1. Introduction

There is consensus in the literature that inequality has been increasing within most advanced economies since the 1980s [e.g., Alvaredo et al. (Reference Alvaredo, Chancel, Piketty, Saez and Zucman2018)]. Initially, the prevailing literature attributed this phenomenon to the bias of technological-knowledge progress in favor of high-skilled workers vis-à-vis low-skilled workers [e.g., Katz and Murphy (Reference Katz and Murphy1992) and Acemoglu (Reference Acemoglu1998, Reference Acemoglu2002)].Footnote 1 In the context of this directed technical change (DTC) literature, low-skilled and high-skilled workers are complemented by specific types of technologies. An increase in the supply of one type of labor causes an expansion of the market size of the technologies it complements (a market-size channel), which, given the associated profitability, creates additional incentives for R&D directed at those technologies. Consequently, technological-knowledge changes due to R&D activity are biased toward those technologies, that is, toward a specific sector. In turn, the bias increases the demand for the type of complementary labor that would supplement the supply. Thus, the proposed modeling explained the increased skill premium due to the increased relative supply of high-skilled labor.

Alternatively, considering three types of workers, as suggested by the finer analysis of the existing data, several authors have found that medium-skilled workers are employed in routine tasks, while low-skilled and high-skilled tasks are mainly employed in “purely manual” and “abstract/cognitive” nonroutine tasks, respectively [e.g., Acemoglu and Autor (Reference Acemoglu and Autor2011), Autor and Dorn (Reference Autor and Dorn2013), and Wang et al. (Reference Wang, Hu and Zhang2021)]; for example, according to the World Bank Group (2016), around 57% of current jobs in the OECD are at risk of being replaced by robots or by relocations of tasks toward developing countries,Footnote 2 mainly at the level of complementary routine tasks for medium-skilled workers [Blanas et al. (Reference Blanas, Gancia and Lee2019)], since these tasks only require methodical repetitions [Autor et al. (Reference Autor, Levy and Murnane2003)]. Both types of nonroutine tasks—purely manual and abstract/cognitive—are difficult to reduce to a specific set of instructions [Chui et al. (Reference Chui, Mayika and Miremadi2016) and Acemoglu and Restrepo (Reference Acemoglu and Restrepo2018a, Reference Acemoglu and Restrepob)]. Indeed, purely manual tasks require human and physical elements (e.g., service occupations), and abstract/cognitive tasks require complex cognitive processes (e.g., managers, technicians, accounting, consulting, planning, and even in various medical specialties, etc.).

There are two main (separately treated until now) explanations for the wage polarization observed in developed countries, which is described as a labor market phenomenon where earnings grow significantly at the tails of the distribution [Autor and Dorn (Reference Autor and Dorn2013)]:

-

• automation (or robotization), which, by leading to an increase in routine tasks performed by machines/robots, makes labor less productive in these tasks and decreases the relative demand for medium-skilled workers—for example, Autor et al. (Reference Autor, Levy and Murnane2003), Acemoglu and Autor (Reference Acemoglu and Autor2011), Autor and Dorn (Reference Autor and Dorn2013), Acemoglu and Loebbing (Reference Acemoglu and Loebbing2022), and Lankisch et al. (Reference Lankisch, Prettner and Prskawetz2019).Footnote 3

-

• offshoring/outsourcing/foreign direct investment (FDI) through which worldwide firms—that is, firms operating in developed/innovator countries and, directly or indirectly, in developing/follower countries—transfer production to countries with lower costs (hereinafter, relocations that promote international trade) that potentially benefit all workers in the world due to efficiency gains [e.g., Grossman and Rossi-Hansberg (Reference Grossman and Rossi-Hansberg2008) and Rodriguez-Clare (Reference Rodriguez-Clare2010)] but also have strong distributional effects that can, for example, have negative implications on wages of medium-skilled workers in developed countries—for example, Feenstra and Hanson (Reference Feenstra, Hanson, Feenstra and Hanson1996, Reference Feenstra and Hanson1999), and Oldenski (Reference Oldenski2014).Footnote 4 That is, greater imports of cheap medium-skilled inputs produced by worldwide firms in developing countries may lead to a decline in the medium-skilled wage and a rise in wage polarization in developed countries.

This paper focuses mainly on the explanation of wage polarization observed in many developed countries, based on the “race” between relocations and the automation of tasks.

Our main contribution is to simultaneously consider two different explanations of wage polarization that until now were treated separately (robotization and relocations) within the same DTC setup. First, our empirical analysis highlights the positive relationship between both automation and relocations on wage polarization, which is even stronger if taken as conditional in one another. Second, we show that the allocation of resources between tasks is such that automation is more important than offshoring if the level of domestic medium-skilled workers exceeds the number existing abroad—that is, if the “room” for automation exceeds the “room” for offshoring—and if the absolute advantage of domestic medium-skilled workers outweighs the absolute advantage of the same type of workers abroad. Moreover, after solving for the general equilibrium, we show unequivocally that wage polarization increases in both tails with automation and offshoring. In particular, wage polarization in favor of domestic (nonroutine) high(low)-skilled workers is positively affected by an increase in domestic (nonroutine) high(low)-skilled labor quantity and/or absolute productivity, although the latter relationship exhibits a downward effect beyond a certain threshold. It is also positively influenced by a rise in foreign (routine) medium-skilled labor quantity and/or absolute productivity while negatively impacted by an increase in domestic (routine) medium-skilled labor quantity and/or absolute productivity, with the latter exhibiting diminishing returns beyond a specific threshold. We show that the effect of offshoring on wage polarization diminishes with the degree of substitutability between routine and nonroutine sectors in the economy, with the share of machines in the production of intermediate goods and with the scale effect. Third, we thoroughly calibrate the model to assess its quantitative implications. By considering the USA as a domestic country, with a high degree of automation exposure and Mexico as a foreign country engaged in substantial cross-border relocations with the domestic nation, we quantify the behavior of crucial variables due to changes in parameters and exogenous variables. Thus, we graphically examine the impact of fluctuations in the values linked to the importance of the routine sector, which plays a crucial role in driving technical change or innovation, in the inter-sector technological-knowledge gap biased in favor of tasks produced by domestic (nonroutine) high- and low-skilled workers. Thereafter, we evaluate the repercussions of a change in the values associated with automation and relocations on the wage polarization in favor of domestic (nonroutine) high- and low-skilled workers. We will observe that the outcomes align with the theoretical findings.

After this Introduction, Section 2 analyzes empirically the relationship between relocation and automation with wage polarization using fixed effects estimations with several controls. In Section 3, the model is detailed; we start by modeling the preferences, which examines the demand side of the model (Section 3.1) and the productive side of the model (Sections 3.2–3.5). In Section 4, the model general equilibrium is solved, and the main theoretical results are derived. In Section 5, a calibration exercise is performed. Finally, in Section 6, the main conclusions are presented.

2. Empirical evidence

Empirical evidence of the impact of these two effects on wage inequality is still scarce, and to our knowledge, none is available that considers both phenomena simultaneously. Therefore, in order to tackle this issue, we begin our empirical analysis by plotting the wage polarization between high-and-medium-skilled,

![]() $\left (\frac{w_{H}}{w_{M}}\right )$

, and low-and-medium-skilled,

$\left (\frac{w_{H}}{w_{M}}\right )$

, and low-and-medium-skilled,

![]() $\left (\frac{w_{L}}{w_{M}}\right )$

, workers against measures of robot density and offshoring—see Figure 1.Footnote 5 For this purpose, we have focused on examining 15 countries with large levels of operational industrial robots as well as high import rates of intermediate goods—Austria, Belgium, Denmark, France, Germany, Ireland, Italy, the Netherlands, Singapore, South Korea, Spain, Sweden, Switzerland, the UK, and the USAFootnote 6— using data from 2002 to 2019.Footnote 7 To measure the three variables linked to wage polarization (

$\left (\frac{w_{L}}{w_{M}}\right )$

, workers against measures of robot density and offshoring—see Figure 1.Footnote 5 For this purpose, we have focused on examining 15 countries with large levels of operational industrial robots as well as high import rates of intermediate goods—Austria, Belgium, Denmark, France, Germany, Ireland, Italy, the Netherlands, Singapore, South Korea, Spain, Sweden, Switzerland, the UK, and the USAFootnote 6— using data from 2002 to 2019.Footnote 7 To measure the three variables linked to wage polarization (

![]() $w_{H}$

,

$w_{H}$

,

![]() $w_{M}$

,

$w_{M}$

,

![]() $w_{L}$

), we used the “average monthly earnings of employees by sex and occupation (in thousands)” dataset, based on the International Standard Classification of Occupations (ISCO) and the respective skill level, provided by the International Labor Organization (ILO). For the earnings of the most highly qualified workers,

$w_{L}$

), we used the “average monthly earnings of employees by sex and occupation (in thousands)” dataset, based on the International Standard Classification of Occupations (ISCO) and the respective skill level, provided by the International Labor Organization (ILO). For the earnings of the most highly qualified workers,

![]() $w_{H}$

, we considered the average among the categories of occupations belonging to skill levels 3 and 4—(1) managers, senior officials, and legislators, (2) professionals, and (3) technicians and associate professionals—while for the wages of the medium qualified workers,

$w_{H}$

, we considered the average among the categories of occupations belonging to skill levels 3 and 4—(1) managers, senior officials, and legislators, (2) professionals, and (3) technicians and associate professionals—while for the wages of the medium qualified workers,

![]() $w_{M}$

, we took into account the average of the statistics reported among the categories falling within skill level 2—(4) clerks, (5) service and sales workers, (6) skilled agricultural and fishery workers, (7) craft and related trades workers, and (8) plant and machine operators, and assemblers. For the wages of low-skilled workers,

$w_{M}$

, we took into account the average of the statistics reported among the categories falling within skill level 2—(4) clerks, (5) service and sales workers, (6) skilled agricultural and fishery workers, (7) craft and related trades workers, and (8) plant and machine operators, and assemblers. For the wages of low-skilled workers,

![]() $w_{L}$

, we included the data presented for the category belonging to skill level 1—(9) elementary occupations. Moreover, robot density was selected as the proxy to assess automation, calculated as the ratio between the number of operational industrial robots, retrieved from the International Federation of Robots, and the number of inhabitants, obtained from the World Bank database, in each country and each year. Finally, offshoring, targeted as a representative measure to analyze the trend in reallocations, was quantified as the intermediate goods imported from the world by the developed country, divided by the total quantity of intermediate goods imported and exported. The data were gathered by the World Integrated Trade Solution database.

