1. Introduction

Stock markets are excessively volatile and subject to strong boom-bust dynamics. As is well known, the vagaries of stock markets can have serious consequences for the real economy. The Great Depression and the Global Financial Crises are just two particularly tragic examples. See Galbraith (Reference Galbraith1994), Reinhart and Rogoff (Reference Reinhart and Rogoff2009), Kindleberger and Aliber (Reference Kindleberger and Aliber2011) and Shiller (Reference Shiller2015) for detailed historical accounts. Fortunately, models with heterogeneous interacting agents have proven to be useful frameworks for better understanding the complex behavior of stock markets. This line of research, pioneered by Zeeman (Reference Zeeman1974), Beja and Goldman (Reference Beja and Goldman1980), Day and Huang (Reference Day and Huang1990), Chiarella (Reference Chiarella1992), Lux (Reference Lux1995) and Brock and Hommes (Reference Brock and Hommes1998), studies the interplay between chartists, fundamentalists and market makers. Chartists are typically modeled as traders who bet on a continuation of the current stock price trend.Footnote 1 Their positive feedback trading tends to destabilize stock markets. Fundamental traders believe in mean reversion. Buying (selling) undervalued (overvalued) stocks tends to stabilize stock markets. Market makers mediate the transactions of chartists and fundamentalists out of equilibrium, adjusting stock prices to reflect current excess demand. Faced with positive (negative) excess demand, market makers raise (lower) the stock price. These three model components result in dynamical systems whose mathematical and numerical analysis advances our understanding of the functioning of stock markets. See Dieci and He (Reference Dieci, He, Dieci and He2018) and Axtell and Farmer (Reference Axtell and Farmer2024) for reviews.

To obtain clear-cut analytical insights into the functioning of stock markets, a branch of this line of research has started to investigate more stylized representations of stock markets. For instance, Huang and Day (Reference Huang, Day, Huang and Day1993), Tramontana et al. (Reference Tramontana, Westerhoff and Gardini2010, Reference Tramontana, Westerhoff and Gardini2013) and Jungeilges et al. (Reference Jungeilges, Maklakova and Perevalova2021, Reference Jungeilges, Maklakova and Perevalova2022) show that the trading behavior of heterogeneous speculators, who rely on piecewise-linear trading rules, may give rise to complex bull and bear market dynamics. The dynamics of this “first-generation” class of stock market models is due to one-dimensional piecewise-linear maps. More recently, Anufriev et al. (Reference Anufriev, Gardini and Radi2020), Dieci et al. (Reference Dieci, Gardini and Westerhoff2022) and Gardini et al. (Reference Gardini, Radi, Schmitt, Sushko and Westerhoff2022a,b,c) have initiated a “second-generation” class of stock market models in which two-dimensional piecewise-linear maps govern stock market dynamics. This new approach not only allows for a richer modeling of the trading behavior of stock market participants—its mathematical properties, which have been little studied, yield insights that may ultimately help policymakers design more efficient stock markets.Footnote 2 In this paper, which belongs to the latter research area, we generalize the stock market model by Gardini et al. (Reference Gardini, Radi, Schmitt, Sushko and Westerhoff2022c). Moreover, we provide a thorough analytical and numerical treatment of the dynamic properties of our new framework. In doing so, we hope to advance this important line of research in both economic and mathematical terms.

Let us briefly recall the model setup by Gardini et al. (Reference Gardini, Radi, Schmitt, Sushko and Westerhoff2022c). Their stock market model is populated by market makers, chartists and fundamentalists. Market makers quote stock prices with respect to speculators’ excess demand, chartists bet on the persistence of stock price trends, and fundamentalists presume that stock prices revert toward their fundamental values. However, fundamentalists’ perception of the stock market’s fundamental value is subject to animal spirits. Gardini et al. (Reference Gardini, Radi, Schmitt, Sushko and Westerhoff2022c) consider two generic sentiment states. Fundamentalists optimistically (pessimistically) believe in a relatively high (low) fundamental value when the stock market increases (decreases). A third non-generic sentiment state applies when the stock market is at rest. Fundamentalists then display a neutral attitude where they correctly perceive the fundamental value of the stock market. A two-dimensional piecewise-linear discontinuous map with essentially two branches—reflecting fundamentalists’ optimistic and pessimistic sentiment—determines the dynamics of their stock market model. Gardini et al. (Reference Gardini, Radi, Schmitt, Sushko and Westerhoff2022c) prove that the mere presence of animal spirits may compromise the stability of stock markets. Instead of converging to its true fundamental value, the stock price either approaches a nonfundamental fixed point or oscillates permanently around its fundamental value. Given their ability to generate endogenous dynamics, their work offers new explanations for the excessively volatile boom-bust behavior of stock markets.Footnote 3

In our stock market model, we assume that fundamentalists’ perception of the fundamental value depends on three generic sentiment states. Fundamentalists neutrally believe in a normal fundamental value as long as the stock market is relatively stable, while they optimistically (pessimistically) believe in a high (low) fundamental value when the stock market rises (falls) sharply. As a result, the dynamics of our stock market model is due to a two-dimensional piecewise-linear discontinuous map with three branches—representing fundamentalists’ optimistic, neutral and pessimistic sentiment. Assuming that fundamentalists’ sentiment may also be neutral is more reasonable and has far-reaching consequences for the behavior of stock prices.

One important novel property of our stock market model is that a locally stable real fixed point, where the stock price equals its fundamental value, may coexist with at least one periodic attractor, where the stock price oscillates around its fundamental value. When exogenous shocks hit the stock market, the coexistence of such attractors can yield intriguing attractor switching dynamics, e.g. alternating episodes of calm and turbulent stock price fluctuations. In this respect, knowledge about the properties of the basins of attraction of the coexisting attractors, e.g. how the behavior of certain trader types affects their size, is important from an economic policy perspective, and we explore how to compute their boundaries. Moreover, we exemplary show how to derive explicit expressions for bifurcation curves that mark the existence regions of periodic attractors. Economically, this means not only that we can rigorously prove that our stock market model can generate excessively volatile boom-bust dynamics, but also that we can analytically characterize how the behavior of the different trader types shapes its dynamics.

What is truly remarkable is that our stock market model can produce everlasting stock market fluctuations for parameter combinations that would ensure a globally stable stock market in the absence of animal spirits. This has to do with the fact that our modeling of animal spirits gives rise to two temporarily attracting virtual fixed points, located above and below the stock market’s fundamental value. To be able to appreciate the destabilizing nature of temporarily attracting virtual fixed points, let us briefly preview how endogenous dynamics may arise in our stock market model. Note first that our stock market model collapses to a simple linear chartist-fundamentalist model when fundamentalists are not subject to animal spirits. The unique fixed point of the underlying two-dimensional linear map, where the stock price reflects its fundamental value, is globally stable, provided that chartists and fundamentalists do not trade too aggressively. Depending on the relative market impact of chartists and fundamentalists, the stock price then approaches its fundamental value in a monotonic, cyclical or alternating manner. For ease of exposition, let us assume that the relative market impact of chartists and fundamentalists is such that the stock price monotonically approaches its fundamental value.

Then, treated separately, each of the three linear branches of our stock market model with animal spirits possesses a unique fixed point, associated with a monotonic convergence path. Consequently, stock prices would converge to a high, normal or low fixed point if fundamentalists’ sentiment were permanently optimistic, neutral or pessimistic. However, fundamentalists’ sentiment is time varying. Suppose that the stock price increases strongly. Fundamentalists are then optimistic and believe in a high fundamental value. As a result, their trading behavior ensures that the stock price monotonically approaches its upper virtual fixed point. Since the rate of adjustment to the upper virtual fixed point automatically decreases as the stock price approaches it, the attracting nature of the upper virtual fixed point is self-defeating. Because the stock price increase has lost momentum, fundamentalists’ sentiment becomes neutral and they start to believe in a normal fundamental value. Now the trading behavior of fundamentalists forces the stock price downwards. As we will see, this downward movement of the stock price may be so strong that fundamentalists become pessimistic, prompting them to believe in a low fundamental value. Consequently, the stock price monotonically approaches its lower virtual fixed point, albeit only for some time. As the rate of convergence to the lower virtual fixed point slows, fundamentalists’ sentiment recovers and the stock price reverses direction once again. Fundamentalists are briefly neutral, but quickly become optimistic again as the stock price begins to rise more rapidly.

From an economic perspective, our analysis reveals that a bidirectional feedback process between stock prices and animal spirits may create boom-bust stock market dynamics that coevolve with waves of optimism and pessimism. Importantly, we are able to identify the forces at work in our stock market model. Indeed, our mathematical analysis makes clear how such dynamics are a consequence of the destabilizing nature of temporarily attracting virtual fixed points. This is not only a new explanation for the excessively volatile boom-bust behavior of stock markets—our analysis reveals that such dynamics may occur for parameter settings that are usually associated with stable stock market dynamics.

The rest of our paper is organized as follows. In Section 2, we develop our stock market model. In Sections 3 and 4, we derive our main analytical and numerical results. In Section 5, we conclude our paper. Appendices A to D contain a number of technical remarks and derivations.

2. A stock market model with animal spirits

Our stock market model is populated by three types of market participants: market makers, chartists and fundamentalists. In Section 2.1, we formalize the behavior of each type of market participant. In Section 2.2, we demonstrate that their trading behavior implies that the stock market’s law of motion corresponds to a two-dimensional piecewise-linear discontinuous map with three branches. As we will see, each branch of this map reflects one of three possible generic sentiment states of fundamentalists. In Section 2.3, we show that the key building blocks of our stock market model are consistent with empirical observations.

