Introduction

The dynamic capability view (DCV) is currently considered one of the most promising frameworks in the strategy agenda, aimed at identifying drivers of long-term firm survival and growth (e.g., Barrales-Molina, Martínez-López, & Gázquez-Abad, Reference Barrales-Molina, Martínez-López and Gázquez-Abad2014; Laaksonen & Peltoniemi, Reference Laaksonen and Peltoniemi2016). In fact, research on dynamic capabilities (DCs) stands amongst the most prolific streams of research within the field of management for the last two decades (Albort-Morant, Leal-Rodríguez, Fernández-Rodríguez, & Ariza-Montes, Reference Albort-Morant, Leal-Rodríguez, Fernández-Rodríguez and Ariza-Montes2018), since the two seminal works by Teece, Pisano, and Shuen (Reference Teece, Pisano and Shuen1997) and Eisenhardt and Martin (Reference Eisenhardt and Martin2000) (Burisch & Wohlgemuth, Reference Burisch and Wohlgemuth2016). Although the concept has been widely explored with recent efforts to consolidate both definitional and theoretical divergences (e.g., Eriksson, Reference Eriksson2014; Laaksonen & Peltoniemi, Reference Laaksonen and Peltoniemi2016; Schilke, Hu, & Helfat, Reference Schilke, Hu and Helfat2018; Wilden, Devinney, & Dowling, Reference Wilden, Devinney and Dowling2016), the literature remains fragmented, disparate and equivocal (Pezeshkan, Fainshmidt, Nair, Lance Frazier, & Markowski, Reference Pezeshkan, Fainshmidt, Nair, Lance Frazier and Markowski2016). Inconsistency between definitions, conceptualizations and measurements of key constructs and variables, along with tested relationships prevails. Perhaps, the most important relationship within this field of research is the one between DCs and performance (Barreto, Reference Barreto2010). Yet, how the nature of such should be quantitatively assessed remains somewhat unclear and deserves attention (e.g., Di Stefano, Peteraf, & Verona, Reference Di Stefano, Peteraf and Verona2014; Wilden, Devinney, & Dowling, Reference Wilden, Devinney and Dowling2016), representing a literature gap.

Regardless of the ongoing progress made in the empirical inquiry regarding the DC effects, it seems that a limited number of studies have provided comprehensive synthetized insight focusing particularly on how the empirical relationship between DC and performance have and should be assessed. A recent meta-analysis reveals that empirical evidence for the relationship between DCs and performance is rather inconsistent (Pezeshkan et al., Reference Pezeshkan, Fainshmidt, Nair, Lance Frazier and Markowski2016). Trying to culminate this gap, the purpose of this paper is two folded. Firstly, it is aimed to present a comprehensive in-depth synthesis of the existing quantitative studies testing the DC–performance relationship, in order to understand what have been done so far, contributing to a more structured sense and coherence to the disperse body of knowledge, while, secondly, based on the systematic analysis, propose a conceptual model for assessing the influence of DCs on performance along with recommendations, guidelines and avenues for future research. To this end, a systematic sight of the current state of the DCV, regarding its quantitative relationship with performance is offered. Through a systematic literature review (SLR) of 92 quantitative articles on performance outcomes related to DCs, an attempt to compile empiric grounds and provide a more updated discussion is made. Accordingly, the nature of their relationship and the inherent aspects are explored, addressing questions like: How has the relationship between DC and performance been assessed in empirical investigations? Which variables (antecedents, mediators, moderators and outcomes) have been applied throughout the literature for empirically assessing the influence of DCs on performance? How should the DC–performance relationship be assessed in future studies? This study synthetizes and maps documentation thus far accumulated, distinguishing between types of relationships along with the presentation of the inherent variables used when investigating the influence of DCs on performance outcomes, offering consistency and unification to the scattered empirical literature and a structured way to address the enduring discussion. The analysis reflects the richness of the research, and by revealing concerns and research possibilities, it contributes towards a forward-looking theoretical and empirical development.

The primary findings from analysis evidence that two divergent groups of conceptual natures of DC–performance relationship (direct and indirect) are represented in the literature. The indirect approach is by far the most dominant, as only 36 of the 92 articles employ an exclusively indirect approach for assessing the influence of DCs on performance outcomes. Regarding the operationalization, empirical studies appear to employ a continuum of conceptualizations, ranging from very specific DCs to generic sets. The majority of the studies measure DCs as generic. The same applies to the varied performance measures adopted. A tendency for using subjective aggregated measures to determine wide-range performance is identified. This indicates that the DC literature still has a long way to go before constituting a robust integrated framework. Based upon the analysis, the most promising research approach seems to be that DCs per se do not directly cause superior firm performance, but rather cause chance that leads to intermediate outcomes, such as change of operational capabilities and process-level performance. That is, DCs appear to be necessary, but an insufficient condition for achieving superior performance directly, evidencing a more complex relationship than firstly put out to be in the literature, as their effects seem to be mediated by operational capability change and development, while simultaneous being contingent upon diverse moderators.

The section below provides a brief theoretical overview of the DCV. The next section introduces the methods used in this SLR, followed by the analysis and discussion in terms of the nature of the DC–performance relationship, conceptualizations of DC variables used and performance measures. Finally, the last section presents resumed conclusions, a conceptual model, recommendations for future research and limitations.

Theoretical Framework

The dynamic capability view

How firms achieve competitive advantage and superior performance remain at the heart of strategic management (Protogerou, Caloghirou, & Lioukas, Reference Protogerou, Caloghirou and Lioukas2012; Schilke, Hu, & Helfat, Reference Schilke, Hu and Helfat2018). The resource based view (RBV) emerged as one of the key frameworks explaining competitive diversity and performance based on internal resources, serving as a response to overcome the limits of industrial economics to explain superior firm performance (Barney, Reference Barney1991; Bleady, Ali, & Ibrahim, Reference Bleady, Ali and Ibrahim2018; Penrose, Reference Penrose1959; Stonehouse & Snowdown, Reference Stonehouse and Snowdown2007). However, it appears that the RBV struggles to explain how firms maintain these advantages over time in dynamic environments, as it gives a static view of a firm's resource portfolio, laying ground for the DVC (e.g., Giniuniene & Jurksiene, Reference Giniuniene and Jurksiene2015; Wilden, Devinney, & Dowling, Reference Wilden, Devinney and Dowling2016). The DCV intends to extent the RBV (Burisch & Wohlgemuth, Reference Burisch and Wohlgemuth2016), serving as a more time-based reaction to the deficiencies of the RBV within the new knowledge and innovation economy conditions, considering how firms develop, reconfigure and renew resources and capabilities over time in turbulent environments (e.g., Bleady, Ali, & Ibrahim, Reference Bleady, Ali and Ibrahim2018; Giniuniene & Jurksiene, Reference Giniuniene and Jurksiene2015, Teece, Reference Teece2018; Teece, Pisano, & Shuen, Reference Teece, Pisano and Shuen1997; Winter, Reference Winter2003). The DCV goes beyond the idea that sustainable competitive advantage is based merely upon a firm's acquisition of valuable, rare, inimitable and organizational (VRIO) resources (Barney, Reference Barney1991; Barney & Hesterly, Reference Barney and Hesterly2006), as it takes into consideration the concern of time, evolution and change (Arndt & Bach, Reference Arndt and Bach2015; Bleady, Ali, & Ibrahim, Reference Bleady, Ali and Ibrahim2018; Galvin, Rice, & Liao, Reference Galvin, Rice and Liao2014). In short, this view emerges as an approach for understanding strategic change (Teece, Pisano, & Shuen, Reference Teece, Pisano and Shuen1997), seeking to provide a framework to understand how firms develop and maintain a competitive advantage over time in turbulent markets, while aiming to identify underlying drivers of long-term success (Wilden, Devinney, & Dowling, Reference Wilden, Devinney and Dowling2016).

Throughout the years, an impressive body of published DC research have widely revised, discussed and extended the concept, resulting in a number of conceptualizations (see e.g., Albort-Morant et al., Reference Albort-Morant, Leal-Rodríguez, Fernández-Rodríguez and Ariza-Montes2018). Bibliographic reviews (e.g., Peteraf, Di Stefano, & Verona, Reference Peteraf, Di Stefano and Verona2013) suggest that the fragmented literature, although partially complementary, does not necessarily share one clear common theoretical grounding (Burisch & Wohlgemuth, Reference Burisch and Wohlgemuth2016). It is commonly agreed that the DC concept has largely been developed under the influence of two main papers – Teece, Pisano, and Shuen (Reference Teece, Pisano and Shuen1997) and Eisenhardt and Martin (Reference Eisenhardt and Martin2000), which largely represent two somewhat different DC research streams (e.g., Albort-Morant et al., Reference Albort-Morant, Leal-Rodríguez, Fernández-Rodríguez and Ariza-Montes2018; Di Stefano, Peteraf, & Verona, Reference Di Stefano, Peteraf and Verona2014; Giniuniene & Jurksiene, Reference Giniuniene and Jurksiene2015; Ringov, Reference Ringov2017). In fact, these two approaches have different theoretical underpinnings, different assumptions about the nature of DCs, employ different types of reasoning and adopt a different perspective regarding the influence on performance (Peteraf, Di Stefano, & Verona, Reference Peteraf, Di Stefano and Verona2013). DCs have been defined as both abilities (Teece, Pisano, & Shuen, Reference Teece, Pisano and Shuen1997) and processes, best practices or routines (Eisenhardt & Martin, Reference Eisenhardt and Martin2000). Teece, Pisano, and Shuen (Reference Teece, Pisano and Shuen1997) originally defined DCs as the firm's ability to integrate, build and reconfigure internal and external competences to address rapidly changing environments. Following Teece, Pisano, and Shuen (Reference Teece, Pisano and Shuen1997), some authors have considered DCs to be a capability, skill or capacity (e.g., Winter, Reference Winter2003; Zahra, Sapienza, & Davidsson, Reference Zahra, Sapienza and Davidsson2006). Whereas Eisenhardt and Martin (Reference Eisenhardt and Martin2000) relate DCs to the firm's processes that use resources; specifically, the processes to integrate, reconfigure, gain and release resources to match and even create market change. In this way, DCs are understood as identifiable strategic routines, such as product development and strategic decision marking, by which firms achieve new resource configurations as markets emerge, collide, split, evolve and die (Eisenhardt & Martin, Reference Eisenhardt and Martin2000).

Regardless of the theoretical underprint, in an effort to understand the nature of DCs, it is imperative to distinguish between DC and operational capabilities (Albort-Morant et al., Reference Albort-Morant, Leal-Rodríguez, Fernández-Rodríguez and Ariza-Montes2018). In fact, making an empirical distinction between operational capabilities that change and DCs that cause the change is crucial for avoiding tautological arguments (Laaksonen & Peltoniemi, Reference Laaksonen and Peltoniemi2016). DCs work differently than operational capabilities, which are generally static and operate independently (Vijaya, Ganesh, & Rahul, Reference Vijaya, Ganesh and Rahul2019). DCs are not resources in the traditional RBV sense, they are more like abilities or processes, which react upon resources (Ambrosini & Bowman, Reference Ambrosini and Bowman2009; Eisenhardt & Martin, Reference Eisenhardt and Martin2000; Teece, Reference Teece2007). Operational capabilities can be described as more basic capabilities that allow firms to pursue defined sets of activities (Teece, Reference Teece2018). These can be viewed as the capability to execute day-to-day activities, while DCs represent the firm's ability to reconfigure and adapt operational capabilities by sensing the environment needs and opportunities and integrating the existing capabilities with knowledge, generating new value-creating strategies (Ambrosini & Bowman, Reference Ambrosini and Bowman2009; Eisenhardt & Martin, Reference Eisenhardt and Martin2000; Pavlou & El Sawy, Reference Pavlou and El Sawy2013; Teece, Reference Teece2007). Dynamic indicates the role they play in renewal, and ‘capabilities’ stresses that they are strategic responses to adapt to a new context (Barrales-Molina, Martínez-López, & Gázquez-Abad, Reference Barrales-Molina, Martínez-López and Gázquez-Abad2014).

