I. Introduction

The U.S. alcohol retail market has seen several changes over the past two decades, with the growth of large-scale, multiregional vendors (Jernigan and Ross, Reference Jernigan and Ross2020). This phenomenon, characterized by the proliferation of large-scale corporate retailers—albeit often with a regional presence—presents a modern-day “David versus Goliath” scenario, where small-scale independent retailers face increasing competition from corporate entities. The dynamics of this competition are complex, often reflecting broader economic and regulatory adjustments. For instance, changes in licensing laws, consumer preferences, and distribution channels have played a crucial role in shaping the current market structure (Anderson et al., Reference Anderson, Meloni and Swinnen2018). These developments have led to a reconfiguration of the (off-premises) alcohol retail industry, raising questions about the competitiveness of small-scale alcohol retailers (Connolly et al., Reference Connolly, Graziano, McDonnell and Steinbach2023). This paper studies this transformation in two ways. First, we analyze the impact of corporate expansion on the market structure of the alcohol retail industry. Then, we examine the broader competitive implications of this shift in industry dynamics for incumbent, noncorporate businesses. The research is critical in understanding the evolving landscape of the U.S. alcohol retail sector and the potential challenges independent retailers face in an increasingly corporatized and multichannel market.

An expanding body of literature assesses the repercussions of competitive market entry on the economic outcomes of established firms. Related studies encompass various sectors, including banking (Berger et al., Reference Berger, Bonime, Goldberg and White2004), craft beer (Fan and Yang, Reference Fan and Yang2022), digital services (Calvano and Polo, Reference Calvano and Polo2021), energy (Koh et al., Reference Koh, Jeon and Lee2022), food retailing (Arcidiacono et al., Reference Arcidiacono, Ellickson, Mela and Singleton2020; Basker, Reference Basker2007; Chenarides et al., Reference Chenarides, Çakır and Richards2024; Lopez et al., Reference Lopez, Marchesi and Steinbach2024), hospitality (Chang and Sokol, Reference Chang and Sokol2022; Mazzeo, Reference Mazzeo2002), pharmaceuticals (Li et al., Reference Li, Lo and Thakor2021), religious services (Rennhoff and Owens, Reference Rennhoff and Owens2012), and telecommunication (Bourreau et al., Reference Bourreau, Sun and Verboven2021). While the conventional practice of studying the impact of corporate entry entails relying on administrative or statistical units, such as census tracts or counties, as proxies for market boundaries (as in Berger et al., Reference Berger, Bonime, Goldberg and White2004; Chenarides et al., Reference Chenarides, Çakır and Richards2024; Lopez et al., Reference Lopez, Marchesi and Steinbach2024), other recent research had assessed the impact of market entry by employing distance bands to gauge the exposure of incumbent firms to new competitors (e.g., Arcidiacono et al., Reference Arcidiacono, Ellickson, Mela and Singleton2020; Rennhoff and Owens, Reference Rennhoff and Owens2012; Seim, Reference Seim2006). One of the few empirical investigations addressing market power in the alcohol retail industry offers evidence regarding market concentration and a heterogeneous response of firms to alcohol policy shifts (Illanes and Moshary, Reference Illanes and Moshary2020). More recently, Connolly et al. (Reference Connolly, Graziano, McDonnell and Steinbach2023)showed that partial competition from corporate retailers in the form of grocery store chains has had limited effects on liquor store turnaround and survivability, although limited to beer sales in one state.

