1. Introduction

Can a universal basic income (UBI) have a positive effect on turnout among an entire electorate? The UBI has found its way to the forefront of current debates around an appropriate social, political, and financial response to changing realities of job markets. A UBI is a cash grant paid out regularly to all members of a community, “without means test, regardless of personal desert, with no strings attached” (Bidadanure, Reference Bidadanure2019, 482). Especially in western European countries the discourse revolves around the question if a UBI constitutes the welfare state of the future. Will moving away from a punitive understanding of public assistance—one in which each individual has to prove its indigence and progress to an extensive monitoring mechanism able to impose transfer cuts (van den Berg, van der Klaauw, and van Ours, Reference van den Berg, van der Klaauw and van Ours2004)—not only lead to economic, but also political inclusion? Asking this question seems especially relevant as research has shown the importance of political participation for the stability of democratic systems (Stockemer and Scruggs, Reference Stockemer and Scruggs2012; Akee et al., Reference Akee, Copeland, Costello, Holbein and Simeonova2018)—yet, decreasing turnout rates are a development observable in most democracies over the past decades (Blais, Reference Blais, Dalton and Klingemann2009; Dalton, Reference Dalton2007).

Findings on participatory effects of transfer policies remain scarce and reflect mixed results. Analyses of means-tested program such as Medicaid and Latin American conditional cash transfer (CCT) programs documented a short-run turnout increase, with other authors unable to identify any participatory effect (Baez et al., Reference Baez, Camacho, Conover and Zárate2012; De La O, Reference De La O2013; Baicker and Finkelstein, Reference Baicker and Finkelstein2019; Imai et al., Reference Imai, King and Rivera2020). These programs however were contingent upon recipients changing their behavior, making it difficult to isolate a turnout effect (Akee et al., Reference Akee, Copeland, Costello, Holbein and Simeonova2018, 9)—leading me to expect that turnout responds differently to the introduction of a UBI. Not only is a UBI universally available to an entire population that is made up of individuals from a range of socioeconomic backgrounds, it is also available sans conditions.

This paper is among the first to investigate the link between an unconditional cash transfer and voter turnout by analyzing the Alaskan Permanent Fund Dividend program (dividend or Alaskan UBI hereafter), considered to be the “only existing basic income in the world” (Zelleke, Reference Zelleke, Widerquist and Howard2016, 141). The program is available since 1982 and consists of a dividend disbursed annually to every Alaskan permanent resident. I find evidence that the Alaskan UBI has a significant positive effect on turnout, with the participatory effect lasting over an almost 20-year period. I argue that two potential mechanisms are able to account for the increase in turnout: resource and interpretive effects. The resource effect is based on the finding that an increase in income not only reduces economic pressure on citizens but makes it more likely that they have the necessary resources to participate in the political process (Schlozman et al., Reference Schlozman, Brady and Verba2018). The interpretive effect entails that unconditional cash payments can convey “messages of inclusion and empowerment” (Baicker and Finkelstein, Reference Baicker and Finkelstein2019, 387), changing the way an administration and its citizens interact.

This paper makes several contributions to the existing literature. To start, this paper forwards our understanding of the relationsip between income and political participation by showing that there is indeed an income effect on turnout. This is estimated with an exogenous variation of income as is the case with a UBI. Findings are therefore in line with—amongst others—Markovich and White (Reference Markovich and White2022) and Akee et al. (Reference Akee, Copeland, Costello, Holbein and Simeonova2018). The second contribution is on the turnout-enhancing effects of a UBI, whereby this study is the first to look at an effect on turnout behavior among an entire electorate as well as analyzing heterogeneous effects by socioeconomic background. Thirdly, the paper provides compelling evidence that a UBI can cause lasting participatory change after the Alaskan UBI has been introduced. Finally, the paper also contributes to a better understanding of the very particular case of Alaska and should therefore function as a call for more research on how a UBI could work in other countries.

All contributions should jointly have an evidence-based impact on the politics as well as political effects of a UBI in an otherwise highly emotionalized debate.

2. Theory and prior evidence

The present paper analyzes whether a UBI disbursed to all citizens without a means-test affects the turnout rate of an entire electorate. It integrates into research studying the link between income and political participation, finding that more affluent citizens have a higher probability to turn out to vote than poorer citizens (Solt, Reference Solt2008; Leighley and Nagler, Reference Leighley and Nagler2014; Schlozman et al., Reference Schlozman, Brady and Verba2018)—or that with a “diminishing marginal utility of income” (Ojeda, Reference Ojeda2018, 814) the income effect on turnout is larger for those who are poor (Rosenstone, Reference Rosenstone1982).

Navigating the voting process is inherently costly (Akee et al., Reference Akee, Copeland, Costello, Holbein and Simeonova2018, 5); the ability to deal with these costs—to overcome time constraints, navigate registration requirements, or acquire information in order to participate in a political system—depends on the individual's endowment of resources (Knack and White, Reference Knack and White2000; Sondheimer and Green, Reference Sondheimer and Green2010; Markovich and White, Reference Markovich and White2022). Amongst others, the resources time, money, civic skills, health, and education have been identified “that make it possible to take part” (Verba and Nie, Reference Verba and Nie1972; Brady et al., Reference Brady, Verba and Schlozman1995; Schlozman et al., Reference Schlozman, Brady and Verba2018, 73). Accordingly, income allows for the development and acquisition of abilities necessary for participation, having a job or being in school further allows building social connections and civic skills that enhance participation (Schlozman et al., Reference Schlozman, Brady and Verba2018). An increase in income based on the introduction of a UBI may hence affect turnout as a resource effect materializes—allowing recipients to deal with the act of voting.

Research has identified the existence of an “income gradient” in turnout, a clear causal mechanism could not be verified (Akee et al., Reference Akee, Copeland, Costello, Holbein and Simeonova2018). Smets and van Ham (Reference Smets and van Ham2013) demonstrate that in the majority of turnout studies included in their meta-analysis, income has a significant turnout-enhancing effect. It has however also been shown that only the interaction of income with factors such as education, race, neighborhood affluence, or employment status significantly influences voter turnout (Wolfinger and Rosenstone, Reference Wolfinger and Rosenstone1980; Leighley and Nagler, Reference Leighley and Nagler1992; Estrada-Correa and Johnson, Reference Estrada-Correa and Johnson2012; Burden and Wichowsky, Reference Burden and Wichowsky2014; Cebula, Reference Cebula2017).

