Introduction

A ‘fundamental principle’ of English planning law is that matters of judgment on the merits of a planning application, including weighing of material considerations, (hereafter ‘planning judgment’)Footnote 1 are within the exclusive province of the decision-maker.Footnote 2 This is ‘forbidden territory’Footnote 3 to the courts who consider the planning system to be the ‘political responsibility’ of central and local government.Footnote 4 The court's sole concern is the legality of the decision-making process.Footnote 5 The wide discretion this confers renders it ‘notoriously difficult’Footnote 6 to establish planning judgments as Wednesbury unreasonable (ie a conclusion so unreasonable that no reasonable person could ever have come to it).Footnote 7 Nevertheless, it is heralded by BoothFootnote 8 and Tewdwr-JonesFootnote 9 as a valued attribute of the planning system for it confers flexibility and ability to cope with an uncertain future. The trade-off is absence of certainty.Footnote 10 Though, for McAuslan, the planning system is not one of ‘unregulated discretion’, as even where legislation seemingly confers wide, uncontrollable discretion, the courts step in to provide ‘guides and parameters’.Footnote 11 Planning policy also helps to ‘focus’Footnote 12 discretion and act as a ‘constraint’Footnote 13 upon it.

This paper evaluates the wide discretion afforded to planning decision-makers (local planning authorities (LPAs), Planning Inspectors and the Secretary of State) under the English planning system. It does so in respect of a key but often overlooked question in the transition to renewables: whether the developer/owner of an onshore wind project ought to be required to provide a ‘bond’ to ensure decommissioning and site restoration (DSR) occurs at the end of its operational life (the ‘bonding question’). DSR usually involves restoring the site to its former use (eg agricultural), dismantling and removing all above-ground level elements, removing turbine bases to a specified depth, often one metre, with cabling left in situ.Footnote 14 Bonds are financial instruments used to evidence ability to fund these works.

The answer to the bonding question and, if answered positively, the requisite characteristics of the bond, such as its value, the need for this to be reviewed at regular intervals and permitted instruments (eg bank guarantee or cash deposit), will be a matter of planning judgment for the decision-maker. The balance is a delicate one. Through their designation of funds for DSR, efficacious bonds reduce the recognisedFootnote 15 risk of infrastructure abandonment due to the financial deterioration of project participants – developer(s), owner(s) and landowner(s).Footnote 16 The stringency of the bond requirement will likely correlate negatively with abandonment risk. Equally, bonds are a long-term cost burden for developers/owners.Footnote 17 A desire to save costs may lead them to locate in a jurisdiction (local authority or nation) whose approach to bonding is lax.Footnote 18 Planning decision-makers will be acutely aware that the way they exercise their discretion could influence whether the jurisdiction is chosen for the project or whether investors relocate to one more sensitive to their needs.Footnote 19 Thus, there is a clear connection between the bonding question and the ability of decision-makers to meet local,Footnote 20 regionalFootnote 21 and UK-wideFootnote 22 renewable energy targets.

The use of discretion is evaluated through a study of 275 onshore wind projects in England. The study is empirical and theoretical. Empirically, it uncovers how and why the bonding question was answered as it was, findings essential to understanding the bonding strategies adopted in the sector and, crucially, the associated risks. This element of the work is original as the way that, and extent to which, bonds are used in England's onshore wind sector was previously unknown.Footnote 23 Theoretically, using Dworkin's typology of discretion, it seeks to conceptualise planning judgment before exposing the implications of the associated discretion, both in terms of the rigour of the substantive bonding decision and quality of reasons proffered for it. Whilst Fisher,Footnote 24 LeeFootnote 25 and Rydin et alFootnote 26 capture the dominant role planning judgment plays in the determination of wind project proposals, its connection to the bonding question and broad discretionary space it creates for abandonment risk to be traded in the shadows, beyond public scrutiny, against market entry costs remains entirely unexplored in the existing literature.

Three issues emerge, each of which is connected to the discretionary space which judicial deference to planning judgment creates. The first is shown to be a causative factor of the other two. First, lack of government guidance on bonding, vague ‘threshold’ terms in law and planning policy and failure of decision-makers to consider how others had decided the question result in a lack of markers to inform use of discretion, with bonds being rare (present in only 15.6% of projects) and stringency of their requirements across LPAs inconsistent. Secondly, this lack of markers legitimises risky, cost-saving practices prohibited in offshore wind, where government guidance informs bonding decisions. Thirdly, reasons for decisions on the question are weak or absent, inhibiting achievement of the justifications for their provision in an administrative context (eg disciplining decision-making). The quality of decision has been compromised and the implications of not requiring a bond overlooked.

The importance of the study is two-fold. First, it evidences that whilst discretion enhanced capacity to generate electricity from wind by facilitating a reduction in market entry costs, assisting movement towards renewable energy targets, it resulted in abandonment risk largely being ignored. This strategy is seen elsewhere in England's energy sector, such as coal and oil and gas. There, as we shall see, a ‘light touch’ approach to bonding for end-of-life obligations has, traditionally, been adopted to avoid hindering development of projects deemed desirable at a particular point in time. Approaches receptive to investors certainly benefit the wider strategy of securing more energy from renewable sources, in line with targets set, though it may result in project participants being unable to fund DSR. The potential scale of the problem has not been appreciated to date. Secondly, it affords a better understanding of current bonding practices. There is a significant ‘hurdle’ to new onshore wind projects in England: impacts identified by affected local communities must be ‘fully addressed’ and the proposal must have their ‘backing’.Footnote 27 Developing better bonding strategies may ameliorate abandonment concerns raised in Parliament and by communities, eliminating one important source of objections.

This paper is structured as follows. Section 1 affords context to the study by providing an account of the core functions of bonds for end-of-life obligations in the energy sector. Section 2 outlines the methodology and applicable legal framework. Section 3 sets out the study's key empirical findings. Section 4 explores three problematic issues emerging from the study. The paper ends with some conclusions.

1. The function of bonds

It is prudent to begin with a primer on bonding for end-of-life obligations in the energy sector. The principal justifications for bonds, specifically their capacity to guarantee performance of future obligations and the prospect for ‘productive’ cost internalisation this facilitates, are then examined. These, it is submitted, point towards the need for an efficacious bond to be required for all energy projects in respect of which end-of-life obligations are imposed. In its absence, in England, if a regulatee fails to discharge their obligations, legal responsibility for them falls, ultimately, to the landowner(s) for onshore projects,Footnote 28 and the government for offshore ones.Footnote 29 Whilst the latter necessitates use of public funds, the financial standing of the landowner(s) is key to the former. The LPA has two options if the landowner(s) cannot fund the works: first, perform them itself using public funds and look to recover value from the infrastructure in scrappage/resale; or secondly, leave the infrastructure in situ, with the ensuing visual blight and lost opportunity to reintegrate the materials to the economy. Neither is an appealing prospect.

(a) Bonding for end-of-life obligations in the energy sector: a primer

When the operational life of an energy project ends, the regulatee is often legally required to close the site safely and restore it to its original condition or to a level that could accommodate another productive use. As these ‘end-of-life obligations’ are to be completed in the future, often decades after being imposed, there is the risk of the regulatee becoming insolvent or simply not having the financial means to undertake the works when required. A recognised means of guarding against this is to require that they provide a ‘bond’ prior to construction of the project. In this context, a bond is a financial instrument used to evidence to a regulator a regulatee's ability to finance their end-of-life obligations.

The power to require a bond for end-of-life obligations exists across the UK's energy sector.Footnote 30 It has, however, been the tradition for regulators to adopt a ‘light-touch’ approach to bonding so as not to hinder development of desired energy projects through the imposition of onerous (and so, invariably, expensive) bond requirements. For instance, government guidance on planning for mineral extraction, which covers coal and shale gas projects, asserts that a bond ‘to cover restoration and aftercare costs will normally only be justified in exceptional cases’.Footnote 31 And under the framework governing decommissioning in the offshore oil and gas sector, the power to mandate a bond is so rarely invoked that, as of January 2019, regulatees had only been required to set aside £844 million.Footnote 32 The total estimated cost of decommissioning UK Continental Shelf upstream oil and gas infrastructure is currently £37–£55 billion (central estimate of £45 billion).Footnote 33 This means that the bonds provided cover only 1.53–2.28% of the total estimated liabilities. Thus, despite the existence of powers to require regulatees to provide a bond, it is relatively rare for them to be used in the energy sector.

