Introduction

Global consumption of medicines has increased significantly in recent decades.Reference Tannoury and Attieh1 With the advent of the COVID-19 pandemic, this growth has significantly accelerated in some parts of the world.Reference Kabir, Moreino and Siam2 In addition, technological development, innovation, and rapid advances in biomedicine, genomics, and therapeutics have changed the paradigm of chemical molecules for biological, high-affinity, and highly effective drugs.Reference López-Cortés, Guevara-Ramírez and Kyriakidis3 These drugs are called biologicals, a class of very large molecules made from living organisms, such as bacteria, rather than synthetic, chemically developed products.Reference Dave, Hartzema and Kesselheim4 These living organisms are modified to produce the active ingredient of the drug, which is then extracted and placed in a dosage form.Reference Ortiz, Ponce and Vasconez5 The U.S. Food and Drug Administration (FDA) defines a biosimilar as a biological product that is highly similar to and has no clinically significant differences from an existing FDA-approved reference product.6 Like their reference products, biosimilars are created using living cells. However, since the synthesis pathway of the reference biologic is often patented during the first years of sale, biosimilar manufacturers may need to reverse engineer a feasible non-infringing synthesis pathway until patents expire.Reference Kaida-Yip, Deshpande, Saran and Vyas7

As of 2022, the European Medicines Agency has recommended the approval of 88 biosimilars, although 16 approvals were later withdrawn, leaving a total of 72 biosimilars approved in Europe. By contrast, the FDA has approved just 38 biosimilars to date.8 The cost of developing a biosimilar has been suggested to range from 100 to 200 million, in contrast to 800 million to 1.3 billion for the development of a the reference biotherapeutic on which the biosimilar product is based.Reference Rathore and Bhargava9 In Europe, biosimilars are commonly sold at a reduced price of roughly 20% to 35% when compared to their reference products.Reference Car, Vulto, Van Houdenhoven, Huys and Simoens10 This pricing strategy enables patients to receive treatments that were previously challenging or unattainable. In nations such as Bulgaria, the Czech Republic, and Romania, where access to epoetins was particularly limited, the cost savings are estimated to be as high as 50% with the average use of biosimilars increasing by more than 250%.Reference Farhat, Torres and Park11

The Latin American biosimilars market was valued at $517 million in 2018 and is expected to increase more than 7-fold, to $3.9 billion by 2025, reflecting a compound annual growth rate (CAGR) of around 33% during 2018-2025Reference Cosmos12 with the country with the most approved biosimilars being Brazil, Mexico, Argentina, Chile and Ecuador.13

The biologics market is anticipated to exhibit substantial growth and is predicted to exceed $893 billion by 2032. This remarkable growth trajectory is attributed to several factors, including significant advancements in biomedical sciences and the escalating prevalence of chronic illnesses worldwide.Reference Simoens and Vulto15 The research and development of novel therapies, along with the increasing demand for personalized medicine, are also major contributors to the expansion of the biologics market. Additionally, rising healthcare expenditure, expanding healthcare infrastructure, and government initiatives aimed at improving healthcare access and affordability are expected to fuel the growth of the biologics market in the coming years.Reference Luukkanen, Tolonen, Airaksinen and Saarukka16 It is estimated an annual increase rate of 3% to 6%, especially in regions such as Europe where information is fully available, at least 30% of drug spending is driven by biological products.17 In a market valued at $254.9 billion in 2017 with a potential growth expected to reach $580.5 billion by 2026, understanding regional trends is vital.18 Due to the informal nature of markets in Latin America, and the lack of centralized data collection, it is crucial to integrate the available sources of information to gain a comprehensive understanding of the regional biosimilar market. Despite the challenges posed by this, the commercial potential of the biosimilar market in Latin America is substantial. While there is a significant demand for biosimilars in Latin America, the limited supply of these products can have a notable impact on public health and patients’ adherence to treatment. Therefore, it is crucial to ensure that the needs of patients are met in terms of safety, efficacy, and affordability while also creating a sustainable and profitable market for biosimilars in the region.19 Achieving this balance is essential for promoting access to affordable, high-quality healthcare while also fostering innovation and growth in the biologics industry in Latin America.

Due to the informal nature of markets in Latin America, and the lack of centralized data collection, it is crucial to integrate the available sources of information to gain a comprehensive understanding of the regional biosimilar market. Despite the challenges posed by this, the commercial potential of the biosimilar market in Latin America is substantial. While there is a significant demand for biosimilars in Latin America, the limited supply of these products can have a notable impact on public health and patients’ adherence to treatment. Therefore, it is crucial to ensure that the needs of patients are met in terms of safety, efficacy, and affordability while also creating a sustainable and profitable market for biosimilars in the region.

The objective of this investigation is to provide a comprehensive description of the principal trends related to the market share of biologic products in Latin America.

