Introduction

New venture creation was already a central question of early entrepreneurship studies; indeed numerous scholars consider venture creation the core of entrepreneurship (Bygrave & Hofer, Reference Bygrave and Hofer1991; Gartner, Reference Gartner1985). Still, the perceptions behind new venture creation and the degree of objectiveness of those perceptions leave numerous unanswered questions (see e.g., Åstebro, Herz, Nanda, & Weber, Reference Åstebro, Herz, Nanda and Weber2014; Bosma, Coduras, Litovsky, & Seaman, Reference Bosma, Coduras, Litovsky and Seaman2012; Zhang & Cueto, Reference Zhang and Cueto2017). Several researchers argue the need for more insight into the distinguishing traits of entrepreneurial cognition related to opportunity recognition and exploitation; that is, new venture creation (Gaglio & Winter, Reference Gaglio, Winter, Brännback and Carsrud2017; Zhang & Cueto, Reference Zhang and Cueto2017).

Overconfidence is one of the biases often associated with new venture creation (e.g., Baron, Reference Baron1998; Cooper, Woo, & Dunkelberg, Reference Cooper, Woo and Dunkelberg1988; Costa, de Melo Carvalho, de Melo Moreira, & do Prado, Reference Costa, de Melo Carvalho, de Melo Moreira and do Prado2017). Although theoretically, the relationship between entrepreneurial overconfidence and new venture creation seems well founded (Hayward, Shepherd, & Griffin, Reference Hayward, Shepherd and Griffin2006; Navis & Ozbek, Reference Navis and Ozbek2017; Robinson & Marino, Reference Robinson and Marino2015; Simon, Houghton, & Aquino, Reference Simon, Houghton and Aquino2000) the overall picture that empirical studies give is ambiguous (see Thomas, Reference Thomas2018; Zhang & Cueto, Reference Zhang and Cueto2017).

The authors argue that the empirical results are ambivalent for two reasons.

First, the definition of overconfidence itself varies among entrepreneurship studies (Moore & Schatz, Reference Moore and Schatz2017). Overconfidence may refer to absolutely or relatively inflated skill beliefs or overly strong belief perseverance. The necessity of distinguishing among the diverse forms of overconfidence in entrepreneurship research has already been pointed out (see Zhang & Cueto, Reference Zhang and Cueto2017). We show that it is possible and crucially important to differentiate the forms of overconfidence as their function in new venture creation decisions may vary.

Second, overconfidence is assessed by a large variety of methods. Of course, this is partially a consequence of the first issue; that is, different definitions imply different methods. In addition, however, entrepreneurship researchers often use outcome expectations as proxies for overconfidence (e.g., Cooper, Woo, & Dunkelberg, Reference Cooper, Woo and Dunkelberg1988; Malmendier & Tate, Reference Malmendier and Tate2005) and methods mixing the forms of overconfidence (Busenitz & Barney, Reference Busenitz and Barney1997; Forbes, Reference Forbes2005; Robinson & Marino, Reference Robinson and Marino2015; Simon, Houghton, & Aquino, Reference Simon, Houghton and Aquino2000). These methods evaluate people's trait-like, general overconfidence while people may become overconfident in certain situations by using specific information processing and reasoning heuristics, such as the confirmation bias (Kunda, Reference Kunda1990; Muthukrishna et al., Reference Muthukrishna, Henrich, Toyokawa, Hamamura, Kameda and Heine2018; Nickerson, Reference Nickerson1998). Indeed, scholars particularly called for empirical research on heuristics that may lead to overconfidence at venture creation (Shepherd, Reference Shepherd2015; Zhang & Cueto, Reference Zhang and Cueto2017).

The present study draws attention to the definitional, methodological, and measurement controversies around entrepreneurial overconfidence and presents new empirical evidence on the role of the different forms of overconfidence in new venture creation. Overconfidence may cause unrealistically high entrepreneurial expectations (e.g., Ajzen, Reference Ajzen2005; Fishbein & Ajzen, Reference Fishbein and Ajzen2010). In turn, unrealistically high entrepreneurial expectations may result in disappointment and failures (Betzer, van den Bongard, Theissen, & Volkman, Reference Betzer, van den Bongard, Theissen and Volkman2017; Hayward, Shepherd, & Griffin, Reference Hayward, Shepherd and Griffin2006; Invernizzi, Menozzi, Passarani, Patton, & Viglia, Reference Invernizzi, Menozzi, Passarani, Patton and Viglia2017; Malmendier & Tate, Reference Malmendier and Tate2005; Simon & Houghton, Reference Simon and Houghton2003). It is not possible to help venture founders to make their expectations more reasonable unless the underlying factors, such as the forms of overconfidence, are mapped.

Literature Review

Beliefs are actively created, subjective interpretations that often result in biased mental models (e.g., Johnson-Laird, Reference Johnson-Laird2005). Indeed, research implies that entrepreneurs tend to perceive themselves and situations differently from nonentrepreneurs (Baron, Reference Baron1998; Busenitz & Barney, Reference Busenitz and Barney1997).