(b) The justifications for bonds

The literature presents two distinct normative justifications for bonds. First, they act as a ‘guarantee’ for the ‘performance of a known future action’ by a regulatee, such as a restoration, or other performance-related, requirement.Footnote 34 In so doing, they can ‘complement’ command-and-control regulation.Footnote 35 To explain, the regulatee ‘posts’ a bond with the regulator prior to construction of the project. This is released when end-of-life obligations are performed. If performance does not occur, the bond will be forfeited and the funds associated with it may then be used by the regulator to undertake the works. Thus, bonds engender performance of these prescribed obligations (the ‘command’), reducing but not eliminating the need for enforcement action to be taken by the regulator in the event of their breach (the ‘control’).

This capacity of bonds to operate as the crucial point of connection between the regulation of a company by corporate/insolvency law on one hand with public law (eg planning law) on the other is, perhaps, their greatest strength. Through ensuring the dedication of funds sufficient to perform end-of-life obligations, efficacious bonds reduce the possibility of strategic use of corporate/insolvency law, and its capacity to facilitate lawful unilateral delimitation of the bounds and extent of liability, by the regulatee to avoid performing (and, indeed, paying for) their responsibilities under public law. This is even more important given that there is now ‘very little room’ to impose upon the controller of a regulatee, via the corporate law remedy of ‘veil piercing’, a liability incurred lawfully by a regulatee.Footnote 36

Secondly, they act as a ‘guarantee’ that a regulatee ‘can cover any present and future environmental costs of his or her activities’.Footnote 37 Cost coverage is traditionally connected to the economic idea of cost internalisation. This occurs when the pertinent costs are reflected in a regulatee's costs of production or covered in the pricing of its goods (eg electricity) or services.Footnote 38 The costs associated with providing a bond, such as purchasing a bank guarantee or making a cash deposit, of a value sufficient to ensure performance of end-of-life obligations will be a significant cost of production. These newly internalised costs are ‘very real’ to the regulatee and can be expected to reduce a project's profitability.Footnote 39 Whilst they may be expected to have an (upward) effect on the cost of the energy generated by the project, this will create a more accurate price signal for consumers and policy makers.Footnote 40

We must, however, be careful in how far we take cost internalisation, as a goal distinct to guaranteeing performance, as a justification for bonding requirements. It is consistent with the literature to treat cost internalisation as occurring where regulatees incorporate the estimated costs of performing the obligations in their accounts,Footnote 41 or take them into account in their decision-making processes.Footnote 42 That these costs have been ‘internalised’ does not mean that the funds necessary for performance exist or, where they do exist, are protected from the claims of the regulatee's creditors should it be unable to pay its debts and be wound up. Thus, ‘bare’ cost internalisation (ie the regulatee is merely required to reflect the costs in the pricing of its energy) is an inadequate function for bonding if performance is a regulatory priority. If it is, the funds designated for performance must be segregated from the general body of the regulatee's assets and be available when needed. Mackie and Besco term this ‘productive cost internalization’.Footnote 43 This facilitates convergence of the core justifications for bonds, creating potential to ensure that: (i) performance occurs; and (ii) energy is priced more accurately.

There is, however, a trade-off. First, bond requirements create a direct and, potentially, an indirect cost burden.Footnote 44 This will weigh more heavily as requirements increase in stringency. Whilst direct costs comprise, for instance, the costs of purchasing the instrument (eg bank guarantee) for the project's duration, indirect costs arise where, for instance, the provider (eg a bank) requires collateral. Assets used for collateral will be likely be unavailable to act as security to generate further debt finance, inhibiting borrowing. Secondly, this cost burden may harm the economic competitiveness of a jurisdiction.Footnote 45 Other things being equal, regulatees in jurisdictions with stringent bonding requirements will be at a competitive disadvantage to those in jurisdictions with lax ones (or where none exist) owing to the higher compliance costs of the former.Footnote 46 As we have seen, this may impact on the jurisdiction selected for the project.

Despite the cost burden, an efficacious bond ought to be required for end-of-life obligations. In its absence, other stakeholders, often local communities, are left to bear the costs if a regulatee defaults on their obligations. This not only masks the true cost of the energy generated but these ‘externalised costs’ provide an indirect subsidy that gives the regulatee an inequitable advantage in the market.Footnote 47

2. Methodology

The Department for Business, Innovation and Industry Strategy's (BEIS) Renewable Energy Planning Database (REPD) provided the source data.Footnote 48 It contains granular detail for UK renewable energy projects over 150kW. The study's dataset was curated using the following criteria: wind onshore projects in England; awaiting construction; under construction; operational; decommissioned; application date of April 1990–October 2022. This produced a dataset of 302 projects (see Figure 1).

Figure 1. a map of REPD data showing the geographical spread of the 302 onshore wind energy projects in England

For offshore wind, section 106(4) of the Energy Act 2004 empowers the regulator, BEIS, to require a bond. There is no equivalent power in onshore wind. Decision-makers must utilise general powers under the Town and Country Planning Act 1990 (the 1990 Act). There are two options. First, impose a planning condition requiring a bond (section 70). Secondly, provide for a bond via planning obligation (section 106). As detailed below, a planning condition is a legally binding condition attached to a permission. A planning obligation is a private contractual agreement separate to that permission.

An intensive manual search of the LPA's public access system was conducted for each project to establish whether a DSR bond was required by the decision-maker or volunteered by the developer/owner, and, if so, how and why.Footnote 49 Details were recorded. Decision notices, planning officer reports, committee reports, planning obligations (section 106 agreements and unilateral undertakings),Footnote 50 appeal decisions and public inquiry reports of Inspectors and decisions of the Secretary of State were examined. If documents were not available via the public access system then they were sought from the LPA. Generally, copies were forthcoming. As key documentation could not be obtained (eg section 106 agreements and appeal decisions), twenty-seven (27) projects were excised from the dataset. This resulted in a final dataset of 275 projects, representing a total of 2838 MW installed capacity and 1501 turbines.

(a) Bonding requirements via planning condition

Planning conditions help control and mitigate adverse effects, enabling development to proceed where it would otherwise be necessary to refuse permission.Footnote 51 LPAs have powers under the 1990 Act to impose them.Footnote 52 For instance, section 70 enables LPAs to grant planning permission ‘subject to such conditions as they think fit’.Footnote 53 This seemingly unlimited discretion is restricted substantially by case law and policy which ‘frame’ what a legally acceptable condition looks like.Footnote 54 The Secretary of State can impose them on appeal.Footnote 55 Conditions bind successors in title.Footnote 56

A condition must satisfy the Newbury criteria to be lawful, meaning it must: (1) be for a planning purpose; (2) fairly and reasonably relate to the development; and (3) be reasonable (ie not be so unreasonable that no reasonable LPA could have imposed it).Footnote 57 Tests set out in national planning policy, which LPAs must take into account as ‘material considerations’,Footnote 58 also apply. According to Circular 11/95, conditions should only be imposed where they are ‘necessary and reasonable, as well as enforceable, precise and relevant both to planning and to the development to be permitted’.Footnote 59 Those that place ‘unjustifiable and disproportionate’ financial burdens on applicants will not pass the reasonableness test,Footnote 60 limitations that appear particularly pertinent to bonds. The National Planning Policy Framework (NPPF) states that conditions ‘should be kept to a minimum and only imposed where they are necessary, relevant to planning and to the development to be permitted, enforceable, precise and reasonable in all other respects’.Footnote 61 There are overlaps between these ‘threshold’ terms (eg necessary, relevant and reasonable) in law and policy that will be revisited later in this paper.

