Despite the ongoing march of democracy around the world, how political institutions affect human well-being remains open to debate (Besley and Persson Reference Besley and Persson2019). Boettke (Reference Boettke2004) claims that autocracies provide a more efficient mechanism to encourage development through their credible and binding commitment to limiting government predation. If leaders do not establish and signal a credible commitment to the population, then reform measures will lack trust and business endeavors will move to the underground economy or to nonproductive activities intended to favor friends of the government (Baumol Reference Baumol1990).Footnote 1

Economies such as China, Singapore, Hong Kong, and the United Arab Emirates are often used to support the argument that some top-down regimes may play a critical role in economic growth. According to this argument, autocracies with good leaders produce good economic outcomes despite constraining civil liberties. Much of this performance could be due to regime stability. Stable political regimes cope better with economic crises, domestic conflict, and civil war. A long-lived autocracy could establish a system of rules that foster growth. According to Butkiewicz and Yanikkaya (Reference Butkiewicz and Yanikkaya2007), stability can be as crucial for growth as property rights are, especially in autocratic regimes. Although there is no consensus among scholars regarding the link between regime type and growth, autocracies do display higher levels of variance in growth rates than do democracies (Blaydes and Kayser Reference Blaydes and Andreas Kayser2011; Weede Reference Weede1996). Nonetheless, Easterly (Reference Easterly2011) claims that most of the stories of benevolent autocrats are ultimately unfalsifiable.

Augusto Pinochet, who ruled Chile for seventeen years, is a typical example and a test case for this hypothesis. Pinochet is a controversial figure who led a coup d’état, rewrote Chile’s constitution, and restructured its economy. Conventional wisdom tends to attribute the outstanding Chilean performance to the “free market reforms instituted by the administration of General Augusto Pinochet from 1973 to 1989” (Barro Reference Barro2000, 22). However, his regime systematically violated human rights and imposed strong censorship (Alonso Reference Alonso2019). The Valech Report documented 38,254 victims who were held as political prisoners and tortured.Footnote 2 During this time, and mainly after, poverty fell, Chile grew economically, investments moved to the country, local industries flourished, and many perceived Pinochet as a hero. Even more recently, Chileans support political movements that they identify as the heirs of the Chilean strongman (MORI 2015).

The violent coup to establish his regime and the subsequent growth raise the question of whether the reorientation of the Chilean economy and the effects of economic policies under Pinochet’s tenure were made possible by the characteristics of his vertical leadership. Pinochet’s autocracy seems to represent a critical contradiction in using force to establish free markets.Footnote 3 Several reforms during the Pinochet regime were also groundbreaking elsewhere in the world. The pioneering Chilean economic reforms preceded reforms in the United States and Great Britain in the 1980s. For Packenham and Ratliff (Reference Packenham and Ratliff2007), Chile became “the first country in the world to make that momentous break with the past—away from socialism and extreme state capitalism toward more market-oriented structures and policies.”

I construct a counterfactual by using the synthetic control method, which assesses the economic effects of Augusto Pinochet’s regime on Chile. The article focuses specifically on economic growth, which is often presented as the greatest achievement of autocracy. Chile began the period under examination as a politically and economically turbulent country in the 1960s and 1970s. Shortly after Pinochet’s coup in 1973, and during the 1980s, the country began to move in the direction of economic liberalism while remaining politically repressive (Lawson and Clark Reference Lawson and Clark2010). A synthetic control will allow observation of the direct relation of Pinochet’s regime to what later came to be known as the Chilean miracle.Footnote 4 Friedman (Reference Friedman1982) saw Chile in this regard due to the average growth of 8 percent between 1976 and 1980 after inflation was reduced from 700 percent a year in mid-1974 to less than 10 percent a year.

In order to investigate the economic effects of Pinochet’s regime, I compare the income per capita of a synthetic Chile with that under Pinochet.Footnote 5 Synthetic Chile is a weighted average of control countries that best fit Chile’s experience in the thirteen years before Pinochet’s coup. The results show that income, measured as real GDP per capita, did not improve significantly more than it would have in the absence of Pinochet’s coup until several years after the coup. Maybe more striking, the autocracy underperformed in terms of economic growth compared to the counterfactual during this period. The positive gap between the control and the treated unit begins in 1988, fifteen years after the introduction of the military regime.

Chile’s takeoff and autocracies

Currently, Chile is a highly urbanized, economically stable South American country of roughly nineteen million people.Footnote 6 Like many other countries in South America, after gaining independence in 1818, the country did not enjoy a continuously peaceful transfer of power from one party to another. Democracies and dictatorships alternated through the nineteenth century and the first part of the twentieth century. In 1964, a few years before Pinochet’s coup, Eduardo Frei, the leader of the Chilean government, confronted increasing opposition from socialists, who claimed his reforms were insufficient, and from conservatives, who thought they were excessive. By the time Frei ended his term, he had not fully achieved his party’s ambitious goals.Footnote 7

In the 1970 election, Chileans elected as president Senator Salvador Allende, who became the first socialist president elected democratically in the world. One year later, Augusto Pinochet was named commander of the Santiago Army Garrison. The next year, in 1972, Pinochet was appointed general chief of staff of the army. With increasing internal contention in Chile, Pinochet was appointed commander in chief of the army on August 23, 1973, by Allende. The nomination came the day after the Chamber of Deputies approved a resolution claiming the Allende administration had failed to respect the constitution. A few days later, on September 11, 1973, the combined Chilean Armed Forces—the army, navy, air force, and carabineros (police force)—overthrew Allende’s government in a coup, during which the presidential palace, La Moneda, was shelled and Allende committed suicide.Footnote 8 A military junta was established following the coup that exercised both executive and legislative functions of the government. Among the junta’s first actions was to dismantle the economic and political framework Allende had developed. Most state enterprises were privatized along with part of the social security, education, and health care systems. Congress and the constitution were immediately suspended. Following that, the junta imposed strict censorship and restrictions, banned all parties, and halted all gatherings and protests.

