The fates of public policies depend on the amount of support they have in the public and whether citizens are activated and organized to defend them. As the literature on policy feedback emphasizes, these political factors can themselves be shaped by the policies already in place. When government makes policies, the benefits those policies confer can activate constituencies that then mobilize and protect them (Pierson Reference Pierson1993). In studies of cases ranging from Social Security to Medicaid to the GI Bill, scholars have shown how these processes have shaped American politics and public policy (Campbell Reference Campbell2003; Hacker Reference Hacker2002; Mettler Reference Mettler2005; Michener Reference Michener2018).

Although policy feedback research has traditionally relied on historical analysis, recently scholars have blended feedback theory with political behavior research, asking whether receiving benefits from government programs affects individuals’ political participation and political attitudes.Footnote 1 The findings of this newer work are rich and varied—and they also show that feedback effects are “contingent, conditional, and contested” (Patashnik and Zelizer Reference Patashnik and Zelizer2013, 1072). As it stands, however, this political behavior segment of the literature is limited in three respects.

First, it focuses almost entirely on social programs such as Medicare, Medicaid, Social Security, and TANF (Temporary Assistance for Needy Families). These are important policies but not all that government does. Moreover, one main hypothesis is that receiving benefits makes individuals more supportive of those programs, yet for many of the programs analyzed, the beneficiaries lean liberal and Democratic (Morin, Taylor, and Patten Reference Morin, Taylor and Patten2012; Sances and Clinton Reference Sances and Clinton2019)—and might have supported the policies (and government) anyway.

In this article, we examine a different set of programs: US Department of Agriculture (USDA) farm aid programs. The recipients of agricultural assistance are a predominantly white, rural, conservative, and Republican group of Americans—and thus they provide a distinctive population for assessing the scope of policy feedback theory. It is also a population that is highly important to American politics: there are over three million agricultural producers in the United States, and more generally, rural Americans are overrepresented in American political institutions due to a variety of factors, including malapportionment in the US Senate. Furthermore, agricultural assistance programs are an important part of the US fiscal state: they distribute billions of dollars to American farmers each year, and they recently increased in salience as the Trump administration ramped up farm program spending to offset damage dealt by retaliatory tariffs (Rappeport Reference Rappeport2020). Consequently, there is much to be learned from broadening the policy feedback literature to include such programs.

Second, the literature has focused more on political participation than attitudes and has placed heavy emphasis on the importance of internal policy design features. But understanding the connection between receiving government benefits and political attitudes is important, both as a test of policy feedback theory and as it connects to a broader puzzle of American politics: as Mettler (Reference Mettler2018, 18) puts it, “How can we explain why Americans and US politics have been veering in an antigovernment direction at a time when more people than ever are personally benefitting from government?” Recently, moreover, the divisive, intensely partisan politics of the Affordable Care Act (ACA) have raised questions about whether variation in policy feedback may depend on more than just policy design.

We advance the literature on this dimension by asking whether receiving payments from the USDA is associated with recipients’ political attitudes, both on the policy in question and the role of government more broadly. Also, in considering the possibility of varying effects, we evaluate two newer theoretical proposals: that feedback effects depend on (1) the divisiveness of program enactment and implementation (Patashnik and Zelizer Reference Patashnik and Zelizer2013) and (2) recipients’ ideology or partisanship—especially for programs that are themselves highly partisan (Lerman and McCabe Reference Lerman and McCabe2017; McCabe Reference McCabe2016; Sances and Clinton Reference Sances and Clinton2021).

Third, even though policy feedback theory implies that effects should vary at the individual level, empirical research gives pride of place to policy-level variables, most likely because of the difficulty of determining which individuals received which benefits. Notably, the few studies that do measure individuals’ experiences with policies mainly rely on survey self-reports of program participation, which raises questions about whether respondents with more positive experiences and views are more likely to report having used government programs.

We overcome this data hurdle by using administrative data on USDA payments. We pair these data on individuals’ receipts of agricultural assistance with an original, first-of-its-kind survey of 1,072 producers, designed to measure their political attitudes. We also build in an experiment in which a group of respondents is reminded of the amounts of assistance they have received in past years to assess whether making payments salient in producers’ minds affects their attitudes.

Our results suggest that benefit receipt is sometimes, but not always, associated with political attitudes. For a relatively new program that is strongly associated with the Trump administration (and was created by unilateral executive action), those who receive benefits—and those who receive larger benefits—do tend to be more supportive of the program. However, there is heterogeneity by political ideology. Politically conservative farmers, whose predispositions make them more supportive of Trump to begin with, support the program regardless of whether they personally benefit. However, for liberal and moderate farmers, program support increases sharply in the level of benefits, overcoming predispositions to be less supportive of a Trump-associated policy. In contrast, receiving larger benefits from traditional farm subsidies—which are less partisan but have a long history of major policy changes and political contention—is not associated with greater support for the programs. And for a program that provides payments to farmers to incentivize conservation, which has changed very little over the years and has not been subject to major political fights, larger benefits are clearly associated with greater support for the program regardless of recipient ideology. However, we find no evidence that receiving agricultural assistance from any of the programs is related to support for government more generally. Thus, although some scholars find that citizens’ misperceptions about their connection to government contributes to antigovernment sentiment (Lerman Reference Lerman2019; Mettler Reference Mettler2018), our findings show that even when these citizens get checks directly from the federal government—and in some cases are reminded of those benefits—it still has no association with their attitudes toward government.

Existing Literature: Themes and Opportunities

The policy feedback literature has its roots in the historical institutionalism tradition, and many of its core theoretical ideas were developed to explain the evolution of the welfare state. Central is the notion that policies can reshape politics in ways that define the future trajectory of policy making—making some policy paths more likely and closing off others. Agenda-setting work by Pierson (Reference Pierson1994) explains how policies help to generate their own supportive constituencies, giving rise to path dependence that makes retrenchment politically difficult. In the years since, scholars have shown that positive path dependence is only one possible outcome and have developed theories of the conditions under which policies can be self-reinforcing or self-undermining (Hacker Reference Hacker2002; Jacobs and Weaver Reference Jacobs and Weaver2015; Patashnik Reference Patashnik2008; Sheingate Reference Sheingate2001; Weaver Reference Weaver2010).

Much of this literature relies on historical analysis at the level of institutions, groups, and the political economy (Sheingate Reference Sheingate2014), but a growing branch of policy feedback research focuses on political behavior, quantitative analysis, and a particular component of policy feedback theory: that by delivering benefits, public policies can affect political participation and attitudes. As Campbell (Reference Campbell2003) describes, the expansion of Social Security during the mid-twentieth century gave rise to a politically active, engaged, and well-organized constituency of senior citizens—and a constituency highly supportive and protective of Social Security benefits. Similarly, the GI Bill conferred resources (education) and conveyed to veterans that government worked for people like them, which helped to transform veterans into an effective, supportive constituency (Mettler Reference Mettler2005). Today, a large body of research evaluates whether receiving government benefits affects the political behavior of mass publics (Campbell Reference Campbell2012), and this trend has intensified in recent years as scholars have examined the possibility of feedback effects of the ACA.

Three broad features of this behavior-oriented policy feedback literature are worth highlighting. First, following the historical institutionalism branch of the literature, it focuses almost entirely on social policies, including Social Security, the major health care programs, welfare, and nutrition assistance (Campbell Reference Campbell2003; Mettler Reference Mettler2018; Michener Reference Michener2018; Morgan and Campbell Reference Morgan and Campbell2011; Soss Reference Soss1999; Reference Soss2000; Soss and Schram Reference Soss and Schram2007). These policies are important, of course, but they are not the sum total of what government does, and because many of them deliver benefits to Americans who might be predisposed toward supporting government programs, the conclusions that can be drawn from this literature may be limited. Moreover, Sheingate’s historical analysis of agricultural subsidies (which he argues should be thought of as part of the American welfare state) suggests that policy feedback may work differently in areas outside of social policy: his focus is on the development of policy, institutions, and interest groups, but he finds that retrenchment has been easier in agricultural policy than Pierson’s account of welfare state resilience might suggest (Sheingate Reference Sheingate2001).

