INTRODUCTION

Although the presence of women in middle management positions has improved, the situation is different in top positions (Hoobler, Lemmon, & Wayne, Reference Hoobler, Wayne and Lemmon2011). The proportion of senior business roles held by women stands at 24% (Medland, Reference Miller and Le Breton-Miller2016), but in 85% of cases where CEOs are women they are the sole owners (Lee, Jasper, & Fitzgerald, Reference Lerner and Malach-Pines2010), therefore it is a self-employment formula. The presence of female top managers in larger companies remains extremely low (Dawley, Hoffman, & Smith, Reference Dawley, Hoffman and Smith2004). In addition to social reasons, the absence of a greater number of female managers represents a loss of extraordinary talent (Hewlett, Reference Hewlett and Luce2002). In practice, women have fewer opportunities for promotion to posts involving power and decision-making, among others, due to limitations to balancing work and life (Durbin & Tomlinson, Reference Durbin and Tomlinson2014) and the gendered nature of organizations (Acker, Reference Acker1990). According to Eagly and Karau (Reference Eagly and Karau2002), there is a mismatch between stereotypes of women and stereotypes of leaders.

The situation in family businesses is different; traditionally women have adopted important but subtle roles that help to ensure continuity and growth (Jimenez, Reference Kanuk and Berenson2009). In recent years, a formalization of the role of women in the company is taking place. The proportion of female managers in family businesses is increasing (Barrett & Moores, Reference Barrett and Moores2009; Humphreys, Reference Huybrechts, Voordeckers and Lybaert2013) and 33% of family businesses are estimated to be run by women in the United States (Sonfield & Lussier, Reference Trauth2012). The interplay between the private and professional contexts in family businesses can reduce the gender gap and enable women to take further leadership roles when they become familiar with the business (Bjursell & Bäckvall, Reference Bjursell and Bäckvall2011). In short, the lack of association of leadership with women may be smaller in family firms.

Despite the importance of women in the family business, the genre has been largely ignored. In fact, gender has been omitted as future research in the family firm domain (Al-Dajani, Bika, Collins, & Swail, Reference Al-Dajani, Bika, Collins and Swail2014). Research on women in the family business is still small, fragmented and conceptual (Danes & Olson, Reference Danes and Olson2003; Sharma & Irving, Reference Smith, Smith and Verner2005; Vera & Dean, Reference Wang2005; Jimenez, Reference Kanuk and Berenson2009; Bjursell & Bäckvall, Reference Bjursell and Bäckvall2011) especially on their involvement in top management (Cappuyns, Reference Cappuyns2007; Lerner & Malach-Pines, Reference Longstreth, Ord and Mauldin2011). Initial investigations have focused on the invisible woman with predominantly passive and family roles (Bjursell & Bäckvall, Reference Bjursell and Bäckvall2011) and on the obstacles encountered by women (Dumas, Reference Dumas1989). Only recently research is investigating the adoption of more active roles by analyzing the advantages of family firms for avoiding the classic glass ceiling (Jimenez, Reference Kanuk and Berenson2009).

The literature review reveals two sets of organizational conditions where gender differences persist. On the one hand, research on structural disadvantages (size, age, sector) derived from a lower resources endowment associated with female leadership (human, social and financial capital) (Marlow & Patton, Reference Medland2005) and, second, variables related to female management profile (age, experience, etc.) (Eagly & Carli, Reference Eagly and Carli2007). Organizational conditions have played a secondary role in research, primarily as they have been mainly used as control variables. According to authors like Díaz García and Jiménez Moreno (Reference Díaz García and Jiménez Moreno2010), it would be necessary to investigate precisely these variables of type of company and managerial characteristics to identify possible gender differences. In that vein, we think it is promising to research whether organizational conditions that increase the likelihood of promoting women to senior positions are also present in family firms. We expect that family involvement in terms of ownership and management might ease women’s access to CEO positions and the development of a management career eliminating the differences in organizational conditions found in the literature. Specifically, family firms led by women would not differ in structural elements (size, age and sector) or in manager profile (age, experience, education) from those led by men.

Following the suggestion by Overbeke, Bilimoria, and Perelli (Reference Parkes and Langford2013), we find socioemotional wealth (SEW) an appropriate perspective to investigate the role of women in family businesses. SEW summarizes the affective endowment of family owners (Berrone, Cruz, & Gomez-Mejia, Reference Berrone, Cruz and Gomez-Mejia2012) and is characterized by the emotional needs of identity, the ability of family members to influence the firm and preserving the family dynasty (Gomez-Mejia, Haynes, Nunez-Nickel, Jacobson, & Moyano-Fuentes, Reference Gomez-Mejia, Haynes, Nunez-Nickel, Jacobson and Moyano-Fuentes2007). This approach accommodates an analysis of the facilitators that family firms provide women to assume management positions at the highest level. The introduction of family values in the company (Dyer, Reference Dyer2003), altruistic behavior among family members (Lubatkin, Schulze, Ling, & Dino, Reference Marlow and Patton2005) and a commitment to family succession candidates (Gomez-Mejia, Cruz, Berrone, & De Castro, Reference Gomez-Mejia, Cruz, Berrone and De Castro2011) are particular factors of family businesses that pave the way for access to positions of responsibility.