The use of conditions to require a bond is complicated by the fact that planning policyFootnote 62 and government guidanceFootnote 63 assert that no payment of money or other consideration can be required when granting planning permission. This reflects Lloyd LJ's observation in Bradford City Metropolitan Council v Secretary of State for the Environment that ‘[i]t has usually been regarded as axiomatic that planning consent cannot be bought or sold’.Footnote 64 Voluntary provision of a bond may also be problematic for where a payment is offered as a ‘general inducement’ to the LPA to grant permission then this will be treated as attempting to buy permission and not permitted.Footnote 65 However, it is submitted that providing a bond as security for DSR costs, whether required or volunteered, ought not to raise concerns that permission has been ‘bought’. LPAs will not benefit financially from a bond when conferring permission. Rather, the bond merely facilitates performance of DSR in the event of abandonment (ie it lessens the likelihood of a loss). Where applicable tests are satisfied, a negatively worded condition prohibiting development until a specified action is complete (eg bond provision) may be used.Footnote 66 Whilst some see conditions as inappropriate vehicles for imposing bond requirements,Footnote 67 LPAs,Footnote 68 InspectorsFootnote 69 and the Secretary of StateFootnote 70 deem their use to be entirely lawful.

(b) Bonding requirements via planning obligation

Planning obligations present a further legal tool to mitigate the impact of unacceptable development so as to make it acceptable in planning terms.Footnote 71 They are to be used where conditions cannot address unacceptable impacts (eg due to the perception that conditions are inappropriate for imposing bond requirements).Footnote 72 Section 106(1) of the 1990 Act empowers LPAs to, inter alia, mandate that ‘a sum or sums … be paid to the authority on a specified date or dates or periodically’. An LPA may enter an obligation (a ‘section 106 agreement’) with ‘any person interested in land’,Footnote 73 often the developer/owner, landowner(s) and mortgagee. Or a person with such an interest may enter the obligation without making the LPA a party to it (a ‘unilateral undertaking’),Footnote 74 a route appropriate where time is of the essence. Unilateral undertakings usually permit enforcement under section 106 by the LPA. An obligation will either be volunteered by the developer/owner or, if deemed appropriate, required by the LPA before permission is granted. Obligations will not be required by Inspectors or Secretary of State, though they may assess their compatibility with law and policy as part of their wider consideration of a planning application.

Obligations must comply with regulation 122 of the Community Infrastructure Levy (CIL) Regulations 2010, a test repeated in the NPPF.Footnote 75 Whilst the levy does not apply to wind projects,Footnote 76 regulation 122 does.Footnote 77 It applies where a decision results in permission being granted.Footnote 78 An obligation may only constitute a ‘reason’ for granting permission if it is ‘(a) necessary to make the development acceptable in planning terms; (b) directly related to the development; and (c) fairly and reasonably related in scale and kind to the development’.Footnote 79 Whether an obligation meets this legal test is a matter of planning judgment for the decision-maker, which can only be interfered with in the presence of legal error (eg irrationality).Footnote 80 As judgment is required, it is not a question to which there is an objectively ‘correct’ answer.Footnote 81 Thus, while law and policy frames our understanding of what an acceptable obligation looks like, as Fisher observes, the ‘frames are not always in themselves legally certain’.Footnote 82

2. The ‘how’ question

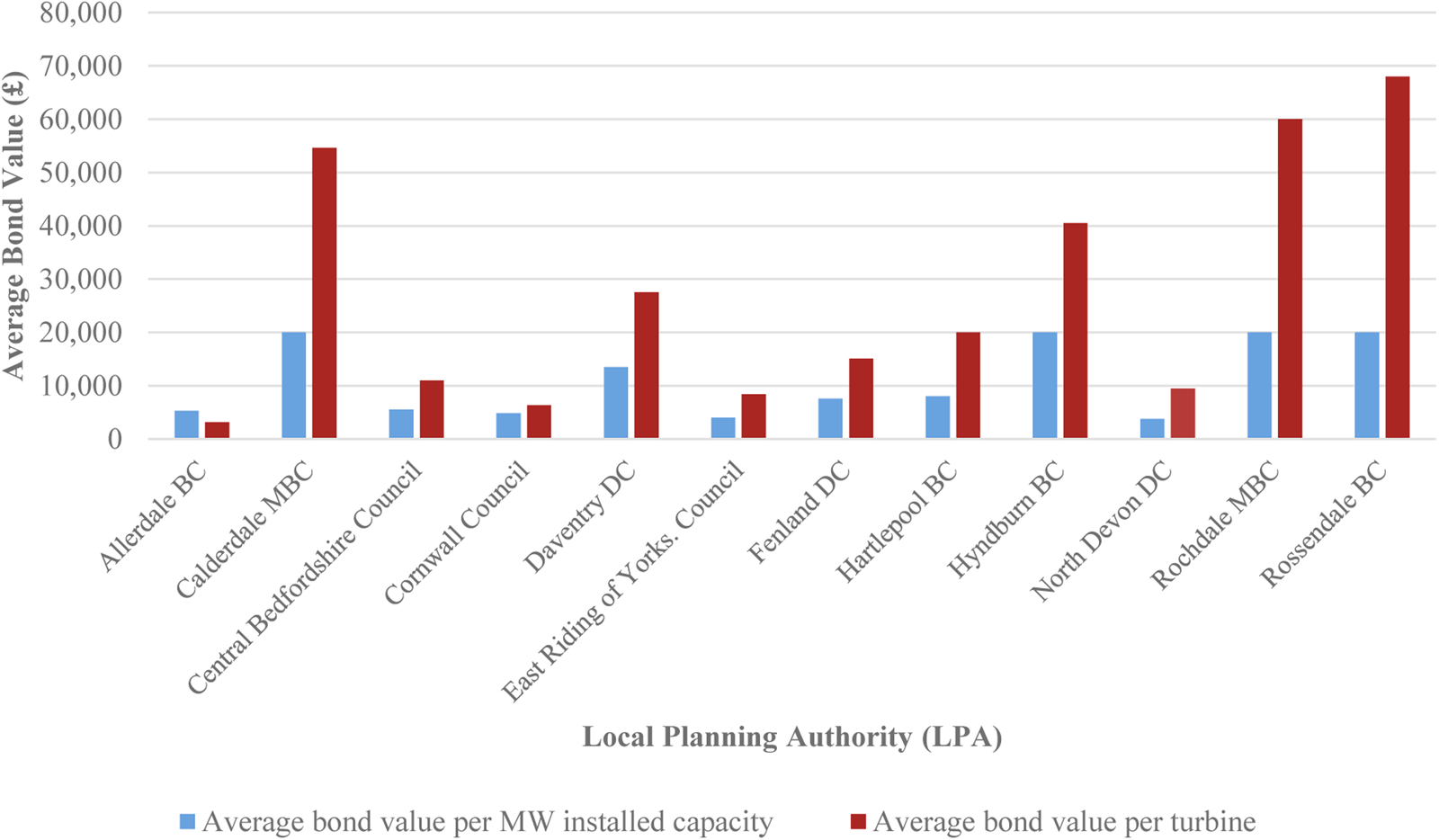

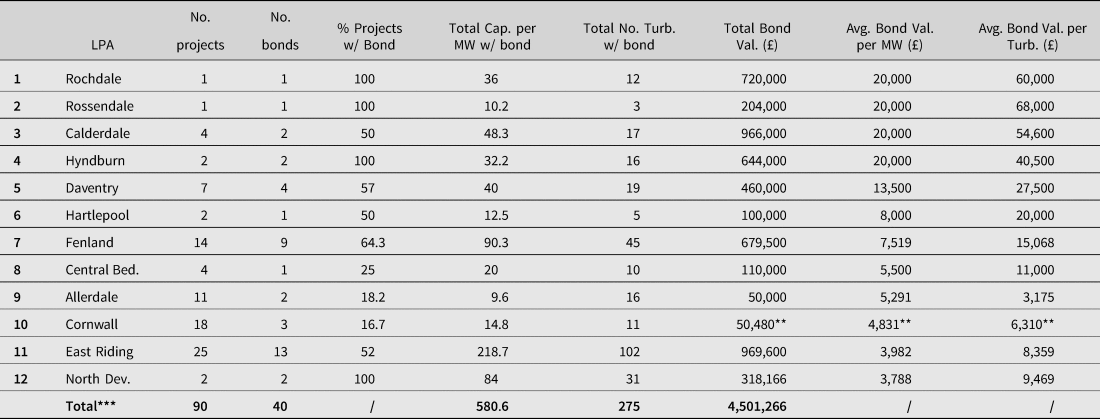

This section details how bonds were used. Their derivation (ie condition or obligation) and characteristics are outlined. The full list of bonds comprised within this study is detailed in the Bond Dataset. A link to this supplementary material can be found at the end of this paper. Bonds were provided in 15.6% of projects (43 of 275). They were required by decision-makers in 10.5% of projects (29 of 275) and volunteered by developers in 4.7% (13 of 275).Footnote 83 Of the 39 bonds whose values were known, the average bond value per MW installed capacity was £8,071 (per turbine it was £17,471). Average bond values per MW of installed capacity vary widely amongst LPAs. As seen from Figure 2 and Table 1, at the high end of the spectrum were Rochdale, Rossendale, Calderdale and Hyndburn with £20,000. At the low end were Cornwall (£4,831), East Riding (£3,982) and North Devon (£3,788).

