1. Introduction

The subject of how microeconomic productivity shocks translate into aggregate macroeconomic fluctuations, in light of production networks, has been widely studied in the business cycle literature. Regarding production networks, the works of Long and Plosser (Reference Long and Plosser1983), Horvath (Reference Horvath1998, Reference Horvath2000), and Dupor (Reference Dupor1999) are concerned with input-output linkages, whereas Acemoglu et al. (Reference Acemoglu, Carvalho, Ozdaglar and Tahbaz-Salehi2012, Reference Acemoglu, Ozdaglar and Tahbaz-Salehi2017), Acemoglu and Azar (Reference Acemoglu and Azar2020) base their analysis on a multisectoral general equilibrium model under a unitary elasticity of substitution or Cobb-Douglas economy. In a Cobb-Douglas economy, Domar aggregation becomes linear with respect to sectoral productivity shocks, and because the Leontief inverse that plays the essential role in their aggregation is granular [Gabaix (Reference Gabaix2011)], some important dilation of volatility in aggregate fluctuations becomes explainable.

Moreover, peculiar aggregate fluctuations are evident from the statistical record. Figure 1 depicts the quantile-quantile (QQ) plots of the HP-detrended postwar quarterly log GDP using the Hodrick-Prescott (HP) filter against the standard normal for the USA (left) and Japan (right). These figures indicate that either the Cobb-Douglas or the normal shock assumption is questionable, since these assumptions together make the QQ plot a straight line. Acemoglu et al. (Reference Acemoglu, Ozdaglar and Tahbaz-Salehi2017) explained the non-normal frequency of large economic downturns (in the USA), using non-normal (heavy-tailed) microeconomic productivity shocks. Baqaee and Farhi (Reference Baqaee and Farhi2019), on the other hand, claim that a non-Cobb-Douglas economy (thus, with nonlinear Domar aggregation) can lead to such non-normality in macroeconomic fluctuations under normally distributed productivity shocks.

Indeed, the asymmetric tails in the left panel of Figure 1 seem to coincide with the case in which the aggregated shocks are evaluated in a Leontief economy. We know this because a Cobb-Douglas economy with more alternative technologies can always yield a better solution (technology) than a Leontief economy with a single technology. Thus, if a Cobb-Douglas economy generates an aggregate output that corresponds to the straight line of the QQ plot, an unrobust Leontief economy that can generate less than a Cobb-Douglas economy must take the QQ plot below the straight line. This feature (of an inelastic economy) is also consistent with the analysis based on the general equilibrium model with intermediate production with a very low (almost Leontief) elasticity of substitution studied in Baqaee and Farhi (Reference Baqaee and Farhi2019).

If the theory that the elasticity of substitution dictates the shape of the tails of the distribution of the aggregate macroeconomic shocks were to stand, Japan would have to have an elastic economy according to the right panel of Figure 1. Consequently, one basis of this study is to empirically evaluate the sectoral elasticity of substitution for the Japanese economy.Footnote

1

To do so, we utilize the time-series linked input-output tables, spanning 100 sectors for 22 years (1994–2015), available from the JIP (2019) database. We extract factor prices (as deflators) from the linked transaction tables available in both nominal and real values. We use the sectoral series of TFP that are also included in the database to instrument for the potentially endogenous explanatory variable (price) in our panel regression analysis. Note in advance that our sectoral average elasticity estimates (

![]() $\bar{\hat{\sigma }}=1.54$

) exceeded unity.

$\bar{\hat{\sigma }}=1.54$

) exceeded unity.

To ensure that our study is compatible with the production networks across sectors, we construct a multisector general equilibrium model with the estimated sector-specific CES elasticities. We assume constant returns to scale for all production so that we can work on the system of quantity-free unit cost functions to study the potential transformation of the production networks along with the propagation of productivity shocks in terms of price. Specifically, given the sectoral productivity shocks, the fixed point solution of the system of unit cost functions allows us to identify the equilibrium production network (i.e. input-output linkages) by the gradient of the mapping. By eliminating all other complications that can potentially affect the linearity of the Domar aggregation, we are able to single out the role of the substitution elasticity on the asymmetric tails of the aggregated shocks.

The remainder of this paper proceeds as follows. We present our benchmark model of a CES economy with sector-specific elasticities and then reduce the model to Leontief and Cobb-Douglas economies in Section 2. We also refer to the viability of the equilibrium structures with respect to the aforementioned economies and show that non-Cobb-Douglas economies are not necessarily prevented from exhibiting an unviable structure. In Section 3, we present our panel regression equation and estimate sectoral elasticities of substitution with respect to the consistency of the estimator. Our main results are presented in Section 4 where we show that our nonlinear (and recursive) Domar aggregators for non-Cobb-Douglas economies qualitatively replicate the asymmetric tails presented in this section. Section 5 concludes the paper. Replication data and Stata codes for this study are available at Nakano and Nishimura (Reference Nakano and Nishimura2022).

2. The CES economy

2.1. Model

Below are a constant-returns-to-scale CES production function and the corresponding CES unit cost function for the

![]() $j$

th sector (index omitted) of

$j$

th sector (index omitted) of

![]() $n$

sectors, with

$n$

sectors, with

![]() $i = 1, \cdots, n$

being an intermediate and a single primary factor of production labeled

$i = 1, \cdots, n$

being an intermediate and a single primary factor of production labeled

![]() $i=0$

.

$i=0$

.

\begin{align*} x = z \left ( \sum _{i=0}^n (\alpha _{i})^{\frac{1}{\sigma }} (x_{i})^{\frac{\sigma -1}{\sigma }} \right )^{\frac{\sigma }{\sigma -1}}, && \pi =\frac{1}{z}\left ( \sum _{i=0}^n \alpha _{i} (\pi _{i})^{\gamma } \right )^{{1}/{\gamma }} \end{align*}

\begin{align*} x = z \left ( \sum _{i=0}^n (\alpha _{i})^{\frac{1}{\sigma }} (x_{i})^{\frac{\sigma -1}{\sigma }} \right )^{\frac{\sigma }{\sigma -1}}, && \pi =\frac{1}{z}\left ( \sum _{i=0}^n \alpha _{i} (\pi _{i})^{\gamma } \right )^{{1}/{\gamma }} \end{align*}

Here,

![]() $\sigma =1-\gamma$

denotes the elasticity of substitution, while

$\sigma =1-\gamma$

denotes the elasticity of substitution, while

![]() $\alpha _{i}$

denotes the share parameter with

$\alpha _{i}$

denotes the share parameter with

![]() $\sum _{i=0}^n \alpha _{i}=1$

. Quantities and prices are denoted by

$\sum _{i=0}^n \alpha _{i}=1$

. Quantities and prices are denoted by

![]() $x$

and

$x$

and

![]() $\pi$

, respectively. Note that the output price equals the unit cost due to the constancy of returns to scale. The Hicks-neutral productivity level of the sector is denoted by

$\pi$

, respectively. Note that the output price equals the unit cost due to the constancy of returns to scale. The Hicks-neutral productivity level of the sector is denoted by

![]() $z$

. The duality asserts zero profit in all sectors

$z$

. The duality asserts zero profit in all sectors

![]() $j=1,\cdots,n$

, that is,

$j=1,\cdots,n$

, that is,

![]() $\pi _j x_j = \sum _{i=0}^n \pi _i x_{ij}$

.

$\pi _j x_j = \sum _{i=0}^n \pi _i x_{ij}$

.

By applying Shephard’s lemma to the unit cost function of the

![]() $j$

th sector, we have:

$j$

th sector, we have:

where

![]() $s_{ij}$

denotes the

$s_{ij}$

denotes the

![]() $i$

th factor cost share of the

$i$

th factor cost share of the

![]() $j$

th sector. For later convenience, let us calibrate the share parameter at the benchmark where price and productivity are standardized, that is,

$j$

th sector. For later convenience, let us calibrate the share parameter at the benchmark where price and productivity are standardized, that is,

![]() $\pi _0 = \pi _1 = \cdots = \pi _n = 1$

and

$\pi _0 = \pi _1 = \cdots = \pi _n = 1$

and

![]() $z_1 = \cdots = z_n =1$

. Since we know the benchmark cost-share structure from the input-output coefficients of the benchmark period

$z_1 = \cdots = z_n =1$

. Since we know the benchmark cost-share structure from the input-output coefficients of the benchmark period

![]() $a_{ij}$

, the benchmark-calibrated share parameter must therefore be

$a_{ij}$

, the benchmark-calibrated share parameter must therefore be

![]() $\alpha _{ij} = a_{ij}$

. Taking this into account, the equilibrium price

$\alpha _{ij} = a_{ij}$

. Taking this into account, the equilibrium price

![]() $\boldsymbol{\pi }=(\pi _1, \cdots, \pi _n)$

given

$\boldsymbol{\pi }=(\pi _1, \cdots, \pi _n)$

given

![]() $\boldsymbol{z}=(z_1, \cdots, z_n)$

must be the solution to the following system of

$\boldsymbol{z}=(z_1, \cdots, z_n)$

must be the solution to the following system of

![]() $n$

equations:

$n$

equations:

\begin{align*} \pi _1 &= (z_1)^{-1} \left ( a_{01} (\pi _0)^{\gamma _1} + a_{11} (\pi _1)^{\gamma _1} + \cdots + a_{n1} (\pi _n)^{\gamma _1} \right )^{1/\gamma _1} \\ \pi _2 &= (z_2)^{-1} \left ( a_{02} (\pi _0)^{\gamma _2} + a_{12} (\pi _1)^{\gamma _2} + \cdots + a_{n2} (\pi _n)^{\gamma _2} \right )^{1/\gamma _2} \\ &\vdots \\ \pi _n &= (z_n)^{-1} \left ( a_{0n} (\pi _0)^{\gamma _n} + a_{1n} (\pi _1)^{\gamma _n} + \cdots + a_{nn} (\pi _n)^{\gamma _n} \right )^{1/\gamma _n} \end{align*}

\begin{align*} \pi _1 &= (z_1)^{-1} \left ( a_{01} (\pi _0)^{\gamma _1} + a_{11} (\pi _1)^{\gamma _1} + \cdots + a_{n1} (\pi _n)^{\gamma _1} \right )^{1/\gamma _1} \\ \pi _2 &= (z_2)^{-1} \left ( a_{02} (\pi _0)^{\gamma _2} + a_{12} (\pi _1)^{\gamma _2} + \cdots + a_{n2} (\pi _n)^{\gamma _2} \right )^{1/\gamma _2} \\ &\vdots \\ \pi _n &= (z_n)^{-1} \left ( a_{0n} (\pi _0)^{\gamma _n} + a_{1n} (\pi _1)^{\gamma _n} + \cdots + a_{nn} (\pi _n)^{\gamma _n} \right )^{1/\gamma _n} \end{align*}

where we can set the price of the primary factor

![]() $\pi _0$

as the numéraire.

$\pi _0$

as the numéraire.

Note that this system of equations is equivalent to Miranda-Pinto and Young (Reference Miranda-Pinto and Young2022)’s specification of equilibrium price for a CES economy with sectoral distortions (Proposition 3), which reads as follows:

The correspondence of symbols are

![]() $P = (\pi _1, \pi _2, \cdots, \pi _n)$

,

$P = (\pi _1, \pi _2, \cdots, \pi _n)$

,

![]() $(1-\epsilon _{Q}) = (\gamma _1, \gamma _2, \cdots, \gamma _n)$

,

$(1-\epsilon _{Q}) = (\gamma _1, \gamma _2, \cdots, \gamma _n)$

,

![]() $Z = (z_1, z_2, \cdots, z_n)$

,

$Z = (z_1, z_2, \cdots, z_n)$

,

![]() $a = (a_{01}, a_{02}, \cdots, a_{0n})$

, and

$a = (a_{01}, a_{02}, \cdots, a_{0n})$

, and

\begin{align*} (1-a) \cdot \Omega ^\prime = \left ({\begin{array}{c@{\quad}c@{\quad}c@{\quad}c} a_{11} & a_{12} & \cdots & a_{1n}\\[4pt] a_{21} & a_{22} & \cdots & a_{2n}\\[4pt] \vdots & \vdots & \ddots & \vdots \\[4pt] a_{n1} & a_{n2} & \cdots & a_{nn}\\ \end{array} } \right ). \end{align*}

\begin{align*} (1-a) \cdot \Omega ^\prime = \left ({\begin{array}{c@{\quad}c@{\quad}c@{\quad}c} a_{11} & a_{12} & \cdots & a_{1n}\\[4pt] a_{21} & a_{22} & \cdots & a_{2n}\\[4pt] \vdots & \vdots & \ddots & \vdots \\[4pt] a_{n1} & a_{n2} & \cdots & a_{nn}\\ \end{array} } \right ). \end{align*}

The only difference is that the sectoral wedges (

![]() $\vartheta ^m, \vartheta ^w$

) are all equal to 1 in our model, since the firms are assumed to be unconstrained, that is, that there is no binding constraint other than the budget. Sectoral production choices are, therefore, undistorted in our model.Footnote

2

$\vartheta ^m, \vartheta ^w$

) are all equal to 1 in our model, since the firms are assumed to be unconstrained, that is, that there is no binding constraint other than the budget. Sectoral production choices are, therefore, undistorted in our model.Footnote

2

For later convenience, we write the above system in a more concise form as follows:

Here, angled brackets indicate the diagonalization of a vector. Note that

![]() $\boldsymbol{c}: \mathbb{R}^{n}_{+} \to \mathbb{R}^{n}_{+}$

is strictly concave and

$\boldsymbol{c}: \mathbb{R}^{n}_{+} \to \mathbb{R}^{n}_{+}$

is strictly concave and

![]() $\boldsymbol{z} \in \mathbb{R}^{n}_{+}$

. Consider a mapping

$\boldsymbol{z} \in \mathbb{R}^{n}_{+}$

. Consider a mapping

![]() $\mathcal{E}$

that nests the equilibrium solution (fixed point)

$\mathcal{E}$

that nests the equilibrium solution (fixed point)

![]() $\boldsymbol{\pi }$

of equation (2) and maps the (exogenous) productivity

$\boldsymbol{\pi }$

of equation (2) and maps the (exogenous) productivity

![]() $\boldsymbol{z}$

onto the equilibrium price

$\boldsymbol{z}$

onto the equilibrium price

![]() $\boldsymbol{\pi }$

, that is,

$\boldsymbol{\pi }$

, that is,

There is no closed-form solution to equation (3). However, one can be found for the case of uniform elasticity, that is,

![]() $\gamma _1 = \cdots = \gamma _n = \gamma$

, which is as follows:

$\gamma _1 = \cdots = \gamma _n = \gamma$

, which is as follows:

where the

![]() $n$

row vector

$n$

row vector

![]() $\boldsymbol{a}_0 = (a_{01}, \cdots, a_{0n})$

is called the primary factor coefficient vector and the

$\boldsymbol{a}_0 = (a_{01}, \cdots, a_{0n})$

is called the primary factor coefficient vector and the

![]() $n \times n$

matrix

$n \times n$

matrix

![]() $\mathbf{A} = \{ a_{ij} \}$

is called the input-output coefficient matrix. The case of a Leontief economy, where

$\mathbf{A} = \{ a_{ij} \}$

is called the input-output coefficient matrix. The case of a Leontief economy, where

![]() $1-\gamma =0$

, equation (4), can be reduced straightforwardly as follows:

$1-\gamma =0$

, equation (4), can be reduced straightforwardly as follows:

For the case of a Cobb-Douglas economy, where

![]() $\gamma =0$

, we first take the log and let

$\gamma =0$

, we first take the log and let

![]() $\gamma \to 0$

where L’Hôspital’s rule is applicable since

$\gamma \to 0$

where L’Hôspital’s rule is applicable since

![]() $\sum _{i=0}^n a_{ij}= 1$

for

$\sum _{i=0}^n a_{ij}= 1$

for

![]() $j=1,\cdots,n$

.

$j=1,\cdots,n$

.

Thus, equation (4) can be reduced in the following manner:

It is notable that the growth of the equilibrium price

![]() $\textrm{dln}\, \boldsymbol{\pi }=(\textrm{dln}\, \pi _1, \cdots, \textrm{dln}\, \pi _n)$

is a linear combination of the growth of sectoral productivity

$\textrm{dln}\, \boldsymbol{\pi }=(\textrm{dln}\, \pi _1, \cdots, \textrm{dln}\, \pi _n)$

is a linear combination of the growth of sectoral productivity

![]() $\textrm{dln}\, \boldsymbol{z}=(\textrm{dln}\, z_1, \cdots, \textrm{dln}\, z_n)$

in the case of a Cobb-Douglas economy.

$\textrm{dln}\, \boldsymbol{z}=(\textrm{dln}\, z_1, \cdots, \textrm{dln}\, z_n)$

in the case of a Cobb-Douglas economy.

