in the document in the local currency.

The bill of exchange was used in a variety of ways. As we have just indicated, its typical function corresponded to today's money transfer,Footnote 9 namely an international payment that took place without the physical circulation of money. The remitter transferred money in the local currency to a payee, who received the equivalent in the currency of his market. The intermediaries in the operation were the taker and the drawee, who had perforce to maintain close correspondence – and not only because of their geographical distance – so as to consolidate over time their respective functions of debtor and creditor in order to be able to execute the contracts of exchange.

Bills of exchange could also be used as tools for credit and speculation. Thanks to their thorough knowledge of foreign exchange markets and their wide-ranging network of relations, Florentine merchants made loans or speculated on the basis of the difference between exchange rates in two cities, by means of an exchange of bills (with the remitter of the first bill becoming the payee of the second, and the drawee now functioning as beneficiary). In the case that a bill of exchange was used as a loan, it was often guaranteed by means of a preliminary agreement in which the parties established the amount of the return exchange (a cambium siccum, or ‘dry exchange’).Footnote 10 This was understandably a practice that met with strong condemnation on the part of the Church, as the parties could conceal the interest rate in the exchange rate of the second bill.

The mechanism of speculation in bills of exchange, meanwhile, can be clarified by describing a hypothetical situation based on real data. On 5 August 1395 in Palma de Mallorca, Tom paid 1 real for a bill of 15.5 Barcelonan soldi to be paid to Dick (within the usual time period – 10 days from presentation of the bill). On 3 September, Dick bought a return bill to be paid to Tom, using the 15.5 soldi which he had just collected. On that day, the exchange rate in Mallorca was 14.916 soldi, such that with the 15.5 soldi Dick transferred 1.039 reales to Palma, assuring Tom a substantial profit, amounting to 3.9 per cent for 29 days, or 49 per cent per annum (Nigro Reference Nigro, Iradiel, Navarro, Igual and Villanueva2016, p. 306).Footnote 11

Operations of this nature, however, were characterized by a degree of uncertainty, represented by the real fluctuations of the exchange rates (it was indeed this unpredictability that enabled merchants to dodge the Church's condemnation): only if agents had prompt, accurate news of rate variations were they able to carry out profitable transactions. It comes as no surprise, then, that commercial correspondence contains frequent pleas for information, such as that made by Valenza Aliso degli Alberti to Cristofano Carocci in Palma: ‘When you write again, tell us whether exchanges are being made there, not only ones directed here (Valencia) and to Barcelona, but also to Bruges, Avignon and Montpellier. And if so, give us the rates: if we find them favorable, we might make some as well’ (Orlandi Reference Orlandi2008, p. 140).Footnote 12

III

In commercial and banking companies, purchases and sales of bills of exchange were recorded in the so-called book of exchange bills, whose sole purpose was to keep track of such operations: as such, this book represents the most specialized and technical record that basic accounting methods were capable of producing.

As we have indicated, our study focuses on an examination of the Book of Exchange Bills labeled ‘G’ from the Barcelonan branch of the Datini company. Here were recorded transfers of money and exchange operations carried out by this firm during the opening years of the fifteenth century. In particular, we looked at all operations involving monetary transfers, including bills of exchange that were purchased, sold, paid or redeemed by Simone BellandiFootnote 13 between 6 March 1403 and 10 March 1404. During that year, the Barcelonan firm recorded 1,050 operations, of which 1,038 were valid for our analysis.Footnote 14 Overall, the firm moved 56,619,848 million deniers, equal to 235,916 Barcelonan pounds and 8 deniers. In Florentine florins this sum was equal to 277,548 florins 4 soldi and 8 deniers, which was quite a substantial amount if we consider that the share capital of the Barcelonan branch totaled 3,000 florins, while that of the entire Catalan company amounted to 9,600 florins (Melis Reference Melis1962, p. 248).

The markets involved in these money transfers were Avignon, Bruges, Florence, Genoa, Mallorca, Milan, Montpellier, Naples, Palermo, Paris, Perpignan, Pisa, Rome, Saragossa, Valencia and Venice – in other words, the most important markets of the period.

Table 1 and Figure 1 respectively indicate and illustrate the value of the monetary flows to and from Barcelona of the Datini branch operating in the Catalan capital. Overall, incoming and outgoing flows were equal, which could suggest that trade and payment balances in Barcelona were in substantial equilibrium. Yet this is not completely true because in general these flows were also the result of purely financial operations which could have various effects according to time and place. As examples, we have reconstructed the cases of Pisa and Avignon. With regard to the former, we know that monetary flows often underwent significant variations and that those values may contain sums earmarked for speculative activity or simple monetary transfers. During the year in question, Pisa functioned as a financial market more than a commercial one for the Barcelonan company. This circumstance accounts for the substantial difference between outgoing and incoming sums leaving and entering the Catalan capital. To better understand this difference, we examined the details of the commercial correspondence of 1403, which reveals that the company of Lodovico and Francesco Borromei in Pisa played a role in the speculative triangulation with the Ricci banking firms in Genoa and Florence. This activity produced a web of financial flows which explain this discrepancy.Footnote 15

Table 1. Movement of money to and from Barcelona (6 March 1403 – 10 March 1404)

