I. Introduction

In February 2021, the California Department of Alcoholic Beverage Control launched an interactive website for breweries selling beer outside their own premises in California to register prices and products. This marked a disruptive transition away from the previously inaccessible paper filings. For each beer product-package combination, breweries and/or wholesalers must register the county of destination, stage in the three-tier distribution system, and price. The dataset is continually updated, with more than 3.8 million observations as of August 15, 2023. This dataset affords new, never-before-accessible information on the beer supply chain for both brewery competitors and academic researchers.

The beer industry has been the focus of countless market structure and pricing studies, for example, Hellerstein (Reference Hellerstein2008) and Goldberg and Hellerstein (Reference Goldberg and Hellerstein2013) on exchange rate pass-through; Alviarez, Head, and Mayer (Reference Alviarez, Head and Mayer2021) and Doan and Sercu (Reference Doan and Sercu2021) on multinational mergers and acquisitions; Miller, Sheu, and Weinberg (Reference Miller, Sheu and Weinberg2021) on oligopolistic price leadership and mergers; and Anderson (Reference Anderson2023), Elzinga (Reference Elzinga2011), Elzinga, Tremblay, and Tremblay (Reference Elzinga, Tremblay and Tremblay2015), and McCullough, Berning, and Hanson (Reference McCullough, Berning and Hanson2019) on changing market structures. But until now, access to granular level of data on production and distribution of small breweries has either been proprietary, such as on-premise sales data collected by brewers, or comes at a hefty cost, such as primary collected data (e.g., Hart, Reference Hart2018; Staples et al., Reference Staples, Reeling, Olynk Widmar and Lusk2020) or scanner-level data collected by companies like Nielsen and IRI (see Volpe et al., Reference Volpe, McCullough, Adjemian and Park2016; Rojas and Peterson, Reference Rojas and Peterson2008; Burgdorf, Reference Burgdorf2019).

We combine the price postings from February 2021 through June 2022 with California county statistics and brewery statistics to conduct an exploratory analysis of the California beer market to highlight the potential uses of this new dataset. In particular, we first provide a brief background on the United States’ largest beer-producing state, California. We follow with a description of a new dataset and a general analysis of the supply chain broken down by brewery type (Macro, Crafty, Craft, and Import) and by package type (Bottle, Keg, Loose, and Pack). We next focus only on California breweries and describe supply chain use and distribution reach within California. Furthermore, utilizing the full dataset, we can demonstrate real-time differences between self-distribution and three-tier price margins, how prices differ between brewery ownership structures, and off- versus on-premise consumption.

Throughout the paper, we provide avenues for potential future research utilizing the dataset that we construct. As this is an exploratory analysis of newly available data, we employ a variety of traditional statistical methods to bring to light questions that could be explored in further detail. For instance, we use a simple linear regression analysis to estimate the differences in markups over wholesale prices at various stages in the supply chain, for example, a brewery selling directly to a retailer versus a distributer selling to a retailer in the same county. Moreover, we illustrate that there is a great deal of heterogeneity across both brewery and package types. In many specifications, “cutting out the middleman” results in no significant difference in markup. A potential avenue of research would be to better understand the bargaining dynamic between a brewery and its distributer.

This analysis is the first step toward better understanding the impact of the three-tier distribution system and market concentration on brewers in the largest brewing state in the United States. There is a wealth of research focusing on different aspects of the three-tier distribution system of beer in the United States, but most analyses are restricted due to data limitations. This analysis and dataset should provide many opportunities to extend past efforts. The remaining paper is organized as follows: Section 2 describes the Californian market; Section 3 refers to population demographics; Section 4 contains a description of the data; Section 5 describes the supply chain for the California beer market; Section 6 focuses on California-produced beer; Section 7 analyzes price differentials; and Section 8 concludes with suggestions for future analysis.

II. California

In this section, we describe the regulatory environment for the beer market in California as well as illustrate the heterogeneity in consumer demographics across counties throughout California to motivate why this is a rich environment for study.

a. Regulatory environment

After the repeal of Prohibition, most states adopted a three-tier distribution system, mandating a third-party distributer between the brewery and consumer retail locations and limiting the ability for brewers to dictate pricing at the retail level. Over time, these restrictions have lessened, and California brewers have the ability to sell directly to consumer retail locations (and consumers themselves), their own distribution companies, and there are explicit tied-house exemptions.