Confidence levels can be considered excessive when the confidence in subjective beliefs exceeds the objective accuracy of beliefs. Simon, Houghton, and Aquino (Reference Simon, Houghton and Aquino2000) argued, for example, that as entrepreneurs are overconfident, they do not see the uncertainty and risk associated with their new venture creation decisions. According to the hubris theory of entrepreneurship (Hayward, Shepherd, & Griffin, Reference Hayward, Shepherd and Griffin2006), more confident people tend to create new ventures and tackle that overconfidence when they allocate resources and make business decisions. A few empirical works evidenced the positive effect of inflated entrepreneurial skill beliefs on new venture creation (Artinger & Powell, Reference Artinger and Powell2016; Bayon, Vaillant, & Lafuente, Reference Bayon, Vaillant and Lafuente2015; Bolger, Pulford, & Colman, Reference Bolger, Pulford and Colman2008; Gutierrez & Astebro, Reference Gutierrez and Astebro2016; Koellinger, Minniti, & Schade, Reference Koellinger, Minniti and Schade2007; Moore & Cain, Reference Moore and Cain2007; Wu & Knott, Reference Wu and Knott2006). However, these studies used different proxies, such as school attainment to determine the inflated nature of skill beliefs and did not compare skill beliefs directly to the actual ability factor. Other studies established entrepreneurial overconfidence in own skills based on outcome expectations. The belief of widespread entrepreneurial overconfidence is largely based on the famous study of Cooper, Woo, and Dunkelberg (Reference Cooper, Woo and Dunkelberg1988) and other research showing that market entries are not driven by judgments based on objective success probabilities (Cooper, Woo, & Dunkelberg, Reference Cooper, Woo and Dunkelberg1988; Hall & Woodward, Reference Hall and Woodward2010; Hamilton, Reference Hamilton2000). According to the US Bureau of Labor Statistics, only about half of all new businesses survive 5 years. In contrast, Cooper, Woo, and Dunkelberg (Reference Cooper, Woo and Dunkelberg1988) revealed that 81% of business founders believe that the likelihood of the success of their venture is over 70%.

In the entrepreneurship research, the concept of overconfidence is typically used and assessed as a trait-like, unified construct, even though the psychology literature recently started distinguishing three forms of overconfidence affecting behavior at different times and in different ways (Moore & Schatz, Reference Moore and Schatz2017). Recent studies also suggest that overconfidence may be domain-dependent (Muthukrishna et al., Reference Muthukrishna, Henrich, Toyokawa, Hamamura, Kameda and Heine2018). Therefore, we enumerate the forms of overconfidence separately and try to concentrate on overconfidence in the entrepreneurial context.

The first form of overconfidence, overestimation, is believing that someone is better than reality justifies. The second and most common form of overconfidence, overplacement, is the distorted belief that someone is better than others (Chamorro-Premuzic, Reference Chamorro-Premuzic2013). Thus, overplacement and overestimation refer to the relative or absolute beliefs related to the own skill level. In the field of entrepreneurship, these two forms of overconfidence in entrepreneurial skills can be considered as the inflated forms of entrepreneurial self-efficacy; that is, ‘the degree to which people perceive themselves as having the ability to successfully perform the various roles and tasks of entrepreneurship’ (Hmieleski & Baron, Reference Hmieleski and Baron2008).

In general, people tend to overestimate the outcome of complex tasks while underestimating their performance in very easy ones (Lichtenstein & Fischhoff, Reference Lichtenstein and Fischhoff1977). Overplacement works in the opposite direction to overestimation across task difficulty levels; that is, underplacement is more typical in difficult tasks (Moore & Healy, Reference Moore and Healy2008). Thus, while overestimation and overplacement are not mutually exclusive, overplacement may be coupled with underestimation.

There is very little research examining the form of overconfidence in entrepreneurial skills at market entry. By market game experiments, Bolger, Pulford, and Colman (Reference Bolger, Pulford and Colman2008) found that new venture creation is driven by overestimation. In their experiments, the disregarding of market size and the potential number of competitors, together with exaggerated self-esteem, were responsible for too many market entries in skill-based games. Contradicting Bolger, Pulford, and Colman (Reference Bolger, Pulford and Colman2008), Moore and Cain (Reference Moore and Cain2007) results suggest that market entries are based on overplacement. Cain, Moore, and Haran (Reference Cain, Moore and Haran2015) reconciled the psychology and entrepreneurship literature by showing that people choose markets considered easy to enter. According to their argumentation, as a result of that self-selection process, nascent entrepreneurs feel that the tasks associated with new venture creation are relatively simple and easy. Thus, overplacement may be responsible for excessive market entries into competitive fields with low boundaries and high fluctuations.