DCs have frequently been operationalized as a set of distinct clusters of activities to explain how they work. According to Barrales-Molina, Martínez-López, and Gázquez-Abad (Reference Barrales-Molina, Martínez-López and Gázquez-Abad2014) these can be broadly divided into generally accepted features of DC processes, such as, reconfiguration, leveraging, learning, integration, coordination (Eisenhardt & Martin, Reference Eisenhardt and Martin2000; Teece, Pisano, & Shuen, Reference Teece, Pisano and Shuen1997), environmental sensing and opportunity seizing (Teece, Reference Teece2007), learning processes, such as experience accumulation, knowledge articulation and knowledge codification (Zollo & Winter, Reference Zollo and Winter2002). Throughout the literature it becomes apparent that these components are some of the most common conceptualization of DCs, leading to a quantitative tendency, measuring DCs through their underlying processes (Barrales-Molina, Martínez-López, & Gázquez-Abad, Reference Barrales-Molina, Martínez-López and Gázquez-Abad2014; Eriksson, Reference Eriksson2014). Some organizational processes and capabilities have been considered as more specific identifiable DCs, such as dynamic marketing capabilities (e.g., new product development, customer relationship management) (e.g., Peng & Lin, Reference Peng and Lin2017), dynamic managerial capabilities (e.g., Li & Liu, Reference Li and Liu2014), specific supply-chain capabilities (Lee & Rha, Reference Lee and Rha2016) and dynamic it-enabled capabilities (e.g., Drnevich & Kriauciunas, Reference Drnevich and Kriauciunas2011). Eriksson (Reference Eriksson2014) states that, generally, according to the former approach, DCs may be unique and hence difficult to imitate (Teece, Pisano, & Shuen, Reference Teece, Pisano and Shuen1997), whereas the latter view implies commonalities among organizations, meaning that only the resource and capability configurations DCs create can be unique (Eisenhardt & Martin, Reference Eisenhardt and Martin2000).

Dynamic capabilities and performance

According to Bleady, Ali, and Ibrahim (Reference Bleady, Ali and Ibrahim2018) intense criticisms have been levelled against the DCV, such as the nature of the DC term itself, the absence of clear models to measure these capabilities and how they actually affect firm performance (Zahra, Sapienza, & Davidsson, Reference Zahra, Sapienza and Davidsson2006; Zott, Reference Zott2003). The purpose of DC research should be to explain sources of superior competitivity (Teece, Pisano, & Shuen, Reference Teece, Pisano and Shuen1997), indicating that firm performance is a key component of the theory and usually seen as the ultimate aim (Laaksonen & Peltoniemi, Reference Laaksonen and Peltoniemi2016). There seems to be a boras consensus that DCs positively influences firm performance in multiple ways (Wilden, Gudergan, Nielsen, & Lings, Reference Wilden, Gudergan, Nielsen and Lings2013); these extend or modify the resource base (Helfat & Peteraf, Reference Helfat and Peteraf2009), to match the changing environments (Teece, Pisano, & Shuen, Reference Teece, Pisano and Shuen1997), as thus, improving firm effectiveness (Zollo & Winter, Reference Zollo and Winter2002), create market change (Eisenhardt & Martin, Reference Eisenhardt and Martin2000) and support both the resource-picking and capability-building rent-generating mechanisms (Makadok, Reference Makadok2001). This will ultimately strengthen performance (Wilden et al., Reference Wilden, Gudergan, Nielsen and Lings2013). However, the discussion about the exact nature of the relationship between DCs and firm performance started about the same time as the concept itself (Dias & Pereira, Reference Dias and Pereira2017) and the question of how DCs actually affect firm performance remains unclear and at the centre of debate (Pezeshkan et al., Reference Pezeshkan, Fainshmidt, Nair, Lance Frazier and Markowski2016).

Different opinions exist as to whether a DC itself can be the source of superior performance (Wilden, Devinney, & Dowling, Reference Wilden, Devinney and Dowling2016). Actually, one of the greatest divergences between the Teece, Pisano and Shuen (Reference Teece, Pisano and Shuen1997) and Eisenhardt and Martin (Reference Eisenhardt and Martin2000) approaches regards the role of DCs in gaining superior firm results (Peteraf, Di Stefano, & Verona, Reference Peteraf, Di Stefano and Verona2013). At an early stage of the DCV, a direct relationship between firms' DCs and their performance was postulated (Makadok, Reference Makadok2001; Teece, Pisano, & Shuen, Reference Teece, Pisano and Shuen1997). Teece, Pisano, and Shuen (Reference Teece, Pisano and Shuen1997) share fundamental assumptions with the RBV of which require resources to be VRIO-criteria. If DCs possess these characteristics, they can be a direct source of sustainable competitive advantages and thus superior performance (Barney, Reference Barney1991; Teece, Pisano, & Shuen, Reference Teece, Pisano and Shuen1997). In contrast, others have shown less confidence in the compulsory and direct link (Barreto, Reference Barreto2010). Eisenhardt and Martin (Reference Eisenhardt and Martin2000) opposed that DCs are indeed necessary, but not sufficient for competitive advantage. Contrary to Teece, Pisano, and Shuen (Reference Teece, Pisano and Shuen1997) conceptualization, it is explicitly stated that DCs do not necessarily meet all of the VRIO (Eisenhardt & Martin, Reference Eisenhardt and Martin2000). By depicting DCs as routines, Eisenhardt and Martin (Reference Eisenhardt and Martin2000) effectively implies that any competitive advantage that is attributable directly to DC is likely to be rather small and insignificant, because they are likely not to satisfy VRIO conditions, being more homogeneous than before assumed (Peteraf, Di Stefano, & Verona, Reference Peteraf, Di Stefano and Verona2013). In this view, long-term performance does not rely on DCs themselves, but on routines, resource configurations and change effect, that is, essentially how DCs are used (Barreto, Reference Barreto2010). Additionally, Helfat and Peteraf (Reference Helfat and Peteraf2009) elaborate that performance effects of DCs should be assessed using the concept of both task performance, a more specific intermediate performance outcome, and evolutionary fitness, as the extend of evolutionary fitness depends on how well the DCs of an organization match the context in which the organization operates.

Apparently, DCs can influence firm performance in multiple ways. As a result of the fragmented literature and results, indications of while performance benefits from DCs, their effect may not be automatic, straightforward, nor apparent, can be retrieved. Their relationship may not be as linear and direct as the former theoretical assumptions. It becomes apparent that the nature of the DC–performance relationship, conceptualization, along with the amount and types of included additional variables when assessing firm performance, should be dependent upon the theoretical framework and definition of the concept itself, however, this is not always verified in the quantitative literature. As such, drawing a general overview of the quantitative evidence on the DC–performance relationship, through a synthesized and analytical lens, seems pertinent in order to evidence the current standpoint, concerns and gaps, enabling future studies.

Method

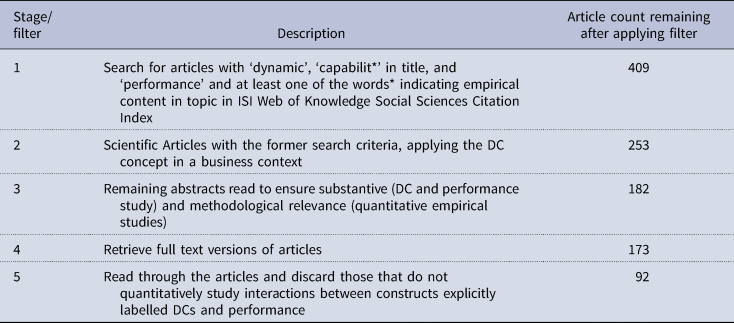

In order to analyse the nature and provide a more comprehensive overview of the investigated relationships between DCs and performance, a SLR of quantitative content was undertaken. Firstly, relevant studies were identified and the roles of DCs and employed relationship to performance outcomes were analysed. Accordingly, procedures and methodological aspects used by Newbert (Reference Newbert2007), Pezeshkan et al. (Reference Pezeshkan, Fainshmidt, Nair, Lance Frazier and Markowski2016), Eriksson (Reference Eriksson2014) and Laaksonen and Peltoniemi (Reference Laaksonen and Peltoniemi2016) were followed for reliable guidance (Table 1). As journal articles seem to be the most respected and efficient way of disseminating research findings (Eriksson, Reference Eriksson2014), they were chosen as the source material. Given the focus on evidence-based knowledge, this analysis is built on a review of empirical content, hence conceptual articles were excluded.

Table 1. Number of articles after each round of elimination

*‘empirical’, ‘test*’, ‘data’, ‘finding*’, ‘statistical’, ‘result*’, ‘quantitative’ or ‘evidence*’.

The search for articles was conducted in the ISI Web of Knowledge Social Sciences Citation Index, including articles from 2017, by the following procedures (Table 1):

(1) To ensure relevance, the search criteria were drawn upon the terms ‘dynamic capabilit*’ and ‘performance’. ‘Dynamic capabilit*’ was required in the title and ‘performance’ should occur in at least one of the following parts: title, abstract or keywords (topic). To provide further relevance and quantitative empirical content, a requirement was the inclusion of at least one of the sequential methodological words in the topic: ‘empirical’, ‘test*’, ‘data’, ‘finding*’, ‘statistical’, ‘result*’, ‘quantitative’ or ‘evidence*’.

(2) As it appears that DC has become a buzzword in many investigation areas (Eriksson, Reference Eriksson2013), articles employing the concept in contexts other than business, (e.g., robotics, mechanics and engineering), was not considered of fundamental relevance for the review, hence excluded, along with any proceeding paper or review.

(3) Read through the abstracts and discard the ones that did not indicate any quantitative work and empirical test of the DC–performance relationship, by for example mentioning roles of DCs, their influence on specific performance-related outcomes or quantitative measures employed. As a result, a number of articles were excluded from the review. At this stage, conceptual articles were left out, along with qualitative and case studies.

(4) Full text of the remaining articles was retrieved.

(5) Read through the articles and discard the ones that did not quantitatively study the interaction between constructs labelled DC and performance. At this stage, a rigorous analysis was preformed, with the main aim of dividing the studies in types of DC–performance relationship. Articles were included in the final sample only if (a) discussed at least one construct explicitly identified as a DC, (b) specified their operationalization and measurement based on quantitative data (c), explicitly utilized the DC construct to analyse some sort of influence on performance-related outcomes (d) and indicated variables of performance, being used as an outcome. Hence, articles including only modelling and simulations (e.g., Liu et al., Reference Liu, Xu, Russell, Davies, Webster, Luo and Venters2012), studies where capabilities were not suitably and explicitly identified and operationalized as DCs (e.g., Jeng & Pak, Reference Jeng and Pak2016) and performance was not an outcome variable (e.g., Nieves & Haller, Reference Nieves and Haller2014) were excluded.

As evidenced by Table 1, the first search yield 409 articles, then further refined by a business context, excluding 81 articles in, for instance, an engineering or robotic context, leaving 328 articles. Proceeding papers (58) and reviews (17) were excluded, leaving only scientific articles. Thus, 253 articles were left for reading through the abstracts. Close to half (79) of the excluded articles (161) from the 253 articles, were left out based on their conceptual (28) and qualitative nature (51). Based on the integral search criteria summarized in Table 1, 92 articles were left to be included in the analysis. This number may imply that while the ideas of DC research have been pervasive, operationalizing the concept continues to prove challenging (Laaksonen & Peltoniemi, Reference Laaksonen and Peltoniemi2016).