Otherwise, the fixed point

![]() $\boldsymbol{\pi }$

given

$\boldsymbol{\pi }$

given

![]() $\boldsymbol{z}$

can be searched for by using the simple recursive method applied to equation (2). Since the unit cost function

$\boldsymbol{z}$

can be searched for by using the simple recursive method applied to equation (2). Since the unit cost function

![]() $\pi _j = (z_j)^{-1} c_j(\boldsymbol{\pi };\, \pi _0)$

is monotonically increasing and strictly concave in

$\pi _j = (z_j)^{-1} c_j(\boldsymbol{\pi };\, \pi _0)$

is monotonically increasing and strictly concave in

![]() $\boldsymbol{\pi }$

, we know by Krasnosel’skiĭ (Reference Krasnosel’skiĭ1964) and Kennan (Reference Kennan2001) that equation (2) is a contraction mapping that globally converges onto a unique fixed point, if it exists in

$\boldsymbol{\pi }$

, we know by Krasnosel’skiĭ (Reference Krasnosel’skiĭ1964) and Kennan (Reference Kennan2001) that equation (2) is a contraction mapping that globally converges onto a unique fixed point, if it exists in

![]() $\mathbb{R}^{n}_{+}$

. Note that if

$\mathbb{R}^{n}_{+}$

. Note that if

![]() $\pi _0=1$

and

$\pi _0=1$

and

![]() $(z_1,\cdots,z_n)=(1,\cdots,1)$

, then

$(z_1,\cdots,z_n)=(1,\cdots,1)$

, then

![]() $(\pi _1,\cdots,\pi _n)=(1, \cdots,1)$

is an equilibrium, which must be unique. Moreover, note that obviously from equation (6), the existence of a positive fixed point

$(\pi _1,\cdots,\pi _n)=(1, \cdots,1)$

is an equilibrium, which must be unique. Moreover, note that obviously from equation (6), the existence of a positive fixed point

![]() $\boldsymbol{\pi } \in \mathbb{R}^n_{+}$

for any given

$\boldsymbol{\pi } \in \mathbb{R}^n_{+}$

for any given

![]() $\boldsymbol{z} \in \mathbb{R}^n_{+}$

can be asserted for the case of a Cobb-Douglas economy. Specifically, it is possible to show from equation (6) that:

$\boldsymbol{z} \in \mathbb{R}^n_{+}$

can be asserted for the case of a Cobb-Douglas economy. Specifically, it is possible to show from equation (6) that:

\begin{align*} \left ( \pi _1, \cdots, \pi _n \right ) = \left ( \prod _{i=1}^n \frac{e^{a_{01} \ell _{i1}\ln \pi _0}}{(z_i)^{\ell _{i1}}}, \cdots, \prod _{i=1}^n \frac{e^{a_{0n} \ell _{in}\ln \pi _0}}{(z_i)^{\ell _{in}}} \right ) \gt \left ( 0, \cdots, 0 \right ) \end{align*}

\begin{align*} \left ( \pi _1, \cdots, \pi _n \right ) = \left ( \prod _{i=1}^n \frac{e^{a_{01} \ell _{i1}\ln \pi _0}}{(z_i)^{\ell _{i1}}}, \cdots, \prod _{i=1}^n \frac{e^{a_{0n} \ell _{in}\ln \pi _0}}{(z_i)^{\ell _{in}}} \right ) \gt \left ( 0, \cdots, 0 \right ) \end{align*}

where

![]() $\ell _{ij}$

denotes the

$\ell _{ij}$

denotes the

![]() $ij$

element of the Leontief inverse

$ij$

element of the Leontief inverse

![]() $[\mathbf{I}-\mathbf{A}]^{-1}$

. Conversely,

$[\mathbf{I}-\mathbf{A}]^{-1}$

. Conversely,

![]() $\boldsymbol{\pi }$

can have negative elements or may not even exist in

$\boldsymbol{\pi }$

can have negative elements or may not even exist in

![]() $\mathbb{R}^n$

for non-Cobb-Douglas economies. One may see this by replacing

$\mathbb{R}^n$

for non-Cobb-Douglas economies. One may see this by replacing

![]() $\boldsymbol{z}$

with small (but positive) elements in equations (4) and (5).

$\boldsymbol{z}$

with small (but positive) elements in equations (4) and (5).

2.2. Viability of the equilibrium structure

From another perspective,

![]() $c_j(\boldsymbol{\pi };\, \pi _0)$

is homogeneous of degree one in

$c_j(\boldsymbol{\pi };\, \pi _0)$

is homogeneous of degree one in

![]() $(\pi _0, \cdots,{\pi _n})$

, so by Euler’s homogeneous function theorem, it follows that:

$(\pi _0, \cdots,{\pi _n})$

, so by Euler’s homogeneous function theorem, it follows that:

Here, by Shephard’s lemma,

![]() $b_{ij}$

denotes the equilibrium physical input-output coefficient. In matrix form, this is equivalent to:

$b_{ij}$

denotes the equilibrium physical input-output coefficient. In matrix form, this is equivalent to:

Let us hereafter call

![]() $(\mathbf{B}, \boldsymbol{b}_0)$

the equilibrium structure (of an economy). Note that if

$(\mathbf{B}, \boldsymbol{b}_0)$

the equilibrium structure (of an economy). Note that if

![]() $\boldsymbol{\pi }$

exists in

$\boldsymbol{\pi }$

exists in

![]() $\mathbb{R}^{n}_{+}$

, while

$\mathbb{R}^{n}_{+}$

, while

![]() $\boldsymbol{b}_{0} \in \mathbb{R}^{n}_{+}$

(i.e. all sectors, upon production, physically utilize the primary factor), then

$\boldsymbol{b}_{0} \in \mathbb{R}^{n}_{+}$

(i.e. all sectors, upon production, physically utilize the primary factor), then

![]() $[\mathbf{I}-\mathbf{B}]$

, where

$[\mathbf{I}-\mathbf{B}]$

, where

![]() $\boldsymbol{\pi } [ \mathbf{I} - \mathbf{B} ] =\pi _0 \boldsymbol{b}_0$

, is said to satisfy the Hawkins-Simon (HS) condition [Theorem 4.D.4, Takayama (Reference Takayama1985); Hawkins and Simon (Reference Hawkins and Simon1949)].

$\boldsymbol{\pi } [ \mathbf{I} - \mathbf{B} ] =\pi _0 \boldsymbol{b}_0$

, is said to satisfy the Hawkins-Simon (HS) condition [Theorem 4.D.4, Takayama (Reference Takayama1985); Hawkins and Simon (Reference Hawkins and Simon1949)].

The existence of a solution

![]() $\boldsymbol{y} \in \mathbb{R}^{n}_{+}$

for

$\boldsymbol{y} \in \mathbb{R}^{n}_{+}$

for

![]() $[\mathbf{I}-\mathbf{B}] \boldsymbol{y} = \boldsymbol{d}$

given any

$[\mathbf{I}-\mathbf{B}] \boldsymbol{y} = \boldsymbol{d}$

given any

![]() $\boldsymbol{d} \in \mathbb{R}^{n}_{+}$

and the matrix

$\boldsymbol{d} \in \mathbb{R}^{n}_{+}$

and the matrix

![]() $[\mathbf{I}-\mathbf{B}]$

satisfying the HS condition are two equivalent statements [Theorem 4.D.1, Takayama (Reference Takayama1985)]. Thus, a structure that

$[\mathbf{I}-\mathbf{B}]$

satisfying the HS condition are two equivalent statements [Theorem 4.D.1, Takayama (Reference Takayama1985)]. Thus, a structure that

![]() $[\mathbf{I}-\mathbf{B}]$

satisfies the HS condition is said to be viable. Conversely, for an unviable structure (that

$[\mathbf{I}-\mathbf{B}]$

satisfies the HS condition is said to be viable. Conversely, for an unviable structure (that

![]() $[\mathbf{I}-\mathbf{B}]$

does not satisfy the HS condition), no positive production schedule

$[\mathbf{I}-\mathbf{B}]$

does not satisfy the HS condition), no positive production schedule

![]() $\boldsymbol{y} \in \mathbb{R}^{n}_{+}$

can be possible for fulfilling any positive final demand

$\boldsymbol{y} \in \mathbb{R}^{n}_{+}$

can be possible for fulfilling any positive final demand

![]() $\boldsymbol{d} \in \mathbb{R}^{n}_{+}$

. For a Cobb-Douglas economy, we can assert that the equilibrium structure is always viable, since we know from equation (6) that it is always the case that

$\boldsymbol{d} \in \mathbb{R}^{n}_{+}$

. For a Cobb-Douglas economy, we can assert that the equilibrium structure is always viable, since we know from equation (6) that it is always the case that

![]() $\boldsymbol{\pi } \in \mathbb{R}^n_+$

. Otherwise,

$\boldsymbol{\pi } \in \mathbb{R}^n_+$

. Otherwise,

![]() $\boldsymbol{\pi }$

may have negative elements, in which case the equilibrium structure must be unviable. An unviable equilibrium structure may never appear during the recursive process, however, if the equilibrium price search is such that it is installed in the recursive process of equation (2); instead, the recursive process will not be convergent since equation (2) maps into an open set

$\boldsymbol{\pi }$

may have negative elements, in which case the equilibrium structure must be unviable. An unviable equilibrium structure may never appear during the recursive process, however, if the equilibrium price search is such that it is installed in the recursive process of equation (2); instead, the recursive process will not be convergent since equation (2) maps into an open set

![]() $\mathbb{R}^n_+$

.

$\mathbb{R}^n_+$

.

Last, let us specify below the structural transformation (as the physical input-output coefficient matrix

![]() $\mathbf{B}$

) and network transformation (as the cost-share structure or the monetary input-output coefficient matrix

$\mathbf{B}$

) and network transformation (as the cost-share structure or the monetary input-output coefficient matrix

![]() $\mathbf{S}$

) given

$\mathbf{S}$

) given

![]() $\boldsymbol{z}$

in a uniform CES economy. Since an element of the gradient of the CES aggregator is:

$\boldsymbol{z}$

in a uniform CES economy. Since an element of the gradient of the CES aggregator is:

the gradient of the uniform CES aggregator can be written as follows:

Thus, below are the transformed structure and networks, where

![]() $\boldsymbol{\pi }$

is given by equation (4):

$\boldsymbol{\pi }$

is given by equation (4):

Observe that

![]() $\mathbf{S}=\mathbf{A}$

in a Cobb-Douglas economy (

$\mathbf{S}=\mathbf{A}$

in a Cobb-Douglas economy (

![]() $\gamma =0$

) and

$\gamma =0$

) and

![]() $\mathbf{B}=\mathbf{A} \langle 1/\boldsymbol{z} \rangle$

in a Leontief economy (

$\mathbf{B}=\mathbf{A} \langle 1/\boldsymbol{z} \rangle$

in a Leontief economy (

![]() $\gamma =1$

).

