1. Introduction

Digitalization is transforming international trade, changing the nature of cross-border economic interactions.Footnote 1 An increasing proportion of goods and services are ordered and delivered virtually, data have become a major cross-border economic flow, and digital technologies are embedded throughout supply chains. Meanwhile, the internet has enabled the emergence of platform companies of unprecedented size and global reach, and allowed a growing number of small businesses, individual workers, and consumers to engage in cross-border trade.

These shifts have created new cross-border opportunities and challenges, spurring governments to negotiate new trade rules. The range of issues is broad, ranging from the governance of cross-border data flows and the digitalization of customs documents to the enhanced protections for source code. Discussions started at the World Trade Organization (WTO) in 1998 but made little progress,Footnote 2 so governments turned to preferential trade agreements, initially including a handful of provisions and then expanding the scope to include dedicated chapters.Footnote 3 By the end of 2022, there were 167 preferential agreements containing provisions on digital trade, with 109 containing dedicated chapters.Footnote 4

Among the three major blocs in the world economy, the US has embraced the move to negotiate digital trade rules, while the EU and China have been much more hesitant.Footnote 5 From the early 2000s, the US used trade agreements to pursue its ‘Digital Agenda’, and was central in digital trade rule-making. More than half of all new provisions on digital trade, introduced between 2000 and 2019, were in trade agreements where the US was a signatory.Footnote 6 Digital trade was a major priority of the Obama administration, reflected in the extensive digital trade provisions in the Trans-Pacific Partnership agreement (TPP), which was signed in 2016. (This later became the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) in 2018, following the Trump administration decision to withdraw).Footnote 7 The TPP was followed by the US–Mexico–Canada Agreement (USMCA), concluded in 2018, and the Japan–US Digital Trade Agreement in 2019. The US focused on the liberalization of data flows, and the removal of other government measures deemed by large US technology companies to be impediments to their business model, including the so-called ‘forced transfer’ of software and source code. Through these agreements, the US claimed it had set a new ‘gold standard’ for digital trade rules.

With the expiry of the US Trade Promotion Authority in 2021, and an initial turn away from trade agreements under the Biden administration, the US has been less of a driving force in shaping digital trade rules. Yet other governments have continued to negotiate extensive digital commitments, including the preferential trade agreements negotiated by the UK after Brexit. In 2020, Chile, New Zealand, and Singapore negotiated the world's first stand-alone digital economy agreement, with the explicit aim of shaping global norms.

This article seeks to establish whether, and to what extent, recent digital trade agreements replicate the earlier US approach or depart from it. Moreover, where agreements differ, is this part of a wider pattern of change? Alternatively put, to what extent has normative change been happening in digital trade since the US stepped back, and which states are acting as norm entrepreneurs? Following Finnemore and Sikkink, we identify norm entrepreneurs as states that attempt to influence a critical mass of other states to embrace new norms (standards of appropriate behaviour).Footnote 8 Normative change occurs when these norms become more widely accepted and internalized among states.

To establish whether, and to what extent, norm entrepreneurship is occurring in digital trade, we systematically compare provisions in 12 agreements concluded between 2018 and 2023 that we identify as containing extensive digital provisions. These include three US-led agreements, concluded over 2018 and 2019, and nine other agreements, concluded since then. As explained in detail below, we organize the agreements chronologically and systematically code each provision according to the legal nature of the commitment being made. This enables us to identify the ways in which digital trade commitments have evolved across time, the jurisdictions, and issue areas.

We find evidence of substantial innovation in recent digital trade agreements and identify Singapore as a norm entrepreneur. We show that the most substantial innovation occurred in the Digital Economic Partnership Agreement (DEPA) between Chile, New Zealand, and Singapore (June 2020) and the Digital Economy Agreement (DEA) between Australia and Singapore (Australia–Singapore DEA) (August 2020). Subsequent agreements, including the UK's post-Brexit digital trade agreements incorporated many of these innovations, with some additional adaptations occurring at the margins. While the Singapore-led wave of agreements incorporates core elements of the previous US-led agreements, the recent agreements are more expansive in scope, covering 14 additional issues, including commitments on digital identities, e-invoicing and e-payments, as well as the governance of AI and new digital technologies. There are also drafting novelties in other areas with, for instance, stronger commitments on paperless trade.

While the emphasis of earlier US-led agreements was on promoting the market access of US technology companies and protecting their business models,Footnote 9 we show that the Singapore-led agreements place greater emphasis on promoting regulatory cooperation, technical interoperability between digital systems, and international standard-setting for digital technologies. Reflecting these differing objectives, many digital trade provisions in US-led agreements are hard law commitments, while many of the novel provisions introduced through Singapore-led agreements are couched as soft law.

We find substantial evidence that Singapore intentionally set out to shape global norms, rather than negotiating digital trade agreements simply to enhance its bilateral trade relations. In addition to providing a revised normative framework and set of rules for digital trade, it deployed a variety of strategies to persuade other states to follow, with some success. We attribute norm entrepreneurship on the part of Singapore and its allies to a desire to capitalize on digitalization and position themselves as ‘digital hubs’ in the global economy; spur rule-making in areas of the digital economy where there are gaps and regulatory uncertainties; and promote digital interconnectivity at a time when governments around the world, including the three digital superpowers (the US, EU, and China), were adopting divergent regulatory approaches.Footnote 10

Our work contributes to a growing body of literature that seeks to understand the evolution of digital trade rules. Several scholars have conducted comparative analyses of the US and EU approach to digital trade agreements,Footnote 11 while others, such as Yakovleva and Shaffer, have undertaken comparative analyses of specific issues, contrasting the more liberal approach of the US with the EU's more guarded one.Footnote 12 Some scholars have compared US and EU approaches with those of China,Footnote 13 while others have interrogated the role of the US in shaping the framing and nature of commitments in digital-related trade agreements worldwide.Footnote 14 Other scholars have analysed the interface between digital provisions in bilateral and regional trade agreements in light of commitments under the WTO's GATT and GATS.Footnote 15 Wunsch-Vincent and Hold coded and examined digital provisions in a select number of FTAs concluded between 2000 and 2010, determining the extent of liberalization in these agreements.Footnote 16 Burri and Polanco built on this work by creating a broader dataset of all relevant FTAs concluded since 2000.Footnote 17 Their analysis employs a detailed coding system to map the evolution of digital provisions in trade agreements, giving particular attention to the level of commitment by analysing the strength of the legal language.Footnote 18 The conclusion of DEPA, the world's first stand-alone digital economy agreement in 2020, has spurred discussion on the extent and nature of evolution in digital trade law.Footnote 19

We contribute to this literature by revealing the role played by Singapore in digital trade innovation, helping disrupt the conventional narrative which assumes that the US, EU, and China are the normative drivers of digital policymaking. We provide a systematic and detailed analysis of how the new wave of ‘Singapore-led’ agreements compare to other recent digital trade agreements, showing how the scope of commitments has expanded, and the precise ways in which the legal drafting of commitments compares with the earlier US-led wave. We also contribute to coding methodologies, providing an example of how to systematically incorporate analysis of public policy flexibilities into coding decisions, thereby enhancing our collective understanding of the nature of legal commitments that countries are making in trade agreements.

The article proceeds as follows. In Section 2, we explain our methodology. In Section 3 we present our overall findings, showing that substantial innovation is taking place and propose that a new and distinct ‘Singapore-led’ wave of digital trade agreements is emerging. Drawing on scholarship on norm entrepreneurship, we argue that Singapore is acting as a norm entrepreneur in digital trade, substantiating our argument with a range of primary evidence. In Section 4 we analyse the nature of the ‘Singapore-led’ wave of trade agreements in detail, showing how they compare with the earlier US-wave in coverage and in legal drafting. In the conclusion, we reflect on the progress and prospects of Singapore's norm entrepreneurship in digital trade.

2. Research Methods

To understand how digital trade rulemaking has evolved over time, we systematically compare the digital trade provisions in 12 agreements concluded between March 2018 and January 2023. This includes the three major digital agreements that were led by the US (CPTPP,Footnote 20 USMCA,Footnote 21 and the Japan–US Digital Trade AgreementFootnote 22) and nine agreements with substantive digital trade provisions that have been negotiated since then: Digital Economic Partnership Agreement (DEPA) between Chile, New Zealand, and Singapore (June 2020);Footnote 23 Australia–Singapore Digital Economy Agreement (August 2020);Footnote 24 Japan–UK Free Trade Agreement (October 2020);Footnote 25 Regional Comprehensive Economic Partnership Agreement (RCEP) (November 2020);Footnote 26 EU–UK Trade and Cooperation Agreement (December 2020);Footnote 27 Australia–UK Free Trade Agreement (December 2021);Footnote 28 Singapore–UK Digital Economy Agreement (February 2022);Footnote 29 New Zealand–UK Free Trade Agreement (February 2022);Footnote 30 and Korea–Singapore Digital Economy Agreement (January 2023).Footnote 31 While other trade agreements have been concluded during this period, we excluded those without substantial digital chapters from our analysis, as our aim is to understand the scope and nature of the frontier of rulemaking in digital trade rather than to provide an exhaustive analysis of all digital provisions in recent trade agreements.

We extracted provisions on digital trade from these 12 agreements, identifying 34 different issues which we divided into six thematic areas.Footnote 32 The database includes provisions from digital trade chapters as well as provisions in other chapters that specifically relate to digital trade (for instance, commitments on cross-border flows of financial data are often found in the financial services chapter, while commitments on the liability of internet service providers are typically found in intellectual property chapters). Where a digital agreement is being negotiated to update and amend an underlying FTA, we examine the original treaty to ensure we included any provisions that are incorporated (or excluded) by reference.Footnote 33

We code the digital provisions in each trade agreement using a two-part coding system. Our approach draws on recent debates about the nature of legalization in international relations, and the difference between ‘hard’ and ‘soft’ legal obligations. Abbott and Snidal use the term ‘hard law’ to refer to legally binding obligations that are precise (or can be made precise through adjudication or the issuance of detailed regulations) and that delegate authority for interpreting and implementing the law.Footnote 34 ‘Soft law’ is a residual category, referring to legal arrangements that are weakened along one or more dimensions of obligation, precision, and delegation. A treaty is soft in terms of obligation if it is non-binding. It is also soft in terms of precision if it is formally binding but couched in vague language that leaves almost complete discretion to the parties as to its implementation. In contrast, an agreement that fails to delegate any authority to a third party to monitor its implementation or to interpret and enforce it, is soft in terms of delegation.Footnote 35 While trade law is closest to the ideal type of ‘hard law’, it can also be ‘soft’ in important ways. This is particularly true for recent digital trade agreements where technological change is occurring so quickly that commitments may not be ‘treaty-ready’.

The first part of our coding system builds from our discussion on legalization and we assign a numerical value between one and four to capture varying degrees of obligation and precision in individual treaty commitments. In assigning values, we are not making a judgement as to the economic or societal value of the commitment (e.g. whether it is more or less liberalizing, or more or less protective of consumers), but merely assessing its legal nature. Where a commitment is assigned the value of ‘zero’, this means that agreement does not contain a provision on a given issue. The value of ‘one’ is assigned where the agreement contains a provision couched in purely hortatory language such that, even if the treaty as a whole is binding, the individual commitment is non-binding. For example, under ‘regulating cross-border logistics’ in Table 1, DEPA is assigned a ‘one’ because the drafting language is purely hortatory, such as ‘recognize the importance of’ and ‘shall endeavour to’, reflecting the non-binding nature of the commitment.

