Introduction

In the winter of 2020 (a hot, humid summer in the southern hemisphere), I was living in Dar es Salaam, Tanzania, conducting an on-foot field survey of Chinese manufacturing firms in the city's industrial zones. But manufacturing was not the most visible form taken by Chinese investment in the city. For example, the room I had rented was in a relatively new apartment complex built by a Chinese construction company in the mid-2010s. Across the street was an even newer building, constructed, owned, and managed by AVIC International, the major overseas wing of the Aviation Industry Corporation of China (中国航空工业集团公司), a large, state-owned conglomerate with numerous subsidiaries. As with many of China's largest companies, the firm lies under the supervision of the central state through the state-owned Assets Supervision and Administration Commission (SASAC). Further down the same street was one of the construction sites for the New Selander Bridge, being built mostly by a Chinese construction crew from China Railway Seventh Group, the international subsidiary of the China Railway Group, one of the largest construction companies in the world and itself a subsidiary of the China Railway Engineering Corporation (中国铁路工程总公司), another of China's major conglomerates underneath the SASAC umbrella. These large, state-backed infrastructure firms tend to be the focus of most research and reporting on Chinese investment in Africa, obscuring the more important role of the many small and largely anonymous Chinese manufacturers scattered throughout the city's industrial zones, which were the focus of my own survey.Footnote 1

Most days, leaving and returning to the apartment, I would walk down neighboring Barack Obama Drive, where fruit-sellers had makeshift stalls set up in the shade of enormous roadside trees filled with chirping fruit bats. As the air cooled in the evening, the bats would alight in massive black clouds, swarming through the gaping windows of unfinished apartment towers and swooping down into the mangrove swamp beneath the old Selander Bridge. In retrospect, the bats would seem to be a dim omen of the approaching pandemic. At the time, though, they seemed to simply symbolize a bustling nightfall in of one of the world's most rapidly growing cities. Breakneck urbanization had reshaped almost every aspect of the metropolis, placing fruit sellers under fruit bats and choking out the edges of the mangrove swamp with new high-rises. Over the past decade, Dar es Salaam has been among the fastest growing cities in the world, with an estimated population in 2020 of 6.7 million, projected to nearly double by the 2030s.Footnote 2 Both migration and high total fertility rates have been contributing to this boom, with Tanzania among the 9 or 10 countries estimated to contribute the bulk of global population growth through 2050.Footnote 3

While this rapid rate of urban growth helped to attract financing for the city's boom, even the smallest of the new apartment complexes were inaccessible for the average urban resident. Most of the city's de facto build-out came in the shape of informal settlements, colloquially referred to as uswahilini,Footnote 4 where upwards of 70 percent of Dar es Salaam's population resided throughout the 2010s.Footnote 5 Both Tanzania's murky land tenure system and the physical geography of the coastal plain facilitate this horizontal sprawl of peri-urban settlement.Footnote 6 But the lack of systematic urban planning or any rigorous oversight of these settlements has also led to poor utilities access and extreme exposure to deadly floods in the rainy season, which often wash away entire neighborhoods.Footnote 7 Such haphazard, horizontal urbanization has coexisted alongside, outside, and beneath the city's more formal development, which is marked by the vertical growth of new city center skyscrapers and residential apartment towers, both of which are global in almost every sense—they house the city's international elite, host offices for multinationals, and were built at least in part with excess capital pouring out of the Chinese real estate market. The result is a deeply disjointed urban complex, where half-finished or mostly empty condo towers speckled with the sharp white light of welding torches or the soft yellow glow of a spare few inhabitants otherwise loom dark in the night, towering above the true life of the city: the bustling uswahilini beneath and beyond, spilling out into the coastal plain in every direction.

When talking to the fruit sellers, pikipiki (motorbike) and bajaji drivers or the many street hawkers who would walk between stalled traffic during rush hour knocking on windows, trying to sell maps, books, peanuts and all sorts of other snacks and knick-knacks, conversations tended to gravitate to where people were from and how and why they had made their way to the city. The answers were familiar. On the one hand, this familiarity was a distant echo of my own life, despite deep differences—I myself am, technically, a rural outmigrant in the United States who left a declining agricultural region for hopes of better prospects in the city. But the conversations also echoed those I'd had when living in China throughout the early 2010s, chatting with street hawkers outside the university in the southwestern city of Kunming or migrant workers outside the factory complexes of Shenzhen, in the Pearl River Delta. Whether in Tanzania, China, or the United States, this was always a similar story told in a similar tone: there is no future in the countryside, I hear there is work in the city, we lost our land, I want my children to have a better chance than me.

And yet there were equally stark differences in the details of each story, rooted in the divergent position each region held in the global hierarchy of production: In the Chinese case, the rapid inflow of rural migrants first to the newly-ascendant coastal sunbelts such as the Pearl River Delta (in the 1990s and early 2000s) and then into interior cities such as Kunming (in the 2010s) was driven by some similar push factors: the intentional deindustrialization of the Northeast industrial belt, pursued as part of the restructuring of socialist-era industry,Footnote 8 as well as the collapse of employment in the rural Township and Village Enterprise (TVE) bubble that had built up over the course of the 1980s, peaking as indebtedness led to systematic privatizations, consolidations, and bankruptcies.Footnote 9 But this was also part of a more general displacement of rural subsistence production, accompanied by the slow de facto dispossession of the rural population in a process that mirrored the historical experience of original accumulation elsewhere—though with distinct characteristics, given China's unique socialist-era institutional structure.Footnote 10 The other pole of industrialization was the pull of the sunbelt export industries in places like the Pearl River Delta, where in-migration created what is now one of the largest mega-cities in the world, with the built-up area skyrocketingFootnote 11 and the “floating population” of migrants in newly urbanized zones, such as Shenzhen, growing far beyond the population of official residents.Footnote 12 Here, industrialization was the driving force, with most new migrants employed in export-oriented manufacturing.Footnote 13

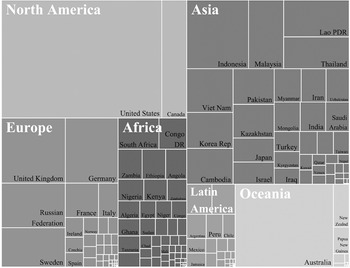

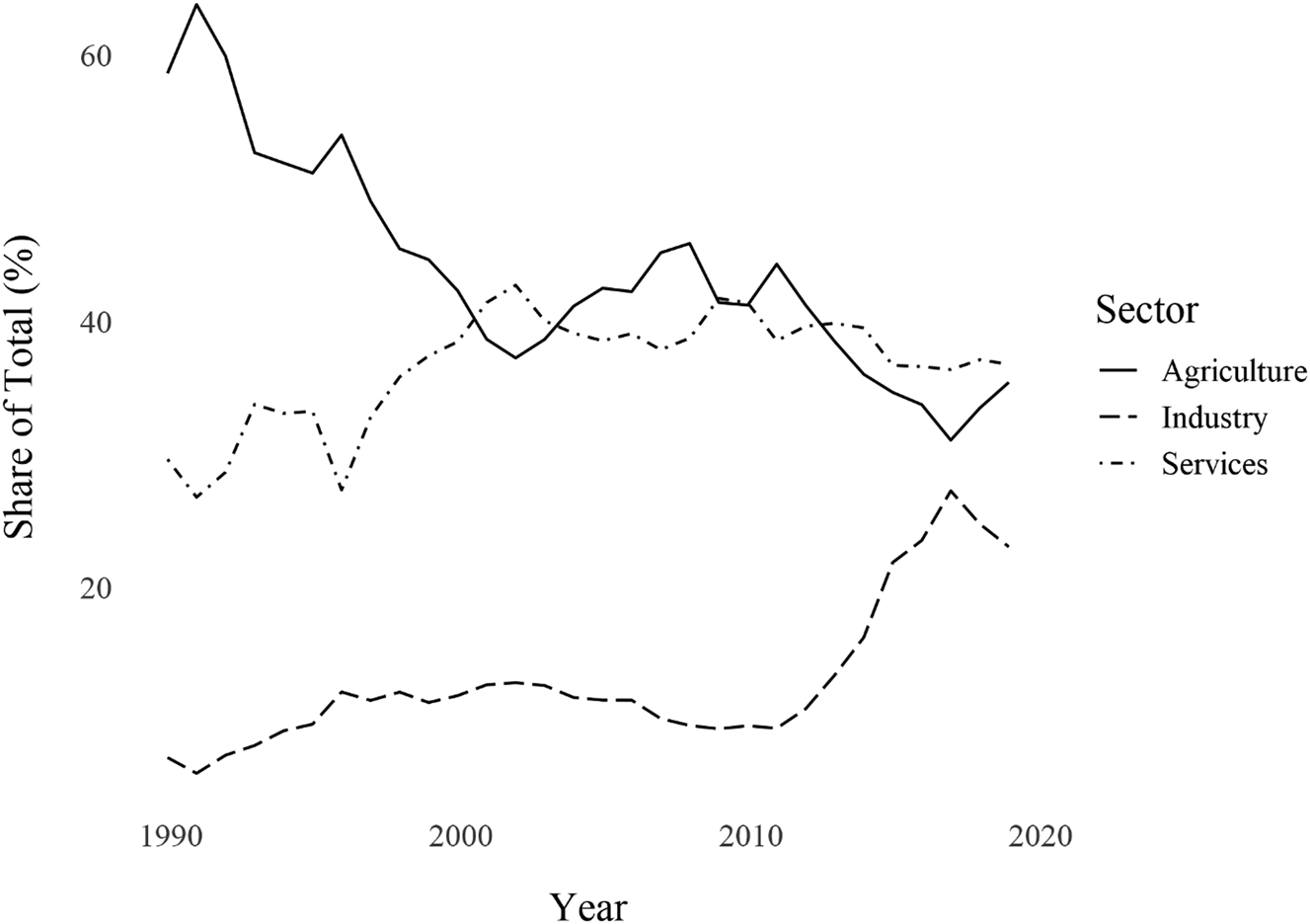

In Dar es Salaam, it would be natural to presume that the basic dynamic was the same. After all, the stories on the ground seemed similar enough: ruralites seeing few prospects in the country, facing alienation from their land,Footnote 14 confronted with environmental catastrophe,Footnote 15 or simply hoping for a better future for their children have all flooded into the coastal economic capital of the country in a wave of urbanization that seems set to match or even surpass the littoral urbanization of China some thirty years prior.Footnote 16 Meanwhile, industrial output as a share of total GDP (including construction) has grown consistently since the turn of the millennium, at the expense of both agriculture and services (see Figure 1).Footnote 17 Over the course of the 2010s, trends such as these gave birth to widespread reports on rising “African Lion” economies,Footnote 18 predictions that Africa is set to become the next “factory of the world,”Footnote 19 and even targeted industrial policy designed to emulate the developmental models of the East Asian “Tiger” economies.Footnote 20

Figure 1. Output in Tanzania, 1991–2020

Source: World Bank.

