Introduction

Tunisian small and medium-sized enterprises (SMEs) are positioned today as a real lever for growth, wealth creation, employment, and export. According to the National Institute of Statistics (NIS) figures relating to 2018, Tunisian SMEs contribute to creating jobs and development. They provide more than 70% of private sector jobs and 50% of the gross domestic product. These figures reflect the importance of SMEs in Tunisia and their place in the country's national economy. Since the Tunisian revolution and the overthrow of the political regime in 2011, these SMEs have been the most vulnerable structures. The transition period was characterized by high social tensions, repeated strikes, low economic growth, and rising unemployment (Moalla, Reference Moalla2019). According to a census of operating companies in Tunisia carried out regularly by the Agency for the Promotion of Industry and Innovation, the companies most affected are those exporting, particularly in the textile, agri-food, and chemical sectors.

After years of weak growth, there have been signs of recovery. In 2018, for example, the growth rate reached 2.8% compared to 1.8% in 2017. At this level, measures have been taken to support organizations, mainly SMEs, that are facing financial difficulties. Aware of this problem, the Tunisian government has taken actions at the national level by facilitating their access to public markets and helping them to export by signing partnerships with foreign markets. Over 2017–2019, a budget of 4.5 million dinars (around 1.7 million dollars) has been allocated to the export promotion center (CEPEX) to carry out a marketing and commercialization strategy for textile products, for example.

Despite these initiatives, efforts still need to fully meet the expectations of these structures' managers. A recent study conducted by the bank for financing small and medium-sized enterprises (BFPME) shows that only 24% of SMEs consider government measures effective, especially during the Covid period.

SMEs must rely on their innovative capacities and proactive spirit in these exceptional circumstances. This extremely challenging and competitive environment has encouraged the implementation of new business practices, such as clean manufacturing, to increase efficiency. Besides the evolution of business models toward new collaborative organizational forms through knowledge sharing, the search for new partners is developed to create new revenue sources and ensure their survival.

Drawing on adaptive (AC) and network capabilities (NCs) theories, this research investigates the effect of SMEs' AC and NCs on their entrepreneurial orientation (EO) in the Tunisian context. AC is related to the firm expertise in altering its understanding of market expectations (Eshima & Anderson, Reference Eshima and Anderson2016; Lockett, Wiklund, Davidsson, & Girma, Reference Lockett, Wiklund, Davidsson and Girma2011). NCs concern the firm's ability to develop and use inter-organizational relationships to access various resources held by other actors (Walter, Auer, & Ritter, Reference Walter, Auer and Ritter2006).

While researchers have a growing consensus that entrepreneurial SMEs are more competitive than conservative ones (Anderson & Eshima, Reference Anderson and Eshima2013; Brouthers, Nakos, & Dimitratos, Reference Brouthers, Nakos and Dimitratos2015), there is little research on how SMEs in developing countries can develop their EO through their internal and external capabilities when facing an institutional crisis. By institutional crisis, we refer to a period in which a substantial change and destabilization confront an institution due to external shocks creating a rupture in their functioning (Cheung, Reference Cheung2005; Schmidt, Boersma, & Groenewegen, Reference Schmidt, Boersma and Groenewegen2018). Several studies showed that the Arab Spring, which started in Tunisia and quickly spread to other countries in the Maghreb and the Middle East (e.g., Libya, Egypt, Yemen, etc.), was a major crisis in which these countries experienced a radical change. This crisis has severely disrupted and reduced economic and social activities (see, Al-Abdin, Dean, & Nicholson, Reference Al-Abdin, Dean and Nicholson2016; Elbanna, Abdelzaher, & Ramadan, Reference Elbanna, Abdelzaher and Ramadan2020).

To deal with this context, promoting EO in these SMEs appears necessary to face the lack of resources and to survive in such an unpredictable environment (Laskovaia, Marino, Shirokova, & Wales, Reference Laskovaia, Marino, Shirokova and Wales2019). SME managers try to stay resilient and innovate new approaches to face high uncertainty. They must invest in entrepreneurial activities by developing highly risky innovations.

The reasons for conducting this study are multiple. First, while the question of the benefits of EO on performance has arisen the interest of many entrepreneurship researchers (e.g., Basco, Hernández-Perlines, & Rodríguez-García, Reference Basco, Hernández-Perlines and Rodríguez-García2020; Shan, Song, & Ju, Reference Shan, Song and Ju2016), the subject of the determinants remains underexploited (Monteiro, Soares, & Rua, Reference Monteiro, Soares and Rua2019; Rodrigo-Alarcón, García-Villaverde, Ruiz-Ortega, & Parra-Requena, Reference Rodrigo-Alarcón, García-Villaverde, Ruiz-Ortega and Parra-Requena2018; Wales, Covin, & Monsen, Reference Wales, Covin and Monsen2020a; Wales, Kraus, Filser, Stockmann, & Covin, Reference Wales, Kraus, Filser, Stockmann and Covin2020b). Second, little work has been done on EO in the SME context, as research in this area has mainly focused on growth factors (Anderson & Eshima, Reference Anderson and Eshima2013; Moreno & Casillas, Reference Moreno and Casillas2008). Third, the role of dynamic (DCs) and NCs in developing EO in the context of the crisis has received less attention and deserves to be studied in the entrepreneurship literature. To address this research gap and enhance our knowledge of developing countries in the Middle East North Africa (MENA) region, the paper draws upon data collected from 182 SMEs in Tunisia, where businesses face a challenging situation linked to political instability and the lack of financial resources.

This study offers three contributions to the EO and broader entrepreneurship literature. The first contribution of this research relates to analyzing determinants of EO in SMEs in the context of crisis, a critical but little-explored field of research. In their recent conversation on EO, Wales et al. observed that only a few researchers have studied the antecedents (Wales et al., Reference Wales, Covin and Monsen2020a, Reference Wales, Kraus, Filser, Stockmann and Covin2020b). Our present research responds to their call for more research into the factors that develop this entrepreneurial behavior within organizations. Second, this paper contributes to the small business management literature by providing a holistic analysis of how to mobilize DCs, such as AC and NCs, to promote EO through innovativeness, proactiveness, and risk-taking. SMEs can exploit networks to access opportunities to enhance their organizational agility in a highly competitive environment and enables superior organizational performance (e.g., Liu & Yang, Reference Liu and Yang2019; Wincent, Thorgren, & Anokhin, Reference Wincent, Thorgren and Anokhin2014). Finally, the current study offers a methodological contribution to the literature. We mobilize a multi-method approach, which integrates structural equation modeling (SEM) and fuzzy-set qualitative comparative analysis (fsQCA) methodologies. SEM analysis was conducted to gauge the causal path potentially, e.g., direct and indirect effects of the variables under investigation, namely, AC, NCs, and EO. fsQCA was adopted to provide an in-depth understanding of the complex, asymmetric, and synergistic effects of AC and NCs on conditioning a higher degree of EO. Therefore, the value-added stemming from the use of fsQCA reflects the complexity of the EO concept and its determinants.