Moving toward transfer programs, the assignment to CCT programs provide mixed evidence on a turnout-enhancing effect. On the one hand, studies found turnout and the intent to vote to increase (Baez et al., Reference Baez, Camacho, Conover and Zárate2012; Pop-Eleches and Pop-Eleches, Reference Pop-Eleches and Pop-Eleches2012; De La O, Reference De La O2013), yet only when the payment is relatively large (Galiani et al., Reference Galiani, Ibarraran and McEwan2016). On the other hand, Imai et al. (Reference Imai, King and Rivera2020) reevaluate two CCT programs in Mexico whereby they are unable to detect a significant effect, thereby refuting De La O's (Reference De La O2013) findings. After all, the programs being available only to population subgroups combined with a conditionality clause aggravate the reliability of the measurements. Programs were tied to recipients attending community meetings and health checkups, children's school attendance or enrolment, or were earmarked for the purchase of certain goods (Pop-Eleches and Pop-Eleches, Reference Pop-Eleches and Pop-Eleches2012; De La O, Reference De La O2013; Galiani et al., Reference Galiani, Ibarraran and McEwan2016; Imai et al., Reference Imai, King and Rivera2020). Health, education, and civil skills are all resources that are associated with participatory behavior, the effect of additional economic resources on turnout based on CCT programs may thereby not be isolated from the adjusted behavior (Akee et al., Reference Akee, Copeland, Costello, Holbein and Simeonova2018). There hence exists a research gap with regard to turnout responses based on an unconditional income, making the causal identification strategy of this paper more valuable.

Besides these empirical limitations, further, theoretical limitations become apparent. Scholars have focused on the actual increase in monetary resources and their participatory effects, yet an increase in income may also be a “meaningful political symbol” to beneficiaries of the payments and can result in interpretive effects (Markovich and White, Reference Markovich and White2022). Selected studies on means-tested government programs utilize the same theoretical mechanism and hypothesize both monetary resources and positive psychological effects to account for a turnout increase (Clinton and Sances, Reference Clinton and Sances2018; Baicker and Finkelstein, Reference Baicker and Finkelstein2019). I hence assume a UBI to also affect the “cognitive processes of social actors” (Pierson, Reference Pierson1993, 610). Attitudes and awareness toward political institutions and their activities may change as policies can convey “messages of inclusion and empowerment”, increasing participatory behavior (Baicker and Finkelstein, Reference Baicker and Finkelstein2019, 387). A policy tends to be interpreted affirmatively as it is not means-tested and individual claims become unconditionally legitimate. This may lead to a different understanding of the role an administration plays in the lives of citizens and of their own role in the political system (Campbell, Reference Campbell2012, 342; Clinton and Sances, Reference Clinton and Sances2018, 17; Markovich and White, Reference Markovich and White2022, 4). Payments may hence cause intrinsic reciprocity as citizens derive utility from “giving back” by turning out to vote (Galiani et al., Reference Galiani, Ibarraran and McEwan2016, 5).

Based on these considerations I theorize both mechanisms—resource and interpretive effects—to occur as a response to the introduction of a UBI and thereby result in overall turnout to increase. The unconditional nature of the UBI payments allows me to overcome empirical limitations of available research as I am able to isolate the effect of income on political participation but also tackle theoretical limitations of studies that solely focus on an increase in monetary resources and leave out psychological or positive interpretive effects.

2.1 Universal basic income

Discussions around a UBI date back to the last century (Friedman, Reference Friedman1962; Van Parijs, Reference Van Parijs1991; Bidadanure, Reference Bidadanure2019, 482), yet empirical findings are still mainly limited to economic effects, investigating whether a UBI discourages employment and reduces productivity within an economy (Bastagli et al., Reference Bastagli, Hagen-Zanker, Harman, Barca, Sturge, Schmidt and Pellerano2016; Banerjee et al., Reference Banerjee, Hanna, Kreindler and Olken2017; Feinberg and Kuehn, Reference Feinberg and Kuehn2018; Jones and Marinescu, Reference Jones and Marinescu2018; Kangas et al., Reference Kangas, Jauhiainen and Simanainen2019). Social and wellbeing effects—impacts on health, education, stress, and trust—were reported (Bastagli et al., Reference Bastagli, Hagen-Zanker, Harman, Barca, Sturge, Schmidt and Pellerano2016; Kangas et al., Reference Kangas, Jauhiainen and Simanainen2019), political and especially participatory consequences remain after all largely understudied. Akee et al. (Reference Akee, Copeland, Costello, Holbein and Simeonova2018) analyze the opening of a casino in an Eastern Cherokee reservation, leading to profits being unconditionally distributed to all adult tribal members. They find that an additional income increased turnout among children of initially poorer families. The authors argue that income increasing early-life resources has a stronger effect on turnout behavior than income later in life, when political behavior remains largely stable (Akee et al., Reference Akee, Copeland, Costello, Holbein and Simeonova2018, 10–11). A second study that focuses on a public welfare program available to senior citizens in Alaska finds that applicants that were admitted to a cash payment prior to the 1976 election were less likely to vote, with the author arguing that individuals prioritize personal consumption over their own interest in political outcomes (Mahdavi, Reference Mahdavi2020). The program itself was however only available to citizens that had remained in Alaska for at least 25 years and the sample is relatively small.

3. Background: the Alaska permanent fund dividend

To test the effect of a UBI on voter turnout I use data from a natural experiment: the Alaska Permanent Fund Dividend program (dividend or Alaskan UBI thereafter). It was introduced in 1982, disbursing a share of Alaska's Permanent Fund evenly among all recipients each year just one month prior to the November general elections. Every resident that has lived in Alaska during the previous calendar year is eligible for the payments (Alaska Department of Revenue, 2020), which is why the program is considered “essentially universal” (Jones and Marinescu, Reference Jones and Marinescu2018, 7).

