In the winter of 1563 Juan Henriquez, a marine insurance broker of Spanish origin active in Antwerp, died. Due to legal conflict over the division of his estate, two voluminous account books dealing with the period August 1562 to September 1563 survived. These books detail 1,621 marine insurance policies signed during an important period in the history of Antwerp's and the European insurance market.

Marine insurance had become established at Antwerp only a couple of decades before Henriquez's death; the practice having been introduced by Portuguese, Spanish, and Italian traders who had relocated from Bruges, an important center for commerce and marine insurance during the fifteenth century (De Groote Reference Groote and Henry1975, Reference Groote, Henry and Asaert1976; De ruysscher Reference De ruysscher and Leonard2016; Goris Reference Goris1925; Verlinden Reference Verlinden1948). Marine insurance in the form of a premium paid for the promise of an indemnity in the event of a specified loss originated in fourteenth-century Italy (Genoa and Palermo) and gradually spread to the rest of Italy, the Mediterranean and, in the wake of Italian merchants, to Northwestern Europe in the fifteenth and sixteenth centuries.Footnote 1

Analysis of Henriquez's ledgers and other sources show that by 1562–1563 Antwerp had become a major market for marine insurance—both in terms of scale and geographical reach. Insurance contracts are affected by agency problems and information asymmetries between the parties involved (Go Reference Go2009; Kingston Reference Kingston2014; North Reference North1990, pp. 126–27; Pearson Reference Pearson2002). Rules, both formal and informal, and enforcement based on reputation, arbitrage or the invervention of courts, reduce these agency problems and information asymmetries.Footnote 2 The caprices of history and local context produced a variety of different paths of institutional development (Kingston Reference Kingston2014). For example, in the eighteenth century, the London insurance community continued to rely on private underwriting (through Lloyd's), while in the American colonies and subsequent United States corporate insurers became much more important with the comparative advantage of corporations demonstrating the possibility of multiple equilibria, contingency, and path-dependency in institutional change (Kingston Reference Kingston2007, Reference Kingston2011).

This study of sixteenth-century Antwerp marine insurance contributes to our understanding of the institutional foundations of insurance markets in several ways. First, substantial sources on the actual operations and organization of marine insurance (either policies or merchant accounts) are scarce (Casado Alonso Reference Casado Alonso1992, p. 277; Spooner Reference Spooner1983, p. 2). The haphazard survival of documents on insurance has limited the study of marine insurance. Research has focused on either late medieval Italy (Venice, Genoa, Firenze), its dependencies, or the more mature insurance markets of eighteenth-century Northwestern Europe such as Amsterdam, London, La Rochelle, and Cadiz.Footnote 3 The two main account ledgers of Henriquez are thus an exceptional source for studying marine insurance between those two periods. Second, the Antwerp insurance community not only grew in number, scale, and scope, it also became more international in nature with German and Flemish merchants joining Italian, Portuguese, and Spanish. Adrian Leonard (Reference Leonard and Leonard2015) shows how the arrival of newcomers in insurance frequently induced legal changes and the formalization of informal rules to accommodate the relatively unexperienced newcomers. Indeed, Antwerp's commercial success has recently been explained by the city's open-access institutions open to all economic agents (Gelderblom Reference Gelderblom2013; North, Wallis, and Weingast Reference North, Joseph Wallis and Weingast2009; Ogilvie Reference Ogilvie2011; Ogilvie and Carus Reference Ogilvie, Carus, Philippe and Durlauf Steven2014; Puttevils Reference Puttevils2015a, Reference Puttevils2015b).

Here we demonstrate how Antwerp's insurance market functioned in a private underwriting system which could not (yet) rely on strong formal rules and which was controlled by a high-volume broker who had earned the recognition and trust of the insurance community. Moral hazard on the part of the insured (over- or double insurance, undisclosed information) could (partially) be solved by the value the insured would attach to future dealings with the broker, who was able to find underwriters more quickly and at lower premiums than could an individual merchant. To maintain a good reputation with potential insurance purchasers, the broker had an incentive to find credible and creditworthy underwriters.Footnote 4 We examine how insurance was priced and the extent to which the premium related to the trading environment using the detailed contracts from Juan Henriquez, the most important Antwerp broker at the time. The Henriquez ledgers allow a careful reconstruction of the factors affecting the premium, their relative weight, and of the role of the broker. In addition, using the Henriquez ledgers and other sources such as court cases, legal discussions, merchant account books and letters, we attempt to unravel the incentives and strategies of insurance purchasers and underwriters.Footnote 5

BIOGRAPHY OF AN ANTWERP INSURANCE BROKER

Antwerp (now the second-largest city in Belgium) is located in the Scheldt estuary providing easy access to the North Sea and the Meuse and Rhine rivers. Its geostrategic location put the city in an ideal position to profit from the renewed continental trade and sea-bound traffic of the sixteenth century. Commerce and commerce-related industries turned the relatively small town into a major metropolis with more than 100,000 inhabitants by 1568. Commercial and financial activities grew feverishly from the end of the fifteenth century and ended quite abruptly in 1585 when the city was reconquered by Spanish armies, causing trade to shift north to the Dutch Republic. Antwerp's trade consisted of the re-export of English textiles, Portuguese spices, and German metals, alongside textiles and luxury goods produced in the Low Countries. The trade was organized by a large group of foreign and native traders.Footnote 6 From about 1520 Antwerp-based merchants started to use premium marine insurance, which displaced traditional risk-transfer practices such as charter contracts. At least by the 1550s Antwerp had become a leading insurance centre (De ruysscher Reference De ruysscher and Leonard2016).

Juan Henriquez, was born in Bruges around 1511, where his father, Andres Henriquez, was a Spanish merchant. By 1540, Juan had moved to Antwerp and the first document mentioning his name cites him in an insurance contract as an underwriter.Footnote 7 In 1557, shortly before his second marriage to Maria Paez (his previous wife Barbara Centurion, of Genoese descent, died), he built a new house in the Korte Klarenstraat, next to the Antwerp Bourse, where his clientele met every day to gather intelligence and do business, much like Lloyd's Coffee House in London at the end of the seventeenth century (De Groote Reference Groote and Henry1975, p. 153).Footnote 8 Henriquez died in the winter of 1563.Footnote 9

Henriquez was an important merchant and underwriter. In fact, he was suggested by Cornelis De Schepper, a senior central government administrator, as an advisor on insurance to Mary of Hungary, the governor-general of the Low Countries (September 1551) (Sicking Reference Sicking2004, p. 258, n. 186). Henriquez ran a sizeable enterprise. In March 1565 (after Henriquez's death) contemporaries put the total number of brokers and underwriters in Antwerp at six hundred persons and Henriquez worked with 183, almost one-third of the total.Footnote 10 As we discuss in more detail later, Henriquez brokered an average of three policies per day. To give some idea of the scale of the Antwerp insurance market, 2.2 contracts per day were signed in Genoa (1427–1431), two contracts per day in Florence (1524–1526), 1.2 contracts per day in Burgos (1565–1570), and 0.4–1.2 policies per day in Genoa (1570–1572: see Casado Alonso Reference Casado Alonso1992, p. 283; Ceccarelli 2012, pp. 19, 163–64; Piccinno Reference Piccinno and Leonard2015, p. 39).