Table 1. Coding of digital provisions in trade agreements concluded between March 2018 and January 2023 (date of signature)

Notes: All provisions which are coded in brackets (e.g. RCEP e-commerce chapter and Australia–UK innovation chapter) reflect the fact that the provision is not subject to dispute settlement.

Source: Legal coding of provisions by authors (see annex for code book).

We code as ‘two’ where the commitment made is binding but non-specific. This mostly occurs where parties made a commitment to ‘cooperate’ or ‘exchange information’, or where the drafting language was vague or indeterminate, resulting in the nature of the commitment being unclear and leaving a high level of discretion to the parties with regards to implementation. For example, under ‘domestic electronic transactions framework’ in Table 1, the provisions in the Japan–US DTA are classified as ‘two’ because although they contain binding language, the commitments are unspecific, establishing that parties ‘shall maintain a legal framework governing electronic transactions consistent with the principles of the UNCITRAL Model Law on Electronic Commerce 1996’ but providing no details of what this consistency would entail. As will be further discussed below, when pertinent issues around some of the definitions and scope are not clearly provided, the provision is broad enough to allow a state to implement a wide range of approaches and avoid being in breach of its obligation, making the commitment less substantive.

Our coding of ‘three’ and ‘four’ reflects more substantive binding obligations where a state could reasonably be found in breach. Under the value of ‘three’, we put commitments that are binding and specific, with actions to be taken (or not taken) described in clear and precise language. Examples of this include Japan–US DTA and USMCA provisions on data localization, where parties specifically commit to not requiring use or establishment of computing facilities as a condition of conducting business. Finally, we assign a score of ‘four’ where a provision goes further with binding and specific language and, in addition, obligations that are more extensive in scope and very detailed. For example, Korea–Singapore's provision on paperless trade received a ‘four’ because in addition to having binding language, it also provides specific and extensive detail on what parties must do, such as the commitment to interconnect their single windows.

The second part of our coding seeks to capture the degree of public policy flexibility that parties built into each individual commitment, beyond the flexibility provided by general exceptions. As is routine practice, all the agreements we examine have general exceptions, typically based on WTO law (Article XX and Article XXI of GATT, and Article XIV of GATS), which allow governments to derogate from treaty commitments for specific public policy reasons, such as public health or national security. Many digital chapters have additional exceptions, such as the exclusion of financial services or government procurement. The EU has introduced an additional general exception in its digital trade chapters on the ‘right to regulate’ under which the parties ‘reaffirm the right to regulate within their territories to achieve legitimate policy objectives’. The provision includes a non-exclusive list of objectives to which the ‘right to regulate’ applies, mentioning several that are not explicitly stated in WTO exceptions such as climate change, and privacy and data protection.Footnote 36 In some cases, states introduce additional flexibility by excluding the digital provisions from dispute settlement, notably in the case of the e-commerce chapter in RCEP and the innovation chapter in the Australia–UK agreement.

In addition to these agreement-wide and chapter-wide exceptions, flexibilities are built into individual provisions, which our coding aims to capture by assigning stars (*).Footnote 37 These exceptions may narrow the scope of the obligation by listing specific sectors to which it does not apply, or they may specify qualifying criteria to justify actions that would otherwise breach the obligation.Footnote 38 No star is assigned if no additional flexibility is built into the provision. If additional flexibility is included but the scope of the carve-out is narrow or the qualifying criteria are relatively stringent, we assign one star (*). For instance, many commitments on cross-border data flows allow for a restriction only if it is for a ‘legitimate public policy objective’, does not amount to ‘arbitrary or unjustifiable discrimination or a disguised restriction on trade’, and is not ‘greater than required to achieve the objective’. This language is borrowed from GATT Article XX, whose interpretation can sometimes be narrow.Footnote 39

We assign two stars (**) to provisions that allow for discretionary action through expansive drafting. This may include cases where a party may breach the rule for any ‘legitimate public policy’ reason without further qualification, or where the rule is subject to a broad qualification such as ‘except as otherwise provided for in its laws and regulations’. Finally, we assign three stars (***) to exceptions that are expansively drafted and self-judging. For example, under the topic on data localization of non-financial data, we assign three stars to RCEP based on the language used in its carve-out. In particular, paragraph three of article 12.14 provides that where parties adopt measures inconsistent with the obligation ‘such measures shall not be disputed by other parties’.Footnote 40

Combining both components of our coding methodology allows us to distinguish between provisions where the strictness of the core obligation is comparable but there are notable variations in the extent to which public policy flexibilities are incorporated, leading to differences in the overall nature of the commitment. It is worth noting that coding legal provisions requires the exercise of judgment since determining the scope of an obligation or the extent of public policy flexibilities involves interpreting intricate legal drafting. To enhance the reliability of the coding, the three authors independently coded in the initial stage and then reconciled differences, relying on existing research on digital trade and international trade law to guide final coding decisions. For more comprehensive details about the coding methodology and the issues covered, a codebook is available in the appendix.

