1. Introduction

The global financial crisis featured significant disruption of financial intermediaries and cross-border spillovers. The meltdown of the shadow banking system due to the collapse of the U.S. housing market bubble and loose regulatory policies deteriorated the entire financial system and the world economy. Thus, a new generation of DSGE models incorporate frictions in financial intermediariesFootnote 1 such as Cúrdia and Woodford (Reference Cúrdia and Woodford2016), Gertler and Karadi (Reference Gertler and Karadi2011), Gertler and Kiyotaki (Reference Gertler and Kiyotaki2010, Reference Gertler and Kiyotaki2015), Gertler et al. (Reference Gertler, Kiyotaki and Queralto2012), Gertler et al. (Reference Gertler, Kiyotaki and Prestipino2020) and Akinci & Queralto (Reference Akinci and Queralto2022).

In order to capture cross-border capital flows through the banking sector across countries and to evaluate the role of international financial imperfections, the model in this paper introduces a global banking system into a small open economy DSGE model and analyses how the source of funds (deposits and global bank loans) changes in response to financial shocks. We construct a microfounded two-country model to fully investigate the transmission mechanism of foreign shocks on the small open economy through international risk sharing, global banking and trade channels. While depreciation of the exchange rate raises net exports, it also raises the real interest rates and lowers consumption through risk sharing conditions. Also, the balance sheet of domestic banks shrinks due to debts denominated in foreign currency from the global banks, making the economy more vulnerable. In a closed economy DSGE model with financial frictions, where banks are constrained in obtaining funds from households, a financial crisis affects the economy through a financial accelerator mechanism. We identify that in our open economy model, global bank loans and risk sharing conditions generate additional financial channels. In particular, domestic banks in the small open economy can obtain additional funds from global banks and this in turn, exposes to the risk of capital flights and the currency risk, which influence the balance sheet of domestic banks.

Since small open economies are vulnerable to global financial and nonfinancial conditions, our model embeds small open economy features in a tractable way. The response of the terms of trade and the real exchange rate allows us to investigate changes in trade and the current account. Also, allowing different degree of trade openness and banking system stability offers sources of heterogeneous dynamics of small open economies. A distinctive feature is that our model embeds an incomplete asset market structure in line with empirical evidence on the lack of risk sharing (i.e the Backus and Smith (Reference Backus and Smith1993) puzzle)Footnote 2 in terms of both international government bonds and the global bank loans market thereby allowing imperfect risk sharing in consumption and making explicit international links between the real interest rate, the real exchange rate and consumption. In other words, this model makes it possible to explore the role of international financial imperfections, and the transmission mechanism of foreign shocks and policies in a way consistent with empirical grounds.

We document the effects of foreign financial shocks and then, look at the role of credit policy based on domestic and international credit spread, an expansionary monetary policy,Footnote 3 and alternative monetary policy rules to combat the financial crisis. Two main findings stand out. Firstly, foreign financial shocks capture cross-border spillovers in the small open economy through the global banking system. In particular, the shocks broadly mimic a global financial crisis in the small open economy as defined by Calvo et al. (Reference Calvo, Izquierdo and Talvi2006), Mendoza (Reference Mendoza2010) and Gourinchas and Obstfeld (Reference Gourinchas and Obstfeld2012): (a) contractions of output and investment, (b) decline in the net worth and asset prices, (c) a fall in CPI inflation, (d) reversals of international capital flows in terms of an increase in net exports and drops of global bank loans, (e) a depreciation of the terms of trade and the real exchange rate. Also, we show that country differences in the severity of the shocks depend on the degree of trade openness and banking system stability.

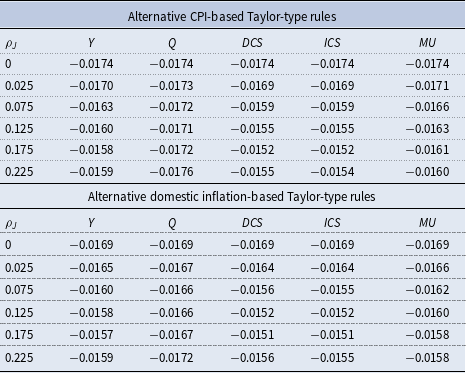

Secondly, while credit policy is powerful in response to foreign financial shocks by injecting credit flows to intermediate firms, the expansionary monetary policy and alternative monetary policy rules are not sufficient to alleviate the global financial crisis. We find that among alternative monetary policy rules, the Taylor rules with international credit spread which refers to the spread between the return on domestic private assets and international borrowing costs of domestic banks, outperform the Taylor rules with output, real exchange rate and markup. In particular, credit policy based on international credit spread formed by international financial imperfections outperforms credit policy based on domestic credit spread since the latter leads to “excess smoothness” in the exchange rate and interrupts a role of the real exchange rate as a foreign financial shock absorber. On the other hand, a feedback rule with international credit spread attempts to remove distortions from international financial imperfections, allows a fall in global bank interest rate and an appreciation of the real exchange rate, and thus reduces the real cost of global bank loans. This in turn, increases investment, price of assets, consumption and output further. The global banking channel dominates a trade channel which reduces net exports and output in response to the appreciation. This implies that international financial imperfections play a major role in monetary and credit policies in an open economy.

1.1. Literature

There have been many attempts to incorporate incomplete international asset markets with and without financial intermediaries in an open economy framework. Gabaix and Maggiori (Reference Gabaix and Maggiori2015) and Itskhoki and Mukhin (Reference Itskhoki and Mukhin2021) among others provide a theory of the determination of exchange rates in imperfect financial markets where financiers having limited risk bearing capacity require a risk premium for holding currency risk, resulting in deviations from the uncovered interest parity. Maggiori (Reference Maggiori2017) embeds an international market for interbank loans and asymmetric financial development across countries, and thereby allowing imperfect risk sharing in consumption. Kollmann et al. (Reference Kollmann, Enders and Müller2011) and Dedola et al. (Reference Dedola, Karadi and Lombardo2013) show how country specific shocks lead to financial and macroeconomic interconnections across countries. However, in order to examine two large countries, the literature assumes a symmetric two country framework and does not embed important features of the open economy such as global relative prices (the terms of trade and the real exchange rate) and incomplete asset market structure. In addition, they analyze cross-border capital flows between banks and non-banks and thus they do not embed a global banking system: banks lend funds to both domestic and foreign firms but banks in one country do not lend to banks in another country. However, as shown in Kalemli-Ozcan et al. (Reference Kalemli-Ozcan, Papaioannou and Perri2013) and Bruno and Shin (Reference Bruno and Shin2014), cross-border capital flows through the global banking system account for a large proportion of total cross-border debt flowsFootnote 4 and they are a critical determinant of macroeconomic synchronization. Global bank loans significantly alter the balance sheets of domestic banks, which boost the economy by lending more funds to domestic firms in normal times but trigger a financial crisis by suddenly withdrawing loans. This paper is also related to Banerjee et al. (Reference Banerjee, Devereux and Lombardo2016) and Devereux et al. (Reference Devereux, Engel and Lombardo2020). These papers analyze the optimal policy and the role of international financial intermediaries in a two country model with asymmetric size of the economies and shows that monetary policy needs to take account financially integrated economies. However, they characterize the optimal policy or the optimal policy rules with fixed target coefficients rather than interest rules. Also, they do not embed credit policy and international financial imperfections (i.e., deviations from the uncovered interest parity for both international bond markets and global banking sectors), thereby excluding explicit linkages between the returns of international assets. Aoki et al. (Reference Aoki, Benigno and Kiyotaki2016) develops a small open economy model with financial intermediaries and analyses the transmission mechanism of foreign (interest rate) shocks through the fluctuation of the real exchange rate. In contrast to Aoki et al. (Reference Aoki, Benigno and Kiyotaki2016), we formulate a microfounded two-country structure and compare the effectiveness of monetary and credit policies. In particular, this paper embeds international financial imperfections to explore intrinsically different nature of monetary and credit policies in an open economy from those in a closed economy. Akinci and Queralto (Reference Akinci and Queralto2022) provides a small open economy extension of the macroeconomic model with financial intermediaries and occasionally binding constraint. They find that macro-prudential policy providing subsidy to equity issuance can effectively reduce a risk of crisis.

Also, extensive studies have accessed the role of foreign financial developments on domestic economy. The literature shows that international goods and financial markets are highly integrated due mainly to an international credit channel. Cesa-Bianchi et al. (Reference Cesa-Bianchi, Ferrero and Rebucci2018) construct a small open economy model of collateralized borrowing within housing markets and show that an increase in international credit supply leads to an excessive housing price developments, subject to the loan to value ratio and the share of foreign currency denominated credit. Also, Bergant et al. (Reference Bergant, Grigoli, Hansen and Sandri2024) and Coman and Lloyd (Reference Coman and Lloyd2022) implement empirical analysis and find that the effects of foreign shocks to emerging economies can be partially offset by tighter macro-prudential regulations. Alpanda and Kabaca (Reference Alpanda and Kabaca2020) construct an estimated two-country model with long-term bonds and investigate the international spillover effects of large-scale asset purchases in the United State on the rest of the world. They find that the purchases lead to capital inflows in the rest of the world, thereby reducing the long-term bonds interest rate and stimulating the economy. Bhattarai et al. (Reference Bhattarai, Chatterjee and Park2021) find that while the purchases in the United State reduce the long-term bonds interest rate, they do not find consistent and significant effects on output in emerging market economies using a Bayesian panel VAR. Wu et al. (Reference Wu, Xie and Zhang2024) show that foreign shocks can be amplified as the duration of long-term bonds increases. The longer the duration of the bond, the greater the exchange rate volatility, influencing more on net exports, investments and output. The contribution of this paper is that it presents an appropriately-augmented theoretic framework by embedding global banking system, international financial imperfections and global relative price adjustments to assess a range of policies and financial shocks. In particular, by imposing a fully microfounded structure of foreign country, our model allows to investigate the effects of foreign financial and nonfinancial shocks on a small open economy through both trade and financial channels.