It is imperative to notice the events before the treatment period to understand the relevance of producing a counterfactual for this analysis. During Allende’s administration (1970–1973), the state assumed a dominant role in the economy by controlling prices, interest rates, credit, and capital movements. President Allende’s government encouraged expansionary fiscal policies, including a sharply rising public payroll, which meant a hefty increase in the budget deficit, on the order of 20 percent of GDP in 1973 (Billmeier and Nannicini Reference Billmeier and Nannicini2013). By then, numerous factors were affecting the Chilean economy, including the massive expropriation of businesses by Allende’s government, price controls, protectionist policies, and populist discourse (Hawkins and Rovira Kaltwasser Reference Hawkins and Rovira Kaltwasser2017). Inflation was 600 percent, foreign reserves had been depleted, and GDP was rapidly decreasing (Soto Reference Soto2007). According to Piñera (Reference Piñera2005), before Pinochet’s coup, there was a chaotic succession of events that created general misery and malaise. For Chileans, those days meant rationing, hyperinflation, scarcity of essential goods, a large fiscal deficit, unemployment, and so forth (Piñera Reference Piñera2005, 22).

Pinochet centralized power in the presidency, but the regime decentralized some economic activities. Besides removing price controls, Chile increased trade by eliminating nontariff barriers to imports and reducing tariffs in general. The new policies created a capital market and liberalized foreign investment. Additionally, the regime established the independence of the central bank. Another critical measure was the introduction of flexibility within labor markets: entry barriers were eliminated for most jobs, and government intervention in private negotiations was restricted. The military regime provided the opportunity for individuals to invest in privately owned retirement accounts. Reforms extended to health care and higher education by reducing bureaucracy and shifting subsidies from universities to elementary and secondary schools. The final judgment of the quality of education was given to the consumers of these services. Many other services were decentralized, such as sanitation and transportation, among others (Codevilla Reference Codevilla1993).

Pinochet perpetrated multiple waves of human rights violations, which included torture of opposition leaders and kidnapping. Therefore, according to the substantial research linking institutions to growth, the reforms under Pinochet’s autocracy should affect the Chilean economic performance over the whole period. Still, how relevant the role of Pinochet was in the direction of the change remains a question to be answered. Importantly, Pinochet is considered by many as a pro-growth autocrat who improved the lives of average Chileans (MORI 2015). However, many others considered his regime as one that severely violated human rights and damaged the Chilean economy (Petras and Vieux Reference Petras and Vieux1990). This discussion suggests the need to establish a convincing counterfactual to assess the economic influence of this autocracy correctly.

A synthetic control for Chile

Methodology

Abadie, Diamond, and Hainmueller (Reference Abadie, Diamond and Hainmueller2010) developed the synthetic control method in order to test the effect of terrorism in the Basque Country. Later, the method was applied to the economic effects of German reunification (Abadie, Diamond, and Hainmueller Reference Abadie, Diamond and Hainmueller2015), crime-reducing policies (Freire Reference Freire2018), natural disasters (Cavallo et al. Reference Cavallo, Galiani, Noy and Pantano2013), and additional analysis of terrorism (Gautier, Siegmann, and Van Vuuren Reference Gautier, Siegmann and Van Vuuren2009; Montalvo Reference Montalvo2011) among others. The method creates a synthetic counterfactual, a weighted average of control donors with similar conditions, using pretreatment data. The synthetic control design serves to track pretreatment outcomes and match the treated unit on the values of several indicator variables.

A frequent problem in exploring the relationship between political regimes and the economic results often attributed to leaders is the absence of a counterfactual for each case. The ability of the synthetic control method to choose comparison units in comparative case studies and to obtain accurate quantitative inferences (Abadie and Gardeazabal Reference Abadie and Gardeazabal2003) makes it an ideal analytical tool for this specific case. This article empirically evaluates the effect of Pinochet’s regime on Chile’s economic well-being using what few data are available. It constructs a consistent counterfactual to Chile under Pinochet to assess the impact of his regime on the performance of the Chilean economy during his regime.

No single country can approximate the indicators of the economic growth of Chile before Pinochet. The synthetic control offers a systematic way to choose comparison units. The method selects weights given to countries according to how well their characteristics (which include the outcome and familiar predictors of this outcome, such as education and population growth) resemble the characteristics of the treated unit in the pretreatment period. This operation also gives considerable weight to those variables with higher predictive power on the outcome of interest, GDP per capita in this case. Having established that those untreated units have similar behavior during the pretreatment period with the treated unit, any variation in the outcome variable after the treatment should be attributed to the treatment itself (Abadie, Diamond, and Hainmueller Reference Abadie, Diamond and Hainmueller2015; Abadie Reference Abadie2021).