Methods

Study Design and Setting

This study is a secondary, data-based ecological analysis that examines the market share of biological products in Latin American countries. Specifically, we analyzed data on units sold and revenue generated in countries such as Brazil, Argentina, Chile, Colombia, Ecuador, Uruguay, Dominican Republic, and Venezuela. However, it is important to note that data availability was limited for other Latin American countries, and as such, we were unable to include them in our analysis.

Data Sources

Data was obtained and analyzed from IQVIA (formerly known as IMS Health and QuintilesIMS). IQVIA collects prescription data from sample pharmacies all over the world, covering 93% of outpatient prescription activity, and projects this information countrywide.20 In Latin America, both public and private healthcare systems contribute information to achieve a more comprehensive understanding of local consumption. In some countries, this combined approach has led to an accuracy rate of up to 90%. We analyzed the number of molecules available per country, the producers, manufacturers, and distributors region-wide, the price of each molecule by each country on a quartile basis, the Anatomical Therapeutic Chemical (ATC) classification group, the trade name and the name of the biologic product. The data used in this study includes information from 2017 up to the second quarter of 2022. The database comprises at least 2,239 observations from 10 countries in Latin America, including the Central America region, for which data was not desegregated. The information was sourced from both retail expenditure and hospital level data. In cases where data from IQVIA was not available, such as in Cuba, Bolivia, Paraguay, and Costa Rica, a literature review was conducted using previously established methods. We acknowledge that the absence of IQVIA data in certain countries limits the scope of our analysis, but we believe that the combination of available data sources provides a valuable overview of the biologics market in Latin America.Reference Salager-Meyer21

For the literature review, information from primary and secondary sources was obtained via EBSCO research databases using the DelphiS library engine. Databases included the following: EBSCO, JSTOR, Clarivate Analytics, PubMed/Medline, OVID, ScienceDirect, Web of Science, EMBASE and Europe PMC.

Indexed manuscripts were retrieved using the Boolean operators AND/OR in combination with the words ‘biosimilar,’ ‘biosimilares’ (Spanish), ‘biological’ or ‘medicamentos biologicos’ (Spanish). This search combined the term ‘South America’ and the word ‘Latin,’ using the truncation mark (*) to include all documents that contain the specified word at the beginning of the search with the word ‘market,’ in both English and Spanish. All manuscripts that described the biosimilar market in Latin America were included. Manuscripts that did not contain the word ‘market’ in the title or abstract were excluded.

Results

General Analysis

In our analysis we found that the biological market in the last five and a half years in the region represented more than 16.1 billion dollars in biological products and more than 149 million units sold region-wide (Table 1). Brazil is by far the region’s largest market, representing more than 79% of total regional sales, followed by Mexico with 17%, Ecuador 2%, and Argentina with 1% (Figure 1).

Figure 1 Latin American Biosimilars Market

Per capita consumption per country. Source IQVIA. Figure prepared by authors.

Table 1 Units Sold and Selling Price of Biosimilar Molecules from 2017 through the First Quarter of 2022

Source: IQVIA

* # of Prod = Number of products. *# of man = Number of manufacturers. *# of Corp. = Number of corporations.

Within the region we have at least 156 different biological manufacturers, most of them multinational companies, while other biologicals are locally produced (Table 1). As biological products must often be injected or infused intravenously, most of the products are sold throughout hospitals with an average of 533,150 units per year, representing at least $58,240,642.5 million dollars yearly (Table 1).

Producers and Best Sellers

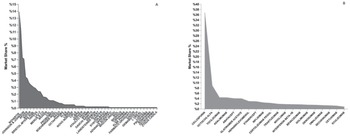

In the region, the biggest companies in terms of market share are Roche (13.9%), Novartis (11.5%), Sanofi (7.3%) and Johnson and Johnson (7.1%) (Figure 1A). On the other hand, the most used molecules in Latin America are Cyclosporine (36.7%), followed by Octocog Alfa (8.9%), Tocilizumab (4.4%), and Adalimumab (4.4%) (Figure 2).

Figure 2 Overall Most Frequent Pharmaceutical Corporations and Biosimilar Molecules Used in Latin America

General Market (Units) and Expenditure (Units sold in $ USD)

During the study period, a total of $ 16,167,237,514.00 dollars has been allocated to purchase biological and biosimilars products in Latin America (Table 1). The market is asymmetrical within countries, having molecules that are the best sellers in some countries while in others are ranked inferiorly. In terms of units sold and therefore units needed (a good proxy for demand) we have ciclosporin with at least 2.175.019 units sold in our study period (2017-2022), followed by Octocog alfa (530.576 units), Tocilizumab (258.066 units), Adalimumab (257.431units), Abatacept (236.532 units), and Glatiramer (235.443 units). In terms of money, Eculizumab was ranked the top seller with $110,988,527.00, followed by Nivolumab $103,257,910.00, Octocog Alfa $75,856,443.00 and Pembrolizumab $74,649,947.00.

