1. Introduction

Hydrogen is becoming an increasingly important element in the global energy transition, including in China.Footnote 1 Developing China's hydrogen economy requires ambitious regulatory reforms,Footnote 2 but hydrogen policy and regulation in China largely remains under-researched, in contrast to the attention given to the topic in the European Union (EU), the United States (US), and Australia.Footnote 3 This is an important gap in the literature, given the impact that China, as a major energy consumer and emitter of greenhouse gases, is expected to have on how the hydrogen sector develops globally.Footnote 4 Thus, understanding China's regulatory developments in the field of hydrogen is relevant to the debate on the role of hydrogen for global decarbonization efforts.

The legal literature on hydrogen has helped to identify common barriers to the development of hydrogen,Footnote 5 proposed regulatory best practices to overcome these barriers,Footnote 6 and examined regulatory pathways to the establishment of a hydrogen market.Footnote 7 In the context of this debate, what is China's regulatory approach to the development of hydrogen technologies? Drawing on the findings of the existing legal literature on hydrogen, this article critically examines China's hydrogen regulation. Specifically, it focuses on hydrogen refuelling stations and fuel cell vehicles, which have been prioritized by China's local and national authorities to date.

Besides its relevance to the global hydrogen industry and the study of regulatory approaches to hydrogen, China's case is of broader theoretical significance for the transnational environmental law scholarship on regulatory decentralization. The Chinese government has adopted the National Hydrogen Development Plan,Footnote 8 but most concrete actions to develop a hydrogen economy have been taken by local governments. As explained in the literature on the decentralization of environmental regulation and ‘environmental federalism’, in many jurisdictions experimentation at the subnational level has played an important role in developing innovative new regulatory approaches, allowing policy learning to take place ahead of national harmonization.Footnote 9 Previous analyses of the decentralization of environmental (and, in particular, climate) governance and federalism have provided insights into a number of major economies, including those of the EU,Footnote 10 US,Footnote 11 Canada,Footnote 12 Australia,Footnote 13 and Russia.Footnote 14 The role of local hydrogen initiatives in China represents an important yet under-researched case in the study of decentralization in environmental regulation.

Against this background, we examine both China's national policy and the acts adopted by the provincial and municipal authorities that have led to the development of hydrogen. Our analysis of the relevant legal texts is complemented by interviews, which shed additional light on the application of the relevant legal framework, and thus bridge the gap between legal theory and practice. The interviews were conducted in 2022 and early 2023 with five practising lawyers with relevant advisory experience in the energy sector (coded HL1 to 5), and with five energy policy analysts researching China's hydrogen economy (coded HP1 to 5) (see Appendix 1 for background information). These experts commented on national and local hydrogen policy and regulation, and expressed their views on the regulatory support required to develop hydrogen projects in China (see interview questionnaire in Appendix 2).

Our analysis of China's hydrogen regulation shows how, with limited regulatory action at the central level, local governments have played a critical role in developing China's hydrogen industry. Although total production of green hydrogen in China remains limited, important progress has been made, through local regulation, with the development of hydrogen refuelling stations and fuel cell vehicles. China's experience is relevant for the broader debates on hydrogen regulation and environmental decentralization, as it illustrates how local action can be instrumental in addressing national regulatory barriers to hydrogen and providing support for this new industry. At the same time, the case of China shows that local initiatives can result in a certain degree of market fragmentation and protectionism. Building on the theory on clean energy federalism and decentralization, we argue that this fragmentation and protectionism require central coordination to avoid harming the further development of China's hydrogen industry. In this process, local regulatory experimentation and international best practices provide valuable inputs for future national hydrogen regulation.

This article is structured as follows. Section 2 introduces the theory on hydrogen regulation and the transnational environmental law scholarship on decentralization/federalism to which this article contributes. Section 3 briefly presents China's hydrogen strategy, and the varying ambitions of the central and local governments. Sections 4 and 5 focus on local initiatives, by firstly looking at the removal of regulatory barriers to the development of hydrogen projects, followed by an analysis of support mechanisms. With this local regulatory experimentation in mind, Sections 6 and 7 critically reflect on the need for a harmonized framework for hydrogen in China, before summarizing the key contribution of our study to the theory on hydrogen regulation and environmental decentralization.

2. Theory on Hydrogen Regulation and Decentralization

In parallel with the increasing attention on hydrogen,Footnote 15 there is growing interest in the regulatory reforms that are needed to enable the development of this new source of energy. The scholarship on such regulatory reforms provides an important basis for understanding the national regulatory barriers to hydrogen in China, including the regulation of hydrogen as a hazardous chemical and the absence of harmonized rules governing the hydrogen infrastructure and the subsidization of hydrogen projects. Reciprocally, understanding China's approach to hydrogen, and, in particular, its focus on fuel cell vehicles and refuelling stations, is highly relevant for the broader debate on hydrogen regulation, given China's role as the largest hydrogen producer in the world and its significant influence on the international energy market.Footnote 16

Besides the technical aspects of hydrogen regulation, the transnational environmental law theory on decentralization and federalism provides a framework for understanding the role of local authorities in China's hydrogen regulation. In China, the importance of local experimentation has been highlighted not only in the governance of its economic rise and technological developmentFootnote 17 but also in its climate and energy policy.Footnote 18 Local experimentation has helped to address certain national regulatory barriers to hydrogen but has created new obstacles of market fragmentation and protectionism that, according to environmental decentralization theory, require central coordination.Footnote 19