The control countries

For Abadie and Gardeazabal (Reference Abadie and Gardeazabal2003), the efficacy of the synthetic control technique depends on the choice of countries: they must have similar economic and institutional characteristics to the country with the treatment. To capture similar conditions of culture, history, and geography, I use most Latin American nations for the overall analysis. Besides these countries, the control includes Spain and Portugal, which had similar political conditions during the period under analysis and share a cultural connection with Chile, given their past as colonizers of most Latin American countries. In the robustness checks, I also include additional countries with significant copper production to capture that effect on the Chilean income per capita. By using two different data sets, donor pools, and pretreatment periods, I examine one outcome indicator: GDP per capita. Table 1 includes the list of countries for each synthetic control analysis, along with their weights assigned. In total, for the first experiment, I consider eighteen control countries as donors and a pretreatment period of thirteen years. I limit the donor pool to countries with similar processes to the treated country. Conveniently, there are available data for every year for the two synthetic controls.Footnote 9

Table 1. Estimated synthetic control weights for each outcome variable.

Note: Columns show the weight assigned to each country in the synthetic controls for Chile for both experiments. RSMPE provides information on the root square mean prediction error for the unit of comparison.

The role of the predictors is to capture the similarity of processes between donor countries and Chile during the pre-Pinochet period. The synthetic control method selects those countries where the relationship of the predictor and the outcome is more similar to the relationship in the case of Chile. Therefore, through the algorithm, I use time-invariant indicators and minimize the difference between the weighted average of these indicators for the synthetic counterfactual and the indicators for Chile. The units that present a closer approximation to the indicator variables of Chile will obtain a higher weight in building the counterfactual. The algorithm also places more value on predictors that have a similar influence over the outcome variable. Table 2 summarizes the sources and predictor variables used for the construction of the controls and checks.

Table 2. Data and sources.

The method requires indicator variables that are known to be good predictors of the outcome variable. To calculate the GDP per capita for the first and main experiment, the control considers income indicators from four pre-Pinochet years (1960, 1965, 1970, and 1972). Footnote 10 The average population growth rate from 1960 to 1973 also contributes to the results, as does openness to trade in 1960 and 1972, both indicators from the Penn World Tables (Aten and Heston Reference Aten and Heston2011), and two educational-attainment variables in 1960 and 1970 from the Barro and Lee (Reference Barro and Lee2013) database—specifically, the average years of primary and total school attendance. Grier and Maynard (Reference Grier and Maynard2016) use similar indicators to assess Hugo Chávez’s effect on the Venezuelan economy. I used similar predictors for the second control, but I extended the potential donor countries and expanded the pretreatment period to 1951. In this case, the control considers the GDP per capita and population growth provided by the Penn World Tables 9.1 (Aten and Heston Reference Aten and Heston2011), which presents information from 1950.Footnote 11 The results from executing the algorithm for both synthetic controls, and the corresponding errors, are shown in table 2.

Results analysis

This section offers an analysis of the estimates obtained through the synthetic control method of the causal impact of Augusto Pinochet’s regime on GDP per capita in Chile. These estimators do not disentangle direct and indirect underlying effects of Pinochet’s regime. Accordingly, they do not focus on any particular subsequent policies or consequences of the regime.Footnote 12 The controls assess the overall performance of the Pinochet effect on the Chilean economy. Though some authoritarian regimes had introduced some free market elements, none had supported a free market economy as a “matter of principle”; in this sense, “Chile is an exception, not the rule” (Friedman Reference Friedman1982, 1). These characteristics made Pinochet’s intervention a particular treatment among several autocratic regimes. Finding a valid comparison for Chile under Pinochet is a challenging endeavor because of the particular conditions prior to Pinochet’s coup and during the democratic transition between 1988 and 1990, when Pinochet left the government. Despite the complexity of this process, the prevailing belief is that Pinochet was a positive and determining factor role in creating the Chilean miracle. Becker (Reference Becker1997) indicated that Chilean annual growth in per capita real income from 1985 to 1996 averaged 5 percent, far above the average of the region.

As with every process to determine a causal connection, drawing a conclusion from the synthetic control method depends on the assumptions previously established. The effectiveness of this method assumes there are no other treatments that could be affecting the results. It is challenging to rule out completely the influence of confounding treatments. For instance, the decline in GDP per capita during the first two years of the Pinochet regime resulted from the populist policies of President Allende. However, it is less likely that those policies produced the general underperformance that the Pinochet regime displays relative to the counterfactual for fifteen years. Another possible cofounding treatment is the crisis of 1982–1983 that produced a surge in unemployment and struck the financial sector, which resulted, ironically, in the nationalization of the two biggest banks (Fisher Reference Fisher, Mirowski and Plehwe2015). It is worth noting that this particular crisis resulted from Pinochet’s government policies that affected the financial sector (Salazar and Pinto Reference Salazar and Pinto2002).