The paper is structured as follows. The following section presents our theoretical framework and the research hypotheses. Section ‘Research hypotheses’ describes the research methodology and analyses of the reliability and validity of the measurement scales. Section ‘Methodology’ presents the results obtained from the SEM and fsQCA analysis. Section ‘Results’ details our results in terms of theoretical and managerial implications and highlights the main limitations of our research and directions for future research.

Theoretical background

Entrepreneurial orientation

Companies, including SMEs, face problems related to environmental change, increasingly similar products, and acute competition (Covin & Lumpkin, Reference Covin and Lumpkin2011; Moreno-Moya & Munuera-Aleman, Reference Moreno-Moya and Munuera-Aleman2016). To face this undesirable situation and create growth opportunities, these enterprises need to identify and exploit opportunities in local and international markets (Lonial & Carter, Reference Lonial and Carter2015; Prashantham & Floyd, Reference Prashantham and Floyd2012). In the literature on corporate entrepreneurship, firms that adopt EO are generally in the most favorable position for accessing these opportunities (Rauch, Wiklund, Lumpkin, & Frese, Reference Rauch, Wiklund, Lumpkin and Frese2009; Su, Xie, & Wang, Reference Su, Xie and Wang2015).

EO is one of the most popular constructs in strategy and entrepreneurship literature used to explain firm performance and growth (Altinay, Madanoglu, De Vita, & Arasli, Reference Altinay, Madanoglu, De Vita and Arasli2016; Eshima & Anderson, Reference Eshima and Anderson2016; Poudel, Carter, & Lonial, Reference Poudel, Carter and Lonial2018; Wales et al., Reference Wales, Covin and Monsen2020a, Reference Wales, Kraus, Filser, Stockmann and Covin2020b). It is manifested through decision-making practices, managerial philosophies, and strategic behaviors that are more oriented toward entrepreneurship (Anderson, Covin, & Slevin, Reference Anderson, Covin and Slevin2009). An entrepreneurial firm is engaged in innovation, bringing new products to market, allowing itself to take part in risky activities, and adopting proactive behavior (Miller, Reference Miller1983). Since innovation is crucial for firms' long-term success and, more particularly, SMEs, there is a need to understand innovation capability and its development. The literature describes two main perspectives on innovation capability management (Eversheim, Reference Eversheim2009). The first perspective is process-oriented and focuses on the sequential steps of innovation activities. The second perspective emphasizes a systemic view and states that innovation capability results from an alignment in an organization's corporate structures, innovation activities, and innovation-related behaviors.

EO also establishes an opportunity-focused orientation that involves exploring market areas that offer future benefits for the firm. This entrepreneurial behavior is associated with acting autonomously in decision-making, adapting to a new vision, and continuing the opportunity discovery process.

Miller (Reference Miller1983) provided a helpful starting point regarding the EO dimensions. He suggests that an entrepreneurial firm is one that ‘engages in product market innovation, undertakes somewhat risky ventures, and is first to come up with proactive innovations, beating competitors to the punch’ (Miller, Reference Miller1983, p. 771). Accordingly, the author used innovativeness, proactiveness, and risk-taking dimensions to characterize the entrepreneurial behavior of a firm. Lumpkin and Dess (Reference Lumpkin and Dess1996) added two other dimensions. The first is competitive aggressiveness, defined as the propensity to engage in exceptional actions to challenge rivals. The second is autonomy which is associated with the organization's tendency toward independent and autonomous action. Recently, Anderson, Kreiser, Kuratko, Hornsby, and Eshima (Reference Anderson, Kreiser, Kuratko, Hornsby and Eshima2015) viewed EO as a mix of entrepreneurial behaviors and managerial attitudes toward risks. The entrepreneurial behaviors emphasize innovativeness and proactiveness and reflect the firm's development and use of new ideas and behaviors. It manifests itself in terms of a new product, service or production method, market, organizational structure, or administrative system. Managerial attitude toward risk – previously the risk-taking dimension – refers to a tendency to pursue opportunities in an uncertain environment with uncertain outcomes.

Determinants of EO

While the definition and benefits of EO are well-studied (Anderson et al., Reference Anderson, Kreiser, Kuratko, Hornsby and Eshima2015), how a firm becomes entrepreneurial remains an unanswered question (Eshima & Anderson, Reference Eshima and Anderson2016; Wales et al., Reference Wales, Covin and Monsen2020a, Reference Wales, Kraus, Filser, Stockmann and Covin2020b). Indeed, several factors can promote this strategic posture internally. For example, strategic reactiveness is considered a tool allowing firms to review their strategies to ensure the success of their entrepreneurial projects. Reactiveness is ‘a firm's ability to adjust its business practices and competitive tactics in response to the perceived efficacy of its strategic actions’ (Green, Covin, & Slevin, Reference Green, Covin and Slevin2008, p. 358). They argue that strategic reactiveness and entrepreneurial behavior depend on a typical organizational capacity that facilitates rapid and informed action. This action is a function of the quality of the residual fit between the organizational structure and the decision-making style.

Similarly, Eshima and Anderson (Reference Eshima and Anderson2016) consider the adaptive capacity a mechanism that allows firms to adjust their decisions in line with market expectations. Other studies have also identified some external factors that can affect EO. Dai and Si (Reference Dai and Si2018) discuss the role government policies could play in developing EO. To this end, the government may deregulate the economy and implement a series of market-friendly reforms, resulting in a proliferation of policies that encourage individuals and incumbent companies to engage in innovative and entrepreneurial activities. Similarly, Fayolle et al. address the role of culture in developing EO (Fayolle, Basso, & Bouchard, Reference Fayolle, Basso and Bouchard2010). Recently, Wales et al. theorized the role of regulatory, normative, and cognitive institutions that impact the EO–performance relationship. Their investigation contextualizes EO and provides a novel picture of how the environment influences the ability of firms to develop EO (Wales, Shirokova, Beliaeva, Micelotta, & Marino, Reference Wales, Shirokova, Beliaeva, Micelotta and Marino2021). Other aspects related to the effects of time and environmental hostility are explored in the entrepreneurship literature (e.g., McKenny, Short, Ketchen, Payne, and Moss, Reference McKenny, Short, Ketchen, Payne and Moss2018).

Research hypotheses

The effect of AC

According to the DC perspective, the capability is the firm's orientation to integrate and reconfigure resources to meet environmental changes and achieve sustainable competitive advantage (Wang & Ahmed, Reference Wang and Ahmed2007). Scholars consider DC as an ability or a capacity (Teece, Reference Teece2007, Reference Teece2018), as a behavioral orientation (Wang & Ahmed, Reference Wang and Ahmed2007), and as a firm's potential to solve problems systemically (Barreto, Reference Barreto2010). Compared to the resource-based approach, which is an organizational framework used to determine the resources that a firm can exploit to achieve sustainable competitive advantage (Barney, Reference Barney1991), DC not only helps firms to adjust and reconfigure organizational structure and management rapidly but also develops and exploits new knowledge to promote innovation (Akgün, Keskin, & Byrne, Reference Akgün, Keskin and Byrne2012). DC is considered a tool that efficiently uses internal and external resources to respond to change and uncertainty (Irwin, Gilstrap, Drnevich, & Sunny, Reference Irwin, Gilstrap, Drnevich and Sunny2022). DC could be disaggregated into the discovery of new opportunities and the ability to align them with the aim and the scope of the firm, to maintain competitiveness (Teece, Reference Teece2007).