Figure 1. Movement of money to and from Barcelona (6 March 1403 – 10 March 1404)

The case of the Avignon company was different. The significant money flows that left the city toward Barcelona are evident from the month of June, when – as we shall see below – demand for money increased in the Catalan capital for the purchase of wool and kermes. This mechanism is once again confirmed by the correspondence: in June of that year, the director of the Barcelonan branch recommended to his counterpart in Avignon not to hold onto money from commercial operations carried out on his behalf but to transfer it to him as soon as possible.Footnote 16

Let us now return to analyzing the money flows in light of what emerges from Table 1. With nearly 14 million deniers, Genoa accounted for just under 25 per cent of the total of the transfers, followed by Bruges, Montpellier and Valencia, with 16.70 per cent, 14.17 per cent and 13.41 per cent, respectively. Venice, Florence and Mallorca totaled 9.70 per cent, 8.35 per cent and 5.42 per cent, respectively. The nine other cities recorded a much lower involvement in these operations, with less than 2.69 per cent each.

If we sum the percentage values of the individual markets by geographical area, we find that the commercial operations of the Barcelona branch extended well beyond the region bounded by the Ebro and the Pyrenees. While this was the area in which the control of the company was most strongly felt, we can identify at least three others which attracted its attention.

The first of these regions is represented by north-central Italy, with Genoa, Pisa, Florence and Venice together accounting for 45.1 per cent of the monetary flows under consideration. The importance of Genoa for the Barcelonan firm is readily comprehended, both because the Datini company here was responsible for establishing the Catalan branches and also because of geographical proximity, which naturally facilitated exchange. Ships leaving Genoa and Savona indeed brought a number of goods to Barcelona, including cloth, linen canvas, gold and silver thread, velvet, metal items such as small knives, fustian from Milan, and products from the Near East, such as cotton fabrics from Cyprus and Damascus. These were goods that were for the most part destined to meet the demand of the thriving Barcelonan market and those of Valencia and Mallorca. On the other hand, Barcelona sent Catalan cloth as well as leather and hides of various kinds to Liguria.

Florence and Pisa, meanwhile, supplied the Barcelonan market with woolen goods, fabrics of silk and gold thread, steel items, and paper from Colle Val d'Elsa; in exchange, they received leather goods and hides, coral rosaries, sugar and locally produced fabrics. Venice was the point of reference for trade with the Levant, Germany and the North Sea; the Datini company in that city purchased a great variety of products from Catalonia, including Spanish leather, wool from Maestrazgo and lute strings, and supplied the region in return with silver, paper, cotton, copper, rhubarb and spices.

A second region of interest was southern France, where Avignon and Montpellier were the focal points of an area of economic significance, accounting for 16.86 per cent of the monetary flows in question. Montpellier was the main port for the typical products of the Languedoc, especially cloth – an item much in demand throughout the Mediterranean – and woad; it traded these in return for kermes, indigo, wax, cloves and other products to be sold either in the local market or in those of cities to the north. Indeed, goods ascended the Rhône to reach Paris, from where trade routes continued to Bruges and London, which represented the ports of northern Europe with which the Barcelonan firm had most contact and where it purchased cloth manufactured in Essex, Mechlin, Wervik and Courtrai. In return, it shipped kermes, saffron, rice (Igual Reference David2016), cotton, spices, sugar, noci sarghe and other products. It was not by chance, then, that Bruges alone accounted for almost 17 per cent of the monetary flows examined in this study.Footnote 17 It goes without saying that a very large part of trade with northern Europe followed the maritime routes which connected the Mediterranean with the Atlantic and the North Sea through the Strait of Gibraltar.

As we have indicated, the Barcelonan branch had extremely varied relations of collaboration and support with its two sister companies of Catalonia (Valencia and Mallorca); in the year under consideration, it transacted 10,663,213 Barcelonan deniers (almost 19 per cent of the total) with them. As the parent branch, it also acted on their behalf on the exchange and insurance markets, while with regard to commercial goods it carried out purchases and sales of their typical products. The two smaller branches of the Catalan company indeed benefitted from the significant position of the port and transport services of the Barcelonan branch within the complex system of international trade of the entire Datini group. In turn, the Barcelonan firm supplied its sisters with goods received in its own port from its correspondents in Genoa and Florence when these could not be sent directly.

The significant percentages of the monetary transactions with these three regions clearly illustrate their importance not only for the Barcelonan branch but also for the overall economy of the city.Footnote 18 Table 2 shows the sums which the company transacted monthly through bills of exchange.

Table 2. Monthly movements of money to and from Barcelona (6 March 1403 – 10 March 1404)

These figures clearly show that the periods during which the firm transferred the greatest sums were those between June/July and September/October. This should come as no surprise: kermes from Valencia and wool from Aragon and the Plain were usually purchased in the summer months. Our data indicate significant movements of money in the month of May as well, contrary to what is found in the Pratiche di mercatura, which often report phenomena that are generally valid but do not always correspond to reality, which is precisely the case with the difference between ‘hearsay’ and real exchange rates. This discrepancy is probably explained by the payment mechanisms for wool purchases: acquisitions were booked the previous autumn, and initial payments began as early as May, when shearing began. Indeed, the three months from May to July saw 302 exchange operations, with an average value of 56,706 deniers per contract.