Analysis

Having collected all the relevant articles, categorization schemes were developed. The initial effort was the elaborate an overview-scheme of existing types of hypothesized relationship between DCs and performance, attempting to categorize the role of DCs used in assessing their influence on performance. That is, whether the DCs were conceived to have a direct, mediating or indirect role in determining performance outcomes. This scheme served as the basis for the analysis. Next, an attempt to schematize the variables (antecedents, mediators, moderators and outcomes) applied for examining the DC influence on performance was made, analysing possible patterns.

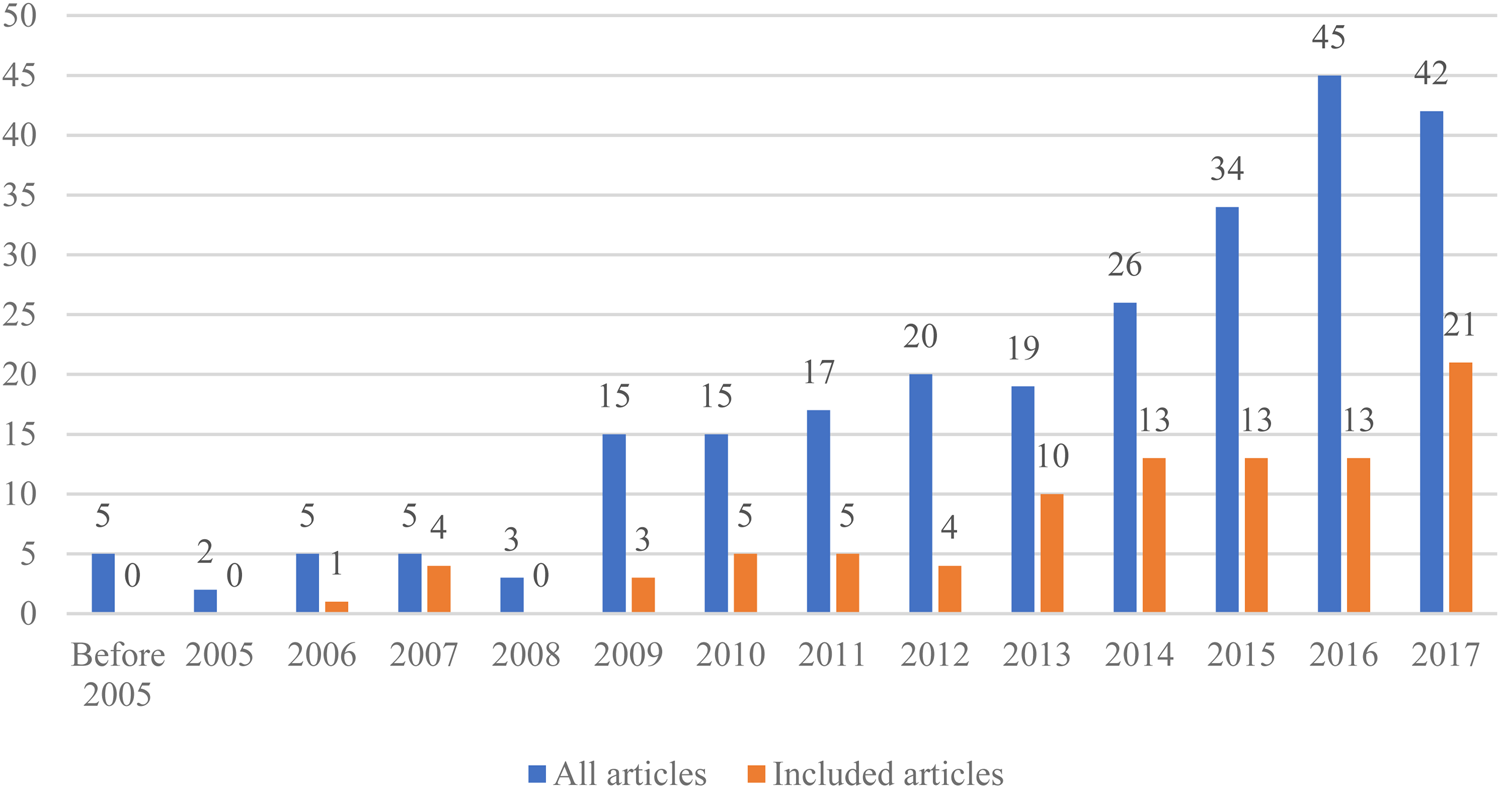

The articles analysed range from 2006–2017. As evidenced by Figure 1, the complex DC–performance relationship has gained increasingly research attention, culminating in 2017, this being the year with most publication. This may counterargument the idea of the DC literature be entering a maturity phase defended by Albort-Morant et al. (Reference Albort-Morant, Leal-Rodríguez, Fernández-Rodríguez and Ariza-Montes2018).

Figure 1. Articles per year.

Hypothesized relationships between dynamic capabilities and performance

A vital reason for the increased interest in DCs is their proposed influence on important outcome variables (Schilke, Hu, & Helfat, Reference Schilke, Hu and Helfat2018). Indeed, the performance-enhancing effect of DCs is often viewed as a key tenet of this literature (Fainshmidt, Nair, & Mallon, Reference Fainshmidt, Nair and Mallon2017). Consensus about DCs detaining an essential influence on performance outcomes seems to exist. Nearly all articles found a positive impact on varied performance outcomes. In fact, the discussion appears to have shifted from whether DCs relate to performance to how they relate (Wilden, Devinney, & Dowling, Reference Wilden, Devinney and Dowling2016). Immediate results of DCs have mainly been examined in terms of either direct performance or changes in operational capabilities, depending on the conceptualization of the hypothesized nature of the DC–performance relationship. Throughout the literature, DCs are given a variety of roles when assessing performance outcomes. They have primarily been used as independent, dependent and mediating variables. Out of the 92 studies, 24 tested the direct impact of the DCs on performance, while 32 used a mixed approach (both direct and indirect role of the DCs), where, at some point, the direct effect of DCs on performance was hypothesized and empirically tested. The remaining 36 studies hypothesized only an indirect role of the DCs for assessing performance outcomes. As such, in 56 of the articles a hypothesized direct relationship is identified, while 68 articles empirically tests, at some point, the indirect effects of DCs on performance outcomes.