The paper is organized as follows: Section 2 describes the key macroeconomic variables in the global financial crisis. In Section 3, we describe the model including the incomplete asset market structure and the global banking system. Section 4 presents quantitative results. We analysis the impact of disturbances to the small open economy and the large economy to the agency cost and show how the disturbances in both economies could influence the small open economy. Then, we evaluate the extent to which credit policy, the expansionary monetary policy and alternative monetary policy rules to alleviate the financial crisis. Finally, our concluding remarks are presented in section 5.

2. Stylised facts of the global financial crisis

Figure 1. U.S., Korea and Canada.

Note: While the nominal interest rate (overnight call rate (Korea and Canada) and effective federal funds rate (U.S.)) and international credit spread (between Libor and the yields on AA rated corporate bonds for Korea (the business prime rate for Canada)) are the annualized, other variables are expressed in log de-trended and estimated from 1994q4 to 2014q3. Following Christiano et al. (Reference Christiano, Trabandt and Walentin2011), stock prices (stock price index (Korea and Canada) and Dow Jones index (U.S.)), scaled by the GDP deflator are included. An increase in the real effective exchange rate indicates depreciation of the Korean and Canadian currencies against a broad basket of currencies. Source: The Bank of Korea, Statistics Canada, Federal Reserve Economic Data and BIS Statistics (Consolidated banking statistics).

Our primary focus is on the experience of small open economies spilled over from a global financial crisis so that we show main US, Korean and Canadian variables during 2008q3–2012q3 in Figure 1. South Korea and Canada have the world’s most open goods and financial markets and thus they can be exposed to volatile capital flows and foreign currency risk. South Korea and Canada are small open economies which are unlikely to influence the foreign interest rate, output and prices. Also, since two economies have different degree of trade openness and banking system stability,Footnote 5 the movement comparison of main macroeconomic variables in different countries offers sources of heterogeneous dynamics of each economy in the global financial crisis.

Financial liberalization, started in the 1990s relaxed restrictions on foreign loans and entry of financial institution and led to a substantial increase in cross-border borrowing from global banks, largely in the form of short-term debt. The stock of consolidated claims of global banks on both Korea and Canada accounted for about

![]() $30\%$

of GDP in 2008q3. The global financial crisis started in the US and featured significant disruption of financial intermediaries and the global banking system. A depreciation of the real exchange rate raised the real cost of global bank loans and confidence of global banks was rapidly eroded in the financial crisis. Thus, Korean and Canadian banks were unable to roll over their short-term debt and foreign capital suddenly outflowed. Also, the banks attempted to reduce leverage by selling their assets and reducing loans to firms. The international credit spread sharply increased during the first two quarters, raising the cost of capital and this in turn reduced investment and output. Correspondingly, real GDP, consumption, CPI inflation, investment and the claims of global banks decreased. While the Canadian economy has a more stable banking system, the economy has more open goods markets so that lower foreign demand for Canadian goods coupled with lower price of imports reduced CPI inflation further and generated a symmetric fall in output. In order to recover the economy, the central banks of the small open economies aggressively reduced the nominal interest rate. Over the period given, variables show strong positive inter-country correlation.

$30\%$

of GDP in 2008q3. The global financial crisis started in the US and featured significant disruption of financial intermediaries and the global banking system. A depreciation of the real exchange rate raised the real cost of global bank loans and confidence of global banks was rapidly eroded in the financial crisis. Thus, Korean and Canadian banks were unable to roll over their short-term debt and foreign capital suddenly outflowed. Also, the banks attempted to reduce leverage by selling their assets and reducing loans to firms. The international credit spread sharply increased during the first two quarters, raising the cost of capital and this in turn reduced investment and output. Correspondingly, real GDP, consumption, CPI inflation, investment and the claims of global banks decreased. While the Canadian economy has a more stable banking system, the economy has more open goods markets so that lower foreign demand for Canadian goods coupled with lower price of imports reduced CPI inflation further and generated a symmetric fall in output. In order to recover the economy, the central banks of the small open economies aggressively reduced the nominal interest rate. Over the period given, variables show strong positive inter-country correlation.

3. Model

We develop a small open economy DSGE model with international financial imperfections and a global banking system. The baseline framework follows Benigno and Benigno (Reference Benigno and Benigno2003), Gali and Monacelli (Reference Gali and Monacelli2005), Benigno (Reference Benigno2009), Gertler and Kiyotaki (Reference Gertler and Kiyotaki2010, Reference Gertler and Kiyotaki2015) and Gertler and Karadi (Reference Gertler and Karadi2011). We extend the baseline DSGE model by embedding an incomplete asset market structure in the model presented in subsection 3.1–3.3 and introducing the global banking system between domestic and global banks presented in subsection 3.4.

3.1. Households

The world is composed of two countries, the “home” and the “foreign” country labeled by f. Households on the subinterval [0, n] live in the home country and households on the subinterval [n, 1] live in the foreign country. Since we assume that the home country is a small economy that is unable to influence the foreign economy, the foreign economy is analogous to a closed economy.

Each domestic household contains a large number of individuals. It supplies labor, makes deposits in domestic banks, and holds both domestic currency denominated bonds and foreign currency denominated bonds. Domestic government bonds and deposits in domestic banks are perfect substitutes. Following Gertler and Karadi (Reference Gertler and Karadi2011), within the household, a fraction 1-e of individuals are workers and a fraction e are bankers. While workers supply labor and earn wages, bankers manage the bank and transfer bank dividends to the household. Each household consumes final goods from domestic and foreign countries, and consumption risk is perfectly pooled within the household.

The intertemporal utility of a representative household in the home economy is given by

where per-period utility is

where

![]() $ \rho$

is the coefficient of relative risk aversion,

$ \rho$

is the coefficient of relative risk aversion,

![]() $h$

is the habit persistence parameter and

$h$

is the habit persistence parameter and

![]() $ \varphi$

is the inverse of the Frisch elasticity of labor supply. Aggregate consumption of a representative home (foreign) household is given by

$ \varphi$

is the inverse of the Frisch elasticity of labor supply. Aggregate consumption of a representative home (foreign) household is given by

\begin{align} {\textrm{C}}_{\textrm{t}} & = \left [{\lambda }^{\frac {{ 1}}{\eta }}{({\textrm{C}}_{\textrm{h,t}})}^{\frac {\eta { -1}}{\eta }}{ +}{{ (1-}\lambda )}^{\frac {{ 1}}{\eta }}{({\textrm{C}}_{\textrm{f,t}})}^{\frac {\eta { -1}}{\eta }}\right ]^{\frac {\eta }{\eta { -1}}} ; \nonumber\\ {\textrm{C}}^{\textrm{f}}_{\textrm{t}} &= \left [{{\lambda }^f}^{\frac {{ 1}}{{\eta }^f }}{\left({\textrm{C}}^{\textrm{f}}_{\textrm{f,t}}\right)}^{\frac {{\eta }^f { -1}}{{\eta }^f }}{ +}{{ (1-}{\lambda }^f)}^{\frac {{ 1}}{{\eta }^f }}{\left({\textrm{C}}^{\textrm{f}}_{\textrm{h,t}}\right)}^{\frac {{\eta }^f { -1}}{{\eta }^f }}\right ]^{\frac {{\eta }^f }{\eta { -1}}} \end{align}

\begin{align} {\textrm{C}}_{\textrm{t}} & = \left [{\lambda }^{\frac {{ 1}}{\eta }}{({\textrm{C}}_{\textrm{h,t}})}^{\frac {\eta { -1}}{\eta }}{ +}{{ (1-}\lambda )}^{\frac {{ 1}}{\eta }}{({\textrm{C}}_{\textrm{f,t}})}^{\frac {\eta { -1}}{\eta }}\right ]^{\frac {\eta }{\eta { -1}}} ; \nonumber\\ {\textrm{C}}^{\textrm{f}}_{\textrm{t}} &= \left [{{\lambda }^f}^{\frac {{ 1}}{{\eta }^f }}{\left({\textrm{C}}^{\textrm{f}}_{\textrm{f,t}}\right)}^{\frac {{\eta }^f { -1}}{{\eta }^f }}{ +}{{ (1-}{\lambda }^f)}^{\frac {{ 1}}{{\eta }^f }}{\left({\textrm{C}}^{\textrm{f}}_{\textrm{h,t}}\right)}^{\frac {{\eta }^f { -1}}{{\eta }^f }}\right ]^{\frac {{\eta }^f }{\eta { -1}}} \end{align}

where

![]() $C_{h,t}$

(

$C_{h,t}$

(

![]() $C^{f}_{f,t}$

) is the consumption of home (foreign) tradable goods and

$C^{f}_{f,t}$

) is the consumption of home (foreign) tradable goods and

![]() $C_{f,t}$

(

$C_{f,t}$

(

![]() $C^{f}_{h,t}$

) is the consumption of foreign (home) tradable goods. Households have a “home bias” that implies, ceteris paribus, that they prefer to consume domestically produced goods. Following Sutherland (Reference Sutherland2005),

$C^{f}_{h,t}$

) is the consumption of foreign (home) tradable goods. Households have a “home bias” that implies, ceteris paribus, that they prefer to consume domestically produced goods. Following Sutherland (Reference Sutherland2005),

![]() $(1-\lambda )=\alpha (1-n)$

is the weight on imported goods, reflecting the relative size of home country

$(1-\lambda )=\alpha (1-n)$

is the weight on imported goods, reflecting the relative size of home country

![]() $n$

and the degree of openness

$n$

and the degree of openness

![]() $\alpha$

. Since a small open economy is characterized by

$\alpha$

. Since a small open economy is characterized by

![]() $n\rightarrow 0$

,

$n\rightarrow 0$

,

![]() $(1-\alpha )$

represents the degree of home bias in preferences.