2.1. The Role of Regulation in Enabling Hydrogen Development

In the debate on the regulation of hydrogen, scholars, legal practitioners, and industry experts firstly focus on its legal nature and, in particular, its characterization as an energy carrier or a dangerous chemical.Footnote 20 Hydrogen has long been used in the chemical industry.Footnote 21 Because hydrogen is highly flammable, its production, transportation, and use have been subject to the stringent regulations applicable to dangerous chemicals.Footnote 22 Complying with these strict regulatory requirements increases the transaction costs for companies in the sector and can delay the realization of hydrogen projects.Footnote 23 By contrast, categorizing hydrogen as an energy carrier and subjecting it to energy regulation allows broadening its use beyond the chemical industry.Footnote 24 Its flammability is manageable by improving the protocols for the safe handling of hydrogen in energy applications, drafting safety standards for hydrogen use, and developing safety practices.Footnote 25 The consensus, therefore, is that, to facilitate the deployment of hydrogen, it is necessary to regulate it as an energy carrier and to formulate new safety standards where existing standards do not adequately reflect the characteristics of this new technology development.Footnote 26

In the context of the energy transition, it is essential to distinguish between the various forms of hydrogen in use and their very different carbon footprints.Footnote 27 Hydrogen is most commonly categorized as grey, blue, green or renewable, and pink.Footnote 28 Green/renewable hydrogen is produced through water electrolysis powered by renewable electricity, while pink hydrogen is produced from nuclear power.Footnote 29 Both blue and grey hydrogen are produced from fossil fuels, but in the case of the former carbon emissions are captured and stored underground.Footnote 30 To recognize the contribution of hydrogen to decarbonization, the different types of hydrogen and their respective carbon footprints must be subject to certification and tracing.Footnote 31

Introducing climate-friendly hydrogen broadens the use of renewable energy power and thus cannot be isolated from renewable energy development.Footnote 32 States have an important role in supporting the creation of hydrogen markets by securing the offtake of hydrogen at a sufficiently attractive price,Footnote 33 as has been the case with the development of electricity production from renewable energy sources. A case in point is the introduction of feed-in tariffs, which catalyzed the deployment of solar and wind energy and enabled production to be scaled up and costs to be reduced.Footnote 34 The creation of demand for hydrogen via policy and regulation will also be needed to stimulate hydrogen production at scale.Footnote 35 As hydrogen does not yet account for a large share of global energy consumption, support mechanisms (such as investment aid, taxation benefits, auctions, and contracts for difference) are essential to create an enabling environment for investment.Footnote 36

To facilitate the development of the infrastructure on which the hydrogen economy depends,Footnote 37 it is necessary to clarify the administrative procedures governing the construction and operation of this infrastructure.Footnote 38 As hydrogen transportation networks will inherit the natural monopoly character of the current gas transmission networks, states also need to determine whether to require the separation (or unbundling) of infrastructure and storage activities from production and supply, and how to organize access to the networks.Footnote 39 Because repurposing existing gas pipelines can be cheaper than building new pipelines, regulators must also consider how to regulate the blending of hydrogen with natural gas and how to repurpose these gas pipelines.Footnote 40 Key issues are whether hydrogen falls within the definition of gas under gas regulations, and how safety codes can be developed for the injection of hydrogen into gas pipelines.Footnote 41 Regulations should also focus on the deployment of hydrogen refuelling stations, required to supply fuel cell vehicles.Footnote 42

A key challenge in the development of the regulatory framework governing hydrogen, and the generating of investment in the field, is the uncertainty that characterizes this new industry, requiring flexibility and experimentation.Footnote 43

2.2. Decentralization and Experimentation in Environmental Regulation

The development of hydrogen faces many uncertainties. Firstly, it remains uncertain whether green hydrogen and its derivatives will play a leading role in a future energy system, because of unresolved technical and resource-related questions.Footnote 44 Secondly, the infrastructural development is at an early stage, and it is not yet clear which mode of hydrogen transport will prevail.Footnote 45 Thirdly, it is difficult to predict both the end-use sectors where hydrogen will play a major role, and its more general role in stabilizing an energy system dominated by renewable resources.Footnote 46 In this context, local experimentation has a role to play in the development of regulatory responses to the uncertainties characterizing the hydrogen industry.

Experimentation in environmental governance by subnational (or decentralized) authorities has played an important role in the development of new mechanisms of energy and climate regulation.Footnote 47 Within the EU, for instance, national policy and regulation sometimes function as de facto experiments before being adopted generally by the EU.Footnote 48 In a similar vein, the literature on ‘clean energy federalism’ highlights the role that subnational authorities may play in stimulating policy innovation.Footnote 49 Regions have served as ‘laboratories’ to test various clean energy policy instruments, and have helped to overcome the climate policy inaction of the central government.Footnote 50

Compared with national regulators, decentralized authorities can be better positioned and equipped to elaborate appropriate policies to tackle specific environmental and energy problems that vary in scope and intensity from place to place.Footnote 51 Innovative regulatory options at the local level, if successful, could then be incorporated into national laws.Footnote 52 Decentralized policy innovation may be motivated by a range of reasons other than their environmental benefit.Footnote 53 Regions may create their own support mechanisms independently from national initiatives to boost local innovation, promote local economic development, create employment, and potentially take advantage of the export opportunities for new technologies.Footnote 54 Although these decentralized initiatives can help to overcome national inaction, they can also result in inefficiencies because of a lack of coordination,Footnote 55 and potentially lead to legal challenges (for example, under trade, competition, or constitutional law).Footnote 56

Scholars have highlighted the benefits that harmonized clean energy rules provide for industry, and the economies of scale associated with this central coordination.Footnote 57 Convergence towards uniform support schemes reduces transaction costs for investors. The familiarity of companies and financiers with the ‘rules of the game’ facilitates their understanding of the regulatory framework and could thus help with investment decisions. A centralized approach also offers the benefits of ‘learning effects’ derived from cumulative volume of production (economies of scope).Footnote 58

The literature on clean energy federalism and regulatory experimentation thus highlights the trade-offs between regulating the hydrogen economy at the national level of government, which may reduce transaction costs and promote economies of scale and scope, and the benefits of local regulatory innovation and learning, driven by economic benefits and flexibility. These trade-offs are discussed in the following section in the context of an emerging hydrogen economy in China, characterized by an significant degree of regulatory experimentation and innovation at the provincial and local levels.