$\gamma =1$

).

3. Estimation

Let us start by taking the log of equation (1) and indexing observations by

![]() $t=1,\cdots,T$

, while omitting the sectoral index (

$t=1,\cdots,T$

, while omitting the sectoral index (

![]() $j$

). The cross-sectional dimension remains, that is,

$j$

). The cross-sectional dimension remains, that is,

![]() $i=0,\cdots,n$

. Here, we substitute

$i=0,\cdots,n$

. Here, we substitute

![]() $p$

for

$p$

for

![]() $\pi$

to emphasize that they are observed data and

$\pi$

to emphasize that they are observed data and

![]() $\zeta$

for

$\zeta$

for

![]() $z$

to emphasize that they are parameters subject to estimation. For the response variable, we use the factor share

$z$

to emphasize that they are parameters subject to estimation. For the response variable, we use the factor share

![]() $a_{it}$

available as the input-output coefficient.

$a_{it}$

available as the input-output coefficient.

Note that the error terms

![]() $\epsilon _{it}$

are assumed to be iid normally distributed with mean zero. The multifactor CES elasticity in which we are interested has been extensively studied in the Armington elasticity literature. Erkel-Rousse and Mirza (Reference Erkel-Rousse and Mirza2002) and Saito (Reference Saito2004) apply between estimation, a typical strategy for the two-input case, to estimate the elasticity of substitution between products from different countries. Between estimation eliminates time-specific effects while saving the individual-specific effects such as the share parameter

$\epsilon _{it}$

are assumed to be iid normally distributed with mean zero. The multifactor CES elasticity in which we are interested has been extensively studied in the Armington elasticity literature. Erkel-Rousse and Mirza (Reference Erkel-Rousse and Mirza2002) and Saito (Reference Saito2004) apply between estimation, a typical strategy for the two-input case, to estimate the elasticity of substitution between products from different countries. Between estimation eliminates time-specific effects while saving the individual-specific effects such as the share parameter

![]() $\alpha _{i}$

. For a two-factor case, the share parameter is usually subject to estimation. However, for a multifactor case, the constraint that

$\alpha _{i}$

. For a two-factor case, the share parameter is usually subject to estimation. However, for a multifactor case, the constraint that

![]() $\sum _{i=0}^n \alpha _{i} = 1$

can hardly be met. Moreover, we know in advance that

$\sum _{i=0}^n \alpha _{i} = 1$

can hardly be met. Moreover, we know in advance that

![]() $\alpha _i = a_{i}$

for the year that the model is standardized. Hence, we opt to apply within (FE) estimation in this study.

$\alpha _i = a_{i}$

for the year that the model is standardized. Hence, we opt to apply within (FE) estimation in this study.

Below we restate equation (7) using time dummy variables such that

![]() $\gamma$

and

$\gamma$

and

![]() $\zeta _t p_t$

can be estimated from

$\zeta _t p_t$

can be estimated from

![]() $p_{it}$

and

$p_{it}$

and

![]() $a_{it}$

via FE panel regression:

$a_{it}$

via FE panel regression:

where

![]() $Y_{it}=\ln a_{it}$

,

$Y_{it}=\ln a_{it}$

,

![]() $X_{it} = \ln p_{it}$

and

$X_{it} = \ln p_{it}$

and

![]() $D_k$

for

$D_k$

for

![]() $k=2, \cdots, T$

denotes a dummy variable that equals

$k=2, \cdots, T$

denotes a dummy variable that equals

![]() $1$

if

$1$

if

![]() $k=t$

and

$k=t$

and

![]() $0$

otherwise. For

$0$

otherwise. For

![]() $t=1$

,

$t=1$

,

![]() $D_2=\cdots =D_T=0$

by definition, so we know that

$D_2=\cdots =D_T=0$

by definition, so we know that

![]() $\mu _t=-\gamma \ln (\zeta _t p_t)$

for

$\mu _t=-\gamma \ln (\zeta _t p_t)$

for

![]() $t=1,\cdots,T$

. The estimable coefficients for equation (8) via FE, therefore, indicate that:

$t=1,\cdots,T$

. The estimable coefficients for equation (8) via FE, therefore, indicate that:

We may thus evaluate the productivity growth at

![]() $t$

, based on

$t$

, based on

![]() $t=1$

, by the following formula:

$t=1$

, by the following formula:

We face the concern that regression (7) suffers from an endogeneity problem. The response variable, that is, the demand for the

![]() $i$

th factor of production by the

$i$

th factor of production by the

![]() $j$

th sector, may well affect the price of the

$j$

th sector, may well affect the price of the

![]() $i$

th factor via the supply function. Because of such reverse causality, the explanatory variable, that is, the price of the

$i$

th factor via the supply function. Because of such reverse causality, the explanatory variable, that is, the price of the

![]() $i$

th commodity, becomes correlated with the error term that corresponds to the demand shock for the

$i$

th commodity, becomes correlated with the error term that corresponds to the demand shock for the

![]() $i$

th factor of production by the

$i$

th factor of production by the

![]() $j$

th sector. To remedy this problem, we apply total factor productivity (TFP) to instrument prices. The JIP (2019) database provides sectoral TFP growth (in terms of the Törnqvist index) as well as the aggregated macro-TFP growth, for each year interval. It is generally assumed that TFP is unlikely to be correlated with the demand shock [Eslava et al. (Reference Eslava, Haltiwanger, Kugler and Kugler2004); Foster et al. (Reference Foster, Haltiwanger and Syverson2008)]. In our case, the

$j$

th sector. To remedy this problem, we apply total factor productivity (TFP) to instrument prices. The JIP (2019) database provides sectoral TFP growth (in terms of the Törnqvist index) as well as the aggregated macro-TFP growth, for each year interval. It is generally assumed that TFP is unlikely to be correlated with the demand shock [Eslava et al. (Reference Eslava, Haltiwanger, Kugler and Kugler2004); Foster et al. (Reference Foster, Haltiwanger and Syverson2008)]. In our case, the

![]() $i$

th sector’s TFP to produce the

$i$

th sector’s TFP to produce the

![]() $i$

th commodity is unlikely to be correlated with the

$i$

th commodity is unlikely to be correlated with the

![]() $j$

th sector’s demand shock for the

$j$

th sector’s demand shock for the

![]() $i$

th commodity. Hence, TFP appears to be suitable as an instrument for our explanatory variable.

$i$

th commodity. Hence, TFP appears to be suitable as an instrument for our explanatory variable.

On the other hand, the price of the primary factor

![]() $i=0$

can be nonresponsive to sectoral demand shocks. The primary factor consists of labor and capital services, while their prices, that is, wages and interest rates, are not purely dependent on the market mechanism but rather subject to government regulations and natural depreciations. Moreover, it is conceivable that the demand shock for the primary factor by one sector has little influence on the prices of its factors, labor, and capital, if not on their quantitative ratios demanded by the sector. Thus, we apply three exogenous variables as instruments for

$i=0$

can be nonresponsive to sectoral demand shocks. The primary factor consists of labor and capital services, while their prices, that is, wages and interest rates, are not purely dependent on the market mechanism but rather subject to government regulations and natural depreciations. Moreover, it is conceivable that the demand shock for the primary factor by one sector has little influence on the prices of its factors, labor, and capital, if not on their quantitative ratios demanded by the sector. Thus, we apply three exogenous variables as instruments for

![]() $X_{0t}$

, namely (1) the macro-TFP, (2) the macro wage rate, and (3) the macro interest rate, which are available in time series in the JIP (2019) database. Specifically, we will be examining three instrumental variables in the FE IV regression of equation (8), namely,

$X_{0t}$

, namely (1) the macro-TFP, (2) the macro wage rate, and (3) the macro interest rate, which are available in time series in the JIP (2019) database. Specifically, we will be examining three instrumental variables in the FE IV regression of equation (8), namely,

![]() $v^a_{it}$

,

$v^a_{it}$

,

![]() $v^b_{it}$

, and

$v^b_{it}$

, and

![]() $v^c_{it}$

, all of which include the sectoral TFP at

$v^c_{it}$

, all of which include the sectoral TFP at

![]() $t$

, for

$t$

, for

![]() $i=1,\cdots,n$

, and where

$i=1,\cdots,n$

, and where

![]() $v^a_{0t}=\text{macro TFP at } t$

,

$v^a_{0t}=\text{macro TFP at } t$

,

![]() $v^b_{0t}=\text{macro wage rate at } t$

, and

$v^b_{0t}=\text{macro wage rate at } t$

, and

![]() $v^c_{0t}=\text{macro interest rate at } t$

.

$v^c_{0t}=\text{macro interest rate at } t$

.