In this study, we consider AC as a part of the DC view (Eshima & Anderson, Reference Eshima and Anderson2016). AC is widely developed to respond to different needs and requirements (Clampit, Lorenz, Gamble, & Lee, Reference Clampit, Lorenz, Gamble and Lee2021). SME managers/owners formulate new ideas based on changes and market dynamism. AC is founded on learning, coordinating organizational resources, capabilities, and processes, and facilitating adaptation (Kor & Mesko, Reference Kor and Mesko2013). Thus, it is necessary to succeed in sensing opportunities and develop an entrepreneurial spirit (Matarazzo, Penco, Profumo, & Quaglia, Reference Matarazzo, Penco, Profumo and Quaglia2021).

Similarly, AC generates new combinations that facilitate recognizing methods to meet requirements and try out new opportunities (Eshima & Anderson, Reference Eshima and Anderson2016). In the SME context, this capacity relates to managers' behavior and the firms' organizational functioning. At the managerial level, AC manifests itself through the SME manager's behavior which impacts the decision-making process (Goerzig & Bauernhansl, Reference Goerzig and Bauernhansl2018; Teece, Reference Teece2014). At the corporate level, SMEs are thus investing in some practices to strengthen their resilience due to their limited resources compared to large companies. The objective is to innovate new approaches to survive and convert threats into opportunities (Zighan, Abualqumboz, Dwaikat, & Alkalha, Reference Zighan, Abualqumboz, Dwaikat and Alkalha2022).

Through AC, SMEs get skills in searching for and exploiting new markets and developing entrepreneurial capabilities. As a result, they feel more confident about launching innovative actions that may concern the product and the process, new initiatives, and risky activities, resulting in a higher level of EO (Ciravegna, Majano, & Ge, Reference Ciravegna, Majano and Ge2014).

Hypothesis 1. The AC has a positive effect on EO.

AC, NCs and EO

Prior studies on NC theory highlight its importance through different labels and terms such as alliance capability (Kale, Dyer, & Singh, Reference Kale, Dyer and Singh2002; O'Dwyer & Gilmore, Reference O'Dwyer and Gilmore2018) and relational capability (Srećković, Reference Srećković2018). In this study, we consider a broader vision of NCs and focus on its dimensions: interpersonal skills, effective internal communication, and knowledge of partners. We study their impact on EO (Ritter & Gemuenden, Reference Ritter and Gemuenden2003; Walter, Auer, & Ritter, Reference Walter, Auer and Ritter2006).

SMEs' NCs consist of the firm's ability to establish and develop inter-organizational collaborations whose purpose is to facilitate access to resources and manage internal and external interdependencies (Cenamor, Parida, & Wincent, Reference Cenamor, Parida and Wincent2019; Lavie, Reference Lavie2006). NCs make it possible to use external sources of innovation and integrate them into internal innovation processes. Due to their small size, entrepreneurial SMEs develop external relationships to overcome their commitments. Lin and Lin (Reference Lin and Lin2016) stipulate that these relationships improve performance through internal and external information flows by stimulating knowledge sharing and accelerating innovation. Entrepreneurial firms are also characterized by a structure that promotes internal communication. This dimension facilitates the optimization of knowledge assimilation and dissemination and, therefore, the decision-making process (Giotopoulos, Kontolaimou, Korra, & Tsakanikas, Reference Giotopoulos, Kontolaimou, Korra and Tsakanikas2017). It is increasingly recognized that SMEs respond more quickly and flexibly to market information (Carson, Cromie, McGowan, & Hill, Reference Carson, Cromie, McGowan and Hill1995). This ability makes these structures better able to cope with changes and market trends.

Developing relational capacities results from a managerial and organizational attitude aiming to take better advantage of the various possibilities presented by the environment. SMEs, especially in a challenging context, seek a balance between their internal constraints due to the lack of resources and an increasingly turbulent external environment. This is only possible through a capacity for adaptation and resilience, which collaborations with different partners will reinforce. Lockett et al. (Reference Lockett, Wiklund, Davidsson and Girma2011) asserted that AC makes it possible to understand and anticipate market expectations due to increased organization boundaries.

Thus, these capacities reinforce the SME's orientation to be more inclined to favor proactivity, encourage innovative activities, and take risks. At this level, the entrepreneurship literature confirms that entrepreneurial behavior, and more particularly EO, results from a commitment, at several levels, to better scan one's environment and detect and exploit opportunities through relationships with partners (Eshima & Anderson, Reference Eshima and Anderson2016; Li, Liu, & Liu, Reference Li, Liu and Liu2011).

Hypothesis 2. NCs mediate the relationship between AC and EO.

Methodology

Sample and data collection

To test our hypotheses, we based ourselves on data collected from Tunisian SMEs. This choice is based on the specificities of the Tunisian context, especially after the fall of the political regime in 2011. The country was experiencing a collapse of institutions, social protests, and strikes, as well as the closure of several companies (Bahri Korbi, Ben-Slimane, & Triki, Reference Bahri Korbi, Ben-Slimane and Triki2021). This situation lasted for several years and was subsequently aggravated by the Covid crisis. The companies most affected by this situation are mainly SMEs. With a somewhat entrepreneurial economic fabric dominated by small businesses, they are experiencing financial fragility and significant difficulties accessing financing and debts at exorbitant rates imposed by banks. Several have disappeared, and others are struggling to maintain their activities.

