1. Introduction

Behavioral bias plays a vital role in shaping household saving behavior, and one’s financial situation can have profound implications for macroeconomic outcomes and policy design (e.g., Farhi and Werning (Reference Farhi and Werning2019), Angeletos and Huo (Reference Angeletos and Huo2021), Pfäuti and Seyrich (Reference Pfäuti and Seyrich2022)). However, this literature generally assumes homogeneous behavioral bias. This assumption contradicts empirical evidence, such as heterogeneity in present bias (e.g., Ameriks et al. Reference Ameriks, Caplin, Leahy and Tyler2007; Chan, Reference Chan2017; Lockwood, Reference Lockwood2020), which affects the model’s predictive power. This evidence raises the following question: Can present bias heterogeneity help us better explain macroeconomic outcomes and guide policy design?

To answer these questions, we incorporate heterogeneous present-biased preferences into the model of Sargent et al. (Reference Sargent, Wang and Yang2021). For tractability, we model present-biased preferences with hyperbolic discount functions in the spirit of Harris and Laibson (Reference Harris and Laibson2013). This formulation captures that agents tend to make decisions using a discount rate that declines in relative time. This feature is in stark contrast to the exponential discount function, where the discount rate remains constant in relative time. Moreover, decision-making is time-inconsistent, so the agent is modeled as a sequence of temporal selves, and the optimal policies can be envisioned as an intrapersonal game between the successive selves. The current selfcontrols the household policies in the current period but derives utility from the entire stream of consumption chosen by her future selves. In our model, the economy is populated by agents with two types of present-biased preferences: completely sophisticated agents who correctly perceive future selves’ present bias and fully naive agents who ignore future selves’ present bias. Individual wealth accumulation is subject to random death shocks, and labor earnings are subject to random income shocks. The agent purchases a “reverse-life-insurance” contract that generates flow payoffs for the living agent in exchange for her terminal wealth upon death shock arrival. Due to market incompleteness, income risk is uninsurable. Access to debt is costly, and heavily indebted households can file for bankruptcy to reduce their leverage. Individuals make the optimal consumption and default choices, and capital market clearing conditions determine the equilibrium interest rate.

We find the following main novel results. First, heterogeneous present bias allows us to match the US average marginal propensity to consume (MPC) while simultaneously matching key statics for wealth distribution in the data. Typically, this is not possible in one-asset HANK models: if the supply of assets is large enough to match the average wealth in the economy, almost all of the households have accumulated a sufficient buffer stock against adverse shocks (Kaplan and Violante, Reference Kaplan and Violante2022). This strong self-insurance effect implies that almost all households should have relatively low MPCs. In our model, however, naive households overlook their future splurging and are overly optimistic about their future financial situations. Consequently, they are more likely to be hand-to-mouth (HtM).Footnote 1 In other words, a large share of naive households are indebted and thus exhibit a high marginal propensity to consume, driving up the average MPC. Sophisticated households, on the other hand, fully understand their future splurging and optimally save more to avoid future financial distress. As a result, wealth inequality in our model is higher than that in its homogeneous preference counterpart and closer to the empirical estimates. Based on our model with heterogenous present bias, we find that consumption is more responsive when fiscal stimulus targets households in the bottom half of wealth distribution.

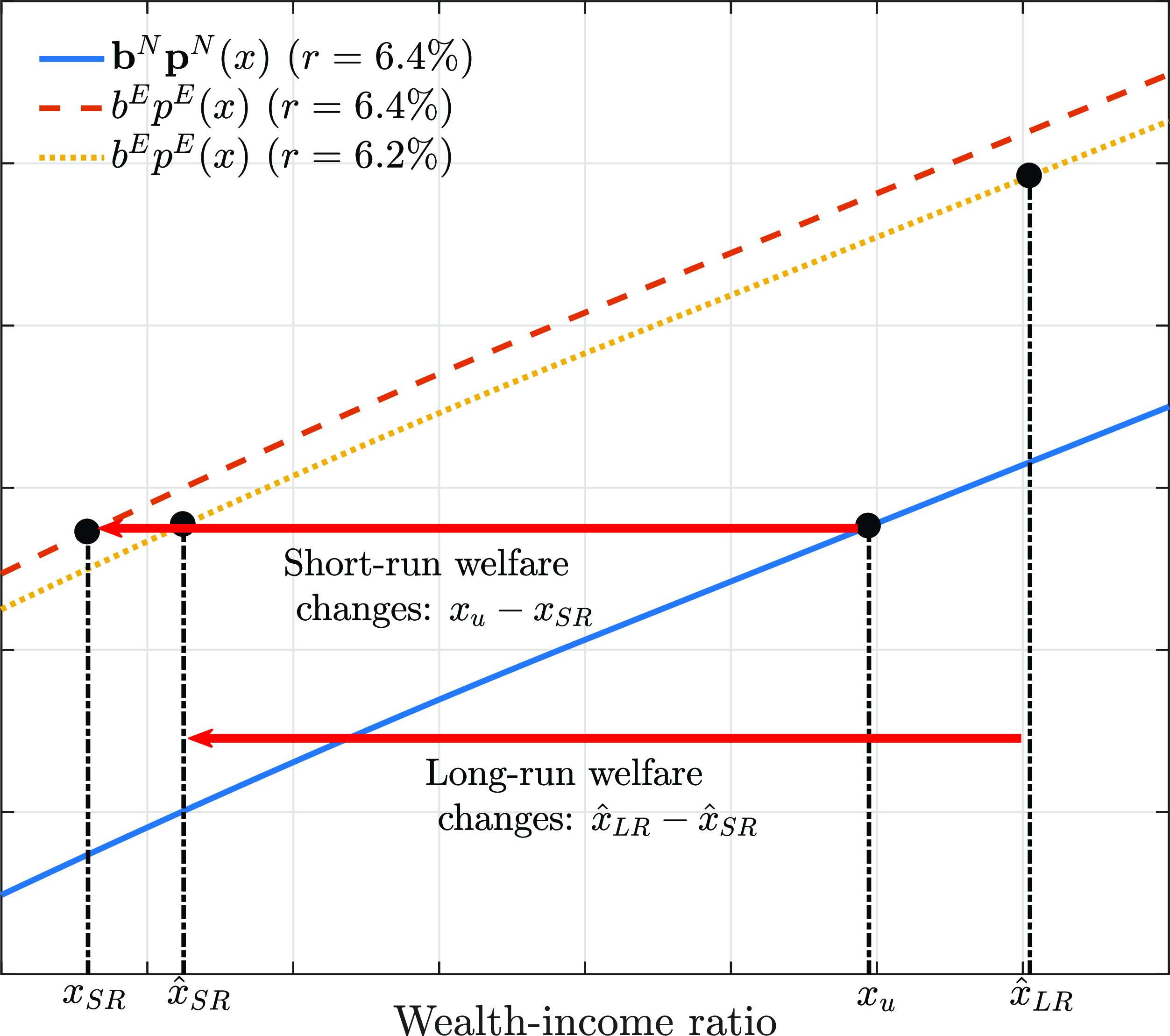

Second, we explore the welfare implications of a financial literacy campaign that effectively removes present bias. Eliminating present bias disciplines household overconsumption, which improves household welfare in the short run (with fixed interest rates and wealth distribution). Nevertheless, the dark side of the campaign arises when we study its long-run effect. Since present bias reduction encourages aggregate wealth accumulation in the economy, a larger capital supply reduces the equilibrium interest rate in the long run. Naive households with little wealth still benefit from the literacy campaign. Nevertheless, once the household accumulates more wealth, reducing present bias is no longer welfare-improving due to the cost of lower return on wealth accumulation. In a similar vein, for sophisticated households, a lower interest rate is always detrimental because it undermines their wealth accumulation incentives. Our result indicates that the literacy campaign, while potentially beneficial in some circumstances, can also lead to welfare losses, especially for households who stay away from financial distress.

Finally, we investigate the effectiveness of commitment devices such as borrowing cost penalties and illiquidity. They are both double-edged swords. On the cost side, inflexibility undermines consumption smoothing in the short run. On the benefit side, they reduce debt-fueled consumption, thereby disciplining borrowing incentives and improving welfare in the long run. Since they both help curb borrowing incentives, the negative impact of present bias and naivete are partially alleviated.

1.1. Related literature

Two groups of papers relate to this work. Our paper is most related to the research emphasizing the role of consumer heterogeneity in explaining endogenous consumption and wealth inequality. Krusell and Smith (Reference Krusell and Smith1998) find that heterogeneous impatience makes wealthier agents save more and better matches wealth inequality. Similarly, Sargent et al. (Reference Sargent, Wang and Yang2021) incorporate individuals’ survival probability interacted with their heterogeneous preferences about consumption plans to determine aggregate savings and the interest rate. In their model, wealth is more unequally distributed and has a fatter tail than labor earnings, as in US data. Epper et al. (Reference Epper, Fehr, Fehr-Duda, Kreiner, Lassen, Leth-Petersen and Rasmussen2020) combine data from preference-elicitation experiments with high-quality administrative data and provide empirical support for the positive relationship between patience heterogeneity and wealth inequality. Gelman (Reference Gelman2021) provides empirical evidence that transitory circumstances (i.e., cash on hand) and persistent characteristics (i.e., the discount factor) both play important roles in explaining the variance of the MPC. We incorporate heterogeneous degrees of present bias. This model helps match both the aggregate MPC level and the wealth distribution. In addition to the right tail of the wealth distribution, the endogenous wealth distribution aligns with the HtM proportion, median wealth, and mean wealth in the data.

