The forecasts for the world and the UK economy reported in this Review are produced using the National Institute's model, NiGEM. The NiGEM model has been in use at NIESR for forecasting and policy analysis since 1987, and is also used by a group of more than 40 model subscribers, mainly in the policy community. Most countries in the OECD are modelled separately,Footnote 1 and there are also separate models of China, India, Russia, Brazil, Hong Kong, Taiwan, Indonesia, Singapore, Vietnam, South Africa, Latvia, Lithuania, Romania and Bulgaria. The rest of the world is modelled through regional blocks so that the model is global in scope. All models contain the determinants of domestic demand, export and import volumes, prices, current accounts and net assets. Output is tied down in the long run by factor inputs and technical progress interacting through production functions, but is driven by demand in the short to medium term. Economies are linked through trade, competitiveness and financial markets and are fully simultaneous. Further details on the NiGEM model are available on http://nimodel.niesr.ac.uk/.

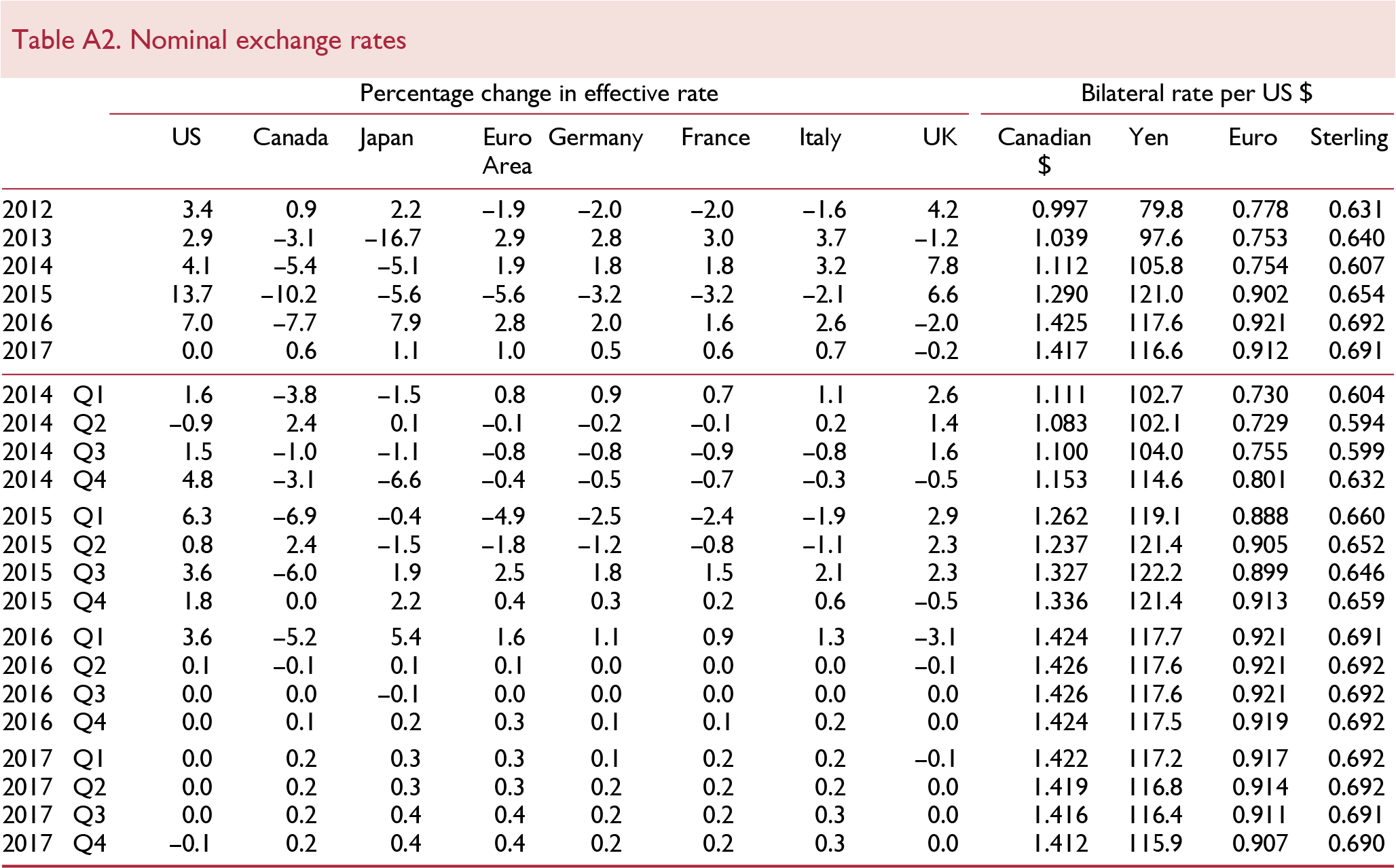

The key interest rate and exchange rate assumptions underlying our current forecast are shown in tables A1–A2. Our short-term interest rate assumptions are generally based on current financial market expectations, as implied by the rates of return on treasury bills and government bonds of different maturities. Long-term interest rate assumptions are consistent with forward estimates of short-term interest rates, allowing for a country-specific term premium. Where term premia do exist, we assume they gradually diminish over time, such that long-term interest rates in the long run are simply the forward convolution of short-term interest rates. Policy rates in major advanced economies are expected to remain at extremely low levels, at least throughout 2016.

The Reserve Bank of Australia left its benchmark interest rate unchanged after cutting it by 50 basis points to 2 per cent in two rounds in the first half of 2015. During 2015, the central bank of New Zealand lowered its policy rate by 25 basis points in June and then by a further 75 basis points in three rounds: July, September and December, to 2.5 per cent. The People's Bank of China and the Indian central bank both reduced their interest rates throughout 2015 by a total of 125 basis points each. While the People's Bank of China lowered them in five steps, the Indian central bank cut its interest rates in four rounds to 4.35 and 6.75 per cent respectively. The Bank of Korea reduced its policy rate by 100 basis points in four steps between August 2014 and June 2015 and has left it unchanged since. After cutting its benchmark interest rate by 25 basis points in February 2015, Indonesia's central bank has lowered it again, by the same magnitude, in January this year. The Central Bank of Turkey has left its policy rate unchanged at 7.5 per cent since February last year, following a spell of reductions around the middle of 2014, where the interest rates were reduced by 250 basis points. Since the end of 2014, the Romanian Central Bank has reduced interest rates by 100 basis points in four steps, while the National Bank of Hungary has brought them down by 75 basis points over five rounds. The central banks of Norway and