Figure 2. average bond values per MW of installed capacity and per turbine for each LPA

Note: Three LPAs (Carlisle, Harborough and South Northamptonshire) are not included in this Figure as the bond values for projects in their area (Beckburn, Swinford and M1 respectively) could not be confirmed.

Table 1. average bond values per MW installed capacity and per turbine for each LPA (high-low)*

Notes:

* Three LPAs (Carlisle, Harborough and South Northamptonshire) are not included in this Table as the bond values for projects in their area (Beckburn, Swinford and M1 respectively) could not be confirmed. This results in a ‘Total’ of 40 bonds.

** Whilst there were three bonds in Cornwall's area, one (Crimp) was removed from these calculations as its value was unknown.

*** The unilateral undertaking for Crook Hill was entered into by both Calderdale and Rochdale as the project spanned the areas of both LPAs. To prevent double counting, the project and financial information relating to its bond was only counted once when calculating the ‘Total’ figures in bold.

(a) Planning conditions

Three projects, representing 31.6 MW of installed capacity and 27 turbines, possessed a condition mandating a DSR bond. This contradicts assertions in the literature that ‘most’ permissions comprise one.Footnote 84 For the two projects whose bond values were known (Siddick and Oldside), the average bond value per MW of installed capacity was £5,291 (per turbine it was £3,175).Footnote 85

Allerdale imposed a condition mandating bond provision for two projects.Footnote 86 These were the earliest examples – 1995 and 1996, respectively – of bond requirements in the sector. The bond values per MW of installed capacity were relatively low at £5,952 and £4,630 (see Bond Dataset). There was no requirement to review their values. The bonds could be provided via bank guarantee or cash deposit.

The third relates to Swinford Wind Farm, Leicestershire.Footnote 87 In December 2009, the Secretary of State, following the Inspector's recommendation,Footnote 88 required provision of a bond to cover ‘all’ DSR costs.Footnote 89 To be maintained for the consent's duration, it was subject to five-yearly review. The condition specified neither the value nor approved instruments. The LPA failed to clarify this when approached. Despite the condition requiring coverage of ‘all’ DSR costs, the developer's agent ‘recommended’ that the LPA accept a bond of £3,400 per MW installed capacity.Footnote 90 If this was accepted, it would place lowest in the dataset (see Bond Dataset). The decommissioning report indicated that the gross DSR cost, not including removal of access roads, would be £18,346 per MW installed capacity (£504,527 in total).Footnote 91

(b) Planning obligations

Forty projects, representing 609.2 MW of installed capacity and 277 turbines, had a planning obligation relating to a DSR bond. Thirty-seven were in operation. Three awaited construction.Footnote 92 Whilst full details of one was not known, its value was.Footnote 93 Of the 40 bonds provided by way of planning obligation, the values of three could not be established.Footnote 94 These were removed from calculations relating to the total bond value and average bond values per MW installed and per turbine. Those calculations were, therefore, based upon a dataset of 37 bonds. The three bonds whose values were unknown were retained in the Bond Dataset as other details were available.

The instruments permitted varied. They included cash deposit, letter of credit, bank guarantee/ bond, surety bond and other ‘acceptable’ financial arrangement. The latter might include, for example, a parent company guarantee. Most bonds provided at least two options for developers. As seen from Figure 3, bank guarantee and cash deposit were the most common options. For most bonds, we cannot, however, determine which was selected by the developer/owner as this information is not made public.

Figure 3. Number of times instrument specified as an option to satisfy bonding requirement

For the bonds provided by way of planning obligation, the average bond value per MW of installed capacity was £8,221 (per turbine it was £18,244). Where entry into the obligation was conditional on permission being granted, it was £8,124 (25). Where offered voluntarily with a view to the appeal/application being decided favourably, it was marginally higher at £8,423 (12).Footnote 95 As seen in the Bond Dataset (column titled ‘Rev’), clauses mandating reviewal of the bond value were common (27). This was usually at years 5 or 6, then at five-yearly intervals thereafter. Twelve had no such clause, meaning their values could not accommodate variations in DSR costs or salvage values. Information on reviewal could not be found for one project.

Eight bonds stated that they covered the ‘net’ DSR cost (see Bond Dataset). This is the difference between two estimates provided by the applicant: (i) DSR costs per MW of installed capacity/per turbine; and (ii) the infrastructure's salvage or resale value per MW of installed capacity/per turbine. For example, if the developer estimates that DSR will cost £60,000 per turbine and believes that £40,000 can be recouped from each turbine in scrappage, the (negative) net DSR cost would be £20,000 per turbine. For this group of eight bonds, the average bond value per MW installed capacity was £12,849 (£30,070 per turbine). This is far larger than the average bond value per MW of installed capacity of £6,944 (£14,982 per turbine) for bonds that did not state that they were based on ‘net’ DSR costs (29).