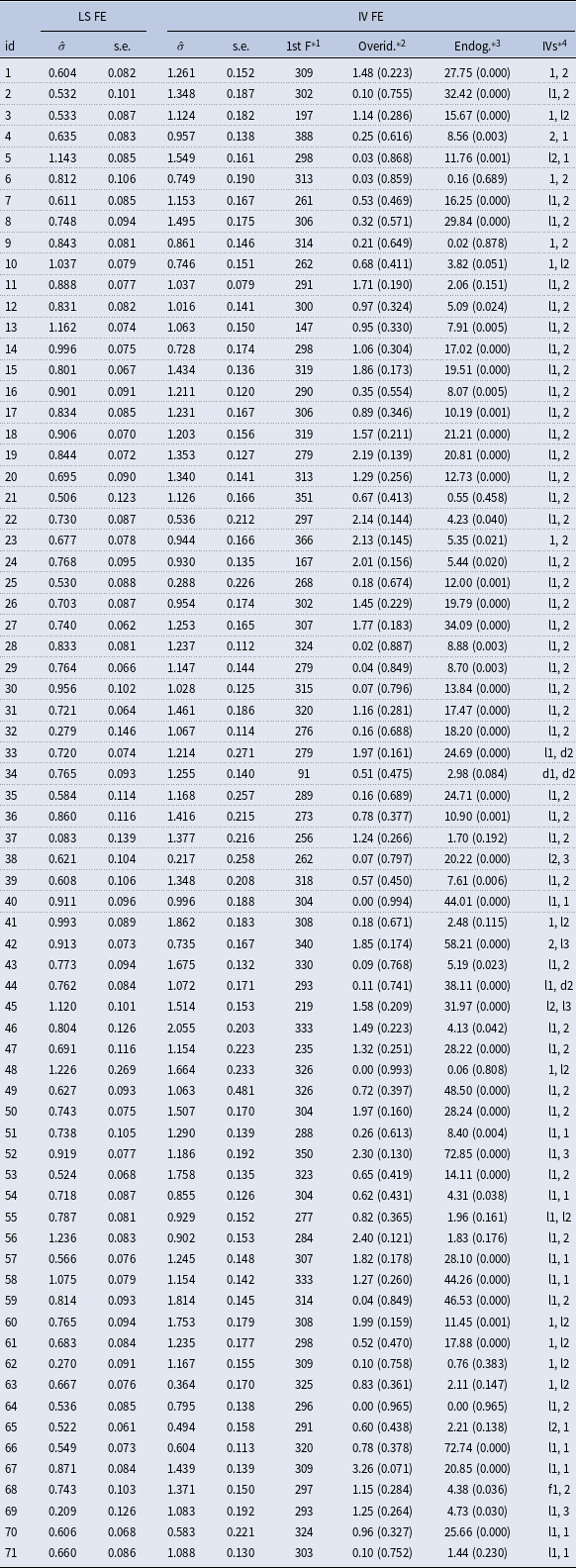

The results are summarized in Table 1. The first column (LS FE) reports the least squares fixed effects estimation results, without instrumenting for the explanatory variable. The second column (IV FE) reports the instrumental variable fixed effects estimation results, using the IVs reported in the last column. In all cases, overidentification tests are not rejected, so we are satisfied with the IVs we applied. Furthermore, first-stage F values are large enough that we are satisfied with the strength of the IVs we applied. Interestingly, the estimates for the elasticity of substitution

![]() $\hat{\sigma }=1-\hat{\gamma }$

are larger when IVs are applied. For later study of the aggregate fluctuations, we select from the elasticity estimates based on the endogeneity test results. Specifically, we use the LS FE estimates for sector ids 6, 12, 27, 52, 62, 70, 71, 81, 88, and, hence, IV FE estimates for the rest of the sectors. Finally, we note that simple mean of the estimated (accepted) elasticity of substitution is

$\hat{\sigma }=1-\hat{\gamma }$

are larger when IVs are applied. For later study of the aggregate fluctuations, we select from the elasticity estimates based on the endogeneity test results. Specifically, we use the LS FE estimates for sector ids 6, 12, 27, 52, 62, 70, 71, 81, 88, and, hence, IV FE estimates for the rest of the sectors. Finally, we note that simple mean of the estimated (accepted) elasticity of substitution is

![]() $\bar{\hat{\sigma }}=1.54$

.Footnote

3

$\bar{\hat{\sigma }}=1.54$

.Footnote

3

Table 1. Estimation of the elasticity of substitution for all 100 sectors

Notes: For sector classifications (ids), see Table 2. The household sector is id = 101. Values in parentheses indicate p-values.

![]() ${}^{*1}$

First-stage (Cragg-Donald Wald) F statistic for 2SLS FE estimation. The rule of thumb to reject the hypothesis that the explanatory variable is only weakly correlated with the instrument is for this to exceed 10.

${}^{*1}$

First-stage (Cragg-Donald Wald) F statistic for 2SLS FE estimation. The rule of thumb to reject the hypothesis that the explanatory variable is only weakly correlated with the instrument is for this to exceed 10.

![]() ${}^{*2}$

Overidentification test by Sargan statistic. Rejection of the null indicates that the instruments are correlated with the residuals.

${}^{*2}$

Overidentification test by Sargan statistic. Rejection of the null indicates that the instruments are correlated with the residuals.

![]() ${}^{*3}$

Endogeneity test by Davidson-MacKinnon F statistic. Rejection of the null indicates that the instrumental variables fixed effects estimator should be employed.

${}^{*3}$

Endogeneity test by Davidson-MacKinnon F statistic. Rejection of the null indicates that the instrumental variables fixed effects estimator should be employed.

![]() ${}^{*4}$

Instrumental variables applied, where a, b, and c, indicate

${}^{*4}$

Instrumental variables applied, where a, b, and c, indicate

![]() $v^a$

,

$v^a$

,

![]() $v^b$

, and

$v^b$

, and

![]() $v^c$

, respectively, and la, lb, and lc, indicate

$v^c$

, respectively, and la, lb, and lc, indicate

![]() $\ln{v^a}$

,

$\ln{v^a}$

,

![]() $\ln{v^b}$

, and

$\ln{v^b}$

, and

![]() $\ln{v^c}$

, respectively.

$\ln{v^c}$

, respectively.

4. Aggregate fluctuations

4.1. Representative household

Let us now consider a representative household that maximizes the following CES utility:

The household determines the consumption schedule

![]() $\boldsymbol{h}=(h_1, \cdots, h_n)^\intercal$

given the budget constraint

$\boldsymbol{h}=(h_1, \cdots, h_n)^\intercal$

given the budget constraint

![]() $W = \sum _{i=1}^n \pi _i h_i$

and prices of all goods

$W = \sum _{i=1}^n \pi _i h_i$

and prices of all goods

![]() $\boldsymbol{\pi }=(\pi _1, \cdots, \pi _n)$

. The source of the budget is the renumeration for the household’s supply of the primary factor to the production sectors, so we know that

$\boldsymbol{\pi }=(\pi _1, \cdots, \pi _n)$

. The source of the budget is the renumeration for the household’s supply of the primary factor to the production sectors, so we know that

![]() $ W = \sum _{j=1}^n v_{j}$

(total value added, or GDP of the economy) is the representative household’s (or national) income. The indirect utility of the household can then be specified as follows:

$ W = \sum _{j=1}^n v_{j}$

(total value added, or GDP of the economy) is the representative household’s (or national) income. The indirect utility of the household can then be specified as follows:

where

![]() $\Pi$

, as defined as above, denotes the representative household’s CES price index. Note that

$\Pi$

, as defined as above, denotes the representative household’s CES price index. Note that

![]() $H=W$

at the baseline

$H=W$

at the baseline

![]() $(z_1, \cdots, z_n)=(1, \cdots, 1)$

where

$(z_1, \cdots, z_n)=(1, \cdots, 1)$

where

![]() $\Pi =1$

. Thus,

$\Pi =1$

. Thus,

![]() $H$

is the utility (in terms of money) that the representative household can obtain from its income

$H$

is the utility (in terms of money) that the representative household can obtain from its income

![]() $W$

given the price change

$W$

given the price change

![]() $\boldsymbol{\pi }$

(due to the productivity shock

$\boldsymbol{\pi }$

(due to the productivity shock

![]() $\boldsymbol{z}$

) while holding the primary input’s price constant at

$\boldsymbol{z}$

) while holding the primary input’s price constant at

![]() $\pi _0 =1$

. In other words,

$\pi _0 =1$

. In other words,

![]() $H$

is the real GDP if

$H$

is the real GDP if

![]() $W$

is the nominal GDP.

$W$

is the nominal GDP.

From another perspective, we note that the household’s income

![]() $W$

can also be affected by the productivity shock. When there is a productivity gain in a production process, this process can either increase its output while holding all its inputs fixed or reduce the inputs while holding the output fixed. In the former case, the national income

$W$

can also be affected by the productivity shock. When there is a productivity gain in a production process, this process can either increase its output while holding all its inputs fixed or reduce the inputs while holding the output fixed. In the former case, the national income

![]() $W$

(nominal GDP) remains at the baseline level, which equals real GDP in the previous year

$W$

(nominal GDP) remains at the baseline level, which equals real GDP in the previous year

![]() $\overline{H}$

, and GDP growth (

$\overline{H}$

, and GDP growth (

![]() $\Delta \ln H = \ln H - \ln \overline{H}=-\ln \Pi (\boldsymbol{\pi })$

) is fully accounted for. In the latter case, however, the national income can be reduced by as much as

$\Delta \ln H = \ln H - \ln \overline{H}=-\ln \Pi (\boldsymbol{\pi })$

) is fully accounted for. In the latter case, however, the national income can be reduced by as much as

![]() $W=\overline{H}\Pi (\boldsymbol{\pi })$

, in which case we have

$W=\overline{H}\Pi (\boldsymbol{\pi })$

, in which case we have

![]() $\Delta \ln H=0$

that is, no GDP growth will be accounted for.