The present paper has several contributions. First, grounded on the SEW approach we analyze the presence of female managers in family businesses. To our knowledge, there is no precedent of applying the socioemotional approach to this issue. Second, empirical evidence is provided here about the lack of differences of organizational conditions in the presence of women in top management positions in family businesses of some complexity beyond the formulas of self-employment. Finally, the specific situation of family firms related to the generation in charge of the company is analyzed. Although a dearth of daughter successors is claimed (Dumas, Reference Dumas1989), there are arguments to surpass gender barriers in succession processes.

The remainder of the paper is structured as follows. First, the literature on these issues is reviewed and a number of assumptions are made. In the next section, the methodological issues of the empirical study conducted with 433 family businesses are detailed. Finally, results are presented and discussed and main conclusions are summarized.

LITERATURE REVIEW

Women and management

Gender theory has established the issue of gender as an important aspect of organization theory (Eriksson-Zetterquist & Styhre, Reference Eriksson-Zetterquist and Styhre2008). Gender theory takes different approaches, two of which are seen as the most salient in organization studies: gender essentialism and social construction theory (Ridley & Young, Reference Ross-Smith and Chesterman2012; Trauth, Reference Vera and Dean2013). Following the gender essentialist theorizing, the dominant gender theory in the past (Ridley & Young, Reference Ross-Smith and Chesterman2012), observed differences in men’s and women’s behaviors would be attributed to what are assumed to be fixed, inherent and immutable differences between all males as a group and all females as a group, with such differences assumed to derive from underlying biological or psychological sources (Trauth, Reference Vera and Dean2013).

Situated in sociology and social psychology, the social shaping of gender theory rejects the assumption of fixed, inherent bio-psychological differences. Hence, observed gender differences are attributed to the social shaping or social construction of gender and gender roles that are internalized by all women in a society in the same ways (Trauth, Reference Vera and Dean2013). Social construction theory proposes that human actions are the product of the culture in which people are born and raised (Ridley & Young, Reference Ross-Smith and Chesterman2012). Widely held socially constructed beliefs about gender (gender beliefs) powerfully affect individuals’ cognitions and treatment of men and women (Overbeke, Bilimoria, & Perelli, Reference Parkes and Langford2013).

The term ‘glass ceiling,’ considered by some gender theorists as the practical consequence of the cultural or cognitive perspective of gender in society and in organizations (Eriksson-Zetterquist & Styhre, Reference Eriksson-Zetterquist and Styhre2008), has been coined to indicate an invisible barrier that prevents women from advancing in their career beyond a certain level. It is founded on the idea that a manager has traits of masculinity: ‘think manager, think male’ (Schein, Reference Schein, Mueller, Lituchy and Liu1975), becoming a global phenomenon that remains in cultures as diverse as Chinese, German or English (Schein, Mueller, Lituchy, & Liu, Reference Sharma1996). Women managers must confront the prevailing prejudice against female leaders (Koenig, Eagly, Mitchell, & Ristikari, Reference Kuratko, Hornsby and Naffziger2011). Hewlett and Luce (Reference Hoetker2005) find that the leading cause for women leaving management positions is to increase time for family in 44% of cases, while in men that is the fifth leading cause reported by only 12% of cases. Hoobler, Lemmon, and Wayne (Reference Hoobler, Wayne and Lemmon2011) revise the most common explanations for the lack of female access to management positions: the aforementioned existence of the glass ceiling; the ‘pipeline’ argument based on the lack of qualified women – in terms of education and experience – to reach top positions; the lower genetic predisposition of women to top management roles; and, finally, the structure of working hours of top managers incompatible with family life. Nowadays, not only the genetic explanation is overcome but also the pipeline argument is considered outdated. Contemporary career women seem to have gained the requisite experience and education, but the pipeline seems to be ‘leaking’ on the way to the top positions (Hoobler, Lemmon, & Wayne, Reference Hoobler, Wayne and Lemmon2011). These authors propose the work-family conflict factor and find that the mere fact of being a woman is a sign that the family will interfere with her management work regardless of being married or having children, and that this bias occurs only at management levels both for men and for women.

In an attempt to provide explanations that are more nuanced and finely attuned to local organizational contexts (Ross-Smith & Huppatz, Reference Ryan and Haslam2010), we aim to understand the role of female managers in the specific context of family firms. Grounded on social construction gender theory, we consider that a family business can be seen as a societal group of people where gendered actions are defined. Also, Overbeke, Bilimoria, and Perelli (Reference Parkes and Langford2013) consider family firms as gendered systems. Therefore, the unit of analysis here is not the society in general but the family firm. Additionally, in our opinion, SEW is an appropriate perspective to investigate the role of women in family businesses, thus focusing on the social perspective of gender. It is clear that leader gender cannot be fully understood without reference to organizational cultures. The SEW approach and the familiness concept suggest that family firms are characterized by specific cultural values.