3. China's Hydrogen Policy

With a volume of 35 million tons at the end of 2022, China's hydrogen production accounts for approximately one third of the global output.Footnote 59 However, most of China's hydrogen is still produced from coal,Footnote 60 with renewable hydrogen production amounting only to 56,000 tons in 2022.Footnote 61 Hydrogen is utilized primarily in the refinery and chemical industries.Footnote 62 To meet this demand, China has developed a hydrogen transportation infrastructure, which includes eight pure hydrogen pipelines and five gas pipelines with hydrogen blending.Footnote 63 Hydrogen development has been concentrated mainly in five regions, building on existing chemical capacity (namely, the Beijing-Tianjin-Hebei Region, Yangtze River Delta, Pearl River Delta, the emerging ‘Hydrogen Corridor’ in Henan province, and the Ningdong Energy and Chemical Industry Base).Footnote 64 In parallel, China is manufacturing hydrogen fuel cells, and has started to deploy fuel cell vehicles.Footnote 65 In 2022, China had more than 12,682 licensed fuel cell vehicles,Footnote 66 the third largest stock of such vehicles worldwide (after Korea and the US), and the fastest-growing market, with a 60% increase in 2022.Footnote 67 China also had more than 300 hydrogen refuelling stations in operation, the largest refuelling capacity globally.Footnote 68

In March 2022, the Chinese government adopted its National Hydrogen Development Plan, emphasizing the role of hydrogen in decarbonizing energy consumption and achieving carbon neutrality in hard-to-abate sectors.Footnote 69 The Plan prioritizes fuel cell vehicles (focusing on heavy-duty commercial vehicles), with a target of around 50,000 units by 2025.Footnote 70 To supply these vehicles, the government promotes the development of hydrogen refuelling stations, by converting existing petrol and gas stations and by constructing refuelling stations with on-site hydrogen production. China aims to produce 100,000 to 200,000 tons of green hydrogen per year by 2025.Footnote 71 The 14th Five-Year Plan of Renewable Energy Development, also adopted in 2022, aims to develop demonstration projects for on-grid renewable hydrogen production, referring to hydrogen production from power grids with a large penetration of renewable energy power that is recognized by China's Green Electricity Certificate system,Footnote 72 and off-grid renewable hydrogen production.Footnote 73 Besides green hydrogen, China aims to produce pink hydrogen from nuclear power.Footnote 74

China's national hydrogen targets are complemented by more ambitious local initiatives.Footnote 75 Local hydrogen development plans emphasize boosting the productivity of fuel cells and fuel cell vehicles to develop local value chains in this sector.Footnote 76 The production targets for fuel cell vehicles at the local level (see Table 1) exceed the central government's target. Building hydrogen refuelling stations is another priority at the local level (see Table 2),Footnote 81 while the central government did not disclose its targeted volume of hydrogen refuelling stations.

Table 1. Local Targets for Hydrogen Fuel Cell Vehicles

Source: Authors’ own research, based on local hydrogen development plansFootnote 77 and media reportsFootnote 78

Table 2. Local Targets for Hydrogen Refuelling Stations

Source: Authors’ own research, based on local hydrogen development plansFootnote 79 and media reportsFootnote 80

In the formulation of its hydrogen strategy, China has taken into account the experience of other countries, such as Japan,Footnote 82 which has been committed to hydrogen production from fossil fuels and the development of fuel cell vehicles (passenger vehicles).Footnote 83 However, inadequate attention to renewable hydrogen production is a liability for Japan's energy transition,Footnote 84 and electric vehicles and hybrid vehicles have proven to be more competitive in the passenger vehicles market, compared with fuel cell vehicles.Footnote 85 Building on this experience, China's National Hydrogen Development Plan focuses on the promotion of heavy-duty commercial vehicles and renewable hydrogen production. To achieve its targets, China must remove the existing regulatory barriers to hydrogen, building on the relevant international regulatory experience.Footnote 86

4. Removing Regulatory Barriers to Hydrogen in China

In contrast to other jurisdictions that have started to develop a specific legal basis to facilitate the deployment of hydrogen,Footnote 87 the Chinese government has not yet adopted a national framework on hydrogen, which thus remains subject to China's rules on dangerous chemicals and infrastructure. In this context, regulatory experimentation by local governments has focused on relaxing the existing requirements governing hazardous chemicals imposed on the production, transportation, storage, and use of hydrogen to accelerate the development of this industry, while seeking to ensure the safe operation of hydrogen projects. This experience is relevant to the broader debates on hydrogen regulation and environmental decentralization, as it illustrates the relevance of local experimentation, for example, on the legal status of hydrogen and the permitting of refuelling stations, to overcome national regulatory paralysis.

