In conventional analysis, contracts exist within formal institutional frameworks built on coercive enforcement (North Reference North1990). The posting of collateral in corporate lending provides an egregious instance. Collateral is a vital instrument for ensuring the performance of debt contracts. In standard corporate debt models of collateral provision, collateral is pledged because of a lack of information on the borrower’s type or because of monitoring difficulties. Theory interprets collateralization as an institution that can mitigate information asymmetry and moral hazard in credit relationships. The act of posting collateral is a costly signal; as such, it helps borrowers disclose their quality to lenders ex-ante. Moreover, increasing borrowers’ stakes ex-post limits insider incentives to mismanage resources and protects investors against dilution. A consequence is that, by decreasing the need to investigate the project behind the debt, the posting of collateral makes debt less “information-sensitive” (Berger, Frame, and Ioannidou 2011; Gorton and Ordoñez Reference Gorton and Ordoñez2014).

Consistent with such economic logic, private credit markets’ reliance on collateral dates back far in time. Economic agents soon realized that the pledging of assets and the creation of automatic repossession mechanisms would support lending. For instance, land registries were developed in Early Modern Britain to identify and mobilize private property as security to assist lending activity (Ito Reference Ito2013). In today’s corporate debt markets, investors achieve collateralization with the help of Central Securities Depositories (CSD). Capturing the essence of the coercive logic, CSDs operate as trustees for the owners of the security, storing collateral and automatically transferring it to secured lenders in case of non-performance. Equally crucially, in cases of dispute, courts have jurisdiction over collateral ownership. Research documents a positive link between collateral enforceability and performance and credit (Degryse et al. Reference Degryse, Ioannidou, María Liberti and Sturgess2020; Calomiris et al. Reference Calomiris, Larrain, Liberti and Sturgess2017).

Against this backdrop, a puzzling phenomenon is the appearance of collateral clauses in sovereign debt contracts as happens nowadays in the context of Chinese agencies’ lending to developing countries (IMF and World Bank 2020). This phenomenon puzzling because of how difficult it is to repossess sovereign property. As the design of modern CSDs underlines, securing creditors through tangible repossession guarantees requires borrowers to surrender control over their property. In the case of a sovereign asset, this amounts to a reduction of sovereignty. But shackling sovereigns is difficult because, while decrees and laws can be made instructing government agents to transfer to creditors the income from a certain source, decrees and laws can be made to repeal the instruction. In fact, sovereign immunity doctrines and politics place limits on foreign and domestic courts’ ability to bind sovereigns.

While sovereign debt hypothecations existed before, the nineteenth century, a period sometimes described as the “first age of financial globalization,” generalized their use (Gelpern et al. Reference Gelpern, Sebastian Horn, Parks and Trebesch2022, p. 6; Jenks Reference Jenks1927). As Fishlow (Reference Fishlow1985, p. 400) describes, “customs, land-holdings, and other natural resources” became ubiquitous in foreign government debt prospectuses. A famous instance was the Peruvian loans secured with the help of guano, a bird manure, pledged as security in numerous contracts (Mathew Reference Mathew1981; Vizcarra Reference Vizcarra2009). As we shall see, collateral clauses had critics and yet, when the center of sovereign lending shifted to New York in the twentieth century, sovereign hypothecations remained part of the boilerplate. They were extensively used during the sovereign debt boom of the 1920s (Coleman Reference Coleman1936).Footnote 1 To date, the purpose they served has remained a matter of debate.

In the existing literature, historical sovereign hypothecations have been understood in three different ways. First and foremost, they have been read against the backdrop of their corporate counterpart that is, emphasizing the execution of the security. For instance, Vizcarra (Reference Vizcarra2009) argues that guano in Peruvian bonds was an attractive security because, being an export commodity, it was an easy target for creditor execution in case of default. The threat of foreign interception would have rendered the collateral executable, conferring credibility to Peru’s debt, pretty much as would have been the case with a secured corporate loan.

A second idea is that hypothecations might have existed because of the willingness of imperial powers to enforce them. Pondering the meaning of ostensibly unenforceable historical sovereign debt contract, legal scholar W. Mark C. Weidemaier (Reference Weidemaier2010) suggests that the clauses they contained were rooted in the implicit understanding that violations of provisions would trigger the dispatch of British gunboats. Ahmed, Alfaro, and Maurer (Reference Ahmed, Alfaro and Maurer2010) liken the function of gunboats to that of a court of justice having the power to execute a defaulter. If this “contracting for state intervention” view is applied to the specific case of hypothecations, then a possible interpretation is that hypothecations were written down because they were in fact enforceable.

A final interpretation holds that hypothecations were a scam. Sovereign hypothecations created with the complicity of law firms had a deceptive intent. And the method used was to create a misleading likeness with corporate collateral. As Coleman (Reference Coleman1936, p. 674) puts it, “lawyers took over from the field of corporation law principles which, although valid in that field, were in no sense applicable to a sovereign nation.” In fact, he says sovereign hypothecations were “phantom security.” In the words of Allen W. Dulles, speaking before the U.S. Securities and Exchange Commission as it examined secured bond lending in both the sovereign and corporate context, sovereign hypothecations were for their part not “worth the paper they are written on” (Securities Exchange Commission 1936, pp. 17, 22).

Though these interpretations contain elements of truth, they do not fully account for the hypothecation phenomenon. Drawing on the experience of the “hypothecation mania” of the mid-nineteenth century (1849–1875), we argue they fail to grasp the legal context. Under then prevailing understandings of sovereign immunity, sovereign assets were privileged, even when located abroad. Next, current interpretations of the Law of Nations (Jus Gentium) held that it was up to the government of the creditor country to enforce the contract. Thus, the British government was tasked with deciding whether it should intervene on behalf of British creditors. However, fearing moral hazard and given that debts issued in London were held globally, Britain developed a doctrine that ruled out enforcement. Finally, investors, educated by well-informed corporate lawyers, had a rather good grasp of this legal context, making them unlikely prey to systematic exploitation.

Against this backdrop, this paper elaborates a novel explanation of sovereign hypothecations. We argue that sovereign hypothecations were not at all about repossession. They were about information provision. We show this by gathering and examining the population of individual sovereign capital calls on the London Stock Exchange during the period 1849–1875. Albeit many (more than half) of the bond issues had collateral clauses, very few considered enforcement. Typical hypothecations did not even bother to discuss the repossession process, using instead vague words such as “solemn pledge.” There were indeed a few cases where the security could be executed; But, as we find, they were a minority. We will refer to the first template as Type I and to the second as Type II.

A heuristic way to distil the logic at play in sovereign hypothecations is to think of “Fintech” and “Big Data” lending, which relies on information automation technologies to reduce information asymmetries.Footnote 2 The literature describes how lenders take advantage of modern technology to organize data harvesting, resulting in what the authors describe as a “data for collateral” substitution effect (Gambacorta et al. Reference Gambacorta, Yiping Huang, Qiu and Chen2023). Likewise, we argue that in the historical context we consider here, lawyer-structured sovereign hypothecations took advantage of the data that financial intermediaries were coming by, turning information into screening technologies and ultimately facilitating third-party lending.Footnote 3

Likewise, we argue that, at a time when fragmentary tax data was the norm, sovereign lending was often a blind date, triggering efforts by private lenders to overcome resulting information asymmetries (Flandreau Reference Flandreau, Flandreau, Holtfrerich and James2003). In such a context, collateralization provided creditors with the opportunity to extract reliable evidence on tax-harvesting output. Ex ante, hypothecations mitigated the limited visibility over the country’s fiscal process by identifying a fiscal resource and describing its earning capacity. Ex post, collateral clauses set precise progress-to-repayment checklists, allowing bondholders to focus monitoring efforts.Footnote 4

As we document, hypothecations served to construct sometimes complex data observatories that informed investors about local fiscal developments. This was done through setting up a monitoring technology. Concretely, the legal engineers who crafted sovereign hypothecations exploited creatively the fact that the economic flows that crisscrossed the burgeoning global economy left measurable traces. Operatives were tasked with following the money. For instance, if custom revenues had been pledged, local agents posted at the customhouse would follow the collection of the interest service. They would then provide updates to London via mail or telegraph, enabling investors to know if the government had transferred the funds as stipulated in the covenant. These updates enabled tracking the funds all the way to the banker’s counting house in London. Conversely, if a diversion occurred, bondholders would learn about it firsthand, providing a signal for mobilization.

The observatory functioned like a data-generating algorithm: “security” was not a physical asset reassigned automatically by a third party; it was a process instead. This process afforded many advantages. By creating checkpoints, the hypothecation observatory system provided for synchronized disclosure, limiting the risk that investors would be trading against superior information. It revealed the fiscal position because each new debt had to identify a matching resource. It checked over-borrowing because a sovereign running out of collateral had to stop borrowing or re-hypothecate, a form of spoliation. By clarifying responsibilities and rights, sovereign collateral also helped coordinate creditor interventions in case of default.

At a fundamental level, this paper uncovers the function of lawyers and law firms as designers of legal-financial institutions, contributing in a so far overlooked way to the export of capital. The story we tell is that of the major contribution English lawyers made to unlocking the international capital market and of a surprising “modern” channel whereby this was achieved—through improved data harvesting. The emphasis on financial inclusion as a precondition for development is familiar in classic accounts of the import of institutions for economic growth. Yet, as suggested by North and Weingast (Reference North and Weingast1989), the perspective is domestic and macro-economic. It focuses on such macro-institutions as State, Parliament. Departing from this conventional approach, we document the micro-economic and transnational underpinnings of private monitoring and information production outside the purview of the sovereign borrower. We do not say that such a regime was without shortcomings. But we do say that its existence has not been recognized before and should be considered seriously in future research.