The third form of overconfidence, overprecision, manifests itself in a too narrow confidence interval on the truth; that is, an exaggerated certainty in own beliefs. Overprecision is considered the most prevalent and persistent form of overconfidence (Moore & Healy, Reference Moore and Healy2008). The definition of overconfidence used by some entrepreneurship researchers is, at least partially, based on the notion of overprecision. According to Simon, Houghton, and Aquino (Reference Simon, Houghton and Aquino2000), for example, overconfidence may occur when entrepreneurs do not adjust their initial estimates to new information. Empirical research on the role of overconfidence at new venture creation – based on the precision of skill beliefs – has produced conflicting empirical results so far (Forbes, Reference Forbes2005; Robinson & Marino, Reference Robinson and Marino2015; Simon & Kim, Reference Simon and Kim2017; Simon, Houghton, & Aquino, Reference Simon, Houghton and Aquino2000).

These studies are intended to assess trait-like, general, or natural tendencies toward overconfidence typically, by questions unrelated to entrepreneurship (Simon & Kim, Reference Simon and Kim2017). This does not take into account the fact that people may become overprecise in certain situations by using specific information processing and reasoning heuristics, such as confirmation bias (Kunda, Reference Kunda1990; Nickerson, Reference Nickerson1998). When people acquire new information, they do not simply take it in but actively evaluate it. Research shows that this evaluation process is far from bias free. Belief persistence is often associated with cognitive dissonance, confirmation bias, and motivated reasoning (Kunda, Reference Kunda1990; Nickerson, Reference Nickerson1998; Rabin & Schrag, Reference Rabin and Schrag1999; Stone & Wood, Reference Stone and Wood2018). Cognitive dissonance occurs when behavior does not match beliefs. A way to reestablish psychological comfort is to quit the behavior or produce or acquire new information to change discomforting beliefs and align beliefs with behavior (Festinger, Reference Festinger1957). According to confirmation bias, decision makers tend to seek for and prefer information confirming their point of view and disregard or underweight information contradicting their beliefs (Nickerson, Reference Nickerson1998; Russo & Shoemaker, Reference Russo and Shoemaker1992). Motivated reasoning is a biased reasoning leading to the desired conclusion. Evidence shows that people have a tendency to arrive at the conclusion they want (Kunda, Reference Kunda1990). Both confirmation bias and motivated reasoning help to reduce or eliminate the cognitive dissonance deriving from opposing information and lead to overprecision (Stone & Wood, Reference Stone and Wood2018). As a result of the close connection between these three biases, Stone and Wood (Reference Stone and Wood2018) called them collectively CD-MR-CB.

In the field of entrepreneurship, Gaglio and Katz (Reference Gaglio and Katz2001) claim that the same information on markets is widely available but each entrepreneur unconsciously chooses by entrepreneurial alertness (see Kirzner, Reference Kirzner1973) what information is important to notice and what weight to give to each piece of information. Yet, to the best of our knowledge, empirical studies evaluating the role of information processing heuristics, their effect on entrepreneurial overprecision, and new venture creation are basically missing (see also Zhang & Cueto, Reference Zhang and Cueto2017).

Theory and Hypotheses

In this section, the authors formulate their hypotheses on the role of the different forms of overconfidence in new venture creation within the framework of the theory of planned behavior (TPB; Ajzen, Reference Ajzen2005; Fishbein & Ajzen, Reference Fishbein and Ajzen2010). According to the TPB, behaviors and behavioral intentions are guided by three kinds of beliefs: (1) beliefs on the likely outcomes of the behavior (behavioral beliefs); (2) beliefs on descriptive and injunctive norms and motivation to comply with them (normative beliefs); (3) beliefs on factors and their power that may support or hamper the performance of the behavior (control beliefs). The theory suggests that people are more likely to create new ventures if they believe that they are skilled enough to do so and their environment is supportive.

Form of overconfidence at market entry

Supposing that market entries are based on inflated skill beliefs is in line with many theoretical argumentations and empirical cues as well (Artinger & Powell, Reference Artinger and Powell2016; Gutierrez & Astebro, Reference Gutierrez and Astebro2016; Hayward, Shepherd, & Griffin, Reference Hayward, Shepherd and Griffin2006; Koellinger, Minniti, & Schade, Reference Koellinger, Minniti and Schade2007; Navis & Ozbek, Reference Navis and Ozbek2017; Robinson & Marino, Reference Robinson and Marino2015; Wu & Knott, Reference Wu and Knott2006). At the same time, the empirical cues are based on methods using different proxies (see the literature review). Thus, showing entrepreneurial overconfidence in skills at new venture creation by directly analyzing the skill beliefs would produce new insights.

There is a debate on the relative or absolute nature of overconfidence at new venture creation (Bolger, Pulford, & Colman, Reference Bolger, Pulford and Colman2008; Moore & Cain, Reference Moore and Cain2007). On the one hand, the results and argumentation of Cain, Moore, and Haran (Reference Cain, Moore and Haran2015) seem reasonable. On the other hand, the participants of Moore and Cain's (Reference Moore and Cain2007) experiments received immediate feedback about their peers. This protocol may prompt thinking about own skills relative to others. Moreover, we think that even if most entrepreneurs create new ventures in fields considered relatively easy-to-enter, they may feel running their new venture a very hard task. The perceived hardness of the tasks of an owner of a newly created business may be very different from how the market is judged globally, relatively to other markets.