In total, Henriquez brokered £ 583,856 Fl. gr. in marine insurance generating £ 42,063 Fl. gr. in premiums. In comparison, in 1565, all policies signed at Burgos were worth 846,545 ducats or around £ 250,000 Fl. gr. (Casado Alonso Reference Casado Alonso1992).Footnote 11 The total value insured by Henriquez can be compared to import and export values from the reconstruction of the trade between the Iberian Peninsula and the Low Countries in the 1560s.Footnote 12 A total of £ 102,373 Fl. gr. going from the Low Countries to Spain and Portugal was insured through Henriquez in 1562–1563, and a total of £ 133,061 Fl. gr. going in the other direction was also insured through Henriquez. On an annual basis this would be £ 87,748 Fl. gr. worth of exports and £ 96,909 Fl. gr. of imports to the Low Countries. Wilfrid Brulez puts imports from the Iberian Peninsula amounting at around £ 780,000 Fl. gr. and exports to this region from the Low Countries at £ 914,000 pounds Fl. gr. In comparison to this, Henriquez brokered the insurance of 11 percent of all exports going to Spain and Portugal and of 17 percent of incoming imports. Even if we do not know for sure whether the insured value was either cargo or the value of the vessel, the data demonstrate that Henriquez was a major player.Footnote 13

HENRIQUEZ'S LEDGERS

Henriquez's account books cover a period between a failed attempt to set up a government-sanctioned monopoly in brokering and registering marine insurance policies in the late 1550s and the Dutch Revolt from 1566, which would ultimately end Antwerp's commercial hegemony.Footnote 14 The two ledgers cover the period from 1 August 1562 to 26 September 1563 and are written in Spanish (see Image 1).Footnote 15 The ledgers contain personal accounts of underwriters and insurance purchasers in which the specifics of the insurance contracts and payment of premiums, average and total losses are written down. The books provide evidence on 1,621 marine insurance contracts and a small number of life insurances and insurance on overland transportation. Both ledgers follow the principles of double-entry bookkeeping, meaning that insurances are recorded on the debit side with details on the amount to be insured, the voyage, the ship name, and the name of the shipmaster and the date provided. On the credit side, the premium is divided among the underwriters; each underwriter's personal account mentions the risked amount underwritten and details on the insurance contract (as on the debit side).Footnote 16

Image 1 FOLIO FROM JUAN HENRIQUEZ' ACCOUNT BOOK

The two ledgers provide a voluminous corpus of highly detailed data. There are, however, some limitations. First, while the insured amount is always mentioned, the insured asset—ship, equipment, and/or merchandise—is, in most cases, unclear. The insured amount could also be a combination of the equipped ship's value and that of the merchandise (Wastiels Reference Wastiels1967, p. 58; De ruysscher, Reference De ruysscher and Leonard2016, p. 83). Moreover, the law in 1562–1563 stipulated that only up to 90 percent of the value could be insured (if the insured value was less than £ 2,000 Fl. gr.). If the merchandise was valued above 2,000 pounds Flemish groat (£ Fl. gr.), the insured had to risk £ 200 Fl. gr. (comparable to a modern insurance deductible) but then the remaining part (1,800 pounds or more) could be fully insured (De Groote Reference Groote and Henry1975, p. 35; Laurent, Lameere, and Simont Reference Laurent, Lameere and Simont1893–1922).Footnote 17 Second, different contract clauses could be added to each policy which would affect the insurance premium. Unfortunately, all of Henriquez's policies have been lost. We must, therefore, rely on sporadic references to contract clauses “sobra buena o mala nueva” or “good or bad news,” “mas asegurar” or additional insurance after the original contract to tell us something about the exact content and coverage of the contract. Third, some information about contracts signed before the period covered by these ledgers exists because payments were executed on these contracts in our period. However, we lack information about potential average and total loss payments after September 1563 (when the ledgers end) even on the contracts signed in the period when the ledgers were drawn up. Finally, the ledgers cover slightly less than a year and a half.

Despite the short time period, the ledgers cover the relatively peaceful years before the disruptive events of the Dutch Revolt (Brulez Reference Brulez1959, pp. 32–33; Gelderblom Reference Gelderblom2013, pp. 222–23). War and unrest increase premiums: at the end of the 1540s wars and corsairs had triggered an increase in demand for insurance in Antwerp (De ruysscher Reference De ruysscher and Leonard2016, p. 87). The war between France and England in 1563 and 1564 (after the end of the ledgers) led to an embargo on the Low Countries' trade with England (winter 1563 to winter 1564) (Enthoven Reference Enthoven1996, p. 18). The tension between Sweden and Denmark erupted into a full-blown war, which targeted Low Countries' shipping (Van der Wee Reference Van der Wee1963, p. 228–29). All the policies brokered by Henriquez preceded these events. As discussed later, premiums, of course, might have already begun to mirror the uncertainty of subsequent years.

AN ANTWERP BROKER'S CLIENTELE

The insurance market of sixteenth-century Antwerp stands out because of its international insurance community: It was dominated early on in the century by Italians and Iberians, local merchants from the Low Countries joined in in the second half of the sixteenth century (a process which was not unlike London's market). In other centres such as Burgos, Venice, or Florence the insurance market was firmly in the hands of the natives (De ruysscher Reference De ruysscher and Leonard2016; Rossi Reference Rossi and Leonard2015). In that sense, Antwerp was much more open to all types of merchants.

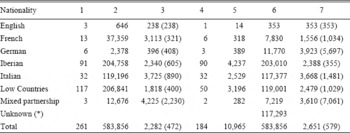

In Table 1 we show the nationality both of insurance purchasers and of underwriters in our data. Iberians and Italians were prominent purchasers of insurance takers but Henriquez's clientele was not limited to those groups. The dominance of Iberian and Italian underwriters does not come as a surprise given their centuries of underwriting experience, Henriquez's own origins, and his marriage with a member of an important Genoese merchant clan. However, the community of Low Countries merchants residing in Antwerp was also responsible for sizeable insured values through Henriquez. Twenty-eight underwriters were partnerships involving several individuals.Footnote 18

Table 1 INSURANCE PURCHASERS AND UNDERWRITERS IN THE ACCOUNT BOOKS OF JUAN HENRIQUEZ (1562–1563)

1: Number of insurance purchasers; 2: Total insured value (£ Fl. gr.); 3: Mean (median) insured value (£ Fl. gr.) per insured; 4: Number of underwriters; 5: Number of underwritings; 6: Total insured value (£ Fl. gr.); 7: Mean (median) insured value (£ Fl. gr.) per underwriter

(∗) We do not know the names of the actual underwriters for several policies.

Source: Authors' database, based on FAA, Insolvente Boedelkamer, Account books of Juan Henriquez, IB #2314 and 2315, and Wastiels (Reference Wastiels1967).