SOVEREIGN DEBT CONTRACTS IN THE AGE OF ABSOLUTE SOVEREIGN IMMUNITY

Sovereign Hypothecation Not a Security

One influential view about sovereign collateral is that, thanks to clever selection of the security, it could operate as corporate collateral. A previous paper published in this Journal by Vizcarra (Reference Vizcarra2009) argues that guano extracted from Peru’s state-owned repositories in the Chincha Islands credibly secured Peruvian bonds issued in London after 1849. The reason for the trustworthiness of the instrument would be that guano could be seized abroad. According to Vizcarra (Reference Vizcarra2009, pp. 359, 376), the guano security was credible since its handling “did not involve meddling by the Peruvian government. […] Guano revenues were collected at the point of sale abroad […] outside the jurisdiction of the Peruvian government.” The assumption is that creditors could collect with the help of the courts of justice.

Under absolute sovereign immunity as it prevailed in the nineteenth and early twentieth centuries in English courts of justice however, there was no way a creditor would have been able to get a court to execute sovereign collateral.Footnote 5 In the language of John Westlake’s influential legal textbook, “Foreign states, and those persons in them who are called sovereigns, whether their title be emperor, king, grand-duke, or any other, and whether their power in their states be absolute or limited, cannot be sued in England on their obligations” (Westlake Reference Westlake1858, p. 226). Sovereign possessions being immune, guano was a fortiori immune even when abroad. It was immune, too, when handled by a government agent, because states’ agents inherited their principal’s immunity (Story Reference Story1839, p. 306; Chitty Reference Chitty1841, pp. 278–9). Under this regime, English courts dismissed creditor attempts at laying their hands on sovereign property. In fact, they considered that, had verdicts enforcing such clauses been returned, they would have amounted to acts of war against the foreign sovereign (Flandreau 2022).

Several contemporary decisions confirmed it. The most influential one was Smith v. Weguelin (1869), a spirited effort to have a court of justice assist repossession.Footnote 6 William Smith was a holder of Peruvian securities with guano clauses who claimed that Peru had failed to amortize (redeem) the amount of bonds stipulated in the contract, depressing prices. He brought a lawsuit in the Court of Chancery where he asked the court to direct the agents to use money from the sale of Peruvian guano held in London to perform the amortization.Footnote 7 Aware that they were on fragile grounds Ashurst, Morris & Co—the London sovereign debt law firm representing Smith—tried a bold legal theory. They flashed two fancy authorities: George Jessel, a renowned corporate finance lawyer who later became a judge in Chancery, and the famous John Westlake himself. They argued that hypothecations amounted to a deed of trust, where agents of the government were trustees and the bondholders’ beneficiaries and asked the court to enforce the trust. If the court had admitted the theory, then a way around sovereign immunity would have been found. Nevertheless, the attempt failed.Footnote 8

In his lengthy opinion, Lord Romilly M.R. called the trust theory the “most singular part of the argument.” If Peru had wanted to establish a deed of trust, they should have created one. In no place had the covenant granted creditors “the right of intercepting or dealing with the guano,” and so the construction was preposterous.Footnote 9 As the judge added, a decision favorable to the plaintiffs would have enabled every bondholder holding hypothecations “by the aid of the Court of Chancery practically to declare war against a foreign country.” Smith was dismissed with costs.Footnote 10 Thus, one should be skeptical of Vizcarra’s main point that a Peruvian default would result in “the disruption of the guano trade” (Vizcarra Reference Vizcarra2009, p. 375) and more generally that hypothecation by means of an export commodity was enforceable (as claimed by Chabot and Santarosa Reference Chabot and Santarosa2017).

Hypothecations Not a Scam: A Test

The next possibility is that sovereigns and underwriters devised hypothecations to arouse unwarranted belief in such enforcement (Coleman Reference Coleman1936). Hypothecations “gaslighted” investors: If they added value, it was because of unwarranted beliefs about their role. We argue that this is not a very credible interpretation because sovereign hypothecations occurred in plain sight and were subjected to intense scrutiny. Before the Smith verdict, the impossibility of enforcing simple hypothecations was frequently emphasized by observers, and warnings were issued not to misconstrue the clauses. Debates on the subject were not confined to the legal insiders of Lincoln’s Inn. The British press often made fun of the hypothecations, suggesting they were a ploy. The satirical Punch joked about Spain’s hypothecation of “Quicksilver” that the country might repay in “slow gold.”Footnote 11 The more austere Thomas Baring, partner of the famous merchant bank Baring Brothers, declared flatly in 1865 that one could not take “precautions against the repudiation of a hypothecation.” This was reprinted in several journals that followed sovereign debt matters.Footnote 12 Likewise, Smith received large coverage, with the Times itself printing the Judge’s charge on hypothecations. The provincial press waxed on.Footnote 13 Tellingly, The Economist’s coverage of Smith consisted of “reminding” readers that the verdict was old news and that the “creditors of a foreign government cannot enforce their rights by attaching property hypothecated to them.”Footnote 14

As a result, Smith provides a testing opportunity for the hypothesis that hypothecations amounted to a scam. Given that an English court had stated loud and clear that enforcement of sovereign hypothecation was not an option, either (i) there had been no delusion to begin with, implying that the verdict caused no surprise; or (ii) there had been delusion. In which case, significant selling activity ought to have resulted. Moreover, not only should Peruvian bond spreads have increased, but the spreads of all bonds with clauses should have increased too, because of the generic value of the verdict.

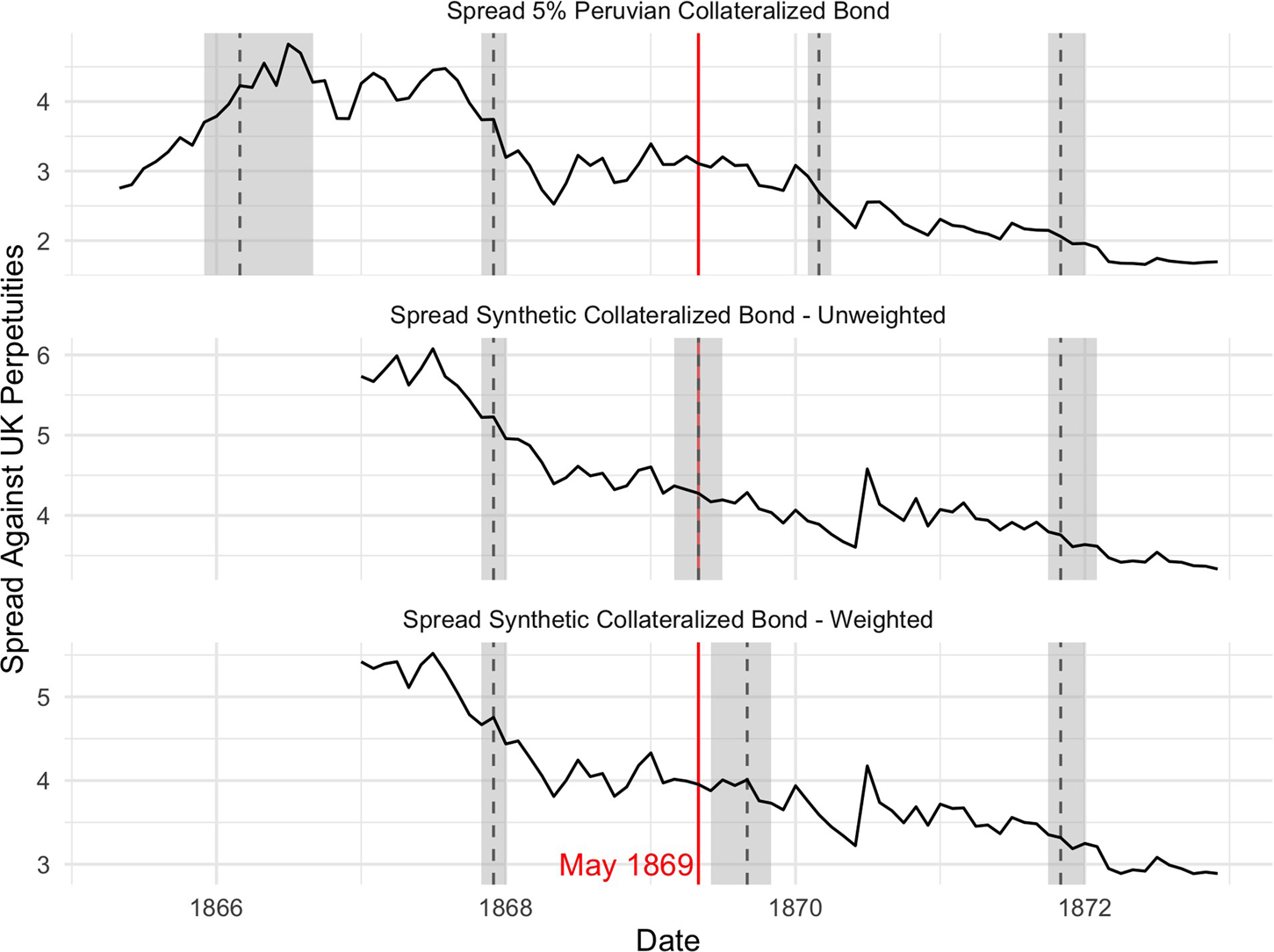

Against this backdrop, we first looked at high-frequency price movements around Smith (27 May 1869) but failed to detect anything significant, including commentary.Footnote 15 We next applied, based on monthly data, the Bai-Perron procedure, which tests for structural breaks (Bai and Perron Reference Bai and Perron1998).Footnote 16 We used the yield spread against risk-free British consols of a representative Peruvian guano bond. Because the verdict mattered for all hypothecations, we also considered two portfolios: a weighted and an unweighted average of collateralized bonds.Footnote 17

There are two conditions for rejecting the scam theory. The test should not single out Smith as a significant event, and if it does single it out, then spreads should not increase afterward. Figure 1 plots the time series of monthly spreads for the Peruvian bond, the two portfolios, and the structural breaks. Dashed lines capture Bai-Perron break dates, while shaded grey areas represent confidence intervals. For the Peruvian bond and weighted portfolio, no break is detectable. For the unweighted synthetic bond, a break around Smith is identified, but the spread decreases thereafter, which is the opposite of what should happen under the scam theory. The evidence being incoherent with hypothesis (ii), we conclude that Smith was old news, as the Economist had put it. The verdict merely confirmed what the marginal investor already knew, namely that courts would not enforce hypothecations.