In September and especially October, 180 transactions were conducted for an average of 87,467 deniers per contract. It is probable that a substantial part of these regarded the purchase of saffron.

During the five months in question, over 27,000,000 deniers was transacted, nearly 48 per cent of the total. In general, it is interesting to note that precisely in the months of May, June, July, September and October the company recorded the highest income flows (Table 2), a fact which highlights the influence that trade had on monetary supply and demand and therefore on the factors of abundance and scarcity of money, which were crucial in determining exchange rates.

IV

As we have indicated, new forms of loans aiming at sustaining companies began to spread at the turn of the fourteenth to the fifteenth century. The significance of the bill of exchange in this context was not simply due to speculative operations but also to the need to transfer funds quickly from one business to another. Indeed, bills were bought and sold to satisfy the demand for currency on the part of commercial agents; the question of oscillations in exchange rates therefore played a key role in their decisions.

In our analysis of the exchange contracts made by the Datini company in Barcelona between March 1403 and March 1404, our database tallied 930 valid transactions. From the overall total we indeed eliminated all operations of monetary transfers which did not require an exchange of currency because the money in question was the same for both markets. For example, monetary flows to and from Valencia and Perpignan were made in Barcelonan pounds, which of course was the currency of reference in Barcelona itself.Footnote 19

In addition, we decided to examine sums transferred by means of bills of exchange and the relative fluctuations in exchange rates only for those cities which during the year under consideration recorded the greatest number of transactions and as such are the most relevant statistically, namely, Genoa (212), Montpellier (167) and Bruges (113).

A final point to bear in mind is that the method of exchange used in Barcelona was based on the price quotation system with regard to all markets: that is, the Catalan firm established rates based on an unknown amount of local currency (Melis Reference Melis1972, p. 101).

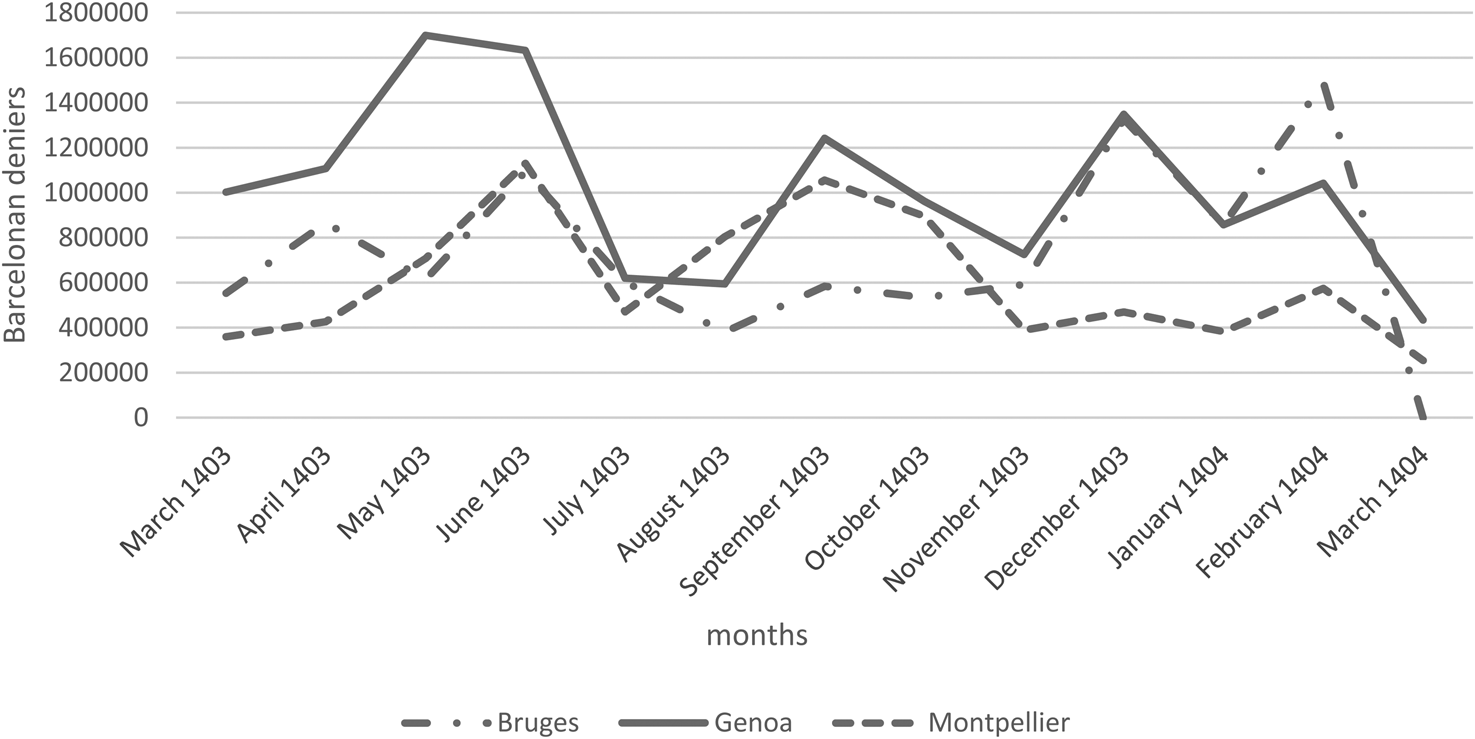

Table 3 and Figure 2 show that with these three markets the Datini company of Barcelona exchanged 492 bills in foreign currency for a value of 30,689,218 deniers, representing almost 59 per cent of the total of 52,173,205 deniers.