Second, this literature emphasizes certain types of dependent and independent variables. On the dependent variable side, scholars have focused more on political participation than political attitudes. For example, several recent studies examine how Medicaid and features of the ACA affect turnout (e.g., Clinton and Sances Reference Clinton and Sances2018; Haselswerdt Reference Haselswerdt2017; Jacobs, Mettler, and Zhu Reference Jacobs, Mettler and Zhu2021; Michener Reference Michener2018). On the independent variable side, the literature underscores the importance of policy design. For example, a primary hypothesis is that government programs that deliver large benefits generate stronger feedback effects than those that confer small benefits (Campbell Reference Campbell2003; Reference Campbell2012; Howard Reference Howard2007). Another insight is that feedback effects can be muted or nonexistent for programs whose benefits are “submerged”—or not easy for recipients to attribute to government (Mettler Reference Mettler2011). Feedback effects can also be negative. Soss (Reference Soss1999; Reference Soss2000) finds that participation in Aid to Families with Dependent Children (AFDC) lowered recipients’ political engagement because in order to receive benefits, they had to interact regularly with caseworkers who had considerable control over program administration—in a way that seemed arbitrary, unresponsive, and threatening. Moreover, as Lerman and Weaver (Reference Lerman and Weaver2014) show in their study of the criminal justice system, some policies impose costs on individuals, which also works to reduce participation.

There are fewer studies of how policies affect political attitudes, with mixed results, and here, too, scholars focus on policy design. Soss and Schram (Reference Soss and Schram2007) and Morgan and Campbell (Reference Morgan and Campbell2011) examine whether political attitudes changed after major reforms to welfare and Medicare and find no such effects. However, Mettler and Stonecash (Reference Mettler and Stonecash2008) find that individuals who report having used social policies are more likely to say those policies are effective. A number of recent studies find positive effects of Medicaid expansion or gaining public health insurance on individuals’ favorability toward the ACA (Hopkins and Parish Reference Hopkins and Parish2019; Hosek Reference Hosek2019; Jacobs and Mettler Reference Jacobs and Mettler2018; Lerman and McCabe Reference Lerman and McCabe2017; McCabe Reference McCabe2016; Sances and Clinton Reference Sances and Clinton2021), but the effects are modest, and researchers have speculated that policy design may be a reason (Campbell Reference Campbell2020). Also, in general, Mettler (Reference Mettler2018) finds little evidence that receiving social benefits increases support for government.

A third feature of this literature is that even though the hypothesized effects should occur at the level of individuals, there is a major challenge involved in carrying out empirical analysis at the individual level: the difficulty of measuring which individuals received which benefits. Theory implies that feedback effects should be larger for individuals receiving larger benefits and for benefits they are aware of compared with those receiving smaller benefits and those they are less aware of (Arnold Reference Arnold1990; Moe Reference Moe2015). Moreover, policy-level variables may be too blunt an instrument for detecting feedback effects in some cases, especially considering that there can be significant individual-level variation in people’s experiences with a single government program (Hobbs and Hopkins Reference Hobbs and Hopkins2021).

The literature on the ACA has made some strides on this front, but with researchers using proxies for who received benefits (based on program eligibility criteria), aggregate-level comparisons of places affected and unaffected by reforms, and surveys in which respondents self-report which benefits they have received. For example, Hopkins and Parish (Reference Hopkins and Parish2019) focus on low-income respondents under 65 to evaluate whether Medicaid expansion increased favorability toward the ACA. Clinton and Sances (Reference Clinton and Sances2018) compare aggregate data on uninsured rates in counties whose parent states did and did not expand Medicaid. Other studies rely on surveys that ask respondents where they get their health insurance (Hosek Reference Hosek2019; Lerman and McCabe Reference Lerman and McCabe2017), whether their insurance status changed (McCabe Reference McCabe2016), or about their usage of social programs (Mettler Reference Mettler2018; Mettler and Stonecash Reference Mettler and Stonecash2008). That these studies leverage data on benefit receipts is an advance, but at best they capture whether or not individuals received benefits—not more nuanced measures of the size of the benefits or recipients’ awareness of the benefits received. More critically, survey respondents who remember or are willing to report having received a benefit may be those more supportive of the policy.

In recent years, the rise in party polarization and salience of the ACA have inspired some promising new theoretical developments in this literature. One is a broadening of the policy-level variables proposed to be important. As Patashnik and Zelizer (Reference Patashnik and Zelizer2013) argue, internal policy design features matter, but so also may the politics of how a policy is enacted and implemented. When policy enactment is divisive and when implementation is marked by ongoing political tug-of-war, policies may be less likely to endure. Second, scholars have considered how feedback effects of the ACA might be conditional on individuals’ party identification and ideology (Jacobs and Mettler Reference Jacobs and Mettler2018). Lerman and McCabe (Reference Lerman and McCabe2017) find that the effect of receiving public health insurance on support for Medicare spending is positive and significant for Republicans but not for Democrats. In another study of the ACA, however, Sances and Clinton (Reference Sances and Clinton2021) find that the effect of Medicaid expansion on support for the ACA does not vary by respondent party identification. Although still in its infancy, this is a promising line of inquiry given the salience of party and ideology in modern American politics.

In summary, the policy feedback literature is theoretically rich and diverse in its empirical approaches, but there are several open questions of importance to American politics: Do the theorized effects of receiving benefits on political behavior and attitudes extend beyond social policy—perhaps to realms of governmental activity where benefit recipients are predominantly conservative and hostile toward government? Do any such feedback effects depend on the divisiveness or partisan nature of policy enactment and implementation or on the party identification or ideology of the recipient? And would this come into sharper focus if we could track which individuals got which benefits?

Agricultural Policy: Background and Theoretical Expectations

To answer these questions, we focus on USDA farm aid programs, examining how participation in agricultural assistance programs shapes political attitudes. We start by describing the primary elements of US agricultural policy and laying out our theoretical expectations, including our expectations for conditional relationships.

Background

Modern USDA farm aid programs fall into three main categories: (1) commodity programs, which give farmers financial support to grow crops or raise livestock; (2) conservation programs, which pay farmers to leave farmland fallow to preserve environmental health; and (3) disaster programs, which provide relief to farmers who fall victim to natural disasters. As we discuss in “Further Supplemental Information” on this article’s Dataverse, these three categories of farm aid together constitute a substantial fraction of agricultural producers’ net income.

The term “farm subsidies” typically refers to commodity programs in which payments are provided to farmers as part of the normal course of business. Spending on such programs is governed by the bidecennial farm bill. As we will discuss, these programs have a long history and have varied considerably over the years. For example, when the 2008 farm bill was implemented, the USDA distributed most of its commodity payments through the Direct and Counter-Cyclical Program (DCP), which—among other things—paid large subsidies to farmers regardless of market conditions or current production choices.Footnote 2 The 2014 farm bill marked a major shift, conditioning the vast majority of farm payments on challenging market conditions. At that time, the DCP was eliminated and replaced with a combination of the Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC) programs. The ARC and PLC programs are quite similar in that they both protect against market downturns for covered commodities, and farmers must periodically choose which of the two programs to enroll in. Together, the ARC/PLC programs have constituted the dominant channel for commodity subsidies since 2015, and although the 2018 farm bill made a few tweaks, it left this funding paradigm largely intact (FSA 2019a). As Figure 1 illustrates, ARC/PLC made up the majority of farm program spending from the implementation of the 2014 farm bill through 2017.Footnote 3

Figure 1. USDA Farm Program Spending across Four Farm Bills

Note: Figure omits other types of conservation payments (most of which are not administered by the Farm Service Agency), payments obtained by exercising a USDA marketing loan option, payments associated with the 2020 COVID relief legislation, and miscellaneous minor commodity program payments. None of these categories constituted a substantial fraction of USDA farm aid during our sample period of 2015–2019.

Recently, however, billions of dollars have also been issued through another, very different commodity program—one that operates outside of the farm bill: the Market Facilitation Program (MFP). In 2018, trade conflict between the US and China quickly led to Chinese retaliatory tariffs being placed on US agriculture. The Trump administration responded with the MFP, authorizing direct payments to affected farmers, with a renewed tranche of payments issued in 2019. The MFP is not only a very recent development but also a massive outlier in the history of USDA farm aid, as well as an exceptionally large unilateral presidential fiscal action.