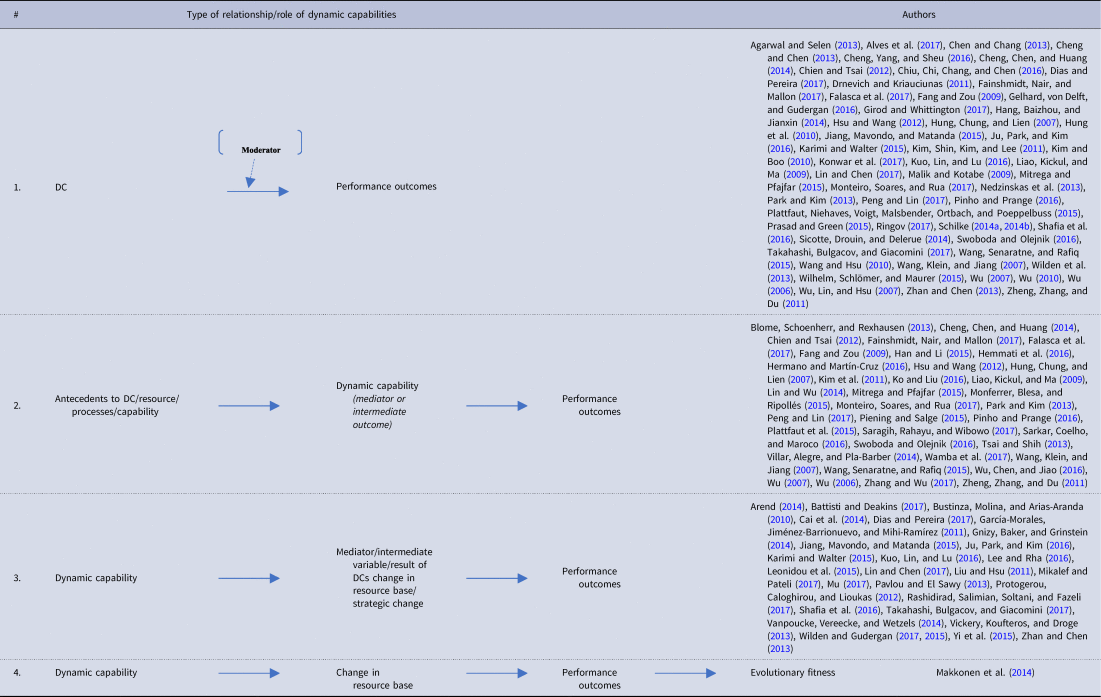

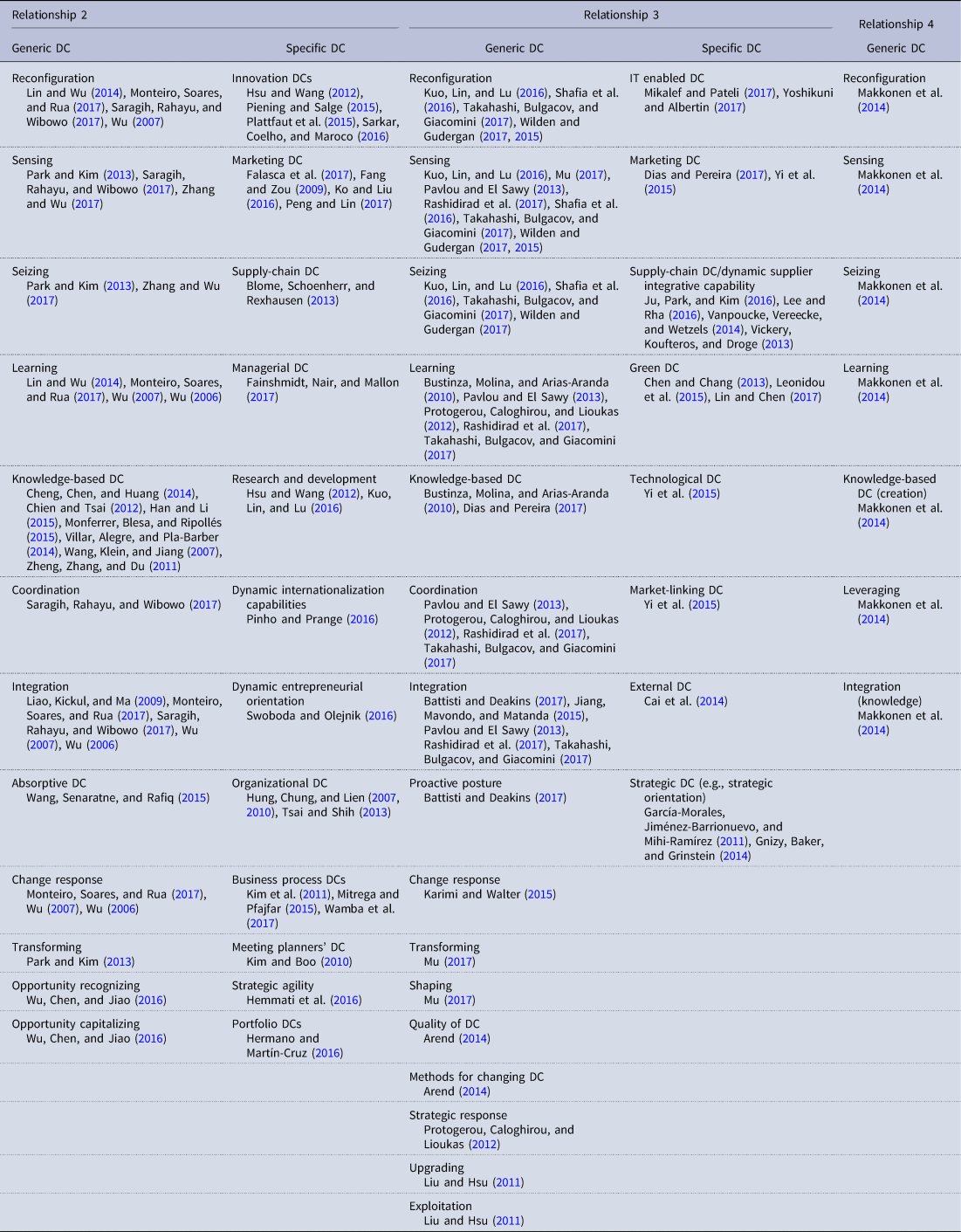

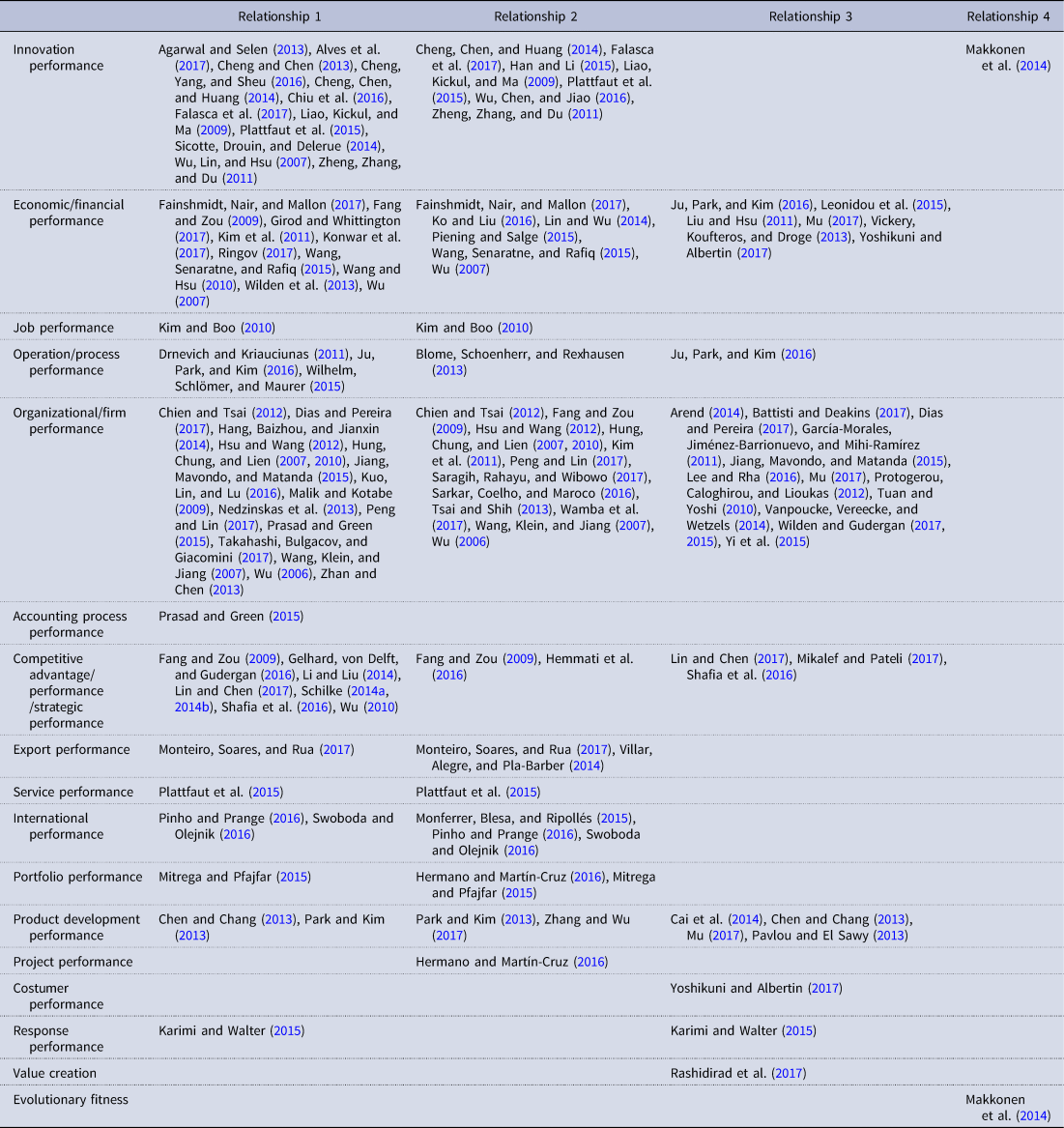

Drawing on the analysis, four broad types of hypothesized relationships between DCs and performance were identified, illustrated in Table 2. In total, 56 empirically tested the first type of relationship, 38 tested the second, 29 tested the third and 1 tested the fourth.

Table 2. Hypothesized relationships between DCs and performance

The first identified type of hypothesized relationship is the direct one. Following Eriksson (Reference Eriksson2014), the direct relationship is discussed either in isolation or as influenced by moderating factors (Example 1, Table 2). Among these studies, only two (Alves, Barbieux, Reichert, Tello-Gamarra, & Zawislak, Reference Alves, Barbieux, Reichert, Tello-Gamarra and Zawislak2017; Sicotte, Drouin, & Delerue, Reference Sicotte, Drouin and Delerue2014) postulated a direct relationship without any moderating factors interfering with the relationship. The remaining studies grouped within the direct relationship approach all included a moderator, after testing the direct relationship between DCs and performance.

The number of studies hypothesizing a direct relationship is quite high, yet in accordance with other analytical results (e.g., Laaksonen & Peltoniemi, Reference Laaksonen and Peltoniemi2016). The earliest 13 studies ranging from 2006–2010 test a direct relationship, in accordance with the expected. However, the more recent adoption of this approach, is somewhat alarming, as the promotion of an indirect relationship has been a conceptual concern for quite some time (e.g., Barreto, Reference Barreto2010; Wilden, Devinney, & Dowling, Reference Wilden, Devinney and Dowling2016). A total of 56 of the analysed studies conceptualized, at some point, a direct approach for analysing the effects of DCs on performance, being 11 of them published as recent as 2017. A possible explanation can be attributed to the quantitative measures of DCs that may just oversimplify the phenomenon and research design (Eriksson, Reference Eriksson2014) or evidence that there is still a long way to go, regarding a concise approach for assessing the DC–performance relationship for scholars to adopt.

Examples 2, 3 and 4 in Table 2 represent an indirect conceptualization of the DC–performance relationship. In total, 68 studies tested at some point an indirect relationship, whereas 36 of them adopted an exclusively indirect approach for assessing DCs' influence on performance outcomes. A total of 38 articles, 23 from the mixed approach and 15 from the indirect approach, adopted example 2 as the tested relationship, assuming DC as a mediator or intermediating variable. A total of 29 studies, 9 from the mixed approach and 20 from the indirect approach, viewed DCs as an independent variable (Example 3, Table 2), while only one article tested the relationship in example 4 (Table 2), including evolutionary fitness as a final outcome variable.

In the second type of relationship (Example 2, Table 2), DCs are recognized to have antecedents, serving as a mediating variable. Throughout the literature, DCs have been used as a mediating variable between organizational resources and performance (e.g., Liao, Kickul, & Ma, Reference Liao, Kickul and Ma2009; Lin & Wu, Reference Lin and Wu2014; Wamba, Gunasekaran, Akter, Ren, Dubey, & Childe, Reference Wamba, Gunasekaran, Akter, Ren, Dubey and Childe2017; Zhang & Wu, Reference Zhang and Wu2017), strategic orientation and performance (Sarkar, Coelho, & Maroco, Reference Sarkar, Coelho and Maroco2016), organizational process alignment and performance (Hung, Yang, Lien, McLean, & Kuo, Reference Hung, Yang, Lien, McLean and Kuo2010), knowledge management practices and performance (Falasca, Zhang, Conchar, & Li, Reference Falasca, Zhang, Conchar and Li2017; Villar, Alegre, & Pla-Barber, Reference Villar, Alegre and Pla-Barber2014), international diversification and performance (Wu, Chen, & Jiao, Reference Wu, Chen and Jiao2016) and among others.

According to Di Stefano, Peteraf, and Verona (Reference Di Stefano, Peteraf and Verona2014), a direct relationship is not even a matter for debate anymore; it is nothing but a matter of confusion, in that it produces the same tautology of which the DCV has been accused of. Although the second type of relationship is a bit more complex than the anterior, Eriksson (Reference Eriksson2014) defends that viewing DCs as mediators or intermediaries, is still not enough, because some sort of direct relationship with performance is implied, due to the lack of change output that should derive from the DCs, before affecting the final performance outcome. Attributing DCs a direct influence on performance is in conflict with the idea of them involving change. Actually, results of anterior investigations, having left out operational capabilities, raise a question of validity of the positive influence documented, as the observed improved performance may not be caused by DCs (Laaksonen & Peltoniemi, Reference Laaksonen and Peltoniemi2016).

Consequently, attributing DCs an indirect role, in the form of examples 3 or 4 (Table 2), appears to be the most promising approach, portraying the DC construct in a more in-depth manner (e.g., Barreto, Reference Barreto2010; Laaksonen & Peltoniemi, Reference Laaksonen and Peltoniemi2016; Wilden, Devinney, & Dowling, Reference Wilden, Devinney and Dowling2016). This stream of quantitative research investigates the performance implications of DCs by considering the mediating role of the organizational resource base, change and improvements. Amongst these studies, results indicate an indirect association enhanced by local integration and marketing program adoptions (Gnizy, Baker, & Grinstein, Reference Gnizy, Baker and Grinstein2014), speed of strategic change (Yi, He, Ndofor, & Wei, Reference Yi, He, Ndofor and Wei2015) and product and process innovation (Ju, Park, & Kim, Reference Ju, Park and Kim2016). Others examine changes in specific operational capabilities as a direct result of DCs (e.g., Mu, Reference Mu2017; Pavlou & El Sawy, Reference Pavlou and El Sawy2013; Wilden & Gudergan, Reference Wilden and Gudergan2015). On a broader level, studies focus on organizational change in general (Makkonen, Pohjola, Olkkonen, & Koponen, Reference Makkonen, Pohjola, Olkkonen and Koponen2014), business process improvements (Yoshikuni & Albertin, Reference Yoshikuni and Albertin2017), competitive advantage (Kuo, Lin, & Lu, Reference Kuo, Lin and Lu2016) or operational performance, including increased process flexibility and efficiency (Vanpoucke, Vereecke, & Wetzels, Reference Vanpoucke, Vereecke and Wetzels2014) as an immediate outcome of DCs.

Assuming the indirect approach as the most pertinent, forthcoming investigations should use a configurational framework to assess both the performance of the individual system elements and the outcomes of the entire configuration (Wilden, Devinney, & Dowling, Reference Wilden, Devinney and Dowling2016). Helfat and Peteraf (Reference Helfat and Peteraf2009) recommend that empirical assessments of the DC–performance relationship should firstly address the DC effect on intermediate outcomes, such as operational or strategic change, and, subsequently, measure the effect of these intermediate outcomes on task-oriented performance and hence, survival and growth, measured in the context of evolutionary fitness. This represents the illustrated relationship in example 4 (Table 2). The study of Makkonen et al. (Reference Makkonen, Pohjola, Olkkonen and Koponen2014) is the only strong example assessed through this lens. This study investigates the indirect effect of DCs, though the effect of organizational change (intermediate outcome of DC) and product innovation performance (specific task performance), for, lastly, assessing the influence on the evolutionary fitness (general performance growth over time). In sum, the investigations included in the third and fourth example (Table 2) have in common the consideration of DCs' connection to change, implying an effect on performance, however indirectly, by reconfiguring operational capabilities into new ones that better fit the environment. These are one step closer to overcome the critique of DCs being tautologically linked to performance (Pavlou & El Sawy, Reference Pavlou and El Sawy2013). Consequently, assessing the change aspect in a more exhaustive manner presents opportunities for further refinement of the DC, as it enhances the understanding of solid consequences of DCs.