$\Delta \ln H=0$

that is, no GDP growth will be accounted for.

Of course, the reality must be in between the two extreme cases. In this study, we conservatively evaluate national income (as nominal GDP) to the following extent:

The real GDP under the equilibrium price, which equals the household’s expenditure, can then be evaluated as follows:

If we assume Cobb-Douglas utility (

![]() $\kappa \to 0$

) and normalize the initial real GDP (

$\kappa \to 0$

) and normalize the initial real GDP (

![]() $\overline{H}=1$

), we have the following exposition:

$\overline{H}=1$

), we have the following exposition:

where

![]() $\boldsymbol{\mu }=(\mu _1,\cdots,\mu _n)^\intercal$

denotes the column vector of expenditure share parameters. The first identity indicates that the real GDP growth is the negative price index growth of the economy less the negative price index growth of a simple economy.Footnote

4

Moreover, if we assume a Cobb-Douglas economy (

$\boldsymbol{\mu }=(\mu _1,\cdots,\mu _n)^\intercal$

denotes the column vector of expenditure share parameters. The first identity indicates that the real GDP growth is the negative price index growth of the economy less the negative price index growth of a simple economy.Footnote

4

Moreover, if we assume a Cobb-Douglas economy (

![]() $\gamma _j \to 0$

), we arrive at the following:

$\gamma _j \to 0$

), we arrive at the following:

\begin{align*}{\ln H} = - (\!\ln \boldsymbol{z} ) \left ( \left [ \mathbf{I} - \mathbf{A} \right ]^{-1} + \mathbf{I} \right ) \boldsymbol{\mu } = \sum _{j=1}^n \lambda _j \ln z_j \end{align*}

\begin{align*}{\ln H} = - (\!\ln \boldsymbol{z} ) \left ( \left [ \mathbf{I} - \mathbf{A} \right ]^{-1} + \mathbf{I} \right ) \boldsymbol{\mu } = \sum _{j=1}^n \lambda _j \ln z_j \end{align*}

Note that

![]() $\lambda _j$

is the Domar weight [Hulten (Reference Hulten1978)] in this particular case.

$\lambda _j$

is the Domar weight [Hulten (Reference Hulten1978)] in this particular case.

The parameters of the utility function are also subject to estimation. By applying Roy’s identity, that is,

![]() $h_i = - \frac{\partial H}{\partial p_i}/\frac{\partial H}{\partial W}$

, we have the following expansion for the household’s expenditure share on the

$h_i = - \frac{\partial H}{\partial p_i}/\frac{\partial H}{\partial W}$

, we have the following expansion for the household’s expenditure share on the

![]() $i$

th commodity:

$i$

th commodity:

where

![]() $s_{i}$

denotes the expenditure share of the

$s_{i}$

denotes the expenditure share of the

![]() $i$

th commodity for the representative household. By taking the log of equation (10) and indexing observations by

$i$

th commodity for the representative household. By taking the log of equation (10) and indexing observations by

![]() $t=1,\cdots,T$

, we obtain the following regression equation where the parameter

$t=1,\cdots,T$

, we obtain the following regression equation where the parameter

![]() $\kappa$

can be estimated via FE.

$\kappa$

can be estimated via FE.

As is typical, the error term

![]() $\delta _{it}$

is assumed to be iid normally distributed with mean zero. Here, we replace

$\delta _{it}$

is assumed to be iid normally distributed with mean zero. Here, we replace

![]() $\pi$

with

$\pi$

with

![]() $p$

to emphasize that they are observed data. For the response variable, we use the expenditure share

$p$

to emphasize that they are observed data. For the response variable, we use the expenditure share

![]() $m_{it}$

of the final demand available from the input-output tables. The cross-sectional dimension of the data for regression equation (11) is

$m_{it}$

of the final demand available from the input-output tables. The cross-sectional dimension of the data for regression equation (11) is

![]() $i=1,\cdots,n$

, whereas it is

$i=1,\cdots,n$

, whereas it is

![]() $i=0,1,\cdots,n$

for equation (7). Thus, we apply sectoral TFP available for

$i=0,1,\cdots,n$

for equation (7). Thus, we apply sectoral TFP available for

![]() $t=1, \cdots, T$

from the JIP (2019) database as instruments to fix the endogeneity of the explanatory variable. The estimation result for

$t=1, \cdots, T$

from the JIP (2019) database as instruments to fix the endogeneity of the explanatory variable. The estimation result for

![]() $\kappa$

using time dummy variables as in equation (8) (such that we may retrieve the estimates for

$\kappa$

using time dummy variables as in equation (8) (such that we may retrieve the estimates for

![]() $\Pi _t$

) is presented in Table 1 (id = 101).

$\Pi _t$

) is presented in Table 1 (id = 101).

4.2. Tail asymmetry and robustness

For a quantitative illustration, we study the distribution of aggregate output

![]() $\ln H$

when sectoral shocks

$\ln H$

when sectoral shocks

![]() $\ln \boldsymbol{z}$

are drawn from a normal distribution. Specifically, we use 10,000

$\ln \boldsymbol{z}$

are drawn from a normal distribution. Specifically, we use 10,000

![]() $\ln z_j \sim \mathcal{N}(0, 0.2)$

iid samples for

$\ln z_j \sim \mathcal{N}(0, 0.2)$

iid samples for

![]() $j=1,\cdots,n$

, where the standard deviation (i.e. annual volatility of 20%) is chosen with reference to the annual volatility of the estimated sectoral productivity growth

$j=1,\cdots,n$

, where the standard deviation (i.e. annual volatility of 20%) is chosen with reference to the annual volatility of the estimated sectoral productivity growth

![]() $\ln \zeta _j$

(see Appendix A). Let us first examine the granularity of our baseline production networks (i.e. 2011 input-output linkages). Below are both Cobb-Douglas price indices in terms of productivity shocks

$\ln \zeta _j$

(see Appendix A). Let us first examine the granularity of our baseline production networks (i.e. 2011 input-output linkages). Below are both Cobb-Douglas price indices in terms of productivity shocks

![]() $\ln \boldsymbol{z}$

for the Cobb-Douglas and simple economies:

$\ln \boldsymbol{z}$

for the Cobb-Douglas and simple economies:

Here, we set the share parameter

![]() $\boldsymbol{\mu }$

at the standard expenditure share of the final demand

$\boldsymbol{\mu }$

at the standard expenditure share of the final demand

![]() $\boldsymbol{m}=(m_1, \cdots, m_n)^\intercal$

for the year 2011. Both indices must follow normal distributions because they are both linear with respect to the normal shocks

$\boldsymbol{m}=(m_1, \cdots, m_n)^\intercal$

for the year 2011. Both indices must follow normal distributions because they are both linear with respect to the normal shocks

![]() $\ln \boldsymbol{z}$

. The variances differ, however, and the left panel of Figure 2 depicts the difference. Observe the dilation of the variance in the Cobb-Douglas economy where the power-law granularity of the Leontief inverse causes the difference [Gabaix (Reference Gabaix2011); Acemoglu et al. (Reference Acemoglu, Carvalho, Ozdaglar and Tahbaz-Salehi2012)].

$\ln \boldsymbol{z}$

. The variances differ, however, and the left panel of Figure 2 depicts the difference. Observe the dilation of the variance in the Cobb-Douglas economy where the power-law granularity of the Leontief inverse causes the difference [Gabaix (Reference Gabaix2011); Acemoglu et al. (Reference Acemoglu, Carvalho, Ozdaglar and Tahbaz-Salehi2012)].

Figure 2. Left: Price index dispersion in Cobb-Douglas and Simple economies under Cobb-Douglas utility. Dispersion is larger in the Cobb-Douglas than in the Simple economy, due to the power-law granularity of the Leontief inverse. Right: QQ plot of the aggregate output fluctuations generated by the linear Domar aggregator for the Cobb-Douglas economy and utility.

Replacing the equilibrium price of equation (9) with the output of equation (3) yields the following Domar aggregator, where exogenous productivity shocks (

![]() $\ln \boldsymbol{z}$

) are aggregated into the growth of output (

$\ln \boldsymbol{z}$

) are aggregated into the growth of output (

![]() $\ln H$

) for a CES economy.

$\ln H$

) for a CES economy.

