1. Introduction

Corporate income tax (hereafter, CIT) has detrimental effects on investment by firms. Modern prevailing opinions advocate that CIT should be cut to promote economic growth. Governments in developed countries have lowered the CIT rate in recent years: The average rate of CIT in OECD countries decreased from 32.5% to 24.2% between 2000 and 2017.Footnote 1 However, because CIT is an important tax basis for public finance, cutting the CIT rate reduces public investment in infrastructure (productive public services) and may lower the rate of economic growth (e.g., Barro (Reference Barro1990)).Footnote 2 Therefore, setting CIT rates involves a trade-off between private investment and the provision of productive public services for economic growth, and it is an important policy issue.

In addition, tax evasion by firms is a serious problem of CIT. There is large-scale tax evasion in real economies. For example, in the USA, from 2008 to 2010, the Internal Revenue Service (2016) reported an annual average of about 44 billion dollars in the estimated tax gaps of CIT (the amount of true tax liability that is not paid voluntarily and timely).Footnote 3 Nonetheless, the actual audit coverage of taxed corporations is very limited, primarily because of fiscal tightness; only 1.0% of taxed returns were examined in the USA in 2016, and only 3.1% of all taxed corporations were audited in Japan in 2015.Footnote 4

One of the most general ways of tax evasion is to under-declare income (e.g., Allingham and Sandmo (Reference Allingham and Sandmo1972)). To under-declare corporate income, firms may understate their productivity and overstate their costs. There is institutional cause for such tax evasion behavior at the microeconomic level. The CIT systems in many countries have reduction and exemption measures; deficits of corporations can be carried forward and CITs of corporations with small income are reduced or exempted. Such systems give corporations a loophole to under-declare their profit intentionally by overstating cost. These are neither unusual nor insignificant at the macroeconomic level. For example, the National Tax Agency (2016) reports that, on average, more than two-thirds of the ordinary corporations in Japan were loss-making corporations between 2011 and 2015. The reported losses amounted to 11.3 billion yen in 2015 and occupied a quarter of the reported total income in the corporate sector.

With these problems of CIT as motivation, this study investigates an optimal CIT policy in a growing economy with tax evasion by firms. The evaded tax payments are utilized for private investment, while a part of the tax revenue is lost. This affects the trade-off between private investment and the provision of productive public services. We are particularly interested in how CIT evasion by firms changes the optimal rate of CIT.

To tackle this problem, we construct a variety-expansion model of growth in which private firms invest to earn monopolistic profits and their investments sustain economic growth.Footnote 5 A single final good is produced by using intermediate goods. Each intermediate good is produced by a monopolistically competitive firm. Each intermediate good firm invests to enter into business and pursues monopolistic profits. CIT discourages private investment because the monopolistic profits are subject to CIT. Meanwhile, productive public services have a positive effect on the monopolistic profits of intermediate good firms. Thus, CIT has a positive effect on private investment through productive public services financed by CIT.

In our model, facing CIT, firms have an incentive to evade tax payment by under-declaring their profits in the absence of a perfect tax enforcement system. Because each firm can avoid a part of tax payment, tax evasion weakens the discouraging effect of CIT on private investment. Simultaneously, tax evasion reduces the provision of productive public services. Thus, tax evasion by the corporate sector affects private investment, the provision of productive public services, and economic growth.

In a tractable model, we obtain a qualitative result that both the growth- and welfare-maximizing CIT rates are higher than the output-elasticity of public service. This contrasts with the familiar Barro’s (Reference Barro1990) rule, which indicates that the tax rate should be set at the output elasticity of public services. The mechanism behind our result is as follows. When the government raises the CIT rate, the effective CIT rate and the tax revenue rise.Footnote 6 This increases the provision of productive public services and promotes economic growth. Simultaneously, raising the CIT rate discourages private investment and has a detrimental effect on growth. However, this negative effect on growth is weakened by tax evasion. This is because, in response to a tax hike, firms attempt to secure profits by increasing tax evasion. It alleviates the reduction in private investment and the tax base of CIT. CIT evasion generates the benefits of raising the CIT rate for the provision of productive public services.

Next, we extend the model to obtain quantitative results. Our quantitative analyses show that tax evasion significantly raises the optimal CIT rate. In particular, the optimal tax rate is 40% for the benchmark case, which is much higher than the standard values of the output elasticity of public service, for example, 10%. This optimal CIT rate in our model, at 40%, is close to that in Aghion et al. (Reference Aghion, Akcigit, Cagé and Kerr2016) mentioned below. Besides, we decompose the difference between the optimal tax rate and the output elasticity of public service into several parts including a part associated with the effect of CIT evasion. We find that the effect of CIT evasion occupies more than half of the total difference between the optimal tax rate and the output elasticity of public service for a wide range of reasonable parameter values. That is, even quantitatively, the effect of CIT evasion is the main source of the high optimal tax rate.

1.1 Related literature

Largely, our study is part of the literature starting with Barro (Reference Barro1990), which explores optimal taxation in an endogenous growth model with productive public service (capital) (e.g., Futagami et al. (Reference Futagami, Morita and Shibata1993), Glomm and Ravikumar (Reference Glomm and Ravikumar1994), Turnovsky (Reference Turnovsky1997)).Footnote 7 These studies emphasize that the growth-maximizing income tax rate equals the output elasticity of public capital, and it coincides with the welfare-maximizing one in the balanced growth path. This is the so-called Barro rule.

More recent studies cast some doubts on the Barro rule. Some studies (e.g., Futagami et al. (Reference Futagami, Morita and Shibata1993), Ghosh and Roy (Reference Ghosh and Roy2004), Agénor (Reference Agénor2008)) show that the welfare-maximizing tax rate is lower than the growth-maximizing one (output elasticity of public capital), while other studies (e.g., Kalaitzidakis and Kalyvitis (Reference Kalaitzidakis and Kalyvitis2004), Chang and Chang (Reference Chang and Chang2015)) show the opposite result.Footnote 8 While these existing studies consider neither CIT nor tax evasion, our study investigates optimal taxation, theoretically and quantitatively, incorporating CIT evasion.Footnote 9

Among the existing studies of tax evasion and growth, we should refer to Chen (Reference Chen2003) and Kafkalas et al. (Reference Kafkalas, Kalaitzidakis and Tzouvelekas2014).Footnote 10 They investigate tax evasion by household-firms in Barro’s (Reference Barro1990) type model, in which government incurs inspection expenditure to audit taxpayers. These authors focus on the trade-off between the government’s inspection expenditure and public investment. Chen (Reference Chen2003) shows that the growth-maximizing announced tax rate is higher than the output elasticity of public service, under the assumption that inspection expenditure is proportional to output and household firms must incur tax evasion costs. Meanwhile, Kafkalas et al. (Reference Kafkalas, Kalaitzidakis and Tzouvelekas2014) assume that the government’s inspection expenditure is proportional to tax revenues. They show that, even with tax evasion, the growth-(and utility-) maximizing effective tax rate equals the output elasticity of public capital, in line with Barro’s rule.

In contrast to these studies, we do not focus on the role of inspection expenditure. Therefore, we adopt the same specification of inspection expenditure as Kafkalas et al. (Reference Kafkalas, Kalaitzidakis and Tzouvelekas2014), which does not affect Barro’s rule. Thus, we can concentrate on the role of tax evasion behavior of firms with market power.

Although the findings on optimal tax rates from Chen (Reference Chen2003) and Kafkalas et al. (Reference Kafkalas, Kalaitzidakis and Tzouvelekas2014) are interesting, there are some reservations. First, they consider tax evasion by household-firms, where the firm is the same as a household. Since there is no difference between CIT and a household’s income tax in their models, they do not consider the role of CIT evasion. Second, they assume a competitive goods market, and therefore, ignore tax evasion associated with profit maximization in an imperfectly competitive product market.Footnote 11 Thus, although tax evasion affects the aggregate economy through the government budget in their models, these studies do not consider the role of tax evasion in the production side directly.

Our study is also comparable to Aghion et al. (Reference Aghion, Akcigit, Cagé and Kerr2016). They examine the relationship among corporate taxation, growth, and welfare, focusing on corruption. Aghion et al. (Reference Aghion, Akcigit, Cagé and Kerr2016) construct an endogenous growth model in which public capital raises the expected returns to entrepreneurial efforts on R&D but tax revenue decreases due to the corruption of officers after tax collection. They suggest that the relationship between the CIT rate and growth is an inverted-U shape, and the welfare-maximizing CIT rate is 42% in the calibrated model. However, Aghion et al. (Reference Aghion, Akcigit, Cagé and Kerr2016) do not consider tax evasion by firms but focus on the corruption between government and households. In this study, we incorporate corporate tax evasion in an endogenous growth model and suggest that the optimal CIT rate is as high as Aghion et al.’s (Reference Aghion, Akcigit, Cagé and Kerr2016) estimate.

2. Model

Time is discrete and denoted by

![]() $t = 0,1, \ \cdot\cdot\cdot$

. The economy is inhabited by the following four types of agents: producers of final outputs, producers of intermediate goods, a representative household, and government. An infinitely living representative household has perfect foresight and is endowed with L unit of labor. Labor moves freely across different production sectors. The intermediate goods sector is monopolistically competitive. The number of intermediate goods in period t is

$t = 0,1, \ \cdot\cdot\cdot$

. The economy is inhabited by the following four types of agents: producers of final outputs, producers of intermediate goods, a representative household, and government. An infinitely living representative household has perfect foresight and is endowed with L unit of labor. Labor moves freely across different production sectors. The intermediate goods sector is monopolistically competitive. The number of intermediate goods in period t is

![]() $ N_t $

. We assume

$ N_t $

. We assume

![]() $N_0=1$

without loss of generality. To operate in period t, each intermediate good producer invests in period

$N_0=1$

without loss of generality. To operate in period t, each intermediate good producer invests in period

![]() $ t-1 $

. This investment increases the number of intermediate goods

$ t-1 $

. This investment increases the number of intermediate goods

![]() $ N_t $

over time. This is the growth engine of our model.

$ N_t $

over time. This is the growth engine of our model.

2.1 Producers of final good

A single final output is produced by perfectly competitive producers using the following technology:

where

![]() $Y_t$

is output,

$Y_t$

is output,

![]() $L_{Y,t}$

is labor input in the final goods sector, and

$L_{Y,t}$

is labor input in the final goods sector, and

![]() $x_{i,t}$

is the input of intermediate good i. Following Barro (Reference Barro1990), public services,

$x_{i,t}$

is the input of intermediate good i. Following Barro (Reference Barro1990), public services,

![]() $G_t$

, increase the productivity of output. We take the final output as the numeraire. Although

$G_t$

, increase the productivity of output. We take the final output as the numeraire. Although

![]() $\alpha$

encompasses both (i) the output elasticity of public services and (ii) the price elasticity of intermediate goods

$\alpha$

encompasses both (i) the output elasticity of public services and (ii) the price elasticity of intermediate goods

![]() $1/(1-\alpha)$

, we examine the former in this simple model. In the extended model (Section 5), we separate (i) and (ii). We denote the price of intermediate good i and wage rate as

$1/(1-\alpha)$

, we examine the former in this simple model. In the extended model (Section 5), we separate (i) and (ii). We denote the price of intermediate good i and wage rate as

![]() $p_{i,t}$

and

$p_{i,t}$

and

![]() $w_t$

, respectively. The profit maximization yields

$w_t$

, respectively. The profit maximization yields

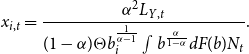

Solving (2) and (3) with respect to

![]() $x_{i,t}$

yields the demand function for the product of firm i:

$x_{i,t}$

yields the demand function for the product of firm i:

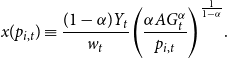

\begin{equation}x(p_{i,t})\equiv\frac{(1-\alpha)Y_t}{w_t}\Bigg(\frac{\alpha A G_t^\alpha}{p_{i,t}}\Bigg)^{\frac{1}{1-\alpha}}. \end{equation}

\begin{equation}x(p_{i,t})\equiv\frac{(1-\alpha)Y_t}{w_t}\Bigg(\frac{\alpha A G_t^\alpha}{p_{i,t}}\Bigg)^{\frac{1}{1-\alpha}}. \end{equation}

2.2 Producers of intermediate goods

2.2.1 Entry into the intermediate goods market

Each intermediate good is produced by a monopolistically competitive firm. To operate in period t, each intermediate good firm must invest

![]() $\eta$

unit of the final good in period

$\eta$

unit of the final good in period

![]() $t-1$

. Firms finance the cost of this investment by borrowing from households. Because firms must incur investment costs in each period, the planning horizon of each firm is one period, as in Young (Reference Young1998). When incurring investment costs, each firm draws its productivity

$t-1$

. Firms finance the cost of this investment by borrowing from households. Because firms must incur investment costs in each period, the planning horizon of each firm is one period, as in Young (Reference Young1998). When incurring investment costs, each firm draws its productivity

![]() $b>0 $

from distribution F(b). We assume that (i) b is independent and identically distributed (iid) over time as well as across firms and (ii) b is private information. These two assumptions are useful in describing an environment where the true tax base of each firm cannot be observable without auditing firms, as we explain in Sections 2.2.2 and 2.2.3. Besides, heterogeneity among firms’ productivity enables us to describe the realistic firm size distribution for the quantitative analysis in Section 5.

$b>0 $

from distribution F(b). We assume that (i) b is independent and identically distributed (iid) over time as well as across firms and (ii) b is private information. These two assumptions are useful in describing an environment where the true tax base of each firm cannot be observable without auditing firms, as we explain in Sections 2.2.2 and 2.2.3. Besides, heterogeneity among firms’ productivity enables us to describe the realistic firm size distribution for the quantitative analysis in Section 5.

Let us denote the expected after-tax operating profit of a firm with productivity b in period t by

![]() $ \pi^{e}_{i,t}$

.

$ \pi^{e}_{i,t}$

.

![]() $\pi^{e}_{i,t}$

depends on b. The next subsection discusses

$\pi^{e}_{i,t}$

depends on b. The next subsection discusses

![]() $ \pi^{e}_{i,t} $

in detail. The objective of intermediate good firm i that invests in period

$ \pi^{e}_{i,t} $

in detail. The objective of intermediate good firm i that invests in period

![]() $ t-1 $

is given by

$ t-1 $

is given by

where

![]() $R_{t-1}$

is the gross interest rate between periods

$R_{t-1}$

is the gross interest rate between periods

![]() $t-1$

and t. Since b is iid across firms, all firms face the same

$t-1$

and t. Since b is iid across firms, all firms face the same

![]() $ \Pi_{t-1} $

in period

$ \Pi_{t-1} $

in period

![]() $ t-1 $

. Free entry into the intermediate goods market implies

$ t-1 $

. Free entry into the intermediate goods market implies

2.2.2 Expected operating profits

We assume that the price of each intermediate good

![]() $p_{i,t}$

is public information. A firm with productivity b needs

$p_{i,t}$

is public information. A firm with productivity b needs

![]() $1/b$

unit of labor to produce one unit of the intermediate good. The true operating profit of firm i is given by

$1/b$

unit of labor to produce one unit of the intermediate good. The true operating profit of firm i is given by

We use the word “true” to distinguish the true operating profit from the operating profit that firm i declares,

![]() $\tilde{\pi}_{i,t}$

, to the government. Because b is private information, the government cannot directly observe the true operating profit,

$\tilde{\pi}_{i,t}$

, to the government. Because b is private information, the government cannot directly observe the true operating profit,

![]() $ \pi_{i,t} $

, and thus, cannot know whether the declared profit (

$ \pi_{i,t} $

, and thus, cannot know whether the declared profit (

![]() $\tilde{\pi}_{i,t}$

) is equal to the true profit (

$\tilde{\pi}_{i,t}$

) is equal to the true profit (

![]() $\pi_{i,t}$

) without conducting an audit.

$\pi_{i,t}$

) without conducting an audit.

Denote the announced CIT rate by

![]() $\tau\in (0,1]$

. The after-tax profit of each firm is given by

$\tau\in (0,1]$

. The after-tax profit of each firm is given by

![]() $\pi_{i,t}-\tau \tilde{\pi}_{i,t}$

, because CIT is imposed on declared profit

$\pi_{i,t}-\tau \tilde{\pi}_{i,t}$

, because CIT is imposed on declared profit

![]() $ \tilde{\pi}_{i,t}$

. We denote the probability of an audit by

$ \tilde{\pi}_{i,t}$

. We denote the probability of an audit by

![]() $ {\bar q} \in [0,1]$

, and assume it is given exogenously. We impose a further assumption on

$ {\bar q} \in [0,1]$

, and assume it is given exogenously. We impose a further assumption on

![]() $ \bar{q} $

later. Suppose that a firm is audited. If this firm under-declares its operating profit (

$ \bar{q} $

later. Suppose that a firm is audited. If this firm under-declares its operating profit (

![]() $ \tilde{\pi}_{i,t} < \pi_{i,t} $

) to the government, it has to pay a penalty of

$ \tilde{\pi}_{i,t} < \pi_{i,t} $

) to the government, it has to pay a penalty of

![]() $ (1+s)\tau(\pi_{i,t}-\tilde{\pi}_{i,t} )$

, where the exogenous parameter

$ (1+s)\tau(\pi_{i,t}-\tilde{\pi}_{i,t} )$

, where the exogenous parameter

![]() $ s(\ge0) $

is an additional tax rate. If the firm over-declares its operating profit (

$ s(\ge0) $

is an additional tax rate. If the firm over-declares its operating profit (

![]() $ \tilde{\pi}_{i,t} > \pi_{i,t} $

), the overpayment,

$ \tilde{\pi}_{i,t} > \pi_{i,t} $

), the overpayment,

![]() $ \tau (\tilde{\pi}_{i,t}-\pi_{i,t}) $

, is refunded. The expected after-tax operating profit of firm i is given by

$ \tau (\tilde{\pi}_{i,t}-\pi_{i,t}) $

, is refunded. The expected after-tax operating profit of firm i is given by

Given

![]() $ \pi_{i,t} $

,

$ \pi_{i,t} $

,

![]() $ \pi^e_{i,t} $

decreases with

$ \pi^e_{i,t} $

decreases with

![]() $ \tilde{\pi}_{i,t} $

if

$ \tilde{\pi}_{i,t} $

if

![]() $ \tilde{\pi}_{i,t} > \pi_{i,t} $

, and therefore no firms over-declare their operating profits, and the last term is equal to zero. Thus,

$ \tilde{\pi}_{i,t} > \pi_{i,t} $

, and therefore no firms over-declare their operating profits, and the last term is equal to zero. Thus,

![]() $ \tilde{\pi}_{i,t} \le \pi_{i,t} $

must be satisfied in the following discussion. Then, the expected after-tax operating profit,

$ \tilde{\pi}_{i,t} \le \pi_{i,t} $

must be satisfied in the following discussion. Then, the expected after-tax operating profit,

![]() $\pi^e_{i,t}$

, for

$\pi^e_{i,t}$

, for

![]() $ \tilde{\pi}_{i,t} \le \pi_{i,t}$

, is

$ \tilde{\pi}_{i,t} \le \pi_{i,t}$

, is

where

![]() $\tilde{\tau}$

is the effective CIT rate and defined as

$\tilde{\tau}$

is the effective CIT rate and defined as

2.2.3 Tax evasion and maximization of the expected operating profits

Firm i chooses

![]() $\tilde{\pi}_{i,t}$

and

$\tilde{\pi}_{i,t}$

and

![]() $p_{i,t}$

to maximize

$p_{i,t}$

to maximize

![]() $\pi^{e}_{i,t}$

. Our specification of tax evasion behavior is essentially similar to that of Allingham and Sandmo (Reference Allingham and Sandmo1972), who consider tax evasion by a representative household, which evades income tax by choosing a declared income when its actual income is not directly known by the government. In our setting, each firm chooses its declared profit,

$\pi^{e}_{i,t}$

. Our specification of tax evasion behavior is essentially similar to that of Allingham and Sandmo (Reference Allingham and Sandmo1972), who consider tax evasion by a representative household, which evades income tax by choosing a declared income when its actual income is not directly known by the government. In our setting, each firm chooses its declared profit,

![]() $ \tilde{\pi}_{i,t}$

, by adjusting the price level when its actual profit,

$ \tilde{\pi}_{i,t}$

, by adjusting the price level when its actual profit,

![]() $\pi_{i,t}$

, is not directly known by the government.

$\pi_{i,t}$

, is not directly known by the government.

As a first step, we briefly discuss the case where the government can observe the true operating profits of each firm without any costs. We still assume that b is private information. Let us define the following function of p :

where x(p) is defined by (4). Since the government can observe the true operating profits, each firm declares its profits truthfully. We substitute

![]() $ \tilde{\pi}_{i,t}=\pi_{i,t} $

into (8), which yields

$ \tilde{\pi}_{i,t}=\pi_{i,t} $

into (8), which yields

![]() $ \pi^e_{i,t}=(1-\tau)\pi_{i,t} $

. Thus,

$ \pi^e_{i,t}=(1-\tau)\pi_{i,t} $

. Thus,

![]() $ \pi^e_{i,t} $

is maximized at

$ \pi^e_{i,t} $

is maximized at

![]() $p_{i,t} = p^*_{i,t}$

, where

$p_{i,t} = p^*_{i,t}$

, where

![]() $p^\ast_{i,t}$

is defined as

$p^\ast_{i,t}$

is defined as

![]() $p^*_{i,t} \equiv \frac{w_t}{\alpha b_i}$

. The maximized operating profits is given by

$p^*_{i,t} \equiv \frac{w_t}{\alpha b_i}$

. The maximized operating profits is given by

![]() $ \Lambda( p^*_{i,t} ) $

. Since firm i declares truthfully, the declared profit

$ \Lambda( p^*_{i,t} ) $

. Since firm i declares truthfully, the declared profit

![]() $ \tilde{\pi}_{i,t} $

satisfies

$ \tilde{\pi}_{i,t} $

satisfies

![]() $ \tilde{\pi}_{i,t} = \Lambda( p^*_{i,t} ) $

. The following points should be noted. First, function

$ \tilde{\pi}_{i,t} = \Lambda( p^*_{i,t} ) $

. The following points should be noted. First, function

![]() $ \Lambda(p) $

does not depend on b. Thus, although b is not observable, the government knows the functional form of

$ \Lambda(p) $

does not depend on b. Thus, although b is not observable, the government knows the functional form of

![]() $ \Lambda(p) $

as long as it knows the demand function, (4). Second, since b is private information, the government cannot directly observe whether the price set by firm i,

$ \Lambda(p) $

as long as it knows the demand function, (4). Second, since b is private information, the government cannot directly observe whether the price set by firm i,

![]() $ p_{i,t} $

, is actually equal to

$ p_{i,t} $

, is actually equal to

![]() $ p^*_{i,t} = \frac{w_t}{\alpha b_i} $

. Finally, the above result suggests that if firm i declares truthfully, the price set by the firm,

$ p^*_{i,t} = \frac{w_t}{\alpha b_i} $

. Finally, the above result suggests that if firm i declares truthfully, the price set by the firm,

![]() $ p_{i,t} $

, and its declared profits,

$ p_{i,t} $

, and its declared profits,

![]() $ \tilde{\pi}_{i,t} $

, satisfy

$ \tilde{\pi}_{i,t} $

, satisfy

![]() $ \tilde{\pi}_{i,t} = \Lambda (p_{i,t}) $

. Conversely, if

$ \tilde{\pi}_{i,t} = \Lambda (p_{i,t}) $

. Conversely, if

![]() $ p_{i,t} $

and

$ p_{i,t} $

and

![]() $ \tilde{\pi}_{i,t} $

do not satisfy

$ \tilde{\pi}_{i,t} $

do not satisfy

![]() $ \tilde{\pi}_{i,t} = \Lambda (p_{i,t}) $

, firm i declares dishonestly.

$ \tilde{\pi}_{i,t} = \Lambda (p_{i,t}) $

, firm i declares dishonestly.

We now consider the case where the government cannot observe the true operating profits of each firm without any costs. We consider two subcases. First, assume that

![]() $ 1-\bar{q}(1+s)< 0 $

. We rewrite (8) as

$ 1-\bar{q}(1+s)< 0 $

. We rewrite (8) as

If

![]() $1-\bar{q}(1+s)<0$

, firm i chooses

$1-\bar{q}(1+s)<0$

, firm i chooses

![]() $\tilde{\pi}_{i,t}=\pi_{i,t}$

because

$\tilde{\pi}_{i,t}=\pi_{i,t}$

because

![]() $\pi^e_{i,t}$

is increasing in

$\pi^e_{i,t}$

is increasing in

![]() $\tilde{\pi}_{i,t}$

. Then, each firm declares its profit truthfully. Thus, each firm sets

$\tilde{\pi}_{i,t}$

. Then, each firm declares its profit truthfully. Thus, each firm sets

![]() $ p_{i,t} =p^*_{i,t} $

. Furthermore,

$ p_{i,t} =p^*_{i,t} $

. Furthermore,

![]() $\tilde{\tau}=\tau$

by (9). Intuitively, if the expected additional tax rate is higher than the rate under honest declaration (

$\tilde{\tau}=\tau$

by (9). Intuitively, if the expected additional tax rate is higher than the rate under honest declaration (

![]() $\bar q(1+s)\tau> \tau$

), firms have no incentive to under-declare profits because CIT does not affect

$\bar q(1+s)\tau> \tau$

), firms have no incentive to under-declare profits because CIT does not affect

![]() $\tilde{\pi}_{i,t}$

. Thus, they declare true profits (

$\tilde{\pi}_{i,t}$

. Thus, they declare true profits (

![]() $\tilde{\pi}_{i,t}=\pi_{i,t}$

), and tax evasion does not occur.

$\tilde{\pi}_{i,t}=\pi_{i,t}$

), and tax evasion does not occur.

If

![]() $1-\bar{q}(1+s)=0$

, we obtain

$1-\bar{q}(1+s)=0$

, we obtain

![]() $\pi^e_{i,t}=(1-\tau)\pi_{i,t}$

by (11). In this case, the expected after-tax profit does not depend on whether a firm declares its profit truthfully. The maximization of

$\pi^e_{i,t}=(1-\tau)\pi_{i,t}$

by (11). In this case, the expected after-tax profit does not depend on whether a firm declares its profit truthfully. The maximization of

![]() $\pi^e_{i,t}=(1-\tau)\pi_{i,t}$

yields the same results as those of truth-telling firms. Summing up, we obtain the following.

$\pi^e_{i,t}=(1-\tau)\pi_{i,t}$

yields the same results as those of truth-telling firms. Summing up, we obtain the following.

Proposition 1. If

![]() $1-\bar{q}(1+s)\le0$

, then each firm i declares its true profit,

$1-\bar{q}(1+s)\le0$

, then each firm i declares its true profit,

![]() $\tilde{\pi}_{i,t}=\pi_{i,t}$

, and set its price level as

$\tilde{\pi}_{i,t}=\pi_{i,t}$

, and set its price level as

![]() $p_{i,t}=p^\ast_{i,t}$

. The effective CIT rate coincides with the announced CIT rate,

$p_{i,t}=p^\ast_{i,t}$

. The effective CIT rate coincides with the announced CIT rate,

![]() $\tilde{\tau}=\tau$

.

$\tilde{\tau}=\tau$

.

Next, we assume that

![]() $ 1-\bar{q}(1+s)> 0 $

. Then, (11) shows that

$ 1-\bar{q}(1+s)> 0 $

. Then, (11) shows that

![]() $\pi^e_{i,t}$

decreases with

$\pi^e_{i,t}$

decreases with

![]() $\tilde{\pi}_{i,t}$

. Thus, firm i has an incentive to under-declare its profits,

$\tilde{\pi}_{i,t}$

. Thus, firm i has an incentive to under-declare its profits,

![]() $ \tilde{\pi}^e_{i,t} < \pi^e_{i,t} $

. Remember that the government can observe the price set by firm i,

$ \tilde{\pi}^e_{i,t} < \pi^e_{i,t} $

. Remember that the government can observe the price set by firm i,

![]() $ p_{i,t} $

, and its declared operating profits,

$ p_{i,t} $

, and its declared operating profits,

![]() $ \tilde{\pi}_{i,t} $

, but cannot observe

$ \tilde{\pi}_{i,t} $

, but cannot observe

![]() $ b_i $

. This means that the government cannot observe whether firm i sets

$ b_i $

. This means that the government cannot observe whether firm i sets

![]() $ p_{i,t} $

according to

$ p_{i,t} $

according to

![]() $ p_{i,t} = \frac{w_t}{\alpha b_i} $

. Suppose that

$ p_{i,t} = \frac{w_t}{\alpha b_i} $

. Suppose that

![]() $ p_{i,t} $

and

$ p_{i,t} $

and

![]() $ \tilde{\pi}_{i,t} $

satisfy

$ \tilde{\pi}_{i,t} $

satisfy

![]() $\tilde{\pi}_{i,t} \neq \Lambda( p_{i,t} )$

, where function

$\tilde{\pi}_{i,t} \neq \Lambda( p_{i,t} )$

, where function

![]() $ \Lambda( \cdot ) $

is defined by (10). From the discussion in the paragraph that includes (10), the government knows that the firm declares dishonestly. In contrast, suppose that

$ \Lambda( \cdot ) $

is defined by (10). From the discussion in the paragraph that includes (10), the government knows that the firm declares dishonestly. In contrast, suppose that

![]() $ p_{i,t} $

and

$ p_{i,t} $

and

![]() $ \tilde{\pi}_{i,t} $

satisfy

$ \tilde{\pi}_{i,t} $

satisfy

Remember that the government cannot know whether the price set by firm i,

![]() $ p_{i,t} $

, is equal to

$ p_{i,t} $

, is equal to

![]() $ p^*_{i,t} =\frac{w_t}{\alpha b_i} $

. Thus, without auditing the firm, the government cannot know whether the firm declares truthfully. Given the discussion so far, we impose the following assumption.

$ p^*_{i,t} =\frac{w_t}{\alpha b_i} $

. Thus, without auditing the firm, the government cannot know whether the firm declares truthfully. Given the discussion so far, we impose the following assumption.

Assumption 1. Consider a firm that sets the price at

![]() $p_{i,t} $

. (i) If the firm’s declared profit satisfies

$p_{i,t} $

. (i) If the firm’s declared profit satisfies

![]() $ \tilde{\pi}_{i,t} \neq \Lambda( p_{i,t} ) $

, the firm is audited with a probability of one;

$ \tilde{\pi}_{i,t} \neq \Lambda( p_{i,t} ) $

, the firm is audited with a probability of one;

![]() $ \bar{q}=1 $

. (ii) If the firm’s declared profit satisfies

$ \bar{q}=1 $

. (ii) If the firm’s declared profit satisfies

![]() $ \tilde{\pi}_{i,t} = \Lambda( p_{i,t} ) $

, the firm is audited with a probability lower than one;

$ \tilde{\pi}_{i,t} = \Lambda( p_{i,t} ) $

, the firm is audited with a probability lower than one;

![]() $ \bar{q}=q \in[0,1) $

.

$ \bar{q}=q \in[0,1) $

.

This assumption captures the idea that if a firm unnaturally declares its profits, the government audits the firm. Under this assumption, we first demonstrate how each firm declares its profits in the following lemma.

Lemma. Suppose that

![]() $ 1-q(1+s)>0$

and that firm i sets

$ 1-q(1+s)>0$

and that firm i sets

![]() $ p_{i,t} $

. Then, its declared profit satisfies

$ p_{i,t} $

. Then, its declared profit satisfies

![]() $ \tilde{\pi}_{i,t} = \Lambda( p_{i,t} ) $

.

$ \tilde{\pi}_{i,t} = \Lambda( p_{i,t} ) $

.

Proof. See Appendix A.

Using Lemma, we consider firm i’s choice of the price level,

![]() $p_{i,t}$

.Footnote 12

$p_{i,t}$

.Footnote 12

Suppose that

![]() $ 1-q(1+s)> 0$

. Then, by (11),

$ 1-q(1+s)> 0$

. Then, by (11),

![]() $ \tilde{\pi}_{i,t} = \Lambda( p_{i,t} ) $

, and

$ \tilde{\pi}_{i,t} = \Lambda( p_{i,t} ) $

, and

![]() $\bar q =q$

, the problem of firm i is reduced to the problem to choose

$\bar q =q$

, the problem of firm i is reduced to the problem to choose

![]() $p_{i,t}$

to maximize

$p_{i,t}$

to maximize

subject to

![]() $p_{it}\geq p^\ast_{i,t}$

, which is from

$p_{it}\geq p^\ast_{i,t}$

, which is from

![]() $\tilde{\pi}_{i,t}\leq\pi_{i,t}$

.

$\tilde{\pi}_{i,t}\leq\pi_{i,t}$

.

The first-order condition is given by

\begin{align}\frac{\partial \pi^e_{i,t}}{\partial p_{i,t}}&=[1-q(1+s)\tau]\frac{\partial\pi_{i,t}}{\partial p_{i,t}}-[1-q(1+s)]\tau \Lambda'(p_{i,t})\nonumber\\[5pt]&=\frac{\alpha x(p_{i,t})}{p_{i,t}} \left\{-\frac{1-q(1+s)\tau}{1-\alpha}\left(p_{i,t}-\frac{w_t}{\alpha b_i} \right)+[1-q(1+s)]\tau p_{i,t} \right\}=0, \end{align}

\begin{align}\frac{\partial \pi^e_{i,t}}{\partial p_{i,t}}&=[1-q(1+s)\tau]\frac{\partial\pi_{i,t}}{\partial p_{i,t}}-[1-q(1+s)]\tau \Lambda'(p_{i,t})\nonumber\\[5pt]&=\frac{\alpha x(p_{i,t})}{p_{i,t}} \left\{-\frac{1-q(1+s)\tau}{1-\alpha}\left(p_{i,t}-\frac{w_t}{\alpha b_i} \right)+[1-q(1+s)]\tau p_{i,t} \right\}=0, \end{align}

given that

![]() $\frac{\partial \pi_{i,t}}{\partial p_{i,t}}=-\alpha x(p_{i,t}) \left[\frac{p_{i,t}-w_t/(\alpha b_i)}{(1-\alpha)p_{i,t}} \right]$

and

$\frac{\partial \pi_{i,t}}{\partial p_{i,t}}=-\alpha x(p_{i,t}) \left[\frac{p_{i,t}-w_t/(\alpha b_i)}{(1-\alpha)p_{i,t}} \right]$

and

![]() $\Lambda'(p_{i,t})=-\alpha x(p_{i,t})$

. Because

$\Lambda'(p_{i,t})=-\alpha x(p_{i,t})$

. Because

![]() $ 1-q(1+s)>0 $

holds, we have that

$ 1-q(1+s)>0 $

holds, we have that

![]() $ 0< (1-\alpha)[1-q(1+s)]\tau < [1-q(1+s)]\tau < 1-q(1+s)\tau $

, which ensures the second-order condition. Solving (13) yields the following interior solution for

$ 0< (1-\alpha)[1-q(1+s)]\tau < [1-q(1+s)]\tau < 1-q(1+s)\tau $

, which ensures the second-order condition. Solving (13) yields the following interior solution for

![]() $p_{it} > w_t/\alpha b_i$

, which is denoted by

$p_{it} > w_t/\alpha b_i$

, which is denoted by

![]() $\tilde{p}_{i,t}$

:

$\tilde{p}_{i,t}$

:

Because

![]() $ 1-q(1+s)>0 $

and

$ 1-q(1+s)>0 $

and

![]() $ (1-\alpha)[1-q(1+s)]\tau < 1-q(1+s)\tau $

, we have

$ (1-\alpha)[1-q(1+s)]\tau < 1-q(1+s)\tau $

, we have

![]() $ \Gamma(\tau)>1 $

and, hence,

$ \Gamma(\tau)>1 $

and, hence,

![]() $ \tilde{p}_{i,t} >w_t/(\alpha b_i) $

is satisfied.

$ \tilde{p}_{i,t} >w_t/(\alpha b_i) $

is satisfied.

The following proposition summarizes firm i’s choice in which tax evasion occurs.

Proposition 2. Suppose that

![]() $ 1-q(1+s)>0$

and that Assumption 1 holds. Firms with productivity

$ 1-q(1+s)>0$

and that Assumption 1 holds. Firms with productivity

![]() $ b_i $

set the price,

$ b_i $

set the price,

![]() $\tilde{p}_{i,t}$

, as (14). The declared profit satisfies (12). The true profit and the expected after-tax operating profit are, respectively, given by

$\tilde{p}_{i,t}$

, as (14). The declared profit satisfies (12). The true profit and the expected after-tax operating profit are, respectively, given by

The inequality

![]() $ \pi_{i,t} > \tilde{\pi}_{i,t} $

in (15) indicates that all firms under-declare their operating profits. The effective CIT rate,

$ \pi_{i,t} > \tilde{\pi}_{i,t} $

in (15) indicates that all firms under-declare their operating profits. The effective CIT rate,

![]() $\tilde{\tau}\in \left(0,\frac{1+\alpha q(1+s)}{1+\alpha}\right]$

, satisfies that

$\tilde{\tau}\in \left(0,\frac{1+\alpha q(1+s)}{1+\alpha}\right]$

, satisfies that

![]() $\tilde{\tau} < \tau$

.

$\tilde{\tau} < \tau$

.

Proof. See the text and Appendix B.

Proposition 2 states that if the expected additional tax rate is lower than the rate under honest declaration (

![]() $q(1+s)<1$

), firms choose to evade CIT by under-declaring profits (

$q(1+s)<1$

), firms choose to evade CIT by under-declaring profits (

![]() $\tilde{\pi}_{i,t} < \pi_{i,t}$

). This is captured by

$\tilde{\pi}_{i,t} < \pi_{i,t}$

). This is captured by

![]() $\Gamma(\tau)$

, which is the only difference between the honest and dishonest declaration. Because

$\Gamma(\tau)$

, which is the only difference between the honest and dishonest declaration. Because

![]() $\Lambda'(p_{i,t})=-\alpha x (p_{i,t})<0$

, a firm can under-declare its profit by raising its price level. When firms under-declare profits, they pretend to be less productive, which leads to a higher price setting (

$\Lambda'(p_{i,t})=-\alpha x (p_{i,t})<0$

, a firm can under-declare its profit by raising its price level. When firms under-declare profits, they pretend to be less productive, which leads to a higher price setting (

![]() $\Gamma (\tau)>1$

), as represented by (14).

$\Gamma (\tau)>1$

), as represented by (14).

Notably, the CIT rate itself has a substantial effect on tax evasion through the term

![]() $\Gamma(\tau)$

. From (9) and (15), we have

$\Gamma(\tau)$

. From (9) and (15), we have

![]() $\mbox{sign} d(\tilde{\pi}_{i,t}/\pi_{i,t})/d\tau=\mbox{sign} d(\tilde{\tau}/\tau)/d\tau =\mbox{sign} d(1/\Gamma(\tau))/d\tau<0$

.Footnote 13 Thus, a rise in the CIT rate increases the difference between the true profit (

$\mbox{sign} d(\tilde{\pi}_{i,t}/\pi_{i,t})/d\tau=\mbox{sign} d(\tilde{\tau}/\tau)/d\tau =\mbox{sign} d(1/\Gamma(\tau))/d\tau<0$

.Footnote 13 Thus, a rise in the CIT rate increases the difference between the true profit (

![]() $\pi_{i,t}$

) and the declared profit (

$\pi_{i,t}$

) and the declared profit (

![]() $\tilde{\pi}_{i,t}$

) and encourages tax evasion.

$\tilde{\pi}_{i,t}$

) and encourages tax evasion.

Tax evasion by firms may not be possible if we assume that the government incorporates the equilibrium behavior of firms (14) and, thus, can infer productivity

![]() $b_i$

from

$b_i$

from

![]() $\tilde{p}_{i,t}$

. Although recent literature on optimal taxation using the mechanism design approach includes this assumption, we do not. Instead, we assume that a government does not conduct such a perfect back calculation, as in Allingham and Sandmo (Reference Allingham and Sandmo1972), because this simple setting allows us to provide interesting analyses on the macroeconomic consequences of CIT evasion in a tractable model.

$\tilde{p}_{i,t}$

. Although recent literature on optimal taxation using the mechanism design approach includes this assumption, we do not. Instead, we assume that a government does not conduct such a perfect back calculation, as in Allingham and Sandmo (Reference Allingham and Sandmo1972), because this simple setting allows us to provide interesting analyses on the macroeconomic consequences of CIT evasion in a tractable model.

REMARKS

The properties

![]() $d\tilde{\tau}/d\tau>0$

and

$d\tilde{\tau}/d\tau>0$

and

![]() $d(\tilde{\tau}/\tau)/d\tau < 0$

are in line with Roubini and Sala-i-Martin (Reference Roubini1995) and Kafkalas et al. (Reference Kafkalas, Kalaitzidakis and Tzouvelekas2014).Footnote 14 However, the tax evasion considered in our model departs from these previous studies in the following respects.

$d(\tilde{\tau}/\tau)/d\tau < 0$

are in line with Roubini and Sala-i-Martin (Reference Roubini1995) and Kafkalas et al. (Reference Kafkalas, Kalaitzidakis and Tzouvelekas2014).Footnote 14 However, the tax evasion considered in our model departs from these previous studies in the following respects.

First, tax evasion in our model is derived endogenously from the micro foundation of firms’ tax evasion behavior, in contrast to the ad-hoc expression by Roubini and Sala-i-Martin (Reference Roubini1995).

Second, Chen (Reference Chen2003) and Kafkalas et al. (Reference Kafkalas, Kalaitzidakis and Tzouvelekas2014) do not consider tax evasion associated with profit maximization in an imperfectly competitive product market. Thus, there is no relationship between the tax rates and the firms’ choice of profits and declarations of profits in their models. In contrast, in our model, the CIT rate affects them substantially, as represented by

![]() $\Gamma(\tau)>1$

and

$\Gamma(\tau)>1$

and

![]() $\Gamma'(\tau)>0$

.

$\Gamma'(\tau)>0$

.

2.3 Household

The population size is constant at one. The utility function of a representative household is

\begin{equation}U_0=\sum_{t=0}^{\infty}\left(\frac{1}{1+\rho}\right)^t u(C_t), u(C_t)=\frac{C^{1-\sigma}_t}{1-\sigma}, \ \ \sigma>0. \end{equation}

\begin{equation}U_0=\sum_{t=0}^{\infty}\left(\frac{1}{1+\rho}\right)^t u(C_t), u(C_t)=\frac{C^{1-\sigma}_t}{1-\sigma}, \ \ \sigma>0. \end{equation}

![]() $u(C_t)=\ln{C_t}$

, when

$u(C_t)=\ln{C_t}$

, when

![]() $\sigma=1$

. Here,

$\sigma=1$

. Here,

![]() $C_t$

,

$C_t$

,

![]() $\rho(>0)$

and

$\rho(>0)$

and

![]() $1/\sigma$

denote consumption in period t, the subjective discount rate, and the intertemporal elasticity of substitution, respectively. The representative household supplies L unit of labor inelastically. The household’s budget constraint is given by

$1/\sigma$

denote consumption in period t, the subjective discount rate, and the intertemporal elasticity of substitution, respectively. The representative household supplies L unit of labor inelastically. The household’s budget constraint is given by

![]() $W_{t}=R_{t-1}W_{t-1} +w_t L -C_t$

, where

$W_{t}=R_{t-1}W_{t-1} +w_t L -C_t$

, where

![]() $W_{t-1}$

is the assets at the end of period

$W_{t-1}$

is the assets at the end of period

![]() $t-1$

. The household’s utility maximization yields

$t-1$

. The household’s utility maximization yields

and the transversality condition (TVC) is

2.4 Government

We assume that the government keeps a balanced budget in each period. From (8) and (9), the aggregate tax revenue of the government is

![]() $\int_0^{N_t}\int \{\tau\tilde{\pi}_{i,t}+q(1+s)\tau[\pi_{i,t}-\tilde{\pi}_{i,t}]\}dF(b)di=\tilde{\tau} \int_0^{N_t}\int \pi_{i,t}dF(b)di= \tilde{\tau} N_t\int \pi_{i,t}dF(b)$

. Here, we use the fact that b is iid across firms. This revenue is allocated to productive government spending,

$\int_0^{N_t}\int \{\tau\tilde{\pi}_{i,t}+q(1+s)\tau[\pi_{i,t}-\tilde{\pi}_{i,t}]\}dF(b)di=\tilde{\tau} \int_0^{N_t}\int \pi_{i,t}dF(b)di= \tilde{\tau} N_t\int \pi_{i,t}dF(b)$

. Here, we use the fact that b is iid across firms. This revenue is allocated to productive government spending,

![]() $G_t$

, and inspection expenditure to detect tax evasion,

$G_t$

, and inspection expenditure to detect tax evasion,

![]() $M_t$

. Thus, the budget constraint of the government is given by

$M_t$

. Thus, the budget constraint of the government is given by

The probability of a successful detection of tax evasion by a firm q occurs when we assume spending a constant fraction, Q, of government revenue on

![]() $M_t$

.Footnote 15 Therefore, the inspection expenditure is given by

$M_t$

.Footnote 15 Therefore, the inspection expenditure is given by

![]() $ M_t =Q \tilde{\tau} N_t \int \pi_{i,t} dF(b) $

. This specification of

$ M_t =Q \tilde{\tau} N_t \int \pi_{i,t} dF(b) $

. This specification of

![]() $M_t$

is in line with Kafkalas et al. (Reference Kafkalas, Kalaitzidakis and Tzouvelekas2014). Thus, (20) reduces to

$M_t$

is in line with Kafkalas et al. (Reference Kafkalas, Kalaitzidakis and Tzouvelekas2014). Thus, (20) reduces to

As mentioned in the Introduction section, such a specification allows us to isolate the role of tax evasion by firms with market power for pursuing Barro’s rule. This is because Kafkalas et al.’s (Reference Kafkalas, Kalaitzidakis and Tzouvelekas2014) result indicate that Barro’s rule holds even with the tax evasion of perfectly competitive firms under inspection expenditure of the form in (21).

3. Equilibrium

An equilibrium is an allocation in which (i) all monopolistically competitive firms choose

![]() $[p_{i,t}, x_{i,t}]^{\infty}_{t=0}$

, for

$[p_{i,t}, x_{i,t}]^{\infty}_{t=0}$

, for

![]() $i\in[0, N_t]$

, to maximize their after-tax operating profits; (ii) the evolution of the varieties of intermediate goods,

$i\in[0, N_t]$

, to maximize their after-tax operating profits; (ii) the evolution of the varieties of intermediate goods,

![]() $[N_t]^{\infty}_{t=0}$

, is determined by free entry; (iii) the evolution of net interest and wage rates,

$[N_t]^{\infty}_{t=0}$

, is determined by free entry; (iii) the evolution of net interest and wage rates,

![]() $[R_{t-1}, w_t ]^{\infty}_{t=0}$

, satisfy market clearing; (iv) the evolution of aggregate consumption and investment,

$[R_{t-1}, w_t ]^{\infty}_{t=0}$

, satisfy market clearing; (iv) the evolution of aggregate consumption and investment,

![]() $[C_t, \eta N_{t+1}]^\infty_{t=0}$

, is consistent with a household’s utility maximization; and (v) the evolution of productive public expenditures and inspection expenditures,

$[C_t, \eta N_{t+1}]^\infty_{t=0}$

, is consistent with a household’s utility maximization; and (v) the evolution of productive public expenditures and inspection expenditures,

![]() $[G_t,M_t]^\infty_{t=0}$

, satisfy the budget constraint of the government, taking the announced CIT rate, additional tax rate, and the probability of an audit,

$[G_t,M_t]^\infty_{t=0}$

, satisfy the budget constraint of the government, taking the announced CIT rate, additional tax rate, and the probability of an audit,

![]() $(\tau,s,q )$

, as given.

$(\tau,s,q )$

, as given.

We begin with the labor market, which clears as

The cost for entry into the intermediate good market

![]() $ \eta $

is financed by borrowing from households. Because

$ \eta $

is financed by borrowing from households. Because

![]() $ N_{t+1} $

firms invest in period t, the asset market equilibrium condition is given by

$ N_{t+1} $

firms invest in period t, the asset market equilibrium condition is given by

![]() $W_{t} =\eta N_{t+1}$

. The final good market clears as

$W_{t} =\eta N_{t+1}$

. The final good market clears as

![]() $Y_t =C_t + \eta N_{t+1} +G_t +M_t$

.

$Y_t =C_t + \eta N_{t+1} +G_t +M_t$

.

We next characterize the dynamic system and the steady state of the economy. Appendix D shows that the dynamic system of the economy is characterized by the following single difference equation with respect to

![]() $z_t\equiv C_t/N_t$

:

$z_t\equiv C_t/N_t$

:

where

\begin{equation*}\Theta=\begin{cases}1 & \text {if $1-q(1+s)\leq 0$}\\[5pt]\Gamma(\tau) & \text {if $1-q(1+s)>0$},\\\end{cases}\end{equation*}

\begin{equation*}\Theta=\begin{cases}1 & \text {if $1-q(1+s)\leq 0$}\\[5pt]\Gamma(\tau) & \text {if $1-q(1+s)>0$},\\\end{cases}\end{equation*}

and

![]() $\Omega(\tilde{\tau})$

in (23) is

$\Omega(\tilde{\tau})$

in (23) is

![]() $Y_t/N_t$

and is constant over time:

$Y_t/N_t$

and is constant over time:

\begin{align}\frac{Y_t}{N_t}\left(=\frac{Y_{t+1}}{N_{t+1}}\right)=\Omega(\tilde{\tau})\equiv&A^{\frac{1}{1-\alpha}}\left[(1-Q)\tilde{\tau}\left(1-\alpha \Theta^{-1} \right)\alpha \right]^{\frac{\alpha}{1-\alpha}} (1-\alpha)\Theta \alpha^{\frac{2\alpha}{1-\alpha}} \nonumber\\&\times\left[\frac{L}{(1-\alpha)\Theta+\alpha^2}\right]^{\frac{1}{1-\alpha}}\left[\int b^{\frac{\alpha}{1-\alpha}} dF(b)\right]. \end{align}

\begin{align}\frac{Y_t}{N_t}\left(=\frac{Y_{t+1}}{N_{t+1}}\right)=\Omega(\tilde{\tau})\equiv&A^{\frac{1}{1-\alpha}}\left[(1-Q)\tilde{\tau}\left(1-\alpha \Theta^{-1} \right)\alpha \right]^{\frac{\alpha}{1-\alpha}} (1-\alpha)\Theta \alpha^{\frac{2\alpha}{1-\alpha}} \nonumber\\&\times\left[\frac{L}{(1-\alpha)\Theta+\alpha^2}\right]^{\frac{1}{1-\alpha}}\left[\int b^{\frac{\alpha}{1-\alpha}} dF(b)\right]. \end{align}

Here, note that since

![]() $Y_t/N_t$

is constant,

$Y_t/N_t$

is constant,

![]() $G_tx_{i,t}$

in (1) is also constant on the balanced growth path. Thus, because

$G_tx_{i,t}$

in (1) is also constant on the balanced growth path. Thus, because

![]() $G_t/N_t$

is constant by (21), the growth rate of

$G_t/N_t$

is constant by (21), the growth rate of

![]() $x_{i,t}$

is

$x_{i,t}$

is

![]() $-\hat{g}$

, where

$-\hat{g}$

, where

![]() $\hat{g}$

is the growth rate in the steady state defined in Proposition 3 below. So that the individual intermediate good firms’ revenues and their profits do not grow at the balanced growth path. However, the economy grows by the expansion of varieties, the increase in

$\hat{g}$

is the growth rate in the steady state defined in Proposition 3 below. So that the individual intermediate good firms’ revenues and their profits do not grow at the balanced growth path. However, the economy grows by the expansion of varieties, the increase in

![]() $N_t$

: See (1).

$N_t$

: See (1).

From (23), we arrive at the following proposition.

Proposition 3. A unique steady state exists. In the steady state,

![]() $z_t$

takes the following constant value:

$z_t$

takes the following constant value:

where

![]() $\bar{z}\equiv\left[1-\tilde{\tau}\left(1-\alpha\Theta^{-1}\right)\alpha \right]\Omega(\tilde{\tau})$

. In the steady state,

$\bar{z}\equiv\left[1-\tilde{\tau}\left(1-\alpha\Theta^{-1}\right)\alpha \right]\Omega(\tilde{\tau})$

. In the steady state,

![]() $C_t$

,

$C_t$

,

![]() $N_t$

, and

$N_t$

, and

![]() $Y_t$

grow at the same constant rate:

$Y_t$

grow at the same constant rate:

The economy jumps to the steady state initially.

Proof. See Appendix E.

The labor allocated to the production of final and intermediate goods,

![]() $ L_{Y,t} $

and

$ L_{Y,t} $

and

![]() $ N_t\int \frac{x_{i,t}}{b}dF(b) $

, are both constant over time during the steady state. In addition,

$ N_t\int \frac{x_{i,t}}{b}dF(b) $

, are both constant over time during the steady state. In addition,

![]() $ Y_t $

,

$ Y_t $

,

![]() $ C_t $

,

$ C_t $

,

![]() $ G_t $

, and

$ G_t $

, and

![]() $ M_t $

grow at the same rate as

$ M_t $

grow at the same rate as

![]() $ N_t $

. Again, note that the source of economic growth in our model is firms’ investment in a new business (

$ N_t $

. Again, note that the source of economic growth in our model is firms’ investment in a new business (

![]() $N_{t+1}$

), as in the standard expanding variety model, which becomes the fundamental source of perpetual growth. In addition, productive government service (

$N_{t+1}$

), as in the standard expanding variety model, which becomes the fundamental source of perpetual growth. In addition, productive government service (

![]() $G_t$

) has a growth effect. It amplifies the demand for intermediate goods, increases the expected profits of the intermediate good firms, promotes their entry, and raises the interest rate through the free entry condition: See (4) and (6). We investigate this growth effect in greater detail in the next section.

$G_t$

) has a growth effect. It amplifies the demand for intermediate goods, increases the expected profits of the intermediate good firms, promotes their entry, and raises the interest rate through the free entry condition: See (4) and (6). We investigate this growth effect in greater detail in the next section.

4. Optimal CIT rates

As mentioned in Section 2, the CIT rate substantially affects the tax evasion behavior of firms in the imperfectly competitive market. Therefore, we analyze the growth- and welfare-maximizing CIT rates under such CIT evasion.Footnote 16

4.1 Growth-maximizing CIT rate

We obtain the following proposition.

Proposition 4. Let us denote the growth-maximizing announced CIT rate and growth-maximizing effective CIT rate as

![]() $\tau^{GM}$

and

$\tau^{GM}$

and

![]() $\tilde{\tau}^{GM}$

, respectively.

$\tilde{\tau}^{GM}$

, respectively.

-

1. When

$1-q(1+s)\leq 0$

and each firm declares its true operating profit,

$1-q(1+s)\leq 0$

and each firm declares its true operating profit,

$\tilde{\tau}^{GM}=\tau^{GM}=\alpha$

holds.

$\tilde{\tau}^{GM}=\tau^{GM}=\alpha$

holds. -

2. When

$1-q(1+s)>0$

and each firm under-declares its operating profit,

$1-q(1+s)>0$

and each firm under-declares its operating profit,

$\tau^{GM}> \tilde{\tau}^{GM}>\alpha$

holds.

$\tau^{GM}> \tilde{\tau}^{GM}>\alpha$

holds.

Proof. See Appendix F.

The first part of Proposition 4 is in line with Barro’s (Reference Barro1990) rule, that is, the tax rate that maximizes long-run growth equals the output elasticity of public services,

![]() $\alpha$

. This result is also consistent with that of Kafkalas et al. (Reference Kafkalas, Kalaitzidakis and Tzouvelekas2014), indicating that even with government spending for detection, the growth-maximizing tax rate coincides with the output elasticity of public services.

$\alpha$

. This result is also consistent with that of Kafkalas et al. (Reference Kafkalas, Kalaitzidakis and Tzouvelekas2014), indicating that even with government spending for detection, the growth-maximizing tax rate coincides with the output elasticity of public services.

Importantly, the mechanism behind this result is the same as that of Barro (Reference Barro1990). In Barro’s model, the growth-maximizing rule is attributed to the following trade-off between income tax and growth. Meanwhile, an increase in income tax decreases the net interest rate ((1

![]() $- $

tax rate)

$- $

tax rate)

![]() $\times$

interest rate) and hurts growth, and an increase in income tax boosts productive government spending and raises the interest rate. This has a positive effect on growth.

$\times$

interest rate) and hurts growth, and an increase in income tax boosts productive government spending and raises the interest rate. This has a positive effect on growth.

The interest rate in our model is determined through the free entry condition of intermediate goods firms as

Here,

![]() $Y_t/N_t$

, given in (24), is positively affected byFootnote 17

$Y_t/N_t$

, given in (24), is positively affected byFootnote 17

This induces essentially the same trade-off as Barro (Reference Barro1990). Thus, in the absence of tax evasion (

![]() $\Theta=1$

), we obtain the same result as Barro (Reference Barro1990).

$\Theta=1$

), we obtain the same result as Barro (Reference Barro1990).

The second part of Proposition 4 states that with under-declaration of profit, the growth-maximizing announced CIT rate is higher than the growth-maximizing effective CIT rate,

![]() $\tau^{GM}>\tilde{\tau}^{GM}$

. Moreover, both are higher than the output elasticity of public services,

$\tau^{GM}>\tilde{\tau}^{GM}$

. Moreover, both are higher than the output elasticity of public services,

![]() $\alpha$

. That is, tax evasion by firms increases the growth-maximizing tax rates,

$\alpha$

. That is, tax evasion by firms increases the growth-maximizing tax rates,

![]() $\tau^{GM}$

and

$\tau^{GM}$

and

![]() $\tilde{\tau}^{GM}$

.

$\tilde{\tau}^{GM}$

.

![]() $\tau^{GM}>\tilde{\tau}^{GM}$

stems simply from the evasion of CIT by firms. Then, we consider the intuition behind the result of

$\tau^{GM}>\tilde{\tau}^{GM}$

stems simply from the evasion of CIT by firms. Then, we consider the intuition behind the result of

![]() $\tilde{\tau}^{GM}>\alpha$

here.

$\tilde{\tau}^{GM}>\alpha$

here.

As we have seen after Proposition 2, in response to a tax hike, each intermediate good firm increases tax evasion. This secures the expected operating after-tax profit,

![]() $\pi^{e}_{i,t}$

, and private investment. Because the true operating profit,

$\pi^{e}_{i,t}$

, and private investment. Because the true operating profit,

![]() $\pi_{i,t}$

, is also secured, the tax base for public service provision (

$\pi_{i,t}$

, is also secured, the tax base for public service provision (

![]() $=N_t \int \pi_{i,t}dF(b)$

) is maintained.Footnote 18 These are caused by the effect of CIT evasion associated with profit maximization in an imperfectly competitive product market, which are captured by the term

$=N_t \int \pi_{i,t}dF(b)$

) is maintained.Footnote 18 These are caused by the effect of CIT evasion associated with profit maximization in an imperfectly competitive product market, which are captured by the term

![]() $1-\alpha\Theta^{-1}$

in (27) and (28), where

$1-\alpha\Theta^{-1}$

in (27) and (28), where

![]() $\Theta=\Gamma(\tau)$

and

$\Theta=\Gamma(\tau)$

and

![]() $\Gamma'(\tau)>0$

. Hereafter, we call this simply the effect of CIT evasion. The effect of CIT evasion mitigates the negative effect of CIT on growth and increases the benefit of raising the CIT rate for the provision of productive public services.Footnote 19

$\Gamma'(\tau)>0$

. Hereafter, we call this simply the effect of CIT evasion. The effect of CIT evasion mitigates the negative effect of CIT on growth and increases the benefit of raising the CIT rate for the provision of productive public services.Footnote 19

Our result (

![]() $\tilde{\tau}^{GM}>\alpha$

) is different from Kafkalas et al. (Reference Kafkalas, Kalaitzidakis and Tzouvelekas2014), who advocate that Barro’s rule holds (

$\tilde{\tau}^{GM}>\alpha$

) is different from Kafkalas et al. (Reference Kafkalas, Kalaitzidakis and Tzouvelekas2014), who advocate that Barro’s rule holds (

![]() $\tilde{\tau}^{GM}=\alpha$

) even in the economy with tax evasion. While tax evasion does not affect firms’ decision making in Kafkalas et al. (Reference Kafkalas, Kalaitzidakis and Tzouvelekas2014), our model includes the effect of CIT evasion as mentioned above, which causes

$\tilde{\tau}^{GM}=\alpha$

) even in the economy with tax evasion. While tax evasion does not affect firms’ decision making in Kafkalas et al. (Reference Kafkalas, Kalaitzidakis and Tzouvelekas2014), our model includes the effect of CIT evasion as mentioned above, which causes

![]() $\tilde{\tau}^{GM}>\alpha$

.Footnote 20

$\tilde{\tau}^{GM}>\alpha$

.Footnote 20

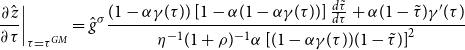

4.2 Welfare-maximizing CIT rate

Next, we analyze the welfare-maximizing CIT rate. Using the balanced growth rate,

![]() $\hat g$

, the equilibrium path of consumption is given by

$\hat g$

, the equilibrium path of consumption is given by

![]() $C_t=\hat g^t C_0=\hat g^t \hat{z}$

.Footnote 21 Substituting it into the lifetime utility function of the representative household, (17), we obtain

$C_t=\hat g^t C_0=\hat g^t \hat{z}$

.Footnote 21 Substituting it into the lifetime utility function of the representative household, (17), we obtain

where

![]() $1>(1+\rho)^{-1}\hat g^{1-\sigma}$

holds by the TVC. The social welfare is determined by the initial level of consumption and the long-run growth rate, both of which depend on the announced CIT rate,

$1>(1+\rho)^{-1}\hat g^{1-\sigma}$

holds by the TVC. The social welfare is determined by the initial level of consumption and the long-run growth rate, both of which depend on the announced CIT rate,

![]() $\tau$

. Let us denote the welfare-maximizing announced CIT rate by

$\tau$

. Let us denote the welfare-maximizing announced CIT rate by

![]() $\tau^{WM}$

.

$\tau^{WM}$

.

Proposition 5.

-

1. When each firm declares its true operating profit,

$1-q(1+s)\leq 0$

,

$1-q(1+s)\leq 0$

,

$\tau^{WM}>\tau^{GM}=\alpha$

holds. Therefore, the welfare-maximizing announced CIT rate,

$\tau^{WM}>\tau^{GM}=\alpha$

holds. Therefore, the welfare-maximizing announced CIT rate,

$\tau^{WM}$

, is higher than the growth-maximizing announced CIT rate,

$\tau^{WM}$

, is higher than the growth-maximizing announced CIT rate,

$\tau^{GM}$

.

$\tau^{GM}$

. -

2. Suppose that

$1-q(1+s)>0 $

and

$1-q(1+s)>0 $

and

$q=0$

. Then, each firm understates its operating profit and a marginal increase in the announced CIT rate at the growth-maximizing CIT rate improves social welfare.

$q=0$

. Then, each firm understates its operating profit and a marginal increase in the announced CIT rate at the growth-maximizing CIT rate improves social welfare.

Proof. See Appendix G.

Proposition 5 shows that the welfare-maximizing CIT is higher than the growth-maximizing one.Footnote 22 Meanwhile, a marginal increase in CIT from

![]() $\tau^{GM}$

does not affect the growth rate because the first-order effect vanishes at

$\tau^{GM}$

does not affect the growth rate because the first-order effect vanishes at

![]() $\tau=\tau^{GM}$

. In addition, it increases current consumption because labor income, which is exempt from taxation, is raised by increases in productive public services (see Appendix G). Therefore, the welfare-maximizing CIT rate is higher than the growth-maximizing one.

$\tau=\tau^{GM}$

. In addition, it increases current consumption because labor income, which is exempt from taxation, is raised by increases in productive public services (see Appendix G). Therefore, the welfare-maximizing CIT rate is higher than the growth-maximizing one.

5. Quantitative analysis

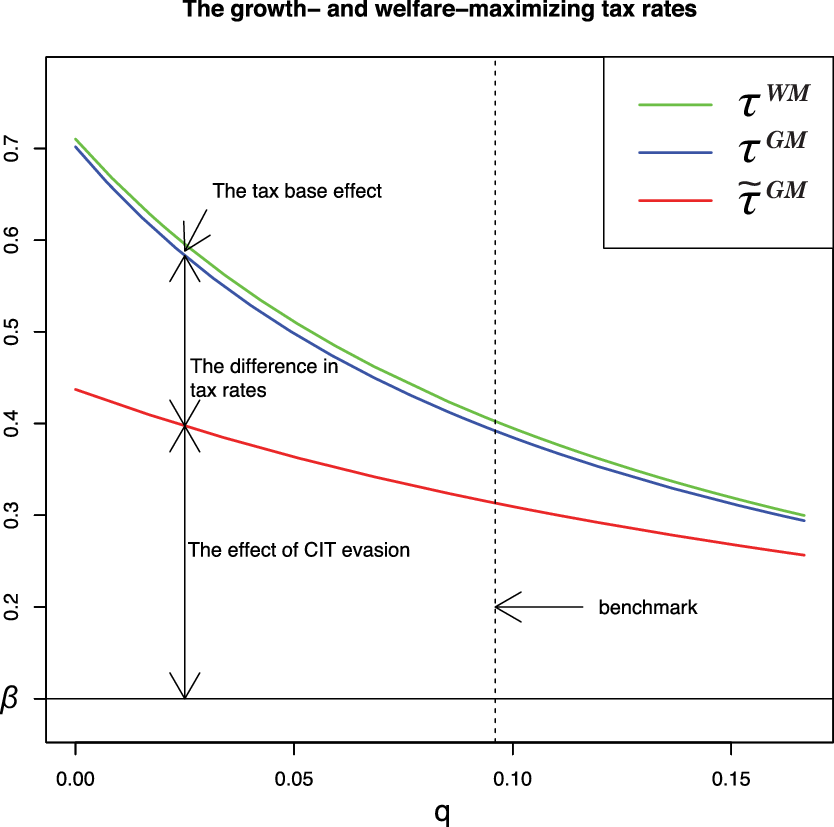

Propositions 4 and 5 summarize that the following three effects make

![]() $\tau^{WM}$

larger than the output elasticity of public services with tax evasion by firms (

$\tau^{WM}$

larger than the output elasticity of public services with tax evasion by firms (

![]() $1-q(1+s)>0$

).

$1-q(1+s)>0$

).

The first effect is represented by

![]() $\tau^{WM} > \tau^{GM}$

; the welfare-maximizing announced tax rate is higher than the growth-maximizing one. This is because the tax base is CIT, and wage income is exempt from taxation as we have seen in Proposition 5. We call this the tax base effect. The second effect is represented by

$\tau^{WM} > \tau^{GM}$

; the welfare-maximizing announced tax rate is higher than the growth-maximizing one. This is because the tax base is CIT, and wage income is exempt from taxation as we have seen in Proposition 5. We call this the tax base effect. The second effect is represented by

![]() $\tau^{GM}>\tilde{\tau}^{GM}$

. This stems from the degree of tax evasion by firms, (

$\tau^{GM}>\tilde{\tau}^{GM}$

. This stems from the degree of tax evasion by firms, (

![]() $\tau>\tilde{\tau}$

). We call this the difference in tax rates. The third effect is represented by

$\tau>\tilde{\tau}$

). We call this the difference in tax rates. The third effect is represented by

![]() $\tilde{\tau}^{GM}>\alpha$

. This is attributable to the effect of CIT evasion, as mentioned in Section 4.1

$\tilde{\tau}^{GM}>\alpha$

. This is attributable to the effect of CIT evasion, as mentioned in Section 4.1

The objective of this section is to investigate how high the welfare-maximizing CIT rate

![]() $\tau^{WM}$

is and which of the three effects contributes most to it. To solve these quantitative problems, we extend the above base model in this section.

$\tau^{WM}$

is and which of the three effects contributes most to it. To solve these quantitative problems, we extend the above base model in this section.

5.1 Extended model

We start with a small revision of the model because the problematic restriction on the parameter lies in the previous form of production technology. The output-elasticity of public services

![]() $\alpha$

must be set at the price elasticity of intermediate good,

$\alpha$

must be set at the price elasticity of intermediate good,

![]() $1/(1-\alpha)$

. To resolve this, we change production technology (1) into

$1/(1-\alpha)$

. To resolve this, we change production technology (1) into

where

The composite externality (31) represents a combination of the role of knowledge spillover, as in Benassy (Reference Benassy1998), together with productive public services, as in Barro (Reference Barro1990).

We adopt this form of composite externality for the following two reasons: First, as will become evident below and as stated by Chatterjee and Turnovsky (Reference Chatterjee and Turnovsky2012), it helps to provide a plausible calibration of the aggregate economy, something that is generically problematic in the conventional one-sector endogenous growth model.Footnote 23 Under (30) and (31), the output-elasticity of public services is

![]() $\beta\equiv \alpha\epsilon ({<}\alpha)$

, which differentiates

$\beta\equiv \alpha\epsilon ({<}\alpha)$

, which differentiates

![]() $\alpha$

from the output-elasticity of public services. Notice that the specification of (30) and (31) is consistent with the existence of the balanced growth by the expanding varieties. Similarly, to the explanation right before Proposition 3,

$\alpha$

from the output-elasticity of public services. Notice that the specification of (30) and (31) is consistent with the existence of the balanced growth by the expanding varieties. Similarly, to the explanation right before Proposition 3,

![]() $G^{\epsilon}_t N^{1-\epsilon}_t x_{i,t}$

in (30) is constant on the balanced growth path. This means that the engine of growth in this extended model is also the expansion of varieties. Second, as the following Remark shows, although we take an additional externality (the spillover of knowledge) into account, the basic property of the benchmark model is maintained.

$G^{\epsilon}_t N^{1-\epsilon}_t x_{i,t}$

in (30) is constant on the balanced growth path. This means that the engine of growth in this extended model is also the expansion of varieties. Second, as the following Remark shows, although we take an additional externality (the spillover of knowledge) into account, the basic property of the benchmark model is maintained.

Remark. The qualitative results do not change in the extended model. By replacing

![]() $\alpha$

with

$\alpha$

with

![]() $\beta$

, the same results as Propositions 4 and 5 hold.

$\beta$

, the same results as Propositions 4 and 5 hold.

Proof: See Appendix H.

5.2 Calibration

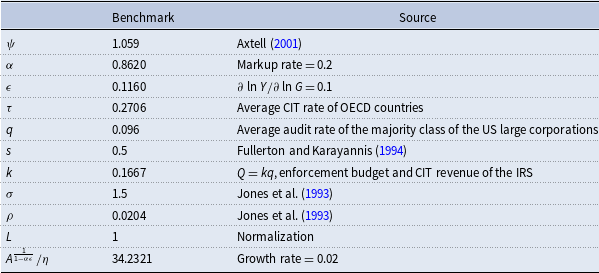

To conduct numerical exercises, we set the baseline parameter value as in Table 1. Appendix I provides details of our calibration.

Table 1. Baseline parameter value

The distribution of firms’ productivity is determined to make the curvature of the distribution function of firm sizes in the model equal to that of the Pareto distribution estimated with US data by Axtell (Reference Axtell2001). This requires

![]() $\psi=$

1.059. We choose

$\psi=$

1.059. We choose

![]() $\alpha =$

0.8620 so that the markup rate of firms

$\alpha =$

0.8620 so that the markup rate of firms

![]() $\mu$

(

$\mu$

(

![]() $=\Gamma(\tau)/\alpha-1$

) takes 20%, which is a standard value of markup rate of firms (e.g., Rotemberg and Woodford (Reference Rotemberg and Woodford1999)).

$=\Gamma(\tau)/\alpha-1$

) takes 20%, which is a standard value of markup rate of firms (e.g., Rotemberg and Woodford (Reference Rotemberg and Woodford1999)).

We set the parameter to measure the knowledge spillover,

![]() $\epsilon$

, to 0.1160, so that the output elasticity of public services,

$\epsilon$

, to 0.1160, so that the output elasticity of public services,

![]() $\beta$

, equals 0.1. Although the estimates of the elasticity vary among some empirical studies, 0.1 is one of the reasonable values of

$\beta$

, equals 0.1. Although the estimates of the elasticity vary among some empirical studies, 0.1 is one of the reasonable values of

![]() $\beta$

.Footnote 24

$\beta$

.Footnote 24

In this subsection, we provide the baseline value of the announced CIT rate,

![]() $\tau=$

0.2706, to determine the baseline balanced growth rate because the balanced growth rate depends on

$\tau=$

0.2706, to determine the baseline balanced growth rate because the balanced growth rate depends on

![]() $\tau$

in this model economy. This value of

$\tau$

in this model economy. This value of

![]() $\tau$

(= 0.2706) is the average CIT rate in OECD countries from 2000 to 2017.Footnote 25 We set the penalty tax rate, s, to

$\tau$

(= 0.2706) is the average CIT rate in OECD countries from 2000 to 2017.Footnote 25 We set the penalty tax rate, s, to

![]() $0.5$

, according to Fullerton and Karayannis (Reference Fullerton and Karayannis1994), who take this value as a normal rate in the USA.

$0.5$

, according to Fullerton and Karayannis (Reference Fullerton and Karayannis1994), who take this value as a normal rate in the USA.

We set the benchmark value of the audit rate, q, to

![]() $0.096$

. To obtain this value, we utilize the statistics provided by the Internal Revenue Service. Each IRS Data Book between 2000 and 2017 provides the actual ratio of the examined corporations to all corporations under a classification by firm size.Footnote 26 We choose the class of the smallest size of the large corporations.Footnote 27 This is because such a class occupies a significantly large part (about 60%) of the large corporations, which are corporations above a certain business size. Besides, the ratios of the audited corporations vary greatly across the classes and so does the number of corporations in the classes. This means that taking the average audit rate among the classes is unreasonable. Therefore, we set the audit rate in such a manner. Later, we confirm the robustness of our results for a range of q, including

$0.096$

. To obtain this value, we utilize the statistics provided by the Internal Revenue Service. Each IRS Data Book between 2000 and 2017 provides the actual ratio of the examined corporations to all corporations under a classification by firm size.Footnote 26 We choose the class of the smallest size of the large corporations.Footnote 27 This is because such a class occupies a significantly large part (about 60%) of the large corporations, which are corporations above a certain business size. Besides, the ratios of the audited corporations vary greatly across the classes and so does the number of corporations in the classes. This means that taking the average audit rate among the classes is unreasonable. Therefore, we set the audit rate in such a manner. Later, we confirm the robustness of our results for a range of q, including

![]() $q=0.089$

, the value adopted by Fullerton and Karayannis (Reference Fullerton and Karayannis1994).

$q=0.089$

, the value adopted by Fullerton and Karayannis (Reference Fullerton and Karayannis1994).

The relationship between q and Q is specified by

![]() $Q=kq$

, where k is a constant, to satisfy the natural properties:

$Q=kq$

, where k is a constant, to satisfy the natural properties:

![]() $\frac{dQ}{dq}>0$

,

$\frac{dQ}{dq}>0$

,

![]() $Q \in{[0,1)}$

for

$Q \in{[0,1)}$

for

![]() $q\in{[0,1]}$

, and

$q\in{[0,1]}$

, and

![]() $Q=0$

for

$Q=0$

for

![]() $q=0$

. We set

$q=0$

. We set

![]() $k=0.167$

to make Q equal the ratio of inspection cost to the CIT revenue in the USA on average from 2000 to 2017.Footnote 28 However, not only the value but also the functional form does not change our results because the growth rate of our model is independent of them: see (26).

$k=0.167$

to make Q equal the ratio of inspection cost to the CIT revenue in the USA on average from 2000 to 2017.Footnote 28 However, not only the value but also the functional form does not change our results because the growth rate of our model is independent of them: see (26).

We set

![]() $\sigma=$

1.5 and

$\sigma=$

1.5 and

![]() $\rho =$

0.0204 according to Jones et al. (Reference Jones, Manuelli and Rossi1993). These are the standard values used in quantifying growth models. We set

$\rho =$

0.0204 according to Jones et al. (Reference Jones, Manuelli and Rossi1993). These are the standard values used in quantifying growth models. We set

![]() $L=$

1 for normalization. Finally, we choose the scale parameter, A, and the cost of developing one intermediate good,

$L=$

1 for normalization. Finally, we choose the scale parameter, A, and the cost of developing one intermediate good,

![]() $\eta$

such that the balanced growth rate equals 2%.Footnote 29

$\eta$

such that the balanced growth rate equals 2%.Footnote 29

The above benchmark parameter set realizes the case of tax evasion,

![]() $q(1+s)-1<0$

.

$q(1+s)-1<0$

.

5.3 Results

5.3.1 Main results

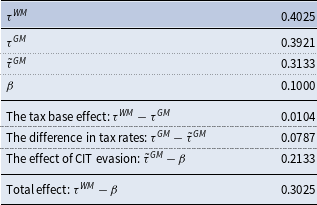

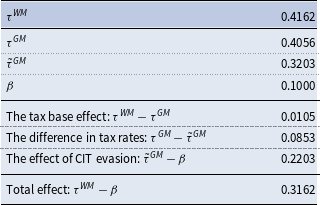

Table 2 provides the welfare-maximizing announced CIT rate,

![]() $\tau^{WM}$

, the growth-maximizing announced rate,

$\tau^{WM}$

, the growth-maximizing announced rate,

![]() $\tau^{GM}$

, and the growth-maximizing effective CIT rate,

$\tau^{GM}$

, and the growth-maximizing effective CIT rate,

![]() $\tilde\tau^{GM}$

for the benchmark case. We find that

$\tilde\tau^{GM}$

for the benchmark case. We find that

![]() $\tau^{WM}=$

0.4025,

$\tau^{WM}=$

0.4025,

![]() $\tau^{GM}=$

0.3921, and

$\tau^{GM}=$

0.3921, and

![]() $\tilde{\tau}^{GM}=$

0.3133. The value of the optimal CIT rate, 0.4025, is close to the estimated value of 42% by Aghion et al. (Reference Aghion, Akcigit, Cagé and Kerr2016). As Propositions 4 and 5 indicate,

$\tilde{\tau}^{GM}=$

0.3133. The value of the optimal CIT rate, 0.4025, is close to the estimated value of 42% by Aghion et al. (Reference Aghion, Akcigit, Cagé and Kerr2016). As Propositions 4 and 5 indicate,

![]() $\tau^{WM}$

,

$\tau^{WM}$

,

![]() $\tau^{GM}$

, and

$\tau^{GM}$

, and

![]() $\tilde{\tau}^{GM}$

are all larger than

$\tilde{\tau}^{GM}$

are all larger than

![]() $\beta(=0.1)$

. Importantly, the difference between

$\beta(=0.1)$

. Importantly, the difference between

![]() $\tau^{WM}$

and

$\tau^{WM}$

and

![]() $\beta$

is 0.3025, which is quite large.

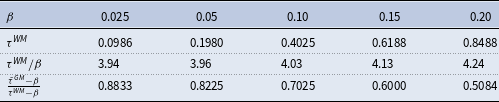

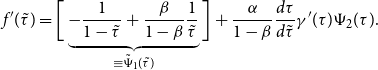

$\beta$