Figure 1 SMITH V. WEGUELIN VERDICT DID NOT IMPACT SPREADS

Notes: From the top, the Figure reports the graphical results of performing the structural break test on, first, the Peruvian 1865 5 percent bond’s spread series; second, the spread series for the unweighted portfolio composed of the Chilean 6 percent 1867 (custom revenues), the Romanian (“Danubian”) 7 percent 1864 (custom revenues), the Egyptian 7 percent 1866 (railways), and the Turkish 6 percent 1862 (excise on tobacco and salt); third, the spread series for the same portfolio of bonds, weighted for issuance size. Dashed lines represent break dates; gray areas cover 95 percent confidence intervals; and solid vertical lines track the month of Smith v, Weguelin’s verdict.

Sources: Bond price data assembled by the authors from various issues of the Course of Exchange; the London Standard; the London Daily News; the Investor Monthly Manual; and Klovland (Reference Klovland1994) for returns on British consols. Yield calculations by the authors.

This result underscores a fairly obvious and general point, that despite what one reads in Pistor (Reference Pistor2019) it is not particularly promising to think of law firms as the handmaids of exploitation. If bond sellers could pay lawyers to find ways to create deceptive instruments, bondholders could hire the same lawyers to defend their interests. In fact, as extensive anecdotal evidence suggests, the law firms drafting sovereign debt contracts were frequently employed by the buy-side of the market. These were prominent institutions, which often still exist today in the form of big legal conglomerates. They had a reputation, and they were unlikely to favor instruments with which they would be uncomfortable when they sat on the other end of the table. A striking case is Baxter, Rose, Norton & Co. (today Norton Rose Fulbright). Its senior partner, Philip Rose, was at one point embedded in Erlanger and Co, a sovereign debt contractor who originated several loans studied in this paper. But Rose was at the same time one of the first promoters of the Council of Foreign Bondholders, a powerful bondholder protective organization launched in 1868.Footnote 18 To be successful over the long run, the solutions conceived by such intermediaries had to abide by the conditions of honest brokerage, that is, they had to work for both buyers and sellers.

Deus Ex Machina

Another reason put forward to explain why sovereign debt contracts existed in the Age of sovereign immunity pertains to what Weidemaier (Reference Weidemaier2010) calls “contracting for state intervention.” This view, also articulated by Ahmed, Alfaro, and Maurer (Reference Ahmed, Alfaro and Maurer2010), holds that sovereign debt covenants are written with the expectation of imperial enforcement. Adapted to the case of sovereign collateral (as considered by Borchard Reference Borchard1951, pp. 257–60), the argument might look like this: Sovereigns pledged collateral that was enforceable because failure to perform would lead to collateral repossession with the help of the Navy of the creditor power.Footnote 19

However, a closer look reveals a slightly more complicated situation. Under contemporary understandings of the Law of Nations (as international law was known) the creditors of a defaulter were justified to require the assistance of their own sovereign if their own efforts had failed. According to Robert Phillimore, who, as Law Officer, was tasked with advising the British Crown on such matters, “the right of interference on the part of a State, for the purpose of enforcing the performance of justice to its citizens from a foreign State, stands upon an unquestionable foundation, when the foreign State has become itself the debtor of these citizens” (Phillimore Reference Phillimore1871, p. 8). At that point, it was up to the sovereign of the lending country to bring pressure to bear on the defaulter and enforce the claims, war being an option.Footnote 20

But here comes the problem: If interventions could be counted upon, a gigantic moral hazard problem was lurching, first identified in the literature by Platt (Reference Platt1968). And so, against the prognosis of the Law of Nations, the established British policy since the beginning of the sovereign debt market in London was that creditors would be prevented from turning the British Navy into a collection agency (Ziegler Reference Ziegler1988). As Platt demonstrates, this policy started under Canning in the 1820s and was turned into an official doctrine by the Palmerston Circular of 1848. The Circular reminded British agents abroad (and foreign governments) that Britain would not go to war to enforce foreign debts. One could not count on an implicit British pledge to enforce it. The pledge, if there was ever one, was that it would not.

Note, however, that the Palmerston doctrine applied to private debts only. Britain reserved the right to intervene in the case of debts owed to, or guaranteed by, the British government itself. The same applied to money owed to British investors but tied to an international treaty ratified by Britain, which also committed the British government. While this has led to mix-ups in the literature, this was something that contemporaries fully understood. For instance, describing the case of the Spanish Indemnity Bond of 1828, a debt that originated in a treaty between Britain and Spain, a leading investment handbook explained that because of this, this bond had a peculiar status in that “power is given to the British government to make reprisals upon Spain in the event of the non-payment of the dividends” (Field Reference Field1838, p. 166).

We will see in a later section the role played by international conventions in designing a handful of bonds for which enforcement was possible. But for the present purpose, if British enforcement was expected for treaty debts only, then the theory of implicit enforcement of private debts cannot be valid in general. This also means that cases where state enforcement could be expected would be clearly identified in the documentation. As a result, the content of the contract mattered. In fact, the British government was too weary to float its signature, and, as we shall see, it insisted on a clarification that waved the responsibility in cases where there might be ambiguity. Again, British enforcement of the lien was unlikely to be the result of “implicit” language. Language in a contract that is only implicit is no language at all.

READING FROM “TYPE I”: WHAT THE DRAFTERS HAD IN MIND

That hypothecations were primarily a technology ensuring disclosure, monitoring, and ultimately reputation building comes out strongly from examining one by one the clauses and how they were crafted. This is what we do in this section. To begin, we identified the universe of new capital calls on the London Stock Exchange during the second foreign debt boom of the nineteenth century, taking the first guano contract as patient zero (1849–1875) (Flandreau et al. Reference Flandreau, Flores, Gaillard and Nieto-Parra2009, for details). This returned a set of 116 individual issues. We then worked to retrieve the documentation for each bond.Footnote 21 The substance of sovereign debt covenants was distilled in the prospectus or “general bond,” but often extensive documentation elaborated on the covenant.Footnote 22 We counted 67 hypothecations, or 58 percent of the total.Footnote 23 The popularity of the instrument warrants our use of the expression “hypothecation mania” to describe the period under study.Footnote 24

What the Contracts Did Not Say

Legal scholars Buchheit and Pam (Reference Buchheit and Pam2004) complain that repossession provisions’ language in nineteenth-century hypothecations was too “vague.” From examining many bonds, the main conclusion we reach instead is that they were generally absent. It is clear from the language that, upon default, creditors were on their own with nothing tangible to grab. In fact, the distinctive trait of what we refer to as Type I hypothecations is that the asset pledged as security was never transferred under the custody of a third party. There was no security. Yet, Type I hypothecations—identified by the fact that repossession is not described—dominate the hypothecation population, with 55 loans out of 67, or 82 percent.

The general style of Type I hypothecations’ language consisted of a solemn though abstract formula whereby sovereigns did “bind” themselves to pledge a designated asset or set of assets as “security” for the “due payment of the interest and amortization of a loan.” When the loan was described as a first “charge” on a designated source, it only meant what it said: that the money was to be paid from that source. It was not a receivership system. The asset remained under the control of the sovereign and was not put in the hands of an independent third party tasked with transferring it to the creditor or executing it in case of non-performance as for modern corporate collateral. In fact, language was sometimes added, emphasizing that there were no further guarantees. In the original guano contract of 1849, Art. 7 of the covenant indicated that guano shipped abroad remained the “exclusive property” of the Peruvian government (Evans Reference Evans1851, p. 220).

What the Contracts Did Say

It is very unlikely, therefore, that hypothecations were written with enforcement in mind. Does that mean that the hypothecations were mere illusions? Not necessarily. If repossession was not described, it was because it had never been the intention in the first place. In fact, the data suggests that the pledging of physical securities was an element of information that was valuable in contexts fraught with data limitations. Consistent with this, Type I hypothecations focused on stating the nature of the asset or “security” and describing its relevant features, in particular its earning capacity or worth: The annual cash flow, or the capital value, and sometimes both. Used in combination with the cost of the loan or its nominal amount, this enabled the calculation of a sustainability ratio often mentioned in the documentation. If the debt service/revenue ratio was low, the prospectus would speak of solid “security.”Footnote 25 In some cases (such as Peru’s guano), revenue time series were appended, enabling the tracking of past performance. In fact, hypothecations documented tax-harvesting activities.