While California is flexible in how beer travels in the three-tier distribution system, it does regulate aspects of the supply chain. To start, the relationship between breweries and whole-saler/distributers are fixed by state franchise laws. A brewery cannot terminate a distribution agreement if the wholesaler does not perform with regards to sales “reasonable under the pre-vailing market conditions” unless provisions were initially written into the wholesale agreement (BPCD9.12.25000). Effectively, it is quite difficult and expensive for a brewer to terminate a contract once a sales agreement is made between them and a wholesaler. California law does allow for annual sales goals to be written into a contract that allows for brewer recourse if they are not met.

California also requires breweries to delineate sales territories upon first completion of a sales contract with a wholesaler. As Burgdorf (Reference Burgdorf2019) noted, mandating exclusive territories in Wisconsin resulted in a decrease in craft beer brands sold, increased the cost of distribution, reduced competition, and gave protection to wholesalers. This creates an interesting dynamic between breweries selling direct to retail and wholesalers selling in the same or close territory. It is ambiguous whether alcohol manufacturers would price above or below wholesalers when selling direct to retail. On the one hand, there are incentives to price at or above wholesalers so as not to undermine the cooperative relationship. However, the manufacturer is now garnering a larger share of the final margin, so it has an incentive to move more products directly to retail with a slightly lower price.

California allows for multiple avenues of sale from a brewery direct to consumers. A brewery or brewpub can sell direct to consumers at the brewery’s premises for both on- and off-site consumption. There are no limitations on the quantities available for sale at these locations. In addition, brewpubs are able to sell beer, wine, and distilled spirits manufactured by other companies. Indeed, it is common for breweries/brewpubs in California to offer for sale a variety of other breweries’ beers.

Finally, in addition to direct-to-consumer sales on-premise, breweries can deliver to consumers at their place of residence either by their own employees or through third-party services such as Drizly.com. The delivery of beer to consumers’ residences has seen a large increase since the start of the global pandemic and will likely continue. Furthermore, federal legislation was first introduced in May 2021 that will allow the U.S. Postal Service to deliver alcoholic beverages.

III. Demographics

With a population of over 39 million people, California would rank 34 in population and 5 in GDP for the world if viewed as an independent country. Furthermore, California has numerous counties that would rank in the top 100 countries in terms of GDP: Los Angeles (21), Santa Clara (37), Orange (49), San Diego (50), San Francisco (53), San Mateo (59), Alameda (59), San Bernardino (67), Sacramento (67), Riverside (70), and Contra Cosa (71). Indeed, California is a very diverse state with a lot of demographic and economic variation across counties. For a brief description of demographic summary statistics, see Table 1. It is also helpful to visualize spatially the variation in demographics across counties. Figure 1(a) shows how income per capita varies, while Figures 1(b)–(d) illustrate the variation among race/ethnicity.Footnote 1

Figure 1. 2020 California county demographics. (a) Per Capita Income, (b) % White, (c) % Hispanic, (d) % Asian.

Table 1. 2020 County demographic summary statistics

Note: Population and personal income are in thousands.

IV. Data

California Business and Professions Code Section 25000 requires breweries, wholesalers, and importers to file beer price schedules with the California Department of Alcoholic Beverage Control (ABC). Until 2020, these price postings were all compiled in paper format, making them largely inaccessible to the general public. As the new system was launched, licensees were given the option to gradually phase into the online system, and as of October 15, 2023, they are now required to post all prices online. Starting on February 16, 2021, price postings were available online through ABC. This paper explores the first year of online observations, from February 2021 to June 2022. Prices are posted:

“If a new licensee, then prior to the first sale of malt beverages to customers in California. After the initial filing, amended schedules of selling prices must be filed when the licensee introduces new brands or types, new package configurations, new bottle/can sizes or when any price changes occur [for each county of sale in California]. If a filing licensee wants to lower a price to meet competition, then an amended schedule of selling prices also must be filed.” (ABC, 2022)

While the price posting data is transactional and displays package configuration and unit size, it does not include quantity sold, nor does it require an amendment every month that a malt beverage is sold if no attributes (including price) of the product change. In addition, transactions at multiple nodes in the beer supply chain may be recorded in the same period. For instance, a 12-pack of 12-oz aluminum cans of Sierra Nevada Pale Ale may be sold by the brewery to a wholesaler and then sold by the wholesaler to a retailer in the same county and month, such that both initial transactions will be recorded in the price posting data set. This particular aspect of the system allows for a glimpse into regional markups along the beer supply chain and potential differences between direct-to-consumer and conventional three-tier distribution. The price posting dataset contains multiple attributes of a particular malt beverage sold in California, including trade and product name, package configuration, product size, container type, destination county, buyer, price, and date.Footnote 2