2.1. Model Setup

Let us turn to the details of our stock market model. We assume that market makers adjust the stock price with respect to the order flow of chartists and fundamentalists. The orders placed by chartists and fundamentalists in period

![]() $t$

are denoted by

$t$

are denoted by

![]() $D_{t}^{C}$

and

$D_{t}^{C}$

and

![]() $D_{t}^{F}$

, respectively. Market makers follow a simple linear price-adjustment rule and quote the stock price for period

$D_{t}^{F}$

, respectively. Market makers follow a simple linear price-adjustment rule and quote the stock price for period

![]() $t+1$

as

$t+1$

as

Parameter

![]() $\alpha \gt 0$

indicates the strength with which market makers change the stock price from period

$\alpha \gt 0$

indicates the strength with which market makers change the stock price from period

![]() $t$

to period

$t$

to period

![]() $t+1$

for a given excess demand. According to (1), market makers increase (decrease) the stock price when the buy orders placed by chartists and fundamentalists exceed (fall short of) their sell orders. Market makers keep the stock price constant when the excess demand of chartists and fundamentalists is equal to zero. The latter, of course, is a prerequisite for a fixed point.

$t+1$

for a given excess demand. According to (1), market makers increase (decrease) the stock price when the buy orders placed by chartists and fundamentalists exceed (fall short of) their sell orders. Market makers keep the stock price constant when the excess demand of chartists and fundamentalists is equal to zero. The latter, of course, is a prerequisite for a fixed point.

Chartists seek to exploit stock price trends. Since chartists bet on the persistence of stock price trends, we formalize their technical trading rule as

Parameter

![]() $\beta \gt 0$

indicates how aggressively chartists react to their technical trading signal. Note that chartists place buy orders when the stock market is rising and sell orders when the stock market is falling. Chartists do not receive trading signals when the stock price remains constant. Together with the behavior of market makers, it is clear that a fixed point requires that fundamentalists do not trade when the stock market is at rest.

$\beta \gt 0$

indicates how aggressively chartists react to their technical trading signal. Note that chartists place buy orders when the stock market is rising and sell orders when the stock market is falling. Chartists do not receive trading signals when the stock price remains constant. Together with the behavior of market makers, it is clear that a fixed point requires that fundamentalists do not trade when the stock market is at rest.

Fundamentalists believe that the stock price moves in the direction of its fundamental value. To compute the fundamental value of a stock market, fundamentalists need to form an opinion about the future state of the economy. Fundamentalists’ evaluation of the stock market’s fundamental value—a truly difficult task—is subject to Keynesian animal spirits. In general, Keynes’ (Reference Keynes1936, Reference Keynes1937) famous notion of animal spirits means that people display a collective, (apparently) spontaneous and significant shift in sentiment, say a general reversal from a pessimistic attitude to an optimistic attitude, upon which they act. In line with Shiller (Reference Shiller2015, Reference Shiller2019), we assume that fundamentalists optimistically believe in an excessively high fundamental value when the stock market rises sharply, and pessimistically believe in an overly low fundamental value when it falls sharply. Fundamentalists’ attitude is neutral when the stock market is relatively stable, prompting them to believe in an intermediate (normal) level of the fundamental value. Fundamentalists thus perceive the stock market’s fundamental value as

\begin{equation}\hat{F}_{t}=\left\{\begin{array}{l@{\quad}l@{\quad}c} F^{o}& if& P_{t}-P_{t-1}\gt h\\ F^{n}& if & -h\leq P_{t}-P_{t-1}\leq h,\\ F^{p} & if & P_{t}-P_{t-1}\lt -h \end{array}\right.\end{equation}

\begin{equation}\hat{F}_{t}=\left\{\begin{array}{l@{\quad}l@{\quad}c} F^{o}& if& P_{t}-P_{t-1}\gt h\\ F^{n}& if & -h\leq P_{t}-P_{t-1}\leq h,\\ F^{p} & if & P_{t}-P_{t-1}\lt -h \end{array}\right.\end{equation}

where

![]() $F^{o}$

,

$F^{o}$

,

![]() $F^{n}$

and

$F^{n}$

and

![]() $F^{p}$

represent fundamentalists’ optimistic, neutral and pessimistic perceptions of the stock market’s fundamental value, respectively, with

$F^{p}$

represent fundamentalists’ optimistic, neutral and pessimistic perceptions of the stock market’s fundamental value, respectively, with

![]() $F^{o}\gt F^{n}\gt F^{p}$

.Footnote 4 Moreover, parameter

$F^{o}\gt F^{n}\gt F^{p}$

.Footnote 4 Moreover, parameter

![]() $h\gt 0$

controls when these three sentiment regimes apply.Footnote 5

$h\gt 0$

controls when these three sentiment regimes apply.Footnote 5

Based on these considerations, we assume that fundamentalists derive their orders via the fundamental trading rule

Parameter

![]() $\gamma \gt 0$

reflects how aggressively fundamentalists react to the stock market’s current mispricing. Accordingly, fundamentalists place buy orders when they perceive an undervalued stock market and sell orders when they perceive an overvalued stock market. Fundamentalists are inactive when they do not perceive mispricing. Note that this is the case when the stock price is either equal to

$\gamma \gt 0$

reflects how aggressively fundamentalists react to the stock market’s current mispricing. Accordingly, fundamentalists place buy orders when they perceive an undervalued stock market and sell orders when they perceive an overvalued stock market. Fundamentalists are inactive when they do not perceive mispricing. Note that this is the case when the stock price is either equal to

![]() $F^{o}$

,

$F^{o}$

,

![]() $F^{n}$

or

$F^{n}$

or

![]() $F^{p}$

. However, neither

$F^{p}$

. However, neither

![]() $F^{o}$

nor

$F^{o}$

nor

![]() $F^{p}$

can be a real fixed point of the stock market—fundamentalists’ sentiment becomes neutral when the stock price is at rest, prompting them to believe in

$F^{p}$

can be a real fixed point of the stock market—fundamentalists’ sentiment becomes neutral when the stock price is at rest, prompting them to believe in

![]() $F^{n}$

. As a result, our stock market model possesses a unique real fixed point, where stock prices are given by

$F^{n}$

. As a result, our stock market model possesses a unique real fixed point, where stock prices are given by

![]() $F^{n}$

, and two so-called virtual fixed points, given by

$F^{n}$

, and two so-called virtual fixed points, given by

![]() $F^{o}$

and

$F^{o}$

and

![]() $F^{p}$

.

$F^{p}$

.

Our modeling of fundamentalists’ animal spirits lays the foundation for a bidirectional feedback process between stock price dynamics and animal spirits: fundamentalists’ sentiment depends on the last stock market change, which in turn depends on the order flow of chartists and fundamentalists. In Section 3, we explain under which conditions this relationship can trigger sentiment-driven boom-bust stock market dynamics.

2.2. The model’s map

For simplicity, let us assume that

![]() $F^{n}$

reflects an unbiased view of the true fundamental value of the stock market, that is

$F^{n}$

reflects an unbiased view of the true fundamental value of the stock market, that is

![]() $F^{n}=F$

, while

$F^{n}=F$

, while

![]() $F^{o}=F^{n}+d$

and

$F^{o}=F^{n}+d$

and

![]() $F^{p}=F^{n}-d$

represent biased views. Since the market makers’ price-adjustment parameter

$F^{p}=F^{n}-d$

represent biased views. Since the market makers’ price-adjustment parameter

![]() $\alpha$

merely scales the market impact of chartists and fundamentalists, let us furthermore replace the aggregate parameters

$\alpha$

merely scales the market impact of chartists and fundamentalists, let us furthermore replace the aggregate parameters

![]() $\alpha \beta$

and

$\alpha \beta$

and

![]() $\alpha \gamma$

with the new parameters

$\alpha \gamma$

with the new parameters

![]() $b$

and

$b$

and

![]() $c$

, respectively. Combining (1) to (4) then reveals that the stock price in period

$c$

, respectively. Combining (1) to (4) then reveals that the stock price in period

![]() $t+1$

adheres to

$t+1$

adheres to

\begin{equation}P_{t+1}=\left\{\begin{array}{l@{\quad}l@{\quad}c} \left(1+b-c\right)P_{t}-bP_{t-1}+c(F+d) & if & P_{t}-P_{t-1}\gt h\\ \left(1+b-c\right)P_{t}-bP_{t-1}+cF & if & -h\lt P_{t}-P_{t-1}\lt h\\ \left(1+b-c\right)P_{t}-bP_{t-1}+c(F-d) & if & P_{t}-P_{t-1}\lt -h \end{array}. \right. \end{equation}

\begin{equation}P_{t+1}=\left\{\begin{array}{l@{\quad}l@{\quad}c} \left(1+b-c\right)P_{t}-bP_{t-1}+c(F+d) & if & P_{t}-P_{t-1}\gt h\\ \left(1+b-c\right)P_{t}-bP_{t-1}+cF & if & -h\lt P_{t}-P_{t-1}\lt h\\ \left(1+b-c\right)P_{t}-bP_{t-1}+c(F-d) & if & P_{t}-P_{t-1}\lt -h \end{array}. \right. \end{equation}

Obviously, the dynamics of our stock market model depends on three competing sentiment regimes, namely optimism, neutrality and pessimism, each of which is associated with a different linear branch. Since it is convenient to express our stock market model in deviation from its fundamental value, let us next define

![]() $x_{t}=P_{t}-F$

. This allows us to transform (5) into

$x_{t}=P_{t}-F$

. This allows us to transform (5) into

\begin{equation}x_{t+1}=\left\{\begin{array}{l@{\quad}l@{\quad}c} \left(1+b-c\right)x_{t}-bx_{t-1}+cd & if & x_{t}-x_{t-1}\gt h\\ \left(1+b-c\right)x_{t}-bx_{t-1} & if & -h\lt x_{t}-x_{t-1}\lt h\\ \left(1+b-c\right)x_{t}-bx_{t-1}-cd & if & x_{t}-x_{t-1}\lt -h \end{array}. \right. \end{equation}

\begin{equation}x_{t+1}=\left\{\begin{array}{l@{\quad}l@{\quad}c} \left(1+b-c\right)x_{t}-bx_{t-1}+cd & if & x_{t}-x_{t-1}\gt h\\ \left(1+b-c\right)x_{t}-bx_{t-1} & if & -h\lt x_{t}-x_{t-1}\lt h\\ \left(1+b-c\right)x_{t}-bx_{t-1}-cd & if & x_{t}-x_{t-1}\lt -h \end{array}. \right. \end{equation}