$w_{L}$

, we included the data presented for the category belonging to skill level 1—(9) elementary occupations. Moreover, robot density was selected as the proxy to assess automation, calculated as the ratio between the number of operational industrial robots, retrieved from the International Federation of Robots, and the number of inhabitants, obtained from the World Bank database, in each country and each year. Finally, offshoring, targeted as a representative measure to analyze the trend in reallocations, was quantified as the intermediate goods imported from the world by the developed country, divided by the total quantity of intermediate goods imported and exported. The data were gathered by the World Integrated Trade Solution database.

Figure 1. Wage polarization, robot density, and offshoring, 2002–2019.

In Figure 1a and b, we plot the wage polarization among high-and-medium-skilled laborers on the vertical axis and the robot density and offshoring on the horizontal axis, respectively, as well as the fitted linear regression. Both slopes exhibit a significant and positive trend, indicating that advances in automation and reallocations correspond to higher earnings for high-skilled workers compared to medium-skilled employees. In Figure 1c and d, we instead plot the wage polarization among low-and-medium-skilled workers on the vertical axis and the robot density and offshoring on the horizontal axis, respectively, paired with the fitted line. In this case, while the plot in Figure 1d provides very similar findings to those above, indicating that progress in reallocations correlates with higher wages for low-skilled workers, the same cannot be said for the results presented in the graph in Figure 1c. In the latter chart, the plotted relationship between the two variables, together with the fitted regression line, does not exhibit strong statistical evidence of a significant correlation.

Furthermore, in order to clarify the findings presented in Figure 1, we implemented an empirical analysis by conducting unbalanced country-year-level panel data. Therefore, we specify the estimation equations for the wage polarization between high-medium-skilled and low-medium-skilled workers as:

where

![]() $c$

indexes countries and

$c$

indexes countries and

![]() $t$

is the time period.

$t$

is the time period.

![]() $\left (\frac{w_{H}}{w_{M}}\right )_{ct}$

and

$\left (\frac{w_{H}}{w_{M}}\right )_{ct}$

and

![]() $\left (\frac{w_{L}}{w_{M}}\right )_{ct}$

are the outcomes of interest, denoting, following the same order, the ratio between the wages of high- and medium-skilled workers and the ratio between the wages of low- and medium-skilled workers. In its turn,

$\left (\frac{w_{L}}{w_{M}}\right )_{ct}$

are the outcomes of interest, denoting, following the same order, the ratio between the wages of high- and medium-skilled workers and the ratio between the wages of low- and medium-skilled workers. In its turn,

![]() $\left (\textit{robot density}\right )_{ct}$

and

$\left (\textit{robot density}\right )_{ct}$

and

![]() $\left (\textit{offshoring}\right )_{ct}$

are the measures adopted to assess the impact of automation and reallocations, respectively, as aforementioned. Lastly, both specifications include also

$\left (\textit{offshoring}\right )_{ct}$

are the measures adopted to assess the impact of automation and reallocations, respectively, as aforementioned. Lastly, both specifications include also

![]() $\left (\textit{controls}\right )_{ct}$

, which are country and year fixed effects and, following the same approach as education level ratios.Footnote 8

$\left (\textit{controls}\right )_{ct}$

, which are country and year fixed effects and, following the same approach as education level ratios.Footnote 8

Panels A and B of Table 1 show the estimates of wage polarization between the high- and medium-skilled workers equation (1) and wage polarization between the low- and medium-skilled workers equation (2). Both panels and columns incorporate country and year fixed effects, along with additional controls such as educational-level ratios. We find consistently significant positive estimates for automation and relocations in all other specifications. We focused our attention on columns (3) common to Panel A and Panel B, which are of greatest relevance to our analysis due to the fact that the effects are conditional to one another. Regarding Panel A, we noticed that a

![]() $1\%$

increase in robot density and a

$1\%$

increase in robot density and a

![]() $1$

percentage point (pp) rise in offshoring ratio are associated, respectively, with a

$1$

percentage point (pp) rise in offshoring ratio are associated, respectively, with a

![]() $0.0379\%$

and a

$0.0379\%$

and a

![]() $50.68\%$

average change in wage polarization between high-skilled and medium-skilled workers, ceteris paribus. We have also noted that a

$50.68\%$

average change in wage polarization between high-skilled and medium-skilled workers, ceteris paribus. We have also noted that a

![]() $1\%$

raise in robot density and a

$1\%$

raise in robot density and a

![]() $1$

pp increase in the offshoring ratio lead, respectively, to an average variation of the wage polarization between low-skilled and medium-skilled workers of

$1$

pp increase in the offshoring ratio lead, respectively, to an average variation of the wage polarization between low-skilled and medium-skilled workers of

![]() $0.0239\%$

and

$0.0239\%$

and

![]() $31.48\%$

, ceteris paribus. Thus, according to the results presented, it should be noted that the reported positive coefficients imply both automation and relocation are possible conditional determinants of (two-sided) wage polarization, also conditional to one another. This constitutes sufficient empirical evidence to support a theoretical approach that considers both determinants together.

$31.48\%$

, ceteris paribus. Thus, according to the results presented, it should be noted that the reported positive coefficients imply both automation and relocation are possible conditional determinants of (two-sided) wage polarization, also conditional to one another. This constitutes sufficient empirical evidence to support a theoretical approach that considers both determinants together.

Table 1. Wage polarization estimates, 2002–2019

Notes: (i) HAC standard errors are in parentheses; (ii) *, **, and *** denote significant at 1%, 5%, and 10%, respectively.

3. The model

Based on an adaptation of the model proposed in Afonso and Pinho (Reference Afonso and Pinho2022), we develop a dynamic general equilibrium endogenous growth model where the aggregate output (i.e., the numeraire good) is produced by a continuum of nonroutine and routine tasks and is used in consumption and investment. The nonroutine sector is country-specific and is composed of tasks that require high-level abstract skills (nonroutine abstract/cognitive tasks) and others that require physical dexterity and proficiency in human interactions (nonroutine manual tasks). The routine sector, in turn, can be automated or relocated abroad by global firms (offshoring). Hence, routine tasks are performed by domestic high- and low-skilled workers, and nonroutine tasks are produced by medium-skilled workers in developed countries or by a mix of different types of workers in developing countries [Blanas et al. (Reference Blanas, Gancia and Lee2019)], where the representative worker in the developing country corresponds to the medium-skilled worker in the developed country. In either sector, nonroutine and routine, a continuum of competitive firms uses specific labor and specific quality-adjusted machines where quality is improved by vertical R&D. The machine sector consists of a continuum of monopolistic producers, each one using a specific design sold by the R&D sector. We intend to analyze the relative impact of automation and relocation (hence, trade) of routine tasks (offshoring) on competitiveness, wages, and economic growth. Relocations immediately affect the country’s competitiveness by decreasing the number of tasks produced in the developed country in contrast to automation. Both—offshoring and automation—provoked the emergence of some effects on wages—labor, market size, and price effects. The two last effects operate through the bias of technological-knowledge progress.Footnote 9 Relocation and automation of tasks performed by medium-skilled workers immediately increase the relative labor supply—the labor effect—thus generating wage polarization. Furthermore, the technological-knowledge bias, generated by the dynamics of market size and price effects, also decisively affects wages, and the observed technological-knowledge progress affects economic growth. Economic growth frees up resources that become partially available for investment in R&D activities, thereby increasing the probability of successful research, which accelerates technological knowledge. The effects of aggregate technological knowledge affect firms’ productivity: when it increases, it generates higher demand and labor productivity. If technological-knowledge progress is biased toward the nonroutine sector, then it contributes to the emergence of wage polarization.

This section describes the economic setup of the closed economy in which infinitely lived households inelastically supply labor, maximize the utility of consumption from the aggregate final good, and invest in a firm’s equity. The inputs of the aggregate numeraire good,

![]() $Y$

, are two final goods, nonroutine (

$Y$

, are two final goods, nonroutine (

![]() $Y_{N}$

produced in the

$Y_{N}$

produced in the

![]() $N$

-sector) and routine (

$N$

-sector) and routine (

![]() $Y_{R}$

produced in the

$Y_{R}$

produced in the

![]() $R$

-sector), each one composed of many competitive firms that produce a continuum of tasks, that is, there are two sectors,

$R$

-sector), each one composed of many competitive firms that produce a continuum of tasks, that is, there are two sectors,

![]() $s=N$

and

$s=N$

and

![]() $s=R$

. In

$s=R$

. In

![]() $s=N$

, there is a positive fixed level of high-skilled labor type,

$s=N$

, there is a positive fixed level of high-skilled labor type,

![]() $L_{N}^{i}$

, and low-skilled labor type,

$L_{N}^{i}$

, and low-skilled labor type,

![]() $L_{N}^{h}$

. In

$L_{N}^{h}$

. In

![]() $s=R$

, the production of the tasks can be carried out domestically by medium-skilled workers if automated,

$s=R$

, the production of the tasks can be carried out domestically by medium-skilled workers if automated,

![]() $L_{R}^{i}$

, or by foreign workers if relocated,

$L_{R}^{i}$

, or by foreign workers if relocated,

![]() $L_{R}^{h}$

. The continuum of tasks of each sector,

$L_{R}^{h}$

. The continuum of tasks of each sector,

![]() $s=\{N,R\}$

, uses, in addition to the specific labor, a continuum of specific nondurable quality-adjusted machines,Footnote 10 produced under monopolistic competition: the monopolist in industry

$s=\{N,R\}$

, uses, in addition to the specific labor, a continuum of specific nondurable quality-adjusted machines,Footnote 10 produced under monopolistic competition: the monopolist in industry

![]() $j$

uses a design, sold by the R&D sector and protected by a patent, and numeraire to produce at a price that maximizes profits. In the R&D sector, each potential entrant devotes numeraire to inventing successful vertical designs to be supplied to a new monopolist machine firm/industry, that is, R&D allows increasing (not the number, but) the quality of machines and, thus, the technological knowledge. Therefore, some endogenous technological knowledge complements high-skilled labor, low-skilled labor, medium-skilled labor, or foreign labor.