But urbanization and rising industrial output in Tanzania have not been accompanied by a similar growth in formal industrial employment (including both construction and manufacturing) or an associated growth in labor productivity. Instead, a declining share of employment in agriculture has been made up for mostly by a rising share of employment in services, not industry—even where services have consistently declined in their contribution to total GDP. Moreover, this is a pattern seen not just in Tanzania, but across many poor countries in sub-Saharan Africa, South Asia, and Latin America. These cases of “premature deindustrialization”Footnote 21 signal a major change in the structural character of growth in developing economies,Footnote 22 which suggests that the new territorial production complexesFootnote 23 taking shape in regions such as the Swahili Coast will diverge in important ways from their predecessors.

Premature deindustrialization also marks an important departure from the cases of failed industrial takeoff or “neoliberal” deindustrialization via structural adjustment documented in critical development studiesFootnote 24 and dependency theory,Footnote 25 since what is at issue here is not the failure to industrialize as such. In other words, these aren't cases where industrial output fails to increase or where any observed growth is primarily linked to the export of natural resources, like oil,Footnote 26 copper,Footnote 27 or agricultural goods.Footnote 28 Instead, these are cases where the industrial output of construction,Footnote 29 manufacturing,Footnote 30 and higher-end agro-processingFootnote 31 have increased as rapidly—or often more rapidly—as exports of ore and unprocessed agricultural goods. In Tanzania, for instance, the share of ores and metals in total exportsFootnote 32 rose throughout the 2000s, peaked in 2010 at 25 percent (half a decade prior to the global peak in the commodity super cycle), and then plummeted over the 2010s, hovering around 1 percent today. Scholarship on “China in Africa” that focuses on countries such as Zambia, where more classic relationships of dependency persistFootnote 33 tend to reduce any novelty (such as the emerging importance of East Asian economies in Africa) to these historic patterns and thereby fail to accurately capture the full network of causes that lie behind structural change in the region.

At the larger scale, cases such as that of Tanzania suggest that changes in the structure of development can illuminate important secular trends in industrial concentration and the composition of employment globally, at least when appraised alongside one another and compared to similar historic data. In retrospect, what becomes visible is a long-run trend toward increasingly “premature” deindustrialization and rising employment in services and the informal sector,Footnote 34 driven by the extremely high level of capital-intensity that prevail across many production lines,Footnote 35 which leads to more intensive international competition between manufacturers resulting in persistent industrial overcapacityFootnote 36 and a general global glut in manufactures.Footnote 37 Rather than an exception, the Chinese case has been central to this process, with its own ascendant production complexes agglomerating more and more of the world's basic industrial potential and thereby contributing to global overcapacity even as these regions themselves began to undergo a similar deindustrialization. Now, as Chinese capital goes outward, following a pattern set by Japan before it,Footnote 38 it does so at a time when the prevailing technical level of production in many product lines is so advanced that each new unit of increased industrial output sees a starkly diminished return in employment. Thus, even as Chinese capital helps to facilitate the urbanization and industrialization (in output terms) of countries like Tanzania, deindustrialization (in employment terms) advances more rapidly. Ultimately, this suggests that the unprecedented conditions of premature deindustrialization observed in such countries will be accompanied by equally unprecedented forms of class struggle.

Weaving Waves and Flying Geese

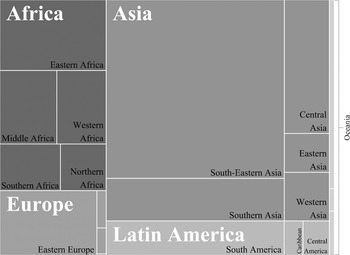

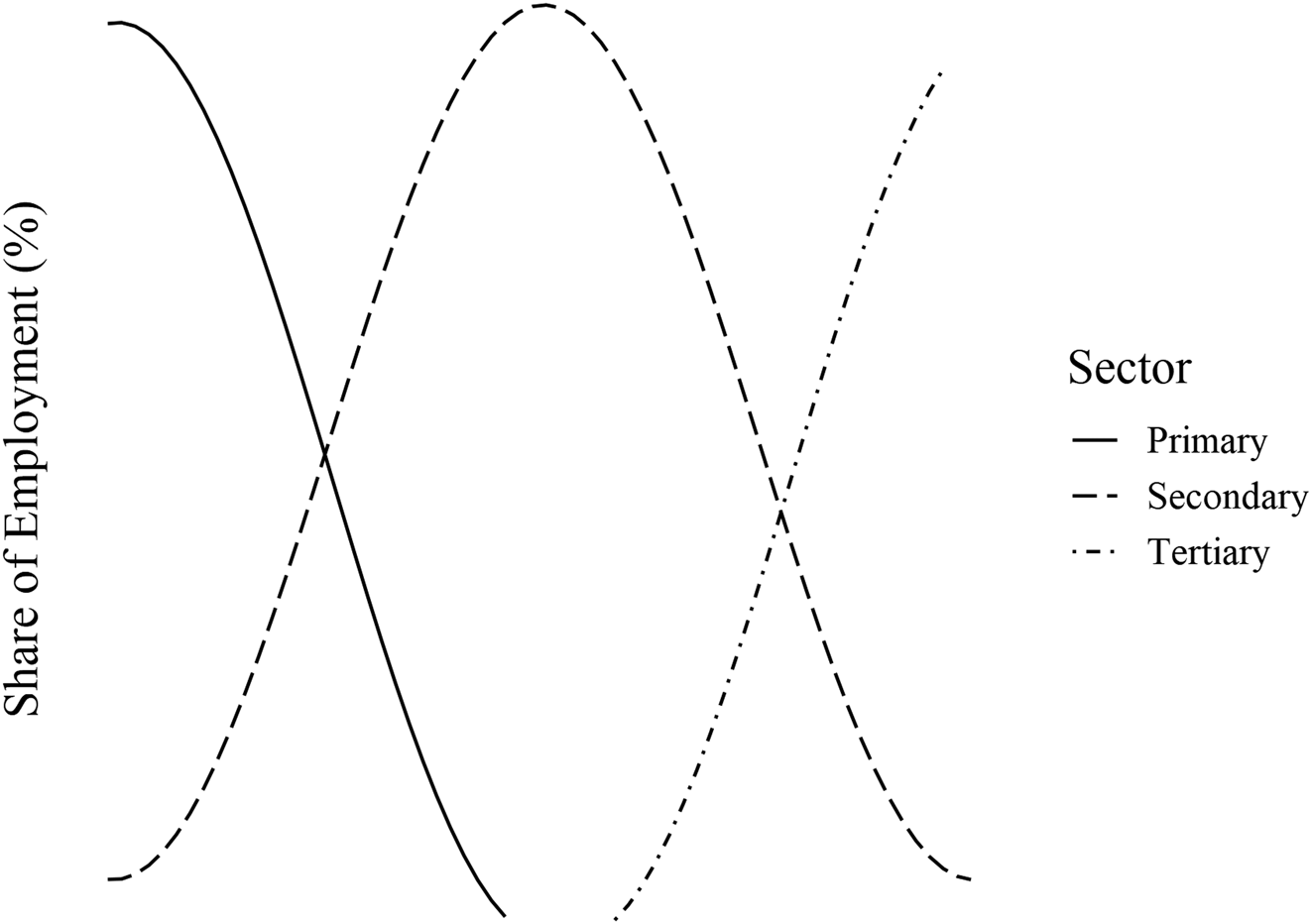

The orthodoxy of development economics is best represented by the “three sector” model.Footnote 39 In this model, the entire process of development is simplified to a series of interwoven waves formed by the changing shares of different sectors in total employment. The simplest form of the model is visualized in Figure 2, although service-sector employment is often acknowledged to compose a relatively higher share from the start and/or to move upward more or less alongside the industrial sector. The basic pattern is that an initially high share of labor committed to agricultural subsistence (the primary sector) is overtaken by an ascendant wave of industrial employment (secondary) and then industry by services (tertiary).

Figure 2. The Three-Sector Model

Source: Clarke (1935), Fisher (1940), Fourastié (1949).

But these structural shifts also imply major social changes. After all, the first shift captured in the model is essentially the transition to capitalist production, with the rising wave of industrial employment preceded by a millennia-long plateau in which most people lived in rural subsistence economies. Similarly, the model often implies a point of developmental “maturity” defined by the final ascent of “post-industrial” employment in services, often portrayed as another plateau. Though the model doesn't make it explicit, each of these developmental stages has also been associated with differential growth rates in output, productivity, and employment. In the United States, for instance, growth in all three peaked sometime between the 1910s and 1970s, depending on the measure.Footnote 40 These shared structural changes in employment, then, also represent more general developmental outcomes with wide-ranging social consequences.