$(1-\alpha )$

represents the degree of home bias in preferences.

![]() $\eta$

(

$\eta$

(

![]() $\eta ^{f}$

) is the elasticity of substitution between home tradable goods and foreign tradable goods. For simplicity, we assume the same elasticity of substitution between different varieties across countries. The foreign weight on imports is defined as

$\eta ^{f}$

) is the elasticity of substitution between home tradable goods and foreign tradable goods. For simplicity, we assume the same elasticity of substitution between different varieties across countries. The foreign weight on imports is defined as

![]() $(1-\lambda ^{f})=n\alpha$

.

$(1-\lambda ^{f})=n\alpha$

.

We assume producer currency pricing so that the law of one price holds:

![]() $P_{f,t}=X_{t}P_{f,t}^{f}$

and

$P_{f,t}=X_{t}P_{f,t}^{f}$

and

![]() $P_{h,t}=X_{t}P_{h,t}^{f}$

where

$P_{h,t}=X_{t}P_{h,t}^{f}$

where

![]() $P_{f,t}$

(

$P_{f,t}$

(

![]() $P_{h,t}$

) is the price of imports (domestic goods) denominated in home currency,

$P_{h,t}$

) is the price of imports (domestic goods) denominated in home currency,

![]() $X_{t}$

is the nominal exchange rate and

$X_{t}$

is the nominal exchange rate and

![]() $P_{f,t}^{f}$

(

$P_{f,t}^{f}$

(

![]() $P_{h,t}^{f}$

) is the price of foreign goods (exports) denominated in foreign currency.

$P_{h,t}^{f}$

) is the price of foreign goods (exports) denominated in foreign currency.

The optimal allocation of consumption between different countries yields the demand functions

\begin{align} C_{f,t}^{f} & = \lambda ^{f}\!\left(\dfrac {P_{f,t}^{f}}{P_{t}^{f}} \right)^{\!-\eta }\!C_{t}^{f};\;\;\;\;\;\; C_{h,t}^{f}=(1-\lambda ^{f})\!\left(\dfrac {P_{h,t}^{f}}{P_{t}^{f}} \right)^{-\eta }C_{t}^{f} \\[6pt] \nonumber \end{align}

\begin{align} C_{f,t}^{f} & = \lambda ^{f}\!\left(\dfrac {P_{f,t}^{f}}{P_{t}^{f}} \right)^{\!-\eta }\!C_{t}^{f};\;\;\;\;\;\; C_{h,t}^{f}=(1-\lambda ^{f})\!\left(\dfrac {P_{h,t}^{f}}{P_{t}^{f}} \right)^{-\eta }C_{t}^{f} \\[6pt] \nonumber \end{align}

The consumer price index (CPI) corresponding to the aggregate consumption in home and foreign country is given by

The household deposits funds in domestic banks and holds domestic and foreign government bonds. These are risk-free assets with a one-period maturity. For simplicity, we assume that while foreign government bonds are traded in both countries, domestic government bonds can only be traded in the domestic country so that foreign households cannot hold domestic government bonds.

Following Schmitt-Grohé and Uribe (Reference Schmitt-Grohé and Uribe2003) and Benigno (Reference Benigno2009) who introduce an incomplete asset market structure by limiting cross-border asset borrowing/saving when trading in a single non-state-contingent bond (as opposed to there being a full set of Arrow–Debreu securities), our model embeds an incomplete asset market in the form of bond transaction costs.Footnote

6

Transactions in foreign currency denominated bonds issued by the foreign government, generate quadratic costs for the foreign government; specifically, quadratic costs are incurred from changing their assets away from the steady state. The foreign government pays these transaction costs to domestic households. The parameter

![]() $\tau$

measures the strength of these transaction costs. Thus, the real budget constraint of the representative domestic household is given by

$\tau$

measures the strength of these transaction costs. Thus, the real budget constraint of the representative domestic household is given by

\begin{align} \begin{split} B_{t+1} + D_{t+1} + Q_{t}B_{f,t+1}=& W_{t}L_{t} + \Pi _{t} - T_{t} + R_{t-1}B_{t} + R_{t-1}D_{t} + \\ & Q_{t}R_{t-1}^{f}B_{f,t} + \dfrac {\tau {Q_{t}}}{2}\left(B_{f,t+1} - {B_{f}}\right)^{2} - C_{t} \end{split} \end{align}

\begin{align} \begin{split} B_{t+1} + D_{t+1} + Q_{t}B_{f,t+1}=& W_{t}L_{t} + \Pi _{t} - T_{t} + R_{t-1}B_{t} + R_{t-1}D_{t} + \\ & Q_{t}R_{t-1}^{f}B_{f,t} + \dfrac {\tau {Q_{t}}}{2}\left(B_{f,t+1} - {B_{f}}\right)^{2} - C_{t} \end{split} \end{align}

The LHS of this expression reflects the real value of domestic government bonds,

![]() $B_{t+1}$

, real deposits,

$B_{t+1}$

, real deposits,

![]() $D_{t+1}$

, and the real value (in terms of domestic currency) of foreign government bonds held by domestic households,

$D_{t+1}$

, and the real value (in terms of domestic currency) of foreign government bonds held by domestic households,

![]() $Q_{t}B_{f,t+1}$

, where

$Q_{t}B_{f,t+1}$

, where

![]() $Q_{t}$

is the real exchange rate. Since both domestic government bonds and deposits are one-period real riskless assets, they are perfect substitutes and pay the same gross real return,

$Q_{t}$

is the real exchange rate. Since both domestic government bonds and deposits are one-period real riskless assets, they are perfect substitutes and pay the same gross real return,

![]() $R_{t-1}$

from t-1 to t. The RHS reflects real labor income,

$R_{t-1}$

from t-1 to t. The RHS reflects real labor income,

![]() $W_{t}L_{t}$

, net profits from the ownership of bank, retail and capital producing firms,

$W_{t}L_{t}$

, net profits from the ownership of bank, retail and capital producing firms,

![]() $\Pi _{t}$

, lump sum taxes,

$\Pi _{t}$

, lump sum taxes,

![]() $T_{t}$

, the gross real interest from holdings of assets, transaction benefits arising from trade in foreign government bonds and consumption.

$T_{t}$

, the gross real interest from holdings of assets, transaction benefits arising from trade in foreign government bonds and consumption.

The corresponding budget constraint for the foreign representative household is

where

![]() $B_{f,t+1}^{f}$

are foreign government bonds held by foreign households and denominated in foreign currency.

$B_{f,t+1}^{f}$

are foreign government bonds held by foreign households and denominated in foreign currency.

The optimal domestic households’ decision in terms of deposits, foreign government bonds and labor supply yields the first order conditions

where

![]() ${\nu }_{t}\equiv (C_{t}-hC_{t-1})^{-\rho }-{\beta }h(C_{t+1}-hC_{t})^{-\rho }$

is the marginal utility of consumption. Let variables with a “hat” denote log deviations around steady state and these steady state values are denoted with letters without time scripts. Log linearizing (10) shows the deviation from real uncovered interest parity

${\nu }_{t}\equiv (C_{t}-hC_{t-1})^{-\rho }-{\beta }h(C_{t+1}-hC_{t})^{-\rho }$

is the marginal utility of consumption. Let variables with a “hat” denote log deviations around steady state and these steady state values are denoted with letters without time scripts. Log linearizing (10) shows the deviation from real uncovered interest parity

where

![]() $\chi \equiv {\tau }B_{f}$

is the costs of adjusting bond holding. This equation implies that a higher effective foreign real interest rate or an expected depreciation of the real exchange rate will be reflected in a higher domestic interest rate. The deviation from real uncovered interest parity can be regarded as international financial imperfections.

$\chi \equiv {\tau }B_{f}$

is the costs of adjusting bond holding. This equation implies that a higher effective foreign real interest rate or an expected depreciation of the real exchange rate will be reflected in a higher domestic interest rate. The deviation from real uncovered interest parity can be regarded as international financial imperfections.