Table 3. Value of monthly currency exchange transactions with Bruges, Genoa and Montpellier (6 March 1403 – 10 March 1404)

With regard to the exchange rates, we must bear in mind that money was treated in the same way as any other product: money, therefore, could be in great or short supply on the market. Commercial agents of the time called these situations monetary abundance or shortage, expressions that defined the greater or lesser quantity of local currency available on a particular market. Alternations between these phases naturally influenced fluctuations in exchange rates as well as the frequency of the operations concerning them. The correspondence of merchants provides ample proof of this fact: when, for example, money was in short supply in Valencia in August 1395, Piero Tecchini wrote to Mallorca that ‘there's a dearth of money on all markets’ (Orlandi Reference Orlandi2008, p. 652),Footnote 20 a situation that would raise exchange rates.

A shortage or abundance of metallic money in circulation was above all due to internal mechanisms, such as variations in the cost of precious metals, the politics of the mints, occurrences of temporary or continuous hoarding, and the credit market. With regard to the last of these factors, we must bear in mind that during the 1380s the Barcelonan money market underwent significant change. In the wake of the bankruptcy of several private bankers, the first public bank in Europe was created (on 20 January 1401). This was the Taula de Canvi, which collected deposits from the municipal government, business operators and private citizens, thus playing a crucial role in influencing liquidity levels in the city (Feliu Reference Feliu and Bernal2000; Orti Gost Reference Orti Gost2000, Reference Orti Gost2001, Reference Orti Gost2007). As we will see, an even more important factor was the rhythms of commerce, which could produce variations in the prices of goods and the demand for foreign currencies. When ships arrived laden with goods the market prices of these products naturally decreased, while the demand for the currency of the country from which they came increased. On the whole, exchange rate oscillations depended on trade and payment balances. Exchange rates could be further influenced by liquidity in the foreign countries in question, by currency exchange speculation, and by interference on the part of governments (De Roover Reference De Roover1968). In the period under consideration, however, we have no evidence of government meddling in the currency market. It is therefore likely that the most relevant factor behind oscillations in the price of money is to be ascribed to periods of currency abundance or shortage caused by commercial operations.

Merchants were well aware that the currency market passed through alternating phases of shortage and abundance and that these variations followed seasonal patterns, which were strongly conditioned by the movement of goods and the rhythms of navigation. In order to take advantage of these situations, commercial agents paid close attention to each variation: their concern was to predict how and where fluctuations in the different exchange rates could occur.

If we wish to attempt to explain the rhythmic phenomena which characterized the Barcelonan market, we can make use of the evidence given in the Pratica di mercatura by Sanminiato de’ Ricci, a Florentine merchant active in Genoa. Here he writes:

In Barcelona there's a lack of money from the first of June till the Feast of St. John because of the purchase of wool in Aragon, in the Plain and at the fairs. The same holds true for acquiring kermes in Valencia. We can therefore assume that the shortage continues throughout the month of August. Then it begins again for the purchase of saffron during the Feast of St. Luke in October. Purchase of saffron causes a shortage of money greater than that triggered by wool and kermes; during this period, whoever has cash makes great profits. The shortage lasts till January, then it gradually slows up and money returns to its previous prices, until the shortage caused by fresh purchases of wool and kermes. (Borlandi Reference Borlandi1963, p. 118)Footnote 21

We have, then, a lengthy period of currency shortage beginning in June and lasting until January; during these months, Barcelonan currency becomes stronger with respect to foreign monies, giving rise to high exchange rates.

Figures 3, 4 and 5 provide a good – even if not perfect – reflection of the observations made by Ricci. Indeed, for all three foreign currencies (the schild for Bruges, the genovino for Genoa and the franc for Montpellier) the curves show that the exchange rates begin to increase in the month of June and remain elevated until at least November. As we have seen, demand for local currency in those periods was high, above all for the purchase of wool, kermes, rice and saffron, products which Florentine and Genoese merchants present in Barcelona purchased not only for themselves but also on behalf of others.

Figure 2. Value of monthly currency exchange transactions with Bruges, Genoa and Montpellier (6 March 1403 – 10 March 1404)

Figure 3. Average exchange rate fluctuations between the Brugeois schild and the Barcelonan pound (6 March 1403 – 10 March 1404)

Figure 4. Average exchange rate fluctuations between the genovino and Barcelonan currency (6 March 1403 – 10 March 1404)

Figure 5. Average exchange rate fluctuations between the franc for Montpellier and Barcelonan currency (6 March 1403 – 10 March 1404)

This situation was accurately depicted by the merchants involved. For example, an agent of the Orlandini firm of Bruges wrote to the director of the Datini company in Barcelona in these words:

We believe that the cost of money there (in Barcelona) will come down when the stocks of saffron have been sold off. Keep us informed about this so we can be ready to make profits. Here (in Bruges) the cost of money of all currencies increased greatly, then it came down, and now we think these prices will continue for the rest of this month. Then, when the ships from Genoa arrive, things will change. We'll let you know.Footnote 22

Our analysis reveals certain differences between real fluctuations and seasonal factors which have been noted by other studies on the contents of several Pratiche di mercatura. We find discrepancies with respect to what Sanminiato dei Ricci reported for the period between November and January. The Florentine merchant stated that the shortage of local money continued until the end of January; yet this claim is belied by Figures 1 and 3 (for Bruges and Montpellier), which are based on real exchange rates. As we have shown above, these rates differed from ‘hearsay’ ones more markedly during the winter months. Indeed, in the cases of both Bruges and Montpelier, the maximum difference was observed in the month of January, with the real exceeding the ‘hearsay’ rate by 13.40 per cent and 6.85 per cent, respectively. It is therefore evident that using ‘hearsay’ rates would have produced distorted results. It was only through an exclusive use of real rates that we were able to conduct this innovative analysis.

The vibrant markets of the cities that we have examined indeed show dynamic variations in exchange rates. The best-informed agents were able to conclude their contracts by taking advantage of every opportunity, including those which might materialize during the course of a single day. The documentation clearly shows that exchange rates could be objects of negotiation between the parties. In a letter sent from Bruges, the company of Orlandini and Benezi wrote that on 9 September 1399 they made exchanges with Barcelona at varying rates: ‘Today we exchanged at different prices: at s. 9 d. 11 and at s. 9 d. 10, and then late in the evening, when we were about to send off the purse, at s. 9 d. 10 ¼14;. Tomorrow the rates will be higher.’Footnote 23

This important detail from our sources allows us to make several salient observations. First of all, it shows the propensity of merchants to negotiate with their customers in order to gain maximum advantage. On that particular day, three different rates were applied; in the course of 24 hours, the value of a schild fell from s. 9 d. 11 to s. 9 d. 10.5, but in the evening, just as the purse was ready to be shipped, contracts were concluded at the rate of s. 9 d. 10.25.Footnote 24

The hurry caused by the imminent departure of the postal service forced the remitter (the purchaser of the Barcelonan currency) to finalize the contract at a less favorable exchange rate. While in the morning a schild would buy 9 soldi 11 deniers, by evening it exchanged for only 9 soldi 10.25 deniers.

Secondly, this particular letter points to a modest volatility in exchange rates, which apparently oscillated between minimum and maximum values of no great difference. While this circumstance confirms what emerged from the series of our database, at the same time it prompted us to broaden our analysis of exchange-rate variability with respect to the markets that traded with Barcelona during the period under examination. Indeed, in the next section of this article we will look at the temporal series of the exchange rates, making use of econometric tools. This analysis, which when combined with the more qualitative economic approaches employed thus far, will aid us in reading this volatility in a different light.

V

In order to carry out an econometric analysis of exchange rate volatility on the Barcelonan market, we examined only those series which are made up of a sufficient number of readings to render the processing relevant.Footnote 25 Overall, eight series meet this criterion: specifically, we analyzed the series of exchanges between the Barcelonan pound and the Avignon franc (AV), the Brugeois schild (BR), the Florentine florin (FL), the Genoese genovino (GE), the Mallorcan real (MA), the Montpellier franc (MP), the Aragonese florin of Valencia (VA) and the Venetian ducat (VE).

As we have seen, the temporal series of the available exchange rates cover a period from March 1403 to March 1404. The readings are irregularly spaced, in the sense that the exchange rates are recorded each time a transaction takes place. As a result, for each day a different number of exchange rate observations are available, greater than or equal to zero.

For each of the eight rates under consideration, we focused on the vector containing the series of the last exchange rates recorded for each day on which at least one transaction occurred.Footnote 26 Formally, we use ![]() $X_t^i $ to denote the last value of the exchange rate for the ith currency recorded on day t, with i = 1, …, 8 and with t assuming values in the grid

$X_t^i $ to denote the last value of the exchange rate for the ith currency recorded on day t, with i = 1, …, 8 and with t assuming values in the grid ![]() $G^i: = \{ 1 = \tau _1^i < \tau _2^i < \ldots < \tau _{{ {N_i} \cr } }^i = N_i\} $, where

$G^i: = \{ 1 = \tau _1^i < \tau _2^i < \ldots < \tau _{{ {N_i} \cr } }^i = N_i\} $, where ![]() $\tau _j^i $ is the integer corresponding to the jth day with at least one transaction made in the ith currency, and where N i is the total number of days with at least one transaction occurring with the ith currency.

$\tau _j^i $ is the integer corresponding to the jth day with at least one transaction made in the ith currency, and where N i is the total number of days with at least one transaction occurring with the ith currency.