For ease of exposition, in the following we will still regard

![]() $x_{t}$

as the stock price (instead of constantly referring to

$x_{t}$

as the stock price (instead of constantly referring to

![]() $x_{t}$

as the stock price in deviation from its fundamental value). Essentially, this implies that the fundamental value of the stock market is equal to

$x_{t}$

as the stock price in deviation from its fundamental value). Essentially, this implies that the fundamental value of the stock market is equal to

![]() $F=0$

and, consequently, that fundamentalists’ perceptions of the fundamental value are equal to

$F=0$

and, consequently, that fundamentalists’ perceptions of the fundamental value are equal to

![]() $F^{n}=0$

,

$F^{n}=0$

,

![]() $F^{o}=d$

and

$F^{o}=d$

and

![]() $F^{p}=-d$

. Introducing the auxiliary variable

$F^{p}=-d$

. Introducing the auxiliary variable

![]() $y_{t}=x_{t-1}$

, we finally arrive at a two-dimensional piecewise-linear discontinuous map that governs the dynamics of our stock market model, namely

$y_{t}=x_{t-1}$

, we finally arrive at a two-dimensional piecewise-linear discontinuous map that governs the dynamics of our stock market model, namely

\begin{equation}T_{C}\colon \begin{cases} x'=\left\{\begin{array}{l@{\quad}l@{\quad}c} \left(1+b-c\right)x-by+cd & if & x-y\gt h\\ \left(1+b-c\right)x-by & if & -h\lt x-y\lt h,\\ \left(1+b-c\right)x-by-cd & if & x-y\lt -h \end{array} \right.\\ y'=x \end{cases}\end{equation}

\begin{equation}T_{C}\colon \begin{cases} x'=\left\{\begin{array}{l@{\quad}l@{\quad}c} \left(1+b-c\right)x-by+cd & if & x-y\gt h\\ \left(1+b-c\right)x-by & if & -h\lt x-y\lt h,\\ \left(1+b-c\right)x-by-cd & if & x-y\lt -h \end{array} \right.\\ y'=x \end{cases}\end{equation}

where the prime symbol stands for the unit time advancement operator. In general, parameters

![]() $b$

,

$b$

,

![]() $c$

,

$c$

,

![]() $d$

and

$d$

and

![]() $h$

are positive. Note that rescaling

$h$

are positive. Note that rescaling

![]() $x\colon =x/h$

,

$x\colon =x/h$

,

![]() $y\colon =y/h$

and

$y\colon =y/h$

and

![]() $d\colon =d/h$

reveals that parameter

$d\colon =d/h$

reveals that parameter

![]() $h$

is a scaling factor. Instead of fixing

$h$

is a scaling factor. Instead of fixing

![]() $h=1$

, however, we keep parameter

$h=1$

, however, we keep parameter

![]() $h$

due to its economic relevance. Nevertheless, our main focus will be on parameters

$h$

due to its economic relevance. Nevertheless, our main focus will be on parameters

![]() $b$

,

$b$

,

![]() $c$

and

$c$

and

![]() $d$

. Recall that Gardini et al. (Reference Gardini, Radi, Schmitt, Sushko and Westerhoff2022c) study a related stock market model with two generic sentiment states, that is optimism and pessimism. By adding a neutral attitude as a third generic sentiment state, our setup can be considered more general. To understand the transition from two to three generic sentiment states, we restrict our attention to the case

$d$

. Recall that Gardini et al. (Reference Gardini, Radi, Schmitt, Sushko and Westerhoff2022c) study a related stock market model with two generic sentiment states, that is optimism and pessimism. By adding a neutral attitude as a third generic sentiment state, our setup can be considered more general. To understand the transition from two to three generic sentiment states, we restrict our attention to the case

![]() $d\gt h\gt 0$

.Footnote 6

$d\gt h\gt 0$

.Footnote 6

2.3. Discussion

A few comments are in order before we start with our analysis. While our stock market model is rather stylized, it captures a number of crucial forces that determine the dynamics of stock prices. The empirical work by Evans and Lyons (Reference Evans and Lyons2002), Lillo et al. (Reference Lillo, Farmer and Mantegna2003) and Bouchaud et al. (Reference Bouchaud, Farmer, Lillo, Bouchaud, Farmer and Lillo2009) indicates that order flow is the key driver of asset price changes. Models that capture this aspect via a market maker scenario include Day and Huang (Reference Day and Huang1990), Farmer and Joshi (Reference Farmer and Joshi2002) and Schmitt and Westerhoff (Reference Schmitt and Westerhoff2021). Questionnaire studies by Menkhoff and Taylor (Reference Menkhoff and Taylor2007) and laboratory evidence by Hommes (Reference Hommes2011) reveal that actual financial market participants rely on technical and fundamental trading rules to determine their speculative orders. Murphy (Reference Murphy1999) provides a general survey of technical trading. Studies that model the behavior of chartists in a similar way to us include Gaunersdorfer and Hommes (Reference Gaunersdorfer, Hommes, Gaunersdorfer and Hommes2007), Franke and Westerhoff (Reference Franke and Westerhoff2012) and Scholl et al. (Reference Scholl, Calinescu and Farmer2021). A classic reference for fundamental analysis is Graham and Dodd (Reference Graham and Dodd1951). Model-theoretic formalizations similar to our setup include Lux (Reference Lux1995), Brock and Hommes (Reference Brock and Hommes1998) and LeBaron (Reference LeBaron2021). Animal spirits, as put forward by Keynes (Reference Keynes1936, Reference Keynes1937), play an important role in economics. See Pigou (Reference Pigou1927), Minsky (Reference Minsky1975), Akerlof and Shiller (Reference Akerlof and Shiller2009) and Franke and Westerhoff (Reference Franke and Westerhoff2017) for a discussion. Our modeling of animal spirits follows Brock and Hommes (Reference Brock and Hommes1998), de Grauwe and Kaltwasser (Reference De Grauwe and Kaltwasser2012), Cavalli et al. (Reference Cavalli, Naimzada and Pireddu2017), Campisi et al. (Reference Campisi, Muzziolo and Tramontana2021) and, of course, Gardini et al. (Reference Gardini, Radi, Schmitt, Sushko and Westerhoff2022c). Overall, it can be argued that the key building blocks of our stock market model are consistent with empirical observations.

3. Analytical and numerical results

In this section, we present our main analytical and numerical results. In Section 3.1, we first study the behavior of a simple linear benchmark stock market model. In Section 3.2, we then discuss a number of general properties of our stock market model. In Sections 3.3 to 3.4, we finally illustrate the functioning of our stock market model for three specific parameter regions.

3.1. A simple linear benchmark stock market model

Let us first explore a simple linear benchmark scenario. In the absence of animal spirits, the complete map

![]() $T_{C}$

simplifies to the reduced map

$T_{C}$

simplifies to the reduced map

\begin{equation}T_{R}\colon \begin{cases} x'=\left(1+b-c\right)x-by,\\ y'=x \end{cases}\end{equation}

\begin{equation}T_{R}\colon \begin{cases} x'=\left(1+b-c\right)x-by,\\ y'=x \end{cases}\end{equation}

The unique fixed point of the two-dimensional linear map

![]() $T_{R}$

is the origin, say

$T_{R}$

is the origin, say

![]() $P_{R}=(0,0)$

. At this fixed point, the stock price is properly aligned with its fundamental value. The global stability of this fixed point depends on the two eigenvalues of the Jacobian matrix

$P_{R}=(0,0)$

. At this fixed point, the stock price is properly aligned with its fundamental value. The global stability of this fixed point depends on the two eigenvalues of the Jacobian matrix

\begin{equation}J=\left(\begin{array}{cc} v & -b\\ 1 & 0 \end{array}\right),\end{equation}

\begin{equation}J=\left(\begin{array}{cc} v & -b\\ 1 & 0 \end{array}\right),\end{equation}

with

![]() $v=1+b-c$

. They are

$v=1+b-c$

. They are

![]() $\lambda _{1}=0.5(v+\sqrt{v^{2}-4b})$

and

$\lambda _{1}=0.5(v+\sqrt{v^{2}-4b})$

and

![]() $\lambda _{2}=0.5(v-\sqrt{v^{2}-4b})$

, respectively. Furthermore, the determinant and the trace of the Jacobian matrix

$\lambda _{2}=0.5(v-\sqrt{v^{2}-4b})$

, respectively. Furthermore, the determinant and the trace of the Jacobian matrix

![]() $J$

are equal to

$J$

are equal to

![]() $\det J=b$

and

$\det J=b$

and

![]() $\mathrm{tr} J=v$

. As is well known, we can conclude that the eigenvalues of the Jacobian matrix

$\mathrm{tr} J=v$

. As is well known, we can conclude that the eigenvalues of the Jacobian matrix

![]() $J$

are inside the unit circle when the three stability conditions (i)

$J$

are inside the unit circle when the three stability conditions (i)

![]() $1+\mathrm{tr} J+\det J\gt 0$

, (ii)

$1+\mathrm{tr} J+\det J\gt 0$

, (ii)

![]() $1-\mathrm{tr} J+\det J\gt 0$

and (iii)

$1-\mathrm{tr} J+\det J\gt 0$

and (iii)