Our paper assesses the impact of corporate, multi-store entry on independent alcohol retailers using establishment-level data for the entire United States. We constructed a unique panel dataset of alcohol retail business activities from the National Establishment Time Series (NETS) database, which covers all U.S. businesses at the establishment level from 1991 to 2021 (Walls & Associates, 2024). For each alcohol retailer location, we have access to a time series of employment counts, gross sales, business locations, headquarters linkages (to gauge the business type), and years of activity. To identify alcohol retail businesses, we rely on the North American Industry Classification System (NAICS) codes. We focus on NAICS code 445310 (Beer, Wine, and Liquor Stores) for the analysis and the period from 2000 to 2020 to exclude the potential effects of the COVID-19 pandemic. Our empirical approach exploits the unique spatial and temporal characteristics of the panel dataset, focusing on states without an alcohol monopoly, to assess the impact of corporate expansion on the exit probability, employment, and revenue of incumbent small-scale alcohol retailers. To do so, we calculate the distance between each small-scale retailer and a corporate entry location within 25 miles Euclidian distance of the incumbent coordinates. We then count the entries based on the distance band and rely on an empirical specification of competitive entry that accounts for establishment characteristics, common time shocks, and market trends following the related literature (e.g., Arcidiacono et al., Reference Arcidiacono, Ellickson, Mela and Singleton2020; Rennhoff and Owens, Reference Rennhoff and Owens2012; Seim, Reference Seim2006). This empirical specification allows us to exploit the timing of corporate entries across states to assess the causal effect of corporate entry proximity on incumbent small-scale alcohol retailers.

Our study of the U.S. alcohol retail industry reveals significant findings related to the impact of corporate entries on small-scale retailers. At the national level, market concentration, measured by the Herfindahl–Hirschman Index (HHI), indicates a low but slowly increasing trend in market concentration. However, at the county level, a notably higher market concentration is observed, especially in nonmetropolitan areas, where it has gradually increased between 2000 and 2020, signaling a degree of regionalization. Our results show that corporate entries within a 1-mile radius of incumbent small-scale retailers have a slight positive impact on the survival rates of these retailers, increasing by about 1.1%. This positive effect lessens with increased distance, with a negligible increase in survival probability when corporate entries occur 10–25 miles away. Employment and revenue also benefit within the 1-mile radius (0.4% higher), but no significant effects are observed beyond this range. This result indicates that proximity to corporate retailers can lead to agglomeration economies, benefiting nearby small-scale businesses by increasing consumer traffic and potentially enhancing their competitiveness. Over time, the positive impacts on survival probabilities from incumbents near corporate entries have more than doubled within the immediate vicinity, suggesting an intensification of co-location benefits. However, for small-scale retailers located 10–25 miles away, the revenue effects of corporate entries appear detrimental, possibly due to consumer substitution effects. These findings are driven by metropolitan areas, where agglomeration economies are more pronounced, contrasting with nonmetropolitan areas without significant corporate proximity benefits. This pattern highlights the varying impact of corporate entries depending on regional market characteristics and the density of the competitive landscape.

This paper is relevant to the discussion on the current economic climate, where the scale and scope of corporate influence in various industries are subjects of intense debate and scrutiny, especially within highly regulated markets. First, our study contributes to the broader understanding of how medium and large-scale corporate entities reshape the competitive landscape in the retail sector (Arcidiacono et al., Reference Arcidiacono, Ellickson, Mela and Singleton2020; Basker, Reference Basker2007; Chenarides et al., Reference Chenarides, Çakır and Richards2024; Lopez et al., Reference Lopez, Marchesi and Steinbach2024). It further provides insights into the strategies employed by corporate retailers and their effects on the market share, financial health, and operational capabilities of incumbent small-scale retailers. This analysis is crucial for policymakers, industry stakeholders, and small business owners navigating the challenges of such market transformations. Second, our research offers empirical evidence on the broader implications of corporate expansion for industry dynamics (Illanes and Moshary, Reference Illanes and Moshary2020; Rennhoff and Owens, Reference Rennhoff and Owens2012; Seim, Reference Seim2006). By revealing that corporate entry benefits incumbent small-scale retailers due to agglomeration economies, our paper provides an essential piece to the puzzle for understanding if and how further liberalization of the U.S. off-premises alcohol industry may affect the market structure and performance of small-scale alcohol retailers (Rosenthal and Strange, Reference Rosenthal and Strange2020). This aspect of our paper is essential in informing ongoing discussions about market regulation and the support mechanisms necessary for the financial sustainability of small-scale businesses.