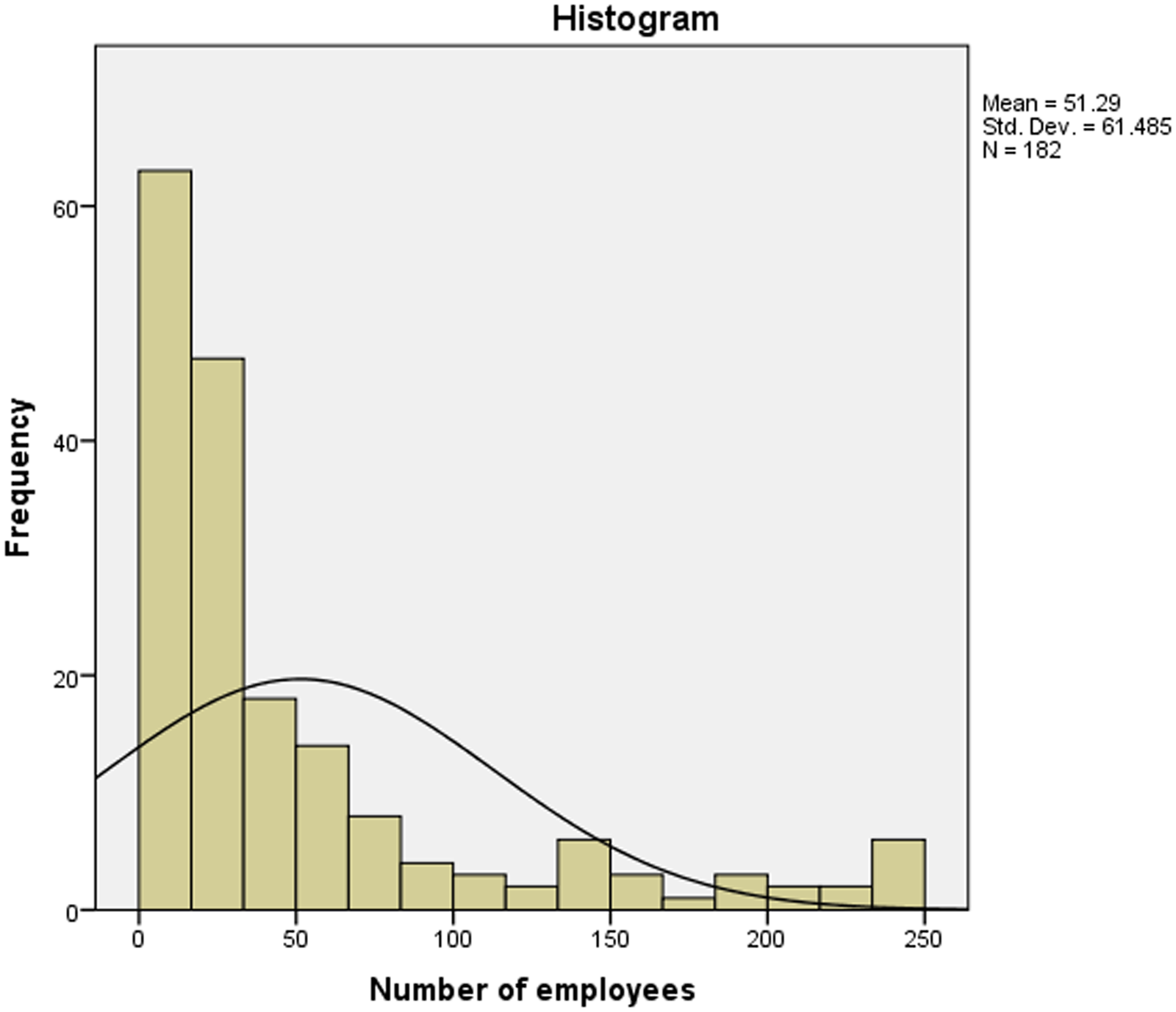

The managers of these structures rely heavily on their flexibility to find new opportunities and expand their business. Thus, to test the importance of the DCs of these SMEs in developing EO, we interviewed their managers or founders. We based our data on several sources, such as the Chamber of Commerce and Industry (CCI) databases, National Institute of Statistics (NIS), and personal networks. We target 1,200 SMEs that contact us by email or telephone. We eliminated several companies because the contacts were not valid. These companies have been definitively closed or have changed their contact information. In the end, we kept 480 SMEs. We sent them a detailed questionnaire with the study's objectives, a section related to dynamic capacities, another related to network capacity, and the last concerning EO. We added complementary questions related to the size, the company's age, and the sector of activity. The first data collection phase resulted in 107 completed questionnaires; the second phase yielded 75 responses. The average size of the SMEs is 51.29 employees, and the average age is 7 years (Figure 1).

Figure 1. Number of employees.

SMEs are mainly present in traditional sectors such as textiles and clothing (28%), industrial products (18.7%), services (9.3%), and food processing (8.2%) (Table 1).

Table 1. Sample characteristics

Measurement

Prior studies adopted multi-item scales to measure the constructs to test the above hypotheses. The AC was measured using four 7-point Likert-style indicators (Ma, Yao, & Xi, Reference Ma, Yao and Xi2009; Park & Luo, Reference Park and Luo2001; Peng & Luo, Reference Peng and Luo2000). We asked respondents to indicate their company's level of capability compared to that of its principal competitors over the past 3 years concerning managing threats and barriers and adapting to changes and environmental uncertainty. The reliability of this scale was well above the recommended threshold (α = .88).

Our conceptualization of NCs was adapted from the works of Walter, Auer, and Ritter (Reference Walter, Auer and Ritter2006) and Ritter and Gemuenden (Reference Ritter and Gemuenden2003), which rely on three salient dimensions: relational skills, internal communication, and partner knowledge. The items measured the extent to which firms can build and develop networks; develop internal communication through meetings, share information and reports; and gather information about partners' actions and strategies. The items were measured on a 7-point Likert scale ranging from 1 = strongly disagree to 7 = strongly agree. For the measurement of relational skills (α = .80) and partner knowledge (α = .89), four items were used, while five items were employed to assess internal communication (α = .75).

Measures of EO were based on Covin and Slevin's (Reference Covin and Slevin1989) scale and the measurement model developed by Anderson et al. (Reference Anderson, Kreiser, Kuratko, Hornsby and Eshima2015), which conceptualizes EO from behavioral and managerial perspectives with two dimensions. The entrepreneurial behavior dimension is based on merging innovativeness and proactiveness items. Six items were used to measure this dimension (α = .90). The second dimension relates to managerial attitudes toward risk and pertains to managers' willingness to search for opportunities. Three items were used to measure this dimension. We obtained a high-reliability value for the scale (α = .89). The Appendix summarizes the items of each measurement scale's items and the sources.

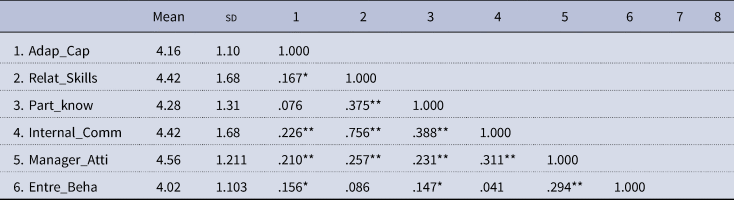

Common bias

According to Podsakoff, Mackenzie, Lee, and Podsakoff (Reference Podsakoff, Mackenzie, Lee and Podsakoff2003), common method variance tests are widely used to detect the existence of variables that can lead to measurement errors and systematic biases in the estimation of relationships between latent variables. Based on the approach of Podsakoff and Organ (Reference Podsakoff and Organ1986), we performed a single-factor Harman test and a common latent factor analysis to capture the common variance among all variables observed in the model. The Harman test showed that any single factor could explain more than 23% of the variance, and there were 11 factors with eigenvalues greater than 1, explaining 73% of the total variance. A confirmatory factor analysis (CFA) was performed, limiting all model elements to a single common factor (Podsakoff et al., Reference Podsakoff, Mackenzie, Lee and Podsakoff2003) (Table 2).