![]() $1-\det J\gt 0$

are jointly met.Footnote 7 If this is the case, then the fixed point

$1-\det J\gt 0$

are jointly met.Footnote 7 If this is the case, then the fixed point

![]() $P_{R}=(0,0)$

is globally stable. It is straightforward to check that in the feasible parameter domain defined by

$P_{R}=(0,0)$

is globally stable. It is straightforward to check that in the feasible parameter domain defined by

![]() $b\gt 0$

and

$b\gt 0$

and

![]() $c\gt 0$

, the eigenvalues of the Jacobian matrix

$c\gt 0$

, the eigenvalues of the Jacobian matrix

![]() $J$

satisfy the condition

$J$

satisfy the condition

![]() $| \lambda _{1,2}| \lt 1$

in the so-called stability box

$| \lambda _{1,2}| \lt 1$

in the so-called stability box

where regions

![]() $R_{1}$

,

$R_{1}$

,

![]() $R_{2}$

and

$R_{2}$

and

![]() $R_{3}$

of stability box

$R_{3}$

of stability box

![]() $S$

have the following properties. In region

$S$

have the following properties. In region

the eigenvalues are real and positive, implying a monotonic convergence of the stock price to its fundamental value. In region

the eigenvalues are complex conjugate, implying a cyclical convergence of the stock price to its fundamental value. In region

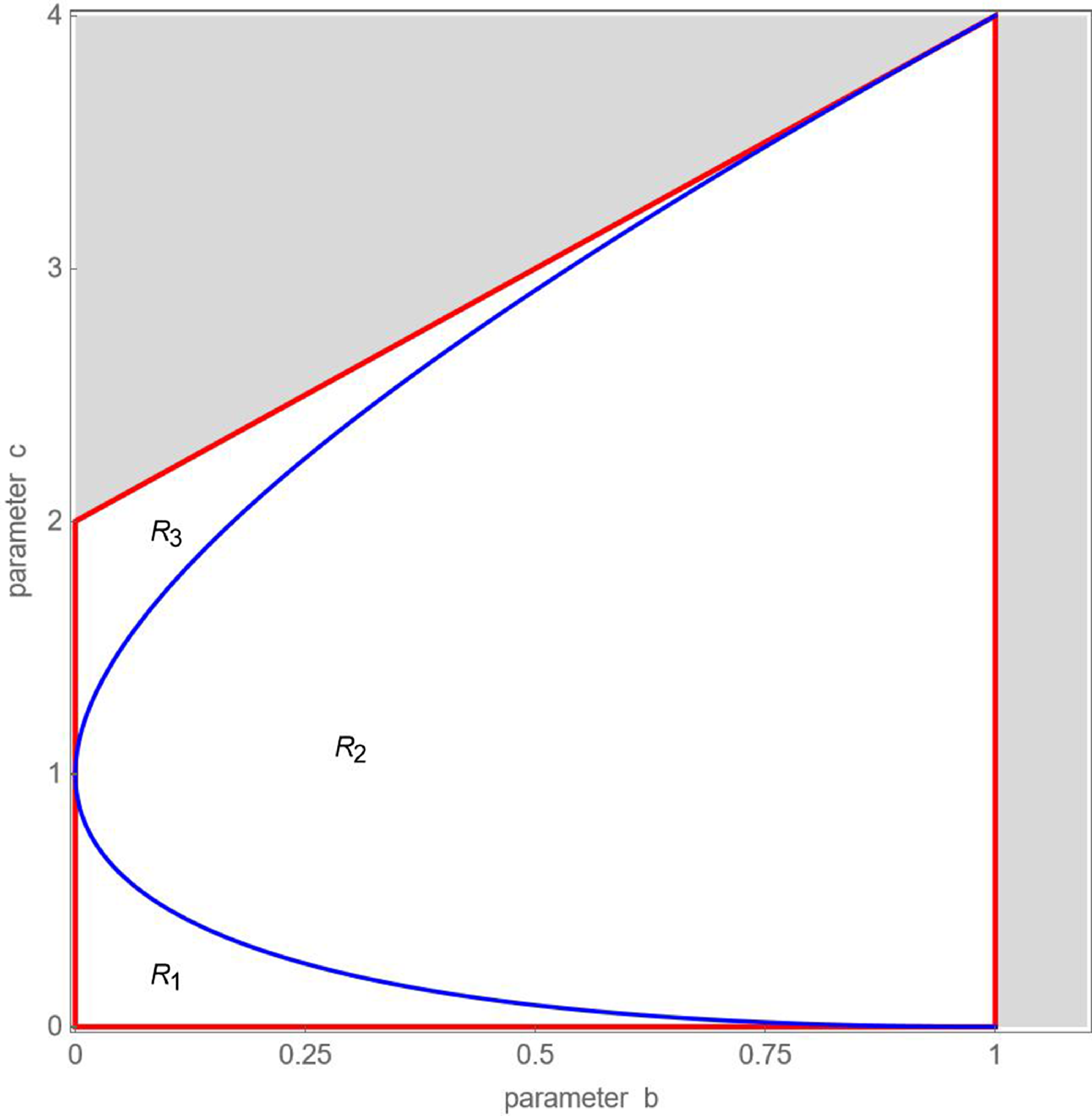

the eigenvalues are real and negative, implying an alternating convergence of the stock price to its fundamental value. Figure 1 portrays stability box

![]() $S$

and its three regions

$S$

and its three regions

![]() $R_{1}$

,

$R_{1}$

,

![]() $R_{2}$

and

$R_{2}$

and

![]() $R_{3}$

for

$R_{3}$

for

![]() $0\lt b\lt 1.1$

and

$0\lt b\lt 1.1$

and

![]() $0\lt c\lt 4$

. Combinations of parameters

$0\lt c\lt 4$

. Combinations of parameters

![]() $b$

and

$b$

and

![]() $c$

located inside stability box

$c$

located inside stability box

![]() $S$

guarantee that the stock price will return towards its fundamental value, while those located outside stability box

$S$

guarantee that the stock price will return towards its fundamental value, while those located outside stability box

![]() $S$

produce divergent stock price dynamics.

$S$

produce divergent stock price dynamics.

Figure 1. Stability box

![]() $S$

of map

$S$

of map

![]() $T_{R}$

. Parameter combinations located inside regions

$T_{R}$

. Parameter combinations located inside regions

![]() $R_{1}$

,

$R_{1}$

,

![]() $R_{2}$

and

$R_{2}$

and

![]() $R_{3}$

yield a monotonic, cyclical and alternating convergence towards the stock market’s fundamental value, respectively. Parameter combinations located outside stability box

$R_{3}$

yield a monotonic, cyclical and alternating convergence towards the stock market’s fundamental value, respectively. Parameter combinations located outside stability box

![]() $S$

produce divergent stock price dynamics.

$S$

produce divergent stock price dynamics.

Figure 2 illustrates our analytical results for map

![]() $T_{R}$

. The black line in the top left panel shows the evolution of the stock price in the time domain, assuming that

$T_{R}$

. The black line in the top left panel shows the evolution of the stock price in the time domain, assuming that

![]() $b=0.1$

and

$b=0.1$

and

![]() $c=0.1$

; the red line depicts the stock market’s fundamental value. Since this parameter combination is located inside region

$c=0.1$

; the red line depicts the stock market’s fundamental value. Since this parameter combination is located inside region

![]() $R_{1}$

, the stock price monotonically approaches its fundamental value. The black line in the top right panel shows the stock price path for

$R_{1}$

, the stock price monotonically approaches its fundamental value. The black line in the top right panel shows the stock price path for

![]() $b=0.8$

and

$b=0.8$

and

![]() $c=0.2$

. As can be seen, the stock price exhibits dampened cyclical motion when the market impact of chartists and fundamentalists is located inside region

$c=0.2$

. As can be seen, the stock price exhibits dampened cyclical motion when the market impact of chartists and fundamentalists is located inside region

![]() $R_{2}$

. The black line in the bottom left panel visualizes a simulation of the stock price based on

$R_{2}$

. The black line in the bottom left panel visualizes a simulation of the stock price based on

![]() $b=0.1$

and

$b=0.1$

and

![]() $c=2.1$

. Since this parameter combination is located in region

$c=2.1$

. Since this parameter combination is located in region

![]() $R_{3}$

, we observe a zigzag adjustment path. Stock prices explode when parameters

$R_{3}$

, we observe a zigzag adjustment path. Stock prices explode when parameters

![]() $b$

and

$b$

and

![]() $c$

are located outside stability box

$c$

are located outside stability box

![]() $S$

. For

$S$

. For

![]() $b=0.1$

and

$b=0.1$

and

![]() $c=2.21$

, for instance, the amplitude of the zigzag path of the stock price increases, as reported in the bottom right panel.

$c=2.21$

, for instance, the amplitude of the zigzag path of the stock price increases, as reported in the bottom right panel.

Figure 2. Stock market dynamics for map

![]() $T_{R}$

. The black lines show the evolution of the stock price in the time domain; the red line marks fundamentalists’ correct perception of the stock market’s fundamental value. The four panels are based on

$T_{R}$

. The black lines show the evolution of the stock price in the time domain; the red line marks fundamentalists’ correct perception of the stock market’s fundamental value. The four panels are based on

![]() $b=0.1$

and

$b=0.1$

and

![]() $c=0.1$

,

$c=0.1$

,

![]() $b=0.8$

and

$b=0.8$

and

![]() $c=0.2$

,

$c=0.2$

,

![]() $b=0.1$

and

$b=0.1$

and

![]() $c=2.1$

and

$c=2.1$

and

![]() $b=0.1$

and

$b=0.1$

and

![]() $c=2.21$

, respectively. Initial conditions are given by

$c=2.21$

, respectively. Initial conditions are given by

![]() $x=0.05$

and

$x=0.05$

and

![]() $y=0$

.

$y=0$

.