Again, the guano contracts epitomize this informational logic. Against the backdrop of a takeoff in international demand for fertilizers, state-owned guano deposits emerged in the 1840s as a major fiscal resource for Peru. Available numbers suggest that in the early 1860s, guano would return about 80 percent of the income of the Peruvian state.Footnote 26 Another advantage of guano deposits from an informational point of view was their transparency. The entire wealth of Peru was sitting in a conspicuous place (the Chincha Islands, which could be approached by ships). Thus, investors had ways to ascertain the “sovereign wealth” of the country in real-time. That guano turned Peru into a very successful borrower (as Vizcarra correctly notes) should not be surprising. This needs not be put in relation to repossession. Rather, we emphasize reduced information asymmetries enabling to realize the latent value.

Contracting for Information

Generalizing on the insight, we argue that the Type I boilerplate aimed at creating a technology to observe tax harvesting, so as to accumulate information on the resources and character of the borrower. Typically, the contract was built on self-generating statistical knowledge, which was then structured in a fashion that ensured reliable reporting. To that end, hypothecations included clauses specifying the roles and responsibilities of the various agents involved. Honest behavior of the agents was rendered credible because these clauses were enforceable before ordinary jurisdictions. The material found in sovereign debt contracts come across as much more than a commitment by a sovereign to repay a given debt in a certain fashion. In fact, the clauses they contained served to govern those tasked with operating the resulting fiscal observatory.

This insight sheds light on the distribution of hypothecations’ pledges. As shown in Online Appendix Figure A.2.2, custom revenues were present in about a third of the population of hypothecations. This makes sense. While customs were a major source of tax income, specialized merchant banks had access to the relevant data through their correspondents and local agents, enabling them to make educated guesses. A supporting institution was the availability of British consuls as certification agents. They came in handy in the sovereign debt hypothecation food chain because they were British government verified experts in their country of residence’s trade data. What is more, funds deposited with them or owned by them were protected because a foreign power mauling diplomatic agents was a casus belli.

As an illustration, consider the prospectus of the Imperial Moorish Loan 5 percent of 1862. The bond provided for the hypothecation of one-half of the country’s annual custom revenues, out of which the annual interest and amortization of the loan would be serviced (Art. 5). As Art. 5 also stated, the British consul in Morocco did “certify” the valuation of trade. Art. 6 clarified that custom revenues were “ample security” for the service of the debt, as this would only absorb about one-fourth of said revenues. Next “Special Commissioners” were tasked with receiving from Moroccan officials the dividend money (Art. 2). Finally, the transfer of funds worked like this: each semester, and no later than six weeks before the coupons became due in London, the commissioners were to receive the funds, and they would transfer them immediately to the agents of Robinson, Fleming in Morocco, the merchant bank that originated the deal and serviced the loan in London.Footnote 27

In this case, we see that the contract had drawn opportunistically on British government-appointed Special Commissioners, in fact a byproduct of the role Britain played at the time as mediator between Morocco and Spain. The advantage of this set up was that, as soon as it came into the hands of the commissioners, international law protected the money. But since a misleading impression that the responsibility of the British government was involved might have been created, an adjustment of the terms of the contract was required specifying that Britain took no liability beyond remitting the funds.Footnote 28 In other words—and this point is vital for the argument we make—government agents (both the consul and the Special Commissioners) were involved in a purely informational role: Morocco could default without triggering a British military intervention.Footnote 29

The Hypothecation Algorithm

Once observability was established, the hypothecation was turned into a transparent algorithm. Creditors were provided with initial input (the statistical data) and, simultaneously, with machinery that enabled them to update their beliefs. This helped creditors “penetrate” inside the fiscal process while at the same time helping borrowers accumulate reputational capital, which was achieved by performing adequate actions upon critical “forks.” If the intermediate target was met, the action and behavior were validated until the next stage. By the very nature of the system, information on debtor performance was disclosed in a coordinated fashion. Evoking parallels with Bloomberg, “collateral news” (intelligence, for instance, that the money for the next dividend’s payment had been received by correspondents) was disclosed simultaneously to all creditors through postings inside the London Stock Exchange and announcements in the press, typically paid by the underwriters. This limited the risk for individual operators to trade against superior information.Footnote 30

One way to think of this dynamic function of hypothecations is therefore to relate it to theoretical interpretations of contracts as “reference points” when coercive enforcement is not the principal goal. Hart and Moore (Reference Hart and Moore2008) analyze the role of contractual stipulations in the management of behavioral expectations. Against this backdrop, the structuring of information provision assisted creditors in the case of default. First, this setup enabled a precise identification of default, while joint ownership of the instrument facilitated creditor cooperation.Footnote 31 What is more, the creation of a multiplicity of sequential reference points helped issue advance warning signals. If one step in the algorithm was aborted, creditors could ask for an adjustment. In the previous example of the Moorish loan, failure to provide the dividend money six weeks before the coupons became due would be a credit event. Likewise, if a country ran out of collateral and started reassigning existing collateral, this was an indication of impending troubles. Creditors were given an opportunity to organize and start bringing pressure to bear preemptively.

We note finally that other institutional modules meant to assist creditor coordination could benefit from the precise information afforded by hypothecations and could have a mutually reinforcing role. One case in point is the London Stock Exchange Committee, a de facto court of sovereign bankruptcy whose rules provided that defaulters would be prevented from issuing new loans (Flandreau 2013). In 1827, when the rule was first made, default was identified with dividends in arrears, but in 1870, a restatement of the rule identified default with any violation of any clause in the contract, perhaps because it was realized that one could take advantage of the spread of hypothecation clauses (Flandreau 2022, pp. 48–51). Thus violations of collateral clauses came within striking distance of the stock exchange tribunal: collateral reallocation or failure to segregate hypothecated revenues might be invoked as a motive to interfere (Flandreau 2022, pp. 51–53 for an example of the first kind).Footnote 32 This was yet another channel through which hypothecations created value.

INFORMATION AND HYPOTHECATION: EMPIRICAL EVIDENCE

In the previous section, a crucial prediction was that Type I collateral emerged in information-poor environments—when fiscal data was incomplete. In this section, we support this claim by demonstrating that hypothecations emerged in contexts of fiscal opacity and when other signaling devices, such as underwriting by a prestigious intermediary, were not available.

Measuring Opacity

To demonstrate that Type I hypothecations emerged when there was a dearth of data, we need to measure fiscal opacity. We rely on the Statesman’s Year-Book, a statistical annual published from 1864 onward by journalist Frederick Martin. At a time when government numbers were still very scattered, the Year-Book was a breakthrough for the unique way it documented fiscal data, in particular budgets (i.e., forecasted revenue and expenditures), realized accounts, and debts. The editor worked with official sources, his ultimate goal being to report such information as it stood for the current year. According to stock exchange member Lionel Cohen (Reference Cohen1876, p. 691), it was pointless to try and second-guess the Statesman’s. According to Steinberg (Reference Steinberg1966), Martin never tried to make guesses. If he could not find what he wanted in already accessible sources, he would write to embassies and seek the support of correspondents, but if this could not address the lacunae, he simply reported the last available figure.Footnote 33

Thus, the Statesman’s Year-Book provides us with a precious instrument to quantify fiscal opacity. The method works as follows: Because each year provided Martin with an opportunity to update tax revenue figures, and because we can reasonably assume that he did his best, we can infer that failure to update captures missing data.Footnote 34 The Year-Book can thus be exploited to produce indicators of the quality of publicly available fiscal information. Going volume by volume, we construct a country-specific transparency index. So, for instance, by calling t the year of the Year-Book edition and l(i t) the information lag for country i at date t, we first generate the information lag series. In the ideal situation of perfect fiscal transparency, the information lag is zero. The most recent figures for country i in volume 1864 correspond to 1864, and so on.