II. Methods and data

a. Methods

Our empirical strategy employs the unique spatial and temporal characteristics of our panel dataset to investigate the implications of corporate expansion in the alcohol retail industry. The empirical analysis is conducted at the establishment-year level, focusing on the exit probability, employment, and revenue of small-scale alcohol retailers, hereafter denoted as ![]() $SA{R_{rt}}$, in the following log-linear regression specification:

$SA{R_{rt}}$, in the following log-linear regression specification:

\begin{equation} SAR_{rt}={\alpha}_{r}+{\alpha}_{t}+{\alpha}_{m(r)}(t)+\sum\limits_{b=0}^{B} \beta_{b}\sum\limits_{j} (D_{rj})CAR_{jt}+\eta_{rt}, \end{equation}

\begin{equation} SAR_{rt}={\alpha}_{r}+{\alpha}_{t}+{\alpha}_{m(r)}(t)+\sum\limits_{b=0}^{B} \beta_{b}\sum\limits_{j} (D_{rj})CAR_{jt}+\eta_{rt}, \end{equation} where the retailer is denoted by ![]() $r$, the year by

$r$, the year by ![]() $t$, and the alcohol retail market with

$t$, and the alcohol retail market with ![]() $m$.

$m$. ![]() $CA{R_{jt}}$ is an indicator variable denoting the presence of the

$CA{R_{jt}}$ is an indicator variable denoting the presence of the ![]() $j$th corporate alcohol retailer in driving distance band

$j$th corporate alcohol retailer in driving distance band ![]() $b$. The term

$b$. The term  $\mathop \sum_{b = 0}^B {\beta _b}\mathop \sum_j \left( {{D_{rj}}} \right)CAR_{jt}$ assesses the corporate alcohol retailer entry effect for six driving distance cumulative bands within 25 miles of the small-scale alcohol retailer following Arcidiacono et al. (Reference Arcidiacono, Ellickson, Mela and Singleton2020). This specification is implemented with a set of indicator variables that take on a value of one or larger when the independent retailer

$\mathop \sum_{b = 0}^B {\beta _b}\mathop \sum_j \left( {{D_{rj}}} \right)CAR_{jt}$ assesses the corporate alcohol retailer entry effect for six driving distance cumulative bands within 25 miles of the small-scale alcohol retailer following Arcidiacono et al. (Reference Arcidiacono, Ellickson, Mela and Singleton2020). This specification is implemented with a set of indicator variables that take on a value of one or larger when the independent retailer ![]() $r$ is exposed to corporate retailer

$r$ is exposed to corporate retailer ![]() $j$ within distance band

$j$ within distance band ![]() $b$. Using discrete driving-distance bands allows us to determine the distance at which the corporate entry effect on the economic outcomes of incumbent firms becomes zero. The fixed effects at the small-scale alcohol retailer and year levels are represented by

$b$. Using discrete driving-distance bands allows us to determine the distance at which the corporate entry effect on the economic outcomes of incumbent firms becomes zero. The fixed effects at the small-scale alcohol retailer and year levels are represented by ![]() ${\alpha}_{r}$ and

${\alpha}_{r}$ and ![]() ${\alpha}_{t}$, respectively, and

${\alpha}_{t}$, respectively, and ![]() ${\eta _{rt}}$ is the error term, which we cluster at the market level

${\eta _{rt}}$ is the error term, which we cluster at the market level ![]() $m$. This model assumes that the effect of a specific corporate entry on the economic outcomes of small-scale alcohol retailers is independent of prior exposure.

$m$. This model assumes that the effect of a specific corporate entry on the economic outcomes of small-scale alcohol retailers is independent of prior exposure.