Second, our study is connected to the fast-growing literature exploring hyperbolic discounting in consumption-saving choices (Acharya et al. Reference Acharya, Jimenez Gomez, Rachinskii and Rivera2022; Liu et al. Reference Liu, Niu, Wang and Yang2020; Maxted, Reference Maxted2022). Our model is closely related to Maxted (2022), who characterizes how present bias affects consumption, illiquid asset demand, and welfare. A key departure is that we focus on the impacts of heterogeneous preferences rather than the implications of present bias alone. We show that reducing the present bias of naive households gets them out of the debt trap but incurs negative welfare impacts on sophisticated households due to a lower equilibrium interest rate.

The remainder of the paper proceeds as follows. Section 2 sets up the model. Section 3 derives the solutions for optimal consumption policies. Section 4 presents the stationary distribution with preference heterogeneity. The quantitative results and welfare implications are discussed in Sections 5 and 6, respectively. Finally, we conclude the paper in Section 7.

2. Model setup

We develop a heterogeneous-agent model with uninsurable labor income and ex ante heterogeneity in present-biased preferences. Present bias distorts the intertemporal choices of consumers. Our model aims to explore how heterogeneous present bias affects the wealth distribution and aggregate MPC level.

2.1. Present-biased preferences and utility

2.1.1. Present bias

Suppose that the agent is risk averse and displays present bias in the form of quasi-hyperbolic discounting (Harris and Laibson, Reference Harris and Laibson2013). Time is divided into two periods: the current and the future. The agent exponentially discounts consumption flows in the current period with a discount rate

![]() $\rho \gt 0$

and further discounts future consumption flows with an additional discount factor

$\rho \gt 0$

and further discounts future consumption flows with an additional discount factor

![]() $\beta \in (0,1)$

, which undermines the present value of consumption flows in future periods.

$\beta \in (0,1)$

, which undermines the present value of consumption flows in future periods.

We model the agent as a sequence of temporal selves. Self

![]() $1$

is born at time

$1$

is born at time

![]() $t_1$

. She regards

$t_1$

. She regards

![]() $[t_{1},t_2)$

as the current period and treats

$[t_{1},t_2)$

as the current period and treats

![]() $[t_{2},\infty )$

as the future periods, and in the current period, she controls the consumption-saving decisions. At time

$[t_{2},\infty )$

as the future periods, and in the current period, she controls the consumption-saving decisions. At time

![]() $t_2$

, self

$t_2$

, self

![]() $2$

replaces self

$2$

replaces self

![]() $1$

. She takes control of the consumption-saving choices in the new current period

$1$

. She takes control of the consumption-saving choices in the new current period

![]() $[t_2,t_{3})$

and treats

$[t_2,t_{3})$

and treats

![]() $[t_{3},\infty )$

as the new future periods. Thus,

$[t_{3},\infty )$

as the new future periods. Thus,

![]() $T_n=t_{n+1}-t_n$

is the lifespan for self

$T_n=t_{n+1}-t_n$

is the lifespan for self

![]() $n$

. Assume that the lifespan of each self is exponentially distributed with the constant parameter

$n$

. Assume that the lifespan of each self is exponentially distributed with the constant parameter

![]() $\xi \gt 0$

. That is, the transition of selves is regulated by a Poisson process with a hazard rate

$\xi \gt 0$

. That is, the transition of selves is regulated by a Poisson process with a hazard rate

![]() $\xi$

. Repeating the process, we can obtain a sequence of selves

$\xi$

. Repeating the process, we can obtain a sequence of selves

![]() $n\in \{1,2,\ldots \}$

. They live in a sequence of time intervals

$n\in \{1,2,\ldots \}$

. They live in a sequence of time intervals

![]() $\{[t_1,t_{2}),[t_2,t_{3}),\ldots \}$

, which are independent and identically distributed (i.i.d.).

$\{[t_1,t_{2}),[t_2,t_{3}),\ldots \}$

, which are independent and identically distributed (i.i.d.).

Denote by

![]() $D_n(t,u)$

the quasi-hyperbolic discount function for self

$D_n(t,u)$

the quasi-hyperbolic discount function for self

![]() $n$

; thus, we have:

$n$

; thus, we have:

\begin{eqnarray} D_n(t,u)=\left \{ \begin{array}{l@{\quad}c} e^{-\rho (u-t)}, &{\textit{if }\ u\in [t_n,t_{n+1})}\\ \beta e^{-\rho (u-t)}, &{\textit{if }\ u\in [t_{n+1},\infty )} \end{array} \right . \end{eqnarray}

\begin{eqnarray} D_n(t,u)=\left \{ \begin{array}{l@{\quad}c} e^{-\rho (u-t)}, &{\textit{if }\ u\in [t_n,t_{n+1})}\\ \beta e^{-\rho (u-t)}, &{\textit{if }\ u\in [t_{n+1},\infty )} \end{array} \right . \end{eqnarray}

where

![]() $u\gt t$

and

$u\gt t$

and

![]() $t_n\lt t_{n+1}$

. For tractability, we focus on the limiting case when

$t_n\lt t_{n+1}$

. For tractability, we focus on the limiting case when

![]() $\xi \rightarrow \infty$

, known as the instantaneous gratification (IG) model pioneered by Harris and Laibson (Reference Harris and Laibson2013). In this case, the above discount function (1) becomes:

$\xi \rightarrow \infty$

, known as the instantaneous gratification (IG) model pioneered by Harris and Laibson (Reference Harris and Laibson2013). In this case, the above discount function (1) becomes:

\begin{eqnarray} D(t,u)=\left \{ \begin{array}{l@{\quad}c} 1, &{\textit{if }\ u=t}\\ \beta e^{-\rho (u-t)}, &{\textit{if }\ u\gt t} \end{array} \right . \end{eqnarray}

\begin{eqnarray} D(t,u)=\left \{ \begin{array}{l@{\quad}c} 1, &{\textit{if }\ u=t}\\ \beta e^{-\rho (u-t)}, &{\textit{if }\ u\gt t} \end{array} \right . \end{eqnarray}

A higher magnitude of present bias is measured by a smaller

![]() $\beta$

. If

$\beta$

. If

![]() $\beta =1$

, equation (2) reduces to the traditional exponential discount function.

$\beta =1$

, equation (2) reduces to the traditional exponential discount function.

Models related to present bias require an assumption about the extent to which agents are aware of their future self-control problems (O’Donoghue and Rabin, Reference O’Donoghue and Rabin1999, Reference O’Donoghue and Rabin2001). In this paper, we focus on two types of present-biased agents: (i) completely sophisticated agents, where the current self correctly perceives her future selves’ present bias (Laibson, Reference Laibson1997), and (ii) fully naive agents, where the current self (falsely) believes that her future selves will act in a time-consistent manner (Akerlof, Reference Akerlof1991).

2.1.2. Utility

Suppose that an agent is born at age

![]() $0$

and dies at a random nonnegative age

$0$

and dies at a random nonnegative age

![]() $\tau$

that is exponentially distributed with a constant mortality hazard rate

$\tau$

that is exponentially distributed with a constant mortality hazard rate

![]() $\lambda$

. Across agents, random deaths are statistically independent. To sustain a constant population, we assume that the newborn arrives at a constant rate

$\lambda$

. Across agents, random deaths are statistically independent. To sustain a constant population, we assume that the newborn arrives at a constant rate

![]() $\lambda$

per unit of time. The agent accrues constant relative risk aversion utility over positive consumption flows

$\lambda$

per unit of time. The agent accrues constant relative risk aversion utility over positive consumption flows

![]() $\{C_t\}_{t=0}^\tau$

:

$\{C_t\}_{t=0}^\tau$

:

where

![]() $\gamma$

denotes the coefficient of relative risk aversion.

$\gamma$

denotes the coefficient of relative risk aversion.

2.2. Labor income and household borrowing

In this section, we introduce two interrelated “regimes.” In a “normal” regime, the household decides her optimal consumption strategy and services her debt obligations. Once the household defaults on existing debt, she enters a “default” regime from which she cannot leave.

2.2.1. Normal regime

We model the labor income in the normal regime,

![]() $Y_t$

, as a diffusion process. All agents start life with identical labor earnings

$Y_t$

, as a diffusion process. All agents start life with identical labor earnings

![]() $Y_0\gt 0$

. The law of motion for labor income is given by:

$Y_0\gt 0$

. The law of motion for labor income is given by:

where

![]() $\mathcal{B}_t$

is a standard Brownian motion,

$\mathcal{B}_t$

is a standard Brownian motion,

![]() $\mu$

is an expected earnings growth rate, and

$\mu$

is an expected earnings growth rate, and

![]() $\sigma$

is a volatility of earnings.

$\sigma$

is a volatility of earnings.