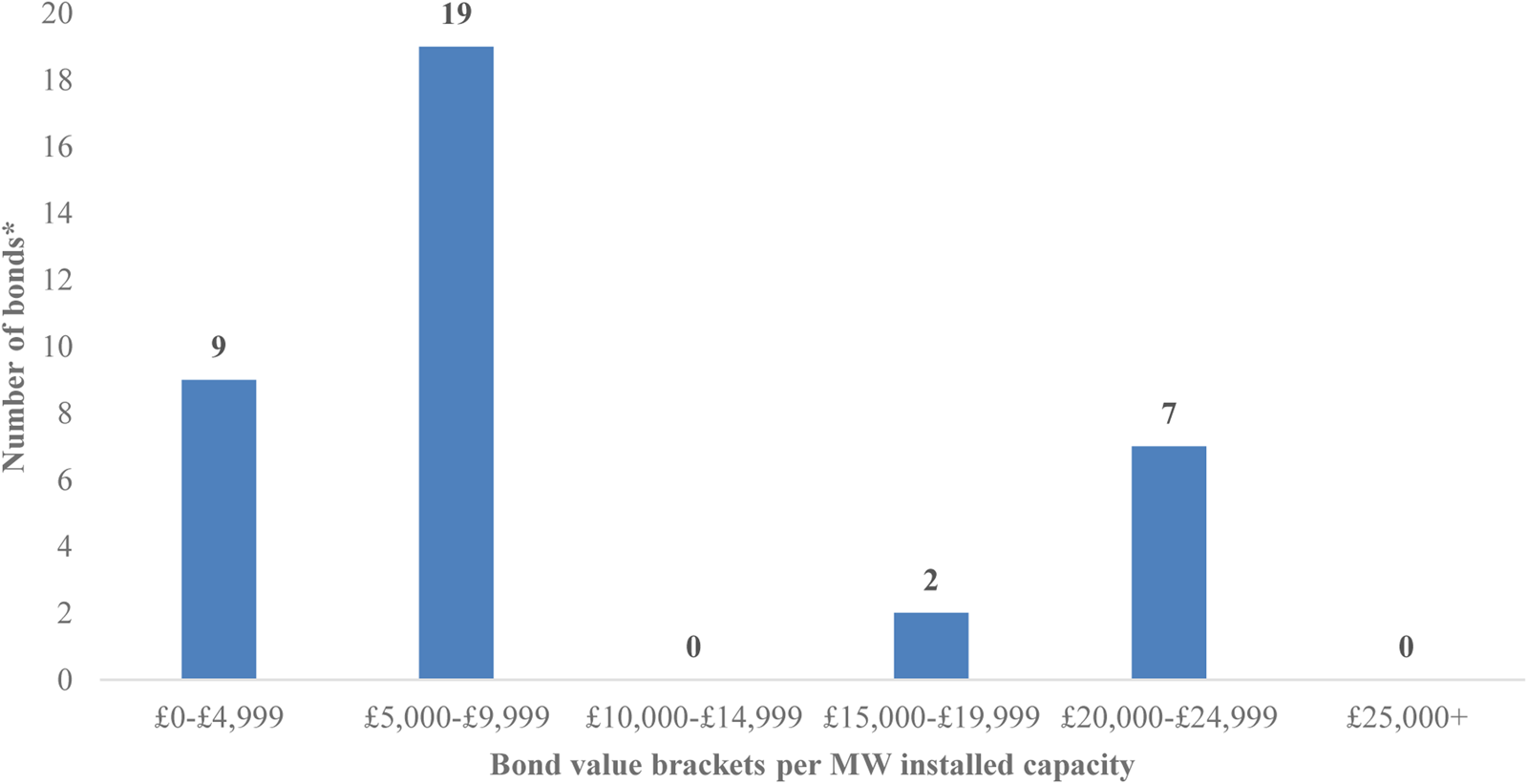

As seen from Figure 4, most (51.3%) bonds fell into the £5,000–£9,999 per MW installed capacity value bracket. 18.9% (7) fell within the £20,000–£24,999 bracket. As we shall see, this bracket edges closer to what it is estimated to cost to perform DSR.

Figure 4. number of bonds provided via planning obligation falling into each per MW installed capacity value bracket

Note: This Figure represents a total of 37 bonds. Three bonds were removed as their values were not known.

3. The ‘why’ question

This section details why Inspectors and the Secretary of State answered the bonding question as they did. For the 99 projects where an LPA's refusal of consent was appealed to the Planning Inspectorate or the application was ‘called in’ by the Secretary of State and decided following public inquiry, the question was discussed for 25 (25.3%). It was answered positively for 13 (52%) and negatively for 12 (48%). The balance is closely matched, with positive answers comprising 263.2 MW installed capacity and 112 turbines and the negative, 235.9 MW installed capacity and 108 turbines. The rationale for examining the reason-giving of Inspectors and the Secretary of State, and not that of LPAs, is that LPAs are under no general statutoryFootnote 96 or general common lawFootnote 97 duty to provide reasons upon granting planning permission. This means that we cannot be sure whether the existence (or lack) of a bond impacted upon an LPA's decision. As InspectorsFootnote 98 and the Secretary of StateFootnote 99 must offer reasons for their decisions, we have greater clarity on this issue.

(a) Planning conditions

There are four decisions to consider. In December 2009, the Secretary of State imposed a condition requiring a bond for Swinford Wind Farm, Leicestershire.Footnote 100 He found the condition ‘reasonable and necessary’ and that it met the tests of Circular 11/95 but did not articulate why.Footnote 101 The Inspector did not provide reasoning either. He merely stated that the bond would need to ‘cover’ all DSR costs.Footnote 102 In contrast, in January 2010, the Inspector was ‘unconvinced of the “need” (in the Circular 11/95 sense)’ for a bond for Carland Cross Wind Farm, Cornwall,Footnote 103 ‘given that the Secretary of State has not sought to require one in similar cases’.Footnote 104 However, they had, two months earlier, deemed a bond necessary for the similarly sized Swinford. The Inspector's reasoning for Carland Cross was, therefore, mistaken. In January 2014, the Inspector, in his decision on Dunsland Cross Wind Farm, Devon,Footnote 105 deemed it ‘very unusual’ to attach a condition requiring a DSR bond for turbines.Footnote 106 He found the condition ‘unnecessary’ as there was ‘nothing before him’ to suggest the turbines would not be removed.Footnote 107 The ‘standard’ DSR conditions would, he believed, be enforceable.Footnote 108

Finally, in July 2017, the Inspector's report to the Secretary of State on the proposed expansion of Scout Moor Wind Farm,Footnote 109 Lancashire, considered bonding in some detail. Citing Carland Cross, which was inaccurately reasoned on this issue, he asserted that the Secretary of State and Inspectors ‘have in previous decisions rightly been resistant to requiring a bond for the restoration of wind farm sites’.Footnote 110 He did not explain why this was ‘right’. The Secretary of State agreed with the Inspector's conclusions and recommendations overall but did not deal with bonds explicitly.Footnote 111

The Inspector gave four reasons for his position, examined further in Section 4. First, as considerable value could be recovered from the infrastructure, the LPA possessed sufficient leverage to ensure DSR took place.Footnote 112 The sums expected to be recouped exceeded the DSR costs.Footnote 113 Secondly, no guidance/policy indicated that a bond ought to be required.Footnote 114 Thirdly, practice was to rely on conditions to facilitate DSR, which accorded with guidance.Footnote 115 Fourthly, citing EN-3, he asserted that onshore wind turbines could be decommissioned ‘relatively easily and cheaply’,Footnote 116 rendering a bond superfluous.Footnote 117

(b) Planning obligations

For the 12 other projects where the bonding question was answered positively, decision-makers often did not explain why. For the second largest wind farm in England, Fullabrook Down,Footnote 118 Devon, the Inspector stated blandly that the obligation ‘met’ the tests in Circular 05/2005,Footnote 119 a document superseded by the NPPF. The Secretary of State did not mention it in his decision approving the application.Footnote 120 Similar positions were taken by the Secretary of State in his co-joined decision on Crook Hill Wind Farm,Footnote 121 Greater Manchester, and Reaps Moss Wind Farm,Footnote 122 Lancashire. He deemed the bond requirement ‘relevant’ to the development and satisfied Circular 05/2005.Footnote 123 The Inspector did not take a position on this but did propose revisions to better protect the LPAs.Footnote 124 For Lilbourne Wind FarmFootnote 125 and Yelvertoft Wind Farm,Footnote 126 both Northamptonshire, the Inspectors merely referenced regulation 122 and the NPPF to justify their decisions. And for Crimp Wind Farm,Footnote 127 Cornwall, the Inspector, approving the appeal, asserted that he had ‘taken into account’ a unilateral undertaking providing for a bond.Footnote 128 These cases are marked by paltry reason-giving on the bonding question.

Marginally fuller justifications were forthcoming for others, with a bond being necessary to: ‘address planning objections’;Footnote 129 ‘protect the appearance of the countryside’, with the bond ‘designed to ensure that, whatever happens to the operators or operation of the site, the scheme would be decommissioned in accordance with the agreed method statement’;Footnote 130 ‘complement’ planning conditions detailing DSR requirements ‘through establishing the financial means to carry out the work’;Footnote 131 ‘protect the character and appearance of the area in the long term from redundant or non-functioning wind turbines’;Footnote 132 ensure that the development ‘would be reversible, and that the site would be restored’;Footnote 133 deal with a situation where the developer did ‘not fulfil commitments and would cover situations such as insolvency’.Footnote 134 And a bond for Burnthouse Wind Farm,Footnote 135 Cambridgeshire, was held by the Inspector to give ‘reassurance’ to the LPA and local communities ‘that the future appearance of the site will be provided for’.Footnote 136 The Inspector's approval of the bond was reversed by the Secretary of State.Footnote 137 The pervading theme in these justifications is that performance of DSR could not be guaranteed without a bond. The focus was the visual impact of abandonment, as opposed to its wider impacts upon, say, the circular economy.

For the 12 decisions where the bonding question was answered negatively, the dominant reason was that planning conditions requiring DSR were sufficient. Tween Bridge Wind Farm,Footnote 138 South Yorkshire, one of England's largest, is a prime example. For the Inspector, a bond was ‘unreasonable’ given the scope and enforceability of the proposed conditions requiring DSR.Footnote 139 The Secretary of State agreed.Footnote 140 The position that conditions requiring DSR provided adequate safeguards was, in addition to the Carland Cross, Dunsland Cross, Scout Moor and Burnthouse Farm projects discussed above, adopted for seven further projects.Footnote 141 The Airfield Farm decision may expose the logic behind this. There, the Inspector speculated that it was ‘very unlikely’ that the conditions would not be complied with.Footnote 142 And he deemed it ‘unlikely’ that when the permission expired, ‘there will be no landowner to enforce against, if that should be necessary’.Footnote 143 It is, however, not their existence that is key, but their capacity to pay. This cannot be determined decades in advance.