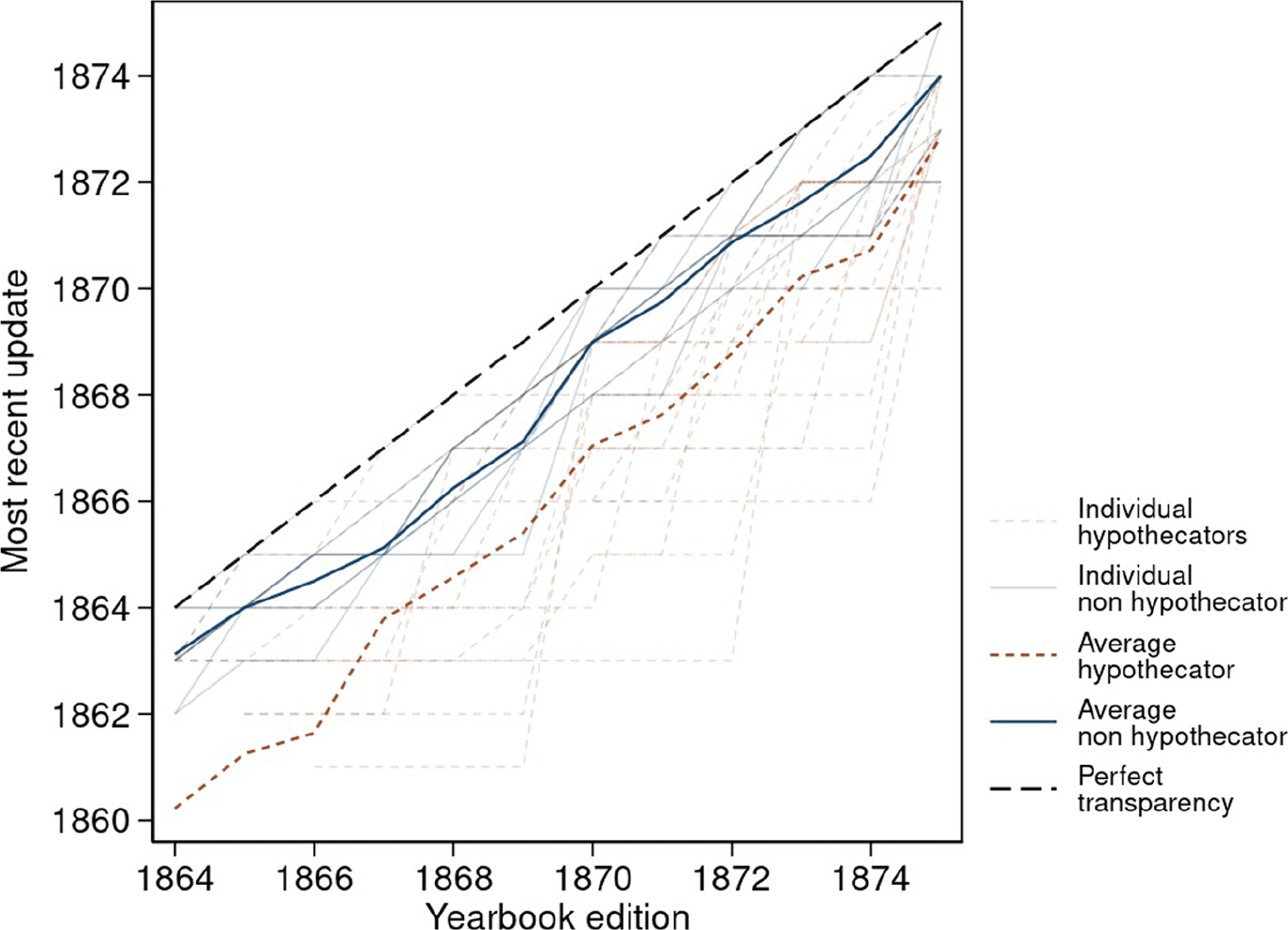

If we plot on the x-axis the year of the Year-Book edition and on the y-axis the year of the most recent budget available, the 45-degree line corresponds to full transparency. Any delay in collecting/releasing new figures leads to the curve falling below the 45-degree line. The further below, the less transparent the country. Figure 2 plots actual transparency lines. “Dashed” countries issue at least one Type I hypothecation. “Solid” countries did never hypothecate. The figure underscores that if information was not perfect overall, arriving with an average lag of 1.5–2 years, it was particularly bad for hypothecating countries.

Figure 2 COLLATERAL CLAUSES AND TRANSPARENCY

Notes: The figure summarizes the availability of revenue data in the Statesman’s Year-Book, distinguishing between sovereigns that issued Type I collateralized bonds (red, short-dashed lines) and sovereigns that did not issue any hypothecation (blue, solid lines). On the x-axis, we list the year of publication of each issue of the Year-Book. On the y-axis, we list the year of the most recent update for each sovereign’s revenue figures. We represent perfect transparency as continuously updated and current figures available each year, that is, the dark, dashed line. Type II is not shown in the chart.

Sources: Data on fiscal information availability and updates from different issues of the Statesman’s Year-Book and calculations by the authors.

Correlates of Opacity

From the Stateman’s, we can extract three alternative opacity indexes. “Recent Data” is a dummy taking value one if fiscal revenue information for sovereign c reported in Year-Book volume t is less than two years old. “Updated Data” is a dummy taking value one if revenue information for a given sovereign in Year-Book volume t is different from the same sovereign’s entry in volume t − 1. “Age of the Data” is a discrete variable recording how old the latest revenue information regarding each sovereign published in volume t of the Year-Book is.

We use these measures to study the incidence of collateralization. The explanatory variable is the Statesman’s Year-Book’s updating speed, and the explained variable is the sovereign’s decision to hypothecate. We predict that the more recent the data, the better it is updated, and the more recent the update, the smaller the incentive to design a Type I hypothecation. The main confounder is country risk, because less transparent sovereigns were likely to be riskier, and so we included a variable capturing it. Another confounding factor is Frederick Martin’s zeal. Anecdotal evidence suggests that the editor of the Year-Book intensified data collection efforts when a loan took place because there was more interest in the country. Thus, we include another dummy controlling for whether a recent issue occurred.

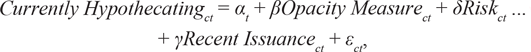

The equation is:

$$Currently\,Hypothecatin{g_{ct}} = {\alpha _t} + \beta Opacity\,Measur{e_{ct}} + \delta Ris{k_{ct}} + \gamma {\mathop{\rm Re}\nolimits} cent\,Issuanc{e_{ct}} + {\varepsilon _{ct}},$$

$$Currently\,Hypothecatin{g_{ct}} = {\alpha _t} + \beta Opacity\,Measur{e_{ct}} + \delta Ris{k_{ct}} + \gamma {\mathop{\rm Re}\nolimits} cent\,Issuanc{e_{ct}} + {\varepsilon _{ct}},$$

where Currently Hypothecating ct is a dummy equal to one if sovereign c’s last bond issued up to current year t is a Type I hypothecation; α t is a year-of-issuance fixed effect, accounting for systematic patterns across editions of the Year-Book; Opacity Measure ct is one of the three proxies for information quality; Risk ct is one of two country-risk controls: the lagged volume-weighted country yield for sovereign c,Footnote 35 computed with yield data we collected (we introduce them in our seventh and penultimate section, discussing the economic value of sovereign collateral), or the country’s lagged GDP per capita in 2011 $ as documented by the Maddison Project, which we treat as a proxy of then known country’s resources (Bolt and van Zanden Reference Bolt and van Zanden2020). Finally, Recent Issuance ct is a dummy equal to one if country c issued bonds in the last two years.

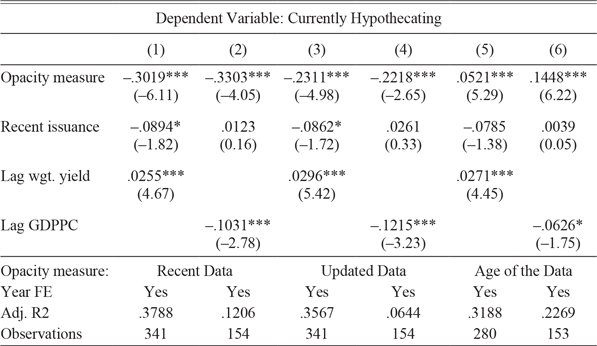

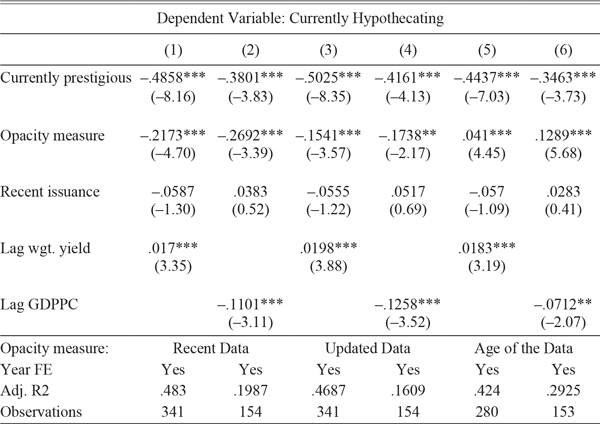

Table 1 shows the result: the less opaque the country, the less likely it was to hypothecate. In particular, Opacity is measured by Recent Data in Columns (1) and (2), Updated Data in (3) and (4), and Age of Data in (5) and (6). Columns (1) and (2) show that a drop in the speed of data updates below “at most two years old” implies an increase of approximately 30 percent in the probability that the last bond issued is a Type I. Columns (3) and (4) show that failure to update increases the probability that the last bond issued by the country is a Type I by about 20 percent. Finally, in Columns (5) and (6), we show that an additional one-year lag in the information disclosed correlates with a 5 to 14 percent greater likelihood of tapping the market with a Type I bond. A 5-year lag increases the probability by 25 percent to 70 percent. In other words, for “absolutely opaque” countries, as a few were, hypothecations were a sine qua non.

Table 1 COUNTRIES ISSUING TYPE I BONDS WERE LESS TRANSPARENT

Notes: The dependent variable “Currently Hypothecating” is a dummy taking value one if the last bond issued by sovereign c is a Type I hypothecation. Opacity measures: “Recent Data” is a dummy taking value one if the revenue information for sovereign c reported in Year-Book volume t is less than two years old; “Updated Data” is a dummy taking value one if revenue information for sovereign c in Year-Book volume t is different from information for the same sovereign in volume t − 1 (second two columns); “Age of the Data” is a discrete variable recording how old is the revenue information published in volume t of the Year-Book regarding each sovereign c. Each pair of columns alternatively controls for country risk with the lag of volume-weighted yield or with lag GDP per capita. Errors are heteroscedasticity robust; t-statistics are in parenthesis.

*p<0.1; **p<0.05;***p<0.01

Source: The table presents results from the estimation of Equation (1) using different information availability proxies as controls.

