No CrossRef data available.

Published online by Cambridge University Press: 20 March 2017

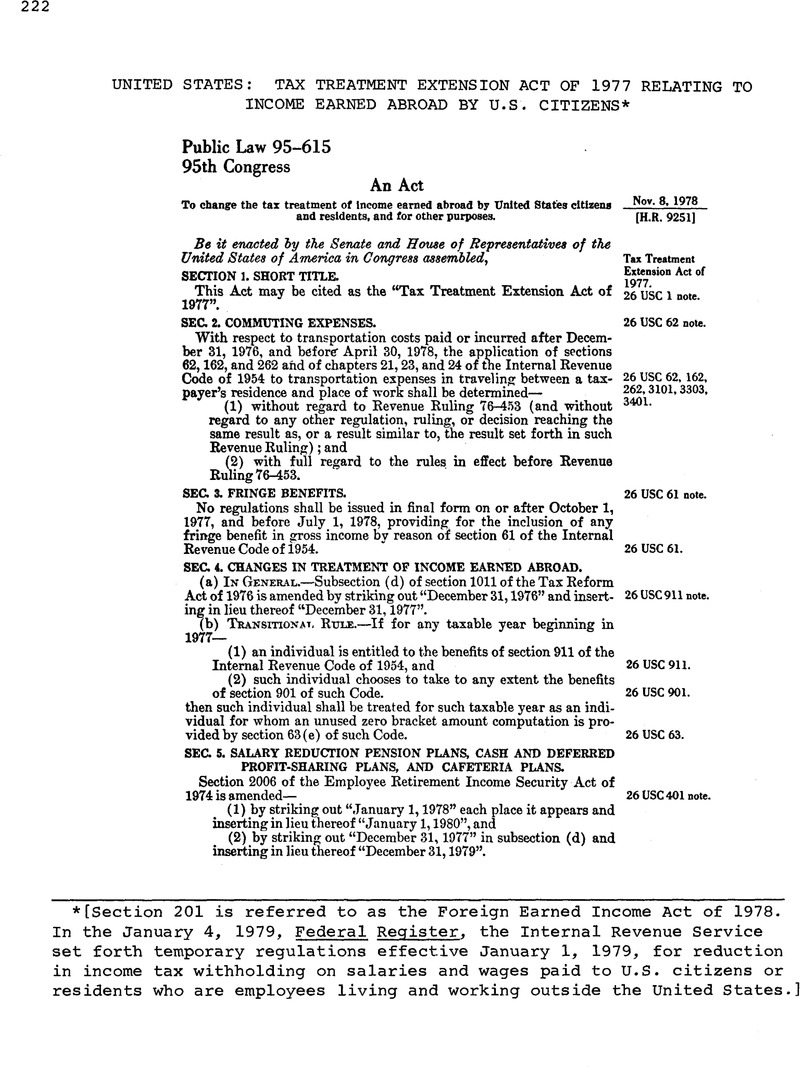

[Section 201 is referred to as the Foreign Earned Income Act of 1978. In the January 4, 1979, Federal Register, the Internal Revenue Service set forth temporary regulations effective January 1, 1979, for reduction in income tax withholding on salaries and wages paid to U.S. citizens or residents who are employees living and working outside the United States.]

* [Section 201 is referred to as the Foreign Earned Income Act of 1978. In the January 4, 1979, Federal Register, the Internal Revenue Service set forth temporary regulations effective January 1, 1979, for reduction in income tax withholding on salaries and wages paid to U.S. citizens or residents who are employees living and working outside the United States.]