$j$

uses a design, sold by the R&D sector and protected by a patent, and numeraire to produce at a price that maximizes profits. In the R&D sector, each potential entrant devotes numeraire to inventing successful vertical designs to be supplied to a new monopolist machine firm/industry, that is, R&D allows increasing (not the number, but) the quality of machines and, thus, the technological knowledge. Therefore, some endogenous technological knowledge complements high-skilled labor, low-skilled labor, medium-skilled labor, or foreign labor.

3.1. Preferences

Infinitely lived households obtain utility from the consumption,

![]() $C$

, of the unique aggregate final good, whose price we normalize to

$C$

, of the unique aggregate final good, whose price we normalize to

![]() $1$

, and collect income from investments in financial assets (equity) and labor. They supply labor to both sectors,

$1$

, and collect income from investments in financial assets (equity) and labor. They supply labor to both sectors,

![]() $s=\{N,R\}$

. Preferences are identical across workers

$s=\{N,R\}$

. Preferences are identical across workers

![]() $L_{N}^{i}$

,

$L_{N}^{i}$

,

![]() $L_{N}^{h}$

,

$L_{N}^{h}$

,

![]() $L_{R}^{i}$

, and

$L_{R}^{i}$

, and

![]() $L_{R}^{h}$

. Thus, there is a representative household with preferences at time

$L_{R}^{h}$

. Thus, there is a representative household with preferences at time

![]() $t=0$

given by

$t=0$

given by

![]() $U_{C}=\int _{0}^{\infty }\left (\frac{C(t)^{1-\theta }-1}{1-\theta }\right )e^{-\rho t}dt$

, where

$U_{C}=\int _{0}^{\infty }\left (\frac{C(t)^{1-\theta }-1}{1-\theta }\right )e^{-\rho t}dt$

, where

![]() $\rho \gt 0$

is the subjective discount rate and

$\rho \gt 0$

is the subjective discount rate and

![]() $\theta \gt 0$

is the inverse of the inter-temporal elasticity of substitution. The flow budget constraint is

$\theta \gt 0$

is the inverse of the inter-temporal elasticity of substitution. The flow budget constraint is

where

![]() $a(t)=\sum _{s=N,R}\left [a_{s}^{h}(t)+a_{s}^{i}(t)\right ]$

denotes household’s real financial assets/wealth holdings (composed of equity of machine producers, considering the profits seized by the top-quality producers),

$a(t)=\sum _{s=N,R}\left [a_{s}^{h}(t)+a_{s}^{i}(t)\right ]$

denotes household’s real financial assets/wealth holdings (composed of equity of machine producers, considering the profits seized by the top-quality producers),

![]() $r$

is the real interest rate, and

$r$

is the real interest rate, and

![]() $w_{s}^{h}$

and

$w_{s}^{h}$

and

![]() $w_{s}^{i}$

are the wage for labor type

$w_{s}^{i}$

are the wage for labor type

![]() $h$

and

$h$

and

![]() $i$

employed in sector

$i$

employed in sector

![]() $s=\{N,R\}$

, respectively. The initial level of wealth

$s=\{N,R\}$

, respectively. The initial level of wealth

![]() $a(0)$

is given, and the non-Ponzi games condition

$a(0)$

is given, and the non-Ponzi games condition

![]() $\lim _{t\rightarrow \infty }e^{-\int _{0}^{t}r(s)ds}a(t)\geq 0$

is imposed. The representative household chooses the path of aggregate consumption

$\lim _{t\rightarrow \infty }e^{-\int _{0}^{t}r(s)ds}a(t)\geq 0$

is imposed. The representative household chooses the path of aggregate consumption

![]() $\left [C(t)\right ]_{t\geq 0}$

to maximize the discounted lifetime utility, resulting in the following optimal consumption path Euler equation:

$\left [C(t)\right ]_{t\geq 0}$

to maximize the discounted lifetime utility, resulting in the following optimal consumption path Euler equation:

Moreover, the transversality condition is also standard:

![]() $\underset{t\rightarrow \infty }{lim}e^{-\rho t}\cdot C(t)^{-\theta }\cdot a(t)=0$

.

$\underset{t\rightarrow \infty }{lim}e^{-\rho t}\cdot C(t)^{-\theta }\cdot a(t)=0$

.

3.2. Technologies, output, and prices

3.2.1. Aggregate economy

The aggregate output

![]() $Y$

is produced with a CES aggregate production function of nonroutine and routine competitively produced final goods:

$Y$

is produced with a CES aggregate production function of nonroutine and routine competitively produced final goods:

where

![]() $Y_{N}$

and

$Y_{N}$

and

![]() $Y_{R}$

are the total outputs of the

$Y_{R}$

are the total outputs of the

![]() $N$

- and the

$N$

- and the

![]() $R$

-sector, respectively,

$R$

-sector, respectively,

![]() $\chi _{N}$

and

$\chi _{N}$

and

![]() $\chi _{R}$

, with

$\chi _{R}$

, with

![]() $\sum _{s=N,R}\chi _{s}=1$

, are the distribution parameters, measuring the importance of the sectors, and

$\sum _{s=N,R}\chi _{s}=1$

, are the distribution parameters, measuring the importance of the sectors, and

![]() $\varepsilon \geq 0$

is the elasticity of substitution between sectors, wherein

$\varepsilon \geq 0$

is the elasticity of substitution between sectors, wherein

![]() $\varepsilon \gt 1$

$\varepsilon \gt 1$

![]() $\left (\varepsilon \lt 1\right )$

means that they are gross substitutes (complements) in the production of

$\left (\varepsilon \lt 1\right )$

means that they are gross substitutes (complements) in the production of

![]() $Y$

. The assumption of competitive final-good firms implies the following maximization problem:

$Y$

. The assumption of competitive final-good firms implies the following maximization problem:

![]() $\max _{Y_{s}}\,\Pi _{Y}=P_{Y}\cdot Y-\sum _{s=N,R}P_{s}\cdot Y_{s}$

. From the first-order conditions emerge the inverse demand for

$\max _{Y_{s}}\,\Pi _{Y}=P_{Y}\cdot Y-\sum _{s=N,R}P_{s}\cdot Y_{s}$

. From the first-order conditions emerge the inverse demand for

![]() $Y_{s}$

:Footnote 11

$Y_{s}$

:Footnote 11

Thus, we obtain the following expression for relative demand for output from the

![]() $N$

-sector:

$N$

-sector:

which depends positively on the

![]() $N$

-sector relative weight parameter and negatively on the

$N$

-sector relative weight parameter and negatively on the

![]() $N$

-sector relative price of output. Replacing (6) in (5), we have that

$N$

-sector relative price of output. Replacing (6) in (5), we have that

![]() $P_{Y}=\left [\sum _{s=N,R}\chi _{s}^{\varepsilon }\cdot P_{s}^{1-\varepsilon }\right ]^{\frac{1}{1-\varepsilon }}$

, where

$P_{Y}=\left [\sum _{s=N,R}\chi _{s}^{\varepsilon }\cdot P_{s}^{1-\varepsilon }\right ]^{\frac{1}{1-\varepsilon }}$

, where

![]() $P_{N}$

and

$P_{N}$

and

![]() $P_{R}$

are the prices of the outputs of, respectively, the

$P_{R}$

are the prices of the outputs of, respectively, the

![]() $N$

- and the

$N$

- and the

![]() $R$

-sector, and thus the right-hand side of the expression is the unit production cost. Summing across sectors, from (6) we have that

$R$

-sector, and thus the right-hand side of the expression is the unit production cost. Summing across sectors, from (6) we have that

![]() $P_{Y}\cdot Y=P_{N}\cdot Y_{N}+P_{R}\cdot Y_{R}$

.

$P_{Y}\cdot Y=P_{N}\cdot Y_{N}+P_{R}\cdot Y_{R}$

.

3.2.2. Sectors of the economy

The output

![]() $Y_{s}$

of each sector

$Y_{s}$

of each sector

![]() $s=\{N,R\}$

is produced in perfect competition by the following production function with constant returns to scale

$s=\{N,R\}$

is produced in perfect competition by the following production function with constant returns to scale

![]() $Y_{s}=\exp\! \left (\int _{0}^{1}\ln Y_{v_{s}}dv_{s}\right )$

, that is,

$Y_{s}=\exp\! \left (\int _{0}^{1}\ln Y_{v_{s}}dv_{s}\right )$

, that is,

![]() $Y_{s}$

is a continuum of the output produced by tasks

$Y_{s}$

is a continuum of the output produced by tasks

![]() $Y_{v_{s}}$

indexed, respectively, by

$Y_{v_{s}}$

indexed, respectively, by

![]() $v_{N}\in \left [0,1\right ]$

and

$v_{N}\in \left [0,1\right ]$

and

![]() $v_{R}\in \left [0,1\right ]$

. Tasks

$v_{R}\in \left [0,1\right ]$

. Tasks

![]() $v_{R}$

are routine tasks. The producer of

$v_{R}$

are routine tasks. The producer of

![]() $Y_{s}$

maximizes profits given by

$Y_{s}$

maximizes profits given by

![]() ${{\Pi _{s}}}=P_{s}\cdot Y_{s}-\int _{0}^{1}P_{v_{s}}\cdot Y_{v_{s}}dv_{s}$