Table 2. Descriptive statistics and correlation matrix

*Correlation is significant at the .05 level.

**Correlation is significant at the .01 level.

Results

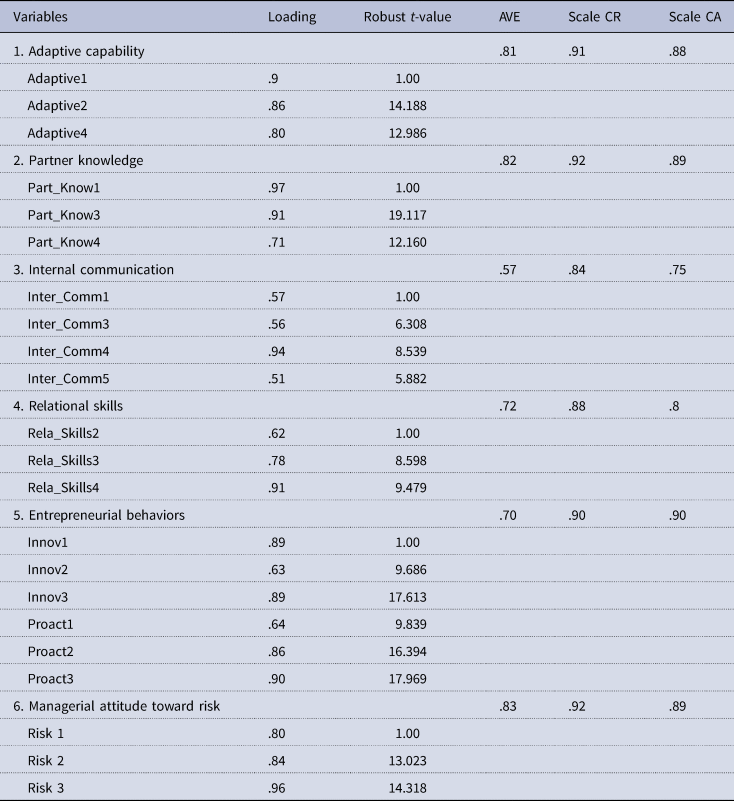

Measurement model

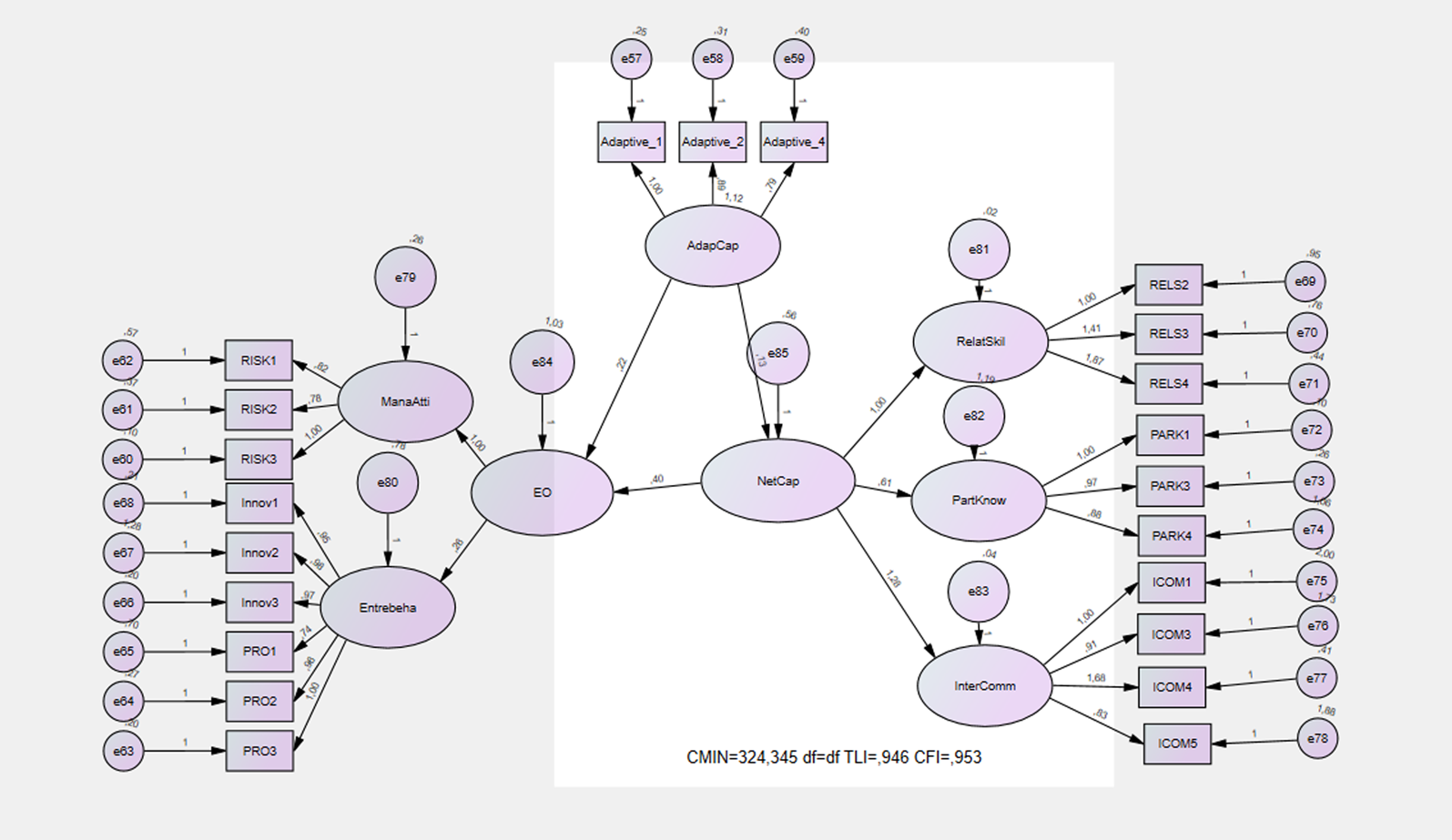

A CFA was conducted using AMOS 26 software to verify the reliability and validity of the constructs. The first step consisted of a robust maximum-likelihood that enabled us to avoid problems of non-normality with the data (Hu & Bentler, Reference Hu, Andbentler and Hoyle1995). Our initial CFA showed satisfactory results; however, some items with low factorial contributions (<.5) needed to be removed to improve the fit of the measurement model. Therefore, ‘Part_Know 2’ (.39), Inter_Comm 2 (.43), RELS 1 (.28), and Adaptive 3 (.37) were dropped from our analysis.