3. Major Trends: A New Wave of Digital Trade Rulemaking Led by Singapore

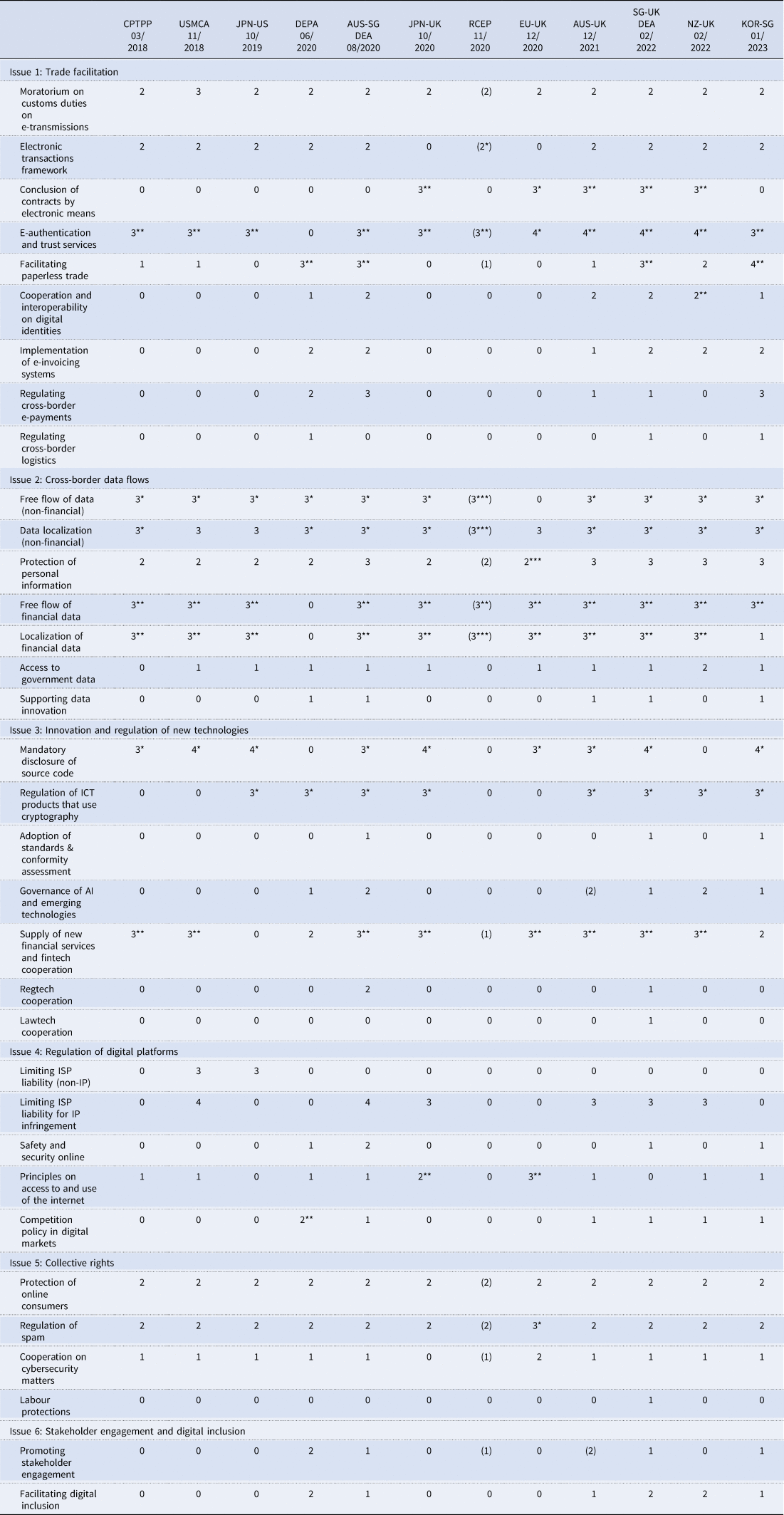

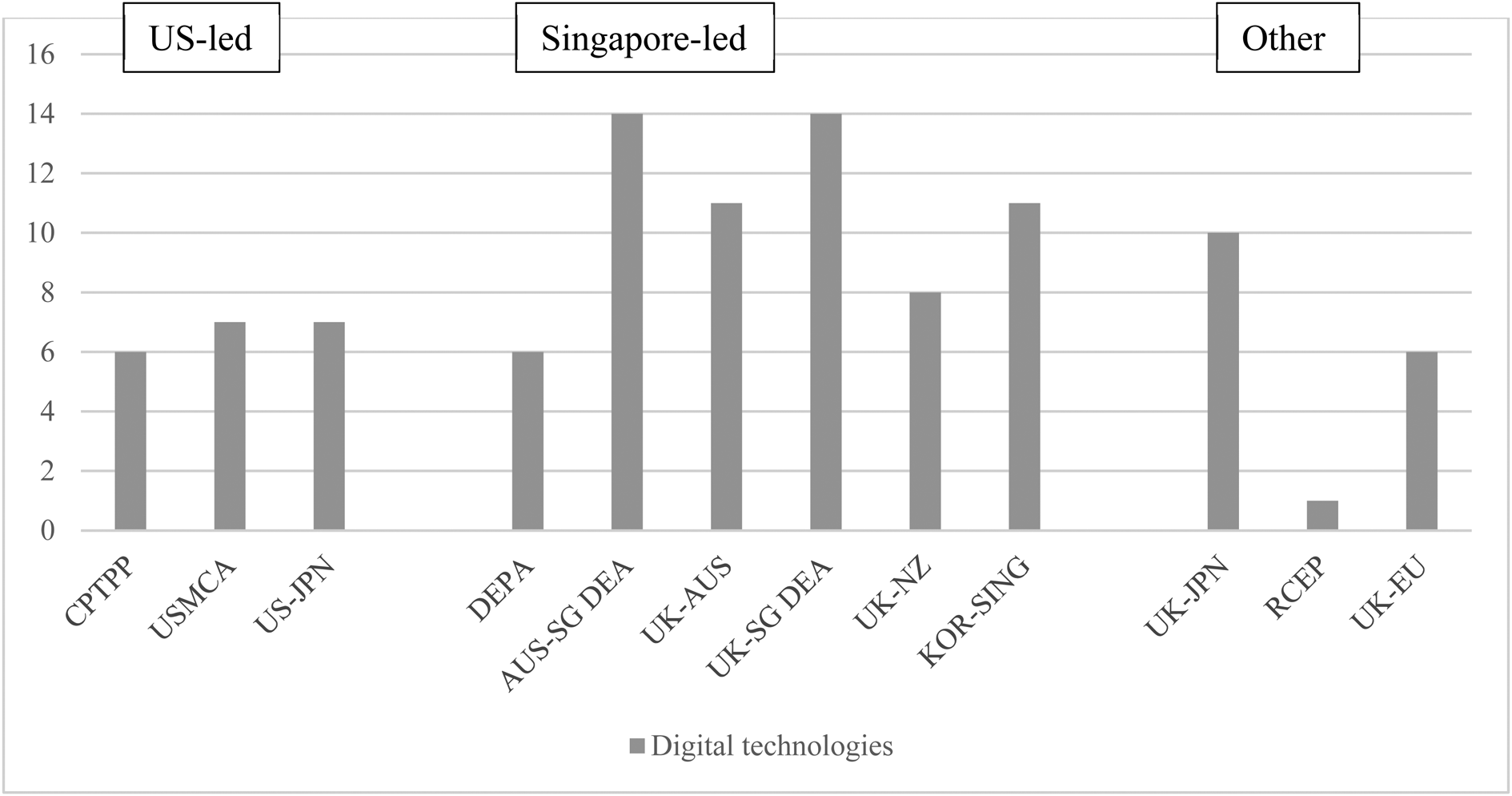

The detailed results of our coding exercise are provided in Table 1, which presents the agreements in chronological order according to date of signature. Figure 1 draws on our coding exercise and presents the aggregate scores for each issue area, conveying headline trends in the evolving scope of legal obligations.Footnote 41

Figure 1. Extensiveness of commitments in recent digital trade agreements (aggregate scores)

Source: Aggregation of legal coding of provisions by authors (see Table 1).

Our provision-by-provision analysis (Table 1) reveals substantial continuity. With the notable exception of the agreements involving China and the EU (RCEP and EU–UK agreement, respectively), recent digital agreements incorporate many core features of the US-led agreements (the first three columns of Table 1). As we explain in greater detail below, recent agreements largely replicate the provisions on cross-border data flows, data localization, source-code protection, and regulation of ICT products using encryption, where provisions in US-led agreements are substantive and binding. They also replicate provisions in areas such as consumer protection, spam, and cybersecurity cooperation, where provisions in US-led agreements are vaguely drafted or hortatory.

Alongside this continuity, we also find substantial innovation. The scope of issues covered by digital trade provisions has grown considerably since the last US-led agreement in 2019. The main innovations were introduced through the DEPA between Chile, New Zealand, and Singapore in June 2020, and the Australia–Singapore DEA in August 2020. These four states were already parties to the CPTPP, and the new agreements were used to expand the scope of digital trade topics being addressed rather than offer a radical departure from the US model. As indicated in Table 1, the DEPA and the Australia–Singapore DEA introduced provisions in 12 areas that had not been covered in the previous US-led agreements: digital identities, e-invoicing, e-payments, logistics, data innovation, standards and conformity assessment, governance of AI, regtech, safety and security online, competition in digital markets, stakeholder engagement, and digital inclusion. In the aftermath of DEPA and DEA, there was little further expansion of scope, as only two more issues were added, namely provisions on lawtech and labour protections, which were mentioned for the first time in the Singapore–UK agreement. Overall, the Australia–Singapore DEA and Singapore–UK agreements contain the most extensive commitments on digital trade (reflected in the highest aggregate scores).

Reflecting the nascent stage of national policymaking in these fast-evolving policy areas, our coding reveals that new issues are usually incorporated as soft law commitments, using non-binding or binding and vague language (assigned values of 1 and 2 in Table 1). Commitments are often broad statements of intent and agreement to cooperate, without specifying specific measures that governments will (or will not) take. This soft law approach is deliberate as it is well-suited to an emerging policy domain where technological innovation is happening apace and there is considerable uncertainty as to what ‘good’ regulation looks like, even in a domestic context.Footnote 42 Soft law commitments encourage dialogue and coordination and aim to support the emergence of common hard law approaches over time. Indeed, there are risks in prematurely adopting a hard law approach, as we discuss below with regards to provisions on source code.

Strikingly, our provision-by-provision analysis reveals that in all 14 instances of new issues being introduced, Singapore was a party to the agreement. In addition to DEPA and the Australia–Singapore DEA, four other agreements incorporate many of the innovations: Australia–UK FTA; Singapore–UK DEA; New Zealand–UK FTA; and Korea–Singapore DEA. In the remainder of the article, we refer to these six agreements as part of a new ‘Singapore-led’ wave of digital trade agreements.

In contrast, three agreements (Japan–UK, EU–UK, and RCEP) exclude many of the Singapore-led innovations, reflected in relatively low aggregate scores (Figure 1). The timing of the Japan–UK negotiations helps explain its more limited nature. In its post-Brexit agreements, the UK pivoted away from the EU's more cautious approach to digital trade, and the Japan–UK agreement is largely modelled on the CPTPP text. It did not incorporate the novelties introduced through DEPA and the Australia–Singapore DEA, largely because it was negotiated during the same period, leaving limited time for emulation. The relatively low score of the EU–UK agreement reflects the EU's comparatively cautious approach to digital trade. Although the EU–UK agreement went beyond the EU's previous commitmentsFootnote 43 the EU continues to be cautious, particularly with regards to commitments on cross-border data flows and provisions on personal data protection.Footnote 44 RCEP similarly reflects the relatively cautious approach of China and many ASEAN countries. While it uses much of the drafting language of CPTPP, it excludes the innovations seen in the ‘Singapore-led’ agreements and, crucially, excludes the digital chapter in its entirety from dispute settlement, rendering the commitments non-enforceable (reflected in the brackets we have added to the coding of RCEP provisions in Table 1). Many RCEP commitments contain additional, extensive, and often self-judging carve-outs, as demonstrated by the high number of double and triple stars assigned to RCEP's provisions.

Beyond our text-based analysis, there is substantial primary evidence which corroborates our finding that Singapore is a norm entrepreneur in digital trade, offering a revised agenda to that found in US trade agreements. The US approach focused on boosting the competitiveness of its large technology companies in global markets by securing commitments from other governments to alter regulations perceived by these companies as impeding their expansion overseas.Footnote 45 Priorities included prohibitions on customs duties on digital products, legal commitments securing the free flow of data across borders and prohibiting data localization, limitations on government access to source code, and limitations on the liability of internet service providers for harms arising from user-generated content and from intellectual property infringements.Footnote 46

In contrast, Singapore is motivated by concerns that, as the digital economy evolves, governments are starting to create regulations which, if uncoordinated, create trade barriers. Through its digital trade agenda, Singapore seeks to find ways to foster regulatory alignment and build bridges across regulatory regimes.Footnote 47 This position echoes the concerns of many states who are concerned about growing regulatory divergences between the US, EU, and China, and heightened geopolitical tensions that are leading to fragmentation, particularly in the digital economy.Footnote 48 Singapore's aims are reflected in the contents of the digital economy agreements it has pioneered, which seek to promote the digitalization of trade as well as address regulatory fragmentation, including by promoting international standard setting and interoperability.

This agenda reflects Singapore's economic interests. As a small, trade-dependent nation, Singapore has succeeded economically by positioning itself as a critical node in global supply chains, first as a shipping hub and then as a conduit for finance and investment.Footnote 49 Singapore has championed the digitalization of its own economy, society, and government, frequently topping global rankingsFootnote 50 and now seeks to position itself as a critical node in the global digital economy. In the words of its trade minister, Singapore is forging digital agreements so that it can ‘become one of the nodes for such data flows [in the global economy], not unlike the way we have emerged as a node for capital flow and goods flows and services flows’.Footnote 51 Singapore's top trading partners are China and the US, so divergent regulatory approaches, particularly between these two major players, has major implications.

By articulating a different set of normative objectives for digital trade – focused on building bridges across regulatory regimes – and providing concrete examples of how these can be reflected in legal provisions, Singapore offered a new cognitive frame for thinking about the purpose and content of digital trade policy, an essential first step in a process of normative change.Footnote 52 Singapore is also explicit about its desire to act as a norm entrepreneur. For instance, the Smart Nation strategy (2018)Footnote 53 speaks of the government's intention to be a thought leader around technology regulation and norms. In 2019, the trade minister also set out the vision for digital trade in parliament explaining that Singapore aims to ‘advocate for an integrated, global digital economy’ and ‘co-develop international trade rules for the digital economy’.Footnote 54

The literature highlights how normative change entails norm entrepreneurs finding platforms through which to promote their normative agenda, strategies for persuading others to adopt the norms, and allies to endorse and help socialize them. Singapore has sought to catalyse talks on digital trade at the WTO, helping set up the Joint Statement Initiative on e-commerce, which it co-chairs with Australia and Japan, and negotiate ‘pathfinder’ digital trade agreements with likeminded partners.Footnote 55 These two platforms are complementary, multilateral negotiations that help foster dialogue and socialization, but are slowed down by divergences between the major players, while digital economy agreements reach fewer countries but are a place where innovation can occur.Footnote 56 Moreover, DEPA was specifically designed as a promulgation mechanism. It is an open plurilateral, which other countries can join, and it comprises a set of modules that are easy for other countries to replicate and integrate into their preferential trade agreements.Footnote 57

Alongside these rule-making initiatives, Singapore has undertaken a series of initiatives to persuade countries of the merits of its approach. These include collaborating with the WTO to hold training programmes for third countries on digital trade to foster peer-learning, and pilot projects to showcase the practical gains from implementation. Projects have involved working with Australia to trial the use of blockchain in issuing and verifying trade documents and working with the UK to trial quantum-secure cross-border electronic trade transactions.

There are signs of norm socialization and acceptance among a wider group of states. By the end of 2023, South Korea had become the first country to accede to DEPA; China, Canada, Costa Rica, and Peru had submitted applications, while others had expressed an interest in joining.Footnote 58 As we show in this article, Singapore's innovations are spreading to agreements where it is not a signatory, including the New Zealand–UK FTA and Australia–UK FTA. Meanwhile at the WTO, by October 2023 90 members, covering 90% of global trade, had joined the WTO Joint Statement Initiative on E-commerce. Several provisions that we identify in this article as part of the ‘Singapore-led’ wave are on the WTO JSI agenda and agreement has reportedly been reached on some of them.Footnote 59 In some cases, drafting language proposed in WTO talks emulates that found in DEPA, including by states that were not party to the agreement, such as the text on e-payments proposed by China.Footnote 60 This suggests a growing degree of acceptance of aspects of Singapore's approach.