The results show income increments that could be attributed to economic reforms established in 1975. This could be another potential treatment, but this economic burst is also captured by the counterfactual, meaning that they were not exclusive to Chile under Pinochet. Similarly, the burst registered in 1984 as a result of a new set of economic policies is in the same direction as the counterfactual. One additional important assumption is that the treatment did not affect any other donor country. This assumption rests on the uniqueness of the Chilean experience and the pioneering measures of the Pinochet regime. With these considerations, it is feasible to assume the effects in GDP per capita are due to Pinochet only and the stable unit treatment value assumption (SUTVA) holds.Footnote 13

Results on per capita income

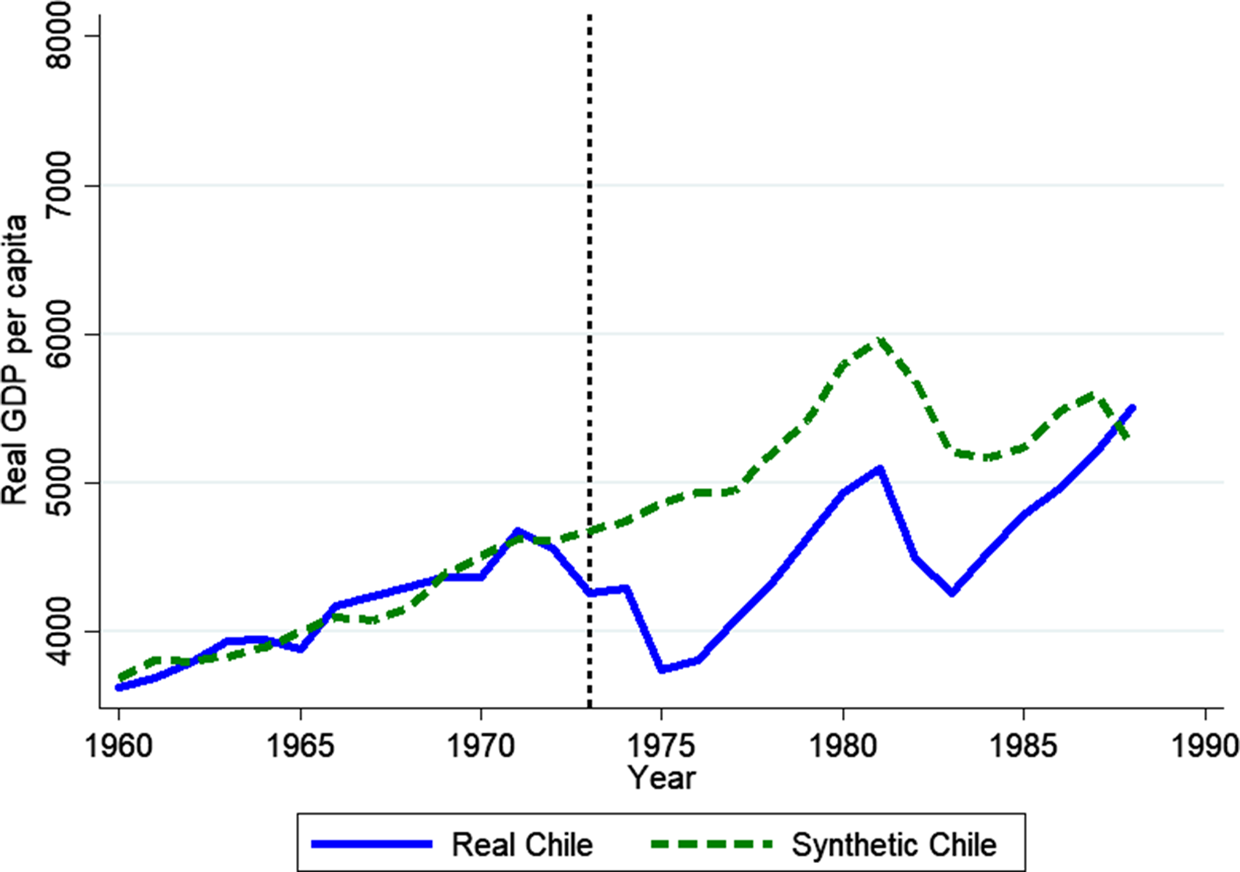

Synthetic Chile serves as a representation of actual Chile with no Pinochet, and I seek to see whether economic outcomes (per capita income, specifically) under Pinochet’s regime deviate from this counterfactual and if so in what direction and the relevance of the magnitude. The control matches the real outcomes closely for the previous thirteen years in the predictors I have selected. Below, figure 1 plots a comparison between actual and synthetic Chile over the pre-Pinochet period. As can be seen, synthetic Chile closely tracks actual Chile during the events before the treatment, which provides a visual indication that the control has been correctly created. I use data from the World Bank in constant 2010 US dollars.

Figure 1. GDP per capita. The solid line represents observed per capita income in Chile, 1960–1988; the dashed line represents the synthetic control for the same period. World Bank data are in constant 2010 US dollars.

Only three of the fifteen potential donors tested as controls for the construction of synthetic Chile received a weight greater than zero: Argentina (3.2 percent), Panama (53.2 percent), and Uruguay (43.6 percent). Table 3 reports the pre-Pinochet values of the predictors for both actual Chile and the synthetic control. Each value is close to its corresponding indicator, which reflects an appropriate match in the pretreatment period. The model fit pre-intervention root-mean-squared prediction error (RMSPE) for the unit of comparison is 0.096.

Table 3. Indicator fits, GDP per capita.

Note: Table shows the values of indicator variables and the average pre-Pinochet outcome variable for actual Chile and synthetic Chile. World Bank Data are in constant 2010 U.S. Dollars.