Hypothecation as Substitute for Prestige

Next, we propose yet another way to test our interpretation of hypothecations. If hypothecations carried information, then they must have been an alternative to another well-documented instrument to reduce information asymmetries, namely recourse to prestigious underwriters. By attaching their name to an issue, prestigious underwriters such as Rothschilds or Barings signaled its creditworthiness, in fact rendering the security “information insensitive.” As a result, for a country banking with a prestigious intermediary, there was no need to produce information; opacity was not a problem. The underwriters managed to extract the information for themselves, and that was it. Note that the role played by prestigious banks may have created a case of informational holdout, whereby sovereigns may have been unable to signal their creditworthiness.

Against this backdrop, we posit a substitution effect between prestigious underwriters and hypothecations. Countries that could not secure the seal of approval of prestigious lenders, or countries that sought to break the informational holdout, should have been more likely to display their “facts” by relying on Type I hypothecations. If this is true, then Type I hypothecations offered an alternative monitoring technique to issuers whose loans prestigious intermediaries would either reject, or ask too exacting conditions to arrange. Conversely, Type I hypothecations enabled less capacious bankers to participate in the sovereign debt market. That such pressures existed in the market is consistent with Flandreau et al. (Reference Flandreau, Flores, Gaillard and Nieto-Parra2009), documenting a declining market share for prestigious banks during 1845–1875, precisely as hypothecations became widespread.Footnote 36

To test whether this substitutability effect holds, we add to Equation (1) a “Currently Prestigious” dummy, equal to one if the current underwriter is either Rothschild or Barings.Footnote 37 If Type I bonds do substitute for prestige, then this dummy’s coefficient should be negative. Other controls are as in Equation (1). Table 2 shows across all specifications a robust negative correlation between prestigious underwriting and issuance of Type I hypothecations. The effect is large: holding fixed other characteristics, a sovereign that issued its most recent bond with the help of a prestigious underwriter was 50 to 35 percent less likely to have employed Type I clauses in that same bond. This confirms that hypothecations helped ordinary (i.e., “non-prestigious”) banks break into the sovereign debt market.

Table 2 HYPOTHECATION AND PRESTIGIOUS UNDERWRITERS WERE SUBSTITUTES

Notes: The dependent variable “Currently Hypothecating” is a dummy taking value one if the last bond issued by sovereign c is a Type I hypothecation. Opacity measures: “Recent Data” is a dummy taking value one if the revenue information for sovereign c reported in Year-Book volume t is less than two years old; “Updated Data” is a dummy taking value one if revenue information for sovereign c in Year-Book volume t is different from information for the same sovereign in volume t − 1 (second two columns); “Age of the Data” is a discrete variable recording how old is the revenue information published in volume t of the Year-Book regarding each sovereign c. Each pair of columns alternatively controls for country risk with the lag of volume-weighted yield or with lag GDP per capita. Errors are heteroscedasticity robust; t-statistics are in parenthesis.

*p<0.1; **p<0.05; ***p<0.01

Source: The table presents results from the estimation of Equation (1), adding as independent variable a dummy tracking whether a prestigious bank (Rothschild or Barings) underwrote the bond and using different information availability proxies as controls.

ENCOUNTERS OF THE SECOND KIND

As suggested, Type I hypothecations were the predominant type, but not the only one. We now consider the alternative type, or Type II, a minority instrument that is only present in 12 out of 67 sovereign bond contracts with collateral. As we show, its goal was to replicate the desirable features of corporate collateral, that is, to give creditors tangible control over the security.Footnote 38 Type II is interesting because it demonstrates that, should they apply their minds to it, contract drafters were capable of building an instrument focused on enforcement. But conversely, this demonstrates that if enforcement was not provided for in Type I hypothecations, it was because it was not the point to begin with.

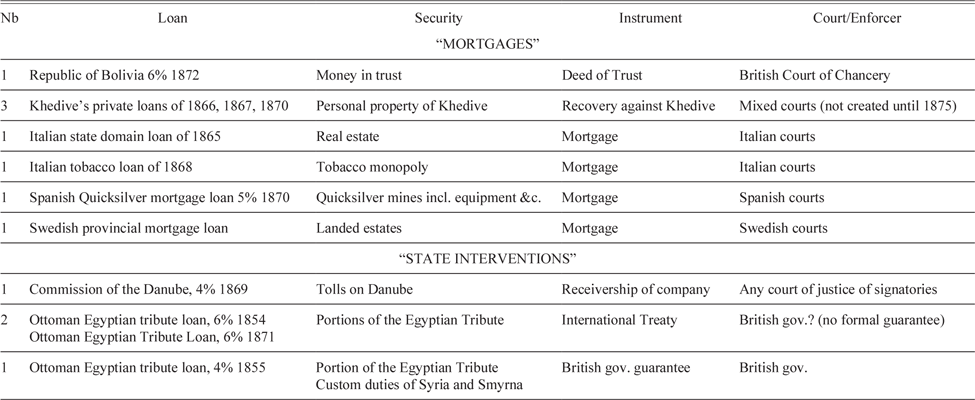

Table 3 lists the Type II bonds we picked out, along with their characteristics. Type II hypothecations may be defined as contracting for repossession. We identify two alternative strategies to achieve this. In the first variant, lawyers sought to “lower” sovereign collateral to the level of private property so as to enable execution because government assets could then be handled as corporate assets.Footnote 39 The other tactic exploited a symmetrical logic: it “elevated” enforcement into the diplomatic sphere. As we have seen, the Law of Nations provided for state enforcement when the contract was tied to a sovereign act. Such a backdrop allowed to contract for state enforcement by taking advantage of diplomatic contexts.

Table 3 MECHANICS OF TYPE II SECURITIES

Notes: See Online Appendix C for full details and references on each Type II loan and its legal design.

Source: Authors’ compilation.

The first strategy foresaw the crafting of a mechanism to put the asset beyond the reach of the sovereign. For instance, some loans to Spain (Quicksilver Loan) and Italy (Tobacco Loan) relied on mortgages that were executable under the respective countries’ domestic laws. To ensure execution, a publicly owned company pledged its assets to the lenders, who were given a right to repossess in case of non-performance. A most interesting case is provided by the Bolivian loan of 1872, a state-sponsored railway and navigation project. The contract—in fact, a system of contracts—had been designed by Baxter, Rose, Norton & Co, who were specialists in the law of trust. They introduced a formal deed of trust, whereby trustees were appointed by the Bolivian government to receive the proceeds of the loan and administer them on behalf of the bondholders (the cestui que or beneficiaries of the trust). The money was put in a strongbox at the Bank of England, and the trustees were tasked with releasing the funds upon evidence that the project proceeded according to plan. It was understood that British courts of justice had jurisdiction because Smith had suggested that judges would recognize a deed of trust if they saw one.Footnote 40

Under the other logic, enforcement was provided by enlisting state support. A characteristic case is the loan to the Commission of the Danube in 1869. The commission was a multilateral body, the result of the Treaty of Paris of 1856, which settled the Crimean War. The loan gave as collateral the “tolls and duties” levied at the mouth of the Danube on the Black Sea, while granting bondholders “full powers of receivership in case of default.”Footnote 41 Because France, Italy, the North German Confederation (incl. Prussia), Turkey, and the United Kingdom guaranteed the loan, all had an incentive to provoke execution. A related case is the Ottoman loan of 1855, which, unusually, had a full British guarantee. Default would turn the loan into an official debt from Turkey to Britain, providing grounds for the British government to execute.

In other cases, the lien was created in a more surreptitious manner, with contract drafters having sought to “piggyback” on diplomatic opportunities. An example is the pledging of the so-called Egyptian Tribute in several Ottoman loans, a rent the ruler of Egypt paid to its overlord (the Ottoman Sultan). Because the Tribute had been set as part of an international convention that Britain ratified, Britain was interested in the performance of the contract, giving it oblique jurisdiction in case of diversion. A factor often mentioned at the time was that the money was paid through London. This did not prevent the Turks from instructing Egypt to pay the money over to them, and Britain had never made any formal pledge in this respect. Still, the lien had a recognized significance. As was later admitted, the Egyptian Tribute loans enjoyed an “exceptional position.”Footnote 42

An interesting aspect of Type II securities was that they often paved the way for subsequent state interventions. This is logical, because some were by construction inviting diplomatic mingling. The way the “Khedive Loans” ended up serving as justification for British intervention provides an example. In this case, the trick used to render collateral executable was that the loans were extended not to Egypt but to the ruler of Egypt (the Khedive) in his private capacity, against the pledging of his personal estates. To enable enforcement of the security, Mixed Courts under joint Egyptian and international authority were given jurisdiction over disputes involving the Khedive’s properties “so long as no question of acts of sovereignty arose” (Hoyle Reference Hoyle1986, 1987, p. 437). The result was that the “private” Khedive really placed himself under the reach of an international treaty when he refused to comply with the Mixed Courts rulings, giving Britain legal grounds to intervene (Hoyle 1987; Wynne Reference Wynne1951, p. 600 ff.).

As already emphasized, Type II hypothecations remained rare. One way to make sense of this is to say that, except under the unusual circumstances we have previously discussed, the instrument was not easy to implement. If “shackling” sovereigns through legal ingenuity was not credible, markets would fail to reward the instrument. The financially proficient lawyers who drafted the contracts realized that the effort was futile, and this nipped in the bud further attempts. Although they demonstrate the ingenuity of their architects, Type II hypothecations are therefore a sideshow. Studying them brings us back to our point: very few hypothecations were about collateral enforcement. And so, even as nineteenth-century lawyers toyed with the idea of turning sovereign collateral into something like its corporate “counterpart,” enforcement was simply not the point in the majority of the cases.