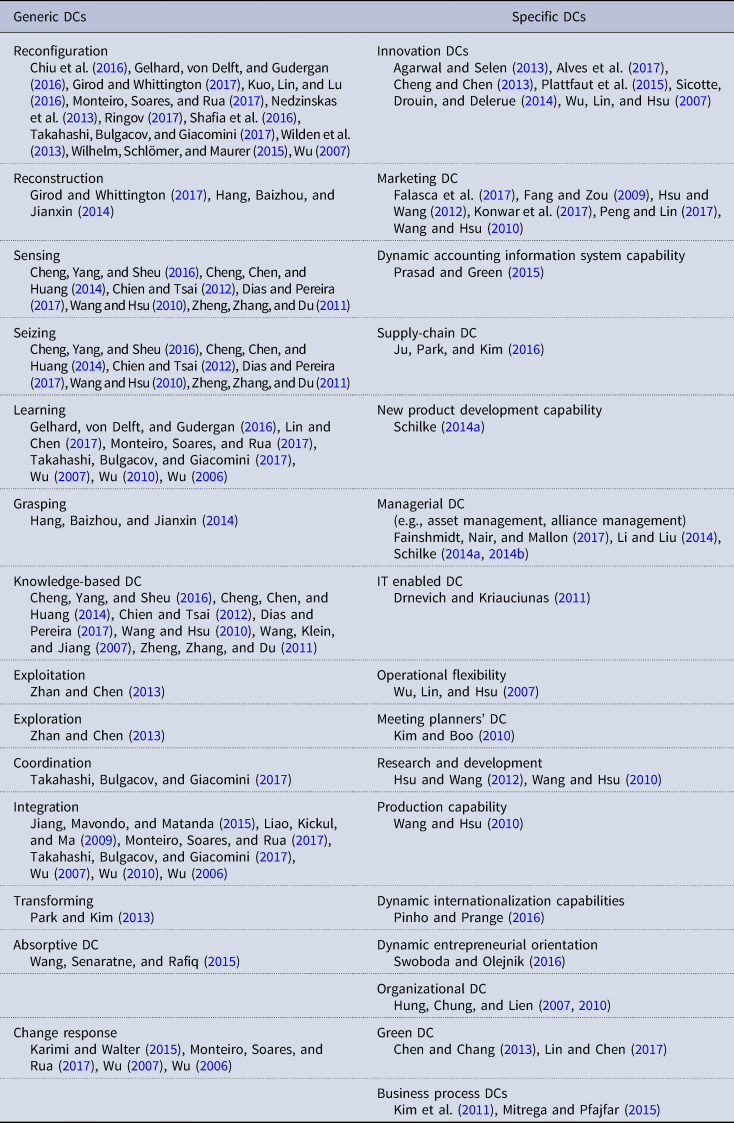

Conceptualization of dynamic capabilities

Throughout the analysis, a lack of homogeneity regarding the conceptualizations of DCs and related variables, along with overlapping are denoted. Generally, the analysed investigations appear to employ a continuum of conceptualization, making it a challenge to identify tendencies or clear categorizations. Tables 3 and 4 are provided for better clearance. Table 3 gives and overview of the conceptualization of DCs used in the direct approach, whereas Table 4 presents the variables used as DCs in the indirect approach.

Table 3. Conceptualization of DCs – direct relationship

Table 4. Conceptualization of DCs – indirect relationships

In accordance with the discussion offered by Eriksson (Reference Eriksson2014), two main tendencies are identified: focus on specific or more generic DCs. Both are indeed represented in the literature, regardless of the relationship hypothesized, as evidenced by Tables 2 and 3. It was found that the DC concept mainly has been defined and operationalized as organizational skills (e.g., Bustinza, Molina, & Arias-Aranda, Reference Bustinza, Molina and Arias-Aranda2010; Fang & Zou, Reference Fang and Zou2009), managerial skills (e.g., Gnizy, Baker, & Grinstein, Reference Gnizy, Baker and Grinstein2014; Nedzinskas, Pundzienė, Buožiūtė-Rafanavičienė, & Pilkienė, Reference Nedzinskas, Pundzienė, Buožiūtė-Rafanavičienė and Pilkienė2013), organizational routines (e.g., Agarwal & Selen, Reference Agarwal and Selen2013) and/or organizational processes (e.g., Piening & Salge, Reference Piening and Salge2015).

Studies conceptualizing DCs as specific tend to focus on marketing DCs (e.g., Falasca et al., Reference Falasca, Zhang, Conchar and Li2017; Ko & Liu, Reference Ko and Liu2016; Yi et al., Reference Yi, He, Ndofor and Wei2015), innovation DCs (e.g., Cheng & Chen, Reference Cheng and Chen2013; Hsu & Wang, Reference Hsu and Wang2012; Hung et al., Reference Hung, Yang, Lien, McLean and Kuo2010), technological/IT related DCs (Drnevich & Kriauciunas, Reference Drnevich and Kriauciunas2011; Mikalef & Pateli, Reference Mikalef and Pateli2017; Yoshikuni & Albertin, Reference Yoshikuni and Albertin2017), managerial DCs, such as timely decision-making capacity (Li & Liu, Reference Li and Liu2014) and asset management capability (Fainshmidt, Nair, & Mallon, Reference Fainshmidt, Nair and Mallon2017), business process related DCs, such as business relationship process management (Mitrega & Pfajfar, Reference Mitrega and Pfajfar2015) and research and development DCs (e.g., Hsu & Wang, Reference Hsu and Wang2012). However, the mainstream of studies uses a more generic approach for operationalization of DCs, in line with Eriksson (Reference Eriksson2014) findings, meaning that they are not confined to any function or task domain throughout the organization (Barreto, Reference Barreto2010). When adopting a direct approach, the use of generalized DCs seems to be the election choice. For the indirect approach, approximately half of the studies use a generic assessment of DCs. The most frequent generalized variables of DCs are: Knowledge-based DCs, learning, integration, sensing, seizing and reconfiguration.

Although different names, some of the generic DCs, are fairly similar or at least overlapping. For example, Makkonen et al. (Reference Makkonen, Pohjola, Olkkonen and Koponen2014) used terms as regenerating and renewing capabilities for operationalizing DCs. Yet, regenerative capabilities are in more detail referring to reconfiguration, leveraging and learning, while renewing capabilities regards knowledge creation, sensing, seizing and integration. Some designate DCs as adaptive capability (e.g., Sarkar, Coelho, & Maroco, Reference Sarkar, Coelho and Maroco2016), which is largely related to the organizational capacity to identify and seize opportunities (Wilden, Devinney, & Dowling, Reference Wilden, Devinney and Dowling2016). The same happens with specific DCs. Some label DCs directly as a new product development capability (Schilke, Reference Schilke2014b), others (e.g., Cheng & Chen, Reference Cheng and Chen2013) as innovative capability, which, in turn, is strongly related to the organizational ability to create new products (Wilden, Devinney, & Dowling, Reference Wilden, Devinney and Dowling2016). These pieces of evidence may prove some reasoning to the idea that DCs continue to be vague and poorly comprehended, in need of further operational clearance, before constituting a robust framework (Barreto, Reference Barreto2010).

In addition to the overlapping, another discrepancy is noted. To some degree, the literature is still in disagreement and confuses potential DCs with possible outcomes. For example, Drnevich and Kriauciunas (Reference Drnevich and Kriauciunas2011) measure their IT-enabled DC as the capability to develop new products/services, to implement new business processes, create new customer relationships and to change ways of doing business. Accordingly, Zahra, Sapienza, and Davidsson (Reference Zahra, Sapienza and Davidsson2006) stressed that the qualifier ‘dynamic’ should distinguish the substantive ability to develop new products from the capability to reform the way the firm develops new products. A new routine for product development is a new operational capability, but the ability to change such capabilities is a DC. Some of the variables used in the study of Drnevich and Kriauciunas (Reference Drnevich and Kriauciunas2011) to measure DC are transaction capability, including the use of formal criteria to select its suppliers and operations capabilities, including using of statistical control of processes. These might be considered more as being a part of managerial and organizational processes that underlie and enable the deployment of DCs, being categorized as the micro foundations of them (Teece, Reference Teece2007) or internal antecedents (Eriksson, Reference Eriksson2014). These types of discrepancies produce confusions that might hinder an effective progress within this field of research. The literature needs to more evidently distinguish between organizational antecedents, such as organizational or managerial capabilities and processes that can facilitate the deployment of the DCs, mediators and intermediate outcomes from the DC concept itself. It is vital that researchers link their findings to previous research, so that knowledge can truly accumulate (Eriksson, Reference Eriksson2014). Researchers also ought to be consistent about the level of analysis, as for whether they are concerned with individual managers or the organization as a whole (Laaksonen & Peltoniemi, Reference Laaksonen and Peltoniemi2016).

Another fundamental aspect is the definition of DCs that need to be considered carefully (Eriksson, Reference Eriksson2014). Theoretically, all of the articles adopting an exclusively direct approach should conceptualize their DCs according to the vision of Teece, Pisano, and Shuen (Reference Teece, Pisano and Shuen1997). In most cases, this is verified. However, some (e.g., Hang, Baizhou, & Jianxin, Reference Hang, Baizhou and Jianxin2014; Konwar, Papageorgiadis, Ahammad, TIan, McDonald, & Wang, Reference Konwar, Papageorgiadis, Ahammad, TIan, McDonald and Wang2017) do not take a clear stand of which theoretical perspective they are undertaking. The same goes for the indirect approach. The majority identifies Teece, Pisano, and Shuen (Reference Teece, Pisano and Shuen1997) line of ideas as their base for operationalizing their study, while only seven articles clearly state that their study is operationalized following the line of Eisenhardt and Martin (Reference Eisenhardt and Martin2000) (e.g., Arend, Reference Arend2014; Makkonen et al., Reference Makkonen, Pohjola, Olkkonen and Koponen2014; Protogerou, Caloghirou, & Lioukas, Reference Protogerou, Caloghirou and Lioukas2012). Many of the articles vividly cite both perspectives, and in the end, they do not make a clear theoretical standpoint for the subsequent operationalization of DCs. Investigators need to explicitly choose as whether they define DCs as organizational and strategic processes and/or routines, viewed as best-practices (Eisenhardt & Martin, Reference Eisenhardt and Martin2000) or unique abilities, skills or capacities (Teece, Pisano, & Shuen, Reference Teece, Pisano and Shuen1997), because this will influence the theoretical development and operationalization of the DC construct. An understandable example is as follows: Eisenhardt and Martin (Reference Eisenhardt and Martin2000) are stronger in their assertions that DCs actually consist of identifiable and specific routines. Thus, their perspective of the DCV could be considered particularly suited when studying a more specific DC, as they strike how e.g., acquisitions, alliances and product innovation can be seen as real DCs. On the contrary, the vein of Teece, Pisano, and Shuen (Reference Teece, Pisano and Shuen1997) could be considered more prominent for analysing more generic DCs, such as seizing, sensing and reconfiguration (Eriksson, Reference Eriksson2014). According to Laaksonen and Peltoniemi (Reference Laaksonen and Peltoniemi2016), Eisenhardt and Martin (Reference Eisenhardt and Martin2000) logic of best practices suggest that DCs should not be measured by their quantity, but rather through a binary variable: a firm either has a best practice, or routine constituting a DC or it does not (see study of Arend, Reference Arend2014). Differently, Teece, Pisano, and Shuen (Reference Teece, Pisano and Shuen1997) suggest that DCs are unique to the firm. This implies that, when DCs are operationalized, they should be measured by their type (Laaksonen & Peltoniemi, Reference Laaksonen and Peltoniemi2016). There is a strong need for accounting for the multilevel nature of DCs, a clearer distinguishing and conceptualization when realizing empirical studies and a need for rethinking rethink methodological approaches in a manner that aligns better to what is theoretically implied (Wilden, Devinney, & Dowling, Reference Wilden, Devinney and Dowling2016).