The first major shift that developing economies supposedly undergo, represented in the three-sector model by the declining wave of agricultural employment and the ascendant wave of industrial employment, is also captured in its own dual sector, or Lewis model.Footnote 41 This model, formulated by the Saint Lucian economist W. Arthur Lewis in the 1950s, offers a more detailed account of the shift from a subsistence-based agricultural economy wherein most of the population lives in the countryside, to a “modern” or “capitalist” industrial economy, defined by rapid urbanization driven by rising employment in manufacturing. The Lewis model also argues that there are important demographic features that attend these changes: initially, death rates decline, birth rates increase, and population therefore booms in the early stages of urbanization and industrialization. As time goes on, however, the fertility rate tends to slow as more of the population moves to the city and the pool of potential workers dries up, ensuring upward pressure on wages. This demographic inflection is usually referred to as the Lewis Turning Point, which is a topic of major debate in China today, where wages have begun to rise and the population pyramid has begun to invert.Footnote 42 Though the rise of the service sector is not explicit in Lewis's model, the demographic turning point that he identifies has traditionally been seen as accompanying such a shift.Footnote 43

After urbanization and its accompanying demographic shift, a stage of economic “maturity”Footnote 44 is reached, wherein the mechanization of industry outpaces the growth of new jobs in the sector. Industrial output may continue to increase throughout, but the share of total employment in manufacturing declines.Footnote 45 In part, this mechanization is driven by rising labor costs. But it is also triggered by intensifying international competition,Footnote 46 which is why the “mature” phase of structural development is also a “pursued” stage, wherein leading countries must fend off competition from later developers able to exploit cheaper supplies of labor while also implementing the newest technologies, since they're unburdened by large pre-existing investments in plants and equipment that must be paid off first.Footnote 47 Overall, the decline in manufacturing employment that attends economic “maturity” is supposed to be made up for by the increase in service employment. But this third structural shift usually sees the emergence of what is called a “dual labor market,”Footnote 48 defined by majority employment in lower-wage servicesFootnote 49 and minority employment in high-wage services in sectors like finance, insurance, real estate, and other “producer service” and “high-tech” industries.Footnote 50 This economic maturity is therefore accompanied both by growing economic inequality and by a deepening geographic inequity within individual countries,Footnote 51 as wealthy “global cities”Footnote 52 diverge from their poorer suburban, exurban, and rural hinterland.Footnote 53

The role of foreign direct investment and export-oriented production as drivers of industrialization has also become central to this orthodox narrative of development, visible in the presumption that the “flying geese” industrialization pattern observed in East Asia in the latter twentieth centuryFootnote 54 represents the general pattern of structural development in an era of globalization.Footnote 55 In this narrative, countries that developed earlier increasingly use their wealth to: ascend up the value-chain by investing in new, more hi-tech and heavily mechanized lines of production, cultivating high-end producer services industries, and stoking financialization, all of which results in a decline in manufacturing as a share of total employment; and capitalize industrialization drives in later-developers, pulled by the relatively lower cost of labor in these locations and pushed by rising costs of land and labor at home. The hallmark case used to illustrate the model is the period of East Asian development in the latter twentieth century. After Japan's postwar industrial boom, Japanese capital poured back into many of Japan's old colonial holdings in East Asia, helping to trigger the industrial booms in South Korea, Taiwan, Hong Kong, and Singapore.Footnote 56 Japan also provided some of the earliest foreign investment in mainland China itselfFootnote 57 and was an important source of capital during the initial industrialization of Southeast Asia, stalled by the Asian Financial Crisis in the late 1990sFootnote 58 but now rekindling with growing Chinese trade and investment in the region.Footnote 59

Premature Deindustrialization

However, one problem has become increasingly evident in recent decades, challenging the fundamental presumptions of the three-sector model: each cluster of later-developing nations has tended to see an accelerated movement between the first structural shift out of agriculture into industry and the third, mature passage from industrial employment to reliance on the service sector.Footnote 60 This trend was already evident in the very “flying geese” economies deemed to be typical cases. But today it has accelerated such that “developing countries are turning into service economies without having gone through a proper experience of industrialization.”Footnote 61 Nor is this merely the experience of a few outliers in the poorest parts of the world: “With some exceptions, confined largely to Asia, developing countries have experienced falling manufacturing shares in both employment and real value added, especially since the 1980s.”Footnote 62 More recently, even as real value added in manufacturing has begun to slowly increase in a few locations (many in sub-Saharan Africa), that increase has not necessarily been accompanied by rising manufacturing employment.Footnote 63

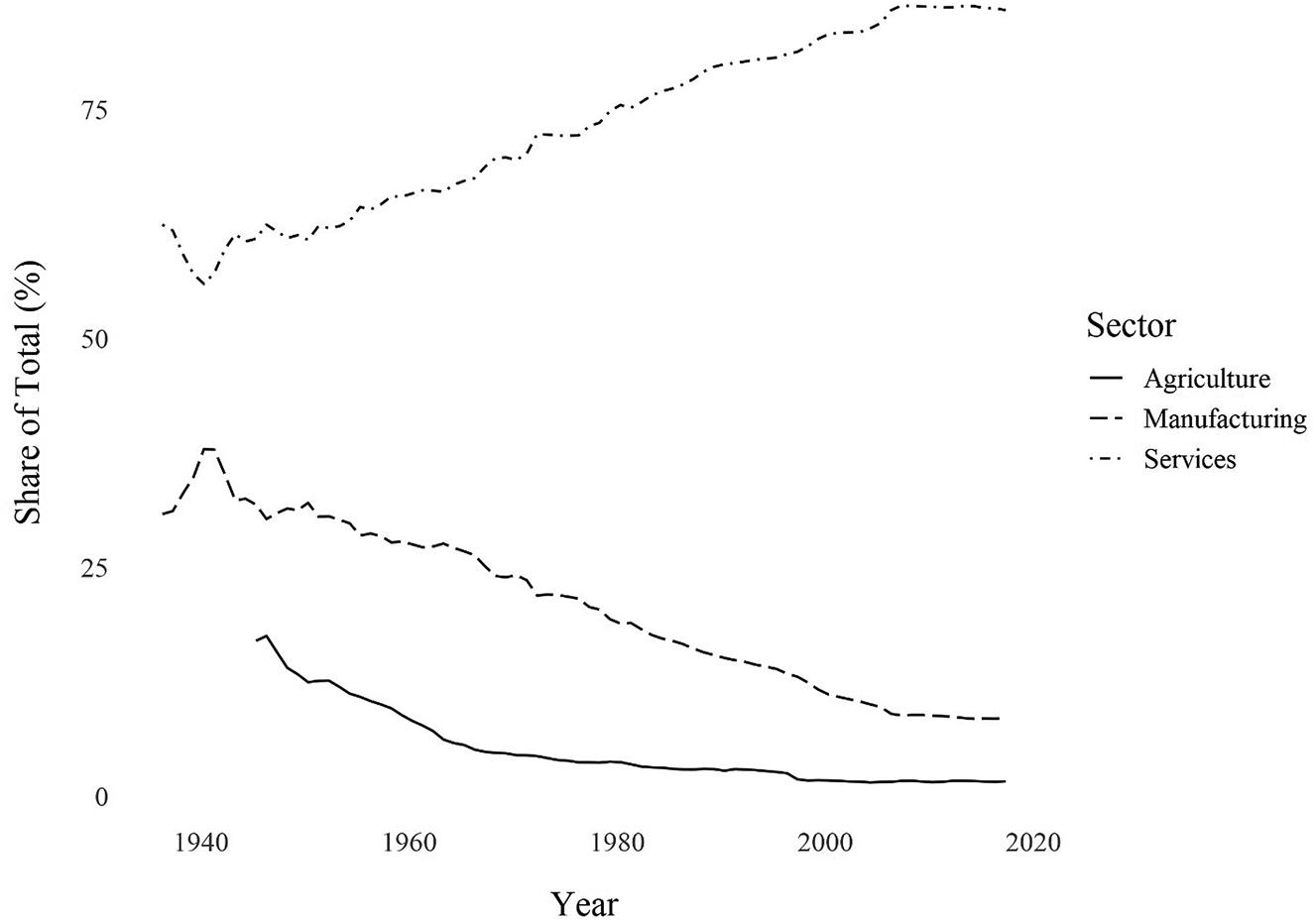

On the one hand, the service sector seems to always have been more prominent than the three-sector model sometimes implies, its share of employment tending to sit above that of industry from the beginning and to grow alongside it. This can be seen in Figure 3, which uses employment data from the Bureau of Labor Statistics to loosely illustrate the divergence in sectoral employment growth over time in the United States.

Figure 3. Employment in the United States, 1939–2020

Source: World Bank.