Poland have lowered their policy rates by 50 basis points each in 2015 to 0.75 and 1.5 per cent respectively. While the central bank of Norway cut its benchmark rate in two steps, the central bank of Poland lowered its rate in March and has left it unchanged since. Over the course of last year, the Swedish Riksbank cut its policy rate by 35 basis points to −0.35 per cent in three rounds. At the turn of 2015 the Swiss National Bank cut its benchmark rate by 25 basis points to −0.75 per cent, while the Central Bank of Denmark reduced them by 15 basis points to just 0.05 per cent. Both central banks have left their main policy rate unchanged since. The Central Bank of Russia kept its benchmark interest rate unchanged after reducing it by 600 basis points to 11 per cent over five stages in the first seven months of 2015. The Bank of Canada has kept its benchmark interest rate unchanged, at 0.5 per cent, after lowering it by 50 basis points over two rounds last year. These were the first changes by Bank of Canada since 2009.

In contrast, the Central Bank of Brazil and the South African Reserve Bank both increased interest rates in response to inflationary and financial market pressures in 2015. While the South African Reserve Bank increased its benchmark rate by 25 basis points in July last year, the Central Bank of Brazil has increased its interest rate by 200 basis points to 14.25 per cent, in a series of steps over the course of 2015. Following a rise in the federal funds rate in the US, the central bank of Mexico increased its interest rate by 25 basis points in January 2016, the first change since 2008, to stem depreciation pressures on the Peso.Footnote 2

In December 2016, the Federal Reserve raised the target range for the federal funds rate by 25 basis points to 0.25–0.50 per cent. This action, agreed unanimously by the Federal Open Market Committee, was taken seven years after the target range had been lowered close to zero, and six and a half years after the end of the recession of December 2007–June 2009. The statement accompanying the Fed's decision emphasised that monetary conditions remained accommodative after the increase; that the timing and size of future adjustments would depend on its assessment of actual and expected economic conditions relative to its objectives, and that it expected that only gradual increases in the rate would be warranted.

The expectation of the first rate change of the Monetary Policy Committee (MPC) of the Bank of England is based on our view of how the economy will evolve over the next few years. At the time of writing, financial markets expect the MPC to first raise rates towards the end of 2018. We think a much earlier move is likely. The market expectations published are based on the mean of the distribution of market participant expectations. As such, a skew to the downside, possibly reflecting the perceived weighting risks to the outlook, would give an arithmetic mean significantly lower than other measures of central tendency. Indeed, it is ‘our modal view’ that we discuss here. Our forecast is for a reasonable pace in the growth of demand, while the rate of CPI inflation is projected to be marginally above target in 2018. These factors suggest to us that a modest increase in the third quarter of 2016 would be consistent with the modal outlook for the UK economy.