Moreover, there are signs that some of Singapore's ‘like-minded’ states are now acting as a ‘norm leaders’ – an actor that is quick to adopt the innovations proposed by the norm entrepreneur and works to promulgate them.Footnote 61 This is most pronounced in the case of the UK. As we show in this article, all trade agreements that the UK negotiated after the conclusion of DEPA closely replicated the Singapore-led approach, and the UK actively seeks to promulgate this approach. As the UK's chief negotiator for the agreement with Singapore explained, ‘The challenge we set ourselves was to make the DEA the most innovative trade agreement in the world … Much of the strategic value in deals such as the DEA comes from the example they can set to others … The UK–Singapore DEA is set to become not only the new gold standard for the UK's digital trade agreements but also, we hope, a modern trade agreement that others can build on.’Footnote 62 Australia also seems to be playing a norm leadership role. Although it has pursued fewer digital trade agreements than the UK, it is active in WTO negotiations and initiatives within ASEAN. In contrast, while Chile and New Zealand helped to forge the Singapore-led approach, reflected in the DEPA agreement, we found no evidence that they are acting as norm leaders.

Overall, our analysis reveals substantial innovation in digital trade rulemaking, led by Singapore. We have found evidence of Singapore acting as a norm entrepreneur, and other countries, including the UK, acting as norm leaders. The norms and rules encapsulated in this ‘Singapore led’ approach are gradually being institutionalized in rules and organizations and some degree of socialization has occurred. However, the innovations embodied in the Singapore-led wave are yet to be widely accepted as global norms for digital trade governance.

4. The New Wave of Digital Rulemaking: In-Depth Analysis of Issue Areas

This section delves into the details of the six agreements we identify as part of the ‘Singapore-led’ wave of digital trade agreements, seeking to establish in precise terms how they compare with the previous US-led wave. The analysis is structured around the issues and scores presented in Table 1, focusing on areas where difference between the US-led and Singapore-led approaches are most prominent.Footnote 63

4.1 Trade Facilitation

The provisions on trade facilitation feature prominently in recent digital trade agreements, accounting for nine of the 34 topics in our database. The aim of these provisions is to support the digitalization of supply chains as, at present, end-to-end digital trade remains rare owing to non-interoperable systems, misaligned regulations, and inadequate underlying legislation.

In several areas, notably commitments on a moratorium on custom duties on electronic transmissions, electronic transaction frameworks, and electronic authentication and trust services, the Singapore-led agreements largely replicate the drafting language found in US-led agreements.Footnote 64 One notable difference is that commitments on electronic transactions frameworks are updated to refer to the UNCITRAL Model Law on Electronic Transferable Records (2017), although commitments to adopt the model law remain non-binding. A cross-border transaction requires, on average, exchange of 36 documents and 240 copies, and less than 1% of trade documents are fully digitized.Footnote 65 The 2017 model law seeks to enable the legal use of electronic transferable records that are linked to the delivery of goods or payment of money, both domestically and across borders, including bills of exchange, promissory notes, consignment notes, bills of lading, and warehouse receipts.

Singapore was the second country in the world to adopt the UNCITRAL 2017 model law after Bahrain and, in addition to promoting its adoption through commitments in its digital trade agreements, it has also embarked on pilot initiatives with Bahrain and the UK to explore how best to implement the legal changes.Footnote 66 Since 2021, the UK has also sought to champion the model law, drafting domestic legislation and promoting the model law during its G7 presidency. Another interesting feature is that the agreements that the UK is a party to, all include specific additional commitments on the conclusion of contracts by electronic means, modelled on language from EU agreements, to which the UK was a party prior to Brexit.

The novel aspects of the Singapore-led agreements are in the areas of paperless trade, digital identities, e-invoicing, e-payments, and logistics. While the commitments examined show a desire to improve regulatory cohesion and interoperability, they are mostly non-binding or include soft commitments to cooperate, indicating that specific binding approaches in these aspects of digital trade facilitation are yet to emerge.

Commitments on ‘paperless trade’ aim to support the digitalization of transactions between private actors and governments and government-to-government (e.g. digital single windows). US-led agreements include short, non-binding commitments to make trade administration documents available in electronic form and accept electronically submitted documents as legally equivalent to paper versions.Footnote 67 In contrast, the Singapore-led agreements introduce much more extensive commitments. In a lengthy provision, the parties in DEPA commit inter alia to: making electronic versions of all trade administration documents publicly available and endeavouring to provide them in machine-readable format; accepting electronic versions of trade administration documents as the legal equivalent of paper documents; establishing a single window and endeavouring to ‘establish or maintain a seamless, trusted, high-availability, and secure interconnection of their respective single windows’; and endeavouring to develop compatible and interoperable data exchange systems, and promoting and advancing the use of such systems.Footnote 68 This language is largely replicated in the Australia–Singapore DEA, Singapore–UK DEA, and Korea–Singapore DEA. The Korea–Singapore DEA includes an additional binding commitment to interconnect the parties' single windows.Footnote 69 The New Zealand–UK FTA, stops short of a binding commitment to accept electronic documents as legally equivalent to paper versions,Footnote 70 while the Australia–UK FTA simply makes best-endeavour commitments, like the CPTPP. Singapore's moves to promote interconnectivity of single windows and interoperable data exchange systems reflects its wider digitalization agenda. Singapore was a very early adopter of a national single window and has since embarked on a series of projects to achieve interconnectivity, including with Hong Kong, part of a wider move to promote a ‘Global Trade Connectivity Network’.Footnote 71

Provisions on digital identities were introduced for the first time in the DEPA and aim to promote regulatory coherence and, ultimately, enable mutual recognition and interoperability, making it easier to use digital identities in cross-border transactions. In DEPA, the parties ‘endeavour to promote the interoperability between their respective regimes for digital identities’,Footnote 72 and similar non-binding wording is found in the Korea–Singapore DEA. The Australia–Singapore DEA contains a slightly stronger commitment as the parties ‘shall pursue the development of mechanisms to promote compatibility between their respective digital identity regimes’,Footnote 73 a commitment mirrored in the Australia–UK FTA, New Zealand–UK FTA, and Singapore–UK DEA. Some agreements are accompanied by Memorandums of Understanding (MOUs) under which they agree to collaborate to work together on digital identities including developing a roadmap for interoperability and mutual recognition.Footnote 74 The relatively soft language in the Singapore-led wave of agreements reflects the fact that countries are at different stages in implementing digital identity regimes, and have very different approaches, ranging from national centralized digital identity schemes to decentralized models based on certification.

Provisions on e-invoicing and e-payments were also introduced through DEPA. E-invoicing schemes enable the exchange of invoice data directly between suppliers' and buyers' financial systems, using a pre-defined set of common data standards or structures, removing the need for paper invoices and manual processing along supply chains. DEPA requires parties to ensure that e-invoicing measures support cross-border interoperability and are based on international standards, where they exist, and to share best practices and collaborate on promoting the adoption of e-invoicing.Footnote 75 Similar wording is found in the Australia–Singapore DEA, Singapore–UK DEA, New Zealand–UK FTA, and Australia–UK FTA, while in the Korea–Singapore DEA the provision is entirely non-binding.

International payments are indispensable for cross-border trade and investment, but cross-border payments are still slow and expensive, with only around 60 countries having instant payment systems for domestic bank accounts in 2021.Footnote 76 DEPA includes a general binding commitment to foster the adoption of internationally accepted standards, interoperability, and innovation and competition in cross-border electronic payments.Footnote 77 A list of possible actions is included, couched in non-binding language. Similar commitments are found in the Australia–UK FTA and Singapore–UK DEA (in entirely non-binding language) but absent from the New Zealand–UK FTA. The commitments in the Australia–Singapore DEA and Korea–Singapore FTA are more substantial than those in DEPA. This includes a pledge not to unjustifiably discriminate between financial and non-financial institutions in terms of access to electronic payment systems, and to promote the adoption of international standards to enable greater interoperability between electronic payment systems.Footnote 78 Again, this variation reflects the state of play on the ground, as the central bank of Singapore has pioneered cross-border e-payment collaborations with central banks in several countries, including Malaysia, India, Thailand, and Australia.

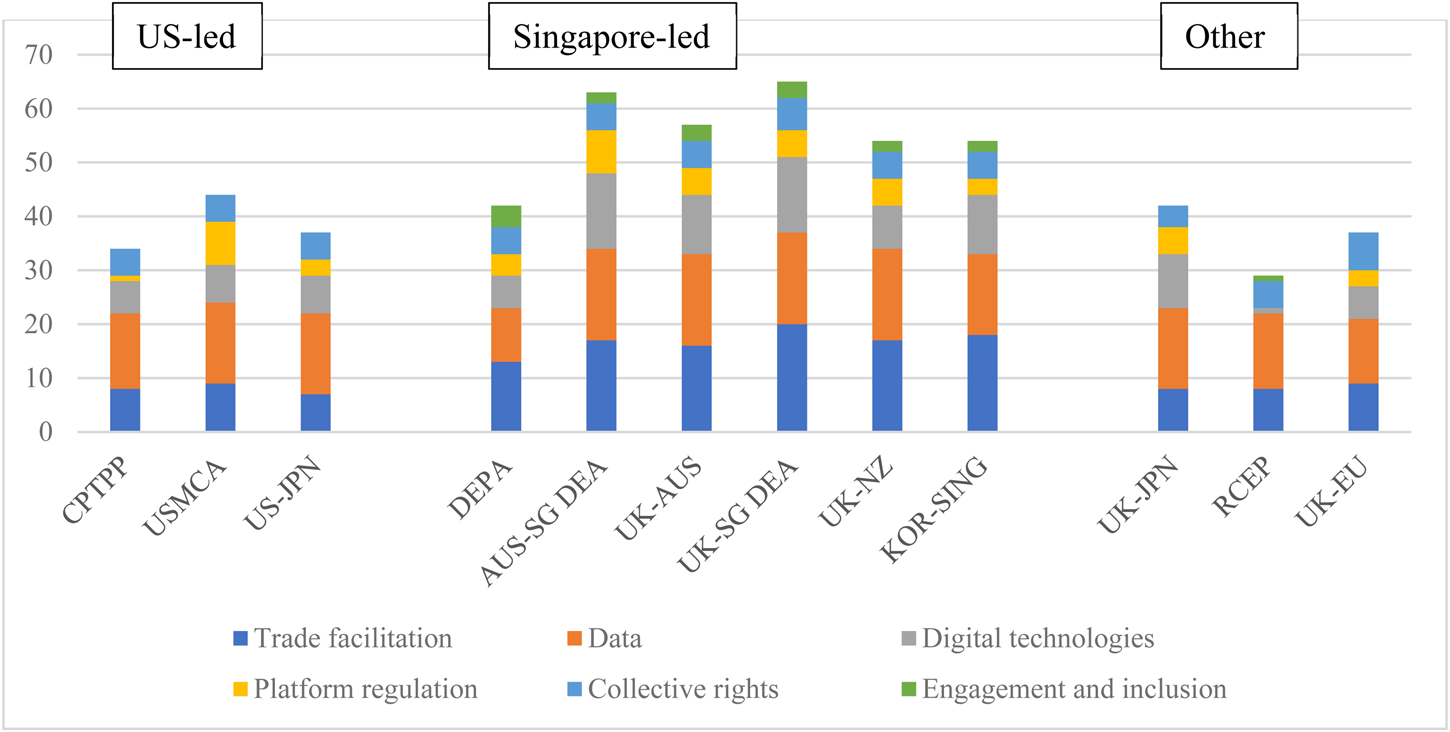

Logistics is the final area within trade facilitation where the Singapore-led agreements introduce changes. Last-mile delivery has proven to be one of the most challenging aspects of the shift to online retail sales, with logistics companies struggling to keep up with demand; retailers having little control or oversight of delivery companies; and delivery vehicles causing additional traffic congestion and pollution. In response, businesses are experimenting with on-demand and dynamic routing solutions, drones, and parcel lockers. These developments raise new questions for governments about how best to regulate these new delivery and business models.Footnote 79 DEPA was the first agreement to include a commitment on logistics, although it simply commits the parties to ‘endeavour to share best practices and general information’. Such commitments remain uncommon, as the Singapore–UK DEA and Korea–Singapore DEA are the only other agreements to include a similar, non-binding provision (Figure 2).