The question remains whether the dividend is indeed a case of a UBI. While most UBI models or experiments are funded through a redistributive mechanism, the program disburses a dividend from a sovereign wealth fund that is based on the state's royalty income from oil production. The Alaskan UBI was and is not communicated to be a welfare program; intention however does not stand in contrast to the definitional requirements of a UBI (Zelleke, Reference Zelleke, Widerquist and Howard2016; Mahdavi, Reference Mahdavi2020). The dividend payments are guaranteed and paid out on a regular basis yet given the variable nature of the fund's performance and therefore the variable nature of the dividend payments—its amount is not. Over time, the dividend is neither able to account for a considerable share of the annual personal income in Alaska nor for a social minimum measured in relation to the US poverty thresholds (see Table A4), leading some authors to consider the dividends a “partial basic income” (Goldsmith, Reference Goldsmith, Widerquist and Howard2016, 49–50; Zelleke, Reference Zelleke, Widerquist and Howard2016). On the other hand, an annual survey by the FED shows, that almost 40 percent of Americans are unable to immediately access USD 400 to cover an emergency expense—with the dividend payments fluctuating between USD 300 and USD 2,000 in the analysis period one can still consider the payment size substantial (The Federal Reserve, 2020).

Albeit these limitations, the Alaskan dividend proves to indeed reflect the features of a UBI as the five definitional characteristics that were formulated by the Basic Income Earth Network are met (BIEN Network, 2020). The dividend is paid out in cash, disbursed annually in early October, it is available to all residents to the state of Alaska irrespective of their age or citizenship, applicants neither have to prove that they are in need nor have to demonstrate a willingness to work, and the dividend is guaranteed as it is based on a constitutional amendment, which underlines that the dividend program was designed to last (Alaska Department of Revenue, 2020). Using data from the Alaskan UBI therefore allows me to empirically test whether an exogenous variation in income through the dividend introduction affects turnout over time. It not only fulfills the definitional requirements of a UBI, it is available to all Alaskan citizens and it has been in place for almost 40 years—guaranteed.

4. Data and empirical strategy

The dataset covers an analysis period from 1978 to 2000 and is determined by both the introduction of the dividend payments in 1982, and the data availability of the dependent variable: US-wide turnout data at the state-level as well as individual-level voting behavior on November general elections (U.S. Census Bureau, Current Population Survey, 2019a, 2019b). I also include a vector of control variables including socioeconomic and demographic factors, GDP, and unemployment rate as well as registration requirements (Rosenstone and Wolfinger, Reference Rosenstone and Wolfinger1978; Barone and de Blasio, Reference Barone and de Blasio2013; Burden et al., Reference Burden, Canon, Mayer and Moynihan2014; Burden and Wichowsky, Reference Burden and Wichowsky2014).

The empirical analyses rely on a differences-in-differences (DiD) estimation methodology comparing the pre- to post-treatment change in both turnout and individual-level voting behavior for the state of Alaska—where the dividend program is introduced in 1982—relative to differences in turnout in all other US states. As no natural control group exists within the state of Alaska, the control group therefore consists of 49 US states plus Washington D.C. that proxy for the counterfactual outcomes in the absence of the dividend payments. Analogous to Bechtel and Hainmueller (Reference Bechtel and Hainmueller2011) I consider i = {1,…, 51} states where biennial statewide general elections took place in the years t = {1978, 1980,…, 2000}. Let ${\cal D}_{it}$![]() denote the binary coded dividend indicator that is coded 1 for the treatment group (Alaska) after the introduction of the Alaskan UBI and 0 otherwise. The indicator is an interaction of a dummy for the state of Alaska and a dummy for the treatment period starting in 1982. Let $\Upsilon _{it}$

denote the binary coded dividend indicator that is coded 1 for the treatment group (Alaska) after the introduction of the Alaskan UBI and 0 otherwise. The indicator is an interaction of a dummy for the state of Alaska and a dummy for the treatment period starting in 1982. Let $\Upsilon _{it}$![]() equal the electoral turnout in state i at time t when exposed to the treatment or the control group. I estimate α 1 which is the causal effect of the dividend payment using a standard fixed-effects model (Equation 1):

equal the electoral turnout in state i at time t when exposed to the treatment or the control group. I estimate α 1 which is the causal effect of the dividend payment using a standard fixed-effects model (Equation 1):

where η i is the state-level fixed effect which allows to control for any time-invariant unobserved factors and δ t is a period-fixed effect included to control for common trends, capturing factors that would have had an effect on turnout even in the absence of the dividend payments, and ${\rm {\rm X}}_{it}^{\rm ^{\prime}}$![]() is a vector of socioeconomic time-varying covariates. As Bertrand et al. (Reference Bertrand, Duflo and Mullainathan2004, 249) point out, conventional DiD standard errors may “severely understate” the coefficients standard deviation. The standard errors are therefore clustered by state to account for potential serial correlation and heteroscedasticity. In order to increase the reliability of the results, I run several DiD analyses, corresponding to elections from 1978 to 1982 (short-term), 1978 to 1990 (medium-term), and 1978 to 2000 (long-term). This not only allows to estimate whether the introduction of the dividend had an effect on turnout in general but if the effect has persisted and changed over time.

is a vector of socioeconomic time-varying covariates. As Bertrand et al. (Reference Bertrand, Duflo and Mullainathan2004, 249) point out, conventional DiD standard errors may “severely understate” the coefficients standard deviation. The standard errors are therefore clustered by state to account for potential serial correlation and heteroscedasticity. In order to increase the reliability of the results, I run several DiD analyses, corresponding to elections from 1978 to 1982 (short-term), 1978 to 1990 (medium-term), and 1978 to 2000 (long-term). This not only allows to estimate whether the introduction of the dividend had an effect on turnout in general but if the effect has persisted and changed over time.

In order to test for the marginal effect of the dividend size, I also estimate a generalized DiD model where I replace the binary coded dividend indicator with the continuous dit treatment indicator. This corresponds to the dividend amount in USD divided by 1,000, adjusted for inflation. The variable measures, whether an increase in the dividend amount increases turnout and reports the marginal effect of the payments. I estimate α 2 which is the causal effect of interest being the dividend payments using a standard fixed-effects model (Equation 2):

The other parameters of the equation remain the same.