PROOF-OF-STAKE

A final way to show that hypothecations were about information provision is to observe the attitude of investors and regulators tasked with protecting them. Had hypothecations been a scam, investors ought to have asked for their abolition and regulators ought to have set their heads against the instrument. However, the evidence suggests otherwise. After a “hypothecation crisis” exposed the risk of underwriters manipulating the information content of hypothecations, regulatory authorities inspired by activist bondholders reacted by creating penalties against mendacious prospectuses. This is inconsistent with the view that hypothecations were meant to secure repossession, that they were inherently a scam, or that they relied on imperial enforcement. But this is consistent with the view that hypothecations were information.

The controversy that developed in the mid-1870s regarding whether hypothecations ought to be outlawed provides illustrations. Critics charged that hypothecations were a red herring and that they created opportunities for manipulation. Parliament was asked to regulate them. The trigger was investigative work by Walter Bagehot, the editor of The Economist, exposing doctored information in a Honduras government “Ship Railway” Loan. On paper, this infrastructure project would have transported vessels across the Central American Isthmus by train. The general bond gave as security the railway line, and accordingly, it quantified its earning potential. But by compiling international trade statistics, The Economist demonstrated that the contractors had massively inflated the gross amount of trade through Cape Horn, so as to exaggerate the trade diversion achieved by the new line and, therefore, its freight revenues.Footnote 43

The project was shelved amidst the outcry, and hypothecations at large came under attack.Footnote 44 The Honduras scandal certainly exposed a weakness in Type I hypothecations. As critics started looking more carefully at the contracts, they found that clauses had been added in some bonds where the contractors of foreign loans described themselves as agents of foreign governments in order to benefit from immunities (Clarke Reference Clarke1879). The prospectus of the Costa Rica loan of 1872, pledging a railway, had an article lifting “responsibility, liability, or trust whatever” for the contractor.Footnote 45 The language used in covenants became suspect, threatening the whole economic logic of hypothecations. Parliament was besieged by requests to legislate. But while some proposed the abolition of hypothecation, the discussion soon gravitated towards reinforcing incentives for truthful disclosures.

In March 1875, corporate lawyer and M.P. H.B. Sheridan tabled a “Foreign Loans Registration Bill.” Not coincidentally, Sheridan was a sovereign debt activist, in fact, he was the former chairman of the Mexican Bondholders Organization. The bill would have compelled contractors to register the data in government loans with the so-called Registrar of Joint Stock Companies.Footnote 46 Created as part of the Joint Stock Companies Act of 1844, the Registrar made available to investors basic company information. This information included the statutes, the names of the company promoters, and the annual shareholder lists. The promoters of new companies signed a statutory declaration that the information was accurate to the best of their knowledge.Footnote 47 If it later surfaced that they had been dishonest, they could be held responsible in court for investors’ losses.Footnote 48 Therefore, by placing sovereign debt data under the authority of the Registrar, Sheridan was borrowing a page from the corporate regulation playbook. His bill provided that intermediaries who would falsify disclosures, especially the “particulars of revenue and taxes,” would be made liable in case investors suffered losses subsequently.

In other words, promoters attempting to forge information like in the Honduras case would face penalties. This was expected to render data in prospectus more credible. Indeed, when asked about the economic logic underpinning the bill, Sheridan responded that if investors could be sure that all the hypothecations were accurately stated in the prospectuses, “states would find it much easier to raise money here” (House of Commons-Select Committee 1875, p. 274). This demonstrates that investors (whom Sheridan may be said to have represented) valued sovereign hypothecations because of the intelligence they contained.

Though Sheridan’s concerns were widely shared, involving the registrar in the business of certifying foreign data was controversial.Footnote 49 One issue was that this might signal wrongly that H.M.’s government vouched for the numbers, creating a liability. A prudent Chancellor of the Exchequer committed the bill to a parliamentary committee, the Select Committee on Loans to Foreign States, which was assigned the broader task of examining the experience of sovereign debt origination and the role played by hypothecations in the process. It was also tasked with coming up with suggestions for regulation.Footnote 50 Again, during the interviews, concerns had emerged with the mendacity of information in prospectuses. When grilling the chairman of the stock exchange, one member of the Select Committee had for instance described the role of the stock exchange committee as “dressing up [the loan] for the market.”Footnote 51

When it came out a few months later, the Report of the Select Committee admitted that, indeed, hypothecations were not enforced after default (House of Commons-Select Committee 1875, pp. xlv, p. 151). Yet, showing that an awareness had grown in Parliament that hypothecations were not about enforcement, it did not recommend abolishing them. The Report harnessed instead the logic of the Sheridan Bill, suggesting that contractors should be required to provide in the prospectus a full statement of the “revenues, lands, forests, public works, or other property upon which the proposed loan is secured, and of prior charges, if any, upon such security” (House of Commons-Select Committee 1875, p. xlix). To deal with the problem of mendacity, it was suggested as in the Sheridan Bill before that truthfulness of disclosures might be secured through a sworn statement that would expose contractors to charges of perjury. Again, this recommendation aimed not at the extinction of hypothecations but at the improvement of their informational content.

The epilogue is found in the archive of the stock exchange committee, where the matter circled back logically. As governing body of the London Stock Exchange, the committee controlled listing requirements (Flandreau 2022). Consistently, as the archive of the stock exchange indicates, lawmakers had encouraged the committee to try and implement the Select Committee’s recommendations.Footnote 52 On 21 January 1876, a special meeting of the stock exchange’s “sub-committee for rules and regulations” considered the matter and ruled that “a statutory declaration be required from Contractors & Agents [of foreign government loans].”Footnote 53 The recommendation was subsequently adopted by the stock exchange committee, which made it part of the market’s Rules and Regulations. Comparing Mihill Slaughter’s 1873 edition of the rules and regulations (Slaughter Reference Slaughter1873) with a subsequent edition (the annotated edition by Melsheimer and Laurence Reference Melsheimer and Laurence1879, p. 144) shows the injection of the new requirement under Rule 125.

Concretely, as application forms in the stock exchange archive show, no application for any sovereign debt issue could be received without the underwriters filling up an affidavit with a sworn – “solemn”— declaration before a notary public that they were submitting the prospectus “conscientiously believing the same to be true.” Footnote 54 Contractors making wrongful disclosures could be sued by investors to the full extent of the losses incurred. Indeed, as stated in Melsheimer and Laurence (Reference Melsheimer and Laurence1879, p. 121), “if false statements are made before the Committee in order to induce them to grant quotation and settlement, the guilty party may at law be made criminally or civilly liable.” The mechanism, which placed dishonest declarations within the reach of the law, discouraged information manipulation.

THE ECONOMIC VALUE OF UNENFORCEABLE COLLATERAL

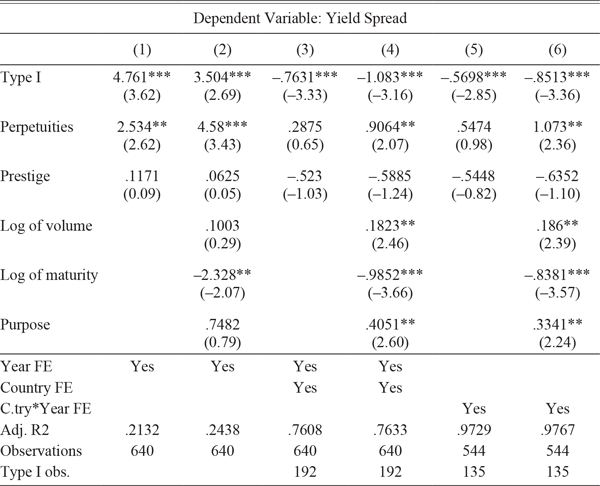

We now show that despite the absence of repossession upon sovereign default, investors still appreciated hypothecation clauses. To show this, we establish that Type I hypothecations lowered yields compared to what the same sovereign would have paid at the same time on a loan without collateral clauses. The model we use is the familiar panel regression with fixed effects employed in the literature. It enables the capture of the Type I premium (Type I hypothecations enjoy a lower yield) in the following way:

Yield Spread bcyt is the spread over British consols for bond b issued by sovereign c in year y and measured in year t. The independent variable of interest, Type I bcy, is a dummy variable taking value one if the bond includes Type I collateral clauses and zero otherwise; η ct are fixed effects; X bcyt is a matrix of covariates, it includes the log of the total issue size (to control for liquidity), the log of maturity (to control for bond and time-specific ex-ante risk born by the bondholders), a dummy for bonds that were perpetuities,Footnote 55 a dummy for bonds whose documentation contained a detailed statement of the project’s purpose, and a dummy for the prestige of the underwriter. Finally, ɛbcyt is the standard error, clustered at the country and year-of-bond-issuance (cy) level.Footnote 56

In order to estimate Equation (2), we assembled a panel of yields for the 116 bonds in our library of contracts by collecting end-of-year prices in the Course of Exchange. Next, we computed each bond’s yield using the exact amortization profile. This important adjustment is typically not done in the current literature (at best, authors take maturity alone into consideration). It is made possible here because we obtained the original documentation, enabling us to calculate rigorous yield-to-maturity (see Flandreau and Legentilhomme (Reference Flandreau and Legentilhomme2021) for detail). Last, we computed spreads using Klovland (Reference Klovland1994) for returns on British consols. Since liquidity effects can have a severe impact on prices, we only focus on the period between 1864 to 1875, when sovereign lending gained momentum, resulting in greater trading activity (Chavaz and Flandreau Reference Chavaz and Flandreau2017). Note that, since bond issues intensified at that point, 70 percent of the complete data is located in this timeframe.