3.2. The terms of trade, the real exchange rate and the risk sharing condition

The terms of trade is the relative price between exports and imports and it is defined as

![]() $S_{t} \equiv P_{f,t}/P_{h,t}$

. The real exchange rate between the domestic economy and country f is defined as

$S_{t} \equiv P_{f,t}/P_{h,t}$

. The real exchange rate between the domestic economy and country f is defined as

![]() $Q_{t} \equiv X_{t}P_{t}^{f}/P_{t}$

. Thus,

$Q_{t} \equiv X_{t}P_{t}^{f}/P_{t}$

. Thus,

![]() $ Q_{t}$

is the relative price of goods between the domestic and foreign countries, expressed in domestic currency. Aggregating optimal domestic and foreign decisions yields the equilibrium risk sharing condition

$ Q_{t}$

is the relative price of goods between the domestic and foreign countries, expressed in domestic currency. Aggregating optimal domestic and foreign decisions yields the equilibrium risk sharing condition

This equation implies imperfect risk sharing in the relative growth of the marginal utility of consumption due to deviations from PPP and to payments of transaction costs by the foreign government to domestic households. An expected real exchange deprecation raises the current (relative) real interest rate as shown in the UIP condition in (12). This in turn increases the growth of domestic consumption and reduces the growth of the marginal utility.Footnote 7

3.3. Government

Domestic and foreign governments issue one-period riskless bonds. Since we assume that domestic households can hold both domestic and foreign government bonds but that foreign households can hold only foreign government bonds, the real domestic government budget constraint can be expressed as

where

![]() $ G_{t}$

is government expenditure. The real foreign government budget constraint is given by

$ G_{t}$

is government expenditure. The real foreign government budget constraint is given by

where

![]() $ B_{t+1}^{f} = B_{f,t+1}^{f} + \dfrac {n}{1-n}B_{f,t+1}$

are the aggregate foreign government bonds held by domestic and foreign households. Since we assume the domestic economy is small,

$ B_{t+1}^{f} = B_{f,t+1}^{f} + \dfrac {n}{1-n}B_{f,t+1}$

are the aggregate foreign government bonds held by domestic and foreign households. Since we assume the domestic economy is small,

![]() $ (n\rightarrow 0)$

, transaction costs do not influence the foreign government budget constraint.

$ (n\rightarrow 0)$

, transaction costs do not influence the foreign government budget constraint.

3.4. Banks

We assume two types of banks: domestic and global banks. Domestic banks on the subinterval [0, n] are located in the home country and global banks on the subinterval [n, 1] are located in the foreign country. In order to specify the small open economy, the relative size of the banks

![]() $n\rightarrow 0$

is introduced.

$n\rightarrow 0$

is introduced.

Following Gertler and Kiyotaki (Reference Gertler and Kiyotaki2010, Reference Gertler and Kiyotaki2015) and Gertler and Karadi (Reference Gertler and Karadi2011), we introduce an incentive constraint on bankers. We also assume that each banker becomes a worker with i.i.d. probability

![]() $1-\sigma$

and survives as a banker with probability

$1-\sigma$

and survives as a banker with probability

![]() $\sigma$

. Also, we assume that bankers can efficiently monitor intermediate firms and enforce their obligations. Thus, banks can frictionlessly lend available funds to intermediate firms and the firms pay state contingent debt.

$\sigma$

. Also, we assume that bankers can efficiently monitor intermediate firms and enforce their obligations. Thus, banks can frictionlessly lend available funds to intermediate firms and the firms pay state contingent debt.

3.4.1. Domestic banks

The domestic bank’s balance sheet is given by

Domestic banks have three sources of funds: (a) deposits from domestic households,

![]() $D_{t+1}$

, (b) borrowing from global banks,

$D_{t+1}$

, (b) borrowing from global banks,

![]() $Q_{t}B_{i,t+1}$

where

$Q_{t}B_{i,t+1}$

where

![]() $B_{i,t+1}$

are loans from global banks denominated in foreign currency (c) net worth,

$B_{i,t+1}$

are loans from global banks denominated in foreign currency (c) net worth,

![]() $ N_{t}$

. They use these funds to make loans to intermediate firms at the price of the loan

$ N_{t}$

. They use these funds to make loans to intermediate firms at the price of the loan

![]() $ H_{t}$

.

$ H_{t}$

.

Due to the absence of frictions between intermediate firms and banks, domestic intermediate firms obtain loans from bank at the end of period t,

![]() $ H_{t}K_{t+1}$

and repay,

$ H_{t}K_{t+1}$

and repay,

![]() $R_{k,t+1}H_{t}K_{t+1}$

at the end of period t + 1 where

$R_{k,t+1}H_{t}K_{t+1}$

at the end of period t + 1 where

![]() $R_{k,t+1}$

is the real gross return of the loans or assets.

$R_{k,t+1}$

is the real gross return of the loans or assets.

The banker’s net worth or equity therefore evolves over time as

Following Gertler and Kiyotaki (Reference Gertler and Kiyotaki2015), we assume that a risk neutral banker gains utility from consumption of their accumlated net worth only when they cease to be a banker and become a worker. Thus, bankers maximize the expected present value of their net worth, given by

In order to limit bankers’ ability to borrow funds from households and global banks, we assume the following moral hazard problem: the banker can divert a fraction

![]() $\kappa _{t}$

of assets and transfer them to the household.Footnote

8

If they do so, there is a forced bancruptcy and the creditors, domestic households and global banks seize the remaining portion,

$\kappa _{t}$

of assets and transfer them to the household.Footnote

8

If they do so, there is a forced bancruptcy and the creditors, domestic households and global banks seize the remaining portion,

![]() $ 1-\kappa _{t}$

of assets. Following the approach of Aoki et al. (Reference Aoki, Benigno and Kiyotaki2016),Footnote

9

we assume that the fraction of divertible assets depends on the sources of funds. In particular, we assume that it depends on global bankers’ ability to divert global bank loans in order to capture and formulate its dependencies or correlations towards foreign banks as a reduced form.

$ 1-\kappa _{t}$

of assets. Following the approach of Aoki et al. (Reference Aoki, Benigno and Kiyotaki2016),Footnote

9

we assume that the fraction of divertible assets depends on the sources of funds. In particular, we assume that it depends on global bankers’ ability to divert global bank loans in order to capture and formulate its dependencies or correlations towards foreign banks as a reduced form.

\begin{align} \kappa _{t} = \kappa \!\left[1+\aleph \!\left(\frac {\kappa ^{f}_{t}}{k^{f}} -1 \right) + \frac {\aleph }{2}\!\left(\frac {\kappa ^{f}_{t}}{\kappa ^{f}} -1 \right)^{2}\right] \end{align}

\begin{align} \kappa _{t} = \kappa \!\left[1+\aleph \!\left(\frac {\kappa ^{f}_{t}}{k^{f}} -1 \right) + \frac {\aleph }{2}\!\left(\frac {\kappa ^{f}_{t}}{\kappa ^{f}} -1 \right)^{2}\right] \end{align}

where

![]() $\aleph \equiv (1-\rho^{a})\Gamma$

measures the degree of home bias in banker’s finance and consists of the degree of financial openness,

$\aleph \equiv (1-\rho^{a})\Gamma$

measures the degree of home bias in banker’s finance and consists of the degree of financial openness,

![]() $(1-\rho^{a})$

and banking system instability,

$(1-\rho^{a})$

and banking system instability,

![]() $\Gamma$

. The degree of banking system instability can be regarded as the degree of confidence in the financial crisis: in the crisis (a trigger), depositors and global banks believe that domestic bankers in unstable banking system, are more attractive to divert funds to themselves. The relationship between financial crisis and banking system stability has extensively analyzed. See, for example, Mishkin (Reference Mishkin1996), Beck et al. (Reference Beck, Demirgüç-Kunt and Levine2006), De Jonghe (Reference De Jonghe2010), and Fu et al. (Reference Fu, Lin and Molyneux2014).

$\Gamma$

. The degree of banking system instability can be regarded as the degree of confidence in the financial crisis: in the crisis (a trigger), depositors and global banks believe that domestic bankers in unstable banking system, are more attractive to divert funds to themselves. The relationship between financial crisis and banking system stability has extensively analyzed. See, for example, Mishkin (Reference Mishkin1996), Beck et al. (Reference Beck, Demirgüç-Kunt and Levine2006), De Jonghe (Reference De Jonghe2010), and Fu et al. (Reference Fu, Lin and Molyneux2014).

![]() $\kappa ^{f}_{t}$

is the divertible asset fraction of global banks. Thus, depositors and global banks will only supply funds if the banker has no incentive to divert funds, implying

$\kappa ^{f}_{t}$

is the divertible asset fraction of global banks. Thus, depositors and global banks will only supply funds if the banker has no incentive to divert funds, implying

We can restate the expected present value of net worth at the end of period

![]() $t-1$

recursively as

$t-1$

recursively as

From the definition of net worth in (17), we use the method of undetermined coefficients and guess that this value function is a linear function of assets, deposits and global bank funds.

where

![]() $ V_{s,t}$

is the marginal value from an additional unit of assets holding constant deposits and global bank funds and

$ V_{s,t}$

is the marginal value from an additional unit of assets holding constant deposits and global bank funds and

![]() $ V_{b,t}$

(

$ V_{b,t}$

(

![]() $V_{g,t}$

) is the marginal cost of deposits (global bank funds). The banks choose

$V_{g,t}$

) is the marginal cost of deposits (global bank funds). The banks choose

![]() $K_{t+1}$

and

$K_{t+1}$

and

![]() $ Q_{t}B_{i,t+1}$

in order to maximize

$ Q_{t}B_{i,t+1}$

in order to maximize

![]() $V_{t}(K_{t+1},D_{t+1},Q_{t}B_{i,t+1})$

subject to the incentive constraint and the bank’s balance sheet constraint. The first order conditions with respect to

$V_{t}(K_{t+1},D_{t+1},Q_{t}B_{i,t+1})$

subject to the incentive constraint and the bank’s balance sheet constraint. The first order conditions with respect to

![]() $K_{t+1}$

,

$K_{t+1}$

,

![]() $ Q_{t}B_{i,t+1}$

and

$ Q_{t}B_{i,t+1}$

and

![]() $\lambda _{t}^{a}$

yield

$\lambda _{t}^{a}$

yield

where

![]() $\lambda _{t}^{a}$

is the Lagrangian multiplier with respect to the incentive constraint and

$\lambda _{t}^{a}$

is the Lagrangian multiplier with respect to the incentive constraint and

![]() $ \mu _{t}^{a} \equiv \dfrac {V_{s,t}}{H_{t}} - V_{b,t}$

.