Women and family business

Family firms provide women with special opportunities (Lerner & Malach-Pines, Reference Longstreth, Ord and Mauldin2011) such as higher salaries, better jobs, as well as greater flexibility in scheduling and security at work to attend to personal needs such as child rearing, parental care and education (Salganicoff, Reference Schein1990; Kirkwood, Reference Kirkwood and Tootell2009). Few research studies have specifically focused on women in family business, and those studies which were conducted were more often conceptual rather than empirical (Sonfield & Lussier, Reference Trauth2012) with an ongoing debate between those who believe that family firms offer women more opportunities and those who document the many difficulties women face (Lerner & Malach-Pines, Reference Longstreth, Ord and Mauldin2011). Humphreys (Reference Huybrechts, Voordeckers and Lybaert2013) divides research on women in family business into two streams: traditional participation and professional participation. The most popular research addresses the role of invisibility and more recently the role of chief trust officer or emotional leadership (Poza & Messer, Reference Ridley and Young2001). Professional participation might include access to and development of a management career by women in family firms. Family ownership offers women the flexibility to manage family and work effectively (Lee, Danes, & Ii, Reference Lee, Jasper and Fitzgerald2006), moreover, family firms provide women access to management positions through succession. Although daughter’s access to leadership may appear limited (Jimenez, Reference Kanuk and Berenson2009), there are many advantages for daughters to remain in the family firm (Vera & Dean, Reference Wang2005), providing them with a doorway into traditionally male-dominated industries (Wang, Reference Watson, Quatman and Edler2010). Finally, the barriers impeding women from fulfilling careers as managers, are related to work-family conflict and gender stereotypes, might be less important in family firms.

The socioemotional approach suggests that family involvement in the business affects strategic decisions conditioning their results both from an economic-financial perspective and from the perspective of accumulation of family capital (Gomez-Mejia et al., Reference Gomez-Mejia, Haynes, Nunez-Nickel, Jacobson and Moyano-Fuentes2007). Thus, the role of non-economic factors in business management is the key distinguishing feature that separates family businesses from other forms of organization. The overlapping nature of family and business subsystems provides these companies with certain characteristics that are reflected in several non-economic aspects. Therefore, the main management decisions will be driven by the desire to preserve and increase family SEW. However, this assumption does not necessarily mean that all decisions that seek to maximize the emotional endowment entail economic losses. In fact, especially long-term strategies based on socioemotional aspects have the potential to become a source of competitive advantage.

Berrone, Cruz, and Gomez-Mejia (Reference Berrone, Cruz and Gomez-Mejia2012) identified five dimensions of SEW. To analyze the presence of women in managerial positions it would be especially applicable the last two: the presence of emotional ties and renewal of family ties through dynastic succession. Emotions and women are particularly related in family firms. Labaki, Michael-Tsabari, and Zachary (Reference Lee, Danes and Ii2013) deal with emotions in the context of family business and family conflicts, personal relationships and family culture. Although not explicitly involved, women pervade family relationships by mediating conflicts, acting as ‘family glue’ (Cappuyns, Reference Cappuyns2007), supporting the motivation of the entrepreneur and the business-related decisions. Even the term ‘invisible woman’ is used for a woman of the family with power and influence over the company but without recognition of her contribution in terms of jobs or wages (Gillis-Donovan & Moynihan-Bradt, Reference Gillis-Donovan and Moynihan-Bradt1990). Regarding the dynastic succession, family firms especially facilitate female access to business. Gomez-Mejia et al. (Reference Gomez-Mejia, Cruz, Berrone and De Castro2011) address the analysis of succession from the socioemotional perspective concluding that family promotes a family successor. The evidence points to the desire to preserve family SEW rather than the economic rationality of choosing the most qualified candidate. The emphasis on training and working with the family successor is a way to ensure the transfer of idiosyncratic knowledge through generations (Castanias & Helfat, Reference Castanias and Helfat1992). Moreover, it is a way to identify a successor within the company and increasing his or her emotional support to the organization (Sharma, Reference Sharma and Irving2004).

RESEARCH MODEL

Women as CEO in family firms and manager profile

This section analyses leadership attributes such as age, managerial experience and education of female managers in order to contrast the possible particularities of the family business. The general literature relating to women and management establishes certain differences regarding the demands of senior management positions that require long hours and traveling (Chernesky, Reference Chernesky2003). Most women in leadership positions have to choose between their careers or their families (Hewlett, Reference Hewlett and Luce2002). Eagly and Carli (Reference Eagly and Carli2007) argues that the demands of family life make more women stop their careers and work mostly part-time. In fact, work–family conflict is less in women working part-time (Parkes & Langford, Reference Peris Ortiz, Peris Bonet and Ribeiro Soriano2008). This translates into less experience and fewer hours of work per year, which slows their career advancement, thus reducing their incomes and limiting their time to build professional networks. The problem is not only abandoning their careers due to family reasons, in addition, companies do not facilitate the return of these professionals (Hewlett & Luce, Reference Hoetker2005). Their lower management experience is also associated with age. The review of the literature suggests that female managers have a lower average age than males. Women often have shorter careers than men, in order to devote time to their children they leave their jobs (Hewlett & Luce, Reference Hoetker2005) or transit to working part time (Durbin & Tomlinson, Reference Durbin and Tomlinson2014).