To address potential estimation biases, such as the strategic location choices of corporate retailers, we include market-specific time trends ![]() ${{{\alpha }}_{m\left( r \right)}}\left( t \right)$ (Arcidiacono et al., Reference Arcidiacono, Ellickson, Mela and Singleton2020). To delineate markets, we rely on the metropolitan statistical area (MSA) codes from the U.S. Census Bureau (2024) for market delineation and use state-specific time trends for census tracts not belonging to an MSA. For a given corporate alcohol retailer entry, the control includes independent retailers who were never exposed and those exposed earlier or later during the sample period. The distance band specification extends this logic to compare independent small-scale alcohol retailers treated at different driving distances. The empirical model operates under the identifying assumption that the timing and location of corporate retailer entry are independent of the error term conditional on retailer fixed effects, year dummies, and linear market trends. Importantly, we focus on states without an alcohol monopoly during the study period.

${{{\alpha }}_{m\left( r \right)}}\left( t \right)$ (Arcidiacono et al., Reference Arcidiacono, Ellickson, Mela and Singleton2020). To delineate markets, we rely on the metropolitan statistical area (MSA) codes from the U.S. Census Bureau (2024) for market delineation and use state-specific time trends for census tracts not belonging to an MSA. For a given corporate alcohol retailer entry, the control includes independent retailers who were never exposed and those exposed earlier or later during the sample period. The distance band specification extends this logic to compare independent small-scale alcohol retailers treated at different driving distances. The empirical model operates under the identifying assumption that the timing and location of corporate retailer entry are independent of the error term conditional on retailer fixed effects, year dummies, and linear market trends. Importantly, we focus on states without an alcohol monopoly during the study period.

b. Data

NETS is a microlevel business dataset by Walls & Associates that relies on Dun & Bradstreet's archival dataset (Walls & Associates, 2024). It covers all U.S. businesses at the establishment level from 1991 to 2021. Each establishment is assigned a unique Data Universal Numbering System (DUNS) number, which follows that establishment over time, relocations, and acquisitions. NETS provides the North American Industry Classification System (NAICS) codes, which are self-reported by each establishment. The NAICS codes in our NETS version are from the 2017 NAICS classification. To identify alcohol retail businesses, we rely on the North American Industry Classification System (NAICS) codes for each establishment. We use NAICS code 445310 (Beer, Wine, and Liquor Stores) for the analysis and focus on the period from 2000 to 2020 to exclude the potential effects of the COVID-19 pandemic. Barnatchez et al. (Reference Barnatchez, Crane and Decker2017) find that NETS correlates strongly with official statistics but does not entirely cover the same firm universe. Lastly, we use the 2013 Rural-Urban Continuum Codes (RUCC) codes to distinguish metropolitan from nonmetropolitan areas as a proxy for urbanization, where 2013 represents the midpoint of the sample period (Economic Research Service, 2024). The descriptive statistics for corporate and small-scale alcohol retailers are provided in Table 1.

Table 1. Descriptive Statistics

Note. The table shows the descriptive statistics of the outcome and treatment variables. We calculated the sum, mean, median, standard deviation (SD), minimum (min.), maximum (max.), and observation numbers (obs.) for the three outcome variables (survival, employment, and revenue). The revenue descriptive statistics are scaled in $1,000.