The USDA has also distributed billions of dollars through the Conservation Reserve Program (CRP)—its hallmark conservation program (FSA 2019b). The CRP offers payments to incentivize conservation. Farmers who enroll are paid annual rental payments to leave cropland fallow and/or plant cover crops, with the goals of controlling soil erosion, protecting water quality, and redeveloping natural habitats.

Theoretical Expectations

Policy feedback theory proposes that individuals who receive benefits from government programs become more supportive of those programs, and that forms our baseline expectation as well: that agricultural producers who receive benefits from major USDA programs will be more supportive of those programs than individuals who do not. The size of the benefits should also matter. We expect individuals who receive larger benefits to express greater support for the program than those who receive smaller benefits (Campbell Reference Campbell2012). Furthermore, individuals who are more aware of having received benefits from a government program, or for whom the benefits are more salient, should be more supportive than individuals who are less aware or for whom benefits are less salient (Mettler Reference Mettler2011). As for whether any such effects spill over onto views of government as a whole, theory is less clear, but Mettler (Reference Mettler2018) finds little evidence that receiving benefits from social programs improves attitudes toward government generally.

Unlike the social policies focused on in the literature, agricultural assistance reaches individuals in their roles as producers, suggesting the importance of examining policy details that affect businesses and organized interests. Notably, however, USDA programs also differ from each other in ways we expect might shape their feedback effects. By comparing across three of the largest USDA programs—the MFP, ARC/PLC, and CRP—we explore two promising, understudied theoretical proposals: (1) that divisive program enactment and implementation can weaken feedback effects (Patashnik and Zelizer Reference Patashnik and Zelizer2013) and (2) that responses to receiving government benefits might vary with recipient party affiliation and ideology (Lerman and McCabe Reference Lerman and McCabe2017; Sances and Clinton Reference Sances and Clinton2021)—especially when the program itself is intensely partisan.

The MFP is a useful starting point because it is comparable in some ways to the ACA, which has been researched a great deal. Both are relatively new, significant policies and products of the hyperpartisan era. Just like the ACA is strongly associated with President Obama, the MFP is strongly associated with President Trump. Notably, some have proposed that the effect of receiving ACA benefits on support for the ACA should be greater for Republicans than Democrats because Democrats tend to support “Obamacare” regardless of their own participation (Lerman and McCabe Reference Lerman and McCabe2017). We expect an analogous pattern for the MFP: that receiving benefits will be associated with a larger increase in support for the program among liberal, moderate, and Democratic farmers because conservative, Republican farmers are likely to support Trump’s policy regardless.

However, the origin of the MFP did not involve protracted, divisive debates in Congress (and across the country in town halls) like the ACA did (e.g., arguments over whether the law would lead to “death panels”). The MFP was a unilateral presidential action. Thus, although policy feedback scholars have pointed to the divisiveness of ACA enactment and implementation as a likely cause of its weaker-than-expected feedback effects (Patashnik and Zelizer Reference Patashnik and Zelizer2013), that feature is absent for the MFP, which bolsters our expectation of positive feedback effects—conditional on recipient ideology and partisanship.

ARC/PLC is different in ways that we expect to be associated with relatively weaker feedback effects. First, it is fundamentally different in its substance and policy legacy. The MFP is an ad hoc response to the trade war, whereas ARC/PLC is just the latest iteration of more than a century of policies intended to deal with low crop prices and shore up farmers’ income.Footnote 4 Moreover, the government has approached this goal in different ways over the years and has substantially reformed its commodity support programs at least a half-dozen times. Specifically, in the last half-century, the government has prevented acreage from being planted (to reduce supply), offered loans on generous terms, created countercyclical target price supports, paid farmers just for running agribusinesses, subsidized crop insurance premiums, and embraced different combinations and variations of these activities.Footnote 5 Therefore, ARC/PLC was not created from a blank slate—far from it—and many beneficiaries of ARC/PLC today may remember alternative funding systems of the past, some of which they may prefer to the existing regime.Footnote 6

Second, the history of ARC/PLC and its predecessor policies has been marked by political divisiveness. Unlike Social Security and Medicare, farm subsidies are set through the appropriations process and thus are renegotiated every few years. And although the farm bill is famous for being bipartisan in terms of ultimate roll-call votes, it is also notoriously messy and contentious: it divides producers along regional lines (pitting the South, Great Plains, and Midwest against each other) or along the lines of individual commodities (Sheingate Reference Sheingate2001), and it ropes together programs as diverse as agricultural subsidies and the Supplemental Nutrition Assistance Program (SNAP) in order to construct a coalition of rural and urban legislators. In 2013, coalition infighting was so intense that the farm bill collapsed, and the bill that was eventually passed a year later made major policy changes (discussed above). And the contentiousness of the farm bill is not new. For example, in a 1985 debate that set Senate Agriculture Committee Chairman Jesse Helms against his House counterpart Kika de la Garza, Helms denounced Southern interests’ victory in extracting improved terms for cotton and rice as “the great train robbery” (Hillgren Reference Hillgren1985). A decade later, de la Garza in turn denounced commodity program reforms in the 1996 farm bill as “a sudden and dramatic abandonment by the Government of its role in sharing the farmer’s risk” (Coppess Reference Coppess2018, citing Cong. Rec. 02/28/1996, H1417).

Given ARC/PLC’s bipartisan history, we do not expect producers to respond to receiving benefits from it in ideological or partisan ways. But we also question whether we should expect to see feedback effects here at all. With such a long history of fractious coalitions and shifting policies—including policy retrenchment (Sheingate Reference Sheingate2001)—producers may view the distribution of benefits as arbitrary and capricious.Footnote 7 Soss (Reference Soss1999) has shown for welfare that perceptions of arbitrariness can weaken feedback effects we would otherwise expect to occur. In the case of welfare, these perceptions are shaped by program administration and caseworker interactions (see also Herd and Moynihan (Reference Herd and Moynihan2018)). However, frequent policy changes and political divisiveness—as highlighted by Patashnik and Zelizer (Reference Patashnik and Zelizer2013)—can potentially create similar perceptions of arbitrariness among agricultural producers and have the same effect of severing the expected link between receiving benefits and supportive attitudes.

What, then, should we expect of the CRP? It, too, has bipartisan origins (and, we note, is an interesting case of an environmental program with Republican support). Therefore, we do not expect partisan or ideological heterogeneity in its feedback effects on attitudes. However, in contrast to ARC/PLC, the CRP does not have a long history of major policy changes and political divisiveness. When it was enacted in 1985 under President Reagan, it was the first USDA program of its kind. It also has not changed much in size, scope, or approach since then, and compared with ARC/PLC and its predecessors, the goal and approach of the CRP is simpler: it pays farmers to conserve land.Footnote 8 Moreover, politically, CRP enactment and implementation have not been noticeably divisive; from the beginning, the policy arrangement was the same for all of the regional and commodity interests. Indeed, the design of the CRP inherently smooths over divides within the farm bill coalition. By taking cropland out of production across the nation, production is broadly suppressed, and all commodity interests benefit from higher prices. Therefore, for the CRP, the feedback-weakening features of ARC/PLC are not present, and we expect to find a link between receiving (greater) benefits and more supportive attitudes toward the program.

Table 1 summarizes our expectations. We anticipate that the strength and conditionality of feedback effects will depend on the divisiveness of enactment and implementation as well as program partisanship. The MFP is partisan but has not involved protracted, divisive debate, so we expect positive feedback effects, conditional on recipient ideology. ARC/PLC is not partisan but has a long history of coalition infighting and major policy changes, so although we do not expect feedback effects to be conditional on recipient party or ideology, we also question whether feedback effects will occur at all. Finally, the CRP is neither divisive nor partisan, suggesting positive feedback effects not conditional on recipient ideology or partisanship.

Table 1. Theoretical Expectations for Policy Feedback

Research Design

To measure the political attitudes of USDA program beneficiaries, we mailed survey invitations to nearly 44,000 farm subsidy recipients for whom we had detailed USDA payment records for the period 1995–2019.Footnote 9 We started by filing a Freedom of Information Act (FOIA) request to obtain records for the universe of farm subsidy payments issued by the USDA’s Farm Service Agency (FSA) between the 2012 and 2019 calendar years. These records feature 26.8 million payments made to approximately 1.8 million distinct individuals and businesses, with around 1 million distinct recipients each year. Each payment record includes the name and address of the recipient, as well as the program name, amount, and disbursement date.