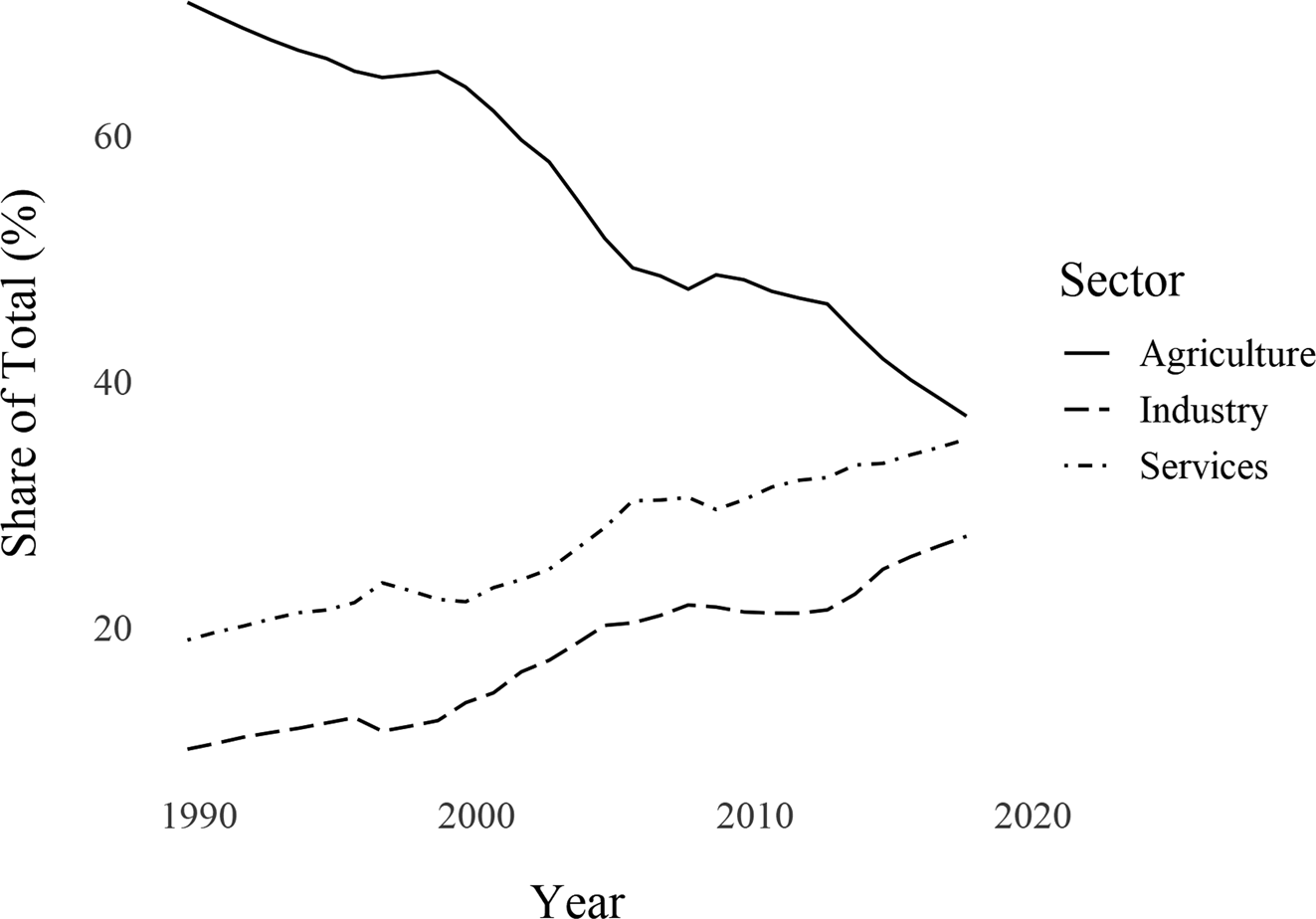

Since the United States was among the typical cases examined in the original formulation of the model, it might serve as a more concrete point of comparison. Based on this case, we might charitably tweak the expectations of the model to include the reality that service employment will tend to outpace industrial employment, grow alongside it and, finally, absorb its losses in the “postindustrial” period. More recently, we can also see the first (agriculture to industry) structural shift seemingly confirmed in Vietnam (Figure 4), which represents the main exception to premature deindustrialization that RodrikFootnote 64 gestures toward.

Figure 4. Employment in Vietnam: 1991–&2019

Source: World Bank.

But even exceptional cases that seem to confirm the classic developmental model have also tended to experience a lower peak of industrial employment and more rapid deindustrialization than that seen in earlier-developers like the United States. This can be seen in the case of China, visualized in Figure 5, where industrial employment grew rapidly from the early 2000s onward, as the country (re-)industrialized but then peaked only a decade later (in 2012 at 30.3 percent) and has been declining ever since.

Figure 5. Employment in China, 1991–2019

Source: World Bank.

In other words, even those countries that seem to confirm the model have also seen their structural shifts accelerated. What was, for the earlier developers, a half-century ascent and similarly a gradual decline in industrial employment was, in China, compressed to a few decades.