Although there was some overlap, the ledgers show that many merchants were either underwriters or insurance purchasers but not both. Of the 351 individuals (or partnerships) mentioned as underwriters and/or insured, 97 were both active as underwriters and had themselves insured, 86 insured others but were not insured themselves, and 168 purchased insurance but did not insure themselves (13 of them could be clearly identified as shipmasters). Of course, when considering the crossover between insurers and insurance purchasers, one has to remember that both groups might have had insurance independent of Henriquez. They could buy or sell insurance directly from and to fellow traders through another broker; they could have been inactive in 1562–1563; or they could have acquired or sold insurance in other insurance centres. Indeed, the peaceful circumstances of the period may have induced some merchants not to buy or sell insurance. Or in contrast, wartime may have attracted buyers and particular sellers while others may have chosen to stop trading or not to underwrite because of the higher risk (Kingston Reference Kingston2011; Baskes Reference Baskes2013).

Although similar to fifteenth-century Genoa's insurance market, Antwerp's composition of the insurance market differs from the Dubrovnik (1563–1591) and Florentine (1520s) insurance communities, where two-thirds of the participants were both buyers and sellers of insurance in comparison to less than one-third in Antwerp (Ceccarelli 2009, p. 392; Tenenti and Tenenti Reference Tenenti and Tenenti1985, p. 412; Piccinno Reference Piccinno and Leonard2015, p. 37). Marine insurance had become a product, accessible to non-insurers.Footnote 19 A merchant community where the insurers were also intensive insurance purchasers was vulnerable. In 1574 a large part of the wool fleet was captured by Netherland rebels, an unforeseen shock which hit the Burgos insurance community hard. Many insurers defaulted on their policies since their own wool was taken as a prize (Phillips and Phillips Reference Phillips and Rahn Phillips1977).

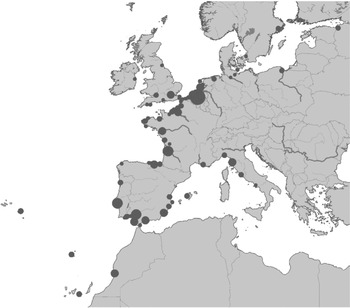

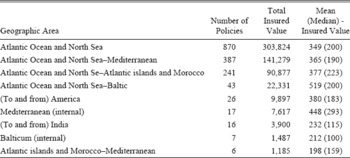

The contracts mention 1,673 ships by name, many of which returned several times in the ledgers. Most insurance concerned shipping in the North Sea, the Baltic, and the western Mediterranean and shipments to and from the Atlantic islands (the Canaries, Madeira, and the Azores), but Henriquez's horizon also extended west to the Caribbean (Jamaica, Honduras, Santo Domingo, Cuba, etc.) and Brazil and east to India (Calicut, Cochin) (see Table 2 and Figures 1 and 2). Henriquez brokered insurance policies covering an average distance of 1,348 nautical miles (median 1,091 nautical miles), or roughly the distance from Antwerp to Seville; distances range between 50 nautical miles (Antwerp to Zeeland) and 19,002 nautical miles (Lisbon to Calicut and back). However, the most frequent voyages insured were Bordeaux–Antwerp, Antwerp–Seville, and Lisbon–Antwerp.

Figure 1 PLACES OF DEPARTURE AND DESTINATION OF VOYAGES INSURED THROUGH HENRIQUEZ (1562–1563)

Figure 2 PLACES OF DEPARTURES AND DESTINATIONS IN EUROPE WEIGHTED BY INSURED VALUE IN THE HENRIQUEZ ACCOUNT BOOKS (1562–1563)

Table 2 GEOGRAPHIC AREAS OF THE INSURED VOYAGES IN THE ACCOUNT BOOKS OF JUAN HENRIQUEZ (1562–1563)

Similar data for every specific route can be found in Supplementary Table 1 in the Online Appendix.

Source: Authors' database, based on FAA, Insolvente Boedelkamer, Account books of Juan Henriquez, IB #2314 and 2315, and Wastiels (Reference Wastiels1967).

Of the 1,621 policies, only 438 (256 if one excludes all Low Countries ports) concerned voyages in which Antwerp was neither the destination nor the port of departure, as noted later this potential adverse selection was priced into the premium. In the 1520s, Florence insured a similar share of non-local traffic (Ceccarelli 2012, pp. 166–67) but in the 1560s and 1570s, Burgos mostly insured voyages with an Iberian port as a destination or point of departure (Casado Alonso Reference Casado Alonso1992, pp. 297, 302–4). Hence, Henriquez's field of operations was vast.

PURCHASING INSURANCE

When we examine the 1,621 marine insurance contracts in Henriquez's ledgers, 265 merchants and shipmasters were insured. The policies were signed by 184 underwriters, and involved 10,975 underwritings or individual shares of the underwriters.Footnote 20 An average of eight underwriters (median five) underwrote each policy with the number of underwriters ranging from 1 to 66. The contracts brokered by Henriquez had an average insured value of £ 360 Fl. gr. (median £ 200 Fl. gr.); the lowest value was £ 5 Fl. gr. and the highest £ 11,935 Fl. gr.Footnote 21

Henriquez's ledgers reveal the identities of those who insured their merchandise and/or ship.Footnote 22 Antwerp merchants had other options: they could forego insurance; they could insure elsewhere; they could insure only part of the value at risk or they could look for underwrites directly or through a broker other than Henriquez.Footnote 23 The few preserved account books and letters of merchants active in sixteenth-century Antwerp offer some insight in the practice of purchasing insurance. The Castilian trader Simon Ruiz, who had strong commercial ties with the Low Countries in the second half of the sixteenth century, spread the majority of his shipments over different ships rather than insure them. When he did purchase insurance, it only covered part of the shipment (Vazquez de Prada Reference Vazquez de Prada1960, p. 50). The Antwerp Della Faille firm only insured 22 percent of its shipments in the 1580s and 1590s and always through the same broker. In those cases, the insured value amounted to less than half of the shipment value, which may have been caused by the high war premiums and the firm's involvement in the direct maritime trade between the Low Countries and Italy which was rather risky (Brulez Reference Brulez1958, p. 1239, 1959, pp. 171–77).