The authors argue that in all probability, most entrepreneurs believe that the entrepreneurial tasks after market entry are hard. The majority of new ventures fail within a few years and the income perspectives of new ventures are usually largely overestimated as well (Cooper, Woo, & Dunkelberg, Reference Cooper, Woo and Dunkelberg1988; Hall & Woodward, Reference Hall and Woodward2010; Hamilton, Reference Hamilton2000; Konon & Kritikos, Reference Konon and Kritikos2015). In this case, the psychological theories on overconfidence (Lichtenstein & Fischhoff, Reference Lichtenstein and Fischhoff1977) would support Bolger, Pulford, and Colman (Reference Bolger, Pulford and Colman2008); that is, that market entry is driven by overestimation. If the task is very hard, it is easy to overestimate our skills.

Besides, dealing with the first sales and generating the first profits on sales are activities characterized by uncertainties related to own skills, the task, and the environment (see Frese, Reference Frese2009). New entrepreneurs have to offer or do something in a novel way to generate profit. By just replicating things, without any competitive advantage, it is indeed hard to survive in the market (Foss & Klein, Reference Foss and Klein2012; Frese, Reference Frese2009). Thus, any assessment on the competitors and their entrepreneurial skills would contain a lot of uncertainties and errors.

Thus, we formulate the following hypotheses on entrepreneurs' skill beliefs at market entry:

Hypothesis 1 New venture creation is positively associated with overestimation in entrepreneurial skills.

Overprecision of beliefs

The authors could not identify any study on the role of CD-MR-CB-based overprecision at venture creation (see also Zhang & Cueto, Reference Zhang and Cueto2017). However, by extension of the results of psychological studies (Kunda, Reference Kunda1990; Nickerson, Reference Nickerson1998; Rabin & Schrag, Reference Rabin and Schrag1999; Stone & Wood, Reference Stone and Wood2018), and in line with Gaglio and Katz (Reference Gaglio and Katz2001), the authors argue that CD-MR-CB-based reasoning-induced overprecision may be especially relevant at new venture creation. In the psychology literature, CD-MR-CB-based reasoning is not considered a consciously biased process. It is more likely that people try to be rational by collecting the necessary evidence that supports the hypothesis and behavior they think is valid (Kunda, Reference Kunda1990; Nickerson, Reference Nickerson1998).

Therefore, complex decisions in an ambiguous or uncertain environment buoy CD-MR-CB-based reasoning (Camerer & Lovallo, Reference Camerer and Lovallo1999; Hayward, Shepherd, & Griffin, Reference Hayward, Shepherd and Griffin2006; Vallone, Griffin, Lin, & Ross, Reference Vallone, Griffin, Lin and Ross1990). The authors argue that newly created venture owners face complex tasks in risky or ambiguous situations (see details on entrepreneurial tasks and the profound selection period under Hypothesis 1). Thus, nascent entrepreneurs find themselves in a situation where it is easy to find one-sided evidence supporting their original beliefs.

Moreover, as nascent entrepreneurs systematically overestimate the growth potential of their business and the income it will generate (see literature review and Hypothesis 1) at market entry, entrepreneurs can get frustrated (CD). To ease their cognitive dissonance, they may leave entrepreneurship altogether. Indeed, about half of the ventures fail within a few years. The cognitive dissonance theory suggests that an alternative to market exit is that entrepreneurs adjust their beliefs to diminish the cognitive dissonance induced by the hardships of nascent entrepreneurs.

The TPB suggests that a person is more likely to start and run a venture if she develops a more favorable attitude toward creating a venture, thinks that the social norms and acquaintances would be supportive toward the behavior, and feels that she can control the behavior. This theory signals that new entrants to the entrepreneurial world pay more attention to or overweight information confirming their decision to enter into entrepreneurship (CB). Alternatively, they may wish to belong to the circle of successful entrepreneurs that may seem more probable if there are plenty of them (MR). One can also think that they may see society in a more supportive way or their skills more suitable for the job among the difficulties associated with starting a business (CB or MR).

In this study, it is supposed that CD-MR-CB-based reasoning and the overprecision of these beliefs is needed to maintain the entrepreneurial grit and diminish the cognitive dissonance that unexpected hardships may cause after new venture creation.

Hypothesis 2 CD-MR-CB-based overprecision in supporting beliefs is positively associated with new venture creation.