In evaluating model fit, we used the following indicators: χ2 = 324, 514; χ2 normed = 1.599, comparative fit index (CFI = .95), incremental fit index (IFI = .95), Tucker–Lewis index (TLI = .94), standardized root mean square residual (SRMR = .05), and root mean square error of approximation (RMSEA = .05) (Hu & Bentler, Reference Hu, Andbentler and Hoyle1995; Hu & Bentler, Reference Hu and Bentler1999). Finally, in terms of convergence validity and reliability, Cronbach's alpha exceeded appropriate thresholds for all items (>.7), average variance extracted (AVE) exceeded .50, and factor loadings were all significant (Table 3).

Table 3. Reliability and validity of measures

Statistical techniques

Hypotheses are tested using SEM and fsQCA analyses. SEM is used to evaluate measurement models and structural paths, particularly when the model is based on latent constructs based on multi items (e.g., NC, EO). Wang and Wang (Reference Wang and Wang2012) consider that SEM ‘provides a powerful means of simultaneously assessing the quality of measurement and examining causal relationships among constructs’. SEM also facilitates the assessment of direct and indirect effects such as mediation and moderation. The approach is based on estimating the covariance matrix when assessing the quality of the structural model.

fsQCA is used to determine the synergistic effect of ACs and NCs on EO. fsQCA captures the limitations of symmetric methods (SEM) (Bouncken & Fredrich, Reference Bouncken and Fredrich2016; Woodside, Reference Woodside2013; Woodside, Reference Woodside2017). It is set-theoretical research based on Boolean algebra and fuzzy-set theory. It enables the capture of highly complex theoretical configurations based on antecedents (Marzi, Fakhar-Manesh, Caputo, Pellegrini, & Vlačić, Reference Marzi, Fakhar-Manesh, Caputo, Pellegrini and Vlačić2022; Rihoux & Ragin, Reference Rihoux and Ragin2009; Urueña & Hidalgo, Reference Urueña and Hidalgo2016). It builds on multiple configurations and considers that an outcome is rarely the result of a single cause, those causes are rarely separated, and that a specific cause may have opposite sign (e.g., negative or positive) effects, depending on the context (Greckhamer, Misangyi, Elms, & Lacey, Reference Greckhamer, Misangyi, Elms and Lacey2008).

This approach aims to complement the SEM approach, which still needs to reveal the causal complexity between variables, a crucial aspect of social science research (Ragin & Pennings, Reference Ragin and Pennings2005).

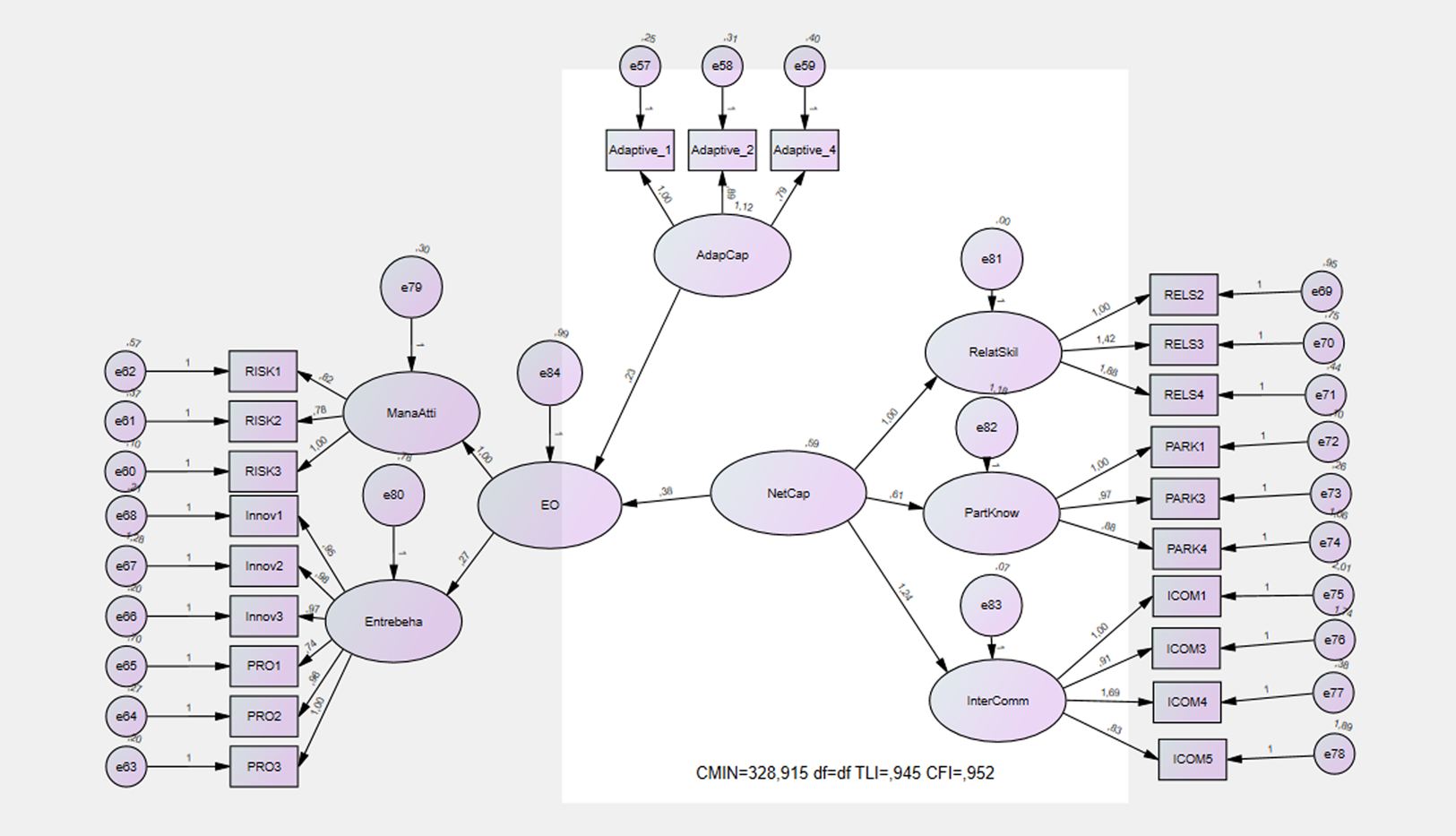

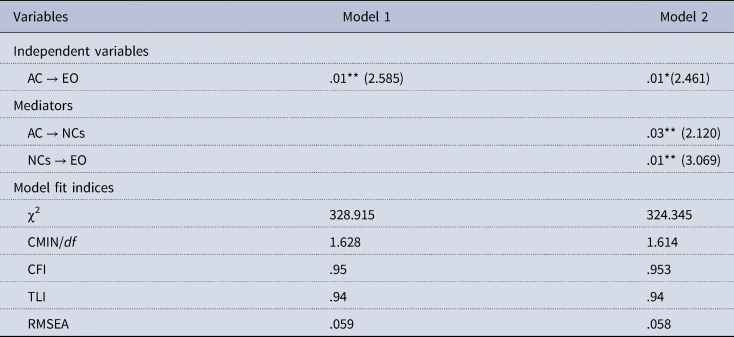

SEM analysis

Table 4 displays the results of the path analysis. We compare two models. Model 1 (Figure 2) deals with the direct effect of AC on EO. Results reveal that this model's normed chi-square (χ2/df) = 1.591. Additionally, approximate fit heuristics (e.g., RMSEA = .057; CFI = .94; TLI = .93). Furthermore, the results confirm that this relationship is significant (.05** [2.582]), thus confirming hypothesis 1.