Sixteenth-century Antwerp offered merchants a menu of options and institutions to hedge the risks they were taking by sharing, spreading, and/or transferring the risks. Because markets of greater scale and scope such as Antwerp allowed merchants to diversify their trade and to insure their ships and cargo against natural and man-made disasters, traders in such markets could sustain higher levels of violence (Gelderblom Reference Gelderblom2013, p. 207). In Antwerp, marine insurance became a product that allowed smaller-scale traders (who could not always diversify their commercial operations) to cover their risks, even though the insurance premium substantially increased the costs of their transactions.Footnote 24

We know little about the precise procedure for negotiating and signing a policy. What is known is that Henriquez could rely on a pool of frequently returning underwriters who allowed him to sign on their behalf. In a 1558 letter to the Antwerp magistracy he was referred to as “having power of attorney of the most important merchants to insure in their name at their convenience” (Génard Reference Génard1882, p. 249). Given the fact that Henriquez brokered three policies per day, on average, it is likely that underwriters underwrote several policies at the same time. Once the full value of the policy was underwritten, Henriquez gave the policy to the purchaser and kept a copy for himself.Footnote 25 Unfortunately none of the 1,621 actual policy documents brokered by Henriquez have survived. In all likelihood, the policies would have resembled the example of a policy in Gabriel Meurier's Formulaire de missives, obligations, quittances, lettres de change printed in Antwerp in 1558, and the model policy imposed by the king in October 1563. These policies included the name of the insured, reference to the customs on marine insurance of London and the Bourse of Antwerp, the trajectory of the ship, the names of the ship and the shipmaster, and the name of the broker and the premium rate. The policy insured the merchandise from the moment it departed until its arrival at the port of destination. The policy insured against the risks of the sea, fire, wind, friends and foes, pirates and corsairs, and arrests by local lords. The policy was due to bearer and, in case of loss, payment was to happen within two months after the notification of the loss of the ship. For loss of goods, the insured formally had to transfer the property rights to the insurers (who could decide to try to salvage the goods). The policy was formal proof and held the same legal validity as aldermen's letters and notarial acts (Meurier Reference Meurier1558, f° 13r–14r; Placcært-boeck 1662, pp. 329–30).

One of the important elements of the negotiation process between the insured, the broker, and the underwriters was the premium. According to the 1608 Antwerp customary laws Compilatae “the price or wage on [marine] insurances is not simple, but is taken and changes after the diversity of the time and after the voyage, together with other dangers in it” (de Longé Reference de Longé1870, IV, p. 226). Underwriters based their decisions of whether to sign a certain policy and at what premium on experience, knowledge of navigation routes, seasons, news on wars and conflicts, and the reputations of the insured, the shipmaster and the intermediaries involved such as the broker (Baskes Reference Baskes2013, p. 209; Ceccarelli 2007). Hence, insurance pricing synthesized all potential risks into one number, the premium rate, based on experience, intuition, and convention (Ceccarelli 2007; Daston Reference Daston1988, p. 119; van Niekerk Reference van Niekerk1998, pp. 585–89).Footnote 26

Different factors affected the premium rate: the season, the distance, the route, the type of ship and its armaments, the type of cargo, the incidence of violent conflicts along the route, and the reputations of the insurance buyers, underwriters, and brokers (Baskes Reference Baskes2013; Ceccarelli 2012; del Treppo Reference del Treppo1972; Spooner Reference Spooner1983; Tenenti Reference Tenenti1959; Tenenti and Tenenti Reference Tenenti and Tenenti1985).Footnote 27 Giovanni Ceccarelli (2007) has shown that contingent (war, corsair activity, etc.) and non-structural risks were particularly responsible for highs and lows in premium rates in late medieval Florence. In the early 1550s, insurance premiums on transport between Antwerp and London, Antwerp and Bordeaux, and Antwerp and Biscay increased by 1 percent, 3 percent, and 4 percent, respectively, because of the ongoing war.

THE DETERMINANTS OF THE PREMIUM FROM HENRIQUEZ CONTRACTS

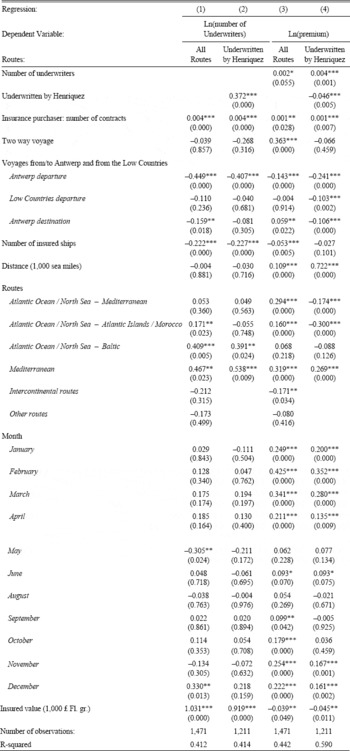

For 1,471 of the 1,621 available contracts, we have complete information on the premium charged and a number of contract characteristics that reflect insurance risk and the information available to the insurers about this risk (Puttevils and Deloof Reference Puttevils and Deloof2017).Footnote 28 For the 1,211 intra-European contracts in this sample we also know the underwriters. This information allows us to quantitatively investigate the extent to which the insurance premium is determined by the degree of asymmetric information between the insurance purchaser and the insurance underwriters, by the different risk factors which were known to Henriquez and the underwriters, and scale effects in the insurance contract. We estimate the following regression model:

The dependent variable is the natural logarithm of the premium percentage which takes into account the skewed distribution of insurance premiums. The first set of independent variables (underwritten by Henriquez, insurance purchaser: number of contracts, two way voyage, voyages from/to Antwerp/Low Countries) are proxies for the degree of asymmetric information between the insurance purchaser and the underwriters. We account for the Henriquez's own participation as an underwriter and the number of contracts purchased by the insured. While the latter may indicate a surcharge for less frequent clients as a way to adjust for asymmetric information, the former functions as a test for the trust underwriters may have had in their broker. Henriquez's participation as an underwriter may have been interpreted as a signal to other underwriters. A number of the voyages in our sample departed from Antwerp. The possibility of inspecting the vessel in port prior to departure and of informing oneself on the captain's capacity may have led to a lower insurance premium. In addition, the broker and the underwriters might also have been better informed if the port of departure was located in the Low countries or if Antwerp was the destination port. Henriquez's ledgers also mention several return voyages: the premium for these voyages may have been lower than the double premium percentage of the one-way voyage because he knew the ship and the captain. Alternatively, they may have been riskier because the ship could not be inspected during one part of the journey, leading to a higher premium.

The second set of independent variables (number of insured ships, distance, routes, months) measure the riskiness of the insured voyage. We expect a negative relation between the insurance premium and the number of insured ships in a given policy because risk was diversified over a greater number of ships. We also expect the insurance premium to be positively correlated with distance. Distance covered is in nautical miles, however, not every nautical mile constituted a similar risk.Footnote 29 Some routes were considered more dangerous than others. So in the regressions we include five dummy variables—for the geographic area in which the voyage took place (Atlantic Ocean, North Sea, Atlantic islands, and Morocco—Atlantic Ocean, North Sea, and Baltic—Atlantic Ocean, North Sea, Atlantic islands—Mediterranean and Mediterranean).Footnote 30 Additionally we include the month in which the insurance contract was signed. The insurance premium was likely higher in the winter months when navigation was more dangerous.Footnote 31 Finally, we consider the insured value expressed in pounds Flemish groat. Scale effects—in the sense of the fixed cost of contracting a policy that can be spread over a larger insured value—could reduce the relative insurance premium as the insured value increases.