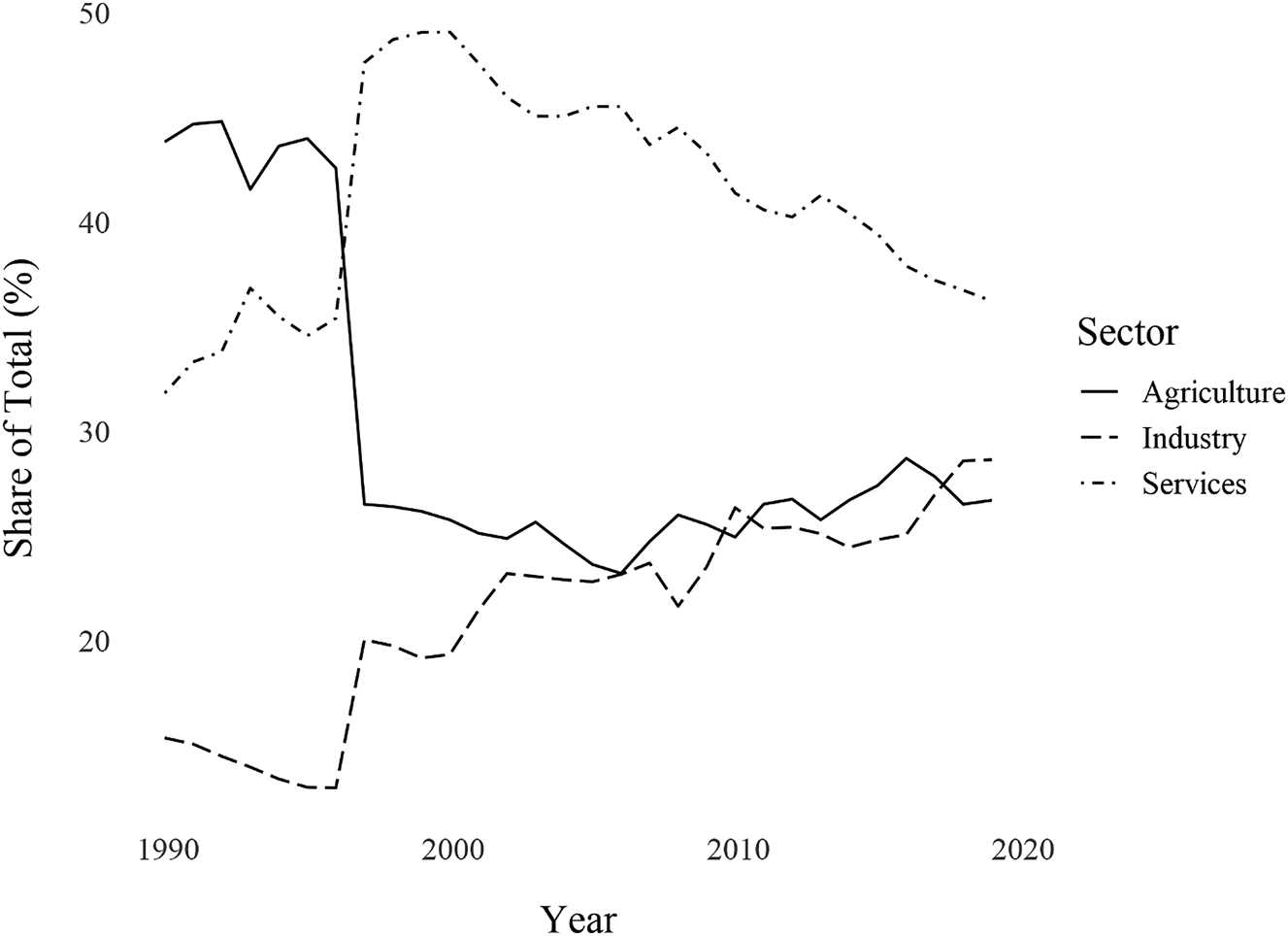

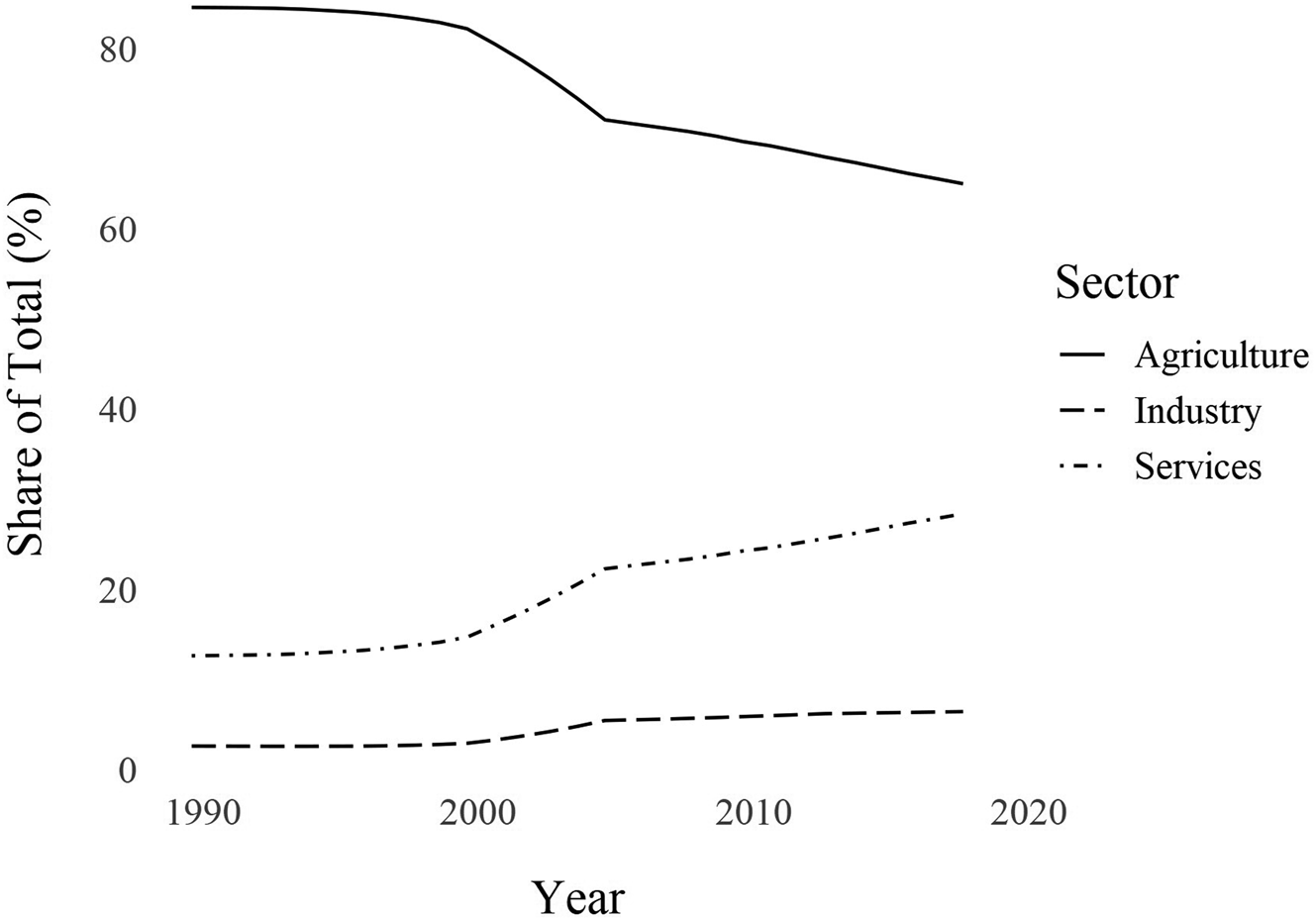

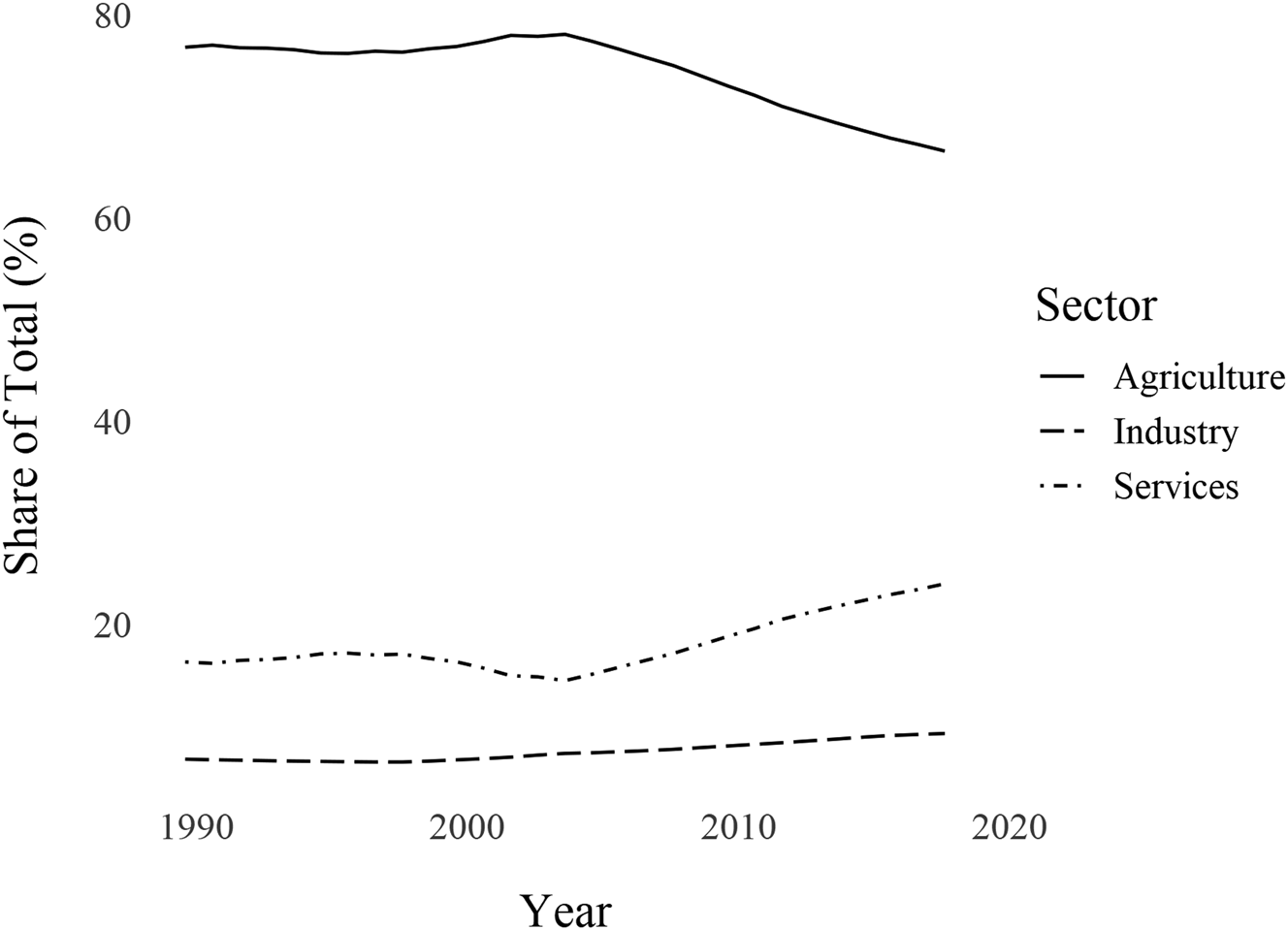

But more common are cases like Tanzania, visualized in Figure 6, where industrial employment (including construction, manufacturing, and mining) has increased only mildly between 2000 and 2019 (by about 2–3 percent) while agricultural employment has plummeted (by almost 20 percent), driven by substantial increases in agricultural productivity. This means that most employment growth has occurred in services, which have risen from 14.2 percent of the total in 2000 to 28.4 percent in 2019. Even the small growth in manufacturing employment has been almost entirely in the informal, rather than formal sector, driving down labor productivity.Footnote 65

Figure 6. Employment in Tanzania, 1991–2019

Source: World Bank.

Contrary to the expectations of both conventional and critical development theory—the former emphasizing flying geese dynamism and the latter static relations of dependency broken only through state intervention, classed according to development models—the Tanzanian case is, in fact, increasingly representative of a global norm wherein countries are jumping from a largely rural economy marked by high levels of subsistence to an increasingly urban and seemingly postindustrial economic base at lower and lower income levels, with shorter and shorter periods of industrialization in between. In terms of the three-sector model, the second employment peak has tended to both flatten and shorten in each new developmental cycle, meaning that the period of high employment in manufacturing (associated with rapid wage growth) is becoming more and more brief. The trend has obvious consequences for labor relations and the overall income distribution, since these periods of rapid wage growth in manufacturing have been, historically, some of the few periods in which inequality has declined. Meanwhile, because the model itself is static, there is no way for it to account for possible structural changes at the scale of the global system of production that might alter its underlying presumptions. But this is exactly what seems to be happening, since the three-sector pattern presumed by the model is slowly being truncated into a two-sector shift from agriculture to services, at least in terms of employment.

By jumping from agricultural subsistence to mass urban employment in services, countries thereby experience a “premature” structural shift relative to total output. This is a problem for two reasons: First, the linkage between output growth and employment is the economic basis for many of the positive features of development, enabling rising wages and rising taxation to fund social services, and encouraging widespread investment in basic education.Footnote 66 Second, output growth in the industrial sector continues to increase, meaning that premature deindustrialization also prematurely limits the positive outcomes of development even while it is still accompanied by many of its negative externalities, such as environmental pollution and mass eviction conducted in the name of urban development. As deindustrialization occurs earlier and earlier in GDP per capita terms, traditional “industrialization” soon becomes so brief and incomplete that, “in many poorer countries […] it may be more accurate to say that they never industrialized in the first place.”Footnote 67 But an important caveat is that industrial output (especially in manufacturing and construction) still increases in these places, even if not as fast.Footnote 68 This is important precisely because it diverges both from the traditional expectations baked into orthodox developmental models and from the accounts of underdevelopment and failed industrial takeoff offered by critical development theorists.Footnote 69

Though total industrial output has increased, its link with employment and productivity has been severed. The major sites of new urban employment in Tanzania are found in the broadly-defined service sector and the informal, semi-service, semi-manufacturing handicrafts industries—those of the street hawkers, the sidewalk furniture shops, the pikipiki drivers, and the mafundi seamstresses and furniture-makers of cities like Dar es Salaam.Footnote 70 Following the pattern seen in the informal economy globally, these sectors are all only partially defined by waged employment, with workers’ de facto pay far below any legal minimum and labor discipline enforced through precarious dependence on direct sales and other factors such as familial obligation.Footnote 71 In the country's interior, an even more stark symbol of this informal industry can be found the form of artisanal and small-scale mining ventures that sit in the shadow of the large, often foreign-financed mines. In this sector, small-scale miners use simple hand tools to glean deposits not profitable enough for exploitation by the multinationals.Footnote 72 Sometimes, this brings them into conflict with the multinationals, as in the Tanzanite industry, where the security forces hired by multinational firm TanzaniteOne have been accused of shooting local miners and attacking them with guard dogs after the artisanal miners trespassed onto the multinational's claim.Footnote 73 As these violent conflicts over gleaning suggest, many of these informal occupations, whether urban or rural, are difficult to distinguish from the sort of grey market subsistence activity that defines unemployment elsewhere.