To efficiently analyze the large dataset, extensive cleaning is conducted. All “non-beer” malt beverages such as seltzers, kombucha, and malt liquor are removed, as well as obvious entry errors such as incomplete filings. Package configuration is converted to one of three types: keg, loose, or pack. Total product size in ounces is calculated from Product Size and Package Configuration. Price per ounce is then calculated based on Price and total product size. Finally, we classify each beer’s ownership structure as Macro, defined as a brewery (or brewery conglomerate) with greater than 6 million barrels of annual production; Craft, as defined by the Brewers Association (2022); Crafty, as being a manufacturer with greater than 25% ownership by a non-alcohol manufacturing company or an alcohol manufacturing company that is not itself a craft brewery; and finally Import. With the price posting data cleaned, additional brewery and county descriptors are added.

The home county for California breweries is appended, as is the production size in 31-gallon barrels (bbls). This information comes from the California State Board of Equalization’s (CBOE) annual postings. County-level demographic data are merged as well. This information comes from the U.S. Bureau of Economic Analysis and provides county-level GDP, population, personal income, and race and age distributions.Footnote 3

Though the data is rich, there are some limitations. Essentially, the posting of a transaction is a registration to sell a particular package configuration in a county at a given price; quantities are not included. A brewery or distributer could post a price without actually selling in a county, such that we may observe a transaction in which 6x4 packs are sold and the price of that configuration, but we do not know how many 6x4 packs are sold in that transaction. Furthermore, we do not have the total universe of transactions. For example, there were 931 craft breweries in California in 2021, but we only have observations for 425 total breweries in California. This likely may be due to most breweries selling solely on their own premises. In addition, Bud Light (a truly ubiquitous beer) had price postings in only 25 counties during our observation timeline. This is likely because breweries are only required to file a transaction if something changes in that county, for example, price or package configuration. Thus, if neither of those things changes in the observation window, there will be missing observations.Footnote 4 Finally, though we observe when a new variety enters a market, we do not know when or if that variety leaves the market. This would be particularly useful information if one were to study the extensive margin of a brewery’s distribution.