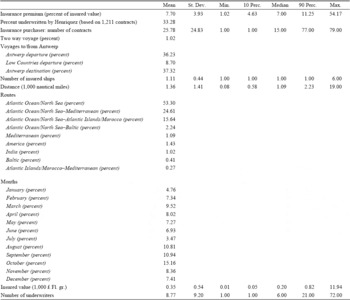

Descriptive statistics are given in Table 3. The average premium rate—the premium sum expressed as a fraction of the total insured value—is 7.70 percent (median 7.00 percent) and ranges between 1.02 percent and 54.17 percent. For the 1,211 contracts for which we know the underwriters, approximately one-third was underwritten by Henriquez. As for the ports of destination and departure, 36.23 percent of the voyages departed from Antwerp, 37.23 percent had Antwerp as destination, and 8.70 percent of the voyages departed from other places in the Low Countries. Typically, only one ship was insured, but there were voyages with more insured ships, with a maximum of six ships. The average distance was 1,360 nautical miles. Most voyages were either in the Atlantic Ocean/North Sea (53.30 percent), between Atlantic Ocean/North Sea and the Mediterranean (24.61 percent), or between the Atlantic Ocean/North Sea and the Atlantic Islands/Morocco (15.6 percent). The voyages are spread over the year fairly equally, though with larger numbers in August, September, and October. Table 3 also reports descriptives on the number of underwriters for individual voyages. The number of underwriters is on average 8.77 (median is 6) and ranges between 1 and 72 underwriters.

Table 3 DESCRIPTIVE STATISTICS (1,471 INSURANCE CONTRACTS IN THE ACCOUNT BOOKS OF JUAN HENRIQUEZ (1562–1563))

Source: Authors' database, based on FAA, Insolvente Boedelkamer, Account books of Juan Henriquez, IB #2314 and 2315, and Wastiels (Reference Wastiels1967).

To estimate the relation between the asymmetric information measures, risk factors, contract size, and the insurance premium, we run Ordinary Least Squares regressions. The results are reported in Table 4.Footnote 32 The results in the first three columns are based on all 1,471 contracts for which we have information on all the variables noted earlier.

Table 4 DETERMINANTS OF THE INSURANCE PREMIUM (DEPENDENT VARIABLE IS LN(PREMIUM)) IN THE ACCOUNT BOOKS OF JUAN HENRIQUEZ (1562–1563)

∗ = Significant at the 10 percent level.

∗∗ = Significant at the 5 percent level.

∗∗∗ = Significant at the 1 percent level.

Note: Based on 1,211 observations.

Source: Author database based on FAA, Insolvente Boedelkamer, Account books of Juan Henriquez, IB #2314 and 2315, and Wastiels (Reference Wastiels1967).

In the first regression (column 1), we include the routes but not distance. Interestingly, we find that voyages to, from, and within the Mediterranean had a significantly higher insurance premium. For example, a voyage between Atlantic Ocean / North Sea and the Mediterranean required an increase in the premium by 48 percent (= exp(0.389) − 1), compared to voyages in the Atlantic Ocean. Fear of Barbary Coast and Ottoman corsairs was calculated into the premium.Footnote 33 Not surprisingly, there was also a much higher premium (exp(0.469) − 1 = 60 percent) for intercontinental traffic to America and India than for voyages in the Atlantic Ocean (e.g., from Antwerp to Bordeaux or from São Tomé to Lisbon). In column 2, we include distance but not the routes, and find that a greater distance is associated with a higher insurance premium. A one standard deviation increase of the route distance (1,410 nautical miles) increases the premium by 18 percent (= 1,410 ∗ (exp(0.118) − 1)). When we include both the routes and the distance of the voyage in column 3, we find that no additional risk was added to the premiums for intercontinental traffic to America and India after taking into account the distance. On the contrary, the premium for intercontinental routes is significantly smaller. This means that these routes were considered safer after factoring in the premium for the distance of the voyage.Footnote 34

For the other variables, we focus on the full model for which results are reported in column 3. Unsurprisingly, premiums are significantly higher in the winter months (November to March) due to weather, storms, and ice along the more northerly routes. For example, the insurance premium was 28 percent (= exp(0.250) − 1) higher in January than in the base month July. We also find there is a negative correlation between the number of ships insured and the premium; the risk was divided among several ships and priced at a lower rate. An additional ship decreased the insurance premium by approximately 6 percent (= exp(–0.060) − 1).

With respect to the asymmetric information measures, we find that less frequent insurance purchasers were not charged an extra risk premium.Footnote 35 In columns 1 and 3 we find a statistically significant positive coefficient for the number of contracts of the insurance purchaser, but the economic effect is very small: one additional contract is related to a 0.1 percent premium increase. We also find that departures out of Antwerp reduced the premium rate by approximately 14 percent (= exp(–0.149) − 1), which is consistent with the argument that the possibility of inspecting the vessel prior to departure and to inform oneself on the captain's capacity is reflected in a lower premium rate.Footnote 36 Another interesting finding is the positive sign of the two way voyage dummy variable: an additional risk premium was charged on top of the double distance, possibly reflecting increased risk because the ship could not be inspected during one leg of the journey. Finally, the magnitude of the insured value itself did not impact the premium, indicating that fixed costs had no substantial impact on the insurance premium of individual contracts.

The results in column 4 are based on 1,211 contracts for which we have details on the underwriters, leaving out voyages to the Americas and India (for which we do not have information on the identities of the underwriters). While this truncates the sample, it allows us to measure the effect of Henriquez underwriting contracts himself. We find that Henriquez's underwriting reduced the premium by 3.4 percent (= exp(–0.035) − 1). His active interest in the policy may have signaled low risk to other underwriters resulting in a lower premium. Unfortunately, because underwritings were not dated in Henriquez's ledgers, we cannot say whether Henriquez himself acted as lead underwriter, a respectable and trusted underwriter who signed first, after which others “followed the lead” (Kingston Reference Kingston2007, p. 8; Ceccarelli 2012, pp. 261–64).

In a next step, we consider the number of underwriters. If underwriters were aware of the risk of the trades they were insuring and wanted to diversify their risks, riskier trades would have likely been underwritten by more insurers. Therefore, the number of underwriters should be positively related to the insurance premium. The first two regression models of Table 5 estimate the determinants of the number of underwriters.

Table 5 THE ROLE OF THE NUMBER OF UNDERWRITERS IN THE ACCOUNT BOOKS OF JUAN HENRIQUEZ (1562–1563)

∗ = Significant at the 10 percent level.

∗∗ = Significant at the 5 percent level.

∗∗∗ = Significant at the 1 percent level.

Source: Author database based on FAA, Insolvente Boedelkamer, Account books of Juan Henriquez, IB #2314 and 2315, and Wastiels (Reference Wastiels1967).

We include the same variables as in equation (1): measures of asymmetric information between the insurance purchaser and the underwriters, different risk factors which were known to Henriquez and the underwriters, and the size of the insurance contract. The first regression is based on all 1,471 contracts, while the second regression is based on the 1,211 contracts for which we can determine whether Henriquez was an underwriter. As the number of underwriters is skewed, the dependent variable is the natural log of the number of underwriters.