But what causes this divergence between the formal and informal sectors? Why, in other words, do many poor countries today not appear to be following the flying geese pattern seen in East Asia? The reasons are more clearly shown in a recent study by Diao et al.,Footnote 74 who compare industrial employment, output, and productivity trends in Tanzania and Ethiopia to those of Vietnam and Taiwan using detailed firm-level panel data that covers both formal and informal employment. Mirroring the divide visible on the ground between artisanal mining and the large multinationals, their work reveals a bifurcation in the East African cases between large, formal firms that employ capital-intensive techniques (often funded by foreign investment) and small, informal firms that are extremely labor intensive. The former have high labor productivity and therefore contribute a large portion of total manufacturing output but, due to their adoption of the global technological standard in their respective industries—set through the homogenizing effect globalization has had on technological adoption worldwide—they tend to absorb disproportionately small shares of labor. By contrast, smaller, informal firms absorb massive amounts of labor but tend to drive down labor productivity. Absent the multiplier of machinery, their contribution to output rises in a more or less linear fashion with the addition of labor. This accounts for the moderate rise in manufacturing output (driven by the large formal firms) and for why it tends to outpace manufacturing employment (driven by the small, informal firms). In other words, to effectively compete against other manufacturers, larger firms in Tanzania and Ethiopia have had no choice but to adopt techniques that are “far more capital-intensive than what would be expected on the basis of the countries’ income levels or relative factor endowments.”Footnote 75 This creates a paradox wherein the very African countries that have seen the most significant structural changes associated with growth in other regions in the past have instead “experienced negative to zero labor productivity growth in their own non-agricultural sectors.”Footnote 76

But even if they are not industrializing, such countries are urbanizing, and their industrial output is increasing, alienating the population from the land in the name of development and ensuring that their foothold within the city is always tenuous.Footnote 77 Without much prospective growth in the formal employment base, traditionally provided by industrialization, it is not clear how the sort of bifurcation visible in a city like Dar es Salaam could be overcome. The most casual conversations on the ground make it clear that new migrants to the city intend to stay. In contrast to China's first generation of rural migrant workers,Footnote 78 there is no expectation that Dar es Salaam's new migrants are simply saving money to ultimately return to the countryside.Footnote 79 Furthermore, in contrast to both China's historical usage of the hukou (household registration) system to control population flowsFootnote 80 and its more recent attempt to redirect these flows through an intricate reworking of the system,Footnote 81 the existing land tenure standards in Tanzania effectively condone such settlement, either through their inherent fuzziness or through the communal nature of much local land administration, even while the state technically retains its ability to displace people at will.Footnote 82 This also means that the many hand-built informal neighborhoods are not really a temporary feature of the urban landscape, despite being treated as such in government eviction campaigns.Footnote 83 That same disjunction visible in the contrast between half-empty condo complexes rising over the city and the uswahilini stretching out below is here replicated at the level of the economy at large: a few big firms tower over the others in terms of investment and output, but the real bulk of employment lies in the sprawling, informal mass of handicrafts, services, and grey market subsistence.

The Technical Basis of Premature Deindustrialization

Truly understanding the cause of premature deindustrialization and the associated bifurcation of space in a city like Dar es Salaam requires reference to large-scale and long-run technical and territorial trends in capital formation and its role within “planetary urbanization.”Footnote 84 In other words, it requires a more robust model of what is conventionally referred to as “development,” but which is better understood as one ancillary outcome of the global expansion of value—a process as destructive as it is developmental. It is tempting here to borrow an easy citation from so-called Marxist or radical geography and attribute this disjunction to “uneven development,”Footnote 85 the “spatial/spatio-temporal fix,”Footnote 86 “accumulation by dispossession,”Footnote 87 or simply a confluence of all three in the form of an “overaccumulation” theory of crisis.Footnote 88 The problem is that such categories, despite their popularity, tend to be extremely open-ended, more eclectic than rigorous, and often act as little more than a de facto endorsement of the flying-geese intuition clothed in critical or Marxist garb, often covering Smithian presumptions.Footnote 89 Overall, they have “generated as much heat as light” and provided “little in the way of a positive alternative theoretical framework.”Footnote 90 Maybe more importantly, they've also resulted in systematically wrong, or at best murky, forecasts of what development will look like in places such as China, tending to reduce contingent and complex historical conjunctures to overused and overly simple discursive schema in a way that ignores both local institutional features and actual long-run secular tendencies in favor of an emphasis on linear path dependence extrapolated from a minority of cases,Footnote 91 as is abundantly evident in the many attempts to apply the critique of neoliberalism to China.Footnote 92

On the other hand, dependency theorists and critical development scholars tend to make a symmetrical error, opposing the conventional theory of development with static theories of underdevelopmentFootnote 93 or pragmatic theories of case-by-case institutional failure.Footnote 94 At best, such accounts emphasize the role played by different development models within structural transformation. These models are usually defined through reference to some combination of unique factor endowments and the intentional cultivation of growth-inducing governance.Footnote 95 The idea of a development model is also closely related to notion of the developmental state, variants of which have been used to explain almost all instances of rapid economic development since at least the nineteenth century,Footnote 96 with the concept's most recent iteration emerging in response to the rapid growth observed in East Asia in the later twentieth century.Footnote 97 Failures to industrialize are therefore accounted for, at the macro level, by pointing to global hierarchies of dependencyFootnote 98 and at the micro level, by appealing to specific failures of governanceFootnote 99—often expressed as the inability or unwillingness to choose an adequate model—or simply incidental failures to build backward and forward linkages within value chains.Footnote 100

Premature deindustrialization challenges each of these positions. Against the dynamic theories that emphasize the relationship between development and industrialization through the relocation of production in accord with the Smithian division of labor, premature deindustrialization calls into question the necessary linkage between the growth rates of output and employment, and demonstrates that, even where this pattern prevails, competition to secure a position within global value chains is becoming a zero-sum game. Against the static theories of underdevelopment, the phenomenon demonstrates that structural change at the level of output is, in fact, occurring even within “dependent” countries, leading to changes in the global structure of trade and investment.Footnote 101 Finally, against the pragmatic theories that emphasize the ability of proper institutional arrangements to guarantee growth, premature deindustrialization seems to suggest that, at the very least, substantial structural limits exist that prevent these institutional arrangements from taking shape. Even while the case of countries such as Vietnam seem to act as a confirmation of the developmental model approach, the case of countries such as Ethiopia provide a counterpoint.

Since Ethiopia has sought to intentionally emulate the East Asian developmental modelFootnote 102 through systematic national industrial plansFootnote 103 upheld by the development of a pragmatic and intricate state institutions designed to facilitate growth and ensure forward and backward linkages within export-oriented value chains,Footnote 104 the country should be experiencing the supposedly traditional pattern of industrialization seen in East Asia. Instead, it is one of the key case studies documenting premature deindustrialization.Footnote 105 In fact, the last two decades of structural change in output and employment in Ethiopia (visualized in Figures 7 and 8) provide an even better case study of premature deindustrialization than Tanzania—with the sharp increase in the industrial share of output (from 9.5 percent in 2011 to 27 percent in 2018) simply not followed by a similar increase in the industrial share of employment (from just over 8 percent in 2011 to 9.2 percent in 2018). Even if one concedes that certain institutional arrangements and supply chain structures are necessary for facilitating development, they are hardly sufficient. Instead, it seems evident that these are merely second-order factors constrained at a deeper level by structural features of the global capitalist system and/or trumped by simple amenities such as geographic proximity to existing territorial production complexes. These structural limits also seem to be tightening over time, reducing the effectiveness of even the “correct” institutional arrangements that once seemed to guarantee sustained economic growth.

Figure 7. Output in Ethiopia, 1991–2020

Source: World Bank.

Figure 8. Employment in Ethiopia, 1991–2019

Source: World Bank.

All of the above theoretical paradigms, including the critical and even the Marxist ones, also tend to ignore or elide a very specific element of Marx's critique of political economy: the role of technical change in long-run crisis and the steady growth of what Marx called the “organic composition of capital,” which is the ratio of constant capital (epitomized by investments in plant and equipment, but not limited to these) to variable capital (the part of the total social surplus value used for the purchase of labor-power).Footnote 106 It is this tendency that is key to understanding what Marx called the “general law of capitalist accumulation” (the title of chapter 25 of Capital, Vol. 1), which is the tendential growth of a surplus population not necessary for production, generated by these very technical transformations:

The higher the productivity of labour, the greater is the pressure of the workers on the means of employment, the more precarious therefore becomes the condition for their existence, namely the sale of their own labour-power for the increase of alien wealth, or in other words the self-valorization of capital.Footnote 107

Even though conventional business statistics don't really measure anything close to the value categories (referring solely to total social value) that Marx himself deals in,Footnote 108 we'd nonetheless expect this prediction of a rising organic composition to be both confirmed by long-run social trends and borne out in conventional measures of capital intensity, since Marx himself argues that the organic composition of capital involves the mirroring of the (more or less measurable) changes in the physical character of the production process by its (unmeasurable) purely social value composition.Footnote 109

Case studies of premature deindustrialization such as those of Rodrik or Diao et al.Footnote 110 are especially relevant here, since the authors make use of precisely such measures of capital-intensity to account for a social phenomenon that seems to match the expectations of the “general law” as formulated by Marx: rising precarity and surplus population, represented by both informality and the general decline in the proportion of the workforce required for industrial production. Moreover, the entire dynamic is structured by interfirm and international competition over the pool of total social surplus value, inducing technical changes in production that, though initially very profitable, become an expensive burden in the long run as the equipment grows more obsolete.Footnote 111 Despite the overblown reporting of impending automation, then, every technological breakthrough has a paradoxical effect.Footnote 112 For developed regions, this is represented in the constant threat of being outpaced by “pursuing” developers. For the poorest countries, however, industrialization is both a necessity and an impossibility. Here, the paradox is that nations can undergo industrialization in output terms and deindustrialization in employment terms at the same time, even if they successfully secure FDI to fund infrastructure and export-production.Footnote 113

The large, formal firms driving output growth in poor countries are forced by competition to adopt the global technological standard to turn a profit. But this means that these leading producers do not contribute to employment growth in equal measure. Overall, these conditions worsen global industrial overcapacity, contribute to declining profitability in manufacturing, and result in a zero-sum competition to attract relocating capital, which leads to further pressure to revolutionize the technical composition of production through both more mechanization and the adoption in less developed countries of the global standard in plant and equipment,Footnote 114 all alongside the consolidation of ownership at multiple points along the value chain, which has now created conditions in which established global brand monopsonies are caught in an antagonistic interdependence with emerging contract manufacturer monopolies, which have rapidly centralized production even in traditionally fragmented and labor-intensive sectors.Footnote 115 Altogether, this creates conditions of general stagnation in which growth rates slow and manufacturing as a share of total employment drops worldwide, even if both may remain high in the particular sites that lie at the forefront of industrial relocation.