III. Results and discussion

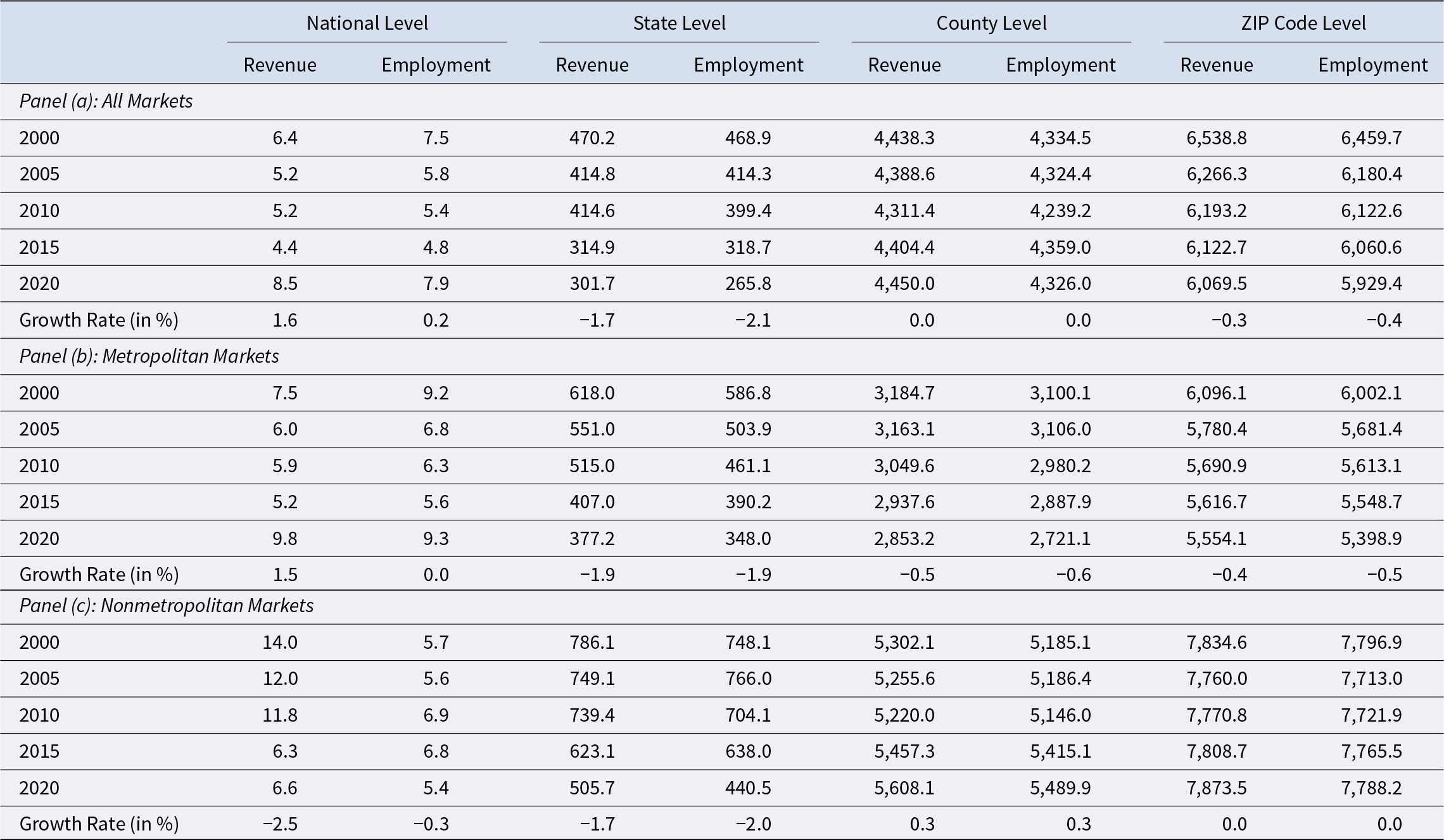

Table 2 illustrates the trends in market concentration within the U.S. alcohol retail industry, analyzed in 5-year intervals from 2000 to 2020. This analysis utilizes the HHI across four market segments in both metropolitan and nonmetropolitan alcohol retail markets. The HHI quantifies market concentration by summing the squares of the individual market shares of all firms within the industry; it ranges from nearly 0 (indicating very low concentration) to 10,000 (signifying high concentration). According to the Antitrust Division of the U.S. Department of Justice (2024), a market with an HHI between 1,000 and 1,800 is moderately concentrated, while an HHI above 1,800 indicates a high concentration. Our findings reveal that, at the national level, the HHI is below 10 and has been rising by approximately 1.6% annually since 2000. However, when focusing on smaller market definitions, the average HHI is significantly larger. For example, at the county level, the HHI exceeds 4,000, with a decrease of about 0.5% annually in metropolitan areas and an increase of 0.3% annually in nonmetropolitan areas since 2000. This suggests that the U.S. alcohol retail industry exhibits high concentration at the substate level, with nonmetropolitan areas displaying nearly double the HHI of metropolitan regions at the same level.