The results of both regressions show that policies for higher values had more underwriters. An increase in the insured value with one standard deviation, £ 540 Fl. gr., is associated with approximately one additional underwriter (= (exp(1.031) − 1) ∗ 0.540). Risk factors such as the number of insured ships, a departure out of Antwerp, and the winter months also significantly affected the number of underwriters. Risky voyages in the Mediterranean and to the Baltic Sea had significantly more underwriters, while voyages to and from Antwerp had fewer underwriters. An increase in the number of insured ships per contract significantly decreased the number of underwriters: an additional ship decreased the premium by approximately 10 percent (= exp(–0.222) − 1). If the voyage was underwritten by Henriquez, this tended to increase the number of underwriters by 45 percent (= exp(0.372) − 1).Footnote 37 In columns 3 and 4 of Table 5, in which the dependent variable is ln(premium), we find that, after accounting for insured value and measurable risk factors, the number of underwriters is still positively correlated with the premium, suggesting that the number of underwriters picks up additional risk not captured by other risk factors included in the model. These findings from Table 5 indicate that riskier voyages, that is, those with higher premiums, were spread and shared by more underwriters.

The Henriquez ledgers provide data not just on the policies and premiums but also on payments for damage and loss. Henriquez distinguishes between damage (avería) and total loss (pierde/pérdida). Recorded damage was on average 7.26 percent of the insured value and ranged from 0.21 percent to 90.59 percent, recorded total loss averaged 98.20 percent of the insured value and ranged from 77.11 to 100 percent. Out of 1,259 contracts, 117 were affected by damage and 33 by a total loss.Footnote 38 The voyage from Mazarrón in Spain to Antwerp, shipping alum for the Mazarrón mines to Antwerp (Soly Reference Soly1974, p. 832), incurred particularly large losses: 7 out of 25 voyages incurred losses (40 percent of the insured value had to be paid out on this route). One of the ships, the San Salvador, was definitely taken by Moorish corsairs.Footnote 39

Since losses were few in Henriquez's accounts, we cannot execute a regression with the same variables as for Table 4. Data on damage and total are based on a short period that includes only a few cases of damage. However, we run an ordered logit regression with damage and total loss as the dependent variable (0 = no damage; 1 = damage; 2 = total loss) and the (ln) premium as the independent variable.

The results in Table 6 show that the insurance premium is positively related to damage or total loss, and that this relation is statistically significant at the 5 percent level if we take the natural log of the insurance premium in the second regression (column 2). To illustrate the economic effect: an insurance premium of 4.95 percent (i.e., the 10 percentile insurance premium) is associated with a probability of damage of 7.39 percent. The probability of damage increases to 10.75 percent for an insurance premium of 12.25 percent (i.e., the 90 percentile insurance premium).Footnote 40 The probability of total loss is 2.16 percent at the 10 percentile insurance premium (4.95 percent) and increases to 3.31 percent at the 90 percentile insurance premium (12.25 percent). These results suggest that the premium reflects real risk.Footnote 41 Underwriters must surely have taken all the variables we observed and used in our analysis, at the same time, they would, for example, have had additional information on the perceived risk of war, differences between individual vessels and captains, the whereabouts of a ship insured after it had departed. These factors would have explained the additional variation in premiums which now goes unexplained.

Table 6 RELATION BETWEEN INSURANCE PREMIUM AND LOSSES IN THE ACCOUNT BOOKS OF JUAN HENRIQUEZ (1562–1563)

Source: Authors' database, based on FAA, Insolvente Boedelkamer, Account books of Juan Henriquez, IB #2314 and 2315, and Wastiels (Reference Wastiels1967).

THE BROKER IN A PRIVATE UNDERWRITING SYSTEM

In a quickly-growing market without a strong legal framework, such as Antwerp in the 1550s and 1560s (De ruysscher Reference De ruysscher and Leonard2016), brokers could play an important role in overcoming problems of asymmetric information between insurance purchasers and underwriters. Christopher Kingston (Reference Kingston2007, Reference Kingston2011, Reference Kingston2014) highlights the advantages and disadvantages of a private underwriting system. It not only allowed for a wide spread of the risk over many underwriters but also could make use of the expertise of underwriters and brokers in a competitive market. However, finding a pool of underwriters for every individual policy increased transaction costs, while the financial stability of individual underwriters may have been hard to ascertain for individual insurance purchasers. These disadvantages were attenuated by Henriquez's role as broker and intermediary. Henriquez created a wide pool of underwriters. Indeed, there is no evidence for a payment default by any one of the underwriters in the ledgers or in the available Antwerp sentence books and court case files.Footnote 42 In sixteenth-century London a broker was jointly and severally liable with the insured for the payment of the premium (Rossi Reference Rossi and Leonard2015, p. 143). In Antwerp a broker could not be held liable in case either the underwriter or the insured defaulted on their payment.Footnote 43 As a result, the underwriting system with Henriquez at its centre thrived on informal contract enforcement based on reputation mechanisms.

In 1555, the sector witnessed an intense discussion on the organization of the market. This discussion was triggered by the proposal of Giovanni-Battista Ferrufini sent to the Council of Finance of the Netherlands. A public broker was to be installed to combat the disorder, rampant fraud, and legal uncertainty in the sector, according to Ferrufini. Initially supported by a group of the most prominent Antwerp merchants, general public opinion within the Antwerp mercantile community turned against the proposal quickly and successfully. The office never became operational, and in 1561, Ferrufini backed down (De Groote Reference Groote and Henry1975; De ruysscher and Puttevils Reference De ruysscher and Puttevils2015; De ruysscher Reference De ruysscher and Leonard2016; Génard Reference Génard1882).

The counter petitions against Ferrufini's proposal in the 1550s reveal important ideas and expectations of underwriters and insurance purchasers of how the insurance market should be organized. First and foremost, the petitioners emphasized Antwerp's mercantile liberty, which was the basis of the city's growth and prosperity. All should be free to choose the types and clauses of their policies and their brokers. If this freedom was to be limited, the insurance market would move elsewhere quickly. Indeed, the data reveal a sizeable number of non-local voyages (not departing or arriving in the Low Countries) was insured through Henriquez. The petitioners clearly allude to this fact: if the regulator would become too strict, other centers could take over Low-Countries bound traffic easily, since the link between insurance and a physical port had become rather loose. Second, brokers should be discreet and maintain professional secrecy vis-à-vis the affairs of their clients. The brokers were incentivized to do so by the presence of other brokers in the market which allowed for the formation of a competitive price for insurance and of reputation mechanisms. Third, the protesters were convinced that private brokers supplied better services to smaller traders than could a government-appointed monopolist, who might be co-opted by the large underwriters and purchasers (De ruysscher and Puttevils Reference De ruysscher and Puttevils2015; Génard Reference Génard1882). In the end, the private underwriting system prevailed in Antwerp; the government did provide a clearer legal framework but public registration of policies was not required. This set Antwerp apart from other contemporary insurance centres, such as Burgos, where policies had to be registered by the merchant guild or Consulado, or Florence, where policies had to be brokered by brokers licensed by the city government (Basas Fernández Reference Basas Fernández1963; Casado Alonso Reference Casado Alonso1992; Ceccarelli 2012).