We can thus conclude that—in the absence of animal spirits—the stock price will always converge to its fundamental value, provided that the trading behavior of chartists and fundamentalists does not become too aggressive. The latter means that parameters

![]() $b$

and

$b$

and

![]() $c$

must be located inside stability box

$c$

must be located inside stability box

![]() $S$

.

$S$

.

3.2. General properties of our stock market model

Before we characterize the behavior of our complete stock market model in detail, it is helpful to discuss a number of general properties of map

![]() $T_{C}$

.

$T_{C}$

.

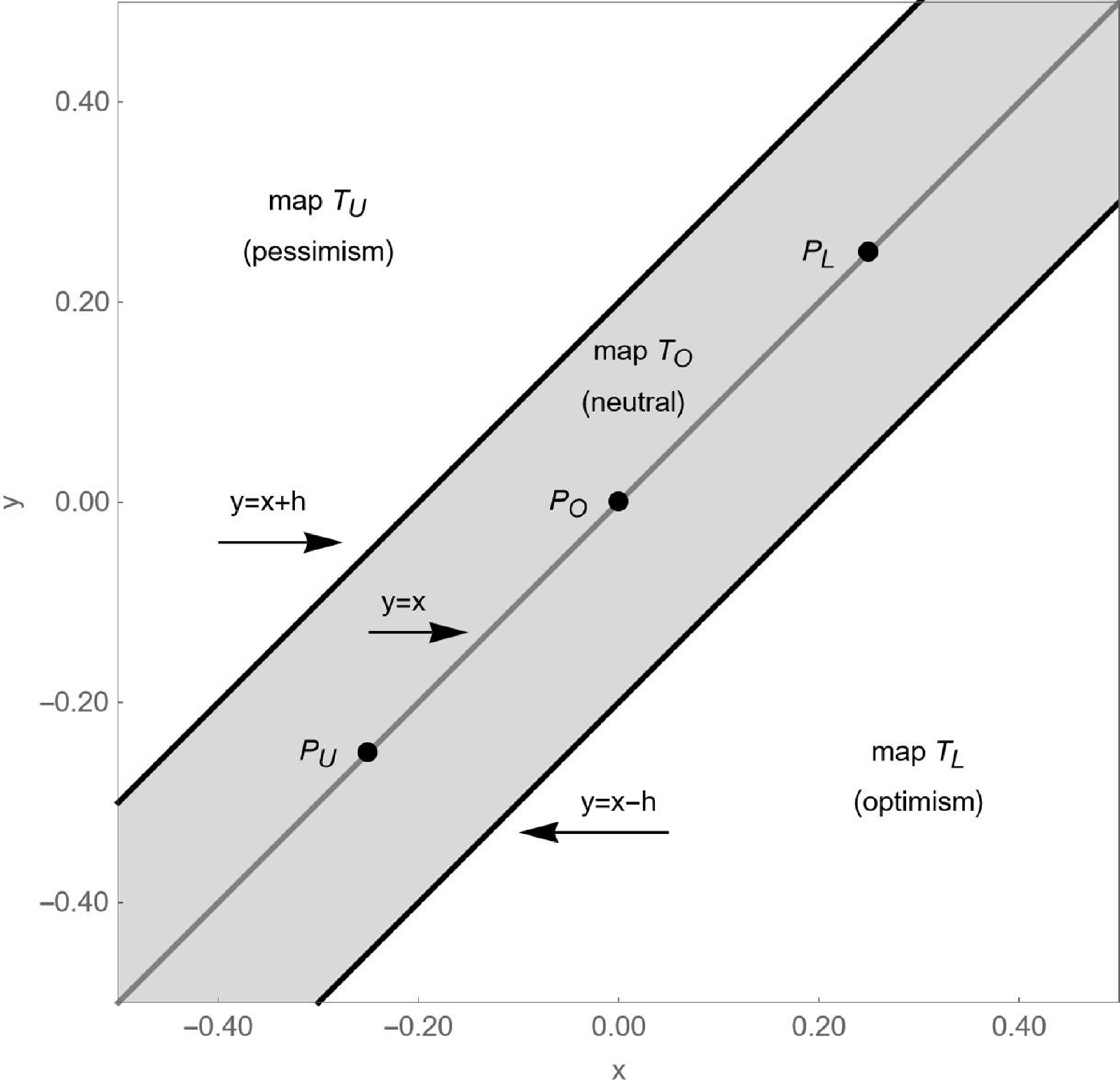

Figure 3. Areas in

![]() $(x,y)$

-state space where maps

$(x,y)$

-state space where maps

![]() $T_{L}$

,

$T_{L}$

,

![]() $T_{U}$

and

$T_{U}$

and

![]() $T_{O}$

apply. In the area of map

$T_{O}$

apply. In the area of map

![]() $T_{L}$

, fundamentalists are optimistic. In the area of map

$T_{L}$

, fundamentalists are optimistic. In the area of map

![]() $T_{U}$

, fundamentalists are pessimistic. In the area of map

$T_{U}$

, fundamentalists are pessimistic. In the area of map

![]() $T_{O}$

, fundamentalists are neutral. Note that the real fixed point

$T_{O}$

, fundamentalists are neutral. Note that the real fixed point

![]() $P_{O}=(0,0)$

and the two virtual fixed points

$P_{O}=(0,0)$

and the two virtual fixed points

![]() $P_{L}=(d,d)$

and

$P_{L}=(d,d)$

and

![]() $P_{U}=(-d,-d)$

are located inside the area of map

$P_{U}=(-d,-d)$

are located inside the area of map

![]() $T_{O}$

.

$T_{O}$

.

First, we can divide the

![]() $(x,y)$

-state space into three areas, each representing a different sentiment regime. See Figure 3 for an example. In the lower right part of the

$(x,y)$

-state space into three areas, each representing a different sentiment regime. See Figure 3 for an example. In the lower right part of the

![]() $(x,y)$

-state space, that is below the straight line

$(x,y)$

-state space, that is below the straight line

![]() $y=x-h$

, map

$y=x-h$

, map

\begin{equation}T_{L}\colon \begin{cases} x'=\left(1+b-c\right)x-by+cd\\ y'=x \end{cases}\end{equation}

\begin{equation}T_{L}\colon \begin{cases} x'=\left(1+b-c\right)x-by+cd\\ y'=x \end{cases}\end{equation}

applies. In this area, fundamentalists optimistically believe in a high fundamental value since the stock price strongly increases. In the upper left part of the

![]() $(x,y)$

-state space, that is above the straight line

$(x,y)$

-state space, that is above the straight line

![]() $y=x+h$

, map

$y=x+h$

, map

\begin{equation}T_{U}\colon \begin{cases} x'=\left(1+b-c\right)x-by-cd\\ y'=x \end{cases}\end{equation}

\begin{equation}T_{U}\colon \begin{cases} x'=\left(1+b-c\right)x-by-cd\\ y'=x \end{cases}\end{equation}

applies. In this area, fundamentalists pessimistically believe in a low fundamental value since the stock price strongly decreases. In the strip between these two straight lines, map

\begin{equation}T_{O}\colon \begin{cases} x'=\left(1+b-c\right)x-by\\ y'=x \end{cases}\end{equation}

\begin{equation}T_{O}\colon \begin{cases} x'=\left(1+b-c\right)x-by\\ y'=x \end{cases}\end{equation}

applies. In this area, stock prices are relatively stable. Hence, fundamentalists are neutral and believe in a normal fundamental value. As we will see, Figure 3 is key to understanding the functioning of our stock market model. Since the dynamics of our stock market model is governed by a map with two dimensions, knowledge about the current coordinates of

![]() $(x,y)=(x_{t},y_{t})=(x_{t},x_{t-1})=(P_{t}-F,P_{t-1}-F)$

allows us to immediately conclude which of the three maps

$(x,y)=(x_{t},y_{t})=(x_{t},x_{t-1})=(P_{t}-F,P_{t-1}-F)$

allows us to immediately conclude which of the three maps

![]() $T_{L}$

,

$T_{L}$

,

![]() $T_{U}$

and

$T_{U}$

and

![]() $T_{O}$

are responsible for determining the next stock price. Clearly, this is the beauty of two-dimensional maps; they give us a clear understanding of the system’s dynamics in the

$T_{O}$

are responsible for determining the next stock price. Clearly, this is the beauty of two-dimensional maps; they give us a clear understanding of the system’s dynamics in the

![]() $(x,y)$

-state space.

$(x,y)$

-state space.

Second, map

![]() $T_{O}$

is identical to map

$T_{O}$

is identical to map

![]() $T_{R}$

. Hence, the fixed point of map

$T_{R}$

. Hence, the fixed point of map

![]() $T_{O}$

, say

$T_{O}$

, say

![]() $P_{O}=(0,0)$

, has the same coordinates as the fixed point of map

$P_{O}=(0,0)$

, has the same coordinates as the fixed point of map

![]() $T_{R}$

. Of course, the fixed point

$T_{R}$

. Of course, the fixed point

![]() $P_{O}=(0,0)$

is also a fixed point of map

$P_{O}=(0,0)$

is also a fixed point of map

![]() $T_{C}$

. Importantly, however, the global stability results that we have established for the fixed point

$T_{C}$

. Importantly, however, the global stability results that we have established for the fixed point

![]() $P_{R}=(0,0)$

of map

$P_{R}=(0,0)$

of map

![]() $T_{R}$

may now only hold locally for the fixed point

$T_{R}$

may now only hold locally for the fixed point

![]() $P_{O}=(0,0)$

of map

$P_{O}=(0,0)$

of map

![]() $T_{C}$

. The following should be noted:

$T_{C}$

. The following should be noted:

-

• Proposition 1 in Appendix A states a sufficient condition for which the fixed point

$P_{O}=(0,0)$

of map

$P_{O}=(0,0)$

of map

$T_{C}$

is globally attracting. Figure 4, based on

$T_{C}$

is globally attracting. Figure 4, based on

$d=0.05$

and

$d=0.05$

and

$h=0.01$

, provides an example. For this parameter constellation, the fixed point

$h=0.01$

, provides an example. For this parameter constellation, the fixed point

$P_{O}=(0,0)$

of map

$P_{O}=(0,0)$

of map

$T_{C}$

is globally attracting for parameter combinations located inside (the green) region

$T_{C}$

is globally attracting for parameter combinations located inside (the green) region

$G$

(the sufficient condition requires that

$G$

(the sufficient condition requires that

$c\lt 0.2-0.25b$

). To establish globally stable stock markets, policymakers need to implement measures that force parameters

$c\lt 0.2-0.25b$

). To establish globally stable stock markets, policymakers need to implement measures that force parameters

$b$

and

$b$

and

$c$

inside region

$c$

inside region

$G$

, e.g. by conducting transactions that counter those of chartists and fundamentalists.