4.1. Hydrogen under China's Hazardous Chemical Regulation

Under Chinese law, hydrogen is still categorized as a hazardous chemical, and is therefore registered under the 2015 Catalogue of Hazardous Chemicals.Footnote 88 The production, transportation, storage, and use of hydrogen, along with the construction of associated infrastructure, is subject to China's relatively strict Regulation on the Safety Management of Hazardous Chemicals (2002).Footnote 89 In particular, hydrogen production requires a safety production licence for hazardous chemicals and a production licence for industrial products.Footnote 90 Hydrogen storage requires an operation licence for hazardous chemicals,Footnote 91 and the transportation of hydrogen by road is subject to monitoring by the public security authorities.Footnote 92 The use of hydrogen also requires safety permits.Footnote 93

As explained in the hydrogen regulation literature (Section 2.1), the status of hydrogen as a hazardous chemical poses a major obstacle to the development of the industry. In China, it limits the development of hydrogen projects to chemical industrial parks.Footnote 94 As confirmed by our interviewees (HL1 to 5), the regulation of hydrogen as a hazardous chemical (as opposed to an energy carrier) is a barrier to the development of infrastructure projects in the sector. The complex administrative procedures associated with the safety requirements for hazardous chemicals can increase the transaction costs for hydrogen companies and delay the realization of hydrogen projects.Footnote 95 China's experience thereby confirms existing transnational analyses of hydrogen regulation, emphasizing how the legal status of hydrogen has an impact on its development in national energy systems.Footnote 96

To promote the development of local hydrogen value chains, a number of provincial and municipal governments have relaxed the requirement to build hydrogen projects in chemical industrial parks. In Shandong province, for instance, projects that combine renewable hydrogen production and hydrogen refuelling can be built outside chemical industrial parks ‘under safe conditions’.Footnote 97 Similarly, in Guangdong province and the district of Lingang in Shanghai, companies can build hydrogen refuelling stations with on-site hydrogen production in logistics parks, open-air parking lots, and port terminals, provided that their safety can be demonstrated.Footnote 98 The Xinjiang Autonomous Region has promoted demonstration projects for renewable hydrogen production and hydrogen refuelling stations with on-site hydrogen production outside chemical industrial parks by granting favourable treatment to project operators in administrative procedures.Footnote 99 The Wuhan government has defined hydrogen production as the production of an energy carrier ‘under safe conditions’.Footnote 100 There have been two large renewable hydrogen projects in Xinjiang, including the world's largest solar-hydrogen project.Footnote 101 In July 2023, the Hebei provincial government exempted renewable hydrogen production from the licensing requirement for hazardous chemicals.Footnote 102

Under Chinese law, provincial and municipal regulations cannot conflict with Chinese constitutional law or national laws and administrative regulations.Footnote 103 Local initiatives that allow hydrogen activities to be carried on outside chemical industrial parks conflict with the Regulation on the Safety Management of Hazardous Chemicals. In practice, safety concerns have also limited the development of hydrogen production and refuelling projects outside chemical industrial parks.Footnote 104 However, according to our interviewees (HL1 and 4), the central government tolerates these local initiatives, as it seeks to explore solutions and experiment with alternative approaches to facilitate the development of China's hydrogen value chain. Indeed, the central government is considering recognizing hydrogen as an energy carrier,Footnote 105 and allowing hydrogen production outside industrial parks.Footnote 106 Local governments and analysts agree that recognition under Chinese law of hydrogen as an energy carrier is necessary to diversify hydrogen applications, remove regulatory barriers, and formulate new standards.Footnote 107

According to the theory on hydrogen regulation (see Section 2.1), these legislative reforms, if adopted, would be an important step in developing China's hydrogen economy. For the International Energy Agency, classifying hydrogen as an energy carrier is necessary for it to be a ‘freely tradable energy asset’, with its transportation subject to less stringent requirements than for hazardous substances (its previous classification).Footnote 108 By officially recognizing hydrogen as an energy carrier, China would follow international regulatory practice in the field. For instance, Germany amended its Energy Industry Act in July 2021 to recognize hydrogen transported through pure hydrogen pipelines as an energy carrier.Footnote 109 In the Netherlands, hydrogen is considered an alternative energy carrier for the purposes of hydrogen transportation.Footnote 110 In the United Kingdom (UK), hydrogen falls within the definition of gas and is regulated as part of gas networks.Footnote 111

4.2. Regulation of Refuelling Stations

Despite the central government's objective of developing hydrogen refuelling stations, hydrogen blending, and hydrogen pipelines,Footnote 112 it has not yet issued specific regulations on the development of these facilities. The energy lawyers interviewed for this article (HL2, 3 and 4) explain this regulatory gap by emphasizing that the hydrogen pipelines already in place are still at the demonstration stage. By contrast, provincial and municipal authorities have taken the initiative to regulate their hydrogen infrastructure and, in particular, hydrogen refuelling stations.Footnote 113

Depending on the location, the construction of hydrogen refuelling stations requires either administrative approval (such as Shanghai, Hebei province, Dalian, Fuzhou, and Foshan)Footnote 114 or merely registration with the local development and reform administration (such as Wuhan and Tianjin).Footnote 115 Licensing requirements typically include a land planning permit, approval by the fire bureau and the meteorology bureau, and construction approval from the administrative approval bureau.Footnote 116 To operate hydrogen refuelling stations, companies must also apply for gas-filling quality certification and an operating permit for dangerous chemicals.Footnote 117 Of these procedures, obtaining land-use permits to build hydrogen refuelling stations with on-site production is particularly challenging,Footnote 118 as it requires permitting for industrial use where local governments have not yet addressed the barrier posed by the regulation of hydrogen as a dangerous chemical.Footnote 119 In these areas, operators of refuelling stations face the difficult task of sourcing and transporting the hydrogen necessary for providing commercial refuelling services.Footnote 120

These investments also face obstacles under the central-level Administrative Measures on Government Concession Rights for Infrastructure and Public Utilities (2015),Footnote 121 which do not explicitly cover hydrogen refuelling stations. Despite this regulatory gap, some local governments (such as Chengdu and Zhejiang) have developed hydrogen refuelling stations based on concession agreements.Footnote 122 As with the development of hydrogen projects outside chemical industrial parks, local authorities are experimenting with the use of concession agreements for hydrogen refuelling stations, pending reform of China's national regulation on concessions.