After the introduction of the treatment, one can notice a widening gap between both series. At 1973, the trajectory of the synthetic GDP per capita continues to outmatch the series of actual Chile. There is a previous decline prior to Pinochet’s coup that the regime was not able to contain. By 1975, Chilean per capita income is almost $1,500 below that of synthetic Chile, and the gap remains around $1,000 in all following years until 1983, when the gap narrows but continues to underperform synthetic Chile for five years more. This divergence would mean, at first glance, that Pinochet’s regime had a negative impact on the country’s GDP per capita. From 1973 onward, it is clear that synthetic Chile experienced higher levels of GDP per capita at least until 1988, fifteen years after the treatment.

The mediocre average GDP per capita growth resulted from two specific events. First, a monetary contraction aimed to control the hyperinflation inherited from the Allende administration. There was a reduction of government spending and public payroll which shrank the economy 13 percent in 1975 (Muñoz Reference Muñoz2008). The growing connectivity of the Chilean economy to the world and the intervention in the banking system in 1981 played a role in creating another recession in 1982, when Chile’s GDP per capita fell to 14.3 percent. The regime had to nationalize banks and industries, moving away from free market principles (Friedman and Friedman Reference Friedman and Friedman1998).

Expanding the donor pool and pretreatment period

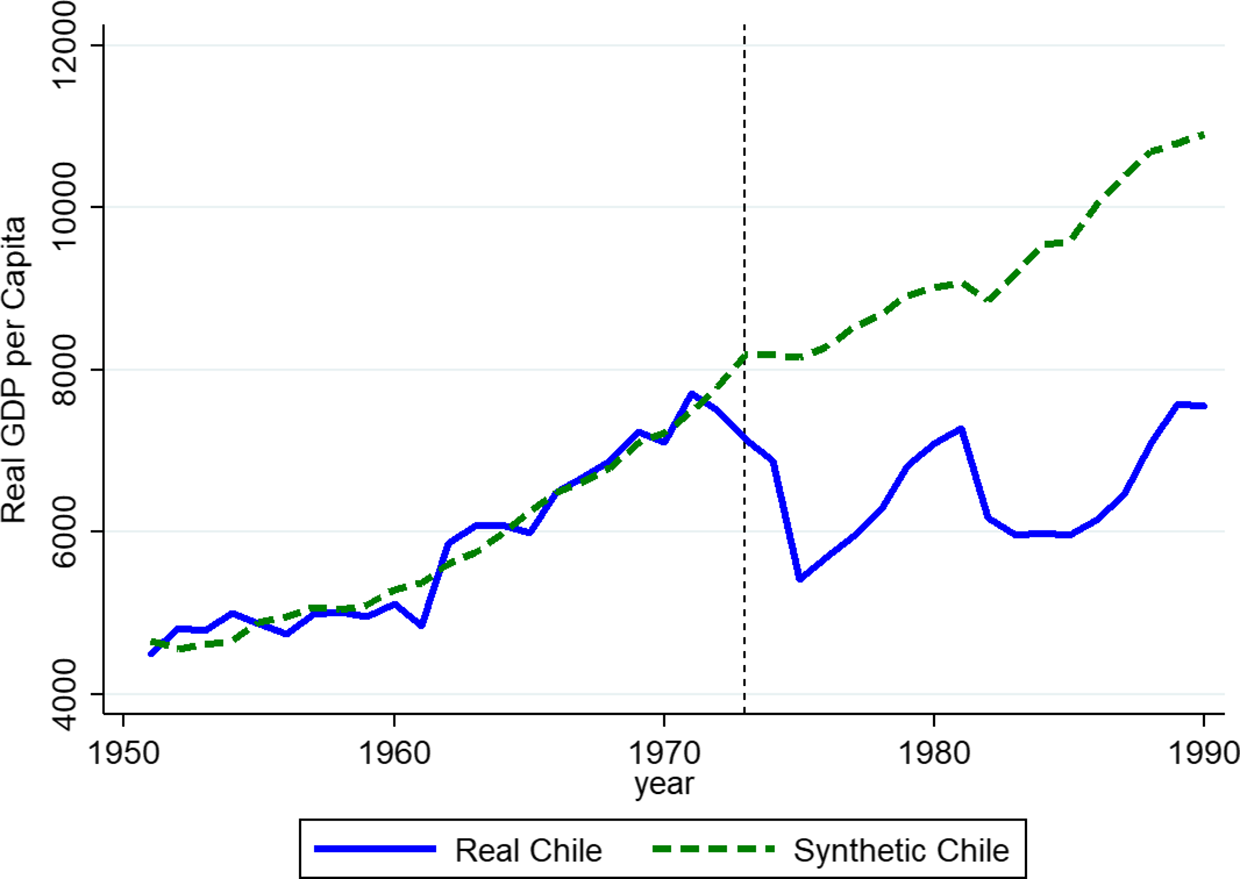

The conventional wisdom is that the Pinochet government, despite its multiple violations of human rights, established some policies and institutions that produced a fundamental and positive change in the Chilean economy. My initial experiment suggests the story may be more complex. To verify what seem to be surprising results, I run a second experiment with a different dataset obtained from the Penn World Tables that registers the GDP per capita since 1951. I also expand the pool of donors to countries with significant copper production to capture the historical influence of this commodity on the Chilean economy. My findings reach similar conclusions.Footnote 14 Figure 2 shows a comparison between actual and synthetic Chile over a longer pre-Pinochet period, which goes back nine more years, until 1951, in this experiment. As in the previous comparison, synthetic Chile closely tracks actual Chile during the events before the treatment.