, where

${{\Pi _{s}}}=P_{s}\cdot Y_{s}-\int _{0}^{1}P_{v_{s}}\cdot Y_{v_{s}}dv_{s}$

, where

![]() $P_{v_{s}}$

is the price of output of task

$P_{v_{s}}$

is the price of output of task

![]() $v_{s}$

, subject to the restriction imposed by the functional form of the production function of

$v_{s}$

, subject to the restriction imposed by the functional form of the production function of

![]() $Y$

. Assuming perfect competition, the maximization problem results in the following first-order conditions:

$Y$

. Assuming perfect competition, the maximization problem results in the following first-order conditions:

![]() $\frac{\partial{\Pi }_{s}}{\partial Y_{v_{s}}}=0\Rightarrow Y_{v_{s}}=\frac{P_{s}\cdot Y_{s}}{P_{v_{s}}}$

. From here

$\frac{\partial{\Pi }_{s}}{\partial Y_{v_{s}}}=0\Rightarrow Y_{v_{s}}=\frac{P_{s}\cdot Y_{s}}{P_{v_{s}}}$

. From here

![]() $P_{v_{s}}\cdot Y_{v_{s}}=P_{s}\cdot Y_{s}$

, which can be replaced in the profits function and the production function results, respectively, in

$P_{v_{s}}\cdot Y_{v_{s}}=P_{s}\cdot Y_{s}$

, which can be replaced in the profits function and the production function results, respectively, in

![]() ${\Pi _{s}}=P_{s}\cdot Y_{s}-\int _{0}^{1}P_{s}\cdot Y_{s}dv_{s}=0$

and also in

${\Pi _{s}}=P_{s}\cdot Y_{s}-\int _{0}^{1}P_{s}\cdot Y_{s}dv_{s}=0$

and also in

3.2.3. Tasks in each sector

Task producers in sector

![]() $s=N$

must choose to produce them either with domestic low-skilled labor type “

$s=N$

must choose to produce them either with domestic low-skilled labor type “

![]() $h$

” or with domestic high-skilled labor type “

$h$

” or with domestic high-skilled labor type “

![]() $i$

,” and task producers in sector

$i$

,” and task producers in sector

![]() $s=R$

must choose to produce them with foreign labor, relocating tasks in developing countries “

$s=R$

must choose to produce them with foreign labor, relocating tasks in developing countries “

![]() $h$

” or with domestic medium-skilled labor employed in automated tasks “

$h$

” or with domestic medium-skilled labor employed in automated tasks “

![]() $i$

,” which implies choosing between the following two Cobb–Douglas production functions:

$i$

,” which implies choosing between the following two Cobb–Douglas production functions:

Each uses two factors: labor of type

![]() $L_{N}^{i},$

$L_{N}^{i},$

![]() $L_{N}^{h}$

, and

$L_{N}^{h}$

, and

![]() $L_{R}^{i}$

—domestic—or

$L_{R}^{i}$

—domestic—or

![]() $L_{R}^{h}$

—foreign—(the second term on the right-hand side) and intermediate goods—machines/robots—(the first term on the right-hand side) with a share in the income of

$L_{R}^{h}$

—foreign—(the second term on the right-hand side) and intermediate goods—machines/robots—(the first term on the right-hand side) with a share in the income of

![]() $\alpha$

and

$\alpha$

and

![]() $1-\alpha$

, respectively. Each machine

$1-\alpha$

, respectively. Each machine

![]() $j$

used in

$j$

used in

![]() $v_{s}$

production is quality-adjusted: the constant quality upgrade is

$v_{s}$

production is quality-adjusted: the constant quality upgrade is

![]() $q\gt 1$

,

$q\gt 1$

,

![]() $k$

is the top-quality rung at

$k$

is the top-quality rung at

![]() $t$

, and

$t$

, and

![]() $x_{v_{s}}^{h}(k,j,t)$

and

$x_{v_{s}}^{h}(k,j,t)$

and

![]() $x_{v_{s}}^{i}(k,j,t)$

represent the units of machines or robots demanded for task

$x_{v_{s}}^{i}(k,j,t)$

represent the units of machines or robots demanded for task

![]() $v_{s}$

if it is produced to be used by

$v_{s}$

if it is produced to be used by

![]() $L_{s}^{h}$

or by

$L_{s}^{h}$

or by

![]() $L_{s}^{i}$

, respectively. The labor term includes the quantities employed in the production of

$L_{s}^{i}$

, respectively. The labor term includes the quantities employed in the production of

![]() $v_{s}$

,

$v_{s}$

,

![]() $L_{v_{s}}^{i}$

or

$L_{v_{s}}^{i}$

or

![]() $L_{v_{s}}^{h}$

, and two types of corrective factors accounting for productivity differentials such that workers are assigned to tasks according to location and the most efficient firm in production, that is, we take into account:

$L_{v_{s}}^{h}$

, and two types of corrective factors accounting for productivity differentials such that workers are assigned to tasks according to location and the most efficient firm in production, that is, we take into account:

-

• The absolute net advantage of labor. For

$s=N$

, we consider

$s=N$

, we consider

$l_{N}^{i}\gt l_{N}^{h}$

since

$l_{N}^{i}\gt l_{N}^{h}$

since

$L_{N}^{i}$

is more qualified than

$L_{N}^{i}$

is more qualified than

$L_{N}^{h}$

, implying that

$L_{N}^{h}$

, implying that

$L_{N}^{i}$

operates in increasingly abstract/cognitive nonroutine tasks, while

$L_{N}^{i}$

operates in increasingly abstract/cognitive nonroutine tasks, while

$L_{N}^{h}$

operates in “purely manual” nonroutine tasks. In

$L_{N}^{h}$

operates in “purely manual” nonroutine tasks. In

$s=R$

, the production can be performed by foreign workers if relocated,

$s=R$

, the production can be performed by foreign workers if relocated,

$L_{R}^{h}$

,Footnote 12 or by domestic medium-skilled workers if automated,

$L_{R}^{h}$

,Footnote 12 or by domestic medium-skilled workers if automated,

$L_{R}^{i}$

, and the quantities used should be corrected by the term

$L_{R}^{i}$

, and the quantities used should be corrected by the term

$l_{R}^{h}$

and

$l_{R}^{h}$

and

$l_{R}^{i}$

due to factors that are specific to automation and relocations; we consider that

$l_{R}^{i}$

due to factors that are specific to automation and relocations; we consider that

$l_{R}^{i}\gt l_{R}^{h}$

since domestic medium-skilled labor has an absolute productivity advantage over foreign labor in developing countries.Footnote 13

$l_{R}^{i}\gt l_{R}^{h}$

since domestic medium-skilled labor has an absolute productivity advantage over foreign labor in developing countries.Footnote 13

-

• The relative productivity advantage of labor. Following the point of view proposed by, for example, Acemoglu and Zilibotti (Reference Acemoglu and Zilibotti2001), through the terms

$(1-v_{s})$

and

$(1-v_{s})$

and

$v_{s}$

in (9) and (10),

$v_{s}$

in (9) and (10),

$L^{i}$

is relatively more productive in tasks indexed by larger

$L^{i}$

is relatively more productive in tasks indexed by larger

$v_{s}$

and vice versa.

$v_{s}$

and vice versa.

In each sector

![]() $s$

, there is substitutability between tasks that use labor type

$s$

, there is substitutability between tasks that use labor type

![]() $h$

and tasks that use labor type

$h$

and tasks that use labor type

![]() $i$

. On the other hand, it is assumed that, regardless of the labor type used by sector

$i$

. On the other hand, it is assumed that, regardless of the labor type used by sector

![]() $s$

, there is complementarity between labor and a specific set of machines or robots. To determine the tasks that use labor type “

$s$

, there is complementarity between labor and a specific set of machines or robots. To determine the tasks that use labor type “

![]() $h$

” and labor type “

$h$

” and labor type “

![]() $i$

” in each sector, firstly, we need to solve the respective maximization problems:

$i$

” in each sector, firstly, we need to solve the respective maximization problems:

bearing in mind (9) and (10), where

![]() $P_{v_{s}}^{h}(t)$

and

$P_{v_{s}}^{h}(t)$

and

![]() $P_{v_{s}}^{i}(t)$

are the price of task

$P_{v_{s}}^{i}(t)$

are the price of task

![]() $v_{s}$

produced by labor type

$v_{s}$

produced by labor type

![]() $h$

and

$h$

and

![]() $i$

, respectively, at time

$i$

, respectively, at time

![]() $t$

,

$t$

,

![]() $p(k,j,t)$

denotes the price paid for the machine

$p(k,j,t)$

denotes the price paid for the machine

![]() $j$

with quality

$j$

with quality

![]() $k$

, at time

$k$

, at time

![]() $t$

,

$t$

,

![]() $w_{s}^{h}(t)$

and

$w_{s}^{h}(t)$

and

![]() $w_{s}^{i}(t)$

are the price of each unit of labor type

$w_{s}^{i}(t)$

are the price of each unit of labor type

![]() $h$

and

$h$

and

![]() $i$

, respectively, at time

$i$

, respectively, at time

![]() $t$

—these prices are given for the perfectly competitive producers of the tasks. From the first-order conditions with respect to machines/robots results:

$t$

—these prices are given for the perfectly competitive producers of the tasks. From the first-order conditions with respect to machines/robots results:

\begin{eqnarray} x_{v_{s}}^{h}(k,j,t) & = & \left [\frac{P_{v_{s}}^{h}(t)\cdot (1-\alpha )}{p(k,j,t)}\right ]^{\frac{1}{\alpha }}\cdot q^{k(j,t)\frac{1-\alpha }{\alpha }}\cdot \left (1-v_{s}(t)\right )\cdot l_{s}^{h}\cdot L_{v_{s}}^{h}, \end{eqnarray}

\begin{eqnarray} x_{v_{s}}^{h}(k,j,t) & = & \left [\frac{P_{v_{s}}^{h}(t)\cdot (1-\alpha )}{p(k,j,t)}\right ]^{\frac{1}{\alpha }}\cdot q^{k(j,t)\frac{1-\alpha }{\alpha }}\cdot \left (1-v_{s}(t)\right )\cdot l_{s}^{h}\cdot L_{v_{s}}^{h}, \end{eqnarray}

\begin{eqnarray} x_{v_{s}}^{i}(k,j,t) & = & \left [\frac{P_{v_{s}}^{i}(t)\cdot (1-\alpha )}{p(k,j,t)}\right ]^{\frac{1}{\alpha }}\cdot q^{k(j,t)\frac{1-\alpha }{\alpha }}\cdot v_{s}(t)\cdot l_{s}^{i}\cdot L_{v_{s}}^{i}. \end{eqnarray}

\begin{eqnarray} x_{v_{s}}^{i}(k,j,t) & = & \left [\frac{P_{v_{s}}^{i}(t)\cdot (1-\alpha )}{p(k,j,t)}\right ]^{\frac{1}{\alpha }}\cdot q^{k(j,t)\frac{1-\alpha }{\alpha }}\cdot v_{s}(t)\cdot l_{s}^{i}\cdot L_{v_{s}}^{i}. \end{eqnarray}

Replacing (13) and (14) in the corresponding production functions (9) and (10), we have that:

\begin{eqnarray} Y_{v_{s}}^{h}(t) & = & \left [\frac{P_{v_{s}}^{h}(t)\cdot (1-\alpha )}{p(k,j,t)}\right ]^{\frac{1-\alpha }{\alpha }}\cdot Q_{s}^{h}(t)\cdot \left (1-v_{s}(t)\right )\cdot l_{s}^{h}\cdot L_{v_{s}}^{h}, \end{eqnarray}

\begin{eqnarray} Y_{v_{s}}^{h}(t) & = & \left [\frac{P_{v_{s}}^{h}(t)\cdot (1-\alpha )}{p(k,j,t)}\right ]^{\frac{1-\alpha }{\alpha }}\cdot Q_{s}^{h}(t)\cdot \left (1-v_{s}(t)\right )\cdot l_{s}^{h}\cdot L_{v_{s}}^{h}, \end{eqnarray}

\begin{eqnarray} Y_{v_{s}}^{i}(t) & = & \left [\frac{P_{v_{s}}^{i}(t)\cdot (1-\alpha )}{p(k,j,t)}\right ]^{\frac{1-\alpha }{\alpha }}\cdot Q_{s}^{i}(t)\cdot v_{s}(t)\cdot l_{s}^{i}\cdot L_{v_{s}}^{i} \end{eqnarray}

\begin{eqnarray} Y_{v_{s}}^{i}(t) & = & \left [\frac{P_{v_{s}}^{i}(t)\cdot (1-\alpha )}{p(k,j,t)}\right ]^{\frac{1-\alpha }{\alpha }}\cdot Q_{s}^{i}(t)\cdot v_{s}(t)\cdot l_{s}^{i}\cdot L_{v_{s}}^{i} \end{eqnarray}

where

![]() $Q_{s}^{h}\equiv \int _{0}^{J}q^{k(j,t)\frac{1-\alpha }{\alpha }}dj$

and

$Q_{s}^{h}\equiv \int _{0}^{J}q^{k(j,t)\frac{1-\alpha }{\alpha }}dj$

and

![]() $Q_{s}^{i}\equiv \int _{J}^{1}q^{k(j,t)\frac{1-\alpha }{\alpha }}dj$

are measures of the quality level of machines/robots used in sector

$Q_{s}^{i}\equiv \int _{J}^{1}q^{k(j,t)\frac{1-\alpha }{\alpha }}dj$

are measures of the quality level of machines/robots used in sector

![]() $s$

to be endogenously determined in Section 3, thereby originating the dynamic effects of the model.

$s$

to be endogenously determined in Section 3, thereby originating the dynamic effects of the model.

3.2.4. Wages and threshold task in each sector

From the first-order conditions with respect to labor units results:

In equilibrium, there is a threshold task

![]() $v_{s}$

, that ensures that each type of labor gets the same wage regardless of the task it is used for. To this end, we can define the following price indexes:

$v_{s}$

, that ensures that each type of labor gets the same wage regardless of the task it is used for. To this end, we can define the following price indexes:

As shown in Appendix A.1, in sector

![]() $s=\{N,R\}$

(i) tasks with a very low (high)

$s=\{N,R\}$

(i) tasks with a very low (high)

![]() $v_{s}$

have a lower price if produced by

$v_{s}$

have a lower price if produced by

![]() $L_{s}^{h}$

(

$L_{s}^{h}$

(

![]() $L_{s}^{i}$

) rather than

$L_{s}^{i}$

) rather than

![]() $L_{s}^{i}$

(

$L_{s}^{i}$

(

![]() $L_{s}^{h}$

), such that perfectly competitive producers use

$L_{s}^{h}$

), such that perfectly competitive producers use

![]() $L_{s}^{h}$

(

$L_{s}^{h}$

(

![]() $L_{s}^{i}$

) to avoid being driven out of the market, and (ii) there is a threshold task

$L_{s}^{i}$

) to avoid being driven out of the market, and (ii) there is a threshold task

![]() $v_{s},$

where prices are equal and is given by the following expression:

$v_{s},$

where prices are equal and is given by the following expression:

\begin{equation} \overline{v}_{s}=\left [1+\left (\frac{Q_{s}^{i}}{Q_{s}^{h}}\frac{l_{s}^{i}}{l_{s}^{h}}\frac{L_{s}^{i}}{L_{s}^{h}}\right )^{\frac{1}{2}}\right ]^{-1}, \end{equation}

\begin{equation} \overline{v}_{s}=\left [1+\left (\frac{Q_{s}^{i}}{Q_{s}^{h}}\frac{l_{s}^{i}}{l_{s}^{h}}\frac{L_{s}^{i}}{L_{s}^{h}}\right )^{\frac{1}{2}}\right ]^{-1}, \end{equation}

which assesses the “comparative advantage” of sector

![]() $s$

. Therefore, if

$s$

. Therefore, if

![]() $\overline{v}_{s}\lt v_{s}$

firms will be biased toward producing tasks using both labor type

$\overline{v}_{s}\lt v_{s}$

firms will be biased toward producing tasks using both labor type

![]() $h$

and the respective technological-knowledge level of each intermediate goods set, in sector

$h$

and the respective technological-knowledge level of each intermediate goods set, in sector

![]() $s$

, while if

$s$

, while if

![]() $\overline{v}_{s}\gt v_{s}$

firms will be biased toward producing tasks using both labor type

$\overline{v}_{s}\gt v_{s}$

firms will be biased toward producing tasks using both labor type

![]() $i$

and the respective technological-knowledge level of each intermediate goods set, in sector

$i$

and the respective technological-knowledge level of each intermediate goods set, in sector

![]() $s.$

$s.$

In particular, whenever labor abroad becomes more productive,Footnote 14 that is,

![]() $l_{R}^{h}$

increases, boosting the number of tasks relocated and promoting globalization. Automation, on the other hand, makes the use of domestic medium-skilled labor less advantageous, translating into a decrease of

$l_{R}^{h}$

increases, boosting the number of tasks relocated and promoting globalization. Automation, on the other hand, makes the use of domestic medium-skilled labor less advantageous, translating into a decrease of

![]() $l_{R}^{i}$

that negatively affects the production of routine tasks at home, thus favoring globalization. Finally, an increase in the technological-knowledge bias toward high-skilled workers decreases the incentive for automation and relocations. On the contrary, an increase in the technological-knowledge bias toward low-skilled workers increases the incentive for automation and relocations. Thus, improvements in the machines or robots’ technology that are biased toward low-skilled tasks would increase automation and relocations.

$l_{R}^{i}$

that negatively affects the production of routine tasks at home, thus favoring globalization. Finally, an increase in the technological-knowledge bias toward high-skilled workers decreases the incentive for automation and relocations. On the contrary, an increase in the technological-knowledge bias toward low-skilled workers increases the incentive for automation and relocations. Thus, improvements in the machines or robots’ technology that are biased toward low-skilled tasks would increase automation and relocations.

3.3. Machines sector

In the machines sector, producing the top quality

![]() $k$

of each

$k$

of each

![]() $j$

needs an initial R&D cost to achieve the new prototype/design. This initial cost can only be recovered if, with the production of the new quality of the robot, profits are made over a certain time in the future. This is assured by a system of intellectual property rights that protect the leader firm’s monopoly. At the same time, this technological knowledge is accessible, practically free of charge, from other firms. Hence, each firm that holds the patent for the top quality

$j$

needs an initial R&D cost to achieve the new prototype/design. This initial cost can only be recovered if, with the production of the new quality of the robot, profits are made over a certain time in the future. This is assured by a system of intellectual property rights that protect the leader firm’s monopoly. At the same time, this technological knowledge is accessible, practically free of charge, from other firms. Hence, each firm that holds the patent for the top quality

![]() $k$

of

$k$

of

![]() $j$

at

$j$

at

![]() $t$

supplies all respective tasks,

$t$

supplies all respective tasks,

![]() $v_{s}$

, in sector

$v_{s}$

, in sector

![]() $s=\{N,R\}$

. If we consider that each unit of robot

$s=\{N,R\}$

. If we consider that each unit of robot

![]() $j$

requires one unit of final output

$j$

requires one unit of final output

![]() $Y$

, since its price is 1 to 1 and the producer of

$Y$

, since its price is 1 to 1 and the producer of

![]() $j$

gets profits

$j$

gets profits

![]() $\pi _{s}(k,j,t)=\left [p(k,j,t)-1\right ]\cdot x_{s}(k,j,t)$

, where

$\pi _{s}(k,j,t)=\left [p(k,j,t)-1\right ]\cdot x_{s}(k,j,t)$

, where

![]() $x_{s}(k,j,t)=\int _{0}^{\overline{v}_{s}}x_{v_{s}}^{h}(k,j,t)\cdot dv_{s}+\int _{\overline{v}_{s}}^{1}x_{v_{s}}^{i}(k,j,t)\cdot dv_{s}$

is the demand for robot

$x_{s}(k,j,t)=\int _{0}^{\overline{v}_{s}}x_{v_{s}}^{h}(k,j,t)\cdot dv_{s}+\int _{\overline{v}_{s}}^{1}x_{v_{s}}^{i}(k,j,t)\cdot dv_{s}$

is the demand for robot

![]() $j$

from all the producers of tasks

$j$

from all the producers of tasks

![]() $v_{s}$

that use such input, regardless of the labor type used in tasks.