5. Results

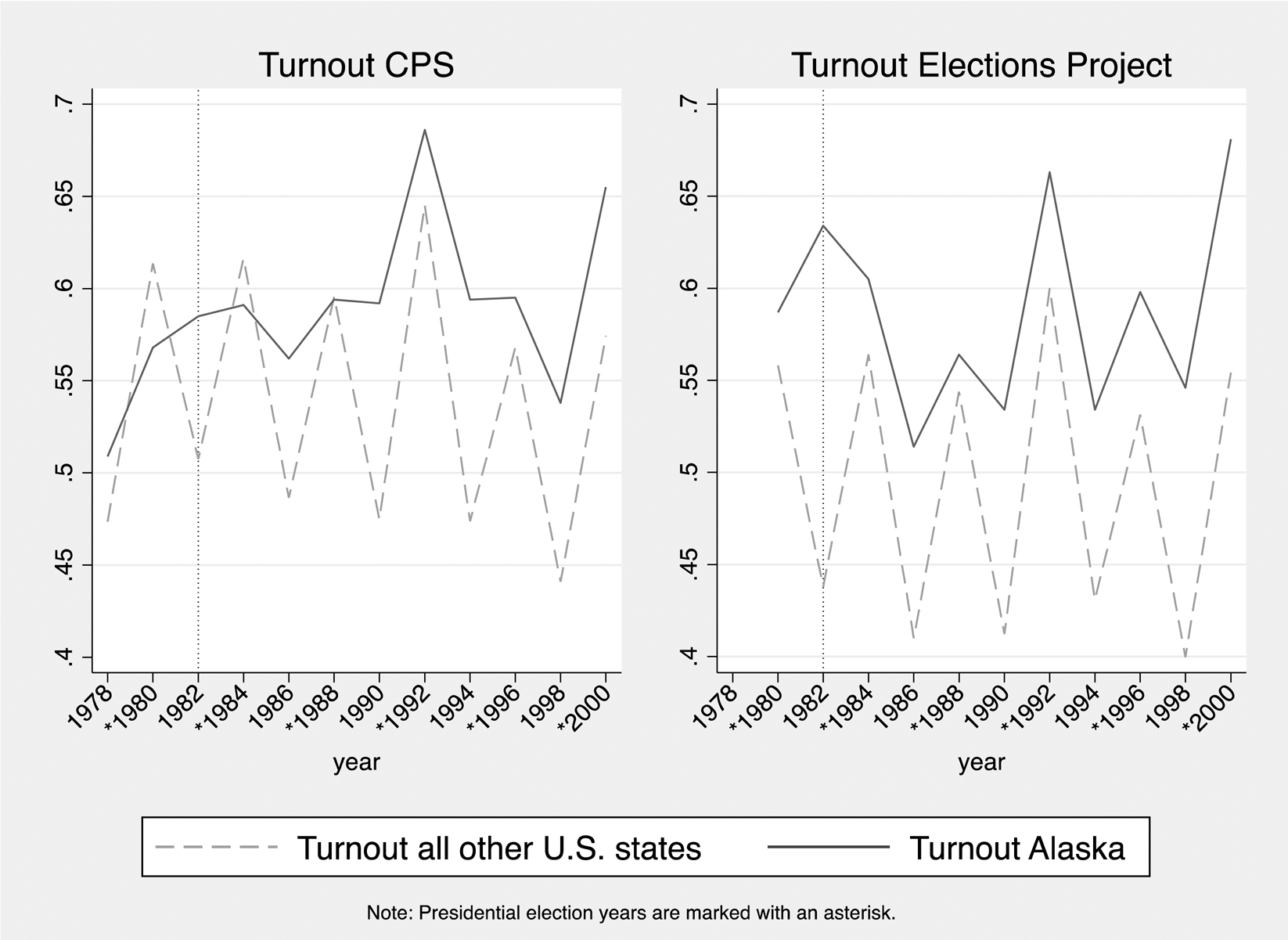

I first present descriptive evidence of turnout in Alaska plotted against the turnout development in all other US states (Figure 1). Turnout in Alaska has historically been higher compared to the US average, which holds for both presidential and midterm elections. Using data from the CPS shows that turnout in Alaska was 8 percentage points higher in the immediate first November election of 1982 after the dividend had been introduced just one month prior, an observation consistent with the hypothesized turnout effect.

Figure 1. Turnout development over time.

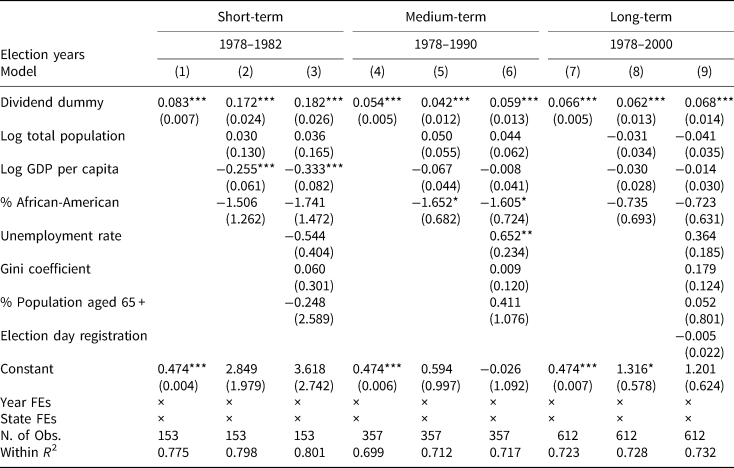

Models 1–3 in Table 1 report the DiD estimates for the turnout effects based on the introduction of the Permanent Fund Dividend in Alaska prior to the 1982 midterm election, as measured by the increase in state-level turnout. Baseline model 1 shows that the state-level turnout increased in the 1982 election—the first election after the introduction of the Alaskan UBI—by 8.3 percentage points, in the full model by 18.2 percentage points. The effect is shown to persist beyond the immediate first election after the introduction of the Alaskan UBI.

Table 1. DiD fixed-effects model

Notes: Regression coefficients shown with robust standard errors in parentheses. Dividend dummy is coded 1 for Alaska after the introduction of the dividend and 0 otherwise and is an interaction of a dummy for Alaska and a dummy for the treatment period starting in 1982. The estimates for the Alaska and the treatment period dummy are not reported. ***p < 0.01, **p < 0.05, *p < 0.1.