There are reasons to believe that this empirical strategy underestimates the true effect of hypothecations. Indeed, by its very nature, this estimation approach relies heavily on countries that issued simultaneously both hypothecated and non-hypothecated bonds that is, countries for whom non-hypothecation was a possibility. By contrast, very opaque countries had no alternative but to select into hypothecations, so that the (high) price they would have paid had they issued a non-hypothecated bond is not observed. Second, there is the problem of information spillover. Although holders of hypothecated bonds enjoyed a set of excludable services, such as the appointment of trustees, non-hypothecated loans benefited from the informational spillover from hypothecated ones. It is unclear how to control for this. Therefore, our estimate of the value of hypothecations provides a lower bound.

After the elimination of the unusable data, the cleaned-up dataset has 85 bonds and 640 observations.Footnote 57 Results are shown in Table 4. Columns (1) and (2) do not include any country fixed effect. They show that, logically, sovereigns issuing Type I securities were riskier: yield spreads were 350 to 476 basis points higher for Type I bonds. Next, Columns (3) to (6) introduce country fixed effects. Comparing bonds with and without Type I clauses issued by the same sovereign in Columns (3) and (4), we find that, on average, spreads on Type I bonds stood at 76 to 108 basis points below their non-hypothecated counterparts. Columns (5) and (6) display the most demanding test result because they control for country-year fixed effects, thus capturing the pure effect of hypothecations for countries whose Type I and non-hypothecated bonds traded simultaneously. We find that hypothecations produced a yield reduction of 57 to 85 basis points, a highly statistically significant result.

Table 4 TYPE I HYPOTHECATIONS HELPED LOWER COST OF DEBT FOR RISKY SOVEREIGN

Notes: The first two columns report estimates that only absorb common year of trade fixed effects; the second two columns add country fixed effects; the last two columns absorb all country-year specific variation via country-year fixed effects. The last line (Type I Obs.) records the number of observations that identify the Type I parameter in the country and country-time fixed effects regressions. Namely, the number of observations belonging to countries floating both Type I and non-hypothecated bonds (Columns (3) and (4)) and those belonging to countries floating both Type I and non-hypothecated bonds at the same time (Columns (5) and (6)). Errors are clustered at the country-year of bond issuance level, with 80 country-year clusters over the first four columns and 72 country-year clusters over the last two columns; t-statistics are in parenthesis.

*p<0.1; **p<0.05; ***p<0.01

Source: The table presents results from the estimation of Equation (2).

To give a sense of economic significance, the numbers noted earlier may be compared to average unconditional yield spreads. The average spread for countries employing at least one Type I bond stood around 679 basis points, while the average spread for countries not employing any hypothecation whatsoever was 253 basis points. Comparing the estimated average Type I premium to the difference between the two, or 426 basis points, we find that it ranges between 13 and 25 percent of the hypothecators’ disadvantage. This amounts to a sizable saving on borrowing costs, especially given that, as we suggested, it’s a lower bound estimate. To sum up, our lower bound estimate of the value of unenforceable hypothecations points to the fact that Type I clauses were an effective tool to decrease the cost of capital, regardless of the fact that they were not enforceable.

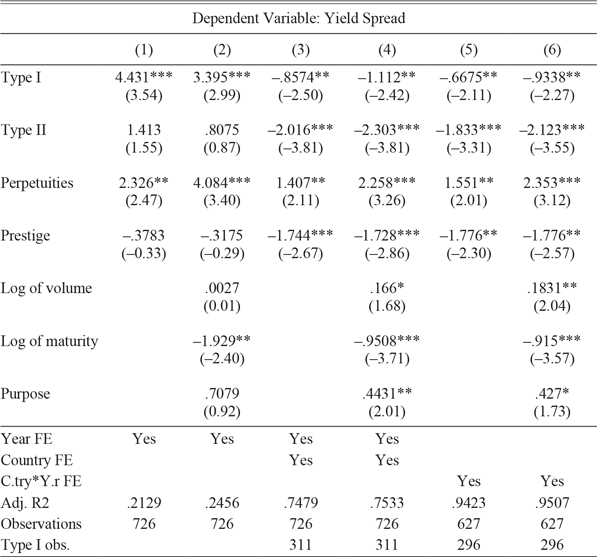

In the previous exercise, we identified Type I hypothecations effect with the help of countries that had Type I and non-hypothecated bonds simultaneously outstanding. This represents five usable borrowing entities out of 32. They account together for 25 bonds, a little below a third of the library of covenants.Footnote 58 These bonds contribute 192 individual spread observations in the country effects specifications (out of 640 observations) and 135 observations in the country-time fixed effects specification (which uses 544 observations). If one were to worry about the relatively limited number of identifying observations, an alternative is to run the same model while including also Type II hypothecations.

Including Type IIs in the regression provides a way to increase the number of observations used to identify the effect of Type I hypothecations. For instance, some countries issued Type I and Type II, but no unsecured bonds and they could not contribute to the identification of the effect of Type I hypothecations in the previous approach because the information in the corresponding bond prices was “thrown out” in the baseline model. But it can be exploited in the specification considered now, which allows for Type II. In practice, by including Type II hypothecations, the number of individual spread observations belonging to countries serving to identify Type I rises from 192 (country FE) and 135 (country-time FE) to 311 and 296, respectively, while the number of “indentifying bonds” goes from 25 to 38.Footnote 59

But doing this is also interesting in itself. Although our discussion has suggested that each Type II hypothecation was sui generis (i.e., all performed differently) they had in common to be executable. Thus, we expect them to reduce the yields of bonds compared to alternatives. In particular, a Type II hypothecation that would closely replicate the features of a genuine mortgage would be expected to reduce the yield below both counterfactual unsecured loans and counterfactual Type I loans of the same country (since the latter have an informational value only).Footnote 60 In what follows, we include Type II in the population and control for them with a common Type II dummy, expecting a bigger effect than that for Type I.

Results, shown in Table 5, reveal three relevant facts: First, the estimated Type I premium remains consistent across all specifications; if anything, it shows up a bit larger than in the baseline (Columns (3) through (6), first line). Second, the Type II premium is large and significant, ranging from 180 to 210 basis points. Such a large premium, which shows that, on average, Type II bonds had much lower yields (higher bond prices), demonstrates that the security was, at least for some such bonds, credible, which is consistent with one study devoted to one such bond (Al Reference Al2012). Third, the implied pecking order across the alternative instruments is the one that one would expect: Other things being equal, and subject to feasibility constraints and other political opportunity costs, it was better to have a Type II hypothecation than a Type I hypothecation, and better to have a Type I hypothecation than nothing. The story of Type I hypothecations is that of the invention of a second best.

Table 5 EFFECTS OF TYPE I AND TYPE II HYPOTHECATIONS

Notes: The first two columns present the results that only absorb common year of trade fixed effects; the second two columns, add country fixed effects; the last two columns, absorb all country-year specific variation via country-year fixed effects. The last line (Type I Obs.) records the number of observations that identify the Type I parameter in the country and country-time fixed effects regressions. Namely, the number of observations belonging to countries floating both Type I and other bond types (Columns (3) and (4)) and those belonging to countries floating both Type I and other bond types at the same time (Columns (5) and (6)). Errors are clustered at the country-year of bond issuance level, with 91 country-year clusters over the first four columns and 82 country-year clusters over the last two columns; t-statistics are in parenthesis.

*p<0.1; **p<0.05; ***p<0.01

Source: The table presents results from the estimation of Equation (2) adding back the observations due to Type II bonds, while singling them out with a Type II dummy.

CONCLUSIONS

Why did nineteenth-century sovereigns hypothecate their assets when at bottom the lien could not be enforced? Departing from previous claims in the literature, this paper proposes a new view. Inclusion of descriptions of sovereign assets, including their location, value, earning potential, and provision of a technology to monitor the above served to reliably document individual countries’ fiscal prospects in contexts where fiscal data was fragmentary. Hypothecations provided valuable information on individual countries’ tax bases, and the circulation of this information served to grease the wheels of international finance. The case of the guano contracts captured the underlying logic very well, explaining why they came to epitomize the hypothecation process. Though the security could not be executed because of absolute sovereign immunity, state-owned guano deposits on Chincha Island served to document sovereign wealth.

A critical contribution of the paper moving forward is to draw the attention of research to the context of fiscal data production, thus extending on Flandreau’s work on fiscal data harvesting and the rise of sovereign risk scoring (Flandreau Reference Flandreau, Flandreau, Holtfrerich and James2003). This paper contributes to the long run history of fiscal data production by offering a new take on the role of financial contracts. The upshot is that data became part of sovereign debt contracting, because while debt itself was unenforceable, putting data into contracts enabled to upgrade the informational basis of contracting. We interpret contract as a data-generating machine, foregrounding the role played by law firms in structuring financial flows and “building” creditworthiness. The legal “biology” of the international numerical order and its legal underpinning is a topic in its own right and of profound importance to our understanding of globalization. It ought to be the object of future consideration.