Figure 2. Extensiveness of trade facilitation commitments

Source: Aggregation of legal coding of provisions by authors (see Table 1).

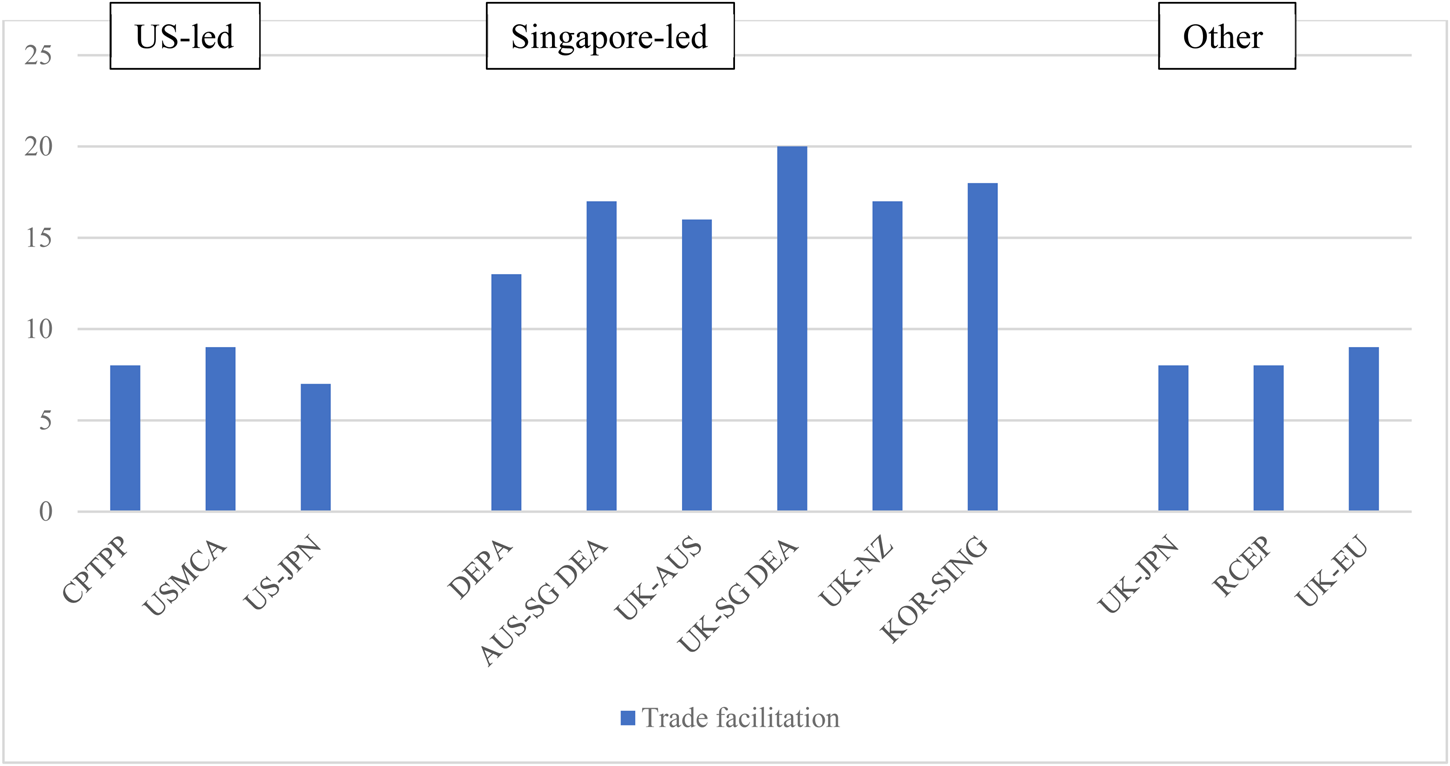

4.2 Data Governance

Data are fundamental to the global digital economy, and data flows underpin digital trade. The volume of data crossing borders has grown exponentially. While it is hard to gauge the economic value of these flows, some argue that cross-border data flows are at least as valuable as trade in goods.Footnote 80 Governments have different regulatory priorities, ranging from promoting business, to protecting privacy of citizens, to pursuing national security objectives, leading to very different approaches to data regulation.Footnote 81 Divergences are a major source of trade frictions, including among the US, EU, and China, and differences are reflected in very different commitments in their trade agreements.Footnote 82

The Singapore-led agreements replicate the US-led approach to commitments on cross-border data flows, data localization, and personal data protection, using the drafting language of the CPTPP with very minor modifications. This said, there are some subtle differences in specific agreements that are worth noting.

Financial data are usually subject to separate provisions, usually found in the financial services chapters of FTAs, so stand-alone digital economy agreements may leave out commitments on financial data altogether (as is the case with DEPA) or include separate provisions for financial data. Reflecting the sensitivities around financial data, including for prudential reasons, commitments are routinely subject to more extensive exceptions (reflected in the higher number of stars in Table 1). While commitments in the Singapore-led agreements are modelled on the CPTPP, the one exception is the Korea–Singapore agreement, where the commitment on localization of financial data is couched in non-binding language, reflecting Korea's preference for retaining a high level of regulatory autonomy.Footnote 83

The drafting language on personal data protection is also slightly different to the US-led agreements. The US-led agreements have binding but vaguely worded commitments. In the CPTPP, parties commit to adopting or maintaining a legal framework that protects the personal information of users of electronic commerce, while ‘taking into account relevant international guidelines’,Footnote 84 and the USMCA specifically references the OECD Guidelines on Privacy and Trans-border Flows of Personal Data and lists key principles on data protection. Such provisions are supplemented with a note that a party can comply with this obligation by adopting measures ranging from comprehensive privacy or personal data protection laws to voluntary privacy undertakings by companies.Footnote 85

By recognizing voluntary undertakings by private companies as sufficient for safeguarding personal data protection, US-led agreements set a very low bar for personal data protection measures. In addition, by recognizing voluntary undertakings as sufficient and simultaneously requiring (under the data flow commitments) that any measure imposed on data flows ‘does not impose restrictions on transfers of information greater than are required to achieve the objective’, US-led agreements effectively impose a ceiling on the stringency of personal data protection measures.Footnote 86 Moreover, if a party to US-style commitments adopts a comprehensive approach to data protection (such as the EU's GDPR) it may be open to challenge by its trading partner on the grounds that its approach is more burdensome than necessary, as it could have met its obligations through a less burdensome approach based on voluntary undertakings.Footnote 87

The Singapore-led agreements replicate the US-led approach, with some modifications. In DEPA there is a binding commitment to ‘adopt non-discriminatory practices in protecting users of electronic commerce from personal information protection violations occurring within its jurisdiction’Footnote 88 (under US-led agreements the wording is non-binding). Similarly, the commitment in DEPA on promoting compatibility and interoperability between respective regimes for protecting personal information is also stronger than in US-led agreements, where it is couched in best-endeavour language. It is noteworthy that reference to ‘voluntary undertakings’ is dropped from the note in the New Zealand–UK FTA and the Singapore–UK DEA.

US-led agreements introduced commitments on ‘open government data’, which are largely replicated in the Singapore-led agreements. Proponents argue that by making their datasets publicly available, public institutions increase their transparency and accountability to citizens, while the ability to use, reuse, and freely distribute datasets promotes business creation and innovative, citizen-centred services.Footnote 89 Since the Japan–US DTA and USMCA, digital trade agreements have usually included provisions on open government data, although these are generally worded as best endeavour commitments to digitalize the data that governments already make public, rather than commitments to further increase the availability of government data.Footnote 90 DEPA goes further by identifying specific areas of possible cooperationFootnote 91 while the New Zealand–UK FTA contains binding language, although it only obliges, for governments to provide ‘the opportunity to request’ the disclosure of specific government data and information.Footnote 92

One criticism of open government data is that major technology companies benefit disproportionately as they have the capacity to collect open data and correlate it with the ‘closed data’ they hold.Footnote 93 There is a growing concern that major technology companies leverage their control over data to reinforce their market power, prompting some jurisdictions to experiment with legally mandated data sharing.Footnote 94 DEPA was the first trade agreement to make reference to ‘data sharing’ although the commitments are generally worded and non-binding. In DEPA, the parties recognize that cross-border data flows and data sharing ‘enable data-driven’ innovation, and acknowledge that data sharing mechanisms, such as trusted data sharing frameworks and open licensing agreements, aid in innovation and knowledge diffusion, and foster competition. The parties commit to ‘endeavour to cooperate’ on data sharing projects and mechanisms.Footnote 95 Similar provisions are found in the Australia–Singapore DEA, Australia–UK FTA, Singapore–UK DEA, and Korea–Singapore DEA.

The approach to data governance in the EU–UK TCA and RCEP are very different. Although the EU–UK TCA exceeds the commitments on data flows and data localization found in previous EU agreements, the commitments remain far less extensive than those found in US-led and Singapore-led agreements. In the EU–UK TCA, the EU declined to make a general commitment on cross-border data flows although it did agree to a list of specific prohibitions related to data localization.Footnote 96 Several scholars have observed that the narrow exception in US-led agreements may unreasonably limit the scope of government measures intended to promote other significant policy goals, including personal data protection.Footnote 97 The EU, in particular, faces difficulties in making any legal commitment that would compromise its ability to implement measures related to personal data protection and the high data protection standards of its General Data Protection Regulation (GDPR).Footnote 98 The EU–UK TCA also includes comprehensive carve-out provision that allows for a very high level of regulatory autonomy with regard to personal data protection (attracting three stars in our coding). The parties agree that nothing in the agreement can prevent a party from adopting or maintaining measures to protect personal data and privacy, including cross-border data transfers, as long as the party's law provides for instruments enabling transfers under conditions of general application for the data's protection. The term ‘conditions of general application’ refers to objective conditions that apply broadly to many economic operators, covering various situations and cases, implying that the EU can adopt any approach it sees fit so long as it does so through a general rather than a specific (discriminatory) approach.Footnote 99

Reflecting on the sensitivities of some RCEP members, notably China, and determination to preserve regulatory autonomy over data, RCEP adopts the general CPTPP approach but builds in extensive self-judging exceptions. In the area of cross-border data flows, a party can implement an inconsistent measure ‘that it considers necessary to achieve a legitimate public policy objective’ or ‘that it considers necessary for the protection of its essential security interests’ [emphasis added]. Moreover, in the case of essential security, ‘such measures shall not be disputed by other Parties’ (Figure 3).Footnote 100

Figure 3. Extensiveness of data governance commitments

Source: Aggregation of legal coding of provisions by authors (see Table 1).