$ \mu _{t}^{a} \equiv \dfrac {V_{s,t}}{H_{t}} - V_{b,t}$

.

Equations (24) and (25) imply that the marginal value of assets is greater than the marginal cost of borrowing when the incentive constraint is binding

![]() $ \lambda _{t}\gt 0$

or

$ \lambda _{t}\gt 0$

or

![]() $\mu _{t}^{a}\gt 0$

. According to equation (25), deposits and global bank funds are perfect substitutes. If the incentive constraint is binding, equation (26) can be written as

$\mu _{t}^{a}\gt 0$

. According to equation (25), deposits and global bank funds are perfect substitutes. If the incentive constraint is binding, equation (26) can be written as

where

![]() $ \phi _{t}\equiv \!\left[\dfrac {V_{b,t}}{(\kappa _{t}-\mu _{t}^{a})} \right]$

is the maximum leverage ratio. As Adrian and Shin (Reference Adrian and Shin2008) point out, during downturns of foreign economy, banks cannot roll over their debt from global banks since the confidence of foreign depositors and global banks is rapidly eroded. A fall in the price of assets leads to a fall in the value of loans funded. Net worth declines even faster and thus, the leverage ratio increases initially. Banks attempt to reduce the leverage by selling their assets and reducing loans to firms. Due to lower asset prices induced by fire sales of assets, their balance sheet is further deteriorated. In particular, banks in the small open economy have greater risk since their borrowers are substantially exposed to the global economy, generating a symmetric loss of domestic financial market efficiency. Thus, a sudden increase in

$ \phi _{t}\equiv \!\left[\dfrac {V_{b,t}}{(\kappa _{t}-\mu _{t}^{a})} \right]$

is the maximum leverage ratio. As Adrian and Shin (Reference Adrian and Shin2008) point out, during downturns of foreign economy, banks cannot roll over their debt from global banks since the confidence of foreign depositors and global banks is rapidly eroded. A fall in the price of assets leads to a fall in the value of loans funded. Net worth declines even faster and thus, the leverage ratio increases initially. Banks attempt to reduce the leverage by selling their assets and reducing loans to firms. Due to lower asset prices induced by fire sales of assets, their balance sheet is further deteriorated. In particular, banks in the small open economy have greater risk since their borrowers are substantially exposed to the global economy, generating a symmetric loss of domestic financial market efficiency. Thus, a sudden increase in

![]() $\kappa _{t}$

due to an increase in the fraction of divertible global bank loans can be thought of as capturing some form of banks’ fragility spilled over from a downturn of the global economy.Footnote

10

$\kappa _{t}$

due to an increase in the fraction of divertible global bank loans can be thought of as capturing some form of banks’ fragility spilled over from a downturn of the global economy.Footnote

10

Combining (16) and (27) yields

Holding net worth constant, an increase in the ability to divert funds,

![]() $\kappa _{t}$

reduces aggregate borrowing. Thus, the moral hazard problem leads to an endogenous financial constraint. Also, this equation implies that additional funds from global banks raises the leverage ratio for a given net worth.

$\kappa _{t}$

reduces aggregate borrowing. Thus, the moral hazard problem leads to an endogenous financial constraint. Also, this equation implies that additional funds from global banks raises the leverage ratio for a given net worth.

We define time varying relative weights on borrowings between home deposits and global bank funds in order to pin down the evolution of deposits and global bank funds.Footnote 11 For a given incentive constraint and aggregate borrowings, domestic banks choose optimal allocation of funds. Aggregate borrowings can be written as

defining

![]() $\rho_{t}^{a}$

as the (time-varying) share of domestic deposits in total borrowing by domestic banks, then

$\rho_{t}^{a}$

as the (time-varying) share of domestic deposits in total borrowing by domestic banks, then

![]() $D_{t+1}=\rho_{t}^{a}B_{t+1}^{all}$

and

$D_{t+1}=\rho_{t}^{a}B_{t+1}^{all}$

and

![]() $Q_{t}B_{i,t+1} = (1-\rho_{t}^{a})B_{t+1}^{all}$

.

$Q_{t}B_{i,t+1} = (1-\rho_{t}^{a})B_{t+1}^{all}$

.

By combining (16) and (27), aggregate borrowings can be rewritten as

![]() $B_{t+1}^{all}=({\phi _{t}-1})N_{t}$

so that the demand of domestic banks for domestic deposits and borrowing from global bank funds yield

$B_{t+1}^{all}=({\phi _{t}-1})N_{t}$

so that the demand of domestic banks for domestic deposits and borrowing from global bank funds yield

Holding constant net worth and relative weights, an increase in the ability to divert borrowing (a reduction of the leverage) restricts demand for each type of borrowing.

Since we assume constant government spending and net profits from the ownership, combining (7), (14) and (30) yields a market clearing condition for deposits. Then, by rearranging and log linearizing this condition around the steady state, the time varying relative weight on deposits can be written as

\begin{align} \begin{split} \hat {\rho}_{t}^{a}= & \dfrac {1}{\beta \upsilon } \left[B_{f}\!\left(\hat {B}_{f,t} + \hat {R}^{f}_{t-1} \right) + D\!\left(\hat {D}_{t}+\hat {R}_{t-1}\right)\right] + \hat {Q}_{t}\!\left(\dfrac {B_{f}}{\beta \upsilon }-\dfrac {B_{f}}{\upsilon }\right) - \left(\dfrac {B_{f}}{\upsilon }\right)\!\hat {B}_{f,t+1}\\ & + \left[\dfrac {WL}{\upsilon }(\hat {W}_{t} + \hat {L}_{t})-\left(\dfrac {C}{\upsilon }\right)\!\hat {C}_{t} \right] - \left[\hat {N}_{t} + \left(\dfrac {\rho^{a}K}{\upsilon }\right)\!\hat {\phi }_{t} \right] \end{split} \end{align}

\begin{align} \begin{split} \hat {\rho}_{t}^{a}= & \dfrac {1}{\beta \upsilon } \left[B_{f}\!\left(\hat {B}_{f,t} + \hat {R}^{f}_{t-1} \right) + D\!\left(\hat {D}_{t}+\hat {R}_{t-1}\right)\right] + \hat {Q}_{t}\!\left(\dfrac {B_{f}}{\beta \upsilon }-\dfrac {B_{f}}{\upsilon }\right) - \left(\dfrac {B_{f}}{\upsilon }\right)\!\hat {B}_{f,t+1}\\ & + \left[\dfrac {WL}{\upsilon }(\hat {W}_{t} + \hat {L}_{t})-\left(\dfrac {C}{\upsilon }\right)\!\hat {C}_{t} \right] - \left[\hat {N}_{t} + \left(\dfrac {\rho^{a}K}{\upsilon }\right)\!\hat {\phi }_{t} \right] \end{split} \end{align}

where

![]() $\upsilon \equiv \rho^{a}(K-N)\gt 0$

. For a given net worth and the leverage or the value of assets, an increase in income from labor supply and gross return of assets, or a reduction of spending on current foreign assets and consumption raises the relative weights on deposits. Conversely, since deposits and global bank funds are perfect substitutes as shown in equation (25), for given deposits, an increase in net worth and the leverage ratio raises demand for aggregate borrowing and thereby increasing (lowering) the relative weights on global bank loans (deposits).

$\upsilon \equiv \rho^{a}(K-N)\gt 0$

. For a given net worth and the leverage or the value of assets, an increase in income from labor supply and gross return of assets, or a reduction of spending on current foreign assets and consumption raises the relative weights on deposits. Conversely, since deposits and global bank funds are perfect substitutes as shown in equation (25), for given deposits, an increase in net worth and the leverage ratio raises demand for aggregate borrowing and thereby increasing (lowering) the relative weights on global bank loans (deposits).

We can rewrite the value function by combining (16), (23) and (25) as

Then, we can verify the linear value implied by the undetermined coefficients solution

where

![]() $\Omega _{t+1}\equiv [(1-\sigma ) + {\sigma }(\mu _{t+1}^{a}{\phi _{t+1}} + V_{b,t+1})]$

is the present value of marginal net worth. From equation (34), a higher debt adjusted global bank interest rate and the real exchange rate depreciation is compensated by higher deposit rate. This also implies uncovered interest parity between deposits and global bank funds.

$\Omega _{t+1}\equiv [(1-\sigma ) + {\sigma }(\mu _{t+1}^{a}{\phi _{t+1}} + V_{b,t+1})]$

is the present value of marginal net worth. From equation (34), a higher debt adjusted global bank interest rate and the real exchange rate depreciation is compensated by higher deposit rate. This also implies uncovered interest parity between deposits and global bank funds.

Aggregate net worth is the sum of the net worth of surviving bankers,

![]() $N_{s,t}$

and that of new bankers,

$N_{s,t}$

and that of new bankers,

![]() $N_{n,t}$

. Since the net worth of surviving bankers in the current period is a fraction,

$N_{n,t}$

. Since the net worth of surviving bankers in the current period is a fraction,

![]() $ {\sigma }$

of the total net worth in the previous period,

$ {\sigma }$

of the total net worth in the previous period,

![]() $N_{s,t}={\sigma }Z_{t}N_{t-1}$

and the household transfers a fraction of assets to the new banker

$N_{s,t}={\sigma }Z_{t}N_{t-1}$

and the household transfers a fraction of assets to the new banker

![]() $ N_{n,t}={\omega }{\phi _{t-1}}N_{t-1}$

, log linearizing aggregate net worth around the steady state gives

$ N_{n,t}={\omega }{\phi _{t-1}}N_{t-1}$

, log linearizing aggregate net worth around the steady state gives

where

![]() $ Z_{t}=\dfrac {N_{t}}{N_{t-1}} = [(R_{k,t} - R_{t-1}){\phi _{t-1}} + R_{t-1}]$

is the growth rate of net worth in period t.