Figure 2. Structural model (direct effect). EntBeha, entrepreneurial behaviors; ManaAtti, managerial attitude toward risk; EO, entrepreneurial orientation; AdapCap, adaptive capability; NetCap, network capabilities.

Table 4. Path analysis results

Note: The numbers in parentheses are critical ratios.

**p < .01, *p < .05.

Model 2 (Figure 3) integrates the mediating effect of NC in the AC–EO relationship. Referring to the results, AC significantly affects NC (.03** [2.120]). The impact of NC on EO is also significant (.01** [3.069]). The results of the bootstrap method confirm the full mediation of NC on the AC–EO relationship (.16, bootstrap standard error; .002, bias-corrected bootstrap confidence interval [.17; .32]). These results support the second hypothesis.

Figure 3. Structural model 1 (mediating effect).

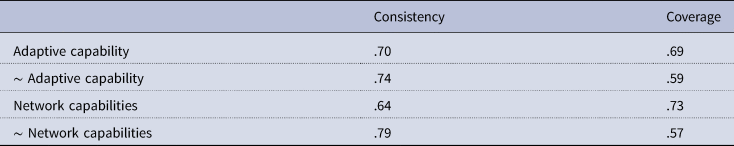

Asymmetric analysis: fsQCA results

To perform the fsQCA, we follow the different steps related to the calibration, necessity analysis, and creating the fuzzy-based truth table to select the configurations to be analyzed. We use the fsQCA 3 Software to test logic and statements of the possible combinations of the independent (e.g., AC, NC) and outcome (EO). Therefore, the method's advantages lie in explaining different causal paths leading to an outcome (Eng and Woodside, Reference Eng and Woodside2012; Schneider & Wagemann, Reference Schneider and Wagemann2007).

To examine the effect of AC and NC on EO, this study calibrates all variables and transforms them into fuzzy sets (Ragin, Reference Ragin2008). In line with previous research, we select .95, .5, and .05 quantiles to represent full set membership, the crossover point, and no set membership, respectively (Ragin, Reference Ragin2008). Following Ordanini, Parasuraman, and Rubera (Reference Ordanini, Parasuraman and Rubera2014), while using the direct calibration method (Ragin, Reference Ragin2008), the following threshold values were mobilized: 6 for full membership, 4 for the crossover point, and 2 for full non-membership.

After calibration, we conducted an initial analysis to identify whether the causal conditions were necessary for the outcome. A condition is considered necessary when its consistency score is above .9. Consistency indicates the degree of coherence of a subset relationship. It is analogous to statistical significance (Schneider & Wagemann, Reference Schneider and Wagemann2010). Table 5 displays the results of the causal necessity analysis. As shown in Table 2, none of the conditions appear to be necessary for companies to exhibit high EO (Xie & Wang, Reference Xie and Wang2020).

Table 5. Analysis of necessary conditions for predicting EO

~ means ‘absence of.’

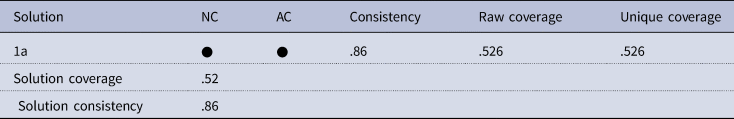

Then, the truth table was constructed based on two criteria: (i) the frequency, defined through the number of cases, and (ii) the consistency is relative to the extent of the explanation of the result by the cases sharing a given causal condition or complexity of causal conditions. The model used for our analysis contains two conditions: EO = f(AC, NC).

According to Ragin (Reference Ragin2008), the minimum frequency is one, and the consistency threshold is .8. We used the Quine–McCluskey to minimize Boolean functions. The parsimonious solution is used in our analysis since it considers only the conditions defined as the ‘core’ of the solution (Schneider & Wagemann, Reference Schneider and Wagemann2010). Furthermore, the parsimonious solution reduces the causal conditions to the smallest possible number.

The results of the truth table are summarized in Table 6. The coverage score of the overall solution was .86 for the presence of EO, demonstrating the coverage of a considerable share of the sample. As reported in Table 6, according to the parsimonious solution, the combination of the AC with a high level of NCs leads to the outcome of survival to occur (high level of EO).

Table 6. Configurations for achieving high scores of EO (parsimonious solution)

Black circle (●) denotes the presence of a causal condition (i.e., high levels of a construct).

Discussion and conclusions

Discussion

The SEM and fsQCA analyses confirmed the effects of DC in developing SMEs' EO. As presented, two DCs were explored in this study: ACs and NCs, to find out if they impact the EO. This result confirms that EO depends on the ability of an organization to mobilize its DCs, whose objective is to cope with environmental changes and uncertainty.

In the following, we will analyze the finding of these two methods. First, the SEM results highlight the critical role that AC plays in developing EO. SMEs' business models are characterized by a proactive search for a balance that facilitates access to resources and the ability to discover and exploit the opportunities offered. This process is enhanced through organizational capabilities. Besides, the results confirm the full mediation effect of NC on the AC–EO relationship. An extended NC enables SMEs to access external resources, knowledge, and potential opportunities.

The results of the fsQCA show that a high level of AC associated with a high NC generates a high EO. This configuration confirms the results of the SEM putting forward the interaction between these two DCs.

Theoretical implications

The findings provide several critical contributions to both EO and SME management literature, as they complement advancements in understanding how strategic and organizational variables affect EO.

First, our results are relevant to the DC literature because they support the theory that capabilities can stimulate entrepreneurial behavior by leveraging the impact of internal dynamism and the ability of a firm to understand its ecosystem better. Following the claims identified in the previous literature, in the present research, we analyzed capabilities that advance our understanding of the process by which a firm develops EO.

We focused on the AC and NCs that enable SMEs to be more competitive by facilitating access to financial, informational, and relational resources. These resources promote both product and process innovations. Thus, our results contribute to the research study on DCs' direct or indirect role in developing EO (e.g., Monteiro, Soares, & Rua, Reference Monteiro, Soares and Rua2019; Rodrigo-Alarcón et al., Reference Rodrigo-Alarcón, García-Villaverde, Ruiz-Ortega and Parra-Requena2018).