Note that this aggregator involves recursion in

![]() $\mathcal{E}$

, as specified by equation (2), for a CES economy with non-uniform substitution elasticities. In this section, Cobb-Douglas utility is assumed for comparison with previous research, whence the Domar aggregator becomes:

$\mathcal{E}$

, as specified by equation (2), for a CES economy with non-uniform substitution elasticities. In this section, Cobb-Douglas utility is assumed for comparison with previous research, whence the Domar aggregator becomes:

Again, we set the share parameter

![]() $\boldsymbol{\mu }$

at the standard expenditure share of the final demand. In the case of the Leontief economy, the closed form is available from equation (5) as follows:

$\boldsymbol{\mu }$

at the standard expenditure share of the final demand. In the case of the Leontief economy, the closed form is available from equation (5) as follows:

The case for the Cobb-Douglas economy is also obtainable from equation (6) as follows:

As is obvious from the linearity of equation (14), the aggregate fluctuations must be normally distributed in the Cobb-Douglas economy. The resulting QQ plot is depicted in the right panel of Figure 2. Note further that

![]() $\mathbb{E} [\ln H] = 0$

because of the linearity of equation (14) and

$\mathbb{E} [\ln H] = 0$

because of the linearity of equation (14) and

![]() $\mathbb{E}[\ln \boldsymbol{z}]=(0,\cdots,0)$

; this is recognizable in the same figure. That is, the expected economic growth is zero against zero-mean turbulences. In other words, the unit elasticity of the Cobb-Douglas economy precisely absorbs the turbulences as if there were none to maintain zero expected growth. Such robustness is absent in a Leontief economy with zero elasticity of substitution. The left panel of Figure 3 illustrates the resulting QQ plot of the aggregate fluctuations generated by the same zero-mean normal shocks by way of equation (13).Footnote

5

In this case, we observe negative expected output growth, that is,

$\mathbb{E}[\ln \boldsymbol{z}]=(0,\cdots,0)$

; this is recognizable in the same figure. That is, the expected economic growth is zero against zero-mean turbulences. In other words, the unit elasticity of the Cobb-Douglas economy precisely absorbs the turbulences as if there were none to maintain zero expected growth. Such robustness is absent in a Leontief economy with zero elasticity of substitution. The left panel of Figure 3 illustrates the resulting QQ plot of the aggregate fluctuations generated by the same zero-mean normal shocks by way of equation (13).Footnote

5

In this case, we observe negative expected output growth, that is,

![]() $\overline{\ln H} =-1.57\%$

, whose absolute value, in turn, can be interpreted as the robustness of the unit elasticity of substitution.Footnote

6

Moreover, we observe that normal shocks to the Leontief economy result in aggregate fluctuations with tail asymmetry similar to that depicted in the left panel of Figure 1.

$\overline{\ln H} =-1.57\%$

, whose absolute value, in turn, can be interpreted as the robustness of the unit elasticity of substitution.Footnote

6

Moreover, we observe that normal shocks to the Leontief economy result in aggregate fluctuations with tail asymmetry similar to that depicted in the left panel of Figure 1.

Figure 3. QQ plots of the aggregate output fluctuations generated by the Domar aggregators for Leontief (left) and elastic CES (right) economies under Cobb-Douglas utility.

In the CES economy with a sector-specific elasticity of substitution, we use the Domar aggregator of general type (12) with recursion. The right panel of Figure 3 depicts the resulting QQ plot of the aggregate fluctuations generated by zero-mean normal shocks. In this case, we observe positive expected output growth that is,

![]() $\overline{\ln H} =1.10\%$

. The value demonstrates the robustness of the elastic CES economy relative to the Cobb-Douglas economy. We also observe that normal shocks to the elastic CES economy result in aggregate fluctuations with tail asymmetry similar to that depicted in the right panel of Figure 1. For sake of credibility, we show in Figure 4 (right) the empirical aggregate output fluctuations focusing on the period 1994–2015 from which our sectoral elasticities are estimated. It is obvious that extreme observations belong to periods around the GFC (global financial crisis), which was a massive external (non-sectoral) shock to the Japanese economy. The plot otherwise appears rather positively skewed, as predicted by our empirical result (

$\overline{\ln H} =1.10\%$

. The value demonstrates the robustness of the elastic CES economy relative to the Cobb-Douglas economy. We also observe that normal shocks to the elastic CES economy result in aggregate fluctuations with tail asymmetry similar to that depicted in the right panel of Figure 1. For sake of credibility, we show in Figure 4 (right) the empirical aggregate output fluctuations focusing on the period 1994–2015 from which our sectoral elasticities are estimated. It is obvious that extreme observations belong to periods around the GFC (global financial crisis), which was a massive external (non-sectoral) shock to the Japanese economy. The plot otherwise appears rather positively skewed, as predicted by our empirical result (

![]() $\bar{\hat{\sigma }}=1.54$

).

$\bar{\hat{\sigma }}=1.54$

).

Figure 4. Quantile-quantile plots of recent (USA: 1997I–2020IV; Japan: 1994I–2015IV) quarterly HP-detrended log GDP against the normal distribution for the USA (left) and Japan (right). The time periods correspond to those when the sectoral elasticities are estimated. Open dots indicate 2007I–2009IV (GFC) and 2019IV– (COVID-19 pandemic) observations. Source: FRED (2021); Cabinet Office (2021).

Figure 4 (left) shows the aggregate output fluctuations focusing on the period 1997–2020 from which we estimated sectoral elasticities for the USA (see Appendix B for details). In this case, the extreme observations also belong to periods around the GFC and COVID-19 pandemic. The plot, however, seems to be in a straight line, which is consistent with our empirical result (

![]() $\bar{\hat{\sigma }}=1.08$

). Our elasticity estimates for the US economy also coincide with the estimates of the elasticity of substitution across intermediate inputs (

$\bar{\hat{\sigma }}=1.08$

). Our elasticity estimates for the US economy also coincide with the estimates of the elasticity of substitution across intermediate inputs (

![]() $\epsilon _M\text{ all}= 1.05$

) by Miranda-Pinto and Young (Reference Miranda-Pinto and Young2022) based on 1997–2007 input-output accounts. These elasticity estimates, however, differ from those obtained by Atalay (Reference Atalay2017) based on 1997–2013 input-output accounts that Baqaee and Farhi (Reference Baqaee and Farhi2019) employed in their simulation (

$\epsilon _M\text{ all}= 1.05$

) by Miranda-Pinto and Young (Reference Miranda-Pinto and Young2022) based on 1997–2007 input-output accounts. These elasticity estimates, however, differ from those obtained by Atalay (Reference Atalay2017) based on 1997–2013 input-output accounts that Baqaee and Farhi (Reference Baqaee and Farhi2019) employed in their simulation (

![]() $\varepsilon = 0.001$

). An inelastic economy as such is rather consistent with negatively skewed aggregate fluctuations spanning the postwar US economy as depicted in Figure 1 (left) than those of recent times depicted in Figure 4 (left).

$\varepsilon = 0.001$

). An inelastic economy as such is rather consistent with negatively skewed aggregate fluctuations spanning the postwar US economy as depicted in Figure 1 (left) than those of recent times depicted in Figure 4 (left).

5. Concluding remarks

Acemoglu et al. (Reference Acemoglu, Ozdaglar and Tahbaz-Salehi2017)’s claim was that a heavy-tailed aggregate fluctuation can emerge from heavy-tailed microeconomic shocks because of the network heterogeneity of the input-output linkages (which will be fixed under Cobb-Douglas economy), even if the central limit theorem implies that the aggregate fluctuation must converge into a normal distribution. Our findings that the US economy in recent years has been essentially a Cobb-Douglas one, and that recent aggregate fluctuations exhibit a tail risk as captured in Figure 4 (left), therefore, indicate a negatively skewed distribution of microeconomic shocks. At the same time, our finding of Japan’s elastic economy, together with the assumption of negatively skewed microeconomic shocks, provides a better understanding of the peculiar pattern of its recent aggregate fluctuations as captured in Figure 4 (right).

In the meanwhile, it is well documented that the Japanese have been more creative in discovering how to produce than in what to produce. The empirical results obtained in this study provide some evidence to believe that such a spirit is engraved in the nation’s economy. Undeniably, the technologies embodied in a production function have been acquired over the long course of research and development. Japan must have developed its elastic economy through the grinding process of discovering more efficient and inexpensive ways to produce while overcoming the many external turbulences it confronted. Whatever the cause may be, an elastic economy equipped with many substitutable technologies must be favorable with respect to robustness against turbulence. Ultimately, human creativity expands the production function in two dimensions: productivity and substitutability, and the elasticity of substitution in particular, which brings synergism between the economic entities, must be worthy of further investigation.

Acknowledgements

The authors wish to thank the anonymous reviewers for their helpful comments and suggestions.

Financial support

JSPS Kakenhi Grant numbers: 19H04380, 20K22139.

Conflict of interest

The authors declare that they have no conflict of interest.

Appendix A. GBM Property of sectoral productivity

A geometric Brownian motion (GBM) can be specified by the following stochastic differential equation (SDE):

Table 2. GBM property of estimated productivity growth for all sectors

Note: The simple mean of all annual volatilities is 0.251. The normality of TFP growth rates is examined by the Shapiro-Wilk W test, where rejection of normality is indicated by the label “no,” and a blank is left otherwise.

![]() ${}^{*1}$

Electronic data processing machines, digital and analog computer equipment and accessories.

${}^{*1}$

Electronic data processing machines, digital and analog computer equipment and accessories.