The variable election day registration included in model 9 of the estimations shows a negative but non-significant effect which runs counter to the existing literature where EDR has been shown to have a turnout-enhancing effect. The state fixed effects I have included in the models may capture some of the EDR effects, as these have not changed much over time: until 2000 only six states introduced election day registration (see Appendix) whereas most existing research measuring a stark turnout response to the policy during the 2000s and 2010s when another wave of states had established EDR (Highton and Wolfinger, Reference Highton and Wolfinger1998; Knack, Reference Knack2001; Highton, Reference Highton2004; Rigby and Springer, Reference Rigby and Springer2011; Burden et al., Reference Burden, Canon, Mayer and Moynihan2014; Xu Reference Xu2017; Grumbach and Hill, Reference Grumbach and Hill2022).

5.1 Generalized differences-in-differences estimation

In order to analyze what the actual marginal effect of the paid-out dividend on aggregate-level turnout is, I estimate a generalized DiD model including the dollar value of the disbursed dividend payments instead of the dividend dummy (Table 2).

Table 2. Generalized differences-in-differences model estimates

Notes: Regression coefficients shown with robust standard errors in parentheses. Dividend in USD/1000 is the dividend payment in 2016 dollars and is an interaction of a dummy for Alaska and the dividend payments starting in 1982. The estimates for the Alaska and the payment amount dummy are not reported. Coefficients for the fixed effects are not reported. ***p < 0.01, **p < 0.05, *p < 0.1.

The results of this model show that with each additional USD 1,000 of the dividend payment, voting increased by 7.6 percentage points in the short-term, by 4.8 in the medium-term, and 4.3 in the long-term. In models 4 and 5 I additionally limit the sample to the post-introduction period, as this allows estimating the marginal effect of the variable payment sizes on turnout over time separately from the introduction of the dividend.

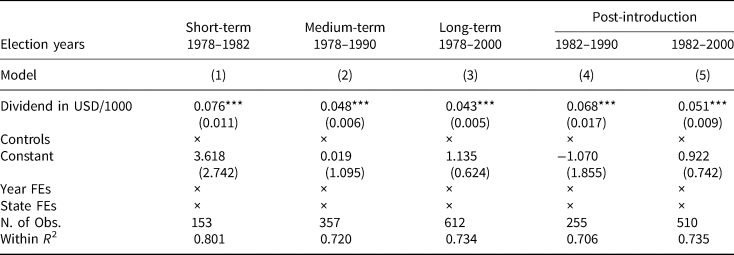

5.2 Robustness: individual-level data

In order to account for a possible sensitivity of the aggregate-level data based on the relatively small number of observations, I also specify the models using individual-level data by the CPS voter supplement (Table 3). While the treatment of state-level turnout happened at an aggregated level, the decision to turn out to vote as a response to receiving the UBI payments is an individual one. The data allow me to control for gender, race, ethnicity, employment status, and educational attainment on the individual-level (Flood et al., Reference Flood, King, Rodgers, Ruggles, Warren and Westberry2021).

Table 3. Linear probability model | Individual-level DiD model estimates

Notes: Regression coefficients shown with robust standard errors in parentheses that are clustered by state. Not in labor force is denoted as NILF. Dividend dummy is coded 1 for Alaska after the introduction of the dividend and 0 otherwise and is an interaction of a dummy for Alaska and a dummy for the treatment period starting in 1982. ***p < 0.01, **p < 0.05, *p < 0.1.

The estimates in the short-run show a turnout increase of 15.3 percentage points in the full model, the effect in the medium- and long-run becomes insignificant when also accounting for macro-level indicators.

5.3 Other robustness tests

The Online Appendix presents several robustness tests including the parallel trends assumption, group-time average treatment effects, and separate effects for midterm and presidential elections (Abadie et al., Reference Abadie, Diamond and Hainmueller2010; Callaway and Sant'Anna, Reference Callaway and Sant'Anna2021). I also replicate my analyses using a second set of turnout data by the United States Elections Project (McDonald, Reference McDonald2020). I also specify the DiD model presented in Table 1 as to only compare the pre-treatment elections of 1978 and 1980 to the 1990 and 2000 election with the elections in between being omitted from the models. I finally also replicate the generalized DiD analyses from Table 2 with individual-level data.

6. Why does a UBI affect turnout

The presented findings on the introduction of the dividend program provide compelling evidence that an entire electorate responds to the payments with an increased turnout rate, with the effect persisting over time. This runs counter to existing research that finds electoral rewards as a response to policies to deteriorate swiftly (Gerber and Green, Reference Gerber and Green1998; Duch and Stevenson, Reference Duch and Stevenson2006). It thereby refutes a popular argument against a UBI—that especially its introduction would only prompt short-term effects inciting reelection seeking incumbents (Gentilini et al., Reference Gentilini, Grosh, Rigolini and Yemtsov2019). Knowledge with regards to political effects of a UBI is fortified, as my findings suggest that cash transfers which are universally and unconditionally available are able bring about lasting turnout change.

The short-term turnout estimates in response to the UBI introduction are large, yet when comparing them to existing research, some differences become apparent. The turnout increase is measured with an exogenous variation in income that with its introduction jumps to USD 1,000 as the UBI is disbursed for the first time, just one month prior to the November election of 1982. Akee et al. (Reference Akee, Copeland, Costello, Holbein and Simeonova2018) model one such variation, finding turnout to increase by around 9 percentage points among children of recipients of an exogenously varied income based on a casino opening. That income was however not available on an individual or universal basis and the income stemmed from the operations of a private business. Other research attempts to analyze income effects on turnout, among them studies analyzing Latin American CCT programs estimated to result in a turnout effect of around 2–7 percentage points (Baez et al., Reference Baez, Camacho, Conover and Zárate2012; De La O, Reference De La O2013) and the expansion of Medicaid resulting in an increase of 3–7 pp (Clinton and Sances, Reference Clinton and Sances2018; Baicker and Finkelstein, Reference Baicker and Finkelstein2019). Turning toward more general wealth effects shows that a higher minimum wage increased turnout by 2.5 pp among affected employees (Markovich and White, Reference Markovich and White2022) and homeownership has a 4–8 pp turnout effect (Hall and Yoder, Reference Hall and Yoder2022). Every two-point change in the unemployment rate was matched by a 1 pp change in turnout (Burden and Wichowsky, Reference Burden and Wichowsky2014; Cebula, Reference Cebula2017), yet with a turnout-depressing effect reported to be at around 7 pp among the unemployed (Aytaç et al., Reference Aytaç, Rau and Stokes2020). Neither of those studies was however able to isolate a direct or indirect income effect from other factors that could affect turnout.