Local regulatory intervention has helped to address national regulatory barriers to the development of hydrogen refuelling stations with on-site production.Footnote 123 By 2022, around 24 hydrogen refuelling stations were operating with on-site hydrogen production in China.Footnote 124 At the same time, analysts point out the heavy administrative burden that project developers face in the absence of regulatory harmonization.Footnote 125

As explained in the literature on environmental federalism and decentralization (Section 2.2), navigating the different environmental requirements that apply in each province and municipality creates challenges, and thus transaction costs, for companies. Esty, for instance, argues that ‘fragmented markets are unattractive to potential investors’.Footnote 126 Reciprocally, as explained by Sovacool, ‘uniformity helps manufacturers and industry by providing a consistent and predictable statutory environment’.Footnote 127 Harmonizing environmental regulation, therefore, benefits the industry by reducing transaction costs. On this basis, regulatory intervention by China's central government would help to streamline the administrative procedures applicable to the construction and operation of refuelling stations, and scale up the infrastructure needed for the development of China's hydrogen economy. This approach would follow international practice, such as in the EU where Member States are required to ensure that a minimum number of publicly accessible hydrogen refuelling stations are deployed by the end of 2030, with operators subject to minimum requirements governing access to their refuelling infrastructure.Footnote 128

5. Regulatory Support for Hydrogen in China

China's central government has established financial mechanisms to support the deployment of fuel cell vehicles and refuelling stations. However, these schemes have remained limited in time and scope, leaving local authorities in charge of supporting the development of China's hydrogen economy. China's decentralized hydrogen regulation helped the hydrogen economy to take off, but local support mechanisms resulted in a subsidy race across regions. China's experience with the subsidization of hydrogen is of broader relevance for the debate on hydrogen regulation and environmental decentralization, as it helps in understanding how local subsidies can replace national initiatives to support the hydrogen industry, but create inefficiencies as local governments compete with each other.

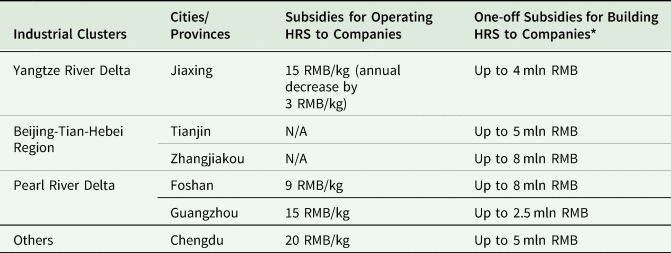

5.1. Subsidizing Fuel Cell Vehicles

Since 2015, China's central government has subsidized the purchase of fuel cell vehicles.Footnote 129 Automobile companies received subsidies; thus, consumers could buy fuel cell vehicles at discounted rates. For example, for a 49-ton hydrogen fuel cell bus costing around 1.4 million renminbi (RMB) in 2016, subsidies could amount up to 500,000 RMB.Footnote 130 These subsidies have been gradually reduced, and were eventually phased out at the end of 2022 to avoid over-investment in fuel cell vehicles (see Table 3).Footnote 131 However, local governments continued to support fuel cell vehicles and the production of fuel cell equipment.Footnote 134 Local governments have also allocated resources to support the construction and the operation of refuelling stations (see Table 4). Local subsidies incentivize the purchase of fuel cell vehicles, stimulate the formation of domestic assembly lines for fuel cells, facilitate access to hydrogen by supporting the construction of hydrogen refuelling stations, and contribute to the formation of hydrogen-industry clusters based on fuel cells and fuel cell vehicles (such as the Beijing-Tianjin-Hebei Region).Footnote 135 As seen above (Section 3), China produced 12,682 units of fuel cell vehicles and needs to bring this number to 37,318 units to meet the 2025 target. This development could be facilitated by the reduction in the cost of fuel cells (at 2,000 yuan/kw in 2022), which in turn reduces the cost of manufacturing fuel cell vehicles and contributes to their commercialization.Footnote 136

Table 3. Central-level Subsidies for the Purchase of Fuel Cell Vehicles between 2016 and 2022

Source: Authors’ own research, based on Ministry of FinanceFootnote 132

Table 4. Local Subsidies for Hydrogen Refuelling Stations

* The subsidies for building hydrogen refuelling stations (HRS) depend on the investment amount and the daily refuelling capacity of stations.