According to the social theory of gender, socially derived gender beliefs produce biases beyond perceptions of competencies: generally, stereotypes cast women as communal, or nurturing, caring and cooperative and men are seen as agentic, or task oriented, competitive and decisive (Eagly & Karau, Reference Eagly and Karau2002). Ross-Smith and Chesterman (Reference Ross-Smith and Huppatz2009) use the tensions between the identity as managers and as women to explain the reticence and ambivalence of women managers. In this sense, they call for changes in the social construction of organizations that perpetuates masculine power and reinforces inequitable gender regimes. Although there is no evidence about these relationships in family businesses, from the perspective of SEW one may expect certain differences. Given the importance of addressing non-economic aspects, development and family care are particularly significant. That is why in the family business, women find more opportunities to develop a managerial career since interruptions are minimized and returning to the job is possible. In this way, they would enjoy conditions more similar to male members. Hypotheses are posited in order to test whether the relationships exposed are supported or not in family firms. Following, formal rules null hypotheses propose no variations while alternative hypotheses postulate the existence of differences. Specifically, we posit that the age and experience of female CEOs are not different than those of male managers:

Null Hypothesis 1: In family firms there are no differences in the age of CEOs according to gender.

Alternative Hypothesis 1: In family firms female CEOs are younger than male CEOs.

Null Hypothesis 2: In family firms there are no differences in the management experience of CEO according to gender.

Alternative Hypothesis 2: In family firms female CEOs are less experienced than male CEOs.

Manager’s qualification is a key distinctive element among successful SMEs. In the case of women, several studies show their higher levels of education (Fernández Palacín, López Fernández, Maeztu Herrera, & Martín Prius, Reference Fernández Palacín, López Fernández, Maeztu Herrera and Martín Prius2010; Lee, Jasper, & Fitzgerald, Reference Lerner and Malach-Pines2010; Peris Ortiz, Peris Bonet, & Ribeiro Soriano, Reference Poza and Messer2010). Due to the major obstacles that women face in assuming management positions, it is expected that those who succeed have higher qualifications. It would therefore be more likely to find more educated women in positions of management. However, in family firms the preservation of the family SEW is primordial, therefore family members are mainly evaluated by their ties to the firm before their education and gender. Thus, no gender differences in manager education are expected:

Null Hypothesis 3: In family firms there are not differences in the education of CEOs according to gender.

Alternative Hypothesis 3: In family firms female CEOs have a higher level of education than male CEOs.

Women as CEOs in family firms and firm type

The literature on women and management revealed a negative association with the size of the company. In his study on female leadership in schools, Collard (Reference Collard2001) found that the confidence of women leaders declined more constantly with increases in size than that of men. In trying to balance work and family, women gravitate to smaller, more manageable companies (Haynes, Rowe, Walker, & Hong, Reference Heck2000; Lee, Jasper, & Fitzgerald; Díaz García & Jiménez Moreno, Reference Díaz García and Jiménez Moreno2010). For many women owning a stable small business is not an interim phase but a conscious choice consistent with their professional, social, family and personal needs (Danes, Stafford, & Loy, Reference Danes, Stafford and Loy2007). In short, female access to general management in small companies would be easier because they have fewer steps to climb and because they are the type of companies where there is greater female entrepreneurship.

The family obligations of female entrepreneurs explain why they have less dedication to the company that would affect their performance and potential (Longstreth, Ord, & Mauldin, Reference Lubatkin, Schulze, Ling and Dino1987). Therefore, while self-employment is an appropriate form due to family support and the flexibility to combine family life, ultimately, family obligations may commit performance and business growth. Kirkwood and Tootell (Reference Koenig, Eagly, Mitchell and Ristikari2008) found that while many women enter entrepreneurship as a means of balancing their work and families, the reality reveals that many women experience work–family conflict. Female entrepreneurs establish maximum limits for the size of the company, thus preferring not to expand beyond those limits (Cliff, Reference Cliff1998). This is consistent with the importance given by women to achieving work–life balance (DeMartino & Barbato, Reference DeMartino and Barbato2003).

With similar reasoning as in the above hypotheses, it is interesting to analyze whether the family business might have certain characteristics regarding firm size, specifically the importance of family values which are part of the organizational culture. We posit that the facilities that family business offers for work–life balance allow to overcome the constrains to growth resulting in no gender differences in firm size:

Null Hypothesis 4: In family firms there are no differences in the size of the firm according to the gender of the CEO.

Alternative Hypothesis 4: In family firms female CEOs manage smaller firms than male CEOs.