The Alaskan UBI was first disbursed prior to a midterm election, an election type generally reflecting lower turnout rates compared to presidential elections, which has been explained with an increased media salience and more sources for mobilization in the run up to presidential elections (Tolbert et al., Reference Tolbert, Grummel and Smith2001; Solt, Reference Solt2010). Midterms may therefore have higher turnout potential and we might expect larger turnout effects as a response to the Alaskan UBI especially during those elections. Diminishing marginal returns of voting would imply that as presidential elections already provide “a large incentive to vote”, the effects of a turnout-enhancing policy are weaker during presidential election years (Smith, Reference Smith2001). Finally, the turnout effect was estimated to be at 12.8 pp when using the Elections Project data which adjust for citizenship and people having lost their right to vote (Holbrook and Heidbreder, Reference Holbrook and Heidbreder2010) (see Appendix).

6.1 Turnout-enhancing mechanisms

There are several possible explanations for the turnout increase in Alaska, the first one being that it may be traced back to the payment amount as such: the resource effect. To navigate the voting process successfully, individuals require resources such as income, but also education, time, health, and civic kills. Income further allows for the development of skills that are necessary for political participation (Schlozman et al., Reference Schlozman, Brady and Verba2018). Contextualizing the dividend payments shows that the Alaskan UBI is not able to account for a considerable share of the per capita personal income (see Appendix) in my analysis period (Zelleke, Reference Zelleke, Widerquist and Howard2016, 150)—the resources necessary for political participation can probably not be expected to increase vastly for the average population.

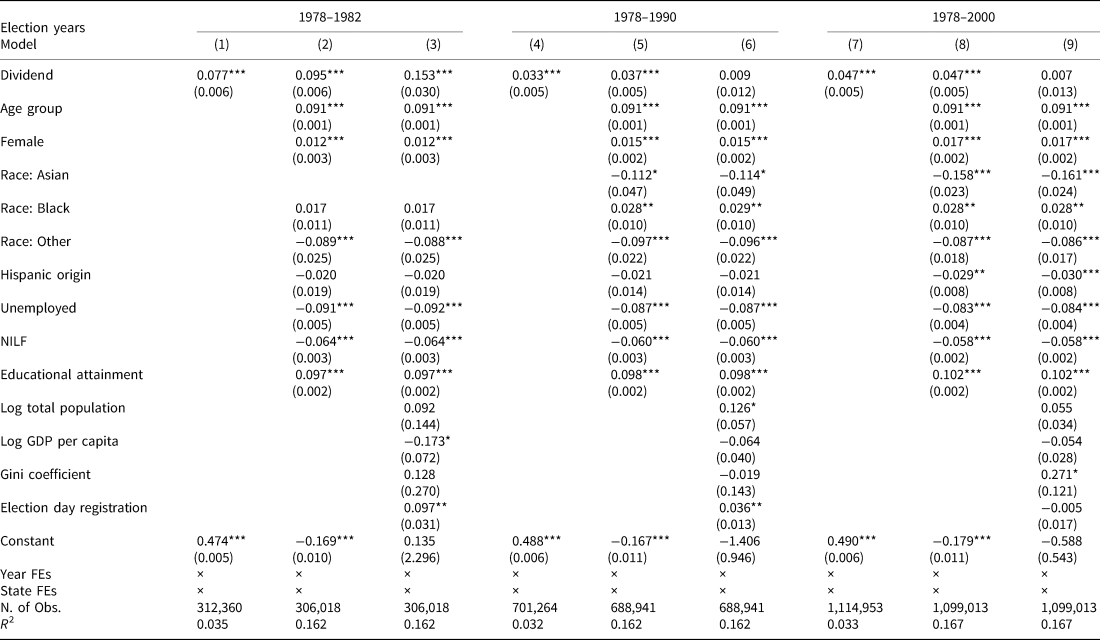

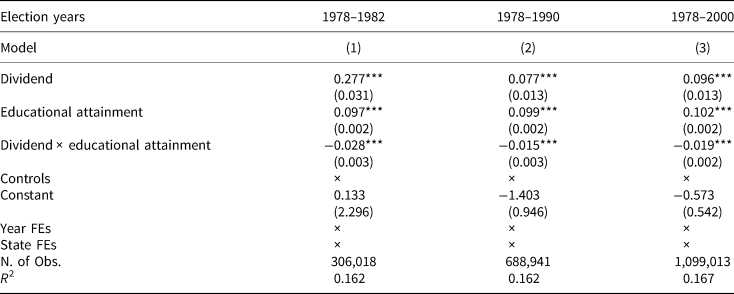

In order to corroborate the theoretical mechanisms proposed, I analyze heterogeneous effects by socioeconomic background (Table 4). As the CPS voter supplement only publishes family income starting in 1982, I proxy for household resources by using individual educational attainment,Footnote 1 two variables that are highly correlated (Wolfinger and Rosenstone, Reference Wolfinger and Rosenstone1980).

Table 4. Heterogeneous effects—educational attainment

Notes: Regression coefficients shown with robust standard errors in parentheses that are clustered by state. Coefficients for the fixed effects are not reported. ***p < 0.01, **p < 0.05, *p < 0.1.