Molecule Cost and Price per Unit

Molecules vary in price from country to country. When analyzing the price of biological and biosimilar products price per unit sold, the molecules with the highest cost were: Inotuzumab Ozogamicin costing in average $7,197 followed by Canakinumab $6,775 and Alemtuzumab $6,775; while the molecules with the lowest cost are Heparin/Levomenol $0.28, Cyclosporine $ 0.60 and Glatiramer Acetate $24 (Figure 3).

Figure 3 Spending Distribution among the Most Widely Used Biosimilar Molecules in Latin America

Biological Market by ATC Group

According to the Anatomical Therapeutic Chemical Classification (ATC) system, the registry of Biosimilars used in Latin America showed that the most used biological and Biosimilars belong to the group of Other Immunosuppressants (L04AX) ranking number one with 1,424,163 units, followed by Specific Antirheumatic Agents (M1C0) with 240,861 and Tumor Necrosis Factor Alpha Inhibitors (L4B0) with 178,715 units sold in our study period. The least used ATC biological drugs were Systemic Antipsoriatic Products (D5B0) with 1,547 followed by Other Anticoagulant Antidotes (B2B9) with the least consumed ATC molecules with 286 unit sold (Figure 5). On the same track, in terms of price, the top seller group are the Monoclonal Antibodies, mainly Antineoplastic Monoclonal Antibodies PD-1/PD-L1 with $45,572,542.00, followed by Antineoplastic Monoclonal Antibodies VEGF/VEGFR with $41,512,580.00 and Antineoplastic Monoclonal Antibodies HER-2 with $41,332,449.00 (Figure 4).

Figure 4 Distribution of Use and Expenditure of Biosimilars in Latin America According to Their ATC Group ATC codes: A7E9: Inflammatory bowel disorder products, other. B1C3: GP IIb/IIIa (glycoprotein) antagonist platelet aggregation inhibitors. B2B9: Antidotes to anticoagulants, other. B2D1: Factor VIII, including substitutes. C10A4: PCSK9 inhibitors. D5B0: Systemic antipsoriasis products. D5X0: Other nonsteroidal products for inflammatory skin disorders. J6H9: Other antiviral immunoglobulins. L1G1: Monoclonal antibody antineoplastics, CD20. L1G2: Monoclonal antibody antineoplastics, VEGF/VEGFR. L1G3: Monoclonal antibody antineoplastics, HER-2. L1G4: Monoclonal antibody antineoplastics, EGFR. L1G5: Monoclonal antibody antineoplastics, PD-1/PD-L1. L1G9: Monoclonal antibody antineoplastics, other. L1X9: All other antineoplastics. L4B0: Tumor necrosis factor alpha (TNF-α) inhibitors. L4C0: Interleukin inhibitors. L4X0: Other immunosuppressants. M1C0: Specific anti-rheumatic agents. M5B9: Other bone calcium regulators. N2C2: Antimigraine CGRP antagonists. N7A0: Multiple sclerosis products. R3M0: Interleukin inhibitor anti-asthmatics. R3X2: All other anti-asthma and COPD products. S1P0: Ocular anti neovascular products.

Figure 5 Biosimilars Usage and Spending Trends from 2017 to 2022 in Latin American Countries

Country-Level Analysis of Total Expenditure on Biologic Products

The behavior of biosimilars observed over time shows different trends in terms of units sold and money spent depending on the country. In terms of units used and money spent, we found a decrease in the use of biological and biosimilars products from 2019 to 2020 in the entire region (Figure 4). Argentina, Colombia, Chile, Ecuador, and Uruguay show a decrease in the trend of biosimilar use from 2017; while in the case of Brazil, Dominican Republic, Mexico, Peru, and Central America, the use of the molecules shows an increasing trend (Figure 6). In relation to spending, a few of the countries that showed a trend toward a reduction in spending as of 2017, among these are Argentina, Uruguay, and Peru (Figure 6).

Figure 6 Overall and Per Capita Spending in Latin American Countries from 2017 to 2022

Disaggregated Individual Analysis

In Latin America, the countries with the largest number of biosimilars are Brazil (n=80), Mexico (n=71) and Argentina (n=59). Spending between countries is higher in more populated countries. For example, Brazil spent $12.789.757.292 in the last 5 years of available data, while Mexico spent $2.819.973.049, followed by Argentina with $87.024.884, Ecuador with $273.000.801, and Chile with $55.785.028. However, when the per capita expenditure analysis is performed, Brazil ranks first with $59.40 spent in biological products per capita, followed by Mexico with $21.31, followed by Ecuador with $15.17 and Chile with $10.79 (Figure 7).