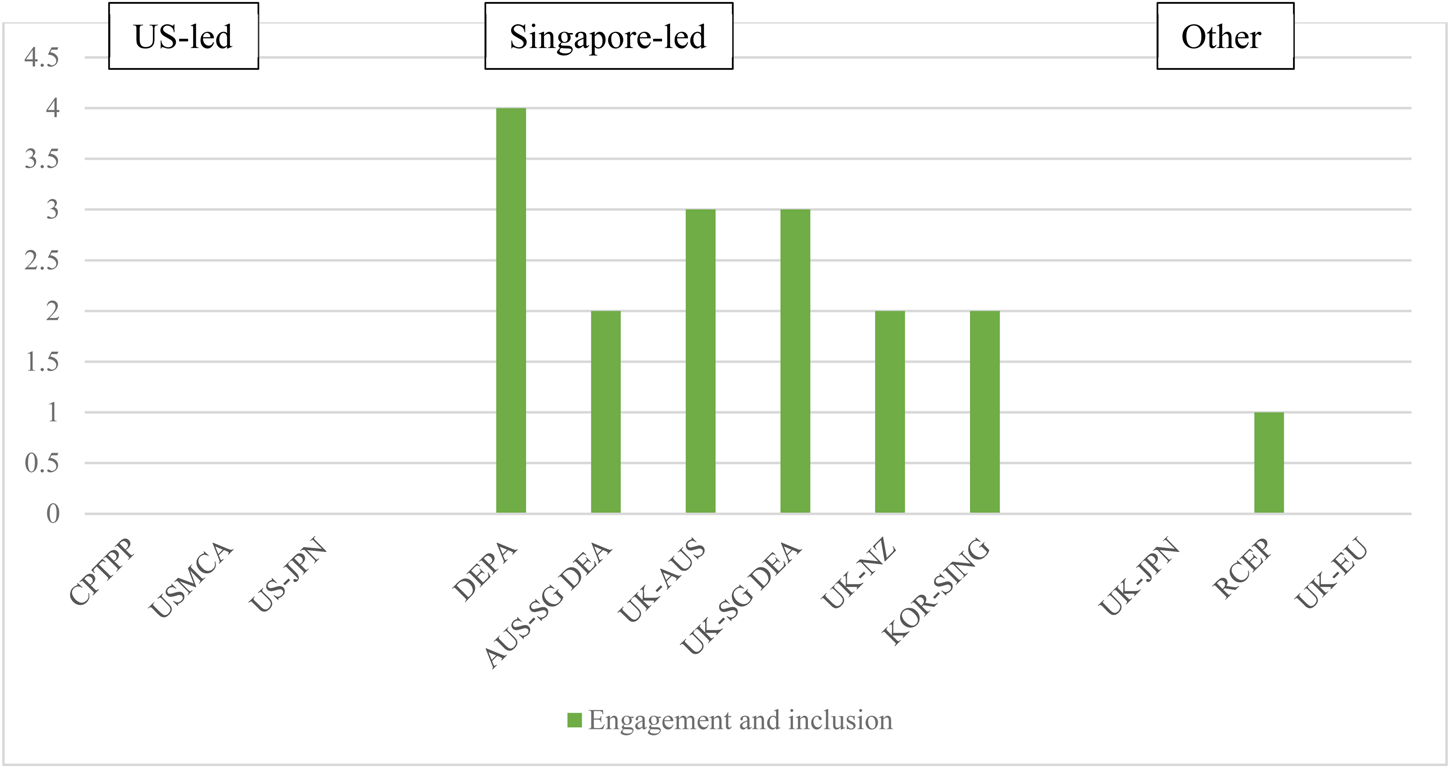

4.3 Regulation of Digital Technologies

Governments are increasingly concerned about the risks associated with the widespread use of digital technologies, such as algorithms and cryptography, including discrimination and a lack of fairness and accountability.Footnote 101 Trade agreements have begun to include provisions regulating the use and access of digital technologies, which have an impact on the fundamental rights of individuals, various government interests (such as law enforcement and innovation), and the commercial interests of technology firms.Footnote 102 As such, finding the delicate balance between the multiple interest at stake is a challenge that trade negotiators, like domestic regulators, are now faced with.

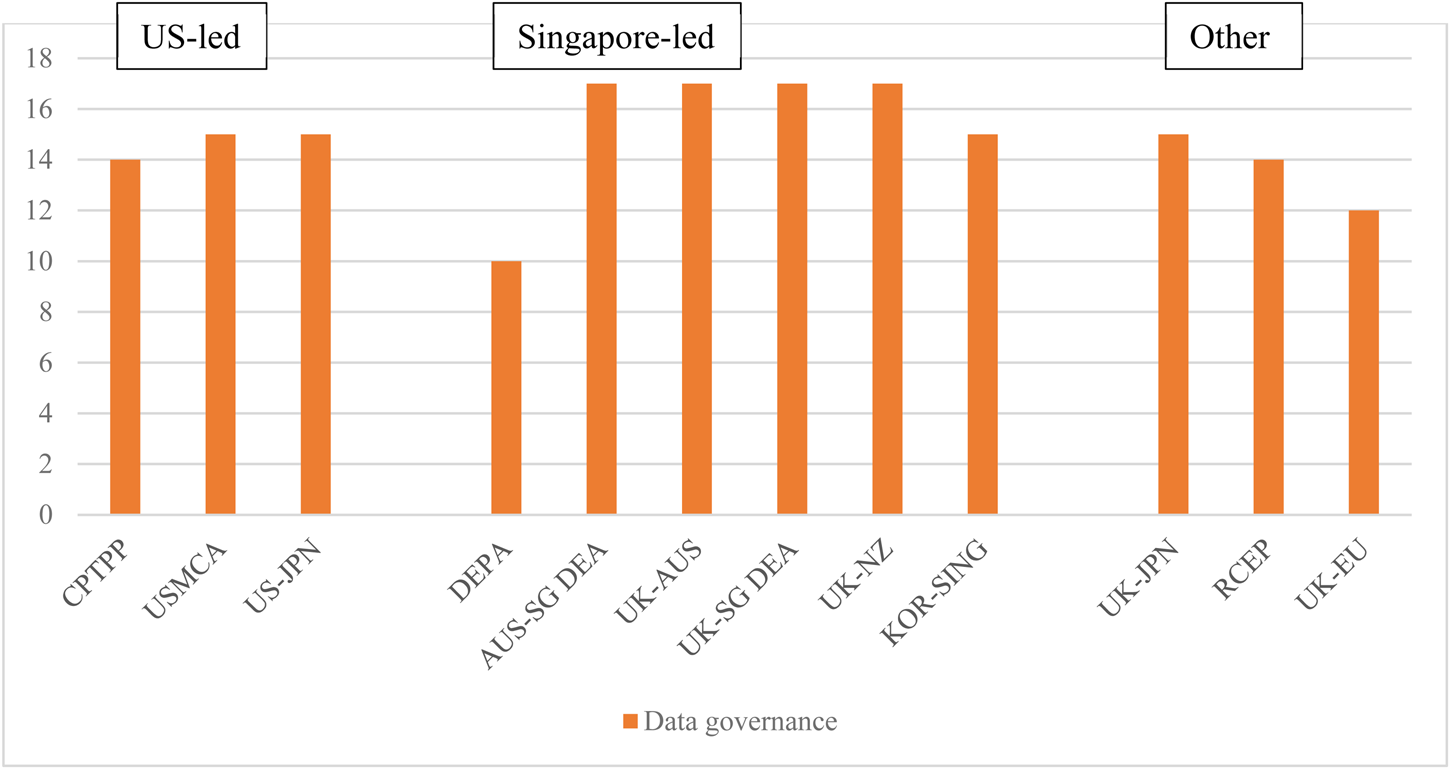

In the area of regulation of digital technologies, the Singapore-led wave of agreements largely replicate the US-led commitments on the mandatory disclosure of source code, regulation of ICT products that use cryptography, and regulation of new financial services, with minor modifications. However, they also innovate by adding new commitments in four areas: digital standards and conformity assessment, AI governance, regtech, and lawtech.

Provisions banning measures that mandate access to, or transfer, or source code have been at the heart of US-led agreements. They aim to protect technology firms from government measures requiring trade secrets to be disclosed as a prerequisite for operating in certain industries, most notably in China. US-led trade agreements offer extensive and binding intellectual property protection for source code which goes beyond the level of protection afforded under the WTO Trade-Related Aspects of Intellectual Property Rights (TRIPS) Agreement, with some deals explicitly including algorithms within the scope of protection. For instance, the CPTPP refers to the ‘source code of software’,Footnote 103 while the USMCA explicitly protects algorithms expressed in source code.Footnote 104 Referring specifically to ‘algorithms expressed in source code’ provides a higher level of protection by clarifying the scope of the provision, and this language has been criticized for potentially conflicting with proposals to regulate algorithmic decision-making, including addressing the risk of discrimination.Footnote 105 Prohibitions on disclosure of source code, software, and algorithms can also impede access to training datasets, hinder technology access and market competition, and limit the availability of open-source software.Footnote 106 The source code provisions in US-led agreements provide some exceptions, although they are narrow and do not address all public policy concerns.Footnote 107 The CPTPP only allows an exception to modify source code to comply with laws and regulations, while the USMCA and Japan–US agreements provide even narrower exceptions, granting access only to selected bodies on a case-by-case basis, thereby leaving no room for ex-ante regulation and oversight.Footnote 108

The Singapore-led wave of agreements includes source code provisions modelled on the provisions in US-led agreements. The text of Australia–Singapore, Australia–UK, and EU–UK agreements includes provisions on the source code of software, but does not include specific mentions to algorithms. In contrast, Singapore–UK, Japan–UK, and Korea–Singapore agreements include a direct reference to the ‘algorithm expressed in that source code’. The notable exceptions are the ones to which New Zealand is a party (DEPA and the New Zealand–UK FTA) and RCEP, which do not include such provisions. In November 2021, the Waitangi Tribunal found the source code provision in the CPTPP to be in breach of the Treaty of Waitangi, with Māori tech experts highlighting the risks of biased assumptions in algorithmic design or training data.Footnote 109 Following this ruling, New Zealand has excluded provisions on source code disclosure from its trade agreements. The absence of similar provisions in RCEP is not surprising given China's history of requiring technology transfers as a condition of doing business.Footnote 110

While there has been some evolution and change in the drafting language of the exceptions when compared to that of a US-led agreement, the level of public policy flexibility granted to the parties in Singapore-led agreements is still limited. The Australia–Singapore agreement widens the range of authorities that can request parties to preserve and make available the source code, including government agencies and requests made in the context of administrative proceedings in the list of exceptions.Footnote 111 The Japan–UK text includes a mention of conformity assessment bodies, and the EU–UK TCA includes exceptions for measures adopted in the context of a ‘certification procedure’.Footnote 112 Notably, the EU–UK agreement expands the scope of the exception by explicitly stating that the provisions do not affect requirements related to competition law, the ‘protection of public safety with regards to users online’, and intellectual property rights.Footnote 113

Subsequent deals include a mix of this wording. The Australia–UK deal allows more government bodies to require disclosure, including a government agency, regulatory body, administrative tribunal, or judicial authority, or a designated conformity assessment body.Footnote 114 The Singapore–UK DEA does not mention government agencies, but also includes a mention of conformity assessment bodies and allows access in a wider range of contexts (including for monitoring compliance with codes of conduct and standards).Footnote 115 The Korea–Singapore text includes a reference to government agencies' administrative proceedings, but no reference to conformity bodies.Footnote 116 Overall, while provisions in the Singapore-led texts are slightly broader exceptions when compared to the US-led texts, these exceptions do not constitute a comprehensive public policy carve-out and are not sufficient to ensure governments will have flexibility to implement ex ante regulation aimed at improving algorithmic transparency and accountability, such as transparency requirements being introduced with the AI Act in the EU. Further, by focusing only on public authorities, these exceptions side-line technical experts from academia and civil society.Footnote 117 Importantly, they may not guarantee access for individuals, workers, or businesses concerned about potential unfair treatment linked to algorithmic decision-making.Footnote 118

The Japan–US agreement was the first to include provision on the use of ICT products that use cryptography, and this provision was replicated in all of the more recent agreements we examined, with the exception of RCEP and the EU–UK TCA.Footnote 119 Overall, these provisions are very similar and prohibit parties from adopting regulation that requires access to a particular cryptography technology, production process, or information – for example the access key.Footnote 120 However, while encryption of private communications is crucial in safeguarding the privacy and freedom of speech of individuals,Footnote 121 businesses might also use it to evade scrutiny of their practices, which could result in reduced transparency and accountability of their operations. Therefore, there is a need for trade provisions to strike a balance when safeguarding the interests served by cryptographic technology.