Let

![]() $X_t$

be an agent’s wealth at time

$X_t$

be an agent’s wealth at time

![]() $t$

, and the initial wealth for all agents is equal to zero, that is,

$t$

, and the initial wealth for all agents is equal to zero, that is,

![]() $X_0=0$

. With liquid wealth

$X_0=0$

. With liquid wealth

![]() $X_t\gt 0$

, the agent can trade a risk-free financial asset that offers a constant risk-free rate of return

$X_t\gt 0$

, the agent can trade a risk-free financial asset that offers a constant risk-free rate of return

![]() $r$

and purchase an actuarially fair “reverse-life-insurance” contract that transfers end-of-life wealth

$r$

and purchase an actuarially fair “reverse-life-insurance” contract that transfers end-of-life wealth

![]() $X_{\tau ^-}$

at time

$X_{\tau ^-}$

at time

![]() $\tau$

to an insurance company in exchange for flow payoffs

$\tau$

to an insurance company in exchange for flow payoffs

![]() $\lambda X_t\gt 0$

until death. Conversely,

$\lambda X_t\gt 0$

until death. Conversely,

![]() $X_t\lt 0$

implies that the agent borrows on a credit card, she can transfer end-of-life debt to an insurance company by paying flow expenditures

$X_t\lt 0$

implies that the agent borrows on a credit card, she can transfer end-of-life debt to an insurance company by paying flow expenditures

![]() $\lambda X_t\lt 0$

; in addition, the agent should pay a borrowing wedge of

$\lambda X_t\lt 0$

; in addition, the agent should pay a borrowing wedge of

![]() $w^{r}\gt 0$

over the sum of the risk-free rate and the mortality hazard rate

$w^{r}\gt 0$

over the sum of the risk-free rate and the mortality hazard rate

![]() $r+\lambda$

. Accordingly, the wealth process is given by:

$r+\lambda$

. Accordingly, the wealth process is given by:

where

![]() $\mathcal{J}$

is a pure jump process with a constant arrival rate of

$\mathcal{J}$

is a pure jump process with a constant arrival rate of

![]() $\lambda$

and

$\lambda$

and

![]() $\unicode{x1D7D9}_{\{X_{t-}\lt 0\}}$

is an indicator function that equals one when

$\unicode{x1D7D9}_{\{X_{t-}\lt 0\}}$

is an indicator function that equals one when

![]() $X_{t-}\lt 0$

, zero otherwise. On the right-hand side of (5), the first term represents the saving rates

$X_{t-}\lt 0$

, zero otherwise. On the right-hand side of (5), the first term represents the saving rates

![]() $G_{t-}$

, and the second term captures a one-time transfer

$G_{t-}$

, and the second term captures a one-time transfer

![]() $X_{\tau ^-}$

from the agent to the insurance company at the stochastic death moment

$X_{\tau ^-}$

from the agent to the insurance company at the stochastic death moment

![]() $\tau$

when

$\tau$

when

![]() $d\mathcal{J}_{\tau }=1$

.

$d\mathcal{J}_{\tau }=1$

.

2.2.2. Default regime

Suppose that an agent’s labor income deteriorates sufficiently due to an economic downturn. In that case, the agent reneges on her debt and is henceforth shunned from credit markets, forcing her savings (and debts) to equal zero. This feature reflects that a majority of households go through bankruptcy file Chapter 7 — in which case debtors forfeit nonexempt assets in exchange for a discharge of eligible debts (Dobbie and Song, Reference Dobbie and Song2015).

Let

![]() $\tau _d$

denote the default arrival time and

$\tau _d$

denote the default arrival time and

![]() $\widehat Y_t$

denote the labor income in the default regime. Following Bos et al. (Reference Bos, Breza and Liberman2018), we assume that at time

$\widehat Y_t$

denote the labor income in the default regime. Following Bos et al. (Reference Bos, Breza and Liberman2018), we assume that at time

![]() $\tau _d$

, the labor income immediately drops from

$\tau _d$

, the labor income immediately drops from

![]() $Y_{\tau _d-}=\lim _{u\uparrow \tau _d-}Y_u$

, the pre-default income level, to

$Y_{\tau _d-}=\lim _{u\uparrow \tau _d-}Y_u$

, the pre-default income level, to

![]() $\widehat Y_{\tau _d}=\kappa Y_{\tau _d-}$

, where the constant

$\widehat Y_{\tau _d}=\kappa Y_{\tau _d-}$

, where the constant

![]() $(1-\kappa )\in (0,1)$

measures the degree of income loss incurred by default, and then the agent permanently enters a default regime. In this regime, the agent can no longer borrow or save

$(1-\kappa )\in (0,1)$

measures the degree of income loss incurred by default, and then the agent permanently enters a default regime. In this regime, the agent can no longer borrow or save

![]() $(X_t=0)$

, and the earnings

$(X_t=0)$

, and the earnings

![]() $\widehat Y_t$

follow the same process (4) as earnings in the normal regime:

$\widehat Y_t$

follow the same process (4) as earnings in the normal regime:

This process starts at time

![]() $\tau _d$

with the value of

$\tau _d$

with the value of

![]() $\widehat Y_{\tau _d}=\kappa Y_{\tau _d-}$

.

$\widehat Y_{\tau _d}=\kappa Y_{\tau _d-}$

.

3. Consumption-saving choice: Intrapersonal game

Under IG time preferences, each self faces self-control problems and disagrees with the expected consumption decisions of future selves. Hence, our consumption-saving problem is a dynamic intrapersonal game played by different selves of the same consumer (Strotz, Reference Strotz1955; Laibson, Reference Laibson1997). Following Harris and Laibson (Reference Harris and Laibson2013), we use a stationary Markov perfect equilibrium (MPE) as the solution concept for the intrapersonal game (Maskin and Tirole, Reference Maskin and Tirole2001). By doing so, a crucial property of IG preferences is that the intrapersonal equilibrium is unique and can be characterized by solving the model without present bias (Harris and Laibson, Reference Harris and Laibson2013; Maxted, Reference Maxted2022).

3.1. Normal regime

3.1.1. Valuation

Under sophisticated IG preferences, the agent correctly anticipates her future selves’ self-control problems. In this situation, the actual continuation-value function is given by:

\begin{eqnarray} F^S(X_t,Y_t)=\mathbb{E}_t\left [\int ^{\tau \wedge \tau ^S_d}_0 e^{-\rho (u-t)}U\left (C^S_u\right )du\right ], \end{eqnarray}

\begin{eqnarray} F^S(X_t,Y_t)=\mathbb{E}_t\left [\int ^{\tau \wedge \tau ^S_d}_0 e^{-\rho (u-t)}U\left (C^S_u\right )du\right ], \end{eqnarray}

where

![]() $C^S_t$

and

$C^S_t$

and

![]() $\tau ^S_d$

denote the consumption rate and default policy adopted by the sophisticated agent, respectively. Then, the actual current-value function is equal to:

$\tau ^S_d$

denote the consumption rate and default policy adopted by the sophisticated agent, respectively. Then, the actual current-value function is equal to:

The intuition for equation (8) is as follows. The current self discounts the utility of all future selves by

![]() $\beta$

. Nevertheless, in continuous time, the current self lives only for a vanishingly short time interval (

$\beta$

. Nevertheless, in continuous time, the current self lives only for a vanishingly short time interval (

![]() $\xi \rightarrow \infty$

); thus, the utility received by the current self has no measurable impact on the overall value function.

$\xi \rightarrow \infty$

); thus, the utility received by the current self has no measurable impact on the overall value function.

Under naive IG preferences, the household (incorrectly) believes that her future selves will behave according to standard exponential discounting. In this situation, the naive agent’s perceived continuation-value function satisfies:

\begin{eqnarray} F^E(X_t,Y_t)=\mathbb{E}_t\left [\int ^{\tau \wedge \tau ^E_d}_0 e^{-\rho (u-t)}U\left (C^E_u\right )du\right ], \end{eqnarray}

\begin{eqnarray} F^E(X_t,Y_t)=\mathbb{E}_t\left [\int ^{\tau \wedge \tau ^E_d}_0 e^{-\rho (u-t)}U\left (C^E_u\right )du\right ], \end{eqnarray}

where

![]() $C^E_t$

and

$C^E_t$

and

![]() $\tau ^E_d$

denote the consumption rate and default strategy adopted by the exponential agent, respectively. The perceived current-value function is

$\tau ^E_d$

denote the consumption rate and default strategy adopted by the exponential agent, respectively. The perceived current-value function is

Define

![]() $F^N(X,Y)$

and

$F^N(X,Y)$

and

![]() $C^N(X,Y)$

as the naive agent’s actual continuation-value function and consumption policy, respectively. Next, we show how to derive the optimal consumption policies in the presence of IG preferences.

$C^N(X,Y)$

as the naive agent’s actual continuation-value function and consumption policy, respectively. Next, we show how to derive the optimal consumption policies in the presence of IG preferences.

3.1.2. Optimal consumption rules

Under a stationary MPE, the Bellman equation for the type-

![]() $j$

agent is given by:

$j$

agent is given by:

\begin{eqnarray} \begin{split} (\rho +\lambda )F^j(X,Y)=& \underbrace{U(C^j)}_{\text{utility}} +\underbrace{G^j(X,Y){F^j_X(X,Y)}}_{\text{evolution of }dX} \\[5pt]&+\underbrace{\mu Y{F^j_Y(X,Y)}+\frac{\sigma ^2}{2}Y^2{F^j_{YY}(X,Y)}}_{\text{evolution of }dY},\quad j\in \{S,N\}, \end{split} \end{eqnarray}

\begin{eqnarray} \begin{split} (\rho +\lambda )F^j(X,Y)=& \underbrace{U(C^j)}_{\text{utility}} +\underbrace{G^j(X,Y){F^j_X(X,Y)}}_{\text{evolution of }dX} \\[5pt]&+\underbrace{\mu Y{F^j_Y(X,Y)}+\frac{\sigma ^2}{2}Y^2{F^j_{YY}(X,Y)}}_{\text{evolution of }dY},\quad j\in \{S,N\}, \end{split} \end{eqnarray}

which shows that the instantaneous change in value due to discounting and mortality risk,

![]() $ (\rho +\lambda )F^j(X,Y)$

, must equal the current utility flow,

$ (\rho +\lambda )F^j(X,Y)$

, must equal the current utility flow,

![]() $U(C^j)$

, plus the expected instantaneous change in the value function,

$U(C^j)$

, plus the expected instantaneous change in the value function,

![]() $\left (\mathbb{E}\left (dF^j\right )/dt\right )$

.

$\left (\mathbb{E}\left (dF^j\right )/dt\right )$

.

The consumption optimality conditions under sophistication and naivete are given by, respectively:

where the marginal utility of consumption on the left-hand side,

![]() $U^{\prime}(C^S)$

or

$U^{\prime}(C^S)$

or

![]() $U^{\prime}(C^N)$

, equals the marginal value of current liquid wealth on the right-hand side,

$U^{\prime}(C^N)$

, equals the marginal value of current liquid wealth on the right-hand side,

![]() $\beta F^S_X(X,Y)$

or

$\beta F^S_X(X,Y)$

or

![]() $\beta F^E_X(X,Y)$

.