Figure 7 A: Price per unit per molecule. Differences among countries B: Price differences among country’s averages

Variability in Price within Molecules within the Region

Within the analysis of the price differences in each of the regions, we can observe that there is significant variability in each of the molecules in relation to the different countries, for example, molecules such as bevacizumab can cost $ 1,900 per unit in the Dominican Republic and $340 in Chile. Rituximab, another monoclonal antibody, costs $ 1,023 per unit in Dominican Republic and only $157 in Mexico (Figure 8). The large prices differences are not only for Dominican Republic; for example, Trastuzumab registers a price of $2,299 in Argentina and a reduction in more than 440% in Brazil (Figure 8).

Figure 8 Comparison of Innovator Drugs to Their Biosimilars for Biologic Treatments

The graph shows the average percentage reduction in price for five biologic drugs (Humira, Avastin, Enbrel, Remicade, and Mabthera) when comparing their innovator drugs to their biosimilars.

Variability in Price Comparing Innovator and Biosimilar

When comparing the prices of biologic drugs such as Humira, Avastin, Enbrel, Remicade, and Mabthera, including their biosimilars, there is significant variability in pricing across different countries. However, overall, the comparison of innovator drugs to their biosimilars shows a significant reduction in average price. For instance, the average price of Humira biosimilars is $187.5 cheaper (40% less), and this difference is statistically significant (p-value: 0.001). Bevacizumab biosimilars are on average $326 cheaper than Avastin (37% less), but this difference is not statistically significant. While Etanercept is on average $65.6 cheaper than Enbrel (33% less), this difference is not statistically significant. In contrast, Infliximab is $184.7 cheaper than Remicade (36% less), and this difference is statistically significant (p-value: 0.04). Finally, rituximab is on average $296.2 cheaper than Mabthera (43% less), and this difference is statistically significant (p-value: <0.001) (Figure 9).

Discussion

The usage patterns of biosimilars in Latin America exhibit significant variability across countries, which can be attributed to several factors. Higher consumption rates of biosimilars in the region compared to other parts of the world, coupled with limited local production capacity, have resulted in a high level of dependence on imported biosimilars.Reference Ortiz-Prado, Espín, Vásconez, Rodríguez-Burneo, Kyriakidis and López-Cortés22 To reduce this dependence and promote local development, countries in the region should consider investing in basic research and development, focused on the creation of new molecules and the establishment of local production facilities for biosimilars.

Developing technological capabilities and advancing the bioeconomy are crucial for driving economic growth and addressing societal challenges.Reference Kourilovitch, Galarza-Maldonado and Ortiz-Prado23 By transitioning from being importers to producers and exporters of high-value, high-demand products like biologicals, member countries can unlock significant economic benefits. While some countries like Cuba, Brazil, and Argentina have made significant strides in local development of biosimilars, others like Venezuela, Bolivia, Paraguay, and Ecuador lack biotechnology companies capable of producing or replicating biosimilar production processes. This results in an economic outflow as these nations import biosimilars, which can have a negative impact on their economies and hinder access to health benefits for their populations.

The burden of diseases requiring biologic products for treatment in Latin America is significant, with chronic autoimmune diseases and various types of cancer being the most prevalent conditions.24 However, access to biologic drugs in the region is limited due to high costs and limited local production, resulting in a high level of dependence on imported biosimilars. The usage patterns of biosimilars in Latin America exhibit significant variability across countries, with some countries like Cuba, Brazil, and Argentina leading the way in local development of biosimilars, while others like Venezuela, Bolivia, Paraguay, and Ecuador lack the technological capabilities to produce or replicate biosimilar production processes.25 To address this dependence and promote local development of biosimilars, countries in the region need to invest in basic research and development, focused on the creation of new molecules and the establishment of local production facilities for biosimilars. Developing technological capabilities and advancing the bioeconomy can drive economic growth and help member countries transition from being importers to producers and exporters of high-value, high-demand products like biologicals, which can have significant economic benefits and improve access to healthcare for their populations (Table 2).

Table 2 Selected Biologic Drugs, Innovators, Mechanisms of Action, and Functions

This table lists selected biologic drugs, including their innovator names, mechanisms of action, and primary functions.