Figure 2. Real GDP per capita at chained PPPs (in mil. 2011 US$). Penn World Table 9.1 going back to 1950 and expanded donor pool.

Table 4 reports results for each indicator. Similar to the previous experiment, the covariate values for the synthetic control match closely, or even better in some cases. Each calculation is close to its corresponding indicator, which reflects an appropriate match in the pretreatment period. This second experiment operates as a robustness check by switching to a different data set that includes more donors and pretreatment periods. Though the trends are similar, the gap is larger; this is expected due to the different base of the new dataset. By 1975 actual Chile underperforms the synthetic counterfactual by a little more than $2,500, and it continues to underperform synthetic Chile for the entire post-treatment period with a wider gap that reaches $3,000 for several post-treatment periods.

Table 4. Indicator fits, GDP per capita.

Note: Table shows the values of indicator variables and the average pre-Pinochet outcome variable for actual Chile and synthetic Chile. Penn World Table 9.1 data chained PPPs (2011 US$) from 1950.

Inference tests

The synthetic control methodology allows me to conduct inference tests to increase confidence in the results. It is possible to offer information about the statistical significance of the findings in the former section. The pretreatment matching in figures 1 and 2 presents a good indication that the methodology was executed correctly and suitable counterfactuals were constructed using two different datasets and pretreatment periods. Additionally, the methodology provides the alternative to conduct in-time and in-place placebo tests to increase the confidence in the results (Powell, Clark, and Nowrasteh Reference Powell, Clark and Nowrasteh2017).

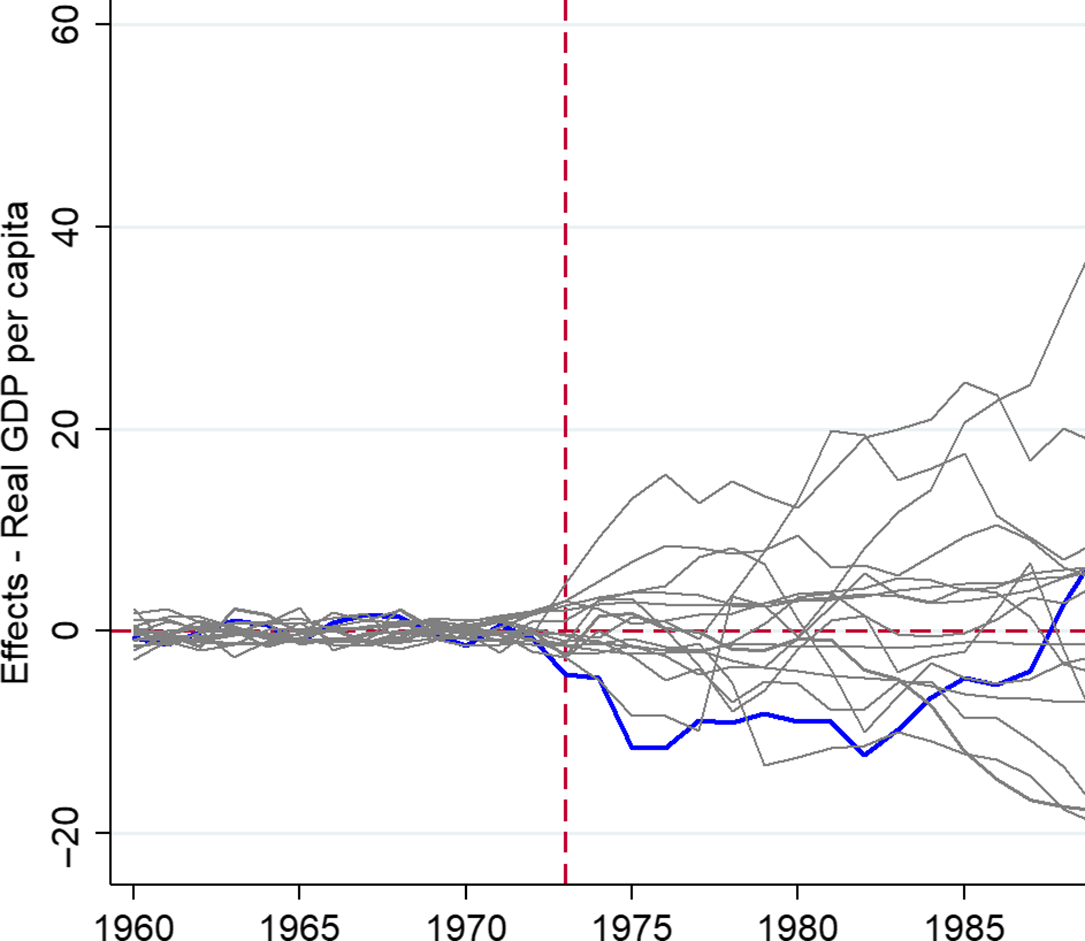

In this particular case, the in-time placebo is not suitable because there are no available data to maintain a similar level of observations before the treatment year, at least in the first central experiment. Therefore, it is more convenient to use a placebo on the geographical location that will simulate a control for each of the other donor countries. The in-place placebo test will serve to increase the confidence that the departure from the performance of synthetic Chile stems from the Pinochet treatment rather than a general deterioration in the predictive power of the synthetic counterfactual. The placebo produces a synthetic version of each control country that did not experience the Pinochet effect. It tests whether the difference between the control and its corresponding synthetic version after 1973 is more significant than the difference in Chile.