$\beta F^E_X(X,Y)$

.

Two observations can be drawn from equation (12). First, present bias alters the consumption optimality condition by a multiplicative factor of

![]() $\beta$

. To see this, note that a standard exponential agent would determine consumption according to:Footnote 2

$\beta$

. To see this, note that a standard exponential agent would determine consumption according to:Footnote 2

Evidently, under IG preferences, the marginal value of current liquid wealth is discounted by

![]() $\beta$

, which arises because wealth is consumed by future selves whose utility is discounted by

$\beta$

, which arises because wealth is consumed by future selves whose utility is discounted by

![]() $\beta$

. Second, the optimality condition under sophistication uses the value function of the present-biased agent

$\beta$

. Second, the optimality condition under sophistication uses the value function of the present-biased agent

![]() $F^S(X,Y)$

. In contrast, the condition under naivete uses the value function of the exponential-discounting agent

$F^S(X,Y)$

. In contrast, the condition under naivete uses the value function of the exponential-discounting agent

![]() $F^E(X,F)$

. This difference reflects the naive agent’s (incorrect) belief.

$F^E(X,F)$

. This difference reflects the naive agent’s (incorrect) belief.

3.2. Default regime

In the default regime, wealth (or debt) is zero, and the household can neither borrow nor save. Hence, consumption equals labor income, and wealth is not an argument of the value function. Under this circumstance, behavioral bias cannot affect consumption rules, and thus, all agents behave as exponential discounters, whose value function is denoted by

![]() $\widehat F^E(\widehat Y)$

. This function satisfies the following differential equation:

$\widehat F^E(\widehat Y)$

. This function satisfies the following differential equation:

where

![]() $\widehat C^E=\widehat Y$

. The first term on the right-hand side of (14) gives the utility received by the household in the default regime. The second and third terms capture the impact of drift and volatility of income on the household’s value function

$\widehat C^E=\widehat Y$

. The first term on the right-hand side of (14) gives the utility received by the household in the default regime. The second and third terms capture the impact of drift and volatility of income on the household’s value function

![]() $\widehat F^E(\widehat Y)$

, respectively.

$\widehat F^E(\widehat Y)$

, respectively.

3.2.1. Debt capacity

$\underline{X}_t$

$\underline{X}_t$

In the two regimes, the value functions

![]() $F^j(X,Y)$

and

$F^j(X,Y)$

and

![]() $\widehat F^E(\widehat Y)$

are connected by the transition from the normal to the default regime. To see this, note that upon default, the labor earnings decrease from

$\widehat F^E(\widehat Y)$

are connected by the transition from the normal to the default regime. To see this, note that upon default, the labor earnings decrease from

![]() $Y_{t-}$

to

$Y_{t-}$

to

![]() $Y_t=\kappa Y_{t-}$

, and the wealth jumps from

$Y_t=\kappa Y_{t-}$

, and the wealth jumps from

![]() $X_{t-}\lt 0$

to

$X_{t-}\lt 0$

to

![]() $X_t=0$

. As a result, the value of wealth at the default time, which we denote by

$X_t=0$

. As a result, the value of wealth at the default time, which we denote by

![]() $\underline{X}_t$

and makes the household indifferent between repaying her debt and defaulting, satisfies the following value-matching condition:

$\underline{X}_t$

and makes the household indifferent between repaying her debt and defaulting, satisfies the following value-matching condition:

We refer to

![]() $\underline{X}_t$

as the household’s debt capacity since it is the maximum amount of debt the household can borrow without triggering default in equilibrium. For tractability, we assume that when the household’s income is less than the interest payments to debt, that is,

$\underline{X}_t$

as the household’s debt capacity since it is the maximum amount of debt the household can borrow without triggering default in equilibrium. For tractability, we assume that when the household’s income is less than the interest payments to debt, that is,

![]() $Y_t\lt -(r+\lambda +w^r)X_t$

, the household defaults. Therefore, the debt capacity

$Y_t\lt -(r+\lambda +w^r)X_t$

, the household defaults. Therefore, the debt capacity

![]() $\underline{X}_t$

is a function of

$\underline{X}_t$

is a function of

![]() $Y_t$

and equals:

$Y_t$

and equals:

3.3. Exploiting the homogeneity property

To solve the Bellman equation (11), a key step in our derivation is to establish that the value function in the normal regime,

![]() $F^j(X,Y)$

, takes the following form:

$F^j(X,Y)$

, takes the following form:

where the constant

![]() $b^j$

is defined in Appendix A. The function

$b^j$

is defined in Appendix A. The function

![]() $P^j(X,Y)$

is interpreted as the certainty-equivalent wealth (CEW), which is the total wealth that makes the household indifferent between the status quo (with liquid wealth

$P^j(X,Y)$

is interpreted as the certainty-equivalent wealth (CEW), which is the total wealth that makes the household indifferent between the status quo (with liquid wealth

![]() $X$

and labor income

$X$

and labor income

![]() $Y$

) and having a wealth level

$Y$

) and having a wealth level

![]() $P(X,Y)$

with no labor earnings:

$P(X,Y)$

with no labor earnings:

Similarly, we show that the value function in the default regime,

![]() $\widehat F^E(\widehat Y)$

, is given by:

$\widehat F^E(\widehat Y)$

, is given by:

where the constant

![]() $b^E$

is given in Appendix A and

$b^E$

is given in Appendix A and

![]() $\widehat P^E(\widehat Y)$

is the CEW in the default regime. By linking the agent’s value function to her CEW, we can transform the agent’s payoff from the value function to the CEW.

$\widehat P^E(\widehat Y)$

is the CEW in the default regime. By linking the agent’s value function to her CEW, we can transform the agent’s payoff from the value function to the CEW.

Applying the homogeneity property, we can analyze the (scaled) CEW

![]() $p^j(x)=P^j(X,Y)/Y$

and the consumption-income ratio

$p^j(x)=P^j(X,Y)/Y$

and the consumption-income ratio

![]() $c^j(x)=C^j(X,Y)/Y$

in terms of a single state variable,

$c^j(x)=C^j(X,Y)/Y$

in terms of a single state variable,

![]() $x=X/Y$

, which denotes the wealth-income ratio. Equation (16) shows that the (scaled) debt capacity

$x=X/Y$

, which denotes the wealth-income ratio. Equation (16) shows that the (scaled) debt capacity

![]() $\underline{x}=\underline{X}/Y=-1/(r+\lambda +w^r)$

is a constant and independent of the present bias parameter

$\underline{x}=\underline{X}/Y=-1/(r+\lambda +w^r)$

is a constant and independent of the present bias parameter

![]() $\beta$

. By using Ito’s lemma, the law of motion for the wealth-income ratio process is given by:

$\beta$

. By using Ito’s lemma, the law of motion for the wealth-income ratio process is given by:

\begin{eqnarray} dx^j_t=\underbrace{\left [1+\left (r+\lambda +w^{r}\unicode{x1D7D9}_{\left \{x^j_{t-}\lt 0\right \}} -\mu +\sigma ^2\right )x^j_{t-}-c^j_{t-}\right ]}_{\text{saving rate, }g^j_{t-}}dt -\sigma x^j_{t-}d\mathcal{B}_t -x^j_{t-}d\mathcal{J}_t. \end{eqnarray}

\begin{eqnarray} dx^j_t=\underbrace{\left [1+\left (r+\lambda +w^{r}\unicode{x1D7D9}_{\left \{x^j_{t-}\lt 0\right \}} -\mu +\sigma ^2\right )x^j_{t-}-c^j_{t-}\right ]}_{\text{saving rate, }g^j_{t-}}dt -\sigma x^j_{t-}d\mathcal{B}_t -x^j_{t-}d\mathcal{J}_t. \end{eqnarray}

The following proposition summarizes the main results in this section.

Proposition 1. (Present bias and overconsumption) The optimal consumption rules for sophisticated and naive agents are given by, respectively:

where

![]() $c^{E}(x)=\left (b^E\right )^{1-1/\gamma }p^{E}(x)\left (p^{E^{\prime}}(x)\right )^{-1/\gamma }$

denotes the consumption-income ratio adopted by the exponential-discounting agent and the scaled CEW

$c^{E}(x)=\left (b^E\right )^{1-1/\gamma }p^{E}(x)\left (p^{E^{\prime}}(x)\right )^{-1/\gamma }$

denotes the consumption-income ratio adopted by the exponential-discounting agent and the scaled CEW

![]() $p^E(x)$

in the normal regime (

$p^E(x)$

in the normal regime (

![]() $x\geq \underline{x}$

) solves the following ordinary differential equation (ODE):

$x\geq \underline{x}$

) solves the following ordinary differential equation (ODE):

\begin{eqnarray} \begin{split} 0=&\left [\frac{\gamma \left (b^Ep^{E^{\prime}}(x)\right )^{1-1/\gamma }-(\rho +\lambda )}{1-\gamma }+\mu -\frac{\gamma \sigma ^2}{2}\right ]p^E(x) +p^{E^{\prime}}(x) \\&+\left (r+\lambda +w^{r}\unicode{x1D7D9}_{\{x\lt 0\}}-\mu +\gamma \sigma ^2\right )xp^{E^{\prime}}(x) +\frac{\sigma ^2x^2}{2}\left [p^{E^{\prime\prime}}(x)-\gamma \frac{\left (p^{E^{\prime}}(x)\right )^2}{p^{E}(x)}\right ]. \end{split} \end{eqnarray}

\begin{eqnarray} \begin{split} 0=&\left [\frac{\gamma \left (b^Ep^{E^{\prime}}(x)\right )^{1-1/\gamma }-(\rho +\lambda )}{1-\gamma }+\mu -\frac{\gamma \sigma ^2}{2}\right ]p^E(x) +p^{E^{\prime}}(x) \\&+\left (r+\lambda +w^{r}\unicode{x1D7D9}_{\{x\lt 0\}}-\mu +\gamma \sigma ^2\right )xp^{E^{\prime}}(x) +\frac{\sigma ^2x^2}{2}\left [p^{E^{\prime\prime}}(x)-\gamma \frac{\left (p^{E^{\prime}}(x)\right )^2}{p^{E}(x)}\right ]. \end{split} \end{eqnarray}