V. Supply chain

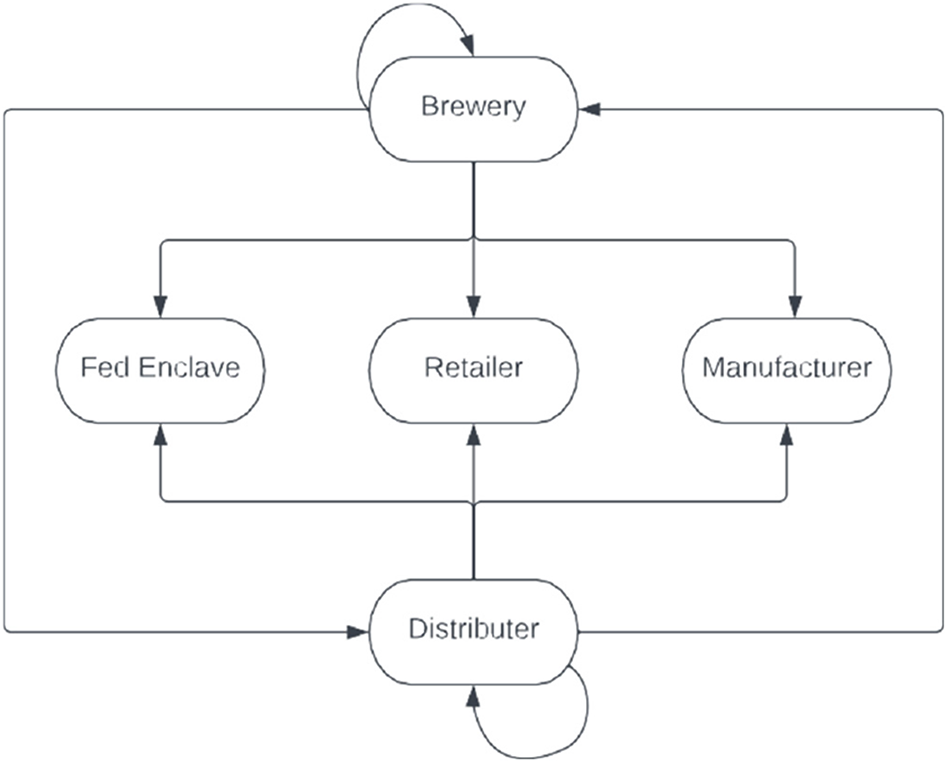

Figure 2 illustrates the supply chain from Brewery to final destination. The way in which beer ends up at its final destination varies across types of breweries: macro, crafty, craft, and import. Table 2 breaks down the observations in the supply chain by type of beer. With self-distribution rights in California, a brewery can sell directly to consumers at their production facility or tap room, directly to retailers, either for on-premise consumption at pubs or restaurants, or for off-premise consumption at grocery or liquor stores, to wholesale distributers that will then sell to retailers, or to federal enclaves that operate their own retail establishments. The California price posting data allows us to observe transactions at every point on this supply chain except for brewery sales direct to consumers.Footnote 5 In addition, lateral flows of goods are recorded. Transactions such as a brewery selling to another brewery, as is the case when one brewery may feature another in their tap room, or an importer selling to a distributer are illustrated in Table 2.

Figure 2. Supply chain flow.

Table 2. Transactions in supply chain by type

Note: See the text for the definition of “Crafty.”

Craft beer has by far the largest volume of observations in the price posting data. While they make up the largest sector of breweries in terms of establishments and beers made, they currently only hold slightly over 13% of the national market in terms of volume (BA 2022). In addition, craft breweries tend to continuously change product lines and recorded an average of 81.74 varieties with price postings over the sample period. Crafty breweries registered 74.74 on average per brewery, while macro and import only registered 11.25 and 9.71, respectively.

We also illustrate the variation in package type across the supply chain in Table 3. Note that a large percentage of observations of keg and pack go from either a brewery straight to retail or a distributer. Moreover, bottles are nearly entirely sold directly from a brewery to a retailer, as well as zero observations of loose packaging sold either from a distributer to a brewery or a federal enclave, or from a brewery directly to a federal enclave. This nuance will be important in order to properly isolate the effect of where in the supply chain the transaction occurs on the price per ounce.

Table 3. Supply chain by package type

VI. California breweries

In this section, we provide some descriptive statistics regarding California breweries. Of the nearly 900 breweries that currently operate in California, only 425 California breweries have listed transactions in our sample. This fraction of breweries in the posting data is likely due to two reasons. First, there are over 600 breweries operating that sell more than 25% of their production onsite, which does not require transaction reports. Second, the breweries might not have new accounts and/or price adjustments during the collection period.

Of the total varieties sold by the 425 CA breweries, 0.3% went to federal enclaves, 0.6% went to manufacturers, 69% went to retailers, and 30% went to wholesalers. The breakdown of supply chain distribution is quite similar to the average across breweries (Table 4). The two largest arms again are brewery direct to retail at 56% and brewery to wholesale at 30%. Interestingly, brewery-to-brewery sales average 0.5% across CA breweries, with a maximum of 1, indicating that there was at least one California brewery that sold all its beers to another brewery.

Table 4. California brewery summary statistics

For California-produced beers, the average price per ounce across all transactions was approximately $0.14, or $2.24 per pint. We further discuss price differentials in the next section. In terms of packaging, the majority of price posting transactions were in the form of kegs at 66.7%. This is not surprising, as this is the common form of packaging used in on-premise consumption at pubs and restaurants. Packs in various forms follow at 30.2%, in most cases intended for off-premise consumption. Individual bottle sales and loose cans make up the remainder at 1.8% and 1.3%, respectively. Finally, on average, a California brewery has beer registered to be served in just over half, 30.66 of 58, of all California counties during our sample period.

Examining individual California breweries provides some valuable insight into the relationship between small, micro, and regional craft breweries’ decisions to distribute beer. Figure 3 provides the percentage of product line price postings for four California breweries of varying size and location: Central Coast Brewing, Firestone Walker Brewing, Modern Times, and Russian River Brewing Company. Modern Times distribution, headquartered in San Diego, is the bottom left figure. In 2021, their total production was about 53,000 bbls and they distributed 135 varieties from February 2021 to June 2022. In addition to distribution, Modern Times ran six brewpub/taprooms in Southern California and one in Oregon State. Post-pandemic shutdowns and the company selling to another craft brewery have forced them to close three of their locations and rethink their business model. Note that for the 135 beer varieties they distributed in 2021/22, most counties that had registered beer obtained a large proportion of their varieties.

Figure 3. Percent of product line sold. (a) Central Coast Brewing, (b) Firestone Walker, (c) Modern Times, (d) Russian River.