Research Design and Methodology

To test the hypotheses, the analyses are based on the Global Entrepreneurship Monitor Adult Population Survey (GEM APS) data. The individual-level variables of the widely used Global Entrepreneurship Index are based on GEM data (Acs, Autio, & Szerb, Reference Acs, Autio and Szerb2014; Acs, Estrin, Mickiewicz, & Szerb, Reference Acs, Estrin, Mickiewicz and Szerb2018). The GEM question on skill perception (see Table 1) is also used by the Global Entrepreneurship Index and other studies to analyze the effect of entrepreneurial skill beliefs (Acs, Autio, & Szerb, Reference Acs, Autio and Szerb2014; Acs et al., Reference Acs, Estrin, Mickiewicz and Szerb2018; Cieślik, Kaciak, & van Stel, Reference Cieślik, Kaciak and van Stel2018; Jeon & Luley, Reference Jeon and Luley2018; Koellinger, Minniti, & Schade, Reference Koellinger, Minniti and Schade2007).

Table 1. GEM variables directly linked to the hypotheses

GEM APS is a representative national survey (Reynolds et al., Reference Reynolds, Bosma, Autio, Hunt, De Bono, Servais and Chin2005). In the GEM APS, all the questions about entrepreneurial perceptions are asked the same way from nonentrepreneurs and the differently experienced business owners. GEM assigns the businesses into experience-based life-cycle cohorts (Reynolds et al., Reference Reynolds, Bosma, Autio, Hunt, De Bono, Servais and Chin2005):

(1) Nascent start-ups are those whose owners are actively involved in setting up a business they will own or co-own. These businesses have not paid salaries, wages, or any other payments to the owners for more than 3 months.

(2) Baby businesses have paid salaries, wages, or any other payments to the owners for more than 3 but less than 42 months. Their owners actively participate in the management of the business.

(3) Established businesses have paid salaries, wages, or any other payments to the owners – who also manage their business – for more than 42 months.

To test the first and second hypotheses, the authors link beliefs on different issues to new venture creation. In these analyses, nonentrepreneurs who did not run a business before are compared to first-time nascent entrepreneurs. If a belief influences the likelihood of venture creation, the changes of those beliefs throughout the business life-cycle will be assessed. For these analyses, first-time nascent entrepreneurs' skill beliefs are compared to their more experienced peers; that is, baby and established entrepreneurs.

To test the first hypothesis, nascent entrepreneurs' skill beliefs will be linked to their relative product or service expectations.

Data and variables

Table 1 lists the variables directly linked to the hypotheses of this study.

Entrepreneurship scholars recognize that learning-by-doing is the foremost way entrepreneurs learn (Dalley & Hamilton, Reference Dalley and Hamilton2000; Minniti & Bygrave, Reference Minniti and Bygrave2001; Politis, Reference Politis2005). By running their business, entrepreneurs learn about, among other factors, their own abilities and the task of running a business (Baron & Ensley, Reference Baron and Ensley2006; Frese, Reference Frese2009; Gervais & Odean, Reference Gervais and Odean2001; Jovanovic, Reference Jovanovic1982; Konon & Kritikos, Reference Konon and Kritikos2015). Thus, by gathering experiential knowledge, entrepreneurs are supposed to become more skilled, knowledgeable, and less biased relative to their entrepreneurial skill level. Thus, we argue here that if nascent entrepreneurs are at least as likely to believe that they possess the necessary skills to create and run a successful venture as their more experienced peers, we can say that nascent entrepreneurs are overconfident.

As cross-sectional analyses are run, the cohort effect, that is, the profound selection taking place in the early stages of entrepreneurship, has to be taken into account as well. Hence, a more experienced cohort of business owners may be more skilled not just because of experiential learning effect but because of the survival of the more skilled and less biased entrepreneurs (see also Konon & Kritikos, Reference Konon and Kritikos2015).

The form of overconfidence determines how entrepreneurs relate to their competitors. If entrepreneurs mostly overestimate their skills, they do not compare themselves to other entrepreneurs (Moore & Schatz, Reference Moore and Schatz2017). Thus, to test the first hypothesis, the authors investigate whether the perceived skill level influences the expectations on the relative qualities –for example, novelty – of the offered products or services. Novelty or unfamiliarity is of basic importance as nascent entrepreneurs have to offer or do something in a novel way to generate profit and survive (see hypotheses).

The idea behind the analyses on the CD-MR-CB-based overprecision is that if the personal interpretation of beliefs is not biased, it should be unified across individuals of a given community.

As this study uses the TPB, we filtered out the socio-economic background effects. That is to say that, we have controlled for education level, work status, gender, and age (Autio, Reference Autio and Minniti2011; BERR, 2008; Terjesen & Szerb, Reference Terjesen and Szerb2008). We considered entrepreneurs as individuals acting embedded in their country and industry (Acs, Autio, & Szerb, Reference Acs, Autio and Szerb2014; Autio, Reference Autio and Minniti2011; Autio & Pathak, Reference Autio and Pathak2010). Opportunity beliefs and risk propensity were taken into account in all analyses. Moreover, market rivalry expectations were included in the models on business expectations (Autio & Pathak, Reference Autio and Pathak2010; Terjesen & Szerb, Reference Terjesen and Szerb2008; Wyrwich, Stuetzer, & Sternberg, Reference Wyrwich, Stuetzer and Sternberg2016).