$ Z_{t}=\dfrac {N_{t}}{N_{t-1}} = [(R_{k,t} - R_{t-1}){\phi _{t-1}} + R_{t-1}]$

is the growth rate of net worth in period t.

3.4.2. Global banks

The global bank balance sheet is given by

A global banker’s net worth evolves as

We assume a global bank interest rate depends on the domestic banks’ asset position denominated in domestic currency. Global banks raise a premium as a fraction of foreign borrowing in total assets increase and require a premium above the riskless rate since they will not lend out funds for which the cost of borrowing is greater than the return of assets.

Thus, the global bank interest rate is determined by

Specifically, we assume

![]() $ {\Xi _{t}} = e^{{\Upsilon }[(Q_{t}B_{i,t})/{HK} - QB_{i}/{HK}]}$

where

$ {\Xi _{t}} = e^{{\Upsilon }[(Q_{t}B_{i,t})/{HK} - QB_{i}/{HK}]}$

where

![]() $ {\Upsilon }\equiv {\Upsilon }^{a}(HK/QB_{i})$

represent the degree of global banking sector imperfection arisen from changes in global bank loans. The log linearized global bank interest rate is given by

$ {\Upsilon }\equiv {\Upsilon }^{a}(HK/QB_{i})$

represent the degree of global banking sector imperfection arisen from changes in global bank loans. The log linearized global bank interest rate is given by

Thus, the real depreciation affects the net worth of domestic banks through two channels: (a) as shown in (17), the same amount of domestic bank debts from the global banks costs more (b) an increase in the global bank interest rate reduces the net worth of domestic banks. Also, this equation shows that the global bank interest rate is determined by the foreign interest rate and the degree of international financial imperfections.

By combining (34) and (41), we can show that the deviation from uncovered interest parity is also shown in terms of global banking sector imperfection

This equation implies that a higher global banking interest rate or an expected depreciation of the real exchange rate will be reflected in a higher domestic interest rate. Thus,

![]() $\Upsilon ^{a}$

can be interpreted as the degree of deviation from uncovered interest parity.

$\Upsilon ^{a}$

can be interpreted as the degree of deviation from uncovered interest parity.

Combining (12) and (42) yields

This equation further implies that since an increase in foreign government bonds held by domestic households should be compensated by a decrease in deposits, domestic banks should require more global bank loans.

Analogous to domestic bankers, the global banker faces the incentive constraint

We guess that the value function is a linear function of assets and deposits.

where

![]() $ V_{s,t}^{f}$

and

$ V_{s,t}^{f}$

and

![]() $ V_{i,t}^{f}$

is the marginal value of loans to foreign intermediate firms and domestic banks and

$ V_{i,t}^{f}$

is the marginal value of loans to foreign intermediate firms and domestic banks and

![]() $ V_{b,t}^{f}$

is the marginal cost of deposits.

$ V_{b,t}^{f}$

is the marginal cost of deposits.

The global banks choose

![]() $K_{t+1}^{f}$

and

$K_{t+1}^{f}$

and

![]() $ D^{f}_{t+1}$

in order to maximize the value function subject to the incentive constraint and the bank’s balance sheet constraint. The first order conditions in terms of

$ D^{f}_{t+1}$

in order to maximize the value function subject to the incentive constraint and the bank’s balance sheet constraint. The first order conditions in terms of

![]() $K_{t+1}^{f}$

,

$K_{t+1}^{f}$

,

![]() $ D^{f}_{t+1}$

and

$ D^{f}_{t+1}$

and

![]() $\lambda _{t}^{a}$

yield

$\lambda _{t}^{a}$

yield

\begin{align} \dfrac {V_{s,t}^{f}}{H^f_{t}} & = V_{i,t}^{f} \\[-2pt] \nonumber \end{align}

\begin{align} \dfrac {V_{s,t}^{f}}{H^f_{t}} & = V_{i,t}^{f} \\[-2pt] \nonumber \end{align}

where

$\phi _{t}^{f}\equiv\!\left[\dfrac {{V_{b,t}^{f}}}{{(\kappa _{t}^{f}-\mu _{t}^{fa})}} \right]$

is the maximum leverage ratio and we assume that stochastic foreign agency cost parameter follows an AR(1) process in logs,

$\phi _{t}^{f}\equiv\!\left[\dfrac {{V_{b,t}^{f}}}{{(\kappa _{t}^{f}-\mu _{t}^{fa})}} \right]$

is the maximum leverage ratio and we assume that stochastic foreign agency cost parameter follows an AR(1) process in logs,

![]() $\hat {\kappa }_{t}^{f} = \rho _{k}^{f}\hat {\kappa }_{t-1}^{f} + \varepsilon _{k,t}^{f} ;$

$\hat {\kappa }_{t}^{f} = \rho _{k}^{f}\hat {\kappa }_{t-1}^{f} + \varepsilon _{k,t}^{f} ;$

![]() $\varepsilon _{k,t}^{f} \sim$

$\varepsilon _{k,t}^{f} \sim$

![]() $N(0, {\sigma ^{f}_{K}}^{2})$

.

$N(0, {\sigma ^{f}_{K}}^{2})$

.

The global banking asset clearing condition is given by

Due to a small open economy specification where

![]() $n$

tends to zero, log linearizing (47) around the steady state yields

$n$

tends to zero, log linearizing (47) around the steady state yields

Thus, a global banking asset market clearing condition coupled with the small open economy specification ensures that domestic banks in the small open economy cannot influence global banks while the converse is not true.

We can rewrite the value function by combining (38),(45) and (46) as

Then, we can verify the assumed linear value function by combining the conjectured value function with the Bellman equation

where

![]() $\Omega _{t+1}^{f}\equiv \!\left[(1-\sigma ^{f}) + {\sigma ^{f}}\!\left(\mu _{t+1}^{fa}{\phi _{t+1}^{f}} + V_{b,t+1}^{f}\right) \right]$

is the present value of marginal net worth. A debt elastic global bank interest rate and the incentive constraint ensure excess returns on global bank loans over deposits,

$\Omega _{t+1}^{f}\equiv \!\left[(1-\sigma ^{f}) + {\sigma ^{f}}\!\left(\mu _{t+1}^{fa}{\phi _{t+1}^{f}} + V_{b,t+1}^{f}\right) \right]$

is the present value of marginal net worth. A debt elastic global bank interest rate and the incentive constraint ensure excess returns on global bank loans over deposits,

![]() $ E_{t}\!\left(\beta \Omega _{t+1}^{f} \right)R_{i,t}\geq {E_{t}}\!\left(\beta \Omega _{t+1}^{f} \right)R_{t}^{f}$

. Without financial imperfections, the global bank rate is always equal to the foreign deposit rate.

$ E_{t}\!\left(\beta \Omega _{t+1}^{f} \right)R_{i,t}\geq {E_{t}}\!\left(\beta \Omega _{t+1}^{f} \right)R_{t}^{f}$

. Without financial imperfections, the global bank rate is always equal to the foreign deposit rate.

The composition of aggregate net worth for global bankers is analogous to domestic banks.

3.5. The goods sector

The capital, intermediate and retail goods sectors consist of a continuum of homogeneous firms. Domestic firms on the subinterval [0, n] are located in the home country and foreign firms on the subinterval [n, 1] are located in the foreign country. We assume symmetric structures of foreign goods sectors without open economy features.

3.5.1. The capital goods sector

Competitive capital producing firms produce new capital,

![]() $ I_{t}$

using final outputs and sell to intermediate firms at the price

$ I_{t}$

using final outputs and sell to intermediate firms at the price

![]() $ H_{t}$

. Following Christiano et al. (Reference Christiano, Eichenbaum and Evans2005), producing new capital incurs investment adjustment costs which depends on the growth rate of investment,

$ H_{t}$

. Following Christiano et al. (Reference Christiano, Eichenbaum and Evans2005), producing new capital incurs investment adjustment costs which depends on the growth rate of investment,

![]() $f\!\left(\dfrac {I_{t}}{I_{t-1}}\right)I_{t}$

.

$f\!\left(\dfrac {I_{t}}{I_{t-1}}\right)I_{t}$

.

A capital producing firm maximizes the present value of discounted profits

Following Dedola et al. (Reference Dedola, Karadi and Lombardo2013), we assume the functional form for the investment adjustment costs to be,

![]() $f\!\left(\dfrac {I_{t}}{I_{t-1}}\right)\equiv \dfrac {\eta _{i}}{2}\!\left(\dfrac {I_{t}}{I_{t-1}}-1 \right)^{2}$

where

$f\!\left(\dfrac {I_{t}}{I_{t-1}}\right)\equiv \dfrac {\eta _{i}}{2}\!\left(\dfrac {I_{t}}{I_{t-1}}-1 \right)^{2}$

where

![]() $ \eta _{i}$

is the inverse elasticity of investment with respect to the price of capital.

$ \eta _{i}$

is the inverse elasticity of investment with respect to the price of capital.

The optimal decision of investment yields the capital supply function.

Tobin’s Q relation shows the positive relation between current investment and the price of capital goods.

The aggregate capital stock comprises new investment and the undepreciated capital stock.

where

![]() $ \delta$

is the rate of depreciation and

$ \delta$

is the rate of depreciation and

![]() $ K_{t}$

is the capital stock after production.

$ K_{t}$

is the capital stock after production.