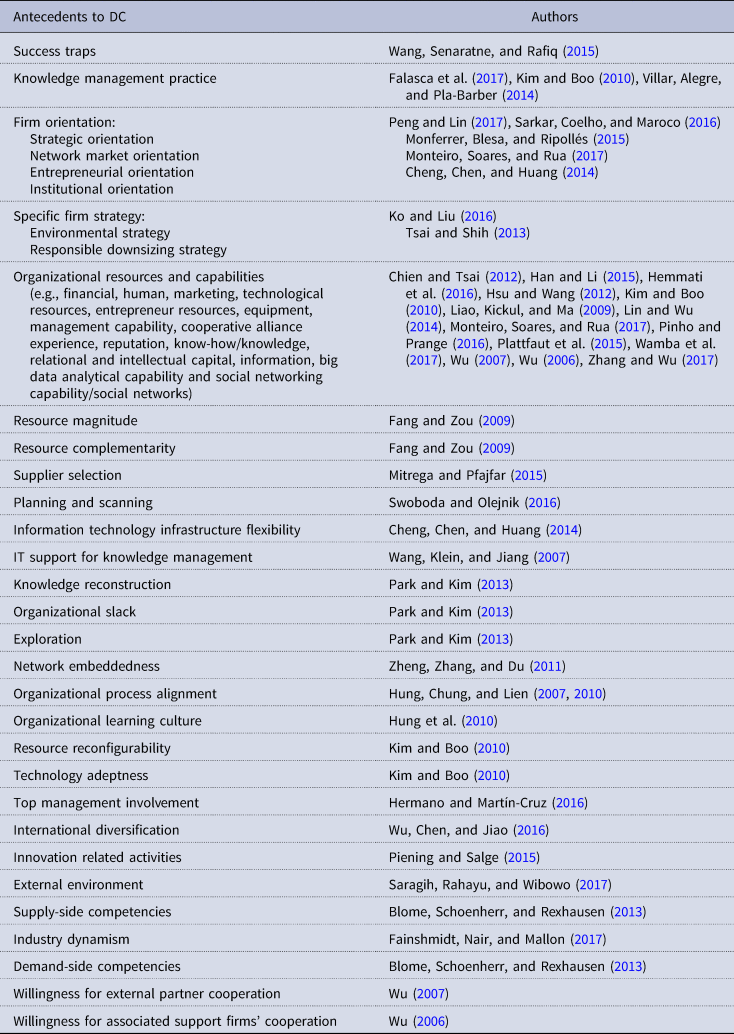

Antecedents to dynamic capabilities

Antecedents refer to the factors, which affect the emergence of DCs (Eriksson, Reference Eriksson2014). For obvious reasons, the direct approach does not acknowledge antecedent for DCs for empirical purposes. However, scholars guided by the second type of relationship (Table 2) have generally recognized the existence of antecedent of DCs, in the assessment of the relationship between DCs and performance, presented in Table 5.

Table 5. Antecedents/influencers to DCs

From Tables 2 and 5, it becomes apparent that scholars continue to remain interested in the origins of DCs. Consistent with Teece, Pisano, and Shuen (Reference Teece, Pisano and Shuen1997) original presentation of the DC perspective and in line with the findings of Schilke, Hu, and Helfat (Reference Schilke, Hu and Helfat2018), existing resources continue to receive attention among relevant organization-level drivers of DCs. Internal operational resources and capabilities that enable a firm to perform activities on an on-going basis, maintaining status quo (Vijaya, Ganesh, & Rahul, Reference Vijaya, Ganesh and Rahul2019), seems to be the choice of election concerning the antecedents to DCs, followed by strategic variables, such as firm orientation (e.g., Peng & Lin, Reference Peng and Lin2017; Sarkar, Coelho, & Maroco, Reference Sarkar, Coelho and Maroco2016) and firm strategy (e.g., Tsai & Shih, Reference Tsai and Shih2013). Scholars have argued that resource-rich firms tend to have greater capability to plan, execute and maintain strategic change (Fang & Zou, Reference Fang and Zou2009; Helfat & Peteraf, Reference Helfat and Peteraf2009; Schilke, Hu, & Helfat, Reference Schilke, Hu and Helfat2018). The existent resource base within a firm has been found to be conductive to DCs, facilitate and influence its development, among them, financial resources (e.g., Monteiro, Soares, & Rua, Reference Monteiro, Soares and Rua2017), technological resources (e.g., Liao, Kickul, & Ma, Reference Liao, Kickul and Ma2009) and entrepreneur resources (e.g., Wu, Reference Wu2007). This indicates that the majority of the studies adopting the second example of relationship assumes that DCs have somewhat of a mediating effect for achieving superior firm performance. Of these, few authors have included external variables as antecedents. For example, Saragih, Rahayu, and Wibowo (Reference Saragih, Rahayu and Wibowo2017) concluded that DCs act as a mediator between the external environment (e.g., technological and economic change, barning power of supplier and rivalry) and business performance, while Fainshmidt, Nair, and Mallon (Reference Fainshmidt, Nair and Mallon2017) found that firms operating in dynamic industries develop stronger asset management capabilities. These investigations highlight that firms' efforts to build DCs do not occur in a vacuum, but are substantially affected by the broader organizational environment (Schilke, Hu, & Helfat, Reference Schilke, Hu and Helfat2018). The inclusion of macro environmental variables, as antecedents to DCs has been modest, as these have predominantly been included as moderators. This is one notable aspect of the DC–performance research, that is, several of the antecedents in the framework depicted in Table 5 are also used as moderators of the relationship. For example, environmental/industry dynamism has both been stated to be an antecedent to DC (Fainshmidt, Nair, & Mallon, Reference Fainshmidt, Nair and Mallon2017; Saragih, Rahayu, & Wibowo, Reference Saragih, Rahayu and Wibowo2017) and a moderator of the DC–performance effect (Schilke, Reference Schilke2014b). Overall, it becomes clear that there is not a single source for DC, in line with the results of Schilke, Hu, and Helfat (Reference Schilke, Hu and Helfat2018). In fact, despite the largely consistent findings regarding the facilitating role of the existing resource base in the development of DC, Schilke, Hu, and Helfat (Reference Schilke, Hu and Helfat2018) further argue that scholars should be aware that the relationship between operational resource and capabilities, DCs and outcomes may be more complicated that originally assumed within this type of postulated relationship (Example 2, Table 2).

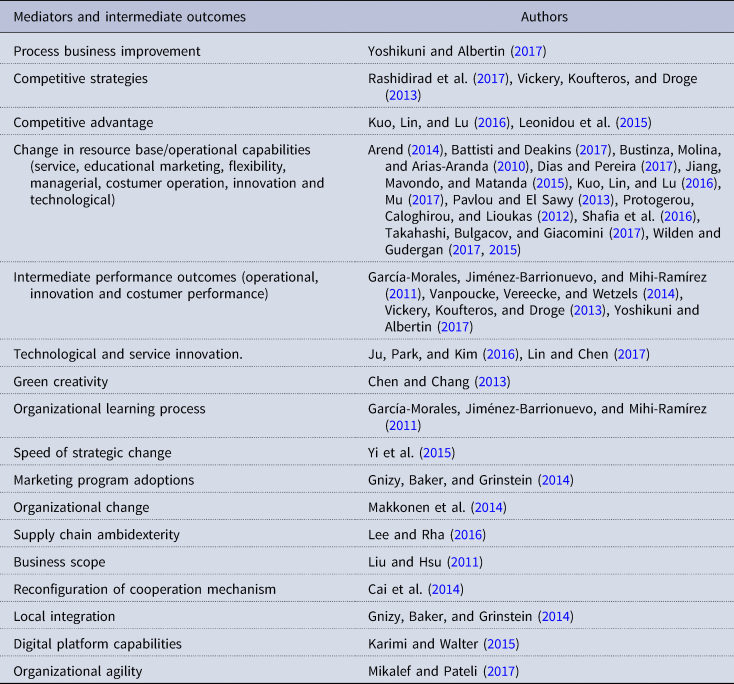

Mediators and intermediate outcomes of dynamic capabilities

The researchers adopting the third and fourth example regarding the type of relationship presented in Table 2 acknowledge that DCs enable superior performance, by adding worth to a firm, through systematic change, for example, by altering its operational capabilities or resource base to facilitate strategic management (Vijaya, Ganesh, & Rahul, Reference Vijaya, Ganesh and Rahul2019) or enhance operational efficiency and enable an increased alignment with the environment (Di Stefano, Peteraf, & Verona, Reference Di Stefano, Peteraf and Verona2014; Peteraf, Di Stefano, & Verona, Reference Peteraf, Di Stefano and Verona2013). As evidenced by Table 6, examples of the mediators and intermediate outcomes of DC applied so far are speed of strategic orientation (Yi et al., Reference Yi, He, Ndofor and Wei2015), process business improvement (Yoshikuni & Albertin, Reference Yoshikuni and Albertin2017), competitive advantage and strategies (e.g., Kuo, Lin, & Lu, Reference Kuo, Lin and Lu2016), change in operational capabilities (service, marketing, managerial, innovation and technological capabilities) (Pavlou & El Sawy, Reference Pavlou and El Sawy2013; Protogerou, Caloghirou, & Lioukas, Reference Protogerou, Caloghirou and Lioukas2012), organizational change (Makkonen et al., Reference Makkonen, Pohjola, Olkkonen and Koponen2014), change in process flexibility and efficiency (operational performance) (Vanpoucke, Vereecke, & Wetzels, Reference Vanpoucke, Vereecke and Wetzels2014) and technological and service innovation (e.g., Ju, Park, & Kim, Reference Ju, Park and Kim2016; Lin & Chen, Reference Lin and Chen2017).

Table 6. Mediators and intermediate outcomes

More consistent with the theoretical positions of Eisenhardt and Martin (Reference Eisenhardt and Martin2000), Zott (Reference Zott2003), Zahra, Sapienza, and Davidsson (Reference Zahra, Sapienza and Davidsson2006), among others, these studies have argued that DCs immediate purpose is to change the resource base, and that this change or renewal, in turn, explains performance variations. According to this argument, changes serve as mediators or intermediate variables, through which DCs affect performance (Schilke, Hu, & Helfat, Reference Schilke, Hu and Helfat2018). Commonly in the studies hypothesizing the third or fourth type of relationship, DCs were found to help firms to bring about organizational change as well as to learn a variety of activities (Schilke, Hu, & Helfat, Reference Schilke, Hu and Helfat2018). The most popular choice for measuring intermediate outcomes is incorporating change in a firm's resource base, that is, measuring the improvement of operational resources. These changes are the causal mechanisms through which DCs affect performance outcomes (Schilke, Hu, & Helfat, Reference Schilke, Hu and Helfat2018). For instance, Protogerou, Caloghirou, and Lioukas (Reference Protogerou, Caloghirou and Lioukas2012) found that DCs support and allow the firm to explore the existing resources, enhancing the reconfiguration and development of new marketing and technological capabilities, which in turn lead to higher competitive performance in terms of market share and profitability. These authors argue, for example, that the effective and efficient realizations of coordination processes, seen as DCs, enhance the integration of tacit and codified knowledge, allowing firms to more cost effectively deliver their products and acquire more information about their customers' needs. Furthermore, change and improvements have been assessed in a variety of ways. For example, Makkonen et al. (Reference Makkonen, Pohjola, Olkkonen and Koponen2014) measured change as new organizational structure embodying the operational capabilities resulting from the DCs as a proxy for organizational change. Yi et al. (Reference Yi, He, Ndofor and Wei2015) viewed the intermediate effect of DCs on performance as speed of strategic change, which consists of the decision-making speed and the speed to implement new strategies.