Russian River Brewing, most famous for their Pliny the Elder and Pliny the Younger beers, produced about 70% as much as Modern Times and distributed 81 varieties (60%) in the same time frame. In addition, their distribution scheme appears much more targeted, concentrating mainly in surrounding Bay Area counties and then up and down the coast. Next, Central Coast Brewing, while only producing 2,727 bbls, registered 64 varieties. Note that their distribution is very localized, with surrounding counties receiving 65–100% of varieties and the rest of the state receiving less than 20%. Finally, contrast the three relatively small craft breweries to one of the largest breweries in California, Firestone Walker, owned by Belgian brewers Duvel Moortgat. Their 2021 production was 528,188 barrels with 135 varieties. The concentration of beers sold in the counties where they are sold is quite dichotomous. It appears they either registered nearly all varieties in a county or hardly any. Again, this may be due to data limitations where transactions could have occurred in the time frame but were not recorded because price or packaging did not change. Regardless, as more data becomes available, this avenue of examining the price posting data will afford a better understanding of brewers’ distribution decision-making.

In Table 5, we run a simple regression on the percent of a brewery’s product line sent to each county to highlight the heterogeneity in supply decisions.Footnote 6 As expected, we find that this percent decreases in the bilateral distance from the home county. However, the more counties a brewery has a presence in, the greater the percent of the product line that is supplied. There is a negative effect on production size, perhaps indicating that larger craft breweries tend to be more targeted in their distribution.Footnote 7

Table 5. Percent of product line sent to each county

Notes: Robust standard errors in parentheses:

*** p < 0.01, **p < 0.05, *p < 0.1. Source and destination county FE are included.

VII. Pricing

This section investigates the pricing strategy of a brewery. PricePerOunceijvghdt is a unit of observation, where i is the source county (missing if outside of California), j is the destination county, v is the variety (name) of beer, g is the “Product” (which represents product configuration, unit size, and container type), h is where it is in the supply chain, d is whether it’s delivered or FOB, and t is time (calendar date). Before exploring all the determinants of pricing, we first explore possible “pricing to market.” The descriptive analysis of variation across counties within California helps motivate potential variation in demand by location. However, recall that our data does not include the total quantity sold to each county, so while it is likely there are differences in quantity sold, it is not entirely clear that prices will also vary across counties. The next subsection explores this possibility and helps motivate the use of county fixed effects in our pricing model.

a. Pricing to market

Even within a single year of observations, the new price posting dataset allows for a geographic exploration of brewers’ and wholesalers’ pricing strategies and how they may differ across brewery sizes.Footnote 8 Take as a unit of observation the price per ounce for a variety to a buyer in the supply chain in a particular county in a particular month for a particular package configuration/size/container type. Define CV Price as the coefficient of variation of prices/oz for a variety to a buyer in the supply chain for a particular month, product (grouping of package configuration, unit size, and container type). Thus, for a given variety/product/supply chain/month/delivery, this will give us the standard deviation in prices relative to the mean. In other words, if CV_Price = 0, then the variety is the same price per oz across counties; if CV_Price > 0, then there is “pricing-to-market.” Table 6 gives summary statistics of this variation in price per ounce across counties. Without any additional controls, macro beer has the highest average variation in prices relative to the mean across counties, followed by crafty beer and then imported beer. Craft beer has the lowest average coefficient of variation, which suggests craft beer participates in less “pricing-to-market” as is to be expected since they typically have had less access to information on competitive prices in a market, a point that is no longer the case with the publishing of this dataset.

Table 6. Coefficient of variation in price by type

Though Table 6 provides some evidence of variation in pricing to market strategies by type, it is important to control for other aspects, like the supply chain. Table 7 provides such an analysis. We regress the coefficient of variation of price per ounce across counties controlling for terms of sale: delivery/FOB; location in the supply chain; and the type of beer (macro, crafty, craft, or import) with product and month fixed effects and clustered standard errors at the product level (recall “product” is the grouping of package configuration, unit size, and container type). Our first specification includes the full sample, while the next four specifications break up the sample by brewery type. Relative to macro beer, craft beer has a negative and statistically significant coefficient. We interpret this as craft beer engaging in less pricing to market relative to macro, crafty, and imported beer. Again, one possible explanation is that craft breweries are predominantly much smaller operations and do not have the resources to determine optimal prices for each market. We also break up the data across brewery types and can see that, relative to sales to a distributer/wholesaler, craft beer has less price variation across counties throughout the supply chain.