As a broker Henriquez charged a broker's fee of 0.25 percent of the value of the policy plus 1 shilling for the writing of the policy itself. He received a similar 0.25 percent commission for the cancellations of insurance contracts (0.25 percent of the insured value), the payment of damage and total loss (0.25 percent of the indemnity value), and 0.25 percent on the reduction of the insured value (if the insurance purchaser chose to lower the insured value in conjunction with the underwriters).Footnote 44 In addition Henriquez collected income from premiums and paid expenses for average and losses as part of his underwriting, both for his own account and together or on behalf of others (co-financing). Given this information, we reconstruct his income and expenses for the period in question in Table 7, understanding that we have only a lower bound on his expenses.

Table 7 RECONSTRUCTION OF REVENUES AND EXPENSES IN THE ACCOUNT BOOKS OF JUAN HENRIQUEZ (1562–1563)

Source: Authors' database, based on FAA, Insolvente Boedelkamer, Account books of Juan Henriquez, IB #2314 and 2315, and Wastiels (Reference Wastiels1967).

By this estimate and with the caveat concerning expenses, Henriquez's enterprise as a broker and insurance underwriter generated a salary of £ 2,232 Fl. gr. or an annual £ 1,913 Fl. gr.Footnote 45 The income from Henriquez's underwriting (£ 349 Fl. gr.) was lower than his brokerage income (£ 1,670 Fl. gr. in marine insurance brokering). At the same time, Henriquez does not appear to have capitalized on his potential insider advantage. His return on capital at risk (collected premiums minus indemnity payments divided by the insured value minus the collected premiums) of 3.11 percent was slightly below that of frequent underwriters, who received 3.30 percent as we discuss in the next section.Footnote 46

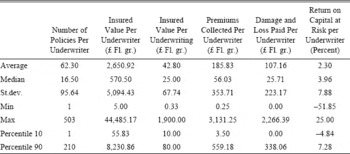

UNDERWRITERS' RISK AND RETURN

The Henriquez ledgers allow us some insight into the underwriting portfolios of those in the Henriquez orbit. Obviously, we have no information on other investments made by these individuals, such as real estate, government debt, or trade goods. But the information allows a rough description of profitability since Henriquez's ledgers not only provide data on the premiums earned but also on the losses underwriters had to pay out. In Table 8, we describe portfolios of underwritings held by those in our sample. The 184 underwriters recorded in Henriquez's ledgers each signed an average of 62 policies; the median was 16, showing that there were a few very large underwriters.Footnote 47 The average underwriting amounted to £ 42.80 Fl. gr. (median £ 25 Fl. gr.), where £ 25 Fl. gr. was equivalent to the annual wages of an Antwerp master mason at that time.Footnote 48 Italian and Iberian merchants signed underwriting amounts, on average, (£ 46 and £ 48 Fl. gr., respectively) compared to their Low Countries (£ 37 Fl. gr.), German (£ 34 Fl. gr.), and French colleagues (£ 25 Fl. gr.). This difference may perhaps be attributed to the long-standing experience of Italian and Iberian underwriters.Footnote 49 Antwerp insurers underwrote contracts with a slightly higher total contract value than their colleagues in Florence in 1524–1526 and a slightly lower value than the insurers in Burgos in 1565–1570.Footnote 50 On average, individual Antwerp insurers signed for larger sums than the Florentines.Footnote 51

Table 8 RECONSTRUCTION OF UNDERWRITER PORTFOLIOS FROM THE ACCOUNT BOOKS OF JUAN HENRIQUEZ (1562–1563)

Source: Authors' database, based on FAA, Insolvente Boedelkamer, Account books of Juan Henriquez, IB #2314 and 2315, and Wastiels (Reference Wastiels1967).

To stay in business, underwriters had to compensate losses on one insurance policy through the premiums earned on others. To calculate the return on capital at risk per underwriter, we divide collected premiums minus indemnity payments, by the insured value minus the collected premiums. Marine insurance through Henriquez earned the underwriters a relatively low mean return on capital invested of 2.30 percent. Investing in marine insurance had its attractions, however. It did not require upfront cash and it was a short-term investment, considering the time involved in European shipping. It was also a flexible investment, comparable to bills of exchange, also a short-term instrument. It is necessary to keep in mind that Henriquez's ledgers cover a peaceful period. Wars and increased piracy will surely have affected the types of insurance purchasers and sellers who remained active and the returns (with premiums rising but the risk of pay-outs increasing as well). Profits made in peacetime could compensate for large losses made when war erupted (Kingston Reference Kingston2011; Baskes Reference Baskes2013). Unfortunately, we cannot measure unmentioned contemporary expectations on future events (such as rumors) which underwriters and insurance purchasers will surely have taken into account.

Only in one instance do we know the amount of capital earmarked to service investments in marine insurance. Christoffel Pruynen, or Cristobal Pruns, in Henriquez's ledgers, was the director of a partnership that invested specifically in marine insurance. This notarized partnership contract for the period May 1563 to May 1566 is preserved. The partnership's capital amounted to £ 800 Fl. gr.Footnote 52 In its first year of activity (May 1563 to April 1564) the partnership earned £ 7,679.6 Fl. gr. in premiums but had to pay £ 13,736.8 Fl. gr. in indemnities (De Groote Reference Groote and Henry1975, pp. 164–68). Between 18 May 1563 and 24 September 1563, Henriquez brokered 42 policies for a total value of £ 11,519.67 Fl. gr. on behalf of Pruynen, earning the latter £ 738.265 Fl. gr. in four months (or annualized premiums of £ 2,214.795 Fl. gr. or a total insured value of £ 34,559 Fl. gr.). We know that Pruynen's company earned more than three times this amount in a year which means that the company probably used other brokers or actively sought insurance purchasers themselves (after Henriquez's death) (De Groote 1975, pp. 164–68).

This mean return on capital at risk in marine insurance of 2.30 percent conceals important variations: Single or large losses could wipe out all gains from other contracts. Moreover, indemnity payments had to be paid quite swiftly: On average 159 days passed between the inscription of the insurance and the inscription of repayment of damage or losses in Henriquez's ledgers.Footnote 53 Quick repayment was, of course, highly valued by the insurance purchaser; Henriquez's reputation as a broker depended on it.Footnote 54

UNDERWRITER STRATEGIES

In his 1458 manuscript Benedetto Cotrugli suggested underwriting “continuously and upon every ship, since they [the policies] balance each another and through many policies [the insurer] makes a profit for sure.”Footnote 55 Daniel Defoe noted in 1697, “For i believe any one will grant me this, it is not the smallness of a premium ruins the insurer, but it is the smallness of the quantity he insures” (p. 332). Indeed, the largest underwriters in Henriquez's account books mostly had positive returns on their capital at risk. But are there differences between small- and large-scale Antwerp underwriters? We have shown that infrequent insurance purchasers received a similar service from Henriquez as did more frequent insurance takers. To compare smaller and larger underwriters, we divide the underwriters into three equally sized categories based on the number of policies underwritten: one to seven contracts (group 1), eight to 52 contracts (group 2), and 53 to 503 contracts (group 3). There was a large group of infrequent insurance underwriters and in this, Antwerp was different from Florence, where small operators were not that important (Ceccarelli 2012, pp. 231–32). For these three categories of underwriters, the premium percentages, indemnities paid (as a percentage of the insured value), and the return per underwriter is summarized in Table 9. This allows us to assess the effects of group preferences and of scale on net return.