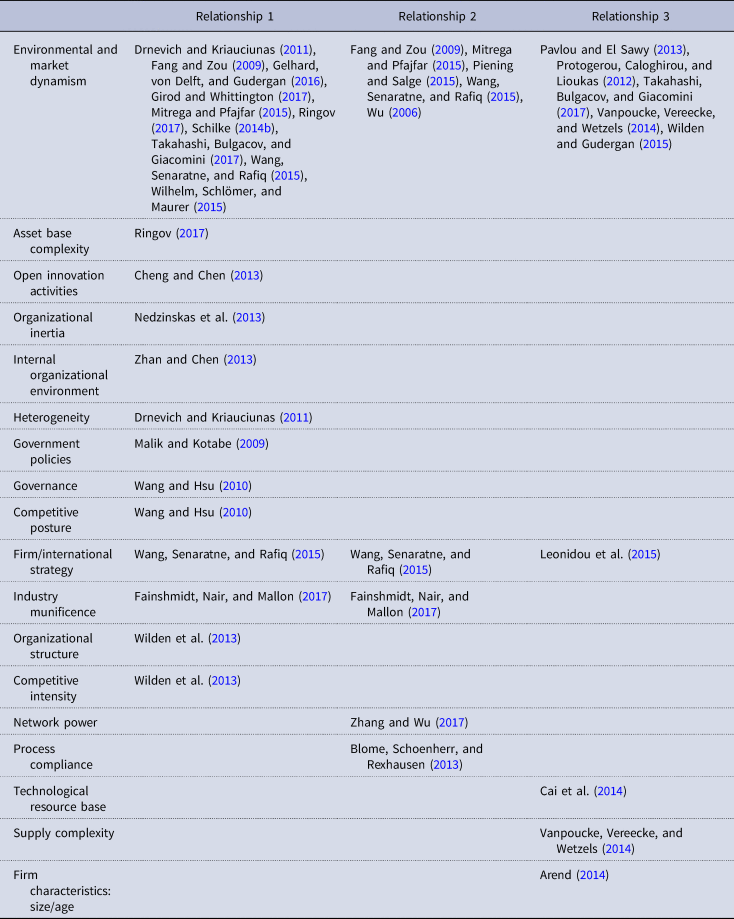

Influencing factors of the dynamic capability–performance relationship

Eriksson (Reference Eriksson2014) found that prior literature has addressed external factors as antecedents for developing DCs. Although this might be true, some studies (see Table 7) seem to consider that the various endogenous and exogenous factors ought to be addressed as moderators rather than antecedents, defending that these affect the strength of the relationship between DCs and consequences (Schilke, Hu, & Helfat, Reference Schilke, Hu and Helfat2018). Many authors, regardless of the direct or indirect approach, used changing environmental conditions as the prime-selection moderator, such as environmental dynamism (e.g., Girod & Whittington, Reference Girod and Whittington2017; Wilhelm, Schlömer, & Maurer, Reference Wilhelm, Schlömer and Maurer2015), technological turbulence (Wilden & Gudergan, Reference Wilden and Gudergan2015), environmental volatility (Wu, Reference Wu2010), market dynamism (Wang, Senaratne, & Rafiq, Reference Wang, Senaratne and Rafiq2015), supply complexity (Vanpoucke, Vereecke, & Wetzels, Reference Vanpoucke, Vereecke and Wetzels2014), government policies (Malik & Kotabe, Reference Malik and Kotabe2009) and competitive intensity (Wilden et al., Reference Wilden, Gudergan, Nielsen and Lings2013). Others have also incorporated firm-specific moderators such as the firm strategy (e.g., Leonidou, Leonidou, Fotiadis, & Aykol, Reference Leonidou, Leonidou, Fotiadis and Aykol2015; Wang, Senaratne, & Rafiq, Reference Wang, Senaratne and Rafiq2015), organizational structure (Wilden et al., Reference Wilden, Gudergan, Nielsen and Lings2013), technological resource base (Cai, Chen, Li, & Liu, Reference Cai, Chen, Li and Liu2014) and firm characteristics, such as size and age (Arend, Reference Arend2014).

Table 7. Moderators

From Table 7 it becomes apparent that the authors testing the second and third type of relationship did not as commonly include moderating factors in their study. In fact, only eight articles adopting relationship 2 and nine adopting relationship 3 included moderators. The only author (Makkonen et al., Reference Makkonen, Pohjola, Olkkonen and Koponen2014) testing the fourth relationship did not include any moderator. Even though moderators are not always included, this could indicate that the DC–performance literature is indeed moving, though slowly, towards the integrating of a contingency perspective. These studies represent an important refinement of empirical work on the consequences of DC, as they rest on the recognition that such effects tend to be highly context specific (Schilke, Hu, & Helfat, Reference Schilke, Hu and Helfat2018). For example, Schilke (Reference Schilke2014a) finds that the DC–performance link is to be stronger under intermediate levels of environmental dynamism, the most frequently studied moderator. Generically, the moderating variables have been evidenced to moderate effects of DCs, which indicates that DCs can vary with levels of turbulence in the external environment and internal firm-specific factors, suggesting that their effects on firm performance are somehow context-dependent. The vast use of external conditions as moderators is not surprising, since it has been widely encouraged theoretically. Actually, it has been argued that DCs are more valuable in unstable environments (Teece, Pisano, & Shuen, Reference Teece, Pisano and Shuen1997). DCs may create market change not only respond to it (Eisenhardt & Martin, Reference Eisenhardt and Martin2000). This indicates that DCs and the environment evolution are not separate phenomena. They are context dependent (Winter, Reference Winter2003), which makes it hard to generalize its influence on performance, without taking into account these context specific moderators. Furthermore, this leads to arguing that future direction for DC studies could be worked towards a contingency perspective, recognizing the environmental features, as moderators, cannot be excluded when analysing the DCs' influence on performance. Rather than seeking formulas for generalized effectiveness, it is important to recognize that the DCs contribute to performance, depending on the firm context. In a similar vein, contingency theory suggests that firm performance depends on the alignment of the organization with the environment (external fit), and the congruence of organizational elements with one another (internal fit) (Wilden et al., Reference Wilden, Gudergan, Nielsen and Lings2013). Thus, for future research, the inclusion of both organization specific and environmental moderators seems pertinent and necessary. In fact, Schilke, Hu, and Helfat (Reference Schilke, Hu and Helfat2018) defend that studies including moderators, when assessing the DC–performance relationship, help culminate and address earlier criticisms regarding the DCV's ill-defined boundary conditions.

Performance measures

A considerable variation of performance outcomes is verified when analysing the literature. These are presented in Table 8, according to the type DC–performance relationship.

Table 8. Performance measures

As evidenced by Table 8, regardless of the type of hypothesized relationship, a considerable variation on what constitutes performance and how it should be operationalized is denoted. Many of the studies focus on firm/organizational performance in general (e.g., Sarkar, Coelho, & Maroco, Reference Sarkar, Coelho and Maroco2016; Vanpoucke, Vereecke, & Wetzels, Reference Vanpoucke, Vereecke and Wetzels2014; Wamba et al., Reference Wamba, Gunasekaran, Akter, Ren, Dubey and Childe2017), whereas others consider, for example, innovation performance (e.g., Falasca et al., Reference Falasca, Zhang, Conchar and Li2017; Makkonen et al., Reference Makkonen, Pohjola, Olkkonen and Koponen2014; Wu, Lin, & Hsu, Reference Wu, Lin and Hsu2007), competitive/strategic performance (e.g., Fang & Zou, Reference Fang and Zou2009; Hemmati, Feiz, Jalivand, & Kholghi, Reference Hemmati, Feiz, Jalivand and Kholghi2016; Shafia, Shavvalpour, Hosseini, & Hosseini, Reference Shafia, Shavvalpour, Hosseini and Hosseini2016) and economic/financial performance (e.g., Fainshmidt, Nair, & Mallon, Reference Fainshmidt, Nair and Mallon2017; Mu, Reference Mu2017; Ringov, Reference Ringov2017). These seem to be the preferred outcome variables when assessing the DC–performance relationship, transversal to all types of relationship presented in Table 2. Thus, the most frequent conceptualization of performance is firm/organizational performance in general, followed by financial and economic based performance and innovation performance. It is striking that none of the articles regarding the third type of relationship denominated their final performance outcome as general innovation performance, an otherwise fairly used indicator. Only one study has included the evolutionary fitness construct as the final desired performance outcome (Makkonen et al., Reference Makkonen, Pohjola, Olkkonen and Koponen2014) (Example 4, Table 2). By including the final performance outcome variable as evolutionary fitness, it embraces one on the fundamental aspects when investigating DCs, namely, the time/sustainability aspect (Eisenhardt & Martin, Reference Eisenhardt and Martin2000; Teece, Reference Teece2018), including indicators such as survival, growth and flexibility (Helfat & Peteraf, Reference Helfat and Peteraf2009; Schilke, Hu, & Helfat, Reference Schilke, Hu and Helfat2018)

Because of this predominating wide-ranging performance approach, a need for investigating more specific aspects of performance to match existing practices in empirical work, rather than simply talking about performance in general when analysing the DC–performance relationship (Wilden, Devinney, & Dowling, Reference Wilden, Devinney and Dowling2016), is implied. Accordingly, some researchers have looked at more domain specific performance outcomes such as export performance (Monteiro, Soares, & Rua, Reference Monteiro, Soares and Rua2017), accounting process performance (Prasad & Green, Reference Prasad and Green2015), portfolio performance (Hermano & Martín-Cruz, Reference Hermano and Martín-Cruz2016; Mitrega & Pfajfar, Reference Mitrega and Pfajfar2015) and product development performance (e.g., Park & Kim, Reference Park and Kim2013) and operational performance, including for example, flexibility and delivery improvement and innovation enhancement (Ju, Park, & Kim, Reference Ju, Park and Kim2016). These studies show that DCs can enhance a variety of domain-specific performance outcomes. For example, Hermano and Martín-Cruz (Reference Hermano and Martín-Cruz2016) reported a positive mediating influence of portfolio DCs on portfolio performance. However, the assessment of these more specific performance outcomes is mostly denoted in the first and second types of relationships. In fact, there is not denoted as strong a variation in the performance measures as for the anterior relationships. Although this approach is relatively low represented in the sample, these are in line with anterior recommendations (Schilke, Hu, & Helfat, Reference Schilke, Hu and Helfat2018) regarding the selection of outcome variables more closely related to the study's focal type of capability, instead of using a broad and aggregated measures. For example, even though a DC may be highly beneficial, a firm may still lack in overall performance for other reasons, making it more difficult to detect an effect of DCs (Schilke, Hu, & Helfat, Reference Schilke, Hu and Helfat2018).

Mainly subjective measures are used and the two most apparent ways to conceptualize performance are: (1) firm performance as a latent broad construct with the various dimensions and (2) performance as separate constructs; e.g. new product development performance and financial performance (Mu, Reference Mu2017) and non-financial and financial performance (Hang, Baizhou, & Jianxin, Reference Hang, Baizhou and Jianxin2014). The vast majority of the studies adopt way 1 to assess performance, using an aggregated measure, including both financial and non-financial subjective indicators to measure broad firm-level performance. The most frequently used indicators are a combination of market share, sales, growth, profit and competitive advantage. Only one study was found to exclusively rely on non-financial measures for assessing firm performance, such as production method flexibility and product efficiency (Wu, Reference Wu2006).