Table 7. Coefficient of variation in price per ounce across counties

Notes: Robust standard errors in parentheses:

*** p < 0.01, **p < 0.05, *p < 0.1. Product and month FE are included. Standard errors are clustered at the tradename level.

b. Price determinants

When thinking about the determinants of prices, we are primarily interested in how the location in the supply chain affects the pricing decision as well as the packaging (keg versus bottle, can, and pack) and the type of beer (macro versus crafty, craft, and imported). We have been motivated in our description of the California market in Section 2 as well as the previous subsection, Section 7a, that one would expect variation across counties, and thus it would be appropriate to include county fixed effects. We further illustrate in Figure 4 that there is variation across months and that “seasonal” effects are present. Though keg prices seem fairly stable, there is more variation with bottle and can prices. At first glance, one might infer that on average, keg prices are lower than bottles and cans. However, we will address this more formally with robust empirical analysis. In the remaining analysis, we omit observations with a price per oz above $0.28879—that is, the top 5% outliers. This is an attempt to eliminate special release/anniversary beers from our analysis.Footnote 9

Figure 4. Prices by month. (a) Bottle Price, (b) Keg Price, (c) Can Price.

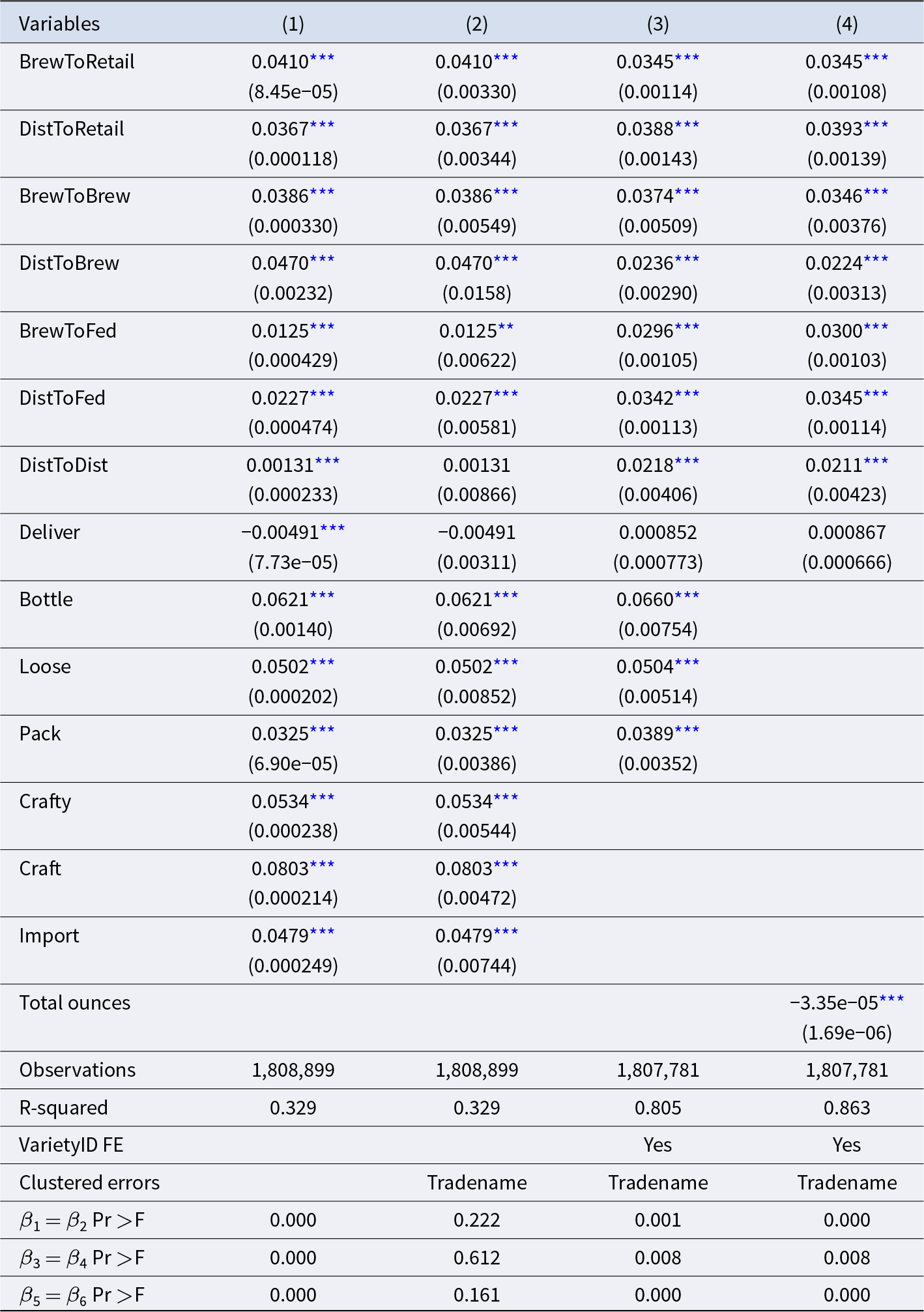

We present four different specifications in Table 8. The first includes county and month fixed effects but does not cluster standard errors. Finding the appropriate level to cluster errors can be debatable (see Abadie et al., Reference Abadie, Athey, Imbens and Wooldridge2023). We have chosen to cluster standard errors at the tradename level, as it seems reasonable that there may be some correlation at this level in pricing strategies across the firm’s product line. Another possibility would be at the manufacturer level, as some manufacturers have multiple trade names, for example, Anheuser-Busch. However, we postulate that any pricing strategies will more likely be at the tradename level; further exploration into pricing strategy differentials between trade name and manufacturer may be a worthwhile endeavor now possible with this dataset.Footnote 10 Specification (2) clusters standard errors, and all coefficients maintain significance with the exception of DistToDist and Deliver. Specifications (3) and (4) add in product name (VarietyID) fixed effects, and Specification (4) includes the variable Total Ounces instead of the package-type binary variables.Footnote 11 We also omit the binary variable CA that indicates whether the brewery is home to California since there would likely be too much multicollinearity between this and Craft breweries, as the predominant type of brewery in California is Craft.Footnote 12