Except for the Japan–US DTA (which does not cover services liberalization), US-led agreements include commitments on the supply of new financial services that promote market access for Fintech companies. Under the CPTPP for instance, the parties commit to ‘permit a financial institution of another Party to supply a new financial service that the Party would permit its own financial institutions, in like circumstances, to supply without adopting a law or modifying an existing law’,Footnote 122 with a ‘new financial service defined as “a financial service not supplied in the Party's territory that is supplied within the territory of another Party’. This provision enables Fintech innovators to register and develop their project in the territory of any of the signing parties and be treated as an innovator, including having access to regulatory sandboxes, where the regulatory regime is softened to allow for the creation and testing of new financial services.Footnote 123 However, this commitment is qualified by an exception specifying that ‘a Party may determine the institutional and juridical form through which the new financial service may be supplied and may require authorization’, although an authorization decision must be made ‘within a reasonable period of time’. The Party may refuse the authorization but ‘only for prudential reasons’.Footnote 124

The Singapore-led agreements typically include commitments on providing market access for new financial services that replicate the US approach (although these are absent from DEPA and the Korea–Singapore agreement). Several also include a commitment to promote cooperation with, for instance, the Singapore–UK DEA stating that the Parties ‘shall endeavour to collaborate, share knowledge, experiences and developments’ to advance financial integrity, consumer protection, financial inclusion, financial stability, operational resilience, sustainability and facilitation of cross-border development of new financial services (Singapore–UK DEA, article 8.53). Similar language is found in the Australia–Singapore DEA and the New–Zealand–UK FTA. DEPA, which does not cover financial services, excludes a commitment on the supply of new financial services and only includes a binding commitment to cooperate in the promotion and regulation of financial innovation. An MOU on a ‘fintech bridge’ accompanies the Singapore–UK DEA, and aims at reviving an earlier cooperation agreement, as well as strengthening cooperation between regulators and industry to promote the sector.

In terms of new issues, Singapore-led agreements introduced commitments to promote the development of standards and conformity assessment for digital technologies. US-led agreements include general commitments to build on WTO agreements around standards, trade facilitation, and tariff reductions, but they are not tailored for digital trade.Footnote 125 Specific commitments appear in three agreements (Australia–Singapore DEA, Singapore–UK DEA, and Korea–Singapore FTA).Footnote 126 In the new provision, the parties recognize the importance of standards, technical regulations, and conformity assessment procedures in fostering the digital economy and reducing barriers to trade. They make non-binding commitments to cooperate in developing and adopting standards that support digital trade and to ‘endeavour to share information’. Although these provisions are mainly aspirational, the Korea–Singapore deal provides more detailed language, listing principles and procedures that could be observed when developing standards for the digital economy.Footnote 127

All six of the Singapore-led agreements incorporate provisions that reflect the growing interest in regulating AI, which were absent from US-led agreements.Footnote 128 However, these are mostly procedural obligations or weak commitments to cooperate, rather than substantive binding commitments, and in some cases are accompanied by MOUs. Some agreements, such as DEPA and the Australia–Singapore DEA, focus on ethical governance frameworks and promote the adoption of principles for the responsible use of AI.Footnote 129 The Australia–UK deal is more focused on reaping the economic benefits of these technologies but also recognizes the relevance of governance frameworks.Footnote 130 The Singapore–UK DEA features a more balanced provision, including substantive obligations to develop policy frameworks and promote algorithmic transparency,Footnote 131 while the New Zealand–UK agreement establishes cooperation on matters such as ethical use and industry-led standards to mitigate issues such as unintended biases and existing divides.Footnote 132 As in the Singapore–UK deal, the New Zealand–UK article refers to measures to improve fairness and accountability of AI, but provides a slightly improved wording of the provision, establishing that cooperation may include ‘ethical use, industry-led standards, and algorithmic transparency, to address issues such as unintended biases and exacerbation of existing divides, by ensuring human diversity is recognised in the development of technologies’.Footnote 133 While many governments are grappling with AI regulation, Singapore has been particularly active in seeking to shape the global policy agenda, launching its Model AI Governance Framework at the World Economic Forum in Davos in 2019, and launching the world's first testing framework and toolkit ‘AI Verify’ in 2022. This was followed by the AI Verify Foundation in 2023, a related multi-stakeholder organization where members can collaborate on AI governance and testing, and which aims to shape international standards on AI.

Provisions on regtech and lawtech were not included in the US-led wave of agreements and feature in only two of the more recent agreements (Australia–Singapore DEA and Singapore–UK DEA). These provisions encourage the adoption of digital technologies in the legal and regulatory sectors, with the aim of improving efficiency, reducing costs, and increasing regulatory compliance. Lawtech provisions typically focus on promoting digital technologies to improve the efficiency and accessibility of legal services, for example through online dispute resolution mechanisms.Footnote 134 Regtech provisions, in turn, are focused on promoting the use of digital technologies to improve regulatory compliance and reduce the burden of compliance for businesses, usually with a focus on financial services (and are usually bundled with commitments on fintech).Footnote 135 The Australia–Singapore DEA was the first to refer to regtech and commits the parties to encourage collaboration between regulators and agencies and promote industry collaboration.Footnote 136 The more recent Singapore–UK DEA provides similar (although non-binding) language on regtech collaboration,Footnote 137 and innovates by including the first stand-alone provision on lawtech.Footnote 138 The article lists potential areas for collaboration, including establishing a dialogue; encouraging the sharing of knowledge between their respective regulators, academics, representative bodies, and industry bodies; and encouraging service suppliers to explore new business opportunities in the other party's territory (Figure 4).

Figure 4. Extensiveness of commitments on regulation of digital technologies

Source: Aggregation of legal coding of provisions by authors (see Table 1).

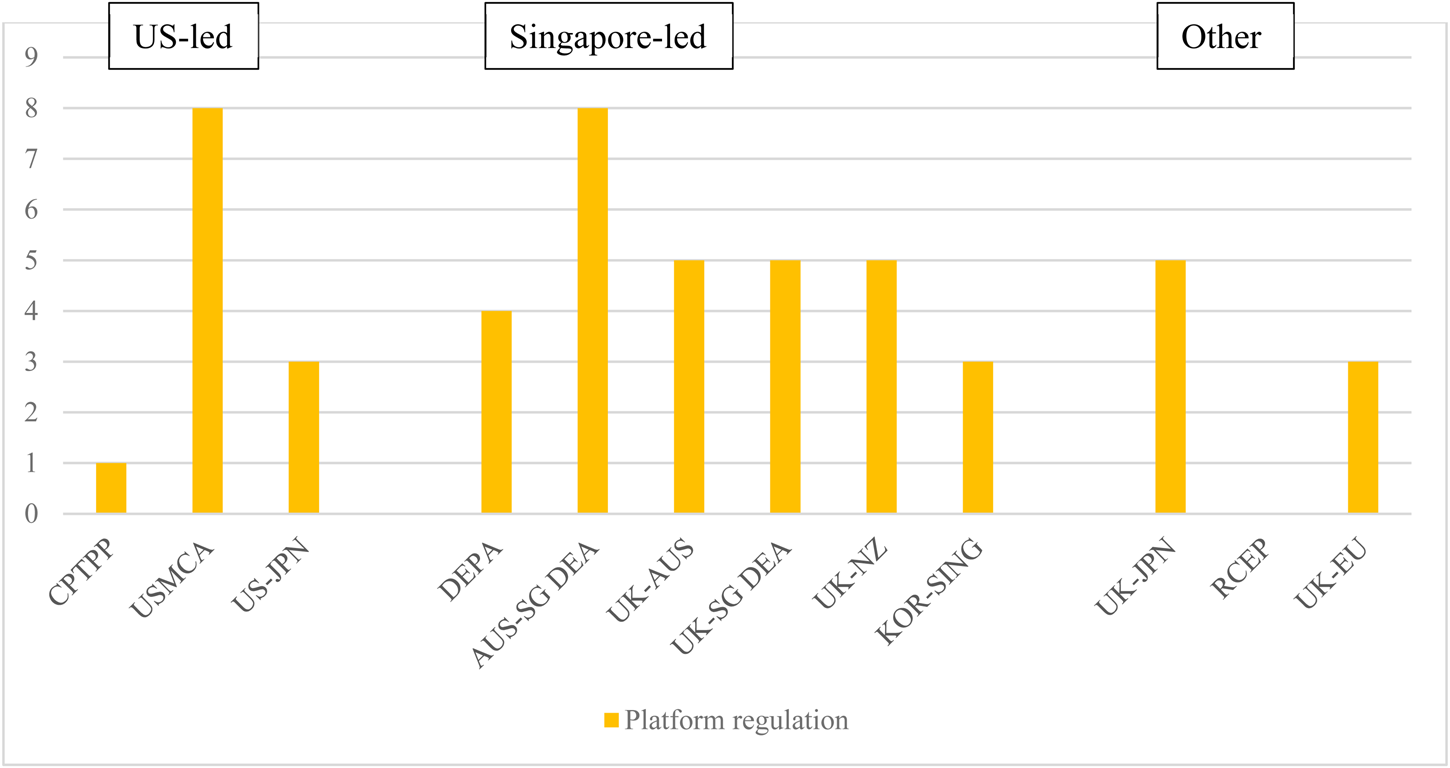

4.4 Regulation of Internet Platforms

The growing penetration of digital platforms creates a new dimension of regulatory and public policy concerns, given the types of content internet users are exposed to and to the interconnected structure of digital ecosystems.Footnote 139 Notably, there has been growing concern about online safety and the extent to which technology companies should take measures to protect users from online harm, which has grown alongside the increasing market power of digital platforms,Footnote 140 and efforts to promote innovation and competition in digital markets.Footnote 141