We then selected a sampling frame from this population that reflects the prominence of ARC/PLC and CRP spending under the 2014 and 2018 farm bill regimes. Specifically, we considered individuals and businesses who, for 2015–2019, were in the top 50% of recipients of both ARC/PLC payments and CRP payments. The median 2015–2019 CRP total among program participants was $6,250, and the median ARC/PLC beneficiary received $4,753. For producers who cleared these two thresholds, we merged in 1995–2018 annual program totals from the Environmental Working Group (EWG) Farm Subsidy Database and selected recipients for whom we could validate exact annual payment histories for 2015–2018.Footnote 10 This yielded 43,941 distinct payment recipients.

Defining our sampling frame in this manner served two purposes: it allowed us to manipulate the salience of payments without using deception (as we describe below), and it ensured that potential respondents have received significant income from the USDA (while still preserving substantial variation in our independent variables). This latter feature is important because many individuals engaged in farming do not consider farming their primary occupation. Although ultimately we are interested in evaluating policy feedback among all farmers, we expect that the clearest constituency generated and mobilized by farm programs would be individuals whose primary employment is agriculture.Footnote 11 To verify that most people in our sampling frame engage in farming as their primary occupation, we merged it with national voter and consumer files we acquired from the vendor L2 (see “Further Supplemental Information” for details). The results show that 53% of individuals in our sampling frame have the primary occupation of “farmers” or “dairymen,” and that is almost certainly an undercount because of considerable missing data in L2’s occupation field.Footnote 12 In addition, as part of our survey, we asked, “People often describe themselves in various ways, for example by their nationality, their religion, or their occupation. How much do you think of yourself as a ‘farmer’?” Overall, 58.8% of respondents responded “a great deal” or “a lot,” whereas only 16.2% said “a little” or “not at all.”Footnote 13

Embedded Survey Experiment

Our main goal for the survey was to measure respondents’ support for agricultural assistance programs and government more generally, but we also embedded an experimental intervention directed at increasing the salience of particular program benefits and reminding respondents of the benefits they received. We randomly assigned each respondent to one of three treatment categories: a control group, an “ARC/PLC treatment” group, or a “CRP treatment” group. Respondents in the control group were first asked an opening block of questions about their farming activities, party identification, and liberal–conservative ideological disposition. They then answered a battery of questions about their views on government and particular policies. Respondents in the ARC/PLC treatment group answered the same questions as the control group, but we inserted an informational screen directly after the opening block of questions with the following prompt:

As an agricultural producer, public records show that you have received assistance from several U.S. Department of Agriculture (USDA) programs over the last 5 years. For instance, you are in the top half of recipients for the Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC) programs for this period. The ARC and PLC programs provide income support payments when crop revenues and prices drop below certain levels. The table below lists the amount of money you have received from these programs in each year.

[Table displaying respondent’s yearly ARC/PLC payments for 2015–2019, as well as the five-year total]

Respondents in the CRP treatment group viewed a prompt regarding their CRP payments after the opening block of questions.

We anticipated the ARC/PLC and CRP treatments to have both a priming effect (by reminding respondents of their recent benefit amounts) and an informational effect (by informing them of their relative position in the program). Our goal was to make the saliency treatment as strong as possible by bundling information about payment histories with a signal of the substantial support they had received from the program. This is similar to powerful treatments in prior research that both reminded individuals about information they already had and provided them potentially novel information about relative standing (see, e.g., Gerber, Green, and Larimer [Reference Gerber, Green and Larimer2008]).Footnote 14 Balance statistics for the experiment are reported in the online appendix. Random assignment produced strong balance on most producer characteristics (e.g., payment histories, age, gender, education, geography). By chance, the control group exhibited less conservative/Republican leanings, so we adjust for ideology in our analyses.

Respondent Characteristics

For each individual in the sampling frame, we mailed an invitation letter that included a link to an online Qualtrics survey and a unique access code for each respondent. We also included a phone number on the invitation letter; this allowed us to administer surveys by mail if requested by the agricultural producer. Approximately 20 respondents completed the survey via a physical questionnaire and returned it by mail.Footnote 15

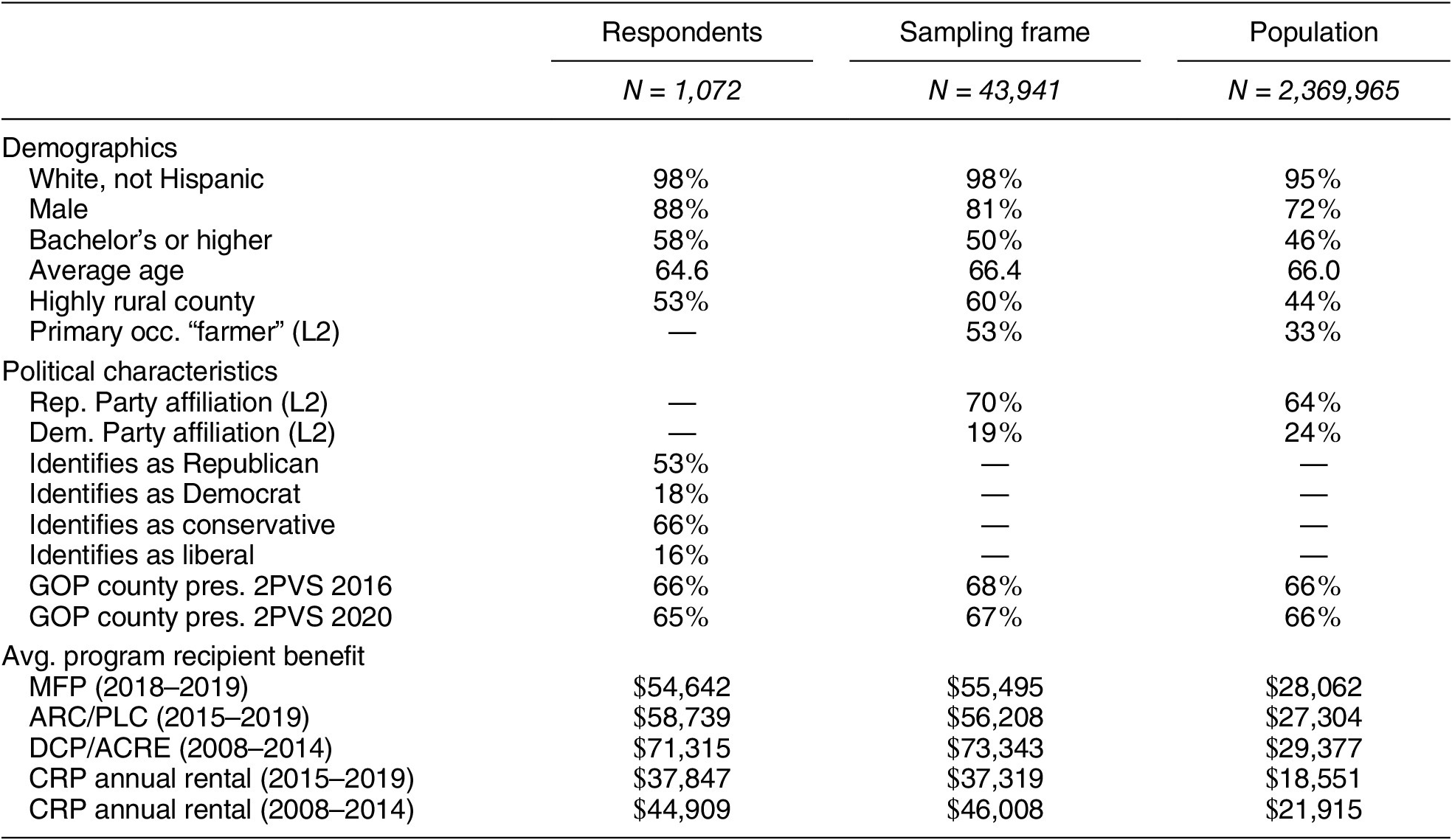

In total, we received 1,072 complete survey responses, yielding a response rate of 2.4%.Footnote 16 Although this response rate may seem low, it is actually comparable to that of many political surveys.Footnote 17 Furthermore, as we show in columns (1) and (2) of Table 2, respondents resemble the overall sampling frame fairly well on a number of geographic and individual covariates, mitigating issues of nonresponse bias. The average respondent’s commodity and conservation payment histories over the past two farm bills were remarkably similar to those of the average sampling frame member. Additionally, respondents’ self-reported demographic characteristics match up fairly well with those of the sampling frame (which we obtained from the merged L2 data). Respondents have higher levels of educational attainment than nonrespondents (which is typical of most public opinion surveys), but both subgroups are predominantly white, male, elderly, and rural. Although we do not have directly comparable measures of political affiliation for respondents and nonrespondents, L2’s party affiliation measure and respondents’ self-identifications suggest Republicans outnumber Democrats in both groups at a rate of roughly three to one. Moreover, Donald Trump’s two-party county-level vote share was similarly around two-thirds in both groups in both 2016 and 2020. Thus, it does not appear that liberal producers were disproportionately likely to respond to the survey invitation.