Another noteworthy mentioning is the almost absolute reliance managers' evaluations to evaluate both DCs and performance, compared to their competitors based on Likert scales (e.g., Dias & Pereira, Reference Dias and Pereira2017; Mikalef & Pateli, Reference Mikalef and Pateli2017; Shafia et al., Reference Shafia, Shavvalpour, Hosseini and Hosseini2016; Wamba et al., Reference Wamba, Gunasekaran, Akter, Ren, Dubey and Childe2017; Wilden & Gudergan, Reference Wilden and Gudergan2015). In these studies, scores for both DC-related variables and performance were obtained from the same informant. This means that the same survey responses are used to construct both the independent and dependent variables, resulting in potential common method variance and the phenomenon of the halo effect (Laaksonen & Peltoniemi, Reference Laaksonen and Peltoniemi2016). The halo effect is a strong overall impression that blurs distinctions between dimensions or attributes, resulting in overestimating of their own capabilities and performance, which may lead to misleading results (Nakayama & Sutcliffe, Reference Nakayama and Sutcliffe2005). The tendency is for managers to evaluate their resources, practices, capabilities etc. according to their performance-level, without been able to evaluate items independently of each other (Laaksonen & Peltoniemi, Reference Laaksonen and Peltoniemi2016; Nakayama & Sutcliffe, Reference Nakayama and Sutcliffe2005). Hence, firm with better previous performance tends to receive a more favourable evaluation in such survey-based ratings on capabilities, than those with poor performance (Santhanam & Hartono, Reference Santhanam and Hartono2003). As noted by Laaksonen and Peltoniemi (Reference Laaksonen and Peltoniemi2016), this is a serious concern in DC–performance investigations, recommending the use of different data sources for DC and performance. Lastly, it was found to be rather common for data to be collected on past performance, in line with the conclusions of Laaksonen and Peltoniemi (Reference Laaksonen and Peltoniemi2016). In the future, this can turn out to be problematic as current DCs impact on future and not past performance (Eriksson, Reference Eriksson2013). Thus, another line for future research presents itself, trying to mitigate this problem.

Conclusions

The synthesizing analysis of the different investigated DC–performance relationships and the mapping of inherent variables can help bring more structure and coherence to the scattered DC literature, allowing a comprehension of what have been assessed and achieved so far. Despite the challenges in categorizing findings from very distinct articles, this paper tries to evidence where results are consistent and ambiguous, highlighting some concerns and research lacks. From the analysis it becomes clear; indeed, a major reason for the ongoing interest in DCs, is their potential for influencing a firm's performance (Zahra, Sapienza, & Davidsson, Reference Zahra, Sapienza and Davidsson2006). However, the literature is greatly scattered and the DC effects remain unclear because of the variety of conceptualization, nature of variables and measurements. At this stage, it seems that the DCV still lacks consensual conceptualizations that allow general comparisons of empirical studies and advance for the theoretical and empirical understanding of the impact of DCs on performance.

Two divergent groups of conceptual natures of the investigated DC–performance relationship were found. The indirect approach is by far the most dominant. The large volume of studies assuming a direct relationship is quite surprising. Although this is supported by early conceptual contributions, the promotion of an indirect relationship has been a conceptual concern for quite some time. It is therefore recommended for future research to give DCs an indirect role when examining performance outcomes. The representation of the underlying assumptions regarding DCs such as the element of change (intermediate outcomes) and sustainability (evolutionary fitness) should also be incorporated, trying to consolidate theoretical foundation with methodology and overcome the critique of DCs being tautologically linked to performance.

The analysed empirical evidence appears to employ a continuum of conceptualization of DCs, ranging from very specific to a far more generic set of variables. Measuring DCs as more generic seems to be the most common choice. As a whole, overlapping is widely present in the empirical DC literature, making it a challenge trying to compare or even catalogue results. For starters, a recommendation for future studies is clearly distinguishing operational capabilities from DCs. A more consolidated approach to differentiate organizational antecedents that can facilitate the deployment of the DCs, mediators and intermediate outcomes from the DC concept itself is needed. Future research ought to strike to achieve a congruence of the concept of DC to ensue proper assumptions and take a clear stand of the nature of DCs, trying not to mix a variety of distinct conceptual perspectives. Widely accepted quantitative measures that can respect the nature of DC are important for more robust results. The evidence also indicates that the effects of DCs on performance are somehow context-dependent. This leads to arguing that future studies could be worked towards a contingency perspective, recognizing the impact of environmental and internal features.

The performance indicators used in the empirical research are varied. The majority use subjective measures for assessing firm performance either as an aggregated construct. The more complex studies employ a combination of subjective and objective measures. The predominating wide-ranging performance approach implies that future studies could investigate more specific aspects of performance. The use of different sources for DCs and performance data, trying to avoid the potential halo effect and measurement biases should be a methodological concern. Additionally, as it was found to be rather common for data to be collected on past performance and the current status of DC, a potential controversy may arise, because of current DC impacts on future. Future studies should try to mitigate this by incorporating time into research designs.

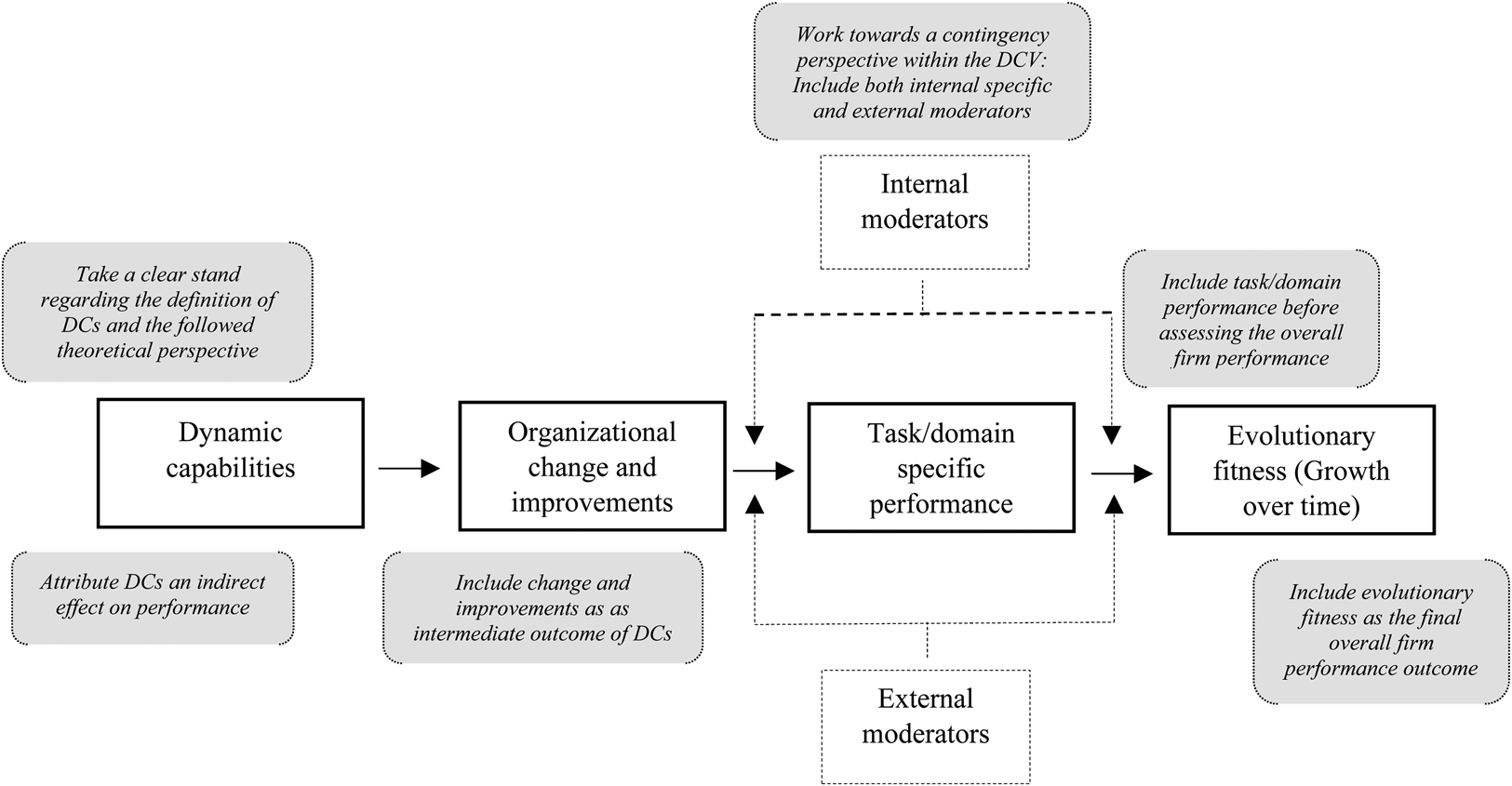

In sum, the most prominent approach for future research seems to be that DCs per se do not cause directly superior firm performance, but rather cause chance, that leads to intermediate outcomes, such as change of operational capabilities and process-level performance. DCs appear to be necessary but not a sufficient condition for achieving superior performance directly. The relationship between DCs and firm performance is more complex than put out to be in the direct approach, as their effects seem to be mediated by operational capability change and development, while simultaneous being contingent upon both internal and external moderators. A suggesting for empirically assessing the relationship between DCs and performance is illustrated in Figure 2.

Figure 2. Proposed conceptual model for assessing the influence of DCs on performance.

This paper serves as a reinforcement of more recent arguments defending an indirect DC–performance relationship, providing future investigations with a fundament for conceptual and hypothesis developments, when it comes to empirically analyse DCs' influence on performance and its related outcome. As such, resumed recommendations for future research are presented: Firstly, in order to avoid inconsistency and simultaneously facilitate the operationalization and measurement of DCs, it could be beneficial for scholars to take a clear stand regarding the adopted theoretical perspective right from the beginning. A decision on whether DCs are to have a direct or indirect influence, going to be assessed as organizational and strategic processes and routines or viewed as best-practices or unique abilities, skills or capacities and operationalize them accordingly. Another fundamental aspect when empirically studying DCs is to assure consistency about the level of analysis. It is worth defining as for whether the concern is with individual managers or the organization as a whole.

Based on the analysis, it is implied that future studies could benefit from attributing DCs an indirect role when assessing its consequences. Including change and improvements as the intermediate outcome of DCs seems highly pertinent, in order to assure theoretical congruence, for example, by applying a configurational framework to assess both task specific performance and firm performance, while considering the DCs' effect on intermediate outcomes, such as strategic and operational capability change. The task/domain specific performance is recommended to be included before assessing overall firm performance. To upgrade and assure further empirical refinement of the DC–performance relationship, the construct of evolutionary fitness, as the final overall firm performance outcome, ought to be introduced.

Moreover, the DC–performance literature could gain from working towards a contingency perspective within the DCV, including both internal specific and external moderators. Finally, it is recommended for future studies to use different sources for DC data and performance data, along with longitudinal data in order to properly assess the change over time aspect.

Despite contributions, this review naturally has limitations. Firstly, this study only includes quantitative studies, which may have influenced the overall results. Secondly, the review draws only on articles from one research base, which could cause the exclusion of some relevant papers. Along the same line, the article selection and interpretations are based on a single evaluation, by which personal opinion and judgement may have prevailed and influenced. Thus, interpretations and the mapping of the conceptualizations should not be viewed as deterministic.