$v_{s}$

that use such input, regardless of the labor type used in tasks.

Assuming that the monopolist charges the same price,

![]() $p(k,j,t)$

, for all these firms, we can find the optimal price by replacing

$p(k,j,t)$

, for all these firms, we can find the optimal price by replacing

![]() $x_{s}(k,j,t)$

by the demand of the producer of a single task

$x_{s}(k,j,t)$

by the demand of the producer of a single task

![]() $v_{s}$

, that is, either by

$v_{s}$

, that is, either by

![]() $x_{v_{s}}^{h}(k,j,t)$

or by

$x_{v_{s}}^{h}(k,j,t)$

or by

![]() $x_{v_{s}}^{i}(k,j,t)$

and then maximizing with respect to

$x_{v_{s}}^{i}(k,j,t)$

and then maximizing with respect to

![]() $p(k,j,t)$

. This can be seen by

$p(k,j,t)$

. This can be seen by

$\pi _{s}(k,j,t)=\int _{0}^{1}\pi _{v_{s}}(k,j,t)\cdot dv_{s}=\underbrace{\int _{0}^{\overline{v}_{s}}\pi _{v_{s}}^{h}(k,j,t)\cdot dv_{s}}_{\pi _{v_{s}}^{h}(k,j,t)}+\underbrace{\int _{\overline{v}_{s}}^{1}\pi _{v_{s}}^{i}(k,j,t)\cdot dv_{s}}_{\pi _{v_{s}}^{i}(k,j,t)}$

, where

$\pi _{s}(k,j,t)=\int _{0}^{1}\pi _{v_{s}}(k,j,t)\cdot dv_{s}=\underbrace{\int _{0}^{\overline{v}_{s}}\pi _{v_{s}}^{h}(k,j,t)\cdot dv_{s}}_{\pi _{v_{s}}^{h}(k,j,t)}+\underbrace{\int _{\overline{v}_{s}}^{1}\pi _{v_{s}}^{i}(k,j,t)\cdot dv_{s}}_{\pi _{v_{s}}^{i}(k,j,t)}$

, where

![]() $\pi _{v_{s}}^{h}(k,j,t)$

and

$\pi _{v_{s}}^{h}(k,j,t)$

and

![]() $\pi _{v_{s}}^{i}(k,j,t)$

denote the profits of the producer of

$\pi _{v_{s}}^{i}(k,j,t)$

denote the profits of the producer of

![]() $j$

for selling this robot to the producer of task

$j$

for selling this robot to the producer of task

![]() $v_{s}$

. Therefore, we can find

$v_{s}$

. Therefore, we can find

![]() $p(k,j,t)$

by solving the following maximization problems

$p(k,j,t)$

by solving the following maximization problems

![]() $\max _{p(k,j,t)}\left [p(k,j,t)-1\right ]\cdot x_{v_{s}}^{h}(k,j,t)$

and

$\max _{p(k,j,t)}\left [p(k,j,t)-1\right ]\cdot x_{v_{s}}^{h}(k,j,t)$

and

![]() $\max _{p(k,j,t)}\left [p(k,j,t)-1\right ]\cdot x_{v_{s}}^{i}(k,j,t)$

, where

$\max _{p(k,j,t)}\left [p(k,j,t)-1\right ]\cdot x_{v_{s}}^{i}(k,j,t)$

, where

![]() $x_{v_{s}}^{h}(k,j,t)$

and

$x_{v_{s}}^{h}(k,j,t)$

and

![]() $x_{v_{s}}^{i}(k,j,t)$

can be done by (13) or (14). From the first-order condition

$x_{v_{s}}^{i}(k,j,t)$

can be done by (13) or (14). From the first-order condition

![]() $\frac{\partial \pi _{s}(k,j,t)}{\partial p(k,j,t)}$

, we have that

$\frac{\partial \pi _{s}(k,j,t)}{\partial p(k,j,t)}$

, we have that

![]() $p(k,j,t)\equiv p=\frac{1}{1-\alpha }=q$

, assuming that the limit pricing strategy is binding.Footnote 15 Taking also into account

$p(k,j,t)\equiv p=\frac{1}{1-\alpha }=q$

, assuming that the limit pricing strategy is binding.Footnote 15 Taking also into account

![]() $p=q$

, (19), (13), and (14), the demand for the machine

$p=q$

, (19), (13), and (14), the demand for the machine

![]() $j$

used in sector

$j$

used in sector

![]() $s$

together with

$s$

together with

![]() $L_{s}^{h}$

and

$L_{s}^{h}$

and

![]() $L_{s}^{i}$

is, respectively,

$L_{s}^{i}$

is, respectively,

\begin{eqnarray} x_{s}^{h}(t) & = & \int _{0}^{\overline{v}_{s}}x_{v_{s}}^{h}(k,j,t)\cdot dv_{s}=\left [\frac{P_{s}^{h}(t)\cdot (1-\alpha )}{q}\right ]^{\frac{1}{\alpha }}\cdot Q_{s}^{h}(t)\cdot l_{s}^{h}\cdot L_{s}^{h}, \end{eqnarray}

\begin{eqnarray} x_{s}^{h}(t) & = & \int _{0}^{\overline{v}_{s}}x_{v_{s}}^{h}(k,j,t)\cdot dv_{s}=\left [\frac{P_{s}^{h}(t)\cdot (1-\alpha )}{q}\right ]^{\frac{1}{\alpha }}\cdot Q_{s}^{h}(t)\cdot l_{s}^{h}\cdot L_{s}^{h}, \end{eqnarray}

\begin{eqnarray} x_{s}^{i}(t) & = & \int _{\overline{v}_{s}}^{1}x_{v_{s}}^{i}(k,j,t)\cdot dv_{s}=\left [\frac{P_{s}^{i}(t)\cdot (1-\alpha )}{q}\right ]^{\frac{1}{\alpha }}\cdot Q_{s}^{i}(t)\cdot l_{s}^{i}\cdot L_{s}^{i}. \end{eqnarray}

\begin{eqnarray} x_{s}^{i}(t) & = & \int _{\overline{v}_{s}}^{1}x_{v_{s}}^{i}(k,j,t)\cdot dv_{s}=\left [\frac{P_{s}^{i}(t)\cdot (1-\alpha )}{q}\right ]^{\frac{1}{\alpha }}\cdot Q_{s}^{i}(t)\cdot l_{s}^{i}\cdot L_{s}^{i}. \end{eqnarray}

Total demand for robot

![]() $j$

used in sector

$j$

used in sector

![]() $s$

is

$s$

is

![]() $X_{s}(j)=x_{s}^{h}(k,j,t)+x_{s}^{i}(k,j,t)$

, and the profits for the machines used in sector

$X_{s}(j)=x_{s}^{h}(k,j,t)+x_{s}^{i}(k,j,t)$

, and the profits for the machines used in sector

![]() $s$

by labor type

$s$

by labor type

![]() $h$

and

$h$

and

![]() $i$

are

$i$

are

![]() $\pi _{s}^{h}(t)=\left (q-1\right )\cdot x_{s}^{h}(t)$

and

$\pi _{s}^{h}(t)=\left (q-1\right )\cdot x_{s}^{h}(t)$

and

![]() $\pi _{s}^{i}(k,j,t)=\left (q-1\right )\cdot x_{s}^{i}(t)$

, respectively.

$\pi _{s}^{i}(k,j,t)=\left (q-1\right )\cdot x_{s}^{i}(t)$

, respectively.

3.4. Allocation of resources

Once determined the threshold task as in (20), we can start by determining absolute values for price indexes. To this end, we use the definition of the price of output underlying the producer’s output maximization problem in sector

![]() $s$

,

$s$

,

![]() $Y_{s}$

, which implies

$Y_{s}$

, which implies

![]() $P_{s}=\exp\! \left (\int _{0}^{1}\ln P_{v_{s}}dv_{s}\right )$

—see (8). We also make use of the result that the value of each task,

$P_{s}=\exp\! \left (\int _{0}^{1}\ln P_{v_{s}}dv_{s}\right )$

—see (8). We also make use of the result that the value of each task,

![]() $P_{v_{s}}Y_{v_{s}}$

, is a constant for all

$P_{v_{s}}Y_{v_{s}}$

, is a constant for all

![]() $v_{s}$

, and we use (19) and (20) to have

$v_{s}$

, and we use (19) and (20) to have

![]() $P_{s}^{i}=\left (\frac{\overline{v}_{s}}{1-\overline{v}_{s}}\right )^{\alpha }P_{s}^{h}$

. From this analysis, we obtain the following expressions—see Appendix A.2:

$P_{s}^{i}=\left (\frac{\overline{v}_{s}}{1-\overline{v}_{s}}\right )^{\alpha }P_{s}^{h}$

. From this analysis, we obtain the following expressions—see Appendix A.2:

where

![]() $P_{N}$

and

$P_{N}$

and

![]() $P_{R}$

are also determined in Appendix A.2. An increase in the labor level of sector

$P_{R}$

are also determined in Appendix A.2. An increase in the labor level of sector

![]() $s$

has a market-size effect on the demand for machines through the term

$s$

has a market-size effect on the demand for machines through the term

![]() $\overline{v}_{s}$

. However, by affecting

$\overline{v}_{s}$

. However, by affecting

![]() $\overline{v}_{s}$

the same effect has, in addition, a price effect since it increases the supply of output of sector

$\overline{v}_{s}$

the same effect has, in addition, a price effect since it increases the supply of output of sector

![]() $s$

that induces a decrease in the absolute price of this output and, therefore, a decrease in the price index of tasks in the sector. This decreases the output of each task, which decreases the demand for machines in the sector—see (21) and (22).