Female management is more common in the service sector, especially in commerce (Cliff, Reference Cliff1998; Haynes et al., Reference Heck2000). In general, companies in the service sector have lower levels of complexity, a factor that would facilitate a better work–life balance. Women tend to choose occupations where investments in human capital are less important and where the cost of removal is minimized (Kilbourne, Farkas, Beron, Weir, & England, Reference Kirkwood1994). Moreover, it can also influence industry knowledge. For years, women have been focused on traditional occupations such as education, health and administration while, for example, fields such as applied sciences have been considered almost exclusively for men (Watson, Quatman, & Edler, Reference Westhead and Cowling2002). In this sense, women would be traditionally less oriented to technical issues related to the industrial sector, and more oriented to human activities such as trade sector. From role congruity theory (Eagly & Karau, Reference Eagly and Karau2002), this situation could be explained as a result of predominant stereotypes of communal qualities people associate with women (nurturing, caring and cooperative). In terms of SEW a higher presence of women can be expected in male-dominated industries either for dynastic succession or merely for the help women receive to reduce the family–work conflict.

Null Hypothesis 5: In family firms there are no differences in the presence of women as CEO according to sector activity.

Alternative Hypothesis 5: In family firms there is a greater presence of women as CEO in the service sector.

Women as CEO in family firms and generation

Generation may also influence the manager profile and the typology of firm managed by women. First-generation firms are characterized by the founder figure occupying the roles of owner, manager and head of family, while in second-generation firms there are various family members sharing ownership and management (Miller, Le Breton-Miller, Lester, & Cannella, Reference Monreal, Calvo-Flores, García, Meroño, Ortíz and Sabater2007). First-generation family firms are more centralized than in later-generation family firms (Dyer, Reference Dyer1988) demanding managers full dedication. Women in management may find it easier to develop a career without interruptions in later-generation family firms. Therefore, even less differences may be expected in terms of age and experience in second or later family firms led by women. A similar reasoning may be applied to typology of firm. As the family grows, the firm should also grow in order to pass it on to following generations (Kuratko, Hornsby, & Naffziger, Reference Labaki, Michael-Tsabari and Zachary1997; Heck, Reference Hewlett2004). Later-generation family firms may put greater emphasis on enhancing business growth to ensure the firm’s survival (Kellermanns, Eddleston, Barnett, & Pearson, Reference Kilbourne, Farkas, Beron, Weir and England2008) independently of the gender of the CEO. In this context, it is interesting to explore the possible differences in size and sector of family firms managed by women due to generation. Specifically, we expect fewer gender differences regarding the variables of this study (CEO age, experience and education; and firm size and industry) between family firms in first and second or later generations.

Transferring the business to the next generation is a critical process. Especially in family SMEs, the exclusion of daughters is a waste of resources (Hewlett, Reference Hewlett and Luce2002) and increases the likelihood of choosing an inappropriate candidate who can jeopardize the continuity of the company (Breton-Miller, Miller, & Steier, Reference Breton-Miller, Miller and Steier2004). Although there is literature showing the preference for the firstborn male (Jimenez, Reference Kanuk and Berenson2009) this approach is often an automatic assumption that frees parents from the unpleasant task of comparing and choosing from their children (Cabrera, Reference Cabrera1998). The reality is that family business is a favorable scenario for the incorporation of women to positions of higher responsibility. Barriers which traditionally limit female access to positions of high responsibility are lower in family businesses. Being part of the owning family allows them to understand and evaluate the true qualifications of potential candidates, which means that in many cases members of the organization may prefer intraorganizational relations, and succession management is based more on familiar ties than on other criteria (Gomez-Mejia et al., Reference Gomez-Mejia, Cruz, Berrone and De Castro2011).

The characteristics associated with women, such as sensitivity, relational style and interpersonal skills, can be priceless in organizations in crisis facing difficult personal decisions. Ryan and Haslam (Reference Salganicoff2007) coined the term ‘glass cliff’ to describe the access of women, and other minorities, to positions of leadership during crisis periods where the chances of failure are high. In family businesses, generational transmission is a critical circumstance. Dumas (Reference Dumas1989) describes the situation where the CEO does not continue in charge of the firm (due to voluntary departure, health or death) and no family members are willing.

In such a case, a daughter’s assumption of control is circumstantial and based on the emergency, urgency or need and the absence of viable male alternatives (Wang, Reference Watson, Quatman and Edler2010). Salganicoff (Reference Schein1990) identified the following reasons for women to join the family business: to help the family, to occupy a position that family members are unwilling to take and being dissatisfied in another job elsewhere. In addition, women did not see their work in the family business as a career and did not intend to be owners of the company. They saw it as another job. Vera and Dean (Reference Wang2005) come to similar conclusions.

In any case, either intentionally or as a makeshift solution, the transition to the next generation in family firms creates unique conditions for women access to top positions of leadership. Thus, we propose:

Null Hypothesis 6: In family firms there are no differences in the presence of women as CEO according to generation.

Alternative Hypothesis 6: In family firms there is a greater presence of women as CEO in second and later generations than in the first generation.