$G$

, e.g. by conducting transactions that counter those of chartists and fundamentalists. -

• Proposition 2 in Appendix B states a sufficient condition for which the fixed point

$P_{O}=(0,0)$

of map

$P_{O}=(0,0)$

of map

$T_{C}$

coexists with one or more cyclical attractors. In Figure 4, this is the case for

$T_{C}$

coexists with one or more cyclical attractors. In Figure 4, this is the case for

$c\gt 1/3$

. Proposition 2 furthermore characterizes the basin of attraction of the fixed point

$c\gt 1/3$

. Proposition 2 furthermore characterizes the basin of attraction of the fixed point

$P_{O}=(0,0)$

of map

$P_{O}=(0,0)$

of map

$T_{C}$

in the presence of coexisting attractors. To be more precise, we can conclude from Proposition 2 that the basin of attraction of the fixed point

$T_{C}$

in the presence of coexisting attractors. To be more precise, we can conclude from Proposition 2 that the basin of attraction of the fixed point

$P_{O}=(0,0)$

of map

$P_{O}=(0,0)$

of map

$T_{C}$

belongs to a quadrilateral region

$T_{C}$

belongs to a quadrilateral region

$Q$

with vertices

$Q$

with vertices

$(x_{L}^{*},y_{L}^{*})$

,

$(x_{L}^{*},y_{L}^{*})$

,

$(x_{U}^{*},y_{U}^{*})$

,

$(x_{U}^{*},y_{U}^{*})$

,

$(-x_{L}^{*},-y_{L}^{*})$

and

$(-x_{L}^{*},-y_{L}^{*})$

and

$(-x_{U}^{*},-y_{U}^{*})$

, where

$(-x_{U}^{*},-y_{U}^{*})$

, where

$(x_{L}^{*},y_{L}^{*})=(h(1+b)/c,x_{L}^{*}-h)$

and

$(x_{L}^{*},y_{L}^{*})=(h(1+b)/c,x_{L}^{*}-h)$

and

$(x_{U}^{*},y_{U}^{*})=(h(1-b)/c,$

$(x_{U}^{*},y_{U}^{*})=(h(1-b)/c,$

$x_{U}^{*}+h)$

. Let us return to Figure 4. For parameter combinations located inside (the blue) region

$x_{U}^{*}+h)$

. Let us return to Figure 4. For parameter combinations located inside (the blue) region

$E$

, the basin of attraction of the fixed point

$E$

, the basin of attraction of the fixed point

$P_{O}=(0,0)$

of map

$P_{O}=(0,0)$

of map

$T_{C}$

is equal to region

$T_{C}$

is equal to region

$Q$

. For parameter combinations located inside one of the two (yellow) regions

$Q$

. For parameter combinations located inside one of the two (yellow) regions

$U$

, the basin of attraction of the fixed point

$U$

, the basin of attraction of the fixed point

$P_{O}=(0,0)$

of map

$P_{O}=(0,0)$

of map

$T_{C}$

is smaller than region

$T_{C}$

is smaller than region

$Q$

. For parameter combinations located inside (the orange) region

$Q$

. For parameter combinations located inside (the orange) region

$A$

, the basin of attraction of the fixed point

$A$

, the basin of attraction of the fixed point

$P_{O}=(0,0)$

of map

$P_{O}=(0,0)$

of map

$T_{C}$

may be smaller or larger than region

$T_{C}$

may be smaller or larger than region

$Q$

. As long as the stock price remains inside the basin of attraction of the fixed point

$Q$

. As long as the stock price remains inside the basin of attraction of the fixed point

$P_{O}=(0,0)$

of map

$P_{O}=(0,0)$

of map

$T_{C}$

, its trajectory will describe a cyclical, monotonic or alternating adjustment path towards its fundamental value, depending on whether parameters

$T_{C}$

, its trajectory will describe a cyclical, monotonic or alternating adjustment path towards its fundamental value, depending on whether parameters

$b$

and

$b$

and

$c$

are located inside regions

$c$

are located inside regions

$R_{1}$

,

$R_{1}$

,

$R_{2}$

and

$R_{2}$

and

$R_{3}$

, respectively. The dynamics we have witnessed in Figure 2 for map

$R_{3}$

, respectively. The dynamics we have witnessed in Figure 2 for map

$T_{R}$

thus also holds for map

$T_{R}$

thus also holds for map

$T_{C}$

, assuming that the stock price remains in the vicinity of its fixed point

$T_{C}$

, assuming that the stock price remains in the vicinity of its fixed point

$P_{O}=(0,0)$

.

$P_{O}=(0,0)$

.

Sections 3.3 to 3.5 discuss the economic implications of these results in more detail.

Figure 4. Properties of map

![]() $T_{C}$

in the

$T_{C}$

in the

![]() $(b,c)$

-parameter plane. Green region

$(b,c)$

-parameter plane. Green region

![]() $G$

: the real fixed point is globally attracting. Blue region

$G$

: the real fixed point is globally attracting. Blue region

![]() $E$

: the basin of attraction of the real fixed point is equal to the quadrilateral region

$E$

: the basin of attraction of the real fixed point is equal to the quadrilateral region

![]() $Q$

. Yellow regions

$Q$

. Yellow regions

![]() $U$

: the basin of attraction of the real fixed point is smaller than the quadrilateral region

$U$

: the basin of attraction of the real fixed point is smaller than the quadrilateral region

![]() $Q$

. Orange region

$Q$

. Orange region

![]() $A$

: the basin of attraction of the real fixed point may be smaller or larger than the quadrilateral region

$A$

: the basin of attraction of the real fixed point may be smaller or larger than the quadrilateral region

![]() $Q$

. White region

$Q$

. White region

![]() $C$

: coexistence of chaotic and divergent dynamics. Gray region

$C$

: coexistence of chaotic and divergent dynamics. Gray region

![]() $D$

: divergent dynamics. Remaining parameters:

$D$

: divergent dynamics. Remaining parameters:

![]() $d=0.05$

and

$d=0.05$

and

![]() $h=0.01$

.

$h=0.01$

.

Third, the fixed points of maps

![]() $T_{L}$

and

$T_{L}$

and

![]() $T_{U}$

are given by

$T_{U}$

are given by

![]() $P_{L}=(d,d)$

and

$P_{L}=(d,d)$

and

![]() $P_{U}=(-d,-d)$

, respectively. While the fixed point

$P_{U}=(-d,-d)$

, respectively. While the fixed point

![]() $P_{L}=(d,d)$

represents an overvalued stock market, the fixed point

$P_{L}=(d,d)$

represents an overvalued stock market, the fixed point

![]() $P_{U}=(-d,-d)$

signifies an undervalued stock market. Since these fixed points are located on the diagonal of the

$P_{U}=(-d,-d)$

signifies an undervalued stock market. Since these fixed points are located on the diagonal of the

![]() $(x,y)$

-state space, as evidenced in Figure 3, they do not belong to the area where their maps apply. For this reason, the fixed points

$(x,y)$

-state space, as evidenced in Figure 3, they do not belong to the area where their maps apply. For this reason, the fixed points

![]() $P_{L}=(d,d)$

and

$P_{L}=(d,d)$

and

![]() $P_{U}=(-d,-d)$

are virtual fixed point for map

$P_{U}=(-d,-d)$

are virtual fixed point for map

![]() $T_{C}$

. Put differently, map

$T_{C}$

. Put differently, map

![]() $T_{C}$

has three fixed points, which we will call the optimistic virtual fixed point

$T_{C}$

has three fixed points, which we will call the optimistic virtual fixed point

![]() $P_{L}=(d,d)$

, the real fixed point

$P_{L}=(d,d)$

, the real fixed point

![]() $P_{O}=(0,0)$

, and the pessimistic virtual fixed point

$P_{O}=(0,0)$

, and the pessimistic virtual fixed point

![]() $P_{U}=(-d,-d)$

.

$P_{U}=(-d,-d)$

.