Argentina

The Argentine biosimilar industry was established in 1983 with the creation of Biosidus, the company that manufactured the first biosimilar in South America, erythropoietin, which was marketed in 1990.26 In 2012, mAbxience, with an investment of 15 million dollars, inaugurated the first monoclonal antibody plant in Latin America in Buenos Aires, launching Rituximab, and Bevacizumab on the market.27 Since that time, the national health system has accrued direct savings of $65.7 million in treatment costs. Biosimilars, being 15 to 25% cheaper, are estimated to save between $12 and $21 million per year.28

In Argentina, the regulatory body in charge of approving biological medicines is the ANMAT (National Administration of Medicines, Food and Medical Technology). Now days, although per capita expenditures on biosimilars are low, Argentina is still leading the Biosimilars market in Latin America. This is due to the fact that the production of biopharmaceuticals has increased its development in the last decade, thanks to the fact that by 2022 there will be 350 laboratories with the capacity to produce biosimilars that were formed thanks to the encouragement of universities, the scientific-technological system and the State. By 2022 Argentina has registered 59 molecules, of which the most used are Cyclosporine (n=220,420) and Denosumab (n=201,314), while the ones with the highest expenditure are Denosumab ($40,711,429), Bevacizumab ($12,814,336) and Factor VIII ($12,007,675) (Figure 3).

Brazil

In 2010, Brazil was the first Latin American country to regulate biosimilars through Resolution of the Collegiate Board of Directors (RDC) No. 055/2010, which specifies the minimum requirements to apply for registration of biological products. The regulatory body in charge of approving biological medicines is ANVISA (Agência Nacional de Vigilância Sanitária), which is linked to the Ministry of Health.29 Brazil, as the largest country in South America, holds significant importance for the pharmaceutical industry. In 2019, Brazil’s pharmaceutical market generated revenues of 85.9 billion reais, or about 17.2 billion dollars, as reported by the Chamber of Regulation of the Medicines Market (CMED) in 2020.30 CMED is responsible for the economic regulation of Brazil’s drug market, while ANVISA (National Agency of Sanitary Surveillance) serves as its Executive Secretary. CMED sets price limits, encourages competition, monitors sales, and enforces compliance. Additionally, the agency manages the mandatory minimum discount for public purchases.31 At present, the investment of the Brazilian government apparently had positive effects on the Biosimilars market that can be observe in an increase of the use and spend in the last 5 years. The most used biosimilars are Cyclosporine, Adalimumab and Octocog Alpha, and the greatest expense was centered on recombinant molecules such as Adalimumab, Trastuzumab and Pembrolizumab (Figure 3).

Mexico

The regulatory body in charge of approving Biosimilars is the Federal Commission for the Protection against Sanitary Risks (COFEPRIS); The legal framework for the registration of biosimilars was established in Mexico in 2009.Reference Silva32 In 2012, Mexico had 180 approved biotech drugs, representing more than US2.3 billion in biosimilar sales; According to COFEPRIS, 35% of the applications for new registrations of innovative substances are related to molecules derived from biotechnological processes.33 In 2022, Mexico is second in the Latin American biosimilar market, after only Brazil. Cyclosporine and Adalizumab are the most used biosimilars, while Trastazumab and Adalizumab were the ones that generated the most spending.

Colombia

In 2013, close to 30% of the total pharmaceutical market in Colombia (2 billion Colombian pesos per year) corresponded to biological medicines.Reference Bernal, Gaitan and Leon34 Sales of the Colombian biomimicry market reached US126,086,839 during 2015–16, according to the Drug Price Information System (SISMED) administered by the Government of Colombia.35 The regulatory body for Biologicals is the National Institute for Food and Drug Surveillance (INVIMA). In the last years, INVIMA has approved several biosimilars within the follicle-stimulating hormone product classes; insulin and tumor necrosis factor inhibitor,36 and for 2022 a total of 37 molecules were available, showing an increase in the biosimilars use. As in the countries with more field in the Biosimilars market, the most used molecule in Colombia is Cyclosporine, followed by Denozumab (Figure 3).

Ecuador

Ecuador spends around US50 million on biological or biosimilar products each year, if both the public and private markets are included.37 In Ecuador, the regulatory entity for the approval of biologicals is the National Agency for Sanitary Regulation, Control and Surveillance (ARCSA) created in August 2012. In 2019, the regulatory guidelines on biosimilars were finalized. The legal framework for biosimilar medicines is established according to the Regulation for Obtaining the Sanitary Registration of Biological Medicines No. 00385-2019, which includes biotechnological and biosimilar medicines.38 By 2022, an impressive increase of 42 Biosimilars were available and per capita expenditures reached $15.17, much higher than that of larger neighboring countries in the Andean cord, such as Colombia and Peru. The Biosimilars that showed the highest expenditure during the last 5 years were Trastuzumab, Bevacizumab and Rituximab, and the most used biosimilar in a similar way was Ciclosporin.