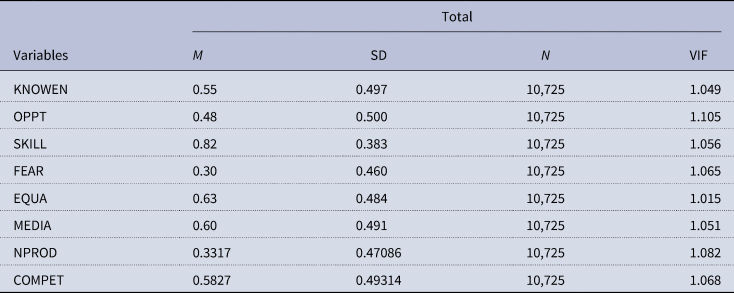

Table 2 shows the descriptive statistics of the GEM variables. According to the VIF values, multicollinearity across the entrepreneurial trait variables is not a concern.

Table 2. Descriptive statistics (only includes venture owners with all data)

Analyses

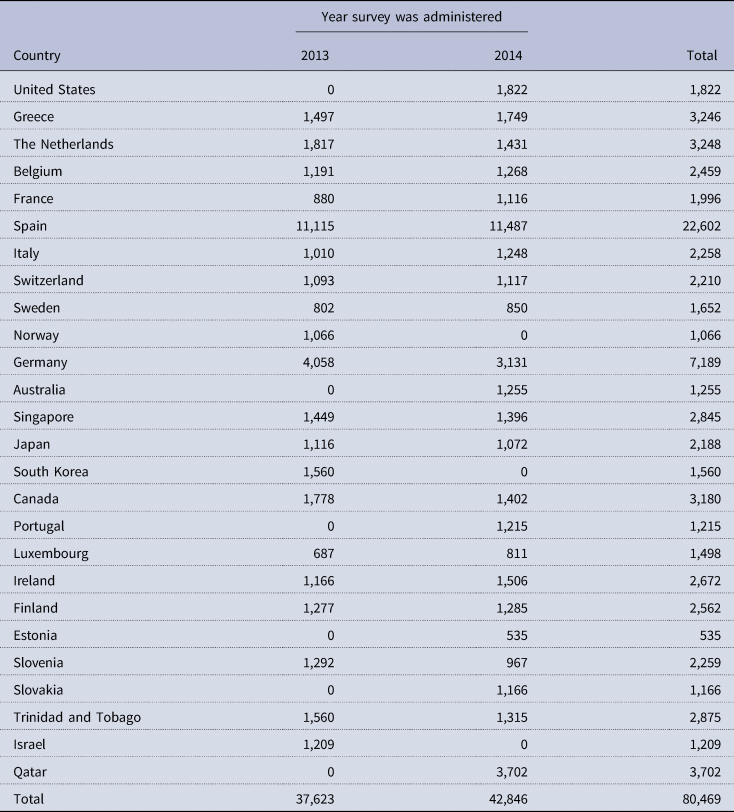

To test the hypotheses, the merged 2013–2014 GEM APS individual data were used. For the purpose of this study, only the population of innovation-driven countries (Appendix 1) aged between 18 and 64 was considered. Habitual (both portfolio and sequential) business owners were left out from the analyses as they have prior managerial and ownership experience.

As merged GEM data from several countries were used, the authors ran generalized linear mixed models with year and country×year random effects in SPSS. This means that we considered entrepreneurs acting embedded in a country at a specific time. Thus, our models accounted for the impact of the economic, regulatory, and social environments of the analyzed countries in the given years. As the dependent variable was always a binary code, generalized linear modeling with a binary logistic link was used.

The results of the models and variables of interest are detailed in tables under the related texts. The list of the significant fixed-effect control variables with their significance level is also indicated in the tables.