Fourth, virtual fixed points may have a significant impact on stock market dynamics, as revealed by the following thought experiment. Recall first that maps

![]() $T_{L}$

and

$T_{L}$

and

![]() $T_{U}$

have the same Jacobian matrix and thus the same eigenvalues as map

$T_{U}$

have the same Jacobian matrix and thus the same eigenvalues as map

![]() $T_{O}$

, implying that their fixed points share the same stability properties. Let us assume, for simplicity, that parameters

$T_{O}$

, implying that their fixed points share the same stability properties. Let us assume, for simplicity, that parameters

![]() $b$

and

$b$

and

![]() $c$

are located inside region

$c$

are located inside region

![]() $R_{1}$

. As a result, the stock price will converge monotonically to a virtual fixed point as long as its trajectory remains inside the area where its map applies. Suppose that the stock price monotonically approaches the optimistic virtual fixed point. Since the stock price change associated with a convergence to this fixed point decreases over time, the stock price will eventually leave this area. This causes a regime change, which may initially result in a movement towards the real fixed point. Suppose that this regime change is associated with a sharp movement towards the real fixed point, a movement that exceeds parameter

$R_{1}$

. As a result, the stock price will converge monotonically to a virtual fixed point as long as its trajectory remains inside the area where its map applies. Suppose that the stock price monotonically approaches the optimistic virtual fixed point. Since the stock price change associated with a convergence to this fixed point decreases over time, the stock price will eventually leave this area. This causes a regime change, which may initially result in a movement towards the real fixed point. Suppose that this regime change is associated with a sharp movement towards the real fixed point, a movement that exceeds parameter

![]() $h$

. Then there is another regime change, and the stock price moves monotonically toward the pessimistic virtual fixed point, albeit only for a few time steps, as the rate of adjustment automatically slows down over time. Importantly, the virtual fixed points of map

$h$

. Then there is another regime change, and the stock price moves monotonically toward the pessimistic virtual fixed point, albeit only for a few time steps, as the rate of adjustment automatically slows down over time. Importantly, the virtual fixed points of map

![]() $T_{C}$

are temporarily attracting but any convergence towards them is eventually self-defeating. As long as the stock price does not get stuck in the basin of attraction of the real fixed point, the existence of virtual fixed points provides the stage for sentiment-driven boom-bust stock market dynamics. We can observe this cycle-generating mechanism in regions

$T_{C}$

are temporarily attracting but any convergence towards them is eventually self-defeating. As long as the stock price does not get stuck in the basin of attraction of the real fixed point, the existence of virtual fixed points provides the stage for sentiment-driven boom-bust stock market dynamics. We can observe this cycle-generating mechanism in regions

![]() $R_{1}$

,

$R_{1}$

,

![]() $R_{2}$

and

$R_{2}$

and

![]() $R_{3}$

, as made clear in Sections 3.3 to 3.5.

$R_{3}$

, as made clear in Sections 3.3 to 3.5.

Fifth, numerical evidence suggests that stability box

![]() $S$

is almost completely filled with families of different types of stock price cycles. The two-dimensional bifurcation diagram depicted in Figure 5 is a first example. Parameters

$S$

is almost completely filled with families of different types of stock price cycles. The two-dimensional bifurcation diagram depicted in Figure 5 is a first example. Parameters

![]() $b$

and

$b$

and

![]() $c$

are varied as in Figure 1, while the remaining parameters are set to

$c$

are varied as in Figure 1, while the remaining parameters are set to

![]() $d=0.05$

and

$d=0.05$

and

![]() $h=0.01$

. The initial conditions are given by

$h=0.01$

. The initial conditions are given by

![]() $x=0.025$

and

$x=0.025$

and

![]() $y=0$

.Footnote 8 Different colors indicate numerically detected stock price cycles with different periods. For instance, the large red, blue, green and yellow areas in the left part of the two-dimensional bifurcation diagram represent parameter combinations that lead to period-4, period-6, period-8 and period-10 stock price cycles, respectively. Moreover, the (smaller) cyan, pink and brown areas in the middle part of the two-dimensional bifurcation diagram reflect parameter combinations that give rise to period-3, period-5 and period-7 stock price cycles, respectively. Parameter combinations that yield cycles with a lag larger than

$y=0$

.Footnote 8 Different colors indicate numerically detected stock price cycles with different periods. For instance, the large red, blue, green and yellow areas in the left part of the two-dimensional bifurcation diagram represent parameter combinations that lead to period-4, period-6, period-8 and period-10 stock price cycles, respectively. Moreover, the (smaller) cyan, pink and brown areas in the middle part of the two-dimensional bifurcation diagram reflect parameter combinations that give rise to period-3, period-5 and period-7 stock price cycles, respectively. Parameter combinations that yield cycles with a lag larger than

![]() $n=42$

are marked purple. Black areas stand for parameter combinations for which the stock price convergences to the real fixed point. White areas mark parameter combinations that yield chaotic stock price dynamics. Gray areas reflect parameter combinations that are associated with divergent dynamics. Qualitatively similar images are obtained for different values of parameters

$n=42$

are marked purple. Black areas stand for parameter combinations for which the stock price convergences to the real fixed point. White areas mark parameter combinations that yield chaotic stock price dynamics. Gray areas reflect parameter combinations that are associated with divergent dynamics. Qualitatively similar images are obtained for different values of parameters

![]() $d$

and

$d$

and

![]() $h$

, provided that

$h$

, provided that

![]() $d\gt h\gt 0$

.

$d\gt h\gt 0$

.

Figure 5. Two-dimensional bifurcation diagram in the

![]() $(b,c)$

-parameter plane for map

$(b,c)$

-parameter plane for map

![]() $T_{C}$

. Differently colored areas mark periodicity regions of different cycles (areas that produce cycles with a period larger than

$T_{C}$

. Differently colored areas mark periodicity regions of different cycles (areas that produce cycles with a period larger than

![]() $n=42$

are marked purple). Black areas mark parameter combinations that result in a convergence to the real fixed point. White areas mark parameter combinations that lead to chaotic dynamics. Gray areas mark parameter combinations that yield divergent dynamics. Numerical observations rely on initial conditions

$n=42$

are marked purple). Black areas mark parameter combinations that result in a convergence to the real fixed point. White areas mark parameter combinations that lead to chaotic dynamics. Gray areas mark parameter combinations that yield divergent dynamics. Numerical observations rely on initial conditions

![]() $x=0.025$

and

$x=0.025$

and

![]() $y=0$

. Remaining parameters:

$y=0$

. Remaining parameters:

![]() $d=0.05$

and

$d=0.05$

and

![]() $h=0.01$

.

$h=0.01$

.

Sixth, map

![]() $T_{C}$

is symmetric with respect to the real fixed point

$T_{C}$

is symmetric with respect to the real fixed point

![]() $P_{O}=(0,0)$

. Since

$P_{O}=(0,0)$

. Since

![]() $T_{O}(-x,-y)=-T_{O}(x,y)$

and

$T_{O}(-x,-y)=-T_{O}(x,y)$

and

![]() $T_{U}(-x,-y)=-T_{L}(x,y)$

, it follows that the trajectory starting at point

$T_{U}(-x,-y)=-T_{L}(x,y)$

, it follows that the trajectory starting at point

![]() $(-x_{0},-y_{0})$

is symmetric with respect to the real fixed point

$(-x_{0},-y_{0})$

is symmetric with respect to the real fixed point

![]() $P_{O}=(0,0)$

to the trajectory of point

$P_{O}=(0,0)$

to the trajectory of point

![]() $(x_{0},y_{0})$

. This means that any invariant set

$(x_{0},y_{0})$

. This means that any invariant set

![]() $A$

of map

$A$

of map

![]() $T$

is symmetric with respect to the real fixed point

$T$

is symmetric with respect to the real fixed point

![]() $P_{O}=(0,0)$

or an invariant set

$P_{O}=(0,0)$

or an invariant set

![]() $A'$

exists that is symmetric to

$A'$

exists that is symmetric to

![]() $A$

with respect to the real fixed point

$A$

with respect to the real fixed point

![]() $P_{O}=(0,0)$

. Hence, any odd-period cycle has a symmetric companion odd-period cycle. Since Figure 5 reports multiple instances of odd-period cycles, this is a first indication that our stock market model may give rise to coexisting cyclical attractors. In Sections 3.3 to 3.5, we will see that there are further forms of coexisting periodic attractors, e.g. odd-period cycles may coexist with one or more even-period cycles. From the next remark, it follows that all existing cycles in stability box

$P_{O}=(0,0)$

. Hence, any odd-period cycle has a symmetric companion odd-period cycle. Since Figure 5 reports multiple instances of odd-period cycles, this is a first indication that our stock market model may give rise to coexisting cyclical attractors. In Sections 3.3 to 3.5, we will see that there are further forms of coexisting periodic attractors, e.g. odd-period cycles may coexist with one or more even-period cycles. From the next remark, it follows that all existing cycles in stability box

![]() $S$

are attracting.

$S$

are attracting.

Seventh, the fact that maps

![]() $T_{L}$

,

$T_{L}$

,

![]() $T_{O}$

and

$T_{O}$

and

![]() $T_{U}$

have the same Jacobian matrix

$T_{U}$

have the same Jacobian matrix

![]() $J$

leads to an important property with respect to the stability or instability of all possible existing cycles of map

$J$

leads to an important property with respect to the stability or instability of all possible existing cycles of map

![]() $T_{C}$

. In fact, a cycle of period

$T_{C}$

. In fact, a cycle of period

![]() $n$

is a fixed point of the

$n$

is a fixed point of the

![]() $n$

-th iterate of map

$n$

-th iterate of map

![]() $T_{C}^{n}$

. Its stability is therefore determined by the eigenvalues of matrix

$T_{C}^{n}$

. Its stability is therefore determined by the eigenvalues of matrix

![]() $J^{n}$

, which in turn are given by

$J^{n}$

, which in turn are given by

![]() $\lambda _{1}^{n}$

and

$\lambda _{1}^{n}$

and

![]() $\lambda _{2}^{n}$

. In particular, for all combinations of parameters

$\lambda _{2}^{n}$

. In particular, for all combinations of parameters

![]() $b$

and

$b$

and

![]() $c$

located inside stability box

$c$

located inside stability box

![]() $S$

, map

$S$

, map

![]() $T_{C}$

cannot have unstable cycles. Since this also rules out the existence of divergent dynamics for all combinations of parameters

$T_{C}$

cannot have unstable cycles. Since this also rules out the existence of divergent dynamics for all combinations of parameters

![]() $b$

and

$b$

and

![]() $c$

located inside stability box

$c$

located inside stability box

![]() $S$

, we can still define that parameter region as a stability region for map

$S$

, we can still define that parameter region as a stability region for map

![]() $T_{C}$

. For all combinations of parameters

$T_{C}$

. For all combinations of parameters

![]() $b$

and

$b$

and

![]() $c$

not located inside stability box

$c$

not located inside stability box

![]() $S$

, map

$S$

, map

![]() $T_{C}$

cannot have stable cycles.