In contrast, the central banks of the Euro Area and Japan have continued with their programmes of large-scale asset purchases. The ECB and the Bank of Japan (BoJ) have continued to expand their balance sheets. In March 2015, the Euro Area's central banks began the ECB's expanded asset purchase programme, announced in January 2015.Footnote 3 The programme involved asset purchases of €60 billion a month, for at least nineteen months. However, in early December 2015, the ECB announced that, after an assessment of the factors slowing the return of inflation to its target, it was taking further action to increase the degree of monetary accommodation. The ECB lowered the interest rate on its deposit facility (negative since June 2014) by 10 basis points to −0.30 per cent and extended its asset purchase programme (APP) to run “until end-March 2017, or beyond, if necessary, and in any case until the Governing Council sees a sustained adjustment in the path of inflation consistent with its aim of achieving inflation rates below, but close to, 2 per cent over the medium term”. If purchases were to end in March 2017, then the programme would have involved asset purchases in total of €1.5 trillion (equivalent to about 15 per cent of Euro Area nominal GDP), compared with €1.14 trillion (equivalent to around 11 per cent of Euro Area nominal GDP) if the purchases had ended in September 2016. As we note in the main body of this chapter, the constraints the APP operates under may inhibit the ECB's ability to expand its balance sheet as much as is planned.

In October 2014, the BoJ surprised financial markets with the announcement that it was expanding its asset purchase programme by about 30 per cent. The programme envisaged an increment of about ¥80 trillion added to the monetary base annually, up from an existing ¥60–70 trillion. In December 2015, the Bank of Japan announced a further modification of its programme of quantitative and qualitative easing (QQE), which involves lengthening of the average maturity of bonds to be purchased from the beginning of 2016 to 7–12 from 7–10 years; increasing purchases of Japan real estate investment trusts and also of exchange-traded funds and loosening collateral constraints by allowing foreign currency bonds and housing loans to be eligible.

Figure A1 illustrates the recent movement in, and our projections for, 10-year government bond yields in the US, Euro Area, the UK and Japan. Convergence in Euro Area bond yields towards those in the US, observed since the start of 2013, reversed at the beginning of last year. Since February 2014, the margin between Euro Area and US bond yields started to widen, reaching a maximum of about 150 basis points (in absolute terms) at the beginning of March 2015. Since then the margin has narrowed, remaining at around 100 basis points. After reaching extremely low levels at the beginning of 2015, government bond yields in the US, UK and the Euro Area picked up in summer, but have since reversed some of these gains in yields. Current expectations for bond yields for the end of 2016 are marginally lower, by about 10–15 basis points, compared with expectations formed just three months ago, for the US, Euro Area, the UK, and Japan.

Figure A1. 10-year government bond yields

Sovereign risks in the Euro Area have been a major macroeconomic issue for the global economy and financial markets over the past five years. Figure A2 depicts the spread between 10-year government bond yields of Spain, Italy, Portugal, Ireland and Greece over Germany's. The final agreement on Private Sector Involvement in the Greek government debt restructuring in February 2012 and the potential for Outright Money Transactions (OMT) announced by the ECB in August 2012 brought some relief to bond yields in these vulnerable economies. Sovereign spreads have remained stable, in most cases, from late July 2014, the most notable exception being a marked widening of Greek spreads. This reflected initial uncertainty over Greece's fiscal stance and debt repayment since the formation of a government dominated by a political party elected on an ‘anti-austerity’ manifesto, followed by the heightened risk of Greece leaving the Euro Area and by the accompanying three-week closure of the domestic banking system, the associated withdrawal limits imposed upon on Greeks’ bank accounts and the imposition of controls on external payments in summer 2015. The dangers relating to the financial difficulties of Greece and the policy programme being negotiated with its European partners has since receded. In mid-August, it was confirmed that negotiators had reached agreement in principle on a 3-year fiscal and structural reform programme to be supported by €86 billion of financing from the European Stability Mechanism (ESM). Since then, disbursements of €13 and €2 billion were made by the ESM last year on 20 August and 23 November, respectively. In our forecast, we have assumed spreads over German bond yields continue to narrow in all Euro Area countries, and that this process resumes in Greece by the end of this year. The implicit assumption underlying the forecast is that the current composition of Euro Area membership persists.