4. Discussion

This section explores three issues emerging from the study. These concern discretion in relation to the bonding question. The first is a lack of decision-making markers. This is a key causative factor in: (i) the degree of discretion available to exercise and reason planning judgment; and (ii) the other two issues examined. The second is the limited function applied to most bonds (ie coverage of net DSR costs) and risks associated with this. The third is the discretion as regards reason-giving and the implications of this for stakeholders. Whilst the first expands the discretionary space, the other two are consequences of it.

(a) Planning judgment

It is submitted that an absence of decision-making markers enlarges the discretionary space and inhibits capacity to exercise and reason planning judgment on the bonding question confidently and consistently. Markers might include pertinent policy, clear legislative provisions and use of precedent. However, there is a dearth of bonding policy for the sector, the drafting of ‘threshold’ terms in law and planning policy is ambiguous and there is a lack of awareness of how others decided the question.

(i) The nature of discretion

Prior to analysing the destabilisation of planning judgment, some theoretical aspects of the discretion comprised within it will be explored. Dworkin's work in Taking Rights Seriously Footnote 144 aids our understanding of the scope of this discretion and helps anchor the assertions of Booth and McAuslan, detailed in the Introduction, that planning law and policy constrain levels of available discretion.

For Dworkin, discretion is present only when a person is ‘in general charged with making decisions subject to standards set by a particular authority’.Footnote 145 Their decisions are not ‘controlled’ by these standards.Footnote 146 If they are, there is no discretion. Whilst he deploys the example of the discretion of a contest judge bound by a rule book, a planning inspector, bound by the rules of the planning system, is equally appropriate. A ‘relative’ (as regards the applicable standards), context-dependent concept ‘colored by the background of understood information against which it used’, it exists only ‘as an area left open by a surrounding belt of restriction’.Footnote 147 That ‘belt of restriction’, which must exist for discretion to be present, comprises the standards imposed on the decision-maker. It will tighten or loosen depending on the context. The idea of ‘discretionary space’ used in this paper is, thus, apt.

There are three ‘senses’ of discretion in Dworkin's typology: two weak senses and a strong one. The first weak sense arises where the applicable standards cannot be applied ‘mechanically’ but require the exercise of ‘judgment’.Footnote 148 Thus, if a planning policy specified that a bond must be provided but left its value to be determined by the decision-maker, we might say that they possessed discretion in this sense. The second weak sense is there is ‘final authority’ to make a decision which cannot be reviewed or reversed.Footnote 149 In England, this will only be true of the Secretary of State as the final arbiter of planning judgment and, as we have seen, can override decisions of Inspectors.

The strong sense, and one most relevant to the study, applies where ‘on some issue’ the official ‘is simply not bound by standards set by the authority in question’.Footnote 150 For example, on the issue of bonding, there is no law or policy (no standards) governing whether decision-makers should require a DSR bond from developers/owners of onshore wind projects. However, they have the power to require one through the imposition of a condition or entry into an obligation, provided the applicable legal and policy tests (the ‘belt of restriction’) can be satisfied. Thus, we might say that decision-makers have discretion in this strong sense to determine whether a bond requirement ought to be imposed. They do not have licence to decide as they wish ‘without recourse to standards of sense and fairness’,Footnote 151 and may be criticised for having made a mistake, or for being careless or malicious, just not for having ‘deprived a participant of a decision to which he was entitled’.Footnote 152 This is because no such entitlement exists.

(ii) The destabilisation of planning judgment

In the context of answering and reasoning the bonding question, the discretionary freedom afforded by judicial deference to planning judgment is wide. However, the absence of certain markers inhibits a confident and consistent approach. First, in addition to the lack of ‘signaling capacity’ conferred by an explicit statutory power to require a bond, akin to section 106(4) of the Energy Act 2004 in offshore wind, there is a dearth of guidance/policy on bonding in England's onshore wind sector. To use Dworkin's language, decision-makers possess discretion in the strong sense when exercising judgment on the question. There are no standards set by the planning system which dictate what the answer ought to be. This undermines the capacity of decision-makers to act with consistency.Footnote 153 For offshore wind, government guidance dictates that a bond will be required but leaves the detail of its delivery (ie its characteristics) to the regulator, BEIS.Footnote 154 BEIS possesses discretion in Dworkin's first weak sense.

The message for onshore wind is less clear. The NPPF, a material consideration which decision-makers must take into account,Footnote 155 refers to bonds once, albeit in the context of mineral extraction: ‘[b]onds or other financial guarantees to underpin planning conditions should only be sought in exceptional circumstances’.Footnote 156 No justification is offered. Whilst not directed at onshore wind, as the NPPF often carries a ‘great deal of weight’Footnote 157 in the planning balance it is likely to weigh heavily in determinations of the bonding question. Government guide on planning obligations notes, in contrast, that bonds ‘can be an effective tool for LPAs to transfer the risk of under- or non-delivery of obligations’,Footnote 158 though their use is not recommended explicitly. This lack of direction at the central level is mirrored at the local level. No LPA in the dataset had published guidance on when (if at all) a bond may be required, its purpose, instruments tolerated and advice as to its value and need for this to be reviewed at regular intervals (eg every five years).

Secondly, whilst the ‘open-ended wording’ of ‘threshold’ terms in the law and policy governing obligations, such as ‘necessary’ and ‘reasonably’ in regulation 122 of the CIL Regulations 2010 and the NPPF, maintains flexibility for decision-makers,Footnote 159 their meaning is vague and ambiguous. This is compounded by a lack of policy/guidance on how these ‘framing’ terms ought to be interpreted in the context of the bonding question (eg when, for example, a bond ought to be deemed ‘necessary to make the development acceptable in planning terms’ under regulation 122). The case law offers limited insights. For instance, that the obligation must be ‘“necessary”, not merely desirable’Footnote 160 and permission ‘ought not to be granted without it’Footnote 161 takes us no closer to understanding the meaning of ‘necessary’.

Lee et al, in examining how the courts approach the meaning of the ‘integrity’ of protected sites within the context of the Habitats Directive,Footnote 162 articulate the idea of a ‘fuzzy’ decision.Footnote 163 This is one comprising elements of fact, law and judgment which ‘makes for a blurring of authority amongst those responsible’.Footnote 164 The construction of threshold terms, such as ‘necessary’ and ‘reasonably’ in law and policy, may be considered an example of such a ‘fuzzy’ decision. Their vagueness and ambiguity must be resolved by planning decision-makers. It is they who must determine whether a bond meets the legal thresholds, such as regulation 122(2) of the CIL Regulations 2010 for obligations.Footnote 165 Thus, what are purportedly questions of law, usually the exclusive province of the courts, are, in fact, matters for the planning judgment of decision-makers.Footnote 166 Given that judgment is involved, there is usually scope for a ‘broad range of possible views by different decision-makers’, none of which could be categorised as Wednesbury unreasonable.Footnote 167 This does little for consistent determination of the question. As a decision-maker's determination of it will not usually be open to legal challenge, we must rely on their decisions (not those of the courts) to help us to understand how these terms ought to be understood. However, as we shall see, their reasoning on this is usually weak or absent, reinforcing the interpretative lacuna.

Thirdly, whilst previous decisions on the bonding question can act as markers for decision-making, Inspectors and Secretaries of State did not, generally, indicate awareness of these. A prior appeal decision may be a material consideration, to which the decision-maker must have regard, a reason being that ‘like cases should be decided in a like manner so that there is consistency in the appellate process’.Footnote 168 It may also ensure consistency in the exercise of planning judgment, another factor of importance to the courts.Footnote 169 However, the law does not require that ‘like cases must always be decided alike’.Footnote 170 Inspectors must exercise their own judgment on the issue and can depart from that of another.Footnote 171 Before doing so, they ought to have regard to the importance of consistency and give reasons for the departure.Footnote 172 Whilst Carland Cross exhibited an element of precedent value in the Scout Moor decision, Inspectors and Secretaries of State do not, generally, tend to draw upon how others had decided. In the single instance when this did happen (Carland), the Inspector did not consider the earlier decision of the Secretary of State (Swinford) which imposed a robust bond requirement, compromising the quality of planning judgment and its precedent value.