Table 2. Market concentration trends in the U.S. alcohol retail industry

Note. The table shows market concentration trends in the U.S. alcohol retail industry. We compare the HHI index separately for all, metropolitan, and nonmetropolitan markets. The index is calculated at the national, state, county, and ZIP code levels for 2000, 2005, 2010, 2015, and 2020. The indexes represent the average over the respective spatial units. The growth rate is the annualized change in the index between 2000 and 2020.

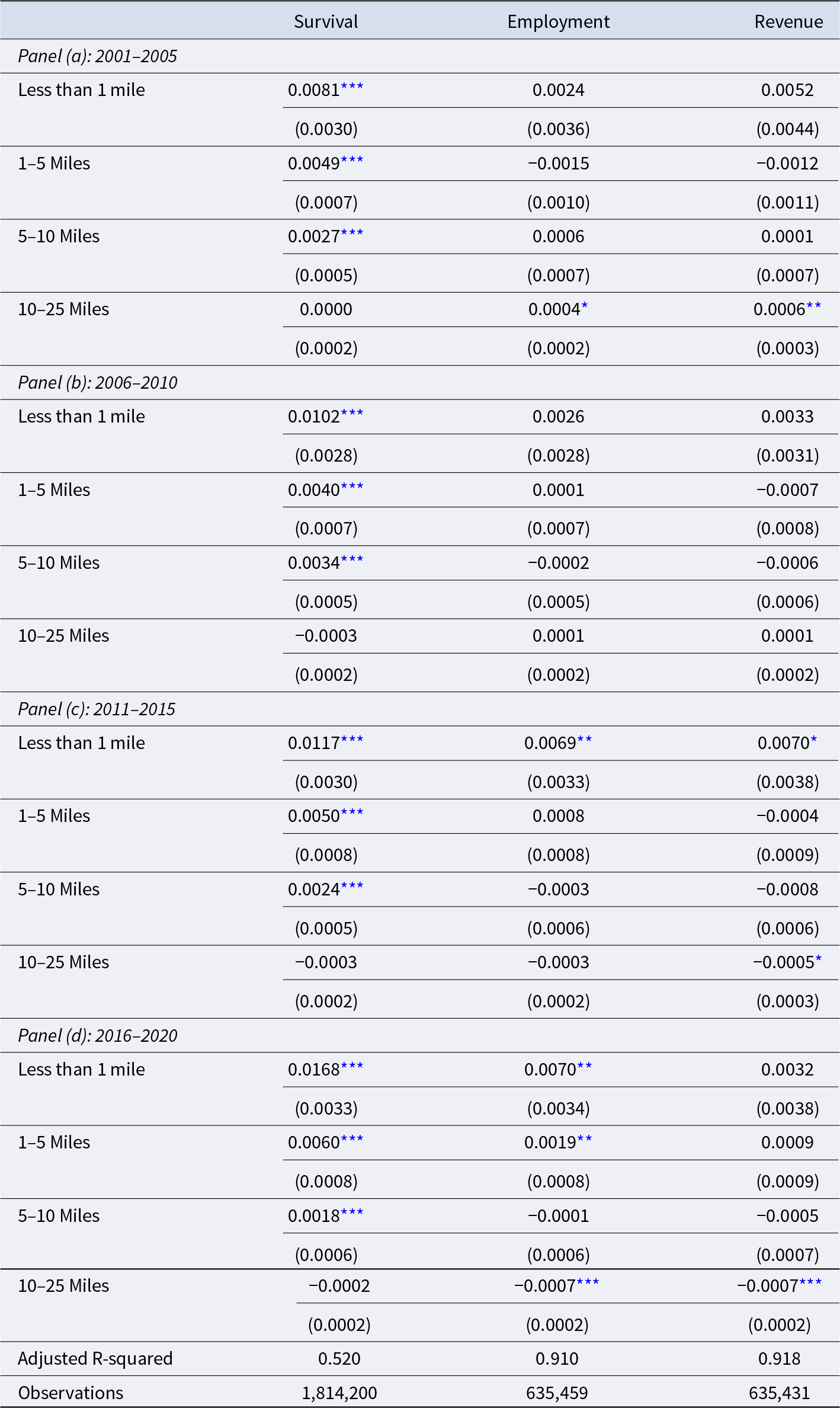

Table 3 shows the impact of corporate entry on the survival, employment, and revenue of incumbent small-scale alcohol retailers by distance band. Each regression includes retailer location fixed effects, year dummies, and linear market trends. Corporate entry within 1 mile of the incumbent retailer increases the survival probability by 1.1%. This effect decreases with distance. An additional entry between 5 and 10 miles from the small-scale retailer increases the survival probability by less than 0.3%. Interestingly, the impact of corporate entry on employment and revenue is positive within the 1-mile distance band but statistically insignificant further away. Corporate entry within 1 mile of the incumbent location results in 0.4% higher employment and revenue for those small-scale retailers. In contrast, entry beyond has no discernible impact on their employment and revenue. These estimates imply that corporate entry has a negligible or small positive impact on incumbent small-scale retailers. The pattern can be explained by agglomeration economies, which benefit small-scale incumbents when corporate entry takes place in proximity. Agglomeration economies benefit small-scale retailers by lowering search costs when consumers choose among differentiated services (Ahn, Reference Ahn2019; Rosenthal and Strange, Reference Rosenthal and Strange2020). This pattern implies that any reduction in sales from increased competition is more than offset by increased sales from higher customer traffic. (Sharma and Chung, Reference Sharma and Chung2022), a likely driver for the observed positive survival effects and the minimal impact on employment and revenue.