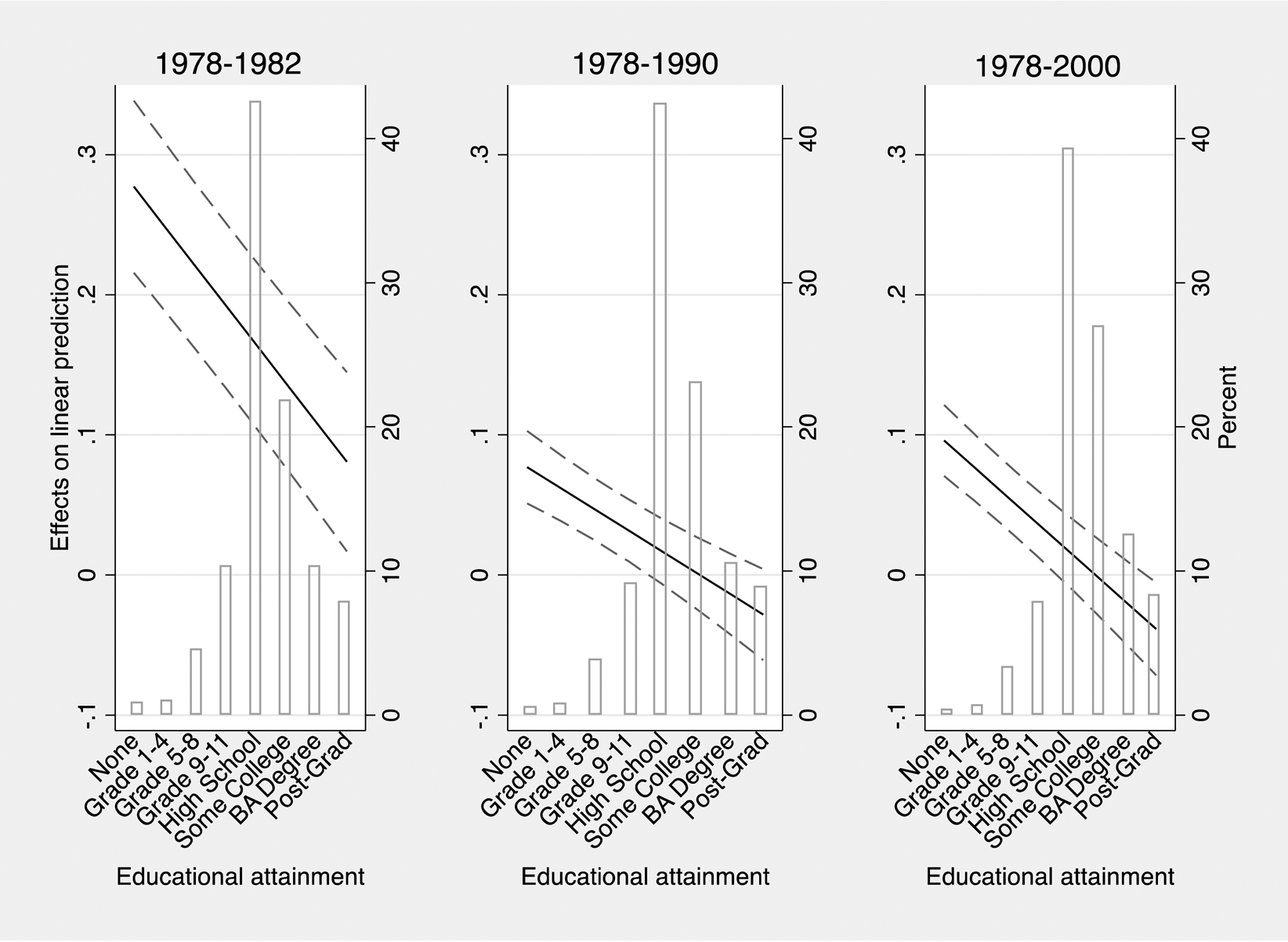

The negative estimates of the interaction of dividend and educational attainment mean that the turnout increasing effect of the dividend decreases as educational attainment increases. Figure 2 displays the marginal effect of the dividend on turnout at different levels of educational attainment as well as the distribution of educational attainment, showing that the UBI has a significant turnout-enhancing effect when educational attainment is low.

Figure 2. Marginal effect of dividend on turnout in Alaska with 95 percent CI.

This indicates that the Alaskan citizenry did not react uniformly to the introduction of the payments. More specifically, the strong reaction of individuals with a lower socioeconomic status indicates a resource effect being at play for those very individuals. A heterogeneous treatment effect analysis by race that is included in the Appendix increases the robustness of this finding, showing that especially American Indians/Aleuts reflected large marginal turnout effects, a population subgroup that fares worse than the average population with regard to income but also factors such as financial literacy, education, and health (Paisano, Reference Paisano1995; Denny et al., Reference Denny, Holtzman, Turner Goins and Croft2005; Murphy et al., Reference Murphy, Gourd and Begay2014). This is in line with research showing that albeit more affluent citizens turn out to vote at higher rates, an income effect voting is higher for poorer citizens (Rosenstone, Reference Rosenstone1982; Ojeda, Reference Ojeda2018, 814). The results stipulate that the dividend—which can account for 20 percent of the poverty threshold in Alaska in some years—can substantially increase citizens' resources and therefore their ability to deal with the costs connected to the voting process. As the results indicate a resource effect having materialized especially among Alaskans with a lower socioeconomic background, the average increase in turnout may thereby be explained by a second mechanism that needs to be considered: interpretive effects.

The Alaskan UBI is paid unconditionally to every permanent resident, and citizens do not approach the government as petitioners applying for public transfer payments with the need to prove their indigence, minimizing the risk of a stigmatizing certain population groups (Bidadanure, Reference Bidadanure2019, 485). Alaskans approach the administration as universally legitimate recipients of the dividend, some even call them shareholders in “Alaska Inc.” (O'Brien and Olson, Reference O'Brien and Olson1990). The program's guaranteed nature may lend legitimacy to the citizens “claim[s] to benefits and their worth to society” (Campbell, Reference Campbell2012, 342). Among the electorate, attitudes toward the administration may shift as the government policy of the dividend is not means-tested—possibly causing reciprocal behavior among citizens as they turn out to vote (Campbell, Reference Campbell2012; Galiani et al., Reference Galiani, Ibarraran and McEwan2016; Markovich and White, Reference Markovich and White2022).

A third potential policy feedback mechanism is the mobilization effect, meaning that a UBI could incentivize program recipients that do not want the program benefits revoked to increase political participation (Campbell, Reference Campbell2012). The dividend program was however only introduced after the Alaskan Permanent Fund was founded based on a constitutional amendment following a referendum. This indicates that the dividend payments never became a politically contested subject as the program was designed to last. The main goal of the sovereign wealth fund is to preserve a share of Alaska's “nonrenewable oil and mineral wealth for future generations” by utilizing a diversified investment strategy to generate additional income, and to place a share of Alaska's oil revenues “beyond the reach of day-to-day government spending” (O'Brien and Olson, Reference O'Brien and Olson1990, 139–141). I therefore argue that mobilization is an unlikely mechanism driving turnout in Alaska.