Table 8. Price per ounce

Notes: Robust standard errors in parentheses:

*** p < 0.01, **p < 0.05, *p < 0.1. County and month FE are included.

Unsurprisingly, relative to kegs, all other packaging types (bottle, loose, and pack) are more expensive per ounce, with single bottles being the most expensive. It is also expected that macro is the cheapest per ounce while craft and crafty are about the same, which is confirmed by our analysis. The results become more interesting when looking at the different markups relative to wholesale prices.Footnote 13 At the aggregate level, when controlling for variety fixed effects, there is about a half-penny discount per oz (or $0.06 per 12-oz beer) when going straight to a retailer or federal enclave from the brewery. When supplying to a brewery, the markup seems to be higher when coming straight from another brewery. However, this could be a selection issue that is not being accounted for, as these might be more collaborations on special releases.

Given the variation across package and brewery types and the fact that our observations overwhelmingly come from craft breweries, it would be prudent to analyze the data accounting for brewery type.Footnote 14 Instead of including many interaction terms, we run our specification for each subgroup separately. We report this analysis in Table 9 with variety-fixed effects.Footnote 15 Here we begin to see the heterogeneity between beer types. Of particular interest is the effect of “cutting out the middleman” when supplying to retailers. Though the markups over wholesale prices are smaller for macro beers, the “discount” is about the same in levels. This half-penny discount is maintained for craft and import beers, while crafty beers are essentially the same. It can also be seen that the difference in markups to federal enclaves is really being driven by craft beer sales, as is the difference in markups to breweries.

Table 9. Price per ounce by type with variety fixed effects

Notes: Robust standard errors in parentheses:

*** p < 0.01, **p < 0.05, *p < 0.1. County, month, and variety FE are included. Standard errors clustered at the tradename level.

Table 10. Observations by packaging/brewery type

We have highlighted the degree of heterogeneity across brewery types, but it is also important to note the heterogeneity across packaging types as well. In the Appendix, we illustrate such heterogeneity with regard to the pricing structure. In Tables 11 and 12, we break the pricing strategy down further by packaging type; specifically, we focus on kegs and packs. Though qualitative results are similar, this highlights that the entire pricing strategy depends on both brewery and packaging types.