Table 2. Characteristics of Respondents, Sampling Frame, and Population

Note: CRP cost-share payments are omitted due to inconsistent data availability for the full population. All payment figures are in 2020 USD. L2 party affiliation is among individuals linked to the L2 voter file. Population and sampling frame demographics are sourced from the L2 voter and commercial files, whereas respondent demographics are survey items. We say a county is “highly rural” if it scores six or more on the USDA’s nine-point rural–urban continuum code scale. This means that the county is not contained in a metropolitan area and has an urban population below 20,000.

To get a sense of how respondents and the sampling frame compare to the broader population of agricultural payment recipients, in column (3), we present the same descriptive information for over 2 million agricultural producers, which we obtained by linking an extended set of 2004–2020 USDA payment records with the L2 data (see “Further Supplemental Information”). Focusing on columns (2) and (3), we again see that our sampling frame has a higher percentage of individuals for whom farming is their primary occupation, compared with the broader population of recipients (53% versus 33%). We also see that the broader population is mostly white, male, elderly, rural, and conservative—similar to our sample and sampling frame.

Most importantly, we find reasonable covariate balance between the sampling frame and respondent sample. Nonetheless, in “Further Supplemental Information,” we gauge the effect of potential differential nonresponse on all of our regression estimates. Using the entropy-balancing methods of Hainmueller (Reference Hainmueller2012), we construct poststratification weights for the sample of respondents that ensure that the first moments of each demographic field (gender, age, five education categories, four geography categories) match those of the sampling frame. In “Further Supplemental Information,” we compare the results of each reported regression coefficient with and without applying weights. None of our empirical conclusions are substantially altered by weighting, suggesting that survey nonresponse does not affect the conclusions we reach.

Political Attitudes on Policies

We first examine whether receiving benefits from major USDA programs is associated with support for the specific programs delivering the benefits, a primary implication of policy feedback theory. To that end, our survey asked respondents to indicate their support for the MFP, the ARC/PLC programs, and the CRP, with responses given on a four-point scale (ranging from “strongly oppose” to “strongly support”) and higher values indicating greater support for the program. The survey questionnaire can be found in “Further Supplemental Information.” We rescaled each of these items—and all other survey variables—to lie between 0 and 1. This allows us to interpret an ordinary least squares regression coefficient as the percentage point effect on the dependent variable of moving from the lowest to highest point on the independent variable.

We also assess whether receiving agricultural assistance increases support for government more generally, analyzing an index that measures a general positive view toward government and support for government’s role in assisting citizens outside the domain of agriculture. To construct the “government positivity” index, we asked respondents 14 questions, scaled them to lie between 0 and 1 so that a value of 0 corresponds to the most antigovernment response and 1 corresponds to the most pro-government response, and averaged all of the items. The items, some of which are drawn from the American National Election Study and Mettler (Reference Mettler2018), ranged from general views of government’s helpfulness to attitudes toward the appropriateness of government involvement in specific domains. The full list of items and question wordings can be found in “Further Supplemental Information.” Cronbach’s alpha for these 14 items is 0.81, suggesting that they scale well and tap an underlying dimension of pro-government attitudes. As described below, we also investigate the items individually.

To test whether individuals who receive benefits from a particular program will be more supportive of that program than individuals who do not, we focus on the MFP. Because all of our respondents have received either ARC/PLC or CRP payments, there is no variation in whether respondents participated in those programs in a given year, although there is substantial variation in the amount of payments received. However, for the MFP there is variation in whether a producer was eligible to participate in 2018 and 2019 based on the types of crops grown. Thus, we operationalize this variable as a binary indicator of whether the producer received MFP funds in either 2018 or 2019. We also test an alternative operationalization: the number of years the producer participated in the MFP.

We test whether the size of the benefit matters using all three programs, operationalizing the independent variable of payment receipt for these programs in terms of quintiles (based on respondents who initially engaged with the survey). We use quintiles because there are massive outliers in terms of the amount of payments received. As shown in the online appendix, the results are robust to an alternate definition of quintiles based on ultimate survey completion. We also use data from our survey experiment to test whether respondents who were reminded of their past ARC/PLC or CRP benefits—and informed that they were in the top half of recipients—express greater support for that program than those in the control group.

As discussed above, we also evaluate whether the relationship between receiving government benefits and political attitudes is conditioned by political ideology—and whether any such heterogeneity depends on the program. In our ordinary least squares regressions where we explore heterogeneity by political ideology, we bifurcate respondents into conservatives (65.8% of sample) and moderates/liberals (34.2% of sample) rather than using the standard seven-point political ideology scale. Given the small number of liberals in the data (only 8.7% of respondents identify as “extremely liberal” or “liberal” versus 48.7% who identify as “extremely conservative” or “conservative”), this approach is preferable to including ideology as a seven-point linear predictor. As discussed below, we examine various operationalizations of political ideology and demonstrate robustness across all of them. Descriptive statistics of these variables are in the online appendix. In all of our models, we also control for as many demographic variables as possible that were included in the survey. In addition to political ideology, we include veteran status, gender, age, education, total acres farmed (in tens of thousands of acres), and total farm value as of 2019 (in tens of millions of dollars).Footnote 18

Results

Market Facilitation Program (MFP)