3.5.2. The intermediate goods sector

The production function of a representative domestic intermediate firm is

where

![]() $ Y_{m,t}$

is intermediate output and

$ Y_{m,t}$

is intermediate output and

![]() $ \alpha ^p$

is effective capital share.

$ \alpha ^p$

is effective capital share.

![]() $ A_{t}$

is an intermediate sector total factor productivity shock.

$ A_{t}$

is an intermediate sector total factor productivity shock.

The real profit of the intermediate firm is given by

The intermediate firm sells intermediate goods,

![]() $P_{m,t}Y_{m,t}$

where

$P_{m,t}Y_{m,t}$

where

![]() $P_{m,t}$

is the real price of intermediate goods, and undepreciated capital to retail firms,

$P_{m,t}$

is the real price of intermediate goods, and undepreciated capital to retail firms,

![]() $H_{t}(1-\delta )K_{t}$

. Also, the firm pays real wage,

$H_{t}(1-\delta )K_{t}$

. Also, the firm pays real wage,

![]() $W_{t}$

to workers.

$W_{t}$

to workers.

The firm chooses labor inputs and capital in order to maximize real profit subject to the production function.

where

![]() $ M_{t}\equiv \dfrac {{\alpha ^p}Y_{m,t}P_{m,t}}{K_{t}}$

is the gross production profit.

$ M_{t}\equiv \dfrac {{\alpha ^p}Y_{m,t}P_{m,t}}{K_{t}}$

is the gross production profit.

3.5.3. Retail goods sector

We assume monopolistic retail firms in order to introduce sticky prices. Retailers purchase intermediate goods from intermediate firms and costlessly diversify them. Then, it sells to households, government and capital producing firms.

Final total domestic (foreign) output,

![]() $ Y_{t}$

(

$ Y_{t}$

(

![]() $ Y_{t}^{f}$

) is a CES composite of a continuum of retail goods.

$ Y_{t}^{f}$

) is a CES composite of a continuum of retail goods.

\begin{align} Y_{t}=\left [\left(\frac {1}{n}\right)^{\frac {1}{\varepsilon }} \int _{0}^{n}Y_{h,t}(r)^{\frac {\varepsilon -1}{\varepsilon }}dr\right ]^{\frac {\varepsilon }{\varepsilon -1}} ;\;\ Y_{t}^{f}=\left [\left(\frac {1}{1-n}\right)^{\frac {1}{\varepsilon ^{f}}} \int _{n}^{1}Y_{f,t}^{f}\left(r^{f} \right)^{\frac {\varepsilon ^{f}-1}{\varepsilon ^{f}}}dr^{f}\right ]^{\frac {\varepsilon ^{f}}{\varepsilon ^{f}-1}} \end{align}

\begin{align} Y_{t}=\left [\left(\frac {1}{n}\right)^{\frac {1}{\varepsilon }} \int _{0}^{n}Y_{h,t}(r)^{\frac {\varepsilon -1}{\varepsilon }}dr\right ]^{\frac {\varepsilon }{\varepsilon -1}} ;\;\ Y_{t}^{f}=\left [\left(\frac {1}{1-n}\right)^{\frac {1}{\varepsilon ^{f}}} \int _{n}^{1}Y_{f,t}^{f}\left(r^{f} \right)^{\frac {\varepsilon ^{f}-1}{\varepsilon ^{f}}}dr^{f}\right ]^{\frac {\varepsilon ^{f}}{\varepsilon ^{f}-1}} \end{align}

where

![]() $ Y_{h,t}(r)$

$ Y_{h,t}(r)$

![]() $(Y_{f,t}^{f}(r^{f}))$

is the domestic (foreign) output of retailer

$(Y_{f,t}^{f}(r^{f}))$

is the domestic (foreign) output of retailer

![]() $r$

(

$r$

(

![]() $r^{f}$

) and

$r^{f}$

) and

![]() $\varepsilon$

(

$\varepsilon$

(

![]() $\varepsilon ^{f}$

) is the elasticity of substitution between goods from the same country. For simplicity, we assume the same elasticity of substitution across countries. The cost minimizing decision of final output users leads to the demand function

$\varepsilon ^{f}$

) is the elasticity of substitution between goods from the same country. For simplicity, we assume the same elasticity of substitution across countries. The cost minimizing decision of final output users leads to the demand function

\begin{align} Y_{h,t}(r)=\left(\frac {1}{n} \right)\left(\frac {P_{h,t}(r)}{P_{h,t}}\right)^{-\varepsilon }Y_{t} ;\;\ Y_{f,t}^{f}\!\left(r^{f}\right)= \left(\frac {1}{1-n} \right)\left(\frac {P_{f,t}^{f}(r^{f})}{P_{f,t}^{f}}\right)^{-\varepsilon ^{f}}Y_{t}^{f} \end{align}

\begin{align} Y_{h,t}(r)=\left(\frac {1}{n} \right)\left(\frac {P_{h,t}(r)}{P_{h,t}}\right)^{-\varepsilon }Y_{t} ;\;\ Y_{f,t}^{f}\!\left(r^{f}\right)= \left(\frac {1}{1-n} \right)\left(\frac {P_{f,t}^{f}(r^{f})}{P_{f,t}^{f}}\right)^{-\varepsilon ^{f}}Y_{t}^{f} \end{align}

A randomly selected proportion

![]() $1-\theta$

of domestic retail firms sets new price,

$1-\theta$

of domestic retail firms sets new price,

![]() $ \overline {P}_{h,t}$

each period while a fraction

$ \overline {P}_{h,t}$

each period while a fraction

![]() $ \theta$

partially index to lagged domestic inflation following Christiano et al. (Reference Christiano, Eichenbaum and Evans2005). Since firms who can set a new price in period t do not know when they will next be able to reset their price, they maximize the expected present value of discounted profits, given by

$ \theta$

partially index to lagged domestic inflation following Christiano et al. (Reference Christiano, Eichenbaum and Evans2005). Since firms who can set a new price in period t do not know when they will next be able to reset their price, they maximize the expected present value of discounted profits, given by

\begin{align} E_{t}\sum _{i=0}^{\infty } (\beta {\theta })^i\!\left[Y_{h,t+i}(r)\dfrac {\overline {P}_{h,t}}{P_{h,t+i}}\prod _{k=1}^{i}{\pi ^{\zeta }_{h,t+k-1}} -TC_{h,t+i}(Y_{h,t+i}(r))\right] \end{align}

\begin{align} E_{t}\sum _{i=0}^{\infty } (\beta {\theta })^i\!\left[Y_{h,t+i}(r)\dfrac {\overline {P}_{h,t}}{P_{h,t+i}}\prod _{k=1}^{i}{\pi ^{\zeta }_{h,t+k-1}} -TC_{h,t+i}(Y_{h,t+i}(r))\right] \end{align}

subject to the sequence of demand functions

where

![]() $ TC_{h,t+i}(Y_{h,t+i}(r))$

is the real total cost induced by purchasing intermediate goods. The first order condition yields

$ TC_{h,t+i}(Y_{h,t+i}(r))$

is the real total cost induced by purchasing intermediate goods. The first order condition yields

\begin{align} E_{t}\sum _{i=0}^{\infty } (\beta {\theta })^i\left[\dfrac {\overline {P}_{h,t}}{P_{h,t+i}P_{h,t-1}}\prod _{k=1}^{i}{\pi ^{\zeta }_{h,t+k-1}} -{\Theta }\dfrac {P_{m,t+i}}{P_{h,t-1}} \right]Y_{h,t+i}(r)=0 \end{align}

\begin{align} E_{t}\sum _{i=0}^{\infty } (\beta {\theta })^i\left[\dfrac {\overline {P}_{h,t}}{P_{h,t+i}P_{h,t-1}}\prod _{k=1}^{i}{\pi ^{\zeta }_{h,t+k-1}} -{\Theta }\dfrac {P_{m,t+i}}{P_{h,t-1}} \right]Y_{h,t+i}(r)=0 \end{align}

where

![]() $ \Theta \equiv \frac {\varepsilon }{\varepsilon -1}$

is the markup of price over marginal cost in steady state and

$ \Theta \equiv \frac {\varepsilon }{\varepsilon -1}$

is the markup of price over marginal cost in steady state and

![]() $\zeta$

measures indexation to past inflation. Real marginal cost is simply equal to the real price of intermediate goods.

$\zeta$

measures indexation to past inflation. Real marginal cost is simply equal to the real price of intermediate goods.