Results

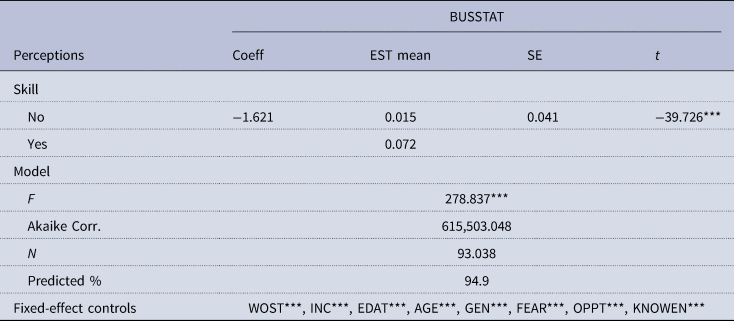

First, it is necessary to show that people who believe in their entrepreneurial skills are more likely to create a new venture. To do so, we compare nascent entrepreneurs' beliefs in their entrepreneurial skills to nonentrepreneurs' skill beliefs. Not surprisingly, the belief of having the right skills to start a business has a very strong effect on new venture creation decisions. This belief increases the likeliness of starting a business by almost five times (Table 3). Second, it is necessary to test if the skill beliefs of nascent entrepreneurs that seem to contribute to venture creation are inflated and do not reflect their real ability level. For this, entrepreneurs' skill beliefs are compared across the stages of the business life-cycle. According to our model, the owners of nascent businesses are as confident of their entrepreneurial skills as their more experienced peers (nascent vs. established t = −1.103, p > .05; baby vs. established t = 1.428, p > .05). About 73–75% of entrepreneurs believe at any stage of the business life-cycle that they are skilled enough to be in the market. Considering the profound selection during the early years of ventures and the very basic assumption that entrepreneurs become more skilled by establishing and running their business, this result is a straightforward sign of overconfidence in skills at new venture creation. Thus, people who believe they possess the skills to run a business are more likely to start a business. At the same time, the skill beliefs that new venture creations are based on are inflated. Therefore, new venture creation is linked to overconfidence.

Table 3. Effect of skill perception on market entry

*p < 0.05, **p < 0.01, ***p < 0.001.

As a next step, the relative or absolute nature of nascent entrepreneurs' overconfidence in their skills was tested. A mixed model showed that accounting for the perceived number of competitors, nascent entrepreneurs' skill beliefs do not influence their product or service novelty expectations (t = −0.519, p > .05), the most important quality of the outcome of their entrepreneurial skill; that is, they mostly overestimate their skills. Hence, Hypothesis 1 is approved.

To test the second hypothesis, we divided nonentrepreneurs into two categories: nonentrepreneurs with entrepreneurial intent and nonentrepreneurs who are not willing to be entrepreneurs. The analyses show that the societal beliefs of nonentrepreneurs who one day may become entrepreneurs are already different from the beliefs of nonentrepreneurs who are not willing to be entrepreneurs. Nascent entrepreneurs and entrepreneurs to be are more likely to think than nonentrepreneurs with no entrepreneurial intent that most people would not prefer that everyone has a similar standard of living and the public media often broadcasts stories about successful new businesses (Table 4). As the information available is about the same for everybody in modern societies, this is a sign of biased reasoning. In addition, the probability of these two biased beliefs does not vary across the stages of the business lifecycle (EQUA: nascent vs. established t = −1.909, p > .05; baby vs. established t = 0.669, p > .05; MEDIA: nascent vs. established t = 0.24, p > .05; baby vs. established t = 0.58, p > .05). Thus, the distorted beliefs are present at the intentional phase and persist throughout entrepreneurship. This means entrepreneurs are overprecise. Hence, Hypothesis 2 is approved.

Table 4. Effect of perceptions linked to overprecision

*p < 0.05, **p < 0.01, ***p < 0.001.

Discussion

The outcomes of our analyses imply that entrepreneurs do create their ventures based on unique perceptions on their skills and the environment they operate in.

The first hypothesis on the exaggerated nature of entrepreneurial confidence in own skills was approved. This result is in line with research arguing or evidencing that overconfidence is positively linked to new venture creation (Baron, Reference Baron1998; Bayon, Vaillant, & Lafuente, Reference Bayon, Vaillant and Lafuente2015; Hayward, Shepherd, & Griffin, Reference Hayward, Shepherd and Griffin2006; Koellinger, Minniti, & Schade, Reference Koellinger, Minniti and Schade2007; Wu & Knott, Reference Wu and Knott2006). However, in contract to numerous previous works (e.g., Cooper, Woo, & Dunkelberg, Reference Cooper, Woo and Dunkelberg1988; Invernizzi et al., Reference Invernizzi, Menozzi, Passarani, Patton and Viglia2017), here, overconfidence was clearly distinguished from outcome expectations and overprecision. In our analyses, data on skill perception was directly used.

Moore and Cain (Reference Moore and Cain2007) and Cain, Moore, and Haran (Reference Cain, Moore and Haran2015) showed that overplacement is responsible for excessive entries into markets with low boundaries. Challenging this argumentation, our investigation revealed that nascent entrepreneurs' overconfidence is mostly based on a self-focusing attitude (see also Bolger, Pulford, & Colman, Reference Bolger, Pulford and Colman2008 for the same result). Data show that taking into account the perceived number of competitors, nascent entrepreneurs' skill beliefs do not influence their expectations on the novelty of their product or service. Thus, our findings imply that even if market entrants self-select themselves into easy-to-enter fields (see Cain, Moore, & Haran, Reference Cain, Moore and Haran2015), nascent entrepreneurs still find the task of starting a venture a relatively difficult task (see Lichtenstein & Fischhoff, Reference Lichtenstein and Fischhoff1977 on the hard-easy effect). Thus, it seems that, on the average, nascent entrepreneurs do not link their skill beliefs to their competitive advantage, that is, how they can differentiate themselves or in what way they can offer something new to their consumers (see also Camerer & Lovallo, Reference Camerer and Lovallo1999; Dosi & Lovallo, Reference Dosi and Lovallo1997 on reference group neglect).