To overcome the problem of readings which are irregularly spaced, we followed the approach of (Engle Reference Engle2000) in modeling the scaled log-return ![]() $\xi _{\tau _j^{\,i} }^i :\unicode{x003D}\!\!\! $

$\xi _{\tau _j^{\,i} }^i :\unicode{x003D}\!\!\! $ ![]() $\;z_{\matrix{ {\tau _j^{\,i} } \cr } }^i \;\;( {{\rm \Delta }_j^{\rm i} } ) ^{-{1 \over 2}}, \;$ where

$\;z_{\matrix{ {\tau _j^{\,i} } \cr } }^i \;\;( {{\rm \Delta }_j^{\rm i} } ) ^{-{1 \over 2}}, \;$ where ![]() $z_{{ {\tau _j^{\,i} } \cr } }^{\,i} : = ln( X_{{ {\tau _j^{\,i} } \cr } }^i $

$z_{{ {\tau _j^{\,i} } \cr } }^{\,i} : = ln( X_{{ {\tau _j^{\,i} } \cr } }^i $ ![]() ${/}X_{{ {\tau _{j-1}^{\,i} } \cr } }^i ) $ and

${/}X_{{ {\tau _{j-1}^{\,i} } \cr } }^i ) $ and ![]() ${\rm \Delta }_j^{\rm i} : = \tau _j^i -\tau _{j-1}^i $, with j = 2, 3, …. The series of scaled log-returns are plotted in Figure 6, while Table 4 shows some sample statistics of these series.

${\rm \Delta }_j^{\rm i} : = \tau _j^i -\tau _{j-1}^i $, with j = 2, 3, …. The series of scaled log-returns are plotted in Figure 6, while Table 4 shows some sample statistics of these series.

Figure 6. Scaled log-returns for the eight exchange rate samples analyzed

Table 4. Sample statistics of the scaled log-returns

In order to decide which model is best suited to the univariate series of scaled log-returns, we began by testing for stationarity. The Augmented Dickey–Fuller test (Dickey and Fuller Reference Dickey and Fuller1979) confirmed that all our series of scaled log-returns could be assumed to be stationary, as the null hypothesis of the presence of a unit root was rejected at the 99 per cent confidence level for all the series. Then, we analyzed the sample autocorrelation functions of the scaled log-return series, which are illustrated in Figure 7.

Figure 7. Sample autocorrelation functions for the eight exchange rate samples analyzed, with 95% confidence bounds for the null hypothesis of a white noise process

The significant lag-1 autocorrelations in Figure 7 suggested that an MA(1) model may represent a suitable fit for the series AV, GE, MA, MP, VA and VE. Instead, the absence of significant autocorrelations indicated that a simple white noise may be sufficient to adequately model the series BR and FL. Furthermore, five out of the eight scaled log-return samples, namely GE, MA, MP, VA and VE, failed the Jarque–Bera Gaussianity test (Jarque and Bera Reference Jarque and BERA1987), performed at the 95 per cent confidence level.Footnote 27 This is consistent with the values of sample kurtosis reported in Table 4.

Based on the overall analysis of univariate samples, we assumed the following model for the scaled log-returns:

where, for each i = 1,…,8, β i is a constant, ![]() $\epsilon _t^i $, t ∈ G i, is an i.i.d. sequence of t-distributed finite-kurtosis shocks with ν i > 4 degrees of freedom, mean equal to zero and variance equal to γ i: = ν i(ν i − 2)−1(σ i)2, σ i > 0. Note that when β i = 0, this model corresponds to white noise and when ν i → ∞ the shocks are Gaussian. We estimated this model on the time series of the eight available scaled log-returns using Maximum Likelihood. The results are summarized in Table 5.

$\epsilon _t^i $, t ∈ G i, is an i.i.d. sequence of t-distributed finite-kurtosis shocks with ν i > 4 degrees of freedom, mean equal to zero and variance equal to γ i: = ν i(ν i − 2)−1(σ i)2, σ i > 0. Note that when β i = 0, this model corresponds to white noise and when ν i → ∞ the shocks are Gaussian. We estimated this model on the time series of the eight available scaled log-returns using Maximum Likelihood. The results are summarized in Table 5.

Table 5. Results of the estimation of model (1) on the eight scaled log-return samples (p-values less than 10−3 are reported as zero)

The presence of an MA(1) structure in six of the eight series shows that an economic agent could have predicted the exchange rate for the following transaction on the basis of the rate for the previous one.

In a certain sense, this result confirms the behavior of medieval merchant-bankers, who had no other way of attempting to predict exchange rates than by monitoring previously applied rates on a daily basis, if not several times a day. Not by chance, then, did agents communicate the ‘hearsay’ rates to their correspondents in nearly every letter. Over the medium and long term, they may also have taken circumstances of monetary abundance or shortage into account, which, as we have seen, caused variations in exchange rates. Indeed, in the absence of extraordinary events, the supply of money was known to merchants, who could make use of this knowledge to fine-tune their predictions of exchange rate fluctuations.

Analysis of the data showed us that six of the eight series examined revealed a correlation between one exchange rate and the previous one. With regard to these six series, then, a merchant could use this information to his advantage in the sale and purchase of bills of exchange.

On the other hand, the series for Bruges and Florence are well modeled by a white noise, that is, exchange rates which are independent of one another. For this reason, the exchange market between Barcelona, Bruges and Florence was more efficient. Indeed, it seems difficult to provide an explanation for these two series. For exchanges directed toward Bruges, we are able to show that during that year neither Barcelona nor the Flemish city totally adhered to predictions of monetary abundance and shortage expected on the two markets. From the beginning of June, in fact, Bruges showed an unusual abundance, caused by conflict between Florence and Pisa which rendered the ports of Motrone and Piombino inaccessible.Footnote 28 The result was a reduction in the demand for the money required to load ships in the port of Sluys which were destined for the Mediterranean. In Barcelona, meanwhile, the exchange rate with Bruges was expected to rise between November and January, when it in fact fell, as we have noted.