METHODOLOGY

The population consists of Spanish family firms with at least six employees and working in manufacturing, building and services sectors. A convenience sample of 433 family firms was selected. Based on an estimation of 72.1% of family firms with the above mentioned features of size and sector (Monreal, Calvo-Flores, García, Meroño, Ortíz, & Sabater, Reference Oppenheim2002), the error is 4.6% at 95% and p=q=0.5. For selecting the family firms, European Group of Family Firms (EGFF) and Family Business Network’s criteria were used. The family character is determined by being largely family-owned with family involvement in the management or governance of the company along with a vocation of continuity. Following Westhead and Cowling (Reference Greene1998), two criteria were combined to identify family firms. The respondent had to answer two questions in the affirmative: (1) ‘Are ownership and management control of the company dominated by one family?’ and (2) ‘Do you consider your business to be a family business?’

The research method is quantitative in nature. For this survey, authors designed the structured questionnaire based on extant literature including a total of 38 questions. The questionnaire was targeted to CEOs in family businesses. A Spanish well-known experienced research agency was contacted for collecting data by interviewing CEOs personally. Data were collected in the first semester of 2010. In coordination with the authors, the research agency managed the data collection using Integra Quest software and Cati-net software. Responses were then coded in SPSS. The 28.5% of returned questionnaires were audited by making phone calls to the firms participating in the survey in order to confirm their responses.

To test the quality of the data gathered, although the sample selection was random, a non-response test was made to check for bias. Following Armstrong and Overton (Reference Armstrong and Overton1977), no significant differences were found in the study variables between the first and last responders, suggesting that response bias is not a problem (Kanuk & Berenson, Reference Kellermanns, Eddleston, Barnett and Pearson1975; Oppenheim, Reference Overbeke, Bilimoria and Perelli1992).

A description of variables included in the analysis is given in Table 1. A multicriteria definition based on family control of ownership and management and a self-defining classification are adopted following previous literature (e.g., Casillas, Moreno, & Barbero, Reference Casillas, Moreno and Barbero2010; Huybrechts, Voordeckers, & Lybaert, Reference Jimenez2013). SEW is described by Berrone, Cruz, and Gomez-Mejia (Reference Berrone, Cruz and Gomez-Mejia2012) as a multidimensional construct although no empirical research on their model has been published (Debicki, Kellermanns, Chrisman, Pearson, & Spencer, Reference Debicki, Kellermanns, Chrisman, Pearson and Spencer2016), instead family ownership and management are used, as in this research, as a proxy for the pursuit of family goals to obtain SEW (Chrisman & Patel, Reference Chrisman and Patel2012).

Table 1 Variables

First, descriptive information is provided together with a correlation analysis to determine the strength of the association between variables. Next, a multivariate analysis is conducted in order to clarify the causal relationships. The technique chosen is multivariable logistic regression where the dependent variable is the gender of the manager and the independent variables are the predictors of female presence in the post. To explore the moderating effect of generation, following recommendations by Hoetker (Reference Hoobler, Lemmon and Wayne2007), we opt for a multigroup logistical analysis and test for χ2 differences.

RESULTS

Descriptives

Table 2 shows descriptive information of the sample, distinguishing by gender, considering the variables that will be later used to test the hypotheses.

Table 2 Descriptives

Note. 1G=first generation; LaterG=later generation.

Correlation analysis (Table 3) shows how women managers are younger, have less management experience, manage second generation companies with a major presence in companies in the service sector. Companies in the first generation are characterized by older managers, mostly male without higher education.

Table 3 Correlation analysis

Note. *p<.1; **p<.05 ; ***p<.01.

Multivariable analysis

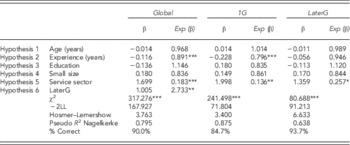

Considering that the dependent variable is dichotomous, a binary logistic model is used to examine the causal relationships. The model incorporates all the variables considered in the hypotheses. The verification of the hypotheses is based on checking whether the coefficients are different from 0. A significant coefficient means that the variable is a predictor of the dependent variable, in our case the manager position is occupied by a woman. As in any other non-linear regression, parameters in the logistic model are not necessarily the marginal effects we are used to analyze (Greene, Reference Griffeth, Allen and Barrett2011). For this reason, information regarding odds ratio (Exp (β)) is also displayed and indicates how the likelihood of a female manager increases with the variable in question assuming all other factors are constant.

Table 4 shows a summary of the standardized coefficients (β) for each independent variable along with the aforementioned Odds-ratio and the main indicators of the goodness of fit. The significance of the log-likelihood ratio reveals a strong relationship between the dependent variables and the corresponding regressors in the three regressions. In addition, Hosmer–Lemershow test indicates that the proposed models are not significantly different from a perfect one that can correctly classify the observations in their respective groups (Chau & Tam, Reference Chau and Tam1997).

Table 4 Logit regression results

Note. 1G=first generation; LaterG=later generation; LL=log-likelihood ratio.

*p<.05; **p<.01; ***p<.001.

Functions indicate rather high percentages of correct classified by models; therefore, models have a high discriminatory power. Finally Nagelkerke’s pseudo R 2 is high meaning that the models explain a significant proportion of the variation in the data.