The domestic price index is given by

![]() $ P_{h,t}= [{\theta }({\pi ^{\zeta }_{h,t-1}}P_{h,t-1})^{1-{\varepsilon }} + (1-{\theta })\overline {P}_{h,t}^{1-{\varepsilon }}]^{\frac {1}{1-\varepsilon }}$

, which, when log linearized around the steady state yields

$ P_{h,t}= [{\theta }({\pi ^{\zeta }_{h,t-1}}P_{h,t-1})^{1-{\varepsilon }} + (1-{\theta })\overline {P}_{h,t}^{1-{\varepsilon }}]^{\frac {1}{1-\varepsilon }}$

, which, when log linearized around the steady state yields

![]() ${\pi }_{h,t}=(1-{\theta })(\overline {P}_{h,t}-\hat {P}_{h,t-1}) + {\theta }{\zeta }{\pi }_{h,t-1}$

. Combining this with the log linearized optimal price setting strategy, we obtain the marginal cost based New Keynesian Philips curve expressed in terms of domestic inflation

${\pi }_{h,t}=(1-{\theta })(\overline {P}_{h,t}-\hat {P}_{h,t-1}) + {\theta }{\zeta }{\pi }_{h,t-1}$

. Combining this with the log linearized optimal price setting strategy, we obtain the marginal cost based New Keynesian Philips curve expressed in terms of domestic inflation

where

![]() $ \varpi \equiv \frac {(1-{\beta }{\theta })(1-{\theta })}{\theta }$

. The log linearized CPI index in equation (6) is

$ \varpi \equiv \frac {(1-{\beta }{\theta })(1-{\theta })}{\theta }$

. The log linearized CPI index in equation (6) is

Thus, CPI inflation is a function of past and expected future domestic inflation, the price of intermediate goods and imports. Foreign optimal price setting strategy is analogous to domestic retail firms and thus foreign log linearized CPI index can be expressed as

3.6. Resource constraint, net exports and monetary policy

While final domestic output consists of consumption of domestic goods in bot countries,Footnote 12 investment and government expenditures, final foreign output is sum of consumption of foreign goods, foreign investment and government expenditures.

\begin{align} Y_{t}= C_{h,t} + C_{h,t}^{f} + \left[1+f\!\left(\frac {I_{t}}{I_{t-1}} \right)\right]I_{t} + G_{t} ;\;\ Y_{t}^{f}= C_{t}^{f} + \left[1+f\!\left(\frac {I_{t}^{f}}{I_{t-1}^{f}}\right)\right]I_{t}^{f} + G_{t}^{f} \end{align}

\begin{align} Y_{t}= C_{h,t} + C_{h,t}^{f} + \left[1+f\!\left(\frac {I_{t}}{I_{t-1}} \right)\right]I_{t} + G_{t} ;\;\ Y_{t}^{f}= C_{t}^{f} + \left[1+f\!\left(\frac {I_{t}^{f}}{I_{t-1}^{f}}\right)\right]I_{t}^{f} + G_{t}^{f} \end{align}

Domestic net exports,

![]() $NX_{t}$

are defined as

$NX_{t}$

are defined as

We assume that policy makers follow a Taylor-type interest rate rule. Let

![]() $i_{t}$

be the nominal interest rate which link to the real interest rate by the Fisher equation,

$i_{t}$

be the nominal interest rate which link to the real interest rate by the Fisher equation,

![]() $\hat {i}_{t}= \hat {R}_{t}+E_{t}(\hat {P}_{t+1}-{\hat {P}_{t}})$

.

$\hat {i}_{t}= \hat {R}_{t}+E_{t}(\hat {P}_{t+1}-{\hat {P}_{t}})$

.

where

![]() $\rho _{i}$

represents the degree of interest rate smoothing and

$\rho _{i}$

represents the degree of interest rate smoothing and

![]() $ \varepsilon _{m,t}$

is an exogenous shock to monetary policy.

$ \varepsilon _{m,t}$

is an exogenous shock to monetary policy.

3.7. Credit policy

Following Gertler and Karadi (Reference Gertler and Karadi2011) and Gertler et al. (Reference Gertler, Kiyotaki and Queralto2012), we assume that the central bank implements credit policy by purchasing domestic private securities in a financial crisis. Accordingly, the total value of intermediated asset has two sources; privately intermediated assets and assets intermediated by the central bank. At the end of period t, the consolidated central bank and government issues government bonds to lend funds to intermediate firms and supplies a fraction

![]() $\varsigma _{t}$

of total intermediated assets. Since the financial crisis in a small open economy can be characterized by an increase in both domestic credit spread and international credit spread (i.e.,

$\varsigma _{t}$

of total intermediated assets. Since the financial crisis in a small open economy can be characterized by an increase in both domestic credit spread and international credit spread (i.e.,

![]() $R_{k,t+1} - R_{i,t}$

), we introduce an alternative feedback rule according to international credit spread

$R_{k,t+1} - R_{i,t}$

), we introduce an alternative feedback rule according to international credit spread

![]() $\varsigma _{i,t}$

, in addition to a feedback rule according to domestic credit spread,

$\varsigma _{i,t}$

, in addition to a feedback rule according to domestic credit spread,

![]() $\varsigma _{d,t}$

.

$\varsigma _{d,t}$

.

where

![]() $ \varsigma$

is the steady state fraction of assets intermediated by the central bank,

$ \varsigma$

is the steady state fraction of assets intermediated by the central bank,

![]() $\varsigma _{t}\in \lbrace \varsigma _{d,t},\varsigma _{i,t}\rbrace$

and

$\varsigma _{t}\in \lbrace \varsigma _{d,t},\varsigma _{i,t}\rbrace$

and

![]() $ \vartheta \in \lbrace \vartheta _{d},\vartheta _{i}\rbrace$

is the value of the feedback coefficient. While the feedback rule according to domestic credit spread mitigates financial frictions, the latter attempts to remove distortions from international financial imperfections, allows an appreciation of the real exchange rate, and thus reduces the real cost of global bank loans. As implied by the UIP, the risk sharing and perfect capital market conditions, the perfect risk sharing and perfect international financial market can be achieved by targeting international credit spread. As in Gertler et al. (Reference Gertler, Kiyotaki and Queralto2012), we also introduce quadratic costs to credit policy and have government expenditures as

$ \vartheta \in \lbrace \vartheta _{d},\vartheta _{i}\rbrace$

is the value of the feedback coefficient. While the feedback rule according to domestic credit spread mitigates financial frictions, the latter attempts to remove distortions from international financial imperfections, allows an appreciation of the real exchange rate, and thus reduces the real cost of global bank loans. As implied by the UIP, the risk sharing and perfect capital market conditions, the perfect risk sharing and perfect international financial market can be achieved by targeting international credit spread. As in Gertler et al. (Reference Gertler, Kiyotaki and Queralto2012), we also introduce quadratic costs to credit policy and have government expenditures as

where

![]() $K_{g,t+1} \equiv \varsigma _{t}K_{t+1}$

denotes assets intermediated by the central bank. Assets intermediated by the central bank are not constrained. With credit policy and efficiency costs, the consolidated government and central bank budget constraint can be rewritten as

$K_{g,t+1} \equiv \varsigma _{t}K_{t+1}$

denotes assets intermediated by the central bank. Assets intermediated by the central bank are not constrained. With credit policy and efficiency costs, the consolidated government and central bank budget constraint can be rewritten as

4. Model analysis

4.1. Parameterization

We choose fairly conventional values of parameters as set out in Table 1.

![]() $ \beta$

is set equal to 0.99 and thus in steady state

$ \beta$

is set equal to 0.99 and thus in steady state

![]() $ \beta =1/R$

which implies a riskless steady state real annual return of approximately

$ \beta =1/R$

which implies a riskless steady state real annual return of approximately

![]() $ 4\%$

. Following Benigno (Reference Benigno2009), the costs of adjusting bond holding is set as

$ 4\%$

. Following Benigno (Reference Benigno2009), the costs of adjusting bond holding is set as

![]() $ \chi =0.012$

and following Gertler and Karadi (Reference Gertler and Karadi2011), the elasticity of substitution between same category are set as

$ \chi =0.012$

and following Gertler and Karadi (Reference Gertler and Karadi2011), the elasticity of substitution between same category are set as

![]() $ \varepsilon =4.167$

. This calibration assumes common values of the risk aversion,

$ \varepsilon =4.167$

. This calibration assumes common values of the risk aversion,

![]() $ \rho =1$

, the inverse Frisch labor supply elasticity,

$ \rho =1$

, the inverse Frisch labor supply elasticity,

![]() $ \varphi =0.276$

and the elasticity of substitution between home and foreign tradable goods,

$ \varphi =0.276$

and the elasticity of substitution between home and foreign tradable goods,

![]() $ \eta =1.5$

. The government share of GDP is set to

$ \eta =1.5$

. The government share of GDP is set to

![]() $ G/Y=0.2$

. The probability of not being able to set a new price is set equal to 0.75 which implies an average of four periods between price adjustment. The capital share in production and depreciation rate are set as

$ G/Y=0.2$

. The probability of not being able to set a new price is set equal to 0.75 which implies an average of four periods between price adjustment. The capital share in production and depreciation rate are set as

![]() $ \alpha ^p=0.33$

and

$ \alpha ^p=0.33$

and

![]() $\delta =0.025$

. We use the import/GDP ratio of Korea during 1994q4 to 2014q3 to pin down the degree of trade openness,

$\delta =0.025$

. We use the import/GDP ratio of Korea during 1994q4 to 2014q3 to pin down the degree of trade openness,

![]() $\alpha =0.3$

which is common value of the trade openness while that of Canada shows

$\alpha =0.3$

which is common value of the trade openness while that of Canada shows

![]() $\alpha =0.4$

for the same period.

$\alpha =0.4$

for the same period.

Table 1. Parameters

Since the efficiency costs of credit policy are likely to be less than 10 basis points per year as Gertler et al. (Reference Gertler, Kiyotaki and Queralto2012) point out, the costs are set as

![]() $\tau _{1}=0.000125$

and

$\tau _{1}=0.000125$

and

![]() $\tau _{2}=0.0012$

. Following García-Cicco et al. (Reference García-Cicco, Pancrazi and Uribe2010), the degree of global banking sector imperfection is set such that in the steady state, a

$\tau _{2}=0.0012$

. Following García-Cicco et al. (Reference García-Cicco, Pancrazi and Uribe2010), the degree of global banking sector imperfection is set such that in the steady state, a

![]() $ 1\%$

increase in global bank debt as a share of assets raises the spread between global bank interest rate and foreign riskless rate by around

$ 1\%$

increase in global bank debt as a share of assets raises the spread between global bank interest rate and foreign riskless rate by around

![]() $ 0.5\%$

which implies

$ 0.5\%$

which implies

![]() $ \Upsilon =0.304$