1. Introduction

Various employment-related policies and programs were implemented in response to the COVID-19 pandemic. These can be broadly characterized as (i) enhancing unemployment insurance programs and (ii) directly subsidizing wage and salary payments. Many countries implemented programs with elements of both (i) and (ii). In the United States, large unemployment benefit and direct transfer programs were enacted, but not a formal wage subsidy. However, the Paycheck Protection Program included the subsidy-like characteristic of loan forgiveness if employees were not laid off. Canada, on the other hand, introduced an explicit wage subsidy, which paid 75

![]() $\%$

of the wages of workers in affected firms, up to a ceiling. At the same time, Canada expanded its unemployment benefit programs. In Australia, affected firms were reimbursed for wage payments to their workers, up to a limit. These workers might have been laid off otherwise and claimed unemployment benefits. Indeed, the vast majority of OECD countries introduced either expanded unemployment benefits, a wage subsidy program, or both.Footnote

1

$\%$

of the wages of workers in affected firms, up to a ceiling. At the same time, Canada expanded its unemployment benefit programs. In Australia, affected firms were reimbursed for wage payments to their workers, up to a limit. These workers might have been laid off otherwise and claimed unemployment benefits. Indeed, the vast majority of OECD countries introduced either expanded unemployment benefits, a wage subsidy program, or both.Footnote

1

An important question to then consider is whether wage subsidies paid to firms are more effective than direct transfers to affected workers (unemployment benefits). The most pressing objective of these policies is to maintain household incomes at a time when people cannot work, and both types of policies accomplish this. An added benefit of a wage subsidy program is described in the legislation enacting Australia’s program: “By temporarily offsetting wage costs, the JobKeeper scheme supports businesses to retain staff and continue paying them despite suffering decreased turnover during this period of downturn. The payment also supports these businesses to recommence their operations or scale up operations quickly without needing to rehire when the downturn is over.”Footnote 2 Put differently, a wage subsidy ensures that worker-firm connections are maintained, speeding up economic recovery after the pandemic ends because a period of high unemployment due to search frictions is avoided. A downside of a wage subsidy, however, is that firms likely anticipate this feature of a recovery and so might have kept their workers on payroll anyway or have kept in close contact with laid-off workers in order to recall them. Thus, some workers wages might be unnecessarily subsidized, which is fiscally costly.Footnote 3 In deciding on the optimal policy mix, a planner must weigh all of these tradeoffs in the generosity of a wage subsidy and at the same time consider unemployment benefits as an alternative.

In this paper, we develop a model of the economic transitions from a pandemic shock through to full economic recovery. The model includes an endogenous distribution of consumption and savings, heterogeneity in both worker and job productivity, and a frictional labor market. The model is used to study the effects of alternative pandemic-era wage subsidy and unemployment benefit programs on the labor market and household welfare. The analysis accounts for short-run effects during the pandemic, the medium-term recovery, and long-run effects through the fiscal implications of alternative policies. We find that (1) it is optimal is to subsidize 85

![]() $\%$

of the wages of affected workers up to a $350 per week ceiling, when unemployment benefits are held constant. (2) However, enhanced unemployment insurance with a 100

$\%$

of the wages of affected workers up to a $350 per week ceiling, when unemployment benefits are held constant. (2) However, enhanced unemployment insurance with a 100

![]() $\%$

replacement rate for workers up to

$\%$

replacement rate for workers up to

![]() $\$275$

per week ceiling in affected sectors is better than the optimal wage subsidy if the shutdown duration is less than 11 weeks, or if the mean profit margin of affected firms is larger than 12.25

$\$275$

per week ceiling in affected sectors is better than the optimal wage subsidy if the shutdown duration is less than 11 weeks, or if the mean profit margin of affected firms is larger than 12.25

![]() $\%$

. (3) The biggest winners from a wage subsidy are workers with little liquidity (credit) and workers who would otherwise have been laid off in the absence of the wage subsidy. These features are correlated with income; hence, low-income workers benefit the most from the wage subsidy, while workers earning more than $1200 per week experience a welfare loss under the optimal wage subsidy scheme. (4) There are substantial welfare gains from implementing a wage subsidy and enhanced unemployment benefits jointly, with the optimal policy being a 90

$\%$

. (3) The biggest winners from a wage subsidy are workers with little liquidity (credit) and workers who would otherwise have been laid off in the absence of the wage subsidy. These features are correlated with income; hence, low-income workers benefit the most from the wage subsidy, while workers earning more than $1200 per week experience a welfare loss under the optimal wage subsidy scheme. (4) There are substantial welfare gains from implementing a wage subsidy and enhanced unemployment benefits jointly, with the optimal policy being a 90

![]() $\%$

subsidy up to $200/week along with up to $275/week of added unemployment benefits.

$\%$

subsidy up to $200/week along with up to $275/week of added unemployment benefits.

Our model builds upon Krusell et al. (Reference Krusell, Mukoyama and Şahin2010) (KMS) in several ways.Footnote 4 First, we introduce fixed heterogeneity in job-specific productivity and labor productivity. This allows us to study how pandemic policies affect different types of workers and jobs. Second, we allow firms to choose to lay off workers. In normal times, this feature does not matter because all jobs generate positive value; however, during the pandemic many jobs have negative value because of production stoppages, so endogenous layoffs do then occur. We allow firms to possibly recall laid off workers, although this option disappears over time. This recall feature is motivated by Fujita and Moscarini (Reference Fujita and Moscarini2017) who show that a substantial share of workers return to their previous employer after a jobless spell. Third, we assume that there is no bargaining when a match between a worker and firm is formed, and instead, wages are fixed in a way that ensures matches are always desirable during normal times. We make this assumption based on the insight of Hall (Reference Hall2005) that a DMP model with fixed wages generates realistic employment fluctuations.Footnote 5 In this way, our model can be thought of as a partial-equilibrium extension of KMS.

The model is ideal for studying the long-run consequences of a short-run disruption in labor markets because it naturally accommodates the welfare effects of the disruption itself, as well as the long-run fiscal costs of related policies. Our model captures the economic disruption as a period in which some firms are forced to suspend production. Firms choose whether or not to lay off their employees in response to this. We assume that a worker who is laid off because of the shutdown remains attached to their firm, and, unless this attachment dissolves, they will be recalled when it is profitable for the firm to do so. A firm’s layoff decision depends on match productivity. For a high-productivity match, the firm will choose to keep their worker on payroll, despite the shutdown, because they anticipate a return to highly profitable production in the future. However, the opposite is true for a low productivity match.

With the introduction of a wage subsidy, the threshold for a match to be productive enough to keep a worker on payroll is lowered so that fewer workers are laid off. One benefit of using the wage subsidy to lower the productivity threshold, and thus cause more matches to be retained, is that these jobs immediately restart production when the lockdown ends. Another benefit is to maintain the income of the worker. Enhanced unemployment benefits also maintain worker income, but some laid-off workers will not return to their previous job. The longer a shutdown goes on for, the smaller the number of laid-off workers who are still attached to their previous job and can be recalled. The cost of either policy is that tax rates must be higher in the future, which lowers the welfare of all taxpayers. A wage subsidy might be more expensive than enhanced unemployment benefits because some firms end up being subsidized even though they would not lay off workers even in the absence of a subsidy.

There are many examples of past research that has incorporated the DMP framework into fully specified macro-models that account for business cycle fluctuations. The theoretical side of such models was first investigated by Howitt (Reference Howitt1988) and Wright (Reference Wright1986), and the quantitative implications were studied by Andolfatto (Reference Andolfatto1996). Shimer (Reference Shimer2005) then argued that the standard DMP model cannot generate the observed business cycle frequency fluctuations in unemployment and job vacancies as observed in the US. Since then, several papers have modified the DMP framework with the intention of solving Shimer’s puzzle. Examples include Hall (Reference Hall2005), Hagedorn and Manovskii (Reference Hagedorn and Manovskii2008), Pissarides (Reference Pissarides2009), and Gertler and Trigari (Reference Gertler and Trigari2009), among others. In a related strand of literature, Krusell et al. (Reference Krusell, Mukoyama, Şahin and Smith2009) and Krusell et al. (Reference Krusell, Mukoyama and Şahin2010) study aggregate welfare under various counterfactual policy experiments within the KMS framework.

There is also a large literature studying the impact of government policies during the pandemic. The most related of these studies is Birinci et al. (Reference Birinci, Karahan, Mercan and See2021), who also compare an unemployment benefit expansion to a payroll subsidy. The primary difference between their work and our own is that our model features an endogenous distribution of wealth, whereas their model assumes households are hand-to-mouth. We are able to analyze how the benefits and costs of the two policy options vary over the wealth distribution and indeed find that there are winners and losers under the optimal policy. Our work is also quite related to Giupponi and Landais (Reference Giupponi and Landais2020) and Giupponi et al. (Reference Giupponi, Landais and Alice2021), who analyze the question of whether policy makers should be concerned with maintaining employment or worker incomes during downturns. Although these latter papers are not directly related to a pandemic, their conclusion that unemployment insurance is complementary to short-time-work, which is similar to a wage subsidy program, is consistent with our own conclusions.

Interactions between the pandemic and labor markets are also studied by Boar and Mongey (Reference Boar and Mongey2020), Fang et al. (Reference Fang, Nie and Xie2020), Gregory et al. (Reference Gregory, Menzio and Wiczer2020), and Mitman and Rabinovich (Reference Mitman and Rabinovich2020). Other work on the macroeconomics of a pandemic includes Eichenbaum et al. (Reference Eichenbaum, Rebelo and Trabandt2020), Faria-e Castro (Reference Faria-e Castro2021), Kapicka and Rupert (Reference Kapicka and Rupert2020), Bayer et al. (Reference Bayer, Born, Luetticke and Müller2020), and Kaplan et al. (Reference Kaplan, Moll and Violante2020), among others, who integrate the Susceptible-Infectious-Recovered (SIR) framework into economic models to study the impact of the COVID-19 pandemic on the economy, and the extent to which fiscal policies (such as transfers or debt forgiveness) could alleviate the economics damage. Other related work include Acemoglu et al. (Reference Acemoglu, Chernozhukov, Werning and Whinston2020) and Glover et al. (Reference Glover, Heathcote, Krueger and Ríos-Rull2020), who develop an overlapping generation model integrated with SIR to study the optimal lockdown and the associated distributional consequence for different age cohorts in the economy. Inoue et al. (Reference Inoue, Murase and Todo2020) and Barrot et al. (Reference Barrot, Grassi and Sauvagnat2020) use a production network model to study the impact of a partial economic lockdown and social distancing on the production of all sectors.

2. Model

We study an environment where the economy starts in a steady-state equilibrium. We then shock the economy by forcing production to cease in a large part of the economy for a period of time, interpreted as the pandemic period, after which production resumes as normal. However, the economy does not immediately return to the pre-pandemic steady-state, but rather follows a (potentially lengthy) transition path to a new steady-state. Because the government offers income replacement and wage subsidy programs during the pandemic, the new steady state will include higher labor income taxes in order to pay back debt accumulated during the shutdown period.

We present a detailed description of the initial steady-state equilibrium before moving on to the pandemic shock.

2.1 Initial steady state

2.1.1 Preliminaries

Time is continuous and indexed by

![]() $t$

. Agents living in the initial steady state believe this equilibrium will continue forever and thus have no foresight about the pandemic. The economy is populated by a unit continuum of workers who live forever. There is also a mass of firms who can post job vacancies and produce when matched with a worker.

$t$

. Agents living in the initial steady state believe this equilibrium will continue forever and thus have no foresight about the pandemic. The economy is populated by a unit continuum of workers who live forever. There is also a mass of firms who can post job vacancies and produce when matched with a worker.

Worker preferences

Each worker has an expected utility function

![]() $\mathbb{E}_0\left [ \int _{t=0}^{\infty }e^{-\rho t}v(c(t))dt\right ]$

, where

$\mathbb{E}_0\left [ \int _{t=0}^{\infty }e^{-\rho t}v(c(t))dt\right ]$

, where

![]() $c$

is time-varying consumption, and

$c$

is time-varying consumption, and

![]() $v(c)=c^{1-\varsigma }/(1-\varsigma )$

is the flow utility function with coefficient of relative risk aversion

$v(c)=c^{1-\varsigma }/(1-\varsigma )$

is the flow utility function with coefficient of relative risk aversion

![]() $\varsigma$

. The discount rate,

$\varsigma$

. The discount rate,

![]() $\rho$

, is heterogeneous in the population, taking one of three values

$\rho$

, is heterogeneous in the population, taking one of three values

![]() $\rho \in \left \{\rho _1,\rho _2,\rho _3\right \}$

. A worker’s

$\rho \in \left \{\rho _1,\rho _2,\rho _3\right \}$

. A worker’s

![]() $\rho$

value is random, but persistent, with the common rate of transition to a new discount rate denoted by

$\rho$

value is random, but persistent, with the common rate of transition to a new discount rate denoted by

![]() $\pi _{\rho }$

. Because the transition rate is the same for all values of

$\pi _{\rho }$

. Because the transition rate is the same for all values of

![]() $\rho$

, in aggregate the discount rate is uniformly distributed across the three support values.

$\rho$

, in aggregate the discount rate is uniformly distributed across the three support values.

Firm technology and payoffs

When a firm matches with a worker, a match-specific productivity

![]() $z$

is drawn. The output of a firm is the product of this draw and the productivity of their worker,

$z$

is drawn. The output of a firm is the product of this draw and the productivity of their worker,

![]() $\theta$

. Workers are paid a wage equal to their productivity, and firms also pay other costs, such as capital depreciation expenses and overhead, which are a proportion

$\theta$

. Workers are paid a wage equal to their productivity, and firms also pay other costs, such as capital depreciation expenses and overhead, which are a proportion

![]() $\beta$

of their revenue. Combined, these features imply that a firm’s profit flow is

$\beta$

of their revenue. Combined, these features imply that a firm’s profit flow is

![]() $z\theta - \theta - \beta z\theta$

. We assume the distribution of

$z\theta - \theta - \beta z\theta$

. We assume the distribution of

![]() $z$

is such that

$z$

is such that

![]() $(1-\beta )z\gt 1$

. Firms discount their profit flow at rate

$(1-\beta )z\gt 1$

. Firms discount their profit flow at rate

![]() $R$

, and this flow ends at the rate of exogenous separation occurrence,

$R$

, and this flow ends at the rate of exogenous separation occurrence,

![]() $\sigma$

. A firm that does not have a worker may pay a flow-cost

$\sigma$

. A firm that does not have a worker may pay a flow-cost

![]() $\kappa$

of posting a vacancy in order to search for a worker.

$\kappa$

of posting a vacancy in order to search for a worker.

Labor market

The measure of unemployed workers at a point in time is denoted

![]() $U$

, and the measure of job vacancies is denoted

$U$

, and the measure of job vacancies is denoted

![]() $\nu$

. The measure of employed workers is

$\nu$

. The measure of employed workers is

![]() $E=1-U$

. Vacant jobs and unemployed workers are randomly matched according a constant-returns-to-scale (CRS) matching function

$E=1-U$

. Vacant jobs and unemployed workers are randomly matched according a constant-returns-to-scale (CRS) matching function

![]() $M(U,\nu )$

. Through this technology, workers find jobs at rate

$M(U,\nu )$

. Through this technology, workers find jobs at rate

![]() $f$

and vacancies are filled at rate

$f$

and vacancies are filled at rate

![]() $q$

, according to

$q$

, according to

\begin{equation} \begin{aligned} & f = \dfrac{M(U,\nu )}{U} = M(1,\Theta ) \\[4pt] & q = \dfrac{M(U,\nu )}{\nu } = M\left(\frac{1}{\Theta },1\right) \end{aligned} \end{equation}

\begin{equation} \begin{aligned} & f = \dfrac{M(U,\nu )}{U} = M(1,\Theta ) \\[4pt] & q = \dfrac{M(U,\nu )}{\nu } = M\left(\frac{1}{\Theta },1\right) \end{aligned} \end{equation}

where

![]() $\Theta \equiv \nu/U$

is the market tightness. From a firm’s perspective, the skill of a matched worker is random, and the match-specific productivity of a job is drawn from a conditional distribution

$\Theta \equiv \nu/U$

is the market tightness. From a firm’s perspective, the skill of a matched worker is random, and the match-specific productivity of a job is drawn from a conditional distribution

![]() $P_z(z|\theta )$

after the match occurs.

$P_z(z|\theta )$

after the match occurs.

Financing

We assume an exogenous real interest rate

![]() $r$

, which is the return on wealth for workers with positive net worth. Workers are able to borrow up to a limit

$r$

, which is the return on wealth for workers with positive net worth. Workers are able to borrow up to a limit

![]() $\underline{b}$

, but pay a different interest rate

$\underline{b}$

, but pay a different interest rate

![]() $R$

than savers earn. We assume an exogenous financing wedge is responsible for this difference, hence

$R$

than savers earn. We assume an exogenous financing wedge is responsible for this difference, hence

![]() $R\gt r$

. This cost of borrowing is also the discount rate of firms. Firms are owned by exogenous entities; thus, households only invest in them indirectly through their saving.

$R\gt r$

. This cost of borrowing is also the discount rate of firms. Firms are owned by exogenous entities; thus, households only invest in them indirectly through their saving.

Government

Government levies a progressive tax on worker earnings described by the tax function

![]() $T(y)$

. Associated revenue is used to finance an unemployment insurance program, which pays

$T(y)$

. Associated revenue is used to finance an unemployment insurance program, which pays

![]() $h(\theta )$

to an unemployed worker whose usual earnings are

$h(\theta )$

to an unemployed worker whose usual earnings are

![]() $\theta$

. Remaining government revenue is used to pay for non-valued government expenditure

$\theta$

. Remaining government revenue is used to pay for non-valued government expenditure

![]() $G$

; thus, the government budget constraint holds every period. These policy parameters are exogenous to the model; thus, the government does not make any decisions in the initial steady-state.

$G$

; thus, the government budget constraint holds every period. These policy parameters are exogenous to the model; thus, the government does not make any decisions in the initial steady-state.

2.1.2 Workers

Workers choose their consumption to maximize their utility, subject to the law-of-motion for their wealth:

![]() $\dot{b}=y + r(b)b - c$

. Worker net income is denoted

$\dot{b}=y + r(b)b - c$

. Worker net income is denoted

![]() $y$

, and the interest rate they face is denoted

$y$

, and the interest rate they face is denoted

![]() $r(b)$

, which depends whether the worker is a borrower or saver (

$r(b)$

, which depends whether the worker is a borrower or saver (

![]() $r(b)=R$

if

$r(b)=R$

if

![]() $b\lt 0$

and

$b\lt 0$

and

![]() $r(b)=r$

if

$r(b)=r$

if

![]() $b\geq 0$

). Worker consumption-savings decisions are subject to a borrowing limit

$b\geq 0$

). Worker consumption-savings decisions are subject to a borrowing limit

![]() $b\geq \underline{b}$

.

$b\geq \underline{b}$

.

A worker’s income depends on their fixed skill level

![]() $\theta$

, as well as their employment status

$\theta$

, as well as their employment status

![]() $s\in \left \{e,u\right \}$

, where

$s\in \left \{e,u\right \}$

, where

![]() $e$

denotes employed and

$e$

denotes employed and

![]() $u$

denotes unemployed. Net income in the two employment states is summarized as follows:

$u$

denotes unemployed. Net income in the two employment states is summarized as follows:

\begin{equation} y=\left \{\begin{matrix} \theta - T(\theta ) & \quad \textrm{if} & \quad s=e\ \\[3pt] h(\theta ) & \quad \textrm{if} & \quad s=u. \\ \end{matrix}\right. \end{equation}

\begin{equation} y=\left \{\begin{matrix} \theta - T(\theta ) & \quad \textrm{if} & \quad s=e\ \\[3pt] h(\theta ) & \quad \textrm{if} & \quad s=u. \\ \end{matrix}\right. \end{equation}

A worker’s flow of income when employed is their productivity

![]() $\theta$

, less their associated flow of tax payments

$\theta$

, less their associated flow of tax payments

![]() $T(\theta )$

.

$T(\theta )$

.

The optimal consumption-savings decisions of employed workers solve the following HJB equation:

\begin{align} \rho _i V(i,b,\theta,e) & = \underset{ c }{\max \:} v(c) + \partial _b V(i,b,\theta,e) \dot{b} + \sigma \big (V(i,b,\theta,u) - V(i,b,\theta,e) \big ) \nonumber\\[2pt] & \quad + \sum _{j\neq i} \pi _{\rho } \big (V(j,b,\theta,e) - V(i,b,\theta,e) \big ) \nonumber\\[2pt] \text{s.t. } \dot{b} & = \theta - T(\theta ) + r(b)b - c, \ \ b \geq \underline{b}. \end{align}

\begin{align} \rho _i V(i,b,\theta,e) & = \underset{ c }{\max \:} v(c) + \partial _b V(i,b,\theta,e) \dot{b} + \sigma \big (V(i,b,\theta,u) - V(i,b,\theta,e) \big ) \nonumber\\[2pt] & \quad + \sum _{j\neq i} \pi _{\rho } \big (V(j,b,\theta,e) - V(i,b,\theta,e) \big ) \nonumber\\[2pt] \text{s.t. } \dot{b} & = \theta - T(\theta ) + r(b)b - c, \ \ b \geq \underline{b}. \end{align}

Here,

![]() $V(i,b,\theta,e)$

is the value function of an employed worker with discount rate

$V(i,b,\theta,e)$

is the value function of an employed worker with discount rate

![]() $\rho _i$

, wealth

$\rho _i$

, wealth

![]() $b$

and productivity (wage rate)

$b$

and productivity (wage rate)

![]() $\theta$

. At rate

$\theta$

. At rate

![]() $\pi _{\rho }$

, the worker’s discount rate will jump from

$\pi _{\rho }$

, the worker’s discount rate will jump from

![]() $\rho _i$

to

$\rho _i$

to

![]() $\rho _j$

, and an associated jump in the value function will occur.Footnote

6

Similarly, at the rate of exogenous worker-firm separation,

$\rho _j$

, and an associated jump in the value function will occur.Footnote

6

Similarly, at the rate of exogenous worker-firm separation,

![]() $\sigma$

, the value function jumps to that of an unemployed worker

$\sigma$

, the value function jumps to that of an unemployed worker

![]() $V(i,b,\theta,u)$

. Workers who are exogenously separated from their employer cannot be recalled; hence, the unemployed worker value function depends on the job-finding rate, as follows:

$V(i,b,\theta,u)$

. Workers who are exogenously separated from their employer cannot be recalled; hence, the unemployed worker value function depends on the job-finding rate, as follows:

\begin{align} \rho _i V(i,b,\theta,u) & = \underset{ c }{\max \:} v(c) + \partial _b V(i,b,\theta,u) \dot{b} + f \big (V(i,b,\theta,e) - V(i,b,\theta,u) \big ) \nonumber\\[2pt] & \quad + \sum _{j\neq i} \pi _{\rho } \big (V(j,b,\theta,u) - V(i,b,\theta,u) \big ) \nonumber\\[2pt] \text{s.t. } \dot{b} & = h(\theta ) + r(b)b - c, \ \ b \geq \underline{b}. \end{align}

\begin{align} \rho _i V(i,b,\theta,u) & = \underset{ c }{\max \:} v(c) + \partial _b V(i,b,\theta,u) \dot{b} + f \big (V(i,b,\theta,e) - V(i,b,\theta,u) \big ) \nonumber\\[2pt] & \quad + \sum _{j\neq i} \pi _{\rho } \big (V(j,b,\theta,u) - V(i,b,\theta,u) \big ) \nonumber\\[2pt] \text{s.t. } \dot{b} & = h(\theta ) + r(b)b - c, \ \ b \geq \underline{b}. \end{align}

The savings decisions in the problems above, along with the employment fluctuations that arise in labor market equilibrium, generate the endogenous distribution of wealth in the model. This joint distribution of wealth and other state variables, denoted

![]() $g(i,b,\theta,s)$

, evolves according to a Kolmogorov Forward Equation (KFE), which is separated into parts due to employed and unemployed workers, as follows:

$g(i,b,\theta,s)$

, evolves according to a Kolmogorov Forward Equation (KFE), which is separated into parts due to employed and unemployed workers, as follows:

\begin{equation} \begin{aligned} \dot{g}(i,b,\theta,e) = & -\partial _b [ \dot{b}(i,b,\theta,e)g(i,b,\theta,e) ] + f g(i,b,\theta,u) - \sigma g(i,b,\theta,e) \\ & + \sum _{j\neq i} \pi _{\rho }\big (g(j,b,\theta,e) - g(i,b,\theta,e)\big ) \\ \dot{g}(i,b,\theta,u) = & -\partial _b [ \dot{b}(i,b,\theta,u)g(i,b,\theta,u) ] - f g(i,b,\theta,u) + \sigma g(i,b,\theta,e) \\ & + \sum _{j\neq i} \pi _{\rho }\big (g(j,b,\theta,u) - g(i,b,\theta,u)\big ). \end{aligned} \end{equation}

\begin{equation} \begin{aligned} \dot{g}(i,b,\theta,e) = & -\partial _b [ \dot{b}(i,b,\theta,e)g(i,b,\theta,e) ] + f g(i,b,\theta,u) - \sigma g(i,b,\theta,e) \\ & + \sum _{j\neq i} \pi _{\rho }\big (g(j,b,\theta,e) - g(i,b,\theta,e)\big ) \\ \dot{g}(i,b,\theta,u) = & -\partial _b [ \dot{b}(i,b,\theta,u)g(i,b,\theta,u) ] - f g(i,b,\theta,u) + \sigma g(i,b,\theta,e) \\ & + \sum _{j\neq i} \pi _{\rho }\big (g(j,b,\theta,u) - g(i,b,\theta,u)\big ). \end{aligned} \end{equation}

The first line on the right hand side (RHS) of each equation is standard, while the second line of each RHS results from the inclusion of time-varying discount factors. In a steady-state equilibrium, the time derivatives of the distribution (the left hand side) will be required to be zero.

2.1.3 Firms

The value of a job with match-specific productivity

![]() $z$

filled by a worker with productivity

$z$

filled by a worker with productivity

![]() $\theta$

is denoted

$\theta$

is denoted

![]() $J(z,\theta )$

. This value satisfies the following HJB equation:

$J(z,\theta )$

. This value satisfies the following HJB equation:

The first terms on the right add up to the flow of profit, where

![]() $z\theta$

is revenue,

$z\theta$

is revenue,

![]() $\theta$

is salary costs, and

$\theta$

is salary costs, and

![]() $\beta z\theta$

are other costs. The remaining term is the separation value, which is the difference between the value of a vacancy,

$\beta z\theta$

are other costs. The remaining term is the separation value, which is the difference between the value of a vacancy,

![]() $W$

, and the job, weighted by the separation rate (in the initial steady-state only exogenous separations occur).Footnote

7

The steady-state value of a job is then:

$W$

, and the job, weighted by the separation rate (in the initial steady-state only exogenous separations occur).Footnote

7

The steady-state value of a job is then:

The value of a vacancy satisfies

where

![]() $\xi$

is the flow-cost of posting a vacancy,

$\xi$

is the flow-cost of posting a vacancy,

![]() $q$

is the vacancy filling rate, and

$q$

is the vacancy filling rate, and

![]() $g(i,b,\theta,u)$

is the measure of unemployed workers with discount rate

$g(i,b,\theta,u)$

is the measure of unemployed workers with discount rate

![]() $\rho _i$

, wealth

$\rho _i$

, wealth

![]() $b$

and skill

$b$

and skill

![]() $\theta$

at a point in time. We assume a free-entry condition that pushes the value of a vacancy to

$\theta$

at a point in time. We assume a free-entry condition that pushes the value of a vacancy to

![]() $W=0$

, and thus, the vacancy filling rate at any time is determined by equating the RHS of (8) with zero.

$W=0$

, and thus, the vacancy filling rate at any time is determined by equating the RHS of (8) with zero.

2.1.4 Government

The government budget constraint in the initial steady-state is

where

![]() $\mathcal{T}$

is total tax revenue and

$\mathcal{T}$

is total tax revenue and

![]() $H$

is total spending on unemployment insurance benefits. We show how these are calculated in Appendix A. The government does not borrow to finance spending in steady state; however, residual expenditure

$H$

is total spending on unemployment insurance benefits. We show how these are calculated in Appendix A. The government does not borrow to finance spending in steady state; however, residual expenditure

![]() $G$

includes costs to service any existing debt.

$G$

includes costs to service any existing debt.

2.1.5 Initial steady-state equilibrium

We formally define the initial steady-state equilibrium in Appendix B. As is usual in such an equilibrium, all value functions and decisions rules are stationary, the equilibrium distribution of workers over their state variables is stationary, and the government budget constraint is satisfied.

2.2 Pandemic period

At

![]() $t=0$

, a proportion

$t=0$

, a proportion

![]() $\phi$

of jobs are forced to stop producing. We refer to jobs where production is halted as the “affected sector,” as opposed to the “unaffected sector.” The lockdown continues until the affected sector reopens at

$\phi$

of jobs are forced to stop producing. We refer to jobs where production is halted as the “affected sector,” as opposed to the “unaffected sector.” The lockdown continues until the affected sector reopens at

![]() $t=t^{open}$

. Agents know the end date of the shutdown. The superscript

$t=t^{open}$

. Agents know the end date of the shutdown. The superscript

![]() $i\in \left \{A,UA\right \}$

denotes affected and unaffected sectors, respectively; for example,

$i\in \left \{A,UA\right \}$

denotes affected and unaffected sectors, respectively; for example,

![]() $U^A_t$

is the unemployment rate in the affected sector. Workers cannot change sectors in the short run.

$U^A_t$

is the unemployment rate in the affected sector. Workers cannot change sectors in the short run.

The wage subsidy and/or enhanced unemployment insurance programs begin at

![]() $t = 0$

, and the government begins issuing debt to finance these programs. Under the wage subsidy, the government pays a proportion

$t = 0$

, and the government begins issuing debt to finance these programs. Under the wage subsidy, the government pays a proportion

![]() $\psi (\theta )$

of the salary of a retained worker in the affected sector, as follows:

$\psi (\theta )$

of the salary of a retained worker in the affected sector, as follows:

\begin{equation} \psi (\theta )=\left \{\begin{matrix} \psi _0 & \quad \textrm{if} \ \theta \leq \overline{\theta } \\[3pt] \psi _0\times (\overline{\theta }/\theta ) & \quad \textrm{if} \ \theta \gt \overline{\theta } \\ \end{matrix}\right. . \end{equation}

\begin{equation} \psi (\theta )=\left \{\begin{matrix} \psi _0 & \quad \textrm{if} \ \theta \leq \overline{\theta } \\[3pt] \psi _0\times (\overline{\theta }/\theta ) & \quad \textrm{if} \ \theta \gt \overline{\theta } \\ \end{matrix}\right. . \end{equation}

When earnings exceed the ceiling

![]() $\overline{\theta }$

, the program pays a fixed amount

$\overline{\theta }$

, the program pays a fixed amount

![]() $\psi _0\overline{\theta }$

. Enhanced unemployment insurance pays an adjusted benefit

$\psi _0\overline{\theta }$

. Enhanced unemployment insurance pays an adjusted benefit

![]() $\tilde{h}(\theta )$

to unemployed workers in the affected sector.

$\tilde{h}(\theta )$

to unemployed workers in the affected sector.

During the shutdown period, endogenous worker-firm separations may occur. In making layoff decisions, firms weigh the cost of maintaining payroll during the pandemic against the benefit of resuming production immediately after the pandemic ends. Workers who are laid off remain temporarily attached to their job, but these attachments dissipate over time. This means that a laid off worker is less likely to be available when production restarts compared to if they remained on payroll. We refer to laid off workers who are still in contact with their firm as “attached-unemployed.” Such workers may (i) exogenously become conventional “unattached-unemployed,” (ii) match with a new job and become employed, or (iii) be recalled from layoff.

The value of having a worker on payroll grows faster than the value of layoff over the shutdown period because the time that a firm must pay their idle worker is getting smaller. This has two important consequences for our model. First, some firms may recall attached-unemployed workers before the shutdown ends, meaning endogenous worker recalls are important to allow for. Second, if a worker is laid off from their job, it happens at the moment the shutdown begins, meaning endogenous layoffs only need to be allowed for at the first instant of the pandemic.

Because of the possibility of attached unemployment, the labor force status possibilities of an affected-sector worker are

![]() $s\in \left \{e,u,a\right \}$

during the shutdown, where

$s\in \left \{e,u,a\right \}$

during the shutdown, where

![]() $a$

is attached unemployment. As will become clear, job productivity

$a$

is attached unemployment. As will become clear, job productivity

![]() $z$

matters for attached-unemployed workers and thus becomes a state variable for affected sector workers. Given this, the probability measure of such workers is denoted

$z$

matters for attached-unemployed workers and thus becomes a state variable for affected sector workers. Given this, the probability measure of such workers is denoted

![]() $\tilde{g}^A_t(i,b,\theta,s,z)$

, where the dependence of this transitional probability measure on time is captured with a subscript

$\tilde{g}^A_t(i,b,\theta,s,z)$

, where the dependence of this transitional probability measure on time is captured with a subscript

![]() $t$

. The probability measure over the usual state variables can be recovered by

$t$

. The probability measure over the usual state variables can be recovered by

![]() $g^A_t(i,b,\theta,s)=\int _z\tilde{g}^A_t(i,b,\theta,s,z)dz$

.

$g^A_t(i,b,\theta,s)=\int _z\tilde{g}^A_t(i,b,\theta,s,z)dz$

.

2.2.1 Firms

The value of a filled job in the affected sector,

![]() $J_t^A(z,\theta )$

, now depends directly on time. This value may be substantially different than the initial steady-state job value function, and firms must decide whether to keep their workers or lay them off.

$J_t^A(z,\theta )$

, now depends directly on time. This value may be substantially different than the initial steady-state job value function, and firms must decide whether to keep their workers or lay them off.

Workers who the firm lays off enter the state of attached unemployment. However, attached-unemployed workers may become conventional (unattached) unemployed workers at an exogenous rate

![]() $\varphi$

. We assume

$\varphi$

. We assume

![]() $\varphi \gt \sigma$

so that firms exogenously lose laid off workers more rapidly than employed workers. In addition, attached-unemployed workers search for new jobs in the same manner as unattached-unemployed workers do. If an attached-unemployed worker finds a job, then they leave the firm that laid them off; thus, attachments also dissolve endogenously at the job-finding rate.

$\varphi \gt \sigma$

so that firms exogenously lose laid off workers more rapidly than employed workers. In addition, attached-unemployed workers search for new jobs in the same manner as unattached-unemployed workers do. If an attached-unemployed worker finds a job, then they leave the firm that laid them off; thus, attachments also dissolve endogenously at the job-finding rate.

Formally, a firm in the affected sector chooses between keeping their worker on payroll, the value of which is

![]() $K^A_t(z,\theta )$

, and laying their worker off so that they become attached-unemployed, the value of which is

$K^A_t(z,\theta )$

, and laying their worker off so that they become attached-unemployed, the value of which is

![]() $L^A_t(z,\theta )$

. At any point in time, the option with the larger value is chosen by the firm; thus,

$L^A_t(z,\theta )$

. At any point in time, the option with the larger value is chosen by the firm; thus,

![]() $J^A_t(z,\theta )=\max \left \{K^A_t(z,\theta ),L^A_t(z,\theta )\right \}$

is the value of a firm in the affected sector during the shutdown. Any worker currently on payroll can be laid off, and any worker currently laid off (and still attached) can be recalled and put back on payroll, depending which option maximizes the value of the firm at that point in time.

$J^A_t(z,\theta )=\max \left \{K^A_t(z,\theta ),L^A_t(z,\theta )\right \}$

is the value of a firm in the affected sector during the shutdown. Any worker currently on payroll can be laid off, and any worker currently laid off (and still attached) can be recalled and put back on payroll, depending which option maximizes the value of the firm at that point in time.

![]() $K_t^A(z,\theta )$

solves

$K_t^A(z,\theta )$

solves

A worker kept on payroll costs the firm the unsubsidized part of their salary; thus t,he flow value is

![]() $-(1-\psi (\theta ))\theta$

. Exogenous separations may still occur at rate

$-(1-\psi (\theta ))\theta$

. Exogenous separations may still occur at rate

![]() $\sigma$

, in which case the value becomes that of an affected sector vacancy,

$\sigma$

, in which case the value becomes that of an affected sector vacancy,

![]() $W_t^A$

. The value of maintaining this job increases as time

$W_t^A$

. The value of maintaining this job increases as time

![]() $t^{\text{open}}$

approaches, which is captured by

$t^{\text{open}}$

approaches, which is captured by

![]() $\partial _tK_t^A(z,\theta )\gt 0$

. When the shutdown ends, workers can immediately resume production, which is captured by the terminal condition

$\partial _tK_t^A(z,\theta )\gt 0$

. When the shutdown ends, workers can immediately resume production, which is captured by the terminal condition

![]() $ K^A_{t^{\text{open}}}(z,\theta ) = J^*(z,\theta )$

.

$ K^A_{t^{\text{open}}}(z,\theta ) = J^*(z,\theta )$

.

We assume that firms will only hire workers for jobs that are worth keeping during the shutdown, formally those for which

![]() $K_t(z,\theta )\geq 0$

. As such, the value of laying off a worker, who then becomes an attached-unemployed, is:

$K_t(z,\theta )\geq 0$

. As such, the value of laying off a worker, who then becomes an attached-unemployed, is:

\begin{equation} \begin{aligned} RL^A_t(z,\theta ) \,=\, & \bigg ( \varphi + f^A_t \int _{\tilde{z}} P(\tilde{z}|\theta ) \mathcal{I} \{K^A(\tilde{z},\theta ) \geq 0 \} d\tilde{z} \bigg ) \left(W^A_t - L^A_t(z,\theta )\right) \\[2pt] & + \partial _t L^A_t(z,\theta ), & &\: \forall t\in [0,t^{\text{open}}) \\[2pt] L^A_{t^{\text{open}}}(z,\theta ) \,=\, & J^*(z,\theta ), & &\: t =t^{\text{open}}. \end{aligned} \end{equation}

\begin{equation} \begin{aligned} RL^A_t(z,\theta ) \,=\, & \bigg ( \varphi + f^A_t \int _{\tilde{z}} P(\tilde{z}|\theta ) \mathcal{I} \{K^A(\tilde{z},\theta ) \geq 0 \} d\tilde{z} \bigg ) \left(W^A_t - L^A_t(z,\theta )\right) \\[2pt] & + \partial _t L^A_t(z,\theta ), & &\: \forall t\in [0,t^{\text{open}}) \\[2pt] L^A_{t^{\text{open}}}(z,\theta ) \,=\, & J^*(z,\theta ), & &\: t =t^{\text{open}}. \end{aligned} \end{equation}

The flow value of having an attached-unemployed worker consists of two terms on the RHS. The first term reflects the possibility that attachment breaks exogenously, which occurs at rate

![]() $\varphi$

, or endogenously, which occurs at the job-finding rate. Because some combinations of worker and job productivity might generate negative value, the job-finding rate depends on both the affected sector matching rate

$\varphi$

, or endogenously, which occurs at the job-finding rate. Because some combinations of worker and job productivity might generate negative value, the job-finding rate depends on both the affected sector matching rate

![]() $f^A_t$

, and the proportion of matches that have positive value, which is captured by

$f^A_t$

, and the proportion of matches that have positive value, which is captured by

![]() $\int _{\tilde{z}} P(\tilde{z}|\theta ) \mathcal{I} \{K(\tilde{z},\theta )\geq 0\}d\tilde{z}$

. At the end of the shutdown, any remaining attached-unemployed workers would be recalled, which is captured by the terminal condition

$\int _{\tilde{z}} P(\tilde{z}|\theta ) \mathcal{I} \{K(\tilde{z},\theta )\geq 0\}d\tilde{z}$

. At the end of the shutdown, any remaining attached-unemployed workers would be recalled, which is captured by the terminal condition

![]() $ L^A_{t^{\text{open}}}(z,\theta ) = J^*(z,\theta )$

.

$ L^A_{t^{\text{open}}}(z,\theta ) = J^*(z,\theta )$

.

Given the assumptions about job posting by firms during the shutdown, the free-entry condition in the affected sector now becomes:

\begin{equation} \begin{aligned} RW^A_t = & -\xi + q^A_t \sum _i\int _b\int _{\theta } \int _z \left(K^A_t(z,\theta )-W^A_t\right) \dfrac{ g_t^A(i,b,\theta,u) + g_t^A(i,b,\theta,a)}{U^A_t}\\ & \times P_z(z|\theta ) \mathcal{I}\{ K^A_t(z,\theta ) \geq 0 \} dz d\theta db. \end{aligned} \end{equation}

\begin{equation} \begin{aligned} RW^A_t = & -\xi + q^A_t \sum _i\int _b\int _{\theta } \int _z \left(K^A_t(z,\theta )-W^A_t\right) \dfrac{ g_t^A(i,b,\theta,u) + g_t^A(i,b,\theta,a)}{U^A_t}\\ & \times P_z(z|\theta ) \mathcal{I}\{ K^A_t(z,\theta ) \geq 0 \} dz d\theta db. \end{aligned} \end{equation}

The expected value of a match depends on the affected-sector measures of unattached- and attached-unemployed workers,

![]() $g^A_t(i,b,\theta,u)$

and

$g^A_t(i,b,\theta,u)$

and

![]() $g_t^A(i,b,\theta,a)$

, respectively, as well as the affected-sector unemployment rate

$g_t^A(i,b,\theta,a)$

, respectively, as well as the affected-sector unemployment rate

![]() $U^A_t$

. Firms are not allowed to lay off new hires during the pandemic in order to ensure that all layoffs occur at

$U^A_t$

. Firms are not allowed to lay off new hires during the pandemic in order to ensure that all layoffs occur at

![]() $t=0$

.

$t=0$

.

Firm decisions in the unaffected sector continue as in the initial steady state, or in other words

![]() $J_t^{UA}(z,\theta )=J^*(z,\theta )$

, because production is allowed to continue there as usual.

$J_t^{UA}(z,\theta )=J^*(z,\theta )$

, because production is allowed to continue there as usual.

2.2.2 Workers

The value function of an affected sector worker,

![]() $V_t^A(i,b,\theta,s,z)$

, depends on their job productivity, as discussed above. However, this state variable only applies to attached-unemployed workers, and so is repressed for other workers.

$V_t^A(i,b,\theta,s,z)$

, depends on their job productivity, as discussed above. However, this state variable only applies to attached-unemployed workers, and so is repressed for other workers.

First, consider an unattached-unemployed worker in the affected sector, who solves the following problem during the shutdown:

\begin{equation} \begin{aligned} \rho _i V_t^A(i,b,\theta,u) =\, & \underset{ c }{\max \:} v(c) + \partial _b V_t^A(i,b,\theta,u) \dot{b} \\ & + f^A_t \int _zP_z(z|\theta ) \mathcal{I}\left\{ K^A_t(z,\theta ) \geq 0 \right\} dz \big (V_t^A(i,b,\theta,e)-V_t^A(i,b,\theta,u) \big ) \\ & + \sum _{j\neq i} \pi _{\rho } \left(V^A_t(j,b,\theta,u) - V^A_t(i,b,\theta,u) \right) + \partial _t V_t^A(i,b,\theta,u)\\ \text{s.t. } \dot{b} =\, & \tilde{h}(\theta ) + b r(b) - c, \ \ b \geq \underline{b}. \\ \end{aligned} \end{equation}

\begin{equation} \begin{aligned} \rho _i V_t^A(i,b,\theta,u) =\, & \underset{ c }{\max \:} v(c) + \partial _b V_t^A(i,b,\theta,u) \dot{b} \\ & + f^A_t \int _zP_z(z|\theta ) \mathcal{I}\left\{ K^A_t(z,\theta ) \geq 0 \right\} dz \big (V_t^A(i,b,\theta,e)-V_t^A(i,b,\theta,u) \big ) \\ & + \sum _{j\neq i} \pi _{\rho } \left(V^A_t(j,b,\theta,u) - V^A_t(i,b,\theta,u) \right) + \partial _t V_t^A(i,b,\theta,u)\\ \text{s.t. } \dot{b} =\, & \tilde{h}(\theta ) + b r(b) - c, \ \ b \geq \underline{b}. \\ \end{aligned} \end{equation}

Affected sector workers match with potential employers at rate

![]() $f^A_t$

, but some matches have negative value and so the job-finding rate is smaller, depending on the proportion of such matches for which

$f^A_t$

, but some matches have negative value and so the job-finding rate is smaller, depending on the proportion of such matches for which

![]() $K_t(z,\theta ) \geq 0$

. When a job is found, the value function jumps to

$K_t(z,\theta ) \geq 0$

. When a job is found, the value function jumps to

![]() $V_t^A(i,b,\theta,e)$

. Notice that the unemployment benefit is now

$V_t^A(i,b,\theta,e)$

. Notice that the unemployment benefit is now

![]() $\tilde{h}(\theta )$

.

$\tilde{h}(\theta )$

.

Attached-unemployed workers solve a similar problem as their unattached counterparts, with two primary differences. First, there will be a term in the attached worker HJB equation that reflects the possibility of losing attachment and becoming an unattached-unemployed worker. Second, attached-unemployed workers anticipate that they may be recalled at some future date. Given the assumptions of our model, workers know with certainty when their firm would recall them. This provides a boundary condition that their value function must satisfy, as they will have the same value function as an employed worker at that time, assuming attachment does not dissolve beforehand. A simple way to express this boundary condition is to impose that the value of an attached worker be equal to that of an equivalent employed worker whenever

![]() $K^A_t(z,\theta )\geq L^A_t(z,\theta )$

, or in other words whenever the firm will prefer to have the worker on payroll. Formally, attached-unemployed workers solve the following problem:

$K^A_t(z,\theta )\geq L^A_t(z,\theta )$

, or in other words whenever the firm will prefer to have the worker on payroll. Formally, attached-unemployed workers solve the following problem:

\begin{equation} \begin{aligned} \rho _i V_t^A(i,b,\theta,a,z) =\, & \underset{ c }{\max \:} v(c) + \partial _b V_t^A(i,b,\theta,a,z) \dot{b} \\ & + f^A_t \int _{\tilde{z}} P({\tilde{z}}|\theta ) \mathcal{I}\{ K_t({\tilde{z}},\theta ) \geq 0 \} d{\tilde{z}} \cdot \big (V_t^A(i,b,\theta,e)-V_t^A(i,b,\theta,a,z) \big ) \\ & + \varphi \big ( V_t^A(i,b,\theta,u) - V_t^A(i,b,\theta, a, z ) \big ) \\ & + \sum _{j\neq i} \pi _{\rho } \big (V^A_t(j,b,\theta,a,z) - V^A_t(i,b,\theta,a,z) \big ) + \partial _t V_t^A(i,b,\theta,a,z)\\ \text{s.t. } \dot{b} =\,& \tilde{h}(\theta ) + b r(b) - c, \ \ b \geq \underline{b},\quad \& \\ V_t^A(i,b,\theta,a,z) =\,& V_t^A(i,b,\theta,e) \: \forall t \ | \ \big ( K^A_t(z,\theta ) \geq L^A_t(z,\theta ) \big ) \end{aligned} \end{equation}

\begin{equation} \begin{aligned} \rho _i V_t^A(i,b,\theta,a,z) =\, & \underset{ c }{\max \:} v(c) + \partial _b V_t^A(i,b,\theta,a,z) \dot{b} \\ & + f^A_t \int _{\tilde{z}} P({\tilde{z}}|\theta ) \mathcal{I}\{ K_t({\tilde{z}},\theta ) \geq 0 \} d{\tilde{z}} \cdot \big (V_t^A(i,b,\theta,e)-V_t^A(i,b,\theta,a,z) \big ) \\ & + \varphi \big ( V_t^A(i,b,\theta,u) - V_t^A(i,b,\theta, a, z ) \big ) \\ & + \sum _{j\neq i} \pi _{\rho } \big (V^A_t(j,b,\theta,a,z) - V^A_t(i,b,\theta,a,z) \big ) + \partial _t V_t^A(i,b,\theta,a,z)\\ \text{s.t. } \dot{b} =\,& \tilde{h}(\theta ) + b r(b) - c, \ \ b \geq \underline{b},\quad \& \\ V_t^A(i,b,\theta,a,z) =\,& V_t^A(i,b,\theta,e) \: \forall t \ | \ \big ( K^A_t(z,\theta ) \geq L^A_t(z,\theta ) \big ) \end{aligned} \end{equation}

The second line captures the possibility of finding a new job before recall occurs, while the third reflects the possibility of exogenous loss of attachment to the job. The boundary condition is specified in the last line.

Employed workers in the affected sector solve a similar problem to that of the initial steady-state, except that their value function depends on time for several reasons. Such workers solve the following problem:

\begin{equation} \begin{aligned} \rho _i V_t^A(i,b,\theta,e) =\, & \underset{ c }{\max \:} v(c) + \partial _b V^A_t(i,b,\theta,e) \dot{b} \\ & + \sigma \big (V_t^A(i,b,\theta,u) - V^A_t(i,b,\theta,e) \big ) \\ & + \sum _{j\neq i} \pi _{\rho } \big (V^A_t(j,b,\theta,e) - V^A_t(i,b,\theta,e) \big ) + \partial _t V^A_t(i,b,\theta,e) \\ \text{s.t. } \dot{b} =\, & \theta - T(\theta ) + b r(b) - c, \ \ b \geq \underline{b}. \end{aligned} \end{equation}

\begin{equation} \begin{aligned} \rho _i V_t^A(i,b,\theta,e) =\, & \underset{ c }{\max \:} v(c) + \partial _b V^A_t(i,b,\theta,e) \dot{b} \\ & + \sigma \big (V_t^A(i,b,\theta,u) - V^A_t(i,b,\theta,e) \big ) \\ & + \sum _{j\neq i} \pi _{\rho } \big (V^A_t(j,b,\theta,e) - V^A_t(i,b,\theta,e) \big ) + \partial _t V^A_t(i,b,\theta,e) \\ \text{s.t. } \dot{b} =\, & \theta - T(\theta ) + b r(b) - c, \ \ b \geq \underline{b}. \end{aligned} \end{equation}

Future changes in government policy cause the value function to change over time, captured by

![]() $\partial _t V^A_t(i,b,\theta,e)$

, and the continuation value in the event of job loss also varies with time.

$\partial _t V^A_t(i,b,\theta,e)$

, and the continuation value in the event of job loss also varies with time.

During the shutdown, unaffected workers continue to solve similar problems as in (3) and (4) with the same job-finding rate as in the steady state. The main difference is that unaffected workers foresee an increase in future taxes and respond accordingly by altering their consumption decisions. As such, their value functions depend directly on time and are now denoted

![]() $V_t^{UA}(i,b,\theta,s)$

, and in general

$V_t^{UA}(i,b,\theta,s)$

, and in general

![]() $\partial _t V_t^{UA} \neq 0$

. This implies an additional term in the HJB equations of unaffected workers; for example, the HJB equation of an unemployed worker in the unaffected sector is

$\partial _t V_t^{UA} \neq 0$

. This implies an additional term in the HJB equations of unaffected workers; for example, the HJB equation of an unemployed worker in the unaffected sector is

\begin{equation} \begin{aligned} \rho _i V_t^{UA}(i,b,\theta,u) =\, & \underset{ c }{\max \:} v(c) + \partial _b V_t^{UA}(i,b,\theta,e) \dot{b} + f \left(V_t^{UA}(i,b,\theta,e) - V_t^{UA}(i,b,\theta,u) \right) \\ & + \sum _{j\neq i} \pi _{\rho } \left(V_t^{UA}(j,b,\theta,u) - V_t^{UA}(i,b,\theta,u) \right) + \partial _t V_t^{UA}(i,b,\theta,u)\\ \text{s.t. } \dot{b} =\, & h(\theta ) + r(b)b - c, \ \ b \geq \underline{b}, \end{aligned} \end{equation}

\begin{equation} \begin{aligned} \rho _i V_t^{UA}(i,b,\theta,u) =\, & \underset{ c }{\max \:} v(c) + \partial _b V_t^{UA}(i,b,\theta,e) \dot{b} + f \left(V_t^{UA}(i,b,\theta,e) - V_t^{UA}(i,b,\theta,u) \right) \\ & + \sum _{j\neq i} \pi _{\rho } \left(V_t^{UA}(j,b,\theta,u) - V_t^{UA}(i,b,\theta,u) \right) + \partial _t V_t^{UA}(i,b,\theta,u)\\ \text{s.t. } \dot{b} =\, & h(\theta ) + r(b)b - c, \ \ b \geq \underline{b}, \end{aligned} \end{equation}

and similar for unaffected employed workers.

2.2.3 Government

During the economic shutdown, the government runs the wage subsidy program, offers expanded unemployment benefits, and borrows in order to balance their budget. The accumulated debt associated with the pandemic at time

![]() $t$

is denoted

$t$

is denoted

![]() $B_t$

. The pandemic-era cost of unemployment benefits,

$B_t$

. The pandemic-era cost of unemployment benefits,

![]() $H_t$

, will be higher than in the initial steady-state due to higher unemployment rates and (possibly) more generous benefits. The cost of the wage subsidy program is captured by an additional expenditure term

$H_t$

, will be higher than in the initial steady-state due to higher unemployment rates and (possibly) more generous benefits. The cost of the wage subsidy program is captured by an additional expenditure term

![]() $Q_t$

. See Appendix A for more details on how these terms are calculated. With these pandemic features, the federal budget constraint at a point in time is

$Q_t$

. See Appendix A for more details on how these terms are calculated. With these pandemic features, the federal budget constraint at a point in time is

Note that tax revenue

![]() $\mathcal{T}_t$

will also differ from the initial steady-state because of lower employment rates. Residual expenditure continues at the initial steady-state level

$\mathcal{T}_t$

will also differ from the initial steady-state because of lower employment rates. Residual expenditure continues at the initial steady-state level

![]() $G$

.

$G$

.

2.3 Recovery and post-recovery periods

The recovery period begins at

![]() $ t=t^{\text{open}}$

. To the extent that unemployment is still above the steady-state level at

$ t=t^{\text{open}}$

. To the extent that unemployment is still above the steady-state level at

![]() $ t=t^{\text{open}}$

, the labor market frictions of the model imply a period of transition back to a stationary labor market. The recovery period ends at time

$ t=t^{\text{open}}$

, the labor market frictions of the model imply a period of transition back to a stationary labor market. The recovery period ends at time

![]() $ t=t^{\text{rec}}$

when the unemployment rate returns to the steady-state level.

$ t=t^{\text{rec}}$

when the unemployment rate returns to the steady-state level.

The wage subsidy and/or enhanced unemployment benefit programs end at

![]() $t^{\text{open}}$

; however, the government still needs to borrow in order to meet debt servicing costs because tax rates have not yet been increased. Instead, we assume that the government waits until the post-recovery period has begun at

$t^{\text{open}}$

; however, the government still needs to borrow in order to meet debt servicing costs because tax rates have not yet been increased. Instead, we assume that the government waits until the post-recovery period has begun at

![]() $t=t^{\text{rec}}$

before raising taxes. At this point, the government stops rolling over debt, and taxes increase by enough to pay for the programs introduced during the shutdown. A period of transitional dynamics continues after

$t=t^{\text{rec}}$

before raising taxes. At this point, the government stops rolling over debt, and taxes increase by enough to pay for the programs introduced during the shutdown. A period of transitional dynamics continues after

![]() $t=t^{\text{rec}}$

, despite the fact that the labor market is in a stationary state, because the household wealth distribution still needs to adjust towards the final steady-state.

$t=t^{\text{rec}}$

, despite the fact that the labor market is in a stationary state, because the household wealth distribution still needs to adjust towards the final steady-state.

2.3.1 Government

During the recovery period the government budget constraint is as in (18), but with

![]() $Q_t=0$

.

$Q_t=0$

.

In the post-recovery period, from

![]() $t^{\text{rec}}$

onwards, the government is ready to begin paying the debt accumulated during the pandemic. At this point, a quantity of debt

$t^{\text{rec}}$

onwards, the government is ready to begin paying the debt accumulated during the pandemic. At this point, a quantity of debt

![]() $B_{t^{\text{rec}}}$

has accumulated. We assume that the government converts this debt to a perpetuity and thus will make payments

$B_{t^{\text{rec}}}$

has accumulated. We assume that the government converts this debt to a perpetuity and thus will make payments

![]() $rB_{t^{\text{rec}}}$

for the rest of time. To accommodate this cost, tax rates are revised such that

$rB_{t^{\text{rec}}}$

for the rest of time. To accommodate this cost, tax rates are revised such that

![]() $\tilde{T}(\theta )$

is the new tax schedule. In the calibrated model, the initial average tax rate will take the functional form

$\tilde{T}(\theta )$

is the new tax schedule. In the calibrated model, the initial average tax rate will take the functional form

![]() $T(\theta )/\theta = 1 - \lambda (\theta/E[\theta ])^{-\gamma }$

as in Heathcote et al. (Reference Heathcote, Storesletten and Violante2017), where

$T(\theta )/\theta = 1 - \lambda (\theta/E[\theta ])^{-\gamma }$

as in Heathcote et al. (Reference Heathcote, Storesletten and Violante2017), where

![]() $E[\theta ]$

is cross-sectional mean earnings in steady-state. The parameter

$E[\theta ]$

is cross-sectional mean earnings in steady-state. The parameter

![]() $\lambda$

will adjust to balance the budget, leaving the progressivity parameter

$\lambda$

will adjust to balance the budget, leaving the progressivity parameter

![]() $\gamma$

unchanged. Under this new tax schedule, government revenue will become

$\gamma$

unchanged. Under this new tax schedule, government revenue will become

![]() $\tilde{\mathcal{T}}$

. The post-recovery government budget constraint is then

$\tilde{\mathcal{T}}$

. The post-recovery government budget constraint is then

This equation determines the post-recovery tax reform, given the debt accumulated under the policies that existed during the pandemic.

2.3.2 Workers

In the recovery period, all jobs have positive value; thus, any match will again result in a job being created. Furthermore, all attached-unemployed workers will be recalled. The HJB equations of unaffected workers continue to be as during the pandemic; for example, (17) is still the problem of an unaffected unemployed worker after the lockdown ends but before the labor market has recovered (

![]() $t^{\text{open}}\leq t\lt t^{\text{rec}}$

).

$t^{\text{open}}\leq t\lt t^{\text{rec}}$

).

The HJB equations of affected sector workers also continue to vary with time until the end of the recovery period. The job-finding rate of the workers,

![]() $f_t^A$

, continues to evolve as the labor market recovers, and so an unemployed affected sector worker has the following problem from

$f_t^A$

, continues to evolve as the labor market recovers, and so an unemployed affected sector worker has the following problem from

![]() $t^{\text{open}}$

to

$t^{\text{open}}$

to

![]() $t^{\text{rec}}$

:

$t^{\text{rec}}$

:

\begin{equation} \begin{aligned} \rho _i V_t^A(i,b,\theta,u) =\,& \underset{ c }{\max \:} v(c) + \partial _b V_t^A(i,b,\theta,u) \dot{b} \\ & + f^A_t \big (V_t^A(i,b,\theta,e)-V_t^A(i,b,\theta,u) \big ) \\ & + \sum _{j\neq i} \pi _{\rho } \big (V^A_t(j,b,\theta,u) - V^A_t(i,b,\theta,u) \big ) + \partial _t V_t^A(i,b,\theta,u)\\ \text{s.t. } \dot{b} =\, & h(\theta ) + b r(b) - c, \ \ b \geq \underline{b}. \\ \end{aligned} \end{equation}

\begin{equation} \begin{aligned} \rho _i V_t^A(i,b,\theta,u) =\,& \underset{ c }{\max \:} v(c) + \partial _b V_t^A(i,b,\theta,u) \dot{b} \\ & + f^A_t \big (V_t^A(i,b,\theta,e)-V_t^A(i,b,\theta,u) \big ) \\ & + \sum _{j\neq i} \pi _{\rho } \big (V^A_t(j,b,\theta,u) - V^A_t(i,b,\theta,u) \big ) + \partial _t V_t^A(i,b,\theta,u)\\ \text{s.t. } \dot{b} =\, & h(\theta ) + b r(b) - c, \ \ b \geq \underline{b}. \\ \end{aligned} \end{equation}

Unlike during the lockdown, all matches result in hires, so the job-finding rate is again the matching rate. Also, the unemployment benefit is back to the baseline schedule

![]() $h(\theta )$

. The HJB equation of an employed worker from

$h(\theta )$

. The HJB equation of an employed worker from

![]() $t^{\text{open}}$

to

$t^{\text{open}}$

to

![]() $t^{\text{rec}}$

is the same is in (16)

$t^{\text{rec}}$

is the same is in (16)

When time

![]() $t^{\text{rec}}$

arrives the tax schedule changes from

$t^{\text{rec}}$

arrives the tax schedule changes from

![]() $T(\theta )$

to

$T(\theta )$

to

![]() $\tilde{T}(\theta )$

, and there will be no further changes to the worker problems thereafter. As such, worker value functions will be the same as the final steady-state value functions, which we denote

$\tilde{T}(\theta )$

, and there will be no further changes to the worker problems thereafter. As such, worker value functions will be the same as the final steady-state value functions, which we denote

![]() $V^f(i,b,\theta,s)$

. That is, in the post-recovery transition period workers will solve the same problems as in the initial steady state [specifically (3) and (4)], without any time dependence of the value functions. The only caveat is that the change in the tax function. Although the value functions will be stationary, the distribution

$V^f(i,b,\theta,s)$

. That is, in the post-recovery transition period workers will solve the same problems as in the initial steady state [specifically (3) and (4)], without any time dependence of the value functions. The only caveat is that the change in the tax function. Although the value functions will be stationary, the distribution

![]() $g_t(i,b,\theta,s)$

will continue to evolve until the final steady-state distribution is attained.

$g_t(i,b,\theta,s)$

will continue to evolve until the final steady-state distribution is attained.

2.3.3 Firms

The affected sector is allowed to resume production; thus, the job posting decisions of firms in both sectors are governed by the same equations as in the initial steady state. However, the affected sector vacancy filling rate,

![]() $q^A_t$

, will vary through the recovery period as the affected sector unemployment rate falls. In the post-recovery period (after

$q^A_t$

, will vary through the recovery period as the affected sector unemployment rate falls. In the post-recovery period (after

![]() $t=t^{\text{rec}}$

), the unemployment rates of both sectors will be at their long-run levels, and the overall labor market will be in a stationary state.

$t=t^{\text{rec}}$

), the unemployment rates of both sectors will be at their long-run levels, and the overall labor market will be in a stationary state.

2.4 Equilibrium

We formally define a recursive competitive equilibrium for the pandemic and post-pandemic periods in Appendix B. Although there are many moving parts in the model, and hence many unique equilibrium objects to pin down, there is nothing non-standard about our equilibrium concept. Agents are rational price-taking optimizers, and the government budget constraint must be satisfied, as has just been described.

3. Calibration

3.1 Government

The government taxes income according to the HSV tax function, as in Heathcote et al. (Reference Heathcote, Storesletten and Violante2017). In particular, the average tax rate of a type-

![]() $\theta$

worker takes the form

$\theta$

worker takes the form

![]() $T(\theta )/\theta = \tau (\theta ) = 1 - \lambda (\theta/E[\theta ])^{-\gamma }$

, where

$T(\theta )/\theta = \tau (\theta ) = 1 - \lambda (\theta/E[\theta ])^{-\gamma }$

, where

![]() $\gamma$

governs the progressivity of the tax system,

$\gamma$

governs the progressivity of the tax system,

![]() $\lambda$

dictates the average level of taxation in the economy, and

$\lambda$

dictates the average level of taxation in the economy, and

![]() $E[\theta ]$

is mean earnings in the steady-state economy. We set

$E[\theta ]$

is mean earnings in the steady-state economy. We set

![]() $\lambda = 0.902$

and

$\lambda = 0.902$

and

![]() $\gamma = 0.036$

according to the estimates by Guner et al. (Reference Guner, Kaygusuz and Ventura2014). For unemployment benefits, we set

$\gamma = 0.036$

according to the estimates by Guner et al. (Reference Guner, Kaygusuz and Ventura2014). For unemployment benefits, we set

![]() $h(\theta ) = 0.4\theta (1-\tau (\theta ))$

, which implies a replacement rate of 40

$h(\theta ) = 0.4\theta (1-\tau (\theta ))$

, which implies a replacement rate of 40

![]() $\%$

of net earnings.Footnote

8

$\%$

of net earnings.Footnote

8

In the post-recovery period, the government must balance a budget that now includes perpetuity payments

![]() $rB_{t^{\text{rec}}}$

as in equation (19). To achieve this, we assume that the government raises the average tax level in the economy by adjusting

$rB_{t^{\text{rec}}}$

as in equation (19). To achieve this, we assume that the government raises the average tax level in the economy by adjusting

![]() $\lambda$

to

$\lambda$

to

![]() $\tilde{\lambda }$

, and thus, the post-recovery average tax function is

$\tilde{\lambda }$

, and thus, the post-recovery average tax function is

![]() $\tilde{\tau }(\theta )= 1 - \tilde{\lambda }(\theta/E[\theta ])^{-\gamma }$

. All calibration parameters and identifying moments are summarized in Table 1.

$\tilde{\tau }(\theta )= 1 - \tilde{\lambda }(\theta/E[\theta ])^{-\gamma }$

. All calibration parameters and identifying moments are summarized in Table 1.

3.2 Labor market parameters

The labor market parameters include those of the matching function

![]() $M(U,\nu )$

, the exogenous separation rate

$M(U,\nu )$

, the exogenous separation rate

![]() $\sigma$

, and the affected proportion of the economy

$\sigma$

, and the affected proportion of the economy

![]() $\phi$

. We assume that the matching function is Cobb-Douglas of the form

$\phi$

. We assume that the matching function is Cobb-Douglas of the form

![]() $M(U,\nu )=\chi U^{\eta }\nu ^{1-\eta }$

, where matching efficiency

$M(U,\nu )=\chi U^{\eta }\nu ^{1-\eta }$

, where matching efficiency

![]() $\chi$

and elasticity

$\chi$

and elasticity

![]() $\eta$

are the parameters to be calibrated. The attachment-dissolution rate,

$\eta$

are the parameters to be calibrated. The attachment-dissolution rate,

![]() $\varphi$

, governs the measure of unemployed workers that get recalled when the shutdown ends.

$\varphi$

, governs the measure of unemployed workers that get recalled when the shutdown ends.

We follow Shimer (Reference Shimer2005) closely in choosing the basic parameter values. We set the

![]() $\eta = 0.72$

,

$\eta = 0.72$

,

![]() $\sigma = 0.008$

and set

$\sigma = 0.008$

and set

![]() $\chi$

and

$\chi$

and

![]() $\xi$

such that the steady-state job-finding rate and market tightness are

$\xi$

such that the steady-state job-finding rate and market tightness are

![]() $0.104$

and 1, respectively. In particular, targeting the market tightness of 1 implies that

$0.104$

and 1, respectively. In particular, targeting the market tightness of 1 implies that

![]() $f_t = \chi$

. Conditional on the calibration of

$f_t = \chi$

. Conditional on the calibration of

![]() $\mu _z$

, the fixed cost of posting a vacancy is then:

$\mu _z$

, the fixed cost of posting a vacancy is then:

where

![]() $P(z,\theta )$

is the joint density of

$P(z,\theta )$

is the joint density of

![]() $z$

and

$z$

and

![]() $\theta$

. This equation is equivalent to the initial steady-state free-entry condition (8), when the market tightness is 1, and

$\theta$

. This equation is equivalent to the initial steady-state free-entry condition (8), when the market tightness is 1, and

![]() $J_t(z,\theta )$

replaced by its value in the initial steady-state. The calibration implies that on average employment lasts for about 2.5 years, and average duration of unemployment is about 2.5 months.

$J_t(z,\theta )$

replaced by its value in the initial steady-state. The calibration implies that on average employment lasts for about 2.5 years, and average duration of unemployment is about 2.5 months.

The parameter that determines the rate at which attached-unemployed workers become unattached is set based on CPS data from April to September of 2020. In particular, for each month we compute the proportion of individuals who report a transition from temporary unemployment that month to any other form of unemployment in the following month. We interpret this as a transition from attached to unattached unemployment, which provides a measure of

![]() $\varphi$

for that month. We average over the six months that we utilize, weighting by the number of new temporarily unemployed workers that month. We find that the weekly rate at which attached-unemployed workers transition to conventional unemployment is

$\varphi$

for that month. We average over the six months that we utilize, weighting by the number of new temporarily unemployed workers that month. We find that the weekly rate at which attached-unemployed workers transition to conventional unemployment is

![]() $\varphi =0.045$

. It is worth noting that this rate is about half as large as would be consistent with the data reported in Fujita and Moscarini (Reference Fujita and Moscarini2017), which shows that the recall rate is much higher after a pandemic lockdown than in normal times. This is consistent with the quick recovery of the US unemployment rate during the pandemic, relative to other recessions as shown in Hall and Kudlyak (Reference Hall and Kudlyak2020).

$\varphi =0.045$

. It is worth noting that this rate is about half as large as would be consistent with the data reported in Fujita and Moscarini (Reference Fujita and Moscarini2017), which shows that the recall rate is much higher after a pandemic lockdown than in normal times. This is consistent with the quick recovery of the US unemployment rate during the pandemic, relative to other recessions as shown in Hall and Kudlyak (Reference Hall and Kudlyak2020).

The last labor market parameter is the affected proportion of the economy

![]() $\phi$

, which we calibrate using data on US firms in January 2021, documented by Damodaran (Reference Damodaran2021). We calculated the number of firms that have a negative profit margin during this period and divide it by the total number of firms in the sample. The result is

$\phi$

, which we calibrate using data on US firms in January 2021, documented by Damodaran (Reference Damodaran2021). We calculated the number of firms that have a negative profit margin during this period and divide it by the total number of firms in the sample. The result is

![]() $\phi = 0.23$

, which implies that 23

$\phi = 0.23$

, which implies that 23

![]() $\%$

of the firms are in the affected sector.

$\%$

of the firms are in the affected sector.

3.3 Household parameters

Household parameters include the flow utility risk aversion parameter

![]() $\varsigma$

, the three values of the discount rate

$\varsigma$

, the three values of the discount rate

![]() $\rho$

, the discounting type transition rate

$\rho$

, the discounting type transition rate

![]() $\pi _{\rho }$

, the borrowing limit

$\pi _{\rho }$

, the borrowing limit

![]() $\underline{b}$

, the interest rates

$\underline{b}$

, the interest rates

![]() $r$

and

$r$

and

![]() $R$

, and the parameters of the distribution of productivity

$R$

, and the parameters of the distribution of productivity

![]() $\theta$

. To begin with, we specify the earnings distribution directly from data. With our earnings function

$\theta$

. To begin with, we specify the earnings distribution directly from data. With our earnings function

![]() $y(\theta ) = \theta$

, we can back out the distribution of

$y(\theta ) = \theta$

, we can back out the distribution of

![]() $\theta$

directly from weekly earnings observed in data. In the model, we approximate the distribution of weekly earnings with a log-normal distribution, implying that

$\theta$

directly from weekly earnings observed in data. In the model, we approximate the distribution of weekly earnings with a log-normal distribution, implying that

![]() $\log (\theta ) \sim \mathcal{N}\big(\mu _\theta, \sigma _\theta ^2\big).$

We use the 2019 CPS March Supplement to estimate

$\log (\theta ) \sim \mathcal{N}\big(\mu _\theta, \sigma _\theta ^2\big).$

We use the 2019 CPS March Supplement to estimate

![]() $\mu _{\theta }$

and

$\mu _{\theta }$

and

![]() $\sigma _{\theta }^2$

. Details can be found in Appendix D. We find that

$\sigma _{\theta }^2$

. Details can be found in Appendix D. We find that

![]() $\mu _{\theta } = 6.755$

and

$\mu _{\theta } = 6.755$

and

![]() $\sigma _{\theta }^2 = 0.8027$

. These estimates imply that mean weekly earnings are about $1127.

$\sigma _{\theta }^2 = 0.8027$

. These estimates imply that mean weekly earnings are about $1127.

Three of the remaining parameters are specified by assumption. The return on saving

![]() $r$

is set to the equivalent of a 4

$r$

is set to the equivalent of a 4

![]() $\%$

annual rate, the coefficient of relative risk aversion is set to

$\%$

annual rate, the coefficient of relative risk aversion is set to

![]() $\varsigma =2$

, and the rate at which discounting transitions occur is set to

$\varsigma =2$

, and the rate at which discounting transitions occur is set to

![]() $\pi _{\rho }=1/4160$

. This value of

$\pi _{\rho }=1/4160$

. This value of

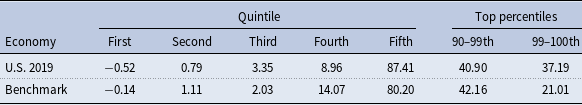

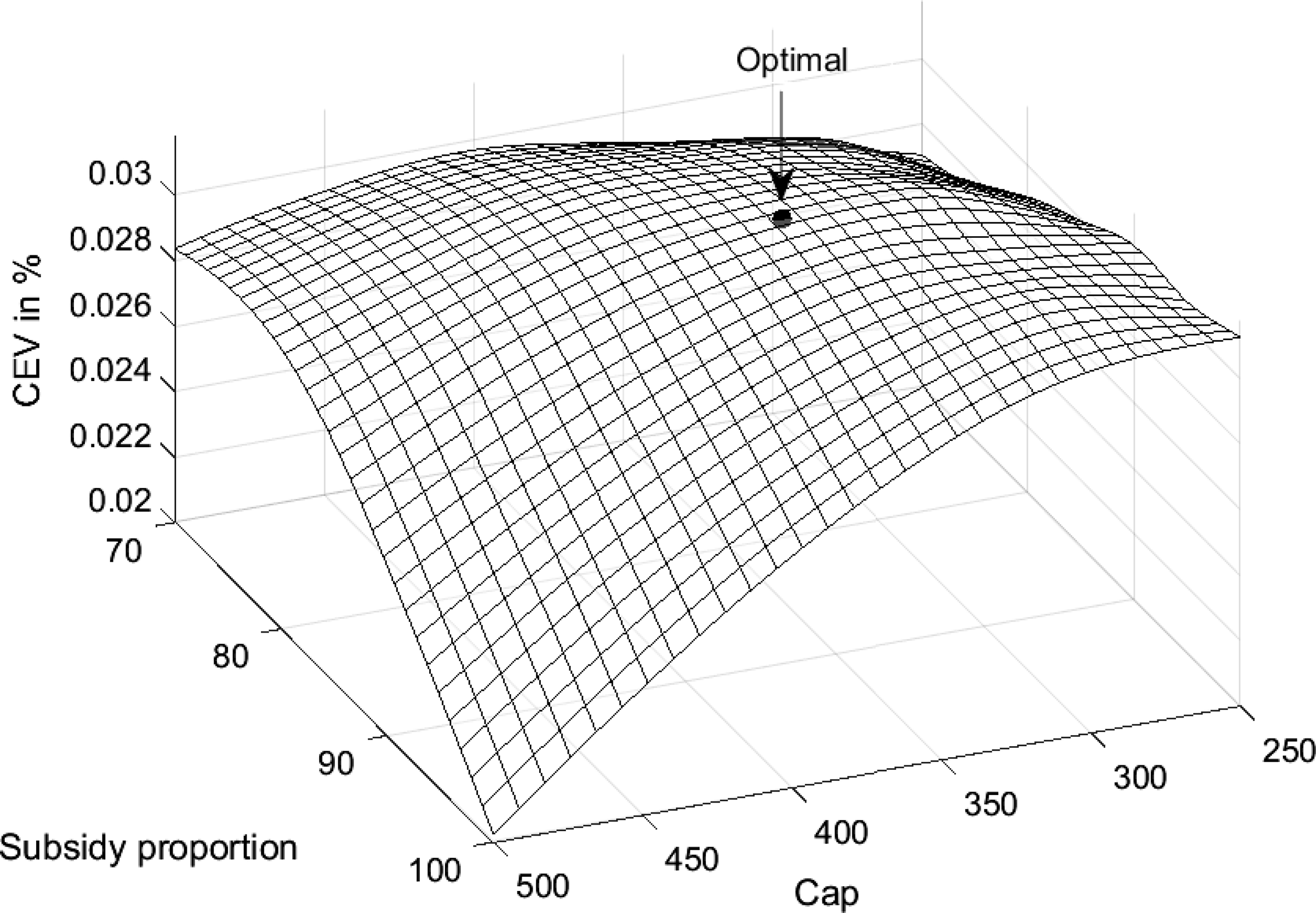

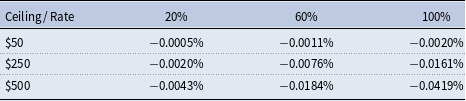

![]() $\pi _{\rho }$