This final point hints at an equally important fact: fixed capital is embedded in specific places and its relocation often has a territorial logic that exceeds simple comparisons of labor costs, instead prioritizing proximity and the ability to interlink and extend existing territorial production complexes in super-regional constellations. Though it is more common to focus on national trends, the reality is that industrial agglomeration is largely regional, a fact well documented by economic geographers.Footnote 116 At the international level, it is true that leading firms will tend to be yoked together into national blocs and that these blocs will always be threatened by those in “pursuing” nations where labor is cheaper and where competitor firms are not weighed down by pre-existing fixed capital that has yet to pay itself off. But the same phenomenon is repeated at the regional scale. This becomes apparent when entirely new lines of production emerge, opening “windows of locational opportunity”Footnote 117 that allow firms in the later-developing areas to adopt cutting-edge production techniques. In some cases, this even allows for a sudden leapfrogging into the most advanced lines of production despite relatively low levels of GDP per capita, as when the Taiwanese developmental state funneled resources into programs designed to attract highly educated members of the Chinese diaspora from countries like the United States to develop the local semiconductor industry.Footnote 118

Thus, even within leading nations, future restructurings can create new rust belts and sunbelts as an economic crisis (in either its immediate sense or simply as long-run stagnation) is accompanied by cascading bankruptcies and relocations. Similarly, the windows of locational opportunity that emerge when entirely new product lines become possible can lead to sub-national as well as international relocation. The semiconductor industry, for instance, not only enabled Taiwan to leap ahead to the global forefront of manufacturing but also transformed the industrial landscape of leading producers such as the United States, enabling the take-off of sunbelt regions such as California and Texas and sealing the fate of trailing industrial hubs in the Midwest and Northeast.Footnote 119 In other words, territorial development is not static. At both the international and regional level, “industries produce economic space” through agglomerationFootnote 120 and this process is epitomized by the formation of entirely new territorial production complexes in developing countries, accompanied by the decline of obsolete territorial complexes elsewhere. But the long-run technical trends of capitalist production also ensure that each new territorial production complex can produce more commodities with fewer workers than equivalent regions in the past, and that later developers will shed labor from manufacturing at an accelerated rate. This is the technical basis of premature deindustrialization.

Going West, Going Out, Going Up

China's Pearl River Delta, in southern Guangdong province, is not truly an exception to premature deindustrializationFootnote 121 but is instead a microcosm illustrating these very trends. The Great Recession hit China toward the end of 2008, when declining consumer demand in the United States and the EU led to widespread layoffs and the beginning of a wave of factory closures, followed by mass protests among migrant workers.Footnote 122 In 2009, China passed a substantial stimulus bill in response to the crisis, which succeeded in reigning in unemployment and redeploying the country's small army of migrant laborers. But the stimulus had also been designed with an eye to evening out China's economic geography by funding the build-out of basic infrastructure in the provinces of the interior and the mountainous west.Footnote 123 A national freeway system was built, high-speed rail was extended, and local governments competed to propose all sorts of expansive development projects that would win them access to stimulus financing.Footnote 124

The fractured nature of Chinese governance in the midst of ongoing state transformationFootnote 125 often sees centrally-directed initiatives conducted via methods of campaign-style governance, where local actors (whether they be local officials or individual firms) are incentivized to frame their decisions (often retroactively) in the language of prevailing central campaigns, creating the illusion that particular investments or local government initiatives came directly from the strategic decisions of central planners.Footnote 126 Often, such campaigns underperform or fall flat. The campaign to encourage investment in the interior was originally branded as the “China Western Development” (西部大开发) strategy at the turn of the century and has since gone through various iterations, each of which have been summarized by the imperative to “Go West.”Footnote 127 Similar campaigns to encourage greater overseas investment (“Go Out”) and industrial upgrading (“Go Up”) have been visible since turn of the century,Footnote 128 often only gaining substantial attention when structural limits within the domestic economy force large numbers of firms to make decisions that align with the imperatives laid out in such policies, creating a post-facto illusion that these decisions were orchestrated via the “grand strategy” of the central state.Footnote 129

Even though they result more from structural pressure than state strategy, the trends themselves were real. In the Pearl River Delta, different cities scrambled to reorient their economic base after the crisis sparked a decade-long decline in the low-end manufacturing sector that had long provided much of the area's employment. Some firms relocated to the interior, assisted by the build-out of domestic infrastructure. Others went overseas to new industrial clusters further down the coastline of the South China Sea in countries such as Vietnam, Cambodia, and Indonesia.Footnote 130 Guangzhou, the provincial capital and largest city in Guangdong, has attempted to reinvent itself as a center for high-end services, replacing old factories with high rises and converting run-down warehouse buildings into art spaces and cafes. On the other side of the delta in Shenzhen, a pivot was made toward higher-end electronics assembly, with the city attempting to market itself as the “Silicon Valley of Hardware.”Footnote 131 Following the same campaign-style governance model, many of these changes have since been portrayed as strategic decisions organized under the banner of the “Greater Bay Area Plan,” designed to better integrate Hong Kong with the mainland and facilitate the industrial upgrading of the region as a whole.Footnote 132 By contrast, the neighboring city of Dongguan, heavily reliant on the textile sector, has been less able to pivot onto a new economic base and has seen both the hemorrhaging of firms as well as strikes and protests on the part of workers seeking back wages and the payout of their social insurance before they left the area.Footnote 133

At the national level, the 2010s were marked by a rapidly rising share of employment in services, a falling share in manufacturing, slowing growth and declining profitability.Footnote 134 At the same time, the boom in construction that accompanied the stimulus also fed into a commodities supercycle that pushed the prices of base commodities up and saw increasing trade and investment between China and the extractive economies in Latin AmericaFootnote 135 and Africa.Footnote 136 When local engineering and construction firms saw domestic contracts begin to dry up as the infrastructural boom hit its limits, they had few choices but to go overseas.Footnote 137 The process was further enabled by the excess capital concentrated in such sectors due to the real estate bubble that had accompanied the infrastructure boom.Footnote 138 Thus, the saturation of the Chinese real estate and construction sectors and the speculative build-up of capital in the context of declining outlets for domestic investment (and declining profitability overall) was directly linked to the financing of the urban boom in cities like Dar es Salaam.Footnote 139 It is not coincidental that these years saw large industrial conglomerates like AVIC—whose core business lay in the very heavy-industrial sectors experiencing the worst global overcapacity—turning more and more to international financial acquisitions, with the revenues of their spin-off holding companies quickly outpacing other segments of the conglomerate. As has been emphasized by Ho-fung Hung,Footnote 140 increasing capital exports can only be understood through reference to domestic overcapacity.

It is easy to find historic parallels in East Asia that force the phenomenon to fit the conventional narrative of structural development, especially considering the key role of Chinese FDI in the ongoing industrial boom in Vietnam.Footnote 141 Both the original formation of the Chinese growth modelFootnote 142 and its export overseas seem to mimic many of the features of the flying geese that came before, suggesting that there may be new waves of geese ready to alight from the Indian Ocean as those along the Pacific Rim begin their long descent. All of this can make it appear as if the dynamics visible in the Chinese case have no relationship to the conditions of premature deindustrialization evident in Tanzania, except maybe as an example of institutional governance that could be emulated. But industrial trends in the Pearl River Delta and Dar es Salaam are, in fact, two aspects of the same phenomenon viewed from different angles. Understanding the technical basis of premature deindustrialization allows us to see their interconnection. It also allows us to see the current wave of territorial development as part of a much longer historical sequence that has never quite matched the conventional flying-geese narrative nor borne out the predictions of critical development theorists when appraising China and East Asia.Footnote 143