Table 3. Corporate retailer entry effects by distance band

Note. The table shows estimates of the corporate retailer entry effect on the survival, employment, and revenue of small-scale alcohol retailers by distance band. All regressions include retailer location fixed effects, year dummies, and linear market trends. Standard errors are adjusted for within-cluster correlation at the retailer level.

* **, **, and * indicate statistical significance at the 1%, 5%, and 10% confidence levels, respectively.

To better understand how the corporate effect effects evolved, we estimate Equation 1, including an interaction term with 5-year intervals. The results of this analysis are presented in Table 4. Interestingly, the positive impact of corporate entry on the survival probability more than doubled from 0.8% to 1.7% within the last 20 years for the less than 1-mile distance band. Although there is no consistent evidence for positive revenue effects within this distance band, the employment of incumbent small-scale retailers is about 0.7% higher between 2016 and 2020. Interestingly, we also find evidence of adverse corporate entry effects for the distance band 10–25 miles. This speaks to potential customer substitution between small-scale and corporate alcohol retailers within this distance band. To further understand how the corporate entry effect may differ between urban and rural communities, we estimate Equation 1 with an interaction term for metropolitan and nonmetropolitan alcohol retail markets. The results in Table 5 indicate that the agglomeration economies caused by corporate entry mainly operate in metropolitan markets. The magnitude of those estimates is like that of the baseline estimates. In contrast, there is no evidence of a positive association between corporate entry and the survival, employment, and revenue of incumbent small-scale retailers in nonmetropolitan markets, which supports our hypothesis that agglomeration economies drive the observed positive survival effects for incumbent small-scale alcohol retailers (Rosenthal and Strange, Reference Rosenthal and Strange2020).