Source: Authors’ own research, based on local hydrogen development plansFootnote 133

However, analysts have warned that local support may not be sufficient to create enough demand for hydrogen in a cost-effective way, and may have only a limited influence on the pace of technological innovation.Footnote 137 As the local subsidy rates for fuel cell vehicles are aimed mainly at increasing the sales volume of such vehicles and the core equipment for fuel cells, rather than improving technology innovation or operational efficiency,Footnote 138 Chinese companies could develop a certain degree of dependence on foreign fuel cell technology.Footnote 139 Also, as current sales are stimulated largely by governmental subsidies, it is difficult to judge how far market forces can play a role in adjusting sales volumes.Footnote 140

At the same time, analysts are concerned that local subsidies could lead to the expansion of the local manufacturing capacity of fuel cell equipment and vehicles without paying sufficient attention to the current demand for these vehicles.Footnote 141 For example, we were told by the board of directors of Sunwise, a company engaged in the hydrogen business, that one of their hydrogen refuelling stations built in Shanghai has not yet become commercially viable because there are not enough fuel cell vehicles in use.Footnote 142 Similarly, in Guangdong province, more than 3,000 fuel cell vehicles have received vehicle licences but, by July 2023, there were only 1,200 vehicles in use.Footnote 143 Sales of fuel cell vehicles do not necessarily equate to the effective utilization of these vehicles.Footnote 144 Although local subsidies played an important role in compensating for reduced national support, these support measures struggled to adequately address one of the crucial factors in building an efficient hydrogen market: a satisfactory balance between supply and demand.

5.2. Pilot Hydrogen Schemes

The central government established a pilot city regime for hydrogen refuelling stations in 2014Footnote 145 and for fuel cell vehicles in 2020.Footnote 146 Establishing pilot regimes for testing energy technologies (fuel cell vehicles in this case) at the local level is a common strategy of the Chinese government.Footnote 147 In both regimes the central government allocates funds from the national budget to pilot cities or pilot city clusters proposed by the local authorities.Footnote 148 Pilot schemes for refuelling stations benefit from central government funds if they meet the technical standards and capacity requirements set by the government (for example, refuelling no less than 200 kg of hydrogen per day).Footnote 149 Similarly, the pilot city regime for fuel cell vehicles aims to commercialize and industrialize the key technologies relevant for fuel cells and fuel cell vehicles, and stimulate hydrogen supply (especially clean hydrogen supply).Footnote 150 The criteria for receiving subsidies include the adoption of a specific fuel cell technology, total vehicle mileage, the volume of total hydrogen supply (more than 5,000 tons per year), the emissions standard for hydrogen production (less than 15 kg CO2 for every 1 kg of hydrogen) and the price of refuelling (no more than 35 yuan/kg hydrogen).Footnote 151 The Ministry of Finance, together with other ministries (including the National Development and Reform Commission), reviews on a yearly basis the compliance of the pilot cities and city clusters with these criteria and grants funding to local governments on this basis.Footnote 152

The technical criteria set by the central government seek to promote further innovation in the manufacturing of fuel cells. The criterion of total vehicle mileage helps to avoid local governments incentivizing companies to manufacture new fuel cell vehicles without requiring these vehicles actually to be used. By creating demand for renewable or low-carbon hydrogen, the criteria for the emissions standard and the volume of hydrogen supply should incentivize decarbonization. Lower refuelling prices can help to incentivize the use of hydrogen fuel cell vehicles without the need for subsidizing the purchase of the vehicles. Thus, through its assessment criteria, the central government aims to contribute to the promotion of fuel cell vehicles and the deployment of hydrogen refuelling facilities.

5.3. The Risk of Local Protectionism

Another effect of local ambition has been the emergence of a certain degree of protectionism, as local authorities seek to maximize the benefits of the hydrogen transition for their economy. For example, the governments of Chengdu, Panzhihua, and Jiaxing grant funding to companies that set up new subsidiaries focusing on fuel cell vehicles in their cities, and help companies in completing the administrative procedures for investing in these places.Footnote 153 The government of Ningxia aims to attract companies that engage in the manufacture of key components for fuel cell vehicles to establish a business presence in Ningxia province.Footnote 154 Changshu seeks to become the manufacturing base of key equipment for hydrogen fuel cells, an objective it seeks to achieve by promoting the development of fuel cells and fuel cell vehicles.Footnote 155 According to our interviewees (HL1 to 5 and HP1, 4, 5), although these plans do not formally impose obligations on companies, many governments view the establishment of local manufacturing capacity as a precondition to benefit from support.

Furthermore, a number of local hydrogen development plans directly identify the main industrial beneficiaries.Footnote 156 Where the local government purchases fuel cell vehicles that are equipped with components manufactured by a certain company, and refers in its tenders to the technical standards corresponding to these components,Footnote 157 competitors’ access to these markets will be jeopardized.

Localization measures can lead to inefficient investment practices, with distortive effects on the emerging national market, in particular where local authorities seek to attract investment in their local hydrogen-industry parks without giving full consideration to the hydrogen supply-demand balance within their administrative area.Footnote 161 In Shanghai, for example, there were already more than 200 companies active in the various segments of the hydrogen value chain in 2020,Footnote 162 a disproportionate number of industrial players, compared with the still limited, albeit growing, volume of licensed fuel cell vehicles in the city (see Table 5). In China more generally, the 300 hydrogen refuelling stations in operation in 2022 could support more than 30,000 hydrogen vehicles,Footnote 163 compared with the 12,682 licensed units.