The boundary conditions for (22) are

where the constant

![]() $q={1}/\left ({r+\lambda -\mu }\right )$

and the scaled value in the default regime,

$q={1}/\left ({r+\lambda -\mu }\right )$

and the scaled value in the default regime,

![]() $\hat p^E=\widehat P^E(\widehat Y)/\widehat Y$

, is:

$\hat p^E=\widehat P^E(\widehat Y)/\widehat Y$

, is:

\begin{eqnarray} \hat p^E=\left (b^E\right )^{-1}\left [\rho +\lambda -(1-\gamma ) \left (\mu -\frac{\gamma \sigma ^2}{2}\right )\right ]^{\frac{1}{\gamma -1}}. \end{eqnarray}

\begin{eqnarray} \hat p^E=\left (b^E\right )^{-1}\left [\rho +\lambda -(1-\gamma ) \left (\mu -\frac{\gamma \sigma ^2}{2}\right )\right ]^{\frac{1}{\gamma -1}}. \end{eqnarray}

To ensure that

![]() $\hat p^E$

is nonnegative, we impose the following condition:

$\hat p^E$

is nonnegative, we impose the following condition:

Proof. All proofs are presented in Appendix A.

The economic interpretation of Proposition1 is as follows. First, equation (21) implies that relative to the exponential-discounting agent, sophistication (naivete) induces overconsumption by a multiplicative factor of

![]() $\frac{\gamma }{\gamma +\beta -1}\gt 1$

(

$\frac{\gamma }{\gamma +\beta -1}\gt 1$

(

![]() ${\beta }^{-\frac{1}{\gamma }}\gt 1$

), since

${\beta }^{-\frac{1}{\gamma }}\gt 1$

), since

![]() $\beta \in (0,1)$

. This result is intuitive: Under IG preferences, the desire for instantaneous gratification drives the agent to overconsume. Second, the first condition in equation (23) follows from the value-matching condition (15) at the default threshold. The second condition implies that when the wealth

$\beta \in (0,1)$

. This result is intuitive: Under IG preferences, the desire for instantaneous gratification drives the agent to overconsume. Second, the first condition in equation (23) follows from the value-matching condition (15) at the default threshold. The second condition implies that when the wealth

![]() $X$

approaches infinity, the CEW

$X$

approaches infinity, the CEW

![]() $\lim _{X\rightarrow \infty }P^E(X,Y)=X+qY$

is simply the sum of wealth

$\lim _{X\rightarrow \infty }P^E(X,Y)=X+qY$

is simply the sum of wealth

![]() $X$

and the “human” wealth

$X$

and the “human” wealth

![]() $qY$

, which is proportional to contemporaneous income. This is because the agent can use holdings of the single risk-free asset completely to buffer all idiosyncratic labor-earning shocks.

$qY$

, which is proportional to contemporaneous income. This is because the agent can use holdings of the single risk-free asset completely to buffer all idiosyncratic labor-earning shocks.

4. Ex ante preference heterogeneity

A central result in this section regards how ex ante preference heterogeneity alters the equilibrium wealth distribution. To this end, we assume that the economy is populated by naive and sophisticated agents. These two groups of agents differ not only in their awareness of future present bias but also in the degree of present bias. We assume that naive agents are more present-biased than their sophisticated counterparts, that is,

![]() $0\lt \beta ^N\lt \beta ^S\lt 1$

. Let

$0\lt \beta ^N\lt \beta ^S\lt 1$

. Let

![]() $\eta ^N$

denote the proportion of naive agents and

$\eta ^N$

denote the proportion of naive agents and

![]() $\eta ^S$

denote the proportion of sophisticated agents, where

$\eta ^S$

denote the proportion of sophisticated agents, where

![]() $\eta ^N+\eta ^S=1$

.

$\eta ^N+\eta ^S=1$

.

4.1. Stationary distribution

4.1.1. Stationary probability density function

Let

![]() $X^j_t$

and

$X^j_t$

and

![]() $Y^j_t$

denote the type-

$Y^j_t$

denote the type-

![]() $j$

agent’s wealth and labor earnings at time

$j$

agent’s wealth and labor earnings at time

![]() $t$

, respectively. To calculate the cross-sectional stationary probability density of labor earnings

$t$

, respectively. To calculate the cross-sectional stationary probability density of labor earnings

![]() $\phi ^j_{Y}(Y)$

and wealth

$\phi ^j_{Y}(Y)$

and wealth

![]() $\phi ^j_{X}(X)$

, we start by solving the cross-sectional joint distribution of wealth and labor earnings

$\phi ^j_{X}(X)$

, we start by solving the cross-sectional joint distribution of wealth and labor earnings

![]() $\phi ^j_{XY}(X,Y)$

. After obtaining

$\phi ^j_{XY}(X,Y)$

. After obtaining

![]() $\phi ^j_{XY}(X,Y)$

, we can compute the cross-sectional stationary distributions of wealth and income by integrating over

$\phi ^j_{XY}(X,Y)$

, we can compute the cross-sectional stationary distributions of wealth and income by integrating over

![]() $Y$

and

$Y$

and

![]() $X$

, respectively:

$X$

, respectively:

Define

![]() $X_t$

and

$X_t$

and

![]() $Y_t$

as the aggregate wealth and labor income in the economy, respectively. After obtaining the probability density function for each group, we can compute the expectation of aggregate wealth

$Y_t$

as the aggregate wealth and labor income in the economy, respectively. After obtaining the probability density function for each group, we can compute the expectation of aggregate wealth

![]() $\mathbb{E}(X)$

and aggregate earnings

$\mathbb{E}(X)$

and aggregate earnings

![]() $\mathbb{E}(Y)$

according to:

$\mathbb{E}(Y)$

according to:

where

![]() $\mathbb{E}(X^j)=\int _{-\infty }^{+\infty } X\phi ^j_X(X)dX$

and

$\mathbb{E}(X^j)=\int _{-\infty }^{+\infty } X\phi ^j_X(X)dX$

and

![]() $\mathbb{E}(Y^j)=\int _{0}^{+\infty } Y\phi ^j_Y(Y)dY$

are the average wealth and income for type-

$\mathbb{E}(Y^j)=\int _{0}^{+\infty } Y\phi ^j_Y(Y)dY$

are the average wealth and income for type-

![]() $j$

group of agents, respectively.

$j$

group of agents, respectively.

4.1.2. Simulation of stationary distribution

We compute the cross-sectional equilibrium wealth and income distribution by simulation. Specifically, we start by simulating a path of the standard Brownian motion

![]() $\mathcal{B}_t$

with

$\mathcal{B}_t$

with

![]() $\mathcal{B}_0=0$

. Next, we use the process for

$\mathcal{B}_0=0$

. Next, we use the process for

![]() $x^j_t$

given in (20) together with the optimal consumption-income ratio

$x^j_t$

given in (20) together with the optimal consumption-income ratio

![]() $c^j(x_t)$

given in (21) to obtain the path for the agents’ wealth-income ratio

$c^j(x_t)$

given in (21) to obtain the path for the agents’ wealth-income ratio

![]() $x^j_t$

with

$x^j_t$

with

![]() $x^j_0=X_0/Y_0=0$

. Once

$x^j_0=X_0/Y_0=0$

. Once

![]() $x^j_t$

is less than the debt capacity

$x^j_t$

is less than the debt capacity

![]() $\underline{x}$

, this agent immediately enters the default regime, and her debt becomes zero, which implies that her wealth-income ratio equals zero forever until she dies. Then, we substitute the simulated path of

$\underline{x}$

, this agent immediately enters the default regime, and her debt becomes zero, which implies that her wealth-income ratio equals zero forever until she dies. Then, we substitute the simulated path of

![]() $\mathcal{B}_t$

into the process for labor earnings given in (4) with the initial value

$\mathcal{B}_t$

into the process for labor earnings given in (4) with the initial value

![]() $Y_0$

and then derive the corresponding simulated path for

$Y_0$

and then derive the corresponding simulated path for

![]() $Y^j_t$

. If the agent defaults during her life, the income drops from

$Y^j_t$

. If the agent defaults during her life, the income drops from

![]() $Y^j_{t-}$

to

$Y^j_{t-}$

to

![]() $Y^j_t=\kappa Y^j_{t-}$

, and we use the process given in (6) to generate the path for labor earnings in the default regime. Finally, we derive the wealth

$Y^j_t=\kappa Y^j_{t-}$

, and we use the process given in (6) to generate the path for labor earnings in the default regime. Finally, we derive the wealth

![]() $X^j_t$

by multiplying the two paths

$X^j_t$

by multiplying the two paths

![]() $x^j_t$

and

$x^j_t$

and

![]() $Y^j_t$

at each

$Y^j_t$

at each

![]() $t$

. When an agent dies, we bring in a new agent with zero wealth and

$t$

. When an agent dies, we bring in a new agent with zero wealth and

![]() $Y_0$

. We continue this process until we reach a very high number of years. In this economy, the proportion of naive to sophisticated households is fixed at

$Y_0$

. We continue this process until we reach a very high number of years. In this economy, the proportion of naive to sophisticated households is fixed at

![]() $\eta ^N/\eta ^S$

.