Table 4. Treatment heterogeneity over time

Note. The table shows estimates of the corporate retailer entry effect on the survival, employment, and revenue of small-scale alcohol retailers by distance band over time. All regressions include retailer location fixed effects, year dummies, and linear market trends. Standard errors are adjusted for within-cluster correlation at the retailer level.

* **, **, and * indicate statistical significance at the 1%, 5%, and 10% confidence levels, respectively.

Table 5. Treatment effects for metro and nonmetro markets

Note. The table shows estimates of the corporate retailer entry effect on the survival, employment, and revenue of small-scale alcohol retailers by distance band for metropolitan and nonmetropolitan alcohol retail markets. All regressions include retailer location fixed effects, year dummies, and linear market trends. Standard errors are adjusted for within-cluster correlation at the retailer level.

* **, **, and * indicate statistical significance at the 1%, 5%, and 10% confidence levels, respectively.

IV. Conclusion

This paper investigated the consequences of corporate expansion in the U.S. alcohol retail sector on incumbent small-scale retailers. We utilized establishment-level data from NETS covering all U.S. alcohol retail businesses from 2000 to 2020 to explore market competition dynamics in states without alcohol monopolies. Our analysis focused on geographical proximity between new corporate entries and existing small-scale retailers, examining the implications for survival rates, employment, and revenue within a 25-mile radius. Our empirical strategy quantified the impact of corporate entries on the alcohol retail landscape by isolating the effects of these entries from broader market trends (Arcidiacono et al., Reference Arcidiacono, Ellickson, Mela and Singleton2020).

The core findings of our empirical analysis show that proximity to corporate entries correlates with a positive impact on the economic performance of small-scale alcohol retailers. This could be driven by the specialization of small-scale retailers on higher-end products. Although there is minimal evidence that the presence of corporate retailers improves the employment and revenue of small-scale businesses within a 1-mile radius, these entries significantly increase the survivability of incumbent retailers. This trend is primarily driven by incumbent retailers in metropolitan markets, where the density of both consumer base and corporate entries amplifies competitive pressures but also leads to agglomeration economies (Rosenthal and Strange, Reference Rosenthal and Strange2020). Over time, these positive effects have persisted and intensified, suggesting that corporate growth strategies may be progressively benefiting smaller alcohol retail establishments in metropolitan markets (Jernigan and Ross, Reference Jernigan and Ross2020; Connolly et al., Reference Connolly, Graziano, McDonnell and Steinbach2023).

Our analysis highlights important considerations for policymakers and industry stakeholders. These insights underscore the need for regulatory frameworks that consider the spatial dimensions of market competition and the unique vulnerabilities of small-scale retailers in corporatizing sectors. By providing a nuanced understanding of how corporate retail strategies affect local market dynamics, our research contributes to ongoing discussions about market regulation and the necessary support mechanisms to ensure the financial sustainability of small-scale businesses. The evidence presented here supports a reevaluation of competitive strategies considering their long-term effects on the industry’s structure and the economic health of smaller market participants. This paper thus adds a critical perspective to debates concerning economic policy and market regulation in the evolving U.S. alcohol retail landscape.

Acknowledgments

The authors would like to express our sincere gratitude to the anonymous reviewer and the editor for their valuable feedback and constructive comments. Additionally, they acknowledge the support the American Association for Wine Economists (AAWE) provided for attending the Annual AAWE Conference in Lausanne, Switzerland (July 1–5, 2024).

Funding statement

This work is supported by the National Institute of Food and Agriculture through the Agriculture and Food Research Initiative Award 2022-67023-36405. Any opinions, findings, conclusions, or recommendations expressed in this paper are those of the authors and do not necessarily reflect the views of the United States Department of Agriculture. This work also benefited from a data award provided by the College of Agriculture, Health, and Natural Resources at the University of Connecticut.

Competing interests

The authors declare none.