$s$

that induces a decrease in the absolute price of this output and, therefore, a decrease in the price index of tasks in the sector. This decreases the output of each task, which decreases the demand for machines in the sector—see (21) and (22).

From the profit maximization problem of the producer of

![]() $Y$

and since in each sector some tasks are produced by labor

$Y$

and since in each sector some tasks are produced by labor

![]() $L_{s}^{h}$

and other parts are performed by labor

$L_{s}^{h}$

and other parts are performed by labor

![]() $L_{s}^{i}$

, the aggregate output is the following:

$L_{s}^{i}$

, the aggregate output is the following:

![]() $P_{s}Y_{s}=\int _{0}^{1}P_{v_{s}}Y_{v_{s}}dv_{s}$

$P_{s}Y_{s}=\int _{0}^{1}P_{v_{s}}Y_{v_{s}}dv_{s}$

![]() $=\int _{0}^{\overline{v}_{s}}P_{v_{s}}^{h}Y_{v_{s}}^{h}dv_{s}+\int _{\overline{v}_{s}}^{1}P_{v_{s}}^{i}Y_{v_{s}}^{i}dv_{s}$

$=\int _{0}^{\overline{v}_{s}}P_{v_{s}}^{h}Y_{v_{s}}^{h}dv_{s}+\int _{\overline{v}_{s}}^{1}P_{v_{s}}^{i}Y_{v_{s}}^{i}dv_{s}$

![]() $=P_{s}Y_{s}^{h}+P_{s}Y_{s}^{i}$

. On the basis of these definitions and taking into account (15), (16), (19), and (23), the outputs in sector

$=P_{s}Y_{s}^{h}+P_{s}Y_{s}^{i}$

. On the basis of these definitions and taking into account (15), (16), (19), and (23), the outputs in sector

![]() $s$

performed by labor type

$s$

performed by labor type

![]() $L_{s}^{h}$

,

$L_{s}^{h}$

,

![]() $Y_{s}^{h}$

, and labor type

$Y_{s}^{h}$

, and labor type

![]() $L_{s}^{i}$

,

$L_{s}^{i}$

,

![]() $Y_{s}^{L_{s}^{i}}$

, are as follows:

$Y_{s}^{L_{s}^{i}}$

, are as follows:

We can use equations (24) and (25) to obtain the intra-country output ratio and the output of each sector as:

where, bearing in mind (20),

![]() $M_{s}=\frac{Q_{s}\cdot l_{s}^{h}\cdot L_{s}^{h}}{\overline{v}_{s}}+\frac{Q_{s}\cdot l_{s}^{i}\cdot L_{s}^{i}}{1-\overline{v}_{s}}=$

$M_{s}=\frac{Q_{s}\cdot l_{s}^{h}\cdot L_{s}^{h}}{\overline{v}_{s}}+\frac{Q_{s}\cdot l_{s}^{i}\cdot L_{s}^{i}}{1-\overline{v}_{s}}=$

![]() $\left [\left (Q_{s}^{h}\cdot l_{s}^{h}\cdot L_{s}^{h}\right )^{\frac{1}{2}}+\left (Q_{s}^{i}\cdot l_{s}^{i}\cdot L_{s}^{i}\right )^{\frac{1}{2}}\right ]^{2}$

evaluates the market size. Similarly, we can obtain an expression for machines produced for each sector

$\left [\left (Q_{s}^{h}\cdot l_{s}^{h}\cdot L_{s}^{h}\right )^{\frac{1}{2}}+\left (Q_{s}^{i}\cdot l_{s}^{i}\cdot L_{s}^{i}\right )^{\frac{1}{2}}\right ]^{2}$

evaluates the market size. Similarly, we can obtain an expression for machines produced for each sector

![]() $s$

:

$s$

:

where the aggregate resources devoted to machines production in sector

![]() $s$

,

$s$

,

![]() $X_{s}$

, is also expressible as a function of the currently given technological knowledge in each sector

$X_{s}$

, is also expressible as a function of the currently given technological knowledge in each sector

![]() $s$

.

$s$

.

The output performed by each labor type in each sector,

![]() $Y_{s}^{h}$

and

$Y_{s}^{h}$

and

![]() $Y_{s}^{i}$

, and the output of sector

$Y_{s}^{i}$

, and the output of sector

![]() $s$

,

$s$

,

![]() $Y_{s}$

, can increase in response to advancements in technological-knowledge levels. Moreover, a rise in the labor levels implies, (i) an increase in the output produced and, thereby, in the relative demand for machines, with an increase in the labor levels due to scale effects—through the terms

$Y_{s}$

, can increase in response to advancements in technological-knowledge levels. Moreover, a rise in the labor levels implies, (i) an increase in the output produced and, thereby, in the relative demand for machines, with an increase in the labor levels due to scale effects—through the terms

![]() $L_{s}^{h}$

or

$L_{s}^{h}$

or

![]() $L_{s}^{i}$

; (ii) a decrease in the output produced and, thereby, in the relative demand for machines, due to price effects through the terms

$L_{s}^{i}$

; (ii) a decrease in the output produced and, thereby, in the relative demand for machines, due to price effects through the terms

![]() $\left (\overline{v}_{s}\right )^{-1}$

and

$\left (\overline{v}_{s}\right )^{-1}$

and

![]() $(1-\overline{v}_{s})^{-1}$

, since it increases the share of tasks produced by the respective labor type, which decreases the price index where such an increase took place.

$(1-\overline{v}_{s})^{-1}$

, since it increases the share of tasks produced by the respective labor type, which decreases the price index where such an increase took place.

Moreover, bearing in mind (26) the computed inter-sector output ratio is

Furthermore, from (7) and considering (26), the relative price of the output in the

![]() $N$

-sector is—see Appendix A.2:

$N$

-sector is—see Appendix A.2:

The intuition behind (29) can be grasped by taking into account that an increase in the relative relevance of the

![]() $N$

-sector in the production of the aggregate final good,

$N$

-sector in the production of the aggregate final good,

![]() $\frac{\chi _{N}}{\chi _{R}}$

, increases the relative demand for output in this sector which leads to an increase in relative prices. Hence, through

$\frac{\chi _{N}}{\chi _{R}}$

, increases the relative demand for output in this sector which leads to an increase in relative prices. Hence, through

![]() $M_{N}$

and

$M_{N}$

and

![]() $M_{R}$

, (29) shows that if either the technological knowledge is highly

$M_{R}$

, (29) shows that if either the technological knowledge is highly

![]() $N$

-biased or if there is a large relative supply of

$N$

-biased or if there is a large relative supply of

![]() $N$

, the output of the

$N$

, the output of the

![]() $N$

-sector is large—see (28), which implies a low relative price of the

$N$

-sector is large—see (28), which implies a low relative price of the

![]() $N$

-sector. In this case, the demand for

$N$

-sector. In this case, the demand for

![]() $N$

-machines is low, which discourages R&D activities aimed at improving their quality, as we will see below. Thus, labor structure affects the direction of R&D through the price channel and/or by the market-size channel. This latter channel may or may not be removed, eliminated, or not in conducting the economic mechanisms.

$N$

-machines is low, which discourages R&D activities aimed at improving their quality, as we will see below. Thus, labor structure affects the direction of R&D through the price channel and/or by the market-size channel. This latter channel may or may not be removed, eliminated, or not in conducting the economic mechanisms.

The question of wages for labor type

![]() $L_{s}^{i}$

and

$L_{s}^{i}$

and

![]() $L_{s}^{h}$

and the differences in wages that can be established still need to be addressed. From (19), the wages in (17) and (18) can be rewritten in the form:

$L_{s}^{h}$

and the differences in wages that can be established still need to be addressed. From (19), the wages in (17) and (18) can be rewritten in the form:

Moreover, we can obtain wage differentials between types of labor in each sector

![]() $s$

,

$s$

,

![]() $\frac{w_{s}^{i}}{w_{s}^{h}}=\left (\frac{Q_{s}^{i}\cdot l_{s}^{i}}{Q_{s}^{h}\cdot l_{s}^{h}}\frac{L_{s}^{h}}{L_{s}^{i}}\right )^{\frac{1}{2}}$

, that allow us to obtain the (domestic) steady-state skill premium and the inter-country wage inequality in favor of the domestic country which are, respectively:

$\frac{w_{s}^{i}}{w_{s}^{h}}=\left (\frac{Q_{s}^{i}\cdot l_{s}^{i}}{Q_{s}^{h}\cdot l_{s}^{h}}\frac{L_{s}^{h}}{L_{s}^{i}}\right )^{\frac{1}{2}}$

, that allow us to obtain the (domestic) steady-state skill premium and the inter-country wage inequality in favor of the domestic country which are, respectively:

\begin{equation} \frac{w_{N}^{i}}{w_{N}^{h}}=\left (\frac{Q_{N}^{i}\cdot l_{N}^{i}}{Q_{N}^{h}\cdot l_{N}^{h}}\frac{L_{N}^{h}}{L_{N}^{i}}\right )^{\frac{1}{2}}\:\text{and}\:\frac{w_{R}^{i}}{w_{R}^{h}}=\left (\frac{Q_{R}^{i}\cdot l_{R}^{i}}{Q_{R}^{h}\cdot l_{R}^{h}}\frac{L_{R}^{h}}{L_{R}^{i}}\right )^{\frac{1}{2}} \end{equation}

\begin{equation} \frac{w_{N}^{i}}{w_{N}^{h}}=\left (\frac{Q_{N}^{i}\cdot l_{N}^{i}}{Q_{N}^{h}\cdot l_{N}^{h}}\frac{L_{N}^{h}}{L_{N}^{i}}\right )^{\frac{1}{2}}\:\text{and}\:\frac{w_{R}^{i}}{w_{R}^{h}}=\left (\frac{Q_{R}^{i}\cdot l_{R}^{i}}{Q_{R}^{h}\cdot l_{R}^{h}}\frac{L_{R}^{h}}{L_{R}^{i}}\right )^{\frac{1}{2}} \end{equation}