Peru

In 2013, the expenses related to purchases of biotechnological products amounted to US35,561,725. It is believed that this may be due to the fact that there are no national manufacturers of biological medicines in Peru; domestic companies only sell finished products.39 The regulatory entity in charge of approving biological medicines is the General Directorate of Medicines, Supplies and Drugs (DIGEMID) of the Ministry of Health of Peru. In 2016, DIGEMID finalized the guidelines for biological products that opt for the similarity route.40 However, the most recent data places Peru among the Latin American countries with the lowest consumption of biosimilars per capita. This is thought to be due to several factors at the local level, such as a weak health regulatory system, problems in the capacity of the regulatory authority, the existence of conflicts of interest and the lack of science, technology and innovation capabilities of the local pharmaceutical industry,41 resulting in only 27 molecules available and a per capita expenditure of $0.89. The biosimilars most used by Peruvians are Heparin/Levomenol and Cyclosporine.

Chile

As of 2014, the Technical Standard for the Sanitary Registration of Biotechnological Products derived from recombinant DNA techniques became effective in Chile. This was a milestone for the Chilean pharmaceutical market in which it becomes possible to register biosimilar drugs in the country based on parameters proposed by international regulations.42 In the period between 2014 and 2022, the public sector made purchases of biological and biosimilar drugs, equivalent to 26% of the total drugs purchased for a value of more than US143,719,000.43 To date, Chile only imports biosimilar products produced and finished in other countries. By 2022, Chile has 52 molecules available, but per capita spending on biosimilars is only $2.85. Cyclosporine, Denosumab and Interferon Beta-1A are the most used biosimilars in Chile during the last 5 years, while the largest spending was observed on Adalimumab, Interferon Beta-1A and Denosumab.

Uruguay

In 2015, a reference guide was proposed for the control of trade and management of Biological products, in which it is established as essential to implement strategies to support staff training, promote investments in Investigation and Development (I + D) and update the legal framework to boost the market for biologics in Uruguay.Reference Azevedo, Sandorff, Siemak and Halbert44 Uruguay has experienced a significant increase in recent years, by 2022 Uruguay, a country with a population of approximately 3.5 million inhabitants, has 26 Biosimilars and Uruguay’s objective is to be able to increase the financing of these drugs to continue improving access to these therapies. However, the populations have considerable more expenditure to this type of product in comparison to other Latin American countries with a per capita expenditures are $10.79. The molecules most used by the Uruguayan population are Ciclosporin, Factor VIII and Interferon Beta-1A.

Venezuela

The Bolivarian Republic of Venezuela is a member of the Mercosur trade bloc, but in 2019, it was suspended from all rights and obligations inherent to its status as a state. This situation, along with the economic crisis affecting the country to this day, has resulted in a significant decline in local manufacturing, including the production of pharmaceutical products. As a result, there is a lack of access to medicines in Venezuela, and only a limited number of centers that can import medicines are distributing biosimilars.

The current state of local production of biosimilars in Venezuela is not promising.45 The National Institute of Hygiene ‘Rafael Rangel’ is responsible for regulating the process of handling and producing biosimilar drugs in the country; however, there is no record of the current regulation of biosimilars in Venezuela so far.

This lack of regulation is concerning as it may lead to a lack of quality control and result in a potential risk to patients. The absence of clear guidelines for biosimilars also creates uncertainty for manufacturers, which may hinder the growth of the biosimilars market in Venezuela.

In summary, the current situation in Venezuela has severely impacted the local manufacturing industry, including the production of biosimilars. With the lack of access to medicines in the country, the need for effective regulation of biosimilars is critical. A clear regulatory framework would ensure the quality and safety of these products, promote competition, and ultimately improve access to these important medicines for Venezuelan citizens.

Central America

Several Central American countries, such as Guatemala and Panama, have taken steps to establish legislation to govern the approval of biologics and biosimilars. These regulations provide a clear framework for the development, testing, and marketing of such products in their respective markets, ensuring safety and efficacy standards are met.46 However, in contrast, countries such as Belize and El Salvador do not have specific regulations in place for biosimilars. This absence of legislation may hinder the growth of the biosimilars market and create uncertainty for both manufacturers and consumers.

Despite this regulatory gap, El Salvador has made efforts to address the issue by publishing a statute recognizing foreign drug regulatory agencies that grant approval for drugs registered in countries adhering to the Pan American Health Organization’s (PAHO) accreditation process. This process requires Level IV certification, ensuring that drugs meet stringent international safety and efficacy standards.47 By acknowledging foreign regulatory agencies and their approvals, El Salvador expands access to a diverse array of biologic and biosimilar products for its citizens, enhancing public health outcomes and fostering the growth of the biosimilars market within the country.48

Unfortunately, data on the biosimilar market in Bolivia, Costa Rica, Cuba, and Paraguay was not available from IQVIA. Despite this limitation, a descriptive analysis is carried out in the subsequent sections and in Supplementary File 2, to provide insights into the state of the biosimilar market in these countries. It is essential that these countries also establish clear regulatory guidelines for biosimilars to ensure that these important medicines are available to their citizens while maintaining high safety and efficacy standards.