Table 9 RECONSTRUCTION OF PREMIUM, INDEMNITIES AND RETURN FOR EACH GROUP (UNDERWRITERS) IN THE ACCOUNT BOOKS OF JUAN HENRIQUEZ (1562–1563)

Source: Authors' database, based on FAA, Insolvente Boedelkamer, Account books of Juan Henriquez, IB #2314 and 2315, and Wastiels (Reference Wastiels1967).

The mean and median premiums were roughly similar for each group. However, medium-scale underwriters paid out higher indemnities than occasional and large-scale underwriters, resulting in a lower mean return. Interestingly, occasional underwriters (group 1) had on average similar returns as large-scale underwriters (group 3), suggesting they had similar information. Indeed, the median return is higher for occasional underwriters than for either medium- and large-scale underwriters. However, occasional underwriters assumed substantially more risk than medium-size underwriters did, while large-scale underwriters were able to achieve a large degree of diversification. Occasional underwriters had different geographic preferences.Footnote 56 They underwrote fewer policies for voyages within the Atlantic and the North Sea and more in the riskier voyage from the Atlantic to the Mediterranean than did their colleagues in the third group. The voyages they insured were longer, on average, than those insured by the third group of insurers.Footnote 57

Regional specialization in insurance increased the level of monitoring underwriters could exert but it exposed them to region-specific risks. We constructed a Berry–Herfindahl index by route for each of the underwriters.Footnote 58 Underwriters in groups 2 and 3 have average Berry–Herfindahl indices of 0.46 and 0.51 (group 2 has a larger standard deviation than group 3 does),Footnote 59 indicating that underwriters in Henriquez ledgers did not really diversify or specialize. But merchants could also diversify in other ways. They could insure voyages in regions in which they themselves were not active as merchants, as Charles Marescoe did in the seventeenth century. He traded in the Baltic but insured American routes (Leonard Reference Leonard and Leonard2015, p. 143). Most underwriters who also bought insurance for their own voyages through Henriquez pursued a similar strategy.Footnote 60

Insurers also sought to limit their risk with multiple policies on the same ship doing the same voyage. We identified voyages by the ship and captain's name and the date of the policy. The overlap of underwriters in the different policies for the same voyage was slightly less than half, meaning that if there are four policies on the same voyage, an individual underwriter will appear in two policies on average and limiting his exposure to a single risk (that of a ship on which multiple policies were underwritten going lost). Another way to diversify risk was to partner up with others as noted earlier (Ceccarelli 2012, p. 246). Several underwriters were partnerships: Ysnardo Felipo Cataneo & Nicolo Doria and Galeotto and Luca Rainieri were the largest among them in terms of underwritten value. These partnerships were probably general trading companies, not specifically intended for marine insurance underwriting. Interestingly these partnerships were not larger insurers than the one-man enterprises (mean total underwritten value of partnerships is £ 2617 vs. £ 2655 Fl. gr. for non-partnership underwriters).Footnote 61 Partnering up may have been more of a risk diversification strategy than a means of collecting sufficient capital to set up a larger underwriting business. As in sixteenth-century Venice, at least two partnerships—including the earlier-mentioned Pruynen partnership—were created with the specific goal of underwriting marine insurance policies in Antwerp (Stefani Reference Stefani1958, pp. 101–102).

Underwriters could transfer their liability to a reinsurer. Reinsurance was quite frequent. In 19 percent of the policies one or more underwriters transferred (part of) their underwriting to either Henriquez or another insurer, mostly Francisco Paez and Juan de Vallejo, who both specialized in reinsurance. A total of £ 5,768 Fl. gr. was reinsured. In most cases the reinsured values were quite low, around £ 20 Fl. gr. on average, and mostly the premium remained the same.Footnote 62 The practice of reinsurance in the Antwerp marine insurance market reveals a secondary market for policies, demonstrating again the sophisticated nature of the Antwerp market.

CONCLUSION

Our analysis of the account books of marine insurance broker, Henriquez, reveals a large and well-functioning insurance market in sixteenth-century Antwerp. Henriquez catered to the needs of several hundred insurance purchasers and underwriters. Not only the scale but also the scope of the Antwerp market was impressive. Henriquez signed contracts on voyages to destinations as far as the Americas and the Indies and within the Mediterranean, competing with the established insurance centers of Venice, Genoa, and Burgos. Specialization was at an advanced stage in Antwerp. Many underwriters did not buy insurance themselves and insurance purchasers were not required to underwrite policies (at least not via Henriquez). Insurance was a viable service industry.

Henriquez's office, close to the Antwerp Bourse, was open to infrequent as well as frequent insurance purchasers. Although, underwriters differed in their degree of activity, the mean net returns on capital at risk were similar for both infrequent and frequent underwriters. Not only were Italian and Iberian merchants well versed in the practice of marine insurance to be found among Henriquez's clientele but also those from the Low Countries, French, and German traders underwrote contracts as well and had similar rates of return. The market for insurance was remarkably open: Both insurers and the insured received a similar service from Henriquez, were exposed to similar risks, and paid and were paid similar premiums. As a result, small-scale traders, who were automatically less able to diversify, could turn to Henriquez to insure their batches of merchandise sent across the seas.

Henriquez's services were highly valued and he earned sizeable revenue from brokering, in addition to his income from underwriting and reinsuring. The petitioners opposing Ferrufini's proposal insisted on openness and mercantile liberty, one of the key strengths of the Antwerp market. Henriquez shows us that, in absence of a tight regulatory framework, a private underwriting system was possible. It is telling that Henriquez did not have a successor but the 1571 comprehensive set of legal rules on marine insurance enabled the continuation of the private underwriting system without a central intermediary.Footnote 63

As we show the premium rate charged by Henriquez and his underwriters was largely determined by underlying risk factors. The reconstruction of the different risk factors demonstrated how underwriters dealt with these relying on rational and sensible risk management strategies. Furthermore, the premium rate itself predicted the actual average and losses. The mean return on risked capital was not especially high, yet investing in marine insurance had serious advantages: No upfront money was required and it was a very short-term investment. It therefore allowed traders to act as underwriters and to invest idle cash. Antwerp welcomed intermediaries such as Henriquez whose services were available to all merchants and were highly valued; he was a trusted figure of high repute. Henriquez was one of the open-access institutions that underpinned Antwerp's commercial growth.

DATA ONLINE

Consumer Price Indices and Wages in Central-Northern Italy and Southern England, 1300–1850 (2012) by Paolo Malanima at http://www.paolomalanima.it/default_file/Page646.htm

Antwerp: Annual Wages and Prices, 1400–1700 by John H. Munro at https://www.economics.utoronto.ca/wwwfiles/archives/munro5/ResearchData.html