In the global model (Table 4), results confirm Null Hypotheses 1, 3 and 4 and Alternative Hypotheses 2, 5 and 6. There are no differences in age and education among CEOs according to gender. The only difference found being that women assuming the CEO position have less management experience than males. Regarding the typology of firms, family firms run by women are not smaller. Also the propensity of women to run firms in the service sector is confirmed. Finally, there is a greater presence of women in family firms in second or later-generations. Examining differences according to generation, in effect there are less differences in second or later-generation firms. Specifically, the lesser management experience of women disappears in family firms in second or later generations (χ2 for difference is significant p<0.05), although the preference for the service sector remains significant.

DISCUSSION AND CONCLUSIONS

The persistence of barriers, summarized by Hoobler, Lemmon, and Wayne (Reference Hoobler, Wayne and Lemmon2011) by the term work–family conflict, prevents the necessary dedication of women to top management positions (Durbin & Tomlinson, Reference Durbin and Tomlinson2014), thus hampering their promotion opportunities (Hoobler, Wayne, & Lemmon, Reference Humphreys2009). As a consequence of the mismatch between stereotypes of women and of leadership, research on female management reveals certain organizational conditions where its presence is more likely, particularly in enterprises with less complexity (small size and service sector) and a specific management profile (younger, less experienced and more educated). Thus, certain organizational conditions favor a greater presence of women in management positions. Women in family businesses have traditionally had a greater role. In fact, the presence of women in management positions is higher in family firms in comparison to non-family firms (Barrett & Moores, Reference Barrett and Moores2009; Sonfield & Lussier, Reference Trauth2012; Humphreys, Reference Huybrechts, Voordeckers and Lybaert2013). Under these assumptions, the aim of the present paper is to discern whether the family business presents organizational differences in those conditions, or instead, the trend is confirmed with regards to the recent literature indicating few differences between men and women in the ownership and management of family firms (Sonfield & Lussier, Reference Trauth2012).

Regarding management profile, female managers in family businesses have less managerial experience (8.7 vs. 17.8 years for men). Although they have a lower average age and higher level of education, none of these variables has, however, a significant effect. Therefore, compared with the general situation, in family businesses the access of women to top management is not explained by their level of education or age. In non-family businesses, female managers are less experienced and younger, mainly due to the demands of the position which leads them to interrupt their careers (Hewlett, Reference Hewlett and Luce2002; Chernesky, Reference Chernesky2003). Our data show that in family businesses female managers also have less managerial experience but are not younger. As possible explanations we suggest that even when women interrupt their careers, the family business facilitates the return of women to the firm management, something that does not happen in non-family businesses (Hewlett & Luce, Reference Hoetker2005). Concerning the types of businesses, family firms do not support the assumption that women run smaller companies. Against the literature stating that women, willing to balance work and family, work in smaller and more manageable companies (Haynes et al., Reference Heck2000; Lee, Jasper, & Fitzgerald, Reference Lerner and Malach-Pines2010), the prevalence of family values (Dyer, Reference Dyer2003) and the preservation of SEW (Gomez-Mejia et al., Reference Gomez-Mejia, Haynes, Nunez-Nickel, Jacobson and Moyano-Fuentes2007) provides women the same opportunities to run the family business regardless of the size. Therefore, women leading family businesses do not significantly prefer working in smaller companies as an option to reconcile family and working life more easily. In addition, it is not true that female leadership is a limiting factor for the growth of companies. This finding opens opportunities for further research and managerial implications with regards to the promotion of women into management positions no matter the size of the firm. Results for family businesses presented here should be studied in other contexts such as non-family firms to learn about the generalization of findings.

The empirical evidence does show differences due to sector: women are significantly more likely to be managers in family businesses providing services. More than 81% of women run services firms against 47% of men. These results support the idea that there is a sectoral ‘gender effect’ (Watson, Quatman, & Edler, Reference Westhead and Cowling2002; Gisbert López, Alarcón García, & Gómez Gras, Reference Gisbert López, Alarcón García and Gómez Gras2009): certain sectors like services are more favorable to female managers (Smith, Smith, & Verner, Reference Sonfield and Lussier2006). Empirical analysis reveals a female preference for service activities even though family values could ease access to all kind of industries. Further research is needed to explore the role of stereotypes that incline women to manage preferentially companies providing services instead of products.

The analysis clearly shows how family businesses in the second generation are prone to the presence of women in top management. Almost 60% of female managers are in family firms in second generation compared with 33% of males. Another relevant fact is that all women in the position of manager are family members. The low 5.5% of non-family managers are all men. The transition to the second generation brings major changes in the family business (Miller & Le Breton-Miller, Reference Miller, Le Breton-Miller, Lester and Cannella2006) that foster the presence of women committed by family ties (Gomez-Mejia et al., Reference Gomez-Mejia, Cruz, Berrone and De Castro2011) and choosing the most suitable candidate regardless of gender. Especially when the transition is troubled, the probability of women reaching the position of manager increases (Ryan & Haslam, Reference Salganicoff2007), a common situation in family businesses where the daughters who could not be considered as candidates end up in top management positions (Wang, Reference Watson, Quatman and Edler2010). Families with more egalitarian cultures and structures increase the demand for women successors (Overbeke, Bilimoria, & Perelli Reference Parkes and Langford2013), the results confirm that this type of owners is predominant in family firms.