$\eta ^N/\eta ^S$

.

4.1.3. Wealth inequality

To numerically illustrate the impacts of preference heterogeneity on wealth inequality, we introduce two widely used measures of inequality. First, the Lorenz curve of wealth

![]() $\mathcal{L}_X(z)$

measures the proportion of aggregate wealth captured by the bottom

$\mathcal{L}_X(z)$

measures the proportion of aggregate wealth captured by the bottom

![]() $z$

percent of people, which is given by:

$z$

percent of people, which is given by:

\begin{eqnarray} \mathcal{L}_X(z)=\frac{\int _{0}^z\Phi _X^{-1}(z)dz}{\int _0^1\Phi _X^{-1}(z)dz}, \end{eqnarray}

\begin{eqnarray} \mathcal{L}_X(z)=\frac{\int _{0}^z\Phi _X^{-1}(z)dz}{\int _0^1\Phi _X^{-1}(z)dz}, \end{eqnarray}

where

![]() $\Phi _X^{-1}({\cdot})$

is the inverse of the cumulative distribution function (CDF),

$\Phi _X^{-1}({\cdot})$

is the inverse of the cumulative distribution function (CDF),

![]() $\Phi _X({\cdot})$

. Second, previous literature also applies the Gini coefficient to measure the magnitude of wealth inequality, which equals:

$\Phi _X({\cdot})$

. Second, previous literature also applies the Gini coefficient to measure the magnitude of wealth inequality, which equals:

4.2. Equilibrium interest rate

Assume that a representative firm operates a production function

![]() $F(K,L)=AK^\alpha L^{1-\alpha }$

, where

$F(K,L)=AK^\alpha L^{1-\alpha }$

, where

![]() $\alpha \in (0,1)$

,

$\alpha \in (0,1)$

,

![]() $A\gt 0$

represents productivity,

$A\gt 0$

represents productivity,

![]() $K$

denotes the aggregate capital stock that depreciates at a constant rate

$K$

denotes the aggregate capital stock that depreciates at a constant rate

![]() $\delta \gt 0$

, and

$\delta \gt 0$

, and

![]() $L$

is the aggregate labor stock. The firm rents capital and labor in competitive markets. In the stationary equilibrium, capital demand equals capital supply:

$L$

is the aggregate labor stock. The firm rents capital and labor in competitive markets. In the stationary equilibrium, capital demand equals capital supply:

Suppose each agent inelastically supplies

![]() $H\gt 0$

h of labor. In equilibrium, labor demand equals labor supply

$H\gt 0$

h of labor. In equilibrium, labor demand equals labor supply

![]() $L=H$

. Define

$L=H$

. Define

![]() $w=\mathbb{E}(Y)/H$

as an average wage rate across all agents. Since aggregate labor cost

$w=\mathbb{E}(Y)/H$

as an average wage rate across all agents. Since aggregate labor cost

![]() $wL$

equals aggregate labor earnings

$wL$

equals aggregate labor earnings

![]() $wH$

, the law of large numbers implies

$wH$

, the law of large numbers implies

Now, the steady-state equilibrium interest rate

![]() $r$

can be stated as follows.

$r$

can be stated as follows.

Proposition 2. (Equilibrium interest rate with preference heterogeneity). In a competitive equilibrium, the firm’s optimization problem indicates that the equilibrium interest rate

![]() $r$

is given by:

$r$

is given by:

where the third equality follows from the expression for the equilibrium average wage rate:

Given the interest rate

![]() $r$

, the equilibrium wage rate

$r$

, the equilibrium wage rate

![]() $w$

, initial labor earnings

$w$

, initial labor earnings

![]() $Y_0$

, and aggregate capital

$Y_0$

, and aggregate capital

![]() $K$

are jointly determined by equations (31) through (33).Footnote 3

$K$

are jointly determined by equations (31) through (33).Footnote 3

Proposition3 shows that a higher expected wealth

![]() $\mathbb{E}(X)$

incurs a lower equilibrium interest rate. To understand this result, note that the equilibrium interest rate is determined by the representative firm’s demand for capital and household savings. A higher

$\mathbb{E}(X)$

incurs a lower equilibrium interest rate. To understand this result, note that the equilibrium interest rate is determined by the representative firm’s demand for capital and household savings. A higher

![]() $\mathbb{E}(X)$

implies that household saving increases, thus raising the capital supply. To strengthen the firm’s demand for capital and clear the asset market, the equilibrium interest rate

$\mathbb{E}(X)$

implies that household saving increases, thus raising the capital supply. To strengthen the firm’s demand for capital and clear the asset market, the equilibrium interest rate

![]() $r$

must decrease. By contrast, a higher expected labor income

$r$

must decrease. By contrast, a higher expected labor income

![]() $\mathbb{E}(Y)$

leads to a higher equilibrium interest rate. This is because a higher

$\mathbb{E}(Y)$

leads to a higher equilibrium interest rate. This is because a higher

![]() $\mathbb{E}(Y)$

strengthens the agent’s incentive to consume; thus, the representative firm will demand more capital for production. As a result, the equilibrium interest rate increases to encourage savings.

$\mathbb{E}(Y)$

strengthens the agent’s incentive to consume; thus, the representative firm will demand more capital for production. As a result, the equilibrium interest rate increases to encourage savings.

5. Quantitative results

This section analyzes the main results. Section 5.1 describes the parameter values used in our model. Section 5.2 characterizes the properties of optimal consumption-saving rules in the presence of present bias. Section 5.3 analyzes the impacts of present-biased preferences on the average MPC and wealth distribution. Finally, we study the efficiency of wealth targeted stimulus payments in Section 5.4.

5.1 Calibration

First, we follow Prescott (Reference Prescott1986) and Cooley and Prescott (Reference Cooley and Prescott1995) and set the capital share of income

![]() $\alpha$

to 0.36. We set an annual depreciation rate of

$\alpha$

to 0.36. We set an annual depreciation rate of

![]() $\delta$

to

$\delta$

to

![]() $1.6\%$

to match an aggregate capital-output ratio

$1.6\%$

to match an aggregate capital-output ratio

![]() $K/F(K,L)$

to

$K/F(K,L)$

to

![]() $4.5$

as reported in Piketty (Reference Piketty2014). We set the productivity parameter

$4.5$

as reported in Piketty (Reference Piketty2014). We set the productivity parameter

![]() $A$

to

$A$

to

![]() $0.774$

, so that the wage rate

$0.774$

, so that the wage rate

![]() $w$

for an agent with the average labor efficiency equals unity. We set the coefficient of risk aversion

$w$

for an agent with the average labor efficiency equals unity. We set the coefficient of risk aversion

![]() $\gamma$

to

$\gamma$

to

![]() $1.5$

, as in Attanasio et al. (Reference Attanasio, Banks, Meghir and Weber1999) and Gourinchas and Parker (Reference Gourinchas and Parker2002). Following Castañeda, Díaz-Giménez, and Ríos- Rull (Reference Castañeda, Díaz-Giménez and Ríos-Rull2003), we set the hazard parameter

$1.5$

, as in Attanasio et al. (Reference Attanasio, Banks, Meghir and Weber1999) and Gourinchas and Parker (Reference Gourinchas and Parker2002). Following Castañeda, Díaz-Giménez, and Ríos- Rull (Reference Castañeda, Díaz-Giménez and Ríos-Rull2003), we set the hazard parameter

![]() $\lambda =0.0167$

to target an agent’s expected lifetime at

$\lambda =0.0167$

to target an agent’s expected lifetime at

![]() $1/\lambda =60$

years. We assume that the present bias parameter

$1/\lambda =60$

years. We assume that the present bias parameter

![]() $\beta$

ranges from

$\beta$

ranges from

![]() $0.5$

to

$0.5$

to

![]() $1$

. This is consistent with the literature, such as Laibson (Reference Laibson1997), Harris and Laibson (Reference Harris and Laibson2013), and Laibson et al. (Reference Laibson, Lee, Maxted, Repetto and Tobacman2024).

$1$

. This is consistent with the literature, such as Laibson (Reference Laibson1997), Harris and Laibson (Reference Harris and Laibson2013), and Laibson et al. (Reference Laibson, Lee, Maxted, Repetto and Tobacman2024).

Second, we calibrate the expected income growth

![]() $\mu$

and labor earnings growth volatility

$\mu$

and labor earnings growth volatility

![]() $\sigma$

by targeting a pair of quantities: a mean labor income of

$\sigma$

by targeting a pair of quantities: a mean labor income of

![]() $\$106,250$

(see 2019 Survey of Consumer Finances, SCFFootnote 4) and a Gini coefficient for the cross-sectional labor earnings of

$\$106,250$

(see 2019 Survey of Consumer Finances, SCFFootnote 4) and a Gini coefficient for the cross-sectional labor earnings of

![]() $0.63$

(Castañeda, Díaz–Giménez, and Ríos– Rull, Reference Castañeda, Díaz-Giménez and Ríos-Rull2003). Similarly, De Nardi (Reference De Nardi2004) targets the Gini coefficient of labor earnings by calibrating income growth volatility. The calibrated values are

$0.63$

(Castañeda, Díaz–Giménez, and Ríos– Rull, Reference Castañeda, Díaz-Giménez and Ríos-Rull2003). Similarly, De Nardi (Reference De Nardi2004) targets the Gini coefficient of labor earnings by calibrating income growth volatility. The calibrated values are

![]() $\mu =1.28\%$

and

$\mu =1.28\%$

and

![]() $\sigma =9.76\%$

. These values are also in line with estimates reported by Meghir and Pistaferri (Reference Meghir and Pistaferri2011).

$\sigma =9.76\%$

. These values are also in line with estimates reported by Meghir and Pistaferri (Reference Meghir and Pistaferri2011).