Confidence in the result that Chile’s per capita income was affected by Pinochet’s autocracy would be weakened if the magnitude of the in-place effect was similar for Chile and other countries. Figure 3 illustrates the synthetic control method in every country in our sample. The result shows that Chile does not have consistent growth in income per capita after Pinochet’s coup. There is a change in the trend years later, which may refer specifically to the establishment of broader liberalization reforms or other variables besides the political regime. Chile has a very noticeable change after introducing the treatment that persists over the post-treatment period, unlike most of the other control countries, which do not have a similar performance for the post-treatment period, 1973–1988.

Figure 3. GDP per capita placebo tests. The blue line represents the difference between observed income in Chile, 1960–1988, and the synthetic control; the synthetic control is normalized to zero. The graph shows placebo tests (light blue lines) for all other countries in the dataset.

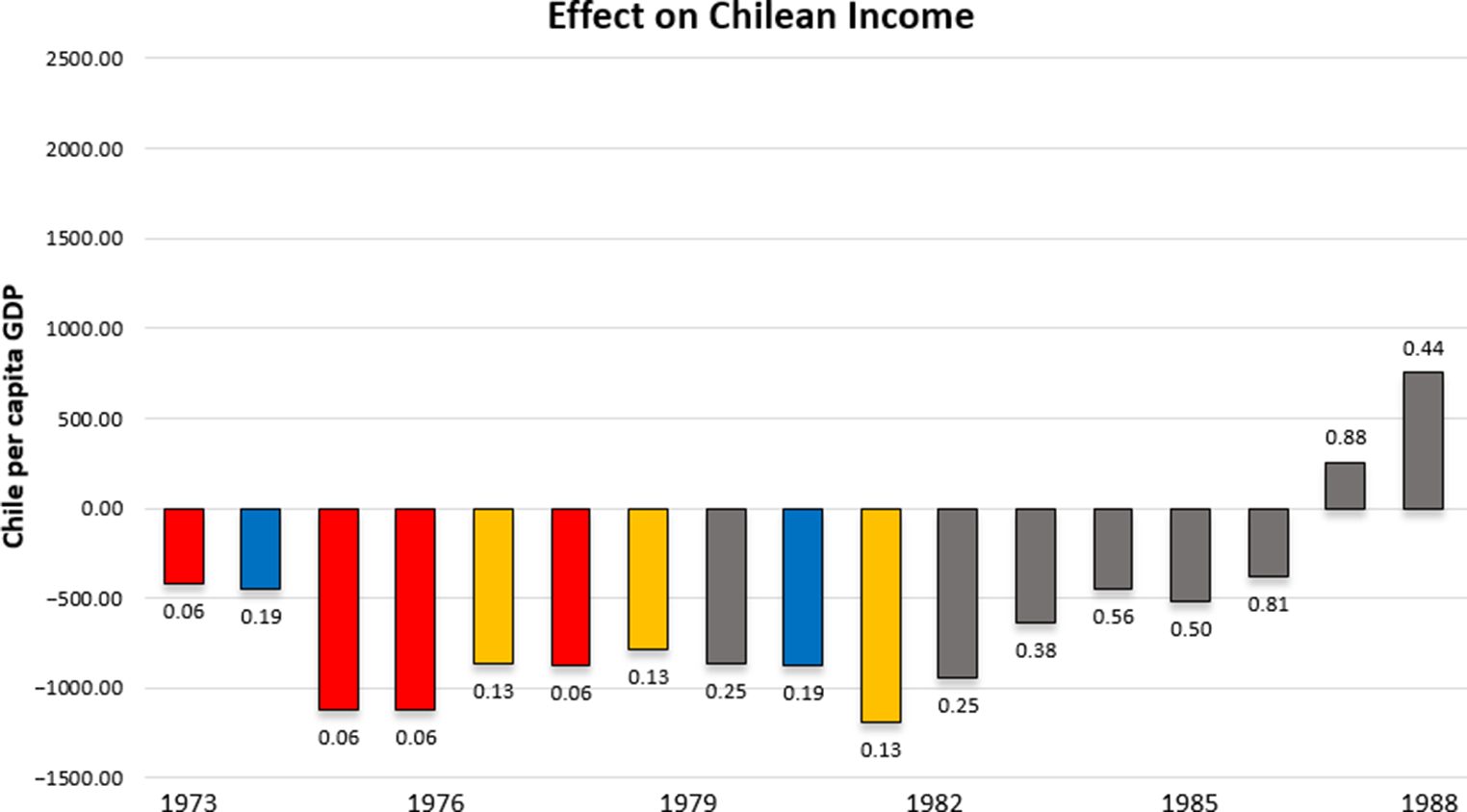

To increase the robustness of the analysis, the synthetic control method enables the calculation of a significance level (p-value) for the estimated Pinochet impact. It is a modified version of the method presented by Cavallo et al. (Reference Cavallo, Galiani, Noy and Pantano2013).Footnote 15 The process considers the absolute value of each period’s treatment effect and ranks it among the absolute values of the period’s placebo effects. The number of placebos with a more extensive estimated effect divided by the total number of placebos provides the p-value for each post-treatment period. This calculation evaluates the effect and the evolution of statistical significance over time. Therefore, the execution of the algorithm considers all countries, treated and donors, but it is important to notice that those countries with a poor fit in the pretreatment period are more likely to present more substantial deviations in any post-treatment period, decreasing the significance in some years of the post-treatment period.