Table 5. Fuel Cell Vehicles and Hydrogen Refuelling Stations in Shanghai

Source: Authors’ own research, based on Shanghai government,Footnote 158 media reports,Footnote 159 and research institutesFootnote 160

In pursuit of career development,Footnote 164 local officials can seek to actively promote the localization of hydrogen manufacturing capacity to take credit for the associated local economic benefits, even if this undermines the development of a more cost-efficient national hydrogen market.Footnote 165 Launching similar projects for fuel cell vehicles in different cities can result in inefficienciesFootnote 166 if companies need to cater for the interests of different local governments.Footnote 167 Moreover, it often happens that the market share of a specific city or province is captured by companies with large local investments rather than those with the most advanced hydrogen technology.Footnote 168 Therefore, administrative intervention to protect local value chains of fuel cell vehicles adopted by local governments may not enable continued technological innovation (for example, hydrogen use in transportation), which is crucial for creating a hydrogen market.Footnote 169 Indeed, this has also been emphasized in the National Hydrogen Development Plan, which identifies signs of low-quality hydrogen development and competition at the local level.Footnote 170

6. National Hydrogen Regulation through Local Experimentation

China's experience with the development of hydrogen illustrates the role of local initiatives in addressing national regulatory barriers and gaps regarding the development of new clean energy technologies. As explained in the literature on environmental decentralization/federalism, regions can act as ‘laboratories’ for the experimentation of new regulatory approachesFootnote 171 and pioneers in the development of new policy initiatives.Footnote 172 To promote local investment in hydrogen, provincial and municipal authorities in China have actively supported the purchase of fuel cell vehicles and the deployment of hydrogen refuelling stations through subsidy schemes. Although absolute numbers remain limited, these local regulatory interventions have started to establish the basis of China's hydrogen economy, compensating for limited central government regulation.

At the same time, China's hydrogen experience confirms the risk of fragmentation associated with local clean energy initiatives, as conceptualized in the literature on environmental federalism and decentralization.Footnote 173 China's case also shows how local ambition can result in a certain degree of protectionism through the preferential treatment of locally manufactured fuel cell equipment and vehicles. The literature on clean energy and trade law discusses how localization incentives for clean energy technologies have increased the cost, and reduced the speed, of their deployment.Footnote 174 Similarly, fragmentation and localization could increase the cost of China's hydrogen transition.Footnote 175

As emphasized in the literature on lead markets, pioneers may benefit from so-called first-mover advantages if their policy initiatives and related technologies are adopted by other regions at a later stage.Footnote 176 These economic benefits may also stimulate a subsidy or regulatory race with other competing regions.Footnote 177 Subsidy races can potentially drive policy innovation and learning, but are frequently also linked to the prioritization of local champions, and may therefore generate inefficiencies (that is, higher costs) and face the risk of legal challenges.

In China, the input that local regulatory experimentation provides to the central government explains why the latter has not yet intervened to rein in the local subsidy race and localization efforts. As explained by our interviewees (HL1 to 5, HP1 and 4), the government's policy is first to allow the development of a hydrogen ecosystem in China before building the national market, even if this comes at the cost of a certain degree of localization. The central government is waiting for value chains to become more mature before regulating the emerging industry. This approach would allow the government to better manage the uncertainties characterizing the hydrogen industry. More detailed and responsive central guidance might then take into account the complexities of hydrogen development and consider the various technicalities of implementing local hydrogen development plans.

To mitigate the transaction costs resulting from market fragmentation and local protectionism, the environmental decentralization literature emphasizes the role of regulatory harmonization.Footnote 178 On this basis, intervention by China's central authorities will eventually be needed to accelerate the development of its hydrogen economy. Steps towards such harmonization are already being taken. Indeed, one of the objectives of establishing a reward regime for pilot city clusters is to push forward cooperation among cities, to break administrative area restrictions and to level the playing field across regions.Footnote 179 Building on the hydrogen investment promotion and administration measures implemented at the local level, the National Development and Reform Commission has a role to play in implementing a unified market access system in the hydrogen sector and requiring local governments to remove their protectionist measures.Footnote 180

However, as advocated by proponents of ‘cooperative federalism’, harmonization should not fully neutralize regulation at the local level, taking into account the benefits of local action for clean energy policy.Footnote 181 In China, a certain degree of harmonization of the criteria governing the support of hydrogen projects would help in managing the expectations of investors in the sector, while preserving the benefits of local hydrogen initiatives. Based on the theory on hydrogen regulation (Section 2.1), regulatory reforms should prioritize the recognition of hydrogen as an energy carrier instead of a hazardous chemical, and should certify the different types of hydrogen to facilitate support for renewable-based generation.Footnote 182 Local initiatives to date have enabled hydrogen projects to develop outside the regulatory regime. This local experimentation provides valuable input to develop a harmonized national framework on hydrogen.

7. Conclusion

There are various challenges for the development of hydrogen as a vehicle for decarbonization. Each challenge requires regulatory intervention across different dimensions, ranging from carbon footprint measurement, safety requirements, and modes of transport to measures to stimulate production and use across different applications and end-use sectors. The role of governments (both central and local) in this context is to reduce uncertainty and risks across the hydrogen sector by defining the regulatory landscape, providing public funding to support infrastructure development, and creating demand for hydrogen and hydrogen-related technologies. However, it is precisely this uncertainty that poses a risk, not only for private entities and investors but also for governments. Against this background, regulatory experimentation can be used to manage the uncertainties of hydrogen development, as with previous developments in the broader field of climate and energy regulation.