Finally, the turnout increase could have also been based on new voters. Franklin (Reference Franklin2004) states that turnout behavior remains constant during adult life, a turnout increase should accordingly be grounded on the voting habits of new voters that either only reached voting age or moved to the state. When looking at the marginal effect of the dividend on turnout at different age groups (Table A12, Appendix), it can be seen that the dividend has a stronger turnout effect among older citizens, this holds both in the short- and medium-run. The share of young voters aged 18–24 can also be seen to have decreased over time in Alaska. The development of the population growth rate in Alaska further indicates that while it increased from immediately after the introduction of the UBI to 5.4 percent it decreased again after 1984. This does not appear to be an unusual development as Alaska's population growth has historically exhibited fluctuations, growth in the early 1980s was due in particular to a booming oil industry (Williams, Reference Williams1985; SEER Program, National Cancer Institute, 2018). Both this population growth and a general population volatility over time are also mirrored in other oil-producing US states including Texas and Oklahoma. I have plotted these growth rates against each other in the Appendix. In order to account for this population growth, I control for the population size in all of my models and am able to estimate a turnout effect persisting until 2000. I further also use the synthetic control method by Abadie et al. (Reference Abadie, Diamond and Hainmueller2010, Reference Abadie, Diamond and Hainmueller2015) that relaxes the parallel trends assumption with the above-mentioned US states included in the baseline group.

7. Conclusion

This paper analyzes the link between a UBI and aggregate turnout. I hypothesize the Alaskan Permanent Fund Dividend as a case of a UBI—celebrated by some to be the only UBI in the world—to have a positive effect on turnout. I employ a DiD estimation strategy to compare the pre- to post-treatment change in turnout for the state of Alaska—where the dividend program is introduced in 1982—relative to the development in all other US states. This paper provides compelling evidence that a UBI increases turnout among an entire electorate persisting over an almost 20-year period—in spite of the dividend payments staying below USD 2,000 and varying considerably.

Among several possible explanations, I analogously to Clinton and Sances (Reference Clinton and Sances2018) argue that two mechanisms are able to account for the lasting increase in turnout, both occurring simultaneously (Pierson, Reference Pierson1993; Schlozman et al., Reference Schlozman, Brady and Verba2018). On the one hand the additional income increases resources for every Alaskan through the dividend, resources that are necessary in order to navigate the voting process. Analyzing the marginal effect of the dividend on voting at different values of educational attainment showed that especially Alaskans with a lower socioeconomic background reflected a strong and significant turnout effect, corroborating findings on the “diminishing marginal utility of income” (Pacheco and Plutzer, Reference Pacheco and Plutzer2008; Ojeda, Reference Ojeda2018, 814). On the other hand, owing to the fact that turnout increased on average as well as the size of the dividend payments may well be expected to have a smaller effect on more affluent Alaskans, it cannot be the increase in resources alone affecting turnout. Rather, an interpretive effect seems to be in place that is grounded on the unconditional nature of the payments. This interpretive effect may emerge, as the role an administration plays in the lives of citizens changes where everyone becomes a program beneficiary. Beyond presenting suggestive evidence I however cannot determine how the discussed mechanisms of interpretive and resource effects interplay.

The basic income in Alaska is able to open new perspectives for the range of effects an unconditional cash transfers may have. Besides findings on economic and wellbeing effects, this paper contributes to the relatively scarce groundwork on political effects of a UBI. The turnout-enhancing estimations of this paper are observed for transfer payment sizes that are well-below those of basic social security benefits in Western Europe. The results are therefore encouraging not only for researchers and practitioners focusing on the UBI but hold insights for the design of welfare systems and redistributive measures in general. With a worldwide economic recession unfolding which will most likely have far-reaching political consequences, the analyses of this paper provide evidence that introducing or redesigning transfer payments in a way in which they appear inclusive, where anyone can unconditionally become a beneficiary, can stabilize political systems. The findings hence also add to the discussion of how to mitigate the development of decreasing turnout rates exhibited in most western democracies for decades now.

First results to partly still ongoing UBI experiments in Finland and the Netherlands have been published only recently, offering a good occasion to test the application of my findings to different contexts (Kangas et al., Reference Kangas, Jauhiainen and Simanainen2019; Verlaat et al., Reference Verlaat, de Kruijk, Rosenkranz, Groot and Sanders2020). My analyses show that a UBI has the potential to get larger parts of the population “back at the table”. Taken together, this research suggests the need to investigate the link between unconditional cash payments and turnout further, first by elaborating more on heterogeneous effects by different socioeconomic backgrounds and including information on income or wealth in the form of asset holdings, for example. UBI recipients could also be surveyed to find out more about how the turnout-enhancing mechanisms play out as within-person changes in income are observed over time.

It would secondly be desirable to analyze how a UBI would work outside of Alaska. Apart from the state of Alaska being a special case in itself due to its remote geographical location and its sparse population being subject to seasonal fluctuations based on demand for workers in the oil and fishing industry, the origin of the payments deserves some scrutiny. Alaska's dividend payments may be different from a UBI in other locations, as they are based on income from the state's oil resources. Rentier state theory commonly links resource revenues to a decrease in political participation as the state refrains from directly imposing burdens on citizens through taxation in order to finance the transfers (McGuirk, Reference McGuirk2013; Paler, Reference Paler2013; Ross Reference Ross2015). The effect of the dividend estimated here thus challenges common beliefs about the political effects of natural resources, and it suggests the need for analyses in other non-rentier states. The marginal effect of a UBI on voting might however be smaller in countries where the cost of voting is lower to begin with, where income inequality is lower or where citizens are already well-protected by a generous social safety net (Busemeyer and Sahm, Reference Busemeyer and Sahm2021). Replicating the analysis in generous welfare states could on the other hand only affect the causal mechanism at play. When citizens already have experience with welfare payments, revoking means-testing could especially trigger an interpretive effect. A UBI may thereby predominantly affect turnout as a meaningful political symbol.

This paper should be seen as a springboard for more research, providing further guidance on how to increase political participation, especially for different societal and politically marginalized groups—adding empirical evidence to an otherwise highly emotionalized and ideologized discussion around a UBI.

Supplementary material

The supplementary material for this article can be found at https://doi.org/10.1017/psrm.2022.38. To obtain replication material for this article, please visit https://doi.org/10.7910/DVN/BDCP2T

Conflict of interest

None.