Bolivia

Despite the approval of similar biotherapeutic products (SBPs) in Bolivia, the government has not yet established a formal regulatory guideline for these products.Reference Desanvicente-Celis, Caro-Moreno, Enciso-Zuluaga and Anaya49 The State Agency for Medicines and Technologies in Health (AGEMED) is responsible for overseeing the approval of biological medicines in Bolivia, but to date, no biosimilar drugs have received approval. However, three rituximab monoclonal antibody biosimilars have been approved for use in the country.50

This situation highlights the need for a clear and comprehensive regulatory framework to facilitate the approval and use of biosimilars in Bolivia. Such a framework would not only ensure the safety and efficacy of these products but also promote their use, which can contribute to improved public health and cost savings in the Bolivian healthcare system.

By establishing clear guidelines for the approval and use of biosimilars, the government can help to increase access to these important medicines and promote competition, which can drive down prices and improve affordability for patients. In addition, a comprehensive regulatory framework can provide guidance for healthcare professionals and help to build trust in the safety and efficacy of biosimilars among patients and healthcare providers.

Overall, the establishment of a clear and comprehensive regulatory framework for biosimilars in Bolivia is crucial for promoting access to high-quality medicines, improving public health outcomes, and reducing healthcare costs in the country

Costa Rica

Costa Rica has registered two biosimilars, Erythropoietin and Filgastrim. In 2010, the Ministry of Health issued decree RTCR 440: 2010, which established regulations for the registration and control of biological drugs. Five years later, the Costa Rican Social Security Fund made a significant investment in these drugs, accounting for more than 48% of the total investment in medicines, equivalent to approximately 24 million USD (51,52). This investment highlights the country’s commitment to providing access to high-quality biological drugs and improving the health of its citizens.Reference Garcia and Araujo51

Cuba

In 2011, the Cuban Ministry of Public Health issued Resolution number 56/2011, which established requirements for the registration of biological products. This was a crucial step in the development of the biotechnology industry in Cuba, and led to the creation of the government-owned pharmaceutical company BioCubaFarma. The company has since played a leading role in the production of biosimilars, as well as the development of innovative biologics and medical devices.

In 2010, Cuba had a trade balance in the pharmaceutical sector of US $303,606,000 in raw materials.Reference Jover and Alfonso52 This indicates a strong foundation in the pharmaceutical industry, which has since been leveraged to expand into biologics and biosimilars. As for exports in biopharmaceuticals, the country reached US $686 million in 2013, showing significant growth in this area.53

Currently, Cuba has 15 biosimilars approved for use, which includes endogenous growth hormone, granulocyte colony-stimulating factor, erythropoiesis-stimulating agent, insulin, tumor necrosis factor (TNF) inhibitor, antivirals, and interferon. Most of these biosimilars are produced in Cuba, demonstrating the country’s growing capacity for local production of biologics. Overall, Cuba serves as a promising example of how a focused investment in biotechnology can lead to significant growth in the biosimilars market.

Paraguay

The availability of reliable data on the Paraguayan pharmaceutical market is limited; however, it is worth noting that in 2016, an agreement was signed between the Argentine pharmaceutical laboratory Biosidus and Lasca to produce recombinant human erythropoietin, which signaled the potential for significant growth in this area. Despite this agreement, as of 2020, only the biosimilar Rituximab was available in Paraguay. However, there have been recent developments in this field, with two new products being registered in the last two years, indicating a potential increase in the market. In 2011, the total pharmaceutical expenditure in Paraguay was USD 445 million, of which USD 248 million was private expenditure.54

Local Production Capabilities

After analyzing all available information related to the production and commercialization of biological, innovative, and biosimilar drugs in Latin America, it is clear that the region holds significant interest in terms of market share. However, in terms of production and innovation, aside from Cuba, the region produces and introduces fewer innovative products to the global market. While some producers in Brazil and Argentina are manufacturing biosimilars, countries like Ecuador are known for registering biosimilars produced in other countries, such as Korea, within their portfolio of locally registered products. In this context, it is challenging to distinguish between products with local production and those with local registration. Nevertheless, based on the data analyzed, we have summarized the findings in the table below.55

Table 3 Listing of Biologics and Biosimilar Producers Categorized by Their Country of Origin

* In this category, we include manufacturing factories that are established in the region or those regional companies that have registered a biological or biosimilar product made in another country but with an exclusive license for the country where the license was obtained.

The production and distribution of biosimilars, exhibit a significant variation across different countries and molecules. For instance, Bristol-Myers Sqb. takes charge of both production and distribution of Abatacept in Argentina and Brazil. On the other hand, Adalimumab sees a more diversified production and distribution network involving multiple companies such as Abbvie, Amgen, and Novartis in various countries like Argentina, Brazil, and Chile.