Figure 4 shows the results of the calculations of the unique p-values for each post-treatment period with the placebo averages. This evidence and the initial results on the synthetic counterfactual suggest that Pinochet’s autocracy either caused a statistically significant decline in GDP per capita, or did not improve the ongoing decline from the previous regime. This decline was consistent during the first ten years after the coup. The control shows a reverse in the direction of GDP per capita around 1983, and it presents nonsignificant results in the final years of the post-treatment period.

Figure 4. This figure shows the estimated treatment effect on per capita GDP for each period following the Pinochet treatment. Effects in red are significant at the .06 level, effects in yellow are significant at the .13 level, effects in blue are significant at the .19 level. Effects in grey are insignificant.

Conclusion

Contrary to conventional wisdom, Pinochet’s autocracy does not seem to have had a decisive positive effect on per capita income, at least when the junta took power in 1973. Rather, it seems the turbulence caused Chile to perform worse in comparison to a synthetic counterfactual formed as a weighted average of similar countries that did not experience the regime of Augusto Pinochet. The results, robustness checks, and inference tests question the relevance of Pinochet to a positive influence on the income per capita that Chile experienced at the end of the twentieth century, or at least it questions how pro-growth the policies were under Pinochet. The confidence of the results may suggest that the economic growth in Chile depended much more on variables other than the introduction of the autocracy.

The findings support other empirical analyses, such as that of Easterly and Pennings (Reference Easterly and Pennings2018).Footnote 16 For them, the stories about benevolent autocrats, or even autocratic systems and growth successes, have not resulted in supporting evidence in the contemporary literature. In this view, the relevance of Pinochet’s autocracy to more substantial economic growth is overrated. Carden and Lawson (Reference Carden and Lawson2010) find a similar trend in their studies. Human rights abuses reduce rather than accelerate the pace of economic liberalization. Additional empirical studies have found democratic institutions and policies to be more supportive of economic progress than authoritarian political regimes are. A cross-country analysis strengthens the relationship and shows that more economic freedom and globalization encourage governments’ respect for human rights (Dreher, Gassebner, and Siemers Reference Dreher, Gassebner and Siemers2012). Rode and Gwartney (Reference Rode and Gwartney2012), for example, find that transitions to democracy are associated with subsequent increases in economic growth. This is also evident in Chile; the income per capita growth is far more impressive during the democratic era after Pinochet (Becker Reference Becker1997).

It is difficult to support a positive economic effect of Pinochet’s regime by looking at the income per capita, especially if this performance is compared to a weighted average of similar coutries, which is what I elaborated in this article by producing a synthetic counterfactual. There is no noticeable positive difference resulting from the political regime per se. Furthermore, the synthetic control evaluation of the Pinochet effect seems to support the claim that regardless of the conditions of the political regime, stable polities promote growth (Butkiewicz and Yanikkaya Reference Butkiewicz and Yanikkaya2007). If society can remove obstacles to the entrepreneurial spirit and unleash the market process, the results are similar most of the time. The presence of autocrats appears to have a secondary role if, as in the Chilean case, there is a will to eliminate hindrances to increasing the quality of economic and political institutions and allowing more extensive space for the market in public policies.

Studying the Glorious Revolution in England, North and Weingast (Reference North and Weingast1989) examined the political factors underpinning economic growth, focusing on both the rules governing economic exchange and the institutions governing how these rules were enforced. The degree to which the regime was committed to or bound by these enforcement rules determined the economic growth and the development of markets. Even though I have not tested this hypothesis in the case of Chile during the Pinochet regime, my results are consistent with it.Footnote 17 It is also possible that greater access to political institutions after Pinochet made the nascent economic growth stronger, following the theory provided by Acemoglu and Robinson (Reference Acemoglu and Robinson2012).

After the 1973 coup, the Chilean government undertook several economic reforms. Later, in 1980, Chileans approved a new constitution, which scheduled a referendum for 1988, in which voters decided if Augusto Pinochet should remain in power until 1997 or not. The “NO” won the referendum and Pinochet accepted the results. A joint presidential and parliamentary election took place the following year. As in early modern England, it is possible the expected transition to democracy served as a credible commitment for the government not to backslide to bad economic policies. Prior to the presidential election of 1989, the Pinochet regime and the opposition agreed to fifty-four modifications to the Constitution that expanded political rights but maintained the economic reforms (Uggla Reference Uggla2005). These changes could reflect an attempt to make credible the government’s ability to continue the path to economic growth and possibly be a factor more relevant than Augusto Pinochet for the Chilean economy.

Supplementary material

To view supplementary material for this article, please visit https://doi.org/10.1017/lar.2022.54

Acknowledgments

This paper was presented at the annual meetings of the Association of Private Enterprise Education in 2017 in Lahaina, Hawaii. The author gratefully acknowledges helpful comments from Adam Martin, Kevin Grier, Robin Grier, Samuel Absher, Alex Salter, Darren Hudson, and Glenn Furton, several scholars at that conference, and comments from anonymous referees.