(b) Bond function

The study's findings indicate that the function of bonding in the sector is principally to cover a project's net DSR costs, an exercise of judgment prohibited in England's offshore wind sector.Footnote 173 There, volatility of salvage/resale values results in them being deemed too unreliable to act as a ‘form of security’.Footnote 174 To explain, when the salvage/resale value is deducted from the gross DSR costs to determine whether a bond ought to be required and, if so, its value, the infrastructure is treated like an ‘asset’. Conceptually, some of the DSR costs (or, indeed, all of them where no bond is required) is secured against it, albeit not in the strict legal sense. Whilst the volatility of the asset's value is disconcerting to BEIS in offshore wind, this is not true for decision-makers in onshore wind, for reasons outlined shortly. The factors set out in section 4(a) loosened the ‘belt of restriction’, enabling the practice to emerge unchallenged.

(i) The function of bonding in England's onshore wind sector

Whilst only eight bonds in the dataset stated explicitly that they were to cover the project's net DSR costs, most of the others were seemingly limited to covering those costs. First, the values of bonds that made no reference to covering net DSR costs were, on average, lower than those whose value was stated to cover them.Footnote 175 Secondly, a 2013 report found that where SSE Renewables, a major player in onshore wind, provided a bond, the typical value was around £15,000 per MW installed capacity and this figure was only to cover the net DSR costs.Footnote 176 Whilst this was nearly double the average bond value per MW installed of £6,944 for bonds not stated explicitly to cover the net DSR costs, it was close to the average bond value per MW installed capacity for those bonds stated to cover net costs (£12,849). Thirdly, publicly available estimates place the cost of decommissioning each MW of installed capacity at £18,000–£52,000, with the precise cost dictated by factors such as location, ease of transportation and turbine size.Footnote 177 With an average bond value of £6,944 per MW installed capacity for bonds not stated to cover net DSR costs (28), it is inconceivable that the bulk of these cover gross DSR costs.

We have seen that a bonding strategy limited to covering net DSR costs conceptualises the infrastructure as an asset capable of facilitating productive cost internalisation: value realised from salvage/resale can help pay for DSR. The argument would run, however, that this will be unnecessary as the owner is considered to be sufficiently incentivised to perform DSR for it would be ‘irrational’ to ‘walk away’ from the asset.Footnote 178 This assumes parity between DSR costs and salvage/resale value or that the salvage/resale value exceeds gross DSR costs. If the salvage/resale value was less than that figure, a bond may be needed to cover the ‘deficit’ to keep the incentives of developers ‘aligned’ with the goal of the LPA.Footnote 179 They may not, otherwise, be incentivised to perform DSR, especially if those costs could be externalised through strategic entry into insolvency proceedings.

(ii) Risks associated with the exercise of discretion

A bonding strategy built on covering net DSR costs, whilst not unlawful or contrary to policy (for there is no directly applicable policy), is a planning judgment – a use of Dworkin's ‘strong’ sense of discretion – exhibiting known abandonment risk. There is uncertainty as to how much DSR will cost and how much value may be recouped through salvage/resale. Whilst the infrastructure will have a salvage value, it is notoriously volatile.Footnote 180 It will be difficult to predict with accuracy what it will be in 25 years or so. Nevertheless, it is presented by applicants, and understood by some decision-makers, as covering most, if not all, of the project's DSR costs.Footnote 181 Even BEIS, when costing electricity generation for onshore wind, adopts the ‘simplifying assumption’ that DSR costs are equal to the infrastructure's scrap value.Footnote 182 Inexperience of DSR within most LPAs means DSR costs are also poorly understood. As of October 2022, only five projects totalling 27.1MW installed capacity and 72 turbines have been decommissioned in England, with three located in Cornwall.Footnote 183 Little is known about the ‘real’ cost of DSR, other than it will be extensive, particularly for more remote sites and large turbines. It is also difficult to predict.

The concern is that there is a commercial incentive for developers to underestimate DSR costs, overestimate scrappage or resale value or do both. The closer the net cost is to zero, the more beneficial to them. It strengthens their case that a bond is unnecessary or, if one is to be mandated or volunteered, its value should be low. The not insignificant cost burden, which they would otherwise shoulder, is alleviated. Where estimates are manipulated, the true net DSR cost may be larger than expected, resulting in the prospect of developers/owners defaulting on DSR if the ‘deficit’ cannot be financed.

BEIS does not permit net costing to inform bonding practices in offshore wind. Its guidance states that whilst developers may assume that scrappage will reduce net decommissioning costs for their internal rate of return calculations, ‘[d]evelopers/owners should not offset scrappage value from their total cost assumptions’ as ‘BEIS does not consider that it is appropriate to rely on estimates of scrap value as a form of security because the value can fluctuate substantially and therefore is not reliable’.Footnote 184 The most likely explanation for the differential practice is that in contrast to onshore wind, the UK Government is the ‘decommissioner of last resort’ for offshore wind infrastructure.Footnote 185 It is, therefore, incentivised to ensure public funds are protected through taking a more precautionary approach to bonding. This comprises creation of an explicit statutory power to require a bond and the supply of detailed guidance for industry on their provision. If the practice is deemed too risky for the Government, it is not clear why it should be a risk that local communities must bear.

The rarity with which bonds are used suggests that decision-makers view the infrastructure as capable of securing performance of DSR or at least the bulk of it. The infrastructure could even be conceptualised as a quasi-bond of sorts. By this, it is meant an asset of fluctuating value that acts as a kind of informal security should DSR be defaulted on by project participants. Indeed, as seen in the next section, it is clear from the reasoning (or lack thereof) of decision-makers that bonds are considered a peripheral regulatory tool. Conditions imposing DSR requirements, and the LPA's powers of enforcement against the quasi-bond in the event of their breach,Footnote 186 are the primary one. This practice, utilised in 84.4% of projects, is unregulated as there are no ‘rules’ to determine the quasi-bond's value. It also an inherently unreliable one given: (i) incentives to inflate it artificially to reduce the cost burden; and (ii) the volatile nature of its value.Footnote 187 These factors limit the capacity of the quasi-bond to facilitate performance of DSR. The advantage is that it comes with a reduced (or no) long-term cost burden for project participants which may be beneficial to a government intent on expanding capacity to generate electricity from wind.Footnote 188 We may conclude that the reduced abandonment risk afforded by bonds has been sacrificed, beyond public scrutiny, to engender lower entry costs for market participants.

(c) Reason-giving

The final issue to be considered concerns the effect which judicial deference to planning judgment has upon reason-giving on the bonding question. It will be argued that the discretion afforded by this led to a culture of inadequate reason-giving, one observed by Booth more generally in England's planning system.Footnote 189 We have seen that it was rare for bonds to be addressed at all, let alone in a meaningful way in the decisions of Inspectors and Secretaries of State. Thus, achievement of the main justifications for reason-giving in an administrative context (ie disciplining decision-making, surfacing legal errors, and communicating respect) may be inhibited and objective quality of decisions compromised.

(i) Reasons for reasons

The giving of reasons for administrative decisions serves several important purposes. First, they help discipline decision-making,Footnote 190 generating ‘more accurate’,Footnote 191 ‘thought through’,Footnote 192 and ‘rational’Footnote 193 outcomes. For Fordham, where decision-makers must articulate their reasons, their minds are more focused and substantive decision-making improved.Footnote 194 Whilst for Le Sueur, reasoning-giving duties increase the likelihood of decisions being in accordance with the applicable legal powers and constraints.Footnote 195 Thus, proper reason-giving may go some way to enhancing the overall quality of the planning judgment and helping to ensure that it was arrived at lawfully.

Secondly, reason-giving can surface legal errors in decision-making. This has two effects. It indicates whether grounds for appeal exist,Footnote 196 reinforcing the rule of law by enabling unlawful decisions to be challenged.Footnote 197 Equally, through ensuring transparency of approach,Footnote 198 reasons give interested parties ‘comfort’ that law and policy was applied correctly with only relevant considerations taken into account.Footnote 199 This may legitimise the decision in their minds,Footnote 200 helping to justify the exercise of the state's ‘coercive power’ over them.Footnote 201 The second is that reasons enable courts to perform their review function.Footnote 202 As Hepburn observes, ‘an unreasoned decision is very difficult to review’.Footnote 203 The threat of judicial review may help ‘discipline’ the decision, indicating a close connection with that justification.