Finally, from (17), (18) [or (30) and (31)], (19), (20), and (23), we obtain the wage polarization in favor of domestic (nonroutine) high- and low-skilled workers:

\begin{eqnarray} \frac{w_{N}^{i}}{w_{R}^{i}} & = & \left (\frac{\chi _{N}}{\chi _{R}}\right )^{\frac{\epsilon }{\epsilon \alpha +1-\alpha }}\cdot \left (\frac{M_{N}}{M_{R}}\right )^{-\frac{1}{\epsilon \alpha +1-\alpha }+\frac{1}{2}}\cdot \left (\frac{Q_{N}^{i}}{Q_{R}^{i}}\cdot \frac{l_{N}^{i}}{l_{R}^{i}}\cdot \frac{L_{R}^{i}}{L_{N}^{i}}\right )^{\frac{1}{2}}, \end{eqnarray}

\begin{eqnarray} \frac{w_{N}^{i}}{w_{R}^{i}} & = & \left (\frac{\chi _{N}}{\chi _{R}}\right )^{\frac{\epsilon }{\epsilon \alpha +1-\alpha }}\cdot \left (\frac{M_{N}}{M_{R}}\right )^{-\frac{1}{\epsilon \alpha +1-\alpha }+\frac{1}{2}}\cdot \left (\frac{Q_{N}^{i}}{Q_{R}^{i}}\cdot \frac{l_{N}^{i}}{l_{R}^{i}}\cdot \frac{L_{R}^{i}}{L_{N}^{i}}\right )^{\frac{1}{2}}, \end{eqnarray}

\begin{eqnarray} \frac{w_{N}^{h}}{w_{R}^{i}} & = & \left (\frac{\chi _{N}}{\chi _{R}}\right )^{\frac{\epsilon }{\epsilon \alpha +1-\alpha }}\cdot \left (\frac{M_{N}}{M_{R}}\right )^{-\frac{1}{\epsilon \alpha +1-\alpha }+\frac{1}{2}}\cdot \left (\frac{Q_{N}^{h}}{Q_{R}^{i}}\frac{l_{N}^{h}}{l_{R}^{i}}\frac{L_{R}^{i}}{L_{N}^{h}}\right )^{\frac{1}{2}}. \end{eqnarray}

\begin{eqnarray} \frac{w_{N}^{h}}{w_{R}^{i}} & = & \left (\frac{\chi _{N}}{\chi _{R}}\right )^{\frac{\epsilon }{\epsilon \alpha +1-\alpha }}\cdot \left (\frac{M_{N}}{M_{R}}\right )^{-\frac{1}{\epsilon \alpha +1-\alpha }+\frac{1}{2}}\cdot \left (\frac{Q_{N}^{h}}{Q_{R}^{i}}\frac{l_{N}^{h}}{l_{R}^{i}}\frac{L_{R}^{i}}{L_{N}^{h}}\right )^{\frac{1}{2}}. \end{eqnarray}

Hence, from (32), both domestic skill premium and the inter-country wage inequality in favor of the domestic country are decreasing in the relative supply factor, since the more abundant factor is substituted for the less abundant one, given, respectively, by

![]() $\frac{L_{N}^{h}}{L_{N}^{i}}$

and

$\frac{L_{N}^{h}}{L_{N}^{i}}$

and

![]() $\frac{L_{R}^{h}}{L_{R}^{i}}$

, and, increasing, in the absolute productivity advantage given, respectively, by

$\frac{L_{R}^{h}}{L_{R}^{i}}$

, and, increasing, in the absolute productivity advantage given, respectively, by

![]() $l_{N}^{i}$

and

$l_{N}^{i}$

and

![]() $l_{R}^{i}$

. Moreover, a rise in technological-knowledge biased toward both

$l_{R}^{i}$

. Moreover, a rise in technological-knowledge biased toward both

![]() $N^{i}$

, in the skill premium function, and

$N^{i}$

, in the skill premium function, and

![]() $R^{i}$

, in the inter-country wage inequality in favor of the domestic country function positively impacts wages. This rise fosters competitiveness within their respective sectors and improves the workers’ relative productivity.

$R^{i}$

, in the inter-country wage inequality in favor of the domestic country function positively impacts wages. This rise fosters competitiveness within their respective sectors and improves the workers’ relative productivity.

Furthermore, within the same context, from (33) and (34), the wage polarization in favor of domestic (nonroutine) high- and low-skilled workers, respectively, is positively affected by a rise in the relative relevance of the

![]() $N$

-sector since it augments the relative demand for output in this sector that leads to an increase in the wage polarization, biased to high- and low-skilled employees. Moreover, if

$N$

-sector since it augments the relative demand for output in this sector that leads to an increase in the wage polarization, biased to high- and low-skilled employees. Moreover, if

![]() $\frac{\epsilon }{\epsilon \alpha +1-\alpha }\gt \frac{1}{2}$

and the market size dominates the price of the price effect channel, an increase either in the technological-knowledge highly

$\frac{\epsilon }{\epsilon \alpha +1-\alpha }\gt \frac{1}{2}$

and the market size dominates the price of the price effect channel, an increase either in the technological-knowledge highly

![]() $N$

-biased, an increase in the relative supply factor of

$N$

-biased, an increase in the relative supply factor of

![]() $R$

-sector, or a decrease in the absolute productivity in the

$R$

-sector, or a decrease in the absolute productivity in the

![]() $R$

-sector stimulates significant wages improvements at the tails of the distribution.

$R$

-sector stimulates significant wages improvements at the tails of the distribution.

These results can be interpreted as short-run results, as R&D has not been considered yet. The exposition of the R&D sector closes the model and allows for the calculation of steady-state or long-run results. In fact, R&D is also responsible for the transitional dynamics of the model. The following subsection describes the R&D sector.

3.5. R&D sector

By producing innovative designs, R&D activities drive the rate and the direction of technological knowledge, and thus wages and economic growth. Innovative designs for the manufacture of new qualities of the machines are patented, and the leader firm in each industry—the one that produces according to the latest patent—uses limit pricing to assure monopoly. The value of the leading-edge patent relies on the profit yields accruing during each time

![]() $t$

to the monopolist and on the duration of the monopoly power. The duration, in turn, depends on the probability of a new innovation, which creatively destroys the current leading-edge design [e.g., Aghion and Howitt (Reference Aghion and Howitt1992), Grossman and Helpman (Reference Grossman and Helpman1991, ch. 12), and Barro and Sala-i-Martin (Reference Barro and Sala-i-Martin2004, ch. 7)]. The probability of successful innovation is, thus, at the heart of the R&D activity. Let

$t$

to the monopolist and on the duration of the monopoly power. The duration, in turn, depends on the probability of a new innovation, which creatively destroys the current leading-edge design [e.g., Aghion and Howitt (Reference Aghion and Howitt1992), Grossman and Helpman (Reference Grossman and Helpman1991, ch. 12), and Barro and Sala-i-Martin (Reference Barro and Sala-i-Martin2004, ch. 7)]. The probability of successful innovation is, thus, at the heart of the R&D activity. Let

![]() $\mathcal{I}_{s}^{h}(k,j,t)$

and

$\mathcal{I}_{s}^{h}(k,j,t)$

and

![]() $\mathcal{I}_{s}^{i}(k,j,t)$

denote the instantaneous probability at time

$\mathcal{I}_{s}^{i}(k,j,t)$

denote the instantaneous probability at time

![]() $t$

in sector

$t$

in sector

![]() $s$

for, respectively,

$s$

for, respectively,

![]() $h$

and

$h$

and

![]() $i$

—a Poisson arrival rate—of successful innovation in the next higher quality

$i$

—a Poisson arrival rate—of successful innovation in the next higher quality

![]() $\left [k(j,t)+1\right ]$

in machine

$\left [k(j,t)+1\right ]$

in machine

![]() $j$

given current rung quality

$j$

given current rung quality

![]() $k$

. We define it as follows:

$k$

. We define it as follows:

where, for example, following Afonso and Sequeira (Reference Afonso and Sequeira2023): (i)

![]() $e_{s}^{h}(k,j,t)$

and

$e_{s}^{h}(k,j,t)$

and

![]() $e_{s}^{i}(k,j,t)$

are the flow of domestic final-good resources devoted to R&D in

$e_{s}^{i}(k,j,t)$

are the flow of domestic final-good resources devoted to R&D in

![]() $j$

belonging to

$j$

belonging to

![]() $s$

for, respectively,

$s$

for, respectively,

![]() $h$

and

$h$

and

![]() $i$

, which define our framework as a lab equipment model; (ii)

$i$

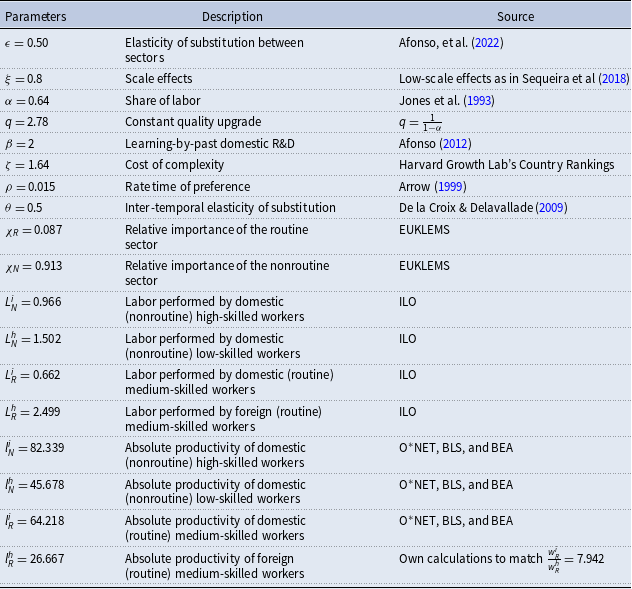

, which define our framework as a lab equipment model; (ii)