$T_{C}$

cannot have stable cycles.

Eighth, Figure 5 reports numerical evidence for the existence of attracting cycles. In a mathematical companion paper, Gardini et al. (Reference Gardini, Radi, Schmitt, Sushko and Westerhoff2023a) explain how to derive analytical expressions for the bifurcation boundaries of different types of families of cycles. While they study a different stock market model, their mathematical techniques also apply to our map. Based on their insights, Figure 6 exemplarily portrays analytically determined bifurcation boundaries of two qualitatively different locally stable period-6 stock price cycles in the

![]() $(b,c)$

-parameter plane for map

$(b,c)$

-parameter plane for map

![]() $T_{C}$

. Parameters

$T_{C}$

. Parameters

![]() $b$

and

$b$

and

![]() $c$

are varied as in Figures 1, 4 and 5, while the remaining parameters are set to

$c$

are varied as in Figures 1, 4 and 5, while the remaining parameters are set to

![]() $d=0.05$

and

$d=0.05$

and

![]() $h=0.01$

. The area between the two cyan curves marks the existence region of a period-6 stock price cycle that involves all three branches of map

$h=0.01$

. The area between the two cyan curves marks the existence region of a period-6 stock price cycle that involves all three branches of map

![]() $T_{C}$

. Note that the existence region of this period-6 stock price cycle covers parts of regions

$T_{C}$

. Note that the existence region of this period-6 stock price cycle covers parts of regions

![]() $R_{1}$

,

$R_{1}$

,

![]() $R_{2}$

and

$R_{2}$

and

![]() $R_{3}$

. Clearly, this proves that our stock market model is able to produce endogenous stock market dynamics in regions

$R_{3}$

. Clearly, this proves that our stock market model is able to produce endogenous stock market dynamics in regions

![]() $R_{1}$

,

$R_{1}$

,

![]() $R_{2}$

and

$R_{2}$

and

![]() $R_{3}$

. The area between the two purple curves marks the existence region of a period-6 stock price cycle that only involves two of the three branches of map

$R_{3}$

. The area between the two purple curves marks the existence region of a period-6 stock price cycle that only involves two of the three branches of map

![]() $T_{C}$

. Note that the existence region of this cycle is entirely located inside region

$T_{C}$

. Note that the existence region of this cycle is entirely located inside region

![]() $R_{2}$

. Obviously, both period-6 stock price cycles coexist in the area between the two cyan and the two purple curves—next to the locally stable real fixed point. We will return to this interesting scenario in Section 3.4. As it turns out, the analytically determined area between the two cyan curves or the two purple curves in Figure 6 nicely overlaps with the numerically identified existence region of period-6 stock price cycles reported in Figure 5. Of course, it is not clear from Figure 5 that we are dealing with two qualitatively different period-6 stock price cycles. Moreover, the image of the two-dimensional bifurcation diagram presented in Figure 5 depends on the initial conditions; other initial conditions may result in different images. In Appendix C, we explicitly derive the analytical bifurcation boundaries reported in Figure 6. We recall that it is possible to determine the analytical bifurcation boundaries for other families of cycles, too.

$R_{2}$

. Obviously, both period-6 stock price cycles coexist in the area between the two cyan and the two purple curves—next to the locally stable real fixed point. We will return to this interesting scenario in Section 3.4. As it turns out, the analytically determined area between the two cyan curves or the two purple curves in Figure 6 nicely overlaps with the numerically identified existence region of period-6 stock price cycles reported in Figure 5. Of course, it is not clear from Figure 5 that we are dealing with two qualitatively different period-6 stock price cycles. Moreover, the image of the two-dimensional bifurcation diagram presented in Figure 5 depends on the initial conditions; other initial conditions may result in different images. In Appendix C, we explicitly derive the analytical bifurcation boundaries reported in Figure 6. We recall that it is possible to determine the analytical bifurcation boundaries for other families of cycles, too.

Figure 6. Analytically determined bifurcation boundaries of two qualitatively different locally stable period-6 cycles in the

![]() $(b,c)$

-parameter plane for map

$(b,c)$

-parameter plane for map

![]() $T_{C}$

. The area between the two cyan curves marks the existence region of a period-6 cycle, covering parts of regions

$T_{C}$

. The area between the two cyan curves marks the existence region of a period-6 cycle, covering parts of regions

![]() $R_{1}$

,

$R_{1}$

,

![]() $R_{2}$

and

$R_{2}$

and

![]() $R_{3}$

. The area between the two purple curves marks the existence region of another period-6 cycle, covering part of region

$R_{3}$

. The area between the two purple curves marks the existence region of another period-6 cycle, covering part of region

![]() $R_{2}$

. Both period-6 cycles coexist in the area between the two cyan and the two purple curves. Remaining parameters:

$R_{2}$

. Both period-6 cycles coexist in the area between the two cyan and the two purple curves. Remaining parameters:

![]() $d=0.05$

and

$d=0.05$

and

![]() $h=0.01$

.

$h=0.01$

.

Ninth, the white triangle-like region in the two-dimensional bifurcation diagram depicted in Figure 5 represents

![]() $(b,c)$

-parameter combinations for which we found chaotic stock price dynamics. In the absence of animal spirits, these parameter combinations would yield divergent stock price dynamics. In the presence of animal spirits, the stock price may exhibit at least bounded dynamics. In this sense, animal spirits can also have a stabilizing impact on stock market dynamics. Since the real fixed point, as well as any other existing cycle of our stock market model, is of course not stable in this parameter region, the chaotic attractor does not coexist with an attracting real fixed point or cycle. However, the dynamics in this parameter domain may also be divergent: stock prices explode when initial conditions exit the basin of attraction of the chaotic attractor. We discuss this issue in more detail in Section 4.1. One further comment is in order. The two-dimensional bifurcation diagram depicted in Figure 5 is the outcome of a simulation exercise. In Appendix D, we analytically derive the existence region of chaotic stock market dynamics. The white region

$(b,c)$

-parameter combinations for which we found chaotic stock price dynamics. In the absence of animal spirits, these parameter combinations would yield divergent stock price dynamics. In the presence of animal spirits, the stock price may exhibit at least bounded dynamics. In this sense, animal spirits can also have a stabilizing impact on stock market dynamics. Since the real fixed point, as well as any other existing cycle of our stock market model, is of course not stable in this parameter region, the chaotic attractor does not coexist with an attracting real fixed point or cycle. However, the dynamics in this parameter domain may also be divergent: stock prices explode when initial conditions exit the basin of attraction of the chaotic attractor. We discuss this issue in more detail in Section 4.1. One further comment is in order. The two-dimensional bifurcation diagram depicted in Figure 5 is the outcome of a simulation exercise. In Appendix D, we analytically derive the existence region of chaotic stock market dynamics. The white region

![]() $C$

in Figure 4 visualizes the analytically determined existence region of chaotic stock market dynamics for

$C$

in Figure 4 visualizes the analytically determined existence region of chaotic stock market dynamics for

![]() $d=0.05$

and

$d=0.05$

and

![]() $h=0.01$

.

$h=0.01$

.

Tenth, we also show in Appendix D that the gray area in the two-dimensional bifurcation diagram depicted in Figure 5 represents

![]() $(b,c)$

-parameter combinations that must necessarily result in divergent dynamics. While Figure 5 is based on numerical results, the gray region in Figure 4, which again reflects divergent dynamics, visualizes our analytical results.

$(b,c)$

-parameter combinations that must necessarily result in divergent dynamics. While Figure 5 is based on numerical results, the gray region in Figure 4, which again reflects divergent dynamics, visualizes our analytical results.

Figure 7. Example of stock price dynamics in region

![]() $R_{1}$

. Left: the blue line shows the evolution of a period-8 stock price cycle in the time domain. The red solid and dashed lines mark fundamentalists’ correct and biased perception of the stock market’s fundamental value, respectively. Right: the connected blue disks depict the evolution of a period-8 stock price cycle in

$R_{1}$

. Left: the blue line shows the evolution of a period-8 stock price cycle in the time domain. The red solid and dashed lines mark fundamentalists’ correct and biased perception of the stock market’s fundamental value, respectively. Right: the connected blue disks depict the evolution of a period-8 stock price cycle in

![]() $(x,y)$

-state space; the red disk and the two red circles indicate the positions of the real fixed point and the two virtual fixed points. The two black dashed lines and the two black dotted lines represent the discontinuity lines

$(x,y)$

-state space; the red disk and the two red circles indicate the positions of the real fixed point and the two virtual fixed points. The two black dashed lines and the two black dotted lines represent the discontinuity lines

![]() $y=x+h$

and

$y=x+h$

and

![]() $y=x-h$

and their rank-1 preimages via map

$y=x-h$

and their rank-1 preimages via map

![]() $T_{O}^{-1}$

, respectively. The four red segments of the quadrilateral region

$T_{O}^{-1}$

, respectively. The four red segments of the quadrilateral region

![]() $Q$

bound the analytically determined basin of attraction of the real fixed point. The light blue and light red areas mark the numerically detected basins of attraction of the period-8 cycle and of the real fixed point, respectively. Parameter setting:

$Q$

bound the analytically determined basin of attraction of the real fixed point. The light blue and light red areas mark the numerically detected basins of attraction of the period-8 cycle and of the real fixed point, respectively. Parameter setting:

![]() $b=0.05$

,

$b=0.05$

,

![]() $c=0.5$

,

$c=0.5$

,

![]() $d=0.05$