Regarding the count of corporations and accurately determining the number of companies that produce and distribute in the region, it can be a complex task. This complexity arises from the fact that a single corporation may be involved in production in one country while only handling distribution in another. On the other hand, a corporation might be responsible for both production and distribution within the same country. To obtain an exact count and to better understand the parameters and distinctions between “production” and “distribution,” we have created a table for your reference. The table, Annex 1, provides information on the main biosimilars, their innovators, and their respective countries of distribution/production. Please review the table to gain a comprehensive understanding of the corporations involved in the region’s production and distribution processes (Annex 1).

Limitations

Although this study had an extensive scope, there were limitations to the analysis. Not every territory in Latin America and the Caribbean could be included due to limitations in the database studied. For instance, Central American countries had to be analyzed as a collective, which prevented the identification of potentially significant differences among these nations. Furthermore, for countries like Bolivia, Costa Rica, Cuba, and Paraguay, there was a lack of quantitative data, so the information provided had to be purely descriptive.

Another limitation was the inability to study the behavior of biosimilar molecules from month to month. This would have allowed for a clearer and more detailed description of their appearance and fluctuations in use and expense. However, the results obtained were based on data corresponding to the distribution by quartiles of each year.

Despite these limitations, the study provides valuable insights into the usage patterns of biosimilars in Latin America and the Caribbean, highlighting the significant variability across countries and the need for increased investment in research and development, and local production of biosimilars to improve access to healthcare for patients in the region.

Conclusions

The biosimilars market in Latin America presents a complex picture with significant variations across countries. The limited production capacity and high dependence on imported products make access to expensive biological medicines challenging, particularly for patients with chronic autoimmune diseases and cancer. However, Latin America is well-positioned to become a hub for biological innovation and production, with some countries already demonstrating their capacity in this field.

The region is also experiencing an epidemiological transition, with a shift from infectious diseases to chronic autoimmune diseases and other non-communicable diseases. As a result, the demand for biological medicines is likely to increase in the coming years.

To address the challenges facing the biosimilars market in Latin America, governments and private industry need to commit to supporting the development of biotechnology clusters and promoting local production of biosimilars. Robust guidelines and regulations for biological medicines would also benefit the region, along with enhancing the capacity of regulatory agencies to conduct pharmacovigilance for approved biosimilar products, ensuring timely evaluation of efficacy and identification of adverse effects.

It is crucial to acknowledge the issue of scarcity in Latin America, which makes it difficult for patients to access expensive drugs. However, the increasing life expectancy in the region also highlights the urgent need for affordable and effective treatments for chronic and complex diseases. As such, investing in the biosimilars market has the potential to improve the health outcomes and quality of life for millions of people in the region.

Conflict of Interest

The authors declare no conflicts of interest related to the research presented in this article, including any commercial or financial relationships that could potentially bias the interpretation or findings.

Acknowledgments

We would like to express our sincere gratitude to Veronica Vargas and Martin Rama from the World Bank for their invaluable assistance in obtaining the necessary data and expert information. Additionally, we would like to thank them for their participation in an in-person meeting with the reviewers, which greatly contributed to the success of this research, especially to Jonathan J. Darrow whose contribution improved the quality of our manuscript significantly. Finally, we are grateful to IQVIA Institute Human Data Science Research Collaborative for sharing their data for the development of this research.

Data Availability Statement

The data used in this study was provided by IQVIA at no cost to the authors. Due to data sharing restrictions, the authors are unable to distribute the data to others. However, the authors are willing to provide additional information or respond to comments to the best of their ability. If more detailed information is needed, interested parties should contact IQVIA directly.

Ethics Statement

In accordance with local research standards, this study, which used secondary source data, did not require approval from an ethics committee. Moreover, the data analyzed did not contain any sensitive information that could have compromised the confidentiality of study participants or otherwise posed ethical concerns. As a result, ethical considerations were adequately addressed in the course of this research.

Author Contributions

EO-P conceptualized and designed the project, obtained access to the data from IQVIA, and was responsible for the overall management of the project, ensuring the integrity and accuracy of the research. JSI-C, JV-G, and RF-N contributed to data acquisition and literature review. EO-P, JSI-C, GD, and RF-N contributed to the statistical analysis and internal validity of the study. EO-P, JSI-C, TMC, and JV-G were involved in the initial drafting of the manuscript. EO-P, JSI-C, GD, and RF-N critically reviewed and edited the final version of the manuscript. All authors contributed to the article and approved the final version.

Funding

This project did not receive any funding.

Annex

Annex 1 Comprehensive Analysis of the Main Biopharmaceutical Licensing Products across Latin America (up to 2022): Detailing Country of License, Corporation, Manufacturer, Molecule List, and International Brand