US-led agreements focused on protecting internet platforms from liability for third-party generated content, protections that are seen as crucial for the growth of online platforms and services.Footnote 142 Internet platform liability provisions have been specific and binding, establishing prescriptive rules on the type of liability regime parties should adopt, while providing no policy or regulatory flexibility through carve-outs or exceptions. During TPP negotiations, the US introduced a commitment aimed at limiting the liability of internet platforms with regard to infringement of intellectual property, a provision that was then suspended when the US withdrew.Footnote 143 The USMCAFootnote 144 and the Japan–US DTAFootnote 145 agreements went further, including provisions on general intermediary liability explicitly modelled on the contentious section 230 of the US Communications Decency Act (CDA), which provides a blanket liability waiver for internet companies that host user-generated content as regards the behaviour of their users.Footnote 146 In both cases, there are no carve-outs or flexibilities that would allow parties to diverge from the safe-harbour model adopted by section 230 of the CDA, exporting the controversial US framework to its trade partners.Footnote 147 The USMCA, in particular, also includes incredibly detailed and binding rules on intermediary liability for intellectual property infringement, committing parties to adopt rules that mimic section 512 of the US Digital Millennium Copyright Act (DMCA).Footnote 148 Except for DEPA and Korea–Singapore DEA, which do not include any provisions on this matter, the Singapore-led agreements follow the original TPP language and only include provisions limiting the liability of internet platforms with regards to infringement of intellectual property. These provisions are generally considered less controversial when compared to broader liability rules, as several countries, including the US and EU, have enacted domestic legislation that protects internet service providers from copyright liability under safe harbour rules.Footnote 149 Notably, the influential US model has also significantly influenced copyright law and policy in Singapore.Footnote 150

Four of the agreements we classify as ‘Singapore-led’ include novel commitments aimed at enhancing internet safety and trust.Footnote 151 This reflects a broader trend in which governments worldwide are discussing domestic regulation. This is for the purpose of increasing the accountability of internet platforms for the content they host, and to prevent the spread of harmful content, such as hate speech, disinformation, and violent extremist content that can harm individuals and the overall health of the digital public sphere.Footnote 152 However, the commitments are mostly procedural and non-binding. For instance, DEPA contains provisions recognizing the relevance of safety and security online for supporting the digital economy and the importance of a multi-stakeholder approach, but only commits parties to ‘endeavour to cooperate’ in advancing global solutions.Footnote 153 Among the agreements examined, the Australia–Singapore DEA features the strongest language on safety and security, with commitments to create and promote a safe online environment, protect users from harmful content, and collaborate within international forums.Footnote 154 While these commitments appear in the agreements to which Singapore is a party, they are absent from the Australia–UK and New Zealand–UK agreements, suggesting that this is a commitment which is yet to be emulated.

US-led agreements, including the CPTPPFootnote 155 and USMCA,Footnote 156 do not include strong provisions on internet access, merely acknowledging the benefits of user choice in accessing services and applications, with a broad mention of ‘reasonable network management’.Footnote 157 This aligns with the US government's domestic policy at the time of revoking network neutrality commitments.Footnote 158 Singapore-led agreements, including DEPA,Footnote 159 the Australia–Singapore DEA,Footnote 160 and the Korea–Singapore deal,Footnote 161 mirror this weak approach, simply ‘recognizing the benefits’ of an open internet. In contrast, EU-led texts include stronger commitments. The Japan–UK agreement requires parties to adopt or maintain appropriate measures to ensure consumers' access to the internet, ‘subject to reasonable, transparent and non-discriminatory network management’.Footnote 162 The EU–UK TCA features the most specific provision, commitment parties to ensure users' access to services and applications, subject to network management that is not only reasonable, transparent, and non-discriminatory, but also adding the term ‘proportionate’.Footnote 163 However, in both the Japan–UK and the EU–UK agreements, there are wide carve-outs in place, as commitments are subject to the parties' ‘applicable policies, laws and regulations’.

Competition in digital markets is another area where provisions are starting to emerge, with language first introduced through DEPA. The need to enhance competition in digital markets has been at the forefront of the agendas of policymakers and regulators, as there is a growing understanding that conventional competition laws need updating to address the unique challenges of digital markets.Footnote 164 While there are variations in wording, the Australia–Singapore DEA,Footnote 165 Australia–UK FTA,Footnote 166 Singapore–UK DEA,Footnote 167 and New Zealand–UK dealFootnote 168 contain similar non-binding commitments expressing specific competition concerns related to digital markets. These provisions acknowledge the significance of international cooperation and outline a non-exhaustive list of areas where parties may collaborate, including exchanging information, sharing best practices, providing advice or training, and exchanging officials. The language in DEPA is slightly stronger, as the parties have agreed to cooperate on competition enforcement issues in digital markets. However, this commitment is subject to the carve-out that parties ‘shall cooperate in a manner compatible with their respective laws, regulations and important interests, and within their reasonably available resources’ (Figure 5).Footnote 169

Figure 5. Extensiveness of commitments on regulation of internet platforms

Source: Aggregation of legal coding of provisions by authors (see Table 1).

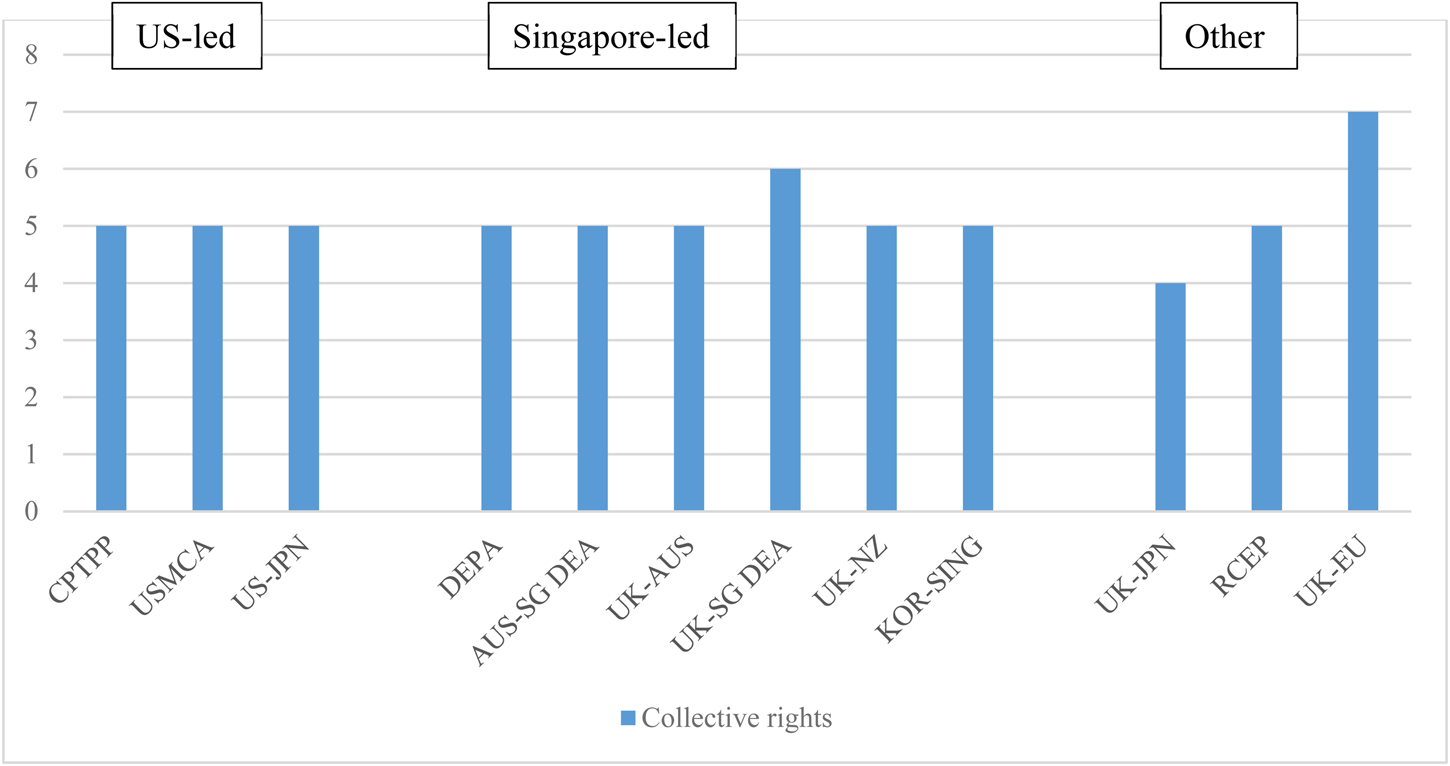

4.5 Collective Rights

The rise of the digital economy has brought with it distinctive challenges for consumer protection, labour rights, and cybersecurity in the context of international trade. Global consumers are often hesitant to engage in cross-border transactions online, owing to a lack of security and insufficient mechanisms for addressing digital-specific issues. While some trade agreements have made progress in regulating consumer issues, emerging issues such as spam, cybersecurity, and labour protection have traditionally been perceived as non-trade related, leading to slow progress.Footnote 170 However, there is a growing recognition that a well-functioning digital economy must protect consumers, workers, and the digital infrastructure.

US-led agreements included commitments to protect online consumers, regulate spam, and cooperate on cybersecurity measures. These have been largely replicated in the Singapore-led agreements, although they have also been extended in some instances. Provisions on online consumer protection in US-led agreements oblige parties to ‘adopt or maintain consumer protection laws to proscribe fraudulent and deceptive commercial activities that cause harm or potential harm to consumers engaged in online commercial activities’.Footnote 171 The CPTPP and USMCA also contain commitments to cooperate to enhance consumer welfare in the context of digital trade, cross-referencing the commitments made on consumer protection elsewhere in the agreement so that they also apply to an online context.

The Singapore-led agreements generally follow the approach of US-led agreements with some adjustments. Notably DEPA goes slightly further than the US-led agreements as the parties ‘recognize the importance of’ providing redress for online consumers, including when they transact with suppliers from another party, and the parties will ‘endeavour to explore’ the benefits of mechanisms, including alternative dispute resolution, to facilitate the resolution of claims relating to e-commerce transactions.Footnote 172 Similar language is found in the other Singapore-led agreements. The one exception is the New Zealand–UK agreement, which takes a different approach, inserting a provision in its consumer protection chapter that commits the parties to ‘provide consumers engaged in online commercial activities with a level of protection not less than that provided under its law to consumers engaged in other forms of commerce’.Footnote 173 The consumer protection chapter also includes a binding commitment on facilitating access to cross-border redress which is not found in the other agreements we examined, providing a higher level of online consumer protection.Footnote 174

Provisions on spam in the US-led agreements are binding and vague, requiring parties to take measures to minimize unsolicited electronic messages and provide recourse against suppliers that do not comply, but providing governments with latitude to determine how they do this. USMCA extends the scope to ‘unsolicited commercial electronic communications sent other than to an electronic mail address’.Footnote 175 However, these commitments have been criticized as they do not address current concerns such as privacy infringement, due process issues, and the increase of spam attacks through botnets and malware.Footnote 176 Singapore-led agreements follow the same approach as the US. In agreements where the UK is a party, an additional clause is included, drawn from EU agreements. It states that ‘Each Party shall ensure that commercial electronic messages are clearly identifiable as such, clearly disclose on whose behalf they are made, and contain the necessary information to enable recipients to request cessation free of charge and at any time.’Footnote 177 The approach of Singapore-led agreements continues to be less robust than that of the EU, where commitments have a wider scope as they apply to ‘unsolicited direct marketing communications’ and prior consent is required, except in case of advertising the supply of ‘their own similar goods and services’.Footnote 178