Thirdly, proper reason-giving ensures those impacted by the decision are treated with respect.Footnote 204 Though, for Allan, respect is shown ‘only when there has been a genuine effort to confront the conditions of uncertainty, complexity, and incommensurability as they bear on the citizen's case’.Footnote 205 Reasons may indicate the effort expended. We may say that no respect is shown through giving invalid or inadequate reasons.Footnote 206 Relatedly, Perry and Ahmed observe an important relationship between reason-giving and relative expertise, an issue pertinent to the discussion of reason-giving as respect. They observe that by through examining reasons, it is possible to determine whether the decision-maker used expertise in arriving at their decision on the issue.Footnote 207 Where they do, a citizen may gain comfort from the perception that the decision has been made by someone with genuine expertise in the issue, enhancing the likelihood of its deemed legitimacy. We may say that they are treated with respect through the fact that their appeal was decided by someone that used their expertise to decide.

Given this background, the law governing reason-giving in the planning context will now be outlined. This standard determines whether the justifications for reasons may be realised.

(ii) Planning and the law of reasons

In South Buckinghamshire DC v Porter No 2,Footnote 208 Lord Brown provided guidance, with which the other Lords agreed, on the main considerations for those considering a reasons challenge to a planning decision. It remains the authoritative statement of law on reason-giving in judicial review claims, setting both a ‘legal standard’ for decision-makers and a ‘standard of rationality’ as to what they ‘must show, what they must address and how their reasons should be understood’.Footnote 209 Though, when applied to determination of the bonding question, these standards present low thresholds for decision-makers.

For Lord Brown, reasons must be ‘intelligible’, ‘adequate’, and ‘enable the reader to understand why the matter was decided as it was and what conclusions were reached on the ‘principal important controversial issues’, disclosing how any issue of law or fact was resolved’.Footnote 210 They could be noted ‘briefly’, with the requisite degree of specificity determined by the nature of the issues to be decided.Footnote 211 Important, complex issues may warrant detailed reasons; minor, peripheral issues less so. The reasoning ought not to give rise to a ‘substantial doubt’ as to whether the decision-maker ‘erred in law’, eg failing to reach a ‘rational’ decision on relevant grounds.Footnote 212 This could include not addressing a point ‘fundamental’ to the decision in their reasoning.Footnote 213 Though, Lord Brown emphasised that the threshold to mount a successful challenge in respect of an error in law was high, with a finding of unlawful reason-giving not to be drawn readily.Footnote 214 The decision-maker's experience and qualifications carry weight in determining this,Footnote 215 evidencing that deference to their expert planning judgment remains the dominant practice of the courts. A challenge will only succeed where an aggrieved party was ‘substantially prejudiced’ by the failure to provide an ‘adequately reasoned decision’.Footnote 216 This may occur where, for instance, there is substantial doubt that the decision was taken within the powers conferred by the Act.Footnote 217

Lord Brown was clear that if the consequence of his guidance was to ‘discourage’ reasons challenges he ‘would count that a benefit’.Footnote 218 There was an obvious desire to limit challenges. For instance, an inadequately reasoned decision, in itself, would not suffice. Substantial prejudice must also be proven. His law of reasons sought to heighten the prospect of deriving finality of decision-making and is one means of enabling the Inspector's judgment to bring closure to the dispute. This enables the regulatory process to continue.Footnote 219 After all, any reason could be criticised on a rational merits basis by those who disagreed with it and had approached the issue(s) differently.Footnote 220

(iii) Reasons and the bonding question

We can now determine whether the discretion conferred by the law facilitates realisation of the justifications for reason-giving. First, the prospect of more disciplined decision-making on the bonding question is limited. Most decision-makers paid little (and often no) attention to the question in their reasoning. For the 25.3% of projects in which it was addressed, decision-makers often stated blandly that a bond was ‘necessary’ or ‘unnecessary’ or that conditions dealing with DSR were sufficient. They did not, and it is submitted wrongly given the legacy implications of abandonment, deem it to be a ‘principal important controversial issue’, a conclusion they are entitled to come to given that this is a planning judgment.Footnote 221 And ‘pure’ planning judgments, which determination of the question is, may not require elaboration in terms of reasoning.Footnote 222 The exception was the appeal decision for the proposed expansion of Scout Moor where we find the only real, considered discussion of the question. There, it emerged as a ‘principal important controversial issue’ necessitating reason-giving, an outcome which appeared to be driven by numerous planning objections to the lack of a DSR bond.

Secondly, whilst reason-giving may help surface legal errors, this may not be fruitful in the context of the question. The key ‘threshold’ terms do not lay down precise legal tests. It is, for instance, a matter of planning judgment whether an obligation satisfies the test in regulation 122(2) of the CIL Regulations 2010.Footnote 223 The court will only interfere if there has been a legal error.Footnote 224 This is, however, a ‘high threshold’ to surmount,Footnote 225 a task that will be especially difficult given Inspectors may not be legally bound to provide their reasoning on it where it is not considered a ‘principal important controversial issue’. That the prospect of exposing a legal error sufficient to warrant successful challenge is low raises important questions as to the accountability of decision-makers on this issue.

Thirdly, it is doubtful whether reasoning on the question confers the respect to which proper reason-giving in an administrative context aspires. A positive correlation between the conferral of respect and deemed expertise of the decision-maker was highlighted above. However, if, as Perry and Ahmed recommend,Footnote 226 we use reasons given to expose the actual expertise of the decision-maker, weak or absent reasoning may indicate a lack of expertise on the issue. Rydin et al see it as a ‘convenient fiction’ to assume that decision-makers have expertise in all planning issues.Footnote 227 Nevertheless, judicial deference to planning judgment ‘by default’ assumes this to be the case. The Inspector's expertise on bonding must be presumed for they do not, generally, attempt to evidence it through reasons. It may, in fact, not exist. Not only does this throw into doubt the respect which impacted parties are shown by the practice of reason-giving but it raises questions as regards the legitimacy of the decisions being made.

It is clear that in the context of the bonding question, the prospect of realising the main theoretical justifications for reason-giving in an administrative context is low. A consequence is that the quality of decisions on the question has been compromised and implications of not requiring a bond (eg increased abandonment risk) overlooked consistently. We may conclude that the way DSR is to be financed in the sector sits at a lowly position in the hierarchy of pertinent material considerations.

Conclusion

This paper offered the first evaluation of the exercise of discretion by planning decision-makers on the role of bonds in facilitating the DSR of onshore wind farms in England. It provides original empirical and theoretical insights into how they dealt with the emergence of a new, ‘green’ energy source. Three principal issues were elicited: first, a dearth of guidance/policy on bonding, ambiguous drafting of ‘threshold’ terms in law and planning policy and lack of awareness of how other planning decision-makers had approached the issue of bonding generate space for largely uncontrollable discretion, with bond requirements being rare and their stringency inconsistent across England; secondly, this space legitimises practices prohibited in offshore wind, where discretion is controlled closely by government guidance on bonding; thirdly, reasons for decisions are weak or absent, inhibiting achievement of the justifications for their provision in an administrative context, such as disciplining decision-making.

The discretion available increased capacity to generate electricity from onshore wind through reducing market entry costs. This meant, in most instances, either not requiring a bond or requiring one of low value, a strategy seen elsewhere in the UK's energy sector. Whilst venerable in the sense that it supports achievement of local, regional and UK-wide renewable energy targets, it creates a significant risk that project participants may not be able to perform their DSR responsibilities when they fall due, a prospect not fully appreciated to date. This realisation must lead us to ensure that DSR and, indeed, the capacity of project participants to fund it, are brought to the fore in deliberations as to the sector's trajectory, both in England and other jurisdictions thinking seriously about using onshore wind to meet their renewable energy targets. (In)ability to pay is not a minor, peripheral point of academic interest but one that sits at the heart of the claimed ‘temporariness’Footnote 228 of these projects in English planning policy.

Supplementary material

To view supplementary material for this article, please visit https://doi.org/10.1017/lst.2022.50.