Figure A2. Spreads over 10-year German government bond yields

Figure A3 reports the spread of corporate bond yields over government bond yields in the US, UK and Euro Area. This acts as a proxy for the margin between private sector and ‘risk-free’ borrowing costs. Private sector borrowing costs have risen more or less in line with the observed rise in government bond yields since the second half of 2013, illustrated by the stability of these spreads in the US, Euro Area and the UK. Our forecast assumption for corporate spreads is that they gradually converge towards their long-term equilibrium level from 2015.

Figure A3. Corporate bond spreads. Spread between BAA corporate and 10-year government bond yields

Nominal exchange rates against the US dollar are generally assumed to remain constant at the rate prevailing on 13 January 2016 until the end of October 2016. After that, they follow a backward-looking uncovered-interest parity condition, based on interest rate differentials relative to the US. Figure A4 plots the recent history as well as our forecast of the effective exchange rate indices for Brazil, Canada, the Euro Area, Japan, UK, Russia and the US. Reflecting relative cyclical positions and associated expectations of monetary policy developments, the US dollar has appreciated by about 10 per cent against most other major currencies in effective terms since the end of the fourth quarter of 2014. However, the rapid appreciation of the US dollar at the beginning of 2015 has eased and the trade-weighted value of the US dollar has risen by about 3.5 per cent between the final quarter of 2015 and January 2016. The appreciation of the US$ has been more pronounced against oil-producing currencies. The rouble's exchange value reached a new low of about 75 roubles to the US$ in January 2016, and has seen a decline of about 15 per cent in its trade-weighted value since the end of 2015. The Brazilian real has depreciated significantly since the end of 2014 and, in effective terms, has declined by about 33 per cent between mid-2014 and January 2016. The trade-weighted value of the Canadian dollar has fallen by more than 5 per cent since the end of 2015. The most notable exceptions to the US dollar's appreciation have been the relative movements of the Japanese Yen, appreciating in effective terms by about 8 per cent since the third quarter of 2015.

Figure A4. Effective exchange rates

Our oil price assumptions for the short term are based on those of the US Energy Information Administration (EIA), published on 12 January 2016, and updated with daily spot price data available up to 15 January 2016. The EIA use information from forward markets as well as an evaluation of supply conditions, and these are illustrated in figure A5. Oil prices declined steeply between mid-2014 and the beginning of 2015. Following a partial recovery between March and mid-June, oil prices resumed a downward trajectory, and by mid-January 2016 reached levels last seen in 2004 (about $30 a barrel). Projections from the EIA suggest little further upside potential in prices in the near term. Overall, current expectations for the position of oil prices at the end of this year have fallen by about 34 per cent, compared to the expectations formed just three months ago, which leaves oil prices around $70 lower than their nominal level in mid-2014. Oil prices are expected to reach $39 and $52 a barrel by the end of 2016 and 2017 respectively.

Figure A5. Oil prices

Our equity price assumptions for the US reflect the expected return on capital. Other equity markets are assumed to move in line with the US market, but are adjusted for different exchange rate movements and shifts in country-specific equity risk premia. Figure A6 illustrates the key equity price assumptions underlying our current forecast. Overall, between 2013 and the second half of 2014, global share prices had performed well, irrespective of a short-lived drop – a reaction to the QE tapering signals emanating from the Federal Reserve in summer 2013. However, concerns about weak growth and low inflation seem to have induced a fall in share prices in many countries in the second half of 2014, with the scale of the drop varying significantly between economies. Share prices in many countries rose again in the first half of this year, especially in the Euro Area economies, partly supported by the wide-scale asset purchase programme introduced by the ECB in March 2015. However, since mid-2015, the performance of share prices globally has been disappointing, most notably in China, where the authorities are attempting to impede the share price correction after encouraging the boom. Equity prices in some countries fell by as much as 24 per cent compared to the second quarter of 2015. Alongside China, the largest drops in equity prices were observed in Greece, Spain and Poland, followed by Canada. While the triggers for the global equity decline seem to have been turmoil in the Chinese equity market, in some cases there are country-specific issues which exacerbate the impact on equity prices.

Figure A6. Share prices

Fiscal policy assumptions for 2016 follow announced policies as of 8 January 2015. Average personal sector tax rates and effective corporate tax rate assumptions underlying the projections are reported in table A3, while table A4 lists assumptions for government spending. Government spending is expected to decline as a share of GDP between 2015 and 2016 in the majority of Euro Area countries reported in the table. A policy loosening relative to our current assumptions poses an upside risk to the short-term outlook in Europe. For a discussion of fiscal multipliers and the impact of fiscal policy on the macroeconomy based on NiGEM simulations, see Reference Barrell, Holland and HurstBarrell et al. (2013).