In this study, under Hypothesis 1, overprecision was newly linked to venture creation. Nascent entrepreneurs were found less likely to believe that most people would prefer equality in their community and to overweight information on successful new businesses. These biased perceptions appear already before market entry and persist throughout entrepreneurship.

The authors believe that the distorted view on the societal desirability of equality signals CD-MR-CB-based biased perception in the perspective of a larger entrepreneurial income. Additional analyses showed that entrepreneurs in the 33% income percentile are more likely to think that equality is important for society than entrepreneurs in the highest income third (t = −4.564, p < .001; 58 vs. 65%). Moreover, 69% of entrepreneurs with no secondary education think that equality is important while only 51% of entrepreneurs in the highest educational category perceive the general beliefs on equality the same way (t = 5.297, p < .001). Thus, wealthier and more educated entrepreneurs are even more likely to presume that their society is open to inequality than other entrepreneurs. Nascent entrepreneurs' biased perception of information on successful entrepreneurs may also diminish the cognitive dissonance caused by the unexpected hardships during the initial stage of start-up creation.

In sum, the study offers new empirical evidence on the role of the different forms of overconfidence in new venture creation. It contributes to the ongoing debate on the relative or absolute nature of entrepreneurial overconfidence at new venture creation and newly links CD-MR-CB-based overprecision to venture creation.

Conclusions

Our results have implications for policy makers and practitioners. Policy makers could organize programs to help entrepreneurs make their beliefs in their entrepreneurial skills and environment more realistic before entering the market or in the early stage of entrepreneurship. Having realistic beliefs would prevent a lot of disappointment and failure. Disseminating knowledge on how to increase decision-making skill, and employable methods to identify biased decisions may lead to reduced overprecision and better founded entrepreneurial expectations.

Our results also suggest that nascent entrepreneurs tend to neglect their reference group. Thus, programs should foster more information collection on products and services on the market and encourage thinking relative to the competitors.

Showing the differences between the forms of overconfidence also benefits entrepreneurship research and theories. In the framework of the TPB, nascent entrepreneurs' overestimation at market entry belongs to control beliefs and influences behavioral beliefs and actual behavior, that is, venture creation (Fishbein & Ajzen, Reference Fishbein and Ajzen2010). At the same time, overprecision may affect any beliefs. In this study, we examined the effect of overprecision on perceived norms. Thus, the different forms of overconfidence affect venture creation decisions in different ways. Theories and empirical research on entrepreneurship should consider the differential effects of the forms of overconfidence. Very little is known on the impact of overprecision of beliefs on the self, society, and the economic environment. The examination of the interactions between the actual and perceived control at the stages of the business life-cycle would also be an intriguing research topic.

In addition, the results show that overprecision may be based on biased information processing. Unfortunately, very little is known about the role of confirmation bias and motivated reasoning in the persistence of entrepreneurial beliefs. Future research could examine how, at what stage of new venture creation and on what perceptions CD-MR-CB-based overprecision unfolds; how and why nascent and future entrepreneurs intake new information and adopt their biased beliefs along the road toward and after venture creation. Studies scrutinizing the separate effect of confirmation bias and motivated reason and how to eliminate biased decisions at the early stages of entrepreneurship would also be of interest.

Finally, we have to concede that the study has certain limitations mainly stemming from its design. First, its cross-sectional nature limits casual inferences and confounding factors (i.e., selection period and cohort effects) influence the results. Data gained by following the same businesses during several years would validate the established relationships across the stages of the business life-cycle and make the argumentations stronger. In addition, it would be interesting to see that at the different stages of the business life-cycle, what entrepreneurs experientially learn about their skills and how they update their skill beliefs. Second, the analyses are based on a large-scale questionnaire. Therefore, skill beliefs were evaluated with a single question. An experimental study using psychometric tests to assess the forms of overconfidence associated with market entry should corroborate the results.

Additionally, some questions that would have represented interest in our investigation but were not assessed remained open. For example, linking performance to biased perceptions would be appealing. Are successful and unsuccessful entrepreneurs' perceptions biased in the same way? Are they equally overconfident and overprecise? Do they adjust their perceptions differently? Connecting biased perceptions to cognitive processes would be equally motivating.

Thus, benefitting theory and practice, the study draws attention to how important it is to distinguish and properly assess the different forms of overconfidence.

Funding

The research was financed by the Higher Education Institutional Excellence Programme of the Ministry of Human Capacities in Hungary, within the framework of the 4th thematic program ‘Enhancing the Role of Domestic Companies in the Reindustrialization of Hungary’ of the University of Pécs (reference number of the contract: 20765-3/2018/FEKUTSTRAT).

Appendix 1

Table A1. The number of GEM participants by country and year