Second, this study has shown that dynamic and network capacities are assets that empower organizations to face an institutional crisis where the economic and political environment is characterized by a significant disruption, which is precisely the case in the Tunisian context. These capabilities allow SMEs to rethink their strategies by seeking partnerships and conquering new markets. Our work is among the few research studies that address the relationship between DCs and EO in the context of the crisis in the MENA region. The literature offers only a few works exploring the role of EO in other contexts, such as Russia (Laskovaia et al., Reference Laskovaia, Marino, Shirokova and Wales2019) or Spain (Navarro-García & Coca-Pérez, Reference Navarro-García, Coca-Pérez, Rüdiger, Peris Ortiz and Blanco González2014).

Third, a vital contribution of this study is to redirect the EO conversation away from EO and performance (Shan, Song, & Ju, Reference Shan, Song and Ju2016) to EO antecedents (Wales et al., Reference Wales, Covin and Monsen2020a, Reference Wales, Kraus, Filser, Stockmann and Covin2020b). We also expand upon Eshima and Anderson's (Reference Eshima and Anderson2016) work that dealt with firm growth, AC, and EO by studying multiple organizational capabilities and testing their dependency. Consistent with their results, we found that, in our context, EO plays a significant role in overall strategy and depends on managerial and organizational factors (Anderson et al., Reference Anderson, Kreiser, Kuratko, Hornsby and Eshima2015; Green & Covin, Reference Green and Covin2008).

Finally, the results of this analysis offer exciting insights into SME management literature as we can provide new configurations for the complex relationship between strategic and relational skills and EO (Altenay et al., Reference Altinay, Madanoglu, De Vita and Arasli2016; Parida and Örtqvist, Reference Parida and Örtqvist2015). From a methodological point of view, this study also illustrates the complementarities between the SEM and the fsQCA. The SEM methodology is appropriate for explaining the causal pathways through which ACs and NCs be ultimately impact EO. At the same time, fsQCA provides a deeper understanding of these organizational capabilities' complex, nonlinear, and synergistic effects, and their contribution to the outcome (EO). SEM results demonstrate the general trend, while fsQCA uncovers the multiple realities that exist in terms of achieving the desired state (a high level of EO).

Managerial contributions

Our research can attract the attention of several actors, in particular, managers and business leaders, entrepreneurs, and public authorities. In a crisis that has profoundly changed economic activity, companies and, more particularly, SMEs face challenging conditions preventing them from developing or maintaining their activities. They must show a certain dynamism in terms of management of their actions but also the search for new development paths. Entrepreneurs and managers are encouraged to develop organizational capabilities to adapt to the various contingencies that may emerge. Managers are called upon to develop dynamic capacities by making their structures more flexible in the face of changes to integrate uncertainty into decision-making. They may detect and exploit opportunities that arise through exports or the transfer of technologies and skills. This situation can be achieved by searching for partnerships and developing their network to access new opportunities and conquer new markets.

In the same way, the search for collaborators with whom the company could develop its activities, whether to improve its production methods, innovate or ensure its presence in international markets. This option can only be provided through expertise in the research and development of networks, which must be reliable to the company and facilitate its growth. This network also constitutes a stock of information, skills, or expertise exchange resources. The managers must also ensure network stability to establish a climate of trust. Given their limited resources, especially in developing countries (Acquaah, Reference Acquaah2007), networks are a promising avenue for internationalization (Dominguez, Mayrhofer, & Obadia, Reference Dominguez, Mayrhofer and Obadia2017).

Our work may encourage public institutions to assist better these structures that have been deeply affected by the political revolution and have been aggravated by the economic crisis caused by the Covid-19 pandemic. Apart from financial aid, support must also be in organizational terms by encouraging these companies to improve their agility and training, for example, the leaders, enabling them to adhere to institutional structures and take advantage of the different network actors. Similarly, the government could also play the role of intermediary in financial guarantee between these companies and their local and foreign partners because the context is marked by a lack of confidence. Another track that public institutions could consider is to create several support structures that promote collaboration between these companies, especially those belonging to the same sectors of activity, to act together and exchange experiences in this period of crisis.

Limitations and directions for future research

One limitation of this study may be related to using cross-sectional data to test our hypotheses. First, we used a symmetric approach (SEM) to study the relationships between the different variables in our model. We used the bootstrap method to ensure the stability of our model. In the second step, we mobilize the fsQCA to study the configurations between the independent variables and the outcome. The objective is to compare the results of the two methods.

Similarly, some control variables could help us to understand more about the relationship between the abilities. The strength of these relationships could also vary with firm size and age so that future research could consider size and age as control variables.

To further our understanding of the determinants of EO, it would be appropriate to incorporate the contingency of different factors impacting an organization, such as degrees of environmental uncertainty and industry competition. In addition, it would be helpful to conduct an empirical study in several countries to compare the results and determine whether they can be generalized.

Appendix

Variables

Adaptive capability (1 = strongly disagree to 7 = strongly agree) (Ma, Yao, & Xi, Reference Ma, Yao and Xi2009; Park & Luo, Reference Park and Luo2001)

During the past 3 years:

(1) Our firm's ability to handle potential threats from markets, banks, trade associations, and governmental agencies has been greater than that of our direct competitors.

(2) Our firm's ability to remove unexpected obstacles that emerged in the competitive environment has been greater than that of our direct competitors.

(3) Our firm's ability to adapt quickly to sudden changes in industrial policies has been greater than that of our direct competitors.

(4) Our firm's ability to succeed in an intensely competitive business environment has been greater than that of our direct competitors.

Network capabilities (1 = strongly disagree to 7 = strongly agree) (Walter, Auer, & Ritter, Reference Walter, Auer and Ritter2006)

Relational skills

We have the ability to build good personal relationships with business partners.

We can put ourselves in our partners' position.

We can deal flexibly with our partners.

We almost always solve problems constructively with our partners.

Partner knowledge

We know our partners' markets.

We know our partners' products/procedures/services.

We know our partners' strengths and weaknesses.

We know our competitors' potentials and strategies.

Internal communication

In our organization, we have regular meetings for every project.

In our organization, employees develop informal contacts among themselves.

In our organization, communication is often across projects and subject areas.

In our organization, managers and employees give intensive feedback on each other.

In our organization, information is often spontaneously exchanged.

Entrepreneurial orientation (1 = strongly disagree to 7 = strongly agree) (Anderson et al., Reference Anderson, Kreiser, Kuratko, Hornsby and Eshima2015; Covin & Slevin, Reference Covin and Slevin1989)

Entrepreneurial behaviors

Strong emphasis on R&D and innovation.

Changes in product/service lines have been dramatic.

Introduction of many new lines of products/service.

Initiate actions to which competitors respond.

Often first to introduce products/services, administrative techniques, etc.

Leader in the market in introducing novel ideas.

Managerial attitude toward risk

Proclivity for high-risk opportunities.

Adopts bold and aggressive posture in times of uncertainty.

Wide range acts are necessary to achieve objectives.

Dr. Arafet Bouhalleb is an associate professor in strategy and entrepreneurship and director of E-business and Digital transformation program at EDC Paris Business School. He is also an associate professor in management sciences at University Paris 8, France. His research focused on scenario planning and entrepreneurial behavior.