Table 11. Price per ounce for kegs by type

Notes: Robust standard errors in parentheses:

*** p < 0.01, **p < 0.05, *p < 0.1. County and month FE are included. Standard errors clustered at the tradename level.

Table 12. Price per ounce for packs by type

Notes: Robust standard errors in parentheses:

*** p < 0.01, **p < 0.05, *p < 0.1. County and month FE are included. Standard errors clustered at the tradename level.

VIII. Conclusion

The purpose of this paper was to provide an exploratory analysis of the beer market within the state of California and highlight the benefits of this new dataset for future research. We have provided a small sample of the types of questions that can be analyzed in more depth with this data. In particular, we have illustrated the likelihood of macro brewers’ pricing-to-market strategies and found less evidence of this for craft brewers. Additionally, we have investigated the determinants of prices, taking into account where in the supply chain the transaction occurs, and illustrated the effects both brewery and packaging types have on the markups over wholesale prices. An alternative way to investigate pricing differentials would be to investigate differences in brewery types across nodes in the supply chain (the transpose of our analysis) or, more ideally, include several interaction terms between brewery type and supply chain node in a larger analysis with explicit demographic variables such as those outlined previously. In time, this dataset will afford the volume of data necessary for such analyses, and we hope this exploration leads to further analysis.

A few notable areas of interesting research that could be pursued with this new dataset include: Analyzing the relationship between breweries and wholesalers, including the different bargaining powers and their relationship with price. For instance, do larger breweries exert more market power and garner a larger share of the margin between wholesale and retail prices? For example, does the percent difference between brewery-to-wholesale and wholesale-to-retail prices increase with brewery size? We find some evidence of statistical differences in direct versus indirect sales. However, there is quite a lot of variation across beer type (macro versus craft) and package type (keg versus pack). This opens the door for future, more robust, analysis.

As the dataset grows and covers a larger number of breweries and their transactions, many more opportunities for intensive and extensive marginal analysis will be afforded. At the time of writing, we do not observe many breweries or wholesalers changing prices. Beer prices are known to be quite sticky at the retail level; a larger dataset could show if this exists further up the supply chain and across individual varieties or tradenames.

There is potential for the new price posting system to affect brewery prices by virtue of more complete information. All breweries and wholesalers, as opposed to those that have compiled and used expensive retail price data in the past, can now easily view their competitors’ prices. As we have illustrated, large brewers have likely only been those that have participated in pricing-to-market. The new ease of access to pricing has the potential to increase regionally-specific competition. Indeed, the authors’ discussions with California brewers suggest that this has already begun to occur. With a long enough time period, while accounting for inflation, researchers could determine if this new open data source is pro- or anti-competitive. Additionally, researchers could utilize this data to investigate the effect of mergers and acquisitions on pricing and distribution reach, along with other shocks to the broader economy such as exchange rate passthrough or tariffs on inputs like aluminum.

Combining the new price posting dataset with brewery and local demographics, as we have shown here, can now allow for a more granular view of the changes in pricing and distribution strategies for breweries. Over time, these changes may become more open for review. For instance, small breweries generally always begin by self-distributing their beer very close to their production facility. As they grow, there becomes a point where it is no longer manageable to self-distribute to enough accounts to cover volume; that is, economies of scale for distribution companies kick in, and it makes sense for the brewery to no longer self-distribute outside their hyper-local areas. There is potential that we may observe this phenomenon within the price posting dataset and estimate a production possibility frontier for distribution methods.

Finally, we have focused solely on the new price-posting dataset being created in California; however, it is not unique in providing open access to granular data regarding brewery prices. Other states, like Florida, compile similar datasets, offering the potential to expand this analysis and the suggested avenues of inquiry across very diverse geographic locations. Even further, combining other states’ postings could allow for impact analysis of differing regulatory environments.

Acknowledgments

For useful comments and conversations, we thank Richard Volpe, Corey White, an anonymous reviewer, and participants of the 2022 Beeronomics conference and a CU Boulder IO brownbag. Cleaned data and instructions can be found on the personal website of Matthew T. Cole.

Appendix California Price Posting Data:

1. Manufacturer: the parent company name of the brewery that manufactured the beer

2. Trade Name: the name of the manufacturing brewery

3. Product Name: the name of the beer sold

4. Package Configuration: 1 keg, 6 x 4 packs, 24 loose, etc.

5. Product Size: the size of each individual unit within the package configuration, for example, 15.5-gallon, 16-ounce, 12-ounce, etc.

6. Container Type: keg, glass bottle, aluminum can, etc.

7. County: the county of the buyer

8. Prices To: the buyer of the beer; wholesaler, federal enclave, retailer, manufacturer

9. Receiving Method: either free on board (FOB) or delivery

10. Price: the price of the package configuration sold in US dollars

11. Container Charge: the price of a container charge, if applicable, in US dollars

12. Licensee: the business licensee posting the information

13. Submitted Date: the date the price was posted

14. Effective Date: the date the price was effective, depending on if it was a new price posting or an amended price

15. Active: whether the posting is active or old