1. Introduction

There has been a surge in the macroeconomics literature on aggregate uncertainty post global financial crisis (GFC) of 2008–2009. Bloom (Reference Bloom2009) was the first paper to show how an increase in the aggregate uncertainty affected firms’ behavior of hiring and investment and led to a fall in the industrial production up to 1% in the US. Later, Gourio et al. (Reference Gourio, Siemer and Verdelhan2013) showed a similar result for G7 countries. Recent literature including Bloom et al. (Reference Bloom, Floetotto, Jaimovich, Saporta-Eksten and Terry2018), Basu and Bundick (Reference Basu and Bundick2017), and Ravn and Sterk (Reference Ravn and Sterk2017) have focused on the role of uncertainty shocks in amplifying the adverse effects of GFC for the advanced economies (AEs). While related literature for the emerging market economies (EMEs) is still growing, Carriere-Swallow and Cespedes (Reference Carriere-Swallow and Cespedes2013) was the first paper to argue that the global uncertainty shocks impact EMEs more severely than the AEs. The authors showed that the consumption (private) and investment in the EMEs are affected more quantitatively than the AEs. Furthermore, the EMEs take more time to recover from such shocks due to incomplete financial markets. Recently, Bonciani and Ricci (Reference Bonciani and Ricci2020) created an alternate global financial risk and uncertainty index and studied its impact on the AEs and the EMEs. Similar to Carriere-Swallow and Cespedes (Reference Carriere-Swallow and Cespedes2013), the authors also found that the EMEs are more severely impacted than the AEs. Additionally, the effect of such shocks is severe for the group of countries that have a higher economic openness and weaker institutions. Bhattarai et al. (Reference Bhattarai, Chatterjee and Park2020) identified heterogeneous monetary policy responses of the Latin American EMEs and the rest of the EMEs to the global uncertainty shocks; which the authors explain is due to the heterogeneous spillover effects of these shocks on these groups of the economies.Footnote 1 While Bhattarai et al. (Reference Bhattarai, Chatterjee and Park2020) emphasize on the trade-offs faced by the policymakers at the central bank of EMEs between financial stability objective versus output and inflation stabilization under inflation-targeting, in the presence of high global uncertainty, they did not go further to analyze an alternate monetary policy that can improve the real outcomes and reduce welfare losses. This paper addresses this gap. To the best of our knowledge, the role of monetary policy in offsetting the adverse effects of global uncertainty shock in an EME and its link with the exchange rates is not explored in the literature. Our analysis shows that the current monetary policy framework of using Taylor type interest rate rules (IRRs) in a floating exchange rate regime is ineffective in stabilizing an EME from global uncertainty shocks. We also find that the standard results hold when the economy is hit with the first-moment shocks. To be precise, the domestic inflation-based Taylor IRR is a welfare dominating rule with a standard first-moment shock but not in the presence of global uncertainty shocks or second-moment shocks.

Open economy macroeconomics literature has time and again emphasized on the importance of the flexibility of exchange rates in stabilizing the domestic economy from a foreign shock going back to Friedman (Reference Friedman1953). Floating exchange rates leave interest rates to be determined by the policymakers as an instrument to stabilize the economy. Gali and Monacelli (Reference Galí and Monacelli2005) through a small open economy (SOE) framework showed that a domestic inflation-based Taylor rule with floating exchange rates is a welfare dominating rule. Recently, Corsetti et al. (Reference Corsetti, Kuester and Muller2017) while revisiting this issue under zero lower bound (ZLB), concludes that the floating exchange rates dominate the PEG rules when a SOE experiences a negative demand shocks from abroad. This happens as the floating exchange rate allows for the domestic currency depreciation and thus it acts as a shock absorber. On the contrary, we find that the flexibility of exchange rates can amplify the real effects of the global uncertainty shocks. The difference is primarily driven by the source of disturbance to the economy. While the above mentioned papers are analyzed with the level or first-moment shocks, the present paper considers global uncertainty shocks which are time-varying volatility shocks or second-moment shocks (Schmitt-Grohé and Uribe (Reference Schmitt-Grohé and Uribe2004); Benigno et al. (Reference Benigno, Benigno and Nisticò2013); Benigno et al. (Reference Benigno, Benigno and Nisticò2012); Fernández-Villaverde et al. (Reference Fernández-Villaverde, Guerrón-Quintana, Rubio-Ramírez and Uribe2011)).

Similar to Bhattarai et al. (Reference Bhattarai, Chatterjee and Park2020) and Bonciani and Ricci (Reference Bonciani and Ricci2020) in our empirical exercise, we strongly observe that the exchange rate movements are significant in EMEs vis-a-vis AEs when global uncertainty rises. To be specific, the data distinctly shows that the exchange rates, both nominal as well real, depreciate strongly during the periods of high global uncertainty. This happens because capital moves out of the EMEs as an immediate response to a higher global uncertainty. Typically when the global risks are high, investors move their risky asset portfolio into safer assets like US treasury bills and that’s why EMEs experience a net portfolio outflow. This is consistent with the flight-to-safety hypothesis. When global risks were high during the GFC, Fratzscher (Reference Fratzscher2012) finds a strong empirical evidence showing a significant net portfolio outflow from EMEs. The author also argues that the global risks have been a key “push factor” driving capital flows from EMEs. The capital outflow from these EMEs during high global uncertainty leads to depreciation of the currency. A depreciating currency in an EME does not lead to an expansion of output, as explained by the expenditure switching via trade channel, because increase in the global uncertainty contracts the world output too. Instead, the depreciating currency is contractionary here. This follows from the existing literature which has emphasized on the contractionary effect of a depreciating currency in EMEs through the financial channel (Avdjiev et al. (Reference Avdjiev, Bruno, Koch and Shin2019); Kearns and Patel (Reference Kearns and Patel2016); Banerjee et al. (Reference Banerjee, Hofmann and Mehrotra2020); Caldara et al. (Reference Caldara, Fuentes-Albero, Gilchrist and Zakrajsek2016); Caballero et al. (Reference Caballero, Fernandez and Park2019); Cook (Reference Cook2004); Korinek (Reference Korinek2018)). The main reason argued in this literature is worsening of the balance sheets of the firms in EMEs, as most of the external debt held by the firms is denominated in dominant currencies such as the US dollar. Caballero et al., (Reference Caballero, Fernandez and Park2019) find that foreign borrowing of corporate in the EMEs have increased from 600 billion US dollars in early 2000s to 2.4 trillion US dollars by the end of 2014. A depreciation (both nominal and real) of the currency would worsens the balance sheets of firms and these firms hit a borrowing/ credit constraint. This can make things worse if the currency depreciates further with capital moving out of the country. This point has also been emphasized in Carriere-Swallow and Cespedes (Reference Carriere-Swallow and Cespedes2013) to explain a longer recovery time period for a fall in investment in emerging markets when hit with a global uncertainty shock.

Further, due to a currency depreciation, domestic consumer prices increase due to an increase in the import prices in the EMEs. As a response to increasing inflationary expectations, the central bank in EMEs increases the nominal interest rate.Footnote 2 Other possible reasons for increasing interest rates could be to put a check on the outflow of capital. Our stylized facts show that emerging markets grapple with a fall in private consumption and investment during episodes of increasing uncertainty, as shown in Carriere-Swallow and Cespedes (Reference Carriere-Swallow and Cespedes2013). An increase in the nominal interest rate can further destabilize a contracting SOE by reinforcing the adverse real effects of the uncertainty shocks. A monetary policy, implemented using Taylor type IRRs, is thus faced with a strong trade-offs in inflation and output stabilization, and between financial stability and output stabilization.

A link between global uncertainty and floating exchange rate regime can be detrimental to the economy for two important reasons. Firstly, as discussed above in the presence of high global uncertainty, investments in the EMEs starts drying up and depreciation further aggravates the issue. Secondly, an independent monetary policy followed by the central bank of EMEs becomes trivial or ineffective as the uncovered interest rate parity (UIP) does not hold. Benigno et al. (Reference Benigno, Benigno and Nisticò2012) argue that when an uncertainty shock hits an economy, fluctuations in the exchange rates are guided by a hedging motive. Under such a scenario, UIP does not hold and time-varying risk premiums are generated.Footnote 3 The left chart of Figure 1 summarizes how key macroeconomic variables are connected in a SOE. Furthermore, when an economy deviates from UIP the link between nominal interest rates (monetary policy instrument) and the nominal exchange rate breaks down. Thus, any attempt to stabilize the nominal exchange rate movement and the economy through an independent monetary policy rule or IRR is unsuccessful.Footnote 4 Stabilization of exchange rates is imperative here as it amplifies the contractionary effect of global uncertainty shocks in an EME and an IRR fails to do so.

Figure 1. In presense of global uncertainty shock (a) Monetary policy using nominal interest rates as instrument (left); (b) Monetary policy using nominal exchange rates as instrument (right).

In the present paper, we consider response of the economy under alternate monetary policy instruments, since IRRs are ineffective here.Footnote 5 To look for a monetary policy rule which minimizes the welfare loss, we build a SOE new Keynesian DSGE model with an uncertainty shock to the world demand and examine the response of real macroeconomic variables under a variety of monetary policy rules. A most obvious alternate policy to be considered here is a fixed exchange rate regime. Cook (Reference Cook2004) has argued that a fixed exchange rate regime (PEG) offers a greater stability than an IRR (or floating exchange rate regime) when currency depreciation destabilizes the business cycle. We find that, while fixed exchange rate regime does better than an IRR in terms of welfare losses, it brings high variability to other nominal variables in the economy like consumer price inflation (CPI), which adjusts more. Although, the PEG rule performs poorly with respect to inflation volatility, the fixed exchange rates does give a higher consumption level than floating exchange rates on impact of the second-moment shocks and a lower variability to consumption in the long-run. This result is different from papers which consider level/ moment shock like Corsetti et al. (Reference Corsetti, Kuester and Muller2017) as UIP is satisfied there. Since floating exchange rate regimes are associated with higher risk premiums than PEG, the latter performs better under high global uncertainty for certain variables.

We find that a monetary policy rule that gives a lowest welfare loss, when a SOE is hit with a global uncertainty shock, is an exchange rate rule (ERR) followed by a PEG rule. When a monetary policy uses the exchange rate as an instrument, the exchange rate follows a rule and is guided by key fundamentals governing the domestic economy, like inflation and output. The Monetary Authority of Singapore (MAS) has been successfully following this rule since 1981 (McCallum (2006)). ERR allows an economy not to choose from corner solutions as dictated by a fixed exchange rates and floating exchange rates (Heiperzt et al. (Reference Heiperzt, Mihov and Santacreu2017)). Since the exchange rate follows a rule with ERR and does not float freely, the hedging/ flight-to-safety motive mentioned above is weakened. Thus, nominal exchange rates are stabilized and welfare losses are reduced significantly. The right chart in Figure 1 shows how a link between monetary policy, exchange rates and key macroeconomic variables like inflation and output is restored when ERRs are followed. This rule restores the lost connection between monetary policy, exchange rates, inflation and output, thus making monetary policy rules much effective in stabilizing the economy. The risk premiums associated with ERRs are also lower due to a lower hedging motive. Due to ERRs association with lower risk premiums the precautionary motive to save and thus consume less, is also weak. This reduces the transmission of uncertainty shocks on the real economy through the aggregate demand channel. ERRs not only reduce welfare losses but also reduce the variability of nominal exchange rates, consumption, and inflation remarkably from the baseline case of IRR. Heiperzt et al. (Reference Heiperzt, Mihov and Santacreu2017) derive an analytical solution to show that the ERRs have lower risk premiums then Taylor rules and smoothing economic fluctuations in SOEs using first-moment shocks. Our results are different from Heiperzt et al. (Reference Heiperzt, Mihov and Santacreu2017) as we do not find that ERRs perform better for a first-moment shock. It is only when the economy is hit with a time-varying second-moment shock the standard results do not hold.

1.1. Empirical evidence

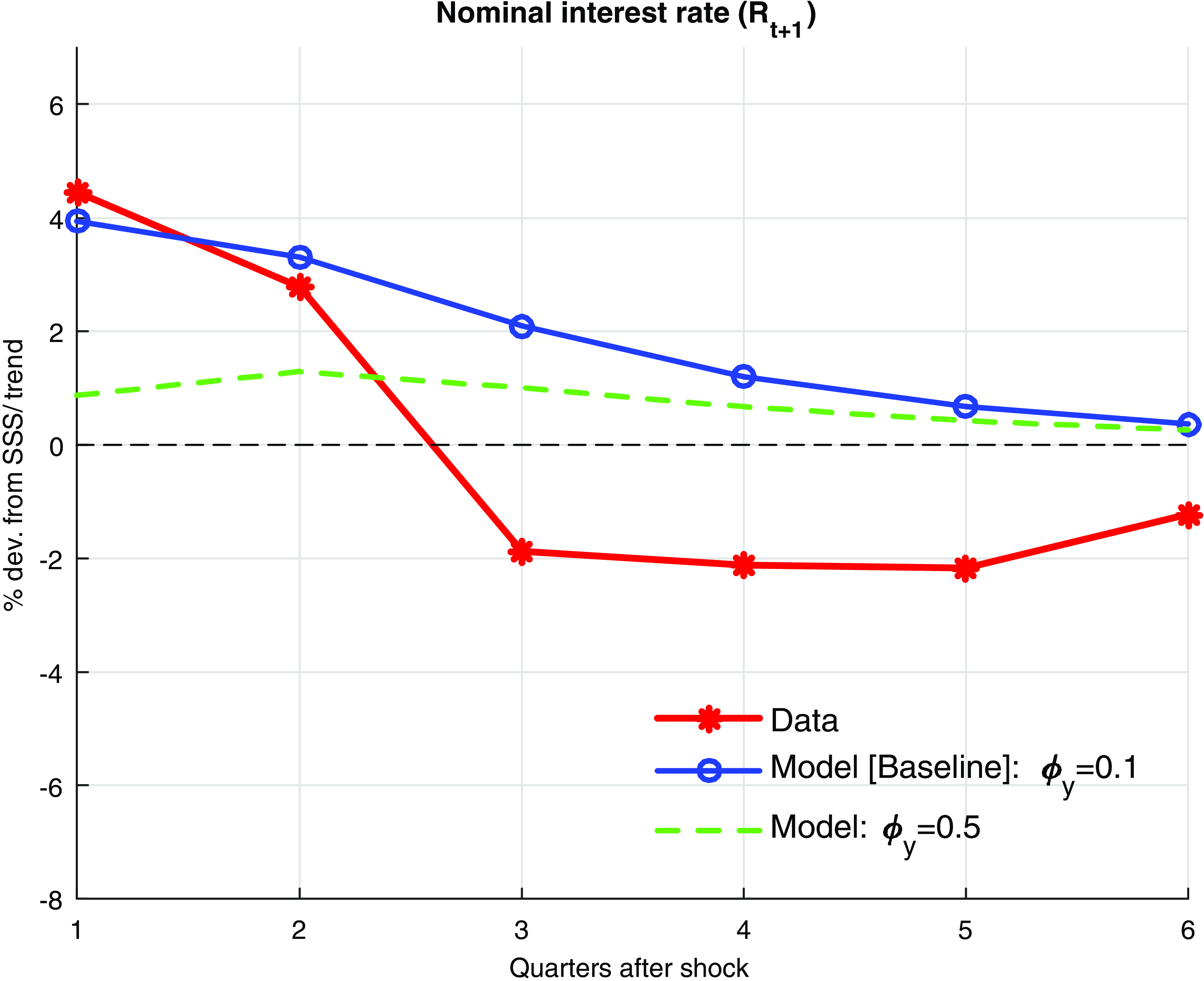

In this section, we do empirical analysis to study the effects of global uncertainty shocks on AEs and EMEs as already done in Bhattarai et al. (Reference Bhattarai, Chatterjee and Park2020) and Bonciani and Ricci (Reference Bonciani and Ricci2020). We redo this exercise because of two reasons. Firstly, besides updating the series for recent years, we use datasets available in the public domain so that the results can be replicated. Due to this, we work with the available quarterly series for the variables in our analysis, unlike the monthly series used in the papers mentioned above.Footnote 6 Secondly, two parameters related to the uncertainty shock process in the model are set to match the impulse response functions of the nominal interest rate from the model with the empirical counterpart. This matching is similar to Basu and Bundick (Reference Basu and Bundick2017). For the empirical strategy, we use a local projection method proposed by Jorda (Reference Jorda2005) to look into the effects of global uncertainty shocks on a wide variety of variables for both AEs and EMEs.Footnote 7 To capture global uncertainty we use the VXO index series as proxied in Bloom (Reference Bloom2009) and Carriere-Swallow and Cespedes (Reference Carriere-Swallow and Cespedes2013). For the VXO series, we use the CBOE S&P 100 Volatility Index’s daily series accessed from the Federal Reserve Bank of St. Louis database from 1996 to 2019.Footnote 8 We also consider VIX volatility index for robustness check and find that the results are consistent. For further analysis, we create a quarterly panel dataset for 14 economies from 1996:Q1 to 2019:Q4. We consider seven AEs (US, UK, Canada, Japan, Australia, South Korea, and Sweden) and seven EMEs (Brazil, Chile, Indonesia, India, Mexico, Russia, and South Africa).Footnote 9 The primary source for most of the macroeconomic series is the quarterly national accounts data compiled by the Organization for Economic Cooperation and Development (OECD (2021)). The macroeconomic series we consider are: real GDP, real consumption, real investment, trade balance, nominal exchange rate, REER, short-term interest rates, consumer price index (CPI), and the net portfolio investment. We also create the net portfolio investment series for Chile, Indonesia, and Mexico using International Monetary Fund’s International Financial Statistics (IFS (2021)). A detailed data description is provided in the Data Appendix A.1.

We estimate panel local projections for horizon,

![]() $h=0,1,2,3,4,5,6,7,8$

as described below,

$h=0,1,2,3,4,5,6,7,8$

as described below,

Here, for country

![]() $i,$

$i,$

![]() $\varsigma _{i,t+h}$

is the projection residual,

$\varsigma _{i,t+h}$

is the projection residual,

![]() $\alpha _{i,h},$

$\alpha _{i,h},$

![]() $\theta _{i,h}$

and

$\theta _{i,h}$

and

![]() $\beta _{i,h}^{q}$

are the projection coefficients. The vector

$\beta _{i,h}^{q}$

are the projection coefficients. The vector

![]() $Y_{t}$

is a set of response variables including real GDP, real consumption, real investment, trade balance, nominal exchange rate, REER, net portfolio investment, inflation, and short-term interest rates. The vector

$Y_{t}$

is a set of response variables including real GDP, real consumption, real investment, trade balance, nominal exchange rate, REER, net portfolio investment, inflation, and short-term interest rates. The vector

![]() $X_{t}$

is a set of control variables including lagged dependent variables and policy variables. The local projection impulse response of

$X_{t}$

is a set of control variables including lagged dependent variables and policy variables. The local projection impulse response of

![]() $Y_{t}$

with respect to

$Y_{t}$

with respect to

![]() $vxo_{t}$

at horizon

$vxo_{t}$

at horizon

![]() $h$

for country

$h$

for country

![]() $i$

is given by

$i$

is given by

![]() $\left \{ \theta _{i,h}\right \}$

for

$\left \{ \theta _{i,h}\right \}$

for

![]() $h\succeq 0.$

The lag of control variables,

$h\succeq 0.$

The lag of control variables,

![]() $q,$

is set to up to four periods. We control for the country fixed effects in our panel regression. It is worth mentioning that since

$q,$

is set to up to four periods. We control for the country fixed effects in our panel regression. It is worth mentioning that since

![]() $vxo_{t}$

captures the volatility in the stock prices in the US economy (AE), for EMEs it is an exogenous shock variable.Footnote 10

$vxo_{t}$

captures the volatility in the stock prices in the US economy (AE), for EMEs it is an exogenous shock variable.Footnote 10

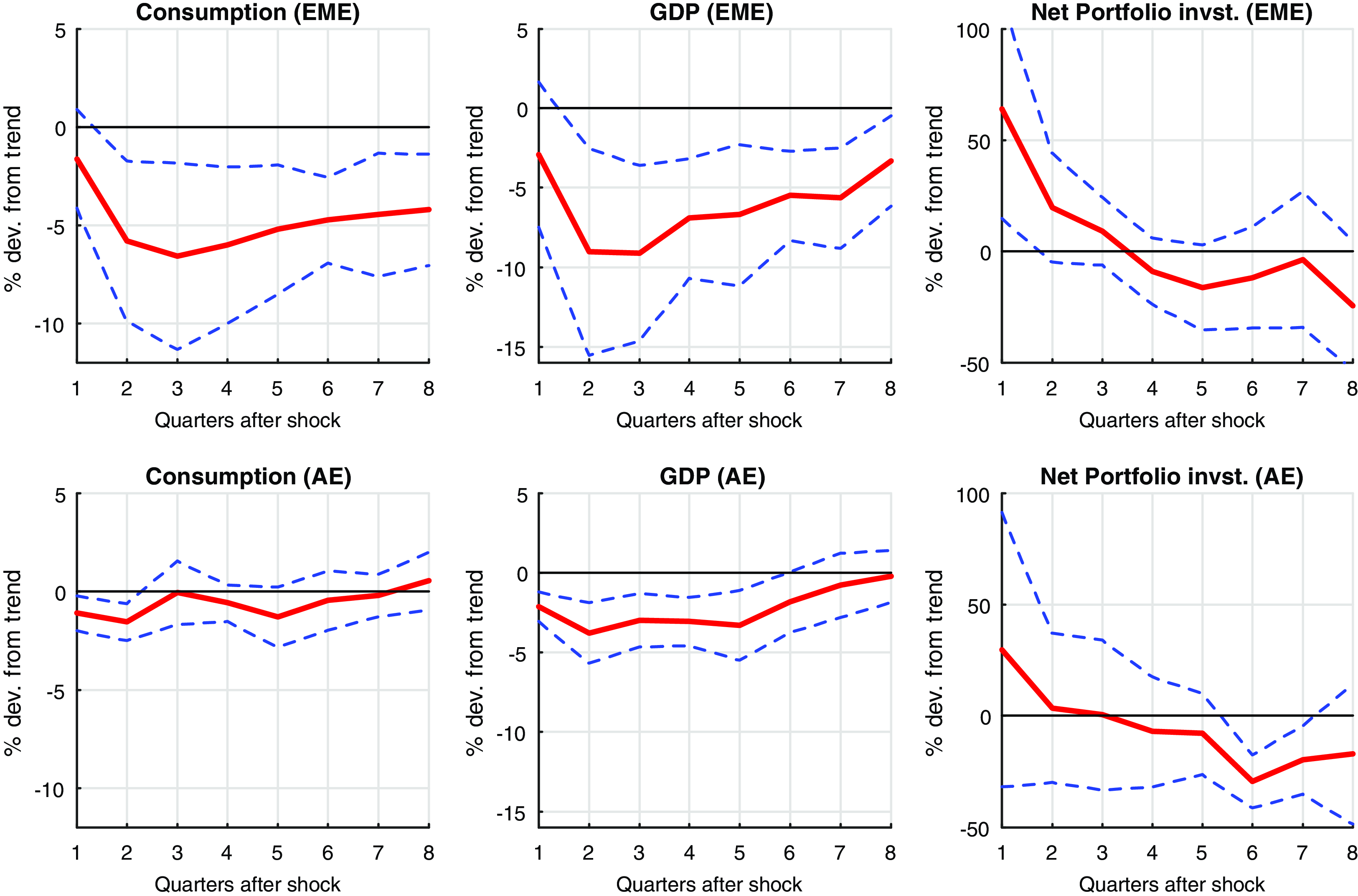

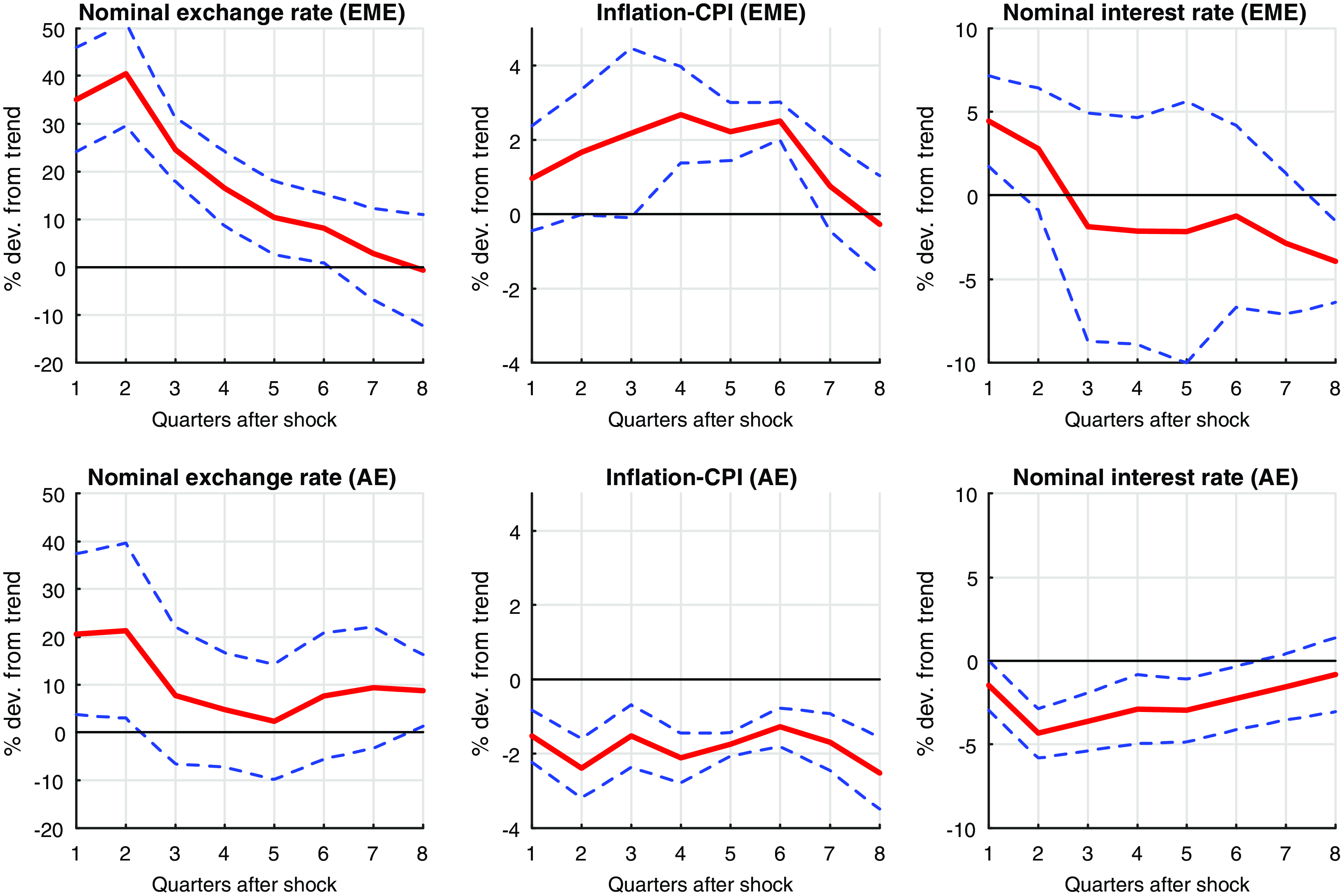

Figure 2. Local projection responses for (col 1) Real GDP; (col 2) Real Consumption; (col 3) Net Portfolio Invt. with VXO impulse [95% CI].

Figure 3. Local projection responses for (col 1) Nominal Exchange Rate; (col 2) Consumer price index; (col 3) Nominal interest rates with VXO impulse [95% CI].

Figures 2 and 3 show local projection responses using OLS for eight quarters after the shock to global uncertainty of 1% from its trend. We plot impulse response functions with 95% confidence bands. Figures 2 shows that the GDP and private consumption decrease in both EMEs and AEs, but the decrease is much higher (up to 10% from the trend) in EMEs compared to the AEs.Footnote 11 These results are consistent with the empirical facts observed in Carriere-Swallow and Cespedes (Reference Carriere-Swallow and Cespedes2013), Forbes and Warnock (Reference Forbes and Warnock2012), Bonciani and Ricci (Reference Bonciani and Ricci2020), and Bhattarai et al. (Reference Bhattarai, Chatterjee and Park2020). The net portfolio investment outflows from the EMEs immediately after the shock. About 50% increase in the net portfolio investment from it’s trend provides a strong evidence of capital outflows in EMEs when global uncertainty increases. AEs do not experience a significant change in there capital movement as compared to the EMEs. The literature has identified high global risk as one of the most important push factor in determining capital outflows from EMEs (Fratzscher (Reference Fratzscher2012); Forbes and Warnock (Reference Forbes and Warnock2012); Caldara et al. (Reference Caldara, Fuentes-Albero, Gilchrist and Zakrajsek2016)). As a result of capital outflows, the domestic currency (nominal exchange rate) in EMEs depreciates by 40% from the trend on impact and remains depreciated upto six quarters after the shock (Figure 3: col 1).Footnote 12 We also see significant exchange rate depreciation in the first quarter after the shock in the group of AEs consider quarters but subsequently the movement is not significant as compared to EMEs. A sustained real or nominal depreciation of the currency amplifies the reduction in real activity and brings instability to the business cycle in EMEs as argued in the literature.Footnote 13 Kido (Reference Kido2016) finds a strong link between US economic policy uncertainty and exchange rates.

Currency depreciation in EMEs leads to a rise in inflation due to a rise in the import goods prices (Figure 3: col 2). For the countries and time periods we consider in our empirical analysis, we find strong evidence of the CPI increasing when the EMEs are hit with an exogenous

![]() $vxo_{t}$

uncertainty shock. Intuitively, multiple channels are working in opposite directions. While demand reduction (both global and domestic) will push down the prices, depreciation and supply-side disturbances will increase the prices. There is ample evidence on how the depreciation tightens the financial conditions of the firms and as a response, the supply gets affected (Caballero et al. (Reference Caballero, Fernandez and Park2019); Caldara et al. (Reference Caldara, Fuentes-Albero, Gilchrist and Zakrajsek2016); Carriere-Swallow and Cespedes (Reference Carriere-Swallow and Cespedes2013)). The depreciation/ supply channel dominates in our empirical exercise as the consumer prices rise for the EMEs.Footnote 14 We do perform the sensitivity analysis by dropping each country one by one but the results do not change significantly. AEs on the other hand, experience a fall in consumer prices as their aggregate demand falls. Bhattarai et al. (Reference Bhattarai, Chatterjee and Park2020) showed that the response of consumer prices varies for the Latin American EMEs and the rest of the EMEs.Footnote 15 Bonciani and Ricci (Reference Bonciani and Ricci2020) found that the consumer prices fall in both the AEs and the EMEs but the price fall in the EMEs is much lower and not significant.Footnote 16

$vxo_{t}$

uncertainty shock. Intuitively, multiple channels are working in opposite directions. While demand reduction (both global and domestic) will push down the prices, depreciation and supply-side disturbances will increase the prices. There is ample evidence on how the depreciation tightens the financial conditions of the firms and as a response, the supply gets affected (Caballero et al. (Reference Caballero, Fernandez and Park2019); Caldara et al. (Reference Caldara, Fuentes-Albero, Gilchrist and Zakrajsek2016); Carriere-Swallow and Cespedes (Reference Carriere-Swallow and Cespedes2013)). The depreciation/ supply channel dominates in our empirical exercise as the consumer prices rise for the EMEs.Footnote 14 We do perform the sensitivity analysis by dropping each country one by one but the results do not change significantly. AEs on the other hand, experience a fall in consumer prices as their aggregate demand falls. Bhattarai et al. (Reference Bhattarai, Chatterjee and Park2020) showed that the response of consumer prices varies for the Latin American EMEs and the rest of the EMEs.Footnote 15 Bonciani and Ricci (Reference Bonciani and Ricci2020) found that the consumer prices fall in both the AEs and the EMEs but the price fall in the EMEs is much lower and not significant.Footnote 16

All countries considered for the present analysis have an inflation-targeting mandate with interest rates as a monetary policy instrument. Interest rates thus fall in AEs as a policy response to a contracting economy and deflation (see Figure 3: col 3). For EMEs, the interest rates increase as a response to an increase in the inflation rate (see Figure 3: col 3). Although for EMEs a contracting economy would suggest a reduction in the interest rates (expansionary monetary policy), and an increase in consumer prices with exchange rate depreciation would suggest an increase in the interest rates (contractionary monetary policy).Footnote 17 Furthermore, as the central bank gives more weight to stabilizing inflation in a Taylor type IRR, we observe an increase in the interest rates in the EMEs by up to 5% (Figure 3: col 3). Another reason for the increased interest rates would be to put a check on the outflow of capital flows or financial stability, as discussed in Bhattarai et al. (Reference Bhattarai, Chatterjee and Park2020) as well. Policymakers in the EMEs are thus faced with the trade-offs between inflation and output stabilization and between financial sector stability versus real sector stabilization. Bhattarai et al. (Reference Bhattarai, Chatterjee and Park2020) did a discussion on the strong trade-offs that central bankers in EMEs face while implementing the inflation-targeting regime and explain the heterogeneous monetary policy response between the Latin American EMEs and the rest of the EMEs. None of the papers in the literature mentioned above highlight the limitation/ ineffectiveness of the IRRs and study how monetary policy response can be improved with an alternate monetary policy instrument. We thus attempt to answer two research questions that emerge from the empirical observations. First, to analyze the trade-offs that arise due to the global uncertainty shocks for the policymakers in the EMEs. Secondly, to study the role of monetary policy and compare alternate monetary policy regimes in the presence of such shocks for the EMEs. We answer both these questions using a theoretical NK-DSGE open economy model featuring a second-moment shock to the demand.Footnote 18

1.2. Summary of the stylized facts

The empirical observations explained above can be summarized as following stylized facts:

Fact 1: An increase in global uncertainty reduces real activity in both AEs as well as EMEs. EMEs experience a greater fall in real GDP, real private consumption, and real investment compared to AEs and also take more time to recover from the shock.

Fact 2: An increase in global uncertainty pulls capital (net portfolio investment) out from EMEs. The trade balances deteriorates initially before improving due to an exchange rate depreciation.

Fact 3: The capital outflow from EMEs leads to a currency (both nominal and real exchange rates) depreciation. As has been emphasized in the literature, an exchange rate depreciation worsens the balance sheets of firms, which is followed by foreign investors pulling out capital further and thus amplifying the effect of the shock on the real economy.

Fact 4: Consumer prices in EMEs increase due to a depreciation, and monetary policy responds by increasing interest rates. A rise in interest rates can thus reinforce the adverse effects of global uncertainty shock on the real economy.

To explain these facts and understand the role of monetary policy, we build a SOE NK-DSGE model with uncertainty shocks. The basic framework of the model is adapted from the two country model (foreign and domestic country) discussed in Benigno et al. (Reference Benigno, Benigno and Nisticò2012). While we characterize the domestic economy as a SOE, the foreign economy is an approximation to the world economy. The uncertainty is present in the preference/ demand shock of households in the foreign economy. We calibrate a SOE and the world economy to a prototypical EME and AE, respectively.

2. Model

Our model is a two-country (domestic and foreign) open economy model in a new Keynesian DSGE setup. The domestic country represents an EME, which is modeled here as a SOE, and the foreign country represents an AE. The idea of calibrating a SOE to an EME in essence captures the limited ability of the EMEs in influencing the global economy, although they do get heavily impacted due to global shocks. The basic framework of the model is adapted from Benigno et al. (Reference Benigno, Benigno and Nisticò2012) with the following modifications. First, in our model the domestic economy is characterized as a SOE and the foreign economy is thus an approximation to the world economy.Footnote 19 Second, we consider a second-moment shock (uncertainty shock) on the demand process of the foreign/ world economy only. We do this because the foreign economy represents the world due to its size, and we are interested in analyzing effects of global uncertainty shocks on a SOE. Third, we follow Fernández-Villaverde et al. (Reference Fernández-Villaverde, Guerrón-Quintana, Rubio-Ramírez and Uribe2011)and take a third-order approximation of the model to solve it. Benigno et al. (Reference Benigno, Benigno and Nisticò2012) follows an approach discussed in Benigno et al. (Reference Benigno, Benigno and Nisticò2013) and take a second-order approximation to solve the model and capture the effects of second-moment shocks. Note that the present model does not have capital and capital borrowings across the countries as we keep the model simple.

2.1. Households

The world is assumed to consist of two countries, domestic

![]() $(D)$

and foreign

$(D)$

and foreign

![]() $(F).$

We assume the size of the domestic economy to be

$(F).$

We assume the size of the domestic economy to be

![]() $n$

relative to the world economy, which is modeled as a foreign economy.Footnote 20 A continuum of domestic households exist over

$n$

relative to the world economy, which is modeled as a foreign economy.Footnote 20 A continuum of domestic households exist over

![]() $[ 0,n]$

, while foreign households from

$[ 0,n]$

, while foreign households from

![]() $(n,1],$

where

$(n,1],$

where

![]() $n\in ( 0,1) .$

An agent in each country is both a consumer and a producer, producing a single differentiated good and consuming all the goods produced in both countries. Also, the population size in each country is set equal to the range of goods produced in that country, such that domestic firms produce goods on

$n\in ( 0,1) .$

An agent in each country is both a consumer and a producer, producing a single differentiated good and consuming all the goods produced in both countries. Also, the population size in each country is set equal to the range of goods produced in that country, such that domestic firms produce goods on

![]() $[0,n]$

, and foreign firms produce goods on

$[0,n]$

, and foreign firms produce goods on

![]() $(n,1]$

. The preferences for both domestic and foreign households is assumed to be recursive following Epstein and Zin (Reference Epstein and Zin1989) framework. The Epstein–Zin preferences are assumed similar to Benigno et al. (Reference Benigno, Benigno and Nisticò2012) and Basu and Bundick (Reference Basu and Bundick2017) as these preferences are risk-sensitive and are able to generate variations in the variables comparable to the empirical counterpart.Footnote 21 Following this a representative household in domestic country is captured by the following recursive utility function,Footnote 22

$(n,1]$

. The preferences for both domestic and foreign households is assumed to be recursive following Epstein and Zin (Reference Epstein and Zin1989) framework. The Epstein–Zin preferences are assumed similar to Benigno et al. (Reference Benigno, Benigno and Nisticò2012) and Basu and Bundick (Reference Basu and Bundick2017) as these preferences are risk-sensitive and are able to generate variations in the variables comparable to the empirical counterpart.Footnote 21 Following this a representative household in domestic country is captured by the following recursive utility function,Footnote 22

\begin{align} V_{D,t}=\left ( U(C_{t},H_{D,t})^{1-\eta }+\beta \left ( E_{t}\left (V_{D,t+1}\right ) ^{1-\gamma }\right ) ^{\frac{\left ( 1-\eta \right ) }{\left ( 1-\gamma \right ) }}\right ) ^{\frac{1}{\left ( 1-\eta \right ) }}. \end{align}

\begin{align} V_{D,t}=\left ( U(C_{t},H_{D,t})^{1-\eta }+\beta \left ( E_{t}\left (V_{D,t+1}\right ) ^{1-\gamma }\right ) ^{\frac{\left ( 1-\eta \right ) }{\left ( 1-\gamma \right ) }}\right ) ^{\frac{1}{\left ( 1-\eta \right ) }}. \end{align}

Here

![]() $C_{t}$

denotes the aggregate consumption index,

$C_{t}$

denotes the aggregate consumption index,

![]() $H_{D,t}$

denotes hours worked by the representative domestic household,

$H_{D,t}$

denotes hours worked by the representative domestic household,

![]() $\eta$

is a measure of the inverse of the intertemporal elasticity of substitution,

$\eta$

is a measure of the inverse of the intertemporal elasticity of substitution,

![]() $\gamma$

is the measure of risk aversion, and

$\gamma$

is the measure of risk aversion, and

![]() $\beta \in (0,1)$

is the discount factor. The utility flow

$\beta \in (0,1)$

is the discount factor. The utility flow

![]() $U(.)$

is represented by a Cobb–Douglas function of aggregate consumption index,

$U(.)$

is represented by a Cobb–Douglas function of aggregate consumption index,

![]() $C_{t}$

and leisure

$C_{t}$

and leisure

![]() $\left (1-H_{D,t}\right ),$

$\left (1-H_{D,t}\right ),$

where

![]() $\nu$

is the weight on consumption over leisure in the utility flow function. The aggregate consumption index,

$\nu$

is the weight on consumption over leisure in the utility flow function. The aggregate consumption index,

![]() $C_{t}$

, is defined as:

$C_{t}$

, is defined as:

\begin{align} C_{t}=\left [ (\mu _{D})^{1/\xi _{D}}\left ( C_{D,t}\right ) ^{\frac{\xi _{D}-1}{\xi _{D}}}+\left ( 1-\mu _{D}\right ) ^{1/\xi _{D}}\left ( C_{F,t}\right ) ^{\frac{\xi _{D}-1}{\xi _{D}}}\right ] ^{\frac{\xi _{D}}{\xi _{D}-1}} \end{align}

\begin{align} C_{t}=\left [ (\mu _{D})^{1/\xi _{D}}\left ( C_{D,t}\right ) ^{\frac{\xi _{D}-1}{\xi _{D}}}+\left ( 1-\mu _{D}\right ) ^{1/\xi _{D}}\left ( C_{F,t}\right ) ^{\frac{\xi _{D}-1}{\xi _{D}}}\right ] ^{\frac{\xi _{D}}{\xi _{D}-1}} \end{align}

where

![]() $C_{D,t}$

and

$C_{D,t}$

and

![]() $C_{F,t}$

denotes the consumption index of domestic goods and foreign goods of domestic households, respectively.

$C_{F,t}$

denotes the consumption index of domestic goods and foreign goods of domestic households, respectively.

![]() $\xi _{D}\gt 0$

is the elasticity of substitution between domestic goods and foreign goods for domestic households and

$\xi _{D}\gt 0$

is the elasticity of substitution between domestic goods and foreign goods for domestic households and

![]() $\mu _{D}\in (0,1)$

is the weight given to domestic goods in the aggregate consumption basket,

$\mu _{D}\in (0,1)$

is the weight given to domestic goods in the aggregate consumption basket,

![]() $C_{t}.$

Footnote 23 Analogous to equation (1), the utility function for a representative household in a foreign country is given by:

$C_{t}.$

Footnote 23 Analogous to equation (1), the utility function for a representative household in a foreign country is given by:

\begin{align} V_{F,t}=\left ( \Gamma _{F,t}U(C_{t}^{\ast },H_{F,t})^{1-\eta }+\beta \left ( E_{t}\left ( V_{F,t+1}\right ) ^{1-\gamma }\right ) ^{\frac{\left ( 1-\eta \right ) }{\left ( 1-\gamma \right ) }}\right ) ^{\frac{1}{\left ( 1-\eta \right ) }} \end{align}

\begin{align} V_{F,t}=\left ( \Gamma _{F,t}U(C_{t}^{\ast },H_{F,t})^{1-\eta }+\beta \left ( E_{t}\left ( V_{F,t+1}\right ) ^{1-\gamma }\right ) ^{\frac{\left ( 1-\eta \right ) }{\left ( 1-\gamma \right ) }}\right ) ^{\frac{1}{\left ( 1-\eta \right ) }} \end{align}

where

![]() $C_{t}^{\ast }$

denotes the aggregate consumption index,

$C_{t}^{\ast }$

denotes the aggregate consumption index,

![]() $H_{F,t}$

denotes hours worked and

$H_{F,t}$

denotes hours worked and

![]() $\Gamma _{F,t}$

is the preference/ demand shock process. The utility flow function is given by:

$\Gamma _{F,t}$

is the preference/ demand shock process. The utility flow function is given by:

The aggregate consumption bundle

![]() $C_{t}^{\ast }$

is given by:

$C_{t}^{\ast }$

is given by:

\begin{align} C_{t}^{\ast }=\left [ (\mu _{F})^{1/\xi _{F}}\left ( C_{D,t}^{\ast }\right ) ^{\frac{\xi _{F}-1}{\xi _{F}}}+\left ( 1-\mu _{F}\right ) ^{1/\xi _{F}}\left ( C_{F,t}^{\ast }\right ) ^{\frac{\xi _{F}-1}{\xi _{F}}}\right ] ^{\frac{\xi _{F}}{\xi _{F}-1}} \end{align}

\begin{align} C_{t}^{\ast }=\left [ (\mu _{F})^{1/\xi _{F}}\left ( C_{D,t}^{\ast }\right ) ^{\frac{\xi _{F}-1}{\xi _{F}}}+\left ( 1-\mu _{F}\right ) ^{1/\xi _{F}}\left ( C_{F,t}^{\ast }\right ) ^{\frac{\xi _{F}-1}{\xi _{F}}}\right ] ^{\frac{\xi _{F}}{\xi _{F}-1}} \end{align}

where

![]() $\mu _{F}\in (0,1)$

is weight given to domestic goods in the aggregate consumption basket,

$\mu _{F}\in (0,1)$

is weight given to domestic goods in the aggregate consumption basket,

![]() $C_{t}^{\ast }$

. Following Benigno et al. (Reference Benigno, Benigno and Nisticò2012), the weights mentioned in the aggregate consumption bundles equations (2) and (4) are related to country sizes through:

$C_{t}^{\ast }$

. Following Benigno et al. (Reference Benigno, Benigno and Nisticò2012), the weights mentioned in the aggregate consumption bundles equations (2) and (4) are related to country sizes through:

Here,

![]() $\chi \in (0,1)$

is the (common) degree of openness between the domestic and foreign country. When

$\chi \in (0,1)$

is the (common) degree of openness between the domestic and foreign country. When

![]() $\chi =0,$

there is no trade of either goods or assets happening across the two countries and it represents an autarky case.

$\chi =0,$

there is no trade of either goods or assets happening across the two countries and it represents an autarky case.

![]() $\chi =1$

, represents a case of complete free trade of both goods and assets between the two countries. Consumption bundles,

$\chi =1$

, represents a case of complete free trade of both goods and assets between the two countries. Consumption bundles,

![]() $C_{D,t}$

,

$C_{D,t}$

,

![]() $C_{F,t},C_{D,t}^{\ast }$

, and

$C_{F,t},C_{D,t}^{\ast }$

, and

![]() $C_{F,t}^{\ast }$

are Dixit–Stiglitz aggregates of differentiated goods produced in two countries and are defined as:

$C_{F,t}^{\ast }$

are Dixit–Stiglitz aggregates of differentiated goods produced in two countries and are defined as:

\begin{align} C_{D,t} =\left [ \left ( \frac{1}{n}\right ) ^{\frac{1}{\sigma }}\int _{0}^{n}\left ( C_{D,t}(i) \right ) ^{\frac{\sigma -1}{\sigma }}di\right ] ^{\frac{\sigma }{\sigma -1}}\text{ ; }C_{F,t}=\left [ \left ( \frac{1}{1-n}\right ) ^{\frac{1}{\sigma }}\int _{n}^{1}\left ( C_{F,t}(i) \right ) ^{\frac{\sigma -1}{\sigma }}di\right ] ^{\frac{\sigma }{\sigma -1}} \end{align}

\begin{align} C_{D,t} =\left [ \left ( \frac{1}{n}\right ) ^{\frac{1}{\sigma }}\int _{0}^{n}\left ( C_{D,t}(i) \right ) ^{\frac{\sigma -1}{\sigma }}di\right ] ^{\frac{\sigma }{\sigma -1}}\text{ ; }C_{F,t}=\left [ \left ( \frac{1}{1-n}\right ) ^{\frac{1}{\sigma }}\int _{n}^{1}\left ( C_{F,t}(i) \right ) ^{\frac{\sigma -1}{\sigma }}di\right ] ^{\frac{\sigma }{\sigma -1}} \end{align}

\begin{align} C_{D,t}^{\ast } &=\left [ \left ( \frac{1}{n}\right ) ^{\frac{1}{\sigma }}\int _{0}^{n}\left ( C_{D,t}^{\ast }(i) \right ) ^{\frac{\sigma -1}{\sigma }}di\right ] ^{\frac{\sigma }{\sigma -1}}\text{ ; }C_{F,t}^{\ast }=\left [ \left ( \frac{1}{1-n}\right ) ^{\frac{1}{\sigma }}\int _{n}^{1}\left ( C_{F,t}^{\ast }(i) \right ) ^{\frac{\sigma -1}{\sigma }}di\right ] ^{\frac{\sigma }{\sigma -1}}. \end{align}

\begin{align} C_{D,t}^{\ast } &=\left [ \left ( \frac{1}{n}\right ) ^{\frac{1}{\sigma }}\int _{0}^{n}\left ( C_{D,t}^{\ast }(i) \right ) ^{\frac{\sigma -1}{\sigma }}di\right ] ^{\frac{\sigma }{\sigma -1}}\text{ ; }C_{F,t}^{\ast }=\left [ \left ( \frac{1}{1-n}\right ) ^{\frac{1}{\sigma }}\int _{n}^{1}\left ( C_{F,t}^{\ast }(i) \right ) ^{\frac{\sigma -1}{\sigma }}di\right ] ^{\frac{\sigma }{\sigma -1}}. \end{align}

Here,

![]() $\sigma$

is the elasticity of substitution between the varieties, where a variety is indexed by

$\sigma$

is the elasticity of substitution between the varieties, where a variety is indexed by

![]() $i\in [ 0,1] .$

The demand for each variety of a differentiated domestic and foreign good by each country’s household is given as follows:

$i\in [ 0,1] .$

The demand for each variety of a differentiated domestic and foreign good by each country’s household is given as follows:

\begin{align} C_{D,t}^{\ast }(i) =\left ( \frac{1}{n}\right ) \left ( \frac{P_{D,t}^{\ast }(i) }{P_{D,t}^{\ast }}\right ) ^{-\sigma }C_{D,t}^{\ast }\text{ ; }C_{F,t}^{\ast }(i) =\left ( \frac{1}{1-n}\right ) \left ( \frac{P_{F,t}^{\ast }(i) }{P_{F,t}^{\ast }}\right ) ^{-\sigma }C_{F,t}^{\ast } \end{align}

\begin{align} C_{D,t}^{\ast }(i) =\left ( \frac{1}{n}\right ) \left ( \frac{P_{D,t}^{\ast }(i) }{P_{D,t}^{\ast }}\right ) ^{-\sigma }C_{D,t}^{\ast }\text{ ; }C_{F,t}^{\ast }(i) =\left ( \frac{1}{1-n}\right ) \left ( \frac{P_{F,t}^{\ast }(i) }{P_{F,t}^{\ast }}\right ) ^{-\sigma }C_{F,t}^{\ast } \end{align}

where

![]() $P_{D,t}(i)$

and

$P_{D,t}(i)$

and

![]() $P_{D,t}^{\ast }(i)$

are prices of a variety

$P_{D,t}^{\ast }(i)$

are prices of a variety

![]() $i$

of a good produced in the domestic country in domestic and foreign currency, respectively. Similarly,

$i$

of a good produced in the domestic country in domestic and foreign currency, respectively. Similarly,

![]() $P_{F,t}(i),$

and

$P_{F,t}(i),$

and

![]() $P_{F,t}^{\ast }(i)$

are prices of a variety

$P_{F,t}^{\ast }(i)$

are prices of a variety

![]() $i$

of a good produced in the foreign country in domestic and foreign currency, respectively.

$i$

of a good produced in the foreign country in domestic and foreign currency, respectively.

![]() $P_{D,t},$

$P_{D,t},$

![]() $P_{F,t},$

$P_{F,t},$

![]() $P_{D,t}^{\ast }$

, and

$P_{D,t}^{\ast }$

, and

![]() $P_{F,t}^{\ast }$

are the price aggregates of the aggregate consumption baskets,

$P_{F,t}^{\ast }$

are the price aggregates of the aggregate consumption baskets,

![]() $C_{D,t},$

$C_{D,t},$

![]() $C_{F,t},$

$C_{F,t},$

![]() $C_{D,t}^{\ast }$

, and

$C_{D,t}^{\ast }$

, and

![]() $C_{F,t}^{\ast },$

, respectively, and are defined as follows:

$C_{F,t}^{\ast },$

, respectively, and are defined as follows:

\begin{align} P_{D,t} =\left [ \left ( \frac{1}{n}\right ) \int _{0}^{n}P_{D,t}(i) ^{1-\sigma }di\right ] ^{\frac{1}{1-\sigma }}\text{ ; }P_{F,t}=\left [ \left ( \frac{1}{1-n}\right ) \int _{n}^{1}P_{F,t}(i) ^{1-\sigma }di\right ] ^{\frac{1}{1-\sigma }} \end{align}

\begin{align} P_{D,t} =\left [ \left ( \frac{1}{n}\right ) \int _{0}^{n}P_{D,t}(i) ^{1-\sigma }di\right ] ^{\frac{1}{1-\sigma }}\text{ ; }P_{F,t}=\left [ \left ( \frac{1}{1-n}\right ) \int _{n}^{1}P_{F,t}(i) ^{1-\sigma }di\right ] ^{\frac{1}{1-\sigma }} \end{align}

\begin{align} P_{D,t}^{\ast } =\left [ \left ( \frac{1}{n}\right ) \int _{0}^{n}P_{D,t}^{\ast }(i) ^{1-\sigma }di\right ] ^{\frac{1}{1-\sigma }}\text{ ; }P_{F,t}^{\ast }=\left [ \left ( \frac{1}{1-n}\right ) \int _{n}^{1}P_{F,t}^{\ast }(i) ^{1-\sigma }di\right ] ^{\frac{1}{1-\sigma }} \end{align}

\begin{align} P_{D,t}^{\ast } =\left [ \left ( \frac{1}{n}\right ) \int _{0}^{n}P_{D,t}^{\ast }(i) ^{1-\sigma }di\right ] ^{\frac{1}{1-\sigma }}\text{ ; }P_{F,t}^{\ast }=\left [ \left ( \frac{1}{1-n}\right ) \int _{n}^{1}P_{F,t}^{\ast }(i) ^{1-\sigma }di\right ] ^{\frac{1}{1-\sigma }} \end{align}

The law of one price is assumed to hold across all individual goods, such that,

![]() $P_{D,t}(i) =X_{t}P_{D,t}^{\ast }(i),$

and

$P_{D,t}(i) =X_{t}P_{D,t}^{\ast }(i),$

and

![]() $P_{F,t}(i) =X_{t}P_{F,t}^{\ast }(i),$

where

$P_{F,t}(i) =X_{t}P_{F,t}^{\ast }(i),$

where

![]() $X_{t}$

is the nominal exchange rate (price of foreign currency in terms of domestic currency). Using this relation with the price aggregates in equations (10) and (11) we also get,

$X_{t}$

is the nominal exchange rate (price of foreign currency in terms of domestic currency). Using this relation with the price aggregates in equations (10) and (11) we also get,

![]() $P_{D,t}=X_{t}P_{D,t}^{\ast }$

and

$P_{D,t}=X_{t}P_{D,t}^{\ast }$

and

![]() $P_{F,t}=X_{t}P_{F,t}^{\ast }.$

Demand functions for the consumption aggregates,

$P_{F,t}=X_{t}P_{F,t}^{\ast }.$

Demand functions for the consumption aggregates,

![]() $C_{D,t},$

$C_{D,t},$

![]() $C_{F,t},$

$C_{F,t},$

![]() $C_{D,t}^{\ast }$

and

$C_{D,t}^{\ast }$

and

![]() $C_{F,t}^{\ast }$

are as follows:

$C_{F,t}^{\ast }$

are as follows:

where

![]() $P_{t}$

and

$P_{t}$

and

![]() $P_{t}^{\ast }$

are the aggregate consumer price indices (CPI) in the domestic and foreign country, in domestic and foreign currency, respectively, and are defined as:

$P_{t}^{\ast }$

are the aggregate consumer price indices (CPI) in the domestic and foreign country, in domestic and foreign currency, respectively, and are defined as:

It can be seen that due to a heterogeneous preference structure across the two countries, purchasing power parity (PPP) does not hold at the aggregate price levels, such that

![]() $P_{t}\neq X_{t}P_{t}^{\ast }.$

PPP holds only when

$P_{t}\neq X_{t}P_{t}^{\ast }.$

PPP holds only when

![]() $\mu _{D}=\mu _{F}$

and

$\mu _{D}=\mu _{F}$

and

![]() $\xi _{D}=\xi _{F}.$

Benigno et al. (Reference Benigno, Benigno and Nisticò2012) assume

$\xi _{D}=\xi _{F}.$

Benigno et al. (Reference Benigno, Benigno and Nisticò2012) assume

![]() $\mu _{D}\neq \mu _{F},$

such that PPP does not hold in their model too. Any deviations from PPP are measured through the real exchange rate, which is defined as the ratio of consumer price indices in the two countries in terms of domestic prices and is given by:

$\mu _{D}\neq \mu _{F},$

such that PPP does not hold in their model too. Any deviations from PPP are measured through the real exchange rate, which is defined as the ratio of consumer price indices in the two countries in terms of domestic prices and is given by:

Rewriting equation (16) gives us the following relationship between CPI in the domestic and foreign country:

Here, CPI in the foreign country and domestic country are defined as

![]() $\pi _{t}^{\ast }=\frac{P_{t}^{\ast }}{P_{t-1}^{\ast }}$

and

$\pi _{t}^{\ast }=\frac{P_{t}^{\ast }}{P_{t-1}^{\ast }}$

and

![]() $\pi _{t}=\frac{P_{t}}{P_{t-1}}$

, respectively. Also, the change in the nominal exchange rate is defined as

$\pi _{t}=\frac{P_{t}}{P_{t-1}}$

, respectively. Also, the change in the nominal exchange rate is defined as

![]() $\pi _{X,t}=\frac{X_{t}}{X_{t-1}}.$

The terms of trade is defined as a ratio of foreign prices to domestic prices, where both price indices are denominated in domestic currency and is given by:

$\pi _{X,t}=\frac{X_{t}}{X_{t-1}}.$

The terms of trade is defined as a ratio of foreign prices to domestic prices, where both price indices are denominated in domestic currency and is given by:

where we define relative price ratios,

![]() $T_{D,t}=\frac{P_{D,t}}{P_{t}}$

and

$T_{D,t}=\frac{P_{D,t}}{P_{t}}$

and

![]() $T_{F,t}=\frac{P_{F,t}}{P_{t}}$

. Using these definitions of relative price ratios with equation (14), we get the following relation,

$T_{F,t}=\frac{P_{F,t}}{P_{t}}$

. Using these definitions of relative price ratios with equation (14), we get the following relation,

\begin{align} T_{F,t}=\left [ \frac{1-\mu _{D}\left ( T_{D,t}\right ) ^{1-\xi _{D}}}{1-\mu _{D}}\right ] ^{\frac{1}{1-\xi _{D}}}. \end{align}

\begin{align} T_{F,t}=\left [ \frac{1-\mu _{D}\left ( T_{D,t}\right ) ^{1-\xi _{D}}}{1-\mu _{D}}\right ] ^{\frac{1}{1-\xi _{D}}}. \end{align}

Similarly, equation (15) can be re-written in terms of gross foreign inflation

![]() $\left (\pi _{F,t}^{\ast }\right ),$

foreign CPI

$\left (\pi _{F,t}^{\ast }\right ),$

foreign CPI

![]() $\left (\pi _{t}^{\ast }\right ),$

and the terms of trade as:

$\left (\pi _{t}^{\ast }\right ),$

and the terms of trade as:

\begin{align} \pi _{t}^{\ast }=\pi _{F,t}^{\ast }\left [ \frac{\mu _{F}\left ( T_{t}\right ) ^{\xi _{F}-1}+\left ( 1-\mu _{F}\right ) }{\mu _{F}\left ( T_{t-1}\right ) ^{\xi _{F}-1}+\left ( 1-\mu _{F}\right ) }\right ] ^{\frac{1}{1-\xi _{F}}} \end{align}

\begin{align} \pi _{t}^{\ast }=\pi _{F,t}^{\ast }\left [ \frac{\mu _{F}\left ( T_{t}\right ) ^{\xi _{F}-1}+\left ( 1-\mu _{F}\right ) }{\mu _{F}\left ( T_{t-1}\right ) ^{\xi _{F}-1}+\left ( 1-\mu _{F}\right ) }\right ] ^{\frac{1}{1-\xi _{F}}} \end{align}

where

![]() $\pi _{F,t}^{\ast }=\frac{P_{F,t}^{\ast }}{P_{F,t-1}^{\ast }}.$

For the above described preferences, the total demand for each variety

$\pi _{F,t}^{\ast }=\frac{P_{F,t}^{\ast }}{P_{F,t-1}^{\ast }}.$

For the above described preferences, the total demand for each variety

![]() $i$

of the domestic produce is given by

$i$

of the domestic produce is given by

![]() $Y_{D,t}(i) =nC_{D,t}(i) +\left ( 1-n\right ) C_{D,t}^{\ast }(i)$

, where

$Y_{D,t}(i) =nC_{D,t}(i) +\left ( 1-n\right ) C_{D,t}^{\ast }(i)$

, where

![]() $nC_{D,t}(i)$

and

$nC_{D,t}(i)$

and

![]() $(1-n) C_{D,t}^{\ast }(i)$

is the aggregate demand of all households in the domestic and foreign country, respectively, for variety

$(1-n) C_{D,t}^{\ast }(i)$

is the aggregate demand of all households in the domestic and foreign country, respectively, for variety

![]() $i$

of the domestic produce. Using the demand functions described in (8) and (9), we get

$i$

of the domestic produce. Using the demand functions described in (8) and (9), we get

where aggregate demand for domestic good (all varieties) is given by

![]() $Y_{D,t}=$

$Y_{D,t}=$

![]() $C_{D,t}+\left ( \frac{1-n}{n}\right ) C_{D,t}^{\ast }.$

Further, using (12) and (13) in equation (21), we can re-write

$C_{D,t}+\left ( \frac{1-n}{n}\right ) C_{D,t}^{\ast }.$

Further, using (12) and (13) in equation (21), we can re-write

![]() $Y_{D,t}$

in terms of aggregate consumption bundles in the two countries, as given by:

$Y_{D,t}$

in terms of aggregate consumption bundles in the two countries, as given by:

Similar to the domestic country, aggregate demand for a variety

![]() $i$

of the foreign good is given by:

$i$

of the foreign good is given by:

where aggregate demand for the foreign good (all varieties),

![]() $Y_{F,t}=\frac{n}{\left ( 1-n\right ) }C_{F,t}+C_{F,t}^{\ast }.$

Aggregate demand,

$Y_{F,t}=\frac{n}{\left ( 1-n\right ) }C_{F,t}+C_{F,t}^{\ast }.$

Aggregate demand,

![]() $Y_{F,t},$

can be rewritten in terms of aggregate consumption bundles in the two countries as:

$Y_{F,t},$

can be rewritten in terms of aggregate consumption bundles in the two countries as:

Households in the domestic and foreign country maximize (1) and (3) subject to the following flow budget constraints,

respectively. Here

![]() $W_{D,t}$

and

$W_{D,t}$

and

![]() $W_{F,t}$

are nominal wages in the domestic and foreign country, respectively. The nominal wages are decided in a common labor market in each country. Also,

$W_{F,t}$

are nominal wages in the domestic and foreign country, respectively. The nominal wages are decided in a common labor market in each country. Also,

![]() $\varpi _{D,t}$

and

$\varpi _{D,t}$

and

![]() $\varpi _{F,t}$

are the nominal profits which households receive from owning monopolistically competitive firms in the domestic and foreign country, respectively. Each household in each country holds equal shares in all firms and there is no trade in firm shares. The asset markets are assumed to be complete both at domestic and at international levels. Households trade in state-contingent nominal securities denominated in the domestic currency.

$\varpi _{F,t}$

are the nominal profits which households receive from owning monopolistically competitive firms in the domestic and foreign country, respectively. Each household in each country holds equal shares in all firms and there is no trade in firm shares. The asset markets are assumed to be complete both at domestic and at international levels. Households trade in state-contingent nominal securities denominated in the domestic currency.

![]() $B_{D,t+1}$

is the state-contingent payoff at time

$B_{D,t+1}$

is the state-contingent payoff at time

![]() $t+1$

of a portfolio of state-contingent nominal securities held by a household in the domestic country at the end of period

$t+1$

of a portfolio of state-contingent nominal securities held by a household in the domestic country at the end of period

![]() $t$

. The value of this portfolio can be written as

$t$

. The value of this portfolio can be written as

![]() $E_{t}\left \{ B_{D,t+1}M_{t,t+1}\right \},$

where

$E_{t}\left \{ B_{D,t+1}M_{t,t+1}\right \},$

where

![]() $M_{t,t+1}$

is the nominal stochastic discount factor for discounting wealth denominated in the domestic currency.

$M_{t,t+1}$

is the nominal stochastic discount factor for discounting wealth denominated in the domestic currency.

Households in the foreign country also trade in state-contingent securities denominated in the domestic currency. Let

![]() $B_{t+1}$

be the state-contingent payoff (denominated in domestic currency) in period

$B_{t+1}$

be the state-contingent payoff (denominated in domestic currency) in period

![]() $t+1$

of the state-contingent portfolio held by foreign households at the end of period

$t+1$

of the state-contingent portfolio held by foreign households at the end of period

![]() $t.$

The payoff in the foreign currency in period

$t.$

The payoff in the foreign currency in period

![]() $t+1$

is given by

$t+1$

is given by

![]() $B_{F,t+1}=\frac{B_{t+1}}{X_{t+1}}.$

Also the value of the portfolio today in foreign currency in period

$B_{F,t+1}=\frac{B_{t+1}}{X_{t+1}}.$

Also the value of the portfolio today in foreign currency in period

![]() $t$

is given by

$t$

is given by

![]() $\frac{E_{t}\left \{ B_{t+1}M_{t,t+1}\right \} }{X_{t}}=\frac{E_{t}\left \{ B_{F,t+1}X_{t+1}M_{t,t+1}\right \} }{X_{t}}.$

The nominal stochastic discount factor for discounting wealth denominated in the foreign currency can thus be defined as:

$\frac{E_{t}\left \{ B_{t+1}M_{t,t+1}\right \} }{X_{t}}=\frac{E_{t}\left \{ B_{F,t+1}X_{t+1}M_{t,t+1}\right \} }{X_{t}}.$

The nominal stochastic discount factor for discounting wealth denominated in the foreign currency can thus be defined as:

The first order conditions for maximizing utility functions (1) and (3) for consumption

![]() $\left ( C_{t},C_{t}^{\ast }\right )$

, labor

$\left ( C_{t},C_{t}^{\ast }\right )$

, labor

![]() $(H_{D,t},H_{F,t})$

and asset holdings

$(H_{D,t},H_{F,t})$

and asset holdings

![]() $(B_{D,t+1,}B_{F,t+1})$

subject to the flow budget constraints (25) and (26), respectively, are given by the following Euler’s equations and labor supply equations:

$(B_{D,t+1,}B_{F,t+1})$

subject to the flow budget constraints (25) and (26), respectively, are given by the following Euler’s equations and labor supply equations:

\begin{align} \text{ }\left ( D\right ) :\,{\small E}_{t}\left \{ M_{t,t+1}\right \}{\small =}{\small \beta }\left ( \frac{E_{t}\left ( V_{t+1}\right ) ^{1-\gamma }}{\left ( V_{t+1}\right ) ^{1-\gamma }}\right ) ^{\frac{\left ( \gamma -\eta \right ) }{\left ( 1-\gamma \right ) }}\left ( \frac{U_{D,t+1}}{U_{D,t}}\right ) ^{1-\eta }\left ( \frac{C_{t}}{C_{t+1}}\right ) \left ( \frac{1}{E_{t}\left \{ \pi _{t+1}\right \} }\right ) \end{align}

\begin{align} \text{ }\left ( D\right ) :\,{\small E}_{t}\left \{ M_{t,t+1}\right \}{\small =}{\small \beta }\left ( \frac{E_{t}\left ( V_{t+1}\right ) ^{1-\gamma }}{\left ( V_{t+1}\right ) ^{1-\gamma }}\right ) ^{\frac{\left ( \gamma -\eta \right ) }{\left ( 1-\gamma \right ) }}\left ( \frac{U_{D,t+1}}{U_{D,t}}\right ) ^{1-\eta }\left ( \frac{C_{t}}{C_{t+1}}\right ) \left ( \frac{1}{E_{t}\left \{ \pi _{t+1}\right \} }\right ) \end{align}

\begin{align} (F) \,:\,E_{t}\left \{ M_{t,t+1}^{\ast }\right \} =\beta \left ( \frac{\Gamma _{F,t+1}}{\Gamma _{F,t}}\right ) \left ( \frac{E_{t}\left ( V_{t+1}^{\ast }\right ) ^{1-\gamma }}{\left ( V_{t+1}^{\ast }\right ) ^{1-\gamma }}\right ) ^{\frac{\left ( \gamma -\eta \right ) }{\left ( 1-\gamma \right ) }}\left ( \frac{U_{F,t+1}}{U_{F,t}}\right ) ^{1-\eta }\left ( \frac{C_{t}^{\ast }}{C_{t+1}^{\ast }}\right ) \left ( \frac{1}{E_{t}\left \{ \pi _{t+1}^{\ast }\right \} }\right ) \end{align}

\begin{align} (F) \,:\,E_{t}\left \{ M_{t,t+1}^{\ast }\right \} =\beta \left ( \frac{\Gamma _{F,t+1}}{\Gamma _{F,t}}\right ) \left ( \frac{E_{t}\left ( V_{t+1}^{\ast }\right ) ^{1-\gamma }}{\left ( V_{t+1}^{\ast }\right ) ^{1-\gamma }}\right ) ^{\frac{\left ( \gamma -\eta \right ) }{\left ( 1-\gamma \right ) }}\left ( \frac{U_{F,t+1}}{U_{F,t}}\right ) ^{1-\eta }\left ( \frac{C_{t}^{\ast }}{C_{t+1}^{\ast }}\right ) \left ( \frac{1}{E_{t}\left \{ \pi _{t+1}^{\ast }\right \} }\right ) \end{align}

Here, the gross nominal interest rate in domestic country is given by

![]() $\left ( 1+R_{t}\right ) =\frac{1}{E_{t}\left \{ M_{t,t+1}\right \} }$

and the gross nominal interest rate in foreign country is given by

$\left ( 1+R_{t}\right ) =\frac{1}{E_{t}\left \{ M_{t,t+1}\right \} }$

and the gross nominal interest rate in foreign country is given by

![]() $\left (1+R_{t}^{\ast }\right ) =\frac{1}{E_{t}\left \{ M_{t,t+1}^{\ast }\right \} }$

. Real wages in the domestic and foreign country are defined, respectively, as

$\left (1+R_{t}^{\ast }\right ) =\frac{1}{E_{t}\left \{ M_{t,t+1}^{\ast }\right \} }$

. Real wages in the domestic and foreign country are defined, respectively, as

![]() $w_{D,t}=\frac{W_{D,t}}{P_{D,t}}$

and

$w_{D,t}=\frac{W_{D,t}}{P_{D,t}}$

and

![]() $w_{F,t}=\frac{W_{F,t}}{P_{F,t}}$

. Combining the Euler equation from equation (28) and (29) with equation (27), we get the following complete asset market condition:

$w_{F,t}=\frac{W_{F,t}}{P_{F,t}}$

. Combining the Euler equation from equation (28) and (29) with equation (27), we get the following complete asset market condition:

\begin{align} \left ( \frac{V_{t+1}^{1-\gamma }E_{t}V_{t+1}^{\ast 1-\gamma }}{V_{t+1}^{\ast 1-\gamma }E_{t}V_{t+1}^{1-\gamma }}\right ) ^{\frac{\left ( \eta -\gamma \right ) }{\left ( 1-\gamma \right ) }}\left ( \frac{U\left ( C_{t+1},H_{D,t+1}\right ) }{U\left ( C_{t+1}^{\ast },H_{F,t+1}\right ) }\right ) ^{1-\eta }\left ( \frac{C_{t+1}^{\ast }}{C_{t+1}}\right ) Q_{t+1}=\left ( \frac{U\left ( C_{t},H_{D,t}\right ) }{U\left ( C_{t}^{\ast },H_{F,t}\right ) }\right ) ^{1-\eta }\left ( \frac{C_{t}^{\ast }}{C_{t}}\right ) Q_{t} \end{align}

\begin{align} \left ( \frac{V_{t+1}^{1-\gamma }E_{t}V_{t+1}^{\ast 1-\gamma }}{V_{t+1}^{\ast 1-\gamma }E_{t}V_{t+1}^{1-\gamma }}\right ) ^{\frac{\left ( \eta -\gamma \right ) }{\left ( 1-\gamma \right ) }}\left ( \frac{U\left ( C_{t+1},H_{D,t+1}\right ) }{U\left ( C_{t+1}^{\ast },H_{F,t+1}\right ) }\right ) ^{1-\eta }\left ( \frac{C_{t+1}^{\ast }}{C_{t+1}}\right ) Q_{t+1}=\left ( \frac{U\left ( C_{t},H_{D,t}\right ) }{U\left ( C_{t}^{\ast },H_{F,t}\right ) }\right ) ^{1-\eta }\left ( \frac{C_{t}^{\ast }}{C_{t}}\right ) Q_{t} \end{align}

Re-writing the above gives us,

\begin{align*} \kappa _{t+1}=\kappa _{t}\left ( \frac {V_{t+1}^{1-\gamma }E_{t}V_{t+1}^{\ast 1-\gamma }}{V_{t+1}^{\ast 1-\gamma }E_{t}V_{t+1}^{1-\gamma }}\right ) ^{\frac {\left ( \eta -\gamma \right ) }{\left ( 1-\gamma \right ) }} \end{align*}

\begin{align*} \kappa _{t+1}=\kappa _{t}\left ( \frac {V_{t+1}^{1-\gamma }E_{t}V_{t+1}^{\ast 1-\gamma }}{V_{t+1}^{\ast 1-\gamma }E_{t}V_{t+1}^{1-\gamma }}\right ) ^{\frac {\left ( \eta -\gamma \right ) }{\left ( 1-\gamma \right ) }} \end{align*}

where

![]() $\kappa _{t}=\left ( \frac{U\left ( C_{t},H_{D,t}\right ) }{U\left ( C_{t}^{\ast },H_{F,t}\right ) }\right ) ^{1-\eta }\left ( \frac{C_{t}^{\ast }}{C_{t}}\right ) Q_{t}.$

We estimate the initial value

$\kappa _{t}=\left ( \frac{U\left ( C_{t},H_{D,t}\right ) }{U\left ( C_{t}^{\ast },H_{F,t}\right ) }\right ) ^{1-\eta }\left ( \frac{C_{t}^{\ast }}{C_{t}}\right ) Q_{t}.$

We estimate the initial value

![]() $\kappa _{0}$

from the data as the ratio of marginal utilities of nominal income across countries in the initial period. Equation (27) when combined with definitions of nominal stochastic discount factors that is,

$\kappa _{0}$

from the data as the ratio of marginal utilities of nominal income across countries in the initial period. Equation (27) when combined with definitions of nominal stochastic discount factors that is,

![]() $E_{t}\left \{ M_{t,t+1}\right \} =\frac{1}{\left ( 1+R_{t}\right ) }$

and

$E_{t}\left \{ M_{t,t+1}\right \} =\frac{1}{\left ( 1+R_{t}\right ) }$

and

![]() $E_{t}\left \{ M_{t,t+1}^{\ast }\right \} =\frac{1}{\left ( 1+R_{t}^{\ast }\right ) },$

gives the following uncovered interest rate parity

$E_{t}\left \{ M_{t,t+1}^{\ast }\right \} =\frac{1}{\left ( 1+R_{t}^{\ast }\right ) },$

gives the following uncovered interest rate parity

![]() $(UIP)$

condition (log-linearized):

$(UIP)$

condition (log-linearized):

where

![]() $r_{t},$

$r_{t},$

![]() $r_{t}^{\ast }$

and

$r_{t}^{\ast }$

and

![]() $E_{t}\left \{ \Delta e_{t+1}\right \}$

are logs of

$E_{t}\left \{ \Delta e_{t+1}\right \}$

are logs of

![]() $\left (1+R_{t}\right ),$

$\left (1+R_{t}\right ),$

![]() $\left (1+R_{t}^{\ast }\right )$

and

$\left (1+R_{t}^{\ast }\right )$

and

![]() $E_{t}\left \{ \frac{X_{t+1}}{X_{t}}\right \},$

respectively. Following Menkhoff et al. (Reference Menkhoff, Sarno, Schmeling and Schrimpf2012), Backus et al. (Reference Backus, Gavazzoni, Telmer and Zin2010) and Benigno et al. (Reference Benigno, Benigno and Nisticò2012), we define time-varying risk premiums as deviations from the UIP condition, mentioned in equation (32). The log-linearized time-varying risk premiums,

$E_{t}\left \{ \frac{X_{t+1}}{X_{t}}\right \},$

respectively. Following Menkhoff et al. (Reference Menkhoff, Sarno, Schmeling and Schrimpf2012), Backus et al. (Reference Backus, Gavazzoni, Telmer and Zin2010) and Benigno et al. (Reference Benigno, Benigno and Nisticò2012), we define time-varying risk premiums as deviations from the UIP condition, mentioned in equation (32). The log-linearized time-varying risk premiums,

![]() $rp_{t},$

are excess returns on holding domestic currency and written as follows:

$rp_{t},$

are excess returns on holding domestic currency and written as follows:

2.2. Firms

The domestic country produces goods on the interval

![]() $\left [ 0,n\right ]$

and the foreign country on

$\left [ 0,n\right ]$

and the foreign country on

![]() $(n,1].$

A firm producing variety

$(n,1].$

A firm producing variety

![]() $i$

of a good in the domestic and foreign country follows a production function linear in labor as given by:

$i$

of a good in the domestic and foreign country follows a production function linear in labor as given by:

respectively. Here,

![]() $A_{D,t}$

and

$A_{D,t}$

and

![]() $A_{F,t}$

are the productivity levels (common) following exogenous processes. We will keep the productivity level of both the firms at the steady state level (

$A_{F,t}$

are the productivity levels (common) following exogenous processes. We will keep the productivity level of both the firms at the steady state level (

![]() $\overline{A}_{D}$

and

$\overline{A}_{D}$

and

![]() $\overline{A}_{F})$

as in the present paper we are focusing on the second-moment shocks to the global demand shocks. Also,

$\overline{A}_{F})$

as in the present paper we are focusing on the second-moment shocks to the global demand shocks. Also,

![]() $\overline{A}_{D}=\overline{A}_{F}=1,$

at the steady state.

$\overline{A}_{D}=\overline{A}_{F}=1,$

at the steady state.

![]() $H_{D,t}(i)$

and

$H_{D,t}(i)$

and

![]() $H_{F,t}(i)$

are composites of all the differentiated labor supplied by household

$H_{F,t}(i)$

are composites of all the differentiated labor supplied by household

![]() $h$

in each country as given by:

$h$

in each country as given by:

where

![]() $H_{D,t}^{h}(i)$

and

$H_{D,t}^{h}(i)$

and

![]() $H_{F,t}^{h}(i)$

are the labor supplied by household

$H_{F,t}^{h}(i)$

are the labor supplied by household

![]() $h$

to firm

$h$

to firm

![]() $i$

in the domestic and foreign country, respectively.

$i$

in the domestic and foreign country, respectively.

2.2.1. Price setting

In the benchmark model we assume that firms in both the countries have nominal price rigidities in the form of price stickiness. We follow Calvo (Reference Calvo1983) to capture price stickiness here. In each period only

![]() $(1-\alpha _{D})$

fraction of firms in the domestic country can reset their prices independent of whether they had a chance to reset them in the last period. A firm

$(1-\alpha _{D})$

fraction of firms in the domestic country can reset their prices independent of whether they had a chance to reset them in the last period. A firm

![]() $i$

which gets a chance to reset its prices,

$i$

which gets a chance to reset its prices,

![]() $\overline{P}_{D,t}(i),$

maximizes a discounted sum of current and future expected values of profit, given by

$\overline{P}_{D,t}(i),$

maximizes a discounted sum of current and future expected values of profit, given by

\begin{align} \max _{\overline{P}_{D,t}(i)}\sum \limits _{k=0}^{\infty }\alpha _{D}^{k}M_{t,t+k}\left ( \overline{P}_{D,t}(i)Y_{D,t_{+k}}(i)-MC_{D,t+k}Y_{D,t_{+k}}(i)\right ) \end{align}

\begin{align} \max _{\overline{P}_{D,t}(i)}\sum \limits _{k=0}^{\infty }\alpha _{D}^{k}M_{t,t+k}\left ( \overline{P}_{D,t}(i)Y_{D,t_{+k}}(i)-MC_{D,t+k}Y_{D,t_{+k}}(i)\right ) \end{align}

where

![]() $MC_{D,t+k}$

is the nominal marginal cost of domestic firms in period

$MC_{D,t+k}$

is the nominal marginal cost of domestic firms in period

![]() $t+k$

and is the same for all firms as the nominal wage is decided in a common labor market and all firms face a common productivity level realization. The demand function

$t+k$

and is the same for all firms as the nominal wage is decided in a common labor market and all firms face a common productivity level realization. The demand function

![]() $Y_{D,t+k}(i),$

for each firm

$Y_{D,t+k}(i),$

for each firm

![]() $i$

in period

$i$

in period

![]() $t+k$

is given by:

$t+k$

is given by:

The optimal price chosen by firms resetting prices is given by:

\begin{align} \overline{P}_{D,t}(i)=\frac{\sigma }{\sigma -1}\frac{\sum \limits _{k=0}^{\infty }\alpha _{D}^{k}M_{t,t+k}MC_{D,t+k}Y_{D,t+k}(i)}{\sum \limits _{k=0}^{\infty }\alpha _{D}^{k}M_{t,t+k}Y_{D,t+k}(i)} \end{align}

\begin{align} \overline{P}_{D,t}(i)=\frac{\sigma }{\sigma -1}\frac{\sum \limits _{k=0}^{\infty }\alpha _{D}^{k}M_{t,t+k}MC_{D,t+k}Y_{D,t+k}(i)}{\sum \limits _{k=0}^{\infty }\alpha _{D}^{k}M_{t,t+k}Y_{D,t+k}(i)} \end{align}

where

![]() $\frac{\sigma }{\sigma -1}$

is the constant markup charged by firms. As can be seen from equation (38), the optimal price today depends on not just current but future marginal costs, and also demand conditions in the economy. A firm

$\frac{\sigma }{\sigma -1}$

is the constant markup charged by firms. As can be seen from equation (38), the optimal price today depends on not just current but future marginal costs, and also demand conditions in the economy. A firm

![]() $i$

, which does not reset its price is assumed to keep the prices same as last year’s prices,

$i$

, which does not reset its price is assumed to keep the prices same as last year’s prices,

![]() $P_{D,t-1}(i).$

Thus, the law of motion for the aggregate producer’s price index (PPI) in the domestic country for Calvo’s model can be written as:

$P_{D,t-1}(i).$

Thus, the law of motion for the aggregate producer’s price index (PPI) in the domestic country for Calvo’s model can be written as:

Using the domestic household’s optimization problem we can write the stochastic discount factor

![]() $M_{t,t+k}$

as:

$M_{t,t+k}$

as:

\begin{align} E_{t}\left \{ M_{t,t+k}\right \} =\beta ^{k}\left ( \frac{E_{t}V_{D,t+k}}{V_{D,t+k}^{1-\gamma }}^{1-\gamma }\right ) ^{\frac{\left ( \gamma -\eta \right ) }{\left ( 1-\gamma \right ) }}\left ( \frac{V_{D,t}}{V_{D,t+k}}\right ) ^{\eta }\frac{\lambda _{D,t+k}}{\lambda _{D,t}}\frac{P_{t}}{P_{t+k}} \end{align}

\begin{align} E_{t}\left \{ M_{t,t+k}\right \} =\beta ^{k}\left ( \frac{E_{t}V_{D,t+k}}{V_{D,t+k}^{1-\gamma }}^{1-\gamma }\right ) ^{\frac{\left ( \gamma -\eta \right ) }{\left ( 1-\gamma \right ) }}\left ( \frac{V_{D,t}}{V_{D,t+k}}\right ) ^{\eta }\frac{\lambda _{D,t+k}}{\lambda _{D,t}}\frac{P_{t}}{P_{t+k}} \end{align}

where

![]() $\lambda _{D,t}=\nu \frac{V_{t}^{\eta }U_{D,t}^{1-\eta }}{C_{t}}$

is the Lagrangian multiplier denoting the marginal utility of income. Combined with equation (40), the price setting equation (38) can be written recursively as:

$\lambda _{D,t}=\nu \frac{V_{t}^{\eta }U_{D,t}^{1-\eta }}{C_{t}}$

is the Lagrangian multiplier denoting the marginal utility of income. Combined with equation (40), the price setting equation (38) can be written recursively as:

where

![]() $X_{D,t}$

and

$X_{D,t}$

and

![]() $Z_{D,t}$

are defined as follows:

$Z_{D,t}$

are defined as follows:

\begin{align} X_{D,t} =\lambda _{D,t}Y_{D,t}mc_{D,t}T_{D,t}+\alpha _{D}\beta \left ( \pi _{D,t+1}\right ) ^{\sigma }\left ( \frac{E_{t}\left ( V_{t+1}\right ) }{\left ( V_{t+1}\right ) ^{1-\gamma }}^{1-\gamma }\right ) ^{\frac{\left ( \gamma -\eta \right ) }{\left ( 1-\gamma \right ) }}\left ( \frac{1}{V_{t+1}}\right ) ^{\eta }E_{t}\left \{ X_{D,t+1}\right \} \end{align}

\begin{align} X_{D,t} =\lambda _{D,t}Y_{D,t}mc_{D,t}T_{D,t}+\alpha _{D}\beta \left ( \pi _{D,t+1}\right ) ^{\sigma }\left ( \frac{E_{t}\left ( V_{t+1}\right ) }{\left ( V_{t+1}\right ) ^{1-\gamma }}^{1-\gamma }\right ) ^{\frac{\left ( \gamma -\eta \right ) }{\left ( 1-\gamma \right ) }}\left ( \frac{1}{V_{t+1}}\right ) ^{\eta }E_{t}\left \{ X_{D,t+1}\right \} \end{align}

\begin{align} Z_{D,t} =\lambda _{D,t}Y_{D,t}T_{D,t+k}+\alpha _{D}\beta \left ( \pi _{D,t+1}\right ) ^{\sigma -1}\left ( \frac{E_{t}\left ( V_{t+k}\right ) }{\left ( V_{t+1}\right ) ^{1-\gamma }}^{1-\gamma }\right ) ^{\frac{\left ( \gamma -\eta \right ) }{\left ( 1-\gamma \right ) }}\left ( \frac{1}{V_{t+1}}\right ) ^{\eta }E_{t}\left \{ Z_{D,t+1}\right \} \end{align}

\begin{align} Z_{D,t} =\lambda _{D,t}Y_{D,t}T_{D,t+k}+\alpha _{D}\beta \left ( \pi _{D,t+1}\right ) ^{\sigma -1}\left ( \frac{E_{t}\left ( V_{t+k}\right ) }{\left ( V_{t+1}\right ) ^{1-\gamma }}^{1-\gamma }\right ) ^{\frac{\left ( \gamma -\eta \right ) }{\left ( 1-\gamma \right ) }}\left ( \frac{1}{V_{t+1}}\right ) ^{\eta }E_{t}\left \{ Z_{D,t+1}\right \} \end{align}

Here, the reset domestic price inflation is defined as

![]() $\overline{\pi }_{D,t}=\frac{\overline{P}_{D,t}}{P_{D,t-1}},$

and domestic price inflation is defined as

$\overline{\pi }_{D,t}=\frac{\overline{P}_{D,t}}{P_{D,t-1}},$

and domestic price inflation is defined as

![]() $\pi _{D,t}=\frac{P_{D,t}}{P_{D,t-1}}.$

The real marginal cost for domestic firms in terms of domestic prices is given by

$\pi _{D,t}=\frac{P_{D,t}}{P_{D,t-1}}.$

The real marginal cost for domestic firms in terms of domestic prices is given by

![]() $mc_{D,t}=\frac{MC_{D,t}}{P_{D,t}}.$

The law of motion for the domestic producer’s prices in equation (39) can be written in terms of inflation as follows:

$mc_{D,t}=\frac{MC_{D,t}}{P_{D,t}}.$

The law of motion for the domestic producer’s prices in equation (39) can be written in terms of inflation as follows:

Since labor is the only input into production, the real marginal cost for domestic firms,

![]() $mc_{D,t},$

in terms of domestic prices would then be

$mc_{D,t},$

in terms of domestic prices would then be

where

![]() $w_{D,t}=\frac{w_{D,t}}{P_{D,t}}$

are real wages in the domestic country.

$w_{D,t}=\frac{w_{D,t}}{P_{D,t}}$

are real wages in the domestic country.

The price setting behavior of firms in the foreign country is similar to the price setting behavior of firms in the domestic country, as described from equation (37)–(60). In the foreign country,

![]() $(1-\alpha _{F})$

proportion of the firms reset their prices to

$(1-\alpha _{F})$

proportion of the firms reset their prices to

![]() $\overline{P}_{F,t}$

and the rest

$\overline{P}_{F,t}$

and the rest

![]() $\alpha _{F}$

proportion keep it the same as last year prices,

$\alpha _{F}$

proportion keep it the same as last year prices,

![]() $P_{F,t-1}^{\ast }.$

Maximizing the current and future stream of profits by firms in the foreign country yields the following equation on reset foreign inflation, similar to equation (41)

$P_{F,t-1}^{\ast }.$

Maximizing the current and future stream of profits by firms in the foreign country yields the following equation on reset foreign inflation, similar to equation (41)

where

![]() $X_{F,t}$

and

$X_{F,t}$

and

![]() $Z_{F,t}$

are defined as follows:

$Z_{F,t}$

are defined as follows:

\begin{align} X_{F,t} =\lambda _{F,t}Y_{F,t}mc_{F,t}T_{F,t}+\alpha _{F}\beta \left ( \pi _{F,t+1}^{\ast }\right ) ^{\sigma }\left ( \frac{E_{t}\left ( V_{t+1}^{\ast }\right ) }{\left ( V_{t+1}^{\ast }\right ) ^{1-\gamma }}^{1-\gamma }\right ) ^{\frac{\left ( \gamma -\eta \right ) }{\left ( 1-\gamma \right ) }}\left ( \frac{1}{V_{t+1}^{\ast }}\right ) ^{\eta }E_{t}\left \{ X_{F,t+1}\right \} \end{align}

\begin{align} X_{F,t} =\lambda _{F,t}Y_{F,t}mc_{F,t}T_{F,t}+\alpha _{F}\beta \left ( \pi _{F,t+1}^{\ast }\right ) ^{\sigma }\left ( \frac{E_{t}\left ( V_{t+1}^{\ast }\right ) }{\left ( V_{t+1}^{\ast }\right ) ^{1-\gamma }}^{1-\gamma }\right ) ^{\frac{\left ( \gamma -\eta \right ) }{\left ( 1-\gamma \right ) }}\left ( \frac{1}{V_{t+1}^{\ast }}\right ) ^{\eta }E_{t}\left \{ X_{F,t+1}\right \} \end{align}

\begin{align} Z_{F,t} =\lambda _{F,t}Y_{F,t}T_{F,t}+\alpha _{F}\beta \left ( \pi _{F,t+1}^{\ast }\right ) ^{\sigma -1}\left ( \frac{E_{t}\left ( V_{t+k}^{\ast }\right ) }{\left ( V_{t+1}^{\ast }\right ) ^{1-\gamma }}^{1-\gamma }\right ) ^{\frac{\left ( \gamma -\eta \right ) }{\left ( 1-\gamma \right ) }}\left ( \frac{1}{V_{t+1}^{\ast }}\right ) ^{\eta }E_{t}\left \{ Z_{F,t+1}\right \} \end{align}

\begin{align} Z_{F,t} =\lambda _{F,t}Y_{F,t}T_{F,t}+\alpha _{F}\beta \left ( \pi _{F,t+1}^{\ast }\right ) ^{\sigma -1}\left ( \frac{E_{t}\left ( V_{t+k}^{\ast }\right ) }{\left ( V_{t+1}^{\ast }\right ) ^{1-\gamma }}^{1-\gamma }\right ) ^{\frac{\left ( \gamma -\eta \right ) }{\left ( 1-\gamma \right ) }}\left ( \frac{1}{V_{t+1}^{\ast }}\right ) ^{\eta }E_{t}\left \{ Z_{F,t+1}\right \} \end{align}

Here, the reset foreign price inflation is defined as

![]() $\overline{\pi }_{F,t}=\frac{\overline{P}_{F,t}}{P_{F,t}^{\ast }},$

and the foreign price inflation is defined as

$\overline{\pi }_{F,t}=\frac{\overline{P}_{F,t}}{P_{F,t}^{\ast }},$

and the foreign price inflation is defined as

![]() $\pi _{F,t}^{\ast }=\frac{P_{F,t}^{\ast }}{P_{F,t-1}^{\ast }}$

. The real marginal cost for the foreign firms in terms of foreign prices is given by

$\pi _{F,t}^{\ast }=\frac{P_{F,t}^{\ast }}{P_{F,t-1}^{\ast }}$

. The real marginal cost for the foreign firms in terms of foreign prices is given by

![]() $mc_{F,t}=\frac{MC_{F,t}}{P_{F,t}}.$

The law of motion for the foreign producer’s inflation is given by:

$mc_{F,t}=\frac{MC_{F,t}}{P_{F,t}}.$

The law of motion for the foreign producer’s inflation is given by:

The real marginal cost for the foreign firms,

![]() $mc_{F,t},$

in terms of foreign prices would be

$mc_{F,t},$

in terms of foreign prices would be

where

![]() $w_{F,t}=\frac{w_{F,t}}{P_{F,t}}$

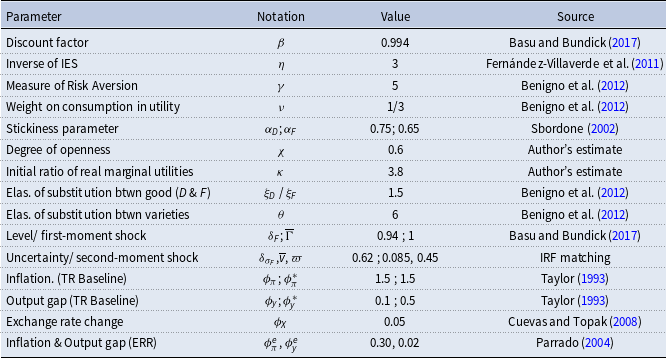

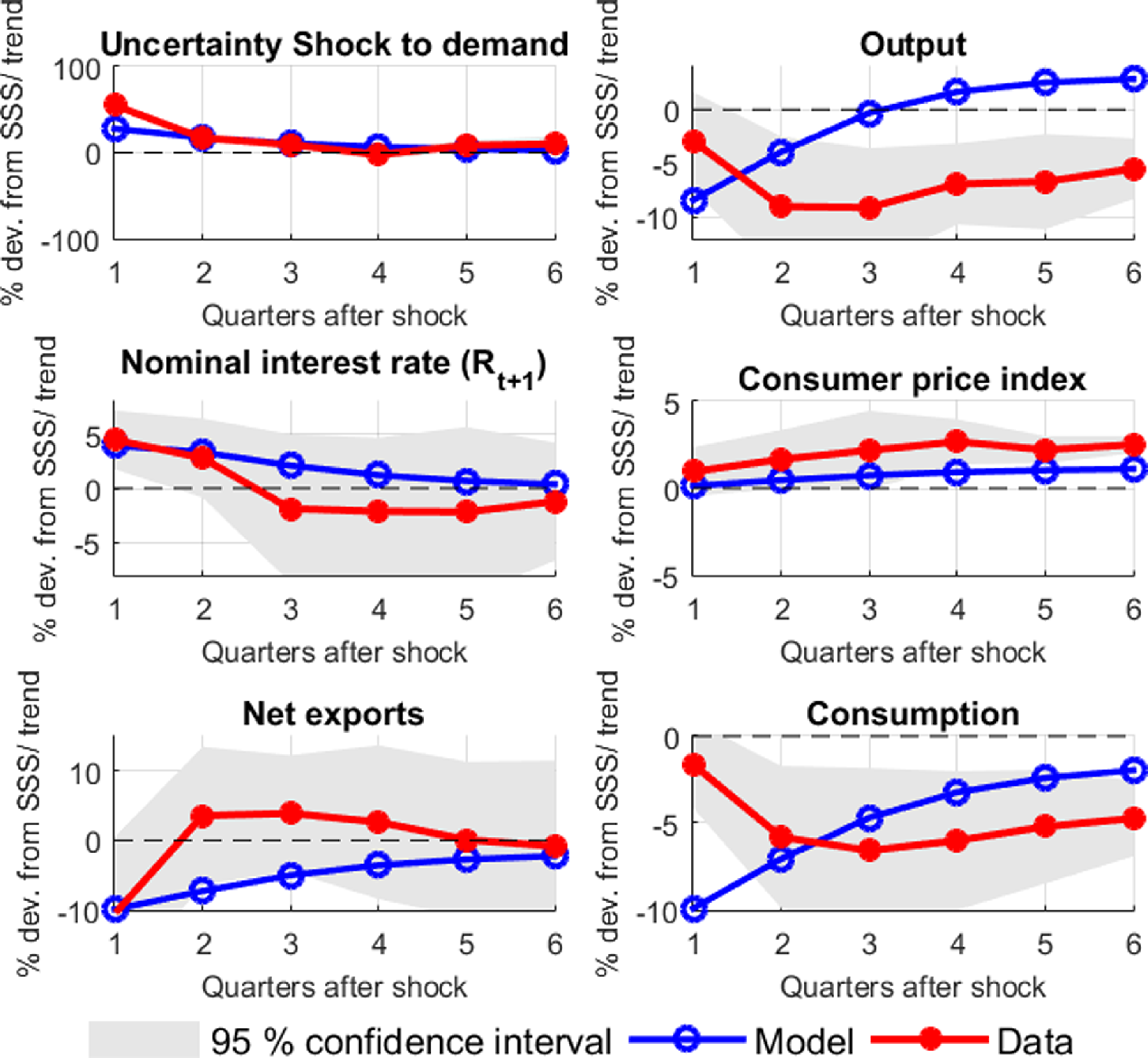

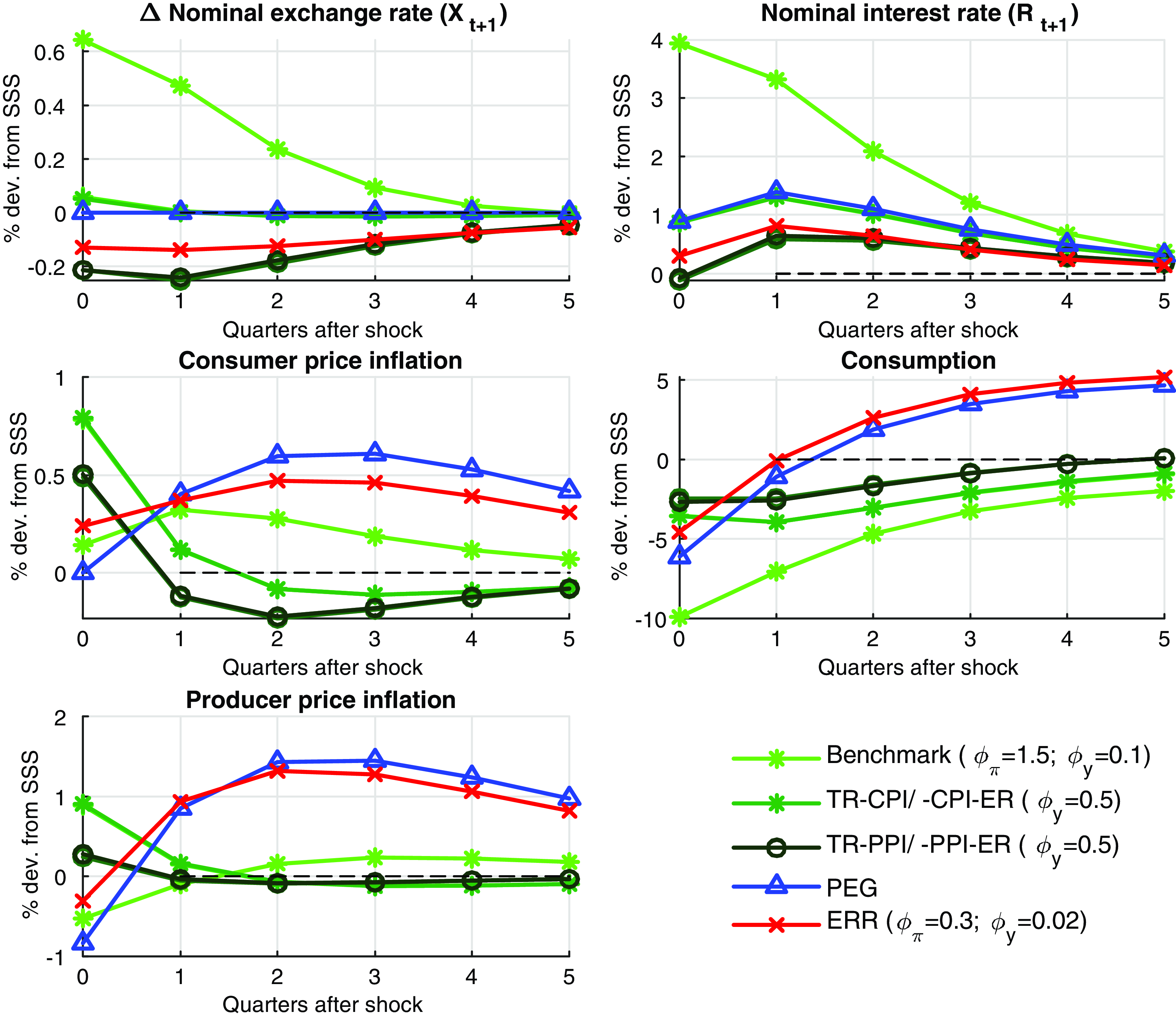

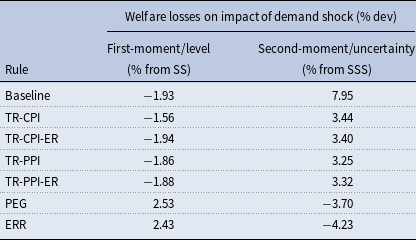

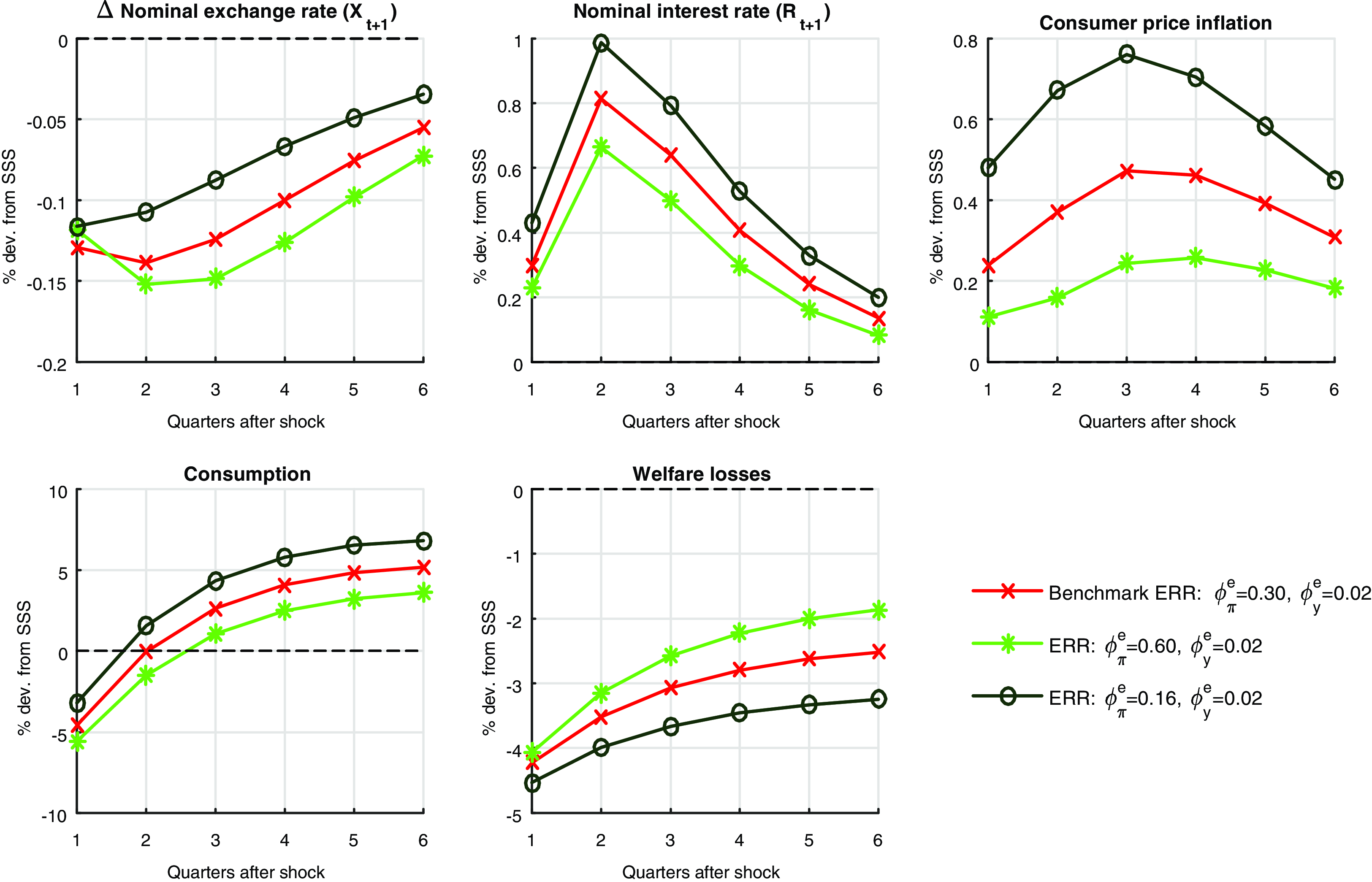

denotes real wages in the foreign country.