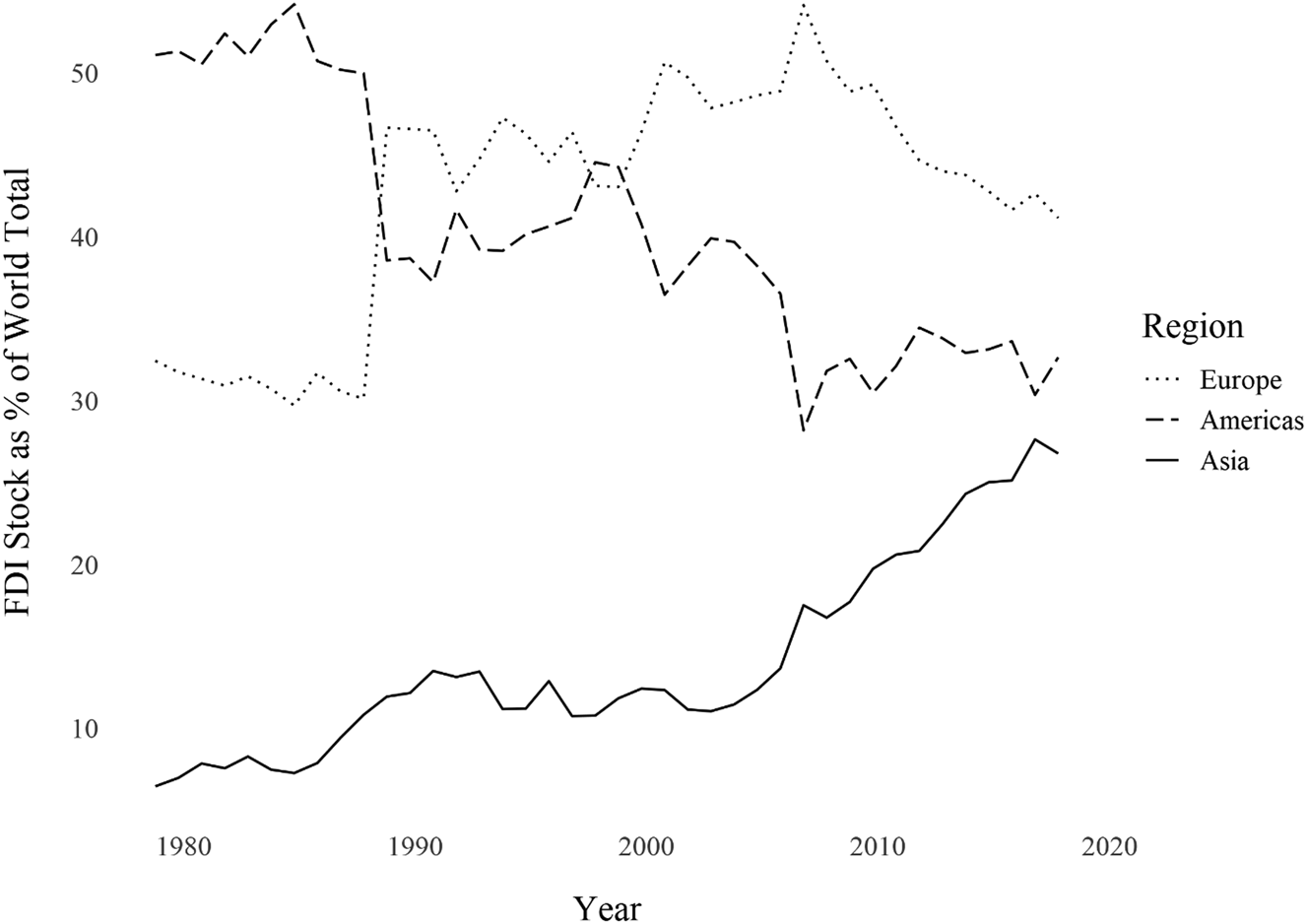

It is not coincidental, then, that the New Selander bridge down the street from my apartment in Dar es Salaam, being built by Chinese workers on the ground and designed and financed by South Korean capital, is set to replace the old Selander bridge, which was itself built by a Japanese firm in the 1980s. Such projects represent both the complexity of large infrastructural projects in sub-Saharan Africa—reduced in orientalist media reports to rising Chinese influence, even though they often signal a complex chain of FDI spanning the globeFootnote 144—and the real ways in which overcapacity and industrial crisis in the world's leading manufacturing areas spill beyond their bounds through speculation. Urbanization in Dar es Salaam has, in many ways, not been attuned to local needs but instead to the needs of international capital. Even the extension of its base infrastructure in the form of roads, bridges, and port rehabilitation projects is better understood as the deployment of global infrastructure,Footnote 145 which must be framed in relation to industrial trends in East Asia since the share of total outward FDI stock owned by Asian firms, of which Chinese FDI is a major part, has increased rapidly over the past decade (Figure 9).

Figure 9. Global Share of Outward FDI Stock, 1980–2019

Source: UNCTAD.

A New Territorial Industrial Complex?

While the boom in outbound investment over the course of the 2010s at first seemed to imply that a string of new, Chinese-funded production complexes might be taking shape across the Indian Ocean, there are many reasons to be skeptical. First, attempts to ground truth official data, media announcements about overseas investment and even evidence of industrial activity in night lights imagery have often found a much more subdued presence than might otherwise be expected.Footnote 146 Second, these claims often conflate the speculative overspilling of finance capital, increasing investments in extractive industries and the deployment of global infrastructure with the wholesale emergence of new industrial complexes undergirded by sustainable growth in construction and manufacturing. But if there is a single, concise lesson to be drawn from China's own infrastructural boom and its associated local debt bubble, it is that building roads, rails, and industrial parks does not necessarily result in actual industrial relocation, especially when every neighboring locality is jostling to do the same.

While the “Belt and Road” discourse often places particular emphasis on development projects across Africa, the reality is that a large portion of Chinese capital exports has gone to the world's wealthiest countries (visible in Figure 9), driven by asset purchases and ongoing mergers and acquisitions.Footnote 147 Of the industrial FDI destined for the developing world (Figure 10), the vast majority has been directed to China's immediate vicinity—and particularly to Southeast Asian countries—resulting in a substantial regionalization in the structure of global value chains following the Great Recession.Footnote 148 By contrast, the entire continent of Africa hosts less than 10 percent of Chinese firms’ overseas capital stock (after correcting for the influence of Hong Kong and tax havens), while Latin America holds a fraction of this.Footnote 149 Ultimately, then, it seems like the areas that are best poised to see new rounds of industrialization lie along the South China Sea and effectively act as southward extensions of the pre-existing littoral industrialization in coastal China. More troublingly, the reality of premature deindustrialization also ensures that fewer new industrial complexes are necessary to produce the same quantity of goods. In other words, the growing output-density of the global industrial system is set to outpace both its extension of employment and its territorial expansion. This only further intensifies the international and interregional competition over where, exactly, these new production complexes emerge.

Figure 10. Chinese FDI Stock, 2020, Minus HK, Macao and Tax Havens

Source: MOFCOM 2020年度中国对外直接投资统计公报.

Figure 11. Chinese FDI Stock, 2020, Excluding High-Income Countries

Source: MOFCOM 2020年度中国对外直接投资统计公报.

East Africa is almost guaranteed to lose out on most of this potential in the immediate future, with investment funneled instead into Southeast Asia. While manufacturing investments are becoming more important in a few countries on the continent,Footnote 150 the extractive economies of Angola and Zambia (alongside Sudan, prior to recent political unrest) still dominate as hosts of Chinese-origin FDI stock in Africa overall,Footnote 151 ensuring that much of the widely-publicized ascent of Africa can be attributed to a “shadow rise” caused by the (now deflating) commodity super cycle.Footnote 152 While it's possible that new infrastructural networks linking China to the Indian ocean through Pakistan and Myanmar might be gradually built up, this would be a long process, merely setting the stage for certain locales in East Africa to see a more substantial industrialization in later decades. But urbanization is already proceeding despite this. More importantly, the secular trend toward premature deindustrialization ensures that every unit of output growth in new industry will see a diminishing return in employment.

Regardless, the intuitive myth is still that industrialization circles the earth like a flock of flying geese, shifting the global center of economic gravity ever Westward in an undying arc: from capitalism's birthplace in Europe across the Atlantic to the United States; from the United States out along the Pacific Rim to Japan, South Korea, Taiwan, Hong Kong, Singapore, and finally, China; and now down into the South China Sea, where Southeast Asian nations such as Vietnam and Indonesia have witnessed the rapid growth of new industrial complexes undergirded by Chinese FDI. Maybe we are witnessing the beginnings of such industrialization in South Asia as well, with booms in Pakistan (again, related to new overland trade links with China), Bangladesh and India that might someday integrate with new industrial territories on the other side of the Indian Ocean Rim, hinting at the mirage of a Swahili Coast productive complex just over the horizon. But premature deindustrialization seems instead to suggest that this arc may be broken by its own momentum, since it is precisely the intensive competition of globalization that has set a world standard in technology, wage rates, and commodity prices, all of which must be beat if any firm in an ascendant nation hopes to survive.

In other words, we might ask what happens to that great circle cut by global development when deindustrialization begins to outpace all the other features of what is now the textbook story of structural transformation: urbanization accompanied by rising industrial employment, then falling fertility rates and the gradual rise of services and the pivot to higher-value-added lines of production? Meanwhile, we are forced to recognize that the economic conditions of countries, like Tanzania today, can no longer simply be attributed to reliance on onerous foreign loans and natural resource extraction by transnational corporations. The structural transformation of the economy has, in fact, been substantialFootnote 153 and has been accompanied by rapid urbanizationFootnote 154 and growing industrial output that has been funded by in part by FDI and in part by the Tanzanian government, attempting to emulate the successes of “developmental states” elsewhere.Footnote 155 But this also means that underdevelopment cannot be (fully) accounted for in the older, more rudimentary terms of postcolonial dependency structured by resource extraction and financial subordination.Footnote 156 More troublingly, it indicates that all these features of underdevelopment are direct outcomes of development itself. They are the direct causes of an ongoing structural transformation in global production that matches the trend predicted by Marx's general law of capitalist accumulation. There is no reason to believe, then, that industrialization will necessarily be attended by development as presumed by the classic model, derived from the East Asian experience, nor by the sort of dependent underdevelopment presumed by the critical model, derived from the African and Latin American experiences. Instead, the great circle may be broken before it circumnavigates the globe.