In short, the objectives of permanence (Casson, Reference Casson1999), the prevalence of family values and the preservation of SEW (Gomez-Mejia et al., Reference Gomez-Mejia, Haynes, Nunez-Nickel, Jacobson and Moyano-Fuentes2007) make family firms a favorable scenario for women to become managers. The interrelation between family and professional contexts in family businesses diminishes gender differences and enables women to perform leadership roles (Bjursell & Bäckvall, Reference Bjursell and Bäckvall2011), thus reducing prejudices on family-work (Hoobler, Lemmon, & Wayne, Reference Hoobler, Wayne and Lemmon2011).

The practical implications of the present paper are various. Family businesses are confirmed as an ideal vehicle to minimize the loss of female talent in our economy. They are able to break the popularly termed ‘glass ceiling’ that prevents women from reaching top management positions providing greater work–life balance. This study should serve to communicate to family firms the need for formal recognition of women’s important contribution to the family business. The role of women must go beyond conflict solver or being improvised candidates in critical situations. It is important to identify and prepare the best candidate, regardless of gender, to take over the company. Although succession in the family business is a favorable scenario for the incorporation of women to leadership, more steps may be taken. In most societies sons are preferred over daughters as successors, very often ignoring women as candidates for succession (Griffeth, Allen, & Barrett, Reference Haynes, Rowe, Walker and Hong2006). Family firms can also serve as a model for non-family business to leverage female talent. In the long term, the existence of shared values to balance personal and professional life can be compatible with economic efficiency. The analysis of organizational conditions considering the generation of the firm reveals that second or later generation family firms have no differences in terms of management profile or size according of the gender of the CEO. The only prevailing difference is sectorial; firms run by women are more common in the service sector.

This work contributes to expanding the knowledge on women in family firms, a research field that remains neglected (Al-Dajani et al., Reference Al-Dajani, Bika, Collins and Swail2014) where research is scarce, fragmented and mainly conceptual (Danes & Olson, Reference Danes and Olson2003; Sharma & Irving, Reference Smith, Smith and Verner2005; Vera & Dean, Reference Wang2005; Jimenez, Reference Kanuk and Berenson2009; Bjursell & Bäckvall, Reference Bjursell and Bäckvall2011) especially with regards to management positions (Cappuyns, Reference Cappuyns2007; Lerner & Malach-Pines, Reference Longstreth, Ord and Mauldin2011). To our knowledge, this is the first work that uses the theory of SEW to support empirical findings of lower gender differences in family firms. Family values allow the interplay of the private and professional contexts encouraging the access and continuity of women to management positions, overcoming stereotypes and prejudices against female leaders. Another contribution of this work is to consider as independent variables those organizational conditions that have traditionally been used as control variables. Specifically, the generation variable is seen as the key to female access to management and career development in business.

Finally, we are aware that this study is not without limitations, which may constitute, in turn, future lines of research. First, this study has been focused on Spanish firms; an interesting extension may be the replication of this study in other countries. Second, it would be desirable to include the explicit measurement of socioemotional aspects representing family values and analyzing their effects on the trajectory of female managers. Third, the classic and simple measure used to identify family firms, although accepted in the literature, could be enriched by including more specific indicators related to the idiosyncrasy of family firms, as exemplified in the F-PEC (Family Power, Experience and Control) scale of familiness (Astrachan, Klein, & Smyrnios, Reference Astrachan, Klein and Smyrnios2002). Finally, this study is based on cross-sectional data, although the generation is introduced, a longitudinal view can help to examine the trajectories female managers follow. Regarding the challenges that stem from this work and which could advance research in the field of women in the family business we face the following. It seems important to analyze the family, cultural and social barriers that limit women’s entrepreneurship and businesses development. In other words, the presence of women leading first-generation family business needs further research. Another possible direction is to investigate the reasons and procedures for the incorporation of women in the second or subsequent generations. Specifically, the existence of critical events is highlighted as the main causes to promote daughters to top management positions (Overbeke, Bilimoria, & Perelli, Reference Parkes and Langford2013). In general, it can be very revealing to identify patterns in careers followed by women in family firms and compare them with non-family businesses run by female managers. We also find it interesting to analyze the relationship between gender and the business sector. Specifically, the reasons why female managers are less frequent in industrial enterprises. The paper is based on socially construction of gender theory. In the future, emergent approaches such as gender intersectionality and minority gender theories (Ridley and Young, Reference Ross-Smith and Chesterman2012; Trauth, Reference Vera and Dean2013) may help in explaining female leadership in family businesses.

Acknowledgements

The authors thank Fundación CajaMurcia for the financial support provided and the grant agreement No. 645791 of European Union’s Horizon 2020 research and innovation program.