![]() ${}^{*2}$

Image information, sound information and character information production

${}^{*2}$

Image information, sound information and character information production

where

![]() $\mu$

denotes the drift parameter,

$\mu$

denotes the drift parameter,

![]() $\sigma$

denotes the volatility, and

$\sigma$

denotes the volatility, and

![]() $B_t \sim \mathcal{N}(0, t)$

. Ito’s Lemma implies that the above SDE is equivalent to the following:

$B_t \sim \mathcal{N}(0, t)$

. Ito’s Lemma implies that the above SDE is equivalent to the following:

where this SDE is solvable by integration. The solution follows below:

Since

![]() $B_T \sim \mathcal{N}(0, T)$

, the first and the second moments for

$B_T \sim \mathcal{N}(0, T)$

, the first and the second moments for

![]() $\ln ({X_T}/{X_0})$

can be evaluated as follows:

$\ln ({X_T}/{X_0})$

can be evaluated as follows:

There are several ways of estimating the volatility and the drift parameters of a GBM empirically from

![]() $\ell$

size of historical data

$\ell$

size of historical data

![]() $(X_1, \cdots, X_{\ell })$

. The obvious approach is the following, which is based on the sample moments:

$(X_1, \cdots, X_{\ell })$

. The obvious approach is the following, which is based on the sample moments:

\begin{align*} \hat{\sigma } = \sqrt{\frac{1}{\ell -2}\sum _{k=1}^{\ell -1} \left (\Delta \ln X_k - \frac{\sum _{k=1}^{\ell -1} \Delta \ln X_k}{\ell -1} \right )^2}, \qquad \hat{\mu } = \frac{\sum _{k=1}^{\ell -1} \Delta \ln X_k}{\ell -1} + \frac{1}{2} \hat{\sigma }^2 \end{align*}

\begin{align*} \hat{\sigma } = \sqrt{\frac{1}{\ell -2}\sum _{k=1}^{\ell -1} \left (\Delta \ln X_k - \frac{\sum _{k=1}^{\ell -1} \Delta \ln X_k}{\ell -1} \right )^2}, \qquad \hat{\mu } = \frac{\sum _{k=1}^{\ell -1} \Delta \ln X_k}{\ell -1} + \frac{1}{2} \hat{\sigma }^2 \end{align*}

Alternatively, Hurn et al. (Reference Hurn, Lindsay and Martin2003) devised parameter estimates of the following based on the simulated maximum likelihood method.

\begin{align} \hat{\sigma } = \sqrt{\frac{1}{\ell -1}\sum _{k=1}^{\ell -1} \left (\frac{X_{k+1}}{X_k} - \frac{\sum _{k=1}^{\ell -1} \frac{X_{k+1}}{X_{k}}}{\ell -1} \right )^2}, \qquad \hat{\mu } = \frac{\sum _{k=1}^{\ell -1} \frac{X_{k+1}}{X_{k}}}{\ell -1} -1 \end{align}

\begin{align} \hat{\sigma } = \sqrt{\frac{1}{\ell -1}\sum _{k=1}^{\ell -1} \left (\frac{X_{k+1}}{X_k} - \frac{\sum _{k=1}^{\ell -1} \frac{X_{k+1}}{X_{k}}}{\ell -1} \right )^2}, \qquad \hat{\mu } = \frac{\sum _{k=1}^{\ell -1} \frac{X_{k+1}}{X_{k}}}{\ell -1} -1 \end{align}

The two methods produce very similar results for our data. Table 2 summarizes the estimated annual volatilities and drift parameters for all 100 sectors by formula (15) using the historical data of sectoral annual TFP from 1995 to 2015. Moreover, conforming to Marathe and Ryan (Reference Marathe and Ryan2005), we check the normality of the annual TFP growth rates using the Shapiro-Wilk W test. Normality was rejected in 19 out of the 100 sectors. The annual volatility, with a t-statistic over 2, ranges from 0.260 to 0.523, whereas the simple average concerning all 100 sectors is 0.251.

Table 3. Estimation of the elasticity of substitution for 71 US sectors

Notes: The id number corresponds to the numerical position of an industry of the input-output table of 71 industries BEA (2022). Values in parentheses indicate p-values.

![]() ${}^{*1}$

First-stage (Cragg-Donald Wald) F statistic for 2SLS FE estimation. The rule of thumb to reject the hypothesis that the explanatory variable is only weakly correlated with the instrument is for this to exceed 10.

${}^{*1}$

First-stage (Cragg-Donald Wald) F statistic for 2SLS FE estimation. The rule of thumb to reject the hypothesis that the explanatory variable is only weakly correlated with the instrument is for this to exceed 10.

![]() ${}^{*2}$

Overidentification test by Sargan statistic. Rejection of the null indicates that the instruments are correlated with the residuals.

${}^{*2}$

Overidentification test by Sargan statistic. Rejection of the null indicates that the instruments are correlated with the residuals.

![]() ${}^{*3}$

Endogeneity test by Davidson-MacKinnon F statistic. Rejection of the null indicates that the instrumental variables fixed effects estimator should be employed.

${}^{*3}$

Endogeneity test by Davidson-MacKinnon F statistic. Rejection of the null indicates that the instrumental variables fixed effects estimator should be employed.

![]() ${}^{*4}$

Instrumental variables applied, where 1, 2, and 3 indicate

${}^{*4}$

Instrumental variables applied, where 1, 2, and 3 indicate

![]() $v^a$

,

$v^a$

,

![]() $v^b$

, and

$v^b$

, and

![]() $v^c$

, respectively, and l, f, and d indicate first lag, first forward, and first difference, respectively.

$v^c$

, respectively, and l, f, and d indicate first lag, first forward, and first difference, respectively.

Appendix B. Sectoral elasticities of substitution for the us economy

This section is devoted to our estimation of sectoral substitution elasticities for the USA, in the same manner as we did for Japan. First, we create

![]() $n\times n$

input-output tables using the make and use tables of

$n\times n$

input-output tables using the make and use tables of

![]() $n = 71$

industries in nominal terms for 24 years (1997–2020), available at BEA (2022). Next, we create tables in real terms by using price indices available as chain-type price indexes for gross output by industry. Note that the real value added of an industry is estimated by double deflation, so that price indices for value added can be derived from nominal and real value-added accounts. As for instruments, we utilize the integrated multifactor productivity (MFP), taken from the 1987–2019 Production Account Capital Table (BLS, 2022) of the BEA-BLS Integrated Industry-level Production Accounts, for

$n = 71$

industries in nominal terms for 24 years (1997–2020), available at BEA (2022). Next, we create tables in real terms by using price indices available as chain-type price indexes for gross output by industry. Note that the real value added of an industry is estimated by double deflation, so that price indices for value added can be derived from nominal and real value-added accounts. As for instruments, we utilize the integrated multifactor productivity (MFP), taken from the 1987–2019 Production Account Capital Table (BLS, 2022) of the BEA-BLS Integrated Industry-level Production Accounts, for

![]() $n$

factor inputs.Footnote

7

To instrument primary factor prices, we apply three different instruments, namely, total factor productivity (i.e. aggregate TFP), a capital price deflator, and a labor price deflator, obtainable from the Annual total factor productivity and related measure for major sectors (BLS, 2022). Thus, our instrumental variables are

$n$

factor inputs.Footnote

7

To instrument primary factor prices, we apply three different instruments, namely, total factor productivity (i.e. aggregate TFP), a capital price deflator, and a labor price deflator, obtainable from the Annual total factor productivity and related measure for major sectors (BLS, 2022). Thus, our instrumental variables are

![]() $v^a$

(sectoral MFP with aggregate TFP),

$v^a$

(sectoral MFP with aggregate TFP),

![]() $v^b$

(sectoral MFP with capital price deflator), and

$v^b$

(sectoral MFP with capital price deflator), and

![]() $v^c$

(sectoral MFP with labor price deflator), all of which are of

$v^c$

(sectoral MFP with labor price deflator), all of which are of

![]() $n+1$

dimension.

$n+1$

dimension.

Estimation of sectoral elasticities of substitution was conducted according to the estimation framework presented in Section 3. The results are summarized in Table 3. The first column (LS FE) reports the least squares fixed effects estimation results, without instrumenting for the explanatory variable. The second column (IV FE) reports the instrumental variable fixed effects estimation results, using the IVs reported in the last column. In all cases, overidentification tests are not rejected. Moreover, first-stage F values are large enough. The estimates for the elasticity of substitution

![]() $\hat{\sigma }$

are larger when IVs are applied. According to the endogeneity test results, we accept the LS FE estimates for sector ids 6, 9, 10, 11, 21, 34, 37, 41, 48, 55, 56, 62, 63, 64, 65, and 71, instead of the IV FE estimates. The simple mean of the estimated (accepted) elasticities is

$\hat{\sigma }$

are larger when IVs are applied. According to the endogeneity test results, we accept the LS FE estimates for sector ids 6, 9, 10, 11, 21, 34, 37, 41, 48, 55, 56, 62, 63, 64, 65, and 71, instead of the IV FE estimates. The simple mean of the estimated (accepted) elasticities is

![]() $\bar{\hat{\sigma }}=1.08$

.

$\bar{\hat{\sigma }}=1.08$

.