China's experience shows that local authorities can play an important role in developing and regulating hydrogen through experimentation. China has started to develop a hydrogen industry, focusing mainly on hydrogen refuelling stations and fuel cell vehicles. The Chinese government did not set out a national regulatory framework on the basis of which this new industry should be developed. Rather, it has relied on local experimentation to gain experience with the development of projects in the various segments of the hydrogen value chains and ‘test the waters’ before addressing the regulatory barriers and inefficiencies that affect these local experiments. Although the deployment of hydrogen – and, in particular, green hydrogen – remains limited in absolute numbers, China's provincial and municipal authorities have played a determining role in starting to develop the sector by helping to overcome regulatory barriers to the realization of hydrogen projects and actively supporting these investments, in close cooperation with industrial actors. In sum, the Chinese experience shows how, in jurisdictions with a sufficient degree of decentralization, local initiatives can help the central government to test regulatory approaches to hydrogen.

At the same time, China's experience points to the limits of developing hydrogen through local initiatives, and the need for regulatory harmonization to accelerate further development of the industry. Because they are overly concerned with the pursuit of local economic benefits, local initiatives in China have resulted in a certain degree of protectionism and inefficiency in the allocation of public finance. Although local hydrogen initiatives have helped China in developing its hydrogen industry, treating local companies more preferably will, in the long run, hinder the development of a hydrogen market in China. National regulation will thus eventually be necessary to address the obstacles that localization requirements and the local subsidy race pose to the development of hydrogen. Following the theory on environmental decentralization and federalism, harmonized hydrogen rules can be expected to reduce transaction costs for investors, and generate economies of scale and learning effects.

The development of a national regulatory approach will be crucial in determining how Chinese actors will engage with the emerging international hydrogen sector. Reducing the scope for local protectionism within China by the introduction of clearly defined national-level rules would also play an important role in ensuring a level playing field within the international market.Footnote 183 At the same time, the absence of a clearly defined national regulatory regime at the current stage offers an important opportunity for promoting harmonization, not only across Chinese provinces but also with other major economies. As the Chinese central government develops its national regulatory approach, it has the opportunity to take into account both local and international experience and engage with other major economies in an effort to promote an internationally harmonized regulatory landscape.

In this vein, future research should engage in comparative analysis of China's approach with other major economies, most importantly the US and the EU. For now, China's approach reveals parallels to the US approach, where the government is relying strongly on the concept of regional hydrogen hubs that have been selected in a competitive process.Footnote 184 At the same time, US federal policy does not seek to restrict any particular form of hydrogen production, but rather provides a broad set of incentives; similar to China, these incentives have raised protectionist concerns. The EU, in contrast, has chosen to develop a detailed regulatory framework, including quotas for renewable hydrogen within the industrial sector. This is intended to steer investment into renewable hydrogen production, based on narrowly defined requirements. This, in turn, has raised fears that this regulatory approach may not provide sufficient incentives for investment, slowing down the hydrogen ramp-up.Footnote 185 The EU's strong regulatory landscape also raises questions regarding future compatibility with approaches in other major economies, such as China and the US, which could hamper the formation of a global hydrogen market. Systematic comparative regulatory analysis could provide an important point of reference for identifying opportunities and barriers for regulatory alignment.

Appendix 1

HL1: senior lawyer, advising on energy and infrastructure projects (law firm)

HL2: lawyer, specializing in energy law (law firm)

HL3: lawyer, specializing in energy law (law firm)

HL4: senior lawyer, with experience advising on hydrogen projects (law firm)

HL5: senior lawyer, specializing in energy law (law firm)

HP1: lead-researcher on China's clean energy transition (research institute)

HP2: policy and economic analyst, specializing in climate finance (research institute)

HP3: policy analyst, focusing on investments in China's renewable energy sector (research institute)

HP4: policy analyst, specializing in China's energy transition, with a focus on hydrogen (research institute)

HP5: senior policy analyst, specializing in hydrogen (research institute)

Appendix 2

Sample questionnaire for lawyers

• What are hydrogen companies most concerned about when making decisions on investing in a hydrogen project or when they lay out their hydrogen business?

• Why did the central government wait to formulate a hydrogen development strategy until hydrogen projects had already started to operate?

• What are the implications of listing hydrogen as energy in the Energy Law (Draft)?

• Do local hydrogen policies or regulatory measures allow the development of hydrogen projects outside chemical industrial parks, despite the requirements of the national law on dangerous chemicals?

• What support mechanisms did local and national authorities adopt to promote the development of hydrogen?

• Is ‘local protectionism’ affecting the development of fuel cell vehicles?

• How would you assess the existing regulation, and governance, governing the construction and operation of hydrogen refuelling stations?

• How do companies navigate the different regulatory requirements governing the implementation of hydrogen projects in different cities and provinces? Could you please give some examples?

• How would you assess the existing local hydrogen development plans? Did they succeed in promoting innovation?

Sample questionnaire for energy policy analysts

• Could you introduce the layout of China's hydrogen value chains?

• What are major technical and economic barriers to the development of hydrogen value chains?

• Can current hydrogen-related policies, together with policies generally in charge of promoting clean energy development, help to address these barriers?

• How can China develop hydrogen without a central regulatory framework at the current stage?

• What companies are playing an important role in developing China's hydrogen development plans? What are their business strategies?

• Why do local governments focus on the development of fuel cell vehicles?

• What is the role of hydrogen in China's energy transition?

• How do companies adjust to the different regulatory requirements governing the implementation of hydrogen projects in different cities and provinces?

• How would you assess the existing local hydrogen development plans? Did they succeed in promoting innovation?

Acknowledgements

Special thanks go to the experts interviewed for this article, and to the three anonymous TEL reviewers for their insightful comments.

Funding statement

The research underlying this article benefited from funding by the German Foreign Office Project, ‘Geopolitics of the Energy Transformation: Implications of an International Hydrogen Economy’ (Grant agreement number AA4521G125).

Competing interests

The authors declare none.