Overall, univariate analysis finds low exchange rate volatility. Table 4 shows limited variance, from a minimum of 0.0002 in Avignon to a maximum of 0.0139 in Valencia. We see, then, that even in the absence of financial and banking institutions which control money markets from a centralized position – as occurs today – the price of money was quite stable. In their awareness of how much their own profits could depend on the correlation between one exchange rate and another, the merchants themselves probably aimed to limit variability. These circumstances of substantial stability meant that fluctuations in exchange rates were not at the root of the profits made by merchants through speculative activities, even if this possibility could never be completely ruled out; rather, earnings were based on the great quantities of money transferred from one market to another: small profit rates applied to large sums guaranteed significant revenues.Footnote 29

Furthermore, by means of multivariate analysis we attempted to isolate the latent factors which affected fluctuations in the exchange rates between the markets of Florence, Genoa, Mallorca, Montpellier, Valencia and Venice during the year in question. We excluded Avignon and Bruges because we did not have at least one monthly datum for these cities. For the former, indeed, we have no observations for August 1403 and January, February and March 1404, while for the latter we have no data for March 1404.

The availability of exchange rate samples for six different currencies calls for a multivariate approach. However, the possibility of performing robust and effective multivariate analysis directly on those samples is compromised by a problem of asynchronicity, that is, by the fact that each sample contains a different number of observations per day, greater than or equal to zero. Consequently, to cope with this lack of uniformity, we resorted to the same solution adopted by (Bell et al. Reference Bell, Brooks, Moore, Casson and Nigar2013), namely, we considered the series of monthly averages of intra-day exchange rates, which we denote by ![]() $M_t^i $, with i = 1, …, 6 and t = 1, …, 13.

$M_t^i $, with i = 1, …, 6 and t = 1, …, 13.

In particular, we performed Principal Component Analysis (PCA). Simply put, given a multi-dimensional random vector, PCA is concerned with using linear combinations of this random vector to explain the structure of its covariance matrix. As a dimension reduction technique, PCA is specifically used to isolate the few sources of variation that explain most of the total variance of a given random vector. A detailed treatment of PCA can be found, for example, in Tsay (Reference Tsay2010). We performed PCA on the standardized log-returns ![]() $\tilde{w}_{\rm t}^{\rm i} : = {{{\rm w}_{\rm t}^{\rm i} {\rm \;}\ndash {\rm \;}{\rm \mu }^{\rm i}} \over {{\rm \;}{\rm \sigma }^{\rm i}}}, \;{\rm \;\;where}$

$\tilde{w}_{\rm t}^{\rm i} : = {{{\rm w}_{\rm t}^{\rm i} {\rm \;}\ndash {\rm \;}{\rm \mu }^{\rm i}} \over {{\rm \;}{\rm \sigma }^{\rm i}}}, \;{\rm \;\;where}$ ![]() ${\rm \;w}_{\rm t}^{\rm i} : = {\rm ln}\left({{{{\rm M}_{{\rm t} + 1}} \over {{\rm M}_{\rm t}}}} \right), \;{\rm \;}{\rm \mu }^{\rm i}$ is the sample mean of

${\rm \;w}_{\rm t}^{\rm i} : = {\rm ln}\left({{{{\rm M}_{{\rm t} + 1}} \over {{\rm M}_{\rm t}}}} \right), \;{\rm \;}{\rm \mu }^{\rm i}$ is the sample mean of![]() ${\rm \;w}_{\rm t}^{\rm i} {\rm \;and\;}{\rm \sigma }^{\rm i}{\rm \;}$is its sample standard deviation. Figure 8 and Table 6 show, respectively, the plots and the sample covariance matrix of the

${\rm \;w}_{\rm t}^{\rm i} {\rm \;and\;}{\rm \sigma }^{\rm i}{\rm \;}$is its sample standard deviation. Figure 8 and Table 6 show, respectively, the plots and the sample covariance matrix of the ![]() $\tilde{w}_{\rm t}^{\rm i} $'s.

$\tilde{w}_{\rm t}^{\rm i} $'s.

Figure 8. Monthly standardized log-returns

Table 6. Covariance matrix of the six series of monthly standardized log-returns

At first, we tested the univariate series of the ![]() $\tilde{w}_{\rm t}^{\rm i} $'s for stationarity using the Augmented Dickey–Fuller test: we found that the null hypothesis of a unit root is always rejected at the 99 per cent confidence level. We then performed PCA of the available 12 × 6 sample. The results are illustrated in Table 7.

$\tilde{w}_{\rm t}^{\rm i} $'s for stationarity using the Augmented Dickey–Fuller test: we found that the null hypothesis of a unit root is always rejected at the 99 per cent confidence level. We then performed PCA of the available 12 × 6 sample. The results are illustrated in Table 7.

Table 7. PCA of the covariance matrix in Table 6

Table 7 shows that almost 40 per cent of the total variance of the data is explained by the first principal component and that the first two principal components alone explain more than 60 per cent of the total variance of the data. In particular, observation of the eigenvectors indicates that the first principal component ascribes positive weight to exchange rates related to financial operations concluded between Barcelona and exchange markets in the western Mediterranean (with the exception of Montpellier, for which the weight is approximately zero), while attributing negative weight to Florence and Venice, geographically more distant from Barcelona. This first principal component, which shows the same positive sign for those markets closest to Barcelona, may thus be interpreted as having geographical relevance. Shorter distances may have meant a more rapid exchange of news between one city and another, including information on exchange rates, as well as greater and faster coordination and synchronization of decisions regarding economic operations. This hypothesis may find further confirmation in the fact that Florence and Venice counted for only 9 per cent and 8 per cent, respectively, of the monetary transactions to and from Barcelona, as shown in Table 1.

The second principal component, on the other hand, ascribes negative weight to all five series except that for Montpellier. This component may therefore be interpreted as having macroeconomic relevance, with roughly the same effect on five of the six exchange rate log-returns. This macroeconomic factor may then be linked to commercial activity. We have seen that relations with Valencia and Mallorca were inevitably close, not only with regard to trade within the area of Catalonia and Aragon but also for operations toward other markets in the western Mediterranean, the North Sea and the African coast. Genoa, Florence and Venice, meanwhile, were the three main markets of the period with which Barcelona had close commercial contacts, whether directly or indirectly.

VI

This study has provided us with further significant information about the intensive use of bills of exchange made by commercial agents. By assuring a more rapid circulation of money, these bills exerted beneficial effects – as Giampiero Nigro has written – on economies such as those of Barcelona, Valencia and Mallorca: albeit in different ways, these markets were each characterized by growing productive and commercial capacity and a relatively high rate of monetization (Nigro Reference Nigro, Iradiel, Navarro, Igual and Villanueva2016, p. 298). At the same time, we must bear in mind that in the Catalan capital the exchange bill market was largely managed by Florentine and Tuscan operators working together with agents from Genoa and Milan and with local businessmen (Feliu Reference Feliu2004, Reference Feliu2007; Orti Reference Orti Gost2000, Reference Orti Gost2007). This dominant role – both from the commercial and financial points of view – of Tuscan merchant-bankers and in particular of those of Datini companies allows us to make the claim (with all due caution) that the results of this study provide a fairly reliable representation of the Barcelonan exchange market.

Although the account book upon which we have relied for this study does not allow us to precisely identify the purposes for which exchange contracts were issued, we are inclined to believe that they were principally used to transfer funds needed to satisfy a great variety of requirements for liquidity. This primary function therefore enables us to answer the first question that we posed at the outset: the most intense financial flows of the Barcelonan firm were with those markets with which it had the closest commercial relations. As we have seen, these were Genoa, Montpellier and its region, and Bruges, which was a true point of reference for trade with northern Europe.

At the same time, the bill of exchange could also be used for loans and for speculative operations on financial markets. In that case, it was essential for commercial agents to be able to predict the volatility of exchange rates.

With regard to our second and more articulated question regarding the reasons for and the modalities and predictability of exchange rate oscillations, we have seen that currency prices were affected by a number of elements, which we have discussed. We have seen that one of the traditional factors was the supply of and demand for money. We know that vacillations between conditions of shortage or abundance of local money were especially connected to fluctuations in the balance of trade and in payments. The Pratiche di mercatura and the comments of agents always tend to emphasize that liquidity on those markets influenced the rhythms of the exchange of products such as wool, kermes, saffron and rice. Fluctuations in the series which we reconstructed essentially reflect conditions of liquidity caused by commercial flows, even if several variations due to institutional conflict, the movement of ships, and monetary policy could also come into play.

In particular, we have seen that seasonal variations in exchange rates are not always confirmed by the study of real rates. Indeed, exchange rates between the currency of Barcelona and those of Bruges and Montpellier differed from those predicted in the Pratiche di mercatura and effectively expressed by ‘hearsay’ rates. On the other hand, ‘hearsay’ rates could not account for rates that spontaneously resulted from negotiations between contracting parties, which, we believe, were often determined by speculative operations. In any case, these negotiated rates played a role in defining fluctuations on the currency market.

Econometric analysis then impelled us to assess other aspects of exchanges, including their markets and their volatility. In particular, this part of the study shows low rate variability, indicating substantial stability, which aided merchants in reducing the risks of speculative operations. As we have seen, this stability enabled operators to profit by moving considerable sums from one market to another.

Finally, multivariate analysis led us to consider the predictability of exchange rates. In addition, this analysis suggests the probable role of geographical and macroeconomic factors able to influence rates. With regard to the former, the geographical proximity of certain areas perhaps allowed for more rapid circulation of news by means of commercial letters – precious sources of information, including currency prices. With reference to the latter factor, commercial activity represented a powerful motor in the economy of the time.

A fundamental role in these questions was played by the skill of merchants – their training and their knowledge of the markets and of economic and financial mechanisms: the result of all this expertise was, incredibly, that the price of money was kept at almost stable levels. Commercial agents were indeed able to profit not only when favorable exchange rates made their lives easy but also when white noise complicated their efforts.