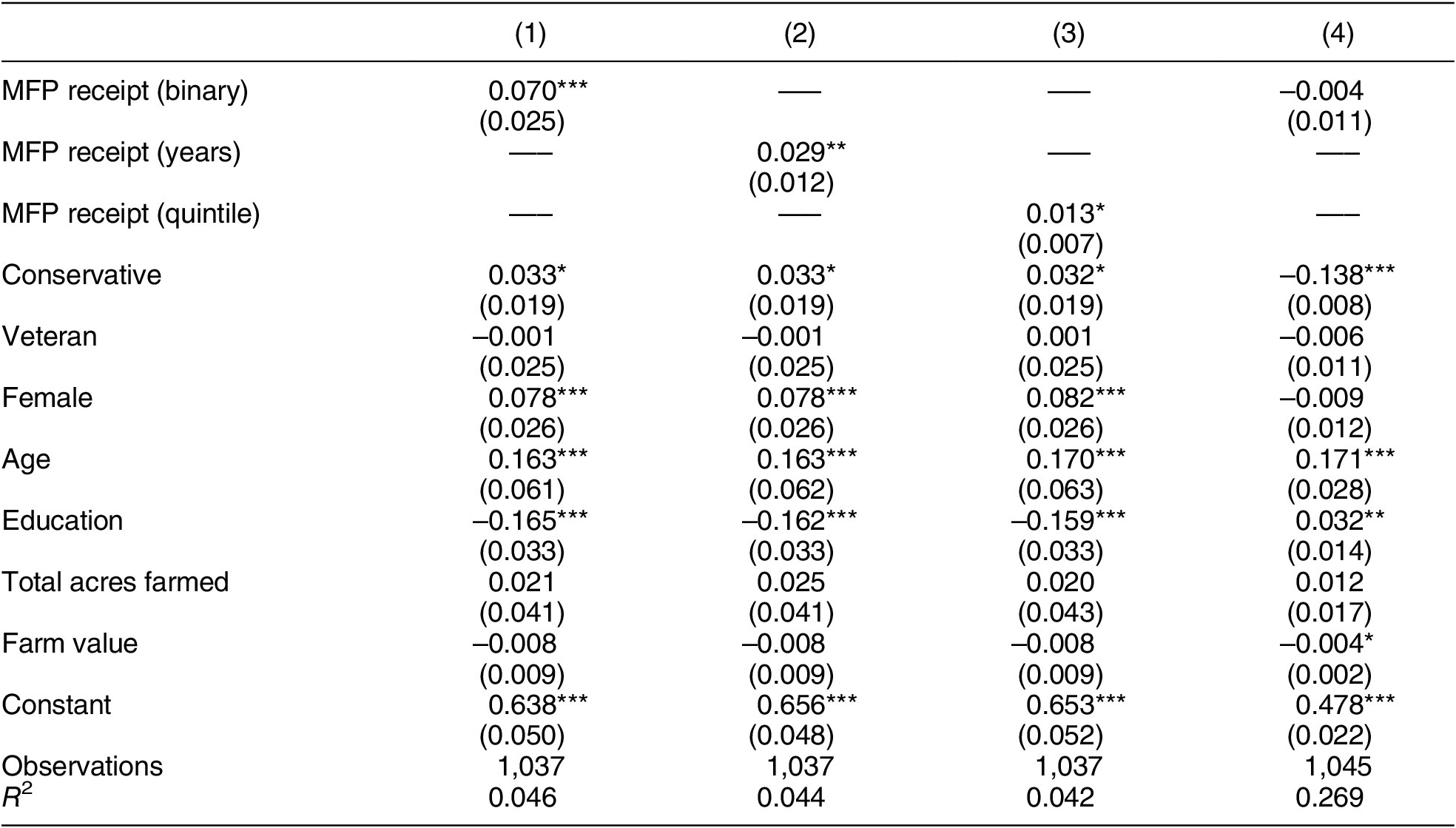

We first examine whether program participation is associated with support for the MFP. Overall, 37.0% of producers “strongly support” the program, 43.3% “somewhat support,” 14.0% “somewhat oppose,” and 5.6% “strongly oppose” (see online appendix), and in general we expect support to be greater among those who have received MFP payments. In column (1) of Table 3, we find that that is the case: producers who received MFP payments in 2018 or 2019 were about 7.0 percentage points more supportive of the MFP (

![]() $ p\hskip0.35em =\hskip0.35em 0.005 $

).Footnote

19

$ p\hskip0.35em =\hskip0.35em 0.005 $

).Footnote

19

Table 3. Receiving MFP Benefits Increases Support for the Policy

Note: Robust standard errors in parentheses. Dependent variable for columns (1)–(3) is support for the MFP. Dependent variable for column (4) is the pro–government index. *p < 0.10, **p < 0.05, ***p < 0.01 (two–tailed).

The coefficient on MFP receipt can be compared with other policy feedback effects reported in the literature. For instance, Hobbs and Hopkins (Reference Hobbs and Hopkins2021) observe that ACA eligibility increased support for the policy by 4.3–6.0 percentage points among individuals around the Medicare age eligibility threshold. Lerman and McCabe (Reference Lerman and McCabe2017) find that personal experience with public health insurance increased positive views toward the ACA by 5 percentage points and toward Medicare by 8 percentage points. Thus, our estimate for the MFP is similar to policy feedback effects found in the domain of public health insurance.

These relationships are also robust to various operationalizations of program participation. As shown in column (2) of Table 3, when we measure participation as the number of years in which MFP was received (zero, one, or two), the coefficient estimate is 2.9 percentage points per year (

![]() $ p\hskip0.35em =\hskip0.35em 0.017 $

), which is 5.7 percentage points across the range of the data. Finally, in column (3), we divide the sample into quintiles of the amount of MFP money received. Going up one quintile is associated with a 1.3-percentage-point increase in program support (p = 0.058). Over the range of the independent variable, the effect size is 5.1 percentage points.

$ p\hskip0.35em =\hskip0.35em 0.017 $

), which is 5.7 percentage points across the range of the data. Finally, in column (3), we divide the sample into quintiles of the amount of MFP money received. Going up one quintile is associated with a 1.3-percentage-point increase in program support (p = 0.058). Over the range of the independent variable, the effect size is 5.1 percentage points.

Despite increasing support for the MFP itself, MFP participation is not associated with more positive views of government generally. As shown in column (4) of Table 3, there is no relationship between program participation and the pro-government index. The estimated coefficient is both substantively small and statistically insignificant. As shown in the online appendix, this null result is consistent across the items that constitute the index, and there is no discernible pattern of what emerges as statistically significant.Footnote 20 For only two of the 14 survey items that constitute the index do we observe a significant relationship, which is about what we would expect by chance alone.Footnote 21

We next evaluate our expectation that, for the MFP, this relationship will be conditioned by ideology. We find that the positive association between MFP program receipt and MFP support is concentrated entirely among liberal and moderate agricultural producers. As shown in column (1) of Table 4, among liberals/moderates the magnitude of the relationship is 15.2 percentage points

![]() $ \left(p\hskip0.35em =\hskip0.35em 0.001\right) $

. Conversely, among conservatives it is 2.7 percentage points (p = 0.34). The interaction term in column (1) represents the difference between these estimates (12.5 percentage points), which is also statistically significant (p = 0.021). Thus, for the MFP, we find that conservatives do not have higher support for the government program when they participate, in contrast to ideological groups whose political predispositions made them less initially supportive of a Trump-led policy. Among nonrecipients, conservatives were 14.1 percentage points more likely to support the program than liberals/moderates (p = 0.005). This also puts the overall effect size of MFP receipt (7 percentage points) into context; it is about half as large as the effect of ideology among nonrecipients.

$ \left(p\hskip0.35em =\hskip0.35em 0.001\right) $

. Conversely, among conservatives it is 2.7 percentage points (p = 0.34). The interaction term in column (1) represents the difference between these estimates (12.5 percentage points), which is also statistically significant (p = 0.021). Thus, for the MFP, we find that conservatives do not have higher support for the government program when they participate, in contrast to ideological groups whose political predispositions made them less initially supportive of a Trump-led policy. Among nonrecipients, conservatives were 14.1 percentage points more likely to support the program than liberals/moderates (p = 0.005). This also puts the overall effect size of MFP receipt (7 percentage points) into context; it is about half as large as the effect of ideology among nonrecipients.

Table 4. Political Ideology Conditions the Relationship between MFP Participation and MFP Support

Note: Robust standard errors in parentheses. Dependent variable for columns (1)–(3) is support for the MFP. Dependent variable for column (4) is the pro–government index. *p < 0.10, **p < 0.05, ***p < 0.01 (two–tailed).

These relationships from the model estimated in column (1) are illustrated in Figure 2. Among moderate and liberal producers who did not receive MFP assistance, support for the program is middling (0.55 on the 0–1 scale). In contrast, support for the program is much higher among conservative producers who did not receive assistance (0.69). However, among moderate and liberal producers who participated in the MFP, support is much closer to their counterpart conservative producers (0.70 vs. 0.72). Thus, the expected policy feedback relationship is present for moderate/liberal farmers but not for conservative farmers. This suggests that participation in the MFP leads moderate/liberal farmers to “catch up” with respect to their policy support to conservatives, who have positive views of the program regardless of their participation because their political predispositions lead them to support a policy associated with President Trump.Footnote 22 These conditional effects by ideology are consistent with the expectations laid out in the first row of Table 1.

Figure 2. Relationship between MFP Receipt and MFP Support, by Ideology

This conditional relationship with ideology is robust to various operationalizations of MFP receipt. As shown in columns (2) and (3) of Table 4, regardless of whether program participation is operationalized as number of years or in terms of quintiles of payment amounts, the interaction term between political ideology and program participation is negative and statistically significant. Among moderate and liberal producers, there is a positive association between participation and support. This relationship is close to zero among conservative producers. Finally, in column (4), we show that the null relationship between program participation and the pro-government index is not conditioned by political ideology.

These results are also robust to different operationalizations of political predispositions. In the online appendix, we report results conditioning payment receipt by party identification instead of political ideology, as well as a continuous measure of ideology. In all cases, the interaction between political predispositions and payment receipt is statistically significant.

Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) Programs

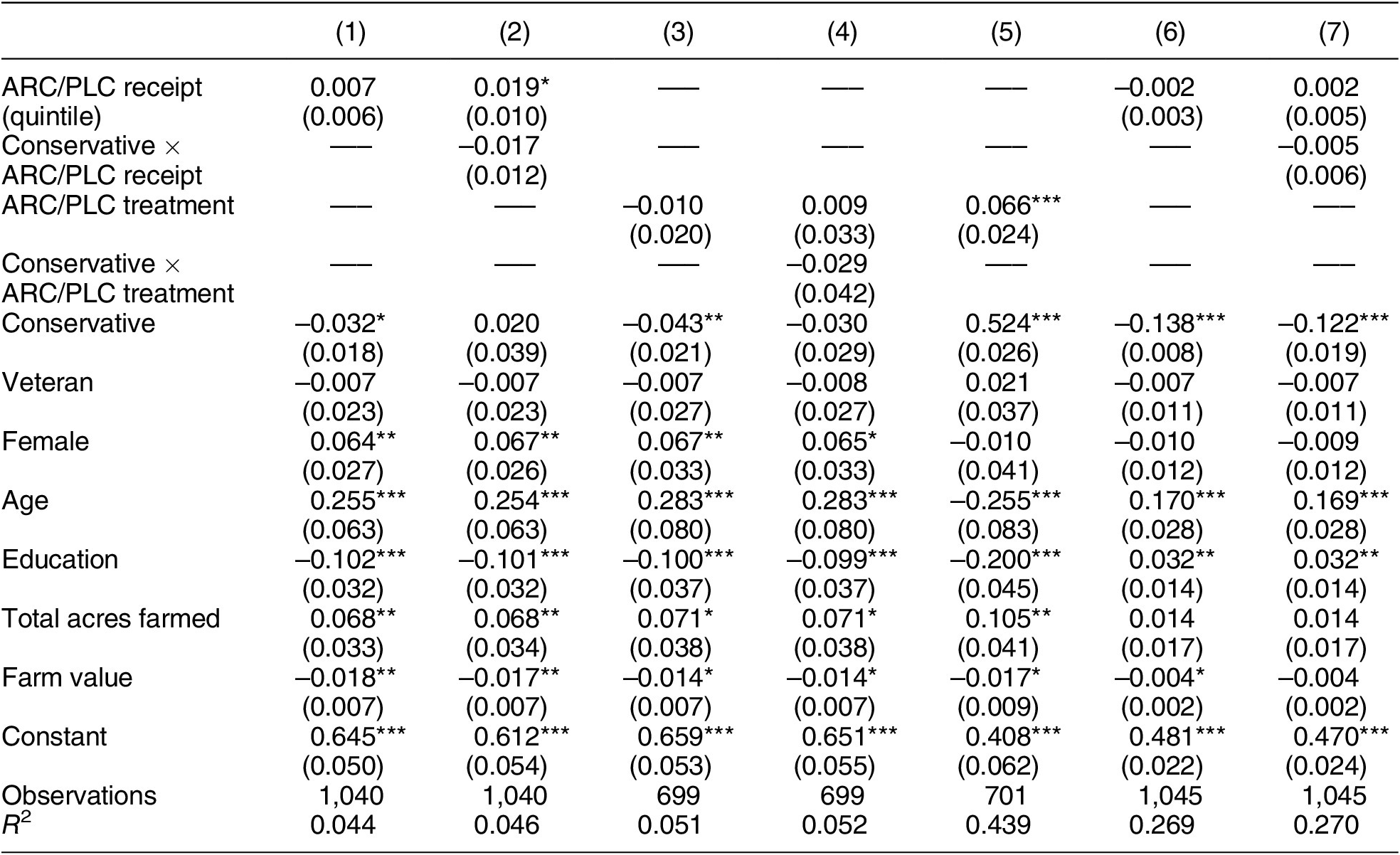

We turn next to analysis of the ARC/PLC programs. As we explained earlier (see Table 1), we anticipate limited feedback effects here because of the long, contentious history of “farm subsidies” and perceptions that the program structure can be capricious and arbitrary. We also do not expect any feedback relationships to be conditional on recipient ideology or party in this case because ARC/PLC payments (and their predecessors) are governed by the traditionally bipartisan farm bill—and are not strongly associated with any political party.

We start in column (1) of Table 5 by examining whether farmers who have received greater benefits from ARC/PLC express attitudes more supportive of those programs. We do not find an overall relationship between receiving benefits and program support. The coefficient associated with “ARC/PLC receipt (quintile)” is both substantively small and statistically insignificant. As with the MFP, there is some suggestive evidence that any positive relationship is concentrated among moderates/liberals, but the interaction term between program participation and political ideology does not achieve standard levels of statistical significance (see column [2]). Note, however, that conservatives are significantly less likely to support the program than moderates/liberals, which is in stark contrast to the MFP and suggests that the ARC/PLC programs are more similar to other types of government support and intervention. Overall, though, for these traditional farm subsidy programs, there is little evidence that receiving larger payments is associated with greater support for the programs, consistent with our expectations.

Table 5. Receiving ARC/PLC Program Support is Unrelated to Policy Support

Note: Robust standard errors in parentheses. Dependent variable for columns (1)–(4) is support for ARC/PLC. Dependent variable for column (5) is approval of President Trump. Dependent variable for columns (6)–(7) is the pro-government index. *p < 0.10, **p < 0.05, ***p < 0.01 (two–tailed).

In column (3), moreover, we find that the experimental treatment—a reminder to make the ARC/PLC programs more salient in producers’ minds—also did not affect support. Nor was there a conditional effect of the treatment information on political attitudes by ideology. It is important to note that this is not because the treatment was weak or not noticed by respondents. As shown in column (5), reminding people of the government support they received did improve evaluations of the incumbent president. The treatment information increased Trump approval by 6.6 percentage points (

![]() $ p\hskip0.35em =\hskip0.35em 0.006 $

).Footnote

23 But perhaps it is not surprising that our reminder of the benefits received did not affect support for the program given that the payments themselves are likely more influential than a psychological “nudge.”Footnote

24 Finally, as shown in columns (6) and (7), receiving larger payments from the ARC/PLC programs is also not associated with more positive views of government.

$ p\hskip0.35em =\hskip0.35em 0.006 $

).Footnote

23 But perhaps it is not surprising that our reminder of the benefits received did not affect support for the program given that the payments themselves are likely more influential than a psychological “nudge.”Footnote

24 Finally, as shown in columns (6) and (7), receiving larger payments from the ARC/PLC programs is also not associated with more positive views of government.

Thus, receiving ARC/PLC benefits appears to have little association with either support for those programs or government more generally. And although our quantitative data do not allow for a thorough evaluation of the mechanism we propose—that feedback is weakened by the contentiousness of the policy’s history—analysis of the open-ended comments producers offered on our survey reveals dissatisfaction with the outcomes of the contentious policy process and preferences for alternative payment structures. Numerous producers complained about the particulars of current program design and expressed preferences for other regimes, such as a return to pre-1996 set-aside policies, lowering the income cap for eligibility, or replacing direct payments with subsidized crop insurance. Many lamented the perceived unfairness of the commodity programs disproportionately helping large corporate farms at the expense of small family farms. Others remarked that the programs prop up “farmers that have made poor decisions.” As one farmer wrote, “I am a strong proponent of farm assistance programs. My problem though, is that there are too many special interest groups with their hands in the pie. The majority of the money is not actually used to help the farmers/ranchers.” Viewed altogether, this suggests that for ARC/PLC, even farmers who get large payments can muster objections to aspects of the programs. We think this is a likely reason why larger benefits are not associated with more support.

Conservation Reserve Program (CRP)

As a final step in our analysis, we examine the CRP—a long-standing program that (unlike ARC/PLC) has seen little change over the years and (unlike the MFP) is not strongly associated with either party or a particular president. Our expectation, as we outline in Table 1, is for positive feedback relationships not conditional on recipient party or ideology.

The survey responses show that the CRP is generally popular. Overall, 57.9% of respondents “strongly support” the CRP and 34.2% “somewhat support” it. In column (1) of Table 6 we test whether receiving greater funding from the CRP is associated with greater support for that program. We find that it is. Moving up one quintile in payment levels is associated with a 1.6-percentage-point increase in support for the program (

![]() $ p\hskip0.35em =\hskip0.35em 0.001 $

). Across the range of the independent variable, this translates into a 6.5-percentage-point relationship. Consistent with our expectations, moreover, there is no conditional relationship between CRP receipt and political ideology (see the insignificant interaction term in column [2]).

$ p\hskip0.35em =\hskip0.35em 0.001 $

). Across the range of the independent variable, this translates into a 6.5-percentage-point relationship. Consistent with our expectations, moreover, there is no conditional relationship between CRP receipt and political ideology (see the insignificant interaction term in column [2]).

Table 6. Receiving CRP Support Increases Policy Support

Note: Robust standard errors in parentheses. Dependent variable for columns (1)–(4) is support for the CRP. Dependent variable for column (5) is approval of President Trump. Dependent variable for columns (6)–(7) is the pro-government index. *p < 0.10, **p < 0.05, ***p < 0.01 (two–tailed).

Again, the qualitative data from the survey help to explain why we find positive relationships here but not for ARC/PLC in the previous section. None of the producers’ qualitative comments suggested changes they would like to see in CRP program design—except some who indicated it should be expanded. One producer wrote, “They need to increase the CRP 10-fold and take 20% of the acres in the USA out of production,” supporting the idea that the CRP helps resolve policy conflict via supply management and overall increased commodity prices. Another said, “Government payments to farmers should continue but be directed more towards incentive payments for conservation practices.”

As with the ARC/PLC experiment, however, we do not find that increasing the salience of the CRP affected support for the policy (see columns [3] and [4]). Again, this is not because the experimental treatment was weak. As shown in column (5), reminding people of the government payments they received increased approval of President Trump by about 5.7 percentage points

![]() $ \left(p\hskip0.35em =\hskip0.35em 0.016\right) $

. Finally, as shown in columns (6) and (7), we again find that receiving larger agricultural program payments is not associated with greater support for government more generally.

$ \left(p\hskip0.35em =\hskip0.35em 0.016\right) $

. Finally, as shown in columns (6) and (7), we again find that receiving larger agricultural program payments is not associated with greater support for government more generally.

Conclusion

Central to policy feedback theory is the idea that receiving government benefits can shape political attitudes, potentially making them more supportive of the policies delivering the benefits. Some have also suggested that benefitting from government programs could also make people more supportive of government generally, but that the hidden nature of much government assistance prevents this from happening. Up to this point, however, empirical research on this question has focused almost exclusively on social programs, has emphasized the importance of internal policy design features, and has been limited by the difficulty of determining which individuals receive which benefits. In this article, we make progress on all of these lines. We turn our focus to a set of large federal government programs that support farmers—a more conservative, rural population than those usually studied in the policy feedback literature. We theorize how feedback effects are shaped by political features of policies, namely the divisiveness of program enactment and implementation and the degree to which the policy is associated with one political party. And we draw on administrative data on actual benefit receipts, pairing them with an original survey of political attitudes.

As expected, the results vary across the three programs we analyze. For the programs that are typically thought of as “farm subsidies”—born out of notoriously conflictual debates (yet ultimate bipartisan resolution) over the farm bill—we find little to no evidence that receiving greater benefits is associated with more positive attitudes toward the programs. In contrast, a similarly bipartisan program that has seen little conflict and change over the years does have greater support among those who receive larger payments. And getting assistance from a very new and large program initiated by President Trump is associated with more support for that program, but in ways that vary by recipient ideology. Conservative farmers generally support the program regardless of whether they receive benefits. It is instead moderate and liberal farmers who are more supportive of the program when they receive (larger) benefits. Thus, we find that feedback relationships are only conditional on party/ideology for the newer, more partisan program—not for the programs with relatively bipartisan origins.

These findings suggest that there would be great promise in broadening policy feedback research in several directions. In the historical institutionalism branch of the literature, policy feedback scholars have long emphasized how policy legacies can shape the future trajectory of policies, but in the political behavior branch of the literature that examines feedback effects on political participation and attitudes, the theoretical emphasis has been on internal policy design features. Our findings suggest that a policy’s legacy—its history of contention, major policy change, and retrenchment (Patashnik and Zelizer Reference Patashnik and Zelizer2013; Sheingate Reference Sheingate2001)—may also shape current recipients’ attitudes toward the policy and influence the degree to which receiving benefits is associated with greater support for the program. Moreover, to the extent that beneficiaries view a program as arbitrary and capricious, those perceptions could be a result of this kind of tumultuous policy history in addition to (or instead of) stigmatizing aspects of program administration.

Also, our results imply that strongly partisan programs may generate different reactions among beneficiaries depending on their party and ideology. Scholars have very recently begun to explore the possibility of such heterogeneous effects in studies of the ACA, but with mixed results. Our findings suggest that researchers should continue to explore and test this possibility and that this may in fact be a primary conditioning factor in policy feedback, especially in the modern, hyperpartisan era.

However, perhaps most provocative and most worth further investigation are our findings related to the puzzle raised at the outset: How it is that antigovernment sentiment can be so strong in the United States when so many citizens receive so much from government (Mettler Reference Mettler2018)? There is no nuance or conditionality to our findings here; there is simply no association between receiving more agricultural assistance and support for government generally, regardless of whether the assistance is coming from a conflictual versus consensual policy or a partisan versus bipartisan one. Existing scholarship argues that many beneficiaries of government programs do not know what they are getting from government—and that that explains why they are not more supportive of government (Cramer Reference Cramer2016; Lerman Reference Lerman2019; Mettler Reference Mettler2018)—but our findings suggest that the “submerged” nature of benefits cannot be the only explanation for this phenomenon. All of our respondents get checks from the federal government. Presumably they know that the agricultural assistance they receive comes from government. Some of them were even reminded of the benefits they received. It did not make a difference. Respondents receiving larger agricultural benefits do not express more supportive views of government.

This points to the possibility of a broader democratic problem worthy of further investigation. Some people receive considerable, direct benefits from government but are no more committed to the social contract as a result. It also suggests that there should be more research on how agricultural producers think about these programs and further efforts to explain variance in producers’ support for them. If many producers view the benefits as compensation for bad government policies—as opposed to market failure or bad luck—perhaps that could explain why receiving greater benefits is not associated with more positive views toward government. Moreover, further qualitative research on producers’ experiences accessing USDA benefits would strengthen linkages to the public administration literature on how administrative burdens can shape the coverage and effectiveness of programs as well as people’s experiences with government (Herd and Moynihan Reference Herd and Moynihan2018).

Finally, policy feedback researchers should continue to do more to study the effects of policies whose beneficiaries (or intended beneficiaries) identify as conservative, affiliate with the Republican Party, or live in rural areas. Our study focuses on a distinctive population of Americans, but this population is highly important to American politics generally and needs to be examined and understood. American politics scholars have begun to prioritize the study of rural Americans in recent years (Cramer Reference Cramer2016), and policy feedback scholarship would do well to do the same.

SUPPLEMENTARY MATERIALS

To view supplementary material for this article, please visit http://doi.org/10.1017/S0003055422000314.

DATA AVAILABILITY STATEMENT

Research documentation and data that support the findings of this study are openly available at the American Political Science Review Dataverse: https://doi.org/10.7910/DVN/HNH7BX. Limitations on data availability are discussed in the online appendix.

ACKNOWLEDGMENTS

The authors are grateful for the feedback of Will Hobbs, Dan Hopkins, Paul Lagunes, Gabe Lenz, Suzanne Mettler, Eric Patashnik, Mike Sances, the APSR editors, and three anonymous reviewers. We also thank the participants of the Research Workshop in American Politics at UC Berkeley, the Goldman School of Public Policy research seminar at UC Berkeley, and the Political Psychology Research Group workshop at Stanford University. In addition to the online appendix associated with the article, there is “Further Supplemental Information” available on this article’s Dataverse.

FUNDING STATEMENT

The authors received no outside funding for this research.

CONFLICT OF INTEREST

The authors declare no ethical issues or conflicts of interest in this research.

ETHICAL STANDARDS

The authors declare the human subjects research in this article was reviewed and approved by institutional review boards at Stanford University (Protocol #55971) and UC Berkeley (Protocol #2020-05-13294). The authors affirm that this article adheres to the APSA’s Principles and Guidance on Human Subject Research.

Comments

No Comments have been published for this article.