Finally, we want an average equilibrium wealth of

![]() $\$746,820$

as in the 2019 SCF, which in light of equation (32) leads to an equilibrium interest rate

$\$746,820$

as in the 2019 SCF, which in light of equation (32) leads to an equilibrium interest rate

![]() $r$

equals

$r$

equals

![]() $6.4\%$

per annum. With respect to household borrowing and default, we set the borrowing wedge

$6.4\%$

per annum. With respect to household borrowing and default, we set the borrowing wedge

![]() $w^r$

to

$w^r$

to

![]() $12.46\%$

and the income loss parameter

$12.46\%$

and the income loss parameter

![]() $\kappa$

to

$\kappa$

to

![]() $0.3$

.

$0.3$

.

5.2 Optimal consumption policies and present bias

Figure 1.

Effects of present bias on consumption-saving rules. This picture depicts the optimal consumption and saving rules. Solid blue lines represent the exponential-discounting case, red dashed lines represent the sophisticated case (

![]() $\beta ^S=0.783$

), and yellow dotted lines represent the naive case (

$\beta ^S=0.783$

), and yellow dotted lines represent the naive case (

![]() $\beta ^N=0.783$

). Under naive (sophisticated) beliefs, the steady-state wealth-income ratio is

$\beta ^N=0.783$

). Under naive (sophisticated) beliefs, the steady-state wealth-income ratio is

![]() $\tilde x^N=-0.085$

(

$\tilde x^N=-0.085$

(

![]() $\tilde x^S=-0.071$

). Other parameter values are reported in Table 1.

$\tilde x^S=-0.071$

). Other parameter values are reported in Table 1.

First, Panel A of Figure 1 plots the optimal consumption-income ratio against the wealth-income ratio

![]() $x$

.Footnote 5 When the credit limit is distant (i.e.,

$x$

.Footnote 5 When the credit limit is distant (i.e.,

![]() $x\geq 0$

), the consumption-income ratio

$x\geq 0$

), the consumption-income ratio

![]() $c(x)$

is increasing and concave in

$c(x)$

is increasing and concave in

![]() $x$

. This is due to the optimal response to buffer shocks and avoiding reliance on costly credit. Specifically, the instantaneous MPC

$x$

. This is due to the optimal response to buffer shocks and avoiding reliance on costly credit. Specifically, the instantaneous MPC

![]() $c^{\prime}(x)$

depicted in Panel B of Figure 1 is given by:Footnote 6

$c^{\prime}(x)$

depicted in Panel B of Figure 1 is given by:Footnote 6

Equation (34) shows that the instantaneous MPC

![]() $c^{\prime}(x)$

is jointly determined by (i) the complete-market MPC

$c^{\prime}(x)$

is jointly determined by (i) the complete-market MPC

![]() $m$

, a constant given in Appendix A, (ii) the endogenous risk aversion

$m$

, a constant given in Appendix A, (ii) the endogenous risk aversion

![]() $\gamma _e(x)\gt 0$

, and (iii) the marginal value of liquidity

$\gamma _e(x)\gt 0$

, and (iii) the marginal value of liquidity

![]() $p^{\prime}(x)\gt 0$

; a higher level of endogenous risk aversion or a lower marginal value of liquidity induce a higher instantaneous MPC

$p^{\prime}(x)\gt 0$

; a higher level of endogenous risk aversion or a lower marginal value of liquidity induce a higher instantaneous MPC

![]() $c^{\prime}(x)$

. As the wealth-income ratio

$c^{\prime}(x)$

. As the wealth-income ratio

![]() $x$

increases, self-insurance against income shocks becomes more effective so that

$x$

increases, self-insurance against income shocks becomes more effective so that

![]() $\gamma _e(x)$

and

$\gamma _e(x)$

and

![]() $p^{\prime}(x)$

jointly decline. Since the impact of

$p^{\prime}(x)$

jointly decline. Since the impact of

![]() $\gamma _e(x)$

plays a dominant role, consumption becomes less responsive to changes in wealth, explaining that

$\gamma _e(x)$

plays a dominant role, consumption becomes less responsive to changes in wealth, explaining that

![]() $c^{\prime}(x)$

is decreasing in

$c^{\prime}(x)$

is decreasing in

![]() $x$

. In the limit

$x$

. In the limit

![]() $x\rightarrow \infty$

, self-insurance is sufficiently effective at achieving the complete-market risk sharing; hence,

$x\rightarrow \infty$

, self-insurance is sufficiently effective at achieving the complete-market risk sharing; hence,

![]() $\lim _{x\rightarrow +\infty }\gamma _{e}(x)=\gamma$

and

$\lim _{x\rightarrow +\infty }\gamma _{e}(x)=\gamma$

and

![]() $\lim _{x\rightarrow +\infty }p^{\prime}(x)=1$

.

$\lim _{x\rightarrow +\infty }p^{\prime}(x)=1$

.

Table 1. Parameter values

Once the agent enters the debt region

![]() $x\lt 0$

, the instantaneous MPC spikes due to additional borrowing costs. In this situation, the precautionary motive is strong because reducing consumption can avoid costly borrowing in the near future. However, if the household accumulates more debt (i.e., a smaller

$x\lt 0$

, the instantaneous MPC spikes due to additional borrowing costs. In this situation, the precautionary motive is strong because reducing consumption can avoid costly borrowing in the near future. However, if the household accumulates more debt (i.e., a smaller

![]() $x$

), the effect of the default option takes place. When the default option is sufficiently in-the-money, the household prioritizes consumption smoothing and responds to negative shocks by default. This reflects the diversification benefits of risky debt because default allows households to reduce leverage. Our result extends the standard concave consumption function to a more general incomplete-market environment with the consumer default option. This option effect also leads to a convex consumption function (see Panel B of Figure 1).

$x$

), the effect of the default option takes place. When the default option is sufficiently in-the-money, the household prioritizes consumption smoothing and responds to negative shocks by default. This reflects the diversification benefits of risky debt because default allows households to reduce leverage. Our result extends the standard concave consumption function to a more general incomplete-market environment with the consumer default option. This option effect also leads to a convex consumption function (see Panel B of Figure 1).

Second, consistent with equation (21), Panel A of Figure 1 confirms that the present-biased agent overconsumes more than her exponential-discounting counterpart, and the degree of overconsumption is proportional to

![]() $c^{E}(x)$

; thus, it might influence the household with high values of

$c^{E}(x)$

; thus, it might influence the household with high values of

![]() $x$

more than her counterparts with low values of

$x$

more than her counterparts with low values of

![]() $x$

. As shown in Panel C of Figure 1, a critical consequence of overconsumption is the negative saving rate

$x$

. As shown in Panel C of Figure 1, a critical consequence of overconsumption is the negative saving rate

![]() $g^j(x)\lt 0$

(

$g^j(x)\lt 0$

(

![]() $j\in \{S,N\}$

). Therefore, exponential-discounting households continue saving since they always have positive saving rates; by contrast, present-biased households dissave so that they are expected to move toward the steady-state wealth-income ratio

$j\in \{S,N\}$

). Therefore, exponential-discounting households continue saving since they always have positive saving rates; by contrast, present-biased households dissave so that they are expected to move toward the steady-state wealth-income ratio

![]() $\tilde x^j$

, at which

$\tilde x^j$

, at which

![]() $g^j(\tilde x^j)=0$

. This negative steady-state wealth-income ratio

$g^j(\tilde x^j)=0$

. This negative steady-state wealth-income ratio

![]() $\tilde x^j\lt 0$

indicates that severely present-biased households will eventually concentrate in the debt region. This result can also be seen from the following Euler equation for the optimal consumption rule:Footnote 7

$\tilde x^j\lt 0$

indicates that severely present-biased households will eventually concentrate in the debt region. This result can also be seen from the following Euler equation for the optimal consumption rule:Footnote 7

\begin{eqnarray} -\frac{\mathbb{E}(dU(C))}{U(C)}=\left \{ \begin{array}{l@{\quad}c} r+w^r\unicode{x1D7D9}_{\{x\lt 0\}}-\rho \overbrace{-\gamma \left (1-\beta ^{1/\gamma }\right )\frac{\partial c^j(x)}{\partial x}}^{\text{ dis-saving motive, }-\Lambda ^j\lt 0}, &{\textit{if } j=N}\\ r+w^r\unicode{x1D7D9}_{\{x\lt 0\}}-\rho \underbrace{-(1-\beta )\frac{\partial c^j(x)}{\partial x}}_{\text{ dis-saving motive, }-\Lambda ^j\lt 0}, &{\textit{if } j=S} \end{array} \right . \end{eqnarray}

\begin{eqnarray} -\frac{\mathbb{E}(dU(C))}{U(C)}=\left \{ \begin{array}{l@{\quad}c} r+w^r\unicode{x1D7D9}_{\{x\lt 0\}}-\rho \overbrace{-\gamma \left (1-\beta ^{1/\gamma }\right )\frac{\partial c^j(x)}{\partial x}}^{\text{ dis-saving motive, }-\Lambda ^j\lt 0}, &{\textit{if } j=N}\\ r+w^r\unicode{x1D7D9}_{\{x\lt 0\}}-\rho \underbrace{-(1-\beta )\frac{\partial c^j(x)}{\partial x}}_{\text{ dis-saving motive, }-\Lambda ^j\lt 0}, &{\textit{if } j=S} \end{array} \right . \end{eqnarray}

Compared to the case with exponential discounting, equation (35) shows that IG preferences induce two competing forces in saving incentives. First, present bias induces a novel term

![]() $-\Lambda ^j$

, which is negative since the instantaneous MPC

$-\Lambda ^j$

, which is negative since the instantaneous MPC

![]() $c^{j^{\prime}}(x)\gt 0$

(see Panel B of Figure 1). This term captures the additional consumption motive or, equivalently, the dissaving motive. Second, lower wealth accumulation incurred by overconsumption reduces the aggregate capital supply in the economy, driving up the equilibrium interest rate (see equation (32)), which in turn encourages saving. This section mainly focuses on the first channel, and Section 6 demonstrates the crucial role of equilibrium interest rate changes in welfare analysis.

$c^{j^{\prime}}(x)\gt 0$

(see Panel B of Figure 1). This term captures the additional consumption motive or, equivalently, the dissaving motive. Second, lower wealth accumulation incurred by overconsumption reduces the aggregate capital supply in the economy, driving up the equilibrium interest rate (see equation (32)), which in turn encourages saving. This section mainly focuses on the first channel, and Section 6 demonstrates the crucial role of equilibrium interest rate changes in welfare analysis.

Note that sophistication partially offsets the overconsumption and reduces the level of the agent’s indebtedness, since the steady-state wealth-income ratio increases from

![]() $\tilde x^N=-0.085$

to

$\tilde x^N=-0.085$

to

![]() $\tilde x^S=-0.071$

. The economic intuition for this result is as follows.Footnote 8 The sophisticated agent correctly anticipates that her future selves’ overconsumption incentives will lead to poverty and costly borrowing, and thus, she acts conservatively by saving more to alleviate future financial distress. By contrast, the naive agent falsely believes that her future selves will behave as exponential discounters. As a consequence, underestimating the probability of future financial distress undercuts her incentives to save.

$\tilde x^S=-0.071$

. The economic intuition for this result is as follows.Footnote 8 The sophisticated agent correctly anticipates that her future selves’ overconsumption incentives will lead to poverty and costly borrowing, and thus, she acts conservatively by saving more to alleviate future financial distress. By contrast, the naive agent falsely believes that her future selves will behave as exponential discounters. As a consequence, underestimating the probability of future financial distress undercuts her incentives to save.

Finally, we draw a comparison between present bias and patience heterogeneity. First, equation (35) indicates that present bias generates within-individual impatience heterogeneity, and this state-dependent discount rate is:

where the instantaneous MPC

![]() $c^{j^{\prime}}(x)$

plays a vital role. When the distance to default is sufficiently large, lower liquid wealth (i.e., a smaller

$c^{j^{\prime}}(x)$

plays a vital role. When the distance to default is sufficiently large, lower liquid wealth (i.e., a smaller

![]() $x$

) always exacerbates the financial constraint and raises

$x$

) always exacerbates the financial constraint and raises

![]() $c^{j^{\prime}}(x)$

, thus incurring a larger

$c^{j^{\prime}}(x)$

, thus incurring a larger

![]() $\rho ^{j}(x)$

. However, if the agent is near the default threshold, the default-option effect weakens the precautionary motive, and thus, the lower the wealth-income ratio

$\rho ^{j}(x)$

. However, if the agent is near the default threshold, the default-option effect weakens the precautionary motive, and thus, the lower the wealth-income ratio

![]() $x$

, the more patient households are. This heterogeneity is endogenously created by the state-dependent effect of the default option and financial constraint. In contrast, patience heterogeneity is exogenously assumed. Second, Ramsey’s conjecture and the related literature (Ramsey, Reference Ramsey1928; Becker, Reference Becker1980; Bewley, Reference Bewley1982; Mitra and Sorger, Reference Mitra and Sorger2013) indicate a strict positive correlation between patience and capital ownership. Nevertheless, wealthy households in our model (manifested by high values of

$x$

, the more patient households are. This heterogeneity is endogenously created by the state-dependent effect of the default option and financial constraint. In contrast, patience heterogeneity is exogenously assumed. Second, Ramsey’s conjecture and the related literature (Ramsey, Reference Ramsey1928; Becker, Reference Becker1980; Bewley, Reference Bewley1982; Mitra and Sorger, Reference Mitra and Sorger2013) indicate a strict positive correlation between patience and capital ownership. Nevertheless, wealthy households in our model (manifested by high values of

![]() $X_t$

) do not necessarily exhibit high levels of patience. To see this, consider the situation in which wealthy households also have high labor income

$X_t$

) do not necessarily exhibit high levels of patience. To see this, consider the situation in which wealthy households also have high labor income

![]() $Y_{t}$

, which decreases the wealth-income ratio

$Y_{t}$

, which decreases the wealth-income ratio

![]() $x_{t}=\frac{X_{t}}{Y_{t}}$

, thus leading to a high instantaneous MPC

$x_{t}=\frac{X_{t}}{Y_{t}}$

, thus leading to a high instantaneous MPC

![]() $c^j(x_t)$

and a high subjective discount rate

$c^j(x_t)$

and a high subjective discount rate

![]() $\rho ^j(x_t)$

.

$\rho ^j(x_t)$

.

5.3. Quarterly MPC and wealth distribution

Column 1 of Table 2 reports the average quarterly MPC and wealth statistics from data. Following Achdou et al. (Reference Achdou, Han, Lasry, Lions and Moll2022), we define the quarterly MPC

![]() $QM^j(X)$

as the change in cumulative consumption over a quarter

$QM^j(X)$

as the change in cumulative consumption over a quarter

![]() $\Delta t$

following a liquidity injection of size

$\Delta t$

following a liquidity injection of size

![]() $\chi$

:

$\chi$

:

where

![]() $C^j_{\Delta t}(X,Y)=\mathbb{E}\left [\int _u^{u+\Delta t}C^j(X_t,Y_t)\mid X_u=X,Y_u=Y\right ]$

is cumulative consumption over a quarter

$C^j_{\Delta t}(X,Y)=\mathbb{E}\left [\int _u^{u+\Delta t}C^j(X_t,Y_t)\mid X_u=X,Y_u=Y\right ]$

is cumulative consumption over a quarter

![]() $\Delta t$

. In this paper, we focus on the quarterly MPC out of

$\Delta t$

. In this paper, we focus on the quarterly MPC out of

![]() $\$500$

, that is,

$\$500$

, that is,

![]() $\chi =\$500$

. The baseline model in Column 2 of Table 2 hits the mean wealth target with the chosen discount rate

$\chi =\$500$

. The baseline model in Column 2 of Table 2 hits the mean wealth target with the chosen discount rate

![]() $\rho =4.99\%$

. Nevertheless, compared to the data, the distribution of aggregate wealth in the baseline model has a thinner right tail, manifested by a smaller Gini coefficient of wealth

$\rho =4.99\%$

. Nevertheless, compared to the data, the distribution of aggregate wealth in the baseline model has a thinner right tail, manifested by a smaller Gini coefficient of wealth

![]() $\Gamma _X=0.78\lt 0.85$

, and the share of wealth-poor households is smaller. For example, exponential-discounting households with wealth less than

$\Gamma _X=0.78\lt 0.85$

, and the share of wealth-poor households is smaller. For example, exponential-discounting households with wealth less than

![]() $\$1,000$

only account for

$\$1,000$

only account for

![]() $0.86\%$

, which is much smaller than the

$0.86\%$

, which is much smaller than the

![]() $15.1\%$

in the data. Moreover, the average quarterly MPC is approximately

$15.1\%$

in the data. Moreover, the average quarterly MPC is approximately

![]() $7.71\%$

in the baseline model, which is much smaller than the empirical estimate (

$7.71\%$

in the baseline model, which is much smaller than the empirical estimate (

![]() $16\%$

). Intuitively, when default is distant (i.e.,

$16\%$

). Intuitively, when default is distant (i.e.,

![]() $x\gt 0$

), a higher

$x\gt 0$

), a higher

![]() $x$

weakens households’ consumption-smoothing motives, implying the smaller MPC (see Panel B of Figure 1). In other words, having insufficient wealth-poor households in the model understates the aggregate quarterly MPC.

$x$

weakens households’ consumption-smoothing motives, implying the smaller MPC (see Panel B of Figure 1). In other words, having insufficient wealth-poor households in the model understates the aggregate quarterly MPC.

Table 2.

Wealth distribution and quarterly MPC. Column 1 contains some key moments of the wealth distribution computed from the 2019 SCF. Column 2: baseline model with exponential discounters, and the discount factor is chosen to match the mean wealth. Column 3: model with ex ante present bias homogeneity (

![]() $\beta ^S=0.783$

). Column 4: model with ex ante heterogeneity in present-biased preferences. The equilibrium interest rate is

$\beta ^S=0.783$

). Column 4: model with ex ante heterogeneity in present-biased preferences. The equilibrium interest rate is

![]() $r=6.4\%$

. Other parameter values are reported in Table 1

$r=6.4\%$

. Other parameter values are reported in Table 1

Next, we consider the economy in which all households hold sophisticated beliefs with the present bias parameter

![]() $\beta ^S=0.783$

. As shown in Column 3 of Table 2, the average quarterly MPC is approximately

$\beta ^S=0.783$

. As shown in Column 3 of Table 2, the average quarterly MPC is approximately

![]() $7.67\%$

, which is still substantially lower than the

$7.67\%$

, which is still substantially lower than the

![]() $16\%$

in the data. The intuition is the following. As emphasized in Kaplan and Violante (Reference Kaplan and Violante2022), although present bias can generate more wealth-poor households due to overconsumption incentives, this effect is substantially attenuated by a lower subjective discount rate

$16\%$

in the data. The intuition is the following. As emphasized in Kaplan and Violante (Reference Kaplan and Violante2022), although present bias can generate more wealth-poor households due to overconsumption incentives, this effect is substantially attenuated by a lower subjective discount rate

![]() $\rho =3.39\%\lt 4.99\%$

when we match the mean wealth, since reducing

$\rho =3.39\%